|

|

市場調査レポート

商品コード

1397373

幹細胞治療の世界市場 (~2028年):タイプ・細胞源・治療用途別Stem Cell Therapy Market by Type, Cell Source, Therapeutic Application - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 幹細胞治療の世界市場 (~2028年):タイプ・細胞源・治療用途別 |

|

出版日: 2023年12月12日

発行: MarketsandMarkets

ページ情報: 英文 197 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | 細胞源・タイプ・治療用途・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

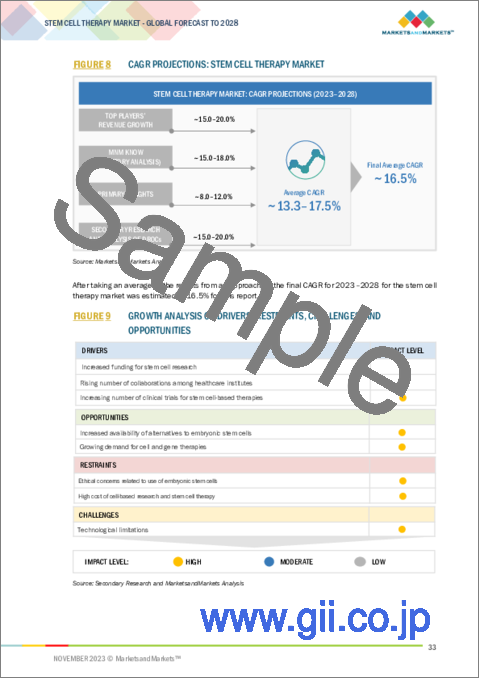

世界の幹細胞治療の市場規模は、2023年の2億8,600万米ドルから、予測期間中は16.5%のCAGRで推移し、2028年には6億1,500万米ドルの規模に成長すると予測されています。

主な参入事業者は、さまざまな疾患に対する新たな幹細胞治療の開発に注力しており、これが今後数年間の市場成長に影響を与える可能性のある主な要因の一つです。ここ数年、幹細胞治療に対するFDAの承認が増加しており、臨床試験の件数が大幅に増加していることも、市場成長に弾みをつけると予想されます。

タイプ別では、同種幹細胞の部門が2022年に圧倒的シェアを示しています。同種幹細胞治療では、1つの細胞源から多くの投与量を得ることができるため、経済的に実行可能であり、時間もかかりません。現在、10種類以上の同種幹細胞治療が商業化され、世界で承認されています。

細胞源別では、脂肪組織由来MSCの部門が2022年に圧倒的なシェアを獲得しました。一方、予測期間中は、骨髄由来MSCの部門が大幅なCAGRで成長すると予測されています。骨髄由来MSCは、幹細胞治療にもっとも好まれるタイプです。骨髄由来MSCの入手が容易であること、体外処理に要する時間が短いことなどが、同細胞の利用に弾みをつけ、同部門の成長を押し上げる主な要因となっています。

地域別では、アジア太平洋地域が予測期間中に大きなCAGRで成長すると予測されています。韓国では、幹細胞治療に対する政府の承認が高まっています。さらに、同地域における幹細胞治療開発のための産業界との提携は、同地域の市場成長をさらに加速させる可能性があります。

当レポートでは、世界の幹細胞治療の市場を調査し、市場概要、市場成長への各種影響因子および市場機会の分析、技術・特許の動向、パイプライン分析、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 技術分析

- 顧客の事業に影響を与える動向・ディスラプション

- バリューチェーン分析

- エコシステム市場マップ

- サプライチェーン分析

- ポーターのファイブフォース分析

- 規制分析

- 価格分析

- 特許分析

- 主要な会議とイベント

- パイプライン分析

- 主なステークホルダーと購入基準

第6章 幹細胞治療市場:細胞源別

- 脂肪組織由来MSC (間葉系幹細胞)

- 骨髄由来MSC (間葉系幹細胞)

- 胎盤・臍帯由来MSC (間葉系幹細胞)

- その他

第7章 幹細胞治療市場:タイプ別

- 同種幹細胞治療

- 自家幹細胞治療

第8章 幹細胞治療市場:治療用途別

- 筋骨格系疾患

- 創傷・手術

- 炎症性疾患・自己免疫疾患

- 心血管疾患

- 神経障害

- その他

第9章 幹細胞治療市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第10章 競合情勢

- 主要企業の採用戦略

- 収益シェア分析

- 市場シェア分析

- 企業評価マトリックス

- 主要企業の競合ベンチマーキング

- 上位15社の地域別のフットプリント

- スタートアップ/中小企業の評価マトリックス

- スタートアップ/中小企業の競合ベンチマーキング

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- SMITH+NEPHEW

- MEDIPOST

- JCR PHARMACEUTICALS CO., LTD.

- TAKEDA PHARMACEUTICAL COMPANY LIMITED

- ANTEROGEN CO., LTD.

- CORESTEM, INC.

- PHARMICELL CO., LTD

- NUVASIVE, INC.

- RTI SURGICAL

- ALLOSOURCE

- HOLOSTEM TERAPIE AVANZATE SRL

- ORTHOFIX MEDICAL INC.

- STEMPEUTICS RESEARCH PVT LTD.

- REGROW BIOSCIENCES PVT LTD.

- その他の企業

- ATHERSYS, INC.

- MESOBLAST LTD.

- BIORESTORATIVE THERAPIES, INC.

- PLURISTEM THERAPEUTICS INC.

- BRAINSTORM CELL LIMITED

- GAMIDA CELL

- VIACYTE, INC.

- KANGSTEM BIOTECH CO., LTD.

- HOPE BIOSCIENCES

- CELLULAR BIOMEDICINE GROUP

- PERSONALIZED STEM CELLS

第12章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Million |

| Segments | Cell Source, Type, Therapeutic Application and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East and Africa |

The global stem cell therapy market is projected to reach USD 615 million by 2028 from USD 286 million in 2023, at a CAGR of 16.5% during the forecast period. Key market players are focusing on developing new stem cell therapies for various disease conditions this is one of the major factor is likely to impact the market growth in coming years. The increasing number of clinical trials has largely in past few years coupled with rise in FDA approvals for stem cell therapy is anticipated to give momentum to the market growth.

"The allogeneic stem cell segment accounted dominant share in 2022"

The stem cell therapy market is segmented into allogeneic and autologous. Allogeneic segment accounted for the dominant share in 2022. In allogeneic stem cell therapy, one cell source can produce numerous doses, thus making allogeneic therapy economically viable and less time-consuming, these are some of the major elements responsible for the doninat share of the segment. Presently, more than ten approved commercialized allogeneic stem cell therapies are available globally.

"Bone Marrow-derived MSCs segment is anticipated to grow at significant CAGR"

Based on the cell source the global stem cell therapy market is segmented into adipose tissue-derived MSCs, bone marrow-derived MSCs, placenta/umbilical cord-derived MSCs, and other cell sources. In 2022, the adipose tissue-derived MSCs segment gained dominant share in the stem cell therapy market. Bone marrow-derived mesenchymal stem cells most preferred type for are stem cell therapies. Easy availability of Bone marrow MSCs and less time required for in-vitro processing are some of the major factorslikely to give momentum to the use of bone marrow derived MSCs uplifting the segmental growth.

"Asia Pacific region is likely to grow at a faster pace."

The stem cell therapy market is segmented into North America, Europe, Asia Pacific and Rest of the world. Asia Pacific region is anticipated to grow at a significant CAGR during the forecast period. Rising approvals from the government for stem cell therapy in South Korea. Furthermore, industrial collabrations in the region for stem cell therapy development is further likely to give pace for the market growth in the region. For instance, Reyon Pharmaceutical and Therabest entered into a joint development agreement for NK cell therapy for treating solid cancer. Under this agreement, the two companies will jointly develop iPSC (induced pluripotent stem cell)-derived NK cell therapy 'TB-100' for solid cancer indications.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 80%, and Demand Side - 20%

- By Designation (Supply Side): Managers - 45%, CXOs & Directors - 30%, Executives- 25%

- By Region: North America -40%, Asia-Pacific -20%, Europe -30%, ROW-10%

List of Companies Profiled in the Report:

- Smith+Nephew (UK)

- MEDIPOST Co. Ltd. (South Korea)

- Anterogen Co. Ltd. (South Korea)

- CORESTEM (South Korea)

- Pharmicell Co. Ltd. (South Korea)

- NuVasive Inc. (US)

- RTI Surgical (US)

- AlloSource (US)

- JCR Pharmaceuticals Co. Ltd. (Japan)

- Takeda Pharmaceutical Company Limited (Japan)

- Holostem Terapie Avanzate Srl (Italy)

- Orthofix (US)

- Regrow Biosciences Pvt Ltd. (India)

- STEMPEUTICS RESEARCH PVT LTD. (India)

- Athersys (US)

- Mesoblast Ltd (Australia)

- Biorestorative Therapies Inc. (US)

- Pluristem Inc. (Israel)

- Brainstorm Cell Limited. (US)

- ViaCyte Inc. (US)

- Gamida Cell (US)

- Kangstem Biotech (South Korea)

- Hope Biosciences (US)

- Cellular Biomedicine Group (US)

- Personalized Stem Cells (US)

Research Coverage:

This report provides a detailed picture of the stem cell therapy market. It aims to estimate the size and future growth potential of the market across different segments, such as such as the type, therapeutic applications, and region. The report also includes an in-depth competitive analysis of the key market players, along with their company profiles, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall stem cell therapy market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Increased funding for stem cell research, rise in collabrations and partnerships is likley to uplift the market growth, Increasing clinical trials for stem cell based-therapies), restraints ( Ethical concerns related to embryonic stem cells, high cost of cell-based research), opportunities (The emergence of iPSCs as an alternative to ESCs, growing demand for stem cell and gene therapy) and challenges (Technical limitations) are influencing the growth of stem cell therapy market.

- Product Development/Innovation: Detailed insights on newly launched products of the stem cell therapy market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the stem cell therapy market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the stem cell therapy market.

- Pipeline Analysis: Detailed information on stem cell therapy under phase 3 clinical trials.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players include Smith+Nephew (UK), MEDIPOST Co. Ltd. (South Korea), Anterogen Co. Ltd. (South Korea), CORESTEM (South Korea) and among others in the stem cell therapy market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 RESEARCH LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- FIGURE 2 BREAKDOWN OF PRIMARIES: STEM CELL THERAPY MARKET

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION FOR SUPPLY-SIDE ANALYSIS, 2022

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS, 2022

- FIGURE 5 SMITH+NEPHEW: REVENUE SHARE ANALYSIS, 2022

- 2.2.1 PRIMARY INSIGHTS

- FIGURE 6 VALIDATION FROM PRIMARY EXPERTS

- 2.2.2 SEGMENT ASSESSMENT METHODOLOGY: STEM CELL THERAPY MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 CAGR PROJECTIONS: STEM CELL THERAPY MARKET

- FIGURE 9 GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- 2.4 STUDY ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 IMPACT OF RECESSION ON STEM CELL THERAPY MARKET

- TABLE 1 GLOBAL INFLATION RATE PROJECTION, 2024-2028 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019-2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023-2027 (USD MILLION)

3 EXECUTIVE SUMMARY

- FIGURE 11 STEM CELL THERAPY MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 STEM CELL THERAPY MARKET, BY CELL SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 REGIONAL SNAPSHOT OF STEM CELL THERAPY MARKET

4 PREMIUM INSIGHTS

- 4.1 STEM CELL THERAPY MARKET OVERVIEW

- FIGURE 15 INCREASING INVESTMENTS AND FUNDING FOR STEM CELL RESEARCH TO DRIVE MARKET

- 4.2 NORTH AMERICA: STEM CELL THERAPY MARKET, BY TYPE AND COUNTRY, 2022

- FIGURE 16 ALLOGENEIC STEM CELL THERAPY ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.3 STEM CELL THERAPY MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- FIGURE 17 SOUTH KOREA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 STEM CELL THERAPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increased funding for stem cell research

- TABLE 4 FUNDING FOR STEM CELL RESEARCH BY INDIAN COUNCIL OF MEDICAL RESEARCH, 2019-2022 (USD)

- TABLE 5 FUNDING FOR CELL-BASED RESEARCH BY NATIONAL INSTITUTES OF HEALTH, 2018-2023 (USD MILLION)

- 5.2.1.2 Rising number of collaborations among healthcare institutes

- 5.2.1.3 Increasing number of clinical trials for stem cell-based therapies

- FIGURE 19 NUMBER OF CLINICAL TRIALS, 2015-2022

- 5.2.2 RESTRAINTS

- 5.2.2.1 Ethical concerns related to use of embryonic stem cells

- 5.2.2.2 High cost of cell-based research and stem cell therapy

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased availability of alternatives to embryonic stem cells

- 5.2.3.2 Growing demand for cell and gene therapies

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological limitations

- 5.3 TECHNOLOGY ANALYSIS

- TABLE 6 COMPARISON BETWEEN STEM CELL THERAPIES AND GENE THERAPIES

- 5.4 DISRUPTIONS AND TRENDS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 20 REVENUE SHIFT AND NEW POCKET FOR KEY PLAYERS IN STEM CELL THERAPY MARKET

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 21 STEM CELL THERAPY MARKET: VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM MARKET MAP

- FIGURE 22 STEM CELL THERAPY MARKET: ECOSYSTEM MARKET MAP

- 5.7 SUPPLY CHAIN ANALYSIS

- FIGURE 23 STEM CELL THERAPY MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 7 SUPPLY CHAIN ANALYSIS: ROLE OF COMMERCIAL-SCALE/KEY MANUFACTURERS

- TABLE 8 SUPPLY CHAIN ANALYSIS: PIPELINE/EMERGING MANUFACTURERS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITION RIVALRY

- 5.9 REGULATORY ANALYSIS

- 5.9.1 REGULATORY LANDSCAPE

- 5.9.1.1 North America

- TABLE 9 NORTH AMERICA: REGULATORY LANDSCAPE FOR STEM CELL THERAPIES

- 5.9.1.2 Europe

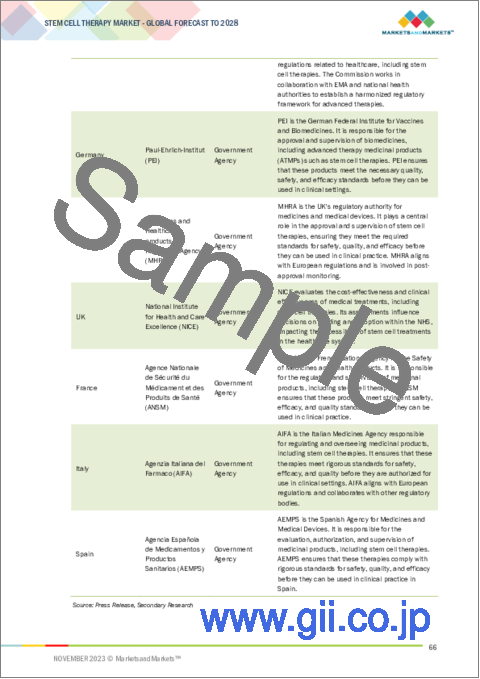

- TABLE 10 EUROPE: REGULATORY LANDSCAPE FOR STEM CELL THERAPIES

- 5.9.1.3 Asia Pacific

- TABLE 11 ASIA PACIFIC: REGULATORY LANDSCAPE FOR STEM CELL THERAPIES

- 5.9.1.4 Rest of the World

- TABLE 12 REST OF THE WORLD: REGULATORY LANDSCAPE FOR STEM CELL THERAPIES

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 REGULATORY LANDSCAPE

- 5.10 PRICING ANALYSIS

- 5.10.1 PRICING ANALYSIS

- TABLE 17 AVERAGE SELLING PRICE OF DRUG THERAPIES OFFERED BY KEY PLAYERS IN STEM CELL THERAPY MARKET

- 5.10.2 AVERAGE SELLING PRICE TREND FOR STEM CELL THERAPIES

- 5.11 PATENT ANALYSIS

- FIGURE 24 STEM CELL THERAPY: PATENT ANALYSIS, 2013-2023

- 5.12 KEY CONFERENCES & EVENTS

- TABLE 18 LIST OF KEY CONFERENCES & EVENTS, 2023-2024

- 5.13 PIPELINE ANALYSIS

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- FIGURE 25 KEY STAKEHOLDERS

- 5.14.1 KEY BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR END USERS

6 STEM CELL THERAPY MARKET, BY CELL SOURCE

- 6.1 INTRODUCTION

- TABLE 19 STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- 6.2 ADIPOSE TISSUE-DERIVED MESENCHYMAL STEM CELLS

- 6.2.1 EASE OF ISOLATION AND HARVESTING TO DRIVE GROWTH

- TABLE 20 ADIPOSE TISSUE-DERIVED MESENCHYMAL STEM CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 21 NORTH AMERICA: ADIPOSE TISSUE-DERIVED MESENCHYMAL STEM CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 22 EUROPE: ADIPOSE TISSUE-DERIVED MESENCHYMAL STEM CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 23 ASIA PACIFIC: ADIPOSE TISSUE-DERIVED MESENCHYMAL STEM CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 BONE MARROW-DERIVED MESENCHYMAL STEM CELLS

- 6.3.1 HIGH PREVALENCE OF METABOLIC DISORDERS TO SUPPORT MARKET GROWTH

- TABLE 24 BONE MARROW-DERIVED MESENCHYMAL STEM CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: BONE MARROW-DERIVED MESENCHYMAL STEM CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 26 EUROPE: BONE MARROW-DERIVED MESENCHYMAL STEM CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 27 ASIA PACIFIC: BONE MARROW-DERIVED MESENCHYMAL STEM CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 PLACENTA/UMBILICAL CORD-DERIVED MESENCHYMAL STEM CELLS

- 6.4.1 LOW CHANCES OF REJECTION FROM IMMUNE SYSTEM TO PROPEL GROWTH

- TABLE 28 PLACENTA/UMBILICAL CORD-DERIVED MESENCHYMAL STEM CELLS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: PLACENTA/UMBILICAL CORD-DERIVED MESENCHYMAL STEM CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 30 EUROPE: PLACENTA/UMBILICAL CORD-DERIVED MESENCHYMAL STEM CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: PLACENTA/UMBILICAL CORD-DERIVED MESENCHYMAL STEM CELLS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.5 OTHER CELL SOURCES

- TABLE 32 STEM CELL THERAPY MARKET FOR OTHER CELL SOURCES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: STEM CELL THERAPY MARKET FOR OTHER CELL SOURCES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 34 EUROPE: STEM CELL THERAPY MARKET FOR OTHER CELL SOURCES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: STEM CELL THERAPY MARKET FOR OTHER CELL SOURCES, BY COUNTRY, 2021-2028 (USD MILLION)

7 STEM CELL THERAPY MARKET, BY TYPE

- 7.1 INTRODUCTION

- TABLE 36 STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 7.2 ALLOGENEIC STEM CELL THERAPY

- 7.2.1 ECONOMICALLY VIABLE AND LESS TIME-CONSUMING-KEY FACTORS DRIVING MARKET GROWTH

- TABLE 37 ALLOGENEIC STEM CELL THERAPY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: ALLOGENEIC STEM CELL THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 39 EUROPE: ALLOGENEIC STEM CELL THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: ALLOGENEIC STEM CELL THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 AUTOLOGOUS STEM CELL THERAPY

- 7.3.1 LOW RISK OF POST-TREATMENT COMPLICATIONS TO DRIVE GROWTH

- TABLE 41 AUTOLOGOUS STEM CELL THERAPY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: AUTOLOGOUS STEM CELL THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 43 EUROPE: AUTOLOGOUS STEM CELL THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 44 ASIA PACIFIC: AUTOLOGOUS STEM CELL THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

8 STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION

- 8.1 INTRODUCTION

- TABLE 45 STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 8.2 MUSCULOSKELETAL DISORDERS

- 8.2.1 INCREASING CASES OF OSTEOARTHRITIS TO DRIVE MARKET

- TABLE 46 STEM CELL THERAPY MARKET FOR MUSCULOSKELETAL DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: STEM CELL THERAPY MARKET FOR MUSCULOSKELETAL DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 48 EUROPE: STEM CELL THERAPY MARKET FOR MUSCULOSKELETAL DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: STEM CELL THERAPY MARKET FOR MUSCULOSKELETAL DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 WOUNDS & SURGERIES

- 8.3.1 INCREASING BENEFITS OF ALLOGENEIC-BASED THERAPIES TO SUPPORT MARKET GROWTH

- TABLE 50 STEM CELL THERAPY MARKET FOR WOUNDS & SURGERIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: STEM CELL THERAPY MARKET FOR WOUNDS & SURGERIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 52 EUROPE: STEM CELL THERAPY MARKET FOR WOUNDS & SURGERIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: STEM CELL THERAPY MARKET FOR WOUNDS & SURGERIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 INFLAMMATORY & AUTOIMMUNE DISEASES

- 8.4.1 INCREASING CLINICAL TRIALS TO SUPPORT MARKET GROWTH

- TABLE 54 STEM CELL THERAPY MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: STEM CELL THERAPY MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 56 EUROPE: STEM CELL THERAPY MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 57 ASIA PACIFIC: STEM CELL THERAPY MARKET FOR INFLAMMATORY & AUTOIMMUNE DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.5 CARDIOVASCULAR DISEASES

- 8.5.1 INCREASING PUBLIC & PRIVATE FUNDING FOR CVD RESEARCH TO DRIVE MARKET

- TABLE 58 STEM CELL THERAPY MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: STEM CELL THERAPY MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 60 EUROPE: STEM CELL THERAPY MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: STEM CELL THERAPY MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.6 NEUROLOGICAL DISORDERS

- 8.6.1 RISING PREVALENCE OF NEUROLOGICAL DISORDERS TO PROPEL MARKET

- TABLE 62 STEM CELL THERAPY MARKET FOR NEUROLOGICAL DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: STEM CELL THERAPY MARKET FOR NEUROLOGICAL DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 64 EUROPE: STEM CELL THERAPY MARKET FOR NEUROLOGICAL DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 65 ASIA PACIFIC: STEM CELL THERAPY MARKET FOR NEUROLOGICAL DISORDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.7 OTHER THERAPEUTIC APPLICATIONS

- TABLE 66 STEM CELL THERAPY MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: STEM CELL THERAPY MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 68 EUROPE: STEM CELL THERAPY MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: STEM CELL THERAPY MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

9 STEM CELL THERAPY MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 70 STEM CELL THERAPY MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 27 NORTH AMERICA: STEM CELL THERAPY MARKET SNAPSHOT

- TABLE 71 NORTH AMERICA: STEM CELL THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Increase in stem cell therapy approvals to drive market

- TABLE 75 US: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 76 US: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 77 US: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Increase in research activities targeted toward stem cell therapies to propel market

- TABLE 78 CANADA: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 79 CANADA: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 80 CANADA: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.2.3 RECESSION IMPACT ON NORTH AMERICAN STEM CELL THERAPY MARKET

- 9.3 EUROPE

- TABLE 81 EUROPE: STEM CELL THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 82 EUROPE: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 83 EUROPE: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 84 EUROPE: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Increasing incidence of sports-related injuries to drive market

- TABLE 85 GERMANY: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 86 GERMANY: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 87 GERMANY: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Rising adoption of cell-based therapies to propel market

- TABLE 88 UK: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 89 UK: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 UK: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Rising R&D expenditure for stem cell therapy to support market growth

- TABLE 91 FRANCE: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 92 FRANCE: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 FRANCE: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Rising prevalence of neurological and cardiovascular disorders to drive market

- TABLE 94 ITALY: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 95 ITALY: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 96 ITALY: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Rising prevalence of CVD to propel market

- TABLE 97 SPAIN: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 98 SPAIN: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 99 SPAIN: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 100 REST OF EUROPE: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 REST OF EUROPE: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.3.7 RECESSION IMPACT ON EUROPEAN STEM CELL THERAPY MARKET

- 9.4 ASIA PACIFIC

- FIGURE 28 ASIA PACIFIC: STEM CELL THERAPY MARKET SNAPSHOT

- TABLE 103 ASIA PACIFIC: STEM CELL THERAPY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.4.1 JAPAN

- 9.4.1.1 Growing geriatric population and faster regulatory approval process to augment market growth

- TABLE 107 JAPAN: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 108 JAPAN: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 109 JAPAN: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.4.2 SOUTH KOREA

- 9.4.2.1 Presence of major players to support market growth in South Korea

- TABLE 110 SOUTH KOREA: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 111 SOUTH KOREA: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 SOUTH KOREA: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Rising incidence of neurodegenerative disorders and diabetes to drive market

- TABLE 113 INDIA: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 114 INDIA: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 INDIA: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.4.4 CHINA

- 9.4.4.1 Increasing investments in stem cell research to drive market

- TABLE 116 CHINA: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 117 CHINA: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 118 CHINA: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 119 REST OF ASIA PACIFIC: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.4.6 RECESSION IMPACT ON ASIA PACIFIC STEM CELL THERAPY MARKET

- 9.5 REST OF THE WORLD

- TABLE 122 REST OF THE WORLD: STEM CELL THERAPY MARKET, BY CELL SOURCE, 2021-2028 (USD MILLION)

- TABLE 123 REST OF THE WORLD: STEM CELL THERAPY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 REST OF THE WORLD: STEM CELL THERAPY MARKET, BY THERAPEUTIC APPLICATION, 2021-2028 (USD MILLION)

- 9.5.1 RECESSION IMPACT ON REST OF THE WORLD STEM CELL THERAPY MARKET

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 29 STEM CELL THERAPY MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS

- FIGURE 30 REVENUE ANALYSIS OF TOP PLAYERS, 2020-2022 (USD MILLION)

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 31 STEM CELL THERAPY MARKET: MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- TABLE 125 STEM CELL THERAPY MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 10.5 COMPANY EVALUATION MATRIX

- FIGURE 32 STEM CELL THERAPY MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 126 THERAPEUTIC APPLICATION FOOTPRINT OF COMPANIES

- 10.7 REGIONAL FOOTPRINT OF TOP 15 COMPANIES

- TABLE 127 REGIONAL FOOTPRINT OF COMPANIES

- 10.8 STARTUP/SME EVALUATION MATRIX

- FIGURE 33 STEM CELL THERAPY MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.9 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 128 STEM CELL THERAPY MARKET: PRODUCT FOOTPRINT ANALYSIS OF STARTUPS/SMES

- TABLE 129 STEM CELL THERAPY MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 10.10 COMPETITIVE SCENARIOS AND TRENDS

- 10.10.1 PRODUCT APPROVALS

- TABLE 130 STEM CELL THERAPY MARKET: PRODUCT APPROVALS, JANUARY 2020-OCTOBER 2023

- 10.10.2 DEALS

- TABLE 131 STEM CELL THERAPY MARKET: DEALS, JANUARY 2020-OCTOBER 2023

- 10.10.3 OTHER DEVELOPMENTS

- TABLE 132 STEM CELL THERAPY MARKET: OTHER DEVELOPMENTS, JANUARY 2020-OCTOBER 2023

11 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1 KEY PLAYERS

- 11.1.1 SMITH+NEPHEW

- TABLE 133 SMITH+NEPHEW: BUSINESS OVERVIEW

- FIGURE 34 SMITH+NEPHEW: COMPANY SNAPSHOT (2022)

- 11.1.2 MEDIPOST

- TABLE 134 MEDIPOST: BUSINESS OVERVIEW

- FIGURE 35 MEDIPOST: COMPANY SNAPSHOT (2021)

- 11.1.3 JCR PHARMACEUTICALS CO., LTD.

- TABLE 135 JCR PHARMACEUTICALS CO., LTD.: BUSINESS OVERVIEW

- FIGURE 36 JCR PHARMACEUTICALS CO., LTD: COMPANY SNAPSHOT (2022)

- 11.1.4 TAKEDA PHARMACEUTICAL COMPANY LIMITED

- TABLE 136 TAKEDA PHARMACEUTICAL COMPANY LIMITED: BUSINESS OVERVIEW

- FIGURE 37 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY SNAPSHOT (2022)

- 11.1.5 ANTEROGEN CO., LTD.

- TABLE 137 ANTEROGEN CO., LTD.: BUSINESS OVERVIEW

- 11.1.6 CORESTEM, INC.

- TABLE 138 CORESTEM INC.: BUSINESS OVERVIEW

- FIGURE 38 CORESTEM INC.: COMPANY SNAPSHOT (2021)

- 11.1.7 PHARMICELL CO., LTD

- TABLE 139 PHARMICELL CO., LTD: BUSINESS OVERVIEW

- 11.1.8 NUVASIVE, INC.

- TABLE 140 NUVASIVE, INC.: BUSINESS OVERVIEW

- FIGURE 39 NUVASIVE, INC.: COMPANY SNAPSHOT (2022)

- 11.1.9 RTI SURGICAL

- TABLE 141 RTI SURGICAL: BUSINESS OVERVIEW

- 11.1.10 ALLOSOURCE

- TABLE 142 ALLOSOURCE: BUSINESS OVERVIEW

- 11.1.11 HOLOSTEM TERAPIE AVANZATE SRL

- TABLE 143 HOLOSTEM TERAPIE AVANZATE SRL: BUSINESS OVERVIEW

- 11.1.12 ORTHOFIX MEDICAL INC.

- TABLE 144 ORTHOFIX MEDICAL INC.: BUSINESS OVERVIEW

- FIGURE 40 ORTHOFIX MEDICAL INC.: COMPANY SNAPSHOT (2022)

- 11.1.13 STEMPEUTICS RESEARCH PVT LTD.

- TABLE 145 STEMPEUTICS RESEARCH PVT LTD.: BUSINESS OVERVIEW

- 11.1.14 REGROW BIOSCIENCES PVT LTD.

- TABLE 146 REGROW BIOSCIENCES PVT LTD.: BUSINESS OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 ATHERSYS, INC.

- TABLE 147 ATHERSYS, INC.: BUSINESS OVERVIEW

- 11.2.2 MESOBLAST LTD.

- TABLE 148 MESOBLAST LTD.: BUSINESS OVERVIEW

- 11.2.3 BIORESTORATIVE THERAPIES, INC.

- TABLE 149 BIORESTORATIVE THERAPIES, INC.: BUSINESS OVERVIEW

- 11.2.4 PLURISTEM THERAPEUTICS INC.

- TABLE 150 PLURISTEM THERAPEUTICS INC.: BUSINESS OVERVIEW

- 11.2.5 BRAINSTORM CELL LIMITED

- TABLE 151 BRAINSTORM CELL LIMITED: BUSINESS OVERVIEW

- 11.2.6 GAMIDA CELL

- TABLE 152 GAMIDA CELL: BUSINESS OVERVIEW

- 11.2.7 VIACYTE, INC.

- TABLE 153 VIACYTE, INC.: BUSINESS OVERVIEW

- 11.2.8 KANGSTEM BIOTECH CO., LTD.

- TABLE 154 KANGSTEM BIOTECH CO., LTD.: BUSINESS OVERVIEW

- 11.2.9 HOPE BIOSCIENCES

- TABLE 155 HOPE BIOSCIENCES: BUSINESS OVERVIEW

- 11.2.10 CELLULAR BIOMEDICINE GROUP

- TABLE 156 CELLULAR BIOMEDICINE GROUP: BUSINESS OVERVIEW

- 11.2.11 PERSONALIZED STEM CELLS

- TABLE 157 PERSONALIZED STEM CELLS: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS