|

|

市場調査レポート

商品コード

1120303

工業用結晶化装置の世界市場:タイプ(DTB、強制循環、流動床)、プロセス(連続、バッチ)、最終用途業界(飲食品、製薬、化学、農薬、廃水処理)、地域別 - 2027年までの予測Industrial Crystallizers Market by Type (DTB, Forced Circulation, Fluidized Bed), Process (Continuous, Batch), End-Use Industry (Food & Beverage, Pharmaceutical, Chemical, Agrochemical, Wastewater Treatment) & Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 工業用結晶化装置の世界市場:タイプ(DTB、強制循環、流動床)、プロセス(連続、バッチ)、最終用途業界(飲食品、製薬、化学、農薬、廃水処理)、地域別 - 2027年までの予測 |

|

出版日: 2022年08月10日

発行: MarketsandMarkets

ページ情報: 英文 173 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の工業用結晶化装置の市場規模は、2022年の38億米ドルから、2027年には48億米ドルへに達すると予測されており、2022年から2027年までの間にCAGR5.1%で成長する見通しです。

工業用結晶化装置の世界市場は、医薬品支出の増加や、さまざまな地域でのZLDシステムの需要増加といった主要な要因によって牽引されています。

"タイプ別では、強制循環式結晶化装置セグメントが2022年から2027年の間に工業用結晶化装置市場で最も急速に成長するセグメントと推定される"

タイプ別では、強制循環式結晶化装置が予測期間中に最も急速に成長するセグメントと推定されます。強制循環式結晶化装置は、化学、飲食品、製薬などの様々な最終用途産業で広く使用されており、特にファウリング製品に使用されています。このタイプの結晶化装置は、操作が簡単で、連続プロセスに最適です。

"プロセスにおける連続セグメントは、予測期間中に最も高いCAGRを記録すると予測されている"

プロセスに基づくと、予測期間中、連続セグメントが最も高いCAGRを記録すると予測されます。連続プロセスは、操作と人件費においてより経済的であり、スケールアップの排除など、バッチプロセスよりもいくつかの利点があります。このタイプの結晶化装置は、結晶の発達を助ける高いレベルの過飽和度を発生させることができます。

"最終用途産業別では、2022年から2027年にかけて、食品・飲料セグメントが工業用結晶化装置市場の最速成長セグメントとなると推定される"

最終用途産業別では、食品・飲料分野が予測期間中に最も急成長する分野と推定されます。食品&飲料産業は、最も急速に成長している産業の1つであり、様々な食品&飲料の処理に結晶器を使用しています。結晶器は、砂糖、ホエー、アイスクリームや他の多くの製品の製造に使用されています。

"アジア太平洋の工業用結晶化装置市場は、予測期間中に最も高いCAGRを示すと予測されている"

アジア太平洋地域は、2022年から2027年にかけて、工業用結晶化装置市場で最高のCAGRを記録すると予測されています。アジア太平洋地域は、工業用結晶化装置の主要市場の1つです。この地域は、製薬、化学、飲食品など、さまざまな最終用途産業からの需要増加により、工業用結晶化装置の高い需要を有しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- バリューチェーン分析

- エコシステム

- 顧客のビジネスに影響を与える動向/ディスラプション

- 特許分析

- 技術分析

- 主な会議とイベント

- 規制状況

- ケーススタディ分析

第6章 工業用結晶化装置市場:タイプ別

- イントロダクション

- DTB結晶化装置

- 強制循環結晶化装置

- 流動床結晶化装置

- その他

第7章 工業用結晶化装置市場:プロセス別

- イントロダクション

- 連続

- バッチ

第8章 工業用結晶化装置市場:最終用途業界別

- イントロダクション

- 製薬

- 農薬

- 金属・鉱物

- 飲食品

- 化学

- 廃水処理

- その他

第9章 工業用結晶化装置市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 韓国

- 日本

- インド

- オーストラリア

- マレーシア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- スペイン

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他

- 南米

- アルゼンチン

- ブラジル

- その他

第10章 競合情勢

- 概要

- 主要企業の戦略

- 市場シェアと収益分析

- 競合ベンチマーキング

- 企業評価クアドラント(2021)

- 中小企業の評価クアドラント(2021)

- 主な市場動向

第11章 企業プロファイル

- 主要企業

- VEOLIA WATER TECHNOLOGIES

- SUMITOMO HEAVY INDUSTRIES, LTD.

- SUEZ WATER TECHNOLOGIES & SOLUTIONS

- GEA GROUP AG

- SULZER LTD.

- TSUKISHIMA KIKAI CO., LTD.

- FIVES GROUP

- CONDORCHEM ENVITECH

- PIOVAN S.P.A

- ALAQUA INC.

- VOBIS LLC

- ANSSEN METALLURGY GROUP C0., LTD.

- EBNER GMBH & CO. KG

- MORETTO SPA

- MOTAN COLORTRONIC

- その他の企業

- TECHNOFORCE LLC

- FASA AB

- BOARDMAN LLC

- OMVE

- NU-VU CONAIR

- DEGA PLASTICS

- SHAANXI AEROSPACE POWER HI-TECH CO., LTD.

- DIAMAT MASCHINENBAU GMBH

- ZHANGJIAGANG YUREFON MACHINERY CO., LTD.

- WHITING EQUIPMENT CANADA, INC.

- ROSENBLAD DESIGN GROUP, INC.

第12章 付録

The industrial crystallizers market is projected to grow from USD 3.8 billion in 2022 to USD 4.8 billion by 2027, at a CAGR of 5.1% from 2022 to 2027. The global market for industrial crystallizers is driven by major factors such as increasing pharmaceutical spending and increasing demand of ZLD systems across various regions.

"By type, the forced circulation crystallizers segment is estimated to be the fastest-growing segment of industrial crystallizers market during 2022 to 2027"

Based on type, the forced circulation crystallizers is estimated to be the fastest growing segment during the forecast period. Forced circulation crystallizers are widely used in various end-use industries such as chemical, food & beverage and pharmaceutical, specially for fouling products. These type of crystallizers are easy to operate and ideal for continuous process

"The continuous segment in process is projected to register the highest CAGR during the forecast period."

Based on process, the continuous segment is projected to register the highest CAGR during the forecast period. Continuous process is more economical in operation and labour cost and has several advantages over batch process such as scale-up elimination. This type of crystallizers can generate high level of supersaturation which helps in development of crystals

"By end-use industry, the food & beverage segment is estimated to be the fastest-growing segment of industrial crystallizers market during 2022 to 2027"

Based on end-use industry, the food & beverage is estimated to be the fastest-growing segment during the forecast period. Food & beverage industry is one of the fastest growing industries and uses crystallizers in various food & beverage processing. Crystallizers are used for manufacturing of sugar, whey, ice creams and many other products.

The industrial crystallizers market in Asia Pacific region is projected to witness the highest CAGR during the forecast period."

Asia Pacific region is projected to register the highest CAGR in the industrial crystallizers market from 2022 to 2027. Asia Pacific is one of the key markets for industrial crystallizers. The region has high demand for the industrial crystallizers due to rising demand from various end use industries such as pharmaceutical, chemical and food & beverage.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 40%, Tier 2 - 20%, and Tier 3 - 40%

- By Designation: C-level Executives - 10%, Directors - 70%, and Others - 20%

- By Region: Asia Pacific - 40%, North America - 25%, Europe - 25%, South America-5%, and Middle East & Africa- 5%

The industrial crystallizers report is dominated by players, such as Veolia Water Technologies (France), Sumitomo Heavy Industries, Ltd. (Japan), Sulzer Ltd. (Switzerland), SUEZ Water Technologies & Solutions (France), GEA Group AG (Germany), Tsukishima Kikai Co., Ltd. (Japan), Condorchem Envitech (Spain), Piovan S.p.A. (Italy), Alaqua Inc. (US), Fives Group (France), Vobis LLC (US), Anssen Metallurgy Group Co., Ltd. (China), Ebner GmbH & Co. Kg (Germany), Moretto SPA (Italy) and Motan Colortronic (Germany)

Research Coverage:

The report defines, segments, and projects the size of the industrial crystallizers market based on type, process, end-use industry and region. It strategically profiles the key players and comprehensively analyses their market share and core competencies. It also tracks and analyses competitive developments, such as agreements, acquisitions, contracts and partnerships, undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them the closest approximations of revenue numbers of the industrial crystallizers market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- TABLE 1 INDUSTRIAL CRYSTALLIZERS MARKET: INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- FIGURE 1 INDUSTRIAL CRYSTALLIZERS MARKET SEGMENTATION

- 1.3.1 REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 RESEARCH LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 INDUSTRIAL CRYSTALLIZERS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Participating companies for primary research

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- FIGURE 5 MARKET SIZE ESTIMATION (SUPPLY SIDE): INDUSTRIAL CRYSTALLIZERS MARKET

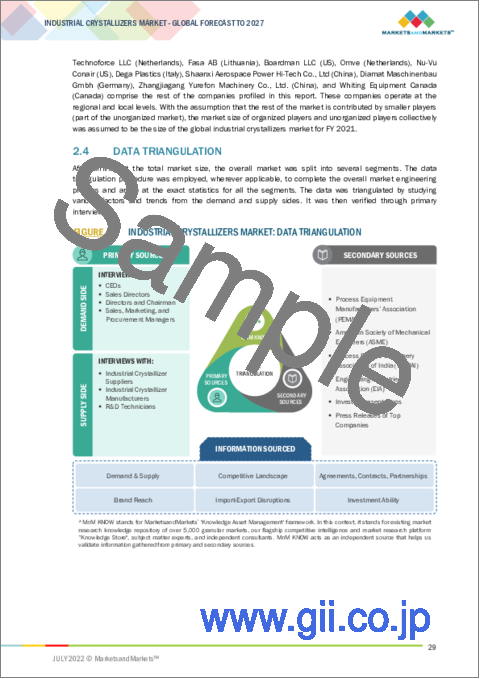

- 2.4 DATA TRIANGULATION

- FIGURE 6 INDUSTRIAL CRYSTALLIZERS MARKET: DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 2 INDUSTRIAL CRYSTALLIZERS MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 7 CONTINUOUS PROCESS ACCOUNTED FOR LARGER SHARE OF INDUSTRIAL CRYSTALLIZERS MARKET IN 2021

- FIGURE 8 FORCED CIRCULATION CRYSTALLIZERS ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 9 PHARMACEUTICAL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 10 ASIA PACIFIC MARKET TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES IN INDUSTRIAL CRYSTALLIZERS MARKET

- FIGURE 11 INDUSTRIAL CRYSTALLIZERS MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

- 4.2 INDUSTRIAL CRYSTALLIZERS MARKET, BY REGION

- FIGURE 12 ASIA PACIFIC TO GROW AT HIGHEST RATE BETWEEN 2022 AND 2027

- 4.3 ASIA PACIFIC INDUSTRIAL CRYSTALLIZERS MARKET, BY PROCESS AND COUNTRY

- FIGURE 13 CHINA TO LEAD ASIA PACIFIC INDUSTRIAL CRYSTALLIZERS MARKET

- 4.4 INDUSTRIAL CRYSTALLIZERS MARKET: MAJOR COUNTRIES

- FIGURE 14 CHINA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INDUSTRIAL CRYSTALLIZERS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in wastewater treatment and growth of food & beverage industry

- FIGURE 16 REVENUE GROWTH IN FOOD & BEVERAGE INDUSTRY, BY COUNTRY (2022)

- 5.2.1.2 Increasing adoption of ZLD in industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 High manufacturing and operational cost

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High demand from metal & mineral and agrochemical sectors in developing regions

- 5.2.4 CHALLENGES

- 5.2.4.1 Highly fragmented market

- 5.2.4.2 Supply chain disruption in global industrial crystallizers market

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INDUSTRIAL CRYSTALLIZERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS: HIGHEST VALUE ADDED DURING MANUFACTURING PHASE

- 5.5 ECOSYSTEM

- FIGURE 18 ECOSYSTEM MAP OF INDUSTRIAL CRYSTALLIZERS MARKET

- TABLE 4 INDUSTRIAL CRYSTALLIZERS MARKET: ECOSYSTEM

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- FIGURE 19 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR INDUSTRIAL CRYSTALLIZERS MARKET

- 5.7 PATENT ANALYSIS

- 5.7.1 INTRODUCTION

- 5.7.2 METHODOLOGY

- 5.7.3 DOCUMENT TYPE

- FIGURE 20 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 21 PUBLICATION TRENDS - LAST 10 YEARS

- 5.7.4 INSIGHTS

- FIGURE 22 LEGAL STATUS OF PATENTS

- 5.7.5 JURISDICTION ANALYSIS

- FIGURE 23 TOP JURISDICTION, BY DOCUMENT

- 5.7.6 TOP COMPANIES/APPLICANTS

- FIGURE 24 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- TABLE 5 LIST OF PATENTS BY CHINA PETROLEUM & CHEMICAL CORP.

- TABLE 6 LIST OF PATENTS BY INSTITUTE OF PROCESS ENGINEERING, CAS

- TABLE 7 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 DTB CRYSTALLIZER

- 5.8.2 VACUUM CRYSTALLIZER

- 5.8.3 FLUIDIZED BED CRYSTALLIZER

- 5.8.4 FORCED CIRCULATION CRYSTALLIZER

- 5.9 KEY CONFERENCES & EVENTS

- TABLE 8 INDUSTRIAL CRYSTALLIZERS MARKET: DETAILED LIST OF CONFERENCES & EVENTS (2022-2023)

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 STANDARDS FOR INDUSTRIAL CRYSTALLIZERS

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 OPTIMIZATION OF INDUSTRIAL CRYSTALLIZATION THROUGH SEMI-AUTOMATED CRYSTALLIZER

- 5.11.2 SUCCESSFUL COMMISSIONING OF CRYSTALLIZATION PLANT

6 INDUSTRIAL CRYSTALLIZERS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 25 INDUSTRIAL CRYSTALLIZERS MARKET, BY TYPE, 2022-2027(USD MILLION)

- TABLE 12 INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- 6.2 DTB CRYSTALLIZERS

- 6.2.1 DTB CRYSTALLIZERS USED TO PRODUCE LARGE SIZE CRYSTALS

- TABLE 13 DTB CRYSTALLIZERS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 6.3 FORCED CIRCULATION CRYSTALLIZERS

- 6.3.1 FORCED CIRCULATION CRYSTALLIZERS IDEAL FOR CONTINUOUS PROCESS

- TABLE 14 FORCED CIRCULATION CRYSTALLIZERS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 6.4 FLUIDIZED BED CRYSTALLIZERS

- 6.4.1 FLUIDIZED BED CRYSTALLIZERS USED FOR WASTEWATER TREATMENT

- TABLE 15 FLUIDIZED BED CRYSTALLIZERS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 6.5 OTHERS

- TABLE 16 OTHER CRYSTALLIZERS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

7 INDUSTRIAL CRYSTALLIZERS MARKET, BY PROCESS

- 7.1 INTRODUCTION

- FIGURE 26 INDUSTRIAL CRYSTALLIZERS MARKET, BY PROCESS, 2022-2027(USD MILLION)

- TABLE 17 INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019-2027 (USD MILLION)

- 7.2 CONTINUOUS

- 7.2.1 CONTINUOUS PROCESS MORE ECONOMICAL THAN BATCH PROCESS

- TABLE 18 INDUSTRIAL CRYSTALLIZERS MARKET SIZE FOR CONTINUOUS PROCESS, BY REGION, 2019-2027 (USD MILLION)

- 7.3 BATCH

- 7.3.1 BATCH PROCESS IDEAL FOR PROCESSING ENCRUSTATION SOLUTIONS

- TABLE 19 INDUSTRIAL CRYSTALLIZERS MARKET SIZE FOR BATCH PROCESS, BY REGION, 2019-2027 (USD MILLION)

8 INDUSTRIAL CRYSTALLIZERS MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 27 INDUSTRIAL CRYSTALLIZERS MARKET, BY END-USE INDUSTRY, 2022-2027(USD MILLION)

- TABLE 20 INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 8.2 PHARMACEUTICAL

- 8.2.1 CRYSTALLIZERS WIDELY USED FOR MANUFACTURING API IN PHARMACEUTICAL SECTOR

- TABLE 21 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2019-2027 (USD MILLION)

- 8.3 AGROCHEMICAL

- 8.3.1 CRYSTALLIZERS USED IN FERTILIZER MANUFACTURING IN AGROCHEMICAL INDUSTRY

- TABLE 22 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN AGROCHEMICAL, BY REGION, 2019-2027 (USD MILLION)

- 8.4 METAL & MINERAL

- 8.4.1 CRYSTALLIZERS USED FOR METAL SEPARATION

- TABLE 23 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN METAL & MINERAL, BY REGION, 2019-2027 (USD MILLION)

- 8.5 FOOD & BEVERAGE

- 8.5.1 ONE OF LEADING CONSUMERS OF INDUSTRIAL CRYSTALLIZERS

- TABLE 24 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2019-2027 (USD MILLION)

- 8.6 CHEMICAL

- 8.6.1 CRYSTALLIZERS USED TO PRODUCE SPECIALTY COMPOUNDS

- TABLE 25 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN CHEMICAL, BY REGION, 2019-2027 (USD MILLION)

- 8.7 WASTEWATER TREATMENT

- 8.7.1 CRYSTALLIZATION IS PROMISING TECHNIQUE FOR WASTEWATER TREATMENT

- TABLE 26 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN WASTEWATER TREATMENT, BY REGION, 2019-2027 (USD MILLION)

- 8.8 OTHERS

- TABLE 27 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019-2027 (USD MILLION)

9 INDUSTRIAL CRYSTALLIZERS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 28 REGIONAL SNAPSHOT: ASIA PACIFIC TO WITNESS HIGHEST GROWTH

- TABLE 28 INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY REGION, 2019-2027 (USD MILLION)

- 9.2 ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SNAPSHOT

- TABLE 29 ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 30 ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 31 ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019-2027 (USD MILLION)

- TABLE 32 ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.2.1 CHINA

- 9.2.1.1 Leading industrial crystallizers market in Asia Pacific

- TABLE 33 CHINA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 34 CHINA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.2.2 SOUTH KOREA

- 9.2.2.1 Growing industrial crystallizers demand in metal industry

- TABLE 35 SOUTH KOREA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 36 SOUTH KOREA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.2.3 JAPAN

- 9.2.3.1 Industrial crystallizers market to grow due to expansion of pharmaceutical sector

- TABLE 37 JAPAN: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 38 JAPAN: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.2.4 INDIA

- 9.2.4.1 Diverse manufacturing industries to create demand for industrial crystallizers

- TABLE 39 INDIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 40 INDIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.2.5 AUSTRALIA

- 9.2.5.1 Metal and food industries to create demand for industrial crystallizers

- TABLE 41 AUSTRALIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 42 AUSTRALIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.2.6 MALAYSIA

- 9.2.6.1 Innovation in specialty chemical industry to create growth opportunities

- TABLE 43 MALAYSIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 44 MALAYSIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.2.7 REST OF ASIA PACIFIC

- TABLE 45 REST OF ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 46 REST OF ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.3 NORTH AMERICA

- FIGURE 30 NORTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SNAPSHOT

- TABLE 47 NORTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 48 NORTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019-2027 (USD MILLION)

- TABLE 50 NORTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.3.1 US

- 9.3.1.1 Industrial crystallizers' demand to increase in pharmaceutical sector in US

- TABLE 51 US: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 52 US: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.3.2 CANADA

- 9.3.2.1 Food & beverage industry to fuel demand for industrial crystallizers

- TABLE 53 CANADA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 54 CANADA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.3.3 MEXICO

- 9.3.3.1 Industrial crystallizers market growth driven by metal industry

- TABLE 55 MEXICO: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 56 MEXICO: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.4 EUROPE

- FIGURE 31 EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SNAPSHOT

- TABLE 57 EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 58 EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 59 EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019-2027 (USD MILLION)

- TABLE 60 EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.4.1 GERMANY

- 9.4.1.1 Growing end-use industries to support market growth

- TABLE 61 GERMANY: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 62 GERMANY: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.4.2 UK

- 9.4.2.1 Rising demand for industrial crystallizers in UK's pharmaceutical sector

- TABLE 63 UK: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 64 UK: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.4.3 FRANCE

- 9.4.3.1 Metal industry to create demand for industrial crystallizers

- TABLE 65 FRANCE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 66 FRANCE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.4.4 ITALY

- 9.4.4.1 Food & beverage industry to drive market

- TABLE 67 ITALY: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 68 ITALY: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.4.5 RUSSIA

- 9.4.5.1 Demand for industrial crystallizers to increase in chemical industry

- TABLE 69 RUSSIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 70 RUSSIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.4.6 SPAIN

- 9.4.6.1 Growth in food & beverage sector to create opportunities

- TABLE 71 SPAIN: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 72 SPAIN: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.4.7 REST OF EUROPE

- TABLE 73 REST OF EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 74 REST OF EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.5 MIDDLE EAST & AFRICA

- TABLE 75 MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 76 MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 77 MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019-2027 (USD MILLION)

- TABLE 78 MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.5.1 SAUDI ARABIA

- 9.5.1.1 Growth in industrial sector to boost demand for industrial crystallizers

- TABLE 79 SAUDI ARABIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 80 SAUDI ARABIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.5.2 UAE

- 9.5.2.1 Metal and other end-use industries to drive market in UAE

- TABLE 81 UAE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 82 UAE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.5.3 SOUTH AFRICA

- 9.5.3.1 Growing industrial sectors to fuel industrial crystallizers market

- TABLE 83 SOUTH AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 84 SOUTH AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 85 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 86 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.6 SOUTH AMERICA

- TABLE 87 SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 88 SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 89 SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019-2027 (USD MILLION)

- TABLE 90 SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.6.1 ARGENTINA

- 9.6.1.1 Growing end-use industries to create demand in Argentina

- TABLE 91 ARGENTINA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 92 ARGENTINA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.6.2 BRAZIL

- 9.6.2.1 Industrial crystallizers market to increase in manufacturing sector

- TABLE 93 BRAZIL: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 94 BRAZIL: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

- 9.6.3 REST OF SOUTH AMERICA

- TABLE 95 REST OF SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019-2027 (USD MILLION)

- TABLE 96 REST OF SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES

- TABLE 97 OVERVIEW OF STRATEGIES ADOPTED BY INDUSTRIAL CRYSTALLIZER MANUFACTURERS

- 10.3 MARKET SHARE AND REVENUE ANALYSIS

- FIGURE 32 INDUSTRIAL CRYSTALLIZERS MARKET SHARE ANALYSIS

- 10.3.1 REVENUE ANALYSIS OF TOP PLAYERS IN INDUSTRIAL CRYSTALLIZERS MARKET

- FIGURE 33 TOP PLAYERS - REVENUE ANALYSIS (2016-2020)

- 10.4 COMPETITIVE BENCHMARKING

- 10.4.1 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN INDUSTRIAL CRYSTALLIZERS MARKET

- 10.4.2 BUSINESS STRATEGY EXCELLENCE

- FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN INDUSTRIAL CRYSTALLIZERS MARKET

- TABLE 98 COMPANY END-USE INDUSTRY FOOTPRINT, 2021

- TABLE 99 COMPANY PRODUCT TYPE FOOTPRINT, 2021

- TABLE 100 COMPANY PROCESS FOOTPRINT, 2021

- TABLE 101 COMPANY REGION FOOTPRINT, 2021

- TABLE 102 COMPANY OVERALL FOOTPRINT, 2021

- 10.5 COMPANY EVALUATION QUADRANT, 2021

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 36 INDUSTRIAL CRYSTALLIZERS MARKET: COMPETITIVE LANDSCAPE MAPPING

- 10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2021

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 37 INDUSTRIAL CRYSTALLIZERS MARKET (GLOBAL): SMES EVALUATION QUADRANT, 2021

- TABLE 103 INDUSTRIAL CRYSTALLIZERS: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 104 INDUSTRIAL CRYSTALLIZERS: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 105 INDUSTRIAL CRYSTALLIZERS: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.7 KEY MARKET DEVELOPMENTS

- TABLE 106 INDUSTRIAL CRYSTALLIZERS MARKET: DEALS, 2016-2022

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats) **

- 11.1.1 VEOLIA WATER TECHNOLOGIES

- TABLE 107 VEOLIA WATER TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 38 VEOLIA WATER TECHNOLOGIES: COMPANY SNAPSHOT

- 11.1.2 SUMITOMO HEAVY INDUSTRIES, LTD.

- TABLE 108 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- FIGURE 39 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- 11.1.3 SUEZ WATER TECHNOLOGIES & SOLUTIONS

- TABLE 109 SUEZ WATER TECHNOLOGIES & SOLUTIONS: COMPANY OVERVIEW

- FIGURE 40 SUEZ WATER TECHNOLOGIES & SOLUTIONS: COMPANY SNAPSHOT

- 11.1.4 GEA GROUP AG

- TABLE 110 GEA GROUP AG: COMPANY OVERVIEW

- FIGURE 41 GEA GROUP AG: COMPANY SNAPSHOT

- 11.1.5 SULZER LTD.

- TABLE 111 SULZER LTD.: COMPANY OVERVIEW

- FIGURE 42 SULZER LTD.: COMPANY SNAPSHOT

- 11.1.6 TSUKISHIMA KIKAI CO., LTD.

- TABLE 112 TSUKISHIMA KIKAI CO., LTD.: COMPANY OVERVIEW

- FIGURE 43 TSUKISHIMA KIKAI CO., LTD.: COMPANY SNAPSHOT

- 11.1.7 FIVES GROUP

- TABLE 113 FIVES GROUP: COMPANY OVERVIEW

- FIGURE 44 FIVES GROUP: COMPANY SNAPSHOT

- 11.1.8 CONDORCHEM ENVITECH

- TABLE 114 CONDORCHEM ENVITECH: COMPANY OVERVIEW

- 11.1.9 PIOVAN S.P.A

- TABLE 115 PIOVAN S.P.A.: COMPANY OVERVIEW

- 11.1.10 ALAQUA INC.

- TABLE 116 ALAQUA INC.: COMPANY OVERVIEW

- 11.1.11 VOBIS LLC

- TABLE 117 VOBIS LLC: COMPANY OVERVIEW

- 11.1.12 ANSSEN METALLURGY GROUP C0., LTD.

- TABLE 118 ANSSEN METALLURGY GROUP CO., LTD.: COMPANY OVERVIEW

- 11.1.13 EBNER GMBH & CO. KG

- TABLE 119 EBNER GMBH & CO. KG: COMPANY OVERVIEW

- 11.1.14 MORETTO SPA

- TABLE 120 MORETTO SPA: COMPANY OVERVIEW

- 11.1.15 MOTAN COLORTRONIC

- TABLE 121 MOTAN COLORTRONIC: COMPANY OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 TECHNOFORCE LLC

- TABLE 122 TECHNOFORCE LLC: COMPANY OVERVIEW

- 11.2.2 FASA AB

- TABLE 123 FASA AB: COMPANY OVERVIEW

- 11.2.3 BOARDMAN LLC

- TABLE 124 BOARDMAN LLC: COMPANY OVERVIEW

- 11.2.4 OMVE

- TABLE 125 OMVE: COMPANY OVERVIEW

- 11.2.5 NU-VU CONAIR

- TABLE 126 NU-VU CONAIR: COMPANY OVERVIEW

- 11.2.6 DEGA PLASTICS

- TABLE 127 DEGA PLASTICS: COMPANY OVERVIEW

- 11.2.7 SHAANXI AEROSPACE POWER HI-TECH CO., LTD.

- TABLE 128 SHAANXI AEROSPACE POWER HI-TECH CO., LTD.: COMPANY OVERVIEW

- 11.2.8 DIAMAT MASCHINENBAU GMBH

- TABLE 129 DIAMAT MASCHINENBAU GMBH: COMPANY OVERVIEW

- 11.2.9 ZHANGJIAGANG YUREFON MACHINERY CO., LTD.

- TABLE 130 ZHANGJIAGANG YUREFON MACHINERY CO., LTD.: COMPANY OVERVIEW

- 11.2.10 WHITING EQUIPMENT CANADA, INC.

- TABLE 131 WHITING EQUIPMENT CANADA, INC.: COMPANY OVERVIEW

- 11.2.11 ROSENBLAD DESIGN GROUP, INC.

- TABLE 132 ROSENBLAD DESIGN GROUP, INC.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS