|

|

市場調査レポート

商品コード

1118274

電子飛行計器システム (EFIS) の世界市場:用途別・プラットフォーム別 (ジェネラルアビエーション、民間航空、軍用航空)・サブシステム別 (ディスプレイシステム、処理システム、制御パネル)・設置段階別・地域別の将来予測 (2027年まで)Electronic Flight Instrument System (EFIS) Market by Application, Platform (General Aviation, Commercial Aviation, Military Aviation), Sub-System (Display Systems, Processing Systems, Control Panel), Fit and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 電子飛行計器システム (EFIS) の世界市場:用途別・プラットフォーム別 (ジェネラルアビエーション、民間航空、軍用航空)・サブシステム別 (ディスプレイシステム、処理システム、制御パネル)・設置段階別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年08月17日

発行: MarketsandMarkets

ページ情報: 英文 221 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

電子飛行計器システム (EFIS) の市場規模は、2022年の6億1,800万米ドルから、2027年には7億2,000万米ドルへと、2022年から2027年にかけて3.1%のCAGRで成長すると予測されています。

運航の安全性と燃料効率の向上、その結果として運航コストを最小限に抑えるための航空機近代化のニーズの高まりが、高度なEFISの採用を促進している要因となっています。

"飛行姿勢セグメントは、予測期間中、用途別で最大の市場シェアを独占する"

用途別では、予測期間中、飛行姿勢セグメントが市場シェアを独占すると予測されています。市場はさらに、ナビゲーション、情報管理、エンジンモニタリングに区分されます。飛行姿勢市場の主要な推進要因の1つは、航空機の動きを制御する高度なアビオニクス機器の統合です。

"民間航空セグメントが予測期間中に電子飛行計器システム (EFIS) 市場をリードする"

プラットフォーム別では、民間航空セグメントが予測期間中、EFIS市場をリードすると予測されています。世界的に航空旅客輸送量は過去10年間で増加し、その需要に応えるために航空会社は航空機の保有数を増やしており、民間航空分野の市場を牽引しています。

"2022年、ディスプレイシステムが最大シェアを占める"

サブシステムタイプ別では、ディスプレイシステム分野が予測期間中、EFIS市場をリードすると予測されています。高度なディスプレイシステムには膨大な需要があります。システム効率を向上させた先進的な航空機の需要が、サブシステムの市場を活性化させています。

"2022年、ラインフィットが最大シェアを占める"

設置段階別では、ラインフィット分野が予測期間中、EFIS市場をリードすると予測されます。これは、増え続ける乗客の需要に効率的に対応するため、より多くの航空機が納入され、航空会社が事業を拡大するためです。古い航空機にはEFISを後付けする機能がないため、ラインフィットの需要が高まっています。

"2022年、北米が最大シェアを占める見通し"

2022年には北米が最大の市場シェアを占め、ラテンアメリカは予測期間中に最も高いCAGRを記録すると予測されています。安全性の向上、より良い精度と状況認識、飛行制御の自動化を実現する軽量な電子飛行計器システムの需要が市場を牽引するものと思われます。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 顧客に影響を与える動向/混乱

- 価格分析

- 市場エコシステム

- バリューチェーン分析

- 技術分析

- ADS-B (放送型自動従属監視)

- 統合モジュール式アビオニクス

- ケーススタディ分析

- ポーターのファイブフォースモデル

- 主な利害関係者と購入基準

- 主な会議とイベント (2022年~2023年)

- 航空宇宙産業の規制状況

第6章 産業動向

- イントロダクション

- サプライチェーン分析

- 技術動向

- AHRS (姿勢方位基準装置)

- TCAS (空中衝突防止システム)

- TAWS (地形認識・警告システム)

- EVS (エンハンスドビジョンシステム)

- AFCS (自動飛行制御システム)

- メガトレンドの影響

- インダストリー4.0の実装

- 電子飛行計器システム製造のサプライチェーンの進歩

- 特許分析

第7章 電子飛行計器システム (EFIS) 市場:用途別

- イントロダクション

- 飛行姿勢

- ナビゲーション

- 情報管理

- エンジン監視

第8章 電子飛行計器システム (EFIS) 市場:プラットフォーム別

- イントロダクション

- 民間航空

- ナローボディ機

- ワイドボディ機

- リージョナルジェット機

- 軍用航空

- 戦闘機

- 軍用ヘリコプター

- 練習機

- 輸送機

- 特殊任務機

- ジェネラルアビエーション

- ビジネスジェット

- 商用ヘリコプター

- 軽飛行機

第9章 電子飛行計器システム (EFIS) 市場:サブシステム別

- イントロダクション

- ディスプレイシステム

- PFD (プライマリフライトディスプレイ)

- MFD (多機能ディスプレイ)

- ナビゲーション用ディスプレイ

- EICAS (エンジン計器・乗員警告システム)

- EFB (電子フライトバッグ)

- コントロールパネル

- 自動操縦装置

- 無線

- インプットセレクター

- 処理システム

- 航空データコンピューター

- フライトコントロールコンピューター

- ナビゲーションコンピュータ

第10章 電子飛行計器システム (EFIS) 市場:設置段階別

- イントロダクション

- ラインフィット (新造時設置)

- レトロフィット (改修時設置)

第11章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- イタリア

- ロシア

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- イスラエル

- 南アフリカ

- ナイジェリア

- 他の中東・アフリカ諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第12章 競合情勢

- イントロダクション

- 主要企業の市場シェア分析 (2021年)

- 上位5社のランキング分析 (2021年)

- 上位5社の収益分析 (2021年)

- 企業の製品フットプリント分析

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオ

- 市場評価フレームワーク

- 新製品の発売と開発

- 資本取引

- ベンチャー/契約/拡張

第13章 企業プロファイル

- イントロダクション

- 主要企業

- HONEYWELL INTERNATIONAL INC.

- RAYTHEON TECHNOLOGIES CORPORATION

- GENERAL ELECTRIC COMPANY

- THALES SA

- BAE SYSTEMS PLC

- L3HARRIS TECHNOLOGIES INC.

- ASTRONAUTICS CORPORATION OF AMERICA

- KORRY ELECTRONICS

- GARMIN LTD.

- CMC ELECTRONICS INC.

- MEGGITT PLC

- UNIVERSAL AVIONICS SYSTEMS CORPORATION

- AVIDYNE CORPORATION

- GENESYS AEROSYSTEMS GROUP INC.

- ASPEN AVIONICS INC.

- DYNON AVIONICS INC.

- TASKEM CORPORATION

- SUZHOU CHANGFENG INSTRUMENTS CO., LTD.

- LPP S.R.O.

- MGL AVIONICS

- その他の企業

- MOVING TERRAIN AG

- KANARDIA D.O.O.

- TALOS AVIONICS P.C.

- GRT AVIONICS

- AVMAP S.R.L.

第14章 付録

The electronic flight instrument system (EFIS) market size is projected to grow from USD 618 Million in 2022 to USD 720 Million by 2027, at a CAGR of 3.1% from 2022 to 2027.The growing need for aircraft modernization to improve operating safety and fuel efficiency, consequently minimizing the operational costs, is something that is propelling the adoption of advanced EFIS.

The Flight Attitude segment is projected to dominate market share in the application segment during the forecast period

Based on application, the flight attitude segment is projected to dominate market share during the forecast period. The market is further segmented into navigation, information management and engine monitoring. One of the key factors driving the flight attitude market is the integration of advanced avionics equipment that control the movement of the aircraft.

The Commercial Aviation segment projected to lead electronic flight instrument system (EFIS) market during forecast period

Based on Platform, the commercial aviation segment is projected to lead the electronic flight instrument system (EFIS) market during the forecast period. Globally the air passenger traffic footprint has increased over the last decade, to meet the demand the airline companies are expanding their aircraft fleet size, thus driving the market for commercial aviation segment.

Display Systems is expected to account for the largest share in 2022

Based on Sub-System type, the display systems segment is projected to lead the electronic flight instrument system (EFIS) market during the forecast period. This segment has been further segmented into display systems, processing systems and control panels. There is huge demand for advanced display system. The demand for advanced aircraft with improved system efficiency is fuelling the market for sub-systems.

Line-Fit is expected to account for the largest share in 2022

Based on Fit, the line-fit segment is projected to lead the electronic flight instrument system (EFIS) market during the forecast period. The demand is because there are more deliveries being made to efficiently handle the continuously increasing passenger demand encouraging airlines to expand their operations. Older aircraft lack the capability to retrofit EFIS equipment, which increases demand for line-fit segment.

North America is expected to account for the largest share in 2022

The electronic flight instrument system (EFIS) market industry has been studied for North America, Europe, Asia Pacific, Middle East& Africa, and Latin America. North America accounted for the largest market share in 2022, and Latin America is projected to witness the highest CAGR during the forecast period. The demand for lighter-weight electronic flight instrument system with enhanced safety, better accuracy and situational awareness and the automation of flight control to drive the market.

The break-up of profile of primary participants in the Electronic Flight Instrument System (EFIS) market:

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: C Level - 50%, Director Level - 25%, Others-25%

- By Region: North America -60%, Europe - 20%, AsiaPacific - 10%, Middle East - 5%, and Latin America - 5%

Major players operating in the electronic flight instrument system (EFIS)market are Honeywell Internationals Inc. (US), Raytheon Technologies Corporation (US),General Electric Company (US), Thales (France), BAE Systems PLC (UK), Astronautics Corporation of America (US), Garmin Limited (US), and L3Harris Technologies Inc. (US) are some of the market players.

Research Coverage:

The report segments the electronic flight instrument system (EFIS) market based on Platform, Application, Sub-System, Fit and Region. Based on Platform, the electronic flight instrument system (EFIS) market is segmented into commercial aviation, general aviation and military aviation. Based on Application, the market is segmented into navigation, flight attitude, engine monitoring, and information management. Based on sub-system, the market is segmented into display systems, control panels, and processing systems. Based on fit, the market is segmented into line-fit and retrofit The electronic flight instrument system (EFIS) market has been studied for North America, Europe, Asia Pacific, Middle East& Africa, and Latin America. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the electronic flight instrument system (EFIS) market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; Contracts, partnerships, agreements new product & service launches, mergers and acquisitions; and recent developments associated with the electronic flight instrument system (EFIS) market. Competitive analysis of upcoming startups in the electronic flight instrument system (EFIS) market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall electronic flight instrument system (EFIS)market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on electronic flight instrument system (EFIS) offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the electronic flight instrument system (EFIS) market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the electronic flight instrument system (EFIS) market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the electronic flight instrument system (EFIS) market

- Competitive Assessment: In-depth assessment of market shares, growth strategies andservice offerings of leading players in the electronic flight instrument system (EFIS) market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY AND PRICING

- TABLE 1 USD EXCHANGE RATES

- 1.5 INCLUSIONS AND EXCLUSIONS

- TABLE 2 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SEGMENT

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET: RESEARCH DESIGN

- 2.2 SECONDARY DATA

- 2.2.1 SECONDARY SOURCES

- 2.3 PRIMARY DATA

- 2.3.1 PRIMARY SOURCES

- 2.3.1.1 Key data from primary sources

- 2.3.2 BREAKDOWN OF PRIMARIES

- 2.3.2.1 Breakdown of primary interviews: By company type, designation, and region

- 2.3.1 PRIMARY SOURCES

- 2.4 DEMAND AND SUPPLY-SIDE ANALYSIS

- 2.4.1 INTRODUCTION

- 2.4.2 DEMAND-SIDE INDICATORS

- 2.4.2.1 Increasing demand for aftermarket services

- 2.4.3 SUPPLY-SIDE INDICATORS

- 2.4.3.1 Advancements in EFIS technologies

- 2.5 RESEARCH APPROACH & METHODOLOGY

- TABLE 3 SEGMENTS AND SUBSEGMENTS

- 2.6 MARKET SIZE ESTIMATION

- 2.6.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND-SIDE)

- 2.6.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY-SIDE)

- 2.7 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- 2.8 GROWTH RATE ASSUMPTIONS

- 2.9 ASSUMPTIONS

- FIGURE 6 PARAMETRIC ASSUMPTIONS MADE FOR MARKET FORECAST

- 2.10 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 7 BY APPLICATION, FLIGHT ATTITUDE SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 8 BY SUB-SYSTEM, PROCESSING SYSTEMS SEGMENT PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 9 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

- FIGURE 10 INCREASING DEMAND FOR ADVANCED LIGHTWEIGHT ELECTRONIC FLIGHT INSTRUMENT SYSTEMS TO DRIVE MARKET DURING FORECAST PERIOD

- 4.2 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM

- FIGURE 11 DISPLAY SYSTEMS SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION

- FIGURE 12 FLIGHT ATTITUDE SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- 4.4 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM

- FIGURE 13 COMMERCIAL AVIATION SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- 4.5 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT

- FIGURE 14 LINE-FIT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of sophisticated avionics with minimal weight profile

- 5.2.1.2 Enhanced safety and situational awareness offered by EFIS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent design regulations pertaining to EFIS

- 5.2.2.2 High installation cost due to ongoing technological disruption

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Planned fleet modernization programs

- 5.2.4 CHALLENGES

- 5.2.4.1 High system complexity requiring proper pilot training for optimum usage

- 5.2.4.2 Electronic failures

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ELECTRONIC FLIGHT INSTRUMENT SYSTEM MANUFACTURERS

- FIGURE 16 REVENUE SHIFT IN ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

- 5.4 PRICING ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE RANGE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET (BY SUBSYSTEM)

- 5.5 MARKET ECOSYSTEM

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- FIGURE 17 MARKET ECOSYSTEM MAP: ELECTRONIC FLIGHT INSTRUMENT SYSTEM

- TABLE 5 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET ECOSYSTEM

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 18 VALUE CHAIN ANALYSIS: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 AUTOMATIC DEPENDENT SURVEILLANCE-BROADCAST (ADS-B)

- 5.7.2 INTEGRATED MODULAR AVIONICS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 NEXT-GENERATION OPEN FLIGHT DECK

- 5.9 PORTER'S FIVE FORCES MODEL

- FIGURE 19 PORTER'S FIVE FORCES MODEL ANALYSIS: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

- TABLE 6 ELECTRONIC FLIGHT INSTRUMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ELECTRONIC FLIGHT INSTRUMENT SYSTEM TECHNOLOGIES

- TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF ELECTRONIC FLIGHT INSTRUMENT SYSTEM TECHNOLOGIES (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 21 KEY BUYING CRITERIA FOR ELECTRONIC FLIGHT INSTRUMENT SYSTEM TECHNOLOGIES

- TABLE 8 KEY BUYING CRITERIA FOR ELECTRONIC FLIGHT INSTRUMENT SYSTEM TECHNOLOGIES

- 5.11 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 9 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.12 TARIFF & REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 22 SUPPLY CHAIN ANALYSIS OF ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

- 6.3 TECHNOLOGY TRENDS

- 6.3.1 ATTITUDE HEADING REFERENCE SYSTEM (AHRS)

- 6.3.2 TRAFFIC ALERT AND COLLISION AVOIDANCE SYSTEM (TCAS)

- 6.3.3 TERRAIN AWARENESS AND WARNING SYSTEM (TAWS)

- 6.3.4 ENHANCED VISION SYSTEM (EVS)

- 6.3.5 AUTOMATIC FLIGHT CONTROL SYSTEM (AFCS)

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 IMPLEMENTATION OF INDUSTRY 4.0

- 6.4.2 ADVANCEMENTS IN SUPPLY CHAIN FOR ELECTRONIC FLIGHT INSTRUMENT SYSTEM MANUFACTURING

- 6.5 PATENT ANALYSIS

- TABLE 14 KEY PATENTS, 2018-2022

7 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 23 BY APPLICATION, FLIGHT ATTITUDE SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 15 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 16 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.2 FLIGHT ATTITUDE

- 7.3 NAVIGATION

- 7.4 INFORMATION MANAGEMENT

- 7.5 ENGINE MONITORING

8 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM

- 8.1 INTRODUCTION

- FIGURE 24 BY PLATFORM, COMMERCIAL AVIATION SEGMENT PROJECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 17 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 18 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 8.2 COMMERCIAL AVIATION

- FIGURE 25 NARROWBODY AIRCRAFT SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 19 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COMMERCIAL AVIATION PLATFORM, 2018-2021 (USD MILLION)

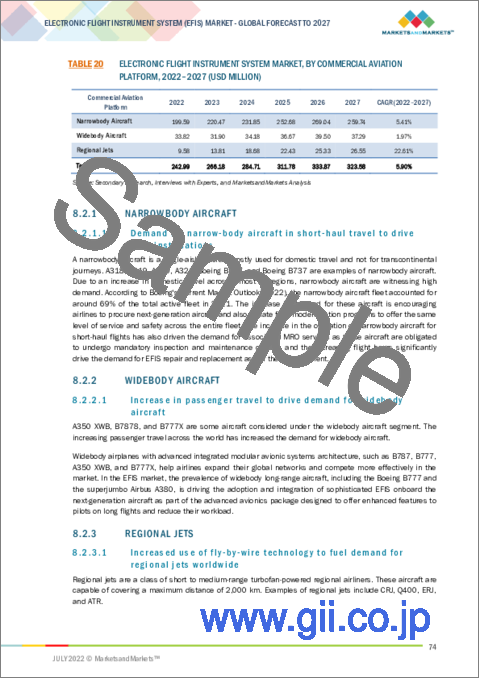

- TABLE 20 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COMMERCIAL AVIATION PLATFORM, 2022-2027 (USD MILLION)

- 8.2.1 NARROWBODY AIRCRAFT

- 8.2.1.1 Demand for narrow-body aircraft in short-haul travel to drive EFIS installations

- 8.2.2 WIDEBODY AIRCRAFT

- 8.2.2.1 Increase in passenger travel to drive demand for widebody aircraft

- 8.2.3 REGIONAL JETS

- 8.2.3.1 Increased use of fly-by-wire technology to fuel demand for regional jets worldwide

- 8.3 MILITARY AVIATION

- FIGURE 26 COMBAT AIRCRAFT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 21 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY MILITARY AVIATION PLATFORM, 2018-2021 (USD MILLION)

- TABLE 22 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY MILITARY AVIATION PLATFORM, 2022-2027 (USD MILLION)

- 8.3.1 COMBAT AIRCRAFT

- 8.3.1.1 Growing procurement of combat aircraft due to increasing geopolitical rift

- 8.3.2 MILITARY HELICOPTERS

- 8.3.2.1 Increasing use of helicopters in combat and search & rescue operations

- 8.3.3 TRAINING AIRCRAFT

- 8.3.3.1 Need for more pilots to drive demand for training aircraft

- 8.3.4 TRANSPORT AIRCRAFT

- 8.3.4.1 Increasing use of transport aircraft in military operations

- 8.3.5 SPECIAL MISSION AIRCRAFT

- 8.3.5.1 Evolving warfare techniques to drive demand

- 8.4 GENERAL AVIATION

- FIGURE 27 CIVIL HELICOPTERS SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 23 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY GENERAL AVIATION PLATFORM, 2018-2021 (USD MILLION)

- TABLE 24 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY GENERAL AVIATION PLATFORM, 2022-2027 (USD MILLION)

- 8.4.1 BUSINESS JETS

- 8.4.1.1 Growth of private aviation companies

- 8.4.2 COMMERCIAL HELICOPTERS

- 8.4.2.1 Increasing use in corporate and civil applications

- 8.4.3 LIGHT AIRCRAFT

- 8.4.3.1 Low cost of maintenance and operations to drive demand

9 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM

- 9.1 INTRODUCTION

- FIGURE 28 BY SUB-SYSTEM, DISPLAY SYSTEMS SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- TABLE 25 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 26 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 9.2 DISPLAY SYSTEMS

- TABLE 27 DISPLAY SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 28 DISPLAY SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 9.2.1 PRIMARY FLIGHT DISPLAY (PFD)

- 9.2.1.1 Rising system efficiency and increasing demand for advanced aircraft

- 9.2.2 MULTI-FUNCTION DISPLAY (MFD)

- 9.2.2.1 Enhanced product functionality due to technological innovations and advancements

- 9.2.3 NAVIGATION DISPLAY

- 9.2.3.1 Enhanced display systems with vertical flight profile addition

- 9.2.4 ENGINE INDICATING AND CREW ALERTING SYSTEM (EICAS)

- 9.2.4.1 Rising demand for lightweight and advanced components with various functionalities in modern aircraft

- 9.2.5 ELECTRONIC FLIGHT BAG (EFB)

- 9.2.5.1 Incorporation of EFB to reduce aircraft weight and real-time data sharing

- 9.2.6 CONTROL PANELS

- TABLE 29 CONTROL PANELS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 30 CONTROL PANELS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 9.2.7 AUTOPILOT

- 9.2.7.1 Digital revolution in aviation sector to accelerate demand for autopilot control systems

- 9.2.8 RADIO

- 9.2.8.1 Consolidation of multi radios into one advanced radio control unit to drive market

- 9.2.9 INPUT SELECTOR

- 9.2.9.1 Integration of input selectors with advanced multi-functional displays

- 9.3 PROCESSING SYSTEMS

- TABLE 31 PROCESSING SYSTEMS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 32 PROCESSING SYSTEMS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 9.3.1 AIR DATA COMPUTER

- 9.3.1.1 Integration of digital air data computers with modern aircraft

- 9.3.2 FLIGHT CONTROL COMPUTER

- 9.3.2.1 Increasing R&D activities to develop advanced flight control computers

- 9.3.3 NAVIGATION COMPUTER

- 9.3.3.1 Development of regional satellite navigation systems

10 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT

- 10.1 INTRODUCTION

- FIGURE 29 BY FIT, LINE-FIT SEGMENT PROJECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 33 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2018-2021 (USD MILLION)

- TABLE 34 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2022-2027 (USD MILLION)

- 10.2 LINE-FIT

- 10.2.1 INCREASING AIRCRAFT DEMAND TO DRIVE SEGMENT

- 10.3 RETROFIT

- 10.3.1 EVOLVING SAFETY REGULATIONS TO DRIVE FLEET MODERNIZATION

11 REGIONAL ANALYSIS

- 11.1 INTRODUCTION

- FIGURE 30 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- TABLE 35 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 31 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SNAPSHOT

- TABLE 37 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 38 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 39 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 40 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2018-2021 (USD MILLION)

- TABLE 42 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT 2022-2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 44 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY PLATFORM 2022-2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY COUNTRY 2018-2021 (USD MILLION)

- TABLE 46 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Increased spending by manufacturers on innovative technologies

- TABLE 47 US: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 48 US: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 49 US: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 50 US: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Increased focus on development of advanced avionics technologies for future aircraft

- TABLE 51 CANADA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 52 CANADA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 53 CANADA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 54 CANADA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS: EUROPE

- FIGURE 32 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SNAPSHOT

- TABLE 55 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 56 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 57 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 58 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- TABLE 59 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2018-2021 (USD MILLION)

- TABLE 60 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2022-2027 (USD MILLION)

- TABLE 61 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 62 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 63 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 64 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Expansion of commercial aircraft fleet by airlines to drive market

- TABLE 65 UK: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 66 UK: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 67 UK: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 68 UK: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Increased competition in airline industry to provide advanced and effective aircraft

- TABLE 69 FRANCE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 70 FRANCE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 71 FRANCE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 72 FRANCE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 Increased procurement of advanced military helicopters

- TABLE 73 GERMANY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 74 GERMANY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 75 GERMANY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 76 GERMANY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.3.5 ITALY

- 11.3.5.1 Growing developments in helicopter industry to drive market

- TABLE 77 ITALY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 78 ITALY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 79 ITALY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 80 ITALY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.3.6 RUSSIA

- 11.3.6.1 Upgrading of existing aircraft fleet in commercial sector

- TABLE 81 RUSSIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 82 RUSSIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 83 RUSSIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 84 RUSSIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.3.7 REST OF EUROPE

- 11.3.7.1 Growing air passenger traffic to drive market

- TABLE 85 REST OF EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 86 REST OF EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 87 REST OF EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 88 REST OF EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SNAPSHOT

- TABLE 89 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 90 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 92 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2018-2021 (USD MILLION)

- TABLE 94 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT 2022-2027 (USD MILLION)

- TABLE 95 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 96 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM 2022-2027 (USD MILLION)

- TABLE 97 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY 2018-2021 (USD MILLION)

- TABLE 98 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Rise in demand for private jets and chartered aircraft

- TABLE 99 CHINA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 100 CHINA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 101 CHINA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 102 CHINA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Improving domestic connectivity under UDAAN scheme

- TABLE 103 INDIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 104 INDIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 105 INDIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 106 INDIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Growing demand for efficient & advanced aircraft equipment

- TABLE 107 JAPAN: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 108 JAPAN: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 109 JAPAN: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 110 JAPAN: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.4.5 AUSTRALIA

- 11.4.5.1 Procurement of different types of aircraft to drive market

- TABLE 111 AUSTRALIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 112 AUSTRALIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 113 AUSTRALIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 114 AUSTRALIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Increased investments in existing aircraft fleet modernization

- TABLE 115 SOUTH KOREA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 116 SOUTH KOREA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 117 SOUTH KOREA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 118 SOUTH KOREA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.4.7 REST OF ASIA PACIFIC

- 11.4.7.1 Rise in R&D of aircraft avionics & electronic systems

- TABLE 119 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.5 MIDDLE EAST AND AFRICA

- 11.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

- FIGURE 34 MIDDLE EAST & AFRICA: ELECTRONIC FLIGHT INSTRUMENT MARKET SNAPSHOT

- TABLE 123 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 124 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 125 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 126 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- TABLE 127 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY FIT, 2018-2021 (USD MILLION)

- TABLE 128 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY FIT 2022-2027 (USD MILLION)

- TABLE 129 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 130 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY PLATFORM 2022-2027 (USD MILLION)

- TABLE 131 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY COUNTRY 2018-2021 (USD MILLION)

- TABLE 132 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.5.2 SAUDI ARABIA

- 11.5.2.1 Modernization of existing defense aircraft and helicopter fleet

- TABLE 133 SAUDI ARABIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 134 SAUDI ARABIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 135 SAUDI ARABIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 136 SAUDI ARABIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.5.3 UAE

- 11.5.3.1 Increasing demand for private planes to drive market

- TABLE 137 UAE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 138 UAE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 139 UAE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 140 UAE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.5.4 ISRAEL

- 11.5.4.1 Advancement of air force aircraft fleet with modern electronic systems

- TABLE 141 ISRAEL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 142 ISRAEL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 143 ISRAEL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 144 ISRAEL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Increased demand for business jets and aircraft for commercial purposes

- TABLE 145 SOUTH AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 146 SOUTH AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 147 SOUTH AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 148 SOUTH AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.5.6 NIGERIA

- 11.5.6.1 Upgrading of electromechanical systems with electronically operated aircraft systems

- TABLE 149 NIGERIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 150 NIGERIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 151 NIGERIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 152 NIGERIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.5.7 REST OF MIDDLE EAST & AFRICA

- 11.5.7.1 Increasing demand for advanced aircraft to cater to growing tourism sector

- TABLE 153 REST OF MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 154 REST OF MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 155 REST OF MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 PESTLE ANALYSIS: LATIN AMERICA

- FIGURE 35 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SNAPSHOT

- TABLE 157 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 158 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 159 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM) MARKET SIZE, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 160 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- TABLE 161 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2018-2021 (USD MILLION)

- TABLE 162 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2022-2027 (USD MILLION)

- TABLE 163 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 164 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- TABLE 165 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 166 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.6.2 BRAZIL

- 11.6.2.1 Increasing demand for aircraft to meet tourism needs

- TABLE 167 BRAZIL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 168 BRAZIL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 169 BRAZIL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 170 BRAZIL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.6.3 MEXICO

- 11.6.3.1 Rising demand for commercial aircraft in domestic airline industry

- TABLE 171 MEXICO: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 172 MEXICO: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 173 MEXICO: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 174 MEXICO: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

- 11.6.4 REST OF LATIN AMERICA

- 11.6.4.1 Ongoing upgrades of existing aircraft fleet with modern avionics & electronics

- TABLE 175 REST OF LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 176 REST OF LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 177 REST OF LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018-2021 (USD MILLION)

- TABLE 178 REST OF LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- TABLE 179 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET: DEGREE OF COMPETITION

- FIGURE 36 SHARE OF TOP PLAYERS IN ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, 2021

- TABLE 180 KEY DEVELOPMENTS BY LEADING PLAYERS IN ELECTRONIC FLIGHT INSTRUMENT SYSTEM (EFIS) MARKET, 2016-2022

- 12.3 TOP FIVE PLAYERS RANKING ANALYSIS, 2021

- FIGURE 37 MARKET RANKING OF LEADING PLAYERS IN ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, 2021

- 12.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2021

- 12.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 181 COMPANY PRODUCT FOOTPRINT

- TABLE 182 COMPANY SOLUTION TYPE FOOTPRINT

- TABLE 183 COMPANY REGION FOOTPRINT

- 12.6 COMPANY EVALUATION QUADRANT

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 38 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- 12.7 START-UP/SME EVALUATION QUADRANT

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 STARTING BLOCKS

- 12.7.4 DYNAMIC COMPANIES

- TABLE 184 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET: DETAILED LIST OF KEY START-UPS/SMES

- FIGURE 39 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET (START-UPS) COMPETITIVE LEADERSHIP MAPPING, 2021

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 MARKET EVALUATION FRAMEWORK

- 12.8.2 NEW PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 185 NEW PRODUCT LAUNCHES AND DEVELOPMENTS, 2020-2022

- 12.8.3 DEALS

- TABLE 186 CONTRACTS, 2020-2022

- 12.8.4 VENTURES/AGREEMENTS/EXPANSIONS

- TABLE 187 ACQUISITIONS/PARTNERSHIPS/JOINT VENTURES/AGREEMENTS/ EXPANSIONS, 2016-2022

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 13.2.1 HONEYWELL INTERNATIONAL INC.

- TABLE 188 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- FIGURE 40 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 189 HONEYWELL INTERNATIONAL INC.: DEALS

- 13.2.2 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 190 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 41 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 191 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 192 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- 13.2.3 GENERAL ELECTRIC COMPANY

- TABLE 193 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

- FIGURE 42 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- TABLE 194 GENERAL ELECTRIC COMPANY: DEALS

- 13.2.4 THALES SA

- TABLE 195 THALES SA: BUSINESS OVERVIEW

- FIGURE 43 THALES SA: COMPANY SNAPSHOT

- TABLE 196 THALES SA: PRODUCT DEVELOPMENTS

- TABLE 197 THALES SA: DEALS

- 13.2.5 BAE SYSTEMS PLC

- TABLE 198 BAE SYSTEMS PLC: BUSINESS OVERVIEW

- FIGURE 44 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- TABLE 199 BAE SYSTEMS PLC: PRODUCT DEVELOPMENTS

- TABLE 200 BAE SYSTEMS PLC: DEALS

- 13.2.6 L3HARRIS TECHNOLOGIES INC.

- TABLE 201 L3HARRIS TECHNOLOGIES INC.: BUSINESS OVERVIEW

- FIGURE 45 L3HARRIS TECHNOLOGIES INC.: COMPANY SNAPSHOT

- TABLE 202 L3HARRIS TECHNOLOGIES INC.: DEALS

- 13.2.7 ASTRONAUTICS CORPORATION OF AMERICA

- TABLE 203 ASTRONAUTICS CORPORATION OF AMERICA: BUSINESS OVERVIEW

- TABLE 204 ASTRONAUTICS CORPORATION OF AMERICA: DEALS

- 13.2.8 KORRY ELECTRONICS

- TABLE 205 KORRY ELECTRONICS: BUSINESS OVERVIEW

- 13.2.9 GARMIN LTD.

- TABLE 206 GARMIN LTD.: BUSINESS OVERVIEW

- FIGURE 46 GARMIN LTD.: COMPANY SNAPSHOT

- TABLE 207 GARMIN LTD.: PRODUCT LAUNCHES

- TABLE 208 GARMIN LTD.: DEALS

- 13.2.10 CMC ELECTRONICS INC.

- TABLE 209 CMC ELECTRONICS INC.: BUSINESS OVERVIEW

- TABLE 210 CMC ELECTRONICS INC: DEALS

- 13.2.11 MEGGITT PLC

- TABLE 211 MEGGITT PLC: BUSINESS OVERVIEW

- FIGURE 47 MEGGITT PLC: COMPANY SNAPSHOT

- TABLE 212 MEGGITT PLC.: DEALS

- 13.2.12 UNIVERSAL AVIONICS SYSTEMS CORPORATION

- TABLE 213 UNIVERSAL AVIONICS SYSTEMS CORPORATION: BUSINESS OVERVIEW

- TABLE 214 UNIVERSAL AVIONICS SYSTEMS CORPORATION: DEALS

- 13.2.13 AVIDYNE CORPORATION

- TABLE 215 AVIDYNE CORPORATION: BUSINESS OVERVIEW

- 13.2.14 GENESYS AEROSYSTEMS GROUP INC.

- TABLE 216 GENESYS AEROSYSTEMS GROUP INC.: BUSINESS OVERVIEW

- TABLE 217 GENESYS AEROSYSTEMS GROUP INC.: DEALS

- 13.2.15 ASPEN AVIONICS INC.

- TABLE 218 ASPEN AVIONICS INC.: BUSINESS OVERVIEW

- 13.2.16 DYNON AVIONICS INC.

- TABLE 219 DYNON AVIONICS INC.: BUSINESS OVERVIEW

- 13.2.17 TASKEM CORPORATION

- TABLE 220 TASKEM CORPORATION: BUSINESS OVERVIEW

- 13.2.18 SUZHOU CHANGFENG INSTRUMENTS CO., LTD.

- TABLE 221 SUZHOU CHANGFENG INSTRUMENTS CO., LTD.: BUSINESS OVERVIEW

- 13.2.19 LPP S.R.O.

- TABLE 222 LPP S.R.O.: BUSINESS OVERVIEW

- 13.2.20 MGL AVIONICS

- TABLE 223 MGL AVIONICS: BUSINESS OVERVIEW

- 13.3 OTHER PLAYERS

- 13.3.1 MOVING TERRAIN AG

- TABLE 224 MOVING TERRAIN AG: COMPANY OVERVIEW

- 13.3.2 KANARDIA D.O.O.

- TABLE 225 KANARDIA D.O.O.: COMPANY OVERVIEW

- 13.3.3 TALOS AVIONICS P.C.

- TABLE 226 TALOS AVIONICS P.C.: COMPANY OVERVIEW

- 13.3.4 GRT AVIONICS

- TABLE 227 GRT AVIONICS: COMPANY OVERVIEW

- 13.3.5 AVMAP S.R.L.

- TABLE 228 AVMAP S.R.L.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths/Right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS