|

|

市場調査レポート

商品コード

1111041

ガラス繊維糸の世界市場:繊維の種類別 (Eガラス型、Sガラス型)・糸の種類別 (単糸、合撚糸)・用途別 (PCB、ファサード、大理石・モザイクタイル、構造部品)・最終用途産業別・地域別の将来予測 (2027年まで)Glass Fiber Yarn Market by Fiber Type (E-glass type, S-glass type), Yarn Type (Single Yarn, Piled yarn), Application (PCB, Facade, Marble & Mosaic Tiles, Structural parts), End-use Industry and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ガラス繊維糸の世界市場:繊維の種類別 (Eガラス型、Sガラス型)・糸の種類別 (単糸、合撚糸)・用途別 (PCB、ファサード、大理石・モザイクタイル、構造部品)・最終用途産業別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年08月05日

発行: MarketsandMarkets

ページ情報: 英文 214 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

ガラス繊維糸の世界市場は、2022年に25億米ドルと推定され、2022年から2027年の間に6.5%のCAGRで成長し、2027年までに35億米ドルに達すると予測されています。

"Eガラス型が金額ベースで最大の市場"

2021年の市場全体では、Eガラス繊維型が金額ベースで55.3%のシェアを獲得し、市場を牽引しています。Eガラス繊維は電気絶縁性に優れているため、情報・電子産業の基材として適しています。Eガラス繊維糸の主な用途は、パソコンおよび周辺機器、LEDテレビ、通信、基地局サーボ装置、デジタル機器、自動車パネルなどです。Sガラス繊維のセグメントは、予測期間中に最も高いCAGRを記録すると予想されます。

"PCB (プリント基板) はガラス繊維糸の用途の中で、金額ベースで最も成長している"

アジア太平洋のPCB分野におけるガラス繊維糸市場は、金額ベースで、予測期間中に7.1%のCAGRを記録すると予測されています。北米の同セグメント市場は、CAGR5%を記録すると予測されています。小型化という長期的な傾向と、商業製品および消費者製品における電子機器の使用の増加が、電子機器分野におけるガラス繊維糸市場の成長を促進するでしょう。予測期間中は、中国がアジア太平洋地域の電子機器市場を独占すると予想され、消費者意識の高まりと急速な工業化により、インドがかなりの成長率を記録するものと思われます。

"風力発電は、ガラス繊維糸の最終用途産業として、金額ベースで最も急成長している"

風力タービンブレードは、風力発電システムの重要な構成要素です。ガラス繊維糸は、高い引張強度などの優れた特性を備えているため、風力タービンブレードの製造に使用されています。また、ガラス繊維は耐腐食性に優れているため、悪環境下でも有効に機能します。また、ブレード以外にも、風力発電機の発電機室やナセル、ドームなどにも使用されています。風力発電分野におけるガラス繊維糸の市場は、予測期間中にCAGR7.6%で成長すると予想されます。

"アジア太平洋地域のガラス繊維糸市場:中国が最速で成長"

中国は、2021年のアジア太平洋のガラス繊維糸市場の56% (金額ベース) を占めています。世界的には、多数の電子チップ製造企業の存在、自動車需要の増加、近年の風力タービン設置の増加などにより、ガラス繊維糸の主要な生産国・消費国の1つとなっています。

電気・電子産業は、2021年に金額ベースで27.08%を占める国内最大のガラス繊維糸の消費者です。風力エネルギー産業は、同国で最も急速に成長している分野です。風力エネルギー分野の高成長は、再生可能エネルギー資源への注目が高まっていることに起因しています。また、自動車・運輸分野の市場は、予測期間中に8.1%の高いCAGRを記録し、2027年には1億9,558万米ドルの市場規模に達すると予測されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 産業動向

- エコシステム:ガラス繊維糸市場

- バリューチェーン分析

- 原材料

- メーカー

- サプライチェーン分析

- COVID-19の影響

- COVID-19の自動車・輸送機械産業への影響

- COVID-19の造船・航空宇宙産業への影響

- ガラス繊維糸市場:楽観的、悲観的、現実的なシナリオ

- 価格分析

- 平均販売価格

- 主要な輸出国・輸入国の市場

- 日本

- 中国

- 韓国

- 米国

- インド

- 特許分析

- 技術分析

- ケーススタディ分析

- 関税と規制

- 顧客に影響を与える傾向と混乱

第6章 ガラス繊維糸市場:ガラス繊維の種類別

- イントロダクション

- Eガラス繊維

- Sガラス繊維

- その他

第7章 ガラス繊維糸市場:糸の種類別

- イントロダクション

- 単糸

- 合撚糸

- その他

第8章 ガラス繊維糸市場:用途別

- イントロダクション

- PCB (プリント基板)

- ファサード

- 大理石・モザイクタイル

- 構造部品

- その他

第9章 ガラス繊維糸市場:最終用途産業別

- イントロダクション

- 電気・電子機器

- 自動車・輸送機械

- 風力発電

- 建築・建設

- 造船

- その他の最終用途産業

第10章 ガラス繊維糸市場:地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 市場シェア分析

- 市場ランキング

- 市場評価フレームワーク

- 主要企業の収益分析

- 企業評価マトリックス

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 企業評価クアドラント (主要企業)

- スタートアップ/中小企業の競合ベンチマーキング

- 中小企業の評価マトリックス

- スタートアップ/中小企業の評価マトリックス

第12章 企業プロファイル

- 主要企業

- OWENS CORNING

- CHINA JUSHI CO., LTD.

- CHONGQING POLYCOMP INTERNATIONAL CORPORATION

- PFG FIBER GLASS CORPORATION

- NIPPON ELECTRIC GLASS CO., LTD.

- SAINT-GOBAIN S.A.

- TAISHAN FIBERGLASS INC.

- AGY HOLDINGCORP.

- TAIWAN GLASS INDUSTRY CORPORATION

- FULLTECH FIBER GLASS CORP.

- その他の企業

- CHINA BEIHAI FIBERGLASS CO., LTD.

- PPG INDUSTRIES, INC.

- NITTO BOSEKI CO., LTD.

- JIANGSU JIUDING NEW MATERIAL CO., LTD.

- NEWTEX INDUSTRIES, INC.

- SHREE LAXMI UDYOG

- HEBEI YUNIU FIBERGLASS MANUFACTURING CO., LTD.

- CHANGSHU DONGYU INSULATED COMPOUND MATERIALS CO., LTD.

- PARABEAM BV

- VALMIERAS STIKLA SIEDRA

第13章 付録

The global glass fiber yarn market is estimated to be USD 2.5 Billion in 2022 and is projected to reach USD 3.5 Billion by 2027, at a CAGR of 6.5% between 2022 and 2027.

Glass fiber yarns are woven on air-jet looms or rapier looms to manufacture printed circuit boards (PCBs) for radios, television units, mobile phones, personal computers, servers, and digital cameras. They are made from natural or synthetic fibers and are also used to develop industrial cloth and materials. Other applications of yarns include the development of reinforced cloth for construction and grinding wheel discs.

"E-glass type is the largest market in glass fiber type of glass fiber yarn, in terms of value."

The E-glass fiber segment led the overall market with a market share of 55.3%, in terms of value, in 2021. Due to the outstanding electric insulation properties of E-glass fiber, it is suitable as the base material in the information and electronic industries. The main applications of E-glass fiber yarn include personal computers and peripheral equipment, LED TVs, telecommunications, base station servo devices, digital equipment, and automobile panels, among others. The S-glass fiber segment is expected to register the highest CAGR during the forecast period.

"PCB is the fastest-growing application of glass fiber yarn, in terms of value."

A printed circuit board, or PCB, is a type of circuit board that is used to mechanically support and electrically connect electronic components by etching conductive pathways, tracks, or signal traces from copper sheets laminated onto a non-conductive substrate. In terms of value, the glass fiber yarn market in the PCB segment in Asia Pacific is projected to register a CAGR of 7.1% during the forecast period. The market for this segment in North America is projected to witness a CAGR of 5%.

The high growth of the market for this segment in Asia Pacific is attributed to the rising expenditure on personal electronics and other electronic appliances in Asian countries. The long-term trend of miniaturization and increased use of electronics in commercial and consumer products will fuel the growth of the glass fiber yarn market in the electronics sector. China is expected to dominate the Asia Pacific electronics market during the forecast period, while India is expected to register a substantial growth rate due to increasing consumer awareness and rapid industrialization.

"Wind energy is the fastest-growing end-use industry of glass fiber yarn, in terms of value."

Wind turbine blades are critical components of wind power generation systems. Glass fiber yarn is used in the manufacturing of wind turbine blades as it offers exceptional properties, such as high tensile strength. Wind turbine blades made of glass fiber can function effectively even under adverse environmental conditions, owing to the corrosion-resistance properties of glass fiber. In addition to turbine blades, glass fiber yarn is used in generator rooms, nacelles, and domes of wind turbine generator systems. The market of glass fiber yarn in wind energy sector is expected to grow with a CAGR of 7.6% during the forecast period.

"China is the fastest-growing Glass Fiber Yarn market in Asia Pacific region."

China accounted for 56% of the Asia Pacific glass fiber yarn market, in terms of value, in 2021. Globally, it is one of the leading manufacturers and consumers of glass fiber yarn, owing to the presence of a large number of electronic chips manufacturing companies, increasing demand for automobiles, and growing wind turbine installations in recent years.

The electrical & electronics industry is the largest consumer of glass fiber yarn in the country, accounting for 27.08% , in terms of value, in 2021. The wind energy industry is the fastest-growing segment in the country. The high growth in the wind energy sector is attributed to the increasing focus on renewable energy resources. The market in the automotive & transportation segment is also projected to register a high CAGR of 8.1% during the forecast period and reach a market size of USD 195.58 million by 2027.

This study has been validated through primary interviews conducted with various industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 37%, Tier 2- 33%, and Tier 3- 30%

- By Designation- C Level- 50%, Director Level- 20%, and Others- 30%

- By Region- North America- 15%, Europe- 50%, Asia Pacific (APAC) - 20%, Latin America-5%, Middle East & Africa (MEA)-10%,

The report provides a comprehensive analysis of company profiles stated below:

Owens Corning (US), China Jushi Group Ltd (China), Chongqing Polycomp International Corporation (China), Saint-Gobain S.A (France), Nippon Electric Glass Co. Ltd (Japan), AGY Holdings Corp. (US), China Beihai Fiberglass Co. Ltd. (China), Taiwan Glass Industry Corp. (Taiwan)

Research Coverage

This report covers the global glass fiber yarn market and forecasts the market size until 2026. The report includes the market segmentation - Glass Fiber Type (E-glass fiber, S-glass fiber and Other), Yarn Type( Single Yarn, Piled yarn, and others), Application (PCB, Facade, Marble & Mosaic Tiles, Structural parts and others), End-use Industry (Wind Energy, Automotive & Transportation, Building & Construction, Marine, , Electrical & Electronics, and Others) and Region (Europe, North America, APAC, South America, and MEA). Porter's Five Forces analysis, along with the drivers, restraints, opportunities, and challenges, are discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global glass fiber yarn market.

Key benefits of buying the report:

The report will help market leaders/new entrants in this market in the following ways:

1. This report segments the global glass fiber yarn market comprehensively and provides the closest approximations of the revenues for the overall market and the sub-segments across different verticals and regions.

2. The report helps stakeholders understand the pulse of the glass fiber yarnmarket and provides them with information on key market drivers, restraints, challenges, and opportunities.

3. This report will help stakeholders to understand competitors better and gain more insights to better their position in their businesses. The competitive landscape section includes the competitor ecosystem, new product development, agreement, and acquisitions.

Reasons to buy the report:

The report will help market leaders/new entrants in this market by providing them with the closest approximations of the revenues for the overall glass fiber yarn market and the sub-segments. This report will help stakeholders to understand the competitive landscape and gain more insights and position their businesses and market strategies in a better way. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 GLASS FIBER YARN MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 GLASS FIBER YARN MARKET: RESEARCH DESIGN

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 MARKET SIZE ESTIMATION

- 2.2.2 MARKET SIZE CALCULATION, BY END-USE INDUSTRY

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SECONDARY DATA

- 2.3.1.1 Key data from secondary sources

- 2.3.2 PRIMARY DATA

- 2.3.2.1 Key data from primary sources

- 2.3.2.2 Primary interviews - Top glass fiber yarn manufacturers

- 2.3.2.3 Breakdown of primary interviews

- 2.3.2.4 Key industry insights

- 2.3.1 SECONDARY DATA

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 2 GLASS FIBER YARN MARKET: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 3 GLASS FIBER YARN MARKET: TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 4 GLASS FIBER YARN MARKET: DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 ASSUMPTIONS

- 2.8 MARKET GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.9 LIMITATIONS

- 2.10 RISKS ASSOCIATED WITH GLASS FIBER YARN MARKET

3 EXECUTIVE SUMMARY

- FIGURE 5 E-GLASS FIBER SEGMENT LED OVERALL GLASS FIBER YARN MARKET IN 2021

- FIGURE 6 OTHERS SEGMENT ACCOUNTED FOR MAJOR SHARE OF OVERALL GLASS FIBER YARN MARKET

- FIGURE 7 PCB IS LARGEST APPLICATION OF GLASS FIBER YARN MARKET

- FIGURE 8 ELECTRICAL & ELECTRONICS SEGMENT LED GLASS FIBER YARN MARKET IN 2021

- FIGURE 9 CHINA PROJECTED TO LEAD GLASS FIBER MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC LED GLOBAL GLASS FIBER YARN MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN GLASS FIBER YARN MARKET

- FIGURE 11 RISING DEMAND FOR CONSUMER ELECTRONICS AND LIGHTWEIGHT VEHICLES TO DRIVE GLASS FIBER YARN MARKET

- 4.2 GLASS FIBER YARN MARKET, BY GLASS FIBER TYPE

- FIGURE 12 E-GLASS FIBER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- 4.3 GLASS FIBER YARN MARKET, BY YARN TYPE

- FIGURE 13 OTHERS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- 4.4 GLASS FIBER YARN MARKET, BY APPLICATION

- FIGURE 14 PCB WAS LARGEST APPLICATION IN 2021

- 4.5 GLASS FIBER YARN MARKET, BY END-USE INDUSTRY

- FIGURE 15 ELECTRICAL & ELECTRONICS WAS LARGEST END-USE INDUSTRY IN 2021

- 4.6 GLASS FIBER YARN MARKET, BY KEY COUNTRIES

- FIGURE 16 MARKET IN INDIA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GLASS FIBER YARN MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing consumption of glass fiber yarn in automotive and marine applications

- 5.2.1.2 Extensive use of glass fiber yarn in construction industry

- 5.2.1.3 Increasing demand for PCBs made of glass fiber fabrics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Issues associated with glass fiber yarn recycling

- 5.2.2.2 High production cost of glass fiber yarn

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for power generation from renewable sources

- 5.2.3.2 Increasing demand for glass fiber yarn in Middle East & Africa for construction and infrastructure

- 5.2.3.3 Increasing demand from wind energy sector in US

- 5.2.4 CHALLENGES

- 5.2.4.1 Capital-intensive production and complex manufacturing process of glass fiber yarn

- 5.3 INDUSTRY TRENDS

- 5.3.1 PORTER'S FIVE FORCE ANALYSIS

- FIGURE 18 GLASS FIBER YARN MARKET: PORTER'S FIVE FORCE ANALYSIS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 BARGAINING POWER OF BUYERS

- 5.3.6 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 1 GLASS FIBER YARN MARKET: PORTER'S FIVE FORCE ANALYSIS

- 5.4 ECOSYSTEM: GLASS FIBER YARN MARKET

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 19 GLASS FIBER YARN MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIALS

- 5.5.2 MANUFACTURERS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 IMPACT OF COVID-19

- 5.7.1 IMPACT OF COVID-19 ON AUTOMOTIVE AND TRANSPORTATION INDUSTRIES

- 5.7.2 IMPACT OF COVID-19 ON MARINE AND AEROSPACE INDUSTRIES

- 5.8 GLASS FIBER YARN MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

- TABLE 2 GLASS FIBER YARN MARKET: CAGR (BY VALUE) IN OPTIMISTIC, PESSIMISTIC AND REALISTIC SCENARIOS

- 5.8.1 OPTIMISTIC SCENARIO

- 5.8.2 PESSIMISTIC SCENARIO

- 5.8.3 REALISTIC SCENARIO

- 5.9 PRICING ANALYSIS

- 5.10 AVERAGE SELLING PRICE

- TABLE 3 GLASS FIBER YARN: AVERAGE SELLING PRICE

- TABLE 4 AVERAGE SELLING PRICES OF KEY PLAYERS (USD/KG), BY END-USE INDUSTRY

- 5.11 KEY MARKETS FOR IMPORT/EXPORT

- 5.11.1 JAPAN

- 5.11.2 CHINA

- 5.11.3 SOUTH KOREA

- 5.11.4 US

- 5.11.5 INDIA

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 METHODOLOGY

- 5.12.3 DOCUMENT TYPE

- TABLE 5 GLASS FIBER YARN MARKET: GLOBAL PATENTS

- FIGURE 20 GLOBAL PATENT PUBLICATION TREND ANALYSIS: 2011-2021

- 5.12.4 INSIGHTS

- 5.12.5 LEGAL STATUS OF PATENTS

- FIGURE 21 GLASS FIBER YARN MARKET: LEGAL STATUS OF PATENTS

- 5.12.6 JURISDICTION ANALYSIS

- FIGURE 22 GLOBAL JURISDICTION ANALYSIS

- 5.12.7 TOP APPLICANT'S ANALYSIS

- FIGURE 23 SCOTT & FYFE LTD HAS HIGHEST NUMBER OF PATENTS

- 5.12.8 LIST OF PATENTS

- 5.13 TECHNOLOGY ANALYSIS

- 5.14 CASE STUDY ANALYSIS

- 5.15 TARIFFS AND REGULATIONS

- TABLE 6 CURRENT CODES FOR GLASS FIBER YARN MARKET

- 5.16 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

6 GLASS FIBER YARN MARKET, BY GLASS FIBER TYPE

- 6.1 INTRODUCTION

- FIGURE 24 E-GLASS FIBER TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- TABLE 7 GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (USD MILLION)

- TABLE 8 GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (KILOTON)

- 6.2 E-GLASS FIBER

- 6.2.1 E-GLASS FIBERS WIDELY USED IN TEXTILE INDUSTRY

- FIGURE 25 ASIA PACIFIC TO BE LEADING MARKET FOR E-GLASS FIBER YARN

- 6.2.2 E-GLASS FIBER: GLASS FIBER YARN MARKET, BY REGION

- TABLE 9 E-GLASS FIBER: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 10 E-GLASS FIBER: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 11 E-GLASS PRODUCT SPECIFICATIONS AND ITS APPLICATION

- 6.3 S-GLASS FIBER

- 6.3.1 S-GLASS FIBER USED IN HIGH-PERFORMANCE APPLICATIONS

- FIGURE 26 ASIA PACIFIC DOMINATES MARKET FOR S-GLASS FIBER SEGMENT

- 6.3.2 S-GLASS FIBER: GLASS FIBER YARN MARKET, BY REGION

- TABLE 12 S-GLASS FIBER: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 13 S-GLASS FIBER: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 14 S-GLASS PRODUCT SPECIFICATION AND ITS APPLICATION

- 6.4 OTHERS

- 6.4.1 OTHER GLASS FIBER TYPES: GLASS FIBER YARN MARKET, BY REGION

- TABLE 15 OTHER GLASS FIBER TYPES: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

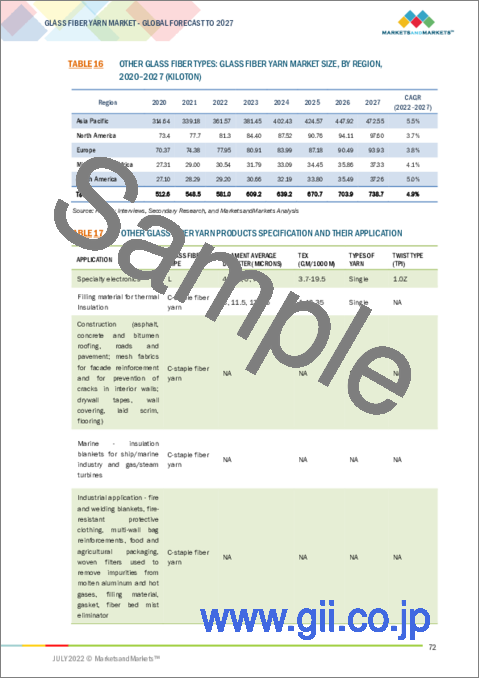

- TABLE 16 OTHER GLASS FIBER TYPES: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 17 OTHER GLASS FIBER YARN PRODUCTS SPECIFICATION AND THEIR APPLICATION

7 GLASS FIBER YARN MARKET, BY YARN TYPE

- 7.1 INTRODUCTION

- FIGURE 27 PLIED YARN SEGMENT PROJECTED TO WITNESS HIGHEST CAGR

- TABLE 18 GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (USD MILLION)

- TABLE 19 GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (KILOTON)

- 7.2 SINGLE

- 7.2.1 RISING DEMAND FOR LIGHTWEIGHT PRODUCTS IN VARIOUS INDUSTRIES

- FIGURE 28 ASIA PACIFIC TO BE LARGEST MARKET FOR SINGLE YARN SEGMENT

- 7.2.2 SINGLE: GLASS FIBER YARN MARKET, BY REGION

- TABLE 20 SINGLE: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027(USD MILLION)

- TABLE 21 SINGLE: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 7.3 PLIED

- 7.3.1 PLIED GLASS FIBER YARN USED FOR HIGH-STRENGTH APPLICATION

- FIGURE 29 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR PLIED YARN SEGMENT

- 7.3.2 PLIED: GLASS FIBER YARN MARKET, BY REGION

- TABLE 22 PLIED: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 23 PLIED: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 7.4 OTHERS

- FIGURE 30 ASIA PACIFIC TO BE LARGEST MARKET IN OTHERS SEGMENT

- 7.4.1 OTHERS: GLASS FIBER YARN MARKET, BY REGION

- TABLE 24 OTHERS: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 25 OTHERS: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

8 GLASS FIBER YARN MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 31 PCB TO LEAD GLASS FIBER YARN MARKET DURING FORECAST PERIOD

- TABLE 26 GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 27 GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 8.2 PCB

- 8.2.1 RISING DEMAND FOR CONSUMER ELECTRONICS FUELING MARKET IN PCB APPLICATION

- FIGURE 32 ASIA PACIFIC TO BE LARGEST MARKET IN PCB APPLICATION

- 8.2.2 PCB: GLASS FIBER YARN MARKET, BY REGION

- TABLE 28 PCB: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 29 PCB: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 30 PRODUCT SPECIFICATION FOR PCB APPLICATION

- 8.3 FACADE

- 8.3.1 GLASS FIBER YARN USED FOR EXTERNAL INSULATION OF BUILDINGS

- FIGURE 33 ASIA PACIFIC TO LEAD MARKET IN FACADE APPLICATION

- 8.3.2 FACADE: GLASS FIBER YARN MARKET, BY REGION

- TABLE 31 FACADE: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 32 FACADE: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 33 PRODUCT SPECIFICATION FOR FACADE APPLICATION

- 8.4 MARBLE & MOSAIC TILES

- 8.4.1 AVAILABILITY IN VARIOUS STYLES AND COLORS

- FIGURE 34 ASIA PACIFIC TO BE LARGEST MARKET IN MARBLE & MOSAIC TILES APPLICATION

- 8.4.2 MARBLE & MOSAIC TILES: GLASS FIBER YARN MARKET, BY REGION

- TABLE 34 MARBLE & MOSAIC TILES: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 35 MARBLE & MOSAIC TILES: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- 8.5 STRUCTURAL PARTS

- 8.5.1 DEMAND FOR LIGHTWEIGHT VEHICLES DRIVING USAGE OF GLASS FIBER YARNS IN AUTOMOTIVE STRUCTURAL PARTS

- FIGURE 35 ASIA PACIFIC TO BE LARGEST MARKET IN STRUCTURAL PARTS APPLICATION

- 8.5.2 STRUCTURAL PARTS: GLASS FIBER YARN MARKET, BY REGION

- TABLE 36 STRUCTURAL PARTS: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 37 STRUCTURAL PARTS: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 38 PRODUCT SPECIFICATION FOR STRUCTURAL PARTS

- 8.6 OTHERS

- 8.6.1 OTHER APPLICATIONS: GLASS FIBER YARN MARKET, BY REGION

- TABLE 39 OTHER APPLICATIONS: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 40 OTHER APPLICATIONS: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 41 PRODUCT SPECIFICATION FOR OTHER APPLICATIONS

9 GLASS FIBER YARN MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 36 ELECTRICAL & ELECTRONICS SEGMENT TO LEAD GLASS FIBER YARN MARKET DURING FORECAST PERIOD

- TABLE 42 GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 43 GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 9.2 ELECTRICAL & ELECTRONICS

- 9.2.1 GLASS FIBER YARN USED IN ELECTRONICS DUE TO HIGH THERMAL RESISTANCE AND ELECTRICAL CONDUCTIVITY

- FIGURE 37 ASIA PACIFIC TO BE LARGEST MARKET IN ELECTRICAL & ELECTRONICS SEGMENT

- 9.2.2 ELECTRICAL & ELECTRONICS: GLASS FIBER YARN MARKET, BY REGION

- TABLE 44 ELECTRICAL & ELECTRONICS: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 45 ELECTRICAL & ELECTRONICS: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 46 SPECIFICATION OF GLASS FIBER YARN PRODUCTS USED IN ELECTRICAL & ELECTRONICS

- 9.3 AUTOMOTIVE & TRANSPORTATION

- 9.3.1 WEIGHT REDUCTION AND INCREASED PROCESSING SPEED ENCOURAGE GLASS FIBER YARN ADOPTION

- FIGURE 38 ASIA PACIFIC TO BE LARGEST MARKET IN AUTOMOTIVE & TRANSPORTATION

- 9.3.2 AUTOMOTIVE & TRANSPORTATION: GLASS FIBER YARN MARKET, BY REGION

- TABLE 47 AUTOMOTIVE & TRANSPORTATION: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 48 AUTOMOTIVE & TRANSPORTATION: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 49 SPECIFICATION OF GLASS FIBER YARN PRODUCTS USED IN AUTOMOTIVE & TRANSPORTATION

- 9.4 WIND ENERGY

- 9.4.1 HIGH TENSILE STRENGTH OF GLASS FIBER YARN FUELING DEMAND IN WIND TURBINE BLADES MANUFACTURING

- FIGURE 39 ASIA PACIFIC TO BE LARGEST MARKET IN WIND ENERGY SEGMENT

- 9.4.2 WIND ENERGY: GLASS FIBER YARN MARKET, BY REGION

- TABLE 50 WIND ENERGY: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 51 WIND ENERGY: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 52 SPECIFICATION OF GLASS FIBER YARN PRODUCTS USED IN WIND ENERGY

- 9.5 BUILDING & CONSTRUCTION

- 9.5.1 WEIGHT, TENSILE STRENGTH, AND STRENGTH-TO-WEIGHT RATIO OF GLASS FIBER YARN IDEAL FOR THIS SEGMENT

- FIGURE 40 ASIA PACIFIC DOMINATES GLASS FIBER YARN MARKET IN BUILDING & CONSTRUCTION

- 9.5.2 BUILDING & CONSTRUCTION: GLASS FIBER YARN MARKET, BY REGION

- TABLE 53 BUILDING & CONSTRUCTION: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 54 BUILDING & CONSTRUCTION: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 55 SPECIFICATION OF GLASS FIBER YARN PRODUCTS USED FOR BUILDING & CONSTRUCTION

- 9.6 MARINE

- 9.6.1 GROWING MARINE INDUSTRY TO BOOST MARKET

- FIGURE 41 ASIA PACIFIC TO BE LARGEST MARKET IN MARINE SEGMENT

- 9.6.2 MARINE: GLASS FIBER YARN MARKET, BY REGION

- TABLE 56 MARINE: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 57 MARINE: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 58 SPECIFICATION OF GLASS FIBER YARN PRODUCTS USED IN MARINE

- 9.7 OTHER END-USE INDUSTRIES

- 9.7.1 HIGH QUALITY, LIGHTWEIGHT, AND CORROSION RESISTANCE PROPERTIES MAKE GLASS FIBER YARN IDEAL FOR THIS SEGMENT

- 9.7.2 OTHER END-USE INDUSTRIES: GLASS FIBER YARN MARKET, BY REGION

- TABLE 59 OTHER END-USE INDUSTRIES: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 60 OTHER END-USE INDUSTRIES: GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (KILOTON)

- TABLE 61 SPECIFICATION OF GLASS FIBER YARN PRODUCTS USED IN OTHER INDUSTRIES

10 GLASS FIBER YARN MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 42 INDIA TO BE FASTEST-GROWING GLASS FIBER YARN MARKET DURING FORECAST PERIOD

- TABLE 62 GLASS FIBER YARN MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 63 GLASS FIBER YARN MARKET, BY REGION, 2020-2027 (KILOTON)

- 10.2 NORTH AMERICA

- FIGURE 43 NORTH AMERICA: GLASS FIBER YARN MARKET SNAPSHOT

- 10.2.1 GLASS FIBER YARN MARKET IN NORTH AMERICA, BY YARN TYPE

- TABLE 64 NORTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (KILOTON)

- 10.2.2 GLASS FIBER YARN MARKET IN NORTH AMERICA, BY GLASS FIBER TYPE

- TABLE 66 NORTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (KILOTON)

- 10.2.3 GLASS FIBER YARN MARKET IN NORTH AMERICA, BY APPLICATION

- TABLE 68 NORTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 69 NORTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.2.4 GLASS FIBER YARN MARKET IN NORTH AMERICA, BY END-USE INDUSTRY

- TABLE 70 NORTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.2.5 GLASS FIBER YARN MARKET IN NORTH AMERICA, BY COUNTRY

- TABLE 72 NORTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- 10.2.5.1 US

- 10.2.5.1.1 Increasing demand for automobiles to fuel glass fiber yarn demand

- 10.2.5.1 US

- TABLE 74 US: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 75 US: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.2.5.2 Canada

- 10.2.5.2.1 Demand in aerospace industry driving glass fiber yarn market in Canada

- 10.2.5.2 Canada

- TABLE 76 CANADA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 77 CANADA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.2.5.3 Mexico

- 10.2.5.3.1 Growth in energy infrastructure driving glass fiber yarn market

- 10.2.5.3 Mexico

- TABLE 78 MEXICO: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 79 MEXICO: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3 EUROPE

- FIGURE 44 EUROPE: GLASS FIBER YARN MARKET SNAPSHOT

- 10.3.1 GLASS FIBER YARN MARKET IN EUROPE, BY YARN TYPE

- TABLE 80 EUROPE: GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (USD MILLION)

- TABLE 81 EUROPE: GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (KILOTON)

- 10.3.2 GLASS FIBER YARN MARKET IN EUROPE, BY GLASS FIBER TYPE

- TABLE 82 EUROPE: GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (USD MILLION)

- TABLE 83 EUROPE: GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (KILOTON)

- 10.3.3 GLASS FIBER YARN MARKET IN EUROPE, BY APPLICATION

- TABLE 84 EUROPE: GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 85 EUROPE: GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.3.4 GLASS FIBER YARN MARKET IN EUROPE, BY END-USE INDUSTRY

- TABLE 86 EUROPE: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 87 EUROPE: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.5 GLASS FIBER YARN MARKET IN EUROPE, BY COUNTRY

- TABLE 88 EUROPE: GLASS FIBER YARN MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 89 EUROPE: GLASS FIBER YARN MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- 10.3.5.1 Germany

- 10.3.5.1.1 Increasing demand in automotive applications to drive consumption of glass fiber yarn

- 10.3.5.1 Germany

- TABLE 90 GERMANY: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 91 GERMANY: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.5.2 France

- 10.3.5.2.1 France witnessing increasing consumption of glass fiber yarn in construction industry

- 10.3.5.2 France

- TABLE 92 FRANCE: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 93 FRANCE: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.5.3 UK

- 10.3.5.3.1 Improvement in economy fueling glass fiber yarn market

- 10.3.5.3 UK

- TABLE 94 UK: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 95 UK: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.5.4 Italy

- 10.3.5.4.1 Increasing consumption in building & construction industry driving glass fiber yarn market

- 10.3.5.4 Italy

- TABLE 96 ITALY: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 97 ITALY: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.5.5 Russia

- 10.3.5.5.1 Government initiatives toward composite consumption fueling glass fiber yarn market

- 10.3.5.5 Russia

- TABLE 98 RUSSIA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 99 RUSSIA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.5.6 Spain

- 10.3.5.6.1 Growth in wind energy sector impacting glass fiber yarn market positively

- 10.3.5.6 Spain

- TABLE 100 SPAIN: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 101 SPAIN: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.5.7 Turkey

- 10.3.5.7.1 Advancements in automotive technology to boost glass fiber yarn market

- 10.3.5.7 Turkey

- TABLE 102 TURKEY: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 103 TURKEY: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.3.5.8 Rest of Europe

- 10.3.5.8.1 Cost of raw material and labor to impact growth of glass fiber yarn market

- 10.3.5.8 Rest of Europe

- TABLE 104 REST OF EUROPE: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 105 REST OF EUROPE: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.4 ASIA PACIFIC

- FIGURE 45 ASIA PACIFIC: GLASS FIBER YARN MARKET SNAPSHOT

- 10.4.1 GLASS FIBER YARN MARKET IN ASIA PACIFIC, BY YARN TYPE

- TABLE 106 ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (KILOTON)

- 10.4.2 GLASS FIBER YARN MARKET IN ASIA PACIFIC, BY GLASS FIBER TYPE

- TABLE 108 ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (KILOTON)

- 10.4.3 GLASS FIBER YARN MARKET IN ASIA PACIFIC, BY APPLICATION

- TABLE 110 ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.4.4 GLASS FIBER YARN MARKET IN ASIA PACIFIC, BY END-USE INDUSTRY

- TABLE 112 ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.4.5 GLASS FIBER YARN MARKET IN ASIA PACIFIC, BY COUNTRY

- TABLE 114 ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 115 ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- 10.4.5.1 China

- 10.4.5.1.1 Increasing wind turbine installation to boost consumption of glass fiber yarn

- 10.4.5.1 China

- TABLE 116 CHINA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 117 CHINA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.4.5.2 Japan

- 10.4.5.2.1 Increasing installation of offshore wind farms boosts consumption of glass fiber yarn

- 10.4.5.2 Japan

- TABLE 118 JAPAN: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 119 JAPAN: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.4.5.3 India

- 10.4.5.3.1 Improvement in economy fueling glass fiber yarn market

- 10.4.5.3 India

- TABLE 120 INDIA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 121 INDIA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.4.5.4 South Korea

- 10.4.5.4.1 Growing demand for wind turbines to boost glass fiber yarn market

- 10.4.5.4 South Korea

- TABLE 122 SOUTH KOREA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 123 SOUTH KOREA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.4.5.5 Rest of Asia Pacific

- 10.4.5.5.1 Cost of raw material and labor to impact growth of glass fiber yarn market

- 10.4.5.5 Rest of Asia Pacific

- TABLE 124 REST OF ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GLASS FIBER YARN MARKET IN MIDDLE EAST & AFRICA, BY YARN TYPE

- TABLE 126 MIDDLE EAST & AFRICA; GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (KILOTON)

- 10.5.2 GLASS FIBER YARN MARKET IN MIDDLE EAST & AFRICA, BY GLASS FIBER TYPE

- TABLE 128 MIDDLE EAST & AFRICA: GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (KILOTON)

- 10.5.3 GLASS FIBER YARN MARKET IN MIDDLE EAST & AFRICA, BY END-USE INDUSTRY

- TABLE 130 MIDDLE EAST & AFRICA; GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.5.4 GLASS FIBER YARN MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION

- TABLE 132 MIDDLE EAST & AFRICA: GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.5.5 GLASS FIBER YARN MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY

- TABLE 134 MIDDLE EAST & AFRICA: GLASS FIBER YARN MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: GLASS FIBER YARN MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- 10.5.5.1 Saudi Arabia

- 10.5.5.1.1 Increasing demand in automotive applications to fuel glass fiber yarn consumption

- 10.5.5.1 Saudi Arabia

- TABLE 136 SAUDI ARABIA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 137 SAUDI ARABIA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.5.5.2 UAE

- 10.5.5.2.1 Growth in tourism investments fueling glass fiber yarn market

- 10.5.5.2 UAE

- TABLE 138 UAE: GLASS FIBER YARN MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 139 UAE: GLASS FIBER YARN MARKET, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.5.5.3 South Africa

- 10.5.5.3.1 Improvement in purchase power of people driving market

- 10.5.5.3 South Africa

- TABLE 140 SOUTH AFRICA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 141 SOUTH AFRICA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.5.5.4 Rest of Middle East & Africa

- TABLE 142 REST OF MIDDLE EAST & AFRICA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 143 REST OF MIDDLE EAST & AFRICA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.6 SOUTH AMERICA

- 10.6.1 GLASS FIBER YARN MARKET IN SOUTH AMERICA, BY YARN TYPE

- TABLE 144 SOUTH AMERICA; GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (USD MILLION)

- TABLE 145 SOUTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY YARN TYPE, 2020-2027 (KILOTON)

- 10.6.2 GLASS FIBER YARN MARKET IN SOUTH AMERICA, BY GLASS FIBER TYPE

- TABLE 146 SOUTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (USD MILLION)

- TABLE 147 SOUTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY GLASS FIBER TYPE, 2020-2027 (KILOTON)

- 10.6.3 GLASS FIBER YARN MARKET IN SOUTH AMERICA, BY END-USE INDUSTRY

- TABLE 148 SOUTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 149 SOUTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.6.4 GLASS FIBER YARN MARKET IN SOUTH AMERICA, BY APPLICATION

- TABLE 150 SOUTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 151 SOUTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY APPLICATION, 2020-2027 (KILOTON)

- 10.6.5 GLASS FIBER YARN MARKET IN SOUTH AMERICA, BY COUNTRY

- TABLE 152 SOUTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 153 SOUTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY COUNTRY, 2020-2027 (KILOTON)

- 10.6.5.1 Brazil

- 10.6.5.1.1 Growth in automotive industry to fuel glass fiber yarn demand

- 10.6.5.1 Brazil

- TABLE 154 BRAZIL: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 155 BRAZIL: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.6.5.2 Argentina

- 10.6.5.2.1 Growth in investments in wind energy to boost glass fiber yarn market

- 10.6.5.2 Argentina

- TABLE 156 ARGENTINA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 157 ARGENTINA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

- 10.6.5.3 Rest of South America

- 10.6.5.3.1 Growth in energy infrastructure fueling glass fiber yarn market

- 10.6.5.3 Rest of South America

- TABLE 158 REST OF SOUTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 159 REST OF SOUTH AMERICA: GLASS FIBER YARN MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- FIGURE 46 SHARE OF TOP COMPANIES IN GLASS FIBER YARN MARKET

- TABLE 160 DEGREE OF COMPETITION: GLASS FIBER YARN MARKET

- 11.3 MARKET RANKING

- FIGURE 47 RANKING OF TOP FIVE PLAYERS IN GLASS FIBER YARN MARKET

- 11.4 MARKET EVALUATION FRAMEWORK

- TABLE 161 GLASS FIBER YARN MARKET: DEALS, 2018-2022

- TABLE 162 GLASS FIBER YARN MARKET: OTHERS, 2018-2022

- TABLE 163 GLASS FIBER YARN MARKET: NEW PRODUCT DEVELOPMENT, 2018-2022

- 11.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- 11.6 COMPANY EVALUATION MATRIX

- TABLE 164 COMPANY PRODUCT FOOTPRINT

- TABLE 165 COMPANY GLASS FIBER TYPE FOOTPRINT

- TABLE 166 COMPANY APPLICATION FOOTPRINT

- TABLE 167 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 168 COMPANY REGION FOOTPRINT

- 11.6.1 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 48 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN GLASS FIBER YARN MARKET

- 11.6.2 BUSINESS STRATEGY EXCELLENCE

- FIGURE 49 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN GLASS FIBER YARN MARKET

- 11.7 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 11.7.1 STARS

- 11.7.2 PERVASIVE PLAYERS

- 11.7.3 PARTICIPANTS

- 11.7.4 EMERGING LEADERS

- FIGURE 50 GLASS FIBER YARN MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

- 11.8 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 169 GLASS FIBER YARN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 170 GLASS FIBER YARN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.9 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 11.10 START-UPS/ SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 11.10.1 PROGRESSIVE COMPANIES

- 11.10.2 RESPONSIVE COMPANIES

- 11.10.3 DYNAMIC COMPANIES

- 11.10.4 STARTING BLOCKS

- FIGURE 51 GLASS FIBER YARN MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

12 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 12.1 MAJOR PLAYERS

- 12.1.1 OWENS CORNING

- TABLE 171 OWENS CORNING: COMPANY OVERVIEW

- FIGURE 52 OWENS CORNING: COMPANY SNAPSHOT

- 12.1.2 CHINA JUSHI CO., LTD.

- TABLE 172 CHINA JUSHI CO., LTD.: COMPANY OVERVIEW

- 12.1.3 CHONGQING POLYCOMP INTERNATIONAL CORPORATION

- TABLE 173 CHONGQING POLYCOMP INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- 12.1.4 PFG FIBER GLASS CORPORATION

- TABLE 174 PFG FIBER GLASS CORPORATION: COMPANY OVERVIEW

- 12.1.5 NIPPON ELECTRIC GLASS CO., LTD.

- TABLE 175 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY OVERVIEW

- FIGURE 53 NIPPON ELECTRIC GLASS CO., LTD.: COMPANY SNAPSHOT

- 12.1.6 SAINT-GOBAIN S.A.

- TABLE 176 SAINT-GOBAIN S.A.: COMPANY OVERVIEW

- FIGURE 54 SAINT-GOBAIN S.A.: COMPANY SNAPSHOT

- 12.1.7 TAISHAN FIBERGLASS INC.

- TABLE 177 TAISHAN FIBERGLASS INC.: COMPANY OVERVIEW

- 12.1.8 AGY HOLDINGCORP.

- TABLE 178 AGY HOLDING CORP.: COMPANY OVERVIEW

- 12.1.9 TAIWAN GLASS INDUSTRY CORPORATION

- TABLE 179 TAIWAN GLASS INDUSTRY CORPORATION: COMPANY OVERVIEW

- FIGURE 55 TAIWAN GLASS INDUSTRY CORPORATION: COMPANY SNAPSHOT

- 12.1.10 FULLTECH FIBER GLASS CORP.

- TABLE 180 FULLTECH FIBER GLASS CORP.: COMPANY OVERVIEW

- FIGURE 56 FULLTECH FIBER GLASS CORP.: COMPANY SNAPSHOT

- 12.2 OTHER COMPANIES

- 12.2.1 CHINA BEIHAI FIBERGLASS CO., LTD.

- 12.2.2 PPG INDUSTRIES, INC.

- 12.2.3 NITTO BOSEKI CO., LTD.

- 12.2.4 JIANGSU JIUDING NEW MATERIAL CO., LTD.

- 12.2.5 NEWTEX INDUSTRIES, INC.

- 12.2.6 SHREE LAXMI UDYOG

- 12.2.7 HEBEI YUNIU FIBERGLASS MANUFACTURING CO., LTD.

- 12.2.8 CHANGSHU DONGYU INSULATED COMPOUND MATERIALS CO., LTD.

- 12.2.9 PARABEAM BV

- 12.2.10 VALMIERAS STIKLA SIEDRA

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS