|

|

市場調査レポート

商品コード

1109071

医療機器再生処理の世界市場:タイプ(再生処理医療機器)、機器カテゴリ(クリティカルデバイス、セミクリティカルデバイス、非クリティカルデバイス)、用途(循環器科、婦人科、消化器科、麻酔科)別 - 2027年までの予測Medical Device Reprocessing Market by Type (Reprocessed Medical Devices), Device Category (Critical- Devices, Semi-Critical Devices, Non-Critical Devices), Application (Cardiology, Gynecology, Gastroenterology, Anesthesia) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 医療機器再生処理の世界市場:タイプ(再生処理医療機器)、機器カテゴリ(クリティカルデバイス、セミクリティカルデバイス、非クリティカルデバイス)、用途(循環器科、婦人科、消化器科、麻酔科)別 - 2027年までの予測 |

|

出版日: 2022年07月28日

発行: MarketsandMarkets

ページ情報: 英文 173 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の医療機器再生処理市場は、予測期間中のCAGRは13.7%となり、2022年の20億米ドルから、2027年には39億米ドルに達すると予測されています。

市場の成長は主に、病院費用を最小限に抑えるニーズの高まりや高齢人口の増加、シングルユースの再処理医療機器の再利用に対する有利な規制認可が要因となっています。しかし、医療機器再生処理市場に参入するためには、厳しい規制手続きに従わなければならないことが、市場成長の脅威となる可能性があります。

タイプ別では、再生処理サポート&サービス部門が2021年に最大の市場シェアを占める

医療機器再生処理市場は、タイプ別に、再生処理サポート&サービスと再生処理医療機器に区分されます。2021年には、主に医療廃棄物を減らすための戦略を実行する必要性が高まっていることから、再生処理サポート&サービス分野が最大のシェアを占めています。

デバイスタイプ別では、クリティカルデバイス部門が医療機器再生処理市場で最大のシェアを占める

医療機器再生処理市場は、デバイスタイプ別に、クリティカルデバイス、セミクリティカルデバイス、ノンクリティカルデバイスに区分されます。2021年には、クリティカルデバイスのセグメントがこの市場の最大のシェアを占めています。このセグメントの成長は、主に心臓手術や電気生理学的処置のために再処理された医療機器の利用が増加したことに起因しています。

用途別では、心臓病学分野が予測期間中に最も高いCAGRを示すと予想される

医療機器の再処理市場は、用途別に、循環器科、消化器科、婦人科、関節鏡および整形外科、一般外科および麻酔科、その他の用途(泌尿器、非侵襲性外科、患者モニタリング)に区分されます。予測期間中は、心臓病学分野が最も高い成長を記録すると予想されます。これは、心血管疾患の有病率の増加や、大量の再処理された心臓カテーテルやその他の機器を使用する心臓手術の増加に起因しています。

2021年の医療機器再生処理市場は、北米が最大のシェアを占めている

2021年の医療機器再生処理市場は、北米が最大のシェアを占めています。米国における医療費削減ニーズの高まりや、米国地域におけるトップクラスの医療機器再生処理サービスプロバイダーの存在などの要因が、北米の医療機器再生処理市場の成長に寄与すると期待されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 主な会議とイベント

- 産業の動向

- ポーターのファイブフォース分析

- 規制機関、政府機関、およびその他の組織

- 規制分析

- 技術分析

- サプライチェーン分析

- エコシステム分析

- 医療機器再生処理市場:特許分析

- COVID-19の医療機器再生処理市場への影響

第6章 タイプ別:医療機器再生処理市場

- イントロダクション

- 再生処理サポート・サービス

- 再生処理医療機器

第7章 デバイスタイプ別:医療機器再生処理市場

- イントロダクション

- クリティカルデバイス

- セミクリティカルデバイス

- 非クリティカルデバイス

第8章 用途別:医療機器再生処理市場

- イントロダクション

- 循環器科

- 消化器科学

- 関節鏡検査および整形外科

- 婦人科

- 一般外科

- その他

第9章 地域別:医療機器再生処理市場

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋地域

- オーストラリア

- 日本

- 中国

- インド

- その他アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 主要企業の収益シェア分析

- 市場シェア分析、2021年

- 競合ベンチマーキング

- 企業のフットプリント

- 企業評価象限

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- STRYKER CORPORATION

- JOHNSON & JOHNSON

- MEDTRONIC PLC

- STERIS HEALTHCARE

- CARDINAL HEALTH(SUSTAINABLE TECHNOLOGIES)

- ARJO GROUP(RENU MEDICAL, INC.)

- VANGUARD AG

- MEDLINE RENEWAL

- INNOVATIVE HEALTH

- STERIPRO CANADA, INC

- NORTHEAST SCIENTIFIC, INC.

- その他の企業

- SURETEK MEDICAL

- KONOIKE GROUP

- AVANTE HEALTH SOLUTIONS

- MEDSALV

- VITRUVIA MEDICAL AG

第12章 付録

The medical device reprocessing market is projected to reach USD 3.9 billion by 2027 from USD 2.0 billion in 2022, at a CAGR of 13.7% during the forecast period. Growth in the market is mainly driven by the growing need to minimize hospital costs and the rising geriatric population, and the favourable regulatory approvals for reuse of single-use reprocessed medical devices. However, the requirement to follow stringent regulatory procedures to enter the medical device reprocessing market may pose a threat to the market growth.

Based on type, the reprocessing support & services segment holds the largest market share in 2021

Based on type, the medical device reprocessing market is segmented into reprocessing support & services and reprocessed medical devices. In 2021, the reprocessing support & services segment accounted for the largest share of this market, primarily due to the growing need implement strategies to reduce medical wastes.

Based on device type , critical devices segment accounted for the largest share of the medical device reprocessing market

Based on the device type, the medical device reprocessing market is segmented into critical devices, semi-critical devices, and non-critical devices. In 2021, the critical devices segment accounted for the largest share of this market. The growth of this segment is mainly attributed to the increased utilization of reprocessed medical devices for cardiac surgeries and electrophysiology procedures.

Based on application, cardiology segment is expected to have the highest CAGR during the forecast period

Based on application, the medical device reprocessing market is segmented into cardiology, gastroenterology, gynecology, arthroscopy and orthopedic surgery, general surgery & anesthesia, and other applications (urology, non-invasive surgeries, and patient monitoring). The cardiology segment is expected to register the highest growth during the forecast period. This can be attributed to the increasing prevalence of cardiovascular diseases as well as the increasing number of cardiac procedures, which utilizes a large volume of reprocessed cardiology catheters and other equipments.

North America accounted for the largest share of the medical device reprocessing market in 2021

North America accounted for the largest share of the medical device reprocessing market in 2021. Factors such as the increasing need to reduce the healthcare costs in US, and the presence of top medical device reprocessing service providers in the US region are expected to contribute to the growth of the medical device reprocessing market in North America.

Break of primary participants was as mentioned below:

- By Company Type - Tier 1-35%, Tier 2-45%, and Tier 3-20%

- By Designation - C-level-35%, Director-level-25%, Others-40%

- By Region - North America-45%, Europe-30%, Asia Pacific-20%, Latin America- 3%, Middle East and Africa-2%

Key players in the Medical Device Reprocessing Market

The key players operating in the medical device reprocessing market include Stryker Corporation (US), Johnson & Johnson (US), Vanguard AG (Germany), Medtronic PLC (Ireland), Steris Healthcare (US), Medline ReNewal (US), Innovative Health (US), Arjo Group (ReNu Medical, Inc.) (Sweden), SteriPro Canada, INC. (Canada), Northeast Scientific, INC. (US), Cardinal Health (Sustainable Technologies) (US), SureTek Medical (US), Konoike Group (Japan), Avante Health Solutions (US), Medsalv (New Zealand), and Vitruvia Medical AG (Switzerland).

Research Coverage:

The report analyzes the medical device reprocessing market aims at estimating the market size and future growth potential of this market based on various segments such as type, device type, application, and region. The report also includes a service portfolio matrix of various medical device reprocessing services available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, service offerings, and key market strategies.

Reasons to Buy the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn would help them, garner a more significant share of the market. Firms purchasing the report could use one or any combination of the below-mentioned strategies to strengthen their position in the market.

This report provides insights into the following pointers:

- Market Penetration: Comprehensive information on service portfolios offered by the top players in the global medical device reprocessing market. The report analyzes this market by type, device type, and application.

- Service Enhancement/FDA Approvals: Detailed insights on upcoming trends and service approvals in the global medical device reprocessing market

- Market Development: Comprehensive information on the lucrative emerging markets by type, device type, and application.

- Market Diversification: Exhaustive information about new services, growing geographies, recent developments, and investments in the global medical device reprocessing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, service offerings, competitive leadership mapping, and capabilities of leading players in the global medical device reprocessing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKETS COVERED

- FIGURE 1 MEDICAL DEVICE REPROCESSING MARKET SEGMENTATION

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2021

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.2 RESEARCH METHODOLOGY DESIGN

- FIGURE 2 MEDICAL DEVICE REPROCESSING MARKET: RESEARCH DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Insights from primary experts

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 8 TOP-DOWN APPROACH

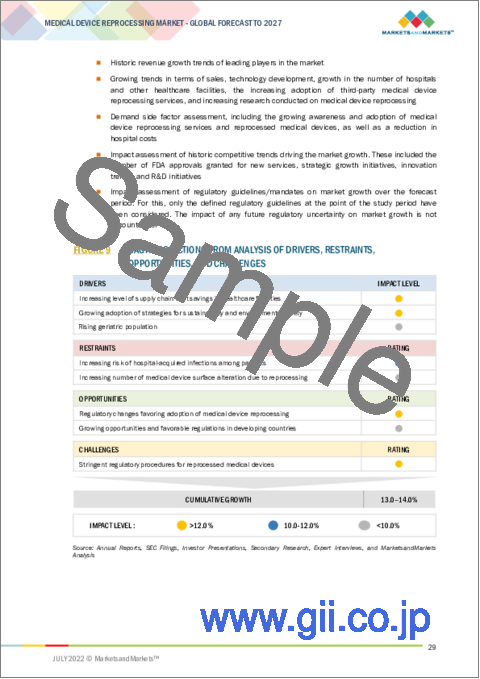

- FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 10 CAGR PROJECTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- 2.5 MARKET SHARE ESTIMATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

- 2.8 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: MEDICAL DEVICE REPROCESSING MARKET

3 EXECUTIVE SUMMARY

- FIGURE 12 MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 GEOGRAPHICAL SNAPSHOT OF MEDICAL DEVICE REPROCESSING MARKET

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF MEDICAL DEVICE REPROCESSING MARKET

- FIGURE 16 INCREASING NEED TO MINIMIZE MEDICAL WASTE AND REDUCE HEALTHCARE COSTS TO DRIVE MARKET

- 4.2 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE AND COUNTRY (2021)

- FIGURE 17 AUSTRALIA TO DOMINATE ASIA PACIFIC MEDICAL DEVICE REPROCESSING MARKET DURING FORECAST PERIOD

- 4.3 MEDICAL DEVICE REPROCESSING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.4 MEDICAL DEVICE REPROCESSING MARKET, BY REGION (2020-2027)

- FIGURE 19 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 MEDICAL DEVICE REPROCESSING MARKET: DEVELOPED VS. DEVELOPING MARKETS

- FIGURE 20 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 MEDICAL DEVICE REPROCESSING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing level of supply chain cost savings in healthcare facilities

- 5.2.1.2 Growing adoption of strategies for sustainability and environmental safety

- TABLE 3 EXAMPLES OF MARKET PLAYERS PROVIDING SUSTAINABILITY THROUGH REPROCESSING

- 5.2.1.3 Rising geriatric population

- FIGURE 22 GLOBAL GERIATRIC POPULATION (65 YEARS & ABOVE), BY REGION

- TABLE 4 IMPACT ANALYSIS: MARKET DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing risk of hospital-acquired infections among patients

- 5.2.2.2 Increasing number of medical device surface alterations due to reprocessing

- TABLE 5 IMPACT ANALYSIS: RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Regulatory changes favoring adoption of medical device reprocessing

- 5.2.3.2 Growing opportunities and favorable regulations in developing countries

- TABLE 6 IMPACT ANALYSIS: OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulatory procedures for reprocessed medical devices

- TABLE 7 IMPACT ANALYSIS: CHALLENGES

- 5.3 KEY CONFERENCES AND EVENTS

- TABLE 8 MEDICAL DEVICE REPROCESSING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.4 INDUSTRY TRENDS

- 5.4.1 EXPANDING SERVICE PORTFOLIO AND MARKET REACH THROUGH ACQUISITIONS

- TABLE 9 MAJOR ACQUISITIONS IN MEDICAL DEVICE REPROCESSING MARKET

- 5.4.2 SPECIALTY REPROCESSING

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT FROM NEW ENTRANTS

- 5.5.2 THREAT FROM SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7 REGULATORY ANALYSIS

- 5.7.1 NORTH AMERICA

- 5.7.1.1 US

- FIGURE 23 PREMARKET NOTIFICATION: 510 (K) APPROVAL FOR REPROCESSED MEDICAL DEVICES

- 5.7.1.2 Canada

- 5.7.2 EUROPE

- TABLE 12 EU COUNTRIES AND THEIR TERRITORY LAWS THAT AUTHORIZE SINGLE-USE DEVICE REPROCESSING

- 5.7.3 ASIA PACIFIC

- 5.7.3.1 Japan

- 5.7.3.2 Australia

- 5.7.3.3 Rest of Asia Pacific

- TABLE 13 INTERNATIONAL STANDARDS FOR MEDICAL DEVICE REPROCESSING

- 5.7.1 NORTH AMERICA

- 5.8 TECHNOLOGY ANALYSIS

- TABLE 14 TECHNOLOGY AND INNOVATION IN MEDICAL DEVICE REPROCESSING MARKET

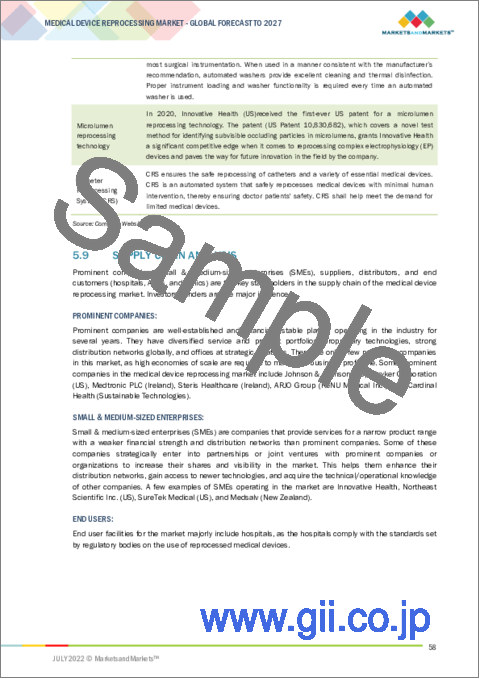

- 5.9 SUPPLY CHAIN ANALYSIS

- FIGURE 24 SUPPLY CHAIN: MEDICAL DEVICE REPROCESSING MARKET

- 5.10 ECOSYSTEM ANALYSIS

- FIGURE 25 MEDICAL DEVICE REPROCESSING MARKET: ECOSYSTEM ANALYSIS

- 5.11 MEDICAL DEVICE REPROCESSING MARKET: PATENT ANALYSIS

- 5.11.1 PATENT PUBLICATION TRENDS FOR MEDICAL DEVICE REPROCESSING

- FIGURE 26 PATENT PUBLICATION TRENDS (2011-JULY 2022)

- 5.11.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 27 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR MEDICAL DEVICE REPROCESSING (JANUARY 2011-JULY 2022)

- FIGURE 28 TOP APPLICANT JURISDICTIONS FOR MEDICAL DEVICE REPROCESSING PATENTS (JANUARY 2011-JULY 2022)

- TABLE 15 LIST OF PATENTS/PATENT APPLICATIONS IN MEDICAL DEVICE REPROCESSING MARKET, 2021-2022

- 5.12 IMPACT OF COVID-19 ON MEDICAL DEVICE REPROCESSING MARKET

6 MEDICAL DEVICE REPROCESSING MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 16 MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 6.2 REPROCESSING SUPPORT AND SERVICES

- 6.2.1 REDUCING IN-HOUSE REPROCESSING COSTS AND INCREASING REGULATORY MANDATES TO DRIVE MARKET

- TABLE 17 REPROCESSING SUPPORT AND SERVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3 REPROCESSED MEDICAL DEVICES

- 6.3.1 INCREASING ADOPTION OF REPROCESSED DEVICES AT LOWER COSTS TO DRIVE MARKET

- TABLE 18 REPROCESSED MEDICAL DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 19 REPROCESSED MEDICAL DEVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

7 MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE

- 7.1 INTRODUCTION

- TABLE 20 MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- 7.2 CRITICAL DEVICES

- 7.2.1 HIGH COST OF BUYING NEW DEVICES TO DRIVE MARKET

- TABLE 21 REPROCESSED CRITICAL MEDICAL DEVICE CATEGORY

- TABLE 22 CRITICAL DEVICES REPROCESSING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 SEMI-CRITICAL DEVICES

- 7.3.1 INCREASED CASES OF HOSPITAL-ACQUIRED INFECTIONS TO DRIVE MARKET

- TABLE 23 SEMI-CRITICAL DEVICE REPROCESSING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.4 NON-CRITICAL DEVICES

- 7.4.1 INCREASING MEDICAL PROCEDURES AND SURGERIES TO DRIVE MARKET

- TABLE 24 NON-CRITICAL DEVICE REPROCESSING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

8 MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 25 MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2 CARDIOLOGY

- 8.2.1 RISING CORONARY ARTERY DISEASE CASES TO PROPEL MARKET

- TABLE 26 MEDICAL DEVICE REPROCESSING MARKET FOR CARDIOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3 GASTROENTEROLOGY

- 8.3.1 INCREASING USE OF ENDOSCOPES FOR DISEASE DIAGNOSIS TO DRIVE MARKET

- TABLE 27 MEDICAL DEVICE REPROCESSING MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.4 ARTHROSCOPY AND ORTHOPEDIC SURGERY

- 8.4.1 REGULATORY INITIATIVES AND COST REDUCTION TO DRIVE MARKET

- TABLE 28 APPROVED ORTHOPEDIC/ARTHROSCOPIC DEVICES FOR REPROCESSING

- TABLE 29 MEDICAL DEVICE REPROCESSING MARKET FOR ARTHROSCOPY AND ORTHOPEDIC SURGERY, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.5 GYNECOLOGY

- 8.5.1 INCREASING GYNECOLOGY PROCEDURES TO DRIVE MARKET

- TABLE 30 MEDICAL DEVICE REPROCESSING MARKET FOR GYNECOLOGY, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.6 GENERAL SURGERY

- 8.6.1 LOW-COST GENERAL SURGERY DEVICES TO IMPACT MARKET

- TABLE 31 MEDICAL DEVICE REPROCESSING MARKET FOR GENERAL SURGERIES, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.7 OTHER APPLICATIONS

- TABLE 32 MEDICAL DEVICE REPROCESSING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020-2027 (USD MILLION)

9 MEDICAL DEVICE REPROCESSING MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 29 MEDICAL DEVICE REPROCESSING MARKET: GEOGRAPHIC SNAPSHOT (2021)

- TABLE 33 MEDICAL DEVICE REPROCESSING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 30 NORTH AMERICA: MEDICAL DEVICE REPROCESSING MARKET SNAPSHOT

- TABLE 34 NORTH AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 35 NORTH AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 36 NORTH AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 37 NORTH AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Presence of major players and healthcare cost reduction strategies to drive market

- FIGURE 31 US: TOTAL NUMBER OF HOSPITALS

- TABLE 38 US: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 39 US: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 40 US: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Growing geriatric population and increasing chronic diseases to drive market

- TABLE 41 CANADA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 42 CANADA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 43 CANADA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3 EUROPE

- TABLE 44 EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 45 EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 46 EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 47 EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Government initiatives and well-established standards to drive market

- TABLE 48 GERMANY: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 49 GERMANY: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 50 GERMANY: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Increasing hospital admissions to drive market

- TABLE 51 UK: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 52 UK: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 53 UK: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Growing diagnostic medical device market with rising chronic diseases to propel market

- TABLE 54 FRANCE: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 55 FRANCE: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 56 FRANCE: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Increasing use of diagnostic devices and government initiatives to drive market

- TABLE 57 ITALY: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 58 ITALY: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 59 ITALY: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Increasing focus on reducing hospital costs to drive market

- TABLE 60 SPAIN: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 61 SPAIN: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 62 SPAIN: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 63 REST OF EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 64 REST OF EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 65 REST OF EUROPE: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 32 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET SNAPSHOT

- TABLE 66 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 67 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 68 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 69 ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.1 AUSTRALIA

- 9.4.1.1 Growing adoption of medical devices for diagnosis and treatment to drive market

- TABLE 70 AUSTRALIA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 71 AUSTRALIA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 72 AUSTRALIA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Regulatory reforms and need to reduce hospital costs to drive market

- TABLE 73 JAPAN: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 74 JAPAN: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 75 JAPAN: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Government initiatives and developing economy to drive market

- TABLE 76 CHINA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 77 CHINA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 78 CHINA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Government initiatives for diagnosis and treatment to drive market

- TABLE 79 INDIA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 80 INDIA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE 2020-2027 (USD MILLION)

- TABLE 81 INDIA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 82 REST OF ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 83 REST OF ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 84 REST OF ASIA PACIFIC: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.5 LATIN AMERICA

- 9.5.1 INCREASING CHRONIC DISEASES AND ADOPTION OF MEDICAL DEVICES TO DRIVE MARKET

- TABLE 85 LATIN AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 86 LATIN AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 87 LATIN AMERICA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 EMERGENCE OF REGULATORY FRAMEWORKS TO DRIVE MARKET

- TABLE 88 MIDDLE EAST & AFRICA: MEDICAL DEVICE REPROCESSING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 89 MIDDLE EAST & AFRICA: MEDICAL DEVICE REPROCESSING MARKET, BY DEVICE TYPE, 2020-2027 (USD MILLION)

- TABLE 90 MIDDLE EAST & AFRICA: MEDICAL DEVICE REPROCESSING MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MEDICAL DEVICE REPROCESSING MARKET

- 10.3 REVENUE SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS IN MEDICAL DEVICE REPROCESSING MARKET

- 10.4 MARKET SHARE ANALYSIS, 2021

- FIGURE 34 MEDICAL DEVICE REPROCESSING MARKET SHARES, BY KEY PLAYER, 2021

- TABLE 91 MEDICAL DEVICE REPROCESSING MARKET: DEGREE OF COMPETITION

- 10.5 COMPETITIVE BENCHMARKING

- TABLE 92 MEDICAL DEVICE REPROCESSING MARKET: DETAILED LIST OF SMALL AND MEDIUM PLAYERS

- 10.6 COMPANY FOOTPRINT

- TABLE 93 FOOTPRINT OF COMPANIES IN MEDICAL DEVICE REPROCESSING MARKET

- TABLE 94 SERVICE FOOTPRINT OF COMPANIES (16 COMPANIES)

- TABLE 95 APPLICATION FOOTPRINT OF COMPANIES (16 COMPANIES)

- TABLE 96 REGIONAL FOOTPRINT OF COMPANIES (16 COMPANIES)

- 10.7 COMPANY EVALUATION QUADRANT

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- FIGURE 35 MEDICAL DEVICE REPROCESSING MARKET: COMPANY EVALUATION QUADRANT (2021)

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 FDA APPROVALS/SERVICE ENHANCEMENTS

- 10.8.2 DEALS

- 10.8.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1.1 STRYKER CORPORATION

- TABLE 100 STRYKER CORPORATION: COMPANY OVERVIEW

- FIGURE 36 STRYKER CORPORATION: COMPANY SNAPSHOT (2021)

- 11.1.2 JOHNSON & JOHNSON

- TABLE 101 JOHNSON & JOHNSON: COMPANY OVERVIEW

- FIGURE 37 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

- 11.1.3 MEDTRONIC PLC

- TABLE 102 MEDTRONIC PLC: COMPANY OVERVIEW

- FIGURE 38 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

- 11.1.4 STERIS HEALTHCARE

- TABLE 103 STERIS HEALTHCARE: COMPANY OVERVIEW

- FIGURE 39 STERIS HEALTHCARE: COMPANY SNAPSHOT (2021)

- 11.1.5 CARDINAL HEALTH (SUSTAINABLE TECHNOLOGIES)

- TABLE 104 CARDINAL HEALTH: COMPANY OVERVIEW

- FIGURE 40 CARDINAL HEALTH: COMPANY SNAPSHOT (2021)

- 11.1.6 ARJO GROUP (RENU MEDICAL, INC.)

- TABLE 105 ARJO GROUP: COMPANY OVERVIEW

- FIGURE 41 ARJO GROUP: COMPANY SNAPSHOT (2021)

- 11.1.7 VANGUARD AG

- TABLE 106 VANGUARD AG: COMPANY OVERVIEW

- 11.1.8 MEDLINE RENEWAL

- TABLE 107 MEDLINE RENEWAL: COMPANY OVERVIEW

- 11.1.9 INNOVATIVE HEALTH

- TABLE 108 INNOVATIVE HEALTH: COMPANY OVERVIEW

- 11.1.10 STERIPRO CANADA, INC

- TABLE 109 STERIPRO CANADA, INC.: COMPANY OVERVIEW

- 11.1.11 NORTHEAST SCIENTIFIC, INC.

- TABLE 110 NE SCIENTIFIC, INC.: COMPANY OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 SURETEK MEDICAL

- 11.2.2 KONOIKE GROUP

- 11.2.3 AVANTE HEALTH SOLUTIONS

- 11.2.4 MEDSALV

- 11.2.5 VITRUVIA MEDICAL AG

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS