|

|

市場調査レポート

商品コード

1109067

熱伝導性プラスチックの世界市場:タイプ別(ポリアミド、PBT、ポリカーボネート、PPS、PEI、ポリスルホン)、最終用途別(電気・電子、自動車、産業、航空宇宙、ヘルスケア、通信)、地域別 - 2027年までの予測Thermally Conductive Plastics Market by Type (Polyamide, PBT, Polycarbonate, PPS, PEI, Polysulfones), End-use (Electrical & Electronics, Automotive, Industrial, Aerospace, Healthcare, Telecommunications) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 熱伝導性プラスチックの世界市場:タイプ別(ポリアミド、PBT、ポリカーボネート、PPS、PEI、ポリスルホン)、最終用途別(電気・電子、自動車、産業、航空宇宙、ヘルスケア、通信)、地域別 - 2027年までの予測 |

|

出版日: 2022年07月29日

発行: MarketsandMarkets

ページ情報: 英文 264 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

熱伝導性プラスチックの世界市場規模は、2021年の1億2100万米ドルから、2027年には2億9800万米ドルに達し、2022年から2027年にかけてCAGR16.2%で成長すると予測されます。

LED照明における放熱材料の需要増加、電気自動車の普及拡大、電子部品の小型化などが、熱伝導性プラスチック市場成長の主な要因となっています。通信インフラや5G通信機器の配備は、熱伝導性プラスチックメーカーに大きな成長機会をもたらすでしょう。しかし、従来の材料が入手可能であることや、プラスチックの熱伝導率が低いことが、市場の成長を制限すると予想されます。

金額ベースでは、予測期間中、熱伝導性プラスチックにおいて3番目に急成長するタイプであるPEI

PEIは、熱伝導性フィラーとともに、製造工程や接合部が少ないため、費用対効果の高いソリューションとなります。耐クリープ性、低発煙性、難燃性により、熱伝導性プラスチックとしてのPEIの需要は大幅に増加しています。PEIは、発煙量が極めて少ないため、ジェットエンジン部品、医療機器、電気・電子絶縁体などの用途に使用されています。

熱伝導性プラスチック市場の最終用途別では、金額ベースで医療が2番目の急成長分野と推定される

脳神経外科や脊椎外科などの重要な手術に用いられる手術用ロボット産業の発展が、医療機器における熱伝導性プラスチックの需要を高めると予想されます。熱伝導性プラスチックは、電磁波による電子機器の誤動作を防ぐ静電気放電(ESD)や無線周波数干渉(RFI)シールドなど、従来の素材にはないさまざまな利点を備えています。医療機器の重要部品のハウジングやヒートシンクは、ヘルスケア産業における熱伝導性プラスチックの数少ない用途の一つです。

熱伝導性プラスチックの市場規模は、欧州が3位となる

多様な最終用途産業、メーカー、コンパウンダー、流通業者、ポリマー試験・分析の技術サービスプロバイダーが存在し、市場の成長機会を提供しています。欧州は、フォルクスワーゲン、BMW、ダイムラーといった自動車メーカーが存在することから、自動車の中心地と考えられています。材料科学の開拓、技術革新、自動車、工業オートメーション、エネルギー、電子照明、医療機器などの研究開発への高い投資が、欧州の熱伝導性プラスチック市場を牽引していくでしょう。欧州で使用されている熱伝導性プラスチックは、PBT、PA、PPS、PCなどのベースポリマーが最も一般的な種類です。欧州の熱伝導性プラスチック市場には、BASF、DSM、Covestro AG、Ensinger、LANXESS、Lehmann&Voss&Co.、LATI Industria Termoplastici S.p.A.およびWITCOM Engineering Plastics BVなどのメーカーが参入しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- バリューチェーン分析

- エコシステムマッピング

- 貿易分析

- 価格分析

- 熱伝導性プラスチック市場に対するCOVID-19の影響

- 顧客のビジネスに影響を与える動向/ディスラプション

- 特許分析

- 技術分析

- ケーススタディ分析

- 原料分析

- マーケティングチャネル

- 2022年から2023年の主な会議とイベント

- 規制状況と規制の状況

- 運用データ

- 購入決定に影響を与える主な要因

- マクロ経済分析

第6章 タイプ別:熱伝導性プラスチック市場

- イントロダクション

- ポリアミド

- ポリカーボネート

- ポリフェニレンスルフィド

- ポリブチレンテレフタレート

- ポリエーテルイミド

- ポリスルホン

- その他

- ポリエーテルエーテルケトン

- ポリプロピレン

- アクリロニトリルブタジエンスチレン

- 液晶ポリマー

第7章 エンドユース業界別:熱伝導性プラスチック市場

- イントロダクション

- 電気・電子機器

- LED照明

- 電子デバイス

- その他

- 自動車

- 電気自動車(EV)

- バッテリー

- 充電インフラ

- その他

- 工業

- HVAC

- エネルギー

- その他

- ヘルスケア

- 航空宇宙

- 電気通信

- ワイヤレスデバイス

- その他

- その他

- 防衛・セキュリティ

- 海洋

第8章 地域別:熱伝導性プラスチック市場

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- 台湾

- インドネシア

- その他

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- 中東およびアフリカ

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第9章 競合情勢

- イントロダクション

- 主要企業の採用戦略

- 市場評価マトリックス

- 主要企業の収益分析

- 市場ランキング分析

- 市場シェア分析

- CELANESE CORPORATION

- DSM

- SABIC

- BASF

- DUPONT

- 企業評価マトリックス

- 競合ベンチマーキング

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- スタートアップおよび中小企業の評価マトリックス

- 競合シナリオ

第10章 企業プロファイル

- 主要企業

- CELANESE CORPORATION

- DSM

- SABIC

- BASF

- DUPONT

- COVESTRO AG

- AVIENT CORPORATION

- KANEKA CORPORATION

- ENSINGER

- MITSUBISHI ENGINEERING-PLASTICS CORPORATION

- TORAY INDUSTRIES, INC.

- LANXESS

- その他の企業

- SUMITOMO BAKELITE CO., LTD.

- LOTTE CHEMICAL

- LATI INDUSTRIA TERMOPLASTICI S.P.A.

- LEHMANN&VOSS&CO.

- KRAIBURG TPE GMBH & CO. KG

- KENNER MATERIAL & SYSTEM CO., LTD

- ASCEND PERFORMANCE MATERIALS

- UGENT TECH SDN BHD.

- WITCOM ENGINEERING PLASTICS BV

- XIAMEN KEYUAN PLASTIC CO., LTD

- DONGGUAN ZIITEK ELECTRONIC MATERIAL AND TECHNOLOGY LTD.

- RADICAL MATERIALS LTD

- COOLMAG THERMO CONDUCTIVE, S.L.

第11章 付録

The global thermally conductive plastics market size is projected to grow from USD 121 million in 2021 to reach USD 298 million by 2027, at a CAGR of 16.2% between 2022 and 2027. Rising demand for heat dissipation materials in LED lightings, increasing adoption of electric vehicles, and miniaturization of electronic components are key factors for the growth of thermally conductive plastics market. Deployment of telecommunication infrastructure and 5G communication devices will provide significant growth opportunities to thermally conductive plastics manufacturers. However, availability of conventional materials and low thermal conductivity of plastics is expected to limit the growth of the market.

In terms of value, PEI is the third fastest-growing type in the thermally conductive plastics, during the forecast period.

PEI, along with thermally conductive fillers, is a cost-effective solution due to lesser manufacturing steps and joints. Due to its creep resistance, low smoke emission, and flame resistance, the demand for PEI as a thermally conductive plastic has increased significantly. PEI has applications in jet engine components, medical devices, and electrical & electronics insulators owing to its extremely low smoke generation.

In terms of value, healthcare is estimated to be second fastest-growing segment in thermally conductive plastics market, by end-use industry, during the forecast period.

The developments in the surgical robot industry for critical surgeries such as neurosurgery and spinal surgery are expected to increase the demand for thermally conductive plastics in medical equipment. Thermally conductive plastics offer various advantages over conventional materials, such as electrostatic discharge (ESD) and radio frequency interference (RFI) shielding, which protect against electronic malfunction due to electromagnetic waves. The housing of critical components in medical equipment and heat sinks are a few applications of thermally conductive plastics in the healthcare industry.

Europe region accounted for the third-largest share in the thermally conductive plastics market by value.

The presence of diversified end-use industries, manufacturers, compounders, distributors, and technical service providers for polymer testing and analysis present growth opportunities for the market. Europe is considered an automotive hub, owing to the presence of established automobile manufacturers, such as Volkswagen, BMW, and Daimler. Development in material science, innovation, and high investment in R&D for automotive, industrial automation, energy, electronic lighting, and medical devices will drive the European market for thermally conductive plastics. Base polymers, including PBT, PA, PPS, and PC are the most common types of thermally conductive plastics used in Europe. Some of the European manufacturers in the thermally conductive plastics market are BASF, DSM, Covestro AG, Ensinger, LANXESS, Lehmann&Voss&Co., LATI Industria Termoplastici S.p.A., and WITCOM Engineering Plastics BV.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the thermally conductive plastics market, and information was gathered from secondary research to determine and verify the market size of several segments. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

- By Region: APAC - 30%, Europe - 30%, North America - 20%, the Middle East & Africa - 10%, and South America- 10%

Major players operating in the global thermally conductive plastics market includes Celanese Corporation (US), DSM (The Netherlands), SABIC (Saudi Arabia), BASF (Germany), DuPont (US), LANXESS (Germany), Mitsubishi Engineering-Plastics Corporation (Japan), Ensinger (Germany), TORAY INDUSTRIES, INC.( Japan), and KANEKA CORPORATION (Japan).

Research Coverage:

This report provides detailed segmentation of the thermally conductive plastics market based on by type, by end-use industry, and region. Based on type, the market has been segmented into polyamide, PC, PPS, PBT, PEI, and polysulfones. Based on end-use industry, the market has been segmented into electrical & electronics, automotive, telecommunications, industrial, healthcare, and aerospace.

Key Benefits of Buying the Report:

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market ranking of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the thermally conductive plastics market; high growth regions; and market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 THERMALLY CONDUCTIVE PLASTICS MARKET SEGMENTATION

- 1.4.1 YEARS CONSIDERED

- 1.4.2 REGIONAL SCOPE

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 THERMALLY CONDUCTIVE PLASTICS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.3 PRIMARY INTERVIEWS

- 2.1.3.1 Primary interviews - demand and supply sides

- 2.1.3.2 Key industry insights

- 2.1.3.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION APPROACH

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Approach for arriving at market size using top-down approach

- FIGURE 4 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach for arriving at market size using bottom-up approach

- FIGURE 5 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

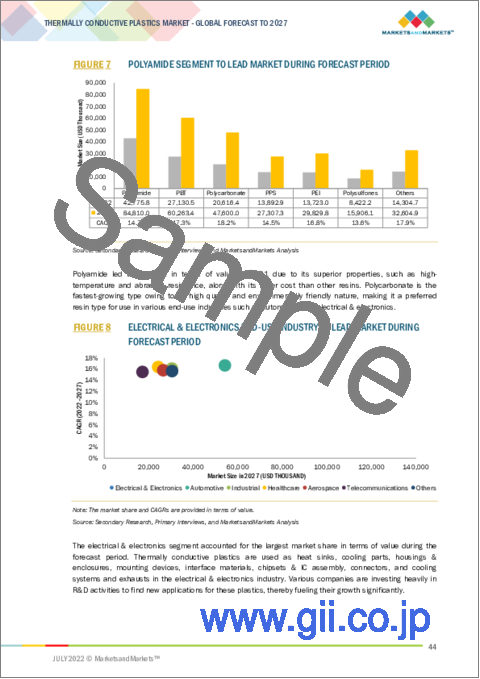

- FIGURE 7 POLYAMIDE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 ELECTRICAL & ELECTRONICS END-USE INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 EMERGING ECONOMIES TO WITNESS HIGH GROWTH IN THERMALLY CONDUCTIVE PLASTICS MARKET

- FIGURE 10 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

- 4.2 THERMALLY CONDUCTIVE PLASTICS MARKET, BY TYPE

- FIGURE 11 POLYAMIDE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 THERMALLY CONDUCTIVE PLASTICS MARKET, BY END-USE INDUSTRY

- FIGURE 12 ELECTRICAL & ELECTRONICS INDUSTRY TO LEAD MARKET BY 2027

- 4.4 GLOBAL THERMALLY CONDUCTIVE PLASTICS MARKET, BY COUNTRY

- FIGURE 13 MARKET IN INDIA TO GROW AT HIGHEST CAGR

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMALLY CONDUCTIVE PLASTICS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Miniaturization of electronic components and development of power electronics

- 5.2.1.2 Rising demand for lightweight and customizable parts in automotive industry

- 5.2.1.3 Advancements in E-mobility and telecommunications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lower thermal conductivity than traditional metals

- 5.2.2.2 Sluggish growth of electronics industry due to geopolitical uncertainties

- 5.2.2.3 Stringent regulations on plastic recycling and disposal to increase capital expenditure for manufacturers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for heat dissipation in electronics, automotive, and telecommunications industries

- 5.2.3.2 Replacing conventional plastics & metals for weight reduction and superior thermal management

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuating crude oil prices to impact prices of polymer resin

- 5.2.4.2 High production cost and complex processing

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 THERMALLY CONDUCTIVE PLASTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 1 THERMALLY CONDUCTIVE PLASTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 16 THERMALLY CONDUCTIVE PLASTICS VALUE CHAIN

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 MANUFACTURERS

- 5.4.3 FILLER & ADDITIVE PRODUCERS

- 5.4.4 COMPOUNDERS

- 5.4.5 CONVERTERS

- 5.4.6 DISTRIBUTORS

- 5.4.7 END-USE INDUSTRIES

- 5.5 ECOSYSTEM MAPPING

- FIGURE 17 THERMALLY CONDUCTIVE PLASTICS ECOSYSTEM

- 5.6 TRADE ANALYSIS

- TABLE 2 IMPORT DATA FOR PLASTICS AND RELATED MATERIALS (USD THOUSAND)

- TABLE 3 EXPORT DATA FOR PLASTICS AND RELATED MATERIALS (USD THOUSAND)

- 5.7 PRICING ANALYSIS

- FIGURE 18 AVERAGE PRICING ANALYSIS, BY REGION

- FIGURE 19 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 END-USE INDUSTRIES

- TABLE 4 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 END-USE INDUSTRIES (USD)

- 5.8 IMPACT OF COVID-19 ON THERMALLY CONDUCTIVE PLASTICS MARKET

- 5.8.1 IMPACT OF COVID-19 ON ELECTRONICS INDUSTRY

- 5.8.2 IMPACT OF COVID-19 ON AUTOMOTIVE INDUSTRY

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.10 PATENT ANALYSIS

- 5.10.1 INTRODUCTION

- 5.10.2 METHODOLOGY

- 5.10.3 DOCUMENT TYPE

- FIGURE 21 GRANTED PATENTS

- FIGURE 22 NUMBER OF PATENTS PUBLISHED IN LAST 10 YEARS

- 5.10.4 INSIGHTS

- 5.10.5 LEGAL STATUS OF PATENTS

- FIGURE 23 LEGAL STATUS

- FIGURE 24 TOP JURISDICTION - BY DOCUMENT

- 5.10.6 TOP COMPANIES/APPLICANTS

- FIGURE 25 TOP 10 PATENT APPLICANTS

- TABLE 5 LIST OF PATENTS BY DUPONT

- TABLE 6 LIST OF PATENTS BY LG CHEM

- TABLE 7 LIST OF PATENTS BY SABIC GLOBAL TECHNOLOGIES BV.

- TABLE 8 TOP PATENT OWNERS (US) IN LAST 10 YEARS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 DEPLOYMENT OF 5G TELECOMMUNICATIONS AND INTEGRATION OF IOT

- 5.11.2 DEVELOPMENT OF E-MOBILITY

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 HEAT MANAGEMENT OPTIMIZATION IN LED LIGHTING WITH MAKROLON THERMALLY CONDUCTIVE PLASTICS BY COVESTRO AG

- 5.12.2 REPLACEMENT OF METAL HEAT SINKS WITH AVIENT'S THERMALLY CONDUCTIVE PLASTICS IN SWIMMING POOL LIGHTING

- 5.13 RAW MATERIAL ANALYSIS

- 5.13.1 POLYAMIDE

- 5.13.2 POLYCARBONATE

- 5.13.3 POLYPHENYLENE SULFIDE

- 5.13.4 POLYBUTYLENE TEREPHTHALATE

- 5.13.5 POLYETHERIMIDE

- 5.13.6 POLYSULFONES

- 5.14 MARKETING CHANNELS

- 5.15 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 9 THERMALLY CONDUCTIVE PLASTICS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.16 TARIFF AND REGULATORY LANDSCAPE

- 5.16.1 NORTH AMERICA

- 5.16.2 EUROPE

- 5.16.3 ASIA PACIFIC

- 5.16.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17 OPERATIONAL DATA

- 5.17.1 TRENDS IN AUTOMOTIVE INDUSTRY

- TABLE 14 GOVERNMENT INCENTIVES FOR EVS IN 2021, BY COUNTRY

- FIGURE 26 GLOBAL SALES OF ELECTRIC CARS IN MAJOR COUNTRIES (THOUSAND UNIT)

- 5.17.2 TRENDS IN ELECTRICAL & ELECTRONICS INDUSTRY

- FIGURE 27 MARKET SHARE OF SEMICONDUCTOR MANUFACTURING COUNTRIES (2018-2020)

- TABLE 15 GOVERNMENT INCENTIVES FOR SEMICONDUCTOR MANUFACTURING IN 2021, BY COUNTRY

- 5.17.3 TRENDS IN TELECOMMUNICATIONS INDUSTRY

- 5.18 KEY FACTORS AFFECTING BUYING DECISIONS

- 5.18.1 QUALITY

- TABLE 16 UNMET NEEDS AFFECTING BUYING DECISION

- 5.18.2 SERVICE

- FIGURE 28 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.19 MACROECONOMIC ANALYSIS

- TABLE 17 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2018-2025

6 THERMALLY CONDUCTIVE PLASTICS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 29 POLYCARBONATE TO BE FASTEST-GROWING TYPE DURING FORECAST PERIOD

- TABLE 18 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 19 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (USD THOUSAND)

- TABLE 20 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 21 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (TON)

- 6.2 POLYAMIDE

- TABLE 22 POLYAMIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 23 POLYAMIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 6.3 POLYCARBONATE

- TABLE 24 POLYCARBONATE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 25 POLYCARBONATE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 6.4 POLYPHENYLENE SULFIDE

- TABLE 26 POLYPHENYLENE SULFIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 27 POLYPHENYLENE SULFIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

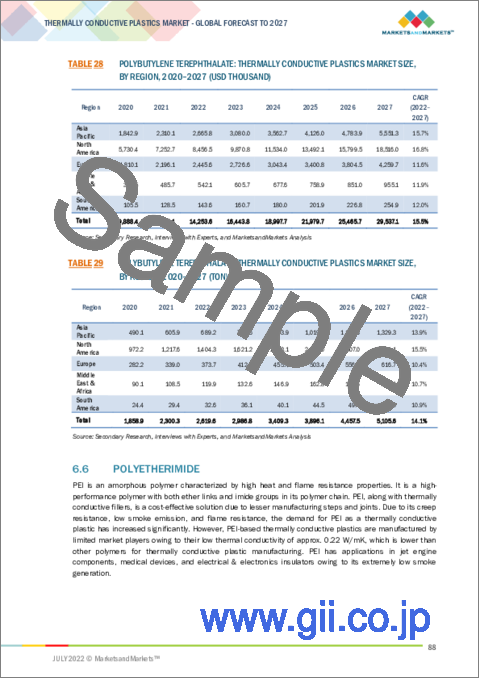

- 6.5 POLYBUTYLENE TEREPHTHALATE

- TABLE 28 POLYBUTYLENE TEREPHTHALATE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 29 POLYBUTYLENE TEREPHTHALATE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 6.6 POLYETHERIMIDE

- TABLE 30 POLYETHERIMIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 31 POLYETHERIMIDE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 6.7 POLYSULFONES

- TABLE 32 POLYSULFONES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 33 POLYSULFONES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 6.8 OTHERS

- 6.8.1 POLYETHER ETHER KETONE

- 6.8.2 POLYPROPYLENE

- 6.8.3 ACRYLONITRILE BUTADIENE STYRENE

- 6.8.4 LIQUID CRYSTAL POLYMER

- TABLE 34 OTHER TYPES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 35 OTHER TYPES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

7 THERMALLY CONDUCTIVE PLASTICS MARKET, BY END-USE INDUSTRY

- 7.1 INTRODUCTION

- FIGURE 30 ELECTRICAL & ELECTRONICS TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- TABLE 36 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 37 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 38 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 39 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 7.2 ELECTRICAL & ELECTRONICS

- 7.2.1 LED LIGHTING

- 7.2.2 ELECTRONIC DEVICES

- 7.2.3 OTHERS

- TABLE 40 ELECTRICAL & ELECTRONICS: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 41 ELECTRICAL & ELECTRONICS: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 7.3 AUTOMOTIVE

- 7.3.1 ELECTRIC VEHICLE (EV)

- 7.3.2 BATTERIES

- 7.3.3 CHARGING INFRASTRUCTURE

- 7.3.4 OTHERS

- TABLE 42 AUTOMOTIVE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 43 AUTOMOTIVE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 7.4 INDUSTRIAL

- 7.4.1 HVAC

- 7.4.2 ENERGY

- 7.4.3 OTHERS

- TABLE 44 INDUSTRIAL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 45 INDUSTRIAL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 7.5 HEALTHCARE

- TABLE 46 HEALTHCARE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 47 HEALTHCARE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 7.6 AEROSPACE

- TABLE 48 AEROSPACE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 49 AEROSPACE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 7.7 TELECOMMUNICATIONS

- 7.7.1 WIRELESS DEVICES

- 7.7.2 OTHERS

- TABLE 50 TELECOMMUNICATIONS: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 51 TELECOMMUNICATIONS: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 7.8 OTHERS

- 7.8.1 DEFENSE & SECURITY

- 7.8.2 MARINE

- TABLE 52 OTHER END-USE INDUSTRIES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 53 OTHER END-USE INDUSTRIES: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2020-2027 (TON)

8 THERMALLY CONDUCTIVE PLASTICS MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 31 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 54 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 55 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2022-2027 (USD THOUSAND)

- TABLE 56 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 57 THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY REGION, 2022-2027 (TON)

- 8.2 NORTH AMERICA

- FIGURE 32 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SNAPSHOT

- TABLE 58 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018-2021 (USD THOUSAND)

- TABLE 59 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022-2027 (USD THOUSAND)

- TABLE 60 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 61 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 62 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 63 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (USD THOUSAND)

- TABLE 64 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 65 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 66 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 67 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 68 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 69 NORTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.1 US

- 8.2.1.1 Miniaturization of electronic components to drive market

- TABLE 70 US: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 71 US: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 72 US: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 73 US: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.2 CANADA

- 8.2.2.1 Automotive industry to propel demand for thermally conductive plastics

- TABLE 74 CANADA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 75 CANADA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 76 CANADA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 77 CANADA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.3 MEXICO

- 8.2.3.1 Rising investments in electrical & electronics sector to boost market

- TABLE 78 MEXICO: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 79 MEXICO: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 80 MEXICO: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 81 MEXICO: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3 ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SNAPSHOT

- TABLE 82 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018-2021 (USD THOUSAND)

- TABLE 83 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022-2027 (USD THOUSAND)

- TABLE 84 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 85 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 86 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 87 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (USD THOUSAND)

- TABLE 88 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 89 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 90 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 91 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 92 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 93 ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.1 CHINA

- 8.3.1.1 Government initiatives for EV manufacturing to propel market

- TABLE 94 CHINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 95 CHINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 96 CHINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 97 CHINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.2 JAPAN

- 8.3.2.1 Diversified end-use industries to increasingly consume thermally conductive plastics

- TABLE 98 JAPAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 99 JAPAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 100 JAPAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 101 JAPAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.3 INDIA

- 8.3.3.1 Growing automotive industry and government investments in semiconductor industry to drive market

- TABLE 102 INDIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 103 INDIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 104 INDIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 105 INDIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.4 SOUTH KOREA

- 8.3.4.1 Growing electronics industry and skilled workforce to boost market

- TABLE 106 SOUTH KOREA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 107 SOUTH KOREA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 108 SOUTH KOREA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 109 SOUTH KOREA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.5 TAIWAN

- 8.3.5.1 Established electronics industry and investments in telecommunications industry to drive market

- TABLE 110 TAIWAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 111 TAIWAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 112 TAIWAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 113 TAIWAN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.6 INDONESIA

- 8.3.6.1 Industrial equipment and manufacturing industries to boost demand for thermally conductive plastics

- TABLE 114 INDONESIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 115 INDONESIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 116 INDONESIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 117 INDONESIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.7 REST OF ASIA PACIFIC

- TABLE 118 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 119 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 120 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 121 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4 EUROPE

- FIGURE 34 AUTOMOTIVE TO BE FASTEST-GROWING END-USE INDUSTRY IN EUROPE

- TABLE 122 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018-2021 (USD THOUSAND)

- TABLE 123 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022-2027 (USD THOUSAND)

- TABLE 124 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 125 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 126 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 127 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (USD THOUSAND)

- TABLE 128 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 129 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 130 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 131 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 132 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 133 EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.1 GERMANY

- 8.4.1.1 Presence of leading market players to spur growth

- TABLE 134 GERMANY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 135 GERMANY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 136 GERMANY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 137 GERMANY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.2 UK

- 8.4.2.1 Government's plan to achieve net-zero carbon emissions to boost E-mobility

- TABLE 138 UK: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 139 UK: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 140 UK: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 141 UK: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.3 FRANCE

- 8.4.3.1 Government investments in technology infrastructure to support market growth

- TABLE 142 FRANCE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 143 FRANCE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 144 FRANCE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 145 FRANCE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.4 ITALY

- 8.4.4.1 Presence of luxury automobile industry to drive market

- TABLE 146 ITALY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 147 ITALY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 148 ITALY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 149 ITALY: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.5 SPAIN

- 8.4.5.1 Adoption of E-mobility by aerospace industry to propel market

- TABLE 150 SPAIN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 151 SPAIN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 152 SPAIN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 153 SPAIN: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.6 REST OF EUROPE

- TABLE 154 REST OF EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 155 REST OF EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 156 REST OF EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 157 REST OF EUROPE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5 MIDDLE EAST & AFRICA

- TABLE 158 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018-2021 (USD THOUSAND)

- TABLE 159 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022-2027 (USD THOUSAND)

- TABLE 160 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 161 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 162 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 163 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (USD THOUSAND)

- TABLE 164 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 165 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 166 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 167 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 168 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 169 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5.1 SAUDI ARABIA

- 8.5.1.1 Positive trends in automotive and electrical & electronics industries to drive market

- TABLE 170 SAUDI ARABIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 171 SAUDI ARABIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 172 SAUDI ARABIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 173 SAUDI ARABIA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5.2 SOUTH AFRICA

- 8.5.2.1 Developments in electrical & electronics, industrial processing, and automotive industries to favor market growth

- TABLE 174 SOUTH AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 175 SOUTH AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 176 SOUTH AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 177 SOUTH AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5.3 UAE

- 8.5.3.1 IoT-related applications in various industries to boost demand for thermally conductive plastics

- TABLE 178 UAE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 179 UAE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 180 UAE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 181 UAE: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 182 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6 SOUTH AMERICA

- TABLE 186 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018-2021 (USD THOUSAND)

- TABLE 187 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022-2027 (USD THOUSAND)

- TABLE 188 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 189 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 190 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (USD THOUSAND)

- TABLE 191 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (USD THOUSAND)

- TABLE 192 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 193 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 194 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 195 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 196 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 197 SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6.1 BRAZIL

- 8.6.1.1 Investments in automotive industry to propel market

- TABLE 198 BRAZIL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 199 BRAZIL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 200 BRAZIL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 201 BRAZIL: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6.2 ARGENTINA

- 8.6.2.1 Government initiatives for E-mobility to increase consumption of thermally conductive plastics

- TABLE 202 ARGENTINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 203 ARGENTINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 204 ARGENTINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 205 ARGENTINA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6.3 REST OF SOUTH AMERICA

- TABLE 206 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD THOUSAND)

- TABLE 207 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD THOUSAND)

- TABLE 208 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 209 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE PLASTICS MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 35 COMPANIES ADOPTED INVESTMENT & EXPANSION AND NEW PRODUCT LAUNCH AS KEY GROWTH STRATEGIES BETWEEN 2017 AND 2022

- 9.3 MARKET EVALUATION MATRIX

- TABLE 210 MARKET EVALUATION MATRIX

- 9.4 REVENUE ANALYSIS OF TOP PLAYERS

- TABLE 211 THERMALLY CONDUCTIVE PLASTICS MARKET: REVENUE ANALYSIS (USD)

- 9.5 MARKET RANKING ANALYSIS

- FIGURE 36 RANKING OF TOP FIVE PLAYERS IN THERMALLY CONDUCTIVE PLASTICS MARKET, 2021

- 9.6 MARKET SHARE ANALYSIS

- FIGURE 37 THERMALLY CONDUCTIVE PLASTICS MARKET SHARE, BY COMPANY, 2021

- TABLE 212 THERMALLY CONDUCTIVE PLASTICS MARKET: DEGREE OF COMPETITION

- 9.6.1 CELANESE CORPORATION

- 9.6.2 DSM

- 9.6.3 SABIC

- 9.6.4 BASF

- 9.6.5 DUPONT

- 9.7 COMPANY EVALUATION MATRIX

- 9.7.1 STARS

- 9.7.2 EMERGING LEADERS

- 9.7.3 PERVASIVE PLAYERS

- 9.7.4 PARTICIPANTS

- FIGURE 38 THERMALLY CONDUCTIVE PLASTICS MARKET: COMPANY EVALUATION MATRIX, 2021

- 9.8 COMPETITIVE BENCHMARKING

- TABLE 213 THERMALLY CONDUCTIVE PLASTICS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 214 THERMALLY CONDUCTIVE PLASTICS MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 9.8.1 COMPANY FOOTPRINT

- TABLE 215 OVERALL COMPANY FOOTPRINT

- 9.8.2 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 216 OVERALL END-USE INDUSTRY FOOTPRINT

- 9.8.3 COMPANY TYPE FOOTPRINT

- TABLE 217 OVERALL TYPE FOOTPRINT

- 9.8.4 COMPANY REGION FOOTPRINT

- TABLE 218 OVERALL REGION FOOTPRINT

- 9.9 STRENGTH OF PRODUCT PORTFOLIO

- 9.10 BUSINESS STRATEGY EXCELLENCE

- 9.11 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 9.11.1 PROGRESSIVE COMPANIES

- 9.11.2 RESPONSIVE COMPANIES

- 9.11.3 STARTING BLOCKS

- 9.11.4 DYNAMIC COMPANIES

- FIGURE 39 THERMALLY CONDUCTIVE PLASTICS MARKET: START-UPS AND SMES MATRIX, 2021

- 9.12 COMPETITIVE SCENARIO

- 9.12.1 NEW PRODUCT LAUNCHES

- TABLE 219 NEW PRODUCT LAUNCHES, 2017-2022

- 9.12.2 DEALS

- TABLE 220 DEALS, 2017-2022

- 9.12.3 OTHER DEVELOPMENTS

- TABLE 221 OTHER DEVELOPMENTS, 2017-2022

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- (Business overview, Products/Solutions offered, Recent Developments, MNM view)**

- 10.1.1 CELANESE CORPORATION

- TABLE 222 CELANESE CORPORATION: COMPANY OVERVIEW

- FIGURE 40 CELANESE CORPORATION: COMPANY SNAPSHOT

- TABLE 223 CELANESE CORPORATION: PRODUCT OFFERINGS

- TABLE 224 CELANESE CORPORATION: DEALS

- TABLE 225 CELANESE CORPORATION: OTHERS

- 10.1.2 DSM

- TABLE 226 DSM: COMPANY OVERVIEW

- FIGURE 41 DSM: COMPANY SNAPSHOT

- TABLE 227 DSM: PRODUCT OFFERINGS

- TABLE 228 DSM: PRODUCT LAUNCHES

- TABLE 229 DSM: DEALS

- TABLE 230 DSM: OTHERS

- 10.1.3 SABIC

- TABLE 231 SABIC: COMPANY OVERVIEW

- FIGURE 42 SABIC: COMPANY SNAPSHOT

- TABLE 232 SABIC: PRODUCT OFFERINGS

- TABLE 233 SABIC: OTHERS

- 10.1.4 BASF

- TABLE 234 BASF SE: COMPANY OVERVIEW

- FIGURE 43 BASF SE: COMPANY SNAPSHOT

- TABLE 235 BASF: PRODUCT OFFERINGS

- TABLE 236 BASF: PRODUCT LAUNCHES

- TABLE 237 BASF: DEALS

- TABLE 238 BASF: OTHERS

- 10.1.5 DUPONT

- TABLE 239 DUPONT: COMPANY OVERVIEW

- FIGURE 44 DUPONT: COMPANY SNAPSHOT

- TABLE 240 DUPONT: PRODUCT OFFERINGS

- TABLE 241 DUPONT: PRODUCT LAUNCHES

- 10.1.6 COVESTRO AG

- TABLE 242 COVESTRO AG: COMPANY OVERVIEW

- FIGURE 45 COVESTRO AG: COMPANY SNAPSHOT

- TABLE 243 COVESTRO AG: PRODUCT OFFERINGS

- TABLE 244 COVESTRO: DEALS

- TABLE 245 COVESTRO: OTHERS

- 10.1.7 AVIENT CORPORATION

- TABLE 246 AVIENT CORPORATION: COMPANY OVERVIEW

- FIGURE 46 AVIENT CORPORATION: COMPANY SNAPSHOT

- TABLE 247 AVIENT CORPORATION: PRODUCT OFFERINGS

- TABLE 248 AVIENT CORPORATION: DEALS

- 10.1.8 KANEKA CORPORATION

- TABLE 249 KANEKA CORPORATION: COMPANY OVERVIEW

- FIGURE 47 KANEKA CORPORATION: COMPANY SNAPSHOT

- TABLE 250 KANEKA CORPORATION: PRODUCT OFFERINGS

- 10.1.9 ENSINGER

- TABLE 251 ENSINGER: COMPANY OVERVIEW

- TABLE 252 ENSINGER: PRODUCT OFFERINGS

- TABLE 253 ENSINGER: PRODUCT LAUNCHES

- 10.1.10 MITSUBISHI ENGINEERING-PLASTICS CORPORATION

- TABLE 254 MITSUBISHI ENGINEERING-PLASTICS CORPORATION: COMPANY OVERVIEW

- TABLE 255 MITSUBISHI ENGINEERING-PLASTICS CORPORATION: PRODUCT OFFERINGS

- 10.1.11 TORAY INDUSTRIES, INC.

- TABLE 256 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 48 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 257 TORAY INDUSTRIES, INC.: PRODUCT OFFERINGS

- TABLE 258 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 259 TORAY INDUSTRIES, INC.: OTHERS

- 10.1.12 LANXESS

- TABLE 260 LANXESS: COMPANY OVERVIEW

- FIGURE 49 LANXESS: COMPANY SNAPSHOT

- TABLE 261 LANXESS: PRODUCT OFFERINGS

- TABLE 262 LANXESS: PRODUCT LAUNCHES

- TABLE 263 LANXESS: DEALS

- TABLE 264 LANXESS: OTHERS

- *Details on Business overview, Products/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 10.2 OTHER PLAYERS

- 10.2.1 SUMITOMO BAKELITE CO., LTD.

- TABLE 265 SUMITOMO BAKELITE CO., LTD.: COMPANY OVERVIEW

- 10.2.2 LOTTE CHEMICAL

- TABLE 266 LOTTE CHEMICAL: COMPANY OVERVIEW

- 10.2.3 LATI INDUSTRIA TERMOPLASTICI S.P.A.

- TABLE 267 LATI INDUSTRIA TERMOPLASTICI S.P.A.: COMPANY OVERVIEW

- 10.2.4 LEHMANN&VOSS&CO.

- TABLE 268 LEHMANN&VOSS&CO.: COMPANY OVERVIEW

- 10.2.5 KRAIBURG TPE GMBH & CO. KG

- TABLE 269 KRAIBURG TPE GMBH & CO. KG: COMPANY OVERVIEW

- 10.2.6 KENNER MATERIAL & SYSTEM CO., LTD

- TABLE 270 KENNER MATERIAL & SYSTEM CO., LTD: COMPANY OVERVIEW

- 10.2.7 ASCEND PERFORMANCE MATERIALS

- TABLE 271 ASCEND PERFORMANCE MATERIALS: COMPANY OVERVIEW

- 10.2.8 UGENT TECH SDN BHD.

- TABLE 272 UGENT TECH SDN BHD.: COMPANY OVERVIEW

- 10.2.9 WITCOM ENGINEERING PLASTICS BV

- TABLE 273 WITCOM ENGINEERING PLASTICS BV: COMPANY OVERVIEW

- 10.2.10 XIAMEN KEYUAN PLASTIC CO., LTD

- TABLE 274 XIAMEN KEYUAN PLASTIC CO., LTD: COMPANY OVERVIEW

- 10.2.11 DONGGUAN ZIITEK ELECTRONIC MATERIAL AND TECHNOLOGY LTD.

- TABLE 275 DONGGUAN ZIITEK ELECTRONIC MATERIAL AND TECHNOLOGY LTD.: COMPANY OVERVIEW

- 10.2.12 RADICAL MATERIALS LTD

- TABLE 276 RADICAL MATERIALS LTD: COMPANY OVERVIEW

- 10.2.13 COOLMAG THERMO CONDUCTIVE, S.L.

- TABLE 277 COOLMAG THERMO CONDUCTIVE, S.L.: COMPANY OVERVIEW

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 AVAILABLE CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS