|

|

市場調査レポート

商品コード

1103428

分散剤の世界市場:種類別・構造別 (陰イオン性、非イオン性、疎水性、親水性、カチオン性、両性)・最終用途産業別・地域別 (北米、欧州、アジア太平洋、中東・アフリカ、南米) の将来予測 (2027年まで)Dispersing Agents Market by Type (Waterborne, Solventborne), Structure (Anionic, Nonionic, Hydrophobic, Hydrophilic, Cationic, Amphoteric), End-use Industry and Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 分散剤の世界市場:種類別・構造別 (陰イオン性、非イオン性、疎水性、親水性、カチオン性、両性)・最終用途産業別・地域別 (北米、欧州、アジア太平洋、中東・アフリカ、南米) の将来予測 (2027年まで) |

|

出版日: 2022年07月14日

発行: MarketsandMarkets

ページ情報: 英文 280 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

分散剤の世界市場は、2022年の71億米ドルから、5.5%のCAGRで成長し、2027年には93億米ドルに達すると予想されています。

揮発性有機化合物 (VOC) は、1つ以上の炭素原子を含み、高い蒸気圧を持つため、空気中で急速に蒸発します。従来の溶剤はVOC含有量が高く、塗料やコーティング剤、接着剤、シーラント、印刷インキ、ワニスなどに使用されています。VOCはスモッグを発生させ、人体や動物の健康に悪影響を及ぼします。また、環境にも影響を与え、農作物や商業用森林の収穫量を減少させる可能性があります。溶剤型塗料から水性塗料やその他の無溶剤型塗料への移行が、従来の溶剤の需要にマイナスの影響を与え、分散剤市場を牽引しています。

"予測期間中、水性タイプが分散剤市場の最速成長タイプになる見通し"

VOC含有量に関する規制が強化される中、エンドユーザーはVOC含有量の低減に役立つ分散剤を使用するか、水系分散剤にシフトすることを余儀なくされています。住宅建設の増加や住宅リフォームの改善により、特にインドや中国などの新興国において水系分散剤市場の牽引役となることが予想されます。また、低コストの労働力と入手しやすい原材料を背景に、石油・ガス、医薬品、建設業界を中心に海外からの投資が増加していることも、市場を押し上げる要因となっています。

"2021年の分散剤市場において、非イオン構造は金額ベースで2番目に大きな用途となる見通し"

非イオン性構造の分散剤は、主に綿、ウール、ほとんどの合成繊維とその混合物に使用され、染色のために均一に整えられた表面を提供します。非イオン性構造型分散剤は、より過酷な条件下で乳化した油滴または水滴の合体を防ぐことにより、エマルションシステムを安定化させるために、処方における作業上の柔軟性を提供します。非イオン性構造型分散剤は、他の荷電分子との相溶性、さまざまな用途での使用、一部の非イオン性構造型分散剤の低毒性なども、世界市場での成長を後押しする要因となっています。

"予測期間中、製薬産業が分散剤市場の最終用途産業として最も成長率が高くなる見通し"

分散剤は医療産業で広く使用されています。薬物にとって、溶液中の濃度が均一であることは必須であり、そうでなければ、設計通りの効果を発揮できない可能性があります。分散剤は、薬物溶液に添加することで微細に分散された溶液を形成します。錠剤にも一定量の分散剤が添加されています。分散剤を使用することで、錠剤が患者の体内で均一に崩壊し、効果的に作用するのです。また、錠剤に含まれる顔料や色を均一に分散させるためにも、分散剤が必要です。

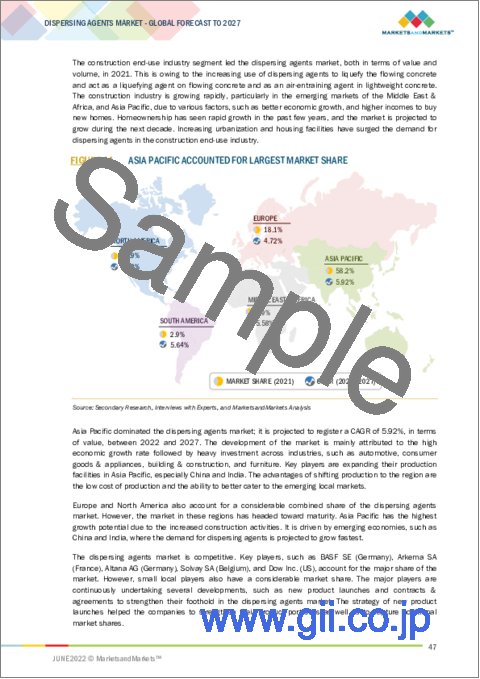

"2021年、欧州は金額ベースで2番目に大きな分散剤市場になると推定される"

欧州地域における分散剤市場は着実に成長すると推定されます。この市場は主にパーソナルケア製品の消費者から生じる需要によって牽引されるでしょう。欧州には数多くの大手分散剤メーカーが存在しています。欧州の分散剤メーカーにとっての主な課題は、金融の浮き沈みの中で原料価格と最終製品コストのバランスを保つこと、環境に優しい製品への意識の高まり (例えば、低VOC含有量やアルキルフェノールエトキシレートフリー製品) 、製品の範囲とその応用分野の増加です。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

- 主要国のGDPの動向と予測

- COVID-19の影響

- COVID-19の影響:顧客分析

第6章 産業動向

- サプライチェーン分析

- 原材料

- メーカー

- 流通ネットワーク

- バイヤー

- 分散剤市場:現実的、悲観的、楽観的、非COVID-19シナリオ

- 価格分析

- 顧客のビジネスに影響を与える傾向/混乱

- 接続市場:エコシステム

- 技術分析

- ケーススタディ分析

- 貿易データ統計

- 規制状況

- 2022年から2023年の主要な会議とイベント

- 特許分析

第7章 分散剤市場:種類別

- イントロダクション

- 水性

- 溶剤系

- その他

第8章 分散剤市場:構造別

- イントロダクション

- 陰イオン性

- 非イオン性

- 疎水性

- 親水性

- カチオン性

- 両性

第9章 分散剤市場:最終用途産業別

- イントロダクション

- 建設業

- 塗料・コーティング

- パルプ・製紙

- 洗剤

- 石油・ガス

- 農業

- 医薬品

- その他

第10章 地域分析

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- 南米

第11章 競合情勢

- イントロダクション

- 主要企業に採用された戦略

- 市場シェア分析

- 主要企業のランキング (2021年)

- 主要企業の市場シェア

- 上位5社の収益分析

- 企業の製品フットプリント分析

- 企業評価マトリックス (ティア1)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- 競争の状況と動向

- 製品の発売

- 取引

- その他の動向

第12章 企業プロファイル

- 主要企業

- ALTANA AG

- ARKEMA SA

- BASF SE

- CRODA INTERNATIONAL PLC

- SOLVAY SA

- ELEMENTIS PLC

- LANXESS AG

- DOW INC.

- NIPPON PAPER INDUSTRIES CO., LTD.

- CLARIANT AG

- その他の企業

- SAINT-GOBAIN SA

- EVONIK INDUSTRIES AG

- SHUBH INDUSTRIES PVT. LTD.

- KING INDUSTRIES, INC.

- LUBRIZOL CORPORATION

- RUDOLF GMBH

- UNIQCHEM GMBH

- SHAH PATIL & COMPANY

- HARMONY ADDITIVE PVT. LTD.

- FINE ORGANICS

- SANYO CHEMICAL INDUSTRIES LTD.

- ARXADA AG

- ANGUS CHEMICAL COMPANY

- ASHLAND GLOBAL HOLDINGS INC.

- NICCA CHEMICAL CO. LTD.

第13章 隣接・関連市場

- イントロダクション

- 制限

- 塗料・コーティング市場

- 塗料・コーティング市場:地域別

第14章 付録

The global dispersing agents market will grow to USD 9.3 billion by 2027, at a CAGR of 5.5% from USD 7.1 billion in 2022. Volatile organic compounds (VOCs) contain one or more carbon atoms that have high vapor pressures and, therefore, evaporate rapidly in the air. Conventional solvents are high in VOC content and are used in paints & coatings, adhesives, sealants, printing inks, and varnishes. VOCs contain smog which has an adverse impact on human and animal health. They also have environmental effects and can lead to a reduction in agricultural crops and other commercial forest yields. The shift from solvent-based paints to water-based or other solvent-free paints has affected the demand for conventional solvents negatively and has driven the dispersing agents market.

"Waterborne type is projected to be the fastest-growing type of dispersing agents market during the forecast period."

With the tightening of regulations over VOC content, the end-users are forced to either use dispersing agents that help in reducing the VOC content or shift to water-borne dispersing agents. The increasing residential construction and improved home remodeling practices are expected to drive the waterborne dispersing agents market, especially in emerging countries like India and China. In addition, increasing foreign investments, especially in the oil & gas, pharmaceuticals, and construction industries, due to low-cost labor and easily accessible raw materials, are boosting the market.

"Non-ionic structure is estimated to be the second largest application in dispersing agents market, in terms of value, in 2021"

Non-ionic structured dispersing agents are mainly used on cotton, wool, and most synthetics and their blends to provide a uniformly prepared surface for dyeing. The non-ionic structured dispersing agents provide an extra degree of working flexibility in formulation to stabilize the emulsion systems by preventing the coalescence of emulsified oil or water droplets under more extreme conditions. The compatibility of non-ionic structured dispersing agents with other charged molecules, their use in various applications, and the low toxicity of some non-ionic structured dispersing agents are other factors driving their growth in the global market.

"Pharmaceutical end-use industry is projected to be the fastest-growing end-use industry of dispersing agents market during the forecast period."

Dispersing agents have wide usage in the medical industry. It is imperative for a drug to have a homogenous concentration in a solution; otherwise, it may not be as effective as it was designed to be. Dispersing agents are added to the drug solution to form a finely dispersed solution. Tablets also have a certain amount of dispersing agents added to them. By using dispersing agents, the tablet disintegrates evenly inside the patient's body, thereby working effectively. Homogenous distribution of the pigment or color in the tablet also requires dispersing agents.

"Europe is estimated to be the second-largest dispersing agents market, in terms of value, in 2021"

The European region is estimated to witness steady growth in the dispersing agents market. The market will be mainly driven by demand arising from consumers for personal care products. Europe is home to major dispersing agent manufacturers, including BASF SE (Germany), Altana AG (Germany), Arkema SA (France), Solvay SA (Belgium), Clariant AG (Switzerland), LANXESS AG (Germany), Elementis plc (UK), and Croda International Plc (UK). The major challenges for dispersing agent manufacturers in Europe would be maintaining the balance between raw material price and final product cost during the financial ups and downs, increasing awareness toward eco-friendly products (for instance, low VOC content and alkyl phenol ethoxylates-free products), and increasing scope of products as well as their application segments

Breakdown of primaries

The study contains insights from various industry experts, ranging from raw material suppliers to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 46%, Tier 2 - 31%, and Tier 3 - 23%

- By Designation: C-Level - 46%, Director Level - 27%, and Others - 27%

- By Region: North America - 33%, Europe - 27%, APAC - 27%, South America - 7%, Middle East & Africa - 6%,

The key market players profiled in the report include BASF SE (Germany), Arkema SA (France), Altana AG (Germany), Solvay SA (Belgium), and Dow Inc. (US), Croda International Plc. (UK), Solvay SA (Belgium), LANXESS AG (Germany), Elementis Plc. (Germany), Nippon Paper Industries Co., Ltd. (Japan), Clariant AG (Switzerland) and others.

Research Coverage

This report segments the market for dispersing agents is based on type, structure, end-use industry, and region, and provides estimations for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, associated with the market for dispersing agents.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the dispersing agents market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on dispersing agents offered by top players in the global market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for dispersing agents across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global dispersing agents market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the dispersing agents market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 DISPERSING AGENTS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.2.2 DISPERSING AGENTS MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.2.3 DISPERSING AGENTS MARKET DEFINITION AND INCLUSIONS, BY STRUCTURE

- 1.2.4 DISPERSING AGENTS MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- 1.3 MARKET SCOPE

- FIGURE 1 DISPERSING AGENTS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 DISPERSING AGENTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary Interviews-Demand and Supply Sides

- 2.1.2.2 Key Industry Insights

- 2.1.2.3 Breakdown of Primary Interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- FIGURE 5 DISPERSING AGENTS MARKET: DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- FIGURE 6 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- FIGURE 7 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 RISK ASSESSMENT

- TABLE 1 DISPERSING AGENTS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 WATERBORNE TYPE LED DISPERSING AGENTS MARKET

- FIGURE 9 ANIONIC SEGMENT TO BE FASTEST-GROWING STRUCTURE DURING FORECAST PERIOD

- FIGURE 10 CONSTRUCTION END-USE INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN DISPERSING AGENTS MARKET

- FIGURE 12 GROWING CONSTRUCTION END-USE INDUSTRY TO DRIVE DISPERSING AGENTS MARKET DURING FORECAST PERIOD

- 4.2 DISPERSING AGENTS MARKET SIZE, BY REGION

- FIGURE 13 ASIA PACIFIC TO BE LARGEST MARKET FOR DISPERSING AGENTS DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: DISPERSING AGENTS MARKET, BY END-USE INDUSTRY AND COUNTRY, 2021

- FIGURE 14 CONSTRUCTION END-USE INDUSTRY AND CHINA ACCOUNTED FOR LARGEST SHARES

- 4.4 DISPERSING AGENTS MARKET SIZE, BY STRUCTURE

- FIGURE 15 ANIONIC TO BE LARGEST STRUCTURE IN DISPERSING AGENTS MARKET

- 4.5 DISPERSING AGENTS MARKET SIZE, TYPE VS. REGION

- FIGURE 16 WATERBORNE TYPE LED DISPERSING AGENTS MARKET ACROSS REGIONS

- 4.6 DISPERSING AGENTS MARKET: MAJOR COUNTRIES

- FIGURE 17 INDIA TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DISPERSING AGENTS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing oil drilling & exploration activities

- 5.2.1.2 Rising cement production

- FIGURE 19 GLOBAL CEMENT PRODUCTION (MILLION TON), 2010-2020

- 5.2.1.3 Growing demand for waterborne dispersing agents

- FIGURE 20 GLOBAL VOC EMISSIONS, 2015-2019 (KILOTON)

- 5.2.1.4 Enhanced demand from paints & coatings industry

- TABLE 2 TOP 10 GLOBAL PAINTS & COATINGS COMPANIES, 2021

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuating cost of raw materials

- 5.2.2.2 Lack of innovation in the industry

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand in current & emerging end-use industries

- 5.2.4 CHALLENGES

- 5.2.4.1 Harmful environmental impact of dispersing agents

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 DISPERSING AGENTS: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 DISPERSING AGENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP-THREE APPLICATIONS

- TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.4.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- TABLE 6 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2019-2027 (USD BILLION)

- 5.6 IMPACT OF COVID-19

- 5.6.1 INTRODUCTION

- 5.6.2 COVID-19 HEALTH ASSESSMENT

- FIGURE 24 COUNTRY-WISE SPREAD OF COVID-19

- 5.6.3 COVID-19 ECONOMIC ASSESSMENT

- FIGURE 25 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2022

- 5.7 IMPACT OF COVID-19: CUSTOMER ANALYSIS

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 26 DISPERSING AGENTS: SUPPLY CHAIN

- 6.1.1 RAW MATERIALS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTION NETWORK

- 6.1.4 BUYERS

- 6.2 DISPERSING AGENTS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- FIGURE 27 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- TABLE 7 DISPERSING AGENTS MARKET FORECAST SCENARIO, 2019-2027 (USD MILLION)

- 6.2.1 NON-COVID-19 SCENARIO

- 6.2.2 OPTIMISTIC SCENARIO

- 6.2.3 PESSIMISTIC SCENARIO

- 6.2.4 REALISTIC SCENARIO

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

- FIGURE 28 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP-THREE APPLICATIONS

- TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS USD/KG

- 6.3.2 AVERAGE SELLING PRICE, BY REGION

- FIGURE 29 AVERAGE SELLING PRICE OF DISPERSING AGENTS, BY REGION (USD/KG)

- TABLE 9 AVERAGE SELLING PRICE OF DISPERSING AGENTS, BY REGION (USD/KG)

- 6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4.1 REVENUE SHIFTS & REVENUE POCKETS FOR DISPERSING AGENTS MARKET

- FIGURE 30 REVENUE SHIFT FOR DISPERSING AGENTS MARKET

- 6.5 CONNECTED MARKETS: ECOSYSTEM

- TABLE 10 DISPERSING AGENTS MARKET: ECOSYSTEM

- FIGURE 31 DISPERSING AGENTS: ECOSYSTEM

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 HIGH MOLAR VOLUME (HMV) POLYMER TECHNOLOGY

- TABLE 11 ADVANTAGES OF HMV POLYMER TECHNOLOGY

- 6.6.2 RENEWABLE DISPERSANT TECHNOLOGY

- 6.6.3 CONTROLLED FREE-RADICAL POLYMERIZATION (CFRP) TECHNOLOGY

- TABLE 12 BENEFITS OF CFRP TECHNOLOGY

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 CASE STUDY ON BASF SE

- 6.8 TRADE DATA STATISTICS

- 6.8.1 IMPORT SCENARIO OF DISPERSING AGENTS

- FIGURE 32 IMPORTS OF DISPERSING AGENTS, BY KEY COUNTRY (2015-2020)

- TABLE 13 IMPORTS OF DISPERSING AGENTS, BY REGION, 2015-2020 (USD MILLION)

- 6.8.2 EXPORT SCENARIO OF DISPERSING AGENTS

- FIGURE 33 EXPORTS OF DISPERSING AGENTS, BY KEY COUNTRY (2015-2020)

- TABLE 14 EXPORTS OF DISPERSING AGENTS, BY REGION, 2015-2020 (USD MILLION)

- 6.9 REGULATORY LANDSCAPE

- 6.9.1 REGULATIONS RELATED TO DISPERSING AGENTS

- 6.10 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 15 DISPERSING AGENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPE

- TABLE 16 GRANTED PATENTS ACCOUNT FOR 5% OF ALL PATENTS BETWEEN 2011 AND 2021

- FIGURE 34 PATENTS REGISTERED FOR DISPERSING AGENTS, 2011-2021

- FIGURE 35 PATENT PUBLICATION TRENDS FOR DISPERSING AGENTS, 2011-2021

- 6.11.3 LEGAL STATUS OF PATENTS

- FIGURE 36 LEGAL STATUS OF PATENTS FILED FOR DISPERSING AGENTS

- 6.11.4 JURISDICTION ANALYSIS

- FIGURE 37 HIGHEST NUMBER OF PATENTS FILED BY COMPANIES IN CHINA

- 6.11.5 TOP APPLICANTS

- FIGURE 38 GUANGXI UNIVERSITY REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2011 AND 2021

- TABLE 17 LIST OF PATENTS BY SINOPEC

- TABLE 18 LIST OF PATENTS BY BASF SE

- TABLE 19 TOP TEN PATENT OWNERS (US) DURING LAST TEN YEARS

7 DISPERSING AGENTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 39 WATERBORNE SEGMENT TO DOMINATE DISPERSING AGENTS MARKET BETWEEN 2022 AND 2027

- TABLE 20 DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 21 DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 22 DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 23 DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- 7.2 WATERBORNE

- 7.2.1 NEED TO REDUCE VOC CONTENT DRIVING DEMAND FOR WATERBORNE DISPERSING AGENTS

- TABLE 24 WATERBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 25 WATERBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 26 WATERBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2017-2020 (KILOTON)

- TABLE 27 WATERBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2021-2027 (KILOTON)

- 7.3 SOLVENTBORNE

- 7.3.1 HIGH PERFORMANCE AND FLEXIBILITY OF SOLVENTBORNE AGENTS TO DRIVE MARKET DEMAND

- TABLE 28 SOLVENTBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 29 SOLVENTBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 30 SOLVENTBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2017-2020 (KILOTON)

- TABLE 31 SOLVENTBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2021-2027 (KILOTON)

- 7.4 OTHERS

- TABLE 32 OTHER DISPERSING AGENTS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 33 OTHER DISPERSING AGENTS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 34 OTHER DISPERSING AGENTS MARKET SIZE, BY REGION, 2017-2020 (KILOTON)

- TABLE 35 OTHER DISPERSING AGENTS MARKET SIZE, BY REGION, 2021-2027 (KILOTON)

8 DISPERSING AGENTS MARKET, BY STRUCTURE

- 8.1 INTRODUCTION

- FIGURE 40 ANIONIC DISPERSANT TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

- TABLE 36 DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (USD MILLION)

- TABLE 37 DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027 (USD MILLION)

- TABLE 38 DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (KILOTON)

- TABLE 39 DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027 (KILOTON)

- 8.2 ANIONIC

- 8.2.1 LOW COST & EASY AVAILABILITY TO DRIVE DEMAND FOR ANIONIC STRUCTURED DISPERSING AGENTS

- TABLE 40 ANIONIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 41 ANIONIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 42 ANIONIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 43 ANIONIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (KILOTON)

- 8.3 NON-IONIC

- 8.3.1 LOW FOAMING AND SUPERIOR EMULSIFYING PROPERTIES DRIVE DEMAND FOR THIS SEGMENT

- TABLE 44 NON-IONIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 45 NON-IONIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 46 NON-IONIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 47 NON-IONIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (KILOTON)

- 8.4 HYDROPHOBIC

- 8.4.1 CONSTRUCTION AND OTHER ARCHITECTURAL WORKS TO DRIVE DEMAND FOR HYDROPHOBIC STRUCTURED DISPERSING AGENTS

- TABLE 48 HYDROPHOBIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 49 HYDROPHOBIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 50 HYDROPHOBIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 51 HYDROPHOBIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (KILOTON)

- 8.5 HYDROPHILIC

- 8.5.1 INSTITUTIONAL CLEANING TO DRIVE DEMAND FOR HYDROPHILIC STRUCTURED DISPERSING AGENTS

- TABLE 52 HYDROPHILIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 53 HYDROPHILIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 54 HYDROPHILIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 55 HYDROPHILIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (KILOTON)

- 8.6 CATIONIC

- 8.6.1 NON-MIXABILITY WITH ANIONIC DISPERSING AGENTS TO POSITIVELY AFFECT CATIONIC DISPERSING AGENT SEGMENT

- TABLE 56 CATIONIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 57 CATIONIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 58 CATIONIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 59 CATIONIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (KILOTON)

- 8.7 AMPHOTERIC

- 8.7.1 GROWING DEMAND FOR PERSONAL CARE PRODUCTS TO DRIVE DEMAND FOR AMPHOTERIC SEGMENT

- TABLE 60 AMPHOTERIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 61 AMPHOTERIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 62 AMPHOTERIC: DISPERSING AGENTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 63 AMPHOTERIC: DISPERSING AGENTS MARKET, BY REGION, 2021-2027 (KILOTON)

9 DISPERSING AGENTS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 41 PHARMACEUTICALS PROJECTED TO BE FASTEST-GROWING END-USE INDUSTRY OF DISPERSING AGENTS MARKET

- TABLE 64 DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 65 DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 66 DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 67 DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 9.2 CONSTRUCTION

- 9.2.1 RISING GLOBAL CONSTRUCTION ACTIVITIES DRIVING DEMAND FOR DISPERSING AGENTS

- TABLE 68 DISPERSING AGENTS MARKET SIZE IN CONSTRUCTION, BY REGION, 2017-2020 (USD MILLION)

- TABLE 69 DISPERSING AGENTS MARKET SIZE IN CONSTRUCTION, BY REGION, 2021-2027 (USD MILLION)

- TABLE 70 DISPERSING AGENTS MARKET SIZE IN CONSTRUCTION, BY REGION, 2017-2020 (KILOTON)

- TABLE 71 DISPERSING AGENTS MARKET SIZE IN CONSTRUCTION, BY REGION, 2021-2027 (KILOTON)

- 9.3 PAINTS & COATINGS

- 9.3.1 RISING GLOBAL MOTOR VEHICLE PRODUCTION DRIVES DEMAND FOR DISPERSING AGENTS IN PAINTS & COATINGS INDUSTRY

- TABLE 72 DISPERSING AGENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 73 DISPERSING AGENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2021-2027 (USD MILLION)

- TABLE 74 DISPERSING AGENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2017-2020 (KILOTON)

- TABLE 75 DISPERSING AGENTS MARKET SIZE IN PAINTS & COATINGS END-USE INDUSTRY, BY REGION, 2021-2027 (KILOTON)

- 9.4 PULP & PAPER

- 9.4.1 INCREASING CONSUMER DEMAND AND QUALITY STANDARDS DRIVE DEMAND FOR PULP & PAPER INDUSTRY

- TABLE 76 DISPERSING AGENTS MARKET SIZE IN PULP & PAPER, BY REGION, 2017-2020 (USD MILLION)

- TABLE 77 DISPERSING AGENTS MARKET SIZE IN PULP & PAPER, BY REGION, 2021-2027 (USD MILLION)

- TABLE 78 DISPERSING AGENTS MARKET SIZE IN PULP & PAPER, BY REGION, 2017-2020 (KILOTON)

- TABLE 79 DISPERSING AGENTS MARKET SIZE IN PULP & PAPER, BY REGION, 2021-2027 (KILOTON)

- 9.5 DETERGENTS

- 9.5.1 DEMAND FOR GERM-FREE, DIRT-FREE, AND HYGIENIC WORKSPACE TO PROPEL DETERGENTS SEGMENT

- TABLE 80 DISPERSING AGENTS MARKET SIZE IN DETERGENTS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 81 DISPERSING AGENTS MARKET SIZE IN DETERGENTS, BY REGION, 2021-2027 (USD MILLION)

- TABLE 82 DISPERSING AGENTS MARKET SIZE IN DETERGENTS, BY REGION, 2017-2020 (KILOTON)

- TABLE 83 DISPERSING AGENTS MARKET SIZE IN DETERGENTS, BY REGION, 2021-2027 (KILOTON)

- 9.6 OIL & GAS

- 9.6.1 DEMAND FOR AUTOMOTIVE LUBRICANTS DRIVES MARKET FOR DISPERSING AGENTS IN OIL & GAS INDUSTRY

- TABLE 84 DISPERSING AGENTS MARKET SIZE IN OIL & GAS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 85 DISPERSING AGENTS MARKET SIZE IN OIL & GAS, BY REGION, 2021-2027 (USD MILLION)

- TABLE 86 DISPERSING AGENTS MARKET SIZE IN OIL & GAS, BY REGION, 2017-2020 (KILOTON)

- TABLE 87 DISPERSING AGENTS MARKET SIZE IN OIL & GAS, BY REGION, 2021-2027 (KILOTON)

- 9.7 AGRICULTURE

- 9.7.1 CLIMATIC CHANGES AND NEED FOR AGROCHEMICALS DRIVING DEMAND FOR DISPERSING AGENTS IN THIS SEGMENT

- TABLE 88 DISPERSING AGENTS MARKET SIZE IN AGRICULTURE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 89 DISPERSING AGENTS MARKET SIZE IN AGRICULTURE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 90 DISPERSING AGENTS MARKET SIZE IN AGRICULTURE, BY REGION, 2017-2020 (KILOTON)

- TABLE 91 DISPERSING AGENTS MARKET SIZE IN AGRICULTURE, BY REGION, 2021-2027 (KILOTON)

- 9.8 PHARMACEUTICALS

- 9.8.1 RISING GLOBAL PHARMACEUTICALS PRODUCTION DRIVING DEMAND FOR DISPERSING AGENTS

- TABLE 92 DISPERSING AGENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2017-2020 (USD MILLION)

- TABLE 93 DISPERSING AGENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2021-2027 (USD MILLION)

- TABLE 94 DISPERSING AGENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2017-2020 (KILOTON)

- TABLE 95 DISPERSING AGENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2021-2027 (KILOTON)

- 9.9 OTHERS

- 9.9.1 INNOVATIONS IN PERSONAL CARE INDUSTRY TO DRIVE MARKET

- TABLE 96 DISPERSING AGENTS MARKET SIZE IN OTHERS END-USE INDUSTRIES, BY REGION, 2017-2020 (USD MILLION)

- TABLE 97 DISPERSING AGENTS MARKET SIZE IN OTHERS END-USE INDUSTRIES, BY REGION, 2021-2027 (USD MILLION)

- TABLE 98 DISPERSING AGENTS MARKET SIZE IN OTHERS END-USE INDUSTRIES, BY REGION, 2017-2020 (KILOTON)

- TABLE 99 DISPERSING AGENTS MARKET SIZE IN OTHERS END-USE INDUSTRIES, BY REGION, 2021-2027 (KILOTON)

10 REGIONAL ANALYSIS

- 10.1 INTRODUCTION

- FIGURE 42 ASIA PACIFIC TO BE FASTEST-GROWING DISPERSING AGENTS MARKET BETWEEN 2022 AND 2027

- TABLE 100 DISPERSING AGENTS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 101 DISPERSING AGENTS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 102 DISPERSING AGENTS MARKET SIZE, BY REGION, 2017-2020 (KILOTON)

- TABLE 103 DISPERSING AGENTS MARKET SIZE, BY REGION, 2021-2027 (KILOTON)

- 10.2 ASIA PACIFIC

- FIGURE 43 ASIA PACIFIC: DISPERSING AGENTS MARKET SNAPSHOT

- 10.2.1 ASIA PACIFIC: DISPERSING AGENTS MARKET, BY TYPE

- TABLE 104 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 105 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 106 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 107 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- 10.2.2 ASIA PACIFIC DISPERSING AGENTS MARKET, BY STRUCTURE

- TABLE 108 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (USD MILLION)

- TABLE 109 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027 (USD MILLION)

- TABLE 110 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (KILOTON)

- TABLE 111 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027 (KILOTON)

- 10.2.3 ASIA PACIFIC DISPERSING AGENTS MARKET, BY END-USE INDUSTRY

- TABLE 112 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 113 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 114 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 115 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.2.4 ASIA PACIFIC DISPERSING AGENTS MARKET, BY COUNTRY

- TABLE 116 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 117 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 118 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 119 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- 10.2.4.1 China

- 10.2.4.1.1 Consecutive increase in industrial output to drive market

- 10.2.4.1 China

- TABLE 120 CHINA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 121 CHINA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 122 CHINA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 123 CHINA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.2.4.2 JAPAN

- 10.2.4.2.1 Manufacturing and exporting of surfactants supporting market growth

- 10.2.4.2 JAPAN

- TABLE 124 JAPAN: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 125 JAPAN: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 126 JAPAN: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 127 JAPAN: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.2.4.3 India

- 10.2.4.3.1 Improving economic conditions and government initiatives to support market growth

- 10.2.4.3 India

- TABLE 128 INDIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 129 INDIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 130 INDIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 131 INDIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.2.4.4 South Korea

- 10.2.4.4.1 Presence of technologically advanced vehicle manufacturers to support market growth

- 10.2.4.4 South Korea

- TABLE 132 SOUTH KOREA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 133 SOUTH KOREA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 134 SOUTH KOREA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 135 SOUTH KOREA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.3 EUROPE

- FIGURE 44 EUROPE: DISPERSING AGENTS MARKET SNAPSHOT

- 10.3.1 EUROPE DISPERSING AGENTS MARKET, BY TYPE

- TABLE 136 EUROPE: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 137 EUROPE: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 138 EUROPE: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 139 EUROPE: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- 10.3.2 EUROPE DISPERSING AGENTS MARKET, BY STRUCTURE

- TABLE 140 EUROPE: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (USD MILLION)

- TABLE 141 EUROPE: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027 (USD MILLION)

- TABLE 142 EUROPE: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (KILOTON)

- TABLE 143 EUROPE: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027 (KILOTON)

- 10.3.3 EUROPE DISPERSING AGENTS MARKET, BY END-USE INDUSTRY

- TABLE 144 EUROPE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 145 EUROPE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 146 EUROPE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 147 EUROPE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.3.4 EUROPE DISPERSING AGENTS MARKET, BY COUNTRY

- TABLE 148 EUROPE: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 149 EUROPE: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 150 EUROPE: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 151 EUROPE: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- 10.3.4.1 Germany

- 10.3.4.1.1 Investments from residential and non-profit institutions to favor market growth

- 10.3.4.1 Germany

- TABLE 152 GERMANY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 153 GERMANY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 154 GERMANY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 155 GERMANY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.3.4.2 France

- 10.3.4.2.1 Government regulations and tax reductions in construction industry to drive market

- 10.3.4.2 France

- TABLE 156 FRANCE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 157 FRANCE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 158 FRANCE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 159 FRANCE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.3.4.3 UK

- 10.3.4.3.1 Investments in construction & pharmaceuticals industry to lead to market growth

- 10.3.4.3 UK

- TABLE 160 UK: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 161 UK: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 162 UK: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 163 UK: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.3.4.4 Italy

- 10.3.4.4.1 Presence of domestic car manufacturers to drive market

- 10.3.4.4 Italy

- TABLE 164 ITALY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 165 ITALY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 166 ITALY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 167 ITALY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.4 NORTH AMERICA

- FIGURE 45 NORTH AMERICA: DISPERSING AGENTS MARKET SNAPSHOT

- 10.4.1 NORTH AMERICA DISPERSING AGENTS MARKET, BY TYPE

- TABLE 168 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 169 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 170 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 171 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- 10.4.2 NORTH AMERICA DISPERSING AGENTS MARKET, BY STRUCTURE

- TABLE 172 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (USD MILLION)

- TABLE 173 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027 (USD MILLION)

- TABLE 174 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (KILOTON)

- TABLE 175 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027 (KILOTON)

- 10.4.3 NORTH AMERICA DISPERSING AGENTS MARKET, BY END-USE INDUSTRY

- TABLE 176 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 177 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 178 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 179 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.4.4 NORTH AMERICA DISPERSING AGENTS MARKET, BY COUNTRY

- TABLE 180 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 181 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 182 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 183 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- 10.4.4.1 US

- 10.4.4.1.1 Increased private construction to drive market

- 10.4.4.1 US

- TABLE 184 US: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 185 US: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 186 US: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 187 US: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.4.4.2 Canada

- 10.4.4.2.1 Development of residential, commercial, and infrastructure to boost market

- 10.4.4.2 Canada

- TABLE 188 CANADA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 189 CANADA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 190 CANADA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 191 CANADA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.4.4.3 Mexico

- 10.4.4.3.1 Investments from pharma players to drive market

- 10.4.4.3 Mexico

- TABLE 192 MEXICO: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 193 MEXICO: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 194 MEXICO: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 195 MEXICO: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA DISPERSING AGENTS MARKET, BY TYPE

- TABLE 196 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 199 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- 10.5.2 MIDDLE EAST & AFRICA DISPERSING AGENTS MARKET, BY STRUCTURE

- TABLE 200 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (KILOTON)

- TABLE 203 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027(KILOTON)

- 10.5.3 MIDDLE EAST & AFRICA DISPERSING AGENTS MARKET, BY END-USE INDUSTRY

- TABLE 204 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 207 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.5.4 MIDDLE EAST & AFRICA DISPERSING AGENTS MARKET, BY COUNTRY

- TABLE 208 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 211 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- 10.5.4.1 Saudi Arabia

- 10.5.4.1.1 Investments from residential and non-profit institutions to favor market growth

- 10.5.4.1 Saudi Arabia

- TABLE 212 SAUDI ARABIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 213 SAUDI ARABIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 214 SAUDI ARABIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 215 SAUDI ARABIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.5.4.2 UAE

- 10.5.4.2.1 Increased oil recovery activities to drive demand for dispersing agents

- 10.5.4.2 UAE

- TABLE 216 UAE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 217 UAE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 218 UAE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 219 UAE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.5.4.3 South Africa

- 10.5.4.3.1 Substantial demand for dispersing agents witnessed in building projects

- 10.5.4.3 South Africa

- TABLE 220 SOUTH AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 221 SOUTH AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 222 SOUTH AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 223 SOUTH AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.6 SOUTH AMERICA

- 10.6.1 SOUTH AMERICA DISPERSING AGENTS MARKET, BY TYPE

- TABLE 224 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 225 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 226 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 227 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- 10.6.2 SOUTH AMERICA DISPERSING AGENTS MARKET, BY STRUCTURE

- TABLE 228 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (USD MILLION)

- TABLE 229 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027 (USD MILLION)

- TABLE 230 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017-2020 (KILOTON)

- TABLE 231 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021-2027 (KILOTON)

- 10.6.3 SOUTH AMERICA DISPERSING AGENTS MARKET, BY END-USE INDUSTRY

- TABLE 232 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 233 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 234 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 235 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 10.6.4 SOUTH AMERICA DISPERSING AGENTS MARKET, BY COUNTRY

- TABLE 236 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 237 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 238 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 239 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- 10.6.4.1 Brazil

- 10.6.4.1.1 Rising exploration activities and discovery of new oilfields to drive market

- 10.6.4.1 Brazil

- TABLE 240 BRAZIL: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 241 BRAZIL: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 242 BRAZIL: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 243 BRAZIL: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 244 STRATEGIES ADOPTED BY MANUFACTURERS IN DISPERSING AGENTS MARKET

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 RANKING OF KEY MARKET PLAYERS, 2021

- FIGURE 46 RANKING OF TOP FIVE PLAYERS IN DISPERSING AGENTS MARKET, 2021

- 11.3.2 MARKET SHARE OF KEY PLAYERS

- TABLE 245 DISPERSING AGENTS MARKET: DEGREE OF COMPETITION

- FIGURE 47 BASF SE LEADING PLAYER IN DISPERSING AGENTS MARKET IN 2021

- 11.3.2.1 BASF SE

- 11.3.2.2 Arkema SA

- 11.3.2.3 Altana AG

- 11.3.2.4 Solvay SA

- 11.3.2.5 Dow Inc.

- 11.3.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 48 REVENUE ANALYSIS OF KEY COMPANIES IN PAST FIVE YEARS

- 11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 49 DISPERSING AGENTS MARKET: OVERALL COMPANY FOOTPRINT

- TABLE 246 DISPERSING AGENTS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 247 DISPERSING AGENTS MARKET: TYPE FOOTPRINT

- TABLE 248 DISPERSING AGENTS MARKET: REGION FOOTPRINT

- 11.5 COMPANY EVALUATION MATRIX (TIER 1)

- 11.5.1 STAR

- 11.5.2 EMERGING LEADERS

- FIGURE 50 COMPANY EVALUATION QUADRANT FOR DISPERSING AGENTS MARKET (TIER 1)

- 11.6 COMPETITIVE BENCHMARKING

- TABLE 249 DISPERSING AGENTS MARKET: DETAILED LIST OF KEY START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- TABLE 250 DISPERSING AGENTS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 11.7 START-UPS/ SMES EVALUATION QUADRANT

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 STARTING BLOCKS

- FIGURE 51 START-UP/SME EVALUATION QUADRANT FOR DISPERSING AGENTS MARKET

- 11.8 COMPETITIVE SITUATION AND TRENDS

- 11.8.1 PRODUCT LAUNCHES

- TABLE 251 DISPERSING AGENTS MARKET: PRODUCT LAUNCHES, 2018-2021

- 11.8.2 DEALS

- TABLE 252 DISPERSING AGENTS MARKET: DEALS (2018-2021)

- 11.8.3 OTHER DEVELOPMENTS

- TABLE 253 DISPERSING AGENTS MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2018-2021)

12 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 12.1 MAJOR PLAYERS

- 12.1.1 ALTANA AG

- FIGURE 52 ALTANA AG: COMPANY SNAPSHOT

- TABLE 254 ALTANA AG: BUSINESS OVERVIEW

- 12.1.2 ARKEMA SA

- FIGURE 53 ARKEMA SA: COMPANY SNAPSHOT

- TABLE 255 ARKEMA SA: BUSINESS OVERVIEW

- 12.1.3 BASF SE

- FIGURE 54 BASF SE: COMPANY SNAPSHOT

- TABLE 256 BASF SE: BUSINESS OVERVIEW

- 12.1.4 CRODA INTERNATIONAL PLC

- FIGURE 55 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

- TABLE 257 CRODA INTERNATIONAL PLC: BUSINESS OVERVIEW

- 12.1.5 SOLVAY SA

- FIGURE 56 SOLVAY SA: COMPANY SNAPSHOT

- TABLE 258 SOLVAY SA: BUSINESS OVERVIEW

- 12.1.6 ELEMENTIS PLC

- FIGURE 57 ELEMENTIS PLC: COMPANY SNAPSHOT

- TABLE 259 ELEMENTIS PLC: BUSINESS OVERVIEW

- 12.1.7 LANXESS AG

- FIGURE 58 LANXESS AG: COMPANY SNAPSHOT

- TABLE 260 LANXESS AG: BUSINESS OVERVIEW

- 12.1.8 DOW INC.

- FIGURE 59 DOW INC.: COMPANY SNAPSHOT

- TABLE 261 DOW INC.: BUSINESS OVERVIEW

- 12.1.9 NIPPON PAPER INDUSTRIES CO., LTD.

- FIGURE 60 NIPPON PAPER INDUSTRIES CO., LTD.: COMPANY SNAPSHOT

- TABLE 262 NIPPON PAPER INDUSTRIES CO., LTD.: BUSINESS OVERVIEW

- 12.1.10 CLARIANT AG

- FIGURE 61 CLARIANT AG: COMPANY SNAPSHOT

- TABLE 263 CLARIANT AG: BUSINESS OVERVIEW

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 SAINT-GOBAIN SA

- TABLE 264 SAINT-GOBAIN SA: BUSINESS OVERVIEW

- 12.2.2 EVONIK INDUSTRIES AG

- TABLE 265 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

- 12.2.3 SHUBH INDUSTRIES PVT. LTD.

- TABLE 266 SHUBH INDUSTRIES PVT. LTD.: BUSINESS OVERVIEW

- 12.2.4 KING INDUSTRIES, INC.

- TABLE 267 KING INDUSTRIES, INC.: BUSINESS OVERVIEW

- 12.2.5 LUBRIZOL CORPORATION

- TABLE 268 LUBRIZOL CORPORATION: BUSINESS OVERVIEW

- 12.2.6 RUDOLF GMBH

- TABLE 269 RUDOLF GMBH: BUSINESS OVERVIEW

- 12.2.7 UNIQCHEM GMBH

- TABLE 270 UNIQCHEM GMBH: BUSINESS OVERVIEW

- 12.2.8 SHAH PATIL & COMPANY

- TABLE 271 SHAH PATIL & COMPANY: BUSINESS OVERVIEW

- 12.2.9 HARMONY ADDITIVE PVT. LTD.

- TABLE 272 HARMONY ADDITIVE PVT. LTD.: BUSINESS OVERVIEW

- 12.2.10 FINE ORGANICS

- TABLE 273 FINE ORGANICS: BUSINESS OVERVIEW

- 12.2.11 SANYO CHEMICAL INDUSTRIES LTD.

- TABLE 274 SANYO CHEMICAL INDUSTRIES LTD.: BUSINESS OVERVIEW

- 12.2.12 ARXADA AG

- TABLE 275 ARXADA AG: BUSINESS OVERVIEW

- 12.2.13 ANGUS CHEMICAL COMPANY

- TABLE 276 ANGUS CHEMICAL COMPANY: BUSINESS OVERVIEW

- 12.2.14 ASHLAND GLOBAL HOLDINGS INC.

- TABLE 277 ASHLAND GLOBAL HOLDINGS INC.: BUSINESS OVERVIEW

- 12.2.15 NICCA CHEMICAL CO. LTD.

- TABLE 278 NICCA CHEMICAL CO. LTD.: BUSINESS OVERVIEW

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 PAINTS & COATINGS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 PAINTS & COATINGS MARKET, BY REGION

- TABLE 279 PAINTS & COATINGS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 280 PAINTS & COATINGS MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

- TABLE 281 PAINTS & COATINGS MARKET SIZE, BY REGION, 2017-2020 (KILOTON)

- TABLE 282 PAINTS & COATINGS MARKET SIZE, BY REGION, 2021-2026 (KILOTON)

- 13.4.1 ASIA PACIFIC

- 13.4.1.1 By country

- TABLE 283 ASIA PACIFIC: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 284 ASIA PACIFIC: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021-2026 (USD MILLION)

- TABLE 285 ASIA PACIFIC: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 286 ASIA PACIFIC: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021-2026 (KILOTON)

- 13.4.2 EUROPE

- 13.4.2.1 By country

- TABLE 287 EUROPE: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 288 EUROPE: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021-2026 (USD MILLION)

- TABLE 289 EUROPE: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 290 EUROPE: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021-2026 (KILOTON)

- 13.4.3 NORTH AMERICA

- 13.4.3.1 By country

- TABLE 291 NORTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 292 NORTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021-2026 (USD MILLION)

- TABLE 293 NORTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 294 NORTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021-2026 (KILOTON)

- 13.4.4 MIDDLE EAST & AFRICA

- 13.4.4.1 By country

- TABLE 295 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 296 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021-2026 (USD MILLION)

- TABLE 297 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 298 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021-2026 (KILOTON)

- 13.4.5 SOUTH AMERICA

- 13.4.5.1 By country

- TABLE 299 SOUTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 300 SOUTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021-2026 (USD MILLION)

- TABLE 301 SOUTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 302 SOUTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021-2026 (KILOTON)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS