|

|

市場調査レポート

商品コード

1099208

化粧品用防腐剤の市場:種類(パラベンエステル、ホルムアルデヒド供与体、フェノール誘導体、アルコール、無機物、第四級化合物、有機酸・有機酸塩)、用途、地域(北米、欧州、アジア太平洋、RoW)別-世界予測-2027年Cosmetic Preservatives Market by Type (Paraben Esters, Formaldehyde Donors, Phenol Derivatives, Alcohols, Inorganics, Quaternary Compounds, Organic Acids & Their Salts), Application and Region (North America, Europe, APAC, RoW) -Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 化粧品用防腐剤の市場:種類(パラベンエステル、ホルムアルデヒド供与体、フェノール誘導体、アルコール、無機物、第四級化合物、有機酸・有機酸塩)、用途、地域(北米、欧州、アジア太平洋、RoW)別-世界予測-2027年 |

|

出版日: 2022年07月05日

発行: MarketsandMarkets

ページ情報: 英文 219 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

化粧品用防腐剤市場は、2022年に4億1,000万米ドルと推定され、2022年から2027年の間にCAGR6.5%で、2027年には5億6,200万米ドルに達すると予想されています。

女性の労働人口の増加は、化粧品用防腐剤市場の成長を促進すると予測される最も重要な要因の1つです。また、消費者の購買力の向上や化粧品の保存性向上も、化粧品保存料市場の成長に寄与しています。しかし、有機製品の高コストと厳しい規制規範は、化粧品防腐剤市場に悪影響を与えています。

"女性の労働人口の増加が化粧品防腐剤市場の成長を支える"

世界的に女性の労働人口が増加しています。Statistaによると、2021年に組織化されたセクターで働く女性人口のうち、インドは合計36%のシェアを占めています。欧州連合委員会の報告書によると、2020年に働く女性の人口が占める割合は66.2%。労働統計局によると、2020年の米国における働く女性人口のシェアは約56.2%です。女性の労働人口が増えることで、経済的な自立が可能となり、自分自身で意思決定ができるようになります。

世界的に見ても、化粧品の主要な消費者は女性です。したがって、経済的な自立が化粧品やスキンケア製品の消費を後押しし、それによって化粧品用防腐剤の消費量が増加すると予想されます。

"厳格な規制基準"

化粧品にはさまざまな成分が含まれています。これらの成分には、化粧品用防腐剤、クレンジング剤、独特の香料などが含まれます。規制機関は、健康上の問題を引き起こす成分の使用を禁止または制限するためのイニシアチブを継続的に取っています。製品の製造に使用される成分の開示に関して、各国政府は厳しい規則と規制を実施しています。

米国の食品医薬品局(FDA)は、特定の防腐剤の使用と禁止に関する法的枠組みとガイドラインを提供しています。FDAが制定したFederal Food, Drug, and Cosmetic Act(FFDCA)は、米国における化粧品用防腐剤の使用を規制しています。インドでは、中央医薬品標準管理機構(CDSCO)が、インドにおける防腐剤の使用を規制しています。Drugs and Cosmetics Act(1940)and rules(1945)and Bureau of Indian Standardsが、化粧品と防腐剤の製造に関する法規制を実施しています。

"男性専用化粧品への注目度アップ"

外見やプレゼンテーションが重要であるというのは、一般的な考えです。人々は自分をよく見せてくれる製品を使いたがります。保湿、アンチエイジング、泥パックなど、男性用化粧品の需要は大きいです。若い男性には、脂性肌、ニキビ、抜け毛、シワなど、さまざまな悩みがあります。これらの問題は、適切な化粧品を使用することによって克服することができます。したがって、製造会社は、特に男性セグメントをターゲットとした製品の開発において、有利な機会を得ることができます。

男性における化粧品の使用に関する意識の高まりは、男性が直面する個々の問題をターゲットとする化粧品メーカーに大きなビジネスチャンスを提供しています。この機会は、市場シェアを拡大し、化粧品の新しい用途分野への浸透を助けます。このことが、化粧品用防腐剤市場の成長を高めることになります。

"有機・天然化粧品用防腐剤の高価格化"

市場から求められている有機・天然化粧品用防腐剤の高価格は、重要な課題です。オーガニック防腐剤は、パラベン、ホルムアルデヒド供与剤などの従来の防腐剤よりも、パーソナルケア製品のメーカーに好まれています。有機または天然の防腐剤は、肌トラブルを引き起こさないため、好まれています。防腐剤のコストは、パンデミック後に高品質な製品の供給が不足し、上昇しました。天然・有機化粧品用防腐剤の需要は高いが、防腐剤のコスト高が化粧品メーカーにとって課題となっています。オーガニック・ナチュラル化粧品用防腐剤の市場は、欧州・北米市場で大きな成長が見込まれています。

"アジア太平洋地域は予測期間中に最も高いCAGRで成長すると予想される"

アジア太平洋地域は、世界的に最も急速に成長している化粧品用防腐剤市場です。ライフスタイルの向上、生活コストの上昇、人口の増加、中国、タイ、インドネシア、インドなどの新興国の高い経済成長が、アジア太平洋地域の化粧品用防腐剤市場の成長を牽引しています。人口の増加と手頃な価格の製品の入手可能性が、同地域の高い需要の主な原因となっています。また、環境による肌や髪への影響に対する人々の意識が高まっていることも、予測期間中の化粧品用防腐剤の高い需要につながる要因のひとつです。

本調査は、世界中の様々な業界専門家との一次インタビューを通じて検証されました。これらの一次情報源は、以下の3つのカテゴリーに分類されています。

- 企業タイプ別:Tier 1-37%、Tier 2-33%、Tier 3-30%

- 役職別:Cレベル-50%、ディレクターレベル-20%、その他-30%

- 地域別:欧州-50%、アジア太平洋-25%、北米-15%, 他の国々 (RoW) -10%

本レポートでは、企業プロファイルの包括的な分析:

Ashland Group Holding Inc.(米国)、BASF SE(ドイツ)、Arkema S.r.l(イタリア)、Symrise AG(ドイツ)、Evonik Industries(ドイツ)、Clariant AG(スイス)、Salicylates &Chemicals Pvt. Ltd(インド)、Chemipol(スペイン)、 International Flavors &Fragrances Inc(米国)、Sharon Laboratories(イスラエル)です。

調査対象

本レポートは、世界の化粧品用防腐剤市場を網羅し、2027年までの市場規模を予測します。以下の市場内訳が含まれています。タイプ別(パラベンエステル、ホルムアルデヒド供与体、フェノール誘導体、アルコール、無機物、第四級化合物、有機酸およびその塩、その他)、用途別(ローション、フェイスマスク、日焼け止め、スクラブ。日焼け止め、スクラブ、シャンプー&コンディショナー、石鹸、シャワークレンザー、シェービングジェル、フェイスパウダー&パウダーコンパクト、マウスウォッシュ&歯磨き粉、その他)、地域(北米、欧州、アジア太平洋地域、その他)別に分類。ポーターのファイブフォース分析は、促進要因、阻害要因、機会、課題とともに、レポート内で議論されています。また、世界の化粧品用防腐剤市場の主要企業が採用する企業プロファイルと競合戦略も掲載しています。

レポート購入の主なメリット

本レポートは、本市場における市場リーダー/新規参入者を以下のように支援することが期待されます。

1.このレポートは世界の化粧品用防腐剤市場を包括的にセグメントしています。それは、異なる垂直および地域にわたって、市場全体とサブセグメントの収益の最も近い近似値を提供します。

2.2.本レポートは、関係者が化粧品保存料市場の脈動を理解するのに役立ち、主要な市場促進要因・要因、課題、および機会に関する情報を提供します。

3.本レポートは、ステークホルダーが競合他社をより良く理解し、ビジネスにおける自社のポジションを向上させるためのより多くのインサイトを得るのに役立ちます。4.競合情勢のセクションでは、競合のエコシステム、新製品開発、合意、契約、拡大、買収を含みます。

レポートを購入する理由

本レポートは、化粧品用防腐剤市場全体とサブセグメントの収益に最も近い概算を提供することにより、この市場のリーダー/新規参入者を支援するものです。本レポートは、利害関係者が競合情勢を理解し、より多くの考察を得ることで、自社のビジネスと市場戦略をより良い方法で位置づけるのに役立ちます。

目次

第1章 イントロダクション

- 調査目的

- 市場の定義

- 包含と除外

- 市場範囲

- 化粧品用防腐剤市場のセグメンテーション

- 対象地域

- 対象年

- 通貨

- 単位

- 制限事項

- ステークホルダー

- 変更点のまとめ

第2章 調査手法

- ベースナンバーの算出

- サプライサイドアプローチ

- デマンドサイドアプローチ

- 予測数算出

- 二次資料

- 二次資料からの主要データ

- プライマリーデータ

- 一次資料からの主なデータ

- 一次インタビュー - 需要側と供給側

- プライマリーインタビューの内訳

- 業界の主要な洞察

- 二次資料

- 市場規模・推計

- ボトムアップアプローチ

- トップダウンアプローチ

- データトライアングレーション

- 要因分析

- 前提条件

- 市場成長率の前提条件/成長率予測

- 制限事項

- 化粧品用防腐剤市場に関するリスク

第3章 エグゼクティブサマリー

第4章 重要考察

- 化粧品用防腐剤市場におけるプレイヤーの魅力的な機会

- 化粧品用防腐剤市場、タイプ別

- 化粧品用防腐剤市場、用途別

- 化粧品用防腐剤市場、主要国別

第5章 市場の概要

- イントロダクション

- 市場セグメンテーション

- タイプ別

- 用途別

- 地域別

- 市場力学

- 促進要因

- 消費者の購買力向上

- 女性労働人口の増加

- 賞味期限の向上

- 抑制要因

- オーガニック製品のコスト高

- 厳しい規制基準

- 皮膚感染症の可能性

- 市場機会

- アジア太平洋地域での需要の増加

- 化粧品における天然およびオーガニック防腐剤の需要の増加

- 男性専用化粧品への注目の高まり

- 課題

- 化粧品におけるパラベンフリーの防腐剤

- オーガニック・ナチュラル化粧品用防腐剤の高価格化

- 促進要因

- 業界動向

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 主要なステークホルダーと購買基準

- 購買プロセスにおける主要なステークホルダー

- 購買基準

- サプライチェーン分析

- エコシステム:化粧品用防腐剤市場

- バリューチェーン分析

- 技術分析

- 価格分析

- 主要企業の平均販売価格 (用途別)

- 平均販売価格の動向

- 化粧品用防腐剤市場:楽観的シナリオ、悲観的シナリオ、現実的シナリオ

- 楽観的シナリオ

- 悲観的シナリオ

- 現実的シナリオ

- 輸出入の主要市場

- 米国

- ドイツ

- 中国

- 日本

- インド

- COVID-19が化粧品防腐剤市場に与える影響

- 特許分析

- イントロダクション

- 調査手法

- 文書タイプ

- インサイト

- 特許の法的地位

- 管轄権分析

- トップ出願人の分析

- カントンDAMEKISSデイリーケミカルファクトリー株式会社の特許リスト

- ロレアルパーソナルケアの特許リスト

- バイヤスドルフAGの特許リスト

- 過去10年間の特許権者トップ10(米国

- 2022-2023年の主要会議・イベント

- 関税と規制状況

- 規制機関、政府機関、その他の組織

- 化粧品用防腐剤市場における規制

- ケーススタディ分析

- 顧客に影響を与える動向と混乱

第6章 化粧品用防腐剤市場、タイプ別

- イントロダクション

- パラベンエステル

- 高水分化粧品に広く使用されている

- パラベンエステル:化粧品防腐剤市場(地域別)

- ホルムアルデヒド供与体

- 水性化粧品の寿命が延びる

- ホルムアルデヒド供与体:化粧品防腐剤市場 (地域別)

- フェノール誘導体

- 幅広い微生物に有効

- フェノール誘導体:化粧品用防腐剤の地域別市場

- アルコール

- 防腐効果があるため使用

- アルコール:化粧品用防腐剤の地域別市場

- 無機物

- 紫外線からの保護に効果的

- 無機物:化粧品用防腐剤市場、地域別

- 第四級化合物

- 化粧品中の微生物の繁殖を防ぐ

- 第四級化合物:化粧品用防腐剤の地域別市場

- 有機酸・有機酸塩

- オーガニック化粧品への高い需要

- 有機酸・有機酸塩:化粧品防腐剤市場、地域別

- その他のタイプ

- その他のタイプ:化粧品用防腐剤市場、地域別

第7章 化粧品用防腐剤市場、用途別

- イントロダクション

- ローション、フェイスマスク、サンスクリーン、スクラブ

- 最大のアプリケーションセグメント

- ローション、フェイスマスク、サンスクリーン、スクラブ。化粧品用防腐剤市場 (地域別)

- シャンプー&コンディショナー

- 製品に含まれる高い水分量が防腐剤の需要を牽引

- シャンプー&コンディショナー化粧品用防腐剤市場 (地域別)

- 石鹸、シャワークレンザー、シェービングジェル

- 身だしなみに対する意識の高まり

- 石鹸、シャワークレンザー、シェービングジェル。化粧品用防腐剤市場 (地域別)

- フェイスパウダー、パウダーコンパクト

- オーガニック防腐剤への需要の高まり

- フェイスパウダーとパウダーコンパクト化粧品用防腐剤市場(地域別)

- マウスウォッシュ・歯磨き粉

- 口腔衛生に対する意識の高まり

- マウスウォッシュと歯磨き粉化粧品用防腐剤市場 (地域別)

- その他の用途

- その他の用途化粧品用防腐剤市場、地域別

第8章 化粧品用防腐剤市場、地域別

- イントロダクション

- 北米

- 北米:化粧品用防腐剤市場:タイプ別

- 北米:化粧品用防腐剤市場(用途別)

- 北米:化粧品用防腐剤の国別市場

- 米国

- パーソナルケアおよびコスメティック製品の強力な生産基盤

- カナダ

- 人口増加によりパーソナルケア製品の需要が増加

- メキシコ

- 中間層の増加により、需要が拡大

- 米国

- 欧州

- 欧州化粧品用防腐剤市場(タイプ別)

- 欧州:化粧品用防腐剤市場:用途別

- 欧州化粧品用防腐剤の国別市場

- 英国

- 欧州の化粧品用防腐剤市場をリードする英国

- ドイツ

- 環境配慮型製品の需要増に伴い、需要が拡大

- フランス

- 化粧品の流通経路の拡大が市場成長を促進

- その他の欧州地域

- 英国

- アジア太平洋地域

- アジア太平洋地域:化粧品用防腐剤市場(タイプ別)

- アジア太平洋地域:化粧品用防腐剤市場(用途別)

- アジア太平洋地域:化粧品用防腐剤市場(国別)

- 中国

- ハイエンド化粧品への需要が中国市場を牽引

- 日本

- 日本におけるバイオベース製品への需要の高まり

- インド

- 可処分所得の増加に伴う中間層の増加により、インド市場の成長を促進

- その他のアジア太平洋地域

- 中国

- 世界の残りの地域

- 世界のその他の地域:化粧品用防腐剤市場(タイプ別)

- 世界のその他の地域:化粧品用防腐剤市場(用途別)

- 世界の残りの地域:化粧品用防腐剤市場(国別)

- 南アフリカ

- スキンケア製品の需要増が市場を牽引

- トルコ

- 中産階級の可処分所得の増加が市場成長を牽引

- ブラジル

- 天然素材や生物分解性の高いパーソナルケア製品の生産と需要の増加が、市場を牽引

- その他の国々

- 南アフリカ

第9章 競合情勢

- イントロダクション

- 市場シェア分析

- 市場ランキング

- 市場評価フレームワーク

- トップ企業の収益分析

- 企業評価マトリクス

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 企業評価クワドラント

- スターズ

- ペルベンシブ・プレーヤー

- パーティシパント

- エマージングリーダー

- 主要スタートアップ/SMの競合ベンチマーキング

- 中小企業評価マトリックス

- 先進的な企業

- 対応力のある企業

- ダイナミックな企業

- スターティングブロック

第10章 企業プロファイル

- KEY COMPANIES

- アシュランドグループホールディングス

- BASF SE

- AKEMA S.R.L.

- SYMRISE AG

- クラリアントAG

- サリシレート&ケミカルズPVT.LTD

- ケミポールS.A.

- エボニックインダストリーズAG

- インターナショナル・フレーバー&フレグランスInc.

- シャロンラボラトリーズ

- その他の事業者

- BRENNTAG AG

- トールグループ

- ダディア・ケミカル・インダストリーズ

- グジャラートオーガニックス

- イスカUKリミテッド

- ランクセス

- シスメイタリアS.R.L

- クマール・オーガニック・プロダクツ

- コビオサ

- 株式会社サケム

- AE CHEMIE INC.

- スペクトラム・ケミカル製造(株)

- ストルケム株式会社

- ネバーノット・スキンケア

- ザ・ダウ・ケミカル・カンパニー

第11章 付録

The cosmetic preservatives market is estimated to be USD 410 million in 2022 and is projected to reach USD 562 million by 2027, at a CAGR of 6.5% between 2022 and 2027. The increase in female working population is one of the most significant factors projected to drive the growth of the cosmetic preservatives market. Increased in purchasing power of consumers and shelf life enhancement of cosmetic products are also contributing to the growth of the cosmetic preservatives market. However, high cost of organic products and stringent regulatory norms has affected the cosmetic preservatives market adversely.

"Increase in female working population will support the growth of cosmetic preservatives market"

There is an increase in participation of women in workforces globally. According to Statista, India accounted for a total 36% share of the female population working in organized sectors in 2021. According to a report from the European Union Commission, the population of working women accounted for a 66.2% share in 2020. According to the Bureau of Labor Statistics, the share of the population of working women in the US in 2020 was approximately 56.2%. The increase in the working population of women enables financial independence, allowing them to make their own decisions.

Globally, women are the major consumers of cosmetic products. Therefore, financial independence is expected to boost the consumption of cosmetics and skin care products, thereby increasing the consumption of cosmetic preservatives.

"Stringent regulatory norms"

Cosmetic products contain a range of ingredients. These ingredients cover cosmetic preservatives, cleansing agents, and unique fragrances. Regulatory bodies are continuously taking initiatives to prohibit or limit the use of ingredients that cause health issues. Stringent rules and regulations have been implemented by governments regarding the disclosure of product ingredients utilized in the manufacture of products.

The Food and Drug Administration (FDA) of the US provides the legal framework and guidelines for the usage and prohibition of particular preservatives. The Federal Food, Drug, and Cosmetic Act (FFDCA) passed by the FDA regulates the usage of cosmetic preservatives in cosmetic products in the US. In India, the Central Drugs Standard Control Organisation (CDSCO) regulates the usage of preservative products in India. The Drugs and Cosmetics Act (1940) and rules (1945) and the Bureau of Indian Standards implement the laws and regulations for the manufacture of cosmetic products and preservatives.

"Increasing focus on male-specific cosmetics"

It is a general belief that appearance and presentation matter. People are inclined to use products that make them look good. There is a significant demand for male-specific cosmetics ranging from moisturizers to anti-agers to mud masks. Numerous problems are faced by younger males in general related to oily skin, acne, hair fall, and wrinkles, among others. All these problems can be overcome with awareness about and the use of the proper cosmetics. Manufacturing companies, thus, have lucrative opportunities for the development of products specifically targeting the male segment.

Increasing awareness about the usage of cosmetic products among men offers major opportunities for cosmetic product manufacturers targeting individual issues faced by men. This opportunity widens the market share and helps penetrate the newer application segments of cosmetic products. This, in turn, increases the growth of the cosmetic preservatives market.

"High prices of organic and natural cosmetic preservatives"

The high costs of organic and natural cosmetic preservatives which are in demand from the market is a significant challenge. Organic preservatives are preferred over traditional preservatives such as parabens, formaldehyde donors, and others by manufacturers of personal care products. Organic or natural preservatives are preferred as they do not lead to skin problems. Costs of preservatives increased post the pandemic due to the shortages in the supply of high-quality products. Though there is high demand for natural and organic cosmetic preservatives, the high costs of preservatives pose a challenge for cosmetic manufacturers. The market for organic and natural cosmetic preservatives is expected to grow at a significant pace in the European and North American markets.

"Asia Pacific region is expected to grow with the highest CAGR during the forecast period"

Asia Pacific is the fastest-growing market for cosmetic preservatives globally. Improved lifestyles, increasing cost of living, increasing population, and high economic growth of emerging economies such as China, Thailand, Indonesia, and India will led to the growth of the cosmetic preservatives market in the Asia Pacific. The increasing population and availability of affordable products will be primarily responsible for the high demand in the region. Increasing awareness among the population about the effects of the environment on skin and hair is another factor leading to high demand of the cosmetic preservatives during the forecast period.

This study has been validated through primary interviews conducted with various industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 37%, Tier 2- 33%, and Tier 3- 30%

- By Designation- C Level- 50%, Director Level- 20%, and Others- 30%

- By Region- Europe- 50%, Asia Pacific (APAC) - 25%, North America- 15%, Rest of the World (ROW)-10%

The report provides a comprehensive analysis of company profiles :

Ashland Group Holding Inc. (US), BASF SE (Germany), Arkema S.r.l (Italy), Symrise AG (Germany), Evonik Industries (Germany), Clariant AG (Switzerland), Salicylates & Chemicals Pvt. Ltd (India), Chemipol (Spain), International Flavors & Fragrances Inc. (US), and Sharon Laboratories (Israel).

Research Coverage

This report covers the global cosmetic preservatives market and forecasts the market size until 2027. It includes the following market segmentation - by type (Paraben Esters, Formaldehyde Donors, Phenol Derivatives, Alcohols, Inorganics, Quaternary Compounds, Organic Acids & Their Salts, Others), by application (Lotions, Facemasks, Sunscreens, & Scrubs, Shampoos & Conditioners, Soaps, Shower Cleansers, & Shaving Gels, Face Powders & Powder Compacts, Mouthwashes & Toothpastes, Others), and Region (North America, Europe, Asia Pacific, Rest of the World). Porter's Five Forces Analysis, along with the drivers, restraints, opportunities, and challenges, have been discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global cosmetic preservatives market.

Key benefits of buying the report:

The report is expected to help market leaders/new entrants in this market in the following ways:

1. This report segments the global cosmetic preservatives market comprehensively. It provides the closest approximations of the revenues for the overall market and the sub-segments across different verticals and regions.

2. The report helps stakeholders understand the pulse of the cosmetic preservatives market and provides them with information on key market drivers, restraints, challenges, and opportunities.

3. This report will help stakeholders to understand competitors better and gain more insights to better their position in their businesses. The competitive landscape section includes the competitor ecosystem, new product development, agreement, contract, expansion, and acquisition.

Reasons to buy the report:

The report will help leaders/new entrants in this market by providing them with the closest approximations of the revenues for the overall cosmetic preservatives market and the sub-segments. This report will help stakeholders to understand the competitive landscape and gain more insights and position their businesses and market strategies in a better way.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 COSMETIC PRESERVATIVES MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- FIGURE 1 COSMETIC PRESERVATIVES MARKET: RESEARCH DESIGN

- FIGURE 2 COSMETIC PRESERVATIVES MARKET: RESEARCH APPROACH

- 2.1 BASE NUMBER CALCULATION

- 2.1.1 SUPPLY-SIDE APPROACH

- 2.1.2 DEMAND-SIDE APPROACH

- 2.2 FORECAST NUMBER CALCULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Primary interviews - demand- and supply-sides

- 2.2.2.3 Breakdown of primary interviews

- 2.2.2.4 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 3 COSMETIC PRESERVATIVES MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 4 COSMETIC PRESERVATIVES MARKET: TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 5 COSMETIC PRESERVATIVES MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 MARKET GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.8 LIMITATIONS

- 2.9 RISKS ASSOCIATED WITH COSMETIC PRESERVATIVES MARKET

3 EXECUTIVE SUMMARY

- FIGURE 6 ORGANIC ACIDS & THEIR SALTS SEGMENT LED COSMETIC PRESERVATIVES MARKET IN 2021

- FIGURE 7 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS APPLICATION LED COSMETIC PRESERVATIVES MARKET IN 2021

- FIGURE 8 UK PROJECTED TO LEAD GLOBAL COSMETIC PRESERVATIVES MARKET DURING FORECAST PERIOD

- FIGURE 9 EUROPE LED GLOBAL COSMETIC PRESERVATIVES MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COSMETIC PRESERVATIVES MARKET

- FIGURE 10 DEMAND FOR NATURAL AND ORGANIC PRESERVATIVES TO DRIVE COSMETIC PRESERVATIVES MARKET

- 4.2 COSMETIC PRESERVATIVES MARKET, BY TYPE

- FIGURE 11 PHENOL DERIVATIVES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- 4.3 COSMETIC PRESERVATIVES MARKET, BY APPLICATION

- FIGURE 12 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS WAS LARGEST APPLICATION IN 2021

- 4.4 COSMETIC PRESERVATIVES MARKET, BY KEY COUNTRIES

- FIGURE 13 MARKETS IN FRANCE AND GERMANY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET SEGMENTATION

- 5.2.1 BY TYPE

- 5.2.2 BY APPLICATION

- 5.2.3 BY REGION

- 5.3 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN COSMETIC PRESERVATIVES MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Increase in purchasing power of consumers

- 5.3.1.2 Increase in female working population

- 5.3.1.3 Shelf-life enhancement

- 5.3.2 RESTRAINTS

- 5.3.2.1 High cost of organic products

- 5.3.2.2 Stringent regulatory norms

- 5.3.2.3 Possibilities of skin infections

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increasing demand in Asia Pacific region

- 5.3.3.2 Rising demand for natural and organic preservatives in cosmetics

- 5.3.3.3 Increasing focus on male-specific cosmetics

- 5.3.4 CHALLENGES

- 5.3.4.1 Paraben-free preservatives in cosmetics

- 5.3.4.2 High price of organic and natural cosmetic preservatives

- 5.4 INDUSTRY TRENDS

- 5.4.1 PORTER'S FIVE FORCE ANALYSIS

- FIGURE 15 COSMETIC PRESERVATIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.2 BARGAINING POWER OF BUYERS

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 THREAT OF NEW ENTRANTS

- 5.4.5 THREAT OF SUBSTITUTES

- 5.4.6 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 1 COSMETIC PRESERVATIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 2 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.5.2 BUYING CRITERIA

- FIGURE 17 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 3 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM: COSMETIC PRESERVATIVES MARKET

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 18 COSMETIC PRESERVATIVES: VALUE CHAIN ANALYSIS

- 5.9 TECHNOLOGY ANALYSIS

- TABLE 4 LIST OF PRESERVATIVES IN COSMETIC PRODUCTS

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

- TABLE 5 AVERAGE SELLING PRICES OF KEY PLAYERS (USD/KG)

- 5.10.2 TRENDS IN AVERAGE SELLING PRICE

- TABLE 6 COSMETIC PRESERVATIVES: AVERAGE SELLING PRICES

- 5.11 COSMETIC PRESERVATIVES MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

- TABLE 7 COSMETIC PRESERVATIVES MARKET: CAGRS (IN TERMS OF VALUE) IN OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

- 5.11.1 OPTIMISTIC SCENARIO

- 5.11.2 PESSIMISTIC SCENARIO

- 5.11.3 REALISTIC SCENARIO

- 5.12 KEY MARKETS FOR IMPORT/EXPORT

- 5.12.1 US

- 5.12.2 GERMANY

- 5.12.3 CHINA

- 5.12.4 JAPAN

- 5.12.5 INDIA

- 5.13 IMPACT OF COVID-19 ON COSMETIC PRESERVATIVES MARKET

- 5.14 PATENT ANALYSIS

- 5.14.1 INTRODUCTION

- 5.14.2 METHODOLOGY

- 5.14.3 DOCUMENT TYPE

- TABLE 8 COSMETIC PRESERVATIVES MARKET: GLOBAL PATENTS

- FIGURE 19 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 20 GLOBAL PATENT PUBLICATION TREND ANALYSIS: LAST 10 YEARS

- 5.14.4 INSIGHTS

- 5.14.5 LEGAL STATUS OF PATENTS

- FIGURE 21 COSMETIC PRESERVATIVES MARKET: LEGAL STATUS OF PATENTS

- 5.14.6 JURISDICTION ANALYSIS

- FIGURE 22 GLOBAL JURISDICTION ANALYSIS

- 5.14.7 TOP APPLICANTS' ANALYSIS

- FIGURE 23 CANTON DAMEKISS DAILY CHEMICAL FACTORY LTD CO. HAS HIGHEST NUMBER OF PATENTS

- 5.14.8 LIST OF PATENTS BY CANTON DAMEKISS DAILY CHEMICAL FACTORY LTD CO.

- 5.14.9 LIST OF PATENTS BY L'OREAL PERSONAL CARE

- 5.14.10 LIST OF PATENTS BY BEIERSDORF AG

- 5.14.11 TOP 10 PATENT OWNERS (US) DURING LAST 10 YEARS

- 5.15 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 9 COSMETIC PRESERVATIVES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.16 TARIFF AND REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 REGULATIONS IN COSMETIC PRESERVATIVES MARKET

- TABLE 12 REGULATIONS ON COSMETIC PRESERVATIVES

- 5.17 CASE STUDY ANALYSIS

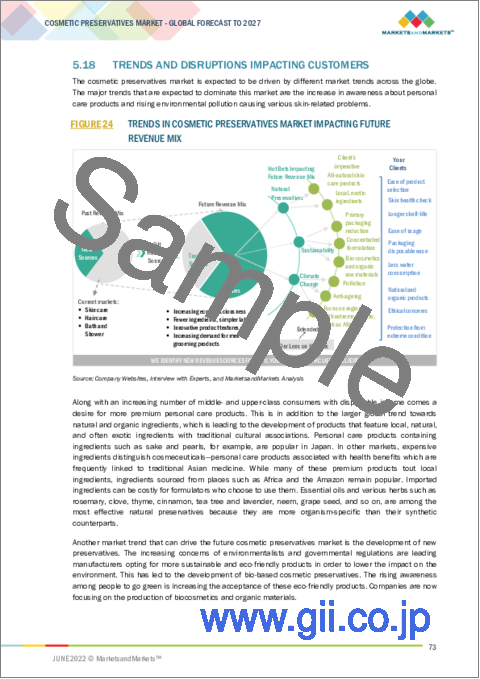

- 5.18 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- FIGURE 24 TRENDS IN COSMETIC PRESERVATIVES MARKET IMPACTING FUTURE REVENUE MIX

6 COSMETIC PRESERVATIVES MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 25 ORGANIC ACIDS & THEIR SALTS SEGMENT TO LEAD COSMETIC PRESERVATIVES MARKET DURING FORECAST PERIOD

- TABLE 13 COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 14 COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 15 COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 16 COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 6.2 PARABEN ESTERS

- 6.2.1 WIDELY USED IN HIGH WATER CONTENT COSMETIC PRODUCTS

- FIGURE 26 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR PARABEN ESTERS

- 6.2.2 PARABEN ESTERS: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 17 PARABEN ESTERS: COSMETIC PRESERVATIVES MARKET, BY REGION, 2018-2021 (TON)

- TABLE 18 PARABEN ESTERS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 19 PARABEN ESTERS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 20 PARABEN ESTERS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.3 FORMALDEHYDE DONORS

- 6.3.1 INCREASED LIFESPAN OF WATER-BASED COSMETIC PRODUCTS

- FIGURE 27 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR FORMALDEHYDE DONORS

- 6.3.2 FORMALDEHYDE DONORS: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 21 FORMALDEHYDE DONORS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 22 FORMALDEHYDE DONORS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 23 FORMALDEHYDE DONORS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 24 FORMALDEHYDE DONORS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.4 PHENOL DERIVATIVES

- 6.4.1 EFFECTIVE AGAINST WIDE RANGE OF MICROBES

- FIGURE 28 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR PHENOL DERIVATIVES

- 6.4.2 PHENOL DERIVATIVES: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 25 PHENOL DERIVATIVES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 26 PHENOL DERIVATIVES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 27 PHENOL DERIVATIVES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 28 PHENOL DERIVATIVES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.5 ALCOHOLS

- 6.5.1 USED DUE TO THEIR ANTISEPTIC PROPERTIES

- FIGURE 29 EUROPE TO BE LARGEST COSMETIC PRESERVATIVES MARKET FOR ALCOHOLS

- 6.5.2 ALCOHOLS: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 29 ALCOHOLS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 30 ALCOHOLS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 ALCOHOLS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 32 ALCOHOLS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.6 INORGANICS

- 6.6.1 EFFECTIVE IN PROTECTION FROM UV RAYS

- FIGURE 30 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR INORGANICS

- 6.6.2 INORGANICS: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 33 INORGANICS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 34 INORGANICS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 INORGANICS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 36 INORGANICS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.7 QUATERNARY COMPOUNDS

- 6.7.1 PREVENT REPRODUCTION OF MICROORGANISMS IN COSMETIC PRODUCTS

- FIGURE 31 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR QUATERNARY COMPOUNDS

- 6.7.2 QUATERNARY COMPOUNDS: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 37 QUATERNARY COMPOUNDS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 38 QUATERNARY COMPOUNDS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 QUATERNARY COMPOUNDS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 40 QUATERNARY COMPOUNDS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.8 ORGANIC ACIDS & THEIR SALTS

- 6.8.1 HIGH DEMAND FOR ORGANIC COSMETIC PRODUCTS

- FIGURE 32 EUROPE TO BE LEADING COSMETIC PRESERVATIVES MARKET FOR ORGANIC ACIDS & THEIR SALTS

- 6.8.2 ORGANIC ACIDS & THEIR SALTS: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 41 ORGANIC ACIDS & THEIR SALTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 42 ORGANIC ACIDS & THEIR SALTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 ORGANIC ACIDS & THEIR SALTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 44 ORGANIC ACIDS & THEIR SALTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 6.9 OTHER TYPES

- 6.9.1 OTHER TYPES: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 45 OTHER TYPES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 46 OTHER TYPES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 OTHER TYPES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 48 OTHER TYPES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

7 COSMETIC PRESERVATIVES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 33 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS SEGMENT TO LEAD COSMETIC PRESERVATIVES MARKET DURING FORECAST PERIOD

- TABLE 49 COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 50 COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 51 COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 52 COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.2 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS

- 7.2.1 LARGEST APPLICATION SEGMENT

- FIGURE 34 EUROPE TO BE LARGEST MARKET FOR LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS

- 7.2.2 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 53 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 54 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 55 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 56 LOTIONS, FACEMASKS, SUNSCREENS, & SCRUBS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.3 SHAMPOOS & CONDITIONERS

- 7.3.1 HIGH WATER CONTENT IN PRODUCTS DRIVES DEMAND FOR PRESERVATIVES

- FIGURE 35 EUROPE TO BE LARGEST MARKET IN SHAMPOOS & CONDITIONERS SEGMENT

- 7.3.2 SHAMPOOS & CONDITIONERS: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 57 SHAMPOOS & CONDITIONERS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 58 SHAMPOOS & CONDITIONERS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 59 SHAMPOOS & CONDITIONERS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 60 SHAMPOOS & CONDITIONERS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.4 SOAPS, SHOWER CLEANSERS, & SHAVING GELS

- 7.4.1 INCREASING AWARENESS ABOUT PERSONAL GROOMING

- FIGURE 36 EUROPE TO BE LARGEST MARKET IN SOAPS, SHOWER CLEANSERS, & SHAVING GELS SEGMENT

- 7.4.2 SOAPS, SHOWER CLEANSERS, & SHAVING GELS: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 61 SOAPS, SHOWER CLEANSERS, & SHAVING GELS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 62 SOAPS, SHOWER CLEANSERS, & SHAVING GELS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 63 SOAPS, SHOWER CLEANSERS, & SHAVING GELS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 64 SOAPS, SHOWER CLEANSERS, & SHAVING GELS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.5 FACE POWDERS & POWDER COMPACTS

- 7.5.1 INCREASING DEMAND FOR ORGANIC PRESERVATIVES

- FIGURE 37 EUROPE TO BE LARGEST MARKET IN FACE POWDERS & POWDER COMPACTS SEGMENT

- 7.5.2 FACE POWDERS & POWDER COMPACTS: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 65 FACE POWDERS & POWDER COMPACTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 66 FACE POWDERS & POWDER COMPACTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 67 FACE POWDERS & POWDER COMPACTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 68 FACE POWDERS & POWDER COMPACTS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.6 MOUTHWASHES & TOOTHPASTES

- 7.6.1 RISING AWARENESS ABOUT ORAL HYGIENE

- FIGURE 38 EUROPE TO BE LARGEST MARKET IN MOUTHWASHES & TOOTHPASTES SEGMENT

- 7.6.2 MOUTHWASHES & TOOTHPASTES: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 69 MOUTHWASHES & TOOTHPASTES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 70 MOUTHWASHES & TOOTHPASTES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 71 MOUTHWASHES & TOOTHPASTES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 72 MOUTHWASHES & TOOTHPASTES: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 7.7 OTHER APPLICATIONS

- 7.7.1 OTHER APPLICATIONS: COSMETIC PRESERVATIVES MARKET, BY REGION

- TABLE 73 OTHER APPLICATIONS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 74 OTHER APPLICATIONS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 75 OTHER APPLICATIONS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 76 OTHER APPLICATIONS: COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

8 COSMETIC PRESERVATIVES MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 39 INDIA TO BE FASTEST-GROWING COSMETIC PRESERVATIVES MARKET DURING FORECAST PERIOD

- TABLE 77 COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 78 COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 79 COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (TON)

- TABLE 80 COSMETIC PRESERVATIVES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 8.2 NORTH AMERICA

- FIGURE 40 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SNAPSHOT

- 8.2.1 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET, BY TYPE

- TABLE 81 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 82 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 83 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 84 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 8.2.2 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET, BY APPLICATION

- TABLE 85 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 86 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 87 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 88 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.2.3 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET, BY COUNTRY

- TABLE 89 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 90 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 91 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 92 NORTH AMERICA: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.2.3.1 US

- 8.2.3.1.1 Strong production base for personal care and cosmetic products

- 8.2.3.1 US

- TABLE 93 US: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 94 US: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 95 US: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 96 US: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.2.3.2 Canada

- 8.2.3.2.1 Rising population to drive demand for personal care products

- 8.2.3.2 Canada

- TABLE 97 CANADA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 98 CANADA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 99 CANADA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 100 CANADA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.2.3.3 Mexico

- 8.2.3.3.1 Increasing middle-class population to drive demand

- 8.2.3.3 Mexico

- TABLE 101 MEXICO: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 102 MEXICO: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 103 MEXICO: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 104 MEXICO: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.3 EUROPE

- FIGURE 41 EUROPE: COSMETICS PRESERVATIVES MARKET SNAPSHOT

- 8.3.1 EUROPE: COSMETIC PRESERVATIVES MARKET, BY TYPE

- TABLE 105 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 106 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 107 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 108 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 8.3.2 EUROPE: COSMETIC PRESERVATIVES MARKET, BY APPLICATION

- TABLE 109 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 110 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 111 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 112 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.3.3 EUROPE: COSMETIC PRESERVATIVES MARKET, BY COUNTRY

- TABLE 113 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 114 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 115 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 116 EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.3.3.1 UK

- 8.3.3.1.1 UK leading European cosmetic preservatives market

- 8.3.3.1 UK

- TABLE 117 UK: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 118 UK: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 119 UK: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 120 UK: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.3.3.2 Germany

- 8.3.3.2.1 Demand for environment-friendly products is leading to increasing demand

- 8.3.3.2 Germany

- TABLE 121 GERMANY: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 122 GERMANY: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 123 GERMANY: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 124 GERMANY: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.3.3.3 France

- 8.3.3.3.1 Increasing distribution channels for cosmetic products fueling market growth

- 8.3.3.3 France

- TABLE 125 FRANCE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 126 FRANCE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 127 FRANCE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 128 FRANCE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.3.3.4 Rest of Europe

- TABLE 129 REST OF EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 130 REST OF EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 131 REST OF EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 132 REST OF EUROPE: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.4 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SNAPSHOT

- 8.4.1 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET, BY TYPE

- TABLE 133 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 134 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 135 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 136 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 8.4.2 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET, BY APPLICATION

- TABLE 137 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 138 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 139 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 140 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.4.3 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET, BY COUNTRY

- TABLE 141 ASIA PACIFIC COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 142 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 143 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 144 ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.4.3.1 China

- 8.4.3.1.1 Demand for high-end cosmetic products driving market in China

- 8.4.3.1 China

- TABLE 145 CHINA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 146 CHINA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 147 CHINA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 148 CHINA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.4.3.2 Japan

- 8.4.3.2.1 Rise in demand for bio-based products in Japan

- 8.4.3.2 Japan

- TABLE 149 JAPAN: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 150 JAPAN: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 151 JAPAN: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 152 JAPAN: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.4.3.3 India

- 8.4.3.3.1 Rising middle-class population with increasing disposable income fueling growth of market in India

- 8.4.3.3 India

- TABLE 153 INDIA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 154 INDIA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 155 INDIA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 156 INDIA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.4.3.4 Rest of Asia Pacific

- TABLE 157 REST OF ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 158 REST OF ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 160 REST OF ASIA PACIFIC: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.5 REST OF THE WORLD

- 8.5.1 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET, BY TYPE

- TABLE 161 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 162 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 163 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 164 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- 8.5.2 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET, BY APPLICATION

- TABLE 165 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 166 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 167 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 168 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.5.3 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET, BY COUNTRY

- TABLE 169 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 170 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 171 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- TABLE 172 REST OF THE WORLD: COSMETIC PRESERVATIVES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 8.5.3.1 South Africa

- 8.5.3.1.1 Rising demand for skin care products to drive market

- 8.5.3.1 South Africa

- TABLE 173 SOUTH AFRICA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 174 SOUTH AFRICA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 175 SOUTH AFRICA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 176 SOUTH AFRICA: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.5.3.2 Turkey

- 8.5.3.2.1 Increasing disposable income of middle-class population to be governing factor for market growth

- 8.5.3.2 Turkey

- TABLE 177 TURKEY: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 178 TURKEY: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 179 TURKEY: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 180 TURKEY: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.5.3.3 Brazil

- 8.5.3.3.1 Growing production and demand for natural and bio-degradable personal care products to propel market

- 8.5.3.3 Brazil

- TABLE 181 BRAZIL: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 182 BRAZIL: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 183 BRAZIL: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 184 BRAZIL: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.5.3.4 Other countries

- TABLE 185 OTHER COUNTRIES: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (TON)

- TABLE 186 OTHER COUNTRIES: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 187 OTHER COUNTRIES: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (TON)

- TABLE 188 OTHER COUNTRIES: COSMETIC PRESERVATIVES MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 MARKET SHARE ANALYSIS

- FIGURE 43 SHARE OF TOP FIVE COMPANIES IN COSMETIC PRESERVATIVES MARKET

- TABLE 189 DEGREE OF COMPETITION: COSMETIC PRESERVATIVES MARKET

- 9.3 MARKET RANKING

- FIGURE 44 RANKING OF TOP FIVE PLAYERS IN COSMETIC PRESERVATIVES MARKET

- 9.4 MARKET EVALUATION FRAMEWORK

- TABLE 190 COSMETIC PRESERVATIVE MARKET: DEALS, 2017-2021

- TABLE 191 COSMETIC PRESERVATIVES MARKET: OTHERS, 2017-2021

- TABLE 192 COSMETIC PRESERVATIVES MARKET: NEW PRODUCT DEVELOPMENTS, 2017-2021

- 9.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 45 REVENUE ANALYSIS OF KEY COMPANIES IN 2021

- 9.6 COMPANY EVALUATION MATRIX

- TABLE 193 COMPANY PRODUCT FOOTPRINT

- TABLE 194 COMPANY TYPE FOOTPRINT

- TABLE 195 COMPANY APPLICATION FOOTPRINT

- TABLE 196 COMPANY REGION FOOTPRINT

- 9.6.1 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 46 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN COSMETIC PRESERVATIVES MARKET

- 9.6.2 BUSINESS STRATEGY EXCELLENCE

- FIGURE 47 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN COSMETIC PRESERVATIVES MARKET

- 9.7 COMPANY EVALUATION QUADRANT

- 9.7.1 STARS

- 9.7.2 PERVASIVE PLAYERS

- 9.7.3 PARTICIPANTS

- 9.7.4 EMERGING LEADERS

- FIGURE 48 COSMETIC PRESERVATIVES MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 197 COSMETIC PRESERVATIVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 198 COSMETIC PRESERVATIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 9.8 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

- 9.8.1 PROGRESSIVE COMPANIES

- 9.8.2 RESPONSIVE COMPANIES

- 9.8.3 DYNAMIC COMPANIES

- 9.8.4 STARTING BLOCKS

- FIGURE 49 COSMETIC PRESERVATIVES MARKET: SMALL- AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

10 COMPANY PROFILES

- 10.1 KEY COMPANIES

(Business Overview, Products Offered, Recent Developments, MnM view, Right to win, Strategic choices made, Weakness competitive threats)**

- 10.1.1 ASHLAND GROUP HOLDINGS INC.

- TABLE 199 ASHLAND GROUP HOLDINGS INC.: COMPANY OVERVIEW

- FIGURE 50 ASHLAND GLOBAL HOLDING INC.: COMPANY SNAPSHOT

- 10.1.2 BASF SE

- TABLE 200 BASF SE: COMPANY OVERVIEW

- FIGURE 51 BASF SE: COMPANY SNAPSHOT

- 10.1.3 AKEMA S.R.L.

- TABLE 201 AKEMA S.R.L.: COMPANY OVERVIEW

- 10.1.4 SYMRISE AG

- TABLE 202 SYMRISE AG: COMPANY OVERVIEW

- FIGURE 52 SYMRISE AG: COMPANY SNAPSHOT

- 10.1.5 CLARIANT AG

- TABLE 203 CLARIANT AG: COMPANY OVERVIEW

- FIGURE 53 CLARIANT AG: COMPANY SNAPSHOT

- 10.1.6 SALICYLATES & CHEMICALS PVT. LTD

- TABLE 204 SALICYLATES & CHEMICALS PVT. LTD: COMPANY OVERVIEW

- 10.1.7 CHEMIPOL S.A.

- TABLE 205 CHEMIPOL S.A.: COMPANY OVERVIEW

- 10.1.8 EVONIK INDUSTRIES AG

- TABLE 206 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- FIGURE 54 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- 10.1.9 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- TABLE 207 INTERNATIONAL FLAVORS & FRAGRANCES: COMPANY OVERVIEW

- FIGURE 55 INTERNATIONAL FLAVORS & FRAGRANCES: COMPANY SNAPSHOT

- 10.1.10 SHARON LABORATORIES

- TABLE 208 SHARON LABORATORIES: COMPANY OVERVIEW

- 10.2 OTHER PLAYERS

- 10.2.1 BRENNTAG AG

- 10.2.2 THOR GROUP LTD.

- 10.2.3 DADIA CHEMICAL INDUSTRIES

- 10.2.4 GUJARAT ORGANICS LIMITED

- 10.2.5 ISCA UK LIMITED

- 10.2.6 LANXESS

- 10.2.7 CISME ITALY S.R.L

- 10.2.8 KUMAR ORGANIC PRODUCTS LIMITED

- 10.2.9 COBIOSA

- 10.2.10 SACHEM INC

- 10.2.11 AE CHEMIE INC.

- 10.2.12 SPECTRUM CHEMICAL MFG CORP.

- 10.2.13 STRUCHEM CO LTD.

- 10.2.14 NEVER NOT SKINCARE

- 10.2.15 THE DOW CHEMICAL COMPANY

- *Details on Business Overview, Products Offered, Recent Developments, MnM view, Right to win, Strategic choices made, Weakness competitive threats might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 AVAILABLE CUSTOMIZATION

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS