|

|

市場調査レポート

商品コード

1356963

DRaaS (Disaster Recovery as a Service) の世界市場 (~2028年):サービスタイプ・導入形態・組織規模・産業・地域別Disaster Recovery as a Service (DRaaS) Market by Service Type (Backup & Restore, Real-Time Replication, Data Protection), Deployment Mode (Public Cloud, Private Cloud), Organization Size, Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| DRaaS (Disaster Recovery as a Service) の世界市場 (~2028年):サービスタイプ・導入形態・組織規模・産業・地域別 |

|

出版日: 2023年09月28日

発行: MarketsandMarkets

ページ情報: 英文 244 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

DRaaS (Disaster Recovery as a Service) の市場規模は、2023年の107億米ドルから、予測期間中は19.8%のCAGRで推移し、2028年には265億米ドルの規模に成長すると予測されています。

DRaaSが企業に提供する堅牢なデータ保護と事業継続戦略に対する認識が高まっており、DRaaSの需要が促進されています。データ量の継続的な増加とサイバー脅威の高度化に伴い、DRaaSはより包括的でプロアクティブなソリューションへと進化していくでしょう。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 米ドル |

| セグメント | サービスタイプ・展開形態・組織規模・産業・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

DRaaSは今後数年間で、AIや機械学習などの先進技術とシームレスに統合されることが予想されます。これらの技術によって予測分析が可能になり、企業は潜在的な災害を予測し、データとオペレーションを保護するための先制措置を講じることができるようになります。さらに、エッジコンピューティングと5Gネットワークの統合により、データ復旧のスピードと信頼性が向上し、災害時のダウンタイムが最小限に抑えられるようになります。また、クラウドは、DRaaSの将来においても中心的な役割を果たし続けると思われます。パブリッククラウドとプライベートクラウドのアプローチはより普及し、データストレージとリカバリにおいてより高い柔軟性と冗長性を提供するでしょう。また、クラウドネイティブソリューションへのシフトにより、スケーラビリティと管理が簡素化され、あらゆる規模の組織にとってDRaaSがより身近なものになるでしょう。

産業別では、IT・ITeSの部門が予測期間中最大のCAGRを示す見通しです。IT・ITeSの部門は、サービスとソリューションを提供するために技術とデータに大きく依存しています。DRaaSは、システム障害、サイバーインシデント、自然災害などの潜在的な混乱に対処するための包括的なフレームワークを提供します。DRaaSは、重要なデータとアプリケーションを安全なオフサイト環境またはクラウド環境に継続的に複製することで、ダウンタイムを最小限に抑え、迅速な復旧と業務の完全性を維持します。ITおよびITeS部門では、機密情報を扱うため、データ保護がもっとも重要です。DRaaSソリューションは、暗号化、安全なストレージ、コンプライアンス遵守を包含し、データセキュリティを強化し、侵害やデータ損失のリスクを軽減します。

当レポートでは、世界のDRaaS (Disaster Recovery as a Service) の市場を調査し、市場概要、市場影響因子および市場機会の分析、特許動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・産業動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- エコシステム分析

- 価格分析

- 平均販売価格の動向

- 主要企業のサービスタイプ別の平均販売価格の動向

- 特許分析

第6章 DRaaS (Disaster Recovery as a Service) 市場:タイプ別

- リアルタイムレプリケーション

- バックアップ&復元

- データ保護

- プロフェッショナルサービス

- 統合

- トレーニング&コンサルティング

- サポート&メンテナンス

第7章 DRaaS (Disaster Recovery as a Service) 市場:導入モード別

- パブリッククラウド

- プライベートクラウド

第8章 DRaaS (Disaster Recovery as a Service) 市場:組織規模別

- 大企業

- 中小企業

第9章 DRaaS (Disaster Recovery as a Service) 市場:産業別

- BFSI

- 通信

- IT・ITES

- 政府・公共部門

- 小売・消費財

- 製造

- エネルギー・ユーティリティ

- メディア・エンターテイメント

- ヘルスケア・ライフサイエンス

- その他

第10章 DRaaS (Disaster Recovery as a Service) 市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- トップベンダーの市場シェア分析

- トップベンダーの過去の収益分析

- 主要企業の企業評価マトリックス

- スタートアップ/中小企業の企業評価マトリクス

- 市場における主な展開

第12章 企業プロファイル

- 主要企業

- AWS

- MICROSOFT

- IBM

- VMWARE

- 11:11 SYSTEMS

- RECOVERY POINT SYSTEMS

- INTERVISION SYSTEMS

- TIERPOINT

- INFRASCALE

- ZERTO

- その他の企業

- ACRONIS

- AXCIENT

- BIOS MIDDLE EAST

- C&W BUSINESS

- CARBONITE

- DAISY

- DATABARRACKS

- DATTO

- DXC TECHNOLOGY

- EVOLVE IP

- EXPEDIENT

- FLEXENTIAL

- NTT DATA

- QUORUM

- UNITRENDS

- SME/スタートアップ

- ARCSERVE

- RACKWARE

- DRUVA

- APTUM

- DARZ

- ZETTAGRID

- PHOENIXNAP

- COHESITY

- ASSURESTOR LIMITED

- HYSTAX

第13章 隣接/関連市場

第14章 付録

The DRaaS market size is expected to grow from USD 10.7 billion in 2023 to USD 26.5 billion by 2028 at a compound annual growth rate (CAGR) of 19.8% during the forecast period. The major factor driving demand for DRaaS is increased awareness of robust data protection and business continuity strategies that DRaaS offers to companies. With the continuous growth of data volumes and the rising sophistication of cyber threats, DRaaS is poised to evolve into a more comprehensive and proactive solution.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD |

| Segments | Service Type, Deployment Mode, Organization Size, Vertical, Region |

| Regions covered | North America, Europe, APAC, Latin America, MEA |

Organizations can expect DRaaS to integrate seamlessly with advanced technologies such as artificial intelligence and machine learning in the coming years. These technologies will enable predictive analytics, allowing organizations to anticipate potential disasters and take preemptive measures to safeguard their data and operations. Additionally, the integration of edge computing and 5G networks will enhance the speed and reliability of data recovery, ensuring minimal downtime during a disaster. Moreover, the cloud will continue to play a central role in the future of DRaaS. Public and private cloud approaches will become more prevalent, offering greater flexibility and redundancy in data storage and recovery. This shift towards cloud-native solutions will also simplify scalability and management, making DRaaS more accessible to organizations of all sizes.

By vertical, the IT & ITeS segment holds the highest CAGR during the forecast period.

The DRaaS market by vertical is divided into BFSI, Telecommunications, IT & ITeS, Government & Public Sector, Retail & Consumer Goods, Manufacturing, Energy & Utilities, Media & Entertainment, Healthcare & Life Sciences, and Other Verticals. The IT & ITeS segment is estimated to grow at the highest CAGR during the forecasted DRaaS market. The IT and ITeS sector heavily relies on technology and data to deliver services and solutions. DRaaS offers a comprehensive framework to counter potential disruptions, such as system failures, cyber incidents, or natural disasters. By continuously replicating critical data and applications to secure off-site or cloud environments, DRaaS minimizes downtime, ensuring prompt recovery and preserving the integrity of operations. Data protection is paramount in the IT and ITeS sector due to the sensitive information handled. DRaaS solutions encompass encryption, secure storage, and compliance adherence, bolstering data security and mitigating breaches or data loss risks.

Business continuity is crucial for IT and ITeS companies, given that their operations often affect clients across various industries. DRaaS enables these organizations to restore services quickly, meet client demands, and fulfill contractual obligations, even in disruptions. Additionally, DRaaS's scalability suits the dynamic nature of the IT and ITeS sectors. These companies can efficiently adjust their resources based on the evolving data volumes and recovery needs, thus optimizing costs and operational efficiency.

The IT and ITeS sector is well-versed in technological advancements, and DRaaS providers are constantly innovating to meet their evolving demands. Solutions such as testing environments, hybrid cloud setups, and seamless application integration ensure that DRaaS aligns with the sector's complex IT ecosystems. In summary, DRaaS is a crucial IT and ITeS industry component, providing strong data protection, rapid recovery, compliance adherence, and efficient business continuity. By embracing DRaaS, IT and ITeS companies can maintain their commitment to clients, strengthen data security, and navigate the rapidly changing landscape with resilience and confidence.

Based on organization size, the large enterprises segment holds the largest market share during the forecast period.

The DRaaS market, by managed security service, is segmented into large enterprises and SMEs. The large enterprises segment is expected to hold the largest market share during the forecast period. The large enterprises segment is crucial in shaping the DRaaS market landscape. These organizations are of significant size and have extensive operations and large volumes of data and critical applications. As a result, large enterprises significantly influence demand and innovation within the DRaaS sector. Large enterprises are among the leading consumers of DRaaS services due to their efficiency, scalability, and cost-effectiveness in managing complex ecosystems. Moreover, these enterprises operate in highly regulated industries such as finance, healthcare, and government, where DRaaS solutions meet stringent compliance requirements by providing secure data replication, encryption, and recovery mechanisms. Considering their responsibility for handling sensitive information, large enterprises seek DRaaS solutions that align with their data protection and privacy needs.

By embracing DRaaS, large enterprises ensure operational resilience, data protection, and compliance adherence in the face of disruptive events. Their intricate IT landscapes and compliance demands contribute significantly to the evolution and expansion of the DRaaS market. In summary, the large enterprises segment is a driving force in the DRaaS market, propelling the growth and refinement of DRaaS solutions.

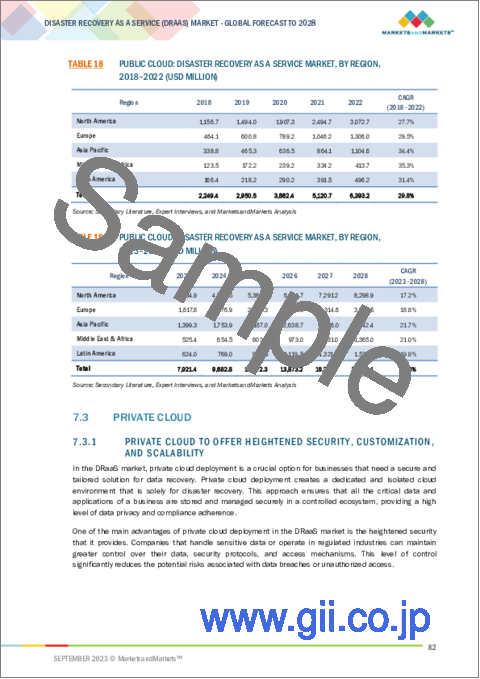

Based on deployment mode, the private cloud segment holds the highest CAGR during the forecast period.

The DRaaS market, by deployment mode, is segmented into public cloud and private cloud. The private cloud segment is estimated to grow at the highest CAGR during the forecasted DRaaS market. In the DRaaS market, private cloud deployment is a crucial option for businesses that need a secure and tailored solution for data recovery. Private cloud deployment creates a dedicated and isolated cloud environment for disaster recovery. This approach ensures that all a business's critical data and applications are stored and managed securely in a controlled ecosystem, providing a high level of data privacy and compliance adherence.

One of the main advantages of private cloud deployment in the DRaaS market is its heightened security. Companies that handle sensitive data or operate in regulated industries can maintain greater control over their data, security protocols, and access mechanisms. This level of control significantly reduces the potential risks associated with data breaches or unauthorized access.

Private cloud deployment offers businesses the benefit of customization and scalability. Organizations can tailor their private cloud environment to suit their requirements, optimizing resource allocation and recovery processes. Efficiently scaling resources enables companies to adapt to changing data volumes and recovery demands. Although private cloud deployment provides enhanced security and customization, it may require more substantial initial investments than public cloud alternatives. Setting up and maintaining a private cloud infrastructure demands higher technical expertise and financial commitment.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the DRaaS market.

- By Company: Tier I: 37%, Tier II: 25%, and Tier III: 34%

- By Designation: C-Level Executives: 31%, Director Level: 34%, and Others: 35%

- By Region: North America: 46%, Europe: 28%, Asia Pacific: 18%, Rest of World: 8%

Some of the significant DRaaS market vendors are AWS (US), Microsoft (US), IBM (US), VMware (US), 11:11 Systems (US), Recovery Point Systems (US), InterVision Systems (US), TierPoint (US), Infrascale (US), and Zerto (US).

Research coverage:

The market study covers the DRaaS market across segments. It aims at estimating the market size and the growth potential across different segments, such as service types, organization sizes, verticals, deployment modes, and regions. It includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall DRaaS market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Need to lower TCO, save time, and enable IT teams to shift focus to higher-value tasks, Increased need for data security and scalability, Rising DRaaS utilization to mitigate risk of cyberattacks on data centers, Increased need for business continuity across SMEs), restraints (Concerns over dependency on service providers, Reluctance of enterprises in adopting cloud-based DRaaS over traditional methods), opportunities (Rising adoption of cloud due to COVID-19 pandemic, Emergence of AI and ML in DRaaS solutions to strengthen DR strategies of enterprises, SMEs represent a significant opportunity within the DRaaS market), and challenges (Difficulty in achieving security and compliance in cloud environments, Potential performance issues with applications running in cloud and bandwidth challenges, Vendor lock-in) influencing the growth of the DRaaS market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the DRaaS market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the DRaaS market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the DRaaS market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, including AWS (US), Microsoft (US), IBM (US), VMware (US), and 11:11 Systems (US), among others in the DRaaS market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 DISASTER RECOVERY AS A SERVICE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key insights from industry experts

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 DISASTER RECOVERY AS A SERVICE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM VENDORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY ̶ APPROACH 2 (BOTTOM-UP): REVENUE GENERATED BY VENDORS FROM EACH APPLICATION

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM DIFFERENT SERVICE TYPES

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RECESSION IMPACT AND RESEARCH ASSUMPTIONS

- TABLE 3 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 DISASTER RECOVERY AS A SERVICE MARKET SNAPSHOT, 2020-2028

- FIGURE 10 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 11 BACKUP & RESTORE SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 12 PUBLIC CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET BY 2028

- FIGURE 13 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET BY 2028

- FIGURE 14 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 15 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN DISASTER RECOVERY AS A SERVICE MARKET

- FIGURE 16 DRASTIC GEOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO HELP DISASTER RECOVERY AS A SERVICE SUSTAIN GROWTH

- 4.2 DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2023 VS. 2028

- FIGURE 17 BACKUP & RESTORE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023 VS. 2028

- FIGURE 18 PUBLIC CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.4 DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023 VS. 2028

- FIGURE 19 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.5 DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2023 VS. 2028

- FIGURE 20 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028

- FIGURE 21 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DISASTER RECOVERY AS A SERVICE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Need to lower TCO, save time, and enable IT teams to shift focus to higher-value tasks

- FIGURE 23 AFFORDABILITY OF DISASTER MANAGEMENT DUE TO FASTER RECOVERY TIMES

- 5.2.1.2 Increased need for data security and scalability

- 5.2.1.3 Rising DRaaS utilization to mitigate risk of cyberattacks on data centers

- 5.2.1.4 Increased need for business continuity across SMEs

- 5.2.2 RESTRAINTS

- 5.2.2.1 Concerns over dependency on service providers

- 5.2.2.2 Reluctance of enterprises in adopting cloud-based DRaaS over traditional methods

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising adoption of cloud due to COVID-19 pandemic

- FIGURE 24 COVID-19 TO DRIVE CLOUD ADOPTION, 2021

- FIGURE 25 GROWING INCLINATION OF ORGANIZATIONS TOWARD MSPS FOR DATA SECURITY AND BACKUP, 2021

- 5.2.3.2 Emergence of AI and ML in DRaaS solutions to strengthen DR strategies of enterprises

- 5.2.3.3 SMEs to represent significant opportunity within DRaaS market

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulty in achieving security and compliance in cloud environments

- 5.2.4.2 Potential performance issues with applications running in cloud and bandwidth challenges

- 5.2.4.3 Vendor lock-in

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: ALLEGANY INSURANCE GROUP SIMPLIFIED ITS DISASTER RECOVERY STRATEGY WITH ILAND

- 5.3.2 CASE STUDY 2: INTERVISION DRAAS TRANSITIONED MANUFACTURING COMPANY FOR GREATER RESILIENCE WITH INTERVISION

- 5.3.3 CASE STUDY 3: COMPUTER-DRIVEN SOLUTIONS DEPLOYED IBDR TO PROTECT DATA AND PREPARE FOR DISASTERS

- 5.3.4 CASE STUDY 4: RMS USED TIERPOINT'S HYBRID CLOUD & DRAAS TO IMPROVE PERFORMANCE AND RELIABILITY

- 5.3.5 CASE STUDY 5: ACRONIS HELPED UCIT SOLUTIONS TRANSITION TO CYBER DISASTER RECOVERY CLOUD

- 5.3.6 CASE STUDY 6: INFOSTREAM SAFEGUARDED CRITICAL DATA AND ENSURED SWIFT RECOVERY WITH AXCIENT CLOUD BACKUP

- 5.3.7 CASE STUDY 7: WAHA CAPITAL SAFEGUARDED BUSINESS CONTINUITY WITH DISASTER RECOVERY FROM CLOUDHPT

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 26 DISASTER RECOVERY AS A SERVICE MARKET: ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.6 AVERAGE SELLING PRICE TRENDS

- 5.7 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY SERVICE TYPE

- TABLE 4 DISASTER RECOVERY AS A SERVICE MARKET: PRICING LEVELS

- 5.8 PATENT ANALYSIS

- FIGURE 27 NUMBER OF PATENTS PUBLISHED, 2012-2022

- FIGURE 28 TOP TEN PATENT APPLICANTS (GLOBAL) IN 2022

- TABLE 5 TOP TEN PATENT OWNERS

6 DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- FIGURE 29 BACKUP & RESTORE SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 6.1.1 SERVICE TYPE: DISASTER RECOVERY AS A SERVICE MARKET DRIVERS

- TABLE 6 DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2022 (USD MILLION)

- TABLE 7 DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 6.2 REAL-TIME REPLICATION

- 6.2.1 REAL-TIME REPLICATION TO HELP PREVENT DATA LOSS AND DOWNTIME DURING DISRUPTIONS

- TABLE 8 REAL-TIME REPLICATION: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 9 REAL-TIME REPLICATION: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 BACKUP & RESTORE

- 6.3.1 BACKUP AND RESTORE TO ENSURE SECURITY OF VITAL DATA AND PROTECT THEM AGAINST POTENTIAL LOSS AND DISRUPTION

- TABLE 10 BACKUP & RESTORE: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 11 BACKUP & RESTORE: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 DATA PROTECTION

- 6.4.1 DATA PROTECTION TO SHIELD BUSINESSES FROM POTENTIAL DISRUPTIONS

- TABLE 12 DATA PROTECTION: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 13 DATA PROTECTION: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.5 PROFESSIONAL SERVICES

- 6.5.1 PROFESSIONAL SERVICES TO PLAN, DEPLOY, INTEGRATE, CONSULT, SUPPORT, AND OFFER IT MAINTENANCE, REPAIR, AND UPGRADE

- TABLE 14 PROFESSIONAL SERVICES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 15 PROFESSIONAL SERVICES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.5.2 INTEGRATION

- 6.5.3 TRAINING & CONSULTING

- 6.5.4 SUPPORT & MAINTENANCE

7 DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- FIGURE 30 PRIVATE CLOUD DEPLOYMENT MODE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 7.1.1 DEPLOYMENT MODE: DISASTER RECOVERY AS A SERVICE MARKET DRIVERS

- TABLE 16 DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 17 DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 7.2 PUBLIC CLOUD

- 7.2.1 PUBLIC CLOUD TO ENABLE RAPID SCALABILITY, IMPROVE DATA RESILIENCE, AND OFFER ADVANCED SECURITY MEASURES

- TABLE 18 PUBLIC CLOUD: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 PUBLIC CLOUD: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 PRIVATE CLOUD

- 7.3.1 PRIVATE CLOUD TO OFFER HEIGHTENED SECURITY, CUSTOMIZATION, AND SCALABILITY

- TABLE 20 PRIVATE CLOUD: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 21 PRIVATE CLOUD: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

8 DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- FIGURE 31 SMES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 8.1.1 ORGANIZATION SIZE: DISASTER RECOVERY AS A SERVICE MARKET DRIVERS

- TABLE 22 DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 23 DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 8.2 LARGE ENTERPRISES

- 8.2.1 DRAAS TO OFFER ORCHESTRATION, TESTING ENVIRONMENTS, AND HYBRID CLOUD SETUPS TO LARGE ENTERPRISES

- TABLE 24 LARGE ENTERPRISES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 LARGE ENTERPRISES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 SMALL & MEDIUM-SIZED ENTERPRISES

- 8.3.1 SMES TO ACCESS COST-EFFECTIVE, FLEXIBLE, AND SCALABLE EASY-TO-MANAGE SOLUTIONS WITH DRAAS

- TABLE 26 SMALL & MEDIUM-SIZED ENTERPRISES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 SMALL & MEDIUM-SIZED ENTERPRISES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

9 DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 32 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- 9.1.1 VERTICAL: DISASTER RECOVERY AS A SERVICE MARKET DRIVERS

- TABLE 28 DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 29 DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2 BFSI

- 9.2.1 DRAAS TO HELP STORE AND MANAGE CUSTOMERS' CONFIDENTIAL INFORMATION AND REDUCE DOWNTIME

- TABLE 30 BFSI: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 BFSI: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 TELECOMMUNICATIONS

- 9.3.1 DRAAS TO ENSURE SEAMLESS CONNECTIVITY, DATA AVAILABILITY, AND CUSTOMER SATISFACTION FOR TELECOMMUNICATIONS COMPANIES

- TABLE 32 TELECOMMUNICATIONS: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 TELECOMMUNICATIONS: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 IT & ITES

- 9.4.1 DRAAS TO REPLICATE CRITICAL DATA AND APPLICATIONS, MINIMIZE DOWNTIME, ENSURE PROMPT RECOVERY, AND PRESERVE INTEGRITY OF OPERATIONS

- TABLE 34 IT & ITES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 IT & ITES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 GOVERNMENT & PUBLIC SECTOR

- 9.5.1 DRAAS TO REPLICATE DATA TO SECURE OFF-SITE OR CLOUD ENVIRONMENTS, MINIMIZE DOWNTIME, AND ALLOW GOVERNMENT ENTITIES TO SWIFTLY RESUME OPERATIONS

- TABLE 36 GOVERNMENT & PUBLIC SECTOR: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 GOVERNMENT & PUBLIC SECTOR: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 RETAIL & CONSUMER GOODS

- 9.6.1 DRAAS TO ENSURE OPERATIONAL CONTINUITY, SAFEGUARD SENSITIVE CUSTOMER DATA, AND MAINTAIN SEAMLESS CUSTOMER EXPERIENCES

- TABLE 38 RETAIL & CONSUMER GOODS: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 RETAIL & CONSUMER GOODS: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 MANUFACTURING

- 9.7.1 DRAAS TO HELP MANUFACTURERS PROTECT THEIR DATA, MAINTAIN PRODUCTION CONTINUITY, AND NAVIGATE UNFORESEEN DISRUPTIONS EFFICIENTLY

- TABLE 40 MANUFACTURING: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 MANUFACTURING: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 ENERGY & UTILITIES

- 9.8.1 DRAAS TO SAFEGUARD ESSENTIAL SERVICES, PROTECT SENSITIVE DATA, AND ENSURE REGULATORY COMPLIANCE

- TABLE 42 ENERGY & UTILITIES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 ENERGY & UTILITIES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.9 MEDIA & ENTERTAINMENT

- 9.9.1 DRAAS TO HELP GAIN FASTER TIME-TO-MARKET, MANAGE LARGE VOLUMES OF DATA, AND REDUCE COSTS

- TABLE 44 MEDIA & ENTERTAINMENT: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 MEDIA & ENTERTAINMENT: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.10 HEALTHCARE & LIFE SCIENCES

- 9.10.1 DRAAS TO SECURE STORAGE, SAFEGUARD SENSITIVE HEALTH INFORMATION, AND REDUCE RISK OF DATA BREACHES OR UNAUTHORIZED ACCESS

- TABLE 46 HEALTHCARE & LIFE SCIENCES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 HEALTHCARE & LIFE SCIENCES: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.11 OTHER VERTICALS

- TABLE 48 OTHER VERTICALS: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 OTHER VERTICALS: DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

10 DISASTER RECOVERY AS A SERVICE MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 33 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE BY 2028

- TABLE 50 DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 DISASTER RECOVERY AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 52 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 DRaaS to ensure business resilience, data protection, and regulatory compliance

- TABLE 62 US: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 63 US: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 64 US: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 65 US: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 DRaaS to help companies comply with regulations by providing secure backup and recovery mechanism for their data

- TABLE 66 CANADA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 67 CANADA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 68 CANADA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 69 CANADA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- TABLE 70 EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2022 (USD MILLION)

- TABLE 71 EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 72 EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 73 EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 74 EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 75 EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 76 EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 77 EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 78 EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 79 EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Presence of major cloud vendors and initiatives taken to expand business to drive market

- TABLE 80 UK: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 81 UK: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 82 UK: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 83 UK: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.3 GERMANY

- 10.3.3.1 Focus on expanding cloud offerings and high demand for public cloud DRaaS among startups to propel market

- TABLE 84 GERMANY: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 85 GERMANY: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 86 GERMANY: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 87 GERMANY: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Adoption of cloud services to store data to drive market

- TABLE 88 FRANCE: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 89 FRANCE: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 90 FRANCE: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 91 FRANCE: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.5 REST OF EUROPE

- TABLE 92 REST OF EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 93 REST OF EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 94 REST OF EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 95 REST OF EUROPE: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 96 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 DRaaS to fortify data security, improve cybersecurity resilience, and ensure business continuity

- TABLE 106 CHINA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 107 CHINA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 108 CHINA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 109 CHINA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Need to recover IT systems quickly and minimize downtime and disruption to drive market

- TABLE 110 JAPAN: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 111 JAPAN: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 112 JAPAN: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 113 JAPAN: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.5 AUSTRALIA

- 10.4.5.1 Advanced and reliable cloud infrastructure and adoption of cloud-based services to propel market

- TABLE 114 AUSTRALIA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 115 AUSTRALIA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 116 AUSTRALIA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 117 AUSTRALIA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 118 REST OF ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 122 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2022 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3 KSA

- 10.5.3.1 Government initiatives and need to develop digital infrastructure to fuel demand for DRaaS solutions

- TABLE 132 KSA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 133 KSA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 134 KSA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 135 KSA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5.4 UAE

- 10.5.4.1 Focus of startups on adopting cloud computing to boost demand for DRaaS solutions

- TABLE 136 UAE: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 137 UAE: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 138 UAE: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 139 UAE: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5.5 SOUTH AFRICA

- 10.5.5.1 Low costs, on-demand availability, and better access to cloud to compel startups to adopt DRaaS

- TABLE 140 SOUTH AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 141 SOUTH AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 142 SOUTH AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 143 SOUTH AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 144 REST OF MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 146 REST OF MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 147 REST OF MIDDLE EAST & AFRICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 148 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2022 (USD MILLION)

- TABLE 149 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 150 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 151 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 152 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 153 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 154 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 155 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 156 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 157 LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 DRaaS to ensure organizations quickly recover their IT systems and data during disaster

- TABLE 158 BRAZIL: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 159 BRAZIL: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 160 BRAZIL: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 161 BRAZIL: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 DRaaS to enable businesses to accelerate their digital transformation and enhance their IT capabilities

- TABLE 162 MEXICO: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 163 MEXICO: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 164 MEXICO: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 165 MEXICO: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6.5 REST OF LATIN AMERICA

- TABLE 166 REST OF LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 167 REST OF LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 168 REST OF LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 169 REST OF LATIN AMERICA: DISASTER RECOVERY AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS OF TOP VENDORS

- TABLE 170 MARKET SHARE OF KEY VENDORS, 2022

- FIGURE 36 DISASTER RECOVERY AS A SERVICE MARKET: MARKET SHARE ANALYSIS

- 11.3 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

- FIGURE 37 HISTORICAL REVENUE ANALYSIS, 2018-2022 (USD MILLION)

- 11.4 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- FIGURE 38 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 39 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- TABLE 171 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS

- 11.5 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- FIGURE 40 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 41 COMPANY EVALUATION MATRIX STARTUPS/SMES, 2022

- TABLE 172 OVERALL COMPANY FOOTPRINT FOR STARTUPS/SMES

- 11.5.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 173 KEY STARTUPS/SMES

- 11.6 KEY MARKET DEVELOPMENTS

- TABLE 174 DISASTER RECOVERY AS A SERVICE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020-2023

- TABLE 175 DISASTER RECOVERY AS A SERVICE MARKET: DEALS, 2020-2023

12 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1 INTRODUCTION

- 12.2 MAJOR PLAYERS

- 12.2.1 AWS

- TABLE 176 AWS: COMPANY OVERVIEW

- FIGURE 42 AWS: COMPANY SNAPSHOT

- TABLE 177 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 179 AWS: DEALS

- 12.2.2 MICROSOFT

- TABLE 180 MICROSOFT: COMPANY OVERVIEW

- FIGURE 43 MICROSOFT: COMPANY SNAPSHOT

- TABLE 181 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 183 MICROSOFT: DEALS

- 12.2.3 IBM

- TABLE 184 IBM: COMPANY OVERVIEW

- FIGURE 44 IBM: COMPANY SNAPSHOT

- TABLE 185 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 187 IBM: DEALS

- 12.2.4 VMWARE

- TABLE 188 VMWARE: COMPANY OVERVIEW

- FIGURE 45 VMWARE: COMPANY SNAPSHOT

- TABLE 189 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 VMWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 191 VMWARE: DEALS

- 12.2.5 11:11 SYSTEMS

- TABLE 192 11:11 SYSTEMS: COMPANY OVERVIEW

- TABLE 193 11:11 SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 11:11 SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 195 11:11 SYSTEMS: DEALS

- 12.2.6 RECOVERY POINT SYSTEMS

- TABLE 196 RECOVERY POINT SYSTEMS: COMPANY OVERVIEW

- TABLE 197 RECOVERY POINT SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 RECOVERY POINT SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 199 RECOVERY POINT SYSTEMS: DEALS

- 12.2.7 INTERVISION SYSTEMS

- TABLE 200 INTERVISION SYSTEMS: COMPANY OVERVIEW

- TABLE 201 INTERVISION SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 INTERVISION SYSTEMS: DEALS

- 12.2.8 TIERPOINT

- TABLE 203 TIERPOINT: COMPANY OVERVIEW

- TABLE 204 TIERPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 TIERPOINT: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.2.9 INFRASCALE

- TABLE 206 INFRASCALE: COMPANY OVERVIEW

- TABLE 207 INFRASCALE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 INFRASCALE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 209 INFRASCALE: DEALS

- 12.2.10 ZERTO

- TABLE 210 ZERTO: COMPANY OVERVIEW

- TABLE 211 ZERTO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 ZERTO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 213 ZERTO: DEALS

- 12.3 OTHER PLAYERS

- 12.3.1 ACRONIS

- 12.3.2 AXCIENT

- 12.3.3 BIOS MIDDLE EAST

- 12.3.4 C&W BUSINESS

- 12.3.5 CARBONITE

- 12.3.6 DAISY

- 12.3.7 DATABARRACKS

- 12.3.8 DATTO

- 12.3.9 DXC TECHNOLOGY

- 12.3.10 EVOLVE IP

- 12.3.11 EXPEDIENT

- 12.3.12 FLEXENTIAL

- 12.3.13 NTT DATA

- 12.3.14 QUORUM

- 12.3.15 UNITRENDS

- 12.4 SMES/STARTUPS

- 12.4.1 ARCSERVE

- 12.4.2 RACKWARE

- 12.4.3 DRUVA

- 12.4.4 APTUM

- 12.4.5 DARZ

- 12.4.6 ZETTAGRID

- 12.4.7 PHOENIXNAP

- 12.4.8 COHESITY

- 12.4.9 ASSURESTOR LIMITED

- 12.4.10 HYSTAX

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.1.1 RELATED MARKETS

- 13.1.2 LIMITATIONS

- 13.2 CLOUD COMPUTING MARKET

- TABLE 214 CLOUD COMPUTING MARKET, BY VERTICAL, 2017-2021 (USD BILLION)

- TABLE 215 CLOUD COMPUTING MARKET, BY VERTICAL, 2022-2027 (USD BILLION)

- 13.3 CLOUD STORAGE MARKET

- TABLE 216 CLOUD STORAGE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 217 CLOUD STORAGE MARKET, BY REGION, 2022-2027 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS