|

|

市場調査レポート

商品コード

1461947

デジタル印刷包装の世界市場:印刷用インク別、印刷技術別、形式別、包装タイプ別、最終用途産業別 - 予測(~2029年)Digital Printing Packaging Market by Printing Ink, Printing Technology, Format, Packaging Type, End-Use Industry - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| デジタル印刷包装の世界市場:印刷用インク別、印刷技術別、形式別、包装タイプ別、最終用途産業別 - 予測(~2029年) |

|

出版日: 2024年04月05日

発行: MarketsandMarkets

ページ情報: 英文 432 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のデジタル印刷包装の市場規模は、2024年の302億米ドルから2029年までに462億米ドルに達し、CAGRで8.9%の成長が予測されます。

近年、市場は複数の主な要因に後押しされ、かなりの拡大を見せています。個性的で視覚的に印象的なデザインに対する消費者の動向の高まりと並んで、オーダーメイドのパーソナライズされた包装ソリューションに対する需要の高まりが、この成長軌道の極めて重大な促進要因となっています。さらに、生産ロットの小ロット化の動向も勢いを増し、市場拡大をさらに後押ししています。印刷品質の向上、生産速度の高速化、コスト効率の改善を特徴とするデジタル印刷技術の進歩は、進化する消費者ニーズに効果的に対応するメーカーの能力を大幅に強化しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(100万/10億米ドル)、数量(A4用紙100万枚) |

| セグメント | 印刷用インク、印刷技術、形式、包装タイプ、最終用途産業、地域 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

「溶剤系インクがデジタル印刷包装市場で使用される最大の印刷用インクとなる」

溶剤系インクは、その広範な採用とさまざまな産業で確立されたプレゼンスにより、デジタル印刷包装市場で最大の印刷用インクタイプとなっています。その優位性は、汎用性、耐久性、包装材料で一般的に使用される幅広い基材との互換性などの要因によるものと考えられます。溶剤系インクは、鮮やかな色とシャープな画像を提供する能力で知られており、高い印刷品質が最優先される用途に特に適しています。

「熱転写印刷がデジタル印刷包装市場で最大の印刷技術となる」

熱転写印刷がデジタル印刷包装市場で最大の印刷技術となっています。この技術は、熱を利用してインクをリボンから基材に転写するもので、ラベル、タグ、軟包装に正確で高品質な印刷を可能にします。その優位性は、色あせ、磨耗、環境要因に対する優れた耐性で、耐久性があり、長持ちする印刷を行う能力によるものと考えられます。

「バリアブルデータ印刷がデジタル印刷包装市場で最大のシェアを占める」

包装産業におけるバリアブルデータ印刷(VDP)の急成長を支える主な促進要因の1つは、大規模なマスカスタマイゼーションを可能にする能力です。データアナリティクスとデジタル印刷技術を活用することで、ブランドは、異なる人口層や地域に響くように、製品の説明、販促オファー、さらには画像など、包装の要素を動的に変更することができます。このレベルのカスタマイズは、ブランドと消費者の関係を強化するだけでなく、コンバージョンやリピート購入の可能性を高めます。

「ラベル包装タイプがデジタル印刷包装市場で最大のシェアを占める」

デジタル印刷包装市場におけるラベルの急成長の主な促進要因の1つは、パーソナライズされたオンデマンド包装ソリューションに対する需要の高まりです。デジタル印刷技術は、ブランドがバリアブルデータ印刷でラベルを少量生産することを可能にし、特定の製品、イベント、または消費者の選好に合わせてカスタマイズされたデザインを可能にします。この柔軟性は、ブランドの信頼性を高めるだけでなく、変化する市場動向や消費者の需要に迅速に対応することを可能にします。

当レポートでは、世界のデジタル印刷包装市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- デジタル印刷包装市場の企業にとって魅力的な機会

- アジア太平洋のデジタル印刷包装市場:印刷用インク別、国別

- デジタル印刷包装市場:印刷用インク別

- デジタル印刷包装市場:印刷技術別

- デジタル印刷包装市場:形式別

- デジタル印刷包装市場:包装タイプ別

- デジタル印刷包装市場:最終用途産業別

- デジタル印刷包装市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向と混乱

- 価格分析

- 主要企業の平均販売価格の動向:印刷用インク別

- 平均販売価格動向:地域別

- サプライチェーン分析

- エコシステム

- 技術分析

- 主要技術

- 補完技術

- 特許分析

- 貿易分析

- デジタル印刷包装市場の輸出シナリオ

- デジタル印刷包装市場の輸入シナリオ

- 主な会議とイベント(2024年~2025年)

- 関税と規制情勢

- デジタル印刷包装市場に関連する関税

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- マクロ経済指標

- 投資と資金調達のシナリオ

第6章 デジタル印刷包装市場:印刷用インク別

- イントロダクション

- 溶剤系インク

- UVインク

- 水性インク

- その他の印刷用インク

第7章 印刷デジタル印刷包装市場:技術別

- イントロダクション

- 熱転写印刷技術

- 電子写真技術、静電印刷技術

- インクジェット印刷技術

- その他の印刷技術

第8章 デジタル印刷包装市場:形式別

- イントロダクション

- フルカラー印刷

- 大判印刷

- バリアブルデータ印刷

- その他の形式

第9章 デジタル印刷包装市場:包装タイプ別

- イントロダクション

- 段ボール

- 折りたたみカートン

- 軟包装

- ラベル

- その他の包装タイプ

第10章 デジタル印刷包装市場:最終用途産業別

- イントロダクション

- 食品・飲料

- 家庭用品・化粧品

- 医薬品・医療

- その他の最終用途産業

第11章 デジタル印刷包装市場:地域別

- イントロダクション

- アジア太平洋

- 景気後退の影響

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 北米

- 景気後退の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 景気後退の影響

- ドイツ

- イタリア

- フランス

- スペイン

- 英国

- ロシア

- その他の欧州

- 中東・アフリカ

- 景気後退の影響

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- 景気後退の影響

- ブラジル

- アルゼンチン

- その他の南米

第12章 競合情勢

- 主要企業戦略

- 市場シェア分析

- 収益分析

- 企業評価と財務指標

- 製品/ブランドの比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- DS SMITH

- SMURFIT KAPPA

- CCL INDUSTRIES

- QUAD/GRAPHICS, INC.

- PRINTPACK, INC.

- HUHTAMAKI OYJ

- CONSTANTIA FLEXIBLES

- THIMM GROUP

- EPAC HOLDINGS, LLC

- AMCOR PLC

- SONOCO PRODUCTS COMPANY

- BERRY GLOBAL GROUP, INC.

- ACME PRINTING

- WESTROCK COMPANY

- その他の企業

- NOSCO, INC.

- QUANTUM PRINT & PACKAGING LTD.

- STORA ENSO OYJ

- TRACO PACKAGING

- TAILORED LABEL PRODUCTS, INC.

- SCHUMACHER PACKAGING GMBH

- CREATIVE LABELS INC.

- REYNDERS LABEL PRINTING

- ELANDERS AB

- COLORDRUCK BAIERSBRONN

- SUN PRINT SOLUTIONS

- XYMOPRINT

- WEBER PACKAGING SOLUTIONS

- PACKMAN PACKAGING PVT. LTD.

- SUNKEY PLASTIC PACKAGING CO., LTD.

第14章 隣接市場と関連市場

- 印刷用インク市場

- イントロダクション

- 制限事項

- 市場の定義

- 市場の概要

- 印刷用インク市場:タイプ別

- 印刷用インク市場:プロセス別

- 印刷用インク市場:用途別

- 印刷用インク市場:地域別

第15章 付録

The digital printing packaging market is projected to grow from USD 30.2 billion in 2024 to USD 46.2 billion by 2029 at a CAGR of 8.9%. In recent years, the digital printing packaging market has seen remarkable expansion, spurred by several key factors. Heightened demand for tailored and personalized packaging solutions, alongside a rising consumer inclination towards distinctive and visually striking designs, has been pivotal in driving this growth trajectory. Additionally, the trend towards smaller production batches has gained momentum, further propelling market expansion. Advancements in digital printing technologies, characterized by enhanced print quality, accelerated production speeds, and improved cost efficiency, have significantly bolstered manufacturers' capabilities to meet evolving consumer needs effectively.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/ Billion) and Volume (million A4 sheets) |

| Segments | Printing Ink, Printing Technology, Format, Packaging Type, End-Use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

"Solvent-based ink to be the largest printing ink used in the digital printing packaging market"

Solvent-based ink stands as the largest printing ink type in the digital printing packaging market, owing to its widespread adoption and established presence across various industries. Its dominance can be attributed to several factors, including its versatility, durability, and compatibility with a wide range of substrates commonly used in packaging materials. Solvent-based inks are renowned for their ability to deliver vibrant colors and sharp images, making them particularly well-suited for applications where high print quality is paramount.

"Thermal transfer printing to be the largest printing technology in the digital printing packaging market."

Thermal transfer printing stands out as the largest printing technology in the digital printing packaging market. This technology utilizes heat to transfer ink from a ribbon onto the substrate, enabling precise and high-quality printing on labels, tags, and flexible packaging. Its dominance can be attributed to its ability to produce durable, long-lasting prints with excellent resistance to fading, abrasion, and environmental factors.

"Variable data printing holds the largest market share in the digital printing packaging market"

One of the key drivers behind the rapid growth of Variable data printing (VDP) in the packaging industry is its ability to enable mass customization at scale. By leveraging data analytics and digital printing technology, brands can dynamically change elements of their packaging, such as product descriptions, promotional offers, or even imagery, to resonate with different demographics or geographical regions. This level of customization not only strengthens brand-consumer relationships but also increases the likelihood of conversion and repeat purchases.

"Labels packaging type holds the largest market share in the digital printing packaging market."

One of the key drivers behind the rapid growth of labels in the digital printing packaging market is the rising demand for personalized and on-demand packaging solutions. Digital printing technology enables brands to produce labels in small quantities with variable data printing, allowing for customized designs tailored to specific products, events, or consumer preferences. This flexibility not only enhances brand authenticity but also enables brands to adapt quickly to changing market trends and consumer demands.

"Food & beverage holds the largest market share in the digital printing packaging market."

The food and beverage industry stands as the largest end-use industry in the digital printing packaging market, owing to its substantial consumption volume, diverse product offerings, and evolving consumer preferences. With a vast array of products ranging from packaged foods and beverages to snacks and confectionery, this industry relies heavily on packaging to attract consumers and differentiate brands on crowded store shelves. As a result, the demand for innovative and eye-catching packaging solutions has surged, driving the adoption of digital printing technology to meet the evolving needs of food and beverage manufacturers..

"Asia Pacific is the biggest market for digital printing packaging."

One of the key drivers behind the rapid growth of digital printing packaging in Asia Pacific is the increasing adoption of advanced printing technologies by packaging manufacturers to meet the evolving needs of consumers. As brands seek to differentiate themselves in competitive markets, there is a growing demand for customized and visually appealing packaging solutions, which digital printing technology enables efficiently. Additionally, the rise of e-commerce platforms and changing retail landscapes in Asia Pacific have further accelerated the adoption of digital printing for packaging, as brands look to enhance their online presence and offer unique packaging experiences to consumers.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments, and information was gathered through secondary research.

The break-up of primary interviews is given below:

- By Department - Sales/Export/Marketing: 47%, Production: 30%, and R&D: 23%

- By Designation - Managers: 56%, CXOs: 23%, and Executives: 21%

- By Region - North America: 30%, Europe: 23%, Asia Pacific: 27%, Middle East & Africa: 15%, and South America: 5%

Companies Covered: The companies profiled in this market research report include DS Smith Plc (UK), Smurfit Kappa Group (Ireland), CCL Industries, Inc. (Canada), Quad/Graphics, Inc. (US), Printpack Inc. (US), Huhtamaki Oyj (Finland), Constantia Flexibles (Austria), THIMM Holding GmbH (Germany), Epac Holdings, LLC (US), Amcor plc (Switzerland), Sonoco Products Company (US), Berry Global Group, Inc. (US), ACME Printing (US), WestRock Company (US), Stora Enso Oyj (Finland), Elanders AB (Sweden), and others.

Research Coverage:

The market study covers digital printing packaging across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on printing ink, printing technology, format, packaging type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the digital printing packaging market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall digital printing packaging market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Customization and personalization demand, Rapid prototyping and time-to-market advantage, Sustainability concerns), restraints (Limited application scope, Volatile raw material cost) opportunities (Growth of the e-commerce industry, Emerging economies offer significant growth opportunities, Emerging markets and niche segments), and challenges (Competition from traditional printing methods, Regulatory compliance and quality standard) influencing the growth of the digital printing packaging market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital printing packaging market

- Market Development: Comprehensive information about lucrative markets - the report analyses the digital printing packaging market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the digital printing packaging market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as DS Smith Plc (UK), Smurfit Kappa Group (Ireland), CCL Industries, Inc. (Canada), Quad/Graphics, Inc. (US), Printpack Inc. (US), Huhtamaki Oyj (Finland), Constantia Flexibles (Austria), THIMM Holding GmbH (Germany), Epac Holdings, LLC (US), Amcor plc (Switzerland), Sonoco Products Company (US), Berry Global Group, Inc. (US), ACME Printing (US), WestRock Company (US), Stora Enso Oyj (Finland), Elanders AB (Sweden), and others in the digital printing packaging market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 DIGITAL PRINTING PACKAGING: MARKET SEGMENTATION

- 1.3.1 YEARS CONSIDERED

- 1.3.2 REGIONS COVERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 DIGITAL PRINTING PACKAGING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF INTERVIEWS WITH EXPERTS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY SIDE

- 2.3 DATA TRIANGULATION

- FIGURE 7 DIGITAL PRINTING PACKAGING MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RECESSION IMPACT

- 2.6 RISKS ASSOCIATED

- 2.7 LIMITATIONS

- 2.8 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 SOLVENT-BASED INKS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 THERMAL TRANSFER PRINTING TO REMAIN LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 10 VARIABLE DATA PRINTING TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 LABELS SEGMENT TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 12 FOOD & BEVERAGE INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC LED DIGITAL PRINTING PACKAGING MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DIGITAL PRINTING PACKAGING MARKET

- FIGURE 14 EMERGING ECONOMIES OFFER LUCRATIVE OPPORTUNITIES IN DIGITAL PRINTING PACKAGING MARKET

- 4.2 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK AND COUNTRY

- FIGURE 15 CHINA AND SOLVENT-BASED PRINTING INK DOMINATED MARKET IN 2023

- 4.3 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK

- FIGURE 16 SOLVENT-BASED INK TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY

- FIGURE 17 INKJET PRINTING SEGMENT TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- 4.5 DIGITAL PRINTING PACKAGING MARKET, BY FORMAT

- FIGURE 18 VARIABLE DATA PRINTING TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.6 DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE

- FIGURE 19 LABELS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.7 DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY

- FIGURE 20 FOOD & BEVERAGE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.8 DIGITAL PRINTING PACKAGING MARKET, BY KEY COUNTRY

- FIGURE 21 CHINA TO WITNESS HIGHEST CAGR FROM 2024 TO 2029

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 DIGITAL PRINTING PACKAGING MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Pressing need for customized and personalized packaging solutions

- 5.2.1.2 Rapid prototyping and time-to-market advantage

- 5.2.1.3 Sustainability concerns

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited applications of digital printing

- 5.2.2.2 Volatile raw material cost

- FIGURE 23 FLUCTUATIONS IN RAW MATERIAL PRICES, 2022-2023 (USD/BARREL)

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth of e-commerce industry

- FIGURE 24 SHARE OF E-COMMERCE IN TOTAL RETAIL SALES IN US, 1999-2023

- 5.2.3.2 Improving living standards in emerging economies

- 5.2.3.3 Emerging markets and niche segments

- 5.2.4 CHALLENGES

- 5.2.4.1 Competition from traditional printing methods

- 5.2.4.2 Pressing need for regulatory compliance and quality standards

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 25 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRINTING INK

- FIGURE 26 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRINTING INK

- TABLE 1 AVERAGE SELLING PRICE TREND OF PRODUCTS OFFERED BY KEY PLAYERS, BY PRINTING INK (USD/A4 SHEET)

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

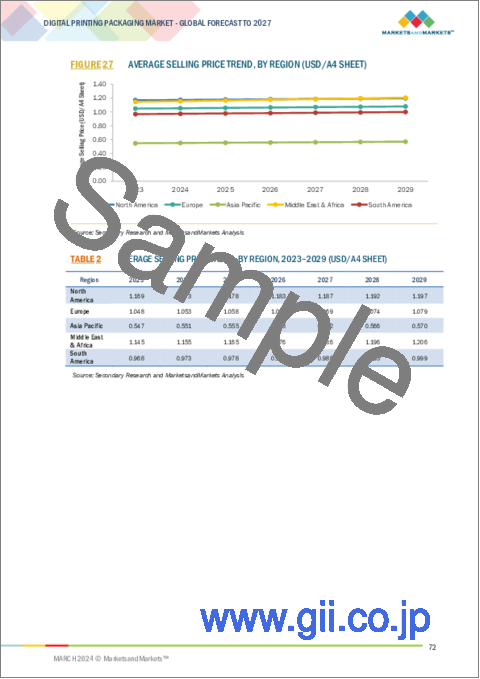

- FIGURE 27 AVERAGE SELLING PRICE TREND, BY REGION (USD/A4 SHEET)

- TABLE 2 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2029 (USD/A4 SHEET)

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 28 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM

- FIGURE 29 KEY PLAYERS IN DIGITAL PRINTING PACKAGING MARKET ECOSYSTEM

- TABLE 3 DIGITAL PRINTING PACKAGING MARKET: ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Electrophotography

- 5.7.1.2 Inkjet

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Hybrid printing

- 5.7.2.2 Varnishes & coatings

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- FIGURE 30 NUMBER OF PATENTS GRANTED FOR DIGITAL PRINTING PACKAGING MARKET, 2014-2023

- FIGURE 31 REGIONAL ANALYSIS OF PATENTS GRANTED FOR DIGITAL PRINTING PACKAGING MARKET, 2014-2023

- TABLE 4 PATENTS IN DIGITAL PRINTING PACKAGING MARKET, 2022-2023

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO OF DIGITAL PRINTING PACKAGING MARKET

- 5.9.1.1 Export scenario for HS Code: 8443

- FIGURE 32 EXPORTS (HS CODE 8443), BY KEY COUNTRY, 2018-2022 (USD BILLION)

- 5.9.2 IMPORT SCENARIO OF DIGITAL PRINTING PACKAGING MARKET

- 5.9.2.1 Import scenario for HS Code: 8443

- FIGURE 33 IMPORTS (HS CODE 8443), BY KEY COUNTRY, 2018-2022 (USD BILLION)

- 5.9.1 EXPORT SCENARIO OF DIGITAL PRINTING PACKAGING MARKET

- 5.10 KEY CONFERENCES AND EVENTS IN 2024-2025

- TABLE 5 DIGITAL PRINTING PACKAGING MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 TARIFF RELATED TO DIGITAL PRINTING PACKAGING MARKET

- TABLE 6 AVERAGE TARIFF RATES FOR HS 8443, BY COUNTRY, 2022

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 DIGITAL PRINTING PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 DIGITAL PRINTING PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 36 KEY BUYING CRITERIA FOR DIGITAL PRINTING PACKAGING FOR TOP THREE APPLICATIONS

- TABLE 13 KEY BUYING CRITERIA FOR DIGITAL PRINTING PACKAGING FOR TOP THREE APPLICATIONS

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 SUNKEY PACKAGING'S DIGITAL PRINTING SOLUTION FOR TYSON FOODS' AGILE PRODUCT DEVELOPMENT NEEDS

- 5.14.1.1 Challenge

- 5.14.1.2 Solution

- 5.14.2 DS SMITH TECNICARTON REVOLUTIONIZES REUSABLE CONTAINER CUSTOMIZATION WITH DIGITAL PRINTING SOLUTIONS

- 5.14.2.1 Challenge

- 5.14.2.2 Solution

- 5.14.3 EPAC'S DIGITAL PRINTING SOLUTIONS REVOLUTIONIZE PRODUCT LAUNCH SPEED FOR WEST SHORE FOODS

- 5.14.3.1 Challenge

- 5.14.3.2 Solution

- 5.14.1 SUNKEY PACKAGING'S DIGITAL PRINTING SOLUTION FOR TYSON FOODS' AGILE PRODUCT DEVELOPMENT NEEDS

- 5.15 MACROECONOMIC INDICATORS

- 5.15.1 GLOBAL GDP OUTLOOK

- TABLE 14 GLOBAL GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- 5.16 INVESTMENT AND FUNDING SCENARIO

- FIGURE 37 INVESTOR FUNDING IN DIGITAL PRINTING PACKAGING SURGED IN 2018

6 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK

- 6.1 INTRODUCTION

- FIGURE 38 UV-BASED INK TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 15 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 16 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 17 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 18 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- 6.2 SOLVENT-BASED INK

- 6.2.1 DURABILITY AND WATERPROOF PRINTING TO DRIVE MARKET

- 6.3 UV-BASED INK

- 6.3.1 EXCELLENT ADHESION PROPERTIES TO DRIVE DEMAND

- 6.4 AQUEOUS INK

- 6.4.1 COMPLIANCE WITH ENVIRONMENTAL PROTECTION STANDARDS TO BOOST MARKET

- 6.5 OTHER PRINTING INKS

7 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 39 INKJET PRINTING TECHNOLOGY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 19 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 20 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 21 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 22 DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- 7.2 THERMAL TRANSFER PRINTING TECHNOLOGY

- 7.2.1 DURABILITY AND RESISTANCE TO VARIOUS CLIMATIC CONDITIONS TO DRIVE DEMAND

- 7.3 ELECTROPHOTOGRAPHY & ELECTROSTATIC PRINTING TECHNOLOGY

- 7.3.1 PRESSING NEED FOR HIGH-QUALITY PRINT TO FOSTER MARKET GROWTH

- 7.4 INKJET PRINTING TECHNOLOGY

- 7.4.1 INCREASED DEMAND FOR COMMERCIAL COLOR PRINTING INKJET SYSTEMS TO DRIVE MARKET

- 7.5 OTHER PRINTING TECHNOLOGIES

8 DIGITAL PRINTING PACKAGING MARKET, BY FORMAT

- 8.1 INTRODUCTION

- FIGURE 40 VARIABLE DATA PRINTING TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 23 DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 24 DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 25 DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 26 DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- 8.2 FULL COLOR PRINTING

- 8.2.1 ACCURACY OF VIVID AND COMPLEX IMAGES TO FUEL DEMAND

- 8.3 LARGE FORMAT PRINTING

- 8.3.1 SHARP AND VIBRANT PRINTS TO BOOST MARKET

- 8.4 VARIABLE DATA PRINTING

- 8.4.1 UNPARALLELED CUSTOMIZATION CAPABILITIES TO DRIVE MARKET

- 8.5 OTHER FORMATS

9 DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE

- 9.1 INTRODUCTION

- FIGURE 41 LABEL PACKAGING TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 27 DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 28 DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 29 DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 30 DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- 9.2 CORRUGATED

- 9.2.1 ADVANCEMENTS IN DIGITAL PRINTING TO DRIVE MARKET

- 9.3 FOLDING CARTONS

- 9.3.1 WIDE APPLICATIONS IN PHARMACEUTICAL AND FOOD INDUSTRIES TO BOOST MARKET

- 9.4 FLEXIBLE

- 9.4.1 HIGH BARRIER-RESISTANCE PROPERTIES TO FUEL MARKET

- 9.5 LABELS

- 9.5.1 INCREASE IN DEMAND FOR CUSTOMIZED LABELS TO DRIVE MARKET

- 9.6 OTHER PACKAGING TYPES

10 DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 42 PHARMACEUTICALS & HEALTHCARE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 31 DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 32 DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 33 DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 34 DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 10.2 FOOD & BEVERAGE

- 10.2.1 RISING DEMAND FOR PACKAGED FOOD TO DRIVE MARKET

- 10.3 HOUSEHOLD & COSMETIC PRODUCTS

- 10.3.1 SURGING NEED FOR PERSONAL CARE AND HOMECARE PRODUCTS TO BOOST MARKET

- 10.4 PHARMACEUTICALS & HEALTHCARE

- 10.4.1 FOCUS ON PATIENT-CENTRIC CARE AND REGULATORY COMPLIANCE TO DRIVE MARKET

- 10.5 OTHER END-USE INDUSTRIES

11 DIGITAL PRINTING PACKAGING MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 43 RISING MANUFACTURING ACTIVITIES AND GROWTH OF E-COMMERCE INDUSTRY TO DRIVE GLOBAL MARKET

- TABLE 35 DIGITAL PRINTING PACKAGING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 DIGITAL PRINTING PACKAGING MARKET, BY REGION, 2018-2021 (MILLION A4 SHEETS)

- TABLE 37 DIGITAL PRINTING PACKAGING MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 38 DIGITAL PRINTING PACKAGING MARKET, BY REGION, 2022-2029 (MILLION A4 SHEETS)

- 11.2 ASIA PACIFIC

- 11.2.1 RECESSION IMPACT

- FIGURE 44 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET SNAPSHOT

- TABLE 39 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 40 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 41 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 42 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 43 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 44 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 45 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 46 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 47 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 48 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 49 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 50 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 51 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 52 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 53 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 54 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 55 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 56 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 57 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 58 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 59 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 60 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 61 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 62 ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.2.2 CHINA

- 11.2.2.1 Robust pharmaceutical and manufacturing sectors to drive market

- TABLE 63 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 64 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 65 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 66 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 67 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 68 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 69 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 70 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 71 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 72 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 73 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 74 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 75 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 76 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 77 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 78 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 79 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 80 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 81 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 82 CHINA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.2.3 JAPAN

- 11.2.3.1 Growing retail food industry to drive market

- TABLE 83 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 84 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 85 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 86 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

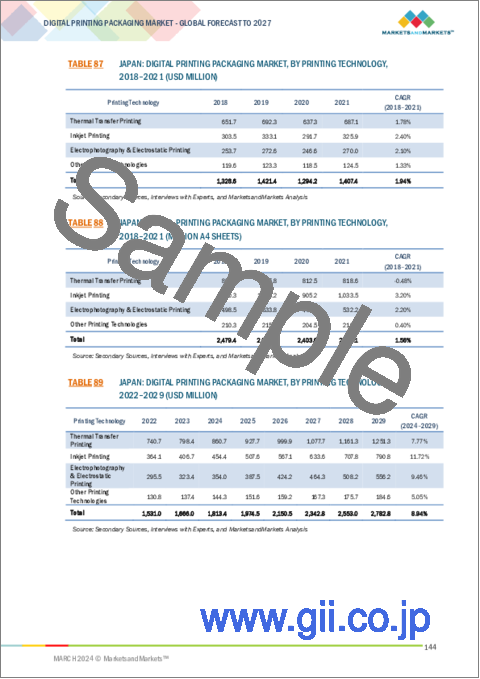

- TABLE 87 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 88 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 89 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 90 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 91 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 92 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 93 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 94 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 95 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 96 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 97 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 98 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 99 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 100 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 101 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 102 JAPAN: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.2.4 INDIA

- 11.2.4.1 Surge in e-commerce activities to drive market

- TABLE 103 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 104 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 105 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 106 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 107 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 108 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 109 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 110 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 111 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 112 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 113 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 114 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 115 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 116 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 117 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 118 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 119 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 120 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 121 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 122 INDIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.2.5 SOUTH KOREA

- 11.2.5.1 Growth of cosmetic industry to drive market

- TABLE 123 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 124 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 125 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 126 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 127 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 128 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 129 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 130 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 131 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 132 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 133 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 134 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 135 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 136 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 137 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 138 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 139 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 140 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 141 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 142 SOUTH KOREA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.2.6 REST OF ASIA PACIFIC

- TABLE 143 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 145 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 147 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 149 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 151 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 153 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 155 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 157 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 159 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 161 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.3 NORTH AMERICA

- 11.3.1 RECESSION IMPACT

- FIGURE 45 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET SNAPSHOT

- TABLE 163 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 164 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 165 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 166 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 167 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 168 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 169 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 170 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 171 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 172 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 173 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 174 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 175 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 176 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 177 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 178 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 179 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 180 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 181 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 182 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 183 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 184 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 185 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 186 NORTH AMERICA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.3.2 US

- 11.3.2.1 Rise in commercial food service establishments and eateries to drive market

- TABLE 187 US: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 188 US: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 189 US: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 190 US: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 191 US: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 192 US: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 193 US: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 194 US: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 195 US: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 196 US: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 197 US: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 198 US: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 199 US: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 200 US: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 201 US: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 202 US: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 203 US: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 204 US: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 205 US: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 206 US: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.3.3 CANADA

- 11.3.3.1 Growing demand for processed food and beverage to drive market

- TABLE 207 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 208 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 209 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 210 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 211 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 212 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 213 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 214 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 215 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 216 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 217 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 218 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 219 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 220 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 221 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 222 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 223 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 224 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 225 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 226 CANADA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.3.4 MEXICO

- 11.3.4.1 FDI inflows and increasing investments from industry giants to drive market

- TABLE 227 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 228 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 229 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 230 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 231 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 232 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 233 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 234 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 235 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 236 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 237 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 238 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 239 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 240 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 241 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 242 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 243 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 244 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 245 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 246 MEXICO: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.4 EUROPE

- 11.4.1 RECESSION IMPACT

- FIGURE 46 EUROPE: DIGITAL PRINTING PACKAGING MARKET SNAPSHOT

- TABLE 247 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 248 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 249 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 250 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 251 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 252 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 253 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 254 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 255 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 256 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 257 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 258 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 259 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 260 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 261 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 262 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 263 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 264 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 265 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 266 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 267 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 268 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 269 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 270 EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.4.2 GERMANY

- 11.4.2.1 Growth of e-commerce industry to drive market

- TABLE 271 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 272 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 273 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 274 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 275 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 276 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 277 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 278 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 279 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 280 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 281 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 282 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 283 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 284 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 285 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 286 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 287 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 288 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 289 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 290 GERMANY: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.4.3 ITALY

- 11.4.3.1 Growth of agrifood business to drive market

- TABLE 291 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 292 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 293 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 294 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 295 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 296 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 297 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 298 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 299 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 300 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 301 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 302 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 303 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 304 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 305 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 306 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 307 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 308 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 309 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 310 ITALY: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.4.4 FRANCE

- 11.4.4.1 Increasing demand for local cosmetic products to drive market

- TABLE 311 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 312 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 313 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 314 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 315 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 316 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 317 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 318 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 319 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 320 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 321 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 322 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 323 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 324 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 325 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 326 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 327 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 328 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 329 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 330 FRANCE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.4.5 SPAIN

- 11.4.5.1 Surge in exports of agricultural goods to propel market

- TABLE 331 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 332 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 333 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 334 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 335 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 336 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 337 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 338 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 339 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 340 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 341 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 342 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 343 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 344 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 345 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 346 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 347 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 348 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 349 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 350 SPAIN: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.4.6 UK

- 11.4.6.1 Increase in online retail sales to drive market

- TABLE 351 UK: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 352 UK: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 353 UK: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 354 UK: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 355 UK: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 356 UK: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 357 UK: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 358 UK: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 359 UK: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 360 UK: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 361 UK: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 362 UK: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 363 UK: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 364 UK: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 365 UK: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 366 UK: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 367 UK: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 368 UK: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 369 UK: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 370 UK: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.4.7 RUSSIA

- 11.4.7.1 Growing demand for packaged food products to drive market

- TABLE 371 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 372 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 373 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 374 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 375 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 376 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 377 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 378 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 379 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 380 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 381 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 382 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 383 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 384 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 385 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 386 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 387 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 388 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 389 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 390 RUSSIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.4.8 REST OF EUROPE

- TABLE 391 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 392 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 393 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 394 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 395 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 396 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 397 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 398 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 399 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 400 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 401 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 402 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 403 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 404 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 405 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 406 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 407 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 408 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 409 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 410 REST OF EUROPE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 RECESSION IMPACT

- TABLE 411 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 412 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 413 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 414 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY COUNTRY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 415 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 416 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 417 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 418 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 419 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 420 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 421 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 422 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 423 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 424 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 425 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 426 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 427 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 428 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 429 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 430 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 431 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 432 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 433 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 434 MIDDLE EAST & AFRICA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.5.2 GCC COUNTRIES

- TABLE 435 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 436 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 437 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 438 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 439 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 440 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 441 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 442 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 443 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 444 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 445 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 446 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 447 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 448 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 449 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 450 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 451 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 452 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 453 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 454 GCC COUNTRIES: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.5.2.1 Saudi Arabia

- 11.5.2.1.1 Focus on diversifying economy to boost market

- 11.5.2.1 Saudi Arabia

- TABLE 455 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 456 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 457 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 458 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 459 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 460 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 461 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 462 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 463 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 464 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 465 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 466 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 467 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 468 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 469 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 470 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 471 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 472 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 473 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 474 SAUDI ARABIA: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.5.2.2 UAE

- 11.5.2.2.1 Rise in non-oil trade to drive market

- 11.5.2.2 UAE

- TABLE 475 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (USD MILLION)

- TABLE 476 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2018-2021 (MILLION A4 SHEETS)

- TABLE 477 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (USD MILLION)

- TABLE 478 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING INK, 2022-2029 (MILLION A4 SHEETS)

- TABLE 479 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 480 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 481 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 482 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PRINTING TECHNOLOGY, 2022-2029 (MILLION A4 SHEETS)

- TABLE 483 UAE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (USD MILLION)

- TABLE 484 UAE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2018-2021 (MILLION A4 SHEETS)

- TABLE 485 UAE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (USD MILLION)

- TABLE 486 UAE: DIGITAL PRINTING PACKAGING MARKET, BY FORMAT, 2022-2029 (MILLION A4 SHEETS)

- TABLE 487 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (USD MILLION)

- TABLE 488 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2018-2021 (MILLION A4 SHEETS)

- TABLE 489 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (USD MILLION)

- TABLE 490 UAE: DIGITAL PRINTING PACKAGING MARKET, BY PACKAGING TYPE, 2022-2029 (MILLION A4 SHEETS)

- TABLE 491 UAE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 492 UAE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2018-2021 (MILLION A4 SHEETS)

- TABLE 493 UAE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 494 UAE: DIGITAL PRINTING PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (MILLION A4 SHEETS)

- 11.5.2.3 Rest of GCC countries