|

|

市場調査レポート

商品コード

1097591

ジメチルホルムアミド(DMF)市場:タイプ別(反応剤、原料)、最終用途産業別(化学、電子、医薬、農薬)、地域別(アジア太平洋、欧州、北米、MEA、南米) - 2027年までの世界予測Dimethylformamide (DMF) Market by Type (Reactant and Feedstock), End-use industries (Chemicals, Electronics, Pharmaceutical, and Agrochemical), and Region (Asia Pacific, Europe, North America, Europe, MEA and South America) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ジメチルホルムアミド(DMF)市場:タイプ別(反応剤、原料)、最終用途産業別(化学、電子、医薬、農薬)、地域別(アジア太平洋、欧州、北米、MEA、南米) - 2027年までの世界予測 |

|

出版日: 2022年06月30日

発行: MarketsandMarkets

ページ情報: 英文 206 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

DMF市場は、2022年の23億米ドルから2027年には27億米ドルに、2022年から2027年の間にCAGR3.2%で成長すると予測されています。

DMFの使用に関連する抑制要因は、市場に関連する厳しい規制です。

"化学品最終用途産業セグメントがDMF市場の最大セグメントと推定されます。"

DMFは、化学産業では樹脂やプラスチックの溶剤として、化学最終用途産業ではアクリル繊維、フィルム、表面コーティング、PU弾性繊維(スパンデックス)、蛍光増白剤、DMFの誘導体を製造するために使用されています。DMFは、化学最終用途産業において、PU、アクリル繊維、コーティング剤、粘着剤の製造に使用されています。化学工業の重要な原料であるPUの製造のための原料として使用されています。消費者関連の幅広い用途で高い需要があります。PU製品はあらゆるところで見かける。ゴムの弾力性と金属の強靭さ、耐久性を併せ持つ、最も汎用性の高い素材の一つです。

PUは、ゴムの弾力性と金属の強靭さ、耐久性を併せ持つ、最も汎用性の高い素材です。PUは重量を吸収し、耐久性を向上させ、製品の絶縁性を高め、快適性と弾力性を付加します。PUコーティングされた合成皮革、靴底、PU弾性フィラメント(スパンデックス)の生産に使用されています。また、DMFは廃水処理の反応剤としても使用されています。DMFはポリマーと結合し、この混合物を水中に通します。DMFは水との混和性が高いので、水に溶ける。これにより、ポリフッ化ビニリデンはより強くなって繊維を形成し、この繊維の束が廃水処理に使われるのです。

"予測期間中、アジア太平洋地域が最も急速にDMF市場を成長させると予測されます。"

アジア太平洋地域は、予測期間中、最も急成長しているDMF市場になると予測されています。アジア太平洋地域は、中国、インド、韓国などの国々で、化学、電子、医薬、農薬など様々な産業でDMFの使用が増加しており、大きな成長が期待されています。

本調査では、市場セグメンテーションを実施し、1次調査と2次調査により、各セグメントおよびサブセグメントの市場規模を測定・検証しています。

プライマリーインタビューの内訳

- 企業タイプ別 ティア1:42%、ティア2:25%、ティア3:33%

- 役職別 Cレベル:36%、Dレベル:19%、その他:45%

- 地域別:アジア太平洋地域42%、北米25%、欧州17%、南米8%、中東・アフリカ8%

本レポートでプロファイルされている主要企業は、Shandong Hualu Hengsheng(中国)、Jiutian Chemical Group Limited(シンガポール)、Luxi Chemical Group Co, Ltd.(中国)、Shaanxi Chemicals Group Co.(中国)、Shaanxi Xinghua Chemistry(米国)、Shangdong Jinmei Riyue Chemical Co.Ltd.(中国)。

調査対象

DMF市場は、タイプ別(反応剤、原料)、最終用途産業別(化学、電子、医薬、農薬、その他)、地域別(アジア太平洋、北米、欧州、南米、中東&アフリカ)に分類されています。

レポート購入の理由

この調査レポートは、洞察の観点から、産業分析(業界動向)、トッププレイヤーの市場シェア分析、企業プロファイルといった様々なレベルの分析に焦点を当てており、これらを合わせて、競合情勢、市場の新興および高成長セグメント、高成長地域、市場の促進要因・課題・機会に関する基本的な見解を構成・考察しています。

本レポートは、以下のポイントに関する考察を提供しています。

- 市場の浸透。市場のトップ企業が提供するDMFに関する包括的な情報

- 製品開発/イノベーション。市場における今後の技術、研究開発活動、新製品発売に関する詳細な洞察。

- 市場の新興国市場。有利な新興市場に関する包括的な情報- 本レポートでは、地域ごとのDMF市場を分析しています。

- 市場の多様化。新製品、未開拓地域、最近の開発、市場への投資に関する詳細な情報

- 競合の評価。市場における主要企業の市場シェア、戦略、製品、製造能力に関する詳細な評価。

目次

第1章 イントロダクション

- 調査目的

- 市場の定義

- 市場に含まれるもの

- 市場の除外

- 市場セグメンテーション

- 対象地域

- 対象年

- 通貨

- 検討単位

- ステークホルダー

- 変更の概要

第2章 調査手法

- 調査データ

- 二次資料

- 二次資料からの主要データ

- プライマリーデータ

- 一次資料からの主なデータ

- 業界の主要な洞察

- プライマリーインタビューの内訳

- 二次資料

- 市場規模・推計

- ボトムアップアプローチ

- トップダウンアプローチ

- データトライアングレーション

- 仮定と限界

- 成長率の前提条件/成長予測

第3章 エグゼクティブサマリー

第4章 重要考察

- DMF市場における魅力的な機会

- DMF市場:最終用途産業別

- DMF市場:最終用途産業別、国別

- DMF市場:先進国vs.途上国新興国市場

- dmf市場:主要国別

第5章 市場概要

- 市場力学

- 原動力

- 最終用途産業における高い需要

- アジア太平洋地域におけるDMFの高い需要

- 抑制要因

- 長期間の暴露別健康への影響に関する懸念

- 可能性

- 自動車産業、電子産業での需要拡大

- 課題

- 厳しい規制

- 原動力

- ポーターズファイブフォース分析

- 新規参入業者の脅威

- 代替品の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 競争企業間の競合関係

- マクロ指標分析

- GDPの動向と予測

- エレクトロニクス産業の動向

- 自動車産業の動向

- フットウェアの動向

- バリューチェーン分析

- プライシング分析

- DMFエコシステムと相互接続市場

- 貿易分析

- 規制とガイドライン

- 特許分析

- 調査手法

- 出版動向

- 特許の法的地位

- 裁判管轄分析

- トップアプリケーション

- 2022-2023年の主要会議・イベント

- 関税と規制状況

- 規制機関、政府機関、その他の組織

第6章 DMF市場:タイプ別

- 反応剤

- DMFは優れた溶解性を持つため、製薬業界の反応・晶析用溶剤として使用されています。

- 原料

- DMFは主にPU製造の原料として使用されます。

第7章 DMF市場:最終用途産業別

- 化学

- DMFの最大の最終用途産業

- ポリウレタン(PU)

- その他

- エレクトロニクス

- 電子製品製造時の溶剤としてDMFの使用増加

- 医薬品

- 医薬品の反応・抽出溶媒として使用

- 農薬

- 農薬の合成に重要な成分として使用されています。

- その他

第8章 DMF市場:地域別

- アジア太平洋地域

- 中国

- アジア太平洋地域最大のDMF市場

- 日本

- 様々な最終用途が需要を押し上げる

- 韓国

- 工業化の進展別需要の増加

- インド

- 政府別経済活性化のための施策が市場の成長に貢献

- インドネシア

- FDI政策の変化が市場を牽引

- タイ

- 合成皮革産業の成長が市場を牽引

- オーストラリア、ニュージーランド

- 製薬業界は市場に大きな影響を与える

- その他のアジア太平洋地域

- 中国

- 北アメリカ

- 米国

- 主要な最終用途産業の成長が需要を押し上げる

- カナダ

- 自動車産業が需要牽引の主役に

- メキシコ

- エレクトロニクス産業がメキシコの市場を牽引

- 米国

- 欧州

- ドイツ

- 自動車産業の発展が需要を押し上げる

- フランス

- 複数の最終用途産業が需要を押し上げる

- イタリア

- 多くの自動車メーカーがイタリアに生産拠点を移し、成長機会を創出

- 英国

- 革新的でエネルギー効率に優れた技術を持つ家電製品が需要を伸ばす

- スペイン

- 様々な最終用途産業への投資により、需要が拡大

- オランダ

- 製薬業界別需要拡大

- トルコ

- 医薬品製造におけるDMFの使用により、需要が増加

- その他の欧州地域

- ドイツ

- 南米

- ブラジル

- 世界で最も急速に成長している製造ハブの1つ

- アルゼンチン

- DMF市場を支える戦略的産業計画2020

- チリ

- DMFの市場成長は低い

- ペルー

- 自動車、製薬、電子部品産業が市場を牽引

- その他の南米地域

- ブラジル

- 中東・アフリカ地域

- アフリカ

- 建設業、自動車産業の拡大が市場成長に影響

- サウジアラビア

- 現地での自動車販売台数の増加が市場成長を後押し

- イラン

- 様々な最終用途産業が市場を牽引

- その他の中東・アフリカ地域

- アフリカ

第9章 競合情勢

- 概要

- 企業評価クワドラントマトリックス。定義と調査手法(2021年版)

- スター企業

- エマージングリーダー

- ペルベーシブカンパニー

- パーティシパント

- 製品ポートフォリオの強み

- SMEマトリックス、2021年

- レスポンシブ

- 先進的な企業

- スターティングブロック

- ダイナミックな企業

- マーケットシェア分析

- 収益分析

- 山東華録恒盛

- 九天化工集団有限公司

- 魯西化学集団股有限公司

- 陝西興華化学

- 山東錦美理悦化学有限公司

- 競合ベンチマーキング

- 市場ランキング分析

- 競合状況・動向

第10章 企業プロファイル

- MAJOR PLAYERS

- SHANDONG HUALU HENGSHENG

- JIUTIAN CHEMICAL GROUP LIMITED

- LUXI CHEMICAL GROUP CO., LTD

- SHAANXI XINGHUA CHEMISTRY CO., LTD.

- SHANDONG JINMEI RIYUE CHEMICAL CO., LTD.

- BASF

- EASTMAN CHEMICAL COMPANY

- HAOHUA JUNHUA GROUP CO., LTD.

- CHINA XLX FERTILISER LTD.

- MERCK KGAA

- MITSUBISHI GAS CHEMICAL COMPANY

- ZHEJIANG JIANGSHAN CHEMICAL CO., LTD.

- CHEMANOL

- BALAJI AMINES

- OTHER COMPANIES

- AK-KIM

- PHARMCO PRODUCTS

- ALPHA CHEMIKA

- HELM AG

- JOHNSON MATTHEY DAVY TECHNOLOGIES

- CCL INTERNATIONAL CHEMICAL COMPANY

- EMCO DYESTUFF PVT. LTD.

第11章 付録

The DMF market is projected to grow from USD 2.3 billion in 2022 to USD 2.7 billion by 2027, at a CAGR of 3.2% between 2022 and 2027. The restraints related to the use of DMF is the stringent regulations related to the market.

"Chemicals end-use industry segment is estimated to be the largest segment of the DMF market."

DMF is used as a solvent for resins and plastics in the chemical industry and to manufacture acrylic fibers, films, surface coatings, PU elastic filament (Spandex), optical brighteners, and derivatives of DMF in the chemical end-use industry. DMF is used to make PU, acrylic fibers, coatings, and adhesives in the chemical end-use industry. It is used as a feedstock for the production of PU, which is an important raw material in the chemical industry. It is in high demand in a wide range of consumer-related applications. PU products are found everywhere. It is one of the most versatile materials, which offers the elasticity of rubber combined with the

toughness and durability of metal. PU absorbs weight, improves durability, enhances insulation in the products, and adds comfort & resiliency. It is used in the production of PU-coated synthetic leathers, shoe soles, and PU-elastic filament (Spandex). DMF is also used as a reactant in wastewater treatment. It is combined with a polymer, and this mixture is passed through water. DMF gets dissolved in water, as it is more miscible with water. This gives polyvinylidene difluoride more strength to form fibers, and this bunch of fibers is used to treat the wastewater.

"Asia Pacific is forecasted to be the fastest-growing DMF market during the forecast period."

Asia Pacific is forecasted to be the fastest-growing DMF market during the forecast period. The Asia Pacific market is expected to witness significant growth due to the rising use of DMF in various industries, such as chemicals, electronics, pharmaceutical, agrochemical, and others use in countries such as China, India, and South Korea.

Extensive primary interviews have been conducted, and information has been gathered from secondary research to determine and verify the market size of several segments and sub-segments.

Breakdown of Primary Interviews:

- By Company Type: Tier 1 - 42%, Tier 2 - 25%, and Tier 3 - 33%

- By Designation: C Level - 36%, D Level - 19%, and Others - 45%

- By Region: Asia Pacific - 42%, North America - 25%, Europe - 17%, South America-8%, and the Middle East & Africa - 8%

The key companies profiled in this report are Shandong Hualu Hengsheng (China), Jiutian Chemical Group Limited (Singapore), Luxi Chemical Group Co., Ltd. (China), Shaanxi Xinghua Chemistry (US), and Shangdong Jinmei Riyue Chemical Co., Ltd. (China).

Research Coverage:

The DMF market has been segmented based by type (Reactant and Feedstock), by end-use industry (Chemicals, Electronics, Pharmaceutical, Agrochemical, and others) and by Region (Asia Pacific, North America, Europe, South America, and Middle East & Africa).

Reasons to Buy the Report

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market share analysis of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the market; high growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on DMF offered by top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the market for DMF across regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 MARKET INCLUSIONS

- 1.2.2 MARKET EXCLUSIONS

- 1.3 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 DMF MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 4 DMF MARKET: DATA TRIANGULATION

- 2.4 ASSUMPTIONS & LIMITATIONS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH LIMITATIONS

- TABLE 3 RISK ANALYSIS

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

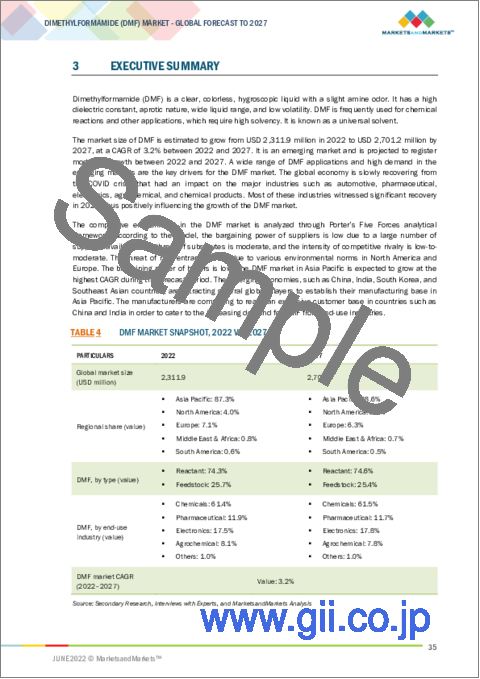

- TABLE 4 DMF MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 5 CHEMICAL END-USE INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 6 ASIA PACIFIC TO LEAD DMF MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 7 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING DMF MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN DMF MARKET

- FIGURE 8 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

- 4.2 DMF MARKET, BY END-USE INDUSTRY

- FIGURE 9 CHEMICALS INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.3 DMF MARKET, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 10 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- 4.4 DMF MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

- FIGURE 11 DMF MARKET TO WITNESS HIGHER GROWTH IN DEVELOPING COUNTRIES

- 4.5 DMF MARKET, BY MAJOR COUNTRIES

- FIGURE 12 INDIA TO REGISTER HIGHEST CAGR IN MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DMF MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 High demand in end-use industries

- 5.2.1.2 High demand for DMF in Asia Pacific

- 5.2.2 RESTRAINTS

- 5.2.2.1 Concerns regarding impact on health due to prolonged exposure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand in automotive and electronic industries

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulations

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 DMF MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 14 PORTER'S FIVE FORCES ANALYSIS: DMF MARKET

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 MACRO INDICATOR ANALYSIS

- 5.4.1 INTRODUCTION

- 5.4.2 TRENDS AND FORECAST OF GDP

- TABLE 6 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2019-2027

- 5.4.3 TRENDS IN ELECTRONICS INDUSTRY

- FIGURE 15 ESTIMATED GROWTH RATES FOR GLOBAL ELECTRONICS INDUSTRY FROM 2020 TO 2022, BY REGION

- 5.4.4 TRENDS IN AUTOMOTIVE INDUSTRY

- TABLE 7 AUTOMOTIVE PRODUCTION, BY COUNTRY, 2018-2021

- 5.4.5 TRENDS IN FOOTWEAR INDUSTRY

- FIGURE 16 DISTRIBUTION OF FOOTWEAR PRODUCTION, BY REGION (QUANTITY), 2021

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 17 DMF: VALUE CHAIN ANALYSIS

- FIGURE 18 DMF VALUE CHAIN: PLAYERS AT EACH NODE

- 5.6 PRICING ANALYSIS

- FIGURE 19 AVERAGE PRICE COMPETITIVENESS IN DMF MARKET, BY REGION

- 5.7 DMF ECOSYSTEM AND INTERCONNECTED MARKET

- TABLE 8 DMF MARKET: SUPPLY CHAIN

- 5.8 TRADE ANALYSIS

- TABLE 9 COUNTRY-WISE IMPORT VALUE DATA, METHYLAMINE OR DIMETHYLAMINE OR TRIMETHYLAMINE AND THEIR SALTS, 2019-2021 (USD THOUSAND)

- TABLE 10 COUNTRY-WISE EXPORT VALUE DATA, METHYLAMINE OR DIMETHYLAMINE OR TRIMETHYLAMINE AND THEIR SALTS, 2019-2021 (USD THOUSAND)

- 5.9 REGULATIONS AND GUIDELINES

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.10.2 PUBLICATION TRENDS

- TABLE 11 TOTAL NUMBER OF DOCUMENTS

- FIGURE 20 NUMBER OF DOCUMENTS, 2011-2021

- FIGURE 21 PUBLICATION TRENDS, 2011-2021

- 5.10.3 LEGAL STATUS OF PATENTS

- FIGURE 22 LEGAL STATUS OF PATENTS

- 5.10.4 JURISDICTION ANALYSIS

- FIGURE 23 PATENTS PUBLISHED BY JURISDICTION, 2011-2021

- 5.10.5 TOP APPLICANTS

- FIGURE 24 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2011-2021

- TABLE 12 LIST OF PATENTS

- TABLE 13 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.11 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 14 DMF MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 DMF MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 25 REACTANT TO BE DOMINANT TYPE IN DMF MARKET

- TABLE 17 DMF MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 18 DMF MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 19 DMF MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 20 DMF MARKET SIZE, BY TYPE, 2022-2027 (TON)

- 6.2 REACTANT

- 6.2.1 DMF USED IN PHARMACEUTICAL INDUSTRY AS REACTION AND CRYSTALLIZATION SOLVENT FOR ITS SUPERIOR SOLVENCY

- TABLE 21 DMF MARKET SIZE AS REACTANT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 22 DMF MARKET SIZE AS REACTANT, BY REGION, 2022-2027 (USD MILLION)

- TABLE 23 DMF MARKET SIZE AS REACTANT, BY REGION, 2018-2021 (TON)

- TABLE 24 DMF MARKET SIZE AS REACTANT, BY REGION, 2022-2027 (TON)

- 6.3 FEEDSTOCK

- 6.3.1 DMF MAINLY USED AS FEEDSTOCK FOR PU PRODUCTION

- TABLE 25 DMF MARKET SIZE AS FEEDSTOCK, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 DMF MARKET SIZE AS FEEDSTOCK, BY REGION, 2022-2027 (USD MILLION)

- TABLE 27 DMF MARKET SIZE AS FEEDSTOCK, BY REGION, 2018-2021 (TON)

- TABLE 28 DMF MARKET SIZE AS FEEDSTOCK, BY REGION, 2022-2027 (TON)

7 DMF MARKET, BY END-USE INDUSTRY

- 7.1 INTRODUCTION

- TABLE 29 DMF: END-USE INDUSTRY AND APPLICATION

- FIGURE 26 CHEMICAL TO BE DOMINANT END-USE INDUSTRY IN DMF MARKET

- TABLE 30 DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 31 DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 32 DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 33 DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 7.2 CHEMICAL

- 7.2.1 LARGEST END-USE INDUSTRY OF DMF

- 7.2.2 POLYURETHANE (PU)

- 7.2.3 OTHERS

- TABLE 34 DMF MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 DMF MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2022-2027 (USD MILLION)

- TABLE 36 DMF MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2018-2021 (TON)

- TABLE 37 DMF MARKET SIZE IN CHEMICAL INDUSTRY, BY REGION, 2022-2027 (TON)

- 7.3 ELECTRONICS

- 7.3.1 INCREASED USE OF DMF AS A SOLVENT WHILE MANUFACTURING ELECTRONIC PRODUCTS

- TABLE 38 DMF MARKET SIZE IN ELECTRONICS INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 DMF MARKET SIZE IN ELECTRONICS INDUSTRY, BY REGION, 2022-2027 (USD MILLION)

- TABLE 40 DMF MARKET SIZE IN ELECTRONICS INDUSTRY, BY REGION, 2018-2021 (TON)

- TABLE 41 DMF MARKET SIZE IN ELECTRONICS INDUSTRY, BY REGION, 2022-2027 (TON)

- 7.4 PHARMACEUTICAL

- 7.4.1 USED AS REACTION AND EXTRACTION SOLVENT FOR PHARMACEUTICAL PREPARATIONS

- TABLE 42 DMF MARKET SIZE IN PHARMACEUTICAL INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 DMF MARKET SIZE IN PHARMACEUTICAL INDUSTRY, BY REGION, 2022-2027 (USD MILLION)

- TABLE 44 DMF MARKET SIZE IN PHARMACEUTICAL INDUSTRY, BY REGION, 2018-2021 (TON)

- TABLE 45 DMF MARKET SIZE IN PHARMACEUTICAL INDUSTRY, BY REGION, 2022-2027 (TON)

- 7.5 AGROCHEMICAL

- 7.5.1 IMPORTANT CONSTITUENT FOR SYNTHESIS OF PESTICIDES

- TABLE 46 DMF MARKET SIZE IN AGROCHEMICAL INDUSTRY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 DMF MARKET SIZE IN AGROCHEMICAL INDUSTRY, BY REGION, 2022-2027 (USD MILLION)

- TABLE 48 DMF MARKET SIZE IN AGROCHEMICAL INDUSTRY, BY REGION, 2018-2021 (TON)

- TABLE 49 DMF MARKET SIZE IN AGROCHEMICAL INDUSTRY, BY REGION, 2022-2027 (TON)

- 7.6 OTHERS

- TABLE 50 DMF MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 DMF MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022-2027 (USD MILLION)

- TABLE 52 DMF MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2021 (TON)

- TABLE 53 DMF MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2022-2027 (TON)

8 DMF MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 27 ASIA PACIFIC TO LEAD DMF MARKET BY 2027

- TABLE 54 DMF MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 55 DMF MARKET SIZE, BY REGION, 2022-2027(USD MILLION)

- TABLE 56 DMF MARKET SIZE, BY REGION, 2018-2021 (TON)

- TABLE 57 DMF MARKET SIZE, BY REGION, 2022-2027 (TON)

- 8.2 ASIA PACIFIC

- FIGURE 28 ASIA PACIFIC: DMF MARKET SNAPSHOT

- TABLE 58 ASIA PACIFIC: DMF MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 59 ASIA PACIFIC: DMF MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 60 ASIA PACIFIC: DMF MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 61 ASIA PACIFIC: DMF MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 62 ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 63 ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 64 ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 65 ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- TABLE 66 ASIA PACIFIC: DMF MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 67 ASIA PACIFIC: DMF MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 68 ASIA PACIFIC: DMF MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 69 ASIA PACIFIC: DMF MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- 8.2.1 CHINA

- 8.2.1.1 Largest DMF market in Asia Pacific

- TABLE 70 CHINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 71 CHINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 72 CHINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 73 CHINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.2 JAPAN

- 8.2.2.1 Different end-use industries to boost demand

- TABLE 74 JAPAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 75 JAPAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 76 JAPAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 77 JAPAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.3 SOUTH KOREA

- 8.2.3.1 Increased industrialization to drive demand

- TABLE 78 SOUTH KOREA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 79 SOUTH KOREA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 80 SOUTH KOREA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 81 SOUTH KOREA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.4 INDIA

- 8.2.4.1 Government initiative to boost country's economy contributes to market growth

- TABLE 82 INDIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 83 INDIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 84 INDIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 85 INDIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.5 INDONESIA

- 8.2.5.1 Changing FDI policies likely to drive market

- TABLE 86 INDONESIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 87 INDONESIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 88 INDONESIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 89 INDONESIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.6 THAILAND

- 8.2.6.1 Growth in synthetic leather industry to drive market

- TABLE 90 THAILAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 91 THAILAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 92 THAILAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 93 THAILAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.7 AUSTRALIA AND NEW ZEALAND

- 8.2.7.1 Pharmaceutical industry to have high impact on market

- TABLE 94 AUSTRALIA & NEW ZEALAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 95 AUSTRALIA & NEW ZEALAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 96 AUSTRALIA & NEW ZEALAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 97 AUSTRALIA & NEW ZEALAND: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2.8 REST OF ASIA PACIFIC

- TABLE 98 REST OF ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 99 REST OF ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 100 REST OF ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 101 REST OF ASIA PACIFIC: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3 NORTH AMERICA

- FIGURE 29 NORTH AMERICA: DMF MARKET SNAPSHOT

- TABLE 102 NORTH AMERICA: DMF MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 103 NORTH AMERICA: DMF MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 104 NORTH AMERICA: DMF MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 105 NORTH AMERICA: DMF MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 106 NORTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 107 NORTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 108 NORTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 109 NORTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- TABLE 110 NORTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 111 NORTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 112 NORTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 113 NORTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- 8.3.1 US

- 8.3.1.1 Growth in major end-use industries to boost demand

- TABLE 114 US: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 115 US: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 116 US: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 117 US: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.2 CANADA

- 8.3.2.1 Automotive sector to play major role in driving demand

- TABLE 118 CANADA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 119 CANADA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 120 CANADA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 121 CANADA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.3.3 MEXICO

- 8.3.3.1 Electronics industry to drive market in Mexico

- TABLE 122 MEXICO: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 123 MEXICO: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 124 MEXICO: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 125 MEXICO: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4 EUROPE

- TABLE 126 EUROPE: DMF MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 127 EUROPE: DMF MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 128 EUROPE: DMF MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 129 EUROPE: DMF MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 130 EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 131 EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 132 EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 133 EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- TABLE 134 EUROPE: DMF MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 135 EUROPE: DMF MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 136 EUROPE: DMF MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 137 EUROPE: DMF MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- 8.4.1 GERMANY

- 8.4.1.1 Developments in automotive industry likely to boost demand

- TABLE 138 GERMANY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 139 GERMANY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 140 GERMANY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 141 GERMANY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.2 FRANCE

- 8.4.2.1 Multiple end-use industries to boost demand

- TABLE 142 FRANCE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 143 FRANCE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 144 FRANCE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 145 FRANCE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.3 ITALY

- 8.4.3.1 Numerous motor manufacturing companies shifting production facilities to Italy, creating growth opportunities

- TABLE 146 ITALY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 147 ITALY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 148 ITALY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 149 ITALY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.4 UK

- 8.4.4.1 Innovative and energy-efficient technology in household appliances to increase demand

- TABLE 150 UK: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 151 UK: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 152 UK: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 153 UK: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.5 SPAIN

- 8.4.5.1 Investment in various end-use industries to boost demand

- TABLE 154 SPAIN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 155 SPAIN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 156 SPAIN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 157 SPAIN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.6 NETHERLANDS

- 8.4.6.1 Pharmaceutical industry to boost demand

- TABLE 158 NETHERLANDS: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 159 NETHERLANDS: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 160 NETHERLANDS: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 161 NETHERLANDS: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.7 TURKEY

- 8.4.7.1 Use of DMF in manufacturing of drugs to drive demand

- TABLE 162 TURKEY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 163 TURKEY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 164 TURKEY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 165 TURKEY: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.4.8 REST OF EUROPE

- TABLE 166 REST OF EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 167 REST OF EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 168 REST OF EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 169 REST OF EUROPE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5 SOUTH AMERICA

- TABLE 170 SOUTH AMERICA: DMF MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 171 SOUTH AMERICA: DMF MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 172 SOUTH AMERICA: DMF MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 173 SOUTH AMERICA: DMF MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 174 SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 175 SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 176 SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 177 SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- TABLE 178 SOUTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 179 SOUTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 180 SOUTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 181 SOUTH AMERICA: DMF MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- 8.5.1 BRAZIL

- 8.5.1.1 One of the fastest-growing manufacturing hubs globally

- TABLE 182 BRAZIL: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 183 BRAZIL: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 184 BRAZIL: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 185 BRAZIL: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5.2 ARGENTINA

- 8.5.2.1 Strategic Industrial Plan 2020 supporting DMF market

- TABLE 186 ARGENTINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 187 ARGENTINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 188 ARGENTINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 189 ARGENTINA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5.3 CHILE

- 8.5.3.1 Low market growth for DMF

- TABLE 190 CHILE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 191 CHILE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 192 CHILE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 193 CHILE: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5.4 PERU

- 8.5.4.1 Automotive, pharmaceutical, and electronic solution industries are driving market

- TABLE 194 PERU: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 195 PERU: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 196 PERU: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 197 PERU: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.5.5 REST OF SOUTH AMERICA

- TABLE 198 REST OF SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 199 REST OF SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 200 REST OF SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 201 REST OF SOUTH AMERICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6 MIDDLE EAST & AFRICA

- TABLE 202 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 205 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY TYPE, 2022-2027 (TON)

- TABLE 206 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 209 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- TABLE 210 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY COUNTRY, 2018-2021 (TON)

- TABLE 213 MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY COUNTRY, 2022-2027 (TON)

- 8.6.1 AFRICA

- 8.6.1.1 Growing construction and automotive industries will impact market growth

- TABLE 214 AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 215 AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 216 AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 217 AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6.2 SAUDI ARABIA

- 8.6.2.1 Increased local car sales to support market growth

- TABLE 218 SAUDI ARABIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 219 SAUDI ARABIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 220 SAUDI ARABIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 221 SAUDI ARABIA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6.3 IRAN

- 8.6.3.1 Different end-use industries likely to drive market

- TABLE 222 IRAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 223 IRAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 224 IRAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 225 IRAN: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.6.4 REST OF MIDDLE EAST & AFRICA

- TABLE 226 REST OF MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 227 REST OF MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 228 REST OF MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 229 REST OF MIDDLE EAST & AFRICA: DMF MARKET SIZE, BY END-USE INDUSTRY, 2022-2027 (TON)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- TABLE 230 OVERVIEW OF STRATEGIES ADOPTED BY KEY DMF PLAYERS

- 9.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021

- 9.2.1 STAR COMPANIES

- 9.2.2 EMERGING LEADERS

- 9.2.3 PERVASIVE COMPANIES

- 9.2.4 PARTICIPANTS

- FIGURE 30 DMF MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.3 STRENGTH OF PRODUCT PORTFOLIO

- 9.4 SME MATRIX, 2021

- 9.4.1 RESPONSIVE COMPANIES

- 9.4.2 PROGRESSIVE COMPANIES

- 9.4.3 STARTING BLOCKS

- 9.4.4 DYNAMIC COMPANIES

- FIGURE 31 DMF MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.5 MARKET SHARE ANALYSIS

- FIGURE 32 MARKET SHARE, BY KEY PLAYERS (2021)

- 9.6 REVENUE ANALYSIS

- 9.6.1 SHANDONG HUALU HENGSHENG

- 9.6.2 JIUTIAN CHEMICAL GROUP LIMITED

- 9.6.3 LUXI CHEMICAL GROUP CO., LTD

- 9.6.4 SHAANXI XINGHUA CHEMISTRY

- 9.6.5 SHANDONG JINMEI RIYUE CHEMICAL CO., LTD.

- 9.7 COMPETITIVE BENCHMARKING

- TABLE 231 DMF MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 232 DMF MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 9.8 MARKET RANKING ANALYSIS

- TABLE 233 MARKET RANKING ANALYSIS 2021

- 9.8.1 COMPETITIVE SITUATIONS AND TRENDS

- TABLE 234 DMF MARKET: PRODUCT LAUNCHES, 2016-2022

- TABLE 235 DMF MARKET: DEALS, 2016-2022

10 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 10.1 MAJOR PLAYERS

- 10.1.1 SHANDONG HUALU HENGSHENG

- TABLE 236 SHANDONG HUALU HENGSHENG: COMPANY OVERVIEW

- 10.1.2 JIUTIAN CHEMICAL GROUP LIMITED

- TABLE 237 JIUTIAN CHEMICAL GROUP LIMITED: COMPANY OVERVIEW

- FIGURE 33 JIUTIAN CHEMICAL GROUP LIMITED: COMPANY SNAPSHOT

- 10.1.3 LUXI CHEMICAL GROUP CO., LTD

- TABLE 238 LUXI CHEMICAL: COMPANY OVERVIEW

- 10.1.4 SHAANXI XINGHUA CHEMISTRY CO., LTD.

- TABLE 239 SHAANXI XINGHUA CHEMISTRY: COMPANY OVERVIEW

- 10.1.5 SHANDONG JINMEI RIYUE CHEMICAL CO., LTD.

- TABLE 240 SHANDONG JINMEI RIYUE CHEMICAL CO., LTD.: COMPANY OVERVIEW

- 10.1.6 BASF

- TABLE 241 BASF: COMPANY OVERVIEW

- FIGURE 34 BASF: COMPANY SNAPSHOT

- TABLE 242 BASF: PRODUCT LAUNCHES

- TABLE 243 BASF: OTHERS

- 10.1.7 EASTMAN CHEMICAL COMPANY

- TABLE 244 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 35 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 245 EASTMAN CHEMICAL COMPANY: DEALS

- 10.1.8 HAOHUA JUNHUA GROUP CO., LTD.

- TABLE 246 HAOHUA JUNHUA GROUP CO., LTD.: COMPANY OVERVIEW

- 10.1.9 CHINA XLX FERTILISER LTD.

- TABLE 247 CHINA XLX FERTILISER LTD.: COMPANY OVERVIEW

- 10.1.10 MERCK KGAA

- TABLE 248 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 36 MERCK KGAA: COMPANY SNAPSHOT

- TABLE 249 MERCK KGAA: OTHERS

- 10.1.11 MITSUBISHI GAS CHEMICAL COMPANY

- TABLE 250 MITSUBISHI GAS CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 37 MITSUBISHI GAS CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 251 MITSUBISHI GAS CHEMICAL COMPANY: DEALS

- 10.1.12 ZHEJIANG JIANGSHAN CHEMICAL CO., LTD.

- TABLE 252 ZHEJIANG JIANGSHAN CHEMICAL CO., LTD.: COMPANY OVERVIEW

- 10.1.13 CHEMANOL

- TABLE 253 CHEMANOL: COMPANY OVERVIEW

- 10.1.14 BALAJI AMINES

- TABLE 254 BALAJI AMINES: COMPANY OVERVIEW

- FIGURE 38 BALAJI AMINES: COMPANY SNAPSHOT

- 10.2 OTHER COMPANIES

- 10.2.1 AK-KIM

- TABLE 255 AK-KIM: COMPANY OVERVIEW

- 10.2.2 PHARMCO PRODUCTS

- TABLE 256 PHARMCO PRODUCTS: COMPANY OVERVIEW

- 10.2.3 ALPHA CHEMIKA

- TABLE 257 ALPHA CHEMIKA: COMPANY OVERVIEW

- 10.2.4 HELM AG

- TABLE 258 HELM AG: COMPANY OVERVIEW

- 10.2.5 JOHNSON MATTHEY DAVY TECHNOLOGIES

- TABLE 259 JOHNSON MATTHEY DAVY TECHNOLOGIES: COMPANY OVERVIEW

- 10.2.6 CCL INTERNATIONAL CHEMICAL COMPANY

- TABLE 260 CCL INTERNATIONAL CHEMICAL COMPANY: COMPANY OVERVIEW

- 10.2.7 EMCO DYESTUFF PVT. LTD.

- TABLE 261 EMCO DYESTUFF PVT. LTD.: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 AVAILABLE CUSTOMIZATIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHORS DETAILS