|

|

市場調査レポート

商品コード

1341055

IoT統合の世界市場 (~2028年):サービス (デバイス&プラットフォーム管理・システム設計&アーキテクチャ・ネットワーク管理・アドバイザリーサービス)・用途 (スマートビル&ホームオートメーション・スマートヘルスケア)・地域別IoT Integration Market by Service (Device & Platform Management, System Design & Architecture, Network Management, Advisory Services), Application (Smart Building & Home Automation, Smart Healthcare) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| IoT統合の世界市場 (~2028年):サービス (デバイス&プラットフォーム管理・システム設計&アーキテクチャ・ネットワーク管理・アドバイザリーサービス)・用途 (スマートビル&ホームオートメーション・スマートヘルスケア)・地域別 |

|

出版日: 2023年08月24日

発行: MarketsandMarkets

ページ情報: 英文 239 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

IoT統合の市場規模は、2023年の32億米ドルから、予測期間中は30.8%のCAGRで推移し、2028年には121億米ドルの規模に成長すると予測されています。

IoTデバイスの普及が進む中で、統合サービスへのニーズが世界的に高まっています。データ分析後に得られる洞察は、ビジネス機能を改善する上で重要です。IoTの統合は、物理的世界とデジタル世界の融合を可能にし、自動化、データ主導の洞察、さまざまな分野におけるユーザーエクスペリエンスの向上など、新たな可能性を切り開きます。

サービスタイプ別では、デバイス&プラットフォーム管理サービスの部門が予測期間中に最大のシェアを示す見通しです。デバイス&プラットフォーム管理サービスは、IoT統合市場の不可欠なコンポーネントであり、IoTデバイスとそれをサポートするプラットフォームの効率的かつ効果的な運用に焦点を当てています。シームレスな機能を確保し、混乱を最小限に抑えることへのニーズが同部門の成長を促進しています。

また、サービスタイプ別では、アプリケーション管理サービスの部門が予測期間中に2番目に高いシェアを示す見通しです。アプリケーション管理サービスは、ネットワーク経由で接続されたデバイスから取得したデータの処理や、アプリケーションのホスティングに役立ちます。また、リモートデバイス管理、データ保存、監視、共有、管理、分析などの追加サービスも提供します。IoT統合市場におけるアプリケーション管理サービスは、最適化されたユーザーエクスペリエンス、セキュリティ、スケーラビリティ、イノベーションのニーズによって推進されています。

地域別では、アジア太平洋地域が予測期間中に高いCAGRを維持する見通しです。同地域の成長は、地域全体で企業のデジタル化が急速に進んでいることが大きな要因となっています。また、アジア太平洋地域では、スマートシティへの取り組みが特に顕著であり、政府や都市がインフラ、交通、エネルギー管理、公共サービスの改善に向けてIoT技術を導入しており、地域全体の市場を牽引しています。

当レポートでは、世界のIoT統合の市場を調査し、市場概要、市場への影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、技術・特許の動向、ケーススタディ、法規制環境、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- エコシステム

- バリューチェーン分析

- 使用事例

- バイヤー/クライアントに影響を与える混乱

- ディスラプティブ技術

- エッジコンピューティング

- 5G

- デジタルツイン

- AI

- 規制の影響

第6章 IoT統合市場:サービス別

- デバイス&プラットフォーム管理サービス

- アプリケーション管理サービス

- アドバイザリーサービス

- システム設計&アーキテクチャサービス

- テストサービス

- サービスプロビジョニング&ディレクトリ管理サービス

- サードパーティAPI管理サービス

- データベース&ブロックストレージ管理サービス

- ネットワーク管理サービス

- インフラ&ワークロード管理サービス

第7章 IoT統合市場:用途別

- スマートビルディング・ホームオートメーション

- スマートヘルスケア

- エネルギー・ユーティリティ

- 工業製造・オートメーション

- スマートリテール

- スマート輸送・物流・テレマティクス

第8章 IoT統合市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第9章 競合情勢

- 主要企業の採用戦略

- 主要企業の市場シェア分析

- 過去の収益分析

- 主要企業の市場ランキング

- 企業評価クアドラント

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第10章 企業プロファイル

- 主要企業

- ACCENTURE

- DXC TECHNOLOGY

- DELOITTE

- ATOS

- TCS

- WIPRO

- CAPGEMINI

- FUJITSU

- IBM

- COGNIZANT

- SALESFORCE

- NTT DATA

- INFOSYS

- HCL

- TECH MAHINDRA

- DELL EMC

- DAMCO

- スタートアップ/SME

- ALLERIN

- SOFTDEL

- PHITOMAS

- EINFOCHIPS

- TIMESYS

- TIBBO

- AERIS

- MACROSOFT

- MESHED

第11章 隣接/関連市場

第12章 付録

The IoT integration market size is expected to grow from USD 3.2 billion in 2023 to USD 12.1 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 30.8% during the forecast period. IoT devices enable performing multiple functions faster in real-time due to their high computational power. The increasing adoption of IoT devices increases the need for integration services globally. The insights obtained after data analysis are important in improving business functions. IoT integration enables the convergence of physical and digital worlds, opening up new possibilities for automation, data-driven insights, and enhanced user experiences across various sectors.

Among service type, Device and Platform Management Services to hold the highest market share during the forecast period

Device and platform management services are integral components of the IoT integration market, focusing on the efficient and effective operation of IoT devices and the platforms that support them. The need to ensure seamless functioning and minimize disruptions will drive the segment's growth.

Among service type, Application Management Services hold the second highest market share during the forecast period

Application management services are instrumental in addressing the data retrieved from connected devices over networks and hosting applications. They also offer additional services, such as remote device management; data storage, monitoring, sharing, and management; and analytics. The application management services in the IoT integration market are driven by the need for optimized user experiences, security, scalability, and innovation.

Among regions, Asia Pacific is to hold a higher CAGR during the forecast period

The growth of the IoT integration market in Asia Pacific is highly driven by the rapid digitalization of enterprises across the region. Also, in Asia Pacific, smart city initiatives are particularly prominent, with governments and cities implementing IoT technologies to improve infrastructure, transportation, energy management, and public services will drive the market across the region.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the IoT integration market.

- By Company: Tier I: 62%, Tier II: 23%, and Tier III: 15%

- By Designation: C-Level Executives: 38%, Directors: 30%, and others: 32%

- By Region: North America: 40%, Europe: 15%, Asia Pacific: 35%, Middle East and Africa: 5%, Latin America: 5%

The report includes the study of key players offering IoT integration solutions and services. It profiles major vendors in the global IoT integration market. The major vendors in the global IoT integration market include TCS Limited (India), Wipro Limited (India), Atos SE (France), Accenture (Ireland), Fujitsu Ltd. (Japan), Infosys Limited (India), Capgemini (France), HCL Technologies Limited (India), Tech Mahindra Limited (India), DXC Technology (US), IBM Corporation (US), Cognizant (US), NTT Data Corporation (Japan), Dell EMC (US), Deloitte (US), Salesforce (US), Allerin Tech Pvt Ltd (India), Softdel (US), Phitomas (Malaysia), eInfochips (US), Timesys Corporation (US), Tibbo Systems (Taiwan), Aeris (US), Macrosoft Inc. (US), Damco (US) and Meshed (Australia).

Research Coverage

The market study covers the IoT integration market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as service, organization size, application, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report would help the market leaders and new entrants in the following ways:

- It comprehensively segments the connected toys market and provides the closest approximations of the revenue numbers for the overall market and its subsegments across different regions.

- It would help stakeholders understand the market's pulse and provide information on the key market drivers, restraints, challenges, and opportunities.

- It would help stakeholders understand their competitors better and gain more insights to enhance their positions in the market. The competitive landscape includes a competitor ecosystem, new service developments, partnerships, and mergers and acquisitions.

The report provides insights on the following pointers:

Analysis of key drivers (Proliferation of connected devices to encourage BYOD and remote workplace management, Development of wireless technologies, Need to increase operational efficiency, Maturing partner agreements of IoT vendors, Emergence of IPv6 ) restraints (Lack of standardization in IoT protocols) opportunities (Growing need to align management strategies with organizations' strategic initiatives, Need for reduced downtime and increased operational efficiency, Increasing demand for automation in business processes, Increasing adoption of iPaaS) challenges (Data security and privacy concerns, Lack of skills and expertise) influencing the growth of the connected toys. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in IoT integration market. Market Development: Comprehensive information about lucrative markets - the report analyses the IoT integration market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the IoT integration market. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players TCS Limited (India), Wipro Limited (India), Atos SE (France), Accenture (Ireland), Fujitsu Ltd. (Japan), Infosys Limited (India), Capgemini (France), HCL Technologies Limited (India), Tech Mahindra Limited (India), DXC Technology (US), IBM Corporation (US), Cognizant (US), NTT Data Corporation (Japan), Dell EMC (US), Deloitte (US), Salesforce (US), Allerin Tech Pvt Ltd (India), Softdel (US), Phitomas (Malaysia), eInfochips (US), Timesys Corporation (US), Tibbo Systems (Taiwan), Aeris (US), Macrosoft Inc. (US), Damco (US) and Meshed (Australia).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 GEOGRAPHICAL SCOPE

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.5 SUMMARY OF CHANGES

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 GLOBAL IOT INTEGRATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- FIGURE 2 BREAKDOWN OF PRIMARIES: BY COMPANY, DESIGNATION, AND REGION

- 2.1.2.2 Primary sources

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1: SUPPLY-SIDE ANALYSIS OF REVENUE FROM IOT INTEGRATION SERVICE PROVIDERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL IOT INTEGRATION SERVICES

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 IMPLICATIONS OF RECESSION ON IOT INTEGRATION MARKET

3 EXECUTIVE SUMMARY

- FIGURE 7 IOT INTEGRATION MARKET, 2021-2028

- FIGURE 8 DEVICE & PLATFORM MANAGEMENT SERVICES PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 SMART BUILDING & HOME AUTOMATION SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 HIGH-GROWTH SEGMENTS IN IOT INTEGRATION MARKET, 2023-2028

- FIGURE 11 IOT INTEGRATION MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN IOT INTEGRATION MARKET

- FIGURE 12 PROLIFERATION OF CONNECTED DEVICES TO DRIVE MARKET

- 4.2 ASIA PACIFIC IOT INTEGRATION MARKET, BY SERVICE AND COUNTRY

- FIGURE 13 DEVICE & PLATFORM MANAGEMENT SERVICES SEGMENT AND CHINA EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IOT INTEGRATION MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Proliferation of connected devices to encourage BYOD and remote workplace management

- 5.2.1.2 Development of wireless technologies

- TABLE 3 PROJECTED PENETRATION OF 5G IN SOUTHEAST ASIA BY 2025

- 5.2.1.3 Need to increase operational efficiency

- 5.2.1.4 Maturing partner agreements of IoT vendors

- 5.2.1.5 Emergence of IPv6

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of standardization in IoT protocols

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing need to align management strategies with organizations' strategic initiatives

- 5.2.3.2 Need for reduced downtime and increased operational efficiency

- 5.2.3.3 Increasing demand for automation in business processes

- 5.2.3.4 Increasing adoption of iPaaS

- 5.2.4 CHALLENGES

- 5.2.4.1 Data security and privacy concerns

- 5.2.4.2 Lack of skills and expertise

- 5.3 ECOSYSTEM

- FIGURE 15 IOT INTEGRATION MARKET: ECOSYSTEM

- TABLE 4 IOT INTEGRATION MARKET: ECOSYSTEM

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 16 IOT INTEGRATION MARKET: VALUE CHAIN

- 5.5 IOT INTEGRATION MARKET: USE CASES

- 5.5.1 USE CASE 1: RETAIL

- 5.5.2 USE CASE 2: HEALTHCARE

- 5.5.3 USE CASE 3: GOVERNMENT

- 5.5.4 USE CASE 4: TRANSPORTATION AND LOGISTICS

- 5.6 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN IOT INTEGRATION MARKET

- FIGURE 17 IOT INTEGRATION MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.7 DISRUPTIVE TECHNOLOGIES

- 5.7.1 EDGE COMPUTING

- 5.7.2 5G

- 5.7.3 DIGITAL TWIN

- 5.7.4 ARTIFICIAL INTELLIGENCE

- 5.8 REGULATORY IMPACT

6 IOT INTEGRATION MARKET, BY SERVICE

- 6.1 INTRODUCTION

- FIGURE 18 DEVICE & PLATFORM MANAGEMENT SERVICES SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- TABLE 5 IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 6 IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 6.2 DEVICE & PLATFORM MANAGEMENT SERVICES

- 6.2.1 REMOTE MONITORING AND SUPPORT FACILITIES THROUGH IOT INTEGRATION SERVICES TO DRIVE MARKET

- 6.2.2 DEVICE & PLATFORM MANAGEMENT SERVICES: IOT INTEGRATION MARKET DRIVERS

- TABLE 7 DEVICE & PLATFORM MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 8 DEVICE & PLATFORM MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 APPLICATION MANAGEMENT SERVICES

- 6.3.1 DEVICE DATA COMMUNICATION AND INTERACTION TO ASSIST REAL-TIME BUSINESS DECISION-MAKING

- 6.3.2 APPLICATION MANAGEMENT SERVICES: IOT INTEGRATION MARKET DRIVERS

- TABLE 9 APPLICATION MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 10 APPLICATION MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 ADVISORY SERVICES

- 6.4.1 STANDARDIZATION OF BUSINESS PROCESSES AND STREAMLINING OF IT OPERATIONS TO PROPEL MARKET GROWTH

- 6.4.2 ADVISORY SERVICES: IOT INTEGRATION MARKET DRIVERS

- TABLE 11 ADVISORY SERVICES: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 12 ADVISORY SERVICES: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.5 SYSTEM DESIGN & ARCHITECTURE SERVICES

- 6.5.1 IMPROVED SYSTEM PERFORMANCE AND TAILORED CONFIGURATION ADVICE TO FUEL MARKET GROWTH

- 6.5.2 SYSTEM DESIGN & ARCHITECTURE SERVICES: IOT INTEGRATION MARKET DRIVERS

- TABLE 13 SYSTEM DESIGN & ARCHITECTURE SERVICES: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 14 SYSTEM DESIGN & ARCHITECTURE SERVICES: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.6 TESTING SERVICES

- 6.6.1 ENHANCED USER EXPERIENCE AND SEAMLESS WORKING OF DEVICES TO BOOST MARKET

- 6.6.2 TESTING SERVICES: IOT INTEGRATION MARKET DRIVERS

- TABLE 15 TESTING SERVICES: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 16 TESTING SERVICES: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.7 SERVICES PROVISIONING & DIRECTORY MANAGEMENT SERVICES

- 6.7.1 MANAGEMENT AND MAINTENANCE OF COMPLEX AND HETEROGENEOUS DIRECTORY DATABASES TO DRIVE MARKET

- 6.7.2 SERVICES PROVISIONING & DIRECTORY MANAGEMENT SERVICES: IOT INTEGRATION MARKET DRIVERS

- TABLE 17 SERVICES PROVISIONING & DIRECTORY SERVICES: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 18 SERVICES PROVISIONING & DIRECTORY MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.8 THIRD-PARTY API MANAGEMENT SERVICES

- 6.8.1 SECURE EXPOSURE OF ENTERPRISE DATA TO MOBILE DEVICES, WEB APPLICATIONS, AND CONNECTED DEVICES TO PROPEL MARKET GROWTH

- 6.8.2 THIRD-PARTY API MANAGEMENT SERVICES: IOT INTEGRATION MARKET DRIVERS

- TABLE 19 THIRD-PARTY API MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 20 THIRD-PARTY API MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.9 DATABASE & BLOCK STORAGE MANAGEMENT SERVICES

- 6.9.1 EFFICIENT QUERY HANDLING AND HETEROGENEOUS DATA INTEGRATION TO BOOST MARKET

- 6.9.2 DATABASE & BLOCK STORAGE MANAGEMENT SERVICES: IOT INTEGRATION MARKET DRIVERS

- TABLE 21 DATABASE & BLOCK STORAGE MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 22 DATABASE & BLOCK STORAGE MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.10 NETWORK MANAGEMENT SERVICES

- 6.10.1 INCREASED EFFICIENCY OF EMPLOYEES AND REDUCED COST OF COMMUNICATIONS TO BOOST MARKET

- 6.10.2 NETWORK MANAGEMENT SERVICES: IOT INTEGRATION MARKET DRIVERS

- TABLE 23 NETWORK MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 NETWORK MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.11 INFRASTRUCTURE & WORKLOAD MANAGEMENT SERVICES

- 6.11.1 COST SAVINGS, OPERATIONAL EFFICIENCIES, AND ENHANCED CUSTOMER EXPERIENCE TO DRIVE MARKET

- 6.11.2 INFRASTRUCTURE & WORKLOAD MANAGEMENT SERVICES: IOT INTEGRATION MARKET DRIVERS

- TABLE 25 INFRASTRUCTURE & WORKLOAD MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 INFRASTRUCTURE & WORKLOAD MANAGEMENT SERVICES: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

7 IOT INTEGRATION MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 19 SMART HEALTHCARE SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 27 IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 28 IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

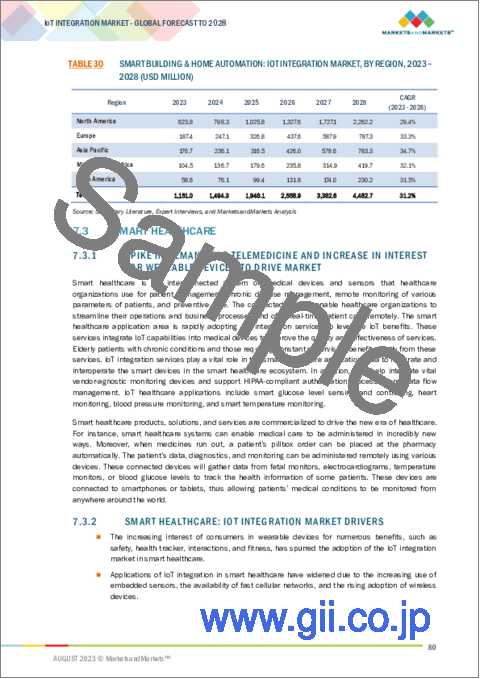

- 7.2 SMART BUILDING & HOME AUTOMATION

- 7.2.1 SUPERIOR QUALITY SOLUTIONS WITH ENHANCED FEATURES TO FUEL MARKET GROWTH

- 7.2.2 SMART BUILDING & HOME AUTOMATION: IOT INTEGRATION MARKET DRIVERS

- TABLE 29 SMART BUILDING & HOME AUTOMATION: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 SMART BUILDING & HOME AUTOMATION: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 SMART HEALTHCARE

- 7.3.1 SPIKE IN DEMAND FOR TELEMEDICINE AND INCREASE IN INTEREST FOR WEARABLE DEVICES TO DRIVE MARKET

- 7.3.2 SMART HEALTHCARE: IOT INTEGRATION MARKET DRIVERS

- TABLE 31 SMART HEALTHCARE: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 SMART HEALTHCARE: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 ENERGY & UTILITIES

- 7.4.1 PROCESS OPTIMIZATION, MINIMAL INVENTORY COSTS, AND IMPROVED PRODUCTIVITY TO DRIVE MARKET

- 7.4.2 ENERGY & UTILITIES: IOT INTEGRATION MARKET DRIVERS

- TABLE 33 ENERGY & UTILITIES: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 ENERGY & UTILITIES: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 INDUSTRIAL MANUFACTURING & AUTOMATION

- 7.5.1 ADOPTION OF IOT INTEGRATION SERVICES DUE TO INCREASED SPEED OF CONNECTIVITY NETWORKS TO DRIVE MARKET

- 7.5.2 INDUSTRIAL MANUFACTURING & AUTOMATION: IOT INTEGRATION MARKET DRIVERS

- TABLE 35 INDUSTRIAL MANUFACTURING & AUTOMATION: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 INDUSTRIAL MANUFACTURING & AUTOMATION: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 SMART RETAIL

- 7.6.1 IMPROVED ORDER AND INVENTORY MANAGEMENT TO BOOST MARKET

- 7.6.2 SMART RETAIL: IOT INTEGRATION MARKET DRIVERS

- TABLE 37 SMART RETAIL: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 SMART RETAIL: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7 SMART TRANSPORTATION, LOGISTICS, AND TELEMATICS

- 7.7.1 GROWING NEED TO MANAGE REAL-TIME DATA OF TRANSPORTATION SYSTEMS TO DRIVE MARKET

- 7.7.2 SMART TRANSPORTATION, LOGISTICS, AND TELEMATICS: IOT INTEGRATION MARKET DRIVERS

- TABLE 39 SMART TRANSPORTATION, LOGISTICS, AND TELEMATICS: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 SMART TRANSPORTATION, LOGISTICS, AND TELEMATICS: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

8 IOT INTEGRATION MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 20 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 41 IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2 NORTH AMERICA

- 8.2.1 NORTH AMERICA: IOT INTEGRATION MARKET DRIVERS

- 8.2.2 NORTH AMERICA: RECESSION IMPACT

- 8.2.3 NORTH AMERICA: TARIFFS AND REGULATIONS

- FIGURE 21 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 43 NORTH AMERICA: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: IOT INTEGRATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: IOT INTEGRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.2.4 US

- 8.2.4.1 Industrial digitization and increased use of connected devices to drive market

- 8.2.4.2 US: IoT integration market drivers

- TABLE 49 US: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 50 US: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 51 US: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 52 US: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2.5 CANADA

- 8.2.5.1 Technological advancements and growing adoption of smart grids to boost market

- 8.2.5.2 Canada: IoT integration market drivers

- TABLE 53 CANADA: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 54 CANADA: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 55 CANADA: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 56 CANADA: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.3 EUROPE

- 8.3.1 EUROPE: IOT INTEGRATION MARKET DRIVERS

- 8.3.2 EUROPE: TARIFFS AND REGULATIONS

- 8.3.3 EUROPE: RECESSION IMPACT

- TABLE 57 EUROPE: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 58 EUROPE: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 59 EUROPE: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 60 EUROPE: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 61 EUROPE: IOT INTEGRATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 62 EUROPE: IOT INTEGRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.3.4 UK

- 8.3.4.1 Strong support from government agencies for development of IoT and innovation to fuel demand for IoT integration services

- 8.3.4.2 UK: IoT integration market drivers

- TABLE 63 UK: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 64 UK: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 65 UK: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 66 UK: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.3.5 GERMANY

- 8.3.5.1 Government initiatives, such as Industrie 4.0, to fuel market growth

- 8.3.5.2 Germany: IoT integration market drivers

- TABLE 67 GERMANY: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 68 GERMANY: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 69 GERMANY: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 70 GERMANY: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.3.6 REST OF EUROPE

- TABLE 71 REST OF EUROPE: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 72 REST OF EUROPE: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 73 REST OF EUROPE: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 74 REST OF EUROPE: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.4 ASIA PACIFIC

- 8.4.1 ASIA PACIFIC: IOT INTEGRATION MARKET DRIVERS

- 8.4.2 ASIA PACIFIC: IMPACT OF RECESSION

- 8.4.3 ASIA PACIFIC: TARIFFS AND REGULATIONS

- FIGURE 22 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 75 ASIA PACIFIC: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 76 ASIA PACIFIC: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.4 CHINA

- 8.4.4.1 Heavy financial and strategic involvement of government in R&D to drive adoption rate of IoT

- 8.4.4.2 China: IoT integration market drivers

- TABLE 81 CHINA: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 82 CHINA: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 83 CHINA: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 84 CHINA: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.4.5 JAPAN

- 8.4.5.1 Increasing automation for asset management processes through IoT integration services to propel market

- 8.4.5.2 Japan: IoT integration market drivers

- TABLE 85 JAPAN: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 86 JAPAN: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 87 JAPAN: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 88 JAPAN: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.4.6 INDIA

- 8.4.6.1 Government initiatives for development of smart cities and smart manufacturing to boost market

- 8.4.6.2 India: IoT integration market drivers

- TABLE 89 INDIA: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 90 INDIA: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 91 INDIA: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 92 INDIA: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.4.7 REST OF ASIA PACIFIC

- TABLE 93 REST OF ASIA PACIFIC: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET DRIVERS

- 8.5.2 MIDDLE EAST & AFRICA: IMPACT OF RECESSION

- 8.5.3 MIDDLE EAST & AFRICA: TARIFFS AND REGULATIONS

- TABLE 97 MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5.4 SAUDI ARABIA

- 8.5.4.1 Increase in smartphone and internet penetration to drive market

- 8.5.4.2 Saudi Arabia: IoT integration market drivers

- TABLE 103 SAUDI ARABIA: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 104 SAUDI ARABIA: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 105 SAUDI ARABIA: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 106 SAUDI ARABIA: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.5.5 UAE

- 8.5.5.1 Increase in adoption of IoT integration services to fuel market growth

- 8.5.5.2 UAE: IoT integration market drivers

- TABLE 107 UAE: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 108 UAE: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 109 UAE: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 110 UAE: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 111 REST OF MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 112 REST OF MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 113 REST OF MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 114 REST OF MIDDLE EAST & AFRICA: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.6 LATIN AMERICA

- 8.6.1 LATIN AMERICA: IOT INTEGRATION MARKET DRIVERS

- 8.6.2 LATIN AMERICA: IMPACT OF RECESSION

- 8.6.3 LATIN AMERICA: TARIFFS AND REGULATIONS

- TABLE 115 LATIN AMERICA: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 116 LATIN AMERICA: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 117 LATIN AMERICA: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 118 LATIN AMERICA: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 119 LATIN AMERICA: IOT INTEGRATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 120 LATIN AMERICA: IOT INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6.4 BRAZIL

- 8.6.4.1 Large startup ecosystem and rapid urbanization to propel market growth

- 8.6.4.2 Brazil: IoT integration market drivers

- TABLE 121 BRAZIL: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 122 BRAZIL: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 123 BRAZIL: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 124 BRAZIL: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.6.5 MEXICO

- 8.6.5.1 Increase in mobile broadband subscriptions and smartphone penetration rates to drive adoption of IoT integration services

- 8.6.5.2 Mexico: IoT integration market drivers

- TABLE 125 MEXICO: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 126 MEXICO: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 127 MEXICO: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 128 MEXICO: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.6.6 REST OF LATIN AMERICA

- TABLE 129 REST OF LATIN AMERICA: IOT INTEGRATION MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 130 REST OF LATIN AMERICA: IOT INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 131 REST OF LATIN AMERICA: IOT INTEGRATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 132 REST OF LATIN AMERICA: IOT INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 133 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN IOT INTEGRATION MARKET

- 9.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 134 IOT INTEGRATION MARKET: DEGREE OF COMPETITION

- 9.4 HISTORICAL REVENUE ANALYSIS

- FIGURE 23 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019-2021 (USD MILLION)

- 9.5 MARKET RANKING OF KEY PLAYERS IN IOT INTEGRATION MARKET, 2023

- FIGURE 24 MARKET RANKING OF KEY PLAYERS, 2023

- 9.6 COMPANY EVALUATION QUADRANT

- 9.6.1 STARS

- 9.6.2 EMERGING LEADERS

- 9.6.3 PERVASIVE PLAYERS

- 9.6.4 PARTICIPANTS

- FIGURE 25 IOT INTEGRATION MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2023

- 9.7 STARTUP/SME EVALUATION MATRIX

- 9.7.1 PROGRESSIVE COMPANIES

- 9.7.2 RESPONSIVE COMPANIES

- 9.7.3 DYNAMIC COMPANIES

- 9.7.4 STARTING BLOCKS

- FIGURE 26 IOT INTEGRATION MARKET (STARTUP): COMPANY EVALUATION MATRIX, 2023

- 9.8 COMPETITIVE SCENARIO

- 9.8.1 PRODUCT LAUNCHES

- TABLE 135 PRODUCT LAUNCHES, 2019-2023

- 9.8.2 DEALS

- TABLE 136 DEALS, 2020-2023

10 COMPANY PROFILES

- 10.1 MAJOR PLAYERS

- (Business overview, Products offered, Recent developments, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)**

- 10.1.1 ACCENTURE

- TABLE 137 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 27 ACCENTURE: FINANCIAL OVERVIEW

- TABLE 138 ACCENTURE: PRODUCTS OFFERED

- TABLE 139 ACCENTURE: DEALS

- TABLE 140 ACCENTURE: OTHER DEVELOPMENTS

- 10.1.2 DXC TECHNOLOGY

- TABLE 141 DXC TECHNOLOGY: BUSINESS OVERVIEW

- FIGURE 28 DXC TECHNOLOGY: FINANCIAL OVERVIEW

- TABLE 142 DXC TECHNOLOGY: PRODUCTS OFFERED

- TABLE 143 DXC TECHNOLOGY: DEALS

- 10.1.3 DELOITTE

- TABLE 144 DELOITTE: BUSINESS OVERVIEW

- FIGURE 29 DELOITTE: FINANCIAL OVERVIEW

- TABLE 145 DELOITTE: PRODUCTS OFFERED

- TABLE 146 DELOITTE: PRODUCT LAUNCHES

- TABLE 147 DELOITTE: DEALS

- 10.1.4 ATOS

- TABLE 148 ATOS: BUSINESS OVERVIEW

- FIGURE 30 ATOS: FINANCIAL OVERVIEW

- TABLE 149 ATOS: PRODUCTS OFFERED

- TABLE 150 ATOS: PRODUCT LAUNCHES

- TABLE 151 ATOS: DEALS

- 10.1.5 TCS

- TABLE 152 TCS: BUSINESS OVERVIEW

- FIGURE 31 TCS: FINANCIAL OVERVIEW

- TABLE 153 TCS: PRODUCTS OFFERED

- TABLE 154 TCS: DEALS

- 10.1.6 WIPRO

- TABLE 155 WIPRO: BUSINESS OVERVIEW

- FIGURE 32 WIPRO: FINANCIAL OVERVIEW

- TABLE 156 WIPRO: PRODUCTS OFFERED

- TABLE 157 WIPRO: PRODUCT LAUNCHES

- TABLE 158 WIPRO: DEALS

- 10.1.7 CAPGEMINI

- TABLE 159 CAPGEMINI: BUSINESS OVERVIEW

- FIGURE 33 CAPGEMINI: FINANCIAL OVERVIEW

- TABLE 160 CAPGEMINI: PRODUCTS OFFERED

- TABLE 161 CAPGEMINI: DEALS

- 10.1.8 FUJITSU

- TABLE 162 FUJITSU: BUSINESS OVERVIEW

- FIGURE 34 FUJITSU: FINANCIAL OVERVIEW

- TABLE 163 FUJITSU: PRODUCTS OFFERED

- TABLE 164 FUJITSU: PRODUCT LAUNCHES

- 10.1.9 IBM

- TABLE 165 IBM: BUSINESS OVERVIEW

- FIGURE 35 IBM: FINANCIAL OVERVIEW

- TABLE 166 IBM: PRODUCTS OFFERED

- TABLE 167 IBM: DEALS

- 10.1.10 COGNIZANT

- TABLE 168 COGNIZANT: BUSINESS OVERVIEW

- FIGURE 36 COGNIZANT: FINANCIAL OVERVIEW

- TABLE 169 COGNIZANT: PRODUCTS OFFERED

- TABLE 170 COGNIZANT: DEALS

- 10.1.11 SALESFORCE

- TABLE 171 SALESFORCE: BUSINESS OVERVIEW

- FIGURE 37 SALESFORCE: FINANCIAL OVERVIEW

- TABLE 172 SALESFORCE: PRODUCTS OFFERED

- TABLE 173 SALESFORCE: DEALS

- 10.1.12 NTT DATA

- TABLE 174 NTT DATA: BUSINESS OVERVIEW

- FIGURE 38 NTT DATA: FINANCIAL OVERVIEW

- TABLE 175 NTT DATA: PRODUCTS OFFERED

- TABLE 176 NTT DATA: DEALS

- 10.1.13 INFOSYS

- 10.1.14 HCL

- 10.1.15 TECH MAHINDRA

- 10.1.16 DELL EMC

- 10.1.17 DAMCO

- 10.2 STARTUPS/SMES

- 10.2.1 ALLERIN

- 10.2.2 SOFTDEL

- 10.2.3 PHITOMAS

- 10.2.4 EINFOCHIPS

- 10.2.5 TIMESYS

- 10.2.6 TIBBO

- 10.2.7 AERIS

- 10.2.8 MACROSOFT

- 10.2.9 MESHED

- *Details on Business overview, Products offered, Recent developments, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 ADJACENT/RELATED MARKETS

- 11.1 IOT MIDDLEWARE MARKET

- 11.1.1 MARKET DEFINITION

- 11.1.2 MARKET OVERVIEW

- 11.1.2.1 IoT middleware market, by platform type

- TABLE 177 IOT MIDDLEWARE MARKET, BY PLATFORM TYPE, 2014-2019 (USD MILLION)

- TABLE 178 IOT MIDDLEWARE MARKET, BY PLATFORM TYPE, 2019-2025 (USD MILLION)

- 11.1.2.2 IoT middleware market, by organization size

- TABLE 179 IOT MIDDLEWARE MARKET, BY ORGANIZATION SIZE, 2014-2019 (USD MILLION)

- TABLE 180 IOT MIDDLEWARE MARKET, BY ORGANIZATION SIZE, 2019-2025 (USD MILLION)

- 11.1.2.3 IoT middleware market, by vertical

- TABLE 181 IOT MIDDLEWARE MARKET, BY VERTICAL, 2014-2019 (USD MILLION)

- TABLE 182 IOT MIDDLEWARE MARKET, BY VERTICAL, 2019-2025 (USD MILLION)

- 11.1.2.4 IoT middleware market, by region

- TABLE 183 IOT MIDDLEWARE MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 184 IOT MIDDLEWARE MARKET, BY REGION, 2019-2025 (USD MILLION)

- 11.2 IOT CLOUD PLATFORM MARKET

- 11.2.1 MARKET DEFINITION

- 11.2.2 MARKET OVERVIEW

- 11.2.2.1 IoT cloud platform market, by offering

- TABLE 185 IOT CLOUD PLATFORM MARKET, BY OFFERING, 2018-2025 (USD MILLION)

- 11.2.2.1.1 Platform

- TABLE 186 OFFERING: IOT CLOUD PLATFORM MARKET, BY PLATFORM, 2018-2025 (USD MILLION)

- 11.2.2.1.2 Services

- TABLE 187 IOT CLOUD PLATFORM MARKET FOR SERVICES, BY TYPE, 2018-2025 (USD MILLION)

- TABLE 188 SERVICES: IOT CLOUD PLATFORM MARKET, BY PROFESSIONAL SERVICE, 2018-2025 (USD MILLION)

- 11.2.2.2 IoT cloud platform market, by deployment mode

- TABLE 189 IOT CLOUD PLATFORM MARKET, BY DEPLOYMENT MODE, 2018-2025 (USD MILLION)

- 11.2.2.2.1 Public cloud

- TABLE 190 PUBLIC CLOUD: IOT CLOUD PLATFORM MARKET, BY REGION, 2018-2025 (USD MILLION)

- 11.2.2.2.2 Private cloud

- TABLE 191 PRIVATE CLOUD: IOT CLOUD PLATFORM MARKET, BY REGION, 2018-2025 (USD MILLION)

- 11.2.2.2.3 Hybrid cloud

- TABLE 192 HYBRID CLOUD: IOT CLOUD PLATFORM MARKET, BY REGION, 2018-2025 (USD MILLION)

- 11.2.2.3 IoT cloud platform market, by application area

- TABLE 193 SMART TRANSPORTATION: IOT CLOUD PLATFORM MARKET, BY REGION, 2018-2025 (USD MILLION)

- TABLE 194 SMART GRID AND UTILITIES: IOT CLOUD PLATFORM MARKET, BY REGION, 2018-2025 (USD MILLION)

- 11.2.2.4 IoT cloud platform market, by region

- TABLE 195 IOT CLOUD PLATFORM MARKET, BY REGION, 2018-2025 (USD MILLION)

- 11.3 IOT PROFESSIONAL SERVICES MARKET

- 11.3.1 MARKET DEFINITION

- 11.3.2 MARKET OVERVIEW

- 11.3.2.1 IoT professional services market, by service type

- TABLE 196 IOT PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 2016-2019 (USD BILLION)

- TABLE 197 IOT PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 2020-2026 (USD BILLION)

- 11.3.2.2 IoT professional services market, by organization size

- TABLE 198 IOT PROFESSIONAL MARKET, BY ORGANIZATION SIZE, 2016-2019 (USD BILLION)

- TABLE 199 IOT PROFESSIONAL MARKET, BY ORGANIZATION SIZE, 2020-2026 (USD BILLION)

- 11.3.2.3 IoT professional services market, by deployment type

- TABLE 200 IOT PROFESSIONAL SERVICES MARKET, BY DEPLOYMENT TYPE, 2016-2019 (USD BILLION)

- TABLE 201 IOT PROFESSIONAL SERVICES MARKET, BY DEPLOYMENT TYPE, 2020-2026 (USD BILLION)

- 11.3.2.4 IoT professional services market, by application

- TABLE 202 IOT PROFESSIONAL SERVICES MARKET, BY APPLICATION, 2016-2019 (USD BILLION)

- TABLE 203 IOT PROFESSIONAL SERVICES MARKET, BY APPLICATION, 2020-2026 (USD BILLION)

- 11.3.2.5 IoT professional services market, by region

- TABLE 204 IOT PROFESSIONAL SERVICES MARKET, BY REGION, 2016-2019 (USD BILLION)

- TABLE 205 IOT PROFESSIONAL SERVICES MARKET, BY REGION, 2020-2026 (USD BILLION)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS