|

|

市場調査レポート

商品コード

1655433

エネルギー管理システム市場:コンポーネント別、展開別、最終用途産業別、タイプ別、地域別 - 2029年までの予測Energy Management Systems Market by Component (Software, Hardware, Services), Type (HEMS, BEMS, IEMS), Deployment (On-premises and Cloud-based), End-use industry, & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| エネルギー管理システム市場:コンポーネント別、展開別、最終用途産業別、タイプ別、地域別 - 2029年までの予測 |

|

出版日: 2025年02月01日

発行: MarketsandMarkets

ページ情報: 英文 319 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のエネルギー管理システムの市場規模は、2024年の441億9,000万米ドルから顕著な伸びを示し、2024年から2029年にかけてのCAGRは13.8%と安定しており、2029年には843億4,000万米ドルに達する勢いです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | コンポーネント別、展開別、最終用途産業別、タイプ別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

2023年の市場シェアは67.96%で、予測期間中、オンプレミスセグメントが最大の市場規模を占めると予測されます。エネルギー管理システム(EMS)市場におけるオンプレミス展開とは、組織の物理的な敷地内にEMSソフトウェアとハードウェアをインストールして運用することを指します。このアプローチは、厳しいセキュリティ、コンプライアンス、パフォーマンス要件により、データやインフラを直接管理する必要がある企業に好まれることが多いです。オンプレミスのセットアップでは、組織はメンテナンス、アップグレード、セキュリティを含むシステム全体に責任を持っています。このモデルは、特定の運用ニーズに合わせたカスタマイズが可能なため、ITインフラを管理・保護するリソースを持つ大企業に特に有利です。

エネルギー管理システムのコンポーネント別に見ると、ソフトウェアセグメントは予測期間2024年から2029年にかけてCAGR 14.6%を記録しました。世界のエネルギー管理システム(EMS)市場のソフトウェア部門は、高度なエネルギー分析、リアルタイムモニタリング、最適化ソリューションの需要増加に牽引され、力強い成長を遂げています。このセグメントの主な製品には、データの可視化、予知保全、AI主導のエネルギー予測のためのプラットフォームが含まれ、これらは組織の運用効率の向上とエネルギーコストの削減を可能にします。IoTとスマートグリッド技術の統合は、EMSソフトウェアの価値をさらに高め、システム間のシームレスな接続とデータ交換を可能にします。主要企業は、住宅用から産業用まで多様な産業ニーズに応える拡張性のあるユーザーフレンドリーなソリューションの開発に注力しており、このソフトウェア分野は世界的にエネルギー効率と持続可能性イニシアチブの重要なイネーブラーとして位置付けられています。

産業用エネルギー管理システムのタイプ別セグメントは、予測期間中最大の市場規模を維持すると予測されます。産業用エネルギー管理システム(IEMS)分野は、エネルギー集約型部門における業務効率化、コスト削減、規制遵守の必要性によって、EMS市場の中で極めて重要な位置を占めています。IEMSソリューションは、製造施設、製油所、その他の産業事業におけるエネルギー使用のリアルタイム監視、制御、最適化を可能にします。持続可能性と二酸化炭素削減がますます重視される中、産業界はIEMSを活用して再生可能エネルギー源を統合し、廃棄物を最小限に抑え、全体的な生産性を高めています。IEMSにIoT、AI、機械学習などの先進技術が採用されることで、市場成長はさらに加速し、この分野は産業エネルギーの効率化と市場競争力を実現する重要な要素となっています。

欧州のエネルギー管理システム(EMS)市場は、欧州連合(EU)の規制枠組みや、エネルギー効率と持続可能性の促進を目的とした多額の投資によって強力に支えられており、ダイナミックかつ急速に発展している分野です。EUの温室効果ガス排出削減とエネルギー効率向上へのコミットメントにより、同地域はEMS技術の導入と発展における世界的リーダーとして位置づけられています。

欧州委員会によると、EUのエネルギー政策、特に欧州グリーンディールとエネルギー効率指令は、EMS市場を牽引する極めて重要な役割を果たしています。これらの政策は、エネルギー節約と排出削減のための野心的な目標を設定しており、その結果、さまざまな部門でエネルギー管理システムが広く採用されるようになっています。例えばエネルギー効率指令は、2030年までにエネルギー効率を32.5%改善するために、EMSの利用を含むエネルギー効率対策を実施することを加盟国に義務付けています。

さらに、欧州各国は、EUのエネルギー効率目標に沿った国家戦略を実施しています。例えば、ドイツのエネルギー効率に関する国家行動計画(NAPE)は、産業・商業部門におけるEMSの導入を促進し、これらのシステムを導入する企業に財政的インセンティブと技術的支援を提供しています。同様に、フランスの「グリーン成長のためのエネルギー転換法」は、さまざまな産業でエネルギー節約と二酸化炭素排出量削減を達成するためにEMSを利用することを強調しています。

当レポートでは、世界のエネルギー管理システム市場について調査し、コンポーネント別、展開別、最終用途産業別、タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 価格分析

- 投資と資金調達のシナリオ

- サプライチェーン分析

- 技術分析

- 2025年~2026年の主な会議とイベント

- 関税と規制

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 購入基準

- ケーススタディ分析

- エネルギー管理システム市場における生成AI/AIの影響

- エネルギー管理システム市場のマクロ経済見通し

第6章 エネルギー管理システム市場(コンポーネント別)

- イントロダクション

- ソフトウェア

- ハードウェア

- サービス

第7章 エネルギー管理システム市場(展開別)

- イントロダクション

- オンプレミス

- クラウドベース

第8章 エネルギー管理システム市場(最終用途産業別)

- イントロダクション

- 電力・エネルギー

- 通信・IT

- 製造

- 住宅・商業施設

- 食品・飲料

- その他

第9章 エネルギー管理システム市場(タイプ別)

- イントロダクション

- 家庭用エネルギー管理システム

- ビルエネルギー管理システム

- 産業用エネルギー管理システム

第10章 エネルギー管理システム市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他

- アジア太平洋

- 中国

- インド

- 日本

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- 湾岸協力会議

- 南アフリカ

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 2023年の参入企業トップ5の市場シェア分析

- 2019年~2023年の市場参入企業トップ5の収益分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- ABB

- SCHNEIDER ELECTRIC

- SIEMENS

- GENERAL ELECTRIC COMPANY

- EMERSON ELECTRIC CO.

- HONEYWELL INTERNATIONAL INC.

- EATON

- MITSUBISHI ELECTRIC CORPORATION

- IBM

- HITACHI LTD

- ROCKWELL AUTOMATION, INC.

- YOKOGAWA ELECTRIC CORPORATION

- DELTA ELECTRONICS, INC.

- DANFOSS

- VERDIGRIS TECHNOLOGIES, INC.

- PANASONIC INDUSTRY CO., LTD.

- WIPRO

- LG ELECTRONICS

- JOHNSON CONTROLS INC.

- AGREGIO SOLUTIONS

- その他の企業

- ENEL X

- NEPTUNE INDIA

- WEIDMULLER

- ENERGY MANAGEMENT SYSTEMS, INC.

- DISTECH CONTROLS

第13章 付録

List of Tables

- TABLE 1 ENERGY MANAGEMENT SYSTEMS MARKET INCLUSIONS AND EXCLUSIONS, BY COMPONENT

- TABLE 2 ENERGY MANAGEMENT SYSTEMS MARKET INCLUSIONS AND EXCLUSIONS, BY TYPE

- TABLE 3 ENERGY MANAGEMENT SYSTEMS MARKET INCLUSIONS AND EXCLUSIONS, BY DEPLOYMENT

- TABLE 4 ENERGY MANAGEMENT SYSTEMS MARKET INCLUSIONS AND EXCLUSIONS, BY END-USE INDUSTRY

- TABLE 5 ENERGY MANAGEMENT SYSTEMS MARKET INCLUSIONS AND EXCLUSIONS, BY REGION

- TABLE 6 KEY SECONDARY SOURCES

- TABLE 7 DEMAND-SIDE ANALYSIS

- TABLE 8 ENERGY MANAGEMENT SYSTEMS MARKET: RISK ASSESSMENT

- TABLE 9 ENERGY MANAGEMENT SYSTEMS MARKET: SNAPSHOT

- TABLE 10 ENERGY MANAGEMENT SYSTEMS MARKET: ROLE IN ECOSYSTEM

- TABLE 11 INDICATIVE PRICING ANALYSIS OF KEY OFFERINGS, BY KEY MARKET PLAYER/COMPETITOR (USD)

- TABLE 12 ENERGY MANAGEMENT SYSTEMS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 IMPORT TARIFFS FOR HS 903210 THERMOSTATS, 2023

- TABLE 14 IMPORT TARIFFS FOR HS 9028 UTILITY METERS, 2023

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ENERGY MANAGEMENT SYSTEMS: CODES AND REGULATIONS

- TABLE 20 EXPORT SCENARIO FOR HS CODE: 903210, BY COUNTRY, 2021-2023 (USD)

- TABLE 21 IMPORT SCENARIO FOR HS CODE: 903210, BY COUNTRY, 2021-2023 (USD)

- TABLE 22 EXPORT SCENARIO FOR HS CODE: 902830, BY COUNTRY, 2021-2023 (USD)

- TABLE 23 EXPORT SCENARIO FOR HS CODE: 902890, BY COUNTRY, 2021-2023 (USD)

- TABLE 24 IMPORT SCENARIO FOR HS CODE: 902830, BY COUNTRY, 2021-2023 (USD)

- TABLE 25 IMPORT SCENARIO FOR HS CODE: 902890, BY COUNTRY, 2021-2023 (USD)

- TABLE 26 ENERGY MANAGEMENT SYSTEMS: INNOVATIONS AND PATENT REGISTRATIONS, JANUARY 2020-DECEMBER 2023

- TABLE 27 ENERGY MANAGEMENT SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 28 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 29 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 30 ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2020-2023 (USD BILLION)

- TABLE 31 ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2024-2029 (USD BILLION)

- TABLE 32 ENERGY MANAGEMENT SOFTWARE SYSTEMS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 33 ENERGY MANAGEMENT SOFTWARE SYSTEMS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 34 ENERGY MANAGEMENT HARDWARE SYSTEMS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 35 ENERGY MANAGEMENT HARDWARE SYSTEMS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 36 ENERGY MANAGEMENT SYSTEM SERVICES MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 37 ENERGY MANAGEMENT SYSTEM SERVICES MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 38 ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2020-2023 (USD BILLION)

- TABLE 39 ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2024-2029 (USD BILLION)

- TABLE 40 ON-PREMISE ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 41 ON-PREMISE ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 42 CLOUD-BASED ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 43 CLOUD-BASED ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 44 ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 45 ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 46 ENERGY MANAGEMENT SYSTEMS MARKET IN POWER & ENERGY, BY REGION, 2020-2023 (USD BILLION)

- TABLE 47 ENERGY MANAGEMENT SYSTEMS MARKET IN POWER & ENERGY, BY REGION, 2024-2029 (USD BILLION)

- TABLE 48 ENERGY MANAGEMENT SYSTEMS MARKET IN TELECOM & IT, BY REGION, 2020-2023 (USD BILLION)

- TABLE 49 ENERGY MANAGEMENT SYSTEMS MARKET IN TELECOM & IT, BY REGION, 2024-2029 (USD BILLION)

- TABLE 50 ENERGY MANAGEMENT SYSTEMS MARKET IN MANUFACTURING, BY REGION, 2020-2023 (USD BILLION)

- TABLE 51 ENERGY MANAGEMENT SYSTEMS MARKET IN MANUFACTURING, BY REGION, 2024-2029 (USD BILLION)

- TABLE 52 ENERGY MANAGEMENT SYSTEMS MARKET IN RESIDENTIAL & COMMERCIAL INDUSTRIES, BY REGION, 2020-2023 (USD BILLION)

- TABLE 53 ENERGY MANAGEMENT SYSTEMS MARKET IN RESIDENTIAL & COMMERCIAL INDUSTRIES, BY REGION, 2024-2029 (USD BILLION)

- TABLE 54 ENERGY MANAGEMENT SYSTEMS MARKET IN FOOD & BEVERAGE, BY REGION, 2020-2023 (USD BILLION)

- TABLE 55 ENERGY MANAGEMENT SYSTEMS MARKET IN FOOD & BEVERAGE, BY REGION, 2024-2029 (USD BILLION)

- TABLE 56 ENERGY MANAGEMENT SYSTEMS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2023 (USD BILLION)

- TABLE 57 ENERGY MANAGEMENT SYSTEMS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2024-2029 (USD BILLION)

- TABLE 58 ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 59 ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 60 HOME ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 61 HOME ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 62 BUILDING ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 63 BUILDING ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 64 INDUSTRIAL ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 65 INDUSTRIAL ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 66 ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2020-2023 (USD BILLION)

- TABLE 67 ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2024-2029 (USD BILLION)

- TABLE 68 ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 69 ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 70 ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2020-2023 (USD BILLION)

- TABLE 71 ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2024-2029 (USD BILLION)

- TABLE 72 ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 73 ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 74 ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 75 ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 76 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2020-2023 (USD BILLION)

- TABLE 77 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2024-2029 (USD BILLION)

- TABLE 78 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 79 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 80 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2020-2023 (USD BILLION)

- TABLE 81 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2024-2029 (USD BILLION)

- TABLE 82 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 83 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 84 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 85 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 86 US: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 87 US: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 88 CANADA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 89 CANADA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 90 MEXICO: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 91 MEXICO: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 92 EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2020-2023 (USD BILLION)

- TABLE 93 EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2024-2029 (USD BILLION)

- TABLE 94 EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 95 EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 96 EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2020-2023 (USD BILLION)

- TABLE 97 EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2024-2029 (USD BILLION)

- TABLE 98 EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 99 EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 100 EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 101 EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 102 GERMANY: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 103 GERMANY: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 104 UK: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 105 UK: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 106 FRANCE: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 107 FRANCE: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 108 ITALY: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 109 ITALY: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 110 REST OF EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 111 REST OF EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 112 ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2020-2023 (USD BILLION)

- TABLE 113 ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2024-2029 (USD BILLION)

- TABLE 114 ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 115 ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 116 ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2020-2023 (USD BILLION)

- TABLE 117 ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2024-2029 (USD BILLION)

- TABLE 118 ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 119 ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 120 ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 121 ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 122 CHINA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 123 CHINA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 124 INDIA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 125 INDIA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 126 JAPAN: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 127 JAPAN: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 128 REST OF ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 129 REST OF ASIA PACIFIC: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 130 SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2020-2023 (USD BILLION)

- TABLE 131 SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2024-2029 (USD BILLION)

- TABLE 132 SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 133 SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 134 SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2020-2023 (USD BILLION)

- TABLE 135 SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2024-2029 (USD BILLION)

- TABLE 136 SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 137 SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 138 SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 139 SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 140 BRAZIL: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 141 BRAZIL: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 142 ARGENTINA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 143 ARGENTINA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 144 REST OF SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 145 REST OF SOUTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 146 MIDDLE EAST & AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2020-2023 (USD BILLION)

- TABLE 147 MIDDLE EAST & AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2024-2029 (USD BILLION)

- TABLE 148 MIDDLE EAST & AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 149 MIDDLE EAST & AFRICA ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 150 MIDDLE EAST & AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2020-2023 (USD BILLION)

- TABLE 151 MIDDLE EAST & AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2024-2029 (USD BILLION)

- TABLE 152 MIDDLE EAST & AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 153 MIDDLE EAST & AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 154 MIDDLE EAST & AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 155 MIDDLE EAST & AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 156 GCC: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 157 GCC: ENERGY MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 158 SAUDI ARABIA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 159 SAUDI ARABIA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 160 UAE: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 161 UAE: ENER-GY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 162 REST OF GCC: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 163 REST OF GCC: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 164 SOUTH AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 165 SOUTH AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 166 REST OF MIDDLE EAST & AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD BILLION)

- TABLE 167 REST OF MIDDLE EAST & AFRICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- TABLE 168 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, 2020-2025

- TABLE 169 ENERGY MANAGEMENT SYSTEMS MARKET: DEGREE OF COMPETITION

- TABLE 170 COMPANY FOOTPRINT, BY COMPONENT

- TABLE 171 COMPANY FOOTPRINT, BY TYPE

- TABLE 172 COMPANY FOOTPRINT, BY DEPLOYMENT

- TABLE 173 COMPANY FOOTPRINT: BY END-USE INDUSTRY

- TABLE 174 COMPANY FOOTPRINT, BY REGION

- TABLE 175 ENERGY MANAGEMENT SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 176 ENERGY MANAGEMENT SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

- TABLE 177 ENERGY MANAGEMENT SYSTEMS MARKET: PRODUCT LAUNCHES, APRIL 2020-JANUARY 2025

- TABLE 178 ENERGY MANAGEMENT SYSTEMS MARKET: DEALS, APRIL 2020-JANUARY 2025

- TABLE 179 ENERGY MANAGEMENT SYSTEMS MARKET: EXPANSIONS, APRIL 2020-JANUARY 2025

- TABLE 180 ENERGY MANAGEMENT SYSTEMS MARKET: OTHER DEVELOPMENTS, APRIL 2020-JANUARY 2025

- TABLE 181 ABB: COMPANY OVERVIEW

- TABLE 182 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 ABB: PRODUCT LAUNCHES

- TABLE 184 ABB: DEALS

- TABLE 185 ABB: OTHER DEVELOPMENTS

- TABLE 186 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- TABLE 187 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 189 SCHNEIDER ELECTRIC: DEALS

- TABLE 190 SIEMENS: COMPANY OVERVIEW

- TABLE 191 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 SIEMENS: DEALS

- TABLE 193 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

- TABLE 194 GENERAL ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 GENERAL ELECTRIC COMPANY: DEALS

- TABLE 196 GENERAL ELECTRIC COMPANY: OTHER DEVELOPMENTS

- TABLE 197 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 198 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 200 EMERSON ELECTRIC CO.: DEALS

- TABLE 201 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 202 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 HONEYWELL INTERNATIONAL INC: PRODUCT LAUNCHES

- TABLE 204 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 205 HONEYWELL INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 206 EATON: COMPANY OVERVIEW

- TABLE 207 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 EATON: PRODUCT LAUNCHES

- TABLE 209 EATON: DEALS

- TABLE 210 EATON: OTHER DEVELOPMENTS

- TABLE 211 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 212 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 214 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 215 MITSUBISHI ELECTRIC CORPORATION: EXPANSIONS

- TABLE 216 IBM: COMPANY OVERVIEW

- TABLE 217 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 IBM: PRODUCT LAUNCHES

- TABLE 219 IBM: DEALS

- TABLE 220 HITACHI LTD: COMPANY OVERVIEW

- TABLE 221 HITACHI LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 HITACHI LTD: DEALS

- TABLE 223 ROCKWELL AUTOMATION, INC.: COMPANY OVERVIEW

- TABLE 224 ROCKWELL AUTOMATION, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 ROCKWELL AUTOMATION, INC.: DEALS

- TABLE 226 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 227 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 228 YOKOGAWA ELECTRIC CORPORATION: DEALS

- TABLE 229 YOKOGAWA ELECTRIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 230 DELTA ELECTRONICS, INC.: BUSINESS OVERVIEW

- TABLE 231 DELTA ELECTRONICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 DELTA ELECTRONICS, INC.: DEALS

- TABLE 233 DANFOSS: COMPANY OVERVIEW

- TABLE 234 DANFOSS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 DANFOSS: DEALS

- TABLE 236 VERDIGRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 237 VERDIGRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 VERDIGRIS TECHNOLOGIES, INC.: DEALS

- TABLE 239 PANASONIC INDUSTRY CO., LTD.: BUSINESS OVERVIEW

- TABLE 240 PANASONIC INDUSTRY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 PANASONIC INDUSTRY CO., LTD.: EXPANSIONS

- TABLE 242 WIPRO: BUSINESS OVERVIEW

- TABLE 243 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 WIPRO: DEALS

- TABLE 245 LG ELECTRONICS: BUSINESS OVERVIEW

- TABLE 246 LG ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 LG ELECTRONICS: DEALS

- TABLE 248 JOHNSON CONTROLS INC.: COMPANY OVERVIEW

- TABLE 249 JOHNSON CONTROLS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 JOHNSON CONTROLS INC.: DEALS

- TABLE 251 AGREGIO SOLUTIONS: COMPANY OVERVIEW

- TABLE 252 AGREGIO SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 ENERGY MANAGEMENT SYSTEMS MARKET SEGMENTATION

- FIGURE 2 STUDY PERIOD CONSIDERED

- FIGURE 3 ENERGY MANAGEMENT SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY INDUSTRY INSIGHTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 METRICS FOR ENERGY MANAGEMENT SYSTEMS TO ASSESS AND ANALYZE DEMAND

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 10 REGIONAL ANALYSIS

- FIGURE 11 COUNTRY ANALYSIS

- FIGURE 12 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY-SIDE OF ENERGY MANAGEMENT SYSTEMS

- FIGURE 13 ENERGY MANAGEMENT SYSTEMS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- FIGURE 15 NORTH AMERICA CAPTURED LARGEST MARKET SHARE OF ENERGY MANAGEMENT SYSTEMS MARKET IN 2023

- FIGURE 16 ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2024-2029 (USD BILLION)

- FIGURE 17 ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- FIGURE 18 ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT, 2024-2029 (USD BILLION)

- FIGURE 19 ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD BILLION)

- FIGURE 20 GROWING EMPHASIS ON ENERGY EFFICIENCY AND SUSTAINABILITY TO DRIVE MARKET

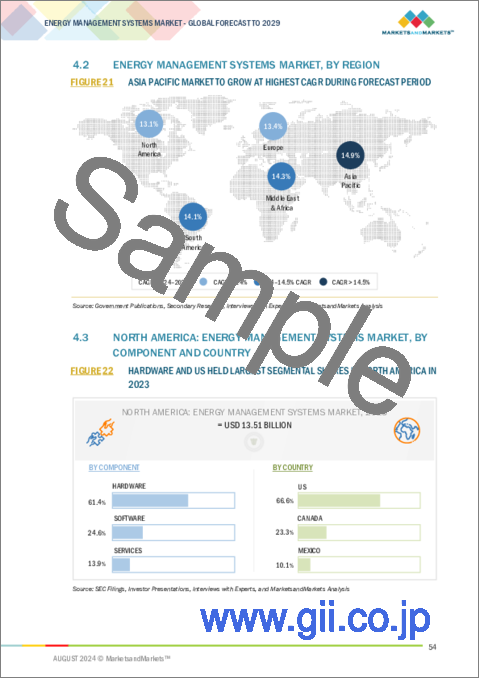

- FIGURE 21 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 HARDWARE AND US HELD LARGEST SEGMENTAL SHARES IN NORTH AMERICA IN 2023

- FIGURE 23 ENERGY MANAGEMENT SYSTEMS HARDWARE TO ACCOUNT FOR DOMINANT MARKET SHARE AMONG COMPONENTS IN 2024

- FIGURE 24 INDUSTRIAL ENERGY MANAGEMENT SYSTEMS TO DOMINATE MARKET AMONG TYPES IN 2024

- FIGURE 25 ON-PREMISE DEPLOYMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 26 MANUFACTURING INDUSTRY TO ACCOUNT FOR LARGEST END USE OF ENERGY MANAGEMENT SYSTEMS IN 2024

- FIGURE 27 ENERGY MANAGEMENT SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 INVESTMENT IN CLEAN ENERGY AND FOSSIL FUELS, 2015-2024 (USD BILLION)

- FIGURE 29 ANNUAL INVESTMENT IN ENERGY EFFICIENCY IN BUILDINGS SECTOR IN NET ZERO SCENARIO, 2017-2030 (USD BILLION)

- FIGURE 30 INVESTMENT SPENDING ON ELECTRICITY GRIDS, 2015-2022 (USD BILLION)

- FIGURE 31 TOTAL CO2 EMISSIONS, BY REGION, 2000-2023 (GT)

- FIGURE 32 GROWTH IN URBAN POPULATION WORLDWIDE, 2013-2023 (BILLION)

- FIGURE 33 KEY MITIGATION MEASURES FOR ENERGY-RELATED CO2 EMISSIONS IN STATED POLICIES SCENARIO TO ANNOUNCED PLEDGES SCENARIO 2030

- FIGURE 34 REVENUE SHIFT FOR ENERGY MANAGEMENT SYSTEM PROVIDERS

- FIGURE 35 ENERGY MANAGEMENT SYSTEMS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 36 FUNDING RAISED BY TOP PLAYERS IN ENERGY MANAGEMENT SYSTEM MARKET, 2020-2023 (USD THOUSAND)

- FIGURE 37 ENERGY MANAGEMENT SYSTEMS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 38 EXPORT SCENARIO FOR HS CODE: 903210 FOR TOP FIVE COUNTRIES, 2021-2023 (USD)

- FIGURE 39 IMPORT SCENARIO FOR HS CODE: 903210 IN TOP FIVE COUNTRIES, 2021-2023 (USD)

- FIGURE 40 EXPORT SCENARIO FOR HS CODE: 902830 IN TOP FIVE COUNTRIES, 2019-2023 (USD)

- FIGURE 41 EXPORT SCENARIO FOR HS CODE: 902890 IN TOP FIVE COUNTRIES, 2019-2023 (USD)

- FIGURE 42 IMPORT SCENARIO FOR HS CODE: 902830 IN TOP FIVE COUNTRIES, 2019-2023 (USD)

- FIGURE 43 IMPORT SCENARIO FOR HS CODE: 902890 IN TOP FIVE COUNTRIES, 2019-2023 (USD)

- FIGURE 44 ENERGY MANAGEMENT SYSTEM MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2013-2023

- FIGURE 45 PORTER'S FIVE FORCES ANALYSIS FOR ENERGY MANAGEMENT SYSTEMS MARKET

- FIGURE 46 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 47 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 48 IMPACT OF AI ON SUPPLY CHAIN OF ENERGY MANAGEMENT SYSTEM MARKET

- FIGURE 49 ENERGY MANAGEMENT SYSTEMS MARKET SHARE, BY COMPONENT, 2023

- FIGURE 50 ENERGY MANAGEMENT SYSTEMS MARKET SHARE, BY DEPLOYMENT, 2023

- FIGURE 51 ENERGY MANAGEMENT SYSTEMS MARKET SHARE, BY END-USE INDUSTRY, 2023

- FIGURE 52 ENERGY MANAGEMENT SYSTEMS MARKET SHARE, BY TYPE, 2023

- FIGURE 53 ENERGY MANAGEMENT SYSTEMS MARKET SHARE, BY REGION, 2023

- FIGURE 54 ASIA PACIFIC ENERGY MANAGEMENT SYSTEMS MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 55 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET SNAPSHOT

- FIGURE 56 EUROPE: ENERGY MANAGEMENT SYSTEMS MARKET SNAPSHOT

- FIGURE 57 ENERGY MANAGEMENT SYSTEMS MARKET SHARE ANALYSIS, 2023

- FIGURE 58 TOP PLAYERS IN ENERGY MANAGEMENT SYSTEMS MARKET, 2019-2023

- FIGURE 59 ENERGY MANAGEMENT SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 60 ENERGY MANAGEMENT SYSTEM MARKET: COMPANY FOOTPRINT

- FIGURE 61 ENERGY MANAGEMENT SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 62 COMPANY VALUATION OF KEY VENDORS, 2024 (USD BILLION)

- FIGURE 63 EV/EBITDA OF KEY VENDORS, 2024

- FIGURE 64 ENERGY MANAGEMENT SYSTEM MARKET: BRAND/PRODUCT COMPARISON OF KEY VENDORS

- FIGURE 65 ABB: COMPANY SNAPSHOT

- FIGURE 66 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 67 SIEMENS: COMPANY SNAPSHOT

- FIGURE 68 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- FIGURE 69 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 70 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 71 EATON: COMPANY SNAPSHOT

- FIGURE 72 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 73 IBM: COMPANY SNAPSHOT

- FIGURE 74 HITACHI LTD: COMPANY SNAPSHOT

- FIGURE 75 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

- FIGURE 76 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 77 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 78 DANFOSS: COMPANY SNAPSHOT

- FIGURE 79 PANASONIC INDUSTRY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 80 WIPRO: COMPANY SNAPSHOT

- FIGURE 81 JOHNSON CONTROLS INC.: COMPANY SNAPSHOT

The global energy management system market is on a trajectory to reach USD 84.34 billion by 2029, a notable increase from the estimated USD 44.19 billion in 2024, with a steady CAGR of 13.8% spanning the period from 2024 to 2029.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, By Deployment, By Type, By End-use industry |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, South America |

"On-premise: The largest segment by deployment in Energy management systems market"

The On-premise segment, by deployment, is projected to hold the largest market size during the forecast period which holds 67.96% market share in 2023. On-premises deployment in the Energy Management System (EMS) market refers to the installation and operation of EMS software and hardware on the physical premises of an organization. This approach is often preferred by businesses that require direct control over their data and infrastructure due to stringent security, compliance, or performance requirements. In an on-premises setup, the organization is responsible for the entire system, including its maintenance, upgrades, and security. This model is particularly advantageous for large enterprises with the resources to manage and secure their IT infrastructure, as it allows for customization tailored to specific operational needs.

"Software: The fastest- growing segment by component of the Energy management systems market"

Based on by component of Energy management systems the software segment segment hold a CAGR of 14.6% during the forecasted period 2024 to 2029. The software segment within the global Energy Management System (EMS) market is experiencing robust growth, driven by the increasing demand for advanced energy analytics, real-time monitoring, and optimization solutions. Key offerings in this segment include platforms for data visualization, predictive maintenance, and AI-driven energy forecasting, which enable organizations to enhance operational efficiency and reduce energy costs. The integration of IoT and smart grid technologies further amplifies the value of EMS software, allowing seamless connectivity and data exchange across systems. Leading companies are focusing on developing scalable, user-friendly solutions that cater to diverse industry needs, from residential to industrial applications, positioning the software segment as a critical enabler of energy efficiency and sustainability initiatives globally.

"Industrial Energy Management System: The largest segment by type in Energy management systems market"

The Industrial Energy Management System segment, by type, is projected to hold the largest market size during the forecast period. The Industrial Energy Management System (IEMS) segment is pivotal within the EMS market, driven by the need for operational efficiency, cost reduction, and regulatory compliance in energy-intensive sectors. IEMS solutions enable real-time monitoring, control, and optimization of energy usage across manufacturing facilities, refineries, and other industrial operations. With increasing emphasis on sustainability and carbon reduction, industries are leveraging IEMS to integrate renewable energy sources, minimize waste, and enhance overall productivity. The adoption of advanced technologies like IoT, AI, and machine learning in IEMS is further accelerating market growth, positioning this segment as a critical enabler of industrial energy efficiency and competitiveness.

"Europe: The second largest region in Energy management systems market"

The Energy Management System (EMS) market in Europe is a dynamic and rapidly evolving sector, strongly supported by the European Union's (EU) regulatory frameworks and substantial investments aimed at promoting energy efficiency and sustainability. The EU's commitment to reducing greenhouse gas emissions and enhancing energy efficiency has positioned the region as a global leader in the adoption and advancement of EMS technologies.

According to the European Commission, the EU's energy policies, particularly the European Green Deal and the Energy Efficiency Directive, play a pivotal role in driving the EMS market. These policies set ambitious targets for energy savings and emissions reductions, which have led to widespread adoption of energy management systems across various sectors. The Energy Efficiency Directive, for instance, mandates member states to implement energy efficiency measures, including the use of EMS, to achieve a 32.5% improvement in energy efficiency by 2030.

Additionally, individual European countries have implemented national strategies aligned with the EU's energy efficiency goals. For example, Germany's National Action Plan on Energy Efficiency (NAPE) promotes the adoption of EMS in industrial and commercial sectors, providing financial incentives and technical support to businesses that implement these systems. Similarly, France's Energy Transition for Green Growth Act emphasizes the use of EMS to achieve energy savings and reduce carbon emissions across various industries.

Breakdown of Primaries:

The key players in the market were identified through secondary research and their market shares in respective regions through both primary and secondary research. This entire process includes studying the annual and financial reports of the top market players and in-depth interviews for key insights with industry leaders, such as CEOs, VPs, directors, sales managers, and marketing executives. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

Through the data triangulation process and data validation through primaries, this study determined and confirmed the exact values of the overall parent market size and each individual market size.

The distribution of primary interviews is as follows:

By Company Type: Tier 1- 55%, Tier 2- 30%, and Tier 3- 15%

By Designation: C-Level- 30%, Director Levels- 20%, and Others- 50%

By Region: North America- 18%, Europe- 8%, Asia Pacific- 60%, the Middle East & Africa- 10%, and South America- 4%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The Energy management systems market is dominated by a few major players that have a wide regional presence. The leading players in the Energy management systems market are ABB (Switzerland), Schneider Electric (France), Siemens (Germany), General Electric Company (US), and Emerson (US).

Research Coverage:

This report provides a comprehensive analysis of the global Energy Management System (EMS) market, segmented by Component (Software, Hardware, and Services), Type (Home Energy Management System, Building Energy Management System, and Industrial Energy Management System), Deployment (On-Premises and Cloud-Based), End-Use Industry (Power and Energy, Telecom and IT, Manufacturing, Residential and Commercial, Food and Beverages, and Others), and Region (North America, Europe, Asia Pacific, Middle East and Africa, and South America). The report offers detailed insights into market size, growth drivers, trends, opportunities, and challenges, supported by qualitative and quantitative data. It also includes an in-depth competitive landscape analysis, highlighting key players, market share, recent developments, and strategic initiatives. Additionally, the report provides future market forecasts, helping stakeholders identify potential growth areas and make informed business decisions.

Key Benefits of Buying the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the relay market and provides them information on key market drivers, restraints, challenges, and opportunities.

- Analysis of key drivers: Escalating energy prices are a primary driver for the adoption of Energy Management Systems . Businesses and industrial operations are increasingly deploying EMS to monitor, control, and optimize energy consumption, aiming to reduce operational costs and enhance financial performance. The growing consumer preference for smart and connected home solutions is accelerating the deployment of Home Energy Management Systems (HEMS). These systems offer users enhanced control over their energy usage, contributing to the broader adoption of EMS.

- Product Development/ Innovation: The Energy Management System market is witnessing significant innovation, driven by advancements in digital technologies, increasing demand for energy efficiency, and the integration of renewable energy sources. Leading companie ABB (Switzerland), Schneider Electric (France), Siemens (Germany), General Electric Company (US), and Emerson Electric Co (US), are focusing on developing next-generation EMS solutions that leverage artificial intelligence (AI), machine learning, and Internet of Things (IoT) to enable real-time monitoring, predictive maintenance, and advanced energy analytics.

- Market Development: The Energy Management System market is experiencing dynamic development, driven by advancements in technology, evolving regulatory landscapes, and increasing emphasis on sustainability. Key developments include the integration of advanced digital technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT), which are enhancing the capabilities of EMS by enabling real-time monitoring, predictive analytics, and improved operational efficiency. The shift towards cloud-based solutions is also reshaping the market, offering scalable and flexible EMS platforms that facilitate remote management and integration with diverse energy sources.

Geographically, the EMS market is expanding rapidly across various regions, with North America and Europe leading in adoption due to stringent regulatory frameworks and high awareness of energy efficiency. Emerging markets in Asia Pacific, the Middle East, and Africa are witnessing accelerated growth as industrialization and urbanization drive demand for sophisticated energy management solutions. Companies are increasingly focusing on product innovation, including user-friendly interfaces, customizable dashboards, and enhanced interoperability with existing industrial systems and smart grids.

Strategic partnerships, investments, and acquisitions are prevalent as companies seek to enhance their technological capabilities and expand their market reach. Additionally, government incentives and subsidies for energy efficiency projects are providing a boost to market growth. Overall, the EMS market is evolving rapidly, with ongoing technological advancements, regulatory support, and increasing market penetration shaping its trajectory and fostering new opportunities for growth.

- Market Diversification: The market is diversifying across end-use industries, with solutions tailored for the power and energy sector focusing on renewable integration and smart grid management. In telecom and IT, EMS is increasingly used in data centers and telecom networks to optimize energy use. For manufacturing, solutions are being developed to enhance energy efficiency in industrial processes. In residential and commercial sectors, there is a focus on user-friendly interfaces and energy savings programs, while the food and beverage industry is seeing solutions designed to meet specific regulatory requirements and improve energy management.

Regionally, North America is driving innovation through smart city initiatives and stringent regulatory standards. Europe emphasizes sustainability and high adoption rates of advanced EMS solutions, driven by EU directives.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ABB (Switzerland), Schneider Electric (France), Siemens (Germany), General Electric Company (US), and Emerson Electric Co (US), among others in the energy management systems market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 Key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 DEMAND-SIDE ANALYSIS

- 2.2.3.1 Regional analysis

- 2.2.3.2 Demand-side assumptions

- 2.2.3.3 Demand-side calculations

- 2.2.4 SUPPLY-SIDE ANALYSIS

- 2.2.4.1 Supply-side assumptions

- 2.2.4.2 Supply-side calculations

- 2.3 DATA TRIANGULATION

- 2.4 FORECAST

- 2.4.1 RESEARCH ASSUMPTIONS

- 2.4.2 RESEARCH LIMITATIONS

- 2.4.3 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ENERGY MANAGEMENT SYSTEMS MARKET

- 4.2 ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION

- 4.3 NORTH AMERICA: ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT AND COUNTRY

- 4.4 ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT

- 4.5 ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE

- 4.6 ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT

- 4.7 ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in energy costs and shift to renewable energy

- 5.2.1.2 Increase in adoption of smart grid technologies and smart meters

- 5.2.1.3 Government regulations and incentives promoting EMS adoption

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial costs and capital investment

- 5.2.2.2 Data privacy and security concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging markets and rapid industrialization

- 5.2.3.2 Fiscal incentives and tax policies for carbon reduction and energy efficiency

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness of SMEs about availability of scalable and cost-effective EMC solutions

- 5.2.4.2 Diverse industry needs

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ENERGY MANAGEMENT SYSTEM PROVIDERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.7.1 RAW MATERIAL PROVIDERS/SUPPLIERS

- 5.7.2 COMPONENT MANUFACTURERS

- 5.7.3 ENERGY MANAGEMENT SYSTEM INTEGRATORS/ASSEMBLERS

- 5.7.4 BUYERS/END USERS

- 5.7.5 POST-SALES SERVICES

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Internet of things (IoT) integration

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Artificial intelligence

- 5.8.2.2 Machine learning

- 5.8.1 KEY TECHNOLOGIES

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 TARIFFS AND REGULATIONS

- 5.10.1 TARIFFS RELATED TO ENERGY MANAGEMENT SYSTEMS

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.3 CODES AND REGULATIONS RELATED TO ENERGY MANAGEMENT SYSTEMS

- 5.11 TRADE ANALYSIS

- 5.11.1 TRADE ANALYSIS FOR THERMOSTATS

- 5.11.1.1 Export scenario for thermostats

- 5.11.1.2 Import scenario for thermostats

- 5.11.2 TRADE ANALYSIS FOR UTILITY METERS

- 5.11.2.1 Export scenario for utility meters

- 5.11.2.2 Import scenario for utility meters

- 5.11.1 TRADE ANALYSIS FOR THERMOSTATS

- 5.12 PATENT ANALYSIS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15 BUYING CRITERIA

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 ABB ENHANCED OPERATIONAL EFFICIENCY IN PETROCHEMICAL COMPLEX

- 5.16.1.1 Problem statement

- 5.16.1.2 Solution

- 5.16.2 GENERAL ELECTRIC COMPANY PROVIDED ENERGY MANAGEMENT FOR HYDROPOWER FLEET

- 5.16.2.1 Problem statement

- 5.16.2.2 Solution

- 5.16.3 ENERGY OPTIMIZATION AT HAMDAN BIN MOHAMMED SMART UNIVERSITY BY HONEYWELL INTERNATIONAL INC.

- 5.16.3.1 Problem statement

- 5.16.3.2 Solution

- 5.16.1 ABB ENHANCED OPERATIONAL EFFICIENCY IN PETROCHEMICAL COMPLEX

- 5.17 IMPACT OF GENERATIVE AI/AI IN ENERGY MANAGEMENT SYSTEM MARKET

- 5.18 MACROECONOMIC OUTLOOK FOR ENERGY MANAGEMENT SYSTEM MARKET

- 5.18.1 GDP

- 5.18.2 RESEARCH & DEVELOPMENT EXPENDITURE

- 5.18.3 INVESTMENTS IN ENERGY MANAGEMENT SYSTEM

- 5.18.4 POWER AND UTILITY SECTOR GROWTH

6 ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 SOFTWARE

- 6.2.1 INTEGRATION OF IOT AND SMART TECHNOLOGIES AND PROLIFERATION OF SMART GRID

- 6.3 HARDWARE

- 6.3.1 RAPID INNOVATION AND INTEGRATION OF ADVANCED TECHNOLOGIES WITHIN ENERGY MANAGEMENT SYSTEMS

- 6.4 SERVICES

- 6.4.1 INCREASE IN SERVICE HELP SOUGHT BY ORGANIZATIONS TO IMPROVE ENERGY EFFICIENCY AND TRANSITION TO RENEWABLE ENERGY SOURCES

7 ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT

- 7.1 INTRODUCTION

- 7.2 ON-PREMISES

- 7.2.1 FOCUS ON DATA SECURITY AND PRIVACY BY ORGANIZATIONS DEALING WITH SENSITIVE, PROPRIETARY INFORMATION

- 7.3 CLOUD-BASED

- 7.3.1 INCREASE IN DEMAND FOR SCALABLE, FLEXIBLE, AND ACCESSIBLE ENERGY MANAGEMENT SOLUTIONS

8 ENERGY MANAGEMENT SYSTEMS MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 POWER & ENERGY

- 8.2.1 GROWTH IN EMPHASIS ON GRID OPTIMIZATION AND RENEWABLE INTEGRATION

- 8.3 TELECOM & IT

- 8.3.1 RISE IN ENERGY DEMAND FROM DATA CENTERS

- 8.4 MANUFACTURING

- 8.4.1 RISE IN ADOPTION OF INDUSTRY 4.0 TECHNOLOGIES, SUCH AS IOT, AI, AND AUTOMATION

- 8.5 RESIDENTIAL & COMMERCIAL

- 8.5.1 RAPID URBANIZATION AND SMART BUILDING INITIATIVES

- 8.6 FOOD & BEVERAGE

- 8.6.1 GROWTH IN FOCUS ON SUSTAINABILITY AND ENERGY EFFICIENCY IN TEMPERATURE CONTROL

- 8.7 OTHER END-USE INDUSTRIES

9 ENERGY MANAGEMENT SYSTEMS MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 HOME ENERGY MANAGEMENT SYSTEMS

- 9.2.1 INCREASED CONSUMER AWARENESS ON ENERGY FOOTPRINT AND SMART HOME ADOPTION

- 9.3 BUILDING ENERGY MANAGEMENT SYSTEMS

- 9.3.1 INCREASE IN FOCUS ON COST-EFFICIENCY AND SUSTAINABILITY IN COMMERCIAL AND RESIDENTIAL BUILDINGS

- 9.4 INDUSTRIAL ENERGY MANAGEMENT SYSTEMS

- 9.4.1 STRATEGIC FOCUS ON OPERATIONAL EFFICIENCY AND INDUSTRY 4.0 INTEGRATION

10 ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Strong federal and state regulations, advancements in smart grid technologies, and focus on energy efficiency and sustainability

- 10.2.2 CANADA

- 10.2.2.1 Need to lower operational costs and meet stringent environmental regulations

- 10.2.3 MEXICO

- 10.2.3.1 Energy Transition Law and National Energy Strategy aim to promote adoption of advanced technologies

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Government Initiatives focused on hardware integration for energy control and reducing residential energy consumption

- 10.3.2 UK

- 10.3.2.1 Policies encouraging clean energy in buildings

- 10.3.3 FRANCE

- 10.3.3.1 Policies aimed at reducing greenhouse gases and growth in emphasis on renewable energy

- 10.3.4 ITALY

- 10.3.4.1 Decarbonization, digitalization, and promotion of smart technologies

- 10.3.5 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Promoting adoption of EMS in manufacturing, construction, and transportation

- 10.4.2 INDIA

- 10.4.2.1 Government initiatives such as Smart Cities Mission and National Smart Grid Mission

- 10.4.3 JAPAN

- 10.4.3.1 Significant strides in clean energy with strong focus on increasing share of renewable energy

- 10.4.4 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Digital transformation in energy sector and target set by National Electric Energy Agency (ANEEL) to improve energy efficiency

- 10.5.2 ARGENTINA

- 10.5.2.1 Energy investments and initiatives such as RenovAr aimed at renewable sources

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC

- 10.6.1.1 Saudi Arabia

- 10.6.1.1.1 Vision 2030 initiative and undertaking energy-efficient mega projects

- 10.6.1.2 UAE

- 10.6.1.2.1 Commitment to sustainability and reducing its carbon footprint

- 10.6.1.3 Rest of GCC

- 10.6.1.1 Saudi Arabia

- 10.6.2 SOUTH AFRICA

- 10.6.2.1 National Energy Efficiency Strategy to improve energy efficiency

- 10.6.3 REST OF MIDDLE EAST & AFRICA

- 10.6.1 GCC

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- 11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2019-2023

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- 11.5.5.2 Component footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Deployment footprint

- 11.5.5.5 End-use industry footprint

- 11.5.5.6 Regional footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key players (startups/SMEs)

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7.1 COMPANY VALUATION

- 11.7.2 FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ABB

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strategies/Right to win

- 12.1.1.4.2 Strategic choices made

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SCHNEIDER ELECTRIC

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strategies/Right to win

- 12.1.2.4.2 Strategic choices made

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 SIEMENS

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strategies/Right to win

- 12.1.3.4.2 Strategic choices made

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 GENERAL ELECTRIC COMPANY

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strategies/Right to win

- 12.1.4.4.2 Strategic choices made

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 EMERSON ELECTRIC CO.

- 12.1.5.1 Business overview

- 12.1.5.2 Product/solutions/services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strategies/right to win

- 12.1.5.4.2 Strategic choices made

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 HONEYWELL INTERNATIONAL INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/solutions/services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.7 EATON

- 12.1.7.1 Business overview

- 12.1.7.2 Products/solutions/services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Other developments

- 12.1.8 MITSUBISHI ELECTRIC CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products/solutions/services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Expansions

- 12.1.9 IBM

- 12.1.9.1 Business overview

- 12.1.9.2 Products/solutions/services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.10 HITACHI LTD

- 12.1.10.1 Business overview

- 12.1.10.2 Products/solutions/services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.11 ROCKWELL AUTOMATION, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/solutions/services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 YOKOGAWA ELECTRIC CORPORATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products/solutions/services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.12.3.2 Other developments

- 12.1.13 DELTA ELECTRONICS, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/solutions/services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.14 DANFOSS

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.15 VERDIGRIS TECHNOLOGIES, INC.

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.16 PANASONIC INDUSTRY CO., LTD.

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Expansions

- 12.1.17 WIPRO

- 12.1.17.1 Business overview

- 12.1.17.2 Products/Solutions/Services offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Deals

- 12.1.18 LG ELECTRONICS

- 12.1.18.1 Business overview

- 12.1.18.2 Products/Solutions/Services offered

- 12.1.18.3 Recent developments

- 12.1.18.3.1 Deals

- 12.1.19 JOHNSON CONTROLS INC.

- 12.1.19.1 Business overview

- 12.1.19.2 Products/Solutions/Services offered

- 12.1.19.3 Recent developments

- 12.1.19.3.1 Deals

- 12.1.20 AGREGIO SOLUTIONS

- 12.1.20.1 Business overview

- 12.1.20.2 Products/Solutions/Services offered

- 12.1.1 ABB

- 12.2 OTHER PLAYERS

- 12.2.1 ENEL X

- 12.2.2 NEPTUNE INDIA

- 12.2.3 WEIDMULLER

- 12.2.4 ENERGY MANAGEMENT SYSTEMS, INC.

- 12.2.5 DISTECH CONTROLS

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS