|

|

市場調査レポート

商品コード

1810320

感染症診断の世界市場:製品・サービス別、検査タイプ別、サンプルタイプ別、疾患タイプ別、技術別、臨床応用別、エンドユーザー別、地域別 - 2030年までの予測Infectious Disease Diagnostics Market by Product & Service, Test Type, Sample, Technology, Disease, End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 感染症診断の世界市場:製品・サービス別、検査タイプ別、サンプルタイプ別、疾患タイプ別、技術別、臨床応用別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月05日

発行: MarketsandMarkets

ページ情報: 英文 447 Pages

納期: 即納可能

|

概要

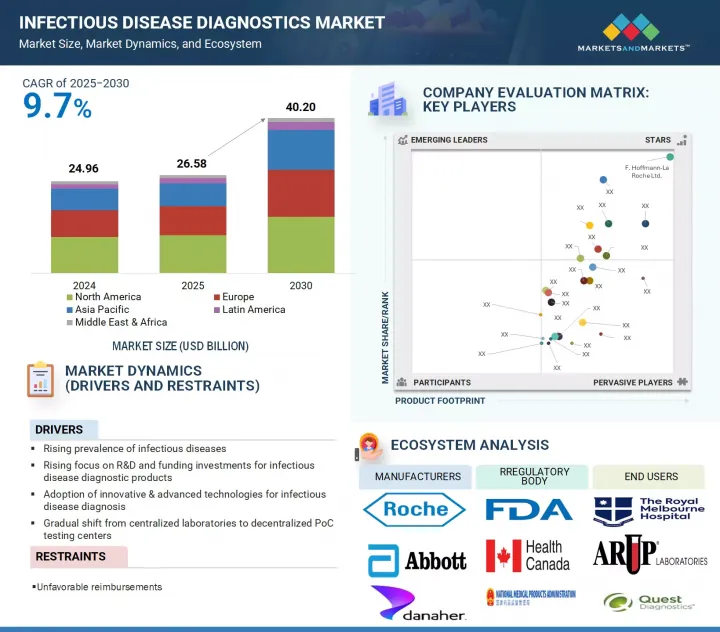

感染症診断の市場規模は、予測期間中に9.7%のCAGRで拡大し、2025年の265億8,000万米ドルから2030年には422億米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品・サービス別、検査タイプ別、サンプルタイプ別、疾患タイプ別、技術別、臨床応用別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

市場成長を促進する要因としては、分散型診断の重視の高まり、CLIA免除のポイントオブケア(PoC)検査に対する需要の高まりなどが挙げられます。これらの動向は、PoC技術の普及に大きく寄与しています。効率的なヘルスケア提供の必要性が、主に分散型PoC検査へのシフトを後押ししています。診断検査をポイント・オブ・ケアに移すことで、ヘルスケアプロバイダーは患者のそばで直接診断を行うことができ、サンプル採取から結果までの時間を最小限に抑えることができます。

検査タイプ別に見ると、感染症診断市場はラボ検査とPoC検査に区分されます。PoC検査分野は予測期間中に最も高いCAGRで成長すると予測されています。このセグメントの成長率が高いのは、主要企業が製品上市や戦略的買収を通じてイノベーションに重点を置き、投資を増やしているためです。PoC検査は、特に臨床・病院環境において、従来のラボ検査と比較していくつかの利点を提供します。PoC検査の主な利点は、診断判断の強化を可能にする迅速なターンアラウンドタイムです。さらに、PoC検査は一般的に少量のサンプルで済むため、侵襲性が低く効率的です。

感染症診断市場は、免疫診断、臨床微生物学、ポリメラーゼ連鎖反応、等温核酸増幅技術、DNシーケンシング・次世代シーケンス、DNAマイクロアレイ、その他の技術に区分されます。DNAシーケンシング・次世代シーケンシング分野は、予測期間中に最も高いCAGRを記録すると予測されています。DNAシーケンシングは使いやすいプラットフォームであり、臨床現場で簡単に導入して迅速に結果を出すことができます。遺伝物質を解析する能力により、個別化医療、がん研究、創薬などの用途で可能性が広がっています。さらに、シーケンシング技術の進歩、複数の領域にわたるアプリケーションの拡大、個別化医療に対する需要の高まりは、今後数年間におけるこの市場セグメントの成長を支える主要因になると予想されます。

市場は地域別に北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカに区分されます。予測期間中、アジア太平洋地域が最も高い成長率を示すと予測されます。同地域の新興国はGDPが安定的に成長しており、可処分所得も顕著に増加していることから、ヘルスケア支出の増加や高度診断薬の普及が見込まれています。その他の成長促進要因としては、感染症の罹患率と有病率の上昇、ヘルスケアインフラの近代化、特に農村部における高度診断技術の採用増加などが挙げられます。

当レポートでは、世界の感染症診断市場について調査し、製品・サービス別、検査タイプ別、サンプルタイプ別、疾患タイプ別、技術別、臨床応用別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- 貿易分析

- エコシステム分析

- ポーターのファイブフォース分析

- 規制状況

- 技術分析

- 2025年~2026年の主な会議とイベント

- 顧客のビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

- 投資と資金調達のシナリオ

- ケーススタディ分析

- AI/生成AIが感染症診断市場に与える影響

- トランプ関税が感染症診断市場に与える影響

第6章 感染症診断市場(製品・サービス別)

- イントロダクション

- 試薬、キット、消耗品

- 機器

- ソフトウェアとサービス

第7章 感染症診断市場(検査タイプ別)

- イントロダクション

- ラボ検査

- POC検査

第8章 感染症診断市場(サンプルタイプ別)

- イントロダクション

- 血液、血清、血漿

- 尿

- その他

第9章 感染症診断市場(疾患タイプ別)

- イントロダクション

- 肝炎

- HIV

- 院内感染

- 蚊媒介性疾患

- HPV

- クラミジア・トラコマティス

- 淋菌

- 結核

- インフルエンザ

- 梅毒

- その他

第10章 感染症診断市場(技術別)

- イントロダクション

- 免疫診断

- 臨床微生物学

- ポリメラーゼ連鎖反応

- 等温核酸増幅技術

- DNAシーケンシングと次世代シーケンシング

- DNAマイクロアレイ

- その他

第11章 感染症診断市場(臨床応用別)

- イントロダクション

- 診断

- スクリーニング

第12章 感染症診断市場(エンドユーザー別)

- イントロダクション

- 診断検査室

- 病院とクリニック

- 学術研究機関

- その他

第13章 感染症診断市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- その他

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- サウジアラビア王国(KSA)

- アラブ首長国連邦(UAE)

- その他

第14章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益シェア分析、2022~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第15章 企業プロファイル

- 主要参入企業

- F. HOFFMANN-LA ROCHE LTD.

- ABBOTT

- DANAHER CORPORATION

- BIOMERIEUX

- THERMO FISHER SCIENTIFIC INC.

- SIEMENS HEALTHINEERS AG

- HOLOGIC, INC.

- BECTON, DICKINSON AND COMPANY(BD)

- REVVITY, INC.

- QIAGEN N.V.

- SEEGENE INC.

- その他の企業

- QUIDELORTHO CORPORATION

- GRIFOLS, S.A.

- DIASORIN S.P.A

- BIO-RAD LABORATORIES, INC.

- SYSMEX CORPORATION

- ORASURE TECHNOLOGIES, INC.

- CO-DIAGNOSTICS, INC.

- SD BIOSENSOR, INC.

- BIOSYNEX SA

- TRINITY BIOTECH

- BRUKER(ELITECHGROUP)

- GENETIC SIGNATURES

- EPITOPE DIAGNOSTICS, INC.

- TRIVITRON HEALTHCARE

- MERIL LIFE SCIENCES PVT. LTD.

- INBIOS INTERNATIONAL, INC.

- UNIOGEN OY

- VELA DIAGNOSTICS

- MOLBIO DIAGNOSTICS LIMITED