|

|

市場調査レポート

商品コード

1090240

ピぺリジンの世界市場:種類別 (純度99%、純度98%)・最終用途産業別 (医薬品、農薬、ゴム、その他)・地域別 (アジア太平洋、欧州、北米、中東・アフリカ、南米) の将来予測 (2027年まで)Piperidine Market by Type (99% Purity and 98% Purity), End Use Industry (Pharmaceutical, Agrochemicals, Rubber, and Others), Region (Asia Pacific, Europe, North America, Middle East & Africa and South America) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ピぺリジンの世界市場:種類別 (純度99%、純度98%)・最終用途産業別 (医薬品、農薬、ゴム、その他)・地域別 (アジア太平洋、欧州、北米、中東・アフリカ、南米) の将来予測 (2027年まで) |

|

出版日: 2022年06月09日

発行: MarketsandMarkets

ページ情報: 英文 166 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のピペリジンの市場規模は、2022年の6,400万米ドルから、2027年までに8,600万米ドルに達する見通しです。

また、2022年から2027年にかけて5.9%のCAGRで成長すると予測されています。市場の主な促進要因として、医薬品・農薬などの産業における溶剤・塩基・触媒としての巨大需要などが挙げられます。

種類別では、純度99%以上のセグメントが最大のシェアを獲得しています。地域別に見ると、アジア太平洋が世界最大の市場となっています。

当レポートでは、世界のピぺリジンの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、市場動向の見通し、種類別・最終用途産業別・地域別の詳細動向、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 分析方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- 課題

第6章 産業動向

- ポーターのファイブフォース分析

- サプライチェーン分析

- エコシステムのマッピング

- 技術分析

- ケーススタディ分析

- 価格分析

- 顧客のビジネスに影響を与える傾向/ディスラプション

- 主要な会議とイベント (2022年~2023年)

- 規制分析

- 貿易分析

- 特許分析

- 世界のピペリジン商品の輸出入

第7章 ピぺリジン市場:種類別

- イントロダクション

- 純度98%

- 純度99%

第8章 ピぺリジン市場:最終用途産業別

- イントロダクション

- 農薬

- 医薬品

- ゴム

- その他

第9章 ピぺリジン市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- ASEAN諸国

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- イタリア

- フランス

- スペイン

- 英国

- ロシア

- 他の欧州諸国

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- 他の中東・アフリカ諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

第10章 競合情勢

- イントロダクション

- 市場シェア分析

- 企業評価マトリックス

- 新興企業・中小企業の評価マトリックス

- 大手企業の収益分析

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 主要な市場開発

- 資本取引

- その他

第11章 企業プロファイル

- 主要企業

- BASF SE

- KOEI CHEMICAL CO. LTD.

- VERTELLUS

- JUBILANT INGREVIA LIMITED

- VASUDHA PHARMA

- TAJ PHARMACEUTICALS LTD.

- AVANTOR INC.

- ALLCHEM LIFESCIENCE PVT. LTD.

- TORONTO RESEARCH CHEMICALS

- MERCK KGAA

- その他の企業

- LANXESS

- OTTO CHEMIE PVT. LTD.

- SIMSON PHARMA

- ROBINSON BROTHERS LIMITED

- ALFA AESAR

- A.R. LIFE SCIENCE PVT. LTD.

- AMI ORGANIC LIMITED

- COREY ORGANICS

- J&K SCIENTIFIC

- PENTA S.R.O

- MUBY CHEMICALS

- VORTEX PRODUCTS LIMITED

- SICHUAN HENGKANG SCIENCE AND TECHNOLOGY DEVELOPMENT CO., LTD.

- VITAL SYNTHESIS

- VANAMALI ORGANICS

第12章 付録

The market size for global piperidine market is projected to grow from USD 64 million in 2022 to USD 86 million by 2027, at a CAGR of 5.9% from 2022 to 2027. The growth of the piperidine market is attributed to their high demand as solvents, base and catalyst in pharmaceutical, agrochemical and others industries.

"99% purity segment to be the largest type of piperidine "

Piperidine with 99% purity and above is the purest form of piperidine available. The pharmaceutical end-use industry is boosting the demand for piperidine with 99% purity. Some piperidine derivatives, namely, N-Methyl, N-Benzyl piperidone derivatives, are extremely useful and versatile API intermediates in organic synthesis.

"Agrochemicals to be the second-largest segment during the forecast period."

Agrochemicals refer to the chemical products used in the agriculture field. They are comprised of pesticides, fertilizers, and other plant-growth hormones used in agriculture. The demand for agrochemical products is driven by the increasing global population and requirements to fulfill the increasing demand for food from limited croplands available.

"Asia Pacific to be the largest market for piperidine "

Emerging economies in the region are expected to experience significant demand for piperidine because of the growing pharmaceutical and agrochemical industries. In addition to this, the growing population in these countries represents a strong customer base. According to the World Bank, Asia Pacific is the world's fastest-growing region in terms of population and economic growth. Factors such as the ready availability of raw materials and workforce, along with sophisticated technologies and innovations, have driven the economy in the Asia Pacific.

This study has been validated through primaries conducted with various industry experts worldwide. These primary sources have been divided into 3 categories, namely by company, by designation, and by region.

- By Department- Sales/Marketing - 50%, Production - 30%, R&D - 20%

- By Designation- Managers - 50%, CXOs - 30%, Executives- 20%

- By Region- North America- 20%, Europe- 20%, Asia Pacific- 40%, and Rest of World - 20%

The piperidine market comprises major manufacturers, Jubilant Ingrevia Limited (India), Vertellus (US), KOEI Chemical Co. Ltd. (Japan), and BASF (Germany). among others. The study includes an in-depth competitive analysis of these key players in the piperidine market, with their company profiles, and key market strategies.

Research Coverage:

The report covers the piperidine market based on type (98% purity, 99% purity), End-Use Industry (Pharmaceutical,Agrochemicals, Rubber, Others), and region. The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the piperidine market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Key Benefits of Buying the Report:

The report will help the leaders/new entrants in this market with information on the closest

approximations of the revenue numbers for the overall market and the sub-segments. This report will

help stakeholders understand the competitive landscape and gain more insights to better position

their businesses and plan suitable go-to-market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 PIPERIDINE MARKET SEGMENTATION

- 1.4.1 YEARS CONSIDERED

- 1.4.2 REGIONAL SCOPE

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PIPERIDINE MARKET: RESEARCH DESIGN

- 2.2 KEY INDUSTRY INSIGHTS

- FIGURE 3 DATA VALIDATION THROUGH PRIMARY EXPERTS

- TABLE 2 LIST OF STAKEHOLDERS INVOLVED

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH - 1

- FIGURE 5 PIPERIDINE MARKET: SUPPLY-SIDE APPROACH - 1

- 2.3.2 SUPPLY-SIDE APPROACH - 2

- FIGURE 6 PIPERIDINE MARKET: SUPPLY-SIDE APPROACH - 2

- 2.3.3 DEMAND-SIDE APPROACH - 1

- FIGURE 7 PIPERIDINE MARKET: DEMAND-SIDE APPROACH - 1

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.5 TRIANGULATION

- 2.5.1 SECONDARY DATA

- 2.5.2 PRIMARY DATA

- FIGURE 8 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS & LIMITATIONS

- 2.6.1 ASSUMPTIONS

- 2.6.2 RISK ASSESSMENT

- TABLE 3 LIMITATIONS & ASSOCIATED RISKS

- 2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM GROWTH DRIVERS AND OPPORTUNITIES

3 EXECUTIVE SUMMARY

- FIGURE 10 99% PURITY SEGMENT TO DOMINATE OVERALL PIPERIDINE MARKET, 2022-2027

- FIGURE 11 PHARMACEUTICAL SEGMENT TO DOMINATE PIPERIDINE MARKET, 2022-2027

- FIGURE 12 ASIA PACIFIC DOMINATED PIPERIDINE MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ASIA PACIFIC TO WITNESS RELATIVELY HIGHER DEMAND FOR PIPERIDINE

- FIGURE 13 ASIA PACIFIC OFFERS ATTRACTIVE OPPORTUNITIES IN PIPERIDINE MARKET

- 4.2 ASIA PACIFIC: PIPERIDINE MARKET, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 14 CHINA WAS LARGEST MARKET FOR PIPERIDINE IN 2021

- 4.3 PIPERIDINE MARKET, BY END-USE INDUSTRY

- FIGURE 15 PHARMACEUTICAL SEGMENT TO LEAD OVERALL PIPERIDINE MARKET DURING FORECAST PERIOD

- 4.4 PIPERIDINE MARKET, BY TYPE

- FIGURE 16 99% PURITY TO LEAD PIPERIDINE MARKET DURING FORECAST PERIOD

- 4.5 PIPERIDINE MARKET, BY COUNTRY

- FIGURE 17 INDIA PROJECTED TO WITNESS HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PIPERIDINE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand from pharmaceutical industry

- 5.2.1.2 Increasing agrochemicals consumption in emerging and highly populated countries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of piperidine and its derivatives as antimetastatic and antiproliferation drug

- 5.2.4 CHALLENGES

- 5.2.4.1 Health risks associated with piperidine

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 PIPERIDINE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 PIPERIDINE MARKET: PORTER'S FIVE FORCE ANALYSIS

- 6.1.1 BARGAINING POWER OF SUPPLIERS

- 6.1.2 BARGAINING POWER OF BUYERS

- 6.1.3 THREAT OF NEW ENTRANTS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 20 PIPERIDINE SUPPLY CHAIN

- 6.3 ECOSYSTEM MAPPING

- FIGURE 21 PIPERIDINE MARKET: ECOSYSTEM MAP

- 6.4 TECHNOLOGY ANALYSIS

- 6.5 CASE STUDY ANALYSIS

- 6.6 PRICE ANALYSIS

- TABLE 5 PIPERIDINE MARKET: PRICE ANALYSIS

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- FIGURE 22 PIPERIDINE MARKET: TRENDS IMPACTING CUSTOMER'S BUSINESS

- 6.8 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 6 PIPERIDINE MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 6.9 REGULATORY ANALYSIS

- 6.9.1 REACH

- 6.9.2 DRUG ENFORCEMENT ADMINISTRATION

- 6.9.3 OSHA (OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION

- 6.9.4 FEDERAL FINAL RULE OF HAZARD COMMUNICATION REVISED IN 2012 (HAZCOM 2012)

- TABLE 7 SKIN CORROSION/IRRITATION: CATEGORY 1C

- 6.9.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT-EXPORT SCENARIO OF PIPERIDINE MARKET

- 6.10.2 EXPORT SCENARIO OF PIPERIDINE

- FIGURE 23 PIPERIDINE MARKET: EXPORTING COUNTRIES

- 6.10.3 IMPORT SCENARIO OF PIPERIDINE

- FIGURE 24 PIPERIDINE MARKET: IMPORTING COUNTRIES

- 6.11 PATENT ANALYSIS

- 6.11.1 INTRODUCTION

- 6.11.2 METHODOLOGY

- 6.11.3 DOCUMENT TYPE

- TABLE 9 PIPERIDINE MARKET: REGISTERED PATENTS

- FIGURE 25 PIPERIDINE MARKET: REGISTERED PATENTS

- 6.11.4 PATENT PUBLICATION TRENDS

- FIGURE 26 PIPERIDINE MARKET: PATENT PUBLICATION TRENDS, 2016-2021

- 6.11.5 INSIGHT

- 6.11.6 LEGAL STATUS OF PATENTS

- FIGURE 27 PIPERIDINE MARKET: LEGAL STATUS

- 6.11.7 JURISDICTION ANALYSIS

- FIGURE 28 PIPERIDINE MARKET: JURISDICTION ANALYSIS

- 6.11.8 TOP PATENT APPLICANTS

- FIGURE 29 PIPERIDINE MARKET: TOP PATENT APPLICANTS

- TABLE 10 PIPERIDINE MARKET: LIST OF PATENTS BY CELGENE CORPORATION

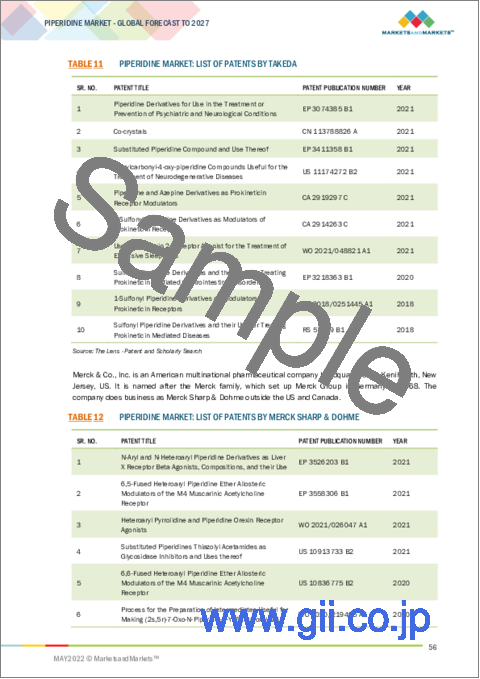

- TABLE 11 PIPERIDINE MARKET: LIST OF PATENTS BY TAKEDA

- TABLE 12 PIPERIDINE MARKET: LIST OF PATENTS BY MERCK SHARP & DOHME

- 6.11.9 LIST OF TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 13 PIPERIDINE MARKET: LIST TOP 10 PATENT OWNERS IN US

- 6.12 PIPERIDINE WORLD MERCHANDISE EXPORTS AND IMPORTS

- 6.12.1 IMPORT-EXPORT SCENARIO OF PIPERIDINE MARKET

- 6.12.2 TOP EXPORTERS OF PIPERIDINE & ITS SALTS

- FIGURE 30 TOP EXPORTERS OF PIPERIDINE IN 2019-2020: SHARE OF WORLD EXPORTS

- 6.12.3 TOP IMPORTERS OF PIPERIDINE & ITS SALTS

- FIGURE 31 TOP IMPORTERS OF PIPERIDINE IN 2019-2020: SHARE OF WORLD IMPORTS

- 6.12.4 EXPORT FLOW

- 6.12.5 IMPORT FLOW

7 PIPERIDINE MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 32 99% PURITY SEGMENT DOMINATED PIPERIDINE MARKET IN 2021

- TABLE 14 PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 15 PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- 7.2 98% PURITY

- 7.2.1 WIDELY USED FOR ELASTOMER PROCESSING

- TABLE 16 98% PURITY: PIPERIDINE MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 17 98% PURITY: PIPERIDINE MARKET SIZE, BY REGION, 2020-2027 (TON)

- 7.3 99% PURITY

- 7.3.1 HIGH DEMAND FROM PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

- TABLE 18 99% PURITY: PIPERIDINE MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 19 99% PURITY: PIPERIDINE MARKET SIZE, BY REGION, 2020-2027 (TON)

8 PIPERIDINE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 33 PHARMACEUTICAL END-USE INDUSTRY TO LEAD PIPERIDINE MARKET

- TABLE 20 PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 21 PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 8.2 AGROCHEMICALS

- 8.2.1 INCREASING GLOBAL POPULATION DRIVING DEMAND FOR AGROCHEMICALS AND, IN TURN, FOR PIPERIDINE

- TABLE 22 PIPERIDINE MARKET SIZE IN AGROCHEMICALS, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 23 PIPERIDINE MARKET SIZE IN AGROCHEMICALS, BY REGION, 2020-2027 (TON)

- 8.3 PHARMACEUTICAL

- 8.3.1 LARGEST END-USE INDUSTRY OF PIPERIDINE

- TABLE 24 PIPERIDINE MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 25 PIPERIDINE MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2020-2027 (TON)

- 8.4 RUBBER

- 8.4.1 HIGH DEMAND FOR PIPERIDINE AS VULCANIZATION CATALYST

- TABLE 26 PIPERIDINE MARKET SIZE IN RUBBER, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 27 PIPERIDINE MARKET SIZE IN RUBBER, BY REGION, 2020-2027 (TON)

- 8.5 OTHERS

- TABLE 28 PIPERIDINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 29 PIPERIDINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2027 (TON)

9 PIPERIDINE MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 34 ARGENTINA TO GROW AT HIGHEST RATE GLOBALLY

- TABLE 30 PIPERIDINE MARKET SIZE, BY REGION, 2020-2027 (USD THOUSAND)

- TABLE 31 PIPERIDINE MARKET SIZE, BY REGION, 2020-2027 (TON)

- 9.2 ASIA PACIFIC

- FIGURE 35 ASIA PACIFIC: PIPERIDINE MARKET SNAPSHOT

- TABLE 32 ASIA PACIFIC: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020-2027 (USD THOUSAND)

- TABLE 33 ASIA PACIFIC: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 34 ASIA PACIFIC: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 35 ASIA PACIFIC: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 36 ASIA PACIFIC: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 37 ASIA PACIFIC: PIPERIDINE MARKET SIZE, END-USE INDUSTRY, 2020-2027 (TON)

- 9.2.1 CHINA

- 9.2.1.1 Largest piperidine market in Asia Pacific

- TABLE 38 CHINA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 39 CHINA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 40 CHINA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 41 CHINA: PIPERIDINE MARKET SIZE, END-USE INDUSTRY, 2020-2027 (TON)

- 9.2.2 INDIA

- 9.2.2.1 Fastest-growing market in region

- TABLE 42 INDIA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 43 INDIA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 44 INDIA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 45 INDIA: PIPERIDINE MARKET SIZE, END-USE INDUSTRY, 2020-2027 (TON)

- 9.2.3 JAPAN

- 9.2.3.1 Second-fastest-growing mature pharmaceutical market in world

- TABLE 46 JAPAN: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 47 JAPAN: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 48 JAPAN: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 49 JAPAN: PIPERIDINE MARKET SIZE, END-USE INDUSTRY, 2020-2027 (TON)

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Growth in pharmaceutical industry to drive the market

- TABLE 50 SOUTH KOREA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 51 SOUTH KOREA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 52 SOUTH KOREA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 53 SOUTH KOREA: PIPERIDINE MARKET SIZE, END-USE INDUSTRY, 2020-2027 (TON)

- 9.2.5 ASEAN COUNTRIES

- 9.2.5.1 Rapid urbanization to be major market driver

- TABLE 54 ASEAN COUNTRIES: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 55 ASEAN COUNTRIES: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 56 ASEAN COUNTRIES: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY 2020-2027 (USD THOUSAND)

- TABLE 57 ASEAN COUNTRIES: PIPERIDINE MARKET SIZE, END-USE INDUSTRY 2020-2027 (TON)

- 9.2.6 REST OF ASIA PACIFIC

- TABLE 58 REST OF ASIA PACIFIC: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 59 REST OF ASIA PACIFIC: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 60 REST OF ASIA PACIFIC: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 61 REST OF ASIA PACIFIC: PIPERIDINE MARKET SIZE, END-USE INDUSTRY, 2020-2027 (TON)

- 9.3 EUROPE

- TABLE 62 EUROPE: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020-2027 (USD THOUSAND)

- TABLE 63 EUROPE: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 64 EUROPE: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 65 EUROPE: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 66 EUROPE: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 67 EUROPE: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.3.1 GERMANY

- 9.3.1.1 Germany to lead market for piperidine in Europe

- TABLE 68 GERMANY: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 69 GERMANY: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 70 GERMANY: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 71 GERMANY: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.3.2 ITALY

- 9.3.2.1 Pharmaceutical and agrochemicals industries to propel growth of piperidine market

- TABLE 72 ITALY: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 73 ITALY: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 74 ITALY: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 75 ITALY: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.3.3 FRANCE

- 9.3.3.1 Growing pharmaceutical industry to drive market

- TABLE 76 FRANCE: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 77 FRANCE: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 78 FRANCE: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 79 FRANCE: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.3.4 SPAIN

- 9.3.4.1 Increase in production and exports of agriculture products to propel growth of piperidine

- TABLE 80 SPAIN: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 81 SPAIN: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 82 SPAIN: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 83 SPAIN: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.3.5 UK

- 9.3.5.1 Increasing government investment in pharmaceutical industry to offer opportunities for piperidine market

- TABLE 84 UK: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 85 UK: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 86 UK: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 87 UK: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.3.6 RUSSIA

- 9.3.6.1 Growing food export to support market growth

- TABLE 88 RUSSIA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 89 RUSSIA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 90 RUSSIA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 91 RUSSIA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.3.7 REST OF EUROPE

- TABLE 92 REST OF EUROPE: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 93 REST OF EUROPE: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 94 REST OF EUROPE: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 95 REST OF EUROPE: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.4 NORTH AMERICA

- TABLE 96 NORTH AMERICA: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020-2027 (USD THOUSAND)

- TABLE 97 NORTH AMERICA: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 98 NORTH AMERICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 99 NORTH AMERICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 100 NORTH AMERICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 101 NORTH AMERICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.4.1 US

- 9.4.1.1 Growing pharmaceutical market and development of new agrochemical products driving market

- TABLE 102 US: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 103 US: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 104 US: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 105 US: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.4.2 CANADA

- 9.4.2.1 Presence of major pharmaceutical companies to boost market

- TABLE 106 CANADA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 107 CANADA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 108 CANADA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 109 CANADA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.4.3 MEXICO

- 9.4.3.1 Growing pharmaceutical production to be key market driver

- TABLE 110 MEXICO: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 111 MEXICO: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 112 MEXICO: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 113 MEXICO: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.5 MIDDLE EAST & AFRICA

- TABLE 114 MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020-2027 (USD THOUSAND)

- TABLE 115 MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 116 MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 117 MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 118 MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 119 MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.5.1 SAUDI ARABIA

- 9.5.1.1 Growing domestic pharmaceutical industry boosting demand for piperidine

- TABLE 120 SAUDI ARABIA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 121 SAUDI ARABIA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 122 SAUDI ARABIA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 123 SAUDI ARABIA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.5.2 UAE

- 9.5.2.1 Increasing need for development of healthcare & pharmaceutical sector to drive demand for piperidine

- TABLE 124 UAE: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 125 UAE: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 126 UAE: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 127 UAE: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.5.3 SOUTH AFRICA

- 9.5.3.1 Huge potential for piperidine market in agrochemicals industry

- TABLE 128 SOUTH AFRICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 129 SOUTH AFRICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 130 SOUTH AFRICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 131 SOUTH AFRICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 132 REST OF MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 133 REST OF MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 134 REST OF MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 135 REST OF MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.6 SOUTH AMERICA

- TABLE 136 SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020-2027 (USD THOUSAND)

- TABLE 137 SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 138 SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 139 SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 140 SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 141 SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.6.1 BRAZIL

- 9.6.1.1 Rising usage of agrochemicals to boost market

- TABLE 142 BRAZIL: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 143 BRAZIL: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 144 BRAZIL: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 145 BRAZIL: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.6.2 ARGENTINA

- 9.6.2.1 Growing agriculture sector to drive market

- TABLE 146 ARGENTINA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 147 ARGENTINA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 148 ARGENTINA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 149 ARGENTINA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 9.6.3 REST OF SOUTH AMERICA

- TABLE 150 REST OF SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (USD THOUSAND)

- TABLE 151 REST OF SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 152 REST OF SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD THOUSAND)

- TABLE 153 REST OF SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- FIGURE 36 ACQUISITION WAS KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2018 AND 2022

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 37 MARKET SHARE OF KEY PLAYERS, 2021

- TABLE 154 PIPERIDINE MARKET: DEGREE OF COMPETITION

- TABLE 155 STRATEGIC POSITIONING OF KEY PLAYERS

- 10.3 COMPANY EVALUATION MATRIX

- 10.3.1 STAR

- 10.3.2 PERVASIVE

- 10.3.3 EMERGING LEADER

- 10.3.4 PARTICIPANT

- FIGURE 38 PIPERIDINE MARKET: COMPANY EVALUATION MATRIX, 2021

- 10.4 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 10.4.1 PROGRESSIVE COMPANIES

- 10.4.2 RESPONSIVE COMPANIES

- 10.4.3 DYNAMIC COMPANIES

- 10.4.4 STARTING BLOCKS

- FIGURE 39 PIPERIDINE MARKET: STARTUP AND SMES MATRIX, 2021

- 10.5 REVENUE ANALYSIS OF TOP PLAYERS

- 10.6 STRENGTH OF PRODUCT PORTFOLIO

- 10.7 BUSINESS STRATEGY EXCELLENCE

- 10.8 KEY MARKET DEVELOPMENTS

- 10.8.1 DEALS

- 10.8.2 OTHERS

11 COMPANY PROFILES

- (Business Overview, Products and solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1 KEY COMPANIES

- 11.1.1 BASF SE

- TABLE 156 BASF SE: COMPANY OVERVIEW

- FIGURE 40 BASF SE: COMPANY SNAPSHOT

- TABLE 157 BASF SE: PRODUCT OFFERED

- 11.1.2 KOEI CHEMICAL CO. LTD.

- TABLE 158 KOEI CHEMICAL CO. LTD.: COMPANY OVERVIEW

- FIGURE 41 KOEI CHEMICAL CO. LTD.: COMPANY SNAPSHOT

- TABLE 159 KOEI CHEMICAL CO. LTD.: PRODUCT OFFERED

- 11.1.3 VERTELLUS

- TABLE 160 VERTELLUS: COMPANY OVERVIEW

- TABLE 161 VERTELLUS: PRODUCT OFFERED

- TABLE 162 VERTELLUS: DEALS

- 11.1.4 JUBILANT INGREVIA LIMITED

- TABLE 163 JUBILANT INGREVIA LIMITED: COMPANY OVERVIEW

- FIGURE 42 JUBILANT INGREVIA LIMITED: COMPANY SNAPSHOT

- TABLE 164 JUBILANT INGREVIA LIMITED: PRODUCT OFFERED

- 11.1.5 VASUDHA PHARMA

- TABLE 165 VASUDHA PHARMA: COMPANY OVERVIEW

- TABLE 166 VASUDHA PHARMA: PRODUCT OFFERED

- 11.1.6 TAJ PHARMACEUTICALS LTD.

- TABLE 167 TAJ PHARMACEUTICALS LTD.: COMPANY OVERVIEW

- TABLE 168 TAJ PHARMACEUTICALS LTD.: PRODUCT OFFERED

- 11.1.7 AVANTOR INC.

- TABLE 169 AVANTOR INC.: COMPANY OVERVIEW

- FIGURE 43 AVANTOR INC.: COMPANY SNAPSHOT

- TABLE 170 AVANTOR INC.: PRODUCT OFFERED

- TABLE 171 AVANTOR INC.: DEALS

- 11.1.8 ALLCHEM LIFESCIENCE PVT. LTD.

- TABLE 172 ALLCHEM LIFESCIENCE PVT. LTD.: COMPANY OVERVIEW

- TABLE 173 ALLCHEM LIFESCIENCE PVT. LTD.: PRODUCT OFFERED

- 11.1.9 TORONTO RESEARCH CHEMICALS

- TABLE 174 TORONTO RESEARCH CHEMICALS: COMPANY OVERVIEW

- TABLE 175 TORONTO RESEARCH CHEMICALS: PRODUCT OFFERED

- 11.1.10 MERCK KGAA

- TABLE 176 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 44 MERCK KGAA: COMPANY SNAPSHOT

- 11.2 OTHER COMPANIES

- 11.2.1 LANXESS

- TABLE 177 LANXESS: BUSINESS OVERVIEW

- 11.2.2 OTTO CHEMIE PVT. LTD.

- TABLE 178 OTTO CHEMIE PVT. LTD.: COMPANY OVERVIEW

- 11.2.3 SIMSON PHARMA

- TABLE 179 SIMSON PHARMA: COMPANY OVERVIEW

- 11.2.4 ROBINSON BROTHERS LIMITED

- TABLE 180 ROBINSON BROTHERS LIMITED: COMPANY OVERVIEW

- 11.2.5 ALFA AESAR

- TABLE 181 ALFA AESAR: COMPANY OVERVIEW

- 11.2.6 A.R. LIFE SCIENCE PVT. LTD.

- TABLE 182 AR LIFE SCIENCE: COMPANY OVERVIEW

- 11.2.7 AMI ORGANIC LIMITED

- TABLE 183 AMI ORGANIC LIMITED: COMPANY OVERVIEW

- 11.2.8 COREY ORGANICS

- TABLE 184 COREY ORGANICS: COMPANY OVERVIEW

- 11.2.9 J&K SCIENTIFIC

- TABLE 185 J&K SCIENTIFIC: COMPANY OVERVIEW

- 11.2.10 PENTA S.R.O

- TABLE 186 PENTA S.R.O: COMPANY OVERVIEW

- 11.2.11 MUBY CHEMICALS

- TABLE 187 MUBY CHEMICALS: COMPANY OVERVIEW

- 11.2.12 VORTEX PRODUCTS LIMITED

- TABLE 188 VORTEX: COMPANY OVERVIEW

- 11.2.13 SICHUAN HENGKANG SCIENCE AND TECHNOLOGY DEVELOPMENT CO., LTD.

- TABLE 189 SICHUAN HENGKANG SCIENCE AND TECHNOLOGY DEVELOPMENT CO., LTD.: COMPANY OVERVIEW

- 11.2.14 VITAL SYNTHESIS

- TABLE 190 VITAL SYNTHESIS: COMPANY OVERVIEW

- 11.2.15 VANAMALI ORGANICS

- TABLE 191 VANAMALI ORGANICS: COMPANY OVERVIEW

- *Details on Business Overview, Products and solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 AVAILABLE CUSTOMIZATIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS