|

|

市場調査レポート

商品コード

1078943

歯科技工所の世界市場:材料(メタルセラミック、CAD/CAM材料(ジルコニア、ガラスセラミック))、装置別(ミリング装置、CAD/CAMシステム、3Dプリンティングシステム、スキャナー、炉)、補綴物別 - 2027年までの予測Dental Laboratories Market by Material(Metal Ceramic, CAD/CAM Material (Zirconia, Glass Ceramic)), Equipment(Milling Equipment, CAD/CAM System, 3D Printing System, Scanner, Furnace), Prosthetics(Bridge, Crown, Veeners, Denture) - Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 歯科技工所の世界市場:材料(メタルセラミック、CAD/CAM材料(ジルコニア、ガラスセラミック))、装置別(ミリング装置、CAD/CAMシステム、3Dプリンティングシステム、スキャナー、炉)、補綴物別 - 2027年までの予測 |

|

出版日: 2022年05月24日

発行: MarketsandMarkets

ページ情報: 英文 291 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

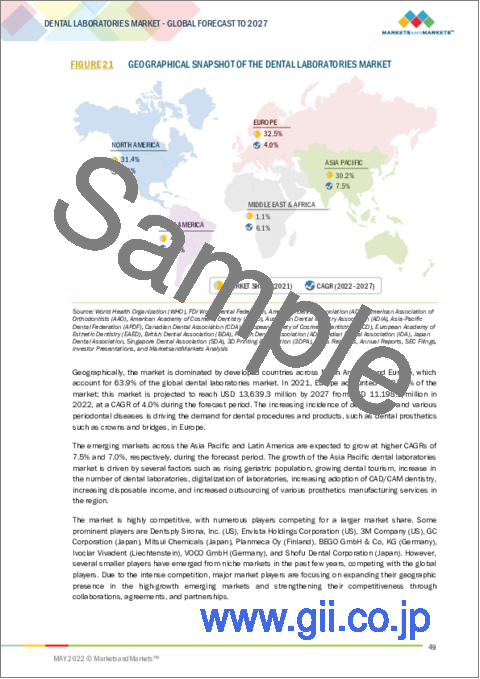

アジア太平洋は、2021年に世界の歯科技工所市場の30.2%を占めています。

同地域市場の成長は、高齢人口の増加、デンタルツーリズムの拡大、歯科技工所数の増加、同地域への各種製造サービスのアウトソーシング増加など、いくつかの要因によってもたらされています。

当レポートでは、世界の歯科技工所市場について調査し、市場力学、価格や特許の分析、エコシステム、セグメント・地域別の市場分析、競合情勢、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 市場機会

- 課題

- 動向

- エコシステム/市場マップ

- 価格分析

- エコシステム分析

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- エンドユーザー別主要購入基準

- 主な会議とイベント(2022-2023)

- 顧客のビジネスに影響を与える動向とディスラプション

- 貿易分析

- 規制状況

- COVID-19による市場への影響

第6章 材料別:歯科技工所市場

- メタルセラミック

- 従来型オールセラミック

- CAD/CAM材料

- プラスチック

- 金属

第7章 装置別:歯科技工所市場

- ミリング装置

- 歯科用スキャナー

- 3Dプリンティングシステム

- 統合CAD/CAMシステム

- 鋳造機

- 炉

- アーティキュレーター

- その他

第8章 補綴物タイプ別:歯科技工所市場

- クラウン

- ブリッジ

- 入れ歯

- ベニア

- クリアアライナー

第9章 地域別:歯科技工所市場

- 欧州

- ドイツ

- イタリア

- スペイン

- フランス

- 英国

- その他

- 北米

- 米国

- カナダ

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- コロンビア

- その他

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要企業の戦略/成功機会

- 主要市場参入企業の収益シェア分析

- 市場ランキング分析

- 競合リーダーシップマッピング

- スタートアップ/中小企業の競合リーダーシップマッピング(2021)

- 競合ベンチマーキング

- 企業のフットプリント

- 歯科技工所市場:研究開発費

- 競争の状況と動向

第11章 企業プロファイル

- 主要企業

- DENTSPLY SIRONA, INC.

- ENVISTA HOLDINGS CORPORATION

- 3M COMPANY

- IVOCLAR VIVADENT AG

- PLANMECA OY

- その他の企業

- GC CORPORATION

- MITSUI CHEMICALS, INC.

- KURARAY NORITAKE DENTAL, INC.

- VOCO GMBH

- AMANN GIRRBACH AG

- BEGO GMBH & CO. KG

- SCHUTZ DENTAL GMBH

- INSTITUT STRAUMANN AG

- VITA ZAHNFABRIK H. RAUTER GMBH & CO. KG

- COLTENE GROUP

- SHOFU INC.

- 3D SYSTEMS, INC.

- STRATASYS

- NAKANISHI INC.

- A-DEC INC.

- ZIRKONZAHN GMBH

- SMART DENT

- SHINING 3D

- ROLAND DG CORPORATION

- FORMLABS

第12章 付録

Edentulism (tooth loss) is a major oral health concern among the elderly; according to the WHO (2020), globally, ~19% of individuals aged between 65 and 74 years are edentulous. Periodontal diseases and dental cavities are the major causes of tooth loss. As the elderly are more susceptible to such ailments, the growth of this population segment will increase the number of people suffering from oral health problems globally. According to the UN, the global geriatric population (aged 65 years and above) will increase from 703 million in 2019 to 1.5 billion in 2050. Thus, significant growth in the geriatric population and associated increase in the prevalence of edentulism are expected to propel the dental laboratories market in these regions in the coming years.

"The Metal-ceramics segment held the largest share during the forecast period."

Metal-ceramics accounted for 47.4% of the dental laboratories market for materials in 2021. Metal-ceramic restorations are thermally bonded to an underlying metal framework cast to fit the tooth or bridge preparation. The high supportive strength of the underlying metal allows metal-ceramic restorations to provide full coverage of the posterior teeth and be used for multiple-tooth bridges. Compared to other indirect restorative materials, metal-ceramics are strong and durable, fracture-resistant, and compatible. However, some patients may show an allergic reaction to the base metals.

"Milling Equipment segment held the largest share during the forecast period."

In 2021, the dental milling equipment segment accounted for 45.5% of the dental laboratories market for equipment. Dental milling equipment is used to fabricate complete or partial dental restorations. Milling equipment is used to cut crowns, bridges, implant abutments, and other materials such as ceramics, zirconia, alloys, and resins. Dry and wet milling is generally performed depending on the type of material. Zirconia, wax, and PMMA (polymethylmethacrylate) are milled using a dry mill. Zirconia and PMMA are also milled using a wet mill. Wet milling is mostly required while milling glass-ceramics, feldspathic porcelains, and composite resins.

"The crowns segment held the largest share during the forecast period."

In 2021, crowns accounted for 46.0% of the dental prosthetics market. Crowns are artificial restorations that fit over the remaining part of a prepared tooth to strengthen it and give it the shape of a natural tooth. They are also used to protect the tooth from further damage and cover discolored or misshapen teeth. The durability of dental crowns is generally 10 to 15 years or more if appropriate care is taken and thorough oral sanitation is maintained. Their durability also depends on the accuracy of fabrication and the materials used for manufacturing. The most widely used crown materials are porcelain, PFM, gold, and zirconium.

"Asia Pacific projected to grow at the highest CAGR during the forecast period."

In 2021, the Asia Pacific accounted for 30.2% of the global dental laboratories market. The growth of the APAC market is driven by several factors, such as the rising geriatric population, growing dental tourism, the increase in the number of dental laboratories, and the increased outsourcing of various manufacturing services to the region. According to the United Nations, the APAC has a high aging population. By 2025, 710 metropolitan cities across the Asia Pacific will be home to 226 million geriatrics, accounting for approximately 11.4% of the population. Furthermore, by 2050, the percentage of the geriatric population in South Korea and China is expected to reach around 34.9% and 23.9%, respectively. Moreover, the incidence of dental caries and gum diseases has increased in Asia Pacific countries. According to the Australian Dental Association, around 11 million new cases of tooth decay are recorded every year in Australia.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the dental laboratoriesmarket.

- By Company Type: Tier 1: 46%, Tier 2: 33%, and Tier 3: 21%

- By Designation: C-level Executives: 43%, Directors: 35%, and Others:22%

- By Region: North America: 30%, Europe: 35%, APAC: 24%, Latin America: 14% and Middle East & Africa: 4%

Prominent players in the dental laboratories market are Dentsply Sirona, Inc. (US), Envista Holdings Corporation (US), 3M Company (US), GC Corporation (Japan), Mitsui Chemicals (Japan), Planmeca Oy (Finland), BEGO GmbH & Co, KG (Germany), Ivoclar Vivadent (Liechtenstein), VOCO GmbH (Germany), Shofu Dental Corporation (Japan), VITA Zahnfabrik H. Rauter GmbH & Co. KG (Germany), Kuraray Noritake Dental Inc. (Japan), Amann Girrbach AG (Austria), Schutz Dental GmbH (Germany), Nakanishi Inc. (Japan), COLTENE Holding AG (Switzerland), Institut Straumann AG (Switzerland), A-dec Inc. (US). Stratasys (US and Israel), 3D Systems (US), Formlabs (US), Roland DG Corporation (Japan), SHINING 3D (US), and Zirkonzahn (US).

Research Coverage:

This report describes and studies the global dental laboratories based material, equipment, prosthetic type, and regional level. It provides detailed information regarding the major factors influencing the growth of this market. The report includes an in-depth competitive analysis and the product matrix of the prominent players in this market, along with their company profiles, product portfolios, recent developments, and MNM overview.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants in this market and provide information regarding the closest approximations of the revenue numbers for the overall dental laboratories market and its subsegments. This report will help stakeholders to understand the competitive landscape,to gain more insights to better position their businesses, and to plan suitable go-to-market strategies. The report will also help the stakeholders to understand the pulse of the market and provide information on key market drivers, restraints, opportunities, and challenges.

This report provides insights on:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the dental laboratories market. The report analyzes this market by material, equipment, prosthetic type, and region

- Market Development: Comprehensive information on the lucrative emerging markets, by material, equipment, prosthetic type, and region

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the dental laboratories market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the dental laboratories market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 GLOBAL DENTAL LABORATORIES MARKET

- 1.3.2 YEARS CONSIDERED FOR THE STUDY

- 1.4 CURRENCY

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 SECONDARY RESEARCH

- 2.1.3 PRIMARY RESEARCH

- FIGURE 3 PRIMARY SOURCES

- 2.1.3.1 Key data from primary sources

- FIGURE 4 INSIGHTS FROM INDUSTRY EXPERTS

- 2.1.3.2 Breakdown of primary sources

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 6 PRIMARY SOURCES

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 7 DENTAL LABORATORIES MARKET (INDIRECT RESTORATIVE MATERIALS): BOTTOM-UP APPROACH

- FIGURE 8 DENTAL LABORATORIES MARKET (EQUIPMENT): BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 SUPPLY-SIDE MATERIAL AND EQUIPMENT MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 11 SUPPLY-SIDE DENTAL PROSTHETICS MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 13 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE DENTAL LABORATORIES MARKET (2022-2027)

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ESTIMATION

- 2.5 ASSUMPTIONS FOR THE STUDY

- 2.6 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: DENTAL LABORATORIES MARKET

- 2.7 COVID-19 HEALTH ASSESSMENT

- 2.8 COVID-19 ECONOMIC ASSESSMENT

- 2.9 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

- FIGURE 15 CRITERIA IMPACTING THE GLOBAL ECONOMY

- FIGURE 16 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY

- FIGURE 17 DENTAL LABORATORIES MARKET, BY MATERIAL, 2022 VS. 2027 (USD MILLION)

- FIGURE 18 CAD/CAM MATERIALS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 19 DENTAL LABORATORIES MARKET, BY EQUIPMENT, 2022 VS. 2027 (USD MILLION)

- FIGURE 20 DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 21 GEOGRAPHICAL SNAPSHOT OF THE DENTAL LABORATORIES MARKET

4 PREMIUM INSIGHTS

- 4.1 DENTAL LABORATORIES MARKET OVERVIEW

- FIGURE 22 INCREASING NUMBER OF DENTAL LABORATORIES INVESTING IN CAD/ CAM TECHNOLOGIES TO DRIVE MARKET GROWTH

- 4.2 DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE (2022-2027)

- FIGURE 23 MILLING EQUIPMENT TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD (2022-2027)

- 4.3 ASIA PACIFIC: DENTAL LABORATORIES MARKET, BY MATERIAL AND COUNTRY (2021)

- FIGURE 24 CHINA ACCOUNTED FOR THE LARGEST SHARE OF THE APAC DENTAL LABORATORIES MARKET IN 2021

- 4.4 DENTAL LABORATORIES MARKET: GEOGRAPHIC MIX

- FIGURE 25 INDIA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

- 4.5 DENTAL LABORATORIES MARKET: DEVELOPED VS. DEVELOPING MARKETS (USD MILLION)

- FIGURE 26 DEVELOPING MARKETS TO REGISTER A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 27 DENTAL LABORATORIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in geriatric population and edentulism cases

- TABLE 3 INCREASE IN GERIATRIC POPULATION, 2019 VS 2050

- TABLE 4 INCREASE IN THE GERIATRIC POPULATION, 2005-2020

- 5.2.1.2 Development of technologically advanced solutions

- TABLE 5 TECHNOLOGICAL ADVANCEMENTS IN LAB EQUIPMENT & INDIRECT RESTORATIVE MATERIALS

- 5.2.1.3 Rising incidence of dental caries and other periodontal diseases

- 5.2.1.4 Increasing outsourcing of manufacturing functions to dental laboratories

- 5.2.1.5 Increasing number of dental laboratories investing in CAD/CAM

- 5.2.1.6 Growing dental tourism

- TABLE 6 AVERAGE COSTS FOR SEVERAL COMMON PROCEDURES IN EACH OF THE TOP 10 DENTAL TOURISM DESTINATIONS

- TABLE 7 COUNTRY-WISE DENTAL TREATMENT COST COMPARISON (USD)

- 5.2.1.7 Increasing dental expenditure along with growth in disposable incomes

- TABLE 8 PER CAPITA NATIONAL INCOME (USD)

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of dental equipment and materials

- TABLE 9 AVERAGE COST OF EQUIPMENT

- 5.2.2.2 Increasing surgical costs and lack of access to reimbursement

- TABLE 10 AVERAGE COST OF DENTAL SURGERIES

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for cosmetic dental procedures

- 5.2.4 CHALLENGES

- 5.2.4.1 Pricing pressure faced by prominent market players

- 5.2.4.2 Dearth of skilled lab professionals

- 5.3 INDUSTRY TRENDS

- 5.3.1 DIGITALIZATION OF LABORATORIES

- FIGURE 28 PENETRATION OF DIGITAL TECHNOLOGIES IN US DENTAL LABS

- FIGURE 29 WORKFLOW COMPARISON: TRADITIONAL VS. DIGITAL DENTISTRY

- 5.3.2 INCREASING ADOPTION OF 3D PRINTING IN DENTAL LABS

- 5.3.3 FOCUS ON ORGANIC GROWTH STRATEGIES

- TABLE 11 NUMBER OF NEW PRODUCT LAUNCHES, BY KEY PLAYER (2019-2021)

- 5.4 ECOSYSTEM/MARKET MAP

- TABLE 12 DENTAL LABORATORIES MARKET: ECOSYSTEM

- 5.5 PRICING ANALYSIS

- TABLE 13 PRICING ANALYSIS OF DENTAL LABORATORY EQUIPMENT (2021)

- TABLE 14 PRICING ANALYSIS OF DENTAL LABORATORY MATERIALS (2021)

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 PATENT ANALYSIS

- 5.7.1 PATENT PUBLICATION TRENDS FOR DENTAL LABORATORY

- FIGURE 30 PATENT PUBLICATION TRENDS (2011-2021)

- FIGURE 31 CAD/CAM SYSTEMS PATENT PUBLICATION TRENDS (2011-2021)

- 5.7.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 32 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR DENTAL LABORATORY PATENTS (JANUARY 2011-FEBRUARY 2022)

- FIGURE 33 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR CAD/CAM SYSTEM PATENTS (JANUARY 2011-FEBRUARY 2022)

- FIGURE 34 TOP APPLICANT COUNTRIES/REGIONS FOR DENTAL LAB PATENTS (JANUARY 2011-FEBRUARY 2022)

- FIGURE 35 TOP APPLICANT COUNTRIES/REGIONS FOR CAD/CAM SYSTEM PATENTS (JANUARY 2011-FEBRUARY 2022)

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 36 DENTAL LABORATORIES MARKET: VALUE CHAIN ANALYSIS

- 5.9 SUPPLY CHAIN ANALYSIS

- FIGURE 37 SUPPLY CHAIN ANALYSIS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 RESTORATIVE DENTISTRY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT FROM NEW ENTRANTS

- 5.10.2 THREAT FROM SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 38 INFLUENCE OF STAKEHOLDER IN BUYING PROCESS FOR DENTAL LABORATORIES PRODUCTS

- TABLE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR PRODUCT SEGMENTS (%)

- 5.12 KEY BUYING CRITERIA BY END USERS

- FIGURE 39 BUYING CRITERIA BY END USERS

- TABLE 17 KEY BUYING CRITERIA FOR PRODUCT SEGMENTS

- 5.13 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 18 DENTAL LABORATORIES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.14 TRENDS & DISRUPTIONS AFFECTING CUSTOMERS' BUSINESS

- FIGURE 40 DENTAL LABORATORIES MARKET: TRENDS & DISRUPTIONS AFFECTING CUSTOMERS' BUSINESS

- 5.15 TRADE ANALYSIS

- TABLE 19 US DENTAL EQUIPMENT AND SUPPLIES, EXPORTS 2013-2018 (THOUSANDS)

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 US

- 5.16.2 EUROPEAN UNION

- 5.16.3 UK

- 5.16.4 CHINA

- 5.17 COVID-19 IMPACT ON THE DENTAL LABORATORIES MARKET

6 DENTAL LABORATORIES MARKET, BY MATERIAL

- 6.1 INTRODUCTION

- TABLE 20 DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 21 DENTAL LABORATORIES MARKET FOR MATERIALS, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.1.1 METAL-CERAMICS

- 6.1.1.1 Poor esthetics of metal-ceramics may restrain the growth of this market in the forecast period

- TABLE 22 METAL-CERAMICS OFFERED BY KEY MARKET PLAYERS

- TABLE 23 DENTAL METAL-CERAMICS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.1.2 TRADITIONAL ALL-CERAMICS

- 6.1.2.1 Demand for traditional all-ceramics has increased owing to their excellent aesthetic properties, high strength, and durability

- TABLE 24 TRADITIONAL ALL-CERAMIC RESTORATIVE MATERIALS OFFERED BY KEY MARKET PLAYERS

- TABLE 25 DENTAL TRADITIONAL ALL-CERAMICS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.1.3 CAD/CAM MATERIALS

- TABLE 26 CAD/CAM MATERIALS OFFERED BY KEY MARKET PLAYERS

- TABLE 27 DENTAL CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 28 DENTAL CAD/CAM MATERIALS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.1.3.1 Zirconia

- 6.1.3.1.1 Zirconia holds the largest share of the CAD/CAM materials segment

- 6.1.3.1 Zirconia

- TABLE 29 ZIRCONIA MATERIALS OFFERED BY KEY MARKET PLAYERS

- TABLE 30 DENTAL ZIRCONIA MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

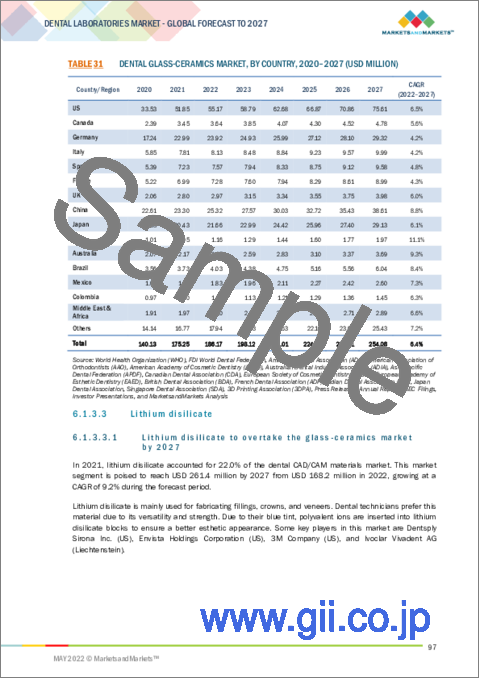

- 6.1.3.2 Glass-ceramics

- 6.1.3.2.1 Glass-ceramics market has seen the development of stronger, tougher materials

- 6.1.3.2 Glass-ceramics

- TABLE 31 DENTAL GLASS-CERAMICS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.1.3.3 Lithium disilicate

- 6.1.3.3.1 Lithium disilicate to overtake the glass-ceramics market by 2027

- 6.1.3.3 Lithium disilicate

- TABLE 32 DENTAL LITHIUM DISILICATE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.1.3.4 Other CAD/CAM materials

- TABLE 33 OTHER CAD/CAM MATERIALS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.1.4 PLASTICS

- 6.1.4.1 High resistance and flexibility of thermoplastics support market growth

- TABLE 34 PLASTIC MATERIALS OFFERED BY KEY MARKET PLAYERS

- TABLE 35 DENTAL PLASTICS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.1.5 METALS

- 6.1.5.1 Anti-leakage properties drive the use of metals in dentistry

- TABLE 36 METAL MATERIALS OFFERED BY KEY MARKET PLAYERS

- TABLE 37 DENTAL METALS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

7 DENTAL LABORATORIES MARKET, BY EQUIPMENT

- 7.1 INTRODUCTION

- TABLE 38 DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 39 DENTAL LABORATORIES MARKET FOR EQUIPMENT, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.2 MILLING EQUIPMENT

- 7.2.1 INCREASING DEMAND TO PRODUCE DENTAL RESTORATIVES RAPIDLY AND RISING ADOPTION OF CAD/CAM DRIVE MARKET GROWTH

- TABLE 40 DENTAL MILLING EQUIPMENT OFFERED BY KEY MARKET PLAYERS

- TABLE 41 DENTAL MILLING EQUIPMENT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 DENTAL SCANNERS

- 7.3.1 RISING DEMAND FOR DIGITAL DENTAL PRODUCTS AND INCREASING EFFORTS TO DELIVER FASTER TREATMENT WILL DRIVE GROWTH

- TABLE 42 DENTAL SCANNERS OFFERED BY KEY MARKET PLAYERS

- TABLE 43 DENTAL SCANNERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.4 3D PRINTING SYSTEMS

- 7.4.1 GROWING DEMAND FOR COSMETIC DENTISTRY AND PREVENTIVE DENTAL CARE TO FUEL THE MARKET FOR 3D PRINTING SYSTEMS

- TABLE 44 3D PRINTING SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 45 DENTAL 3D PRINTING SYSTEMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.5 INTEGRATED CAD/CAM SYSTEMS

- 7.5.1 INCREASING ADOPTION OF CAD/CAM SYSTEMS IN DENTAL LABORATORIES WILL DRIVE THE MARKET

- TABLE 46 INTEGRATED CAD/CAM SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 47 DENTAL INTEGRATED CAD/CAM SYSTEMS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.6 CASTING MACHINES

- 7.6.1 RISING DEMAND FOR CUSTOMIZED PROSTHETICS AND COSMETIC DENTISTRY TO FUEL THE GROWTH OF THE CASTING MACHINES MARKET

- TABLE 48 CASTING DEVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 49 DENTAL CASTING MACHINES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.7 FURNACES

- 7.7.1 TECHNOLOGICAL INNOVATIONS IN DENTAL FURNACES WILL ENSURE SUSTAINED END-USER DEMAND

- TABLE 50 FURNACES OFFERED BY KEY MARKET PLAYERS

- TABLE 51 DENTAL FURNACES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.8 ARTICULATORS

- 7.8.1 ARTICULATORS ARE PRICED LOWER THAN OTHER CAD/CAM EQUIPMENT

- TABLE 52 DENTAL ARTICULATORS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.9 OTHER DENTAL LABORATORY EQUIPMENT

- TABLE 53 LIGHT-CURING EQUIPMENT OFFERED BY KEY MARKET PLAYERS

- TABLE 54 OTHER EQUIPMENT OFFERED BY KEY MARKET PLAYERS

- TABLE 55 OTHER DENTAL LABORATORY EQUIPMENT MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

8 DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE

- 8.1 INTRODUCTION

- TABLE 56 DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- TABLE 57 DENTAL LABORATORIES MARKET FOR PROSTHETICS, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.2 CROWNS

- 8.2.1 GROWING GERIATRIC POPULATION AND THE RISING ADOPTION OF ADVANCED DENTISTRY TECHNOLOGIES WILL DRIVE THE MARKET

- TABLE 58 CROWNS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3 BRIDGES

- 8.3.1 RISING AWARENESS REGARDING COSMETIC DENTISTRY DRIVES THE BRIDGES MARKET

- TABLE 59 BRIDGES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.4 DENTURES

- 8.4.1 EMPHASIS ON PHYSICAL APPEARANCE AMONG THE GERIATRIC POPULATION HAS AUGMENTED THE DEMAND FOR DENTURES

- TABLE 60 DENTURES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.5 VENEERS

- 8.5.1 THE RISING DEMAND FOR COSMETIC DENTISTRY AND PREVENTIVE DENTAL CARE IS EXPECTED TO FURTHER FUEL THE GROWTH OF THE VENEERS MARKET

- TABLE 61 VENEERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.6 CLEAR ALIGNERS

- 8.6.1 INCREASING PREVALENCE OF DENTAL MALOCCLUSION AND MISALIGNMENT TO DRIVE DEMAND FOR ALIGNERS

- TABLE 62 CLEAR ALIGNERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

9 DENTAL LABORATORIES MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 41 DENTAL LABORATORIES MARKET: GEOGRAPHIC SNAPSHOT

- TABLE 63 DENTAL LABORATORIES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2 EUROPE

- FIGURE 42 EUROPE: DENTAL LABORATORIES MARKET SNAPSHOT

- TABLE 64 EUROPE: DENTAL LABORATORIES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 65 EUROPE: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 66 EUROPE: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 67 EUROPE: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 68 EUROPE: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.2.1 GERMANY

- 9.2.1.1 Germany is the largest market for dental lab equipment and products in Europe

- FIGURE 43 GERMANY: DENTAL EXPENDITURE IN GERMANY 2010-2019 (IN MILLION USD)

- TABLE 69 GERMANY: MACROECONOMIC INDICATORS

- TABLE 70 GERMANY: MAJOR LABORATORIES IN GERMANY

- TABLE 71 GERMANY: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 72 GERMANY: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 73 GERMANY: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 74 GERMANY: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.2.2 ITALY

- 9.2.2.1 Rise of local players will drive market growth in Italy

- TABLE 75 ITALY: MACROECONOMIC INDICATORS

- TABLE 76 ITALY: MAJOR DENTAL LABORATORIES

- TABLE 77 ITALY: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 78 ITALY: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 79 ITALY: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 80 ITALY: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.2.3 SPAIN

- 9.2.3.1 Growing number of dentists and labs in the country will drive the growth of the dental laboratories market

- TABLE 81 SPAIN: MACROECONOMIC INDICATORS

- TABLE 82 SPAIN: MAJOR DENTAL LABORATORIES

- TABLE 83 SPAIN: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 84 SPAIN: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 85 SPAIN: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 86 SPAIN: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.2.4 FRANCE

- 9.2.4.1 Increase in the adoption of CAD/CAM systems in the country will drive the growth in the market

- TABLE 87 FRANCE: MACROECONOMIC INDICATORS

- TABLE 88 FRANCE: MAJOR DENTAL LABORATORIES

- TABLE 89 FRANCE: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 90 FRANCE: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 91 FRANCE: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 92 FRANCE: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.2.5 UK

- 9.2.5.1 The increasing incidence of dental disorders will drive demand for dental lab equipment

- TABLE 93 UK: MACROECONOMIC INDICATORS

- TABLE 94 UK: MAJOR DENTAL LABORATORIES

- TABLE 95 UK: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 96 UK: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 97 UK: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 98 UK: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.2.6 REST OF EUROPE

- TABLE 99 ROE: NUMBER OF DENTAL LABORATORIES, BY COUNTRY

- TABLE 100 ROE: MAJOR DENTAL LABORATORIES

- TABLE 101 ROE: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 102 ROE: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 103 ROE: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 104 ROE: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.3 NORTH AMERICA

- TABLE 105 NORTH AMERICA: DENTAL LABORATORIES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 106 NORTH AMERICA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 108 NORTH AMERICA: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 109 NORTH AMERICA: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.3.1 US

- 9.3.1.1 US holds the largest share of the North American market

- FIGURE 44 US: RISE IN DENTAL EXPENDITURE, 2010-2019

- TABLE 110 US: MACROECONOMIC INDICATORS

- TABLE 111 US: MAJOR DENTAL LABORATORIES

- TABLE 112 US: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 113 US: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 114 US: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 115 US: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.3.2 CANADA

- 9.3.2.1 Rising incidence of dental caries to further fuel the growth of the dental labs market in the country

- TABLE 116 CANADA: MACROECONOMIC INDICATORS

- TABLE 117 CANADA: MAJOR DENTAL LABORATORIES

- TABLE 118 CANADA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 119 CANADA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 120 CANADA: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 121 CANADA: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 45 ASIA PACIFIC: DENTAL LABORATORIES MARKET SNAPSHOT

- TABLE 122 ASIA PACIFIC: DENTAL LABORATORIES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 123 ASIA PACIFIC: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 124 ASIA PACIFIC: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 China holds the largest share of the APAC market

- TABLE 127 CHINA: MACROECONOMIC INDICATORS

- TABLE 128 CHINA: MAJOR LABORATORIES

- TABLE 129 CHINA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 130 CHINA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 131 CHINA: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 132 CHINA: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Growing adoption of CAD/CAM technologies will drive the market

- TABLE 133 JAPAN: MACROECONOMIC INDICATORS

- TABLE 134 JAPAN: MAJOR LABORATORIES

- TABLE 135 JAPAN: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 136 JAPAN: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 137 JAPAN: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 138 JAPAN: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 The increase in the dental tourism in the country will drive the growth of the dental laboratories market

- TABLE 139 INDIA VS. US, UK, AND AUSTRALIA: DENTAL TREATMENT COST COMPARISON (USD)

- TABLE 140 INDIA: MACROECONOMIC INDICATORS

- TABLE 141 INDIA: MAJOR DENTAL LABORATORIES

- TABLE 142 INDIA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 143 INDIA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 144 INDIA: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 145 INDIA: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.4.4 AUSTRALIA

- 9.4.4.1 Growing uptake of low-priced or discounted dental products to drive the growth of the dental laboratories market

- TABLE 146 AUSTRALIA: ORAL HEALTH STATUS OF CHILDREN AND ADULTS

- TABLE 147 AUSTRALIA: KEY DENTAL LABORATORIES

- TABLE 148 AUSTRALIA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 149 AUSTRALIA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 150 AUSTRALIA: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 151 AUSTRALIA: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 152 ROAPAC: PERCENTAGE OF EDENTULOUS INDIVIDUALS IN GERIATRIC POPULATION AGED 65 AND ABOVE (2019)

- TABLE 153 ROAPAC: KEY DENTAL LABORATORIES

- TABLE 154 ROAPAC: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 155 ROAPAC: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 156 ROAPAC: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 157 ROAPAC: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.5 LATIN AMERICA

- TABLE 158 LATIN AMERICA: DENTAL LABORATORIES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 159 LATIN AMERICA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 160 LATIN AMERICA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 161 LATIN AMERICA: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 162 LATIN AMERICA: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.5.1 BRAZIL

- 9.5.1.1 Brazil holds the largest share of the LATAM market

- TABLE 163 BRAZIL: GERIATRIC POPULATION BETWEEN 1920 AND 2040

- TABLE 164 BRAZIL: KEY DENTAL LABORATORIES

- TABLE 165 BRAZIL: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 166 BRAZIL: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 167 BRAZIL: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 168 BRAZIL: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.5.2 MEXICO

- 9.5.2.1 Improving healthcare infrastructure and availability of skilled dentists will support market growth

- TABLE 169 US VS. MEXICO: DENTAL PROCEDURE COST COMPARISON

- TABLE 170 MEXICO: KEY DENTAL LABORATORIES

- TABLE 171 MEXICO: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 172 MEXICO: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 173 MEXICO: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 174 MEXICO: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.5.3 COLOMBIA

- 9.5.3.1 Presence of prominent dental laboratories to drive the Colombian market

- TABLE 175 COLOMBIA: KEY DENTAL LABORATORIES

- TABLE 176 COLOMBIA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 177 COLOMBIA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 178 COLOMBIA: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 179 COLOMBIA: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.5.4 REST OF LATIN AMERICA

- TABLE 180 ROLA: GERIATRIC POPULATION, BY COUNTRY

- TABLE 181 ROLA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 182 ROLA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 183 ROLA: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 184 ROLA: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020-2027 (USD MILLION)

- 9.6 MIDDLE EAST AND AFRICA

- 9.6.1 GROWING AWARENESS OF DENTAL HYGIENE TO DRIVE MARKET GROWTH

- TABLE 185 MEA: MAJOR DENTAL LABORATORIES

- TABLE 186 MIDDLE EAST & AFRICA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020-2027 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- FIGURE 46 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE DENTAL LABORATORIES MARKET, JANUARY 2018-APRIL 2022

- 10.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 10.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

- FIGURE 47 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS IN THE DENTAL LABORATORIES (MATERIALS AND EQUIPMENT) MARKET

- TABLE 190 DENTAL LABORATORIES MARKET, BY INDIRECT RESTORATIVE MATERIALS: DEGREE OF COMPETITION

- TABLE 191 DENTAL LABORATORIES MARKET, BY EQUIPMENT: DEGREE OF COMPETITION

- 10.4 MARKET RANKING ANALYSIS

- FIGURE 48 RANK OF COMPANIES IN THE GLOBAL DENTAL LABORATORIES MARKET, BY MATERIAL AND EQUIPMENT (2021)

- 10.5 COMPETITIVE LEADERSHIP MAPPING

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 49 DENTAL LABORATORIES MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

- 10.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 STARTING BLOCKS

- 10.6.3 RESPONSIVE COMPANIES

- 10.6.4 DYNAMIC COMPANIES

- FIGURE 50 DENTAL LABORATORIES MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 192 DENTAL LABORATORIES MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 193 DENTAL LABORATORIES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

- 10.8 COMPANY FOOTPRINT

- TABLE 194 DENTAL LABORATORIES MARKET, BY MATERIAL: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 195 DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 196 COMPANY REGIONAL FOOTPRINT (20 COMPANIES)

- 10.9 DENTAL LABORATORIES MARKET: R&D EXPENDITURE

- FIGURE 51 R&D EXPENDITURE OF KEY PLAYERS IN THE DENTAL LABORATORIES MARKET (2020 VS. 2021)

- 10.10 COMPETITIVE SITUATION AND TRENDS

- 10.10.1 PRODUCT LAUNCHES

- TABLE 197 DENTAL LABORATORIES MARKET: PRODUCT LAUNCHES

- 10.10.2 DEALS

- TABLE 198 DENTAL LABORATORIES MARKET: KEY DEALS

- 10.10.3 OTHER DEVELOPMENTS

- TABLE 199 DENTAL LABORATORIES MARKET: OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 11.1.1 DENTSPLY SIRONA, INC.

- TABLE 200 DENTSPLY SIRONA, INC.: BUSINESS OVERVIEW

- FIGURE 52 DENTSPLY SIRONA, INC.: COMPANY SNAPSHOT (2021)

- 11.1.2 ENVISTA HOLDINGS CORPORATION

- TABLE 201 ENVISTA HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 53 ENVISTA HOLDINGS CORPORATION: COMPANY SNAPSHOT (2021)

- 11.1.3 3M COMPANY

- TABLE 202 3M COMPANY: BUSINESS OVERVIEW

- FIGURE 54 3M COMPANY: COMPANY SNAPSHOT (2021)

- 11.1.4 IVOCLAR VIVADENT AG

- TABLE 203 IVOCLAR VIVADENT AG: BUSINESS OVERVIEW

- 11.1.5 PLANMECA OY

- TABLE 204 PLANMECA OY: BUSINESS OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 GC CORPORATION

- TABLE 205 GC CORPORATION: BUSINESS OVERVIEW

- 11.2.2 MITSUI CHEMICALS, INC.

- TABLE 206 MITSUI CHEMICALS, INC.: BUSINESS OVERVIEW

- FIGURE 55 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT (2021)

- 11.2.3 KURARAY NORITAKE DENTAL, INC.

- TABLE 207 KURARAY NORITAKE DENTAL, INC.: BUSINESS OVERVIEW

- FIGURE 56 KURARAY NORITAKE DENTAL, INC.: COMPANY SNAPSHOT (2021)

- 11.2.4 VOCO GMBH

- TABLE 208 VOCO GMBH: BUSINESS OVERVIEW

- 11.2.5 AMANN GIRRBACH AG

- TABLE 209 AMANN GIRRBACH AG: BUSINESS OVERVIEW

- 11.2.6 BEGO GMBH & CO. KG

- TABLE 210 BEGO GMBH & CO. KG: BUSINESS OVERVIEW

- 11.2.7 SCHUTZ DENTAL GMBH

- TABLE 211 SCHUTZ DENTAL GMBH: BUSINESS OVERVIEW

- 11.2.8 INSTITUT STRAUMANN AG

- TABLE 212 INSTITUT STRAUMANN AG: BUSINESS OVERVIEW

- FIGURE 57 INSTITUT STRAUMANN AG: COMPANY SNAPSHOT (2021)

- 11.2.9 VITA ZAHNFABRIK H. RAUTER GMBH & CO. KG

- TABLE 213 VITA ZAHNFABRIK H. RAUTER GMBH & CO. KG: BUSINESS OVERVIEW

- 11.2.10 COLTENE GROUP

- TABLE 214 COLTENE GROUP: BUSINESS OVERVIEW

- FIGURE 58 COLTENE GROUP: COMPANY SNAPSHOT (2021)

- 11.2.11 SHOFU INC.

- TABLE 215 SHOFU INC.: BUSINESS OVERVIEW

- FIGURE 59 SHOFU INC.: COMPANY SNAPSHOT (2021)

- 11.2.12 3D SYSTEMS, INC.

- TABLE 216 3D SYSTEMS, INC.: BUSINESS OVERVIEW

- FIGURE 60 3D SYSTEMS, INC.: COMPANY SNAPSHOT (2021)

- 11.2.13 STRATASYS

- TABLE 217 STRATASYS: BUSINESS OVERVIEW

- FIGURE 61 STRATASYS: COMPANY SNAPSHOT (2021)

- 11.2.14 NAKANISHI INC.

- TABLE 218 NAKANISHI INC.: BUSINESS OVERVIEW

- 11.2.15 A-DEC INC.

- TABLE 219 A-DEC INC.: BUSINESS OVERVIEW

- 11.2.16 ZIRKONZAHN GMBH

- TABLE 220 ZIRKONZAHN GMBH: COMPANY OVERVIEW

- 11.2.17 SMART DENT

- TABLE 221 SMART DENT: COMPANY OVERVIEW

- 11.2.18 SHINING 3D

- TABLE 222 SHINING 3D: COMPANY OVERVIEW

- 11.2.19 ROLAND DG CORPORATION

- TABLE 223 ROLAND DG: BUSINESS OVERVIEW

- FIGURE 62 ROLAND DG: COMPANY SNAPSHOT (2020)

- 11.2.20 FORMLABS

- TABLE 224 FORMLABS: COMPANY OVERVIEW

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 AVAILABLE CUSTOMIZATIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS