|

|

市場調査レポート

商品コード

1649596

SOCaaS(SOC-as-a-Service)市場:脅威タイプ別、サービスタイプ別、オファリング別、組織規模別、セキュリティタイプ別、セクター別、業界別、地域別 - 2030年までの予測SOC-as-a-Service (SOCaaS) Market by Service Type (Managed SIEM & Log Management, Vulnerability Scanning & Assessment, Threat Detection & Remediation), Security Type (Endpoint Security, Network Security, Cloud Security) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| SOCaaS(SOC-as-a-Service)市場:脅威タイプ別、サービスタイプ別、オファリング別、組織規模別、セキュリティタイプ別、セクター別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年02月03日

発行: MarketsandMarkets

ページ情報: 英文 443 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のSOCaaSの市場規模は、2024年の73億7,000万米ドルから2030年には146億6,000万米ドルに成長し、予測期間中のCAGRは12.2%になると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント別 | 脅威タイプ別、サービスタイプ別、オファリング別、組織規模別、セキュリティタイプ別、セクター別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

脆弱性に対処し、脅威を特定し、危機に対応するための、堅牢でスケーラブルかつコスト効率に優れたソリューションに対する需要の高まりが、SOC as a Service(SOCaaS)業界を後押ししています。企業のデジタル化の進展、クラウドベースのプラットフォームの普及、サイバー攻撃の複雑化などが、洗練されたSOCaaSソリューションへの需要に拍車をかけています。導入コストの高さ、統合の複雑さ、熟練したサイバーセキュリティ専門家の不足といった課題は、カスタマイズされたサービス、自動化ツール、マネージド・セキュリティ・ソリューションの継続的なイノベーションによって緩和されつつあります。脅威の可視化、規制遵守、リアルタイムの監視に重点を置くことで、複雑化するサイバー脅威の状況下で、企業は安全かつ効率的で回復力のあるセキュリティ運用を維持できます。

予測期間中、SOCaaS市場では民間部門が最大の市場規模を占めると予想されます。これは、デジタルトランスフォーメーションプログラムの導入が進んでいることと、民間組織を標的とするサイバー脅威が高度化しているためです。サイバー攻撃はBFSI、IT&ITeS、通信などの業界で特に多発しており、効果的な脅威の検知、対応、修復サービスの提供が必要となっています。さらに、規制基準を遵守し、機密性の高い顧客データを保護し、増大するサイバー危険に直面して事業継続性を維持する必要性が、民間企業がSOCaaSソリューションに多額の費用を投じる原動力となっています。

アジア太平洋におけるSOCaaS市場の主な促進要因は、各業界における急速なデジタル変革、クラウド技術の採用拡大、インド、中国、東南アジア諸国などの新興経済圏におけるサイバーセキュリティ重視の高まりです。複雑なサイバー脅威の増加と社内にサイバーセキュリティの経験が乏しいことが、企業にSOCaaSソリューションの導入を促しています。さらに、サイバーセキュリティに対する意識を高める政府の政策やプログラム、スマートシティプロジェクトやデジタルインフラへの投資が、この地域の市場成長を力強く後押ししています。

当レポートでは、世界のSOCaaS(SOC-as-a-Service)市場について調査し、脅威タイプ別、サービスタイプ別、オファリング別、組織規模別、セキュリティタイプ別、セクター別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- 歴史的進化

- フレームワーク

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- 顧客ビジネスに影響を与える動向/混乱

- ビジネスモデル

- 規制状況

- 主な利害関係者と購入基準

- 2025年の主な会議とイベント

- 投資と資金調達のシナリオ

- テクノロジーロードマップ

- AI/生成AIがSOCaaS市場に与える影響

第6章 SOCaaS(SOC-as-a-Service)市場、脅威タイプ別

- イントロダクション

- 高度な持続的脅威

- 内部の脅威

- DDoS攻撃

- マルウェアとランサムウェア

- フィッシングとソーシャルエンジニアリング攻撃

- その他

第7章 SOCaaS(SOC-as-a-Service)市場、サービスタイプ別

- イントロダクション

- マネージドSIEMとログ管理

- 脆弱性スキャンと評価

- 脅威の検出と修復

- インシデント対応サービス

- ガバナンス、リスク、コンプライアンス

第8章 SOCaaS(SOC-as-a-Service)市場、オファリング別

- イントロダクション

- 完全管理

- 共同管理

第9章 SOCaaS(SOC-as-a-Service)市場、組織規模別

- イントロダクション

- 中小企業

- 大企業

第10章 SOCaaS(SOC-as-a-Service)市場、セキュリティタイプ別

- イントロダクション

- ネットワークセキュリティ

- クラウドセキュリティ

- エンドポイントセキュリティ

- アプリケーションセキュリティ

第11章 SOCaaS(SOC-as-a-Service)市場、セクター別

- イントロダクション

- 公共部門

- 民間部門

第12章 SOCaaS(SOC-as-a-Service)市場、業界別

- イントロダクション

- 銀行、金融サービス、保険(BFSI)

- ヘルスケア

- 政府

- 製造

- エネルギー・ユーティリティ

- IT・ITES

- 通信

- 輸送・物流

- その他

第13章 SOCaaS(SOC-as-a-Service)市場、地域別

- イントロダクション

- 北米

- 北米:SOCaaS(SOC-as-a-Service)市場促進要因

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:SOCaaS(SOC-as-a-Service)市場促進要因

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- オランダ

- その他

- アジア太平洋

- アジア太平洋:SOCaaS(SOC-as-a-Service)市場促進要因

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- シンガポール

- オーストラリアとニュージーランド

- その他

- 中東・アフリカ

- 中東・アフリカ:SOCaaS(SOC-as-a-Service)市場促進要因

- 中東・アフリカ:マクロ経済見通し

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカ:SOCaaS(SOC-as-a-Service)市場促進要因

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第14章 競合情勢

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2020年~2024年

- 企業価値評価と財務指標

- 市場シェア分析、2024年

- 製品/ブランド比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第15章 企業プロファイル

- イントロダクション

- 主要参入企業

- THALES

- AIRBUS CYBERSECURITY

- NTT DATA

- LUMEN TECHNOLOGIES

- FORTINET

- VERIZON

- CLOUDFLARE

- CHECK POINT

- KASEYA

- TRUSTWAVE

- ARCTIC WOLF NETWORKS

- PROFICIO

- LRQA

- INSPIRISYS

- CONNECTWISE

- TECEZE

- CLOUD4C

- INFOPULSE

- その他の企業

- ESENTIRE

- CLEARNETWORK

- CYBERSECOP

- FORESITE CYBERSECURITY

- STATOSPHERE NETWORKS

- ESEC FORTE

- CYBERSAFE SOLUTIONS

- 10XDS

- CISO GLOBAL

- ACE CLOUD HOSTING

- PLUSSERVER

- SAFEAEON

- SOCWISE

- INSOC(ENHANCED.IO)

- WIZARD CYBER

- EVENTUS SECURITY

- CYBER SECURITY HIVE

- SATTRIX INFORMATION SECURITY

- ALERT LOGIC

- SYSCOM GLOBAL SOLUTIONS

- SOURCEPASS

- ONTINUE

- AIUKEN CYBERSECURITY

- DIGISOC

第16章 隣接市場

第17章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 SOC-AS-A-SERVICE MARKET: RESEARCH ASSUMPTIONS

- TABLE 4 SOC-AS-A-SERVICE MARKET: RESEARCH LIMITATIONS

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 PORTER'S FIVE FORCES IMPACT ON SOC-AS-A-SERVICE MARKET

- TABLE 7 AVERAGE SELLING PRICE OF PRODUCTS, BY SECURITY TYPE (2024)

- TABLE 8 INDICATIVE PRICING ANALYSIS OF PRODUCTS, BY SERVICE (2024)

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 14 KEY BUYING CRITERIA ON TOP THREE VERTICALS

- TABLE 15 SOC-AS-A-SERVICE MARKET: LIST OF CONFERENCES AND EVENTS, 2025

- TABLE 16 TECHNOLOGY ROADMAP

- TABLE 17 SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 18 SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 19 MANAGED SIEM & LOG MANAGEMENT: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 20 MANAGED SIEM & LOG MANAGEMENT: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 21 VULNERABILITY SCANNING & ASSESSMENT: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 22 VULNERABILITY SCANNING & ASSESSMENT: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 23 THREAT DETECTION & REMEDIATION: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 24 THREAT DETECTION & REMEDIATION: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 25 INCIDENT RESPONSE SERVICES: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 26 INCIDENT RESPONSE SERVICES: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 27 GOVERNANCE, RISK, & COMPLIANCE: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 28 GOVERNANCE, RISK, & COMPLIANCE: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 29 SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 30 SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 31 FULLY MANAGED: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 32 FULLY MANAGED: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 33 CO-MANAGED: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 34 CO-MANAGED: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 35 SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 36 SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 37 SMALL AND MEDIUM-SIZED ENTERPRISES: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 38 SMALL AND MEDIUM-SIZED ENTERPRISES: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 39 LARGE ENTERPRISES: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 40 LARGE ENTERPRISES: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 41 SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

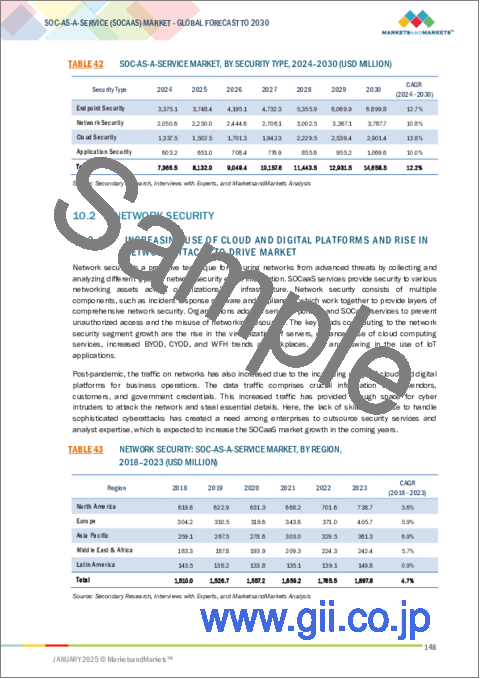

- TABLE 42 SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 43 NETWORK SECURITY: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 44 NETWORK SECURITY: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 45 CLOUD SECURITY: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 46 CLOUD SECURITY: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 47 ENDPOINT SECURITY: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 48 ENDPOINT SECURITY: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 49 APPLICATION SECURITY: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 50 APPLICATION SECURITY: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 51 SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 52 SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 53 PUBLIC SECTOR: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 54 PUBLIC SECTOR: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 55 PRIVATE SECTOR: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 56 PRIVATE SECTOR: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 57 SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 58 SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 59 BFSI: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 60 BFSI: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 61 HEALTHCARE: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 62 HEALTHCARE: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 63 GOVERNMENT: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 64 GOVERNMENT: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 65 MANUFACTURING: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 66 MANUFACTURING: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 67 ENERGY & UTILITIES: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 68 ENERGY & UTILITIES: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 69 IT & ITES: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 70 IT & ITES: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 71 TELECOMMUNICATIONS: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 72 TELECOMMUNICATIONS: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 73 TRANSPORTATION & LOGISTICS: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 74 TRANSPORTATION & LOGISTICS: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 75 SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 76 SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 78 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 88 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 90 NORTH AMERICA: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 91 US: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 92 US: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 93 US: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 94 US: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 95 US: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 96 US: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 97 US: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 98 US: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 99 US: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 100 US: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 101 US: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 102 US: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 103 CANADA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 104 CANADA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 105 CANADA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 106 CANADA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 107 CANADA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 108 CANADA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 109 CANADA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 110 CANADA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 111 CANADA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 112 CANADA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 113 CANADA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 114 CANADA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 115 EUROPE: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 116 EUROPE: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 117 EUROPE: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 118 EUROPE: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 119 EUROPE: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 120 EUROPE: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 121 EUROPE: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 122 EUROPE: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 123 EUROPE: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 124 EUROPE: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 125 EUROPE: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 126 EUROPE: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 127 EUROPE: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 128 EUROPE: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 129 UK: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 130 UK: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 131 UK: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 132 UK: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 133 UK: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 134 UK: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 135 UK: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 136 UK: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 137 UK: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 138 UK: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 139 UK: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 140 UK: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 141 GERMANY: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 142 GERMANY: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 143 GERMANY: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 144 GERMANY: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 145 GERMANY: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 146 GERMANY: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 147 GERMANY: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 148 GERMANY: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 149 GERMANY: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 150 GERMANY: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 151 GERMANY: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 152 GERMANY: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 153 FRANCE: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 154 FRANCE: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 155 FRANCE: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 156 FRANCE: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 157 FRANCE: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 158 FRANCE: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 159 FRANCE: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 160 FRANCE: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 161 FRANCE: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 162 FRANCE: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 163 FRANCE: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 164 FRANCE: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 165 ITALY: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 166 ITALY: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 167 ITALY: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 168 ITALY: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 169 ITALY: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 170 ITALY: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 171 ITALY: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 172 ITALY: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 173 ITALY: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 174 ITALY: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 175 ITALY: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 176 ITALY: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 177 SPAIN: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 178 SPAIN: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 179 SPAIN: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 180 SPAIN: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 181 SPAIN: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 182 SPAIN: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 183 SPAIN: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 184 SPAIN: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 185 SPAIN: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 186 SPAIN: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 187 SPAIN: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 188 SPAIN: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 189 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 190 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 191 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 192 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 193 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 194 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 195 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 196 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 197 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 198 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 199 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 200 NETHERLANDS: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 201 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 202 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 203 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 204 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 205 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 206 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 207 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 208 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 209 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 210 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 211 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 212 REST OF EUROPE: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 214 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 216 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 217 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 218 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 219 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 220 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 221 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 222 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 223 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 224 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 225 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 226 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 227 CHINA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 228 CHINA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 229 CHINA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 230 CHINA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 231 CHINA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 232 CHINA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 233 CHINA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 234 CHINA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 235 CHINA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 236 CHINA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 237 CHINA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 238 CHINA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 239 JAPAN: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 240 JAPAN: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 241 JAPAN: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 242 JAPAN: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 243 JAPAN: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 244 JAPAN: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 245 JAPAN: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 246 JAPAN: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 247 JAPAN: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 248 JAPAN: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 249 JAPAN: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 250 JAPAN: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 251 INDIA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 252 INDIA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 253 INDIA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 254 INDIA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 255 INDIA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 256 INDIA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 257 INDIA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 258 INDIA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 259 INDIA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 260 INDIA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 261 INDIA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 262 INDIA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 263 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 264 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 265 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 266 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 267 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 268 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 269 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 270 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 271 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 272 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 273 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 274 SINGAPORE: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 275 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 276 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 277 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 278 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 279 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 280 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 281 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 282 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 283 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 284 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 285 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 286 AUSTRALIA AND NEW ZEALAND: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 287 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 288 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 289 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 290 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 291 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 292 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 293 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 294 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 295 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 296 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 297 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 298 REST OF ASIA PACIFIC: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 300 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 302 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 303 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 304 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 305 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 306 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 308 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 312 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 313 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 314 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 315 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 316 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 317 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 318 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 319 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 320 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 321 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 322 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 323 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 324 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 325 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 326 MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 327 GCC: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 328 GCC: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 329 GCC: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 330 GCC: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 331 GCC: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 332 GCC: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 333 GCC: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 334 GCC: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 335 GCC: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 336 GCC: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 337 GCC: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 338 GCC: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 339 GCC: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 340 GCC: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 341 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 342 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 343 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 344 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 345 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 346 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 347 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 348 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 349 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 350 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 351 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 352 REST OF MIDDLE EAST: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 353 AFRICA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 354 AFRICA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 355 AFRICA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 356 AFRICA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 357 AFRICA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 358 AFRICA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 359 AFRICA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 360 AFRICA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 361 AFRICA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 362 AFRICA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 363 AFRICA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 364 AFRICA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 365 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 366 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 367 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 368 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 369 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 370 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 371 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 372 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 373 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 374 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 375 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 376 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 377 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 378 LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 379 BRAZIL: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 380 BRAZIL: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 381 BRAZIL: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 382 BRAZIL: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 383 BRAZIL: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 384 BRAZIL: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 385 BRAZIL: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 386 BRAZIL: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 387 BRAZIL: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 388 BRAZIL: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 389 BRAZIL: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 390 BRAZIL: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 391 MEXICO: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 392 MEXICO: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 393 MEXICO: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 394 MEXICO: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 395 MEXICO: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 396 MEXICO: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 397 MEXICO: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 398 MEXICO: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 399 MEXICO: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 400 MEXICO: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 401 MEXICO: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 402 MEXICO: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 403 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 404 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 405 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 406 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 407 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 408 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 409 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 410 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024-2030 (USD MILLION)

- TABLE 411 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2018-2023 (USD MILLION)

- TABLE 412 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024-2030 (USD MILLION)

- TABLE 413 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 414 REST OF LATIN AMERICA: SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 415 OVERVIEW OF STRATEGIES ADOPTED BY KEY SOCAAS VENDORS, 2020-2024

- TABLE 416 SOC-AS-A-SERVICE MARKET: DEGREE OF COMPETITION

- TABLE 417 SOC-AS-A-SERVICE MARKET: REGION FOOTPRINT

- TABLE 418 SOC-AS-A-SERVICE MARKET: SERVICE TYPE FOOTPRINT

- TABLE 419 SOC-AS-A-SERVICE MARKET: OFFERING FOOTPRINT

- TABLE 420 SOC-AS-A-SERVICE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 421 SOC-AS-A-SERVICE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 422 SOC-AS-A-SERVICE MARKET: REGION FOOTPRINT OF KEY STARTUPS/SMES

- TABLE 423 SOC-AS-A-SERVICE MARKET: VERTICAL FOOTPRINT OF KEY STARTUPS/SMES

- TABLE 424 SOC-AS-A-SERVICE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-DECEMBER 2024

- TABLE 425 SOC-AS-A-SERVICE MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 426 THALES: COMPANY OVERVIEW

- TABLE 427 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 428 THALES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 429 THALES: DEALS

- TABLE 430 AIRBUS CYBERSECURITY: COMPANY OVERVIEW

- TABLE 431 AIRBUS CYBERSECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 432 AIRBUS CYBERSECURITY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 433 AIRBUS CYBERSECURITY: DEALS

- TABLE 434 NTT DATA: COMPANY OVERVIEW

- TABLE 435 NTT DATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 436 NTT DATA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 437 NTT DATA: DEALS

- TABLE 438 LUMEN TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 439 LUMEN TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 440 LUMEN TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 441 LUMEN TECHNOLOGIES: DEALS

- TABLE 442 FORTINET: COMPANY OVERVIEW

- TABLE 443 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 444 FORTINET: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 445 FORTINET: DEALS

- TABLE 446 VERIZON: COMPANY OVERVIEW

- TABLE 447 VERIZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 448 VERIZON: DEALS

- TABLE 449 CLOUDFLARE: COMPANY OVERVIEW

- TABLE 450 CLOUDFLARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 451 CLOUDFLARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 452 CLOUDFLARE: DEALS

- TABLE 453 CHECK POINT: COMPANY OVERVIEW

- TABLE 454 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 455 CHECK POINT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 456 CHECK POINT: DEALS

- TABLE 457 KASEYA: COMPANY OVERVIEW

- TABLE 458 KASEYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 459 KASEYA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 460 KASEYA: DEALS

- TABLE 461 TRUSTWAVE: COMPANY OVERVIEW

- TABLE 462 TRUSTWAVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 463 TRUSTWAVE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 464 TRUSTWAVE: DEALS

- TABLE 465 ARCTIC WOLF NETWORKS: COMPANY OVERVIEW

- TABLE 466 ARCTIC WOLF NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 467 ARCTIC WOLF NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 468 ARCTIC WOLF NETWORKS: DEALS

- TABLE 469 PROFICIO: COMPANY OVERVIEW

- TABLE 470 PROFICIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 471 PROFICIO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 472 PROFICIO: DEALS

- TABLE 473 LRQA: COMPANY OVERVIEW

- TABLE 474 LRQA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 475 INSPIRISYS: COMPANY OVERVIEW

- TABLE 476 INSPIRISYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 477 CONNECTWISE: COMPANY OVERVIEW

- TABLE 478 CONNECTWISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 479 CONNECTWISE: PRODUCT ENHANCEMENTS AND ENHANCEMENTS

- TABLE 480 CONNECTWISE: DEALS

- TABLE 481 TECEZE: COMPANY OVERVIEW

- TABLE 482 TECEZE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 483 CLOUD4C: COMPANY OVERVIEW

- TABLE 484 CLOUD4C: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 485 INFOPULSE: COMPANY OVERVIEW

- TABLE 486 INFOPULSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 487 ADJACENT MARKETS AND FORECASTS

- TABLE 488 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 489 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 490 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 491 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 492 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 493 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 494 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 495 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 496 MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 497 MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 498 MANAGED SECURITY SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 499 MANAGED SECURITY SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 500 MANAGED SECURITY SERVICES MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 501 MANAGED SECURITY SERVICES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 502 MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 503 MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 504 MANAGED SECURITY SERVICES MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 505 MANAGED SECURITY SERVICES MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 506 MANAGED SECURITY SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 507 MANAGED SECURITY SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 508 MANAGED SECURITY SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 509 MANAGED SECURITY SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 510 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

- TABLE 511 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

- TABLE 512 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2025 (USD MILLION)

- TABLE 513 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2025 (USD MILLION)

- TABLE 514 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY VERTICAL, 2018-2025 (USD MILLION)

- TABLE 515 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY REGION, 2018-2025 (USD MILLION)

List of Figures

- FIGURE 1 SOC-AS-A-SERVICE MARKET: RESEARCH DESIGN

- FIGURE 2 SOC-AS-A-SERVICE MARKET: DATA TRIANGULATION

- FIGURE 3 SOC-AS-A-SERVICE MARKET: TOP-DOWN APPROACH

- FIGURE 4 SOC-AS-A-SERVICE MARKET: BOTTOM-UP APPROACH

- FIGURE 5 APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOC-AS-A-SERVICE VENDORS

- FIGURE 6 APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 7 SOC-AS-A-SERVICE MARKET ESTIMATION: RESEARCH FLOW

- FIGURE 8 APPROACH 2 - BOTTOM-UP (DEMAND SIDE): PRODUCTS/ SOLUTIONS/SERVICES

- FIGURE 9 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- FIGURE 10 COMPANY EVALUATION QUADRANT (STARTUPS): CRITERIA WEIGHTAGE

- FIGURE 11 SOC-AS-A-SERVICE MARKET SIZE AND Y-O-Y GROWTH RATE, 2021-2030

- FIGURE 12 SEGMENTS WITH SIGNIFICANT MARKET SHARE AND GROWTH RATE

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 14 RISING OCCURRENCE OF CYBERATTACKS AND RAPID TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

- FIGURE 15 MANAGED SIEM & LOG MANAGEMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 CO-MANAGED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 LARGE ENTERPRISES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 ENDPOINT SECURITY SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 19 PRIVATE SECTOR SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 20 BFSI SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 22 SOC-AS-A-SERVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 EVOLUTION OF SECURITY OPERATIONS CENTER

- FIGURE 24 SECURITY OPERATIONS CENTER AS A SERVICE FRAMEWORK

- FIGURE 25 SOC-AS-A-SERVICE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 SOC-AS-A-SERVICE MARKET ECOSYSTEM

- FIGURE 27 SOC-AS-A-SERVICE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 SOC-AS-A-SERVICE MARKET: AVERAGE SELLING PRICE OF PRODUCTS, BY SECURITY TYPE (2024)

- FIGURE 29 LIST OF MAJOR PATENTS FOR SOC-AS-A-SERVICE (SOCAAS)

- FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED FOR SOC-AS-A-SERVICE, 2014-2024

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 33 KEY BUYING CRITERIA ON TOP THREE VERTICALS

- FIGURE 34 LEADING STARTUPS/SMES, BY FUNDING METRICS (TOTAL FUNDING AMOUNT, NUMBER OF INVESTORS, AND FUNDING ROUNDS)

- FIGURE 35 POTENTIAL OF GENERATIVE AI IN ENHANCING SOC-AS-A-SERVICE ACROSS INDUSTRIES

- FIGURE 36 IMPACT OF GENERATIVE AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- FIGURE 37 THREAT DETECTION & REMEDIATION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 CO-MANAGED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 39 SMES SEGMENT TO REGISTER HIGHER CAGR THAN LARGE ENTERPRISES SEGMENT DURING FORECAST PERIOD

- FIGURE 40 CLOUD SECURITY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 PRIVATE SECTOR SEGMENT TO REGISTER HIGHER CAGR THAN PUBLIC SECTOR SEGMENT DURING FORECAST PERIOD

- FIGURE 42 HEALTHCARE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: SOC-AS-A-SERVICE MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET SNAPSHOT

- FIGURE 46 SOC-AS-A-SERVICE MARKET: REVENUE ANALYSIS OF FIVE KEY VENDORS, 2020-2024

- FIGURE 47 COMPANY VALUATION OF KEY SOCAAS VENDORS, 2024

- FIGURE 48 FINANCIAL METRICS OF KEY SOCAAS VENDORS, 2025

- FIGURE 49 SHARE ANALYSIS FOR SOC-AS-A-SERVICE MARKET, 2024

- FIGURE 50 SOC-AS-A-SERVICE MARKET: COMPARISON OF VENDOR BRANDS

- FIGURE 51 SOC-AS-A-SERVICE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 SOC-AS-A-SERVICE MARKET: COMPANY FOOTPRINT

- FIGURE 53 SOC-AS-A-SERVICE MARKET: STARTUP/SME EVALUATION QUADRANT (2024)

- FIGURE 54 THALES: COMPANY SNAPSHOT

- FIGURE 55 LUMEN TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 56 FORTINET: COMPANY SNAPSHOT

- FIGURE 57 VERIZON: COMPANY SNAPSHOT

- FIGURE 58 CLOUDFLARE: COMPANY SNAPSHOT

- FIGURE 59 CHECK POINT: COMPANY SNAPSHOT

- FIGURE 60 INSPIRISYS: COMPANY SNAPSHOT

The global SOCaaS market size is estimated to grow from USD 7.37 Billion in 2024 to USD 14.66 Billion by 2030 at a compound annual growth rate (CAGR) of 12.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | USD (Billion) |

| Segments | By Service Type, Offering, Security Type, Organization Size, Sector, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

The growing demand for robust, scalable, and cost-effective solutions to address vulnerabilities, identify threats, and respond to crises is propelling the SOC as a Service (SOCaaS) industry. The increased digitization of enterprises, the proliferation of cloud-based platforms, and the increasing complexity of cyberattacks have all fueled demand for sophisticated SOCaaS solutions. Challenges such as high implementation costs, integration complexities, and a shortage of skilled cybersecurity professionals are being mitigated by tailored services, automated tools, and ongoing innovations in managed security solutions. A heightened focus on threat visibility, regulatory compliance, and real-time monitoring ensures that organizations can maintain secure, efficient, and resilient security operations in an increasingly complex cyber threat landscape.

By sector, private sector accounts for a larger market size during the forecast period

The private sector segment is expected to hold the largest market size in SOCaaS market during the forecast period. This is because of the increased adoption of digital transformation programs and the sophistication of cyber threats targeting private organizations. Cyberattacks are particularly prevalent in industries such as BFSI, IT & ITeS, and telecoms, necessitating the provision of effective threat detection, response, and remediation services. Furthermore, the need to comply with regulatory standards, secure sensitive customer data, and preserve business continuity in the face of rising cyber dangers is driving private enterprises to spend extensively in SOCaaS solutions.

By region, Asia-Pacific accounts for the highest CAGR during the forecast period.

Major drivers in Asia-Pacific region in SOCaaS market are the rapid digital transformation across industries, increased adoption of cloud technologies, and a growing emphasis on cybersecurity in emerging economies such as India, China, and Southeast Asian countries. The rise in complex cyber threats, along with a dearth of in-house cybersecurity experience, is pushing firms to embrace SOCaaS solutions. Furthermore, favorable government policies and programs boosting cybersecurity awareness, as well as investments in smart city projects and digital infrastructure, are driving the region's strong market growth.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 -35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level Executives - 40% and Managerial & Other Levels - 60%

- By Region: North America - 20%, Europe - 35%, Asia Pacific - 45%

Major vendors in the SOCaaS market include Thales (France), Airbus Cybersecurity (France), NTT (Japan), Lumen Technologies (US), Fortinet (US), Cloudflare (US), Check Point (US), Kaseya (US), Trustwave (US), Arctic Wolf Networks (US), Proficio (US), LRQA (UK), Inspirisys (India), Eventus Security (India), Cyber Security Hive (India), eSentire (Canada), Clearnetwork (US), CyberSecOp (US), Foresite Cybersecurity (US), Stratosphere Networks (US), eSec Forte (India), Cybersafe Solutions (US), 10xDS (India), CISO Global (US), Ace Cloud Hosting (US), plusserver (Germany), SafeAeon (US), SOCWISE (Hungary), inSOC (Enhanced.io) (UK), Wizard Cyber (UK), Eventus Security (India), and Cyber Security Hive (India).

The study includes an in-depth competitive analysis of the key players in the supply chain security market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the SOCaaS market by service type, offering, security type, organization size, sector, vertical, and region.

It forecasts its size by Service type (Managed SIEM & Log Management, Vulnerability Scanning & Assessment, Threat Detection & Remediation, Incident Response, and GRC) Offering (Fully Managed and Co-managed), By Security type (Endpoint Security, Network Security, Cloud Security, and Application Security), By Organization Size (SMEs and Large Enterprises), By Sector (Public Sector and Private Sector), By Vertical (BFSI, Healthcare, Government, Manufacturing, Energy & Utilities, IT & ITeS, Telecommunications, Transportation & Logistics, and Other verticals), By Region ( North America, Europe, Asia Pacific, Middle East and Africa, Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the SOCaaS market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, such as (Escalating complexity and frequency of cyberattacks, Shortage of cybersecurity talent and expertise, Rapid technological advancements and growing trends of BYOD, CYOD, and WFH, Simplifying complex threat response processes, Increasing prevalence of customizable security solutions); Restraints (Integration complexity with compatibility and interoperability issues, Cost constraints); Opportunities (Rising adoption of cloud-based solutions among SMEs, Implementation of AI, ML, and blockchain technologies for cyber defense advancements, Expanding integration with extended detection and response (XDR) platforms) and Challenges (Data privacy and regulatory complexity, Limited customization and misalignment with business needs, Managing alert fatigue and false positives).

- Product Development/Innovation: Detailed insights on upcoming technologies, research development activities, new products, and service launches in the SOCaaS market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the SOCaaS market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the SOCaaS market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players including Thales (France), Airbus Cybersecurity (France), NTT (Japan), Lumen Technologies (US), Fortinet (US), Cloudflare (US), Check Point (US), Kaseya (US), Trustwave (US), Arctic Wolf Networks (US), Proficio (US), LRQA (UK), Inspirisys (India), Eventus Security (India), and Cyber Security Hive (India), among others, in the SOCaaS market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primaries

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 COMPANY EVALUATION QUADRANT METHODOLOGY

- 2.5.1 FOR LARGE PLAYERS

- 2.5.2 FOR STARTUPS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN SOC-AS-A-SERVICE MARKET

- 4.2 SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE, 2024

- 4.3 SOC-AS-A-SERVICE MARKET, BY OFFERING, 2024

- 4.4 SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE, 2024

- 4.5 SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE, 2024

- 4.6 SOC-AS-A-SERVICE MARKET, BY SECTOR, 2024

- 4.7 SOC-AS-A-SERVICE MARKET, BY VERTICAL, 2024

- 4.8 MARKET INVESTMENT SCENARIO

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Escalating complexity and frequency of cyberattacks

- 5.2.1.2 Shortage of cybersecurity talent and expertise

- 5.2.1.3 Rapid technological advancements and growing trends of BYOD, CYOD, and WFH

- 5.2.1.4 Demand for simplifying complex threat response processes

- 5.2.1.5 Increasing prevalence of customizable security solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Integration complexity with compatibility and interoperability issues

- 5.2.2.2 Cost constraints

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising adoption of cloud-based solutions among SMEs

- 5.2.3.2 Implementation of AI, ML, and blockchain technologies for cyber defense advancements

- 5.2.3.3 Expanding integration with extended detection and response (XDR) platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 Data privacy and regulatory complexity

- 5.2.4.2 Limited customization and misalignment with business needs

- 5.2.4.3 Managing alert fatigue and false positives

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 VERIZON HELPED FUJIFILM ENHANCE GLOBAL CYBERSECURITY WITH ADVANCED SOC SERVICES

- 5.3.2 FORTINET HELPED GRAND VIEW UNIVERSITY STRENGTHEN CYBERSECURITY WITH SOCAAS AND MDR SERVICES

- 5.3.3 INSPIRA ENHANCED CYBERSECURITY WITH MODERNIZED SOC POWERED BY IBM QRADAR

- 5.3.4 CHILLISOFT AND ADVANTAGE EMPOWERED FIJI NATIONAL UNIVERSITY'S CYBERSECURITY WITH SOC-AS-A-SERVICE

- 5.3.5 CYBERSECOP HELPED MULTIPLE INDUSTRIES ENHANCE CYBER SECURITY WITH SOC-AS-A-SERVICE

- 5.4 HISTORICAL EVOLUTION

- 5.4.1 EARLY DAYS AND TRADITIONAL FOCUS

- 5.4.2 INTEGRATION OF COMPLIANCE AND TECHNOLOGY

- 5.4.3 GOLDEN PERIOD OF EVOLUTION

- 5.4.4 EMERGENCE OF MANAGED SECURITY SERVICES PROVIDERS (MSSPS)

- 5.4.5 RISE OF NEXT-GEN SOCS

- 5.4.6 THREAT INTELLIGENCE AND CLOUD SECURITY

- 5.4.7 POST-PANDEMIC CHALLENGES AND BEYOND

- 5.4.8 MODERN CYBER DEFENSE CENTERS

- 5.4.9 SERVICES OFFERED BY MODERN CYBER DEFENSE CENTERS

- 5.5 FRAMEWORK

- 5.5.1 BENEFITS OF SOC-AS-A-SERVICE

- 5.5.2 FEATURES OF SOC-AS-A-SERVICE MARKET FRAMEWORK

- 5.6 VALUE CHAIN ANALYSIS

- 5.6.1 ANALYZING OVERALL SECURITY ARCHITECTURE AND PLANNING STRATEGIES ACCORDINGLY

- 5.6.2 OFFERING

- 5.6.3 DISTRIBUTORS/RESELLERS/VARS

- 5.6.4 END-USER GROUPS

- 5.6.5 MONITORING OF ALL BUSINESS PROCESSES

- 5.6.6 INCIDENT RESPONSE

- 5.6.7 MEASURES FOR REMEDIATION

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE OF PRODUCTS, BY SECURITY TYPE

- 5.9.2 INDICATIVE PRICING ANALYSIS OF PRODUCTS, BY SERVICE

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 SIEM

- 5.10.1.2 SOAR

- 5.10.1.3 Extended detection and response (XDR)

- 5.10.1.4 Threat intelligence platforms

- 5.10.1.5 Network traffic analysis

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 IAM

- 5.10.2.2 Deception technology

- 5.10.2.3 ZTNA

- 5.10.2.4 SASE

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Blockchain technology

- 5.10.3.2 OT security

- 5.10.3.3 Quantum-safe cryptography

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.11.1 LIST OF MAJOR PATENTS

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 BUSINESS MODEL

- 5.13.1 CUSTOMERS

- 5.13.2 PRODUCTS AND SERVICES

- 5.13.3 PRICING

- 5.13.4 DISTRIBUTION CHANNELS

- 5.13.5 MARKETING & SALES

- 5.13.6 PARTNERSHIPS

- 5.13.7 OPERATIONS

- 5.13.8 PROFITABILITY

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1.1 Payment Card Industry Data Security Standard (PCI-DSS )

- 5.14.1.2 General Data Protection Regulation (GDPR)

- 5.14.1.3 Sarbanes-Oxley Act (SOX)

- 5.14.1.4 California Consumer Privacy Act (CCPA)

- 5.14.1.5 Gramm-Leach-Bliley Act of 1999 (GLBA)

- 5.14.1.6 Health Insurance Portability and Accountability Act (HIPAA)

- 5.14.1.7 International Organization for Standardization (ISO) Standard 27001

- 5.14.1.8 Federal Information Security Management Act (FISMA)

- 5.14.1.9 FFIEC Cybersecurity Assessment Tool

- 5.14.1.10 NIST Cybersecurity Framework

- 5.14.1.11 Information Technology Infrastructure Library (ITIL)

- 5.14.1.12 CSA STAR

- 5.14.2 REGULATIONS, BY REGION

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 KEY CONFERENCES AND EVENTS, 2025

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 TECHNOLOGY ROADMAP

- 5.19 IMPACT OF AI/GENERATIVE AI ON SOC-AS-A-SERVICE MARKET

- 5.19.1 GENERATIVE AI

- 5.19.2 TOP USE CASES AND MARKET POTENTIAL IN SOC-AS-A-SERVICE MARKET

- 5.19.2.1 Key use cases

- 5.19.3 IMPACT OF GENERATIVE AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.19.3.1 AI & ML

- 5.19.3.2 Blockchain

- 5.19.3.3 Extended detection and response (XDR)

- 5.19.3.4 Cloud

- 5.19.3.5 Endpoint detection and response (EDR)

- 5.19.3.6 Security Information and Event Management (SIEM)

6 SOC-AS-A-SERVICE MARKET, BY THREAT TYPE

- 6.1 INTRODUCTION

- 6.1.1 THREAT TYPE: SOC-AS-A-SERVICE MARKET DRIVERS

- 6.2 ADVANCED PERSISTENT THREATS

- 6.2.1 PERSISTENT THREATS AND EVOLVING CYBERATTACK TO DRIVE MARKET

- 6.3 INSIDER THREATS

- 6.3.1 RISING COMPLEXITY AND NEED FOR PROACTIVE DETECTION TO BOOST MARKET

- 6.4 DDOS ATTACKS

- 6.4.1 RISING THREAT COMPLEXITY AND DEMAND FOR PROACTIVE MITIGATION TO DRIVE MARKET

- 6.5 MALWARE & RANSOMWARE

- 6.5.1 INCREASING THREAT COMPLEXITY AND PROLIFERATION TO AUGMENT MARKET

- 6.6 PHISHING & SOCIAL ENGINEERING ATTACKS

- 6.6.1 SOPHISTICATION OF ATTACKS AND HUMAN VULNERABILITY TO PROPEL MARKET

- 6.7 OTHER THREAT TYPES

7 SOC-AS-A-SERVICE MARKET, BY SERVICE TYPE

- 7.1 INTRODUCTION

- 7.1.1 SERVICE TYPE: SOC-AS-A-SERVICE MARKET DRIVERS

- 7.2 MANAGED SIEM & LOG MANAGEMENT

- 7.2.1 NEED FOR PROACTIVE THREAT DETECTION AND REGULATORY COMPLIANCE TO PROPEL MARKET GROWTH

- 7.3 VULNERABILITY SCANNING & ASSESSMENT

- 7.3.1 DEMAND FOR PROACTIVE RISK MITIGATION AND COMPLIANCE ENABLEMENT TO DRIVE MARKET

- 7.4 THREAT DETECTION & REMEDIATION

- 7.4.1 DEMAND FOR ADVANCED AUTOMATION AND PROACTIVE SECURITY TO BOLSTER MARKET GROWTH

- 7.5 INCIDENT RESPONSE SERVICES

- 7.5.1 NEED FOR RAPID DETECTION AND PROACTIVE MITIGATION TO STRENGTHEN MARKET

- 7.6 GOVERNANCE, RISK, & COMPLIANCE

- 7.6.1 REQUIREMENT FOR ENHANCED COMPLIANCE AND PROACTIVE RISK MANAGEMENT TO FORTIFY MARKET

8 SOC-AS-A-SERVICE MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.1.1 OFFERING: SOC-AS-A-SERVICE MARKET DRIVERS

- 8.2 FULLY MANAGED

- 8.2.1 RISING DEMAND FOR CONVENIENCE ALONG WITH COST AND TIME EFFICIENCY TO DRIVE MARKET

- 8.3 CO-MANAGED

- 8.3.1 NEED FOR ADDRESSING PRIVACY AND SCALABILITY CONCERNS TO DRIVE MARKET

9 SOC-AS-A-SERVICE MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- 9.1.1 ORGANIZATION SIZE: SOC-AS-A-SERVICE MARKET DRIVERS

- 9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 9.2.1 COST BENEFITS AND HIGH-SECURITY RISKS TO FACTOR IN FOR SMES

- 9.3 LARGE ENTERPRISES

- 9.3.1 RAPID INCREASE IN BYOD/CYOD FOLLOWED BY RISE IN SECURITY ATTACKS TO DRIVE DEMAND

10 SOC-AS-A-SERVICE MARKET, BY SECURITY TYPE

- 10.1 INTRODUCTION

- 10.1.1 SECURITY TYPE: SOC-AS-A-SERVICE MARKET DRIVERS

- 10.2 NETWORK SECURITY

- 10.2.1 INCREASING USE OF CLOUD AND DIGITAL PLATFORMS AND RISE IN NETWORK ATTACKS TO DRIVE MARKET

- 10.3 CLOUD SECURITY

- 10.3.1 CONCERNS ABOUT SENSITIVE DATA STORAGE ON CLOUD TO DRIVE MARKET

- 10.4 ENDPOINT SECURITY

- 10.4.1 RISING NUMBER OF MOBILE DEVICES AND GROWTH IN BYOD/CYOD TREND TO DRIVE MARKET

- 10.5 APPLICATION SECURITY

- 10.5.1 GROWTH IN DIGITALIZATION AND BUSINESS-SENSITIVE APPLICATIONS TO DRIVE MARKET

11 SOC-AS-A-SERVICE MARKET, BY SECTOR

- 11.1 INTRODUCTION

- 11.1.1 SECTOR: SOC-AS-A-SERVICE MARKET DRIVERS

- 11.2 PUBLIC SECTOR

- 11.2.1 CRITICAL INFRASTRUCTURE MANAGEMENT AND STRINGENT REGULATIONS TO DRIVE MARKET

- 11.3 PRIVATE SECTOR

- 11.3.1 INCREASING CYBERATTACKS AND NEED TO PROTECT HUGE DATA TO DRIVE MARKET

12 SOC-AS-A-SERVICE MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.1.1 VERTICAL: SOC-AS-A-SERVICE MARKET DRIVERS

- 12.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 12.2.1 GROWTH IN SENSITIVE FINANCIAL DATA AND CYBERATTACKS TO FUEL MARKET

- 12.3 HEALTHCARE

- 12.3.1 CRITICAL NEED TO SAFEGUARD SENSITIVE PATIENT DATA AND ENSURE OPERATIONAL CONTINUITY TO STRENGTHEN MARKET

- 12.4 GOVERNMENT

- 12.4.1 NEED TO PROTECT CRITICAL INFRASTRUCTURE AND SENSITIVE DATA TO BOLSTER MARKET

- 12.5 MANUFACTURING

- 12.5.1 GROWING DEPENDENCE ON DIGITIZED OPERATIONS AND INTERCONNECTED SYSTEMS TO PROPEL MARKET

- 12.6 ENERGY & UTILITIES

- 12.6.1 INCREASING RELIANCE ON DIGITAL AND INTERCONNECTED SYSTEMS TO BOOST MARKET

- 12.7 IT & ITES

- 12.7.1 GROWING DEPENDENCE ON DIGITAL INFRASTRUCTURE AND TECHNOLOGY-DRIVEN OPERATIONS TO DRIVE MARKET

- 12.8 TELECOMMUNICATIONS

- 12.8.1 HEIGHTENED EXPOSURE OF CRITICAL INFRASTRUCTURE TO SOPHISTICATED CYBER THREATS TO DRIVE MARKET

- 12.9 TRANSPORTATION & LOGISTICS

- 12.9.1 INCREASING RELIANCE ON DIGITAL INFRASTRUCTURE AND GROWING CYBER THREATS TO SUPPLY CHAINS TO DRIVE MARKET

- 12.10 OTHERS

13 SOC-AS-A-SERVICE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: SOC-AS-A-SERVICE MARKET DRIVERS

- 13.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 13.2.3 US

- 13.2.3.1 Government initiatives and public-private partnerships to drive market

- 13.2.4 CANADA

- 13.2.4.1 Escalating cyber threats, increasing reliance on digital infrastructures, and government initiatives to propel market

- 13.3 EUROPE

- 13.3.1 EUROPE: SOC-AS-A-SERVICE MARKET DRIVERS

- 13.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 13.3.3 UK

- 13.3.3.1 Cost efficiency and expertise provided by managed SOC services to propel market

- 13.3.4 GERMANY

- 13.3.4.1 Advancements in cloud-native solutions and increased digitalization to boost market

- 13.3.5 FRANCE

- 13.3.5.1 Robust regulatory framework and increasing awareness of digital threats to bolster market

- 13.3.6 ITALY

- 13.3.6.1 Sustainability and digital innovation initiatives to strengthen market

- 13.3.7 SPAIN

- 13.3.7.1 Rising cyber threats, regulatory frameworks, and digitalization to fuel market

- 13.3.8 NETHERLANDS

- 13.3.8.1 Robust digital infrastructure, advanced cyber threats, and strategic investments to drive market

- 13.3.9 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: SOC-AS-A-SERVICE MARKET DRIVERS

- 13.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 13.4.3 CHINA

- 13.4.3.1 Rapid technological advancement and widespread cloud adoption to drive market

- 13.4.4 JAPAN

- 13.4.4.1 Technological advancement and rising cybersecurity breaches to enhance market

- 13.4.5 INDIA

- 13.4.5.1 Rapid cloud adoption and technological advancement to drive market

- 13.4.6 SINGAPORE

- 13.4.6.1 Escalating cyber threats amid rapid cloud adoption to drive market

- 13.4.7 AUSTRALIA AND NEW ZEALAND

- 13.4.7.1 AI, automation, and managed SOCs to fortify market

- 13.4.8 REST OF ASIA PACIFIC

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 MIDDLE EAST & AFRICA: SOC-AS-A-SERVICE MARKET DRIVERS

- 13.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 13.5.3 MIDDLE EAST

- 13.5.3.1 GCC

- 13.5.3.1.1 Increasing digitalization, rising cyber threats, and growing investments in cybersecurity infrastructure to fuel market

- 13.5.3.1.2 KSA

- 13.5.3.1.3 UAE

- 13.5.3.1.4 Qatar

- 13.5.3.1.5 Rest of GCC

- 13.5.3.2 Rest of Middle East

- 13.5.3.1 GCC

- 13.5.4 AFRICA

- 13.5.4.1 Widespread utilization of information and communication technology to boost market

- 13.6 LATIN AMERICA

- 13.6.1 LATIN AMERICA: SOC-AS-A-SERVICE MARKET DRIVERS

- 13.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 13.6.3 BRAZIL

- 13.6.3.1 Rising cyberattacks and increasing adoption of cloud technologies to drive market

- 13.6.4 MEXICO

- 13.6.4.1 Increasing digital transformation across industries and urgent need to combat escalating cyber threats to drive market

- 13.6.5 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE

- 14.1 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 14.2 REVENUE ANALYSIS, 2020-2024

- 14.3 COMPANY VALUATION AND FINANCIAL METRICS

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 PRODUCT/BRAND COMPARISON

- 14.5.1 THALES

- 14.5.2 NTT DATA

- 14.5.3 LUMEN TECHNOLOGIES

- 14.5.4 FORTINET

- 14.5.5 CLOUDFLARE

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Service type footprint

- 14.6.5.4 Offering footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMEs

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 COMPETITIVE SCENARIO

- 14.8.1 PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-DECEMBER 2024

- 14.8.2 DEALS, JANUARY 2021-DECEMBER 2024

15 COMPANY PROFILES

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS

- 15.2.1 THALES

- 15.2.1.1 Business overview

- 15.2.1.2 Products/Solutions/Services offered

- 15.2.1.3 Recent developments

- 15.2.1.3.1 Product launches and enhancements

- 15.2.1.3.2 Deals

- 15.2.1.4 MnM view

- 15.2.1.4.1 Right to win

- 15.2.1.4.2 Strategic choices

- 15.2.1.4.3 Weaknesses and competitive threats

- 15.2.2 AIRBUS CYBERSECURITY

- 15.2.2.1 Business overview

- 15.2.2.2 Products/Solutions/Services offered