|

|

市場調査レポート

商品コード

1410958

建設用粘着テープの世界市場 (~2028年):技術・樹脂タイプ・用途・エンドユーザー産業 (非住宅・住宅)・地域別Construction Adhesive Tapes Market by Technology, Resin Type, Application, End-Use Industry (Non-Residential, Residential), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 建設用粘着テープの世界市場 (~2028年):技術・樹脂タイプ・用途・エンドユーザー産業 (非住宅・住宅)・地域別 |

|

出版日: 2024年01月15日

発行: MarketsandMarkets

ページ情報: 英文 258 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル)・数量 (平方メートル) |

| セグメント | 技術・樹脂タイプ・用途・エンドユーザー産業・地域 |

| 対象地域 | 欧州・北米・アジア太平洋・中東&アフリカ・南米 |

世界の建設用粘着テープの市場規模は、2023年の27億米ドルから、予測期間中は5.7%のCAGRで推移し、2028年には36億米ドルの規模に成長すると予測されています。

建築や建設に関連する活動が依然としてこの需要増加の主な原動力となっています。その用途の多さから、粘着テープはさまざまな建築作業においてますます重要性を増しています。このような需要の高まりは、効果的な粘着ソリューションへの要求だけでなく、耐久性やより迅速な施工への要望によってもたらされています。また、独創的な建築工法や材料の開発も、テープの必要性を高めています。構造的完全性を向上させ、ダウンタイムを最小限に抑え、厳格な品質要件を満たすために絶えず努力しているため、予測期間中も世界のインフラ、商業施設、住宅開発プロジェクトで建設用粘着テープの使用が大幅に増加すると予想されています。

用途別では、床張りの部門が2022年の市場をリードしました。プレフィニッシュパネル、セラミックタイル、カウンタートップラミネート、特殊フローリング下地材など、斬新な床素材や工法の開発は、この需要増加と密接に関連しています。床張り用途では、粘着テープは正確で効果的、かつ長持ちする粘着ソリューションを提供し、品質を犠牲にすることなく速硬化材料を求める業界のニーズに応えています。床張り用途での需要が最も高いのは、構造的完全性を向上させ、施工時間を短縮し、長持ちする性能を保証する能力の結果であり、住宅、商業、工業の各分野で、現代の床施工に不可欠なツールとして位置づけられています。

樹脂タイプ別では、アクリル樹脂の部門が予測期間中に最も高い成長率を示す見通しです。アクリル樹脂の粘着テープは、その優れた性能と幅広い用途により、ますます人気が高まっています。卓越した粘着力、耐候性、耐薬品性、耐溶剤性など、さまざまな特長がその普及に貢献しています。生来の適応性の高さから、さまざまな建設用途に最適な選択肢となっています。さらに、硬化時間が早く、使い方が簡単なため、特に効果や反応の速さが重要な場面での利用が加速しています。

地域別では、アジア太平洋地域が建設用粘着テープの需要拡大の中心的な市場となっており、さまざまな産業でその使用と採用が大幅に増加しています。このような需要の増加は、同地域の開発・建設活動の急速な拡大やインフラプロジェクトの拡大が主な要因となっています。都市化の進展、所得の増加、公共インフラ支援を目的とした政府プログラムが、中国、インドネシア、インドなどの新興経済圏における建設プロジェクトを後押ししています。さらに、この地域の堅調な建設情勢は、安価な労働力、豊富な資源、外国投資の利用可能性によってさらに強化されており、信頼性の高い粘着剤ソリューションの需要を高めています。

当レポートでは、世界の建設用粘着テープの市場を調査し、市場概要、市場影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向とディスラプション

- 価格分析

- 平均販売価格:エンドユーザー産業別

- 平均販売価格:地域別

- エコシステム分析

- 技術分析

- 特許分析

- バリューチェーン分析

- ケーススタディ分析

- 貿易分析

- 関税と規制状況

- 主な会議とイベント

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 建設用粘着テープ市場:技術別

- ホットメルト建設用粘着テープ

- 溶剤系建設用粘着テープ

第7章 建設用粘着テープ市場:樹脂タイプ別

- アクリル系建設用粘着テープ

- ゴム系建設用粘着テープ

- その他

第8章 建設用粘着テープ市場:用途別

- 床張り

- 屋根

- 窓・ドア

- 壁

- 空調設備・断熱材

- その他

第9章 建設用粘着テープ市場:エンドユーザー産業別

- 住宅

- 非住宅

- その他

第10章 建設用粘着テープ市場:地域別

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

- 南米

第11章 競合情勢

- 主要企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- 企業のフットプリント

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ・動向

第12章 企業プロファイル

- 主要企業

- 3M

- NITTO DENKO CORPORATION

- TESA SE

- SCAPA GROUP LTD.

- SIKA AG

- INTERTAPE POLYMER GROUP

- BERRY GLOBAL INC.

- SHURTAPE TECHNOLOGIES, LLC

- MAPEI S.P.A.

- LOHMANN GMBH & CO. KG

- IDEAL TAPE

- SEAL FOR LIFE

- NICHIBAN CO., LTD.

- ADVANCE TAPES INTERNATIONAL

- CARLISLE COMPANIES INC.

- その他の企業

- HICUBE COATING

- POLYGUARD PRODUCTS, INC.

- DENSO-HOLDING GMBH & CO.

- BOSTIK SA

- ARDEX GMBH

- FRANKLIN INTERNATIONAL

- AVERY DENNISON

- LATICRETE INTERNATIONAL

- TERRACO

- SAINT-GOBAIN WEBER

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million), Volume (Million Square Meter) |

| Segments | Technology, Resin Type, Application, End-use Industry, and Region |

| Regions covered | Europe, North America, APAC, MEA, and South America |

The market for construction adhesive tapes, which was estimated to be worth USD 2.7 billion in 2023, is anticipated to grow at a compound annual growth rate (CAGR) of 5.7% to reach USD 3.6 billion by 2028. The activities related to building and construction are still a major driving force behind this increased demand. Due to their many uses, these adhesive tapes are becoming more and more important in a variety of building tasks. This rising demand is driven by the requirement for effective bonding solutions as well as the desires for durability and speedier installation. The development of creative building methods and materials has also increased the need for these tapes. Constantly striving to improve structural integrity, minimize downtime, and satisfy strict quality requirements, the projected period expects a significant increase in the use of construction adhesive tapes in infrastructure, commercial, and residential development projects worldwide.

"Flooring is the largest application segment in terms volume and value."

In 2022, the market for construction adhesive tapes was dominated by the flooring application. The development of novel flooring materials and methods, including pre-finished panels, ceramic tiles, countertop lamination, and specialty flooring underlayment, is closely associated with this increase in demand. These developments have particularly affected the construction sector, where it is critical to have solutions that accelerate installation while minimizing downtime. In flooring applications, adhesive tapes provide accurate, effective, and long-lasting bonding solutions, meeting the industry's need for fast-setting materials without sacrificing quality. The highest demand for construction adhesive tapes in flooring applications is a result of their ability to improve structural integrity, reduce installation time, and guarantee long-lasting performance, positioning them as essential tools in contemporary flooring practices across residential, commercial, and industrial sectors.

"Acrylic resin segment is to witness the highest growth rate during the forecast period."

The substantial market trend reflecting increased usage and a strong compound annual growth rate (CAGR) is seen in the demand for acrylic resin-made construction adhesive tapes. Adhesive tapes made of acrylic resin are becoming more and more popular because of their outstanding performance qualities and wide range of applications. A variety of beneficial qualities, including remarkable adhesion, resilience to weathering, and remarkable chemical and solvent resistance, contribute to their widespread use. Because of their innate adaptability, they are the best option for a variety of construction applications. Moreover, their rapid curing times and simplicity of use have accelerated their use, particularly in situations where effectiveness and speed of response are crucial. Acrylic resin-based tapes have been steadily improving and evolving, which has greatly boosted their demand and excellent compound annual growth rate (CAGR) and established them as industry leaders in the construction adhesive tapes market.

"Solvent based construction adhesive tapes is to be the leading segment during the forecast period."

Solvent based technology is expected to be the largest segment of construction adhesive tapes market. The great demand for this technology can be ascribed to its track record of providing strong and dependable adhesive characteristics in a variety of building applications. Adhesive tapes with a solvent basis provide a very strong binding and can stick to a variety of surfaces, providing strong, long-lasting adhesion. Their adaptability and efficiency in a range of environmental settings add to their allure and make them useful in a variety of construction situations. Furthermore, the fact that they provide robust adherence on both porous and non-porous surfaces has increased their appeal in the market. Due to their proven performance and dependability in providing long-lasting adhesion in construction applications, solvent-based adhesive tapes continue to be in high demand even in the face of increased interest in alternative technologies.

"Residential end use industry to be the fastest growing segment in construction adhesive tapes market"

Residential end use sector is expected to grow with the highest CAGR during the forecasted period. The sector's diverse demands for building, renovation, and maintenance projects are the driving force behind this increase in demand. Adhesive tapes for construction are widely used in a variety of household chores, including wall coverings, flooring installations, tiling, thermal insulation, and numerous building applications. Innovative techniques, materials, and an emphasis on efficiency are driving the demand for high-performance adhesive solutions, which is driving the residential segment's fast compound annual growth rate (CAGR) in the adoption of these tapes. The residential segment is a major driver of the demand for construction adhesive tapes, contributing to the growth of urbanization and housing demands worldwide. This solidifies its position as the sector with the greatest compound annual growth rate (CAGR) in this market.

"Asia Pacific is the leading market for construction adhesive tapes."

The Asia Pacific region has become a focal point for the escalating demand for construction adhesive tapes, marking a significant surge in their usage and adoption across various industries. This increased demand is mostly being driven by the region's rapidly expanding development and construction activity as well as expanding infrastructure projects. Growing urbanization, rising incomes, and government programs aimed at supporting public infrastructure are driving construction projects in Asia Pacific's emerging economies, such as China, Indonesia, India, and others. Furthermore, the region's robust construction scene is further enhanced by the availability of inexpensive labor, plentiful resources, and foreign investments, which increases the demand for dependable adhesive solutions.

Breakdown of Profiles of Primary Interviews:

- By Company Type- Tier 1- 40%, Tier 2- 33%, and Tier 3- 27%

- By Designation- C Level- 50%, Director Level- 30%, and Others- 20%

- By Region- North America- 15%, Europe- 50%, Asia Pacific (APAC) - 20%, Latin America-10%, Middle East & Africa (MEA)-5%,

The report provides a comprehensive analysis of company profiles :

- 3M (US)

- Nitto Denko Corporation (Japan)

- Tesa SE (Germany)

- Scapa Group Ltd (UK)

- Intertape Polymer Group (Canada)

- Beery Global Inc. (US)

- Nichiban Co., Ltd. (Japan)

- Sika AG (Switzerland)

Research Coverage

This report covers the global construction adhesive tapes market by technology, by resin type, by application, by end-use industry, and Region. It aims at estimating the size and future growth potential of the market across various segments. The report also includes an in-depth competitive analysis of the key market players, along with their profiles and key growth strategies.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall construction adhesive tapes market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges influencing the growth of the construction adhesive tapes market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the construction adhesive tapes market

- Market Development: Comprehensive information about lucrative markets - the report analyses the construction adhesive tapes market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the construction adhesive tapes market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players in the construction adhesive tapes market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 CONSTRUCTION ADHESIVE TAPES MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 UNITS CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

- 1.9.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 CONSTRUCTION ADHESIVE TAPES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - top construction adhesive tape manufacturers

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.2 IMPACT OF RECESSION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 BASE NUMBER CALCULATION

- 2.4.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.4.2 APPROACH 2: DEMAND-SIDE APPROACH

- 2.5 MARKET FORECAST APPROACH

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 DATA TRIANGULATION

- FIGURE 5 CONSTRUCTION ADHESIVE TAPES MARKET: DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 ASSUMPTIONS

- 2.9 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

- FIGURE 6 SOLVENT-BASED TECHNOLOGY LED CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

- FIGURE 7 ACRYLIC RESIN SEGMENT DOMINATED CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

- FIGURE 8 FLOORING APPLICATION LED OVERALL CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

- FIGURE 9 RESIDENTIAL SEGMENT DOMINATED CONSTRUCTION ADHESIVE TAPES MARKET

- FIGURE 10 ASIA PACIFIC LED GLOBAL CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN GLOBAL CONSTRUCTION ADHESIVE TAPES MARKET

- FIGURE 11 SIGNIFICANT GROWTH EXPECTED IN CONSTRUCTION ADHESIVE TAPES MARKET BETWEEN 2023 AND 2028

- 4.2 CONSTRUCTION ADHESIVE TAPES MARKET, BY APPLICATION

- FIGURE 12 FLOORING APPLICATION ACCOUNTED FOR LARGEST SHARE IN 2022

- 4.3 CONSTRUCTION ADHESIVE TAPES MARKET, BY TECHNOLOGY AND REGION

- FIGURE 13 ASIA PACIFIC TO BE LARGEST CONSTRUCTION ADHESIVE TAPES MARKET

- 4.4 CONSTRUCTION ADHESIVE TAPES MARKET, BY RESIN TYPE

- FIGURE 14 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES SEGMENT DOMINATED MARKET IN 2022

- 4.5 CONSTRUCTION ADHESIVE TAPES MARKET, BY END-USE INDUSTRY

- FIGURE 15 RESIDENTIAL INDUSTRY DOMINATED CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

- 4.6 CONSTRUCTION ADHESIVE TAPES MARKET GROWTH, BY KEY COUNTRIES

- FIGURE 16 CHINA TO BE FASTEST-GROWING CONSTRUCTION ADHESIVE TAPES MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CONSTRUCTION ADHESIVE TAPES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in global construction industry

- TABLE 1 CONTRIBUTION TO GROWTH IN GLOBAL CONSTRUCTION OUTPUT, BY COUNTRY (2019-2030)

- 5.2.1.2 Increased demand in residential housing and infrastructure sectors

- 5.2.1.3 Versatility and ease of application

- 5.2.2 RESTRAINTS

- 5.2.2.1 Established infrastructure in developed countries

- 5.2.2.2 Volatility in price of raw materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand in emerging economies

- 5.2.3.2 Technological advancements and innovation

- 5.2.4 CHALLENGES

- 5.2.4.1 Changing regulations and environmental concerns

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 18 REVENUE SHIFT AND NEW REVENUE POCKETS IN CONSTRUCTION ADHESIVE TAPES MARKET

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE, BY APPLICATION (KEY PLAYERS)

- FIGURE 19 AVERAGE SELLING PRICE FOR TOP THREE APPLICATIONS, BY KEY PLAYERS (USD/SQUARE METER)

- 5.5 AVERAGE SELLING PRICE, BY END-USE INDUSTRY

- FIGURE 20 AVERAGE SELLING PRICE BASED ON END-USE INDUSTRY (USD/SQUARE METER)

- 5.6 AVERAGE SELLING PRICE, BY REGION

- TABLE 2 AVERAGE SELLING PRICE OF CONSTRUCTION ADHESIVE TAPES, BY REGION

- 5.7 ECOSYSTEM ANALYSIS: CONSTRUCTION ADHESIVE TAPES MARKET

- FIGURE 21 KEY PLAYERS IN CONSTRUCTION ADHESIVE TAPES MARKET ECOSYSTEM

- 5.7.1 RAW MATERIAL PROVIDERS

- 5.7.2 ADHESIVE TAPE MANUFACTURERS

- 5.7.3 DISTRIBUTORS

- 5.7.4 END USERS

- TABLE 3 CONSTRUCTION ADHESIVE TAPES MARKET: ROLE IN ECOSYSTEM

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 SOLVENT-BASED

- 5.8.2 HOT-MELT

- 5.9 PATENT ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 METHODOLOGY

- 5.9.3 DOCUMENT TYPE

- TABLE 4 CONSTRUCTION ADHESIVE TAPES MARKET: GLOBAL PATENTS

- FIGURE 22 GLOBAL PATENT PUBLICATION TREND ANALYSIS, 2013-2023

- 5.9.4 INSIGHTS

- 5.9.5 LEGAL STATUS OF PATENTS

- FIGURE 23 LEGAL STATUS OF PATENTS

- 5.9.6 JURISDICTION ANALYSIS

- FIGURE 24 GLOBAL JURISDICTION ANALYSIS, 2013-2023

- 5.9.7 TOP APPLICANT'S ANALYSIS

- FIGURE 25 3M REGISTERED HIGHEST NUMBER OF PATENTS

- 5.9.8 ACTIVE PATENTS BY 3M

- 5.9.9 ACTIVE PATENTS BY STATE GRID CORP. CHINA

- 5.9.10 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.10 VALUE CHAIN ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS: CONSTRUCTION ADHESIVE TAPES MARKET

- 5.11 CASE STUDY ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO OF ADHESIVE TAPES

- FIGURE 27 ADHESIVE TAPES EXPORT, BY KEY COUNTRIES, 2018-2022 (USD THOUSAND)

- TABLE 5 TOP 10 ADHESIVE TAPES EXPORTING COUNTRIES IN 2022

- 5.12.2 IMPORT SCENARIO OF ADHESIVE TAPES

- FIGURE 28 ADHESIVE TAPES IMPORT, BY KEY COUNTRIES, 2018-2022 (USD THOUSAND)

- TABLE 6 TOP 10 ADHESIVE TAPES IMPORTING COUNTRIES IN 2022

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REGULATIONS/STANDARDS FOR CONSTRUCTION ADHESIVE TAPES

- 5.14 KEY CONFERENCES AND EVENTS

- TABLE 12 CONSTRUCTION ADHESIVE TAPES MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 CONSTRUCTION ADHESIVE TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 BARGAINING POWER OF BUYERS

- 5.15.2 BARGAINING POWER OF SUPPLIERS

- 5.15.3 THREAT OF NEW ENTRANTS

- 5.15.4 THREAT OF SUBSTITUTES

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 13 CONSTRUCTION ADHESIVE TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.16.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 CONSTRUCTION ADHESIVE TAPES MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- FIGURE 32 SOLVENT-BASED TECHNOLOGY TO LEAD CONSTRUCTION ADHESIVE TAPES MARKET DURING FORECAST PERIOD

- TABLE 16 CONSTRUCTION ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 17 CONSTRUCTION ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2020-2022 (MILLION SQUARE METER)

- TABLE 18 CONSTRUCTION ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 19 CONSTRUCTION ADHESIVE TAPES MARKET, BY TECHNOLOGY, 2023-2028 (MILLION SQUARE METER)

- 6.2 HOT-MELT-BASED CONSTRUCTION ADHESIVE TAPES

- 6.2.1 LOW COST AND LOW ENVIRONMENTAL IMPACT TO BOOST DEMAND

- TABLE 20 HOT-MELT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 21 HOT-MELT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 22 HOT-MELT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 23 HOT-MELT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 6.3 SOLVENT-BASED CONSTRUCTION ADHESIVE TAPES

- 6.3.1 STRINGENT REGULATIONS ON VOC EMISSION LIMITING USE OF SOLVENT-BASED TECHNOLOGY

- TABLE 24 SOLVENT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 25 SOLVENT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 26 SOLVENT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 27 SOLVENT-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023-2028 (MILLION SQUARE METER)

7 CONSTRUCTION ADHESIVE TAPES MARKET, BY RESIN TYPE

- 7.1 INTRODUCTION

- FIGURE 33 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 28 CONSTRUCTION ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 29 CONSTRUCTION ADHESIVE TAPES MARKET, BY RESIN TYPE, 2020-2022 (MILLION SQUARE METER)

- TABLE 30 CONSTRUCTION ADHESIVE TAPES MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 31 CONSTRUCTION ADHESIVE TAPES MARKET, BY RESIN TYPE, 2023-2028 (MILLION SQUARE METER)

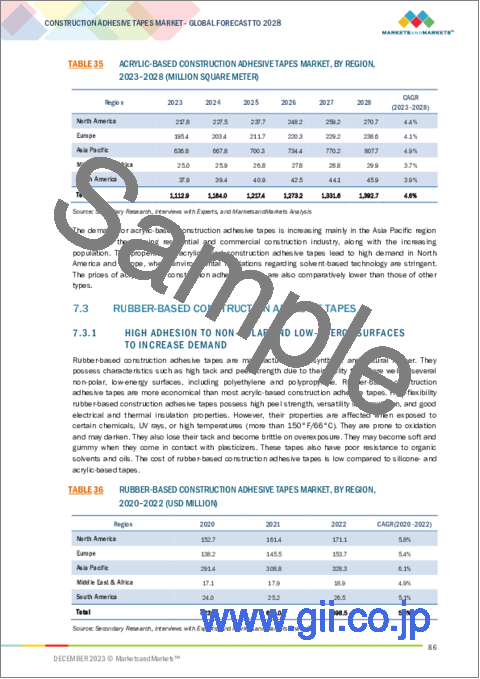

- 7.2 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES

- 7.2.1 HIGH DURABILITY BOOSTING DEMAND

- TABLE 32 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 33 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 34 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 ACRYLIC-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 7.3 RUBBER-BASED CONSTRUCTION ADHESIVE TAPES

- 7.3.1 HIGH ADHESION TO NON-POLAR AND LOW-ENERGY SURFACES TO INCREASE DEMAND

- TABLE 36 RUBBER-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 37 RUBBER-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 38 RUBBER-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 39 RUBBER-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 7.4 OTHER RESINS-BASED CONSTRUCTION ADHESIVE TAPES MARKET

- 7.4.1 INCREASING DEMAND DUE TO MALLEABILITY AND IMPERMEABILITY OF AIR

- TABLE 40 OTHER RESINS-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 41 OTHER RESINS-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 42 OTHER RESINS-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 OTHER RESINS-BASED CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION, 2023-2028 (MILLION SQUARE METER)

8 CONSTRUCTION ADHESIVE TAPES MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 34 FLOORING APPLICATION TO DOMINATE CONSTRUCTION ADHESIVE TAPES MARKET DURING FORECAST PERIOD

- TABLE 44 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 45 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 46 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 47 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 8.2 FLOORING

- 8.2.1 SMOOTH SURFACE FINISH AND HIGH-QUALITY ADHESION TO DRIVE MARKET IN FLOORING APPLICATION

- TABLE 48 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN FLOORING, BY REGION, 2020-2022 (USD MILLION)

- TABLE 49 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN FLOORING, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 50 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN FLOORING, BY REGION, 2023-2028 (USD MILLION)

- TABLE 51 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN FLOORING, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 8.3 ROOFING

- 8.3.1 USAGE OF PRE-CASTED PANELS TO INCREASE CONSUMPTION

- TABLE 52 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN ROOFING, BY REGION, 2020-2022 (USD MILLION)

- TABLE 53 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN ROOFING, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 54 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN ROOFING, BY REGION, 2023-2028 (USD MILLION)

- TABLE 55 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN ROOFING, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 8.4 WINDOWS & DOORS

- 8.4.1 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 56 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WINDOWS & DOORS, BY REGION, 2020-2022 (USD MILLION)

- TABLE 57 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WINDOWS & DOORS, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 58 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WINDOWS & DOORS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 59 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WINDOWS & DOORS, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 8.5 WALLS

- 8.5.1 EXPANSION OF HOME RENOVATION SECTOR TO FUEL DEMAND

- TABLE 60 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WALLS, BY REGION, 2020-2022 (USD MILLION)

- TABLE 61 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WALLS, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 62 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WALLS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 63 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN WALLS, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 8.6 HVAC & INSULATION

- 8.6.1 RAPID URBANIZATION TO DRIVE DEMAND IN HVAC SEGMENT

- TABLE 64 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN HVAC & INSULATION, BY REGION, 2020-2022 (USD MILLION)

- TABLE 65 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN HVAC & INSULATION, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 66 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN HVAC & INSULATION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 67 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN HVAC & INSULATION, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 8.7 OTHER APPLICATIONS

- TABLE 68 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020-2022 (USD MILLION)

- TABLE 69 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 70 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 71 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2023-2028 (MILLION SQUARE METER)

9 CONSTRUCTION ADHESIVE TAPES MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 35 RESIDENTIAL SEGMENT TO DOMINATE CONSTRUCTION ADHESIVE TAPES MARKET DURING FORECAST PERIOD

- TABLE 72 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 73 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (MILLION SQUARE METER)

- TABLE 74 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 75 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (MILLION SQUARE METER)

- 9.2 RESIDENTIAL

- 9.2.1 INCREASED STRENGTH AND SUPERIOR FINISH TO DRIVE MARKET

- TABLE 76 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN RESIDENTIAL, BY REGION, 2020-2022 (USD MILLION)

- TABLE 77 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN RESIDENTIAL, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 78 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN RESIDENTIAL, BY REGION, 2023-2028 (USD MILLION)

- TABLE 79 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN RESIDENTIAL, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 9.3 NON-RESIDENTIAL

- 9.3.1 CONSTRUCTION OF NEW HOSPITALS AND OFFICES TO BOOST DEMAND IN NON-RESIDENTIAL SEGMENT

- TABLE 80 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2020-2022 (USD MILLION)

- TABLE 81 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 82 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2023-2028 (USD MILLION)

- TABLE 83 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 9.4 OTHER END-USE INDUSTRIES

- 9.4.1 GROWING DEMAND IN RAILWAY AND ROAD CONSTRUCTION TO DRIVE MARKET

- TABLE 84 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2022 (USD MILLION)

- TABLE 85 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 86 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 87 CONSTRUCTION ADHESIVE TAPES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023-2028 (MILLION SQUARE METER)

10 CONSTRUCTION ADHESIVE TAPES MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 36 INDIA TO BE FASTEST-GROWING CONSTRUCTION ADHESIVE TAPES MARKET

- TABLE 88 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY REGION, 2020-2022 (USD MILLION)

- TABLE 89 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY REGION, 2020-2022 (MILLION SQUARE METER)

- TABLE 90 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY REGION, 2023-2028 (USD MILLION)

- TABLE 91 CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY REGION, 2023-2028 (MILLION SQUARE METER)

- 10.2 NORTH AMERICA

- 10.2.1 IMPACT OF RECESSION

- FIGURE 37 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SNAPSHOT

- 10.2.2 CONSTRUCTION ADHESIVE TAPES MARKET IN NORTH AMERICA, BY RESIN TYPE

- TABLE 92 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020-2022 (MILLION SQUARE METER)

- TABLE 94 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023-2028 (MILLION SQUARE METER)

- 10.2.3 CONSTRUCTION ADHESIVE TAPES MARKET IN NORTH AMERICA, BY TECHNOLOGY

- TABLE 96 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020-2022 (MILLION SQUARE METER)

- TABLE 98 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023-2028 (MILLION SQUARE METER)

- 10.2.4 CONSTRUCTION ADHESIVE TAPES MARKET IN NORTH AMERICA, BY APPLICATION

- TABLE 100 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 102 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.2.5 CONSTRUCTION ADHESIVE TAPES MARKET IN NORTH AMERICA, BY END-USE INDUSTRY

- TABLE 104 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (MILLION SQUARE METER)

- TABLE 106 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (MILLION SQUARE METER)

- 10.2.6 CONSTRUCTION ADHESIVE TAPES MARKET IN NORTH AMERICA, BY COUNTRY

- TABLE 108 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020-2022 (MILLION SQUARE METER)

- TABLE 110 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023-2028 (MILLION SQUARE METER)

- 10.2.7 US

- 10.2.7.1 Increasing demand from residential sector to drive market

- TABLE 112 US: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 113 US: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 114 US: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 115 US: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.2.8 CANADA

- 10.2.8.1 Growing residential sector fueling demand for construction adhesive tapes

- TABLE 116 CANADA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 117 CANADA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 118 CANADA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 119 CANADA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.2.9 MEXICO

- 10.2.9.1 Rising demand from flooring application to support market growth

- TABLE 120 MEXICO: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 121 MEXICO: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 122 MEXICO: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 123 MEXICO: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.3 ASIA PACIFIC

- 10.3.1 IMPACT OF RECESSION

- FIGURE 38 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SNAPSHOT

- 10.3.2 CONSTRUCTION ADHESIVE TAPES MARKET IN ASIA PACIFIC, BY RESIN TYPE

- TABLE 124 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020-2022 (MILLION SQUARE METER)

- TABLE 126 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023-2028 (MILLION SQUARE METER)

- 10.3.3 CONSTRUCTION ADHESIVE TAPES MARKET IN ASIA PACIFIC, BY TECHNOLOGY

- TABLE 128 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020-2022 (MILLION SQUARE METER)

- TABLE 130 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023-2028 (MILLION SQUARE METER)

- 10.3.4 CONSTRUCTION ADHESIVE TAPES MARKET IN ASIA PACIFIC, BY APPLICATION

- TABLE 132 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 134 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.3.5 CONSTRUCTION ADHESIVE TAPES MARKET IN ASIA PACIFIC, BY END-USE INDUSTRY

- TABLE 136 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (MILLION SQUARE METER)

- TABLE 138 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY 2023-2028 (MILLION SQUARE METER)

- 10.3.6 CONSTRUCTION ADHESIVE TAPES MARKET IN ASIA PACIFIC, BY COUNTRY

- TABLE 140 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020-2022 (MILLION SQUARE METER)

- TABLE 142 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023-2028 (MILLION SQUARE METER)

- 10.3.7 CHINA

- 10.3.7.1 High demand for construction adhesive tapes from roofing and flooring applications

- TABLE 144 CHINA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 145 CHINA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 146 CHINA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 147 CHINA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.3.8 INDIA

- 10.3.8.1 Fastest-growing market for construction adhesive tapes in Asia Pacific

- TABLE 148 INDIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 149 INDIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 150 INDIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 151 INDIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.3.9 JAPAN

- 10.3.9.1 Second-largest construction adhesive tapes market in Asia Pacific

- TABLE 152 JAPAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 153 JAPAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 154 JAPAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 155 JAPAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.3.10 SOUTH KOREA

- 10.3.10.1 Stringent environmental regulations to reduce use of high-VOC content tapes

- TABLE 156 SOUTH KOREA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 157 SOUTH KOREA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 158 SOUTH KOREA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 159 SOUTH KOREA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.3.11 INDONESIA

- 10.3.11.1 Availability of cheap labor and raw materials to propel market growth

- TABLE 160 INDONESIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 161 INDONESIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 162 INDONESIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 163 INDONESIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.3.12 TAIWAN

- 10.3.12.1 Country experiencing higher exports of construction adhesive tapes than domestic demand

- TABLE 164 TAIWAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 165 TAIWAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 166 TAIWAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 167 TAIWAN: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.3.13 REST OF ASIA PACIFIC

- TABLE 168 REST OF ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 170 REST OF ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.4 EUROPE

- 10.4.1 IMPACT OF RECESSION

- FIGURE 39 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SNAPSHOT

- 10.4.2 CONSTRUCTION ADHESIVE TAPES MARKET IN EUROPE, BY RESIN TYPE

- TABLE 172 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 173 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020-2022 (MILLION SQUARE METER)

- TABLE 174 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 175 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023-2028 (MILLION SQUARE METER)

- 10.4.3 CONSTRUCTION ADHESIVE TAPES MARKET IN EUROPE, BY TECHNOLOGY

- TABLE 176 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 177 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020-2022 (MILLION SQUARE METER)

- TABLE 178 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 179 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023-2028 (MILLION SQUARE METER)

- 10.4.4 CONSTRUCTION ADHESIVE TAPES MARKET IN EUROPE, BY APPLICATION

- TABLE 180 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 181 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 182 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 183 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.4.5 CONSTRUCTION ADHESIVE TAPES MARKET IN EUROPE, BY END-USE INDUSTRY

- TABLE 184 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 185 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (MILLION SQUARE METER)

- TABLE 186 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 187 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (MILLION SQUARE METER)

- 10.4.6 CONSTRUCTION ADHESIVE TAPES MARKET IN EUROPE, BY COUNTRY

- TABLE 188 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 189 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020-2022 (MILLION SQUARE METER)

- TABLE 190 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 191 EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023-2028 (MILLION SQUARE METER)

- 10.4.7 GERMANY

- 10.4.7.1 Increasing demand for construction adhesive tapes from residential sector

- TABLE 192 GERMANY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 193 GERMANY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 194 GERMANY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 195 GERMANY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.4.8 ITALY

- 10.4.8.1 Growing residential sector to fuel demand

- TABLE 196 ITALY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 197 ITALY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 198 ITALY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 199 ITALY: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.4.9 FRANCE

- 10.4.9.1 Flooring application to be largest consumer of adhesive tapes

- TABLE 200 FRANCE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 201 FRANCE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 202 FRANCE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 203 FRANCE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.4.10 UK

- 10.4.10.1 HVAC & insulation to be fastest-growing application during forecast period

- TABLE 204 UK: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 205 UK: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 206 UK: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 207 UK: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.4.11 POLAND

- 10.4.11.1 Growing demand in HVAC & insulation application to drive market

- TABLE 208 POLAND: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 209 POLAND: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 210 POLAND: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 211 POLAND: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.4.12 RUSSIA

- 10.4.12.1 Flooring application to be largest consumer of construction adhesive

- TABLE 212 RUSSIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 213 RUSSIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 214 RUSSIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 215 RUSSIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.4.13 REST OF EUROPE

- TABLE 216 REST OF EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 217 REST OF EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 218 REST OF EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 219 REST OF EUROPE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 IMPACT OF RECESSION

- 10.5.2 CONSTRUCTION ADHESIVE TAPES MARKET IN MIDDLE EAST & AFRICA, BY RESIN TYPE

- TABLE 220 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020-2022 (MILLION SQUARE METER)

- TABLE 222 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023-2028 (MILLION SQUARE METER)

- 10.5.3 CONSTRUCTION ADHESIVE TAPES MARKET IN MIDDLE EAST & AFRICA, BY TECHNOLOGY

- TABLE 224 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020-2022 (MILLION SQUARE METER)

- TABLE 226 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023-2028 (MILLION SQUARE METER)

- 10.5.4 CONSTRUCTION ADHESIVE TAPES MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION

- TABLE 228 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 230 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.5.5 CONSTRUCTION ADHESIVE TAPES MARKET IN MIDDLE EAST & AFRICA, BY END-USE INDUSTRY

- TABLE 232 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (MILLION SQUARE METER)

- TABLE 234 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (MILLION SQUARE METER)

- 10.5.6 CONSTRUCTION ADHESIVE TAPES MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY

- TABLE 236 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020-2022 (MILLION SQUARE METER)

- TABLE 238 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023-2028 (MILLION SQUARE METER)

- 10.5.7 SAUDI ARABIA

- 10.5.7.1 Increasing government investments in infrastructure to fuel demand

- TABLE 240 SAUDI ARABIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 241 SAUDI ARABIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 242 SAUDI ARABIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 243 SAUDI ARABIA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.5.8 UAE

- 10.5.8.1 Growing economy and investments to drive market growth

- TABLE 244 UAE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 245 UAE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 246 UAE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 247 UAE: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.5.9 REST OF GCC

- 10.5.9.1 Growing economy and investments to drive market growth

- TABLE 248 REST OF GCC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 249 REST OF GCC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 250 REST OF GCC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 251 REST OF GCC: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.5.10 SOUTH AFRICA

- 10.5.10.1 Increasing government investments in infrastructure to fuel demand

- TABLE 252 SOUTH AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 253 SOUTH AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 254 SOUTH AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 255 SOUTH AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.5.11 REST OF MIDDLE EAST & AFRICA

- TABLE 256 REST OF MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 257 REST OF MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 258 REST OF MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.6 SOUTH AMERICA

- 10.6.1 IMPACT OF RECESSION

- 10.6.2 CONSTRUCTION ADHESIVE TAPES MARKET IN SOUTH AMERICA, BY RESIN TYPE

- TABLE 260 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 261 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2020-2022 (MILLION SQUARE METER)

- TABLE 262 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 263 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY RESIN TYPE, 2023-2028 (MILLION SQUARE METER)

- 10.6.3 CONSTRUCTION ADHESIVE TAPES MARKET IN SOUTH AMERICA, BY TECHNOLOGY

- TABLE 264 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020-2022 (USD MILLION)

- TABLE 265 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2020-2022 (MILLION SQUARE METER)

- TABLE 266 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 267 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY TECHNOLOGY, 2023-2028 (MILLION SQUARE METER)

- 10.6.4 CONSTRUCTION ADHESIVE TAPES MARKET IN SOUTH AMERICA, BY APPLICATION

- TABLE 268 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 269 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 270 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 271 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.6.5 CONSTRUCTION ADHESIVE TAPES MARKET IN SOUTH AMERICA, BY END-USE INDUSTRY

- TABLE 272 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 273 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (MILLION SQUARE METER)

- TABLE 274 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 275 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (MILLION SQUARE METER)

- 10.6.6 CONSTRUCTION ADHESIVE TAPES MARKET IN SOUTH AMERICA, BY COUNTRY

- TABLE 276 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 277 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2020-2022 (MILLION SQUARE METER)

- TABLE 278 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 279 SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY COUNTRY, 2023-2028 (MILLION SQUARE METER)

- 10.6.7 BRAZIL

- 10.6.7.1 Initiatives and investments by government in infrastructure development projects to propel demand

- TABLE 280 BRAZIL: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 281 BRAZIL: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 282 BRAZIL: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 283 BRAZIL: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

- 10.6.8 REST OF SOUTH AMERICA

- TABLE 284 REST OF SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 285 REST OF SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2020-2022 (MILLION SQUARE METER)

- TABLE 286 REST OF SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 287 REST OF SOUTH AMERICA: CONSTRUCTION ADHESIVE TAPES MARKET SIZE, BY APPLICATION, 2023-2028 (MILLION SQUARE METER)

11 COMPETITIVE LANDSCAPE

- 11.1 KEY PLAYER'S STRATEGIES

- TABLE 288 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2 REVENUE ANALYSIS

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS (2018-2022)

- 11.3 MARKET SHARE ANALYSIS

- FIGURE 41 3M LED CONSTRUCTION ADHESIVE TAPES MARKET IN 2022

- TABLE 289 CONSTRUCTION ADHESIVE TAPES MARKET: DEGREE OF COMPETITION

- 11.4 COMPANY EVALUATION MATRIX

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 42 CONSTRUCTION ADHESIVE TAPES MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 11.5 COMPANY FOOTPRINT

- TABLE 290 CONSTRUCTION ADHESIVE TAPES MARKET: COMPANY OVERALL FOOTPRINT

- TABLE 291 CONSTRUCTION ADHESIVE TAPES MARKET: COMPANY RESIN TYPE FOOTPRINT

- TABLE 292 CONSTRUCTION ADHESIVE TAPES MARKET: COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 293 CONSTRUCTION ADHESIVE TAPES MARKET: COMPANY TAPE TYPE FOOTPRINT

- TABLE 294 CONSTRUCTION ADHESIVE TAPES MARKET: COMPANY REGION FOOTPRINT

- 11.6 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 43 CONSTRUCTION ADHESIVE TAPES MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- 11.6.4.1 Competitive benchmarking of key startups/SMEs

- TABLE 295 CONSTRUCTION ADHESIVE TAPES MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 296 CONSTRUCTION ADHESIVE TAPES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.7 COMPETITIVE SCENARIO AND TRENDS

- TABLE 297 CONSTRUCTION ADHESIVE TAPES MARKET: DEALS, 2018-2023

- TABLE 298 CONSTRUCTION ADHESIVE TAPES MARKET: OTHERS, 2018-2023

- TABLE 299 CONSTRUCTION ADHESIVE TAPES MARKET: PRODUCT DEVELOPMENTS, 2018-2023

12 COMPANY PROFILES

- 12.1 KEY COMPANIES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1.1 3M

- TABLE 300 3M: COMPANY OVERVIEW

- FIGURE 44 3M: COMPANY SNAPSHOT

- TABLE 301 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.2 NITTO DENKO CORPORATION

- TABLE 302 NITTO DENKO CORPORATION: COMPANY OVERVIEW

- FIGURE 45 NITTO DENKO CORPORATION: COMPANY SNAPSHOT

- TABLE 303 NITTO DENKO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 NITTO DENKO CORPORATION: PRODUCT DEVELOPMENT

- TABLE 305 NITTO DENKO CORPORATION: OTHERS

- 12.1.3 TESA SE

- TABLE 306 TESA SE: COMPANY OVERVIEW

- TABLE 307 TESA SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 TESA SE: OTHERS

- 12.1.4 SCAPA GROUP LTD.

- TABLE 309 SCAPA GROUP LTD.: COMPANY OVERVIEW

- FIGURE 46 SCAPA GROUP LTD.: COMPANY SNAPSHOT

- TABLE 310 SCAPA GROUP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 SCAPA GROUP LTD.: DEALS

- 12.1.5 SIKA AG

- TABLE 312 SIKA AG: COMPANY OVERVIEW

- FIGURE 47 SIKA AG: COMPANY SNAPSHOT

- TABLE 313 SIKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 SIKA AG: DEALS

- 12.1.6 INTERTAPE POLYMER GROUP

- TABLE 315 INTERTAPE POLYMER GROUP: COMPANY OVERVIEW

- TABLE 316 INTERTAPE POLYMER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 INTERTAPE POLYMER GROUP: PRODUCT DEVELOPMENT

- TABLE 318 INTERTAPE POLYMER GROUP: OTHERS

- 12.1.7 BERRY GLOBAL INC.

- TABLE 319 BERRY GLOBAL INC.: COMPANY OVERVIEW

- FIGURE 48 BERRY GLOBAL INC.: COMPANY SNAPSHOT

- TABLE 320 BERRY GLOBAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.8 SHURTAPE TECHNOLOGIES, LLC

- TABLE 321 SHURTAPE TECHNOLOGIES, LLC: COMPANY OVERVIEW

- TABLE 322 SHURTAPE TECHNOLOGIES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 SHURTAPE TECHNOLOGIES, LLC: PRODUCT DEVELOPMENT

- TABLE 324 SHURTAPE TECHNOLOGIES, LLC: DEALS

- TABLE 325 SHURTAPE TECHNOLOGIES, LLC: OTHERS

- 12.1.9 MAPEI S.P.A.

- TABLE 326 MAPEI S.P.A.: COMPANY OVERVIEW

- FIGURE 49 MAPEI S.P.A.: COMPANY SNAPSHOT

- TABLE 327 MAPEI S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 MAPEI S.P.A.: DEALS

- TABLE 329 MAPEI S.P.A.: OTHERS

- 12.1.10 LOHMANN GMBH & CO. KG

- TABLE 330 LOHMANN GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 331 LOHMANN GMBH & CO. KG.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.11 IDEAL TAPE

- TABLE 332 IDEAL TAPE: COMPANY OVERVIEW

- TABLE 333 IDEAL TAPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.12 SEAL FOR LIFE

- TABLE 334 SEAL FOR LIFE: COMPANY OVERVIEW

- TABLE 335 SEAL FOR LIFE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 SEAL FOR LIFE: DEALS

- 12.1.13 NICHIBAN CO., LTD.

- TABLE 337 NICHIBAN CO., LTD.: COMPANY OVERVIEW

- FIGURE 50 NICHIBAN CO., LTD.: COMPANY SNAPSHOT

- TABLE 338 NICHIBAN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.14 ADVANCE TAPES INTERNATIONAL

- TABLE 339 ADVANCE TAPES INTERNATIONAL: COMPANY OVERVIEW

- TABLE 340 ADVANCE TAPES INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.15 CARLISLE COMPANIES INC.

- TABLE 341 CARLISLE COMPANIES INC.: COMPANY OVERVIEW

- FIGURE 51 CARLISLE COMPANIES INC.: COMPANY SNAPSHOT

- TABLE 342 CARLISLE COMPANIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 CARLISLE COMPANIES INC.: OTHERS

- 12.2 OTHER COMPANIES

- 12.2.1 HICUBE COATING

- TABLE 344 HICUBE COATING: COMPANY OVERVIEW

- 12.2.2 POLYGUARD PRODUCTS, INC.

- TABLE 345 POLYGUARD PRODUCTS, INC.: COMPANY OVERVIEW

- 12.2.3 DENSO-HOLDING GMBH & CO.

- TABLE 346 DENSO-HOLDING GMBH & CO.: COMPANY OVERVIEW

- 12.2.4 BOSTIK SA

- TABLE 347 BOSTIK SA: COMPANY OVERVIEW

- 12.2.5 ARDEX GMBH

- TABLE 348 ARDEX GMBH: COMPANY OVERVIEW

- 12.2.6 FRANKLIN INTERNATIONAL

- TABLE 349 FRANKLIN INTERNATIONAL: COMPANY OVERVIEW

- 12.2.7 AVERY DENNISON

- TABLE 350 AVERY DENNISON: COMPANY OVERVIEW

- 12.2.8 LATICRETE INTERNATIONAL

- TABLE 351 LATICRETE INTERNATIONAL: COMPANY OVERVIEW

- 12.2.9 TERRACO

- TABLE 352 TERRACO: COMPANY OVERVIEW

- 12.2.10 SAINT-GOBAIN WEBER

- TABLE 353 SAINT-GOBAIN WEBER: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS