|

|

市場調査レポート

商品コード

1318154

通信用電力システムの世界市場 (~2028年):グリッドタイプ (オングリッド・オフグリッド・バッドグリッド)・コンポーネント (整流器・インバーター・コントローラー・コンバーター)・電源・技術・電力定格 (10KW未満・10~20KW・20KW超)・地域別Telecom Power System Market by Grid Type (On-Grid, Off-Grid, Bad-Grid), Component (Rectifiers, Inverters, Controllers, Converters), Power Source, Technology, Power Rating (Below 10 KW, 10-20 KW, Above 20 KW) and Geography - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 通信用電力システムの世界市場 (~2028年):グリッドタイプ (オングリッド・オフグリッド・バッドグリッド)・コンポーネント (整流器・インバーター・コントローラー・コンバーター)・電源・技術・電力定格 (10KW未満・10~20KW・20KW超)・地域別 |

|

出版日: 2023年07月19日

発行: MarketsandMarkets

ページ情報: 英文 254 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の通信用電力システムの市場規模は、2023年の42億米ドルから、2028年には66億米ドルに成長すると予測されており、2023年から2028年までのCAGRは9.4%と見込まれています。

通信事業者は、環境への影響を減らすため、太陽光発電や風力発電などの再生可能エネルギー源を積極的に探しています。このため、再生可能エネルギーと円滑に連携する通信用電力システムに対する需要が高まっています。さらに、IoTやクラウドコンピューティング用途での利用が増加しているため、多くの電力が必要とされており、信頼性が高く効率的な電力を供給できる通信用電力システムの必要性が高まっています。

電源別で見ると、ディーゼル・太陽光の部門が2023年から2028年にかけて最も速い成長率を示す可能性が高いとされています。再生可能エネルギー源での通信塔への電力供給は、特に遠隔地の通信塔において環境に優しい通信用電力への一歩です。従来、通信塔はディーゼル発電機で稼働しており、運転とメンテナンスに多大なコストがかかっていました。最近のソーラーパネルと電池の価格の低下により、少なくとも部分的にはディーゼルを再生可能エネルギー源に置き換えられるため、太陽エネルギー発電システムの採用の拡大に道が開かれました。

電力定格別では、5G通信塔や整流モジュールの採用が急増しているため、10~20KWの電力システムが予測期間中に2番目に大きな市場シェアを占めると考えられています。中出力 (10-20 kW) の電力システムは、5G通信塔、待機電源セット、整流器モジュール (3Gシリーズ) 、屋外電力システム、屋上基地局、DC発電機に用いられます。構成可能な中出力タイプの電源は、中間的な電力要件に最適な選択肢です。

グリッドタイプ別では、2023年から2028年にかけて、オフグリッド通信用電力システムの部門が高い成長を示す見通しです。オフグリッド通信用電力システムは、ディーゼル発電機などの従来電源よりも汚染物質の排出が少ない太陽光発電や風力発電といった再生可能エネルギー源を利用するため、環境への影響が最小限となります。これらのシステムは、排出削減に貢献し、エネルギー効率を向上させ、化石燃料への依存を減らし、有限な資源を節約し、通信ネットワークの電源供給の持続可能なアプローチを促進します。

地域別では、2023年から2028年にかけて欧州地市場が第2位の市場になる可能性が高いとされています。欧州は現在、世界のさまざまな地域で実施されている5Gの試験やプロジェクトにおいて、トップランナーとなっています。欧州委員会と加盟国は、地域での5Gを含む先進的な通信技術の採用を促進するため、適切な政策、実験、試験、大規模パイロットプログラムのための産業横断的なハブへの支援を通じてイノベーションを奨励してきました。通信サービスの必要性と重要性はますます高まっています。そのため、通信塔やネットワークの設置ニーズが高まり、地域全体で必要とされる通信用電力システムコンポーネントがさらに増加し、通信用電力システム市場の成長を牽引しています。

当レポートでは、世界の通信用電力システムの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、関連法規制、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客の事業に影響を与える動向/ディスラプション

- エコシステムマッピング

- 技術分析

- 価格分析:平均販売価格の動向

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- ケーススタディ分析

- 貿易データ分析

- 特許分析

- 主要な会議とイベント

- 関税と規制状況

第6章 通信用電力システム市場:コンポーネント別

- 整流器

- インバーター

- コンバーター

- コントローラー

- 熱管理システム

- 発電機

- その他

- 配電ユニット

- 電池

- 太陽電池

- 風力タービン

- サージ保護デバイス

- サーキットブレーカー

第7章 通信用電力システム市場:グリッドタイプ別

- オングリッド

- オフグリッド

- バッドグリッド

第8章 通信用電力システム市場:電力定格別

- 10KW未満

- 10-20KW

- 20KW超

第9章 通信用電力システム市場:電源別

- ディーゼル・電池

- ディーゼル・太陽光

- ディーゼル・風力

- 複数電源 (ディーゼル/太陽光/風力/電池/バイオマス)

第10章 通信用電力システム市場:技術別

- AC電源システム

- DC電源システム

第11章 通信用電力システム市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他

第12章 競合情勢

- 概要

- 主要企業の採用戦略

- 市場シェア分析

- 5カ年企業収益分析

- 主要企業の評価マトリックス

- 企業フットプリント

- スタートアップ/中小企業の評価マトリックス

- 競合ベンチマーキング

- 競合状況・動向

第13章 企業プロファイル

- 主要企業

- EATON

- HUAWEI TECHNOLOGIES CO., LTD.

- CUMMINS INC.

- ZTE CORPORATION

- GENERAL ELECTRIC

- SCHNEIDER ELECTRIC

- ALPHA TECHNOLOGIES

- DELTA ELECTRONICS, INC.

- ABB

- STATICON LTD.

- その他の企業

- ASCOT INDUSTRIAL S.R.L.

- UNIPOWER

- DYNAMIC POWER GROUP

- EFORE

- HANGZHOU ZHONHENG POWER ENERGY

- MYERS POWER PRODUCTS, INC.

- ELTEK

- VERTIV GROUP

- VOLTSERVER INC.

- JMA WIRELESS

- CORNING INCORPORATED

- EMERSON ELECTRIC CO.

- POWERONEUPS

- EXICOM TELE-SYSTEMS

- STATIC POWER

第14章 付録

The global telecom power system market is projected to grow from USD 4.2 billion in 2023 to USD 6.6 billion by 2028; it is expected to grow at a CAGR of 9.4% from 2023 to 2028. Telecom companies are actively looking for renewable energy sources such as solar and wind power to reduce their environmental impact. This has created a greater demand for telecom power systems that work smoothly with renewable energy. Moreover, the increasing use of IoT and cloud computing applications requires substantial power. Consequently, there is a growing need for telecom power systems that can provide reliable and efficient power to support these applications.

"Diesel-Solar based telecom power system is likely to exhibit fastest growth rate between 2023 and 2028"

Powering telecom towers with renewable energy sources is a step toward greener telecommunication power generation-mainly for towers in remote locations. Conventionally, the towers run on diesel gen-sets, which require significant costs for operation and maintenance. The recent price decrease of solar panels and batteries has paved the way for greater adoption of solar energy power systems to at least partially replace diesel with renewable energy sources.

"Power systems of 10-20 KW rating are likely to have second largest market share during the forecast period due to surging adopting in 5G towers and rectifier modules."

Medium-output (10-20 kW) power systems find application in 5G towers, standby generating sets, rectifier modules (3G series), outdoor power systems, rooftop base stations, and DC generators. These power systems have a power range between 10 kW and 20 kW. Configurable types of power supplies with medium output are the best option for intermediate power requirements. Additionally, the increasing use of medium-output power supplies in telecom applications is likely to augment the growth of this market. A few key players manufacturing power systems with 10-20 kW are Eaton, Eltek, Cummins, and ABB.

"Off-grid telecom power systems to offer lucrative growth between 2023 and 2028"

Off-grid telecom power systems have a minimal environmental impact due to their utilization of renewable energy sources, such as solar and wind power, which emit fewer pollutants than traditional power sources like diesel generators. These systems contribute to emission reduction, improve energy efficiency, and decrease reliance on fossil fuels, ultimately conserving finite resources and promoting a sustainable approach to powering telecom networks.

"Europe likely to be the second largest market for telecom power system between 2023 and 2028"

Europe has been the frontrunner in 5G trials and projects that are currently being carried out in various regions of the world. The European Commission and the member states have been encouraging cross-sector innovations through adequate policies and support to cross-sector hubs for experiments, trials, and large-scale pilot programs to facilitate the adoption of advanced telecom technologies, including 5G in the region. The need for and importance of telecommunication services has been increasing. Hence, the need for the installation of towers and networks has increased, further increasing the number of telecom power system components required across the region, which, in turn, drives the market growth of telecom power systems.

Breakdown of profiles of primary participants:

- By Company: Tier 1 = 35%, Tier 2 = 40%, and Tier 3 = 25%

- By Designation: C-level Executives = 30%, Directors = 40%, and Others (sales, marketing, and product managers, as well as members of various organizations) = 30%

- By Region: North America = 40%, APAC = 23%, Europe=32%, and ROW=5%

Major players profiled in this report:

The telecom power system market is dominated by a few established players such as Eaton (US), Huawei Technologies Co., Ltd. (China), Cummins, Inc. (US), ZTE Corporation (China), General Electric (US), Delta Electronics, Inc. (Taiwan), and Schneider Electric (France) are the key players in the global telecom power system market.

Research coverage

This report offers detailed insights into the telecom power system market based on component (rectifiers, inverters, convertors, controllers, generators, heat management systems, others (power distribution units, circuit breakers, batteries, surge protection devices, solar or PV cells, wind turbines)), technology (AC and DC power systems), grid type (on-grid, off-grid and Bad grid), power source (diesel-battery, diesel-solar, diesel-wind power sources and multiple power sources), power rating (below 10 kW, 10-20 kW, above 20 kW) and region (North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW) which includes the Middle East, Africa, and South America.

The report also comprehensively reviews market drivers, restraints, opportunities, and challenges in the telecom power system market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Key Benefits of Buying the Report

- Analysis of key drivers (increasing number of telecom infrastructures in remote areas, growing adoption of telecom services and high data traffic, rising awareness about reducing carbon footprint from telecom power systems, increasing investments in 5G network deployment), restraints (high deployment and operational costs, environmental concerns due to usage of diesel), opportunities (growing adoption of hybrid power systems, increasing technological advancements in cellular networks (5G, LTE services, etc.), surging requirements for advanced telecom infrastructure and M2M connections, rising use of GaN-based power devices with evolution of 5G technology), and challenges (lack of infrastructure development for energy management, design challenges for telecom power systems, need for frequent maintenance and monitoring) influencing the growth of the telecom power system market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the telecom power system market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the telecom power system market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the telecom power system market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Eaton (US), Huawei Technologies Co., Ltd. (China), Cummins, Inc. (US), ZTE Corporation (China), General Electric (US), Delta Electronics, Inc. (Taiwan), Alpha Technologies (US), ABB (Switzerland), Staticon Ltd. (Canada), and Schneider Electric (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 TELECOM POWER SYSTEM MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 IMPACT OF RECESSION ON TELECOM POWER SYSTEM MARKET

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 TELECOM POWER SYSTEM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 TELECOM POWER SYSTEM MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Approach to estimate market size using top-down analysis (supply side)

- FIGURE 4 TOP-DOWN APPROACH: MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 - SUPPLY SIDE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - SUPPLY SIDE

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach to estimate market size using bottom-up analysis (demand side)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND SIDE

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK FACTOR ANALYSIS

- 2.7 ANALYSIS OF RECESSION IMPACT ON TELECOM POWER SYSTEM MARKET

3 EXECUTIVE SUMMARY

- FIGURE 8 TELECOM POWER SYSTEM MARKET, 2019-2028 (USD MILLION)

- FIGURE 9 BAD-GRID TELECOM POWER SYSTEMS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

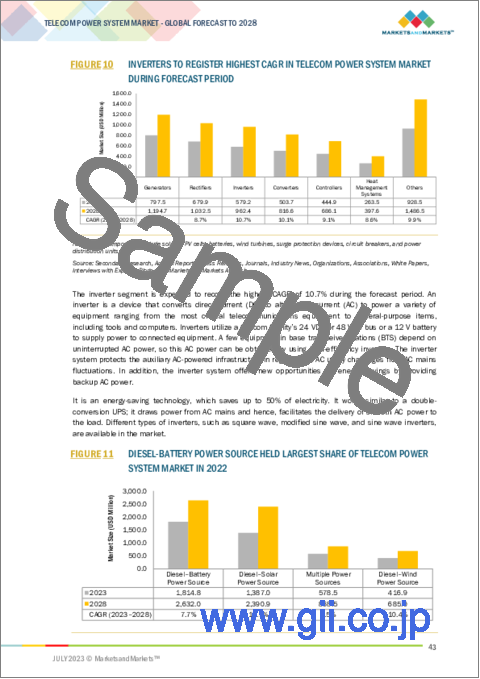

- FIGURE 10 INVERTERS TO REGISTER HIGHEST CAGR IN TELECOM POWER SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 11 DIESEL-BATTERY POWER SOURCE HELD LARGEST SHARE OF TELECOM POWER SYSTEM MARKET IN 2022

- FIGURE 12 DC POWER SYSTEMS TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 13 TELECOM POWER SYSTEMS BELOW 10 KW TO COMMAND MARKET BETWEEN 2023 AND 2028

- FIGURE 14 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN GLOBAL TELECOM POWER SYSTEM MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TELECOM POWER SYSTEM MARKET

- FIGURE 15 DEVELOPMENT OF TELECOMMUNICATION IN RURAL AREAS TO CREATE GROWTH OPPORTUNITIES FOR PLAYERS IN TELECOM POWER SYSTEM PROVIDERS

- 4.2 TELECOM POWER SYSTEM MARKET, BY POWER SOURCE

- FIGURE 16 DIESEL-BATTERY POWER SOURCE SEGMENT TO HOLD LARGEST SHARE OF TELECOM POWER SYSTEM MARKET THROUGHOUT FORECAST PERIOD

- 4.3 TELECOM POWER SYSTEM MARKET, BY GRID TYPE

- FIGURE 17 BAD GRID SEGMENT TO ACCOUNT FOR LARGEST SHARE OF TELECOM POWER SYSTEM MARKET IN 2028

- 4.4 TELECOM POWER SYSTEM MARKET, BY COMPONENT

- FIGURE 18 GENERATORS TO HOLD SIGNIFICANT SHARE OF TELECOM POWER SYSTEM MARKET THROUGHOUT FORECAST PERIOD

- 4.5 TELECOM POWER SYSTEM MARKET, BY POWER RATING

- FIGURE 19 TELECOM POWER SYSTEMS BELOW 10 KW TO DOMINATE MARKET IN 2028

- 4.6 TELECOM POWER SYSTEM MARKET, BY TECHNOLOGY

- FIGURE 20 DC POWER SYSTEMS TO DOMINATE MARKET FROM 2023 TO 2028

- 4.7 TELECOM POWER SYSTEM MARKET, BY REGION

- FIGURE 21 TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 23 TELECOM POWER SYSTEM MARKET DRIVERS AND THEIR IMPACT

- 5.2.1.1 Development of telecom infrastructure in rural areas with growing number of mobile subscribers

- TABLE 2 4G TECHNOLOGY PENETRATION IN URBAN AREAS VS. RURAL AREAS, 2022 (%)

- 5.2.1.2 Expansion of coverage by telecom companies due to growing demand for telecom services

- FIGURE 24 MOBILE DATA TRAFFIC, 2018-2022 (EXABYTE/MONTH)

- TABLE 3 INTERNET USERS, BY GEOGRAPHY, 2022 (%)

- 5.2.1.3 Adoption of cleaner and more sustainable solutions by telecom companies to reduce environmental footprint

- 5.2.1.4 Increasing investments by governments and private firms worldwide in 5G technology

- 5.2.2 RESTRAINTS

- FIGURE 25 TELECOM POWER SYSTEM MARKET RESTRAINTS AND THEIR IMPACT

- 5.2.2.1 High deployment and operational costs of telecom power systems

- 5.2.2.2 Environmental concerns associated with use of diesel generators

- 5.2.3 OPPORTUNITY

- FIGURE 26 TELECOM POWER SYSTEM MARKET OPPORTUNITIES AND THEIR IMPACT

- 5.2.3.1 Growing adoption of hybrid power systems

- 5.2.3.2 Increasing technological advancements in cellular networks

- TABLE 4 4G TECHNOLOGY PENETRATION RATE, 2022 (%)

- 5.2.3.3 Surging requirement for advanced telecom infrastructure with growing popularity of M2M and IoT technologies

- FIGURE 27 GROWING TREND OF CELLULAR IOT CONNECTIONS, 2019 VS. 2025

- 5.2.3.4 Rising use of GaN-based power devices with evolution of 5G technology

- 5.2.4 CHALLENGES

- FIGURE 28 TELECOM POWER SYSTEM MARKET CHALLENGES AND THEIR IMPACT

- 5.2.4.1 Lack of skilled workforce and infrastructure-related issues

- 5.2.4.2 Designing robust and power-efficient telecom power systems

- 5.2.4.3 Need for constant maintenance and monitoring of systems and components

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 29 VALUE CHAIN: TELECOM POWER SYSTEM MARKET

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN TELECOM POWER SYSTEM MARKET

- 5.5 ECOSYSTEM MAPPING

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- FIGURE 31 KEY PLAYERS IN ECOSYSTEM

- 5.5.1 TELECOM INFRASTRUCTURE PROVIDERS (SMALL CELLS, MACRO CELL, ANTENNAS, MASSIVE MIMO, TIC, SDN/NFV SOLUTIONS, TELECOM POWER SYSTEMS)

- 5.5.2 OEMS, PRODUCT MANUFACTURERS (PRODUCTS/MODULES (MODEMS, ROUTERS, SWITCHES, ACCESS POINTS)

- 5.5.3 SYSTEM INTEGRATORS

- 5.5.4 NETWORK OPERATORS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 5G NETWORK

- 5.6.2 SMART MANUFACTURING

- 5.6.3 ASSET PERFORMANCE MANAGEMENT

- 5.6.4 REMOTE MONITORING AND MANAGEMENT (RMM)

- 5.7 PRICING ANALYSIS: AVERAGE SELLING PRICE TRENDS

- FIGURE 32 AVERAGE SELLING PRICE (ASP) OF POWER SYSTEMS WITH DIFFERENT POWER RATINGS (KW), 2019-2028

- 5.7.1 AVERAGE SELLING PRICE OF TELECOM POWER SYSTEMS OFFERED BY KEY PLAYERS, BY POWER RATING

- FIGURE 33 AVERAGE SELLING PRICE OF TELECOM POWER SYSTEMS PROVIDED BY MAJOR PLAYERS, BY POWER RATING

- 5.8 PORTER'S FIVE FORCE ANALYSIS

- TABLE 6 IMPACT ANALYSIS OF PORTER'S FIVE FORCES ON TELECOM POWER SYSTEM MARKET

- FIGURE 34 IMPACT ANALYSIS OF PORTER'S FIVE FORCES ON TELECOM POWER SYSTEM MARKET

- FIGURE 35 TELECOM POWER SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIERS

- 5.8.5 THREAT OF NEW ENTRANTS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 POWER SOURCES

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 POWER SOURCES (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 37 KEY BUYING CRITERIA FOR TOP 3 POWER SOURCES

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 POWER SOURCES

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 INCORPORATION OF HYBRID GENERATOR TO POWER MULTIPLE LARGE TELECOM LOADS AND SEASONAL AIR CONDITIONING LOAD

- 5.10.2 INTEGRATION OF SITEBOSS DEVICE WITH INTERMAPPER SOFTWARE TO ACHIEVE INCREASED VISIBILITY TO SITE OPERATIONS AND MITIGATE RISK OF SITE FAILURE

- 5.10.3 ADOPTION OF METKA IPS MODULAR POWER SYSTEM BY NIGERIAN TELECOM OPERATOR TO OFFER DATA AND VOICE SERVICES THROUGH OFF-GRID LTE NETWORK

- 5.10.4 DEPLOYMENT OF METKA IPS MODULAR POWER SYSTEM AT OFF-GRID TELECOM SITES OF AFTEL TO MINIMIZE DIESEL GENERATOR RUNTIME

- 5.10.5 PARTNERSHIP OF NURI TELECOM WITH MEGACHIPS TO DEVELOP HD-PLC SOLUTION FOR FASTER AND CHEAPER SMART METERING APPLICATIONS

- 5.11 TRADE DATA ANALYSIS

- 5.11.1 IMPORT DATA

- TABLE 9 IMPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD BILLION)

- FIGURE 38 IMPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD BILLION)

- 5.11.2 EXPORT DATA

- TABLE 10 EXPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD BILLION)

- FIGURE 39 EXPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD BILLION)

- 5.12 PATENT ANALYSIS

- TABLE 11 NOTABLE PATENTS PERTAINING TO TELECOM POWER SYSTEMS

- TABLE 12 NUMBER OF PATENTS REGISTERED IN LAST 10 YEARS

- FIGURE 40 TOP 10 COMPANIES WITH HIGHEST PERCENTAGE OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 41 NUMBER OF PATENTS GRANTED PER YEAR, 2013-2022

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 13 LIST OF MAJOR CONFERENCES AND EVENTS RELATED TO TELECOM POWER SYSTEMS

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFFS

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2.1 North America

- 5.14.2.2 Europe

- 5.14.2.3 Asia Pacific

- 5.14.2.4 RoW

- 5.14.3 REGULATIONS

- 5.14.3.1 North America

- 5.14.3.2 Europe

- 5.14.3.3 Asia Pacific

- 5.14.4 STANDARDS

6 TELECOM POWER SYSTEM MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 42 INVERTERS TO REGISTER HIGHEST CAGR IN TELECOM POWER SYSTEM MARKET FROM 2023 TO 2028

- TABLE 14 TELECOM POWER SYSTEM MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 15 TELECOM POWER SYSTEM MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 6.2 RECTIFIERS

- 6.2.1 USE OF RECTIFIERS TO PROTECT TELECOM POWER SYSTEMS AGAINST AC OVERVOLTAGE TO BOOST SEGMENTAL GROWTH

- 6.3 INVERTERS

- 6.3.1 DEPLOYMENT OF INVERTER AS EFFECTIVE AC POWER BACKUP SOLUTION TO BOOST SEGMENTAL GROWTH

- 6.4 CONVERTERS

- 6.4.1 ADOPTION OF CONVERTERS TO OPTIMIZE ENERGY USAGE AND REDUCE WASTAGE TO SUPPORT MARKET GROWTH

- 6.5 CONTROLLERS

- 6.5.1 DEPLOYMENT OF CONTROLLERS IN TELECOM POWER SYSTEMS TO MONITOR OPERATIONAL PARAMETERS AND SAVE OPERATIONAL COSTS TO ACCELERATE MARKET GROWTH

- 6.6 HEAT MANAGEMENT SYSTEMS

- 6.6.1 IMPLEMENTATION OF HEAT MANAGEMENT SYSTEMS FOR HEAT EXCHANGE, DIRECT VENTILATION, AND THERMOELECTRIC COOLING TO DRIVE SEGMENTAL GROWTH

- 6.7 GENERATORS

- 6.7.1 EMPLOYMENT OF GENERATORS TO PREVENT SERVICE INTERRUPTIONS DURING EXTENDED POWER OUTAGES TO BOOST SEGMENTAL GROWTH

- 6.8 OTHERS

- 6.8.1 POWER DISTRIBUTION UNITS

- 6.8.2 BATTERIES

- 6.8.3 SOLAR OR PV CELLS

- 6.8.4 WIND TURBINES

- 6.8.5 SURGE PROTECTION DEVICES

- 6.8.6 CIRCUIT BREAKERS

7 TELECOM POWER SYSTEM MARKET, BY GRID TYPE

- 7.1 INTRODUCTION

- FIGURE 43 OFF-GRID TELECOM POWER SYSTEMS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2019-2022 (USD MILLION)

- TABLE 17 TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2023-2028 (USD MILLION)

- 7.2 ON-GRID

- 7.2.1 USE OF ON-GRID TELECOM POWER SYSTEMS TO REDUCE ENVIRONMENTAL IMPACT TO SUPPORT MARKET GROWTH

- TABLE 18 ON-GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 19 ON-GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 OFF-GRID

- 7.3.1 DEPLOYMENT OF OFF-GRID TELECOM POWER SYSTEMS TO PROVIDE ELECTRICITY TO AREAS FAR FROM T&D INFRASTRUCTURE TO BOOST SEGMENTAL GROWTH

- TABLE 20 OFF-GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 21 OFF-GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 BAD GRID

- 7.4.1 CONCENTRATION OF BAD GRID-CONNECTED TELECOM POWER SYSTEMS IN DEVELOPING COUNTRIES SUCH AS INDIA AND BRAZIL TO SUPPORT SEGMENTAL GROWTH

- TABLE 22 BAD GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 BAD GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

8 TELECOM POWER SYSTEM MARKET, BY POWER RATING

- 8.1 INTRODUCTION

- FIGURE 44 TELECOM POWER SYSTEMS BELOW 10 KW TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 24 TELECOM POWER SYSTEM MARKET, BY POWER RATING, 2019-2022 (USD MILLION)

- TABLE 25 TELECOM POWER SYSTEM MARKET, BY POWER RATING, 2023-2028 (USD MILLION)

- TABLE 26 TELECOM POWER SYSTEM MARKET, BY POWER RATING, 2019-2022 (THOUSAND UNITS)

- TABLE 27 TELECOM POWER SYSTEM MARKET, BY POWER RATING, 2023-2028 (THOUSAND UNITS)

- 8.2 BELOW 10 KW

- 8.2.1 ADOPTION OF LOW-OUTPUT TELECOM POWER SYSTEMS IN CELL TOWERS, BTS, AND BASE STATIONS TO BOOST SEGMENTAL GROWTH

- 8.3 10-20 KW

- 8.3.1 USE OF MEDIUM-OUTPUT POWER SYSTEMS IN 5G TOWERS AND RECTIFIER MODULES TO SUPPORT SEGMENTAL GROWTH

- 8.4 ABOVE 20 KW

- 8.4.1 DEPLOYMENT OF HIGH-OUTPUT POWER SYSTEMS IN ACCESS NETWORKS, DATA CENTERS, AND FTTH NETWORKS TO CONTRIBUTE TO SEGMENTAL GROWTH

9 TELECOM POWER SYSTEM MARKET, BY POWER SOURCE

- 9.1 INTRODUCTION

- FIGURE 45 DIESEL-SOLAR POWER SOURCE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 28 TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 29 TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 9.2 DIESEL-BATTERY POWER SOURCE

- 9.2.1 USE OF DIESEL-BATTERY HYBRID SOLUTIONS IN OFF-GRID AND BAD GRID APPLICATIONS TO DRIVE MARKET

- TABLE 30 ADVANTAGES OF DIESEL-BATTERY POWER SOURCE

- TABLE 31 DISADVANTAGES OF DIESEL-BATTERY POWER SOURCE

- TABLE 32 DIESEL-BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 DIESEL-BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 34 DIESEL-BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 35 DIESEL-BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 36 DIESEL-BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 37 DIESEL-BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 38 DIESEL-BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 39 DIESEL-BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 40 DIESEL-BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 41 DIESEL-BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.3 DIESEL-SOLAR POWER SOURCE

- 9.3.1 IMPLEMENTATION OF DIESEL-SOLAR POWER SOURCE IN REMOTE CELLULAR BASE STATIONS TO SUPPORT MARKET GROWTH

- TABLE 42 ADVANTAGES OF DIESEL-SOLAR POWER SOURCE

- TABLE 43 DISADVANTAGES OF DIESEL-SOLAR POWER SOURCE

- TABLE 44 DIESEL-SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 DIESEL-SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 46 DIESEL-SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 47 DIESEL-SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 48 DIESEL-SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 49 DIESEL-SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 50 DIESEL-SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 51 DIESEL-SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 52 DIESEL-SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 53 DIESEL-SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.4 DIESEL-WIND POWER SOURCE

- 9.4.1 SUITABILITY OF DIESEL-WIND POWER SYSTEMS IN BAD-GRID AND OFF-GRID AREAS TO STIMULATE MARKET GROWTH

- TABLE 54 ADVANTAGES OF DIESEL-WIND POWER SOURCE

- TABLE 55 DISADVANTAGES OF DIESEL-WIND POWER SOURCE

- TABLE 56 DIESEL-WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 DIESEL-WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 58 DIESEL-WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 59 DIESEL-WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 60 DIESEL-WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 61 DIESEL-WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 62 DIESEL-WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 63 DIESEL-WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 64 DIESEL-WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 DIESEL-WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- 9.5 MULTIPLE POWER SOURCES (DIESEL/SOLAR/WIND/BATTERY/BIOMASS)

- 9.5.1 COST-EFFECTIVE GENERATION OF ELECTRICITY TO BOOST DEMAND FOR MULTIPLE POWER SOURCES

- TABLE 66 ADVANTAGES OF DIESEL-BIOMASS POWER SOURCE

- TABLE 67 DISADVANTAGES OF DIESEL-BIOMASS POWER SOURCE

- TABLE 68 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 70 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 71 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 72 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 73 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 74 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 75 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 76 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

10 TELECOM POWER SYSTEM MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- FIGURE 46 DC POWER SYSTEMS TO COMMAND TELECOM POWER SYSTEM MARKET THROUGHOUT FORECAST PERIOD

- TABLE 78 TELECOM POWER SYSTEM MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 79 TELECOM POWER SYSTEM MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 10.2 AC POWER SYSTEMS

- 10.2.1 RISING USE OF AC POWER SYSTEMS TO PROVIDE STABLE AND REGULATED ELECTRICAL POWER SUPPLY TO DRIVE MARKET

- 10.3 DC POWER SYSTEMS

- 10.3.1 GROWING ADOPTION OF DC POWER SYSTEMS BY TELECOM OPERATORS TO ENSURE CONTINUOUS OPERATIONS AND PROTECT CRITICAL EQUIPMENT TO DRIVE MARKET

11 TELECOM POWE SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 47 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 80 TELECOM POWER SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 TELECOM POWER SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 82 TELECOM POWER SYSTEM MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 83 TELECOM POWER SYSTEM MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 11.2 NORTH AMERICA

- FIGURE 48 SNAPSHOT OF TELECOM POWER SYSTEM MARKET IN NORTH AMERICA

- 11.2.1 RECESSION IMPACT ON MARKET IN NORTH AMERICA

- FIGURE 49 IMPACT OF RECESSION ON MARKET IN NORTH AMERICA

- TABLE 84 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2019-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Rapid development of 5G wireless network infrastructure to drive market

- TABLE 90 US: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 91 US: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Development of telecom infrastructure in rural areas to boost demand for telecom power systems

- TABLE 92 CANADA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 93 CANADA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Rising demand for advanced wireless infrastructure to support market growth

- TABLE 94 MEXICO: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 95 MEXICO: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- FIGURE 50 SNAPSHOT OF TELECOM POWER SYSTEM MARKET IN EUROPE

- 11.3.1 RECESSION IMPACT ON MARKET IN EUROPE

- FIGURE 51 IMPACT OF RECESSION ON MARKET IN EUROPE

- TABLE 96 EUROPE: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 97 EUROPE: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 98 EUROPE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 99 EUROPE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- TABLE 100 EUROPE: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2019-2022 (USD MILLION)

- TABLE 101 EUROPE: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2023-2028 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Implementation of smarty city projects to drive market

- TABLE 102 UK: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 103 UK: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.3.3 GERMANY

- 11.3.3.1 Increasing investments in commercial launch of 5G services to boost demand for telecom power systems

- TABLE 104 GERMANY: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 105 GERMANY: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.3.4 FRANCE

- 11.3.4.1 Rising need for advanced networking solutions owing to adoption of IoT technology to boost demand for telecom power systems

- TABLE 106 FRANCE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 107 FRANCE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.3.5 SPAIN

- 11.3.5.1 Innovations in IoT and SCADA technologies to create opportunities for telecom power system providers

- TABLE 108 SPAIN: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 109 SPAIN: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 110 REST OF EUROPE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 111 REST OF EUROPE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 52 SNAPSHOT OF TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC

- 11.4.1 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- FIGURE 53 IMPACT OF RECESSION ON MARKET IN ASIA PACIFIC

- TABLE 112 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2019-2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2023-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Collaboration of telecom companies with providers of advanced wireless infrastructure to contribute to market growth

- TABLE 118 CHINA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 119 CHINA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.4.3 JAPAN

- 11.4.3.1 5G base station deployment plan by telecom operators to present opportunities for telecom power system providers

- TABLE 120 JAPAN: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 121 JAPAN: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Investments in 5G-enabled base stations to create opportunities for telecom power system providers

- TABLE 122 SOUTH KOREA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 123 SOUTH KOREA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.4.5 INDIA

- 11.4.5.1 5G network testing and rollout plans in rural areas of India to boost demand for telecom power systems

- TABLE 124 INDIA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 125 INDIA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.4.6 AUSTRALIA & NEW ZEALAND

- 11.4.6.1 Telecom infrastructure developments to contribute to high demand for telecom power systems

- TABLE 126 AUSTRALIA & NEW ZEALAND: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 127 AUSTRALIA & NEW ZEALAND: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.4.7 REST OF ASIA PACIFIC

- TABLE 128 REST OF ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.5 ROW

- 11.5.1 RECESSION IMPACT ON MARKET IN ROW

- FIGURE 54 IMPACT OF RECESSION ON MARKET IN ROW

- TABLE 130 ROW: TELECOM POWER SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 131 ROW: TELECOM POWER SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 132 ROW: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 133 ROW: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- TABLE 134 ROW: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2019-2022 (USD MILLION)

- TABLE 135 ROW: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2023-2028 (USD MILLION)

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Deployment of cleaner power systems at telecommunication sites to drive market

- TABLE 136 MIDDLE EAST & AFRICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Transition of consumers from 4G to 5G plan to fuel market growth

- TABLE 138 SOUTH AMERICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019-2022 (USD MILLION)

- TABLE 139 SOUTH AMERICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 140 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- 12.2.1 PRODUCT PORTFOLIO

- 12.2.2 REGIONAL FOCUS

- 12.2.3 MANUFACTURING FOOTPRINT

- 12.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

- 12.3 MARKET SHARE ANALYSIS: TELECOM POWER SYSTEM MARKET, 2022

- TABLE 141 TELECOM POWER SYSTEM MARKET: DEGREE OF COMPETITION, 2022

- 12.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

- FIGURE 55 FIVE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN TELECOM POWER SYSTEM MARKET

- 12.5 EVALUATION MATRIX FOR KEY PLAYERS

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 56 TELECOM POWER SYSTEM COMPANY EVALUATION MATRIX, 2022

- 12.6 COMPANY FOOTPRINT

- TABLE 142 OVERALL COMPANY FOOTPRINT

- TABLE 143 FOOTPRINT OF DIFFERENT COMPANIES BASED ON POWER SOURCES

- TABLE 144 FOOTPRINT OF DIFFERENT COMPANIES FOR VARIOUS COMPONENTS

- TABLE 145 FOOTPRINT OF DIFFERENT COMPANIES BASED ON REGIONS

- 12.7 EVALUATION MATRIX FOR STARTUPS/SMES

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 57 TELECOM POWER SYSTEM STARTUPS/SMES EVALUATION MATRIX, 2022

- 12.8 COMPETITIVE BENCHMARKING

- TABLE 146 LIST OF STARTUPS IN TELECOM POWER SYSTEM MARKET

- 12.9 COMPETITIVE SITUATIONS AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- TABLE 147 PRODUCT LAUNCHES, 2020-2023

- 12.9.2 DEALS

- TABLE 148 DEALS, 2020-2023

13 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 EATON

- TABLE 149 EATON: COMPANY OVERVIEW

- FIGURE 58 EATON: COMPANY SNAPSHOT

- 13.2.2 HUAWEI TECHNOLOGIES CO., LTD.

- TABLE 150 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- 13.2.3 CUMMINS INC.

- TABLE 151 CUMMINS: COMPANY SNAPSHOT

- FIGURE 60 CUMMINS INC.: COMPANY SNAPSHOT

- 13.2.4 ZTE CORPORATION

- TABLE 152 ZTE CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 ZTE CORPORATION: COMPANY SNAPSHOT

- 13.2.5 GENERAL ELECTRIC

- TABLE 153 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 62 GENERAL ELECTRIC: COMPANY SNAPSHOT

- 13.2.6 SCHNEIDER ELECTRIC

- TABLE 154 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 63 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- 13.2.7 ALPHA TECHNOLOGIES

- TABLE 155 ALPHA TECHNOLOGIES: COMPANY SNAPSHOT

- 13.2.8 DELTA ELECTRONICS, INC.

- TABLE 156 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 64 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- 13.2.9 ABB

- TABLE 157 ABB: COMPANY SNAPSHOT

- FIGURE 65 ABB: COMPANY SNAPSHOT

- 13.2.10 STATICON LTD.

- TABLE 158 STATICON LTD.: COMPANY SNAPSHOT

- 13.3 OTHER PLAYERS

- 13.3.1 ASCOT INDUSTRIAL S.R.L.

- TABLE 159 ASCOT INDUSTRIAL S.R.L.: COMPANY SNAPSHOT

- 13.3.2 UNIPOWER

- TABLE 160 UNIPOWER: COMPANY SNAPSHOT

- 13.3.3 DYNAMIC POWER GROUP

- TABLE 161 DYNAMIC POWER GROUP: COMPANY SNAPSHOT

- 13.3.4 EFORE

- TABLE 162 EFORE: COMPANY SNAPSHOT

- 13.3.5 HANGZHOU ZHONHENG POWER ENERGY

- TABLE 163 HANGZHOU ZHONHENG POWER ENERGY: COMPANY SNAPSHOT

- 13.3.6 MYERS POWER PRODUCTS, INC.

- TABLE 164 MYERS POWER PRODUCTS, INC.: COMPANY SNAPSHOT

- 13.3.7 ELTEK

- TABLE 165 ELTEK: COMPANY SNAPSHOT

- 13.3.8 VERTIV GROUP

- TABLE 166 VERTIV GROUP: COMPANY SNAPSHOT

- 13.3.9 VOLTSERVER INC.

- TABLE 167 VOLTSERVER: COMPANY SNAPSHOT

- 13.3.10 JMA WIRELESS

- TABLE 168 JMA WIRELESS: COMPANY SNAPSHOT

- 13.3.11 CORNING INCORPORATED

- TABLE 169 CORNING INCORPORATED: COMPANY SNAPSHOT

- 13.3.12 EMERSON ELECTRIC CO.

- TABLE 170 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- 13.3.13 POWERONEUPS

- TABLE 171 POWERONEUPS: COMPANY SNAPSHOT

- 13.3.14 EXICOM TELE-SYSTEMS

- TABLE 172 EXICOM TELE-SYSTEMS: COMPANY SNAPSHOT

- 13.3.15 STATIC POWER

- TABLE 173 STATIC POWER: COMPANY SNAPSHOT

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS