|

|

市場調査レポート

商品コード

1286726

航空構造物の世界市場:材料別 (複合材料、合金・超合金、金属)・コンポーネント別・エンドユーザー別 (OEM、アフターマーケット)・機種別 (民間機、ビジネス機・ジェネラルアビエーション、軍用機、UAV、AAM)・地域別の将来予測 (2028年まで)Aerostructures Market by Material (Composites, Alloys & Superalloys and Metals), Component, End User (OEM, Aftermarket), Aircraft Type (Commercial Aviation, Business & General Aviation, Military Aviation, UAVs and AAM), Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 航空構造物の世界市場:材料別 (複合材料、合金・超合金、金属)・コンポーネント別・エンドユーザー別 (OEM、アフターマーケット)・機種別 (民間機、ビジネス機・ジェネラルアビエーション、軍用機、UAV、AAM)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年05月31日

発行: MarketsandMarkets

ページ情報: 英文 272 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の航空構造物の市場規模は、2023年の610億米ドルから、2028年には840億米ドルに達し、2023年から2028年までの間に6.6%のCAGRで成長すると予測されます。

航空構造物市場は、複合材料の採用拡大や複合材料のコスト低下など、さまざまな要因によって牽引されています。しかし、複合材料のリサイクルに伴う障害や高い設備投資が、市場全体の成長を制限しています。

"動翼が2023年に、コンポーネント別で2番目に大きなシェアを占める"

動翼のセグメントは、2023年に2番目に大きなシェアを獲得すると予測されています。動翼の疲労を軽減して効率を高めるために複合材料の使用が増加していることが、この市場セグメントの成長を促しています。また、航空力学を改善する必要性や高度な製造技術の増加も、飛行制御面の成長に影響を与えています。

"軍用機:2023年に機種別でで2番目に大きなシェアを占める"

軍用機のセグメントは、2023年に2番目に大きなシェアを占めると予測されています。軍用機の近代化プログラムの増加、軍事への投資の増加が、軍用機セグメントの成長を促進しています。また、軍用機や軍用ヘリコプターの調達が増加していることも、このセグメントの成長に影響を与えています。

"欧州が2023年に、地域別で2番目に大きなシェアを占める"

欧州市場 (フランス、英国、ロシア、ドイツ、イタリアなど) は、2023年に地域別で2番目に大きなシェアを占めると推定されます。研究開発への投資の増加、無人航空機の採用の増加、先進的な航空機への研究開発 (R&D) への継続的な注力が、航空構造物市場の成長を促進すると予測されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 航空構造物市場のロードマップ (2010年~2022年)

- 景気後退の影響分析

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 航空構造物市場のエコシステム

- ポーターのファイブフォース分析

- 価格分析

- 市場規模データ (数量ベース):コンポーネント別

- 関税・規制状況

- 貿易分析

- 主要な利害関係者と購入基準

- 主要な会議とイベント (2023年~2024年)

- 技術分析

- 使用事例分析

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- 特許分析

第7章 航空構造物市場:コンポーネント別

- イントロダクション

- 機体

- 尾翼

- 動翼

- 翼

- 機首

- ナセル・パイロン

- ドア・スキッド

第8章 航空構造物市場:エンドユーザー別

- イントロダクション

- OEM

- アフターマーケット

第9章 航空構造物市場:機種別

- イントロダクション

- 民間機

- ビジネス機・ジェネラルアビエーション

- ビジネスジェット

- 超小型・小型航空機

- 軍用機

- 戦闘機

- 輸送機

- 特別任務航空機

- 軍用ヘリコプター

- 無人航空機 (UAV)

- 軍隊

- 政府・司法機関

- 商業

- 先進航空モボリティ (AAM)

- エアタクシー

- エアシャトル・エアメトロ

- 個人用航空機

- 貨物航空機

- 救急航空機・緊急医療機

- ラストマイル配送機

第10章 航空構造物市場:材料別

- イントロダクション

- 複合材料

- 合金・超合金

- 金属

第11章 航空構造物市場:地域別

- イントロダクション

- 地域不況の影響分析

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- イタリア

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東

- イスラエル

- アラブ首長国連邦

- サウジアラビア

- トルコ

- その他の中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他のアフリカ

第12章 競合情勢

- イントロダクション

- ランキング分析 (2022年)

- 収益分析 (2022年)

- 市場シェア分析 (2022年)

- 競合評価クアドラント

- 競合評価クアドラント:スタートアップ/中小企業

- 企業フットプリント分析

- 競合シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要企業

- AIRBUS SE

- SPIRIT AEROSYSTEMS INC.

- RAYTHEON TECHNOLOGIES CORPORATION

- LEONARDO S.P.A.

- GKN PLC

- SAFRAN SA

- SAAB AB

- FACC AG

- KAWASAKI HEAVY INDUSTRIES LTD.

- ST ENGINEERING

- KAMAN CORPORATION

- RUAG INTERNATIONAL HOLDING LTD.

- LATECOERE

- ELBIT SYSTEMS LTD.

- TRIUMPH GROUP

- KOREA AEROSPACE INDUSTRIES LTD.

- ISRAEL AEROSPACE INDUSTRIES LTD.

- MITSUBISHI HEAVY INDUSTRIES LTD.

- AAR CORPORATION

- AEROSPACE INDUSTRIAL DEVELOPMENT CORPORATION (AIDC)

- その他の企業

- SONACA GROUP

- AERNNOVA AEROSPACE S.A

- AERO VODOCHODY

- TURKISH AEROSPACE INDUSTRIES, INC.

- SABCA NV

- DAHER

- THE NORDAM GROUP LLC

- PRECISION CASTPARTS CORPORATION

- COMPOSITES TECHNOLOGY RESEARCH MALAYSIA SDN BHD (CTRM)

- MECACHROME GROUP

第14章 付録

The Aerostructures market is projected to grow from USD 61.0 billion in 2023 to USD 84.0 billion by 2028, at a CAGR of 6.6% from 2023 to 2028. The market for aerostructures is driven by various factors such as increased adoption of composite materials and decline in cost of composite materials. However, obstacles associated with recycling composite materials and high capital investments are limiting the overall growth of the market.

"Flight Control Surfaces: The second largest share in component segment in the aerostructures market in 2023."

The flight control surfaces segment is projected to have the second largest share in 2023. The increased use of composite materials to reduce fatigue of flight control surfaces to increase efficiency is driving the growth of this market segment. The need to improve aerodynamics and increasing advanced manufacturing techniques are also influencing the growth of the flight control surfaces.

"Military Aviation: The second largest share in aircraft type segment in the aerostructures market in 2023."

The military aviation segment is projected to have the second largest share in 2023. The increasing modernization programs for military aircrafts, Increasing investments in military are driving the growth of military aviation segment. Increasing procurement of military aircraft and military helicopters are also influencing the growth of this segment.

"The European region is estimated to have the second largest share in the aerostructures market in 2023."

Europe is estimated to account for the second largest share in the aerostructures in 2023. The European region for this study comprises of France, UK, Russia, Germany, Italy, and Rest of Europe. Increasing investment in R&D, growing adoption of unmanned aircraft and continuous R &D focus on advanced aircraft is projected to drive the growth of the aerostructures market.

The break-up of the profiles of primary participants in the aerostructures market is as follows:

- By Company Type: Tier 1 - 49%; Tier 2 - 37%; and Tier 3 - 14%

- By Designation: C Level Executives - 55%; Directors - 27%; and Others - 18%

- By Region: North America - 32%; Europe - 32%; Asia Pacific - 16%; Latin America - 10%; Middle East - 5%; Africa - 5%

Major Players in the aerostructures market are Triumph Group (US), Latecoere (France), Saab AB (Sweden), Airbus SE (Netherlands) and Elbit Systems (Israel)

Research Coverage

The market study covers the Aerostructures market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on component, material, aircraft type, end user and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aerostructures market and its subsegments. The report covers the entire ecosystem of the aerostructures industry and will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

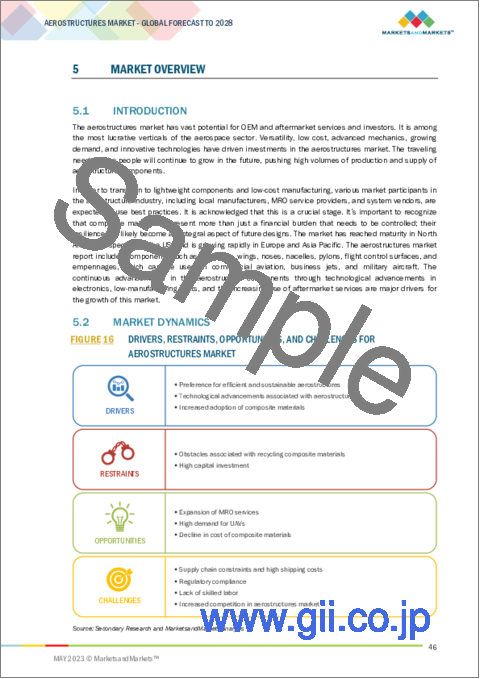

Analysis of key drivers (Preference for efficient and sustainable aerostructures; Technological advancements with aerostructures; Increased adoption of composite materials), restraints (Obstacles associated with recycling composite materials; High capital investment), opportunities (Expansion of MRO services; High demand for UAVs; Decline in cost of composite materials), and challenges (Supply chain constraints and high shipping costs; regulatory compliance; Lack of skilled labor; Increased competition in aerostructures market) influencing the growth of the aerostructures market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the aerostructures market

- Market Development: Comprehensive information about lucrative markets - the report analyses the aerostructures market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aerostructures market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Triumph Group (US), Latecoere (France), Kawasaki Heavy Industries (Japan), Mitsubishi Heavy Industries Ltd. (Japan) and Saab AB (Sweden) among others in the aerostructures market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 AEROSTRUCTURES MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY

- TABLE 2 USD EXCHANGE RATES

- 1.6 LIMITATIONS

- 1.7 MARKET STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 AEROSTRUCTURES OEM MARKET

- 2.3.3 AEROSTRUCTURES AFTERMARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.4 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY ON AEROSTRUCTURES MARKET

- 2.6 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 8 FUSELAGES SEGMENT TO DOMINATE AEROSTRUCTURES MARKET IN 2023

- FIGURE 9 COMPOSITES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 10 COMMERCIAL AVIATION TO SURPASS OTHER SEGMENTS IN 2023

- FIGURE 11 NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN AEROSTRUCTURES MARKET

- FIGURE 12 INCREASED DEMAND FOR ADVANCED AIR MOBILITY AND INTRODUCTION TO LIGHTWEIGHT AIRCRAFT MATERIALS

- 4.2 AEROSTRUCTURES MARKET, BY COMPONENT

- FIGURE 13 FUSELAGES TO SECURE LEADING MARKET POSITION FROM 2023 TO 2028

- 4.3 AEROSTRUCTURES MARKET, BY END USER

- FIGURE 14 OEM TO ACQUIRE MAXIMUM MARKET SHARE BY 2028

- 4.4 AEROSTRUCTURES MARKET, BY COUNTRY

- FIGURE 15 UAE TO BE FASTEST-GROWING COUNTRY DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR AEROSTRUCTURES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Preference for efficient and sustainable aerostructures

- 5.2.1.2 Technological advancements associated with aerostructures

- 5.2.1.3 Increased adoption of composite materials

- 5.2.2 RESTRAINTS

- 5.2.2.1 Obstacles associated with recycling composite materials

- 5.2.2.2 High capital investment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of MRO services

- 5.2.3.2 High demand for UAVs

- 5.2.3.3 Decline in cost of composite materials

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain constraints and high shipping costs

- 5.2.4.2 Regulatory compliance

- 5.2.4.3 Lack of skilled labor

- 5.2.4.4 Increased competition in aerostructures market

- 5.3 ROADMAP OF AEROSTRUCTURES MARKET, 2010-2022

- 5.4 RECESSION IMPACT ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIALS

- 5.5.2 R&D

- 5.5.3 COMPONENT MANUFACTURING

- 5.5.4 OEMS

- 5.5.5 END USERS

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AEROSTRUCTURES MARKET

- FIGURE 18 REVENUE SHIFT CURVE

- 5.7 AEROSTRUCTURES MARKET ECOSYSTEM

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 END USERS

- FIGURE 19 AEROSTRUCTURES MARKET ECOSYSTEM MAP

- TABLE 3 AEROSTRUCTURES MARKET ECOSYSTEM

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 PORTER'S FIVE FORCE ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 PRICING ANALYSIS

- TABLE 5 AVERAGE PRICE ANALYSIS FOR AEROSTRUCTURE COMPONENTS, BY AIRCRAFT TYPE

- 5.10 VOLUME DATA, BY COMPONENT

- TABLE 6 AEROSTRUCTURE OEM MARKET, BY COMPONENT (UNITS)

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- 5.12 TRADE ANALYSIS

- TABLE 9 COUNTRY-WISE IMPORT, 2018-2021 (USD THOUSAND)

- TABLE 10 COUNTRY-WISE EXPORTS, 2018-2021 (USD THOUSAND)

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING AEROSTRUCTURES, BY COMPONENT

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING AEROSTRUCTURES, BY COMPONENT (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR AEROSTRUCTURES, BY COMPONENT

- TABLE 12 KEY BUYING CRITERIA FOR AEROSTRUCTURES, BY COMPONENT

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 13 CONFERENCES AND EVENTS

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGY

- 5.15.1.1 Development of robots

- 5.15.2 SUPPORTING TECHNOLOGY

- 5.15.2.1 Use of computational fluid dynamics (CFD)

- 5.15.1 KEY TECHNOLOGY

- 5.16 USE CASE ANALYSIS

- 5.16.1 USE CASE 1: USE OF SMART STRUCTURES BY COLLINS AEROSPACE

- 5.16.2 USE CASE 2: USE OF ADVANCED MATERIALS IN AEROSTRUCTURES

- 5.16.3 USE CASE 3: USE OF ADDITIVE MANUFACTURING

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 AUTOMATION

- 6.2.2 ADDITIVE MANUFACTURING

- 6.2.3 INTERNET OF THINGS (IOT)

- 6.2.4 MORPHING TECHNOLOGY FOR WINGS

- FIGURE 23 MORPHING WINGS TECHNOLOGY

- 6.2.5 4D PRINTING

- FIGURE 24 4D PRINTING TECHNOLOGY

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 ADVANCED COMPOSITE MATERIALS

- 6.3.2 INDUSTRY 4.0

- 6.4 PATENT ANALYSIS

- TABLE 14 MAJOR PATENTS FOR AEROSTRUCTURES

7 AEROSTRUCTURES MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 25 AEROSTRUCTURES MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 15 AEROSTRUCTURES MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 16 AEROSTRUCTURES MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 7.2 FUSELAGES

- 7.2.1 ENSURE SAFE AND EFFECTIVE TRANSPORTATION OF GOODS

- TABLE 17 FUSELAGES: AEROSTRUCTURES MARKET, BY MATERIAL, 2020-2022 (USD MILLION)

- TABLE 18 FUSELAGES: AEROSTRUCTURES MARKET, BY MATERIAL 2023-2028 (USD MILLION)

- 7.3 EMPENNAGES

- 7.3.1 ENSURE STABILITY AND MANEUVERABILITY DURING FLIGHT

- TABLE 19 EMPENNAGES: AEROSTRUCTURES MARKET, BY MATERIAL, 2020-2022 (USD MILLION)

- TABLE 20 EMPENNAGES: AEROSTRUCTURES MARKET, BY MATERIAL 2023-2028 (USD MILLION)

- 7.4 FLIGHT CONTROL SURFACES

- 7.4.1 ENSURE OPTIMIZED AIRCRAFT PERFORMANCE AND SAFETY

- TABLE 21 FLIGHT CONTROL SURFACES: AEROSTRUCTURES MARKET, BY MATERIAL, 2020-2022 (USD MILLION)

- TABLE 22 FLIGHT CONTROL SURFACES: AEROSTRUCTURES MARKET, BY MATERIAL 2023-2028 (USD MILLION)

- 7.5 WINGS

- 7.5.1 ENSURE REDUCED FUEL CONSUMPTION

- TABLE 23 WINGS: AEROSTRUCTURES MARKET, BY MATERIAL, 2020-2022 (USD MILLION)

- TABLE 24 WINGS: AEROSTRUCTURES MARKET, BY MATERIAL 2023-2028 (USD MILLION)

- 7.6 NOSES

- 7.6.1 ENSURE ENHANCED AIRCRAFT PERFORMANCE

- TABLE 25 NOSES: AEROSTRUCTURES MARKET, BY MATERIAL, 2020-2022 (USD MILLION)

- TABLE 26 NOSES: AEROSTRUCTURES MARKET, BY MATERIAL 2023-2028 (USD MILLION)

- 7.7 NACELLES & PYLONS

- 7.7.1 PLAY VITAL ROLE IN ENSURING AIRCRAFT SAFETY

- TABLE 27 NACELLES & PYLONS: AEROSTRUCTURES MARKET, BY MATERIAL, 2020-2022 (USD MILLION)

- TABLE 28 NACELLES & PYLONS: AEROSTRUCTURES MARKET, BY MATERIAL 2023-2028 (USD MILLION)

- 7.8 DOORS & SKIDS

- 7.8.1 ENSURE BETTER STABILITY AND EASY ACCESS

- TABLE 29 DOORS & SKIDS: AEROSTRUCTURES MARKET, BY MATERIAL, 2020-2022 (USD MILLION)

- TABLE 30 DOORS & SKIDS: AEROSTRUCTURES MARKET, BY MATERIAL 2023-2028 (USD MILLION)

8 AEROSTRUCTURES MARKET, BY END USER

- 8.1 INTRODUCTION

- FIGURE 26 AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 31 AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 32 AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

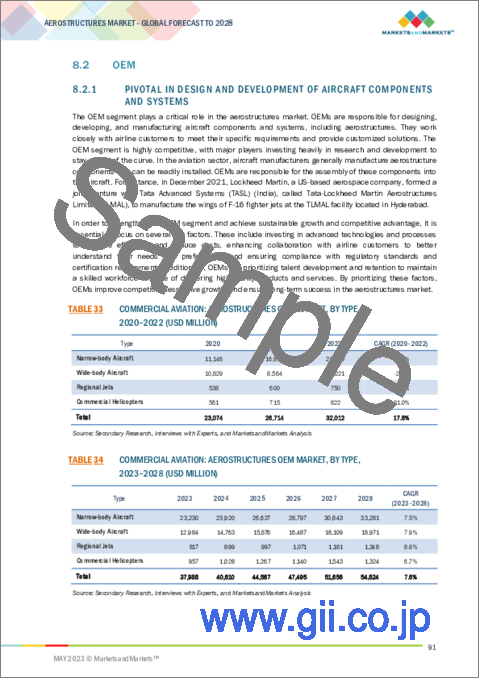

- 8.2 OEM

- 8.2.1 PIVOTAL IN DESIGN AND DEVELOPMENT OF AIRCRAFT COMPONENTS AND SYSTEMS

- TABLE 33 COMMERCIAL AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 34 COMMERCIAL AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 35 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 36 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 37 MILITARY AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 38 MILITARY AVIATION: AEROSTRUCTURES OEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 39 UNMANNED AERIAL VEHICLES: AEROSTRUCTURES OEM MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 40 UNMANNED AERIAL VEHICLES: AEROSTRUCTURES OEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 41 ADVANCED AIR MOBILITY: AEROSTRUCTURES OEM MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 42 ADVANCED AIR MOBILITY: AEROSTRUCTURES OEM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.3 AFTERMARKET

- 8.3.1 ASSISTS IN MAINTENANCE AND REPAIR OF AIRCRAFT

- TABLE 43 COMMERCIAL AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 44 COMMERCIAL AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 45 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 46 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 47 MILITARY AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 48 MILITARY AVIATION: AEROSTRUCTURES AFTERMARKET, BY TYPE, 2023-2028 (USD MILLION)

9 AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE

- 9.1 INTRODUCTION

- FIGURE 27 AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 49 AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 50 AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- 9.2 COMMERCIAL AVIATION

- TABLE 51 COMMERCIAL AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 52 COMMERCIAL AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.2.1 NARROW-BODY AIRCRAFT

- 9.2.1.1 Aerostructures influence performance of narrow-body aircraft

- 9.2.2 WIDE-BODY AIRCRAFT

- 9.2.2.1 Pivotal in long-haul commercial aviation

- 9.2.3 REGIONAL JETS

- 9.2.3.1 Used in connecting regional communities

- 9.2.4 COMMERCIAL HELICOPTERS

- 9.2.4.1 Advancements in aerostructures technology

- 9.3 BUSINESS & GENERAL AVIATION

- TABLE 53 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 54 BUSINESS & GENERAL AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.3.1 BUSINESS JETS

- 9.3.1.1 Innovative aerostructures to enhance comfort and safety

- 9.3.2 ULTRALIGHT & LIGHT AIRCRAFT

- 9.3.2.1 Lightweight aerostructures to optimize efficiency

- 9.4 MILITARY AVIATION

- TABLE 55 MILITARY AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 56 MILITARY AVIATION: AEROSTRUCTURES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.4.1 FIGHTER AIRCRAFT

- 9.4.1.1 Use of advanced composite materials in fighter aircraft aerostructures

- 9.4.2 TRANSPORT AIRCRAFT

- 9.4.2.1 Need to carry heavy loads over long distances

- 9.4.3 SPECIAL MISSION AIRCRAFT

- 9.4.3.1 Multi-mission capabilities of special mission aircraft

- 9.4.4 MILITARY HELICOPTERS

- 9.4.4.1 Need for combat helicopters

- 9.5 UNMANNED AERIAL VEHICLES

- TABLE 57 UNMANNED AERIAL VEHICLES: AEROSTRUCTURES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 58 UNMANNED AERIAL VEHICLES: AEROSTRUCTURES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.5.1 MILITARY

- 9.5.1.1 Wide-scale use of UAVs in military applications

- 9.5.2 GOVERNMENT & LAW

- 9.5.2.1 Increased government investments

- 9.5.3 COMMERCIAL

- 9.5.3.1 Lucrative opportunities for UAVs in commercial sector

- 9.6 ADVANCED AIR MOBILITY

- TABLE 59 ADVANCED AIR MOBILITY: AEROSTRUCTURES MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 60 ADVANCED AIR MOBILITY: AEROSTRUCTURES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.6.1 AIR TAXIS

- 9.6.1.1 Increased adoption of air taxis to cope with rapidly expanding megacities

- 9.6.2 AIR SHUTTLES & AIR METROS

- 9.6.2.1 Need for rapid transportation

- 9.6.3 PERSONAL AERIAL VEHICLES

- 9.6.3.1 Private air transport vehicles offer convenience, speed, and routing efficiency

- 9.6.4 CARGO AIR VEHICLES

- 9.6.4.1 Increased developments by key eVTOL aircraft manufacturers

- 9.6.5 AIR AMBULANCES & MEDICAL EMERGENCY VEHICLES

- 9.6.5.1 Advances in eVTOL aircraft facilitate organ transport

- 9.6.6 LAST-MILE DELIVERY VEHICLES

- 9.6.6.1 Rising adoption of autonomous vehicles

10 AEROSTRUCTURES MARKET, BY MATERIAL

- 10.1 INTRODUCTION

- FIGURE 28 AEROSTRUCTURES MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 61 AEROSTRUCTURES MARKET, BY MATERIAL, 2020-2022 (USD MILLION)

- TABLE 62 AEROSTRUCTURES MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- 10.2 COMPOSITES

- 10.2.1 OFFER LONGEVITY TO AEROSTRUCTURES

- 10.3 ALLOYS & SUPERALLOYS

- 10.3.1 OFFER DURABILITY TO AEROSTRUCTURES

- 10.4 METALS

- 10.4.1 OFFER STRENGTH AND STIFFNESS TO AEROSTRUCTURES

11 AEROSTRUCTURES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 29 AEROSTRUCTURES MARKET, BY REGION, 2023-2028

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 63 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 64 AEROSTRUCTURES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 65 AEROSTRUCTURES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 NORTH AMERICA

- 11.3.1 RECESSION IMPACT ANALYSIS: NORTH AMERICA

- 11.3.2 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 30 NORTH AMERICA: AEROSTRUCTURES MARKET SNAPSHOT

- TABLE 66 NORTH AMERICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.3.3 US

- 11.3.3.1 Presence of leading domestic players

- TABLE 72 US: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 73 US: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 74 US: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 75 US: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.3.4 CANADA

- 11.3.4.1 Increased R&D activities

- TABLE 76 CANADA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 77 CANADA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 78 CANADA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 79 CANADA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4 EUROPE

- 11.4.1 RECESSION IMPACT ANALYSIS: EUROPE

- 11.4.2 PESTLE ANALYSIS: EUROPE

- FIGURE 31 EUROPE: AEROSTRUCTURES MARKET SNAPSHOT

- TABLE 80 EUROPE: AEROSTRUCTURES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 81 EUROPE: AEROSTRUCTURES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 82 EUROPE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 83 EUROPE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 84 EUROPE: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 85 EUROPE: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.3 UK

- 11.4.3.1 Technological advancements in UAVs and UAM

- TABLE 86 UK: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 87 UK: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 88 UK: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 89 UK: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.4 FRANCE

- 11.4.4.1 Presence of several aircraft OEMs

- TABLE 90 FRANCE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 91 FRANCE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 92 FRANCE: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 93 FRANCE: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.5 GERMANY

- 11.4.5.1 Advancements in air transport

- TABLE 94 GERMANY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 95 GERMANY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 96 GERMANY: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 97 GERMANY: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.6 ITALY

- 11.4.6.1 Increasing number of unmanned aircraft

- TABLE 98 ITALY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 99 ITALY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 100 ITALY: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 101 ITALY: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.7 RUSSIA

- 11.4.7.1 Need for military aircraft

- TABLE 102 RUSSIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 103 RUSSIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 104 RUSSIA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 105 RUSSIA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.8 REST OF EUROPE

- 11.4.8.1 Growing focus on timely maintenance and replacement of aircraft parts

- TABLE 106 REST OF EUROPE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5 ASIA PACIFIC

- 11.5.1 RECESSION IMPACT ANALYSIS: ASIA PACIFIC

- 11.5.2 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 32 ASIA PACIFIC: AEROSTRUCTURES MARKET SNAPSHOT

- TABLE 110 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.3 CHINA

- 11.5.3.1 Growing demand for UAVs in military

- TABLE 116 CHINA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 117 CHINA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 118 CHINA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 119 CHINA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.4 INDIA

- 11.5.4.1 Improved domestic OEM capabilities

- TABLE 120 INDIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 121 INDIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 122 INDIA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 123 INDIA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.5 JAPAN

- 11.5.5.1 Diversification of commercial operations

- TABLE 124 JAPAN: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 125 JAPAN: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 126 JAPAN: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 127 JAPAN: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.6 AUSTRALIA

- 11.5.6.1 Use of advanced technology in air transport

- TABLE 128 AUSTRALIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 129 AUSTRALIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 130 AUSTRALIA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 131 AUSTRALIA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.7 SOUTH KOREA

- 11.5.7.1 Rise in defense spending

- TABLE 132 SOUTH KOREA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 133 SOUTH KOREA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 134 SOUTH KOREA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 135 SOUTH KOREA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.8 REST OF ASIA PACIFIC

- 11.5.8.1 Strong manufacturing expertise with composites and metals

- TABLE 136 REST OF ASIA PACIFIC: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 RECESSION IMPACT ANALYSIS: LATIN AMERICA

- 11.6.2 PESTLE ANALYSIS: LATIN AMERICA

- FIGURE 33 LATIN AMERICA: AEROSTRUCTURES MARKET SNAPSHOT

- TABLE 140 LATIN AMERICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 141 LATIN AMERICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 142 LATIN AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 143 LATIN AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 144 LATIN AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 145 LATIN AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.3.1 Significant presence of OEMs and carriers

- TABLE 146 BRAZIL: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 147 BRAZIL: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 148 BRAZIL: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 149 BRAZIL: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.6.4 MEXICO

- 11.6.4.1 Expanding composites industry

- TABLE 150 MEXICO: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 151 MEXICO: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 152 MEXICO: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 153 MEXICO: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.6.5 REST OF LATIN AMERICA

- 11.6.5.1 Rising demand for aircraft

- TABLE 154 REST OF LATIN AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 155 REST OF LATIN AMERICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 156 REST OF LATIN AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 157 REST OF LATIN AMERICA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.7 MIDDLE EAST

- 11.7.1 RECESSION IMPACT ANALYSIS: MIDDLE EAST

- 11.7.2 PESTLE ANALYSIS: MIDDLE EAST

- FIGURE 34 MIDDLE EAST: AEROSTRUCTURES MARKET SNAPSHOT

- TABLE 158 MIDDLE EAST: AEROSTRUCTURES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 159 MIDDLE EAST: AEROSTRUCTURES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 160 MIDDLE EAST: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 161 MIDDLE EAST: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 162 MIDDLE EAST: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 163 MIDDLE EAST: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.7.3 ISRAEL

- 11.7.3.1 Increased investments in UAV R&D

- TABLE 164 ISRAEL: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 165 ISRAEL: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 166 ISRAEL: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 167 ISRAEL: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.7.4 UAE

- 11.7.4.1 Preference for locally produced goods

- TABLE 168 UAE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 169 UAE: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 170 UAE: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 171 UAE: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.7.5 SAUDI ARABIA

- 11.7.5.1 Increased demand for aerostructure components and repair stations

- TABLE 172 SAUDI ARABIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 173 SAUDI ARABIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 174 SAUDI ARABIA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 175 SAUDI ARABIA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.7.6 TURKEY

- 11.7.6.1 Localization of contemporary aircraft platforms and components

- TABLE 176 TURKEY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 177 TURKEY: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 178 TURKEY: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 179 TURKEY: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.7.7 REST OF MIDDLE EAST

- 11.7.7.1 Rise in number of aircraft repair stations

- TABLE 180 REST OF MIDDLE EAST: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.8 AFRICA

- 11.8.1 RECESSION IMPACT ANALYSIS: AFRICA

- 11.8.2 PESTLE ANALYSIS: AFRICA

- FIGURE 35 AFRICA: AEROSTRUCTURES MARKET SNAPSHOT

- TABLE 184 AFRICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 185 AFRICA: AEROSTRUCTURES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 186 AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 187 AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 188 AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 189 AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.8.3 SOUTH AFRICA

- 11.8.3.1 Growing demand for replacement aircraft parts

- TABLE 190 SOUTH AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 191 SOUTH AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 192 SOUTH AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 193 SOUTH AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.8.4 NIGERIA

- 11.8.4.1 Rise in domestic demand for aircraft

- TABLE 194 NIGERIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 195 NIGERIA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 196 NIGERIA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 197 NIGERIA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.8.5 REST OF AFRICA

- 11.8.5.1 Accessibility of affordable materials

- TABLE 198 REST OF AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2020-2022 (USD MILLION)

- TABLE 199 REST OF AFRICA: AEROSTRUCTURES MARKET, BY AIRCRAFT TYPE, 2023-2028 (USD MILLION)

- TABLE 200 REST OF AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 201 REST OF AFRICA: AEROSTRUCTURES MARKET, BY END USER, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- TABLE 202 KEY DEVELOPMENTS BY LEADING PLAYERS IN AEROSTRUCTURES MARKET, 2022-2023

- 12.2 RANKING ANALYSIS, 2022

- FIGURE 36 MARKET RANKING OF TOP FIVE PLAYERS, 2022

- 12.3 REVENUE ANALYSIS, 2022

- FIGURE 37 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2022

- 12.4 MARKET SHARE ANALYSIS, 2022

- FIGURE 38 MARKET SHARE OF TOP FIVE PLAYERS, 2022

- TABLE 203 AEROSTRUCTURES MARKET: DEGREE OF COMPETITION

- 12.5 COMPETITIVE EVALUATION QUADRANT

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 39 MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

- 12.6 START-UP/SME EVALUATION QUADRANT

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 40 START-UP/SME COMPETITIVE LEADERSHIP MAPPING, 2022

- TABLE 204 AEROSTRUCTURES MARKET: KEY START-UPS/SMES

- 12.6.4.1 Competitive benchmarking of key start-ups/SMEs

- TABLE 205 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.7 COMPANY FOOTPRINT ANALYSIS

- TABLE 206 COMPANY FOOTPRINT

- TABLE 207 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 12.8 COMPETITIVE SCENARIO AND TRENDS

- 12.8.1 PRODUCT LAUNCHES

- TABLE 208 PRODUCT LAUNCHES, 2020-2023

- 12.8.2 DEALS

- TABLE 209 DEALS, 2020-2023

13 COMPANY PROFILES

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weakness and competitive threats) **

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 AIRBUS SE

- TABLE 210 AIRBUS SE: BUSINESS OVERVIEW

- FIGURE 41 AIRBUS SE: COMPANY SNAPSHOT

- TABLE 211 AIRBUS SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 AIRBUS SE: DEALS

- 13.2.2 SPIRIT AEROSYSTEMS INC.

- TABLE 213 SPIRIT AEROSYSTEMS INC.: BUSINESS OVERVIEW

- FIGURE 42 SPIRIT AEROSYSTEMS INC.

- TABLE 214 SPIRIT AEROSYSTEMS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 SPRITS AEROSYSTEMS HOLDINGS, INC.: DEALS

- 13.2.3 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 216 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 43 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 217 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- 13.2.4 LEONARDO S.P.A.

- TABLE 219 LEONARDO S.P.A.: BUSINESS OVERVIEW

- FIGURE 44 LEONARDO S.P.A.: COMPANY SNAPSHOT

- TABLE 220 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 LEONARDO S.P.A.: DEALS

- 13.2.5 GKN PLC

- TABLE 222 GKN PLC: BUSINESS OVERVIEW

- FIGURE 45 COMPANY SNAPSHOT: GKN PLC

- TABLE 223 GKN PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 GKN PLC: PRODUCT DEVELOPMENTS

- TABLE 225 GKN PLC: DEALS

- 13.2.6 SAFRAN SA

- TABLE 226 SAFRAN SA: BUSINESS OVERVIEW

- FIGURE 46 SAFRAN SA: COMPANY SNAPSHOT

- TABLE 227 SAFRAN SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 SAFRAN SA: DEALS

- 13.2.7 SAAB AB

- TABLE 229 SAAB AB: BUSINESS OVERVIEW

- FIGURE 47 SAAB AB: COMPANY SNAPSHOT

- TABLE 230 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 SAAB AB: DEALS

- TABLE 232 SAAB AB: OTHERS

- 13.2.8 FACC AG

- TABLE 233 FACC AG: BUSINESS OVERVIEW

- FIGURE 48 FACC AG: COMPANY SNAPSHOT

- TABLE 234 FACC AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 FACC AG: DEALS

- 13.2.9 KAWASAKI HEAVY INDUSTRIES LTD.

- TABLE 236 KAWASAKI HEAVY INDUSTRIES LTD.: BUSINESS OVERVIEW

- FIGURE 49 KAWASAKI HEAVY INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 237 KAWASAKI HEAVY INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 KAWASAKI HEAVY INDUSTRIES LTD.: DEALS

- 13.2.10 ST ENGINEERING

- TABLE 239 ST ENGINEERING: BUSINESS OVERVIEW

- FIGURE 50 ST ENGINEERING: COMPANY SNAPSHOT

- TABLE 240 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 ST ENGINEERING: DEALS

- 13.2.11 KAMAN CORPORATION

- TABLE 242 KAMAN CORPORATION: BUSINESS OVERVIEW

- FIGURE 51 COMPANY SNAPSHOT: KAMAN CORPORATION

- TABLE 243 KAMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.12 RUAG INTERNATIONAL HOLDING LTD.

- TABLE 244 RUAG INTERNATIONAL HOLDING LTD.: BUSINESS OVERVIEW

- FIGURE 52 COMPANY SNAPSHOT: RUAG INTERNATIONAL HOLDING LTD.

- TABLE 245 RUAG INTERNATIONAL HOLDING LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 246 RUAG INTERNATIONAL HOLDING LTD.: DEALS

- 13.2.13 LATECOERE

- TABLE 247 LATECOERE: BUSINESS OVERVIEW

- FIGURE 53 LATECOERE: COMPANY SNAPSHOT

- TABLE 248 LATECOERE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 LATECOERE: DEALS

- 13.2.14 ELBIT SYSTEMS LTD.

- TABLE 250 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- FIGURE 54 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 251 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 ELBIT SYSTEMS LTD.: DEALS

- 13.2.15 TRIUMPH GROUP

- TABLE 253 TRIUMPH GROUP: BUSINESS OVERVIEW

- FIGURE 55 TRIUMPH GROUP: COMPANY SNAPSHOT

- TABLE 254 TRIUMPH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 TRIUMPH GROUP: DEALS

- 13.2.16 KOREA AEROSPACE INDUSTRIES LTD.

- TABLE 256 KOREA AEROSPACE INDUSTRIES LTD.: BUSINESS OVERVIEW

- FIGURE 56 COMPANY SNAPSHOT: KOREA AEROSPACE INDUSTRIES LTD.

- TABLE 257 KOREA AEROSPACE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 258 KOREA AEROSPACE INDUSTRIES LTD.: DEALS

- 13.2.17 ISRAEL AEROSPACE INDUSTRIES LTD.

- TABLE 259 ISRAEL AEROSPACE INDUSTRIES LTD.: BUSINESS OVERVIEW

- FIGURE 57 COMPANY SNAPSHOT: ISRAEL AEROSPACE INDUSTRIES LTD.

- TABLE 260 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 261 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

- 13.2.18 MITSUBISHI HEAVY INDUSTRIES LTD.

- TABLE 262 MITSUBISHI HEAVY INDUSTRIES LTD.: BUSINESS OVERVIEW

- FIGURE 58 COMPANY SNAPSHOT: MITSUBISHI HEAVY INDUSTRIES LTD.

- TABLE 263 MITSUBISHI HEAVY INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- 13.2.19 AAR CORPORATION

- TABLE 264 AAR CORPORATION: BUSINESS OVERVIEW

- FIGURE 59 COMPANY SNAPSHOT: AAR CORPORATION

- TABLE 265 AAR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 AAR CORPORATION: DEALS

- 13.2.20 AEROSPACE INDUSTRIAL DEVELOPMENT CORPORATION (AIDC)

- TABLE 267 AEROSPACE INDUSTRIAL DEVELOPMENT CORPORATION (AIDC): BUSINESS OVERVIEW

- FIGURE 60 COMPANY SNAPSHOT: AEROSPACE INDUSTRIAL DEVELOPMENT CORPORATION (AIDC)

- TABLE 268 AEROSPACE INDUSTRIAL DEVELOPMENT CORPORATION (AIDC): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weakness and competitive threats might not be captured in case of unlisted companies.

- 13.3 OTHER PLAYERS

- 13.3.1 SONACA GROUP

- TABLE 269 SONACA GROUP: COMPANY OVERVIEW

- 13.3.2 AERNNOVA AEROSPACE S.A

- TABLE 270 AERNNOVA AEROSPACE S.A: COMPANY OVERVIEW

- 13.3.3 AERO VODOCHODY

- TABLE 271 AERO VODOCHODY: COMPANY OVERVIEW

- 13.3.4 TURKISH AEROSPACE INDUSTRIES, INC.

- TABLE 272 TURKISH AEROSPACE INDUSTRIES, INC.: COMPANY OVERVIEW

- 13.3.5 SABCA NV

- TABLE 273 SABCA NV: COMPANY OVERVIEW

- 13.3.6 DAHER

- TABLE 274 DAHER: COMPANY OVERVIEW

- 13.3.7 THE NORDAM GROUP LLC

- TABLE 275 THE NORDAM GROUP LLC: COMPANY OVERVIEW

- 13.3.8 PRECISION CASTPARTS CORPORATION

- TABLE 276 PRECISION CASTPARTS CORPORATION: COMPANY OVERVIEW

- 13.3.9 COMPOSITES TECHNOLOGY RESEARCH MALAYSIA SDN BHD (CTRM)

- TABLE 277 COMPOSITES TECHNOLOGY RESEARCH MALAYSIA SDN BHD: COMPANY OVERVIEW

- 13.3.10 MECACHROME GROUP

- TABLE 278 MECACHROME GROUP: BUSINESS OVERVIEW

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS