|

|

市場調査レポート

商品コード

1280715

再生炭素繊維の世界市場:種類別 (チョップド、ミルド)・供給源別 (航空宇宙スクラップ、自動車スクラップ)・最終用途産業別 (自動車・輸送、消費財、スポーツ用品、航空宇宙・防衛)・地域別の将来予測 (2028年まで)Recycled Carbon Fiber Market by Type (Chopped, Milled), Source (Aerospace Scrap, Automotive Scrap), End-use Industry (Automotive & Transportation, Consumer goods, Sporting Goods, Aerospace & Defense), & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 再生炭素繊維の世界市場:種類別 (チョップド、ミルド)・供給源別 (航空宇宙スクラップ、自動車スクラップ)・最終用途産業別 (自動車・輸送、消費財、スポーツ用品、航空宇宙・防衛)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年05月16日

発行: MarketsandMarkets

ページ情報: 英文 233 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の再生炭素繊維の市場規模は、2023年に1億7,200万米ドルの成長が見込まれ、2023年から2028年にかけて10.0%のCAGRで、2028年には2億7,800万米ドルに達すると予測されています。

これらの材料は、高強度・高弾性率、低密度、形状安定性、低熱膨張といった優れた特性を備えています。高性能でコスト効率が高く、環境に優しい素材への需要が、再生炭素繊維の市場を牽引しています。しかし、再生炭素繊維の製造に関する技術的知識の不足が、市場成長を阻害する大きな要因となっています。この繊維は、Eガラス繊維やSガラス繊維など、低価格の成熟した製品との厳しい競合に直面しており、市場の成長をさらに抑制しています。

"2022年の再生炭素繊維市場では、チョップドが金額・数量ともに優位なセグメントである"

チョップド再生炭素繊維は、様々な合成プロセスや射出成形などの工業用ミキシングに適しています。良好な導電性、低密度、低い熱膨張、非腐食性、優れた自由流動性を示します。低温から高温までの用途に使用でき、導電性材料の製造に使用できます。長さは3~100ミリで、航空宇宙・防衛、自動車・輸送、風力発電の最終用途に使用されています。

"自動車スクラップ原料は、金額・数量ともに再生炭素繊維市場で2番目に高いセグメントである"

自動車OEMは、世界各国の政府が実施する厳しい法律に注目し、埋立地での廃棄物処理に制限を設けています。ドイツ、米国、日本を含む先進国では、環境に配慮した製品が広く使用されています。EUは、自動車に使用される材料の85%をリサイクルする必要があると義務付けています。彼らは、炭素繊維を使用したスクラップ製品をリサイクルに提供しています。再生された自動車用スクラップは、さまざまな最終用途産業で使用され、低コストで高性能な製品を製造することができます。自動車スクラップから再生された炭素繊維は、バージン炭素繊維に近い特性を持ち、繊維の強度は小さなばらつきで減少しています。

"最終用途産業別では、消費財が再生炭素繊維の中で金額・数量ともに2番目に大きい"

消費財は2022年に第2位の市場であり、予測期間中もCAGR10.4% (金額ベース) で大きく成長すると予測されます。再生炭素繊維は、マイクロエレクトロニクス製品に使用されるポリマー組成物やコーティングに導電性や帯電防止特性を付与します。機械的特性が向上するため、炭素繊維樹脂を10~60%添加することで、プラスチック部品の軽量化や薄型化を支援することができます。また、炭素繊維の導電性により、プラスチック材料に静電気負荷防止や電磁波シールドなどの性能を付加することができます。このような利点から、再生炭素繊維はノートパソコン、液晶プロジェクター、カメラボディ、レンズなどの電子機器用プラスチック複合材料に多く使用されています。例えば、Dell Computersは、Gen 2 Carbon社 (旧ELG Carbon Fiber社) の製品を購入し、ノートパソコンのケースを製造しています。

"北米は再生炭素繊維市場において、金額・数量ともに2番目に優位な地域である"

北米は、航空宇宙・防衛分野からの需要により、再生炭素繊維の大きな市場となっています。この航空宇宙・防衛、自動車・輸送、消費財、その他の最終用途産業からの需要は、製品イノベーションと技術進歩により増加すると予想されます。Carbon Conversions (米国)、Automotive & Transportation Recycling, Inc. (米国)、Shocker Composites LLC. (米国) などの既存企業の存在が、市場の成長に寄与しています。これらの企業は、様々な最終用途産業からの再生炭素繊維の需要増に対応するため、数多くの契約や拡張を実施しています。例えば、the automotive & transportation recycling (米国) は、テネシー州テーズウェルに、年間最大2,000トンの自動車・輸送用スクラップをリサイクルする能力を持つ施設を建設しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界動向

- 技術分析

- エコシステム

- バリューチェーン分析

- サプライチェーン分析

- 価格分析

- 平均販売価格:地域別

- 主要な利害関係者と購入基準

- 輸出入シナリオ

- 特許分析

- 関税と規制

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向と混乱

- 主要な会議とイベント (2023年~2024年)

第6章 再生炭素繊維市場:種類別

- イントロダクション

- チョップド再生炭素繊維

- ミルド再生炭素繊維

第7章 再生炭素繊維市場:供給源別

- イントロダクション

- 航空宇宙スクラップ

- 自動車スクラップ

- その他のスクラップ

第8章 再生炭素繊維市場:最終用途産業別

- イントロダクション

- 自動車・輸送

- 消費財

- スポーツ用品

- 産業用

- 航空宇宙・防衛

- 船舶

- その他の最終用途産業

第9章 再生炭素繊維市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- アジア太平洋

- 日本

- 中国

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- スペイン

- ロシア

- その他の欧州

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他の中東・アフリカ

第10章 競合情勢

- イントロダクション

- 市場シェア分析

- 市場ランキング

- 上位企業の収益分析

- 企業評価マトリックス

- 競合情勢のマッピング

- 市場評価の枠組み

- 主なスタートアップ/中小企業の競合ベンチマーキング

- 中小企業 (SME) の評価マトリックス

第11章 企業プロファイル

- 主要企業

- TORAY INDUSTRIES, INC.

- MITSUBISHI CHEMICAL GROUP CORPORATION

- CARBON CONVERSIONS

- SHOCKER COMPOSITES, LLC.

- GEN 2 CARBON LIMITED

- PROCOTEX

- CARBON FIBER RECYCLING

- ALPHA RECYCLAGE COMPOSITES

- CARBON FIBER REMANUFACTURING

- CATACK-H

- その他の企業

- VARTEGA INC.

- SIGMATEX

- CARBON FIBER RECYCLE INDUSTRY CO. LTD.

- TEIJIN CARBON EUROPE GMBH

- BCIRCULAR

- FAIRMAT

- ASAHI KASEI

- THERMOLYSIS CO., LTD.

- RYMYC S.R.L.

- MALLINDA INC.

第12章 付録

The recycled carbon fiber market is estimated to grow USD 172 million in 2023 and is projected to reach USD 278 million by 2028, at a CAGR of 10.0% from 2023 to 2028. These material features excellent properties such as high strength and modulus, low density, dimensional stability, and low thermal expansion. The demand for high-performance, cost-efficient, and eco-friendly materials drives the market for recycled carbon fiber. However, a lack of technical knowledge related to the manufacturing of recycled carbon fiber is a major factor inhibiting market growth. This fiber faces tough competition from E-glass and S-glass fibers, among other low-cost mature products, further restraining market growth.

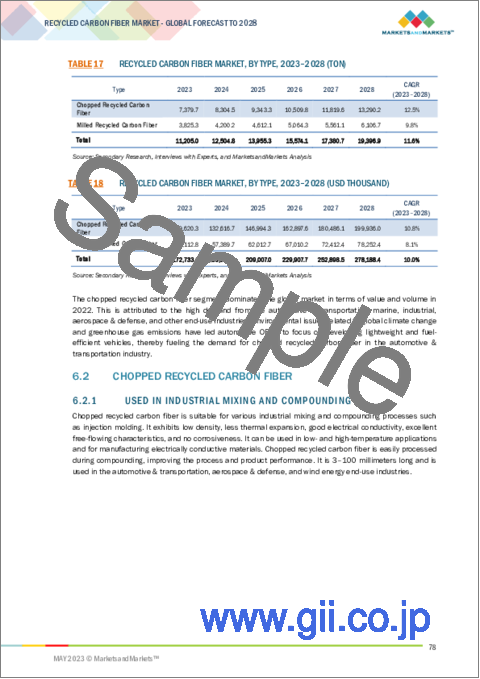

"Chopped type is the dominated segment in the recycled carbon fiber market in terms of both value and volume in 2022."

Chopped recycled carbon fiber is suitable for various compounding processes and industrial mixing such as injection molding. It exhibits good electrical conductivity, low density, less thermal expansion, no corrosiveness, and excellent free-flowing characteristics. It can be used in low- and high-temperature applications and for manufacturing electrically conductive materials. It is 3-100 millimeters long and has applications in the aerospace & defense, automotive & transportation, and wind energy end-use industries.

"Automotive scrap source is the second highest segment in recycle carbon fiber market in terms of both value and volume."

Automotive OEMs focus on stringent laws implemented by governments worldwide, placing restrictions on waste disposal in landfills. Developed countries, including Germany, the US, and Japan, are widely using eco-friendly products. The EU has mandated that 85% of the materials used in vehicles need to be recycled. They offer their carbon fiber-based scrap products for recycling. Recycled automotive scrap is used in various end-use industries to manufacture low-cost and high-performance products. The reclaimed carbon fiber from automotive scrap has properties similar to virgin carbon fiber, with the strength of the fiber reduced by small variations.

"Consumer goods end-use industry to be the second largest in the recycle carbon fiber in terms of both value and volume."

Consumer goods were the second-largest market in 2022 and are anticipated to grow significantly during the forecast period with a CAGR of 10.4% (in terms of value). Recycled carbon fiber provides electrical conductivity and antistatic characteristics to polymer compositions and coatings used in microelectronics products. Due to their improved mechanical properties, carbon fiber resin additions of 10-60% can assist in reducing the weight or thickness of plastic components. In addition, the electric conductivity of carbon fiber provides additional performance to plastic material to prevent static load and offer a shield from electromagnetic interference. Due to its performance advantages, recycled carbon fiber is more frequently used in plastic composites for electronics, including notebook PCs, LCD projectors, camera bodies, and lenses. For instance, Dell Computers buys products from Gen 2 Carbon (previously ELG Carbon Fiber) to make its laptop cases.

"North America is the second-highest dominating region in recycled carbon fiber market in terms of both value and volume."

North America is a prominent market for recycled carbon fiber due to the demand from the aerospace & defense sector. This demand from aerospace & defense, automotive & transportation, consumer goods, and other end-use industries is expected to increase due to product innovations and technological advancements. The presence of established market players such as Carbon Conversions (US), Automotive & Transportation Recycling, Inc. (US), and Shocker Composites LLC. (US), contributes to market growth. These players have undertaken numerous agreements and expansions to cater to the increasing demand for recycled carbon fiber from various end-use industries. For instance, the automotive & transportation recycling (US) has built a facility in Tazewell, Tennessee, with a capacity to recycle up to 2,000 tons of automotive & transportation scrap per annum.

This study has been validated through primary interviews conducted with various industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 37%, Tier 2- 33%, and Tier 3- 30%

- By Designation- C Level- 50%, Director Level- 20%, and Others- 30%

- By Region- Europe- 50%, Asia Pacific (APAC) - 20%, North America- 15%, Middle East & Africa (MEA)-10%, Latin America-5%,

The report provides a comprehensive analysis of company profiles :

Toray Industries, Inc. (Japan), Gen 2 Carbon Limited (UK), Carbon Conversions, Inc. (US), Carbon Fiber Recycling (US), Shocker Composites, LLC. (US), Procotex (Belgium), Carbon Fiber Remanufacturing (US), Alpha Recyclage Composites (France), Mitsubishi Chemical Group (Japan), and CATACK-H (South Korea).

Research Coverage

This report covers the global recycled carbon fiber market and forecasts the market size until 2028. It includes the following market segmentation - by Type (Chopped Recycled Carbon Fiber, Milled Recycled Carbon Fiber), by Source (Aerospace Scrap, Automotive Scrap & Others), by End-use industry (Automotive & Transportation, Consumer Goods, Sporting Goods, Industrial, Marine, Aerospace & Defense, and Others), and Region (North America, Europe, Asia Pacific, Middle East & Africa, Latin America). Porter's Five Forces Analysis, along with the drivers, restraints, opportunities, and challenges, have been discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global recycled carbon fiber market.

Key benefits of buying the report:

The report is expected to help market leaders/new entrants in this market in the following ways:

1. This report segments the global recycled carbon fiber market comprehensively. It provides the closest approximations of the revenues for the overall market and the sub-segments across different verticals and regions.

2. The report helps stakeholders understand the pulse of the recycled carbon fiber market and provides them with information on key market drivers, restraints, challenges, and opportunities.

3. This report will help stakeholders to understand competitors better and gain more insights to better their position in their businesses. The competitive landscape section includes the competitor ecosystem, new product development, agreement, contract, expansion, and acquisition.

Reasons to buy the report:

The report will help leaders/new entrants in this market by providing them with the closest approximations of the revenues for the overall recycled carbon fiber market and the sub-segments. This report will help stakeholders to understand the competitive landscape and gain more insights and position their businesses and market strategies in a better way.

The report provides insights on the following pointers:

- Analysis of key drivers (Regulations on eco-friendly products, Increasing demand for carbon fibers from composites industry), restraints (Lack of technical knowledge, Use of economic products), opportunities (Use of recyclable and lightweight materials in automotive & transportation sectors), and challenges (Promoting recycled carbon fiber for commercial applications, Less availability of composite waste) influencing the growth of the recycled carbon fiber market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the recycled carbon fiber market

- Market Development: Comprehensive information about lucrative markets - the report analyses the recycled carbon fiber market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the recycled carbon fiber industry market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Toray Industries, Inc. (Japan), Gen 2 Carbon Limited (UK), Carbon Conversions, Inc. (US), Carbon Fiber Recycling (US), Shocker Composites, LLC. (US), Procotex (Belgium), Carbon Fiber Remanufacturing (US), Alpha Recyclage Composites (France), Mitsubishi Chemical Group (Japan), and CATACK-H (South Korea), among others in the recycled carbon fiber market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 RECYCLED CARBON FIBER MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 RECYCLED CARBON FIBER MARKET: RESEARCH DESIGN

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.2.2 DEMAND-SIDE APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 RESEARCH DATA

- 2.4.1 SECONDARY DATA

- 2.4.1.1 Key data from secondary sources

- 2.4.2 PRIMARY DATA

- 2.4.2.1 Key data from primary sources

- 2.4.2.2 Primary interviews - demand and supply sides

- 2.4.2.3 Breakdown of primary interviews

- 2.4.2.4 Key industry insights

- 2.4.1 SECONDARY DATA

- 2.5 MARKET SIZE ESTIMATION

- 2.5.1 BOTTOM-UP APPROACH

- FIGURE 2 RECYCLED CARBON FIBER MARKET: BOTTOM-UP APPROACH

- 2.5.2 TOP-DOWN APPROACH

- FIGURE 3 RECYCLED CARBON FIBER MARKET: TOP-DOWN APPROACH

- 2.6 DATA TRIANGULATION

- FIGURE 4 RECYCLED CARBON FIBER MARKET: DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 ASSUMPTIONS

- 2.9 LIMITATIONS

- 2.10 RISK ASSESSMENT

- 2.11 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 5 CHOPPED RECYCLED CARBON FIBER ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 6 AEROSPACE SCRAP SOURCE REGISTERED HIGHEST GROWTH IN 2022

- FIGURE 7 AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY LED MARKET IN 2022

- FIGURE 8 US TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 EUROPE TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RECYCLED CARBON FIBER MARKET

- FIGURE 10 HIGH DEMAND FROM END-USE INDUSTRIES TO DRIVE MARKET

- 4.2 RECYCLED CARBON FIBER MARKET, BY TYPE

- FIGURE 11 CHOPPED RECYCLED CARBON FIBER DOMINATED MARKET IN 2022

- 4.3 RECYCLED CARBON FIBER MARKET, BY SOURCE

- FIGURE 12 AEROSPACE SCRAP SOURCE LED MARKET IN 2022

- 4.4 RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY

- FIGURE 13 AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY RECORDED HIGHEST GROWTH IN 2022

- 4.5 RECYCLED CARBON FIBER MARKET, BY KEY COUNTRY

- FIGURE 14 GERMANY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN RECYCLED CARBON FIBER MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Regulations on eco-friendly products

- 5.2.1.2 Increasing demand for carbon fibers from composites industry

- 5.2.1.3 Waste reduction to protect environment

- 5.2.1.4 Developing eco-friendly carbon fibers from composites

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of technical knowledge

- 5.2.2.2 Use of economic products

- 5.2.2.3 Test procedures for recycled carbon fiber composites

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Use of recyclable and lightweight materials in automotive & transportation sectors

- 5.2.3.2 Rising demand for recycled carbon from emerging markets

- 5.2.3.3 Increased use of recycled carbon fiber in aerospace sector

- TABLE 1 NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION (2022-2041)

- TABLE 2 NEW AIRCRAFT DELIVERIES BETWEEN 2022 AND 2041

- 5.2.4 CHALLENGES

- 5.2.4.1 Promoting recycled carbon fiber for commercial applications

- 5.2.4.2 Low availability of composite waste

- 5.3 INDUSTRY TRENDS

- 5.3.1 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 RECYCLED CARBON FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 BARGAINING POWER OF SUPPLIERS

- 5.3.6 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 RECYCLED CARBON FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 TECHNOLOGY ANALYSIS

- FIGURE 17 RECYCLED CARBON FIBER MARKET: TECHNOLOGY ANALYSIS

- 5.4.1 MECHANICAL RECYCLING

- 5.4.2 THERMAL RECYCLING

- 5.4.3 CHEMICAL RECYCLING

- 5.5 ECOSYSTEM

- FIGURE 18 RECYCLED CARBON FIBER MARKET: ECOSYSTEM

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 19 RECYCLED CARBON FIBER MARKET: VALUE CHAIN ANALYSIS

- 5.6.1 SCRAP SOURCING AND INTERMEDIATE PROCESSING

- 5.6.2 DISTRIBUTION AND APPLICATIONS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE, BY APPLICATION

- FIGURE 20 AVERAGE SELLING PRICE OF KEY PLAYERS FOR VARIOUS APPLICATIONS (USD/KG)

- 5.8.2 AVERAGE SELLING PRICE, BY END-USE INDUSTRY

- FIGURE 21 AVERAGE SELLING PRICE OF END-USE INDUSTRIES (USD/KG)

- 5.8.3 AVERAGE SELLING PRICE, BY TYPE

- FIGURE 22 AVERAGE SELLING PRICE BASED ON TYPES (USD/KG)

- 5.8.4 AVERAGE SELLING PRICE, BY SOURCE

- FIGURE 23 AVERAGE SELLING PRICE BASED ON SOURCE (USD/KG)

- 5.9 AVERAGE SELLING PRICE, BY REGION

- TABLE 4 RECYCLED CARBON FIBER AVERAGE SELLING PRICE, BY REGION

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 5 IMPACT ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- 5.10.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 6 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- 5.11 IMPORT-EXPORT SCENARIO

- 5.11.1 US

- 5.11.2 GERMANY

- 5.11.3 FRANCE

- 5.11.4 CHINA

- 5.11.5 JAPAN

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 METHODOLOGY

- 5.12.3 DOCUMENT TYPES

- TABLE 7 RECYCLED CARBON FIBER MARKET: GLOBAL PATENTS

- FIGURE 26 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 27 GLOBAL PATENT PUBLICATION TREND ANALYSIS (LAST 10 YEARS)

- 5.12.4 INSIGHTS

- 5.12.5 LEGAL STATUS

- FIGURE 28 RECYCLED CARBON FIBER MARKET: LEGAL STATUS OF PATENTS

- 5.12.6 JURISDICTION ANALYSIS

- FIGURE 29 GLOBAL JURISDICTION ANALYSIS

- 5.12.7 TOP APPLICANTS

- FIGURE 30 TOP APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- TABLE 8 PATENTS BY NATIONAL DONG HWA UNIVERSITY

- TABLE 9 PATENTS BY SGL CARBON

- TABLE 10 PATENTS BY EMPIRE TECHNOLOGY DEVELOPMENT LLC

- TABLE 11 TOP TEN PATENT OWNERS (US) IN LAST 10 YEARS

- 5.13 TARIFF AND REGULATIONS

- 5.13.1 REGULATIONS IN RECYCLED CARBON FIBER MARKET

- TABLE 12 CURRENT STANDARD CODES FOR RECYCLED CARBON FIBER

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 RECYCLED CARBON FIBER MARKET: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 CASE STUDY ANALYSIS

- FIGURE 31 RECYCLED CARBON FIBER MARKET: CASE STUDY ANALYSIS

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 RECYCLED CARBON FIBER MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 14 CONFERENCES AND EVENTS FOR RECYCLED CARBON FIBER AND RELATED MARKETS

6 RECYCLED CARBON FIBER MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 33 CHOPPED RECYCLED CARBON FIBER TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 15 RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (TON)

- TABLE 16 RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 17 RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 18 RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- 6.2 CHOPPED RECYCLED CARBON FIBER

- 6.2.1 USED IN INDUSTRIAL MIXING AND COMPOUNDING

- FIGURE 34 EUROPE TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 19 CHOPPED RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 20 CHOPPED RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 21 CHOPPED RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 22 CHOPPED RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 6.3 MILLED RECYCLED CARBON FIBER

- 6.3.1 OFFERS GOOD DIMENSIONAL STABILITY AND ELECTRICAL CONDUCTIVITY

- FIGURE 35 EUROPE TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 23 MILLED RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 24 MILLED RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 25 MILLED RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 26 MILLED RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

7 RECYCLED CARBON FIBER MARKET, BY SOURCE

- 7.1 INTRODUCTION

- FIGURE 36 AEROSPACE SCRAP SEGMENT PROJECTED TO DOMINATE GLOBAL RECYCLED CARBON FIBER MARKET

- TABLE 27 RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (TON)

- TABLE 28 RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 29 RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (TON)

- TABLE 30 RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- 7.2 AEROSPACE SCRAP

- 7.2.1 RECYCLING INITIATIVES BY AIRCRAFT MANUFACTURERS TO DRIVE MARKET

- FIGURE 37 EUROPE TO LEAD AEROSPACE SCRAP SEGMENT DURING FORECAST PERIOD

- TABLE 31 AEROSPACE SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 32 AEROSPACE SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 33 AEROSPACE SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 34 AEROSPACE SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 7.3 AUTOMOTIVE SCRAP

- 7.3.1 STRINGENT REGULATIONS TO FUEL DEMAND FOR RECYCLING SCRAP

- FIGURE 38 EUROPE TO DOMINATE AUTOMOTIVE SCRAP SEGMENT DURING FORECAST PERIOD

- TABLE 35 AUTOMOTIVE SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 36 AUTOMOTIVE SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 37 AUTOMOTIVE SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 38 AUTOMOTIVE SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 7.4 OTHER SCRAP

- FIGURE 39 EUROPE TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 39 OTHER SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 40 OTHER SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 41 OTHER SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 42 OTHER SCRAP: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

8 RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 40 AUTOMOTIVE & TRANSPORTATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 43 RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 44 RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 45 RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 46 RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 8.2 AUTOMOTIVE & TRANSPORTATION

- 8.2.1 USE OF RECYCLED CARBON FIBER IN AUTOMOTIVE PARTS TO PROPEL MARKET

- FIGURE 41 EUROPE TO DOMINATE AUTOMOTIVE & TRANSPORTATION END-USE INDUSTRY DURING FORECAST PERIOD

- TABLE 47 AUTOMOTIVE & TRANSPORTATION: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 48 AUTOMOTIVE & TRANSPORTATION: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 49 AUTOMOTIVE & TRANSPORTATION: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 50 AUTOMOTIVE & TRANSPORTATION: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.3 CONSUMER GOODS

- 8.3.1 USE OF RECYCLED CARBON FIBER IN PLASTIC COMPOSITES TO DRIVE MARKET

- FIGURE 42 EUROPE TO LEAD CONSUMER GOODS END-USE INDUSTRY DURING FORECAST PERIOD

- TABLE 51 CONSUMER GOODS: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 52 CONSUMER GOODS: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 53 CONSUMER GOODS: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 54 CONSUMER GOODS: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.4 SPORTING GOODS

- 8.4.1 RESISTANCE TO CORROSION TO FUEL DEMAND FOR RECYCLED CARBON FIBER IN SPORTING GOODS

- FIGURE 43 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 55 SPORTING GOODS: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 56 SPORTING GOODS: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 57 SPORTING GOODS: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 58 SPORTING GOODS: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.5 INDUSTRIAL

- 8.5.1 USE OF RECYCLED CARBON FIBER IN INDUSTRIAL APPLICATIONS TO FUEL MARKET GROWTH

- FIGURE 44 EUROPE TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- TABLE 59 INDUSTRIAL: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 60 INDUSTRIAL: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 61 INDUSTRIAL: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 62 INDUSTRIAL: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.6 AEROSPACE & DEFENSE

- 8.6.1 INCREASED USE OF RECYCLED CARBON COMPOSITES IN COMMERCIAL AIRCRAFT TO DRIVE MARKET

- FIGURE 45 NORTH AMERICA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 63 AEROSPACE & DEFENSE: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 64 AEROSPACE & DEFENSE: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 65 AEROSPACE & DEFENSE: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 66 AEROSPACE & DEFENSE: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.7 MARINE

- 8.7.1 RESISTANCE TO ENVIRONMENTAL CONDITIONS TO FUEL DEMAND FOR RECYCLED CARBON FIBER

- FIGURE 46 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 67 MARINE: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 68 MARINE: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 69 MARINE: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 70 MARINE: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.8 OTHER END-USE INDUSTRIES

- FIGURE 47 EUROPE TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 71 OTHER END-USE INDUSTRIES: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 72 OTHER END-USE INDUSTRIES: RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 73 OTHER END-USE INDUSTRIES: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 74 OTHER END-USE INDUSTRIES: RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

9 RECYCLED CARBON FIBER, BY REGION

- 9.1 INTRODUCTION

- FIGURE 48 GERMANY TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 75 RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (TON)

- TABLE 76 RECYCLED CARBON FIBER MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 77 RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (TON)

- TABLE 78 RECYCLED CARBON FIBER MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2 NORTH AMERICA

- 9.2.1 RECESSION IMPACT ON NORTH AMERICA

- FIGURE 49 NORTH AMERICA: RECYCLED CARBON FIBER SNAPSHOT

- TABLE 79 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (TON)

- TABLE 80 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 81 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 82 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 83 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (TON)

- TABLE 84 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 85 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (TON)

- TABLE 86 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 87 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 88 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 89 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 90 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- TABLE 91 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2018-2022 (TON)

- TABLE 92 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 93 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 94 NORTH AMERICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- 9.2.2 US

- 9.2.2.1 Consumption of recycled carbon composites in commercial and next-generation aircraft to drive market

- TABLE 95 US: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 96 US: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 97 US: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 98 US: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.2.3 CANADA

- 9.2.3.1 Establishment of aerospace industry to fuel demand for recycled carbon fiber

- TABLE 99 CANADA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 100 CANADA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 101 CANADA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 102 CANADA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.3 ASIA PACIFIC

- 9.3.1 RECESSION IMPACT ON ASIA PACIFIC

- FIGURE 50 ASIA PACIFIC: RECYCLED CARBON FIBER SNAPSHOT

- TABLE 103 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (TON)

- TABLE 104 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 105 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 106 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 107 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (TON)

- TABLE 108 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 109 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (TON)

- TABLE 110 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 111 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 112 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 113 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 114 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- TABLE 115 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2018-2022 (TON)

- TABLE 116 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 117 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 118 ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- 9.3.2 JAPAN

- 9.3.2.1 Increasing use of consumer goods to fuel demand for recycled carbon fiber

- TABLE 119 JAPAN: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 120 JAPAN: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 121 JAPAN: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 122 JAPAN: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.3.3 CHINA

- 9.3.3.1 Growth of composite product manufacturers to propel market

- TABLE 123 CHINA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 124 CHINA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 125 CHINA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 126 CHINA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.3.4 SOUTH KOREA

- 9.3.4.1 Rise of consumer goods industry to fuel demand for recycled carbon fiber

- TABLE 127 SOUTH KOREA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 128 SOUTH KOREA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 129 SOUTH KOREA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 130 SOUTH KOREA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.3.5 REST OF ASIA PACIFIC

- TABLE 131 REST OF ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 132 REST OF ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 133 REST OF ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 134 REST OF ASIA PACIFIC: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.4 EUROPE

- 9.4.1 RECESSION IMPACT ON EUROPE

- FIGURE 51 EUROPE: RECYCLED CARBON FIBER SNAPSHOT

- TABLE 135 EUROPE: RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (TON)

- TABLE 136 EUROPE: RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 137 EUROPE: RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 138 EUROPE: RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 139 EUROPE: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (TON)

- TABLE 140 EUROPE: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 141 EUROPE: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (TON)

- TABLE 142 EUROPE: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 143 EUROPE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 144 EUROPE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 145 EUROPE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 146 EUROPE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- TABLE 147 EUROPE: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2018-2022 (TON)

- TABLE 148 EUROPE: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 149 EUROPE: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 150 EUROPE: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- 9.4.2 GERMANY

- 9.4.2.1 Growth of automotive and aerospace sectors to drive market

- TABLE 151 GERMANY: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 152 GERMANY: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 153 GERMANY: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 154 GERMANY: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.4.3 FRANCE

- 9.4.3.1 Recycling of composite scrap to fuel market growth

- TABLE 155 FRANCE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 156 FRANCE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 157 FRANCE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 158 FRANCE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.4.4 ITALY

- 9.4.4.1 Rise in end-use industries to fuel demand for recycled carbon fiber

- TABLE 159 ITALY: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 160 ITALY: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 161 ITALY: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 162 ITALY: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.4.5 UK

- 9.4.5.1 Increasing demand for lightweight and cost-effective materials to drive market

- TABLE 163 UK: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 164 UK: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 165 UK: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 166 UK: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.4.6 SPAIN

- 9.4.6.1 High demand for recycled carbon fiber from industrial and wind energy sector to propel market

- TABLE 167 SPAIN: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 168 SPAIN: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 169 SPAIN: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 170 SPAIN: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.4.7 RUSSIA

- 9.4.7.1 Development of fiber-reinforced technologies to drive market

- TABLE 171 RUSSIA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 172 RUSSIA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 173 RUSSIA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 174 RUSSIA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.4.8 REST OF EUROPE

- TABLE 175 REST OF EUROPE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 176 REST OF EUROPE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 177 REST OF EUROPE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD TON)

- TABLE 178 REST OF EUROPE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.5 LATIN AMERICA

- 9.5.1 RECESSION IMPACT ON LATIN AMERICA

- TABLE 179 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (TON)

- TABLE 180 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 181 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 182 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 183 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (TON)

- TABLE 184 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 185 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (TON)

- TABLE 186 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 187 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 188 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 189 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 190 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- TABLE 191 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2018-2022 (TON)

- TABLE 192 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 193 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 194 LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- 9.5.2 BRAZIL

- 9.5.2.1 Growth of transportation industry to propel market

- TABLE 195 BRAZIL: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 196 BRAZIL: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 197 BRAZIL: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 198 BRAZIL: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.5.3 MEXICO

- 9.5.3.1 Need for high-strength products to fuel demand for recycled carbon fiber

- TABLE 199 MEXICO: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 200 MEXICO: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 201 MEXICO: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 202 MEXICO: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.5.4 REST OF LATIN AMERICA

- TABLE 203 REST OF LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 204 REST OF LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 205 REST OF LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 206 REST OF LATIN AMERICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- TABLE 207 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (TON)

- TABLE 208 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 209 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 210 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 211 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (TON)

- TABLE 212 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2018-2022 (USD THOUSAND)

- TABLE 213 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (TON)

- TABLE 214 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY SOURCE, 2023-2028 (USD THOUSAND)

- TABLE 215 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 216 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 217 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 218 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- TABLE 219 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2018-2022 (TON)

- TABLE 220 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 221 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 222 MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- 9.6.2 SOUTH AFRICA

- 9.6.2.1 Growth of aerospace sector to boost demand for recycled carbon fiber

- TABLE 223 SOUTH AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 224 SOUTH AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 225 SOUTH AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 226 SOUTH AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.6.3 SAUDI ARABIA

- 9.6.3.1 Growth of automotive sector to propel market

- TABLE 227 SAUDI ARABIA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 228 SAUDI ARABIA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 229 SAUDI ARABIA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 230 SAUDI ARABIA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.6.4 UAE

- 9.6.4.1 Demand for fuel-efficient and high-performance materials to drive market

- TABLE 231 UAE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 232 UAE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 233 UAE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 234 UAE: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

- 9.6.5 REST OF MIDDLE EAST & AFRICA

- TABLE 235 REST OF MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (TON)

- TABLE 236 REST OF MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD THOUSAND)

- TABLE 237 REST OF MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- TABLE 238 REST OF MIDDLE EAST & AFRICA: RECYCLED CARBON FIBER MARKET, BY END-USE INDUSTRY, 2023-2028 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 52 SHARES OF TOP COMPANIES IN RECYCLED CARBON FIBER MARKET

- TABLE 239 DEGREE OF COMPETITION: RECYCLED CARBON FIBER MARKET

- 10.3 MARKET RANKING

- FIGURE 53 RANKING OF TOP FIVE PLAYERS IN RECYCLED CARBON FIBER MARKET

- 10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 54 REVENUE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX

- TABLE 240 COMPANY PRODUCT FOOTPRINT

- TABLE 241 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 242 COMPANY REGION FOOTPRINT

- 10.6 COMPETITIVE LANDSCAPE MAPPING

- 10.6.1 STARS

- 10.6.2 PERVASIVE PLAYERS

- 10.6.3 PARTICIPANTS

- 10.6.4 EMERGING LEADERS

- FIGURE 55 RECYCLED CARBON FIBER MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2022

- 10.6.5 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 56 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN RECYCLED CARBON FIBER MARKET

- 10.6.6 BUSINESS STRATEGY EXCELLENCE

- FIGURE 57 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN RECYCLED CARBON FIBER MARKET

- 10.7 MARKET EVALUATION FRAMEWORK

- TABLE 243 RECYCLED CARBON FIBER MARKET: PRODUCT DEVELOPMENTS, 2017-2023

- TABLE 244 RECYCLED CARBON FIBER MARKET: DEALS, 2017-2023

- TABLE 245 RECYCLED CARBON FIBER MARKET: OTHER DEVELOPMENTS, 2017-2023

- 10.8 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 246 RECYCLED CARBON FIBER MARKET: KEY STARTUPS/SMES

- TABLE 247 RECYCLED CARBON FIBER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.9 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

- 10.9.1 PROGRESSIVE COMPANIES

- 10.9.2 RESPONSIVE COMPANIES

- 10.9.3 DYNAMIC COMPANIES

- 10.9.4 STARTING BLOCKS

- FIGURE 58 RECYCLED CARBON FIBER MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2022

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services offered, Deals, MnM view, Right to win, Strategic choices made, Weakness and competitive threats)**

- 11.1 KEY COMPANIES

- 11.1.1 TORAY INDUSTRIES, INC.

- TABLE 248 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 59 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- 11.1.2 MITSUBISHI CHEMICAL GROUP CORPORATION

- TABLE 249 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- FIGURE 60 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- 11.1.3 CARBON CONVERSIONS

- TABLE 250 CARBON CONVERSIONS: COMPANY OVERVIEW

- 11.1.4 SHOCKER COMPOSITES, LLC.

- TABLE 251 SHOCKER COMPOSITES, LLC.: COMPANY OVERVIEW

- 11.1.5 GEN 2 CARBON LIMITED

- TABLE 252 GEN 2 CARBON LIMITED: COMPANY OVERVIEW

- 11.1.6 PROCOTEX

- TABLE 253 PROCOTEX: COMPANY OVERVIEW

- 11.1.7 CARBON FIBER RECYCLING

- TABLE 254 CARBON FIBER RECYCLING: COMPANY OVERVIEW

- 11.1.8 ALPHA RECYCLAGE COMPOSITES

- TABLE 255 ALPHA RECYCLAGE COMPOSITES: COMPANY OVERVIEW

- 11.1.9 CARBON FIBER REMANUFACTURING

- TABLE 256 CARBON FIBER REMANUFACTURING: COMPANY OVERVIEW

- 11.1.10 CATACK-H

- TABLE 257 CATACK-H: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services offered, Deals, MnM view, Right to win, Strategic choices made, Weakness and competitive threats might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 VARTEGA INC.

- TABLE 258 VARTEGA INC.: COMPANY OVERVIEW

- 11.2.2 SIGMATEX

- TABLE 259 SIGMATEX: COMPANY OVERVIEW

- 11.2.3 CARBON FIBER RECYCLE INDUSTRY CO. LTD.

- TABLE 260 CARBON FIBER RECYCLE INDUSTRY CO. LTD.: COMPANY OVERVIEW

- 11.2.4 TEIJIN CARBON EUROPE GMBH

- TABLE 261 TEIJIN CARBON EUROPE GMBH: COMPANY OVERVIEW

- 11.2.5 BCIRCULAR

- TABLE 262 BCIRCULAR: COMPANY OVERVIEW

- 11.2.6 FAIRMAT

- TABLE 263 FAIRMAT: COMPANY OVERVIEW

- 11.2.7 ASAHI KASEI

- TABLE 264 ASAHI KASEI: COMPANY OVERVIEW

- 11.2.8 THERMOLYSIS CO., LTD.

- TABLE 265 THERMOLYSIS CO., LTD.: COMPANY OVERVIEW

- 11.2.9 RYMYC S.R.L.

- TABLE 266 RYMYC S.R.L.: COMPANY OVERVIEW

- 11.2.10 MALLINDA INC.

- TABLE 267 MALLINDA INC.: COMPANY OVERVIEW

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS