|

|

市場調査レポート

商品コード

1359927

熱可塑性ポリオレフィンの世界市場:タイプ別、用途別、地域別-2028年までの予測Thermoplastic Polyolefin Market by Type (In Situ TPO, Compounded TPO, POEs), Application (Automotive, Building & Construction, Medical, Wire and Cables), Region (North America, Europe, APAC, MEA, South America) - Global forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 熱可塑性ポリオレフィンの世界市場:タイプ別、用途別、地域別-2028年までの予測 |

|

出版日: 2023年10月06日

発行: MarketsandMarkets

ページ情報: 英文 211 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

熱可塑性ポリオレフィンの市場規模は、2023年の54億米ドルからCAGR 6.0%で拡大し、2028年には73億米ドルに達すると予測されています。

熱可塑性ポリオレフィン(TPO)は、その多用途性により、あらゆる産業で多様な用途が見出されています。自動車分野では、バンパーやダッシュボードのような軽量かつ耐久性のある内外装部品の製造に使用されています。TPOは耐候性と紫外線安定性に優れているため、建築用途、特に屋根材や防水材として好まれています。消費財分野では、TPOはその耐衝撃性と加工のしやすさから、鞄、玩具、スポーツ用品などの製品に貢献しています。工業分野では、耐薬品性と耐久性を活かして、ケーブル絶縁、ガスケット、工業用ホースにTPOが採用されています。

自動車分野は、熱可塑性ポリオレフィン(TPO)市場において最も急成長している分野であり、その主な理由は、業界の重要な課題への対応において極めて重要な役割を担っているためです。TPOは非常に軽量であるため、自動車部品においてより重い材料に取って代わり、燃費を向上させ、厳しい排ガス基準に適合させるための最重要選択肢となっています。設計の柔軟性により、革新的で空気力学的な車両設計が可能になり、魅力が向上し、先端技術に対応できるようになります。さらに、TPOの費用対効果の高さは、性能と手頃な価格の両方を求める自動車メーカーによる採用を後押しし、持続可能性と革新に向けた自動車産業の変革が進む中で、TPOは重要な役割を果たしています。

TPOの軽量性は、自動車や航空宇宙といった産業での採用拡大に大きく貢献しています。自動車分野では、厳しい排ガス規制と環境持続可能性の重視の高まりにより、燃費の改善が最重要目標となっています。この課題に対処するため、自動車メーカーは、構造的完全性を損なうことなく車両重量を削減する効果的な手段として、TPOのような軽量素材に着目しています。TPOの良好な強度対重量比は、バンパー、内装トリム、外装ボディパネルなど、さまざまな自動車部品において、金属や他の熱可塑性プラスチックなどの重い材料の代替を可能にします。TPOを自動車設計に取り入れることで、自動車メーカーは顕著な軽量化を達成し、燃費の向上と二酸化炭素排出量の削減を実現することができます。

北米は、熱可塑性ポリオレフィン(TPO)材料の極めて重要な市場であり、その採用は多業種に広がっています。自動車分野では、TPOは軽量の代替材料として重要な役割を果たしており、バンパー、内装トリム、車体外板など、さまざまな自動車部品の生産に幅広く使用されています。同地域の自動車産業は、燃費の向上と厳しい排ガス規制の遵守を達成する上でTPOの重要性を強調しています。建築分野では、TPO屋根膜と防水材がその優れた耐久性と耐候性で脚光を浴び、商業用と住宅用両方の平らな屋根に選ばれています。

当レポートでは、世界の熱可塑性ポリオレフィン市場について調査し、タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

第6章 業界の動向

- 景気後退の影響

- バリューチェーン分析

- マクロ経済指標

- 熱可塑性ポリオレフィン市場規制

- 貿易分析

- 特許分析

- ビジネスに影響を与える動向/混乱

- 生態系

- 技術分析

- 主要な利害関係者と購入基準

- 平均価格分析

- ケーススタディ

第7章 熱可塑性ポリオレフィン市場、タイプ別

- イントロダクション

- In-Situ 熱可塑性ポリオレフィン

- 複合熱可塑性ポリオレフィン

- ポリオレフィンエラストマー(POES)

第8章 熱可塑性ポリオレフィン市場、用途別

- イントロダクション

- 自動車

- 建築・建設

- ワイヤー・ケーブル

- 医療

- その他

第9章 熱可塑性ポリオレフィン市場、地域別

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第10章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 市場シェア分析

- 企業の製品フットプリント分析

- 企業評価クアドラント(Tier 1)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- 競争シナリオと動向

第11章 企業プロファイル

- 主要参入企業

- DOW

- MITSUI CHEMICALS, INC.

- EXXONMOBIL CORPORATION

- SABIC

- SUMITOMO CHEMICAL CO., LTD.

- LYONDELLBASELL INDUSTRIES N.V.

- INEOS GROUP HOLDING SA

- RECENT DEVELOPMENTS

- BOREALIS AG

- FORMOSA PLASTIC CORPORATION

- PRODUCTS/SERVICES/SOLUTIONS OFFERED

- RECENT DEVELOPMENTS

- RTP COMPANY

- その他の企業

- POLYONE CORPORATION

- MITSUBISHI CHEMICAL HOLDING CORPORATION

- ELASTRON

- GAF

- TEKNOR APEX COMPANY

- RAIGH REFINING AND PETROCHEMICAL COMPANY

- NOBLE POLYMERS

- HEXPOL AB

- WASHINGTON PENN

- ALPHAGARY LIMITED

- SAUDI ARAMCO

- KRATON CORPORATION

- ADELL PLASTICS, INC. INCORPORATION

- ASAHI KASEI

- ZEON CORPORATION

第12章 付録

The Thermoplastic polyolefin Market is projected to reach USD 7.3 Billion by 2028, at a CAGR of 6.0% from USD 5.4 Billion in 2023. Thermoplastic polyolefin (TPO) finds diverse applications across industries due to its versatility. In the automotive sector, it is used for crafting lightweight yet durable interior and exterior components like bumpers and dashboards. TPO's weather-resistant and UV-stable properties make it a preferred material for construction applications, particularly in roofing and waterproofing. In consumer goods, TPO contributes to products such as luggage, toys, and sports equipment, benefitting from its impact resistance and ease of processing. The industrial sector employs TPO in cable insulation, gaskets, and industrial hoses, capitalizing on its chemical resistance and durability.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | (USD Billion/Million) |

| Segments | type, application, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

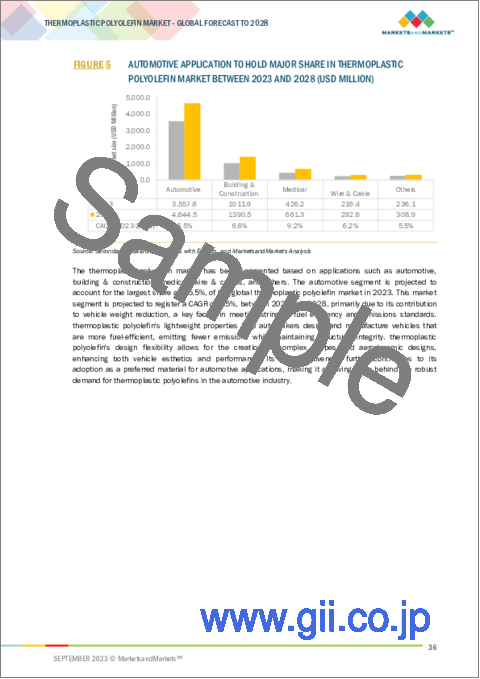

"Automotive, by application, accounts for the second-largest market share in 2022."

The automotive sector stands as the fastest-growing segment in the thermoplastic polyolefin (TPO) market primarily due to its pivotal role in addressing critical industry challenges. TPO's exceptional lightweight properties make it a top choice for replacing heavier materials in automotive components, boosting fuel efficiency and aligning with strict emissions standards. Its design flexibility allows for innovative and aerodynamic vehicle designs, enhancing appeal and accommodating advanced technologies. Moreover, TPO's cost-effectiveness bolsters its adoption by automakers seeking both performance and affordability, making it a key player in the ongoing transformation of the automotive industry towards sustainability and innovation.

"In situ TPO is expected to be the fastest growing at CAGR 6.6% for polyurethane catalyst market during the forecast period, in terms of value."

TPO's lightweight nature has significantly contributed to its growing adoption in industries like automotive and aerospace. In the automotive sector, the pursuit of improved fuel efficiency has become a paramount goal due to stringent emissions regulations and the growing emphasis on environmental sustainability. To address this challenge, automakers have turned to lightweight materials like TPO as an effective means of reducing vehicle weight without compromising structural integrity. TPO's favorable strength-to-weight ratio allows for the replacement of heavier materials like metal or other thermoplastics in various automotive components, such as bumpers, interior trim, and exterior body panels. By incorporating TPO into vehicle design, automakers can achieve notable weight reductions, resulting in enhanced fuel efficiency and reduced carbon emissions, while also improving handling and overall performance.

"Based on region, North America was the second largest market for Thermoplastic polyolefin market in 2022."

North America has been a pivotal market for thermoplastic polyolefin (TPO) materials, with its widespread adoption spanning multiple industries. In the automotive sector, TPO has played a crucial role as a lightweight alternative, finding extensive use in the production of various automotive components like bumpers, interior trim, and exterior body panels. The region's automotive industry has emphasized the importance of TPO in achieving improved fuel efficiency and adhering to stringent emission regulations. In the construction sector, TPO roofing membranes and waterproofing materials have gained prominence for their exceptional durability and weather resistance, making them a preferred choice for flat roofs in both commercial and residential settings.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-Level - 20%, Director Level - 10%, and Others - 70%

- By Region: North America - 20%, Europe -30%, Asia Pacific - 30%, Middle East & Africa - 10%, and South America-10%

The key players in this market include DOW (US), Mitsui Chemical, Inc. (Japan), Exxon Mobil Corporation (Texas), SABIC (Saudi Arabia), Sumitomo Chemicals Co., Ltd. (Japan), LyondellBasell Industries N.V. (Texas), Ineos Group Holdings SA (Switzerland), Borealis AG (Austria), Formosa Plastic Corporation (Taiwan), RTP Company (US).

Research Coverage

This report segments the market for the thermoplastic polyolefin material market on the basis of type, application, and region. It provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisitions associated with the market for the thermoplastic polyolefin material market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the thermoplastic polyolefin material market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers: Increasing demand for advanced technologies, Energy Efficiency and Sustainability.

- Market Penetration: Comprehensive information on the Polyurethane catalyst market offered by top players in the global Polyurethane catalyst market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the Polyurethane catalyst market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for the Polyurethane catalyst market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global Polyurethane catalyst market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the Polyurethane catalyst market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 THERMOPLASTIC POLYOLEFIN MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 LIMITATIONS

- 1.7 UNIT CONSIDERED

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

- 1.10 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 THERMOPLASTIC POLYOLEFIN MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Interviews with experts - top thermoplastic polyolefin manufacturers

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.2.3 Key industry insights

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.2.2 APPROACH 2: DEMAND-SIDE APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 3 THERMOPLASTIC POLYOLEFIN MARKET: DATA TRIANGULATION

- 2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 4 IN-SITU THERMOPLASTIC POLYOLEFIN TO DOMINATE THERMOPLASTIC POLYOLEFIN MARKET BETWEEN 2023 AND 2028 (USD MILLION)

- FIGURE 5 AUTOMOTIVE APPLICATION TO HOLD MAJOR SHARE IN THERMOPLASTIC POLYOLEFIN MARKET BETWEEN 2023 AND 2028 (USD MILLION)

- FIGURE 6 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF THERMOPLASTIC POLYOLEFIN MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN THERMOPLASTIC POLYOLEFIN MARKET

- FIGURE 7 INCREASING AWARENESS REGARDING SUSTAINABLE DEVELOPMENT TO DRIVE MARKET DURING FORECAST PERIOD

- 4.2 THERMOPLASTIC POLYOLEFIN MARKET: REGIONAL ANALYSIS

- FIGURE 8 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 THERMOPLASTIC POLYOLEFIN, BY PRODUCT TYPE

- FIGURE 9 POES SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2028

- 4.4 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION

- FIGURE 10 AUTOMOTIVE SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2028

- 4.5 ASIA PACIFIC THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION AND COUNTRY

- FIGURE 11 CHINA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMOPLASTIC POLYOLEFIN MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing usage of thermoplastic polyolefins in exterior and interior parts of automobiles

- 5.2.1.2 Steady growth in building & construction industry

- 5.2.1.3 Increasing usage of thermoplastic polyolefin waterproofing membrane in repair and maintenance activities

- 5.2.2 RESTRAINTS

- 5.2.2.1 Raw material price volatility

- 5.2.2.2 Limited temperature applications of thermoplastic polyolefin

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Intra replacement of other thermoplastic polymers with thermoplastic polyolefins

- 5.2.3.2 Growing penetration of EVs worldwide

- 5.2.3.3 Rising demand from emerging applications

- 5.2.3.4 Increasing demand from the packaging industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Growing trend of plastic recycling

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 13 THERMOPLASTIC POLYOLEFIN: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS

- 6.1 RECESSION IMPACT

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 14 VALUE CHAIN FOR THERMOPLASTIC POLYOLEFIN MARKET

- 6.2.1 RAW MATERIAL SUPPLIERS

- 6.2.2 THERMOPLASTIC POLYOLEFIN MANUFACTURERS

- 6.2.3 DISTRIBUTORS

- 6.2.4 END USER

- 6.3 MACROECONOMIC INDICATORS

- 6.3.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- TABLE 1 GDP TRENDS AND FORECASTS, BY KEY COUNTRIES, 2019-2027 (USD MILLION)

- 6.4 THERMOPLASTIC POLYOLEFIN MARKET REGULATIONS

- 6.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 2 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO

- FIGURE 15 EXPORT SCENARIO FOR HS CODE 3902300 BY KEY COUNTRIES, (2019 - 2022)

- FIGURE 16 EXPORT SCENARIO FOR HS CODE 3902300 BY KEY COUNTRIES, (2019 - 2022)

- 6.5.2 IMPORT SCENARIO

- FIGURE 17 IMPORT SCENARIO FOR HS CODE 3902300, BY KEY COUNTRIES, (2019 - 2022)

- FIGURE 18 IMPORT SCENARIO FOR HS CODE 390190, BY KEY COUNTRIES, (2019-2022)

- 6.6 PATENT ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 METHODOLOGY

- 6.6.2.1 Document type

- TABLE 5 GRANTED PATENTS ACCOUNTED FOR 37% OF TOTAL COUNT IN LAST 10 YEARS

- 6.6.2.2 Publication trends over last ten years

- 6.6.3 INSIGHTS

- 6.6.4 LEGAL STATUS OF PATENTS

- 6.6.5 JURISDICTION ANALYSIS

- FIGURE 19 TOP JURISDICTION-BY DOCUMENT

- 6.6.6 TOP COMPANIES/APPLICANTS

- 6.7 TRENDS/DISRUPTIONS IMPACTING BUSINESSES

- 6.7.1 REVENUE SHIFTS & NEW REVENUE POCKETS FOR THERMOPLASTIC POLYOLEFIN MARKET

- FIGURE 20 REVENUE SHIFT OF THERMOPLASTIC POLYOLEFIN PROVIDERS

- 6.8 ECOSYSTEM

- TABLE 6 GDP TRENDS AND FORECASTS, BY KEY COUNTRIES, 2019-2027

- FIGURE 21 THERMOPLASTIC POLYOLEFIN MARKET: ECOSYSTEM

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 EXTRUSION

- 6.9.2 INJECTION MOLDING

- TABLE 7 ADVANTAGES OF CATALYST DEVELOPMENT FOR THERMOPLASTIC POLYOLEFINS

- 6.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 5 APPLICATIONS

- TABLE 8 INFLUENCE OF INSTITUTIONAL BUYERS IN BUYING PROCESS FOR TOP 5 APPLICATIONS

- 6.10.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR END-USER INDUSTRIES

- TABLE 9 KEY BUYING CRITERIA FOR END-USER INDUSTRIES

- 6.11 AVERAGE PRICE ANALYSIS

- FIGURE 24 WEIGHTED AVERAGE PRICING ANALYSIS (USD/TON) OF THERMOPLASTIC POLYOLEFIN, BY REGION, 2020

- 6.12 CASE STUDY

7 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 25 POES WAS LARGEST SEGMENT OF THERMOPLASTIC POLYOLEFINS MARKET IN 2022

- TABLE 10 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 11 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 12 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2026 (USD MILLION)

- TABLE 13 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2 IN-SITU THERMOPLASTIC POLYOLEFIN

- 7.2.1 INCREASING APPLICATION IN AUTOMOTIVE AND CONSTRUCTION INDUSTRIES TO DRIVE DEMAND

- 7.3 COMPOUNDED THERMOPLASTIC POLYOLEFIN

- 7.3.1 PHYSICOCHEMICAL CHARACTERISTICS TO DRIVE DEMAND IN AUTOMOTIVE INDUSTRY

- 7.4 POLYOLEFIN ELASTOMERS (POES)

- 7.4.1 INCREASING USAGE AS ALTERNATIVE TO RUBBER TO SUPPORT MARKET GROWTH

8 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 26 AUTOMOTIVE APPLICATION WAS LARGEST SEGMENT OF THERMOPLASTIC POLYOLEFIN MARKET IN 2022

- TABLE 14 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 15 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 16 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 17 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- FIGURE 27 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2026 (USD MILLION)

- 8.2 AUTOMOTIVE

- 8.2.1 INCREASING PENETRATION OF EVS TO DRIVE MARKET

- 8.3 BUILDING & CONSTRUCTION

- 8.3.1 WATERPROOFING THERMOPLASTIC POLYOLEFIN MEMBRANES TO SUPPORT MARKET GROWTH

- 8.4 WIRE & CABLE

- 8.4.1 GROWING DEMAND FOR WIRES & CABLES THERMOPLASTIC POLYOLEFIN TO DRIVE MARKET

- 8.5 MEDICAL

- 8.5.1 COMPLIANCE WITH MEDICAL & HEALTHCARE STANDARDS TO DRIVE MARKET

- 8.6 OTHERS

9 THERMOPLASTIC POLYOLEFIN MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 28 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 18 THERMOPLASTIC POLYOLEFIN MARKET, BY REGION, 2019-2022 (TON)

- TABLE 19 THERMOPLASTIC POLYOLEFIN MARKET, BY REGION, 2023-2028 (TON)

- TABLE 20 THERMOPLASTIC POLYOLEFIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 21 THERMOPLASTIC POLYOLEFIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 22 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 23 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 24 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 25 THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 26 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 27 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 28 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 29 THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.2 ASIA PACIFIC

- 9.3 RECESSION IMPACT

- FIGURE 29 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET SNAPSHOT

- TABLE 30 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 31 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 32 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019-2026 (USD MILLION)

- TABLE 33 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 35 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 36 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 37 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 39 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 40 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 41 ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.3.1 CHINA

- 9.3.1.1 Growing automotive and building & construction sectors and upcoming government policies to drive growth

- TABLE 42 CHINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019-2022 (TON)

- TABLE 43 CHINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023-2028 (TON)

- TABLE 44 CHINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 45 CHINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.3.2 INDIA

- 9.3.2.1 Increasing FDI investment in industrial sector to drive market

- TABLE 46 INDIA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019-2022 (TON)

- TABLE 47 INDIA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023-2028 (TON)

- TABLE 48 INDIA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2026 (USD MILLION)

- TABLE 49 INDIA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.3.3 JAPAN

- 9.3.3.1 High usage rate of thermoplastic polyolefin in automotive industry to drive growth

- TABLE 50 JAPAN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019-2022 (TON)

- TABLE 51 JAPAN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023-2028 (TON)

- TABLE 52 JAPAN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 53 JAPAN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.3.4 SOUTH KOREA

- 9.3.4.1 Building & construction sector to drive market

- TABLE 54 SOUTH KOREA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 55 SOUTH KOREA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 56 SOUTH KOREA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2026 (USD MILLION)

- TABLE 57 SOUTH KOREA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.3.5 REST OF ASIA PACIFIC

- TABLE 58 REST OF ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 59 REST OF ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 60 REST OF ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2026 (USD MILLION)

- TABLE 61 REST OF ASIA PACIFIC: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.4 NORTH AMERICA

- 9.5 RECESSION IMPACT

- FIGURE 30 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET SNAPSHOT

- TABLE 62 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 63 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 64 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019-2026 (USD MILLION)

- TABLE 65 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 67 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 68 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 71 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 72 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.5.1 US

- 9.5.1.1 Increasing usage thermoplastic polyolefin in vehicles due to low weight to drive market

- TABLE 74 US: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019-2022 (USD MILLION)

- TABLE 75 US: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023-2028 (USD MILLION)

- TABLE 76 US: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 77 US: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.5.2 CANADA

- 9.5.2.1 Increasing vehicle production to drive demand

- TABLE 78 CANADA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 79 CANADA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 80 CANADA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 81 CANADA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.5.3 MEXICO

- 9.5.3.1 Rise in automobile production to surge demand

- TABLE 82 MEXICO: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 83 MEXICO: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 84 MEXICO: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 85 MEXICO: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.6 EUROPE

- 9.7 RECESSION IMPACT

- FIGURE 31 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET SNAPSHOT

- TABLE 86 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 87 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 88 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY,2019-2026 (TON)

- TABLE 89 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY,2023-2028 (TON)

- TABLE 90 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019-2022 (TON)

- TABLE 91 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023-2028 (TON)

- TABLE 92 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 93 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 94 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 95 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 96 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 97 EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE,2023-2028 (USD MILLION)

- 9.7.1 GERMANY

- 9.7.1.1 Government support for boosting automotive industry to drive market

- TABLE 98 GERMANY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 99 GERMANY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 100 GERMANY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 101 GERMANY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.7.2 UK

- 9.7.2.1 Increase in automobile registrations and construction industry output to drive market

- TABLE 102 UK: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019-2022 (USD MILLION)

- TABLE 103 UK: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023-2028 (USD MILLION)

- TABLE 104 UK: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 105 UK: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.7.3 FRANCE

- 9.7.3.1 Rising automobile production and output from construction industry to drive market

- TABLE 106 FRANCE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 107 FRANCE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 108 FRANCE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 109 FRANCE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.7.4 SPAIN

- 9.7.4.1 Rise in automobile production to drive demand

- TABLE 110 SPAIN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 111 SPAIN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 112 SPAIN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 113 SPAIN: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.7.5 ITALY

- 9.7.5.1 Growth of automotive sector to drive market

- TABLE 114 ITALY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 115 ITALY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 116 ITALY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 117 ITALY: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.7.6 REST OF EUROPE

- TABLE 118 REST OF EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 119 REST OF EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 121 REST OF EUROPE: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.8 MIDDLE EAST & AFRICA

- 9.9 RECESSION IMPACT

- FIGURE 32 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET SNAPSHOT

- TABLE 122 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 123 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 124 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY,2019-2026 (USD MILLION)

- TABLE 125 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 126 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019-2022 (TON)

- TABLE 127 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023-2028 (TON)

- TABLE 128 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 129 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 130 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 131 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 132 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 133 MIDDLE EAST AND AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.9.1 SOUTH AFRICA

- 9.9.1.1 Steady recovery of several end-use industries from COVID-19 impact to drive market

- TABLE 134 SOUTH AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 135 SOUTH AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 136 SOUTH AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 137 SOUTH AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.9.2 GCC COUNTRIES

- 9.9.2.1 Investment in automotive and construction industries to drive market

- TABLE 138 GCC COUNTRIES: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 139 GCC COUNTRIES: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 140 GCC COUNTRIES: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 141 GCC COUNTRIES: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.9.3 REST OF MIDDLE EAST & AFRICA

- TABLE 142 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019-2022 (TON)

- TABLE 143 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023-2028 (TON)

- TABLE 144 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.10 SOUTH AMERICA

- 9.11 RECESSION IMPACT

- FIGURE 33 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET SNAPSHOT

- TABLE 146 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 147 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 148 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2019-2026 (USD MILLION)

- TABLE 149 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 151 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 152 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 153 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 155 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 156 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 157 SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.11.1 BRAZIL

- 9.11.1.1 Rising demand from automotive sector to drive market

- TABLE 158 BRAZIL: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019-2022 (TON)

- TABLE 159 BRAZIL: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023-2028 (TON)

- TABLE 160 BRAZIL: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 161 BRAZIL: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.11.2 ARGENTINA

- 9.11.2.1 Sluggish growth of manufacturing sector to drive market

- TABLE 162 ARGENTINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019-2022 (TON)

- TABLE 163 ARGENTINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023-2028 (TON)

- TABLE 164 ARGENTINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 165 ARGENTINA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.11.3 REST OF SOUTH AMERICA

- TABLE 166 REST OF SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2019-2022 (TON)

- TABLE 167 REST OF SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION,2023-2028 (TON)

- TABLE 168 REST OF SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 169 REST OF SOUTH AMERICA: THERMOPLASTIC POLYOLEFIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY THERMOPLASTIC POLYOLEFIN MANUFACTURERS

- 10.3 MARKET SHARE ANALYSIS

- 10.3.1 RANKING OF KEY MARKET PLAYERS, 2022

- FIGURE 34 RANKING OF TOP FIVE PLAYERS IN THERMOPLASTIC POLYOLEFIN MARKET, 2022

- 10.3.2 MARKET SHARE OF KEY PLAYERS

- TABLE 170 THERMOPLASTIC POLYOLEFIN: DEGREE OF COMPETITION

- FIGURE 35 THERMOPLASTIC POLYOLEFIN MARKET IN 2022

- 10.3.2.1 SABIC

- 10.3.2.2 Sumitomo Chemical CO., LTD.

- 10.3.2.3 ExxonMobil Corporation

- 10.3.2.4 DOW

- 10.3.2.5 Mitsui Chemicals, Inc

- 10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 171 THERMOPLASTIC POLYOLEFIN MARKET: KEY COMPANY APPLICATION FOOTPRINT

- TABLE 172 THERMOPLASTIC POLYOLEFIN MARKET: KEY COMPANY TYPE FOOTPRINT

- TABLE 173 THERMOPLASTIC POLYOLEFIN MARKET: KEY COMPANY REGION FOOTPRINT

- 10.5 COMPANY EVALUATION QUADRANT (TIER 1)

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 36 THERMOPLASTIC POLYOLEFIN MARKET COMPANY EVALUATION MATRIX, 2022 (TIER 1)

- 10.6 COMPETITIVE BENCHMARKING

- TABLE 174 THERMOPLASTIC POLYOLEFIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 10.6.1 THERMOPLASTIC POLYOLEFIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 175 SME PLAYERS APPLICATION FOOTPRINT

- TABLE 176 SME PLAYERS TYPE FOOTPRINT

- TABLE 177 THERMOPLASTIC POLYOLEFIN MARKET: SME PLAYERS REGION FOOTPRINT

- 10.7 STARTUP/SME EVALUATION QUADRANT

- 10.7.1 RESPONSIVE COMPANIES

- 10.7.2 STARTING BLOCKS

- 10.7.3 PROGRESSIVE COMPANIES

- 10.7.4 DYNAMIC COMPANIES

- FIGURE 37 THERMOPLASTIC POLYOLEFIN MARKET START-UPS/SMES COMPANY EVALUATION MATRIX, 2022

- 10.8 COMPETITIVE SCENARIOS AND TRENDS

- 10.8.1 PRODUCT LAUNCHES

- TABLE 178 THERMOPLASTIC POLYOLEFIN MARKET: PRODUCT LAUNCHES (2019-2022)

- 10.8.2 DEALS

- TABLE 179 THERMOPLASTIC POLYOLEFIN MARKET: DEALS (2020-2023)

- 10.8.3 OTHER DEVELOPMENTS

- TABLE 180 THERMOPLASTIC POLYOLEFIN OTHER DEVELOPMENTS (2021-2023)

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1.1 DOW

- TABLE 181 DOW: COMPANY OVERVIEW

- FIGURE 38 DOW: COMPANY SNAPSHOT

- TABLE 182 DOW: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 183 DOW : OTHER DEVELOPMENTS

- TABLE 184 DOW: PRODUCT LAUNCHES

- 11.1.2 MITSUI CHEMICALS, INC.

- TABLE 185 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 186 MITSUI CHEMICALS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.3 EXXONMOBIL CORPORATION

- TABLE 187 EXXONMOBIL CORPORATION: BUSINESS OVERVIEW

- FIGURE 39 EXXONMOBIL CORPORATION: COMPANY SNAPSHOT

- TABLE 188 EXXONMOBIL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.4 SABIC

- TABLE 189 SABIC: COMPANY OVERVIEW

- FIGURE 40 SABIC: COMPANY SNAPSHOT

- TABLE 190 SABIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 191 SABIC: DEAL

- TABLE 192 SABIC: DEALS

- TABLE 193 SABIC: PRODUCT LAUNCHES

- 11.1.5 SUMITOMO CHEMICAL CO., LTD.

- TABLE 194 SUMITOMO CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- FIGURE 41 SUMITOMO CHEMICAL CO., LTD: COMPANY SNAPSHOT

- TABLE 195 SUMITOMO CHEMICAL CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.6 LYONDELLBASELL INDUSTRIES N.V.

- TABLE 196 LYONDELLBASELL INDUSTRIES N.V.: COMPANY OVERVIEW

- FIGURE 42 LYONDELLBASELL INDUSTRIES N.V.: COMPANY SNAPSHOT

- TABLE 197 LYONDELLBASELL INDUSTRIES N.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.7 INEOS GROUP HOLDING SA

- TABLE 198 INEOS GROUP HOLDINGS S.A.: COMPANY OVERVIEW

- FIGURE 43 INEOS GROUP LTD: COMPANY SNAPSHOT

- TABLE 199 INEOS GROUP HOLDING SA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 11.1.8 RECENT DEVELOPMENTS

- TABLE 200 INEOS GROUP HOLDINGS S.A.: DEALS

- TABLE 201 INEOS GROUP HOLDINGS S.A.: PRODUCT LAUNCH

- 11.1.9 BOREALIS AG

- TABLE 202 BOREALIS AG: BUSINESS OVERVIEW

- FIGURE 44 BOREALIS AG: COMPANY SNAPSHOT

- TABLE 203 BOREALIS AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 204 BOREALIS AG: DEALS

- 11.1.10 FORMOSA PLASTIC CORPORATION

- TABLE 205 FORMOSA PLASTICS CORPORATION: COMPANY OVERVIEW

- 11.1.11 PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 206 FORMOSA PLASTICS CORPORATION: PRODUCT OFFERINGS

- 11.1.12 RECENT DEVELOPMENTS

- TABLE 207 FORMOSA PLASTICS CORPORATION: PRODUCT LAUNCH

- 11.1.13 RTP COMPANY

- TABLE 208 RTP COMPANY: COMPANY OVERVIEW

- TABLE 209 RTP COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 210 RTP COMPANY: DEALS

- 11.2 OTHER PLAYERS

- 11.2.1 POLYONE CORPORATION

- TABLE 211 POLYONE CORPORATION: COMPANY OVERVIEW

- 11.2.2 MITSUBISHI CHEMICAL HOLDING CORPORATION

- TABLE 212 ** MITSUBISHI CHEMICAL HOLDING CORPORATION: COMPANY OVERVIEW

- 11.2.3 ELASTRON

- TABLE 213 ELASTRON: COMPANY OVERVIEW

- 11.2.4 GAF

- TABLE 214 GAF: COMPANY OVERVIEW

- 11.2.5 TEKNOR APEX COMPANY

- TABLE 215 TEKNOR APEX COMPANY : COMPANY OVERVIEW

- 11.2.6 RAIGH REFINING AND PETROCHEMICAL COMPANY

- TABLE 216 RAIGH REFINING AND PETROCHEMICAL COMPANY: COMPANY OVERVIEW

- 11.2.7 NOBLE POLYMERS

- TABLE 217 NOBLE POLYMERS: COMPANY OVERVIEW

- 11.2.8 HEXPOL AB

- TABLE 218 HEXPOL AB: COMPANY OVERVIEW

- 11.2.9 WASHINGTON PENN

- TABLE 219 WASHINGTON PENN: COMPANY OVERVIEW

- 11.2.10 ALPHAGARY LIMITED

- TABLE 220 ALPHAGARY LIMITED: COMPANY OVERVIEW

- 11.2.11 SAUDI ARAMCO

- TABLE 221 SAUDI ARAMCO: COMPANY OVERVIEW

- 11.2.12 KRATON CORPORATION

- TABLE 222 KRATON CORPORATION: COMPANY OVERVIEW

- 11.2.13 ADELL PLASTICS, INC. INCORPORATION

- TABLE 223 ADELL PLASTICS, INC.: COMPANY OVERVIEW

- 11.2.14 ASAHI KASEI

- TABLE 224 ASAHI KASEI: COMPANY OVERVIEW

- 11.2.15 ZEON CORPORATION

- TABLE 225 ZEON CORPORATION: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS