|

|

市場調査レポート

商品コード

1649591

自動倉庫システム市場:タイプ別、可搬重量別、業界別、地域別 - 2030年までの予測Automated Storage and Retrieval System Market by Type (Unit Load ASRS, Mini Load ASRS, Mid-Load ASRS, Vertical Lift Module (VLM), Vertical Carousel, Horizontal Carousel) by Payload Capacity (<500 kg, 500-1,500 kg, >1,500 kg) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動倉庫システム市場:タイプ別、可搬重量別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年01月31日

発行: MarketsandMarkets

ページ情報: 英文 358 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の自動倉庫システムの市場規模は、8.5%のCAGRで拡大し、2025年には98億6,000万米ドル、2030年には148億米ドルに達すると予測されています。

この成長を促進する要因は、eコマース、自動車、飲食品などの業界において、効率的な在庫管理やスペースの最適化に対するニーズが高まっていることです。AI対応システム、ロボット統合、IoT接続などの技術的進歩により、ASRSソリューションはより高精度、高速、スケーラブルになっています。さらに、インダストリー4.0の導入拡大や持続可能性への注目が、エネルギー効率の高い自動化システムへの投資を促し、倉庫業務の近代化や世界サプライチェーンの変革をもたらしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、可搬重量別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

縦型リフトモジュール(VLM)は、その効率性、省スペース設計、業界横断的な汎用性により、予測期間中、自動倉庫システム市場で最高のCAGRを示すと予測されています。VLMは縦スペースを有効活用し、作業効率と在庫追跡を向上させる。このようなシステムは、人件費削減、ピッキング精度の向上、最適な保管密度といった利点から、eコマース、自動車、ヘルスケアなど様々な業種に導入されています。モノのインターネットと拡張知能の統合による技術的進歩は、リアルタイムのモニタリングと予知保全を可能にすることで、VLMの導入をさらに促進しています。ビジネスが自動化と効率化に集中しているため、ASRSセグメント向けVLM市場の成長も拡大するとみられています。

自動車産業は、主に効果的な在庫管理、正確なマテリアルハンドリング、効率的な生産プロセスへの重要なニーズにより、予測期間を通じて自動化保管・検索システム(ASRS)市場で主要な役割を果たすと予測されています。ASRSソリューションは、自動車製造工場や倉庫で一般的に利用されており、部品の保管や取り出し、大量の部品の取り扱い、ジャスト・イン・タイムの生産を促進します。ロボット工学、IoT、AIなどの最先端技術を取り入れることで、業務効率を高め、ミスを最小限に抑え、注文処理を迅速化します。電気自動車の需要が高まり、自動車製造が進歩し続ける中、この分野での強力なASRSソリューションの要件は大幅に増加し、市場成長をさらに促進すると予想されます。

北米は、eコマース、自動車、ヘルスケアなどの分野における高度な自動化技術の迅速な採用により、予測期間中、自動化保管・検索システム市場で大きなシェアを占めると予測されています。同地域では、サプライチェーン効率の向上、運用コストの削減、迅速な注文処理に対する需要の高まりへの対応に重点が置かれており、ASRSソリューションの利用に拍車がかかっています。主要な市場参入企業、堅牢なインフラ、ロボット工学、AI、IoTなどの自動化技術への高い投資が、市場の成長にさらに貢献しています。スマートウェアハウジングと持続可能性を重視する傾向が強まっている北米は、世界のASRS市場における主要参入企業です。

当レポートでは、世界の自動倉庫システム市場について調査し、タイプ別、可搬重量別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 2025年~2026年の主な会議とイベント

- 貿易分析

- 特許分析

- 規制状況

- 自動倉庫システム市場におけるAI/生成AIの影響

第6章 自動倉庫システム市場に影響を与える倉庫業界の動向

- イントロダクション

- マイクロフルフィルメントセンター

- 自律型マシン

- ダークストア

- データ分析とAIの統合

- クラウドベースの管理

- ロボット工学

第7章 自動倉庫システムの機能

- イントロダクション

- 保管

- 注文ピッキング

- 分布

- 組立

- キッティング

- その他

第8章 新興の自動倉庫システム技術の種類

第9章 自動倉庫システムにおけるサービスと新たな用途

- イントロダクション

- 自動倉庫システムの新たな応用

第10章 自動倉庫システムの展開モードとシステムコンポーネント

- イントロダクション

- 展開モード

- コンポーネント

第11章 自動倉庫システム市場(タイプ別)

- イントロダクション

- ユニットロード

- ミニロード

- 縦型リフトモジュール(VLM)

- カルーセル

- ミッドロード

第12章 自動倉庫システム市場(可搬重量別)

- イントロダクション

- 500キログラム未満

- 500~1,500キログラム

- 1,500キログラム

第13章 自動倉庫システム市場(業界別)

- イントロダクション

- 自動車

- 金属・重機

- 食品・飲料

- 化学薬品

- 医薬品

- 医療機器

- 半導体・エレクトロニクス

- eコマース・小売

- 航空

- ロジスティクス

- パルプ・紙

- その他

第14章 自動倉庫システム市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- スウェーデン

- オランダ

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- オーストラリア

- インド

- マレーシア

- インドネシア

- 韓国

- シンガポール

- タイ

- その他

- その他の地域

- マクロ経済見通しは連続

- 中東

- アフリカ

- 南米

第15章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価と財務指標、2024年

- 製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第16章 企業プロファイル

- 主要参入企業

- DAIFUKU CO., LTD.

- MURATA MACHINERY, LTD.

- SSI SCHAEFER

- TGW LOGISTICS GROUP

- KARDEX

- BEUMER GROUP

- HONEYWELL INTERNATIONAL INC.

- KION GROUP AG

- KNAPP AG

- KUKA AG

- MECALUX, S.A.

- SYSTEM LOGISTICS S.P.A.

- TOYOTA INDUSTRIES CORPORATION

- IHI CORPORATION

- STANLEY BLACK & DECKER, INC.

- JUNGHEINRICH AG

- OCADO GROUP PLC.

- その他の企業

- AUTOMATION LOGISTICS CORPORATION

- SNAP-ON AUTOCRIB

- FERRETTO SPA

- HANEL BURO-UND LAGERSYSTEME

- MSI AUTOMATE

- MIAS

- SENCORPWHITE, INC

- WESTFALIA TECHNOLOGIES, INC.

- WITRON LOGISTIK+INFORMATIK GMBH

- ADDVERB TECHNOLOGIES LIMITED

- SIMPL AUTOMATION

- RAPYUTA ROBOTICS

- MULTIWAY ROBOTICS(SHENZHEN)CO., LTD.

第17章 付録

List of Tables

- TABLE 1 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: RESEARCH ASSUMPTION

- TABLE 2 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: RISK ANALYSIS

- TABLE 3 ROLE OF COMPANIES IN AUTOMATED STORAGE AND RETRIEVAL SYSTEM ECOSYSTEM

- TABLE 4 INDICATIVE PRICING OF ASRS OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF ASRS, BY TYPE, 2021-2024 (USD THOUSAND)

- TABLE 6 AVERAGE SELLING PRICE TREND OF UNIT LOAD ASRS, BY REGION, 2021-2024 (USD THOUSAND)

- TABLE 7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 9 KEY BUYING CRITERIA FOR KEY INDUSTRIES

- TABLE 10 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 IMPORT DATA FOR HS CODE 8428-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 12 EXPORT DATA FOR HS CODE 8428-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 13 LIST OF KEY PATENTS, 2023-2024

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 STANDARDS

- TABLE 19 FUNDINGS FOR MICRO-FULFILLMENT CENTERS, 2021-2022

- TABLE 20 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 21 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 22 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 23 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 24 UNIT LOAD: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 25 UNIT LOAD: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 26 MINI LOAD: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 27 MINI LOAD: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 28 VERTICAL LIFT MODULES (VLM): AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 29 VERTICAL LIFT MODULES (VLM): AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 30 CAROUSEL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 31 CAROUSEL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 32 MID LOAD: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 33 MID LOAD: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 34 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 35 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 36 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 37 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 38 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 39 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 43 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 44 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 45 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 46 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 47 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 48 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 AUTOMOTIVE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 METALS & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 51 METALS & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 52 METALS & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 METALS & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 METAL & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 55 METAL & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 56 METAL & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 57 METAL & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 58 METAL & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 59 METAL & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 60 METAL & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 METAL & HEAVY MACHINERY: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 63 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 64 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 67 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 68 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 69 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 70 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 71 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 FOOD & BEVERAGES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 75 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 76 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 CHEMICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 87 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 88 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 95 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 PHARMACEUTICALS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 99 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 100 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 103 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 105 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 106 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 107 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 MEDICAL DEVICES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 111 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 112 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 115 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 116 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 119 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 120 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 SEMICONDUCTOR & ELECTRONICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 E-COMMERCE & RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 123 E-COMMERCE & RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 124 E-COMMERCE & RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 E-COMMERCE AND RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 126 E-COMMERCE & RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 E-COMMERCE & RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 E-COMMERCE & RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 129 E-COMMERCE & RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 E-COMMERCE & RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 131 E-COMMERCE & RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 E-COMMERCE & RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 133 E-COMMERCE & RETAIL: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 134 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 135 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 136 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 137 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 138 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 139 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 140 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 141 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 142 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 143 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 144 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 AVIATION: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 146 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 147 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 148 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 149 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 150 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 153 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 154 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 155 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 157 LOGISTICS: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 158 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 159 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 160 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 161 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 162 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 163 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 164 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 167 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 168 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 169 PULP & PAPER: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 170 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 171 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 172 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 173 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 174 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 175 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 176 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 177 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 178 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 179 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 180 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 181 OTHER INDUSTRIES: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 182 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 183 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 184 NORTH AMERICA: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 185 NORTH AMERICA: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 186 NORTH AMERICA: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 187 NORTH AMERICA: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 188 EUROPE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 189 EUROPE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 190 EUROPE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 191 EUROPE: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 192 ASIA PACIFIC: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 193 ASIA PACIFIC: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 194 ASIA PACIFIC: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 195 ASIA PACIFIC: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 196 ROW: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 197 ROW: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 198 ROW: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 199 ROW: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 200 MIDDLE EAST: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 201 MIDDLE EAST: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 202 GCC: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 203 GCC: AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 204 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 205 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: DEGREE OF COMPETITION

- TABLE 206 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: REGION FOOTPRINT

- TABLE 207 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: TYPE FOOTPRINT

- TABLE 208 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: INDUSTRY FOOTPRINT

- TABLE 209 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 210 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 211 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 212 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 213 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: OTHER DEVELOPMENTS, JANUARY 2021-DECEMBER 2024

- TABLE 214 DAIFUKU CO., LTD.: COMPANY OVERVIEW

- TABLE 215 DAIFUKU CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 DAIFUKU CO., LTD.: DEALS

- TABLE 217 DAIFUKU CO., LTD.: EXPANSIONS

- TABLE 218 MURATA MACHINERY, LTD.: COMPANY OVERVIEW

- TABLE 219 MURATA MACHINERY, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 MURATA MACHINERY, LTD.: EXPANSIONS

- TABLE 221 SSI SCHAEFER: COMPANY OVERVIEW

- TABLE 222 SSI SCHAEFER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 SSI SCHAEFER: PRODUCT LAUNCHES

- TABLE 224 SSI SCHAEFER: DEALS

- TABLE 225 SSI SCHAEFER: OTHER DEVELOPMENTS

- TABLE 226 TGW LOGISTICS GROUP: COMPANY OVERVIEW

- TABLE 227 TGW LOGISTICS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 TGW LOGISTICS GROUP: PRODUCT LAUNCHES

- TABLE 229 TGW LOGISTICS GROUP: DEALS

- TABLE 230 TGW LOGISTICS GROUP: EXPANSIONS

- TABLE 231 TGW LOGISTICS GROUP: OTHER DEVELOPMENTS

- TABLE 232 KARDEX: COMPANY OVERVIEW

- TABLE 233 KARDEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 KARDEX: DEALS

- TABLE 235 KARDEX: EXPANSIONS

- TABLE 236 KARDEX: OTHER DEVELOPMENTS

- TABLE 237 BEUMER GROUP: COMPANY OVERVIEW

- TABLE 238 BEUMER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 BEUMER GROUP: PRODUCT LAUNCHES

- TABLE 240 BEUMER GROUP: DEALS

- TABLE 241 BEUMER GROUP: EXPANSIONS

- TABLE 242 BEUMER GROUP: OTHER DEVELOPMENTS

- TABLE 243 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 244 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 246 KION GROUP AG: COMPANY OVERVIEW

- TABLE 247 KION GROUP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 KION GROUP AG: EXPANSIONS

- TABLE 249 KNAPP AG: COMPANY OVERVIEW

- TABLE 250 KNAPP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 KNAPP AG: DEALS

- TABLE 252 KNAPP AG: OTHER DEVELOPMENTS

- TABLE 253 KUKA AG: COMPANY OVERVIEW

- TABLE 254 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 KUKA AG: PRODUCT LAUNCHES

- TABLE 256 KUKA AG: DEALS

- TABLE 257 KUKA AG: OTHER DEVELOPMENTS

- TABLE 258 MECALUX, S.A.: COMPANY OVERVIEW

- TABLE 259 MECALUX, S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 MECALUX, S.A.: DEALS

- TABLE 261 MECALUX, S.A.: OTHER DEVELOPMENTS

- TABLE 262 SYSTEM LOGISTICS S.P.A.: COMPANY OVERVIEW

- TABLE 263 SYSTEM LOGISTICS S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 SYSTEM LOGISTICS S.P.A.: DEVELOPMENTS

- TABLE 265 TOYOTA INDUSTRIES CORPORATION: COMPANY OVERVIEW

- TABLE 266 TOYOTA INDUSTRIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 TOYOTA INDUSTRIES CORPORATION: PRODUCT LAUNCHES

- TABLE 268 TOYOTA INDUSTRIES CORPORATION: DEALS

- TABLE 269 IHI CORPORATION: COMPANY OVERVIEW

- TABLE 270 IHI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 IHI CORPORATION: DEALS

- TABLE 272 STANLEY BLACK & DECKER, INC.: COMPANY OVERVIEW

- TABLE 273 STANLEY BLACK & DECKER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 STANLEY BLACK & DECKER, INC.: DEALS

- TABLE 275 JUNGHEINRICH AG: COMPANY OVERVIEW

- TABLE 276 JUNGHEINRICH AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 JUNGHEINRICH AG: DEALS

- TABLE 278 JUNGHEINRICH AG: EXPANSIONS

- TABLE 279 OCADO GROUP PLC.: COMPANY OVERVIEW

- TABLE 280 OCADO GROUP PLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 OCADO GROUP PLC.: PRODUCT LAUNCHES

- TABLE 282 OCADO GROUP PLC.: DEALS

- TABLE 283 AUTOMATION LOGISTICS CORPORATION: COMPANY OVERVIEW

- TABLE 284 SNAP-ON AUTOCRIB: COMPANY OVERVIEW

- TABLE 285 FERRETTO SPA: COMPANY OVERVIEW

- TABLE 286 HANEL BURO- UND LAGERSYSTEME: COMPANY OVERVIEW

- TABLE 287 MSI AUTOMATE: COMPANY OVERVIEW

- TABLE 288 MIAS: COMPANY OVERVIEW

- TABLE 289 SENCORPWHITE, INC: COMPANY OVERVIEW

- TABLE 290 WESTFALIA TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 291 WITRON LOGISTIK + INFORMATIK GMBH: COMPANY OVERVIEW

- TABLE 292 ADDVERB TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 293 SIMPL AUTOMATION: COMPANY OVERVIEW

- TABLE 294 RAPYUTA ROBOTICS: COMPANY OVERVIEW

- TABLE 295 MULTIWAY ROBOTICS (SHENZHEN) CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: RESEARCH APPROACH

- FIGURE 4 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: BOTTOM-UP APPROACH

- FIGURE 5 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: TOP-DOWN APPROACH

- FIGURE 6 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 7 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: DATA TRIANGULATION

- FIGURE 8 GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, 2021-2030

- FIGURE 9 UNIT LOAD SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 10 FOOD & BEVERAGES SEGMENT TO CAPTURE LARGEST SHARE OF AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN 2025

- FIGURE 11 500-1,500 KG SEGMENT TO HOLD LARGEST SHARE OF AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN 2025

- FIGURE 12 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 13 BURGEONING DEMAND FOR WAREHOUSE AUTOMATION SOLUTIONS TO AUGMENT MARKET GROWTH

- FIGURE 14 UNIT LOAD SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 15 FOOD & BEVERAGES SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 16 500-1,500 KG SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 17 FOOD & BEVERAGES SEGMENT AND US TO HOLD LARGEST SHARES OF AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA IN 2030

- FIGURE 18 CHINA TO RECORD HIGHEST CAGR IN GLOBAL AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 ECOSYSTEM ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE TREND OF ASRS, BY TYPE, 2021-2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF UNIT LOAD ASRS, BY REGION, 2021-2024

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 30 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 33 IMPORT DATA FOR HS CODE 8428-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 34 EXPORT DATA FOR HS CODE 8428-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 35 PATENT APPLIED AND GRANTED, 2014-2023

- FIGURE 36 KEY USE CASES OF AI/GENERATIVE AI IN AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET

- FIGURE 37 KEY ELEMENTS POWERING DEVELOPMENTS IN MICRO-FULFILLMENT CENTERS SPACE

- FIGURE 38 MFC ECOSYSTEM ANALYSIS

- FIGURE 39 KEY TECHNOLOGIES USED IN MICRO-FULFILLMENT CENTERS

- FIGURE 40 FUNCTIONS OF AUTOMATED STORAGE AND RETRIEVAL SYSTEMS

- FIGURE 41 OFFERINGS IN AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET

- FIGURE 42 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE

- FIGURE 43 UNIT LOAD SEGMENT TO SECURE LARGEST MARKET SHARE IN 2025

- FIGURE 44 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY PAYLOAD CAPACITY

- FIGURE 45 500-1,500 KG SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 46 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY

- FIGURE 47 FOOD & BEVERAGES TO LEAD MARKET IN 2025

- FIGURE 48 AUTOMATED STORAGE AND RETRIEVAL MARKET, BY REGION

- FIGURE 49 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 51 NORTH AMERICA: SNAPSHOT OF AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET

- FIGURE 52 US TO LEAD MARKET IN 2025

- FIGURE 53 EUROPE: SNAPSHOT OF AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET

- FIGURE 54 GERMANY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 55 ASIA PACIFIC: SNAPSHOT OF AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET

- FIGURE 56 CHINA TO DOMINATE MARKET IN 2025

- FIGURE 57 SOUTH AMERICA TO DOMINATE MARKET IN 2025

- FIGURE 58 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: REVENUE ANALYSIS OF THREE KEY PLAYERS, 2019-2023

- FIGURE 59 MARKET SHARE ANALYSIS OF COMPANIES OFFERING AUTOMATED STORAGE AND RETRIEVAL SYSTEMS, 2023

- FIGURE 60 COMPANY VALUATION, 2024

- FIGURE 61 FINANCIAL METRICS, 2024 (EV/EBITDA)

- FIGURE 62 PRODUCT COMPARISON

- FIGURE 63 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 64 COMPANY FOOTPRINT

- FIGURE 65 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 66 DAIFUKU CO., LTD.: COMPANY SNAPSHOT

- FIGURE 67 MURATA MACHINERY, LTD.: COMPANY SNAPSHOT

- FIGURE 68 KARDEX: COMPANY SNAPSHOT

- FIGURE 69 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 70 KION GROUP AG: COMPANY SNAPSHOT

- FIGURE 71 KUKA AG: COMPANY SNAPSHOT

- FIGURE 72 TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 73 IHI CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 STANLEY BLACK & DECKER, INC.: COMPANY SNAPSHOT

- FIGURE 75 JUNGHEINRICH AG: COMPANY SNAPSHOT

- FIGURE 76 OCADO GROUP PLC.: COMPANY SNAPSHOT

The global automated storage and retrieval system market is projected to reach USD 9.86 billion by 2025 and USD 14.80 billion by 2030, at a CAGR of 8.5%. The factors driving this growth are the increasing need for efficient inventory management as well as space optimization in industries as e-commerce, automotive, and food & beverage. Technical advancements such as AI-enabled systems, robotic integration, and IoT connectivity have made the ASRS solutions more precise, faster, and scalable. Furthermore, the expansion in the adoption of Industry 4.0 practices and the focus on sustainability are prompting investments in energy-efficient, automated systems, modernizing warehouse operations and transforming global supply chains.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, By Payload Capacity, By Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Vertical Lift Module (VLM) is expected to witness the highest CAGR during the forecast period."

Vertical Lift Modules (VLMs) are anticipated to exhibit the highest CAGR in the automated storage and retrieval system market during the forecast period, driven by their efficiency, space-saving design, and versatility across industries. VLMs make better use of vertical space and boost work efficiency and inventory tracking. Such systems are deployed across various verticals, like e-commerce, automotive, and healthcare, based on their advantage of labor cost reduction, increase in picking accuracy, and an optimum storage density. Technological advancement, with integration of the Internet of Things and Artificial intelligence, further augments the uptake of VLM by allowing for real-time monitoring and predictive maintenance. As a business is concentrating on automation and efficiency, there will be increased growth in VLMs market for the ASRS segment.

"Automotive is anticipated to hold a significant share in the automated storage and retrieval system market."

The automotive industry is projected to play a major role in the automated storage and retrieval system (ASRS) market throughout the forecast period, primarily due to its critical need for effective inventory management, accurate material handling, and efficient production processes. ASRS solutions are commonly utilized in automotive manufacturing plants and warehouses to store and retrieve components, handle large quantities of parts, and facilitate just-in-time production practices. The incorporation of cutting-edge technologies such as robotics, IoT, and AI boosts operational efficiency, minimizes errors, and accelerates order fulfillment. As the demand for electric vehicles rises and automotive manufacturing continues to advance, the requirement for strong ASRS solutions in this sector is anticipated to increase significantly, further propelling market growth.

"North America is set to hold a significant share in automated storage & retrieval system market"

North America is anticipated to hold a significant share in the automated storage and retrieval system market during the forecast period, driven by the swift adoption of advanced automation technologies in sectors like e-commerce, automotive, and healthcare. The region's strong emphasis on enhancing supply chain efficiency, cutting operational costs, and addressing the growing demand for quick order fulfilment has spurred the use of ASRS solutions. Key market players, robust infrastructure, and high investment in automation technologies such as robotics, AI, and IoT are further contributing to the growth of the market. With increasing emphasis on smart warehousing and sustainability, North America is a key player in the global ASRS market.

Breakdown of primaries

A variety of executives from key organizations operating in the automated storage & retrieval system market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level Executives - 35%, Directors - 45%, and Others - 20%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, and RoW - 10%

Major players profiled in this report are as follows: Major Players: TGW Logistics Group (Austria), Kardex (Switzerland), Daifuku Co., Ltd. (Japan), Murata Manufacturing Co., Ltd. (Japan), and SSI SCHAEFER (Germany) and Others. These leading companies possess a wide portfolio of products, establishing a prominent presence in established as well as emerging markets.

The study provides a detailed competitive analysis of these key players in the automated storage & retrieval system market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

In this report, the automated storage & retrieval system market has been segmented based on type, payload capacity, industry and region. The type segment consists of Unit Load, Mini Load, Vertical Lift Module (VLM), Carousel and Mid Load. The payload capacity segment consists of <500 kg, 500 kg - 1,500 kg and >1,500 kg. The industry segment consists of Automotive, Metals & Heavy Machinery, Food & Beverage, Chemical, Pharmaceuticals, Medical Devices, Semiconductor & Electronics, Retail, Aviation, E-commerce, Pulp & Paper, Others (Printing & Textile). The market has been segmented into four regions-North America, Asia Pacific, Europe, and RoW.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the automated storage & retrieval system market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Strong focus on efficient space utilization and cost saving , Strong focus on efficient space utilization and cost saving , Heightened emphasis on achieving operational excellence through precise and efficient inventory management, Significant demand for ASRS from automakers , and Growing Adoption of Industry 4.0 and IoT Integration), restraints (High installation and maintenance costs, Requirement for technical experts to oversee system operations, and Concerns Over Data Security and Cyber Threats) opportunities (Growing demand for cold chain systems in Asia Pacific, Lucrative opportunities presented by thriving healthcare sector, Opportunities in Small and Medium Enterprises (SMEs) across various verticals), and challenges (Production and revenue losses due to unwanted faults and downtime, Designing flexible and scalable ASRS due to rapidly changing technology and customer requirements, and Longer ROI Periods for Certain Applications) influencing the growth of the automated storage & retrieval system market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the automated storage & retrieval system market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automated storage & retrieval system market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the automated storage & retrieval system market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like TGW Logistics Group (Austria), Kardex (Switzerland), Daifuku Co., Ltd. (Japan), Murata Manufacturing Co., Ltd. (Japan), SSI SCHAEFER (Germany) and Others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET

- 4.2 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE

- 4.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY

- 4.4 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY PAYLOAD CAPACITY

- 4.5 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET IN NORTH AMERICA, BY INDUSTRY AND COUNTRY

- 4.6 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising emphasis on efficient space utilization in warehouses

- 5.2.1.2 Increasing deployment of automation technology in booming e-commerce sector

- 5.2.1.3 Mounting demand for real-time inventory management systems in distribution centers

- 5.2.1.4 High adoption of electric vehicles due to environmental concerns

- 5.2.1.5 Rising integration of ASRS with Industry 4.0 and IoT technologies

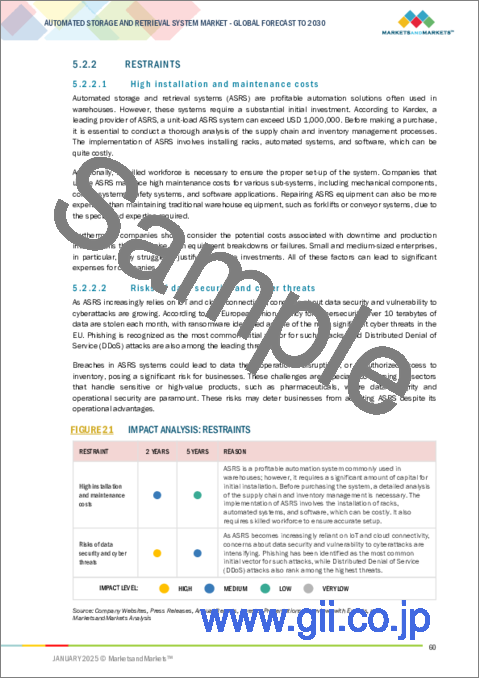

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and maintenance costs

- 5.2.2.2 Risks of data security and cyber threats

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing cold chain operations in Asia Pacific

- 5.2.3.2 Rising implementation of strict guidelines for medical intralogistics

- 5.2.3.3 Increasing availability of modular and cost-effective ASRS solutions for SMEs

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities and technical issues associated with ASRS setup

- 5.2.4.2 Challenges in adapting to ever-evolving technologies and customer demands

- 5.2.4.3 Long ROI periods for small warehouses

- 5.2.4.4 Requirement for technical expertise to avoid inaccuracy in system operations

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING OF ASRS PROVIDED BY KEY PLAYERS, BY TYPE, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF ASRS, BY TYPE, 2021-2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF UNIT LOAD ASRS, BY REGION, 2021-2024

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Industry 4.0

- 5.8.1.2 5G

- 5.8.1.3 Machine learning

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Robotic process automation

- 5.8.2.2 Predictive analytics

- 5.8.3 COMPLEMENTARY TECHNOLOGIES

- 5.8.3.1 Digital twin model builder

- 5.8.3.2 Voice recognition

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS ON BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ABB ADOPTS WHITE SYSTEMS VERTICAL LIFT MODULES TO OPTIMIZE FLOOR SPACE AND ENHANCE PRODUCTIVITY

- 5.11.2 MECALUX, S.A. IMPLEMENTS ADVANCED MINILOAD ASRS TO ENHANCE LOGISTICS EFFICIENCY FOR HISPANOX

- 5.11.3 PEPSICO ADOPTS MECALUX, S.A.'S ASRS TO BOOST EFFICIENCY AND SUSTAINABILITY IN AUTOMATED WAREHOUSES

- 5.11.4 OTTO'S BMW COLLABORATES WITH STANLEY VIDMAR TO OPTIMIZE SPACE AND EFFICIENCY USING AUTOMATED VERTICAL LIFT MODULE

- 5.11.5 ALLIED BEVERAGE GROUP PARTNERS WITH WESTFALIA TECHNOLOGIES, INC. TO ADDRESS OPERATIONAL INEFFICIENCIES WITH HIGH-DENSITY ASRS AND SAVANNA.NET WES

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT DATA (HS CODE 8428)

- 5.13.2 EXPORT DATA (HS CODE 8428)

- 5.14 PATENT ANALYSIS

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 REGULATIONS

- 5.15.3 STANDARDS

- 5.16 IMPACT OF AI/GENERATIVE AI ON AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI/GENERATIVE AI ON AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET

- 5.16.3 TOP USE CASES AND MARKET POTENTIAL

6 TRENDS IN WAREHOUSING IMPACTING AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET

- 6.1 INTRODUCTION

- 6.2 MICRO-FULFILLMENT CENTERS

- 6.2.1 DEVELOPMENTS IN MICRO-FULFILLMENT CENTERS

- 6.2.2 ADVANTAGES OF MICRO-FULFILLMENT CENTERS OVER CENTRALIZED FULFILLMENT CENTERS

- 6.2.3 MICRO-FULFILLMENT CENTER ECOSYSTEM ANALYSIS

- 6.2.4 MAJOR COMPANIES INSTALLING MICRO-FULFILLMENT CENTERS

- 6.2.5 KEY TECHNOLOGIES INTEGRATED IN MICRO-FULFILLMENT CENTERS

- 6.2.5.1 Cube storage

- 6.2.5.2 Autonomous mobile robots

- 6.2.5.3 Automated shuttle systems

- 6.2.5.4 Other technologies

- 6.2.6 INVESTMENTS IN MICRO-FULFILLMENT TECHNOLOGY

- 6.2.7 MICRO-FULFILLMENT CENTERS IN US

- 6.3 AUTONOMOUS MACHINES

- 6.4 DARK STORES

- 6.5 INTEGRATION OF DATA ANALYTICS AND AI

- 6.6 CLOUD-BASED MANAGEMENT

- 6.7 ROBOTICS

7 FUNCTIONS OF AUTOMATED STORAGE AND RETRIEVAL SYSTEMS

- 7.1 INTRODUCTION

- 7.2 STORAGE

- 7.3 ORDER PICKING

- 7.4 DISTRIBUTION

- 7.5 ASSEMBLY

- 7.6 KITTING

- 7.7 OTHER FUNCTIONS

8 TYPES OF EMERGING AUTOMATED STORAGE AND RETRIEVAL SYSTEM TECHNOLOGIES

- 8.1 INTRODUCTION

- 8.2 ROBOTIC CUBE STORAGE

- 8.3 SHUTTLE-BASED AUTOMATED STORAGE AND RETRIEVAL SYSTEMS

- 8.4 OTHERS EMERGING TECHNOLOGIES

9 OFFERINGS AND EMERGING APPLICATIONS IN AUTOMATED STORAGE AND RETRIEVAL SYSTEMS

- 9.1 INTRODUCTION

- 9.1.1 HARDWARE

- 9.1.2 SOFTWARE & SERVICES

- 9.2 EMERGING APPLICATIONS OF AUTOMATED STORAGE AND RETRIEVAL SYSTEMS

- 9.2.1 HEALTHCARE STORAGE AND LOGISTICS

- 9.2.2 LIBRARY AND LABORATORY INVENTORY MANAGEMENT IN ACADEMIC INSTITUTIONS

- 9.2.3 VERTICAL FARMING AND CROP MONITORING AND TRACING

- 9.2.4 ORDER FULFILLMENT AND SUPPLY CHAIN ENHANCEMENT IN FASHION AND APPAREL INDUSTRY

- 9.2.5 WASTE SORTING AND RECYCLING

- 9.2.6 COLD STORAGE AND LOGISTICS

10 DEPLOYMENT MODES AND SYSTEM COMPONENTS OF AUTOMATED SYSTEM AND RETRIEVAL SYSTEMS

- 10.1 INTRODUCTION

- 10.2 DEPLOYMENT MODES

- 10.2.1 STANDALONE

- 10.2.2 INTEGRATED

- 10.3 COMPONENTS

- 10.3.1 RACK STRUCTURE

- 10.3.2 CONTROL SYSTEMS

- 10.3.3 RETRIEVAL SYSTEMS

- 10.3.4 OTHER COMPONENTS

11 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 UNIT LOAD

- 11.2.1 RISING NEED TO REDUCE WORK-IN-PROGRESS INVENTORY TO BOOST DEMAND

- 11.3 MINI LOAD

- 11.3.1 ABILITY TO OFFER HIGH-SPEED MOVEMENT ON THREE-DIMENSIONAL AXIS TO SUPPORT MARKET GROWTH

- 11.4 VERTICAL LIFT MODULE (VLM)

- 11.4.1 INCREASING INTEGRATION WITH PICK-TO-LIGHT TECHNOLOGY TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 11.5 CAROUSEL

- 11.5.1 GROWING DEMAND FOR INCREASED PICKING SPEEDS AND ORDER ACCURACY TO FUEL MARKET GROWTH

- 11.5.2 VERTICAL CAROUSEL

- 11.5.3 HORIZONTAL CAROUSEL

- 11.6 MID LOAD

- 11.6.1 ABILITY TO ENHANCE INVENTORY MANAGEMENT WITH REAL-TIME STOCK LEVELS TO FUEL MARKET GROWTH

12 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY PAYLOAD CAPACITY

- 12.1 INTRODUCTION

- 12.2 <500 KG

- 12.2.1 RISING NEED TO MINIMIZE HUMAN ERRORS AND LOWER LABOR COSTS TO FUEL MARKET GROWTH

- 12.3 500-1,500 KG

- 12.3.1 GROWING DEMAND TO IMPROVE SPEED IN MATERIAL HANDLING TO FOSTER MARKET GROWTH

- 12.4 1,500 KG

- 12.4.1 INCREASING DEMAND IN AUTOMOTIVE, AEROSPACE, AND HEAVY MACHINERY SECTORS TO SUPPORT MARKET GROWTH

13 AUTOMATED STORAGE AND RETRIEVAL SYSTEM MARKET, BY INDUSTRY

- 13.1 INTRODUCTION

- 13.2 AUTOMOTIVE

- 13.2.1 RISING DEMAND FOR EFFICIENT CONVEYOR SYSTEMS FOR AUTOMOTIVE ASSEMBLY PLANTS TO FOSTER MARKET GROWTH

- 13.3 METALS & HEAVY MACHINERY

- 13.3.1 INCREASING IMPLEMENTATION TO FACILITATE INTRALOGISTIC MOVEMENT OF HEAVY GOODS TO BOOST DEMAND

- 13.4 FOOD & BEVERAGES

- 13.4.1 GROWING TREND OF CONSUMING PROCESSED FOOD AND PACKAGED EATABLES TO SUPPORT MARKET GROWTH

- 13.5 CHEMICALS

- 13.5.1 RISING EMPHASIS ON SUSTAINABILITY AND DIGITALIZATION TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 13.6 PHARMACEUTICALS

- 13.6.1 GROWING NEED TO MANAGE INVENTORY EFFICIENTLY AND REDUCE MANUAL HANDLING ERRORS TO FUEL MARKET GROWTH

- 13.7 MEDICAL DEVICES

- 13.7.1 INCREASING ADOPTION FOR MANAGING STORAGE AND MOVEMENT OF HIGH-VALUE AND PRECISION-DRIVEN PRODUCTS TO ACCELERATE DEMAND

- 13.8 SEMICONDUCTOR & ELECTRONICS

- 13.8.1 SURGING DEPLOYMENT OF INFOTAINMENT SYSTEMS AND PRECISION ELECTRONICS TO BOOST DEMAND

- 13.9 E-COMMERCE & RETAIL

- 13.9.1 GROWING IMPLEMENTATION TO AUTOMATE SHIPPING OPERATIONS TO SUPPORT MARKET GROWTH

- 13.10 AVIATION

- 13.10.1 RISING APPLICATION FOR MANUFACTURING AIRCRAFT TO FUEL MARKET GROWTH

- 13.11 LOGISTICS

- 13.11.1 GROWING NEED TO MODERNIZE SUPPLY CHAINS AND REDUCE WASTE TO BOOST DEMAND

- 13.12 PULP & PAPER

- 13.12.1 RISING FOCUS ON REDUCING CARBON FOOTPRINT OF LOGISTICS OPERATIONS TO FUEL MARKET GROWTH

- 13.13 OTHER INDUSTRIES

14 AUTOMATED STORAGE AND RETRIEVAL MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK IN NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 Increasing technological advancements in automotive sector to boost demand

- 14.2.3 CANADA

- 14.2.3.1 Thriving industrial ecosystem to foster market growth

- 14.2.4 MEXICO

- 14.2.4.1 Rising preference for convenience foods and prepared meals to drive market

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK IN EUROPE

- 14.3.2 UK

- 14.3.2.1 Ongoing advancements in material handling technologies to offer lucrative growth opportunities

- 14.3.3 GERMANY

- 14.3.3.1 Presence of prominent automobile players to fuel market growth

- 14.3.4 FRANCE

- 14.3.4.1 Thriving manufacturing sector to support market growth

- 14.3.5 ITALY

- 14.3.5.1 Expansion of e-commerce to boost demand

- 14.3.6 SPAIN

- 14.3.6.1 Developing logistics sector to foster market growth

- 14.3.7 SWEDEN

- 14.3.7.1 Government-led initiatives to promote green technologies to foster market growth

- 14.3.8 NETHERLANDS

- 14.3.8.1 Presence of advanced manufacturing sector to boost demand

- 14.3.9 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK IN ASIA PACIFIC

- 14.4.2 CHINA

- 14.4.2.1 Surging export of manufactured goods to fuel market growth

- 14.4.3 JAPAN

- 14.4.3.1 Rising emphasis on establishing sustainable supply chains to foster market growth

- 14.4.4 AUSTRALIA

- 14.4.4.1 Government-led initiatives to strengthen manufacturing sector to support market growth

- 14.4.5 INDIA

- 14.4.5.1 Increasing adoption of electric vehicles to accelerate demand

- 14.4.6 MALAYSIA

- 14.4.6.1 Growing consumer preference for online shopping and availability of customized payment options to drive market

- 14.4.7 INDONESIA

- 14.4.7.1 Expanding retail and e-commerce to boost demand

- 14.4.8 SOUTH KOREA

- 14.4.8.1 Rising emphasis on boosting share of robotics and automation in manufacturing and warehousing facilities to fuel market growth

- 14.4.9 SINGAPORE

- 14.4.9.1 Growing focus on Industry 4.0 technologies to boost demand

- 14.4.10 THAILAND

- 14.4.10.1 Development of high-tech industrial hub to offer lucrative growth opportunities

- 14.4.11 REST OF ASIA PACIFIC

- 14.5 ROW

- 14.5.1 MACROECONOMIC OUTLOOK IN ROW

- 14.5.2 MIDDLE EAST

- 14.5.2.1 GCC

- 14.5.2.1.1 Saudi Arabia

- 14.5.2.1.1.1 Expanding e-commerce market to boost demand

- 14.5.2.1.2 UAE

- 14.5.2.1.2.1 Growing establishment of airports, malls, and restaurants to support market growth

- 14.5.2.1.3 Rest of GCC

- 14.5.2.1.1 Saudi Arabia

- 14.5.2.2 Rest of Middle East

- 14.5.2.1 GCC

- 14.5.3 AFRICA

- 14.5.3.1 South Africa

- 14.5.3.1.1 Rising emphasis on modernizing industrial and logistics infrastructure to fuel market growth

- 14.5.3.2 Rest of Africa

- 14.5.3.1 South Africa

- 14.5.4 SOUTH AMERICA

- 14.5.4.1 Brazil

- 14.5.4.1.1 Integration of advanced technologies into industrial processes to support market growth

- 14.5.4.2 Argentina

- 14.5.4.2.1 Growing focus on industrial modernization to offer lucrative growth opportunities

- 14.5.4.3 Rest of South America

- 14.5.4.1 Brazil

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 15.3 REVENUE ANALYSIS, 2019-2023

- 15.4 MARKET SHARE ANALYSIS, 2023

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 15.6 PRODUCT COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Type footprint

- 15.7.5.4 Industry footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 DAIFUKU CO., LTD.

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Deals

- 16.1.1.3.2 Expansions

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths/Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses/Competitive threats

- 16.1.2 MURATA MACHINERY, LTD.

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Expansions

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths/Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses/Competitive threats

- 16.1.3 SSI SCHAEFER

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.3.2 Deals

- 16.1.3.3.3 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths/Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses/Competitive threats

- 16.1.4 TGW LOGISTICS GROUP

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Expansions

- 16.1.4.3.4 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths/Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses/Competitive threats

- 16.1.5 KARDEX

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.3.2 Expansions

- 16.1.5.3.3 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths/Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses/Competitive threats

- 16.1.6 BEUMER GROUP

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches

- 16.1.6.3.2 Deals

- 16.1.6.3.3 Expansions

- 16.1.6.3.4 Other developments

- 16.1.7 HONEYWELL INTERNATIONAL INC.

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches

- 16.1.8 KION GROUP AG

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Expansions

- 16.1.9 KNAPP AG

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.9.3.2 Other developments

- 16.1.10 KUKA AG

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.3.2 Deals

- 16.1.10.3.3 Other developments

- 16.1.11 MECALUX, S.A.

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Deals

- 16.1.11.3.2 Other developments

- 16.1.12 SYSTEM LOGISTICS S.P.A.

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Developments

- 16.1.13 TOYOTA INDUSTRIES CORPORATION

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Product launches

- 16.1.13.3.2 Deals

- 16.1.14 IHI CORPORATION

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.14.3 Recent developments

- 16.1.14.3.1 Deals

- 16.1.15 STANLEY BLACK & DECKER, INC.

- 16.1.15.1 Business overview

- 16.1.15.2 Products/Solutions/Services offered

- 16.1.15.3 Recent developments

- 16.1.15.3.1 Deals

- 16.1.16 JUNGHEINRICH AG

- 16.1.16.1 Business overview

- 16.1.16.2 Products/Solutions/Services offered

- 16.1.16.3 Recent developments

- 16.1.16.3.1 Deals

- 16.1.16.3.2 Expansions

- 16.1.17 OCADO GROUP PLC.

- 16.1.17.1 Business overview

- 16.1.17.2 Products/Solutions/Services offered

- 16.1.17.3 Recent developments

- 16.1.17.3.1 Product launches

- 16.1.17.3.2 Deals

- 16.1.1 DAIFUKU CO., LTD.

- 16.2 OTHER PLAYERS

- 16.2.1 AUTOMATION LOGISTICS CORPORATION

- 16.2.2 SNAP-ON AUTOCRIB

- 16.2.3 FERRETTO SPA

- 16.2.4 HANEL BURO- UND LAGERSYSTEME

- 16.2.5 MSI AUTOMATE

- 16.2.6 MIAS

- 16.2.7 SENCORPWHITE, INC

- 16.2.8 WESTFALIA TECHNOLOGIES, INC.

- 16.2.9 WITRON LOGISTIK + INFORMATIK GMBH

- 16.2.10 ADDVERB TECHNOLOGIES LIMITED

- 16.2.11 SIMPL AUTOMATION

- 16.2.12 RAPYUTA ROBOTICS

- 16.2.13 MULTIWAY ROBOTICS (SHENZHEN) CO., LTD.

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS