|

|

市場調査レポート

商品コード

1473749

自動車用ターボチャージャーの世界市場:ディーゼル・ガソリンターボ別、コンポーネント別、材料別、オフハイウェイ機械別、車両タイプ別、燃料タイプ別、アフターマーケット別、地域別 - 予測(~2030年)Automotive Turbocharger Market by Diesel & Gasoline Turbo (VGT, Wastegate, e-Turbo), Component (Turbine Wheel, Compressor Wheel, Housing), Material, Off-Highway Equipment, Vehicle Type, Fuel Type, Aftermarket and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用ターボチャージャーの世界市場:ディーゼル・ガソリンターボ別、コンポーネント別、材料別、オフハイウェイ機械別、車両タイプ別、燃料タイプ別、アフターマーケット別、地域別 - 予測(~2030年) |

|

出版日: 2024年04月29日

発行: MarketsandMarkets

ページ情報: 英文 331 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の自動車用ターボチャージャーの市場規模は、2024年の152億米ドルから2030年までに229億米ドルに達し、CAGRで7.1%の成長が予測されています。

市場は近年安定した成長を示しています。厳しい排ガス規制、TGDI(Turbocharged Gasoline Direct Injection)技術の需要の拡大、低燃費車への需要の拡大といった要因が、自動車用ターボチャージャー技術の進歩に拍車をかけています。ターボチャージャーは、出力を高め、燃費を改善し、排ガス規制を満たすために、ガソリンエンジンやディーゼルエンジンに広く使用されています。自動車メーカーやTier 1サプライヤーが燃費、排出ガスの削減と性能を優先する中、自動車用ターボチャージャー技術の開発が今後数年間に重要な役割を果たすと予測されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | ディーゼル・ガソリンターボ、コンポーネント、材料、オフハイウェイ機器、車両タイプ、燃料タイプ、アフターマーケット、地域 |

| 対象地域 | アジア太平洋、北米、欧州、その他の地域 |

「ガソリン乗用車が予測期間に世界の自動車用ターボチャージャー市場を先導します。」

よりクリーンな環境への関心の高まりにより、OEMはディーゼル乗用車からガソリン乗用車にシフトしています。このシフトは商用車セグメントではあまり見られません。例えばACEAによると、EUのガソリン車は36.7%でしたが、2022年には16%以下に減少しました。さらに、ディーゼルエンジンに対する排ガス規制が強化され、ディーゼルエンジンの成長が低下しているため、ガソリンエンジンを搭載した乗用車の需要が増加しています。ターボチャージャー付きGDIエンジンは、燃焼効率の最適化などの利点を提供します。先進のエンジン設計とターボ過給技術によって強化されたGDIエンジンは、OEMが出力とトルクを一定に保ちながら、より高いレベルの燃料効率を達成することを可能にしています。欧州は近年、ガソリンターボ車の最先端にあります。ACEAの統計によると、欧州のガソリン車は前年比で10.6%成長し、イタリア(24.9%増)やドイツ(16.1%増)といった主要国で大きな伸びを示しました。アジア太平洋と北米諸国も急激な伸びを示し、今後も増加傾向が続くと予測されます。ガソリンエンジンは一般的に、高出力のディーゼルエンジンよりも製造と維持にかかるコストが低いため、ガソリン車による効率的で経済的なオプションの需要は、今後も引き続き主流となると見込みです。

「eターボチャージャーが2030年までにもっとも急成長するターボチャージャータイプになると予測されます。」

先進の技術力を備えた電動ターボチャージャーの登場は、ハイブリッドパワートレインを備えた内燃機関に大きな採用率を示しています。電動ターボチャージャーは、低回転域でのトルクを高め、俊敏性を向上させ、特に車両の停止状態からの加速を最適化します。電動ターボチャージャーは、48Vバッテリーアーキテクチャで作動可能で、排出ガスを低減してターボラグをなくし、燃費を向上させます。電動ターボチャージャーには大きな将来性があるため、小型商用車(LDV)や大型商用車に搭載される可能性があります。例えば、Mercedes-AMG SL 43 convertible、Mercedes-Benz S-Class、Mercedes-Benz S450、Audi SQ7、Volvo XC90 T6などがeターボチャージャーを搭載しています。eターボチャージャーはウェイストゲートやVGT技術よりもコストが高いですが、その利用はプレミアムカーに限られています。しかし、プレミアム価格帯のハイブリッド車に対する需要が高まっていることから、eターボチャージャーを搭載した車両の需要は今後さらに高まり、eターボチャージャー市場の成長につながる見込みです。

当レポートでは、世界の自動車用ターボチャージャー市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 自動車用ターボチャージャー市場の企業にとって魅力的な機会

- 自動車用ターボチャージャー市場:車両タイプ別

- 自動車用ターボチャージャー市場:燃料タイプ別

- 自動車用ガソリンターボチャージャー市場:ターボタイプ別

- 自動車用ガソリンターボチャージャー市場:車両タイプ別

- 自動車用ディーゼルターボチャージャー市場:ターボタイプ別

- 自動車用ターボチャージャー市場:材料別

- オフハイウェイ自動車用ターボチャージャー市場:用途別

- 自動車用ターボチャージャーアフターマーケット:車両タイプ別

- 自動車用ターボチャージャー市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- ターボチャージャーコンポーネントメーカー

- ターボチャージャーメーカー

- OEM

- サプライチェーン分析

- 特許分析

- イントロダクション

- 主要特許のリスト

- 価格設定の分析

- ターボタイプ:地域別

- 車両タイプ:地域別

- ケーススタディ分析

- 技術分析

- 主要技術

- 隣接技術

- 規制情勢

- 規制機関、政府機関、その他の組織

- 排出規制

- 燃費基準

- 米国

- 欧州

- 中国

- インド

- 主なステークホルダーと購入基準

- 主な会議とイベント

- 貿易データアナリティクス

- 輸入データ

- 輸出データ

- 自動車用ターボチャージャー市場に対する規制/貿易協定の影響:地域別

- 北米

- アジア太平洋

- 欧州

- 投資シナリオ

第6章 自動車用ディーゼルターボチャージャー市場:ターボタイプ別

- イントロダクション

- 可変容量ターボチャージャー(VGT)

- ウェイストゲートターボチャージャー

- 電動ターボチャージャー(E-TURBO)

- 可変ツインスクロールターボチャージャー

- ツインターボチャージャー

- フリーフローティングターボチャージャー

- ダブルアクスルターボチャージャー

- 重要考察

第7章 自動車用ガソリンターボチャージャー市場:ターボタイプ別

- イントロダクション

- 可変容量ターボチャージャー/可変ノズルターボチャージャー(VGT/VNT)

- ウェイストゲートターボチャージャー

- 電動ターボチャージャー(E-TURBO)

- 可変ツインスクロールターボチャージャー

- ツインターボチャージャー

- 重要考察

第8章 自動車用ガソリンターボチャージャー市場:車両タイプ別

- イントロダクション

- 乗用車

- 軽商用車(LCV)

- 重要考察

第9章 自動車用ターボチャージャー市場:車両タイプ別

- イントロダクション

- 乗用車

- 軽商用車(LCV)

- トラック

- バス

- 重要考察

第10章 自動車用ターボチャージャー市場:燃料タイプ別

- イントロダクション

- ディーゼル

- ガソリン

- 代替燃料/CNG

- 重要考察

第11章 自動車用ターボチャージャー市場:コンポーネント別

- イントロダクション

- タービンホイール

- コンプレッサーホイール

- ハウジング

- 重要考察

第12章 自動車用ターボチャージャー市場:材料別

- イントロダクション

- 鋳鉄

- アルミニウム

- その他の材料

- 重要考察

第13章 オフハイウェイターボチャージャー市場:用途別

- イントロダクション

- 農業用トラクター

- 建設機械

- 鉱山機械

- 重要考察

第14章 自動車用ターボチャージャーアフターマーケット:車両タイプ別

- イントロダクション

- 軽商用車(LCV)

- 大型商用車(HCV)

- 重要考察

第15章 自動車用ターボチャージャー市場:地域別

- イントロダクション

- アジア太平洋

- 経済不況の影響

- 自動車用ターボチャージャー市場:ターボタイプ別

- 中国

- インド

- 日本

- 韓国

- タイ

- インドネシア

- その他のアジア太平洋

- 欧州

- 経済不況の影響

- 自動車用ターボチャージャー市場:ターボタイプ別

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- ロシア

- トルコ

- その他の欧州

- 北米

- 経済不況の影響

- 自動車用ターボチャージャー市場:ターボタイプ別

- 米国

- カナダ

- メキシコ

- その他の地域

- 景気後退の影響

- 自動車用ターボチャージャー市場:ターボタイプ別

- ブラジル

- アルゼンチン

- イラン

- 南アフリカ

- その他

- 重要考察

第16章 競合情勢

- 概要

- 市場シェア分析(2023年)

- 主な企業の戦略/有力企業(2022年~2024年)

- 企業の評価マトリクス(自動車用ターボチャージャーメーカー)

- 企業の評価マトリクス(自動車用ターボチャージャーコンポーネントメーカー)

- 競合シナリオと動向

- サプライヤー分析

- 企業の評価

- 財務指標

- 製品の比較

- 超合金メーカーのリスト

- タービンホイールメーカーのリスト

第17章 企業プロファイル

- 主要企業

- BORGWARNER INC.

- GARRETT MOTION INC.

- MITSUBISHI HEAVY INDUSTRIES LTD.

- IHI CORPORATION

- CUMMINS INC.

- BMTS TECHNOLOGY

- VITESCO TECHNOLOGIES GMBH

- CHANGCHUN FAWER-IHI TURBOCHARGER CO., LTD

- TURBO ENERGY PRIVATE LIMITED

- CONTINENTAL AG

- その他の企業

- ROTOMASTER

- NINGBO WEIFU TIANLI SUPERCHARGING TECHNOLOGY CO., LTD.

- TURBONETICS INC.

- TURBO INTERNATIONAL

- KOMPRESSORENBAU BANNEWITZ GMBH

- MAGNUM PERFORMANCE TURBOS

- WEIFANG FUYUAN TURBOCHARGER CO., LTD.

- HUNAN TYEN MACHINERY CO., LTD.

- MAN ENERGY SOLUTIONS

- KEYYANG PRECISION CO., LTD

- FUYUAN TURBOCHARGER CO. LTD

第18章 MARKETSANDMARKETSによる推奨

- アジア太平洋が自動車用ターボチャージャーの主要市場に

- 電動ターボチャージャーがメーカーの重点に

- 結論

第19章 付録

The automotive turbocharger market is projected to grow from USD 15.2 billion in 2024 to USD 22.9 billion by 2030, at a CAGR of 7.1%. The global automotive turbocharger market has experienced steady growth in recent years. Factors such as stringent emissions regulations, growing demand for TGDI (Turbocharged Gasoline Direct Injection) technology, and demand for more fuel-efficient vehicles have fueled the advancement in automotive turbocharger technology. Turbochargers are widely used in gasoline and diesel engines to increase power output, improve fuel efficiency, and meet emission limits. As automobile manufacturers and tier-1 suppliers prioritize fuel efficiency, emissions reduction, and performance, the development of automotive turbocharger technology is expected to play a vital role in the coming years.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Diesel & Gasoline Turbo, Component, Material, Off-Highway Equipment, Vehicle Type, Fuel Type, Aftermarket and Region |

| Regions covered | Asia Pacific, North America, Europe, Rest of the World |

"Gasoline passenger cars are leading the global automotive turbocharger market during the forecast period."

Owing to the growing focus on a cleaner environment, OEMs have shifted from diesel to gasoline-passenger cars. This shift is not predominantly observed in the commercial vehicle segment. For instance, according to ACEA, the EU had 36.7% gasoline vehicles, which decreased to ~16% in 2022. Further, growing demand for passenger cars with gasoline engines is observed as there are stricter emission regulations on diesel engines and there is a decline in the growth of diesel-powered engines. Turbocharged GDI engines offer several advantages such as optimized fuel and combustion efficiency. These enhanced GDI engines, with advanced engine design and turbocharging technology, have allowed OEMs to achieve higher levels of fuel efficiency while maintaining a consistent power and torque output. Europe has been at the forefront of gasoline-turbocharged vehicles in recent years. According to ACEA statistics, European gasoline cars grew by 10.6% compared to the previous year, with significant growth in key countries such as Italy (+24.9%) and Germany (+16.1%). The Asia Pacific and North American countries also noticed a sharp increase and are expected to maintain an upward trend. As gasoline engines are generally less expensive to manufacture and maintain than diesel engines with high-power output, the demand for an efficient and economical option with gasoline vehicles will continue to dominate in the coming future.

"E-turbochargers are projected to be the fastest growing turbocharger type by 2030."

The advent of electric turbochargers with advanced technological capabilities has shown a significant adoption rate in internal combustion engines with hybrid powertrains. The electric turbochargers boost torque at lower engine speeds, enhancing agility and optimizing acceleration, particularly from a standstill condition of the vehicle. An electric turbocharger can be operational with a 48 V battery architecture, eliminates turbo lag with reduced emissions, and improves fuel efficiency. The electric turbocharger has huge potential, which is why it can be installed in light-duty vehicles (LDVs) and heavy commercial vehicles. For instance, the Mercedes-AMG SL 43 convertible, Mercedes-Benz S-Class, Mercedes-Benz S450, Audi SQ7, and Volvo XC90 T6 are some vehicle models offered with e-turbochargers. Although e-turbochargers cost more than wastegate and VGT technology, their application is limited to premium vehicles only. However, with the rising demand for hybrid vehicles within the premium price bracket, the demand for these vehicles installed with e-turbochargers will spur in the future, subsequently striving for the growth of the e-turbocharger market.

"Europe is the second largest automotive turbocharger market."

Europe has been at the forefront of turbocharger adoption for several years. Stringent emissions regulations and the demand for smaller, more fuel-efficient engines without compromising performance have driven the widespread adoption of turbocharging technology. Prominent OEMs such as Volkswagen AG, Mercedes-Benz, BMW, Stellantis N.V., and Renault have restricted the production of diesel passenger vehicles, thereby promoting the sales of gasoline and, electric and hybrid vehicles. This will prompt the growth of turbocharger technology installed in the GDI engines, mild-hybrid, and electric passenger cars. On the other hand, a majority of LCVs and heavy commercial vehicles are still diesel-powered. According to ACEA publication 2023, light commercial vehicles, trucks, and buses are still dominant in the EU, with >90% of the fleets running on diesel. This demonstrates the strong position of diesel-powered vehicles in the commercial vehicle segment, and this trend is speculated to be constant during the reviewed period. This will propel the growth of diesel turbochargers in the region.

The break-up of the profile of primary participants in the automotive turbocharger market:

- By Company Type: Tier 1 - 60%, Tier 2 -40 %

- By Designation: C Level - 60%, Director Level - 20%, Others - 20%

- By Region: North America- 50%, Europe - 35%, Asia Pacific - 15%.

Prominent companies include BorgWarner Inc. (US), Garrett Motion Inc. (US), Mitsubishi Heavy Industries (Japan), IHI Corporation (Japan), and Cummins Inc. (US) are the leading manufacturers of automotive turbochargers in the global market.

Research Coverage:

This research report categorizes the Automotive turbocharger market by vehicle type (passenger car, LCV, trucks, buses), fuel type (diesel, gasoline, alternate fuel), diesel by turbo type (VGT, Wastegate, E-turbo), gasoline by turbo type (VGT, Wastegate, E-turbo), gasoline by vehicle type (passenger car, LCV, trucks, buses), by material (cast iron, aluminum, others), by component (turbine wheel, compressor wheel, housing), off-highway by application (agricultural tractors, construction equipment, mining equipment), aftermarket by vehicle type (LCV, HCV), by region (Asia Pacific, North America, Europe, Rest of the World). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the automotive turbocharger market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, recession impact, and recent developments associated with the automotive turbocharger market. This report covers the competitive analysis of upcoming startups in the automotive turbocharger market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall automotive turbocharger market and the subsegments. The report includes a comprehensive market share analysis, supply chain analysis, extensive lists and insights into component manufacturers, chapter segmentation based on materials, a thorough supply chain analysis, and a competitive landscape. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Decrease in NOx emission limit in upcoming emission norms regulation, increase in demand for passenger cars with gasoline engines), restraints (High maintenance cost and more amount of cooling oil requirement and increase in adoption of electric vehicles), opportunities (Development of electric turbochargers), and challenges (Turbo lag and durable, economical, and temperature resistance material requirement) are influencing the growth of the automotive turbocharger market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive turbocharger market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive turbocharger market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive turbocharger market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like BorgWarner Inc. (US), Garrett Motion Inc. (US), Mitsubishi Heavy Industries Ltd. (Japan), IHI Corporation (Japan), and Cummins Inc. (US) among others in the automotive turbocharger market.

The report also helps stakeholders understand the pulse of the automotive micro-mobility market & electric vehicle market by providing them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 AUTOMOTIVE TURBOCHARGER MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources referred to for vehicle production

- 2.1.1.2 Key secondary sources referred to for market sizing

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.1 List of primary participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH (ON-HIGHWAY VEHICLES)

- FIGURE 6 AUTOMOTIVE TURBOCHARGER MARKET ESTIMATION: APPROACH 1 - BOTTOM-UP

- 2.2.2 BOTTOM-UP APPROACH (OFF-HIGHWAY EQUIPMENT)

- FIGURE 7 OFF-HIGHWAY AUTOMOTIVE TURBOCHARGER MARKET ESTIMATION: BOTTOM-UP APPROACH

- 2.2.3 TOP-DOWN APPROACH

- FIGURE 8 AUTOMOTIVE TURBOCHARGER MARKET ESTIMATION, BY MATERIAL: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS AND RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 REPORT SUMMARY

- FIGURE 10 AUTOMOTIVE TURBOCHARGER MARKET OUTLOOK

- FIGURE 11 AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE TURBOCHARGER MARKET

- FIGURE 12 STRINGENT EMISSION AND FUEL ECONOMY REGULATIONS TO DRIVE MARKET

- 4.2 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE

- FIGURE 13 PASSENGER CAR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

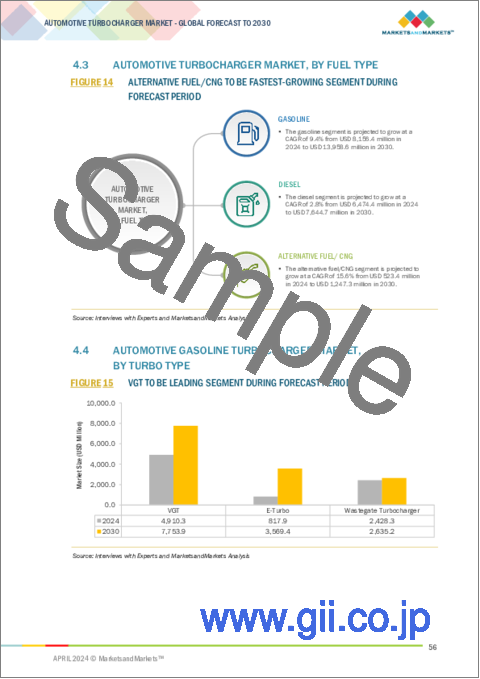

- 4.3 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE

- FIGURE 14 ALTERNATIVE FUEL/CNG TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.4 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY TURBO TYPE

- FIGURE 15 VGT TO BE LEADING SEGMENT DURING FORECAST PERIOD

- 4.5 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY VEHICLE TYPE

- FIGURE 16 PASSENGER CAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY TURBO TYPE

- FIGURE 17 E-TURBO TO BE FASTEST-GROWING SEGMENTING FORECAST PERIOD

- 4.7 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL

- FIGURE 18 CAST IRON MATERIAL TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.8 OFF-HIGHWAY AUTOMOTIVE TURBOCHARGER MARKET, BY APPLICATION

- FIGURE 19 AGRICULTURAL TRACTORS APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- 4.9 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY VEHICLE TYPE

- FIGURE 20 LCV SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.10 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION

- FIGURE 21 ASIA PACIFIC TO DOMINATE MARKET IN 2024

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Strict laws related to NOx and CO2 emission levels

- TABLE 1 OVERVIEW OF EMISSION REGULATION SPECIFICATIONS FOR PASSENGER CARS, 2017-2023

- TABLE 2 EMISSION NORMS FOR PASSENGER CARS, BY COUNTRY

- FIGURE 23 EUROPE: CHANGE IN EMISSION LIMITS

- FIGURE 24 INDIA: CHANGE IN EMISSION LIMITS

- FIGURE 25 CHINA: CHANGE IN EMISSION LIMITS

- 5.2.1.2 Increasing demand for passenger cars with gasoline engines

- FIGURE 26 PASSENGER CAR TRENDS IN EUROPE, BY FUEL TYPE, 2023-2030 (VOLUME SHARE)

- 5.2.2 RESTRAINTS

- 5.2.2.1 High maintenance costs and cooling oil requirements

- 5.2.2.2 Increasing adoption of electric vehicles

- FIGURE 27 ELECTRIC VEHICLE SALES, BY VEHICLE TYPE, 2019 VS. 2030

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of electric turbochargers

- 5.2.4 CHALLENGES

- 5.2.4.1 Turbo lag

- 5.2.4.2 Availability of very few materials to withstand high temperature of turbocharger components

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 UPCOMING EMISSION REGULATIONS TO SHIFT FOCUS TO TURBOCHARGED GASOLINE ENGINES AND ELECTRIC PROPULSION

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 29 ECOSYSTEM ANALYSIS

- 5.4.1 TURBOCHARGER COMPONENT MANUFACTURERS

- 5.4.2 TURBOCHARGER MANUFACTURERS

- 5.4.3 OEMS

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 30 SUPPLY CHAIN ANALYSIS

- 5.6 PATENT ANALYSIS

- 5.6.1 INTRODUCTION

- FIGURE 31 PATENT ANALYSIS

- 5.6.2 LIST OF MAJOR PATENTS

- TABLE 4 INNOVATIONS AND PATENT REGISTRATIONS

- 5.7 PRICING ANALYSIS

- 5.7.1 TURBO TYPE, BY REGION

- TABLE 5 AVERAGE REGIONAL PRICE TREND: BY TURBO TYPE AND REGION (USD/UNIT), 2020-2024

- FIGURE 32 AVERAGE SELLING PRICE TREND, BY TURBO TYPE, 2020-2024

- 5.7.2 VEHICLE TYPE, BY REGION

- TABLE 6 AVERAGE REGIONAL PRICE TREND: BY VEHICLE TYPE, BY REGION (USD/UNIT), 2020-2024

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 DEVELOPMENT OF EBOOSTER TECHNOLOGY BY BORGWARNER TO REDUCE EMISSIONS

- 5.8.2 DEVELOPMENT OF HIGH-EFFICIENCY GAS ENGINE WITH TWO-STAGE TURBOCHARGING SYSTEM BY MITSUBISHI HEAVY INDUSTRIES LTD

- 5.8.3 GARRETT MOTION DEVELOPED E-TURBOCHARGERS FOR PASSENGER CARS

- 5.8.4 DEVELOPMENT OF KEY TECHNOLOGY FOR EU7- HYBRIDIZED POWERTRAIN BY GARRETT

- 5.8.5 TURBOCHARGER HOUSING DESIGN BY IHI CORPORATION

- 5.8.6 DEVELOPMENT OF NATURAL GAS TURBOCHARGER TECHNOLOGY BY CUMMINS TURBO TECHNOLOGIES

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Electric turbochargers

- 5.9.1.2 Two-stage turbochargers

- 5.9.2 ADJACENT TECHNOLOGY

- 5.9.2.1 Turbocharger speed sensors

- 5.9.1 KEY TECHNOLOGIES

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 EMISSION REGULATIONS

- 5.10.2.1 On-road vehicles

- TABLE 11 TIMELINE OF EURO REGULATIONS FOR HEAVY-DUTY ENGINES AND PASSENGER VEHICLES

- TABLE 12 HISTORICAL OVERVIEW OF ON-ROAD VEHICLE EMISSION REGULATIONS FOR PASSENGER CARS, 2016-2021

- FIGURE 33 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR HEAVY-DUTY VEHICLES, 2019-2030

- 5.10.2.2 Non-road mobile machinery (NRMM) emission regulation outlook

- FIGURE 34 NRMM EMISSION REGULATION OUTLOOK, OFF-HIGHWAY VEHICLES, 2019-2030

- 5.11 FUEL ECONOMY NORMS

- 5.11.1 US

- TABLE 13 US: CAFE STANDARDS FOR EACH MODEL YEAR IN MILES PER GALLON, 2019-2025

- 5.11.2 EUROPE

- 5.11.3 CHINA

- TABLE 14 CHINA: CHINA 6A AND 6B STANDARD, 2021 ONWARDS

- 5.11.4 INDIA

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 35 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP VEHICLE TYPES

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VEHICLE TYPES

- 5.12.2 BUYING CRITERIA

- FIGURE 36 KEY BUYING CRITERIA FOR TOP TURBO TYPES

- TABLE 16 KEY BUYING CRITERIA FOR TOP TURBO TYPES

- 5.13 KEY CONFERENCES AND EVENTS

- TABLE 17 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.14 TRADE DATA ANALYSIS

- 5.14.1 IMPORT DATA

- TABLE 18 US: IMPORT SHARE, BY COUNTRY, 2019-2023 (USD)

- TABLE 19 CHINA: IMPORT SHARE, BY COUNTRY, 2019-2023 (USD)

- TABLE 20 JAPAN: IMPORT SHARE, BY COUNTRY, 2019-2023 (USD)

- TABLE 21 GERMANY: IMPORT SHARE, BY COUNTRY, 2019-2023 (USD)

- TABLE 22 FRANCE: IMPORT SHARE, BY COUNTRY, 2019-2023 (USD)

- 5.14.2 EXPORT DATA

- TABLE 23 US: EXPORT SHARE, BY COUNTRY, 2019-2023 (USD)

- TABLE 24 CHINA: EXPORT SHARE, BY COUNTRY, 2019-2023 (USD)

- TABLE 25 JAPAN: EXPORT SHARE, BY COUNTRY, 2019-2023 (USD)

- TABLE 26 INDIA: EXPORT SHARE, BY COUNTRY, 2019-2023 (USD)

- TABLE 27 GERMANY: EXPORT SHARE, BY COUNTRY, 2019-2023 (USD)

- TABLE 28 FRANCE: EXPORT SHARE, BY COUNTRY, 2019-2023 (USD)

- 5.15 IMPACT OF REGULATIONS/TRADE AGREEMENTS ON AUTOMOTIVE TURBOCHARGER MARKET, BY REGION

- 5.15.1 NORTH AMERICA

- 5.15.1.1 United States-Mexico-Canada Agreement (USMCA)

- 5.15.1.2 Investment summary

- 5.15.1.3 Impact on automotive components, including turbochargers

- 5.15.2 ASIA PACIFIC

- 5.15.2.1 Regional Comprehensive Economic Partnership (RCEP)

- 5.15.2.2 Japan-ASEAN Free Trade Agreement (JAEPA)

- 5.15.2.3 Make in India

- 5.15.3 EUROPE

- 5.15.3.1 EU-Japan Economic Partnership Agreement (EPA)

- 5.15.1 NORTH AMERICA

- 5.16 INVESTMENT SCENARIO

- FIGURE 37 INVESTMENT SCENARIO, 2020-2024

- TABLE 29 LIST OF FEW FUNDING IN 2020-2021

6 AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY TURBO TYPE

- 6.1 INTRODUCTION

- FIGURE 38 AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY TURBO TYPE, 2024 VS. 2030

- TABLE 30 AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (THOUSAND UNITS)

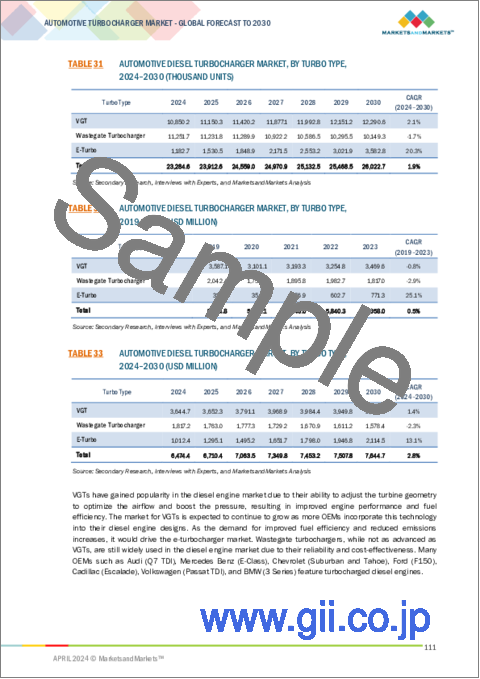

- TABLE 31 AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 32 AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (USD MILLION)

- TABLE 33 AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (USD MILLION)

- 6.2 VARIABLE GEOMETRY TURBOCHARGER (VGT)

- 6.2.1 RISING DEMAND FOR TECHNOLOGIES OFFERING HIGH EFFICIENCY AND LOW CARBON EMISSION TO DRIVE MARKET

- TABLE 34 VGT: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 35 VGT: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 36 VGT: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 37 VGT: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.3 WASTEGATE TURBOCHARGER

- 6.3.1 INCREASING DEMAND FOR SMALL CARS IN ASIA PACIFIC TO DRIVE MARKET

- TABLE 38 WASTEGATE TURBOCHARGER: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 39 WASTEGATE TURBOCHARGER: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 40 WASTEGATE TURBOCHARGER: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 41 WASTEGATE TURBOCHARGER: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.4 ELECTRIC TURBOCHARGER (E-TURBO)

- 6.4.1 INCREASING USE OF MILD HYBRID VEHICLES TO DRIVE MARKET

- TABLE 42 E-TURBO: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 43 E-TURBO: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 44 E-TURBO: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 45 E-TURBO: AUTOMOTIVE DIESEL TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.5 VARIABLE TWIN-SCROLL TURBOCHARGER

- 6.6 TWIN TURBOCHARGER

- 6.6.1 TWO-STAGE SERIES TURBOCHARGER

- 6.6.2 TWO-STAGE PARALLEL TURBOCHARGER

- 6.6.3 TWIN-SCROLL TURBOCHARGER

- 6.7 FREE-FLOATING TURBOCHARGER

- 6.8 DOUBLE AXLE TURBOCHARGER

- 6.9 PRIMARY INSIGHTS

7 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY TURBO TYPE

- 7.1 INTRODUCTION

- FIGURE 39 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY TURBO TYPE, 2024 VS. 2030

- TABLE 46 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 47 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 48 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (USD MILLION)

- TABLE 49 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (USD MILLION)

- 7.2 VARIABLE GEOMETRY TURBOCHARGER/VARIABLE NOZZLE TURBOCHARGER (VGT/VNT)

- 7.2.1 INCREASING DEMAND FOR HIGH-PERFORMANCE VEHICLES TO DRIVE MARKET

- TABLE 50 VGT: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 51 VGT: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 52 VGT: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 53 VGT: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.3 WASTEGATE TURBOCHARGER

- 7.3.1 NEED FOR SMALLER AND MORE EFFICIENT ENGINES TO DRIVE MARKET

- TABLE 54 WASTEGATE TURBOCHARGER: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 55 WASTEGATE TURBOCHARGER: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 56 WASTEGATE TURBOCHARGER: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 57 WASTEGATE TURBOCHARGER: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.4 ELECTRIC TURBOCHARGER (E-TURBO)

- 7.4.1 ENGINE DOWNSIZING TO IMPROVE FUEL EFFICIENCY AND REDUCE EMISSIONS TO DRIVE MARKET

- TABLE 58 E-TURBO: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 59 E-TURBO: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 60 E-TURBO: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 61 E-TURBO: AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.5 VARIABLE TWIN-SCROLL TURBOCHARGER

- 7.6 TWIN TURBOCHARGER

- 7.6.1 TWO-STAGE SERIES TURBOCHARGER

- 7.6.2 TWO-STAGE PARALLEL TURBOCHARGER

- 7.6.3 TWIN-SCROLL TURBOCHARGER

- 7.7 PRIMARY INSIGHTS

8 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- FIGURE 40 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024 VS, 2030

- TABLE 62 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 63 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 64 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 65 AUTOMOTIVE GASOLINE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 8.2 PASSENGER CAR

- 8.2.1 CONSUMER PREFERENCES AND ADVANCEMENTS IN TECHNOLOGY TO DRIVE MARKET

- TABLE 66 PASSENGER CAR: GASOLINE TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 67 PASSENGER CAR: GASOLINE TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 68 PASSENGER CAR: GASOLINE TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 69 PASSENGER CAR: GASOLINE TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.3 LIGHT COMMERCIAL VEHICLE (LCV)

- 8.3.1 LOWER UPFRONT COSTS OF LCVS WITH GASOLINE ENGINES TO DRIVE MARKET

- TABLE 70 LCV: GASOLINE TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 71 LCV: GASOLINE TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 72 LCV: GASOLINE TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 73 LCV: GASOLINE TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.4 PRIMARY INSIGHTS

9 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE

- 9.1 INTRODUCTION

- FIGURE 41 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024 VS. 2030

- TABLE 74 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 75 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 76 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 77 AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 9.2 PASSENGER CAR

- 9.2.1 TREND FOR SMALLER AND MORE FUEL-EFFICIENT GASOLINE ENGINES TO DRIVE MARKET

- TABLE 78 PASSENGER CAR TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 79 PASSENGER CAR TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 80 PASSENGER CAR TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 81 PASSENGER CAR TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.3 LIGHT COMMERCIAL VEHICLE (LCV)

- 9.3.1 GROWING PRODUCTION OF LCVS WITH DIESEL ENGINES TO DRIVE MARKET

- TABLE 82 LCV TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 83 LCV TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 84 LCV TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 85 LCV TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.4 TRUCK

- 9.4.1 GROWTH IN CONSTRUCTION AND TRANSPORTATION INDUSTRIES TO DRIVE MARKET

- TABLE 86 TRUCK TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 87 TRUCK TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 88 TRUCK TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 89 TRUCK TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.5 BUS

- 9.5.1 INCREASE IN DEMAND FOR PUBLIC AND PRIVATE TRANSPORTATION TO DRIVE MARKET

- TABLE 90 BUS TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 91 BUS TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 92 BUS TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 93 BUS TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.6 PRIMARY INSIGHTS

10 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE

- 10.1 INTRODUCTION

- FIGURE 42 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE, 2024 VS. 2030 (USD MILLION)

- TABLE 94 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 95 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 96 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE, 2019-2023 (USD MILLION)

- TABLE 97 AUTOMOTIVE TURBOCHARGER MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- 10.2 DIESEL

- 10.2.1 INCREASING DEMAND FOR HEAVY COMMERCIAL VEHICLES TO DRIVE MARKET

- TABLE 98 DIESEL: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 99 DIESEL: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 100 DIESEL: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 101 DIESEL: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 10.3 GASOLINE

- 10.3.1 ABILITY TO INCREASE ENGINE EFFICIENCY AND DECREASE FUEL USE TO DRIVE MARKET

- TABLE 102 GASOLINE: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 103 GASOLINE: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 104 GASOLINE: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 105 GASOLINE: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 10.4 ALTERNATIVE FUEL/CNG

- 10.4.1 CHANGING GOVERNMENT REGULATIONS TO DRIVE MARKET

- TABLE 106 ALTERNATIVE FUEL/CNG: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 107 ALTERNATIVE FUEL/CNG: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 108 ALTERNATIVE FUEL/CNG: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 109 ALTERNATIVE FUEL/CNG: AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 10.5 PRIMARY INSIGHTS

11 AUTOMOTIVE TURBOCHARGER MARKET, BY COMPONENT

- 11.1 INTRODUCTION

- FIGURE 43 AUTOMOTIVE TURBOCHARGER MARKET, BY COMPONENT, 2024 VS. 2030

- TABLE 110 AUTOMOTIVE TURBOCHARGER MARKET, BY COMPONENT, 2019-2023 (THOUSAND UNITS)

- TABLE 111 AUTOMOTIVE TURBOCHARGER MARKET, BY COMPONENT, 2024-2030 (THOUSAND TONS)

- TABLE 112 AUTOMOTIVE TURBOCHARGER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 113 AUTOMOTIVE TURBOCHARGER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- 11.2 TURBINE WHEEL

- 11.2.1 GROWING DEMAND FOR LDVS TO DRIVE MARKET

- TABLE 114 TURBINE WHEEL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 115 TURBINE WHEEL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 116 TURBINE WHEEL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 117 TURBINE WHEEL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 11.3 COMPRESSOR WHEEL

- 11.3.1 ADDITIVE MANUFACTURING TO DRIVE MARKET

- TABLE 118 COMPRESSOR WHEEL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 119 COMPRESSOR WHEEL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 120 COMPRESSOR WHEEL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 121 COMPRESSOR WHEEL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 11.4 HOUSING

- 11.4.1 LDV SEGMENT TO DRIVE MARKET

- TABLE 122 HOUSING: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 123 HOUSING: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 124 HOUSING: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 125 HOUSING: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 11.5 PRIMARY INSIGHTS

12 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL

- 12.1 INTRODUCTION

- FIGURE 44 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL, 2024 VS. 2030

- TABLE 126 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL, 2019-2023 (THOUSAND TONS)

- TABLE 127 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL, 2024-2030 (THOUSAND TONS)

- TABLE 128 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL, 2019-2023 (USD MILLION)

- TABLE 129 AUTOMOTIVE TURBOCHARGER MARKET, BY MATERIAL, 2024-2030 (USD MILLION)

- 12.2 CAST IRON

- 12.2.1 GROWING DEMAND FOR COST-EFFECTIVE AND HEAT-RESISTANT MATERIALS TO DRIVE MARKET

- TABLE 130 CAST IRON: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND TONS)

- TABLE 131 CAST IRON: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND TONS)

- TABLE 132 CAST IRON: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 133 CAST IRON: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 12.3 ALUMINUM

- 12.3.1 INCREASING USE OF ALUMINUM TURBINE HOUSING IN LDVS TO DRIVE MARKET

- TABLE 134 ALUMINUM: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND TONS)

- TABLE 135 ALUMINUM: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND TONS)

- TABLE 136 ALUMINUM: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 137 ALUMINUM: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 12.4 OTHER MATERIALS

- TABLE 138 OTHER MATERIALS: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND TONS)

- TABLE 139 OTHER MATERIALS: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND TONS)

- TABLE 140 OTHER MATERIALS: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 141 OTHER MATERIALS: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 USD MILLION)

- 12.5 PRIMARY INSIGHTS

13 OFF-HIGHWAY TURBOCHARGER MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- FIGURE 45 OFF-HIGHWAY TURBOCHARGER MARKET, BY APPLICATION, 2024 VS. 2030

- TABLE 142 OFF-HIGHWAY TURBOCHARGER MARKET, BY APPLICATION, 2019-2023 (THOUSAND UNITS)

- TABLE 143 OFF-HIGHWAY TURBOCHARGER MARKET, BY APPLICATION, 2024-2030 (THOUSAND UNITS)

- TABLE 144 OFF-HIGHWAY TURBOCHARGER MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 145 OFF-HIGHWAY TURBOCHARGER MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- 13.2 AGRICULTURAL TRACTORS

- 13.2.1 INCREASING DEMAND FOR HIGH-PERFORMANCE POWER TRACTORS TO DRIVE MARKET

- TABLE 146 AGRICULTURAL TRACTOR TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 147 AGRICULTURAL TRACTOR TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 148 AGRICULTURAL TRACTOR TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 149 AGRICULTURAL TRACTOR TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 13.3 CONSTRUCTION EQUIPMENT

- 13.3.1 GROWTH IN CONSTRUCTION INDUSTRY IN ASIA PACIFIC AND NORTH AMERICA TO DRIVE MARKET

- TABLE 150 CONSTRUCTION EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 151 CONSTRUCTION EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 152 CONSTRUCTION EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 153 CONSTRUCTION EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 13.4 MINING EQUIPMENT

- 13.4.1 GROWING MINING ACTIVITIES TO DRIVE MARKET

- TABLE 154 MINING EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 155 MINING EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 156 MINING EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 157 MINING EQUIPMENT TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 13.5 PRIMARY INSIGHTS

14 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY VEHICLE TYPE

- 14.1 INTRODUCTION

- FIGURE 46 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY VEHICLE TYPE, 2024 VS. 2030 (USD MILLION)

- TABLE 158 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 159 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 160 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 161 AUTOMOTIVE TURBOCHARGER AFTERMARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 14.2 LIGHT COMMERCIAL VEHICLE (LCV)

- 14.2.1 GROWING DEMAND FOR TURBOCHARGER REPLACEMENTS FOR LCVS TO DRIVE MARKET

- TABLE 162 LCV TURBOCHARGER AFTERMARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 163 LCV TURBOCHARGER AFTERMARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 164 LCV TURBOCHARGER AFTERMARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 165 LCV TURBOCHARGER AFTERMARKET, BY REGION, 2024-2030 (USD MILLION)

- 14.3 HEAVY COMMERCIAL VEHICLE (HCV)

- 14.3.1 EXTENSIVE USE OF HCVS IN LOGISTICS AND TRANSPORTATION TO DRIVE MARKET

- TABLE 166 HCV TURBOCHARGER AFTERMARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 167 HCV TURBOCHARGER AFTERMARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 168 HCV TURBOCHARGER AFTERMARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 169 HCV TURBOCHARGER AFTERMARKET, BY REGION, 2024-2030 (USD MILLION)

- 14.4 PRIMARY INSIGHTS

15 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION

- 15.1 INTRODUCTION

- FIGURE 47 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2024-2030

- TABLE 170 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 171 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 172 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 173 AUTOMOTIVE TURBOCHARGER MARKET, BY REGION, 2024-2030 (USD MILLION)

- 15.1.1 AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE

- TABLE 174 AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 175 AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 176 AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (USD MILLION)

- TABLE 177 AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (USD MILLION)

- 15.2 ASIA PACIFIC

- 15.2.1 ECONOMIC RECESSION IMPACT

- FIGURE 48 ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET SNAPSHOT

- TABLE 178 ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 179 ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 180 ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 181 ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 15.2.2 AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE

- TABLE 182 ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 183 ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 184 ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (USD MILLION)

- TABLE 185 ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (USD MILLION)

- 15.2.3 CHINA

- 15.2.3.1 Growing demand for TGDI engines to drive market

- TABLE 186 CHINA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 187 CHINA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 188 CHINA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 189 CHINA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.4 INDIA

- 15.2.4.1 Growth in sales of gasoline vehicles to drive market

- TABLE 190 INDIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 191 INDIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 192 INDIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 193 INDIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.5 JAPAN

- 15.2.5.1 Growing performance-oriented vehicle market to drive market

- TABLE 194 JAPAN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 195 JAPAN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 196 JAPAN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 197 JAPAN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.6 SOUTH KOREA

- 15.2.6.1 Growing popularity of gasoline vehicles to drive market

- TABLE 198 SOUTH KOREA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 199 SOUTH KOREA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 200 SOUTH KOREA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 201 SOUTH KOREA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.7 THAILAND

- 15.2.7.1 Government incentives and stringent emission norms to drive market

- TABLE 202 THAILAND: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 203 THAILAND: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 204 THAILAND: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 205 THAILAND: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.8 INDONESIA

- 15.2.8.1 Rising demand for fuel-efficient vehicles and stricter emission standards to drive market

- TABLE 206 INDONESIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 207 INDONESIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 208 INDONESIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 209 INDONESIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.2.9 REST OF ASIA PACIFIC

- TABLE 210 REST OF ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 211 REST OF ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 212 REST OF ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.3 EUROPE

- 15.3.1 ECONOMIC RECESSION IMPACT

- FIGURE 49 EUROPE: AUTOMOTIVE TURBOCHARGER MARKET SNAPSHOT

- TABLE 214 EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 215 EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 216 EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 217 EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 15.3.2 AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE

- TABLE 218 EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 219 EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 220 EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (USD MILLION)

- TABLE 221 EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (USD MILLION)

- 15.3.3 GERMANY

- 15.3.3.1 Strict emission norms and shift toward gasoline vehicles to drive market

- TABLE 222 GERMANY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 223 GERMANY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 224 GERMANY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 225 GERMANY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.3.4 FRANCE

- 15.3.4.1 Government regulations and presence of domestic automakers to drive market

- TABLE 226 FRANCE: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 227 FRANCE: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 228 FRANCE: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 229 FRANCE: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.3.5 UK

- 15.3.5.1 Target to reduce CO2 emissions from cars to drive market

- TABLE 230 UK: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 231 UK: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 232 UK: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 233 UK: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.3.6 SPAIN

- 15.3.6.1 Commitment to reducing carbon footprint to drive market

- TABLE 234 SPAIN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 235 SPAIN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 236 SPAIN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 237 SPAIN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.3.7 ITALY

- 15.3.7.1 Government subsidies and demand for high-performance vehicles to drive market

- TABLE 238 ITALY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 239 ITALY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 240 ITALY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 241 ITALY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.3.8 RUSSIA

- 15.3.8.1 Stringent emission norms to drive market

- TABLE 242 RUSSIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 243 RUSSIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 244 RUSSIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 245 RUSSIA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.3.9 TURKEY

- 15.3.9.1 Reduced emission limits for diesel vehicles and increased fuel prices to drive market

- TABLE 246 TURKEY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 247 TURKEY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 248 TURKEY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 249 TURKEY: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.3.10 REST OF EUROPE

- TABLE 250 REST OF EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 251 REST OF EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 252 REST OF EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 253 REST OF EUROPE: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.4 NORTH AMERICA

- 15.4.1 ECONOMIC RECESSION IMPACT

- TABLE 254 NORTH AMERICA: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 255 NORTH AMERICA: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 256 NORTH AMERICA: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 257 NORTH AMERICA: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 15.4.2 AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE

- TABLE 258 NORTH AMERICA: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 259 NORTH AMERICA: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 260 NORTH AMERICA: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (USD MILLION)

- TABLE 261 NORTH AMERICA: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (USD MILLION)

- 15.4.3 US

- 15.4.3.1 Stringent emission norms and adoption of gasoline TGDI engines to drive market

- TABLE 262 US: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 263 US: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 264 US: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 265 US: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.4.4 CANADA

- 15.4.4.1 Growing demand for high fuel economy to drive market

- TABLE 266 CANADA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 267 CANADA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 268 CANADA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 269 CANADA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.4.5 MEXICO

- 15.4.5.1 Rising fuel prices and stringent emission norms to drive market

- TABLE 270 MEXICO: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 271 MEXICO: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 272 MEXICO: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 273 MEXICO: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.5 REST OF THE WORLD (ROW)

- 15.5.1 RECESSION IMPACT

- TABLE 274 ROW: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 275 ROW: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 276 ROW: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 277 ROW: AUTOMOTIVE TURBOCHARGER MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 15.5.2 AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE

- TABLE 278 ROW: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 279 ROW: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 280 ROW: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2019-2023 (USD MILLION)

- TABLE 281 ROW: AUTOMOTIVE TURBOCHARGER MARKET, BY TURBO TYPE, 2024-2030 (USD MILLION)

- 15.5.3 BRAZIL

- 15.5.3.1 Increasing sales of diesel vehicles to drive market

- TABLE 282 BRAZIL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 283 BRAZIL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 284 BRAZIL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 285 BRAZIL: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.5.4 ARGENTINA

- 15.5.4.1 Increasing use of commercial vehicles and shift toward alternate fuels to drive market

- TABLE 286 ARGENTINA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 287 ARGENTINA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 288 ARGENTINA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 289 ARGENTINA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.5.5 IRAN

- 15.5.5.1 Emission regulations and exploration of natural gas reserves to drive market

- TABLE 290 IRAN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 291 IRAN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 292 IRAN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 293 IRAN: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.5.6 SOUTH AFRICA

- 15.5.6.1 Increasing production of automobiles and use of HCVs to drive market

- TABLE 294 SOUTH AFRICA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 295 SOUTH AFRICA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 296 SOUTH AFRICA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 297 SOUTH AFRICA: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.5.7 OTHERS

- TABLE 298 OTHERS: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 299 OTHERS: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 300 OTHERS: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 301 OTHERS: AUTOMOTIVE TURBOCHARGER MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 15.6 PRIMARY INSIGHTS

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 MARKET SHARE ANALYSIS, 2023

- FIGURE 50 SHARE OF LEADING PLAYERS IN AUTOMOTIVE TURBOCHARGER MARKET, 2023

- TABLE 302 DEGREE OF COMPETITION, 2023

- FIGURE 51 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020 VS. 2023

- 16.3 KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2022-2024

- TABLE 303 KEY GROWTH STRATEGIES, 2022-2024

- 16.4 COMPANY EVALUATION MATRIX (AUTOMOTIVE TURBOCHARGER MANUFACTURERS)

- 16.4.1 STARS

- 16.4.2 EMERGING LEADERS

- 16.4.3 PERVASIVE PLAYERS

- 16.4.4 PARTICIPANTS

- FIGURE 52 COMPANY EVALUATION MATRIX (AUTOMOTIVE TURBOCHARGER MANUFACTURERS), 2024

- 16.4.5 COMPANY FOOTPRINT (AUTOMOTIVE TURBOCHARGER MANUFACTURERS)

- FIGURE 53 AUTOMOTIVE TURBOCHARGER MARKET: COMPANY FOOTPRINT, 2023

- 16.4.6 VEHICLE TYPE FOOTPRINT

- TABLE 304 AUTOMOTIVE TURBOCHARGER MARKET: VEHICLE TYPE FOOTPRINT, 2023

- 16.4.7 TURBO TYPE FOOTPRINT

- TABLE 305 AUTOMOTIVE TURBOCHARGER MARKET: TURBO TYPE FOOTPRINT, 2023

- 16.4.8 REGION FOOTPRINT

- TABLE 306 AUTOMOTIVE TURBOCHARGER MARKET: REGION FOOTPRINT, 2023

- 16.5 COMPANY EVALUATION MATRIX (AUTOMOTIVE TURBOCHARGER COMPONENT MANUFACTURERS)

- 16.5.1 STARS

- 16.5.2 EMERGING LEADERS

- 16.5.3 PERVASIVE PLAYERS

- 16.5.4 PARTICIPANTS

- FIGURE 54 COMPANY EVALUATION MATRIX (AUTOMOTIVE COMPONENT MANUFACTURERS), 2023

- 16.5.5 COMPANY FOOTPRINT (AUTOMOTIVE TURBOCHARGER COMPONENT MANUFACTURERS)

- FIGURE 55 AUTOMOTIVE TURBOCHARGER (COMPONENT MANUFACTURERS) MARKET: COMPANY FOOTPRINT

- 16.5.6 REGION FOOTPRINT

- TABLE 307 AUTOMOTIVE TURBOCHARGER (COMPONENT MANUFACTURERS) MARKET: REGION FOOTPRINT

- 16.5.7 COMPONENT FOOTPRINT

- TABLE 308 AUTOMOTIVE TURBOCHARGER (COMPONENT MANUFACTURERS) MARKET: COMPONENT FOOTPRINT

- 16.6 COMPETITIVE SCENARIOS AND TRENDS

- 16.6.1 PRODUCT LAUNCHES

- TABLE 309 AUTOMOTIVE TURBOCHARGER MARKET: PRODUCT LAUNCHES, JANUARY 2021- DECEMBER 2022

- 16.6.2 DEALS

- TABLE 310 AUTOMOTIVE TURBOCHARGER MARKET: DEALS, 2021

- 16.6.3 OTHER DEVELOPMENTS

- TABLE 311 AUTOMOTIVE TURBOCHARGER MARKET: OTHER DEVELOPMENTS, JANUARY 2021-DECEMBER 2023

- 16.6.4 EXPANSIONS

- TABLE 312 EXPANSIONS, JANUARY 2022-DECEMBER 2023

- 16.7 SUPPLIER ANALYSIS

- TABLE 313 AUTOMOTIVE TURBOCHARGER MARKET: WHO SUPPLIES WHOM, 2021-2024

- 16.8 COMPANY VALUATION

- FIGURE 56 COMPANY VALUATION, 2023 (USD BILLION)

- 16.9 FINANCIAL METRICS

- FIGURE 57 FINANCIAL METRICS, 2023

- 16.10 PRODUCT COMPARISON

- 16.11 LIST OF SUPERALLOY MANUFACTURERS

- TABLE 314 LIST OF SUPERALLOY MANUFACTURERS

- 16.12 LIST OF TURBINE WHEEL MANUFACTURERS

- TABLE 315 LIST OF TURBINE WHEEL MANUFACTURERS

17 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 17.1 KEY PLAYERS

- 17.1.1 BORGWARNER INC.

- TABLE 316 BORGWARNER INC.: COMPANY OVERVIEW

- FIGURE 58 BORGWARNER INC.: COMPANY SNAPSHOT

- TABLE 317 BORGWARNER INC.: PRODUCTS OFFERED

- TABLE 318 BORGWARNER INC.: PRODUCT LAUNCHES

- TABLE 319 BORGWARNER INC.: DEALS

- TABLE 320 BORGWARNER INC.: OTHERS

- 17.1.2 GARRETT MOTION INC.

- TABLE 321 GARRETT MOTION INC.: COMPANY OVERVIEW

- FIGURE 59 GARRETT MOTION INC.: COMPANY SNAPSHOT

- TABLE 322 GARRETT MOTION INC.: PRODUCTS OFFERED

- TABLE 323 GARRETT MOTION INC.: PRODUCT LAUNCHES

- TABLE 324 GARRETT MOTION INC.: DEALS

- TABLE 325 GARRETT MOTION INC.: EXPANSIONS

- TABLE 326 GARRETT MOTION INC.: OTHERS

- 17.1.3 MITSUBISHI HEAVY INDUSTRIES LTD.

- TABLE 327 MITSUBISHI HEAVY INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 60 MITSUBISHI HEAVY INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 328 MITSUBISHI HEAVY INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 329 MITSUBISHI HEAVY INDUSTRIES LTD.: DEALS

- 17.1.4 IHI CORPORATION

- TABLE 330 IHI CORPORATION: COMPANY OVERVIEW

- FIGURE 61 IHI CORPORATION: COMPANY SNAPSHOT

- TABLE 331 IHI CORPORATION: PRODUCTS OFFERED

- TABLE 332 IHI CORPORATION: DEALS

- TABLE 333 IHI CORPORATION: OTHERS

- 17.1.5 CUMMINS INC.

- TABLE 334 CUMMINS INC.: COMPANY OVERVIEW

- FIGURE 62 CUMMINS INC.: COMPANY SNAPSHOT

- TABLE 335 CUMMINS INC.: PRODUCTS OFFERED

- TABLE 336 CUMMINS INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 337 CUMMINS INC.: EXPANSIONS

- 17.1.6 BMTS TECHNOLOGY

- TABLE 338 BMTS TECHNOLOGY: COMPANY OVERVIEW

- TABLE 339 BMTS TECHNOLOGY: PRODUCTS OFFERED

- TABLE 340 BMTS TECHNOLOGY: DEALS

- TABLE 341 BMTS TECHNOLOGY: OTHERS

- TABLE 342 BMTS TECHNOLOGY: EXPANSIONS

- 17.1.7 VITESCO TECHNOLOGIES GMBH

- TABLE 343 VITESCO TECHNOLOGIES GMBH: COMPANY OVERVIEW

- FIGURE 63 VITESCO TECHNOLOGIES GMBH: COMPANY SNAPSHOT

- TABLE 344 VITESCO TECHNOLOGIES GMBH: PRODUCTS OFFERED

- TABLE 345 VITESCO TECHNOLOGIES GMBH: DEALS

- 17.1.8 CHANGCHUN FAWER-IHI TURBOCHARGER CO., LTD

- TABLE 346 CHANGCHUN FAWER-IHI TURBOCHARGER CO., LTD: COMPANY OVERVIEW

- TABLE 347 CHANGCHUN FAWER-IHI TURBOCHARGER CO., LTD: PRODUCTS OFFERED

- 17.1.9 TURBO ENERGY PRIVATE LIMITED

- TABLE 348 TURBO ENERGY PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 349 TURBO ENERGY PRIVATE LIMITED: PRODUCTS OFFERED

- 17.1.10 CONTINENTAL AG

- TABLE 350 CONTINENTAL AG: COMPANY OVERVIEW

- FIGURE 64 CONTINENTAL AG: COMPANY SNAPSHOT

- TABLE 351 CONTINENTAL AG: PRODUCTS OFFERED

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 17.2 OTHER PLAYERS

- 17.2.1 ROTOMASTER

- TABLE 352 ROTOMASTER: COMPANY OVERVIEW

- 17.2.2 NINGBO WEIFU TIANLI SUPERCHARGING TECHNOLOGY CO., LTD.

- TABLE 353 NINGBO WEIFU TIANLI SUPERCHARGING TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- 17.2.3 TURBONETICS INC.

- TABLE 354 TURBONETICS INC.: COMPANY OVERVIEW

- 17.2.4 TURBO INTERNATIONAL

- TABLE 355 TURBO INTERNATIONAL: COMPANY OVERVIEW

- 17.2.5 KOMPRESSORENBAU BANNEWITZ GMBH

- TABLE 356 KOMPRESSORENBAU BANNEWITZ GMBH: COMPANY OVERVIEW

- 17.2.6 MAGNUM PERFORMANCE TURBOS

- TABLE 357 MAGNUM PERFORMANCE TURBOS: COMPANY OVERVIEW

- 17.2.7 WEIFANG FUYUAN TURBOCHARGER CO., LTD.

- TABLE 358 WEIFANG FUYUAN TURBOCHARGER CO., LTD.: COMPANY OVERVIEW

- 17.2.8 HUNAN TYEN MACHINERY CO., LTD.

- TABLE 359 HUNAN TYEN MACHINERY CO., LTD.: COMPANY OVERVIEW

- 17.2.9 MAN ENERGY SOLUTIONS

- TABLE 360 MAN ENERGY SOLUTIONS: COMPANY OVERVIEW

- 17.2.10 KEYYANG PRECISION CO., LTD

- TABLE 361 KEYYANG PRECISION CO., LTD: COMPANY OVERVIEW

- 17.2.11 FUYUAN TURBOCHARGER CO. LTD

- TABLE 362 FUYUAN TURBOCHARGER CO. LTD: COMPANY OVERVIEW

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 ASIA PACIFIC TO BE MAJOR MARKET FOR AUTOMOTIVE TURBOCHARGERS

- 18.2 ELECTRIC TURBOCHARGERS TO BE KEY FOCUS FOR MANUFACTURERS

- 18.3 CONCLUSION

19 APPENDIX

- 19.1 KEY INDUSTRY INSIGHTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 AUTOMOTIVE TURBOCHARGER MARKET, BY SALES CHANNEL

- 19.4.2 OFF-HIGHWAY TURBOCHARGER MARKET, BY TECHNOLOGY

- 19.4.3 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS