|

|

市場調査レポート

商品コード

1610356

サービスロボットの世界市場:環境別、タイプ別、コンポーネント別、用途別、地域別 - 2029年までの予測Service Robotics Market by Environment (Ground(AGVs, Cleaning, Surgical, Humanoid), Marine, Aerial), Component (Airframe, Sensor, Camera, Actuator, Power Supply, Control System, Navigation System, Propulsion System and Software) -Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| サービスロボットの世界市場:環境別、タイプ別、コンポーネント別、用途別、地域別 - 2029年までの予測 |

|

出版日: 2024年12月09日

発行: MarketsandMarkets

ページ情報: 英文 310 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

サービスロボットの市場規模は、2024年の471億米ドルから2029年には986億5,000万米ドルに達するとみられ、2024年から2029年までのCAGRは15.9%と予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 環境別、タイプ別、コンポーネント別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

院内感染削減への関心の高まりは、サービスロボット市場の主要促進要因のひとつです。院内感染(HAI)は、特に急性期病院で蔓延しています。急性期病院では病室やベッドを定期的に消毒する必要があります。人件費とHAsを削減する必要性から、消毒ロボットが開発されました。これらのロボットは、紫外線C(UV-C)光と過酸化水素ミスト散布により、効率的にHAls感染率を低下させる。世界の大流行により、世界中の病院や医療施設は、社会衛生と手指衛生を最優先する必要に迫られています。消毒ロボットの使用は、現在5~10%である院内感染の有病率の上昇と、流行の継続的な影響により、劇的に増加しています。今後数年間は、さらに増加し続けることが予想されます。多くの政府施設や病院管理チームによって、病院の周囲に細菌がいないことを保証するための厳しい基準が設定されています。病院施設への消毒ロボットの設置は、感染症の脅威の増大と死亡率の上昇により、多くの新興国で最優先事項となっています。

2023年の市場シェアは、業務用サービスロボットの方が高くなっています。サービスロボットは高価なため、家庭用途ではあまり一般的ではないです。例えば、iRobot Corporation(米国)のフーバークリーナーの価格は249米ドルから1,439米ドルです。テレプレゼンス・ロボットは、185~32,000米ドルで販売されています。治療用ロボットのPAROは3,800米ドルです。個人・家庭用ロボット市場は、予測期間中により高いCAGRで成長すると予想されます。これは、ロボットのレンタルが可能になったためです。例えば、ソフトバンクが製造したヒューマノイド「Pepper」は、36ヵ月間で月額360米ドルのサブスクリプション契約で利用できます。しかし、割引を利用すると、ロボットの総費用は14,000米ドルを超えます。

サービスロボットの配備はより用途に特化したものになる可能性が高いため、ソフトウェアコンポーネントのサービスロボット市場は予測期間中に高い成長率で成長すると予測されます。例えば、工場フロアでの群動作用にプログラムされたAGVは、食品配達用にプログラムすることもできます。配達用ドローンは、天候などの環境変数を考慮した操作のためのリアルタイムソフトウェアを必要とします。ロボット掃除機の進歩のほとんどはソフトウェアで行われており、ライブフロアマッピングや音声アシスタントとの統合によるリモート起動などの機能があります。したがって、ソフトウェア市場は予測期間中、ハードウェアよりも高いCAGRで成長する可能性が高いとみられています。

当レポートでは、世界のサービスロボット市場について調査し、環境別、タイプ別、コンポーネント別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 生成AI/AIがサービスロボット市場に与える影響

- ケーススタディ分析

- 特許分析

- 貿易分析

- 関税と規制状況

- 2024年~2025年の主な会議とイベント

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第6章 サービスロボット市場(環境別)

- イントロダクション

- 航空

- 陸上

- 船舶

第7章 サービスロボット市場(タイプ別)

- イントロダクション

- プロ用

- 個人用および家庭用

第8章 サービスロボット市場(コンポーネント別)

- イントロダクション

- ハードウェア

- ソフトウェア

第9章 サービスロボット市場(用途別)

- イントロダクション

- 家庭

- 医療

- 野外

- 防衛、救助、セキュリティ

- エンターテイメント、教育、個人

- 広報

- 検査、メンテナンス

- 物流

- 建設、解体

- 研究、宇宙探査

第10章 サービスロボット市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 韓国

- 日本

- インド

- オーストラリア

- その他アジア太平洋

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- 行

- ROWのマクロ経済見通し

- 南米

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2021年~2023年

- 市場シェア分析、2023年

- 企業評価と財務指標、2024年

- 製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- INTUITIVE SURGICAL OPERATIONS, INC.

- DJI

- DAIFUKU CO., LTD.

- JD.COM, INC.

- IROBOT CORPORATION

- SAMSUNG ELECTRONICS CO., LTD.

- KONGSBERG

- NORTHROP GRUMMAN

- SOFTBANK ROBOTICS GROUP

- DELAVAL

- その他の企業

- KUKA AG

- STRYKER

- NEATO ROBOTICS, INC.

- GENERAL ELECTRIC COMPANY

- LG ELECTRONICS

- HARVEST CROO ROBOTICS LLC

- STARSHIP TECHNOLOGIES

- 3DR, INC.

- LELY

- DILIGENT ROBOTICS INC.

- AMP ROBOTICS

- BLUE OCEAN ROBOTICS

- XAG CO., LTD.

- EXYN TECHNOLOGIES

- ROBOTIS CO., LTD.

第13章 付録

List of Tables

- TABLE 1 SERVICE ROBOTICS MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 SERVICE ROBOTICS MARKET: RISK ANALYSIS

- TABLE 3 INDICATIVE PRICING OF SERVICE ROBOTS OFFERED BY THREE KEY PLAYERS, BY TYPE, 2023

- TABLE 4 INDICATIVE PRICING OF SERVICE ROBOTS, BY REGION, 2023

- TABLE 5 MAPPING OF ROBOT TYPES AND OEMS

- TABLE 6 MAPPING OF ROBOT TYPES AND STARTUPS

- TABLE 7 ROLE OF COMPANIES IN SERVICE ROBOTICS ECOSYSTEM

- TABLE 8 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 9 IMPORT DATA FOR HS CODE 850860-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 850860-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 11 MFN TARIFFS FOR HS CODE 850860-CODE COMPLIANT PRODUCTS EXPORTED BY US, 2023

- TABLE 12 MFN TARIFFS FOR HS CODE 850860-CODE COMPLIANT PRODUCTS EXPORTED BY BELGIUM, 2023

- TABLE 13 MFN TARIFFS FOR HS CODE 850860-CODE COMPLIANT PRODUCTS EXPORTED BY INDIA, 2023

- TABLE 14 MFN TARIFFS FOR HS CODE 850860-CODE COMPLIANT PRODUCTS EXPORTED BY UK, 2023

- TABLE 15 MFN TARIFFS FOR HS CODE 850860-CODE COMPLIANT PRODUCTS EXPORTED BY FRANCE, 2023

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 21 PORTER'S FIVE FORCES ANALYSIS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 24 SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 25 SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 26 LIST OF COMPANIES OFFERING DRONES

- TABLE 27 AERIAL: SERVICE ROBOTICS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 28 AERIAL: SERVICE ROBOTICS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 29 AERIAL: SERVICE ROBOTICS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 30 AERIAL: SERVICE ROBOTICS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 31 AERIAL: SERVICE ROBOTICS MARKET FOR HARDWARE, BY COMPONENT TYPE, 2020-2023 (USD MILLION)

- TABLE 32 AERIAL: SERVICE ROBOTICS MARKET FOR HARDWARE, BY COMPONENT TYPE, 2024-2029 (USD MILLION)

- TABLE 33 AERIAL: SERVICE ROBOTICS MARKET, BY APPLICATION TYPE, 2020-2023 (USD MILLION)

- TABLE 34 AERIAL: SERVICE ROBOTICS MARKET, BY APPLICATION TYPE, 2024-2029 (USD MILLION)

- TABLE 35 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 38 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

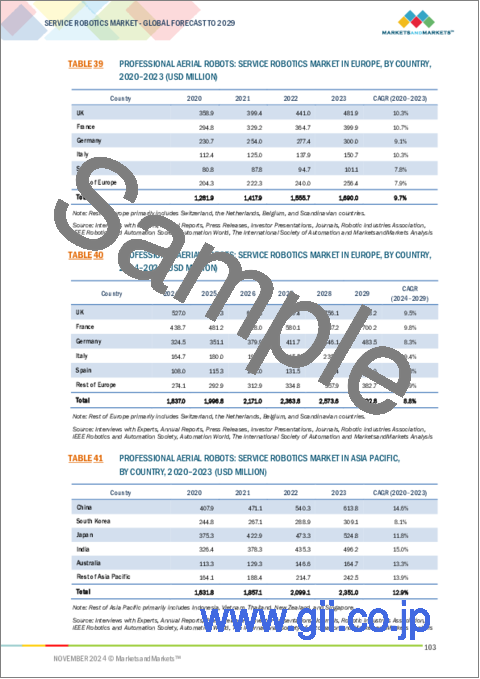

- TABLE 39 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 40 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 41 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 42 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 43 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 46 PROFESSIONAL AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 47 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 50 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 51 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 52 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 53 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 54 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 55 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 58 PERSONAL & DOMESTIC AERIAL ROBOTS: SERVICE ROBOTICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 59 GROUND: SERVICE ROBOTICS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 60 GROUND: SERVICE ROBOTICS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 61 GROUND: SERVICE ROBOTICS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 62 GROUND: SERVICE ROBOTICS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 63 GROUND: SERVICE ROBOTICS MARKET FOR HARDWARE, BY COMPONENT TYPE, 2020-2023 (USD MILLION)

- TABLE 64 GROUND: SERVICE ROBOTICS MARKET FOR HARDWARE, BY COMPONENT TYPE, 2024-2029 (USD MILLION)

- TABLE 65 GROUND: SERVICE ROBOTICS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 66 GROUND: SERVICE ROBOTICS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 67 GROUND: SERVICE ROBOTICS MARKET FOR PROFESSIONAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 GROUND: SERVICE ROBOTICS MARKET FOR PROFESSIONAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 69 GROUND: SERVICE ROBOTICS MARKET IN NORTH AMERICA FOR PROFESSIONAL, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 70 GROUND: SERVICE ROBOTICS MARKET IN NORTH AMERICA FOR PROFESSIONAL, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 71 GROUND: SERVICE ROBOTICS MARKET IN EUROPE FOR PROFESSIONAL, 2020-2023 (USD MILLION)

- TABLE 72 GROUND: SERVICE ROBOTICS MARKET IN EUROPE FOR PROFESSIONAL, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 73 GROUND: SERVICE ROBOTICS MARKET IN ASIA PACIFIC FOR PROFESSIONAL, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 74 GROUND: SERVICE ROBOTICS MARKET IN ASIA PACIFIC FOR PROFESSIONAL, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 75 GROUND: SERVICE ROBOTICS MARKET IN ROW FOR PROFESSIONAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 76 GROUND: SERVICE ROBOTICS MARKET IN ROW FOR PROFESSIONAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 77 GROUND: SERVICE ROBOTICS MARKET IN MIDDLE EAST & AFRICA FOR PROFESSIONAL, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 78 GROUND: SERVICE ROBOTICS MARKET IN MIDDLE EAST & AFRICA FOR PROFESSIONAL, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 79 GROUND: SERVICE ROBOTICS MARKET FOR PERSONAL & DOMESTIC, BY REGION, 2020-2023 (USD MILLION)

- TABLE 80 GROUND: SERVICE ROBOTICS MARKET FOR PERSONAL & DOMESTIC, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 GROUND: SERVICE ROBOTICS MARKET IN NORTH AMERICA FOR PERSONAL & DOMESTIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 82 GROUND: SERVICE ROBOTICS MARKET IN NORTH AMERICA FOR PERSONAL & DOMESTIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 83 GROUND: SERVICE ROBOTICS MARKET IN EUROPE FOR PERSONAL & DOMESTIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 84 GROUND: SERVICE ROBOTICS MARKET IN EUROPE FOR PERSONAL & DOMESTIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 85 GROUND: SERVICE ROBOTICS MARKET IN ASIA PACIFIC FOR PERSONAL & DOMESTIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 86 GROUND: SERVICE ROBOTICS MARKET IN ASIA PACIFIC FOR PERSONAL & DOMESTIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 87 GROUND: SERVICE ROBOTICS MARKET IN ROW FOR PERSONAL & DOMESTIC, BY REGION, 2020-2023 (USD MILLION)

- TABLE 88 GROUND: SERVICE ROBOTICS MARKET IN ROW FOR PERSONAL & DOMESTIC, BY REGION, 2024-2029 (USD MILLION)

- TABLE 89 GROUND: SERVICE ROBOTICS MARKET IN MIDDLE EAST & AFRICA FOR PERSONAL & DOMESTIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 90 GROUND: SERVICE ROBOTICS MARKET IN MIDDLE EAST & AFRICA FOR PERSONAL & DOMESTIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 91 LIST OF COMPANIES PROVIDING AGVS

- TABLE 92 AUTOMATED GUIDED VEHICLES: SERVICE ROBOTICS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 93 AUTOMATED GUIDED VEHICLES: SERVICE ROBOTICS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 94 CLEANING ROBOTS: SERVICE ROBOTICS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 95 CLEANING ROBOTS: SERVICE ROBOTICS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 96 LIST OF COMPANIES OFFERING VACUUMING ROBOTS

- TABLE 97 LIST OF COMPANIES OFFERING LAWNMOWERS

- TABLE 98 LIST OF COMPANIES OFFERING POOL-CLEANING ROBOTS

- TABLE 99 LIST OF COMPANIES OFFERING WINDOW- AND GUTTER-CLEANING ROBOTS

- TABLE 100 LIST OF COMPANIES OFFERING AGRICULTURAL ROBOTS

- TABLE 101 AGRICULTURAL ROBOTS: SERVICE ROBOTICS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 102 AGRICULTURAL ROBOTS: SERVICE ROBOTICS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 103 LIST OF COMPANIES OFFERING SURGICAL ROBOTS

- TABLE 104 LIST OF COMPANIES OFFERING ENTERTAINMENT & LEISURE ROBOTS

- TABLE 105 ENTERTAINMENT & LEISURE ROBOTS: SERVICE ROBOTICS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 106 ENTERTAINMENT & LEISURE ROBOTS: SERVICE ROBOTICS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 107 LIST OF COMPANIES OFFERING INSPECTION ROBOTS

- TABLE 108 LIST OF COMPANIES OFFERING HUMANOID ROBOTS

- TABLE 109 HUMANOID ROBOTS: SERVICE ROBOTICS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 110 HUMANOID ROBOTS: SERVICE ROBOTICS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 111 LIST OF COMPANIES OFFERING POWERED EXOSKELETONS

- TABLE 112 LIST OF COMPANIES OFFERING TELEPRESENCE ROBOTS

- TABLE 113 TELEPRESENCE ROBOTS: SERVICE ROBOTICS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 114 TELEPRESENCE ROBOTS: SERVICE ROBOTICS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 115 MARINE: SERVICE ROBOTICS MARKET, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 116 MARINE: SERVICE ROBOTICS MARKET, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- TABLE 117 MARINE: SERVICE ROBOTICS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 118 MARINE: SERVICE ROBOTICS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 119 MARINE: SERVICE ROBOTICS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 120 MARINE: SERVICE ROBOTICS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 121 MARINE: SERVICE ROBOTICS MARKET FOR HARDWARE, BY COMPONENT TYPE, 2020-2023 (USD MILLION)

- TABLE 122 MARINE: SERVICE ROBOTICS MARKET FOR HARDWARE, BY COMPONENT TYPE, 2024-2029 (USD MILLION)

- TABLE 123 MARINE: SERVICE ROBOTICS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 124 MARINE: SERVICE ROBOTICS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 125 MARINE: SERVICE ROBOTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 126 MARINE: SERVICE ROBOTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 127 MARINE: SERVICE ROBOTICS MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 128 MARINE: SERVICE ROBOTICS MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 129 MARINE: SERVICE ROBOTICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 130 MARINE: SERVICE ROBOTICS MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 131 MARINE: SERVICE ROBOTICS MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 132 MARINE: SERVICE ROBOTICS MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 133 MARINE: SERVICE ROBOTICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 134 MARINE: SERVICE ROBOTICS MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 135 UNMANNED SURFACE VEHICLES (USVS): SERVICE ROBOTICS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 136 UNMANNED SURFACE VEHICLES (USVS): SERVICE ROBOTICS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 137 LIST OF COMPANIES OFFERING USVS

- TABLE 138 AUTONOMOUS UNDERWATER VEHICLES (AUVS): SERVICE ROBOTICS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 139 AUTONOMOUS UNDERWATER VEHICLES (AUVS): SERVICE ROBOTICS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 140 LIST OF COMPANIES OFFERING AUVS

- TABLE 141 REMOTELY OPERATED VEHICLES (ROVS): SERVICE ROBOTICS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 142 REMOTELY OPERATED VEHICLES (ROVS): SERVICE ROBOTICS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 143 LIST OF COMPANIES OFFERING ROVS

- TABLE 144 SERVICE ROBOTICS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 145 SERVICE ROBOTICS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 146 SERVICE ROBOTICS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 147 SERVICE ROBOTICS MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 148 PROFESSIONAL: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 149 PROFESSIONAL: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 150 PERSONAL & DOMESTIC: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 151 PERSONAL & DOMESTIC: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 152 SERVICE ROBOTICS MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- TABLE 153 SERVICE ROBOTICS MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 154 HARDWARE: SERVICE ROBOTICS MARKET, BY COMPONENT TYPE, 2020-2023 (USD MILLION)

- TABLE 155 HARDWARE: SERVICE ROBOTICS MARKET, BY COMPONENT TYPE, 2024-2029 (USD MILLION)

- TABLE 156 HARDWARE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 157 HARDWARE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 158 SOFTWARE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 159 SOFTWARE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 160 SERVICE ROBOTICS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 161 SERVICE ROBOTICS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 162 DOMESTIC: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 163 DOMESTIC: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 164 MEDICAL: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 165 MEDICAL: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 166 FIELD: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 167 FIELD: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 168 DEFENSE, RESCUE & SECURITY: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 169 DEFENSE, RESCUE & SECURITY: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 170 ENTERTAINMENT, EDUCATION & PERSONAL: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 171 ENTERTAINMENT, EDUCATION & PERSONAL: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 172 PUBLIC RELATION: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 173 PUBLIC RELATION: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 174 INSPECTION & MAINTENANCE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 175 INSPECTION & MAINTENANCE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 176 LOGISTICS: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 177 LOGISTICS: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 178 CONSTRUCTION & DEMOLITION: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 179 CONSTRUCTION & DEMOLITION: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 180 MARITIME: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 181 MARITIME: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 182 RESEARCH & SPACE EXPLORATION: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 183 RESEARCH & SPACE EXPLORATION: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 184 SERVICE ROBOTICS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 185 SERVICE ROBOTICS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 186 LIST OF SERVICE ROBOTICS COMPANIES IN NORTH AMERICA

- TABLE 187 NORTH AMERICA: SERVICE ROBOTICS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 188 NORTH AMERICA: SERVICE ROBOTICS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 189 NORTH AMERICA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 190 NORTH AMERICA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 191 NORTH AMERICA: SERVICE ROBOTICS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 192 NORTH AMERICA: SERVICE ROBOTICS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 193 US: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 194 US: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 195 CANADA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 196 CANADA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 197 MEXICO: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 198 MEXICO: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 199 LIST OF SERVICE ROBOTICS COMPANIES IN ASIA PACIFIC

- TABLE 200 ASIA PACIFIC: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 201 ASIA PACIFIC: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 202 ASIA PACIFIC: SERVICE ROBOTICS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 203 ASIA PACIFIC: SERVICE ROBOTICS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 204 ASIA PACIFIC: SERVICE ROBOTICS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 205 ASIA PACIFIC: SERVICE ROBOTICS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 206 CHINA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 207 CHINA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 208 SOUTH KOREA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 209 SOUTH KOREA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 210 JAPAN: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 211 JAPAN: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 212 INDIA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 213 INDIA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 214 AUSTRALIA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 215 AUSTRALIA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 217 REST OF ASIA PACIFIC: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 218 LIST OF SERVICE ROBOTICS COMPANIES IN EUROPE

- TABLE 219 EUROPE: SERVICE ROBOTICS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 220 EUROPE: SERVICE ROBOTICS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 221 EUROPE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 222 EUROPE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 223 EUROPE: SERVICE ROBOTICS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 224 EUROPE: SERVICE ROBOTICS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 225 UK: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 226 UK: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 227 GERMANY: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 228 GERMANY: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 229 FRANCE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 230 FRANCE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 231 ITALY: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 232 ITALY: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 233 SPAIN: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 234 SPAIN: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 235 REST OF EUROPE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 236 REST OF EUROPE: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 237 LIST OF SERVICE ROBOTICS COMPANIES IN ROW

- TABLE 238 ROW: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 239 ROW: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 240 ROW: SERVICE ROBOTICS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 241 ROW: SERVICE ROBOTICS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 242 ROW: SERVICE ROBOTICS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 243 ROW: SERVICE ROBOTICS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: SERVICE ROBOTICS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: SERVICE ROBOTICS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 246 SOUTH AMERICA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 247 SOUTH AMERICA: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 248 GCC COUNTRIES: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 249 GCC COUNTRIES: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 250 AFRICA & REST OF MIDDLE EAST: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2020-2023 (USD MILLION)

- TABLE 251 AFRICA & REST OF MIDDLE EAST: SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2024-2029 (USD MILLION)

- TABLE 252 SERVICE ROBOTICS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 253 SERVICE ROBOTICS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 254 SERVICE ROBOTICS MARKET: REGION FOOTPRINT

- TABLE 255 SERVICE ROBOTICS MARKET: ENVIRONMENT FOOTPRINT

- TABLE 256 SERVICE ROBOTICS MARKET: TYPE FOOTPRINT

- TABLE 257 SERVICE ROBOTICS MARKET: APPLICATION FOOTPRINT

- TABLE 258 SERVICE ROBOTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 259 SERVICE ROBOTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 260 SERVICE ROBOTICS MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2024

- TABLE 261 SERVICE ROBOTICS MARKET: DEALS, JANUARY 2021-JULY 2024

- TABLE 262 SERVICE ROBOTICS MARKET: EXPANSIONS, JANUARY 2021-JULY 2024

- TABLE 263 INTUITIVE SURGICAL OPERATIONS, INC.: COMPANY OVERVIEW

- TABLE 264 INTUITIVE SURGICAL OPERATIONS, INC.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 265 INTUITIVE SURGICAL OPERATIONS, INC.: DEALS

- TABLE 266 INTUITIVE SURGICAL OPERATIONS, INC.: OTHER DEVELOPMENTS

- TABLE 267 DJI: COMPANY OVERVIEW

- TABLE 268 DJI: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 269 DJI: PRODUCT LAUNCHES

- TABLE 270 DAIFUKU CO., LTD.: COMPANY OVERVIEW

- TABLE 271 DAIFUKU CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 272 DAIFUKU CO., LTD.: DEALS

- TABLE 273 DAIFUKU CO., LTD.: EXPANSIONS

- TABLE 274 JD.COM, INC.: COMPANY OVERVIEW

- TABLE 275 JD.COM, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 276 JD.COM, INC.: PRODUCT LAUNCHES

- TABLE 277 IROBOT CORPORATION: COMPANY OVERVIEW

- TABLE 278 IROBOT CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 279 IROBOT CORPORATION: PRODUCT LAUNCHES

- TABLE 280 IROBOT CORPORATION: DEALS

- TABLE 281 SAMSUNG ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 282 SAMSUNG ELECTRONICS CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 283 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES

- TABLE 284 SAMSUNG ELECTRONICS CO., LTD.: DEALS

- TABLE 285 KONGSBERG: COMPANY OVERVIEW

- TABLE 286 KONGSBERG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 287 KONGSBERG: PRODUCT LAUNCHES

- TABLE 288 KONGSBERG: DEALS

- TABLE 289 KONGSBERG: OTHER DEVELOPMENTS

- TABLE 290 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 291 NORTHROP GRUMMAN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 292 SOFTBANK ROBOTICS GROUP: COMPANY OVERVIEW

- TABLE 293 SOFTBANK ROBOTICS GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 294 SOFTBANK ROBOTICS GROUP: DEALS

- TABLE 295 DELAVAL: COMPANY OVERVIEW

- TABLE 296 DELAVAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 297 DELAVAL: PRODUCT LAUNCHES

- TABLE 298 KUKA AG: COMPANY OVERVIEW

- TABLE 299 STRYKER: COMPANY OVERVIEW

- TABLE 300 NEATO ROBOTICS, INC.: COMPANY OVERVIEW

- TABLE 301 GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 302 LG ELECTRONICS: COMPANY OVERVIEW

- TABLE 303 HARVEST CROO ROBOTICS LLC: COMPANY OVERVIEW

- TABLE 304 STARSHIP TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 305 3DR, INC.: COMPANY OVERVIEW

- TABLE 306 LELY: COMPANY OVERVIEW

- TABLE 307 DILIGENT ROBOTICS INC.: COMPANY OVERVIEW

- TABLE 308 AMP ROBOTICS: COMPANY OVERVIEW

- TABLE 309 BLUE OCEAN ROBOTICS: COMPANY OVERVIEW

- TABLE 310 XAG CO., LTD.: COMPANY OVERVIEW

- TABLE 311 EXYN TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 312 ROBOTIS CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SERVICE ROBOTICS MARKET SEGMENTATION

- FIGURE 2 SERVICE ROBOTICS MARKET: RESEARCH DESIGN

- FIGURE 3 SERVICE ROBOTICS MARKET: RESEARCH FLOW

- FIGURE 4 SERVICE ROBOTICS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 SERVICE ROBOTICS MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 6 SERVICE ROBOTICS MARKET: TOP-DOWN APPROACH

- FIGURE 7 SERVICE ROBOTICS MARKET: DATA TRIANGULATION

- FIGURE 8 GROUND SEGMENT TO DOMINATE SERVICE ROBOTICS MARKET DURING FORECAST PERIOD

- FIGURE 9 PERSONAL & DOMESTIC SEGMENT TO REGISTER HIGHER CAGR IN SERVICE ROBOTICS MARKET FROM 2024 TO 2029

- FIGURE 10 SOFTWARE SEGMENT TO EXHIBIT HIGHER CAGR IN SERVICE ROBOTICS MARKET BETWEEN 2024 AND 2029

- FIGURE 11 MEDICAL SEGMENT TO CAPTURE LARGEST SHARE OF SERVICE ROBOTICS MARKET IN 2024

- FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 13 INCREASING GOVERNMENT-LED FUNDING FOR RESEARCH ON ROBOTS TO DRIVE MARKET

- FIGURE 14 GROUND SEGMENT TO HOLD LARGEST SHARE OF SERVICE ROBOTICS MARKET IN 2029

- FIGURE 15 GROUND SEGMENT AND US TO CAPTURE LARGEST SHARES OF SERVICE ROBOTICS MARKET IN NORTH AMERICA IN 2024

- FIGURE 16 MEDICAL SEGMENT TO HOLD LARGEST SHARE OF SERVICE ROBOTICS MARKET IN 2024

- FIGURE 17 CANADA TO RECORD HIGHEST CAGR IN GLOBAL SERVICE ROBOTICS MARKET FROM 2024 TO 2029

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 IMPACT ANALYSIS: DRIVERS

- FIGURE 20 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 22 IMPACT ANALYSIS: CHALLENGES

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 SERVICE ROBOTICS ECOSYSTEM

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2020-2023

- FIGURE 27 IMPACT OF GEN AI/AI ON SERVICE ROBOTICS MARKET

- FIGURE 28 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 29 IMPORT DATA FOR HS CODE 850860-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 30 EXPORT DATA FOR HS CODE 850860-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 31 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 34 GROUND SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 PERSONAL & DOMESTIC SEGMENT TO EXHIBIT HIGHER CAGR BETWEEN 2024 AND 2029

- FIGURE 36 SOFTWARE SEGMENT TO EXHIBIT HIGHER CAGR FROM 2024 TO 2029

- FIGURE 37 MEDICAL SEGMENT TO DOMINATE SERVICE ROBOTICS MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO RECORD HIGHEST CAGR IN SERVICE ROBOTICS MARKET BETWEEN 2024 AND 2029

- FIGURE 39 NORTH AMERICA: SERVICE ROBOTICS MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: SERVICE ROBOTICS MARKET SNAPSHOT

- FIGURE 41 EUROPE: SERVICE ROBOTICS MARKET SNAPSHOT

- FIGURE 42 SERVICE ROBOTICS MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2021-2023

- FIGURE 43 MARKET SHARE ANALYSIS OF COMPANIES OFFERING SERVICE ROBOTICS, 2023

- FIGURE 44 COMPANY VALUATION, 2024

- FIGURE 45 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 46 SERVICE ROBOTICS MARKET: PRODUCT COMPARISON

- FIGURE 47 SERVICE ROBOTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 48 SERVICE ROBOTICS MARKET: COMPANY FOOTPRINT

- FIGURE 49 SERVICE ROBOTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 50 INTUITIVE SURGICAL OPERATIONS, INC.: COMPANY SNAPSHOT

- FIGURE 51 DAIFUKU CO., LTD.: COMPANY SNAPSHOT

- FIGURE 52 JD.COM, INC.: COMPANY SNAPSHOT

- FIGURE 53 IROBOT CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 55 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 56 NORTHROP GRUMMAN: COMPANY SNAPSHOT

The service robotics market is projected to grow from USD 47.10 billion in 2024 to reach USD 98.65 billion by 2029; it is expected to grow at a CAGR of 15.9% from 2024 to 2029.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Environment, Type, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Growing emphasis on reducing hospital-acquired infections is one of the major drivers in the service robotics market. Hospital-acquired infections (HAIs) are widespread, particularly in acute care hospitals. Acute care hospitals need to disinfect patient rooms and beds regularly. The necessity to cut labor expenses and HAls has led to the development of disinfection robots. These robots efficiently lower HAls infection rates by using ultraviolet-C (UV-C) light and hydrogen peroxide mist dispersion. Hospitals and medical facilities around the world have been forced by the global pandemic to give social and hand hygiene top priority. The use of disinfection robots has increased dramatically due to the rising prevalence of HAls, which is currently between 5 and 10%, as well as the continued consequences of the epidemic. In the upcoming years, it is anticipated to keep increasing. Strict criteria have been set by numerous government facilities and hospital management teams to guarantee that all hospital surroundings are free of germs. Installing disinfection robots in hospital facilities has been a top priority in a number of emerging nations due to the growing threat of infectious illnesses and rising mortality rates.

Professional service robotics market held the largest market share in 2023

The market share of professional service robots was higher in 2023. Service robots are less common in household applications because of their expensive cost. For example, iRobot Corporation's (US) hoover cleaners range in price from USD 249 to USD 1,439 USD. Telepresence robots are available in the range of USD 185 to USD 32,000. PARO, a therapeutic robot, costs USD 3,800. The market for personal & domestic robots is expected to grow at a higher CAGR during the forecast period. This can be attributed to the availability of robots on a rental basis. For instance, Pepper, a humanoid manufactured by SoftBank, is available on a monthly subscription contract of USD 360 over 36 months. However, with a discount, the total cost of the robot is over USD 14,000.

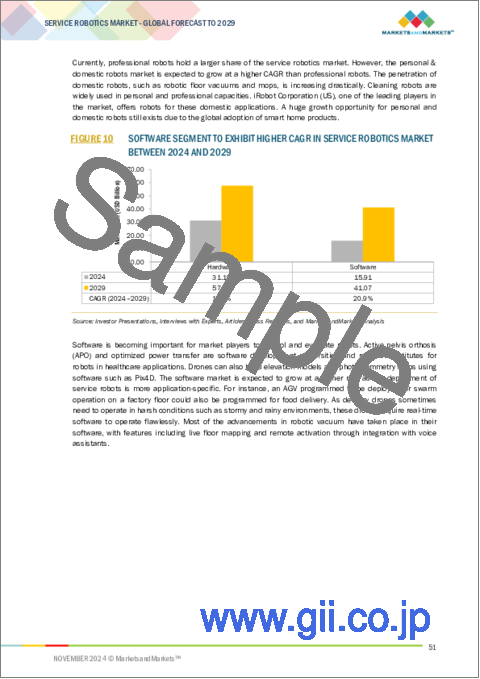

The software component segment is estimated to grow at a higher rate during the forecast period

The service robotics market for the software component is estimated to grow at a higher rate during the forecast period, as the deployment of service robots is likely to become more application-specific. For instance, an AGV programmed to be deployed for swarm operation on a factory floor could also be programmed for food delivery. Delivery drones require real- time software for operations, considering environment variables such as weather. Most advancements in robotic vacuum cleaners have taken place in the software, with features including live floor mapping and remote activation through integration with voice assistants. Hence, the software market is likely to grow at a higher CAGR than hardware during the forecast period.

US is expected to have the largest market for service robotics market during the forecast period

The demand for service robots in the US currently holds the largest market share and is expected to grow rapidly due to the busy lifestyles and high disposable incomes of its citizens. According to the Organization for Economic Co-operation and Development (OECD), the United States has the highest average household net adjusted disposable income per capita among its 40 member countries. As a result, there is expected to be an increase in demand for expensive robots used in surgical procedures. Additionally, wages in the US are high and have been steadily increasing over the years. The U.S. Army is also quickly adopting robotics technology.

In determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key officials in the service robotics market. Following is the breakup of the profiles of the primary participants for the report.

- By Company Type: Tier 1 - 40 %, Tier 2 - 40%, and Tier 3 - 20%

- By Designation: Directors -40%, Managers- 40%, and Others - 20%

- By Region: North America- 40%, Europe- 20%, Asia Pacific - 30%, and RoW - 10%

The report profiles key players in the service robotics market and analyzes their market shares. Players profiled in this report are iRobot Corporation (US), Softbank Robotics Group (Japan), Intuitive Surgical Operations, Inc. (US), Samsung Electronics Co., Ltd. (South Korea), JD.com, Inc. (China), DeLaval (Sweden), Daifuku Co., Ltd. (Japan), DJI (China), KONGSBERG (Norway), Northrop Grumman (US), Neato Robotics, Inc. (US), KUKA AG (Germany), LG Electronics (South Korea), Lely (Netherlands), 3DR, Inc. (US), Stryker (US), and Harvest CROO Robotics LLC (US), among others.

Research Coverage

The report defines, describes, and forecasts the service robotics market based on Component, Environment, Type, Application, and Region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing its growth. It also analyzes competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall service robotics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Mounting adoption of robots to achieve high returns on investment, rising deployment of Internet of Things to enable cost-effective predictive maintenance, growing emphasis on reducing hospital-acquired infections, increasing interest in robotics research, and rising insurance coverage for medical exoskeletons and robotic surgeries), restraints (Concerns regarding data privacy and regulations), opportunities (Increasing reliance on robots to assist handicapped and geriatric population, growing focus on improving endurance and capability of robots, and adoption of swarm intelligence technology to enable robots to perform complex tasks), and challenges (Technical issues of robots) influencing the growth of the service robotics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the service robotics market

- Market Development: Comprehensive information about lucrative markets - the report analyses the service robotics market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the service robotics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like iRobot Corporation (US), Softbank Robotics Group (Japan), Intuitive Surgical Operations, Inc. (US), Samsung Electronics Co., Ltd. (South Korea), JD.com, Inc. (China), DeLaval (Sweden), Daifuku Co., Ltd. (Japan), DJI (China), KONGSBERG (Norway), Northrop Grumman (US), Neato Robotics, Inc. (US), KUKA AG (Germany), LG Electronics (South Korea), Lely (Netherlands), 3DR, Inc. (US), Stryker (US), and Harvest CROO Robotics LLC (US), among others in the service robotics market strategies. The report also helps stakeholders understand the pulse of the automotive airbags & seatbelts market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 PRIMARY AND SECONDARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SERVICE ROBOTICS MARKET

- 4.2 SERVICE ROBOTICS MARKET, BY ENVIRONMENT

- 4.3 SERVICE ROBOTICS MARKET IN NORTH AMERICA, BY ENVIRONMENT AND COUNTRY

- 4.4 SERVICE ROBOTICS MARKET, BY APPLICATION

- 4.5 SERVICE ROBOTICS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Mounting adoption of robots to achieve high returns on investment

- 5.2.1.2 Rising deployment of Internet of Things to enable cost-effective predictive maintenance

- 5.2.1.3 Growing emphasis on reducing hospital-acquired infections

- 5.2.1.4 Increasing interest in robotics research

- 5.2.1.5 Rising insurance coverage for medical exoskeletons and robotic surgeries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Concerns regarding data privacy and regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing reliance on robots to assist handicapped and geriatric population

- 5.2.3.2 Growing focus on improving the endurance and capability of robots

- 5.2.3.3 Adoption of swarm intelligence technology to enable robots to perform complex tasks

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical issues of robots

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING OF SERVICE ROBOTS, BY TYPE, 2023

- 5.4.2 INDICATIVE PRICING OF SERVICE ROBOTS, BY REGION, 2023

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Artificial Intelligence (AI)

- 5.8.1.2 Standard OS

- 5.8.1.3 Telepresence robots and humanoids

- 5.8.1.4 Robot as a service (RaaS)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Vision guidance

- 5.8.1 KEY TECHNOLOGIES

- 5.9 IMPACT OF GEN AI/AI ON SERVICE ROBOTICS MARKET

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 RICE FARMERS IN BRAZIL INCORPORATE DJI'S AGRAS T40 DRONES TO CONTROL PESTS AND ENHANCE FARMING EFFICIENCY

- 5.10.2 PAL ROBOTICS TAKES PART IN SANDRO PROJECT TO INTRODUCE INNOVATIVE ROBOTS TO ASSIST ELDERLY POPULATION

- 5.10.3 NIPPON DINING USES SOFTBANK ROBOTICS GROUP'S KEENBOT ROBOT TO ENSURE COST SAVINGS

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 850860)

- 5.12.2 EXPORT SCENARIO (HS CODE 850860)

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 850860)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.15.2 BARGAINING POWER OF SUPPLIERS

- 5.15.3 BARGAINING POWER OF BUYERS

- 5.15.4 THREAT OF SUBSTITUTES

- 5.15.5 THREAT OF NEW ENTRANTS

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

6 SERVICE ROBOTICS MARKET, BY ENVIRONMENT

- 6.1 INTRODUCTION

- 6.2 AERIAL

- 6.2.1 COMMERCIAL DRONES

- 6.2.1.1 Increasing use in aerial photography, inspection, and other applications to fuel segmental growth

- 6.2.2 CONSUMER DRONES

- 6.2.2.1 Rising adoption in entertainment and commercial applications to augment segmental growth

- 6.2.1 COMMERCIAL DRONES

- 6.3 GROUND

- 6.3.1 AUTOMATED GUIDED VEHICLES

- 6.3.1.1 Tow vehicles

- 6.3.1.1.1 Increasing use to move high loads using multiple trailers to boost segmental growth

- 6.3.1.2 Unit load carriers

- 6.3.1.2.1 Rising utilization to move standard pallets, drums, carts, racks, rolls, and custom containers to drive market

- 6.3.1.3 Pallet trucks

- 6.3.1.3.1 Escalating adoption to move palletized loads along predetermined routes to bolster segmental growth

- 6.3.1.4 Forklift trucks

- 6.3.1.4.1 Growing awareness about seamless tracking and timely picking of goods to accelerate segmental growth

- 6.3.1.5 Assembly line vehicles

- 6.3.1.5.1 Rising implementation at production plants to increase efficiency to bolster segmental growth

- 6.3.1.6 Disinfection robots

- 6.3.1.6.1 Increasing adoption to improve efficiency in hospital management to fuel segmental growth

- 6.3.1.7 Other AGVs

- 6.3.1.1 Tow vehicles

- 6.3.2 CLEANING ROBOTS

- 6.3.2.1 Increasing population and number of nuclear families to contribute to segmental growth

- 6.3.2.2 Vacuuming robots

- 6.3.2.3 Lawnmowers

- 6.3.2.4 Pool-cleaning robots

- 6.3.2.5 Window- and gutter-cleaning robots

- 6.3.3 AGRICULTURAL ROBOTS

- 6.3.3.1 Milking robots

- 6.3.3.1.1 Increasing commercialization as voluntary milking systems to augment segmental growth

- 6.3.3.2 Automated harvesting systems

- 6.3.3.2.1 Rising automation of agricultural harvesting equipment to contribute to segmental growth

- 6.3.3.1 Milking robots

- 6.3.4 SURGICAL ROBOTS

- 6.3.4.1 Growing preference for laparoscopic surgeries to foster segmental growth

- 6.3.4.2 Laparoscopy robotic systems

- 6.3.4.3 Orthopedic robotic systems

- 6.3.4.4 Neurosurgical robotic systems

- 6.3.5 ENTERTAINMENT & LEISURE ROBOTS

- 6.3.5.1 Toy robots

- 6.3.5.1.1 Growing use for entertainment and educational purposes to expedite segmental growth

- 6.3.5.2 Hobby systems

- 6.3.5.2.1 Increasing adoption to perform picking and placing and other simple tasks to fuel segmental growth

- 6.3.5.1 Toy robots

- 6.3.6 INSPECTION ROBOTS

- 6.3.6.1 Increased adoption in hazardous environments to boost segmental growth

- 6.3.7 HUMANOID ROBOTS

- 6.3.7.1 Rising introduction of advanced features to contribute to segmental growth

- 6.3.8 POWERED EXOSKELETONS

- 6.3.8.1 Increasing use in industrial, medical, military, and construction verticals to bolster segmental growth

- 6.3.9 TELEPRESENCE ROBOTS

- 6.3.9.1 Mounting adoption in healthcare and corporate sectors to expedite segmental growth

- 6.3.10 OTHER GROUND ROBOTS

- 6.3.1 AUTOMATED GUIDED VEHICLES

- 6.4 MARINE

- 6.4.1 UNMANNED SURFACE VEHICLES (USVS)

- 6.4.1.1 Rising use in defense, oceanography, surveillance, and search and rescue operations to drive market

- 6.4.2 AUTONOMOUS UNDERWATER VEHICLES (AUVS)

- 6.4.2.1 Increasing deployment to collect oceanographic and geologic information to foster segmental growth

- 6.4.3 REMOTELY OPERATED VEHICLES (ROVS)

- 6.4.3.1 Growing adoption in oil and gas explorations, pipeline inspections, and vessel hull inspections to fuel segmental growth

- 6.4.1 UNMANNED SURFACE VEHICLES (USVS)

7 SERVICE ROBOTICS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 PROFESSIONAL

- 7.2.1 RISING EMPHASIS ON IMPROVING WAREHOUSE OPERATIONS AND REDUCING LABOR COSTS TO AUGMENT SEGMENTAL GROWTH

- 7.3 PERSONAL & DOMESTIC

- 7.3.1 INCREASING FOCUS ON PERSONAL ASSISTANCE AND ELDERLY CARE ROBOTS TO FOSTER SEGMENTAL GROWTH

8 SERVICE ROBOTICS MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 HARDWARE

- 8.2.1 AIRFRAMES

- 8.2.1.1 Growing focus on reducing weight and increasing payload capacity of drones to fuel segmental growth

- 8.2.1.2 Alloy

- 8.2.1.3 Plastic

- 8.2.1.4 Composite

- 8.2.2 SENSORS

- 8.2.2.1 Increasing need to enhance operational capabilities of robots to contribute to segmental growth

- 8.2.2.2 Motion

- 8.2.2.3 Light

- 8.2.2.4 Proximity

- 8.2.2.5 Temperature

- 8.2.2.6 Position

- 8.2.2.7 Other sensors

- 8.2.3 CAMERAS

- 8.2.3.1 Rising adoption for precise 3D mapping and distance measurement to expedite segmental growth

- 8.2.3.2 Multispectral

- 8.2.3.3 Thermal

- 8.2.3.4 Infrared

- 8.2.3.5 LiDAR

- 8.2.3.6 High-resolution

- 8.2.4 ACTUATORS

- 8.2.4.1 Rising deployment for high-speed and repetitive tasks to contribute to segmental growth

- 8.2.4.2 Rotational

- 8.2.4.3 Linear

- 8.2.5 POWER SUPPLY SYSTEMS

- 8.2.5.1 Mounting demand for batteries capable of communicating with robots to accelerate segmental growth

- 8.2.6 CONTROL SYSTEMS

- 8.2.6.1 Rising use to control and coordinate functions of service robots to foster segmental growth

- 8.2.7 NAVIGATION SYSTEMS

- 8.2.7.1 Increasing reliance on autonomous and semi-autonomous operations to expedite segmental growth

- 8.2.7.2 GPS/GNSS & GLONASS

- 8.2.7.3 Inertial

- 8.2.7.4 Safety

- 8.2.7.5 Compass

- 8.2.8 PROPULSION SYSTEMS

- 8.2.8.1 Rising adoption to manage and ensure precise motion control to augment segmental growth

- 8.2.9 OTHER HARDWARE

- 8.2.1 AIRFRAMES

- 8.3 SOFTWARE

- 8.3.1 INCREASING SOPHISTICATION OF ROBOTS TO CONTRIBUTE TO SEGMENTAL GROWTH

9 SERVICE ROBOTICS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 DOMESTIC

- 9.2.1 BURGEONING DEMAND FOR DISINFECTING ROBOTS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.2.2 FLOOR CLEANING

- 9.2.3 LAWN MOWING

- 9.2.4 POOL CLEANING

- 9.2.5 OTHER DOMESTIC APPLICATIONS

- 9.3 MEDICAL

- 9.3.1 INCREASING AGING POPULATION TO ACCELERATE SEGMENTAL GROWTH

- 9.3.2 SURGERY ASSISTANCE

- 9.3.3 HANDICAP ASSISTANCE

- 9.3.4 OTHER MEDICAL APPLICATIONS

- 9.4 FIELD

- 9.4.1 RISING EMPHASIS ON PRECISION IRRIGATION AND FERTILIZATION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.4.2 HARVEST MANAGEMENT

- 9.4.3 FARMING

- 9.4.3.1 Crop monitoring

- 9.4.3.2 Plant scouting

- 9.4.3.3 Crop scouting

- 9.4.4 DAIRY & LIVESTOCK MANAGEMENT

- 9.4.5 OTHER FIELD APPLICATIONS

- 9.5 DEFENSE, RESCUE & SECURITY

- 9.5.1 GROWING RELIANCE ON ROBOTS TO IDENTIFY RISK-PRONE AREAS FROM REMOTE LOCATIONS AND TRACK ILLEGAL ACTIVITIES TO DRIVE MARKET

- 9.5.2 DEMINING

- 9.5.3 FIREFIGHTING & BOMB DISPOSAL

- 9.5.4 BORDER SECURITY & SURVEILLANCE

- 9.5.5 OTHER DEFENSE, RESCUE & SECURITY APPLICATIONS

- 9.6 ENTERTAINMENT, EDUCATION & PERSONAL

- 9.6.1 MOUNTING DEMAND FOR EDUCATIONAL AND TRAINING ROBOTS TO FOSTER SEGMENTAL GROWTH

- 9.6.2 ENTERTAINMENT

- 9.6.3 EDUCATION

- 9.6.4 COMPANIONSHIP & ELDERLY ASSISTANCE

- 9.7 PUBLIC RELATION

- 9.7.1 ESCALATING ADOPTION OF ROBOTS FOR ROOM SERVICE, SECURITY, LAW ENFORCEMENT, AND MOBILE GUIDANCE TO FUEL SEGMENTAL GROWTH

- 9.8 INSPECTION & MAINTENANCE

- 9.8.1 INCREASING USE OF DRONES TO INSPECT POWER PLANTS AND OTHER LARGE STRUCTURES TO BOLSTER SEGMENTAL GROWTH

- 9.8.2 PIPE/PIPELINE INSPECTION

- 9.8.3 POWER PLANT INSPECTION

- 9.8.4 ENERGIZED TRANSMISSION LINE INSPECTION

- 9.8.5 OTHER INSPECTION & MAINTENANCE APPLICATIONS

- 9.9 LOGISTICS

- 9.9.1 RISING DEPLOYMENT OF COST-EFFECTIVE DELIVERY ROBOTS TO REDUCE OVERALL COSTS TO FUEL SEGMENTAL GROWTH

- 9.9.2 WAREHOUSE AUTOMATION

- 9.9.3 LAST-MILE DELIVERY

- 9.10 CONSTRUCTION & DEMOLITION

- 9.10.1 INCREASING USE OF ROBOTS TO REDUCE LABOR COSTS AND ENSURE HIGH RETURNS ON INVESTMENT TO DRIVE MARKET

- 9.11 MARITIME

- 9.11.1 RISING DEEP SEA EXPLORATION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.11.2 OCEANOGRAPHY

- 9.11.3 ENVIRONMENTAL PROTECTION & MONITORING

- 9.11.4 ARCHAEOLOGICAL EXPLORATION

- 9.11.5 OTHER MARITIME APPLICATIONS

- 9.12 RESEARCH & SPACE EXPLORATION

- 9.12.1 MOUNTING DEMAND FOR SPACE EXPLORATION ROBOTS TO BOOST SEGMENTAL GROWTH

10 SERVICE ROBOTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Increasing aging population and high disposable income to boost market growth

- 10.2.3 CANADA

- 10.2.3.1 Rising wages and labor shortages to contribute to market growth

- 10.2.4 MEXICO

- 10.2.4.1 Escalating adoption of commercial drones in agricultural applications to drive market

- 10.3 ASIA PACIFIC

- 10.3.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.3.2 CHINA

- 10.3.2.1 Mounting demand for personal and domestic robots to bolster market growth

- 10.3.3 SOUTH KOREA

- 10.3.3.1 Increasing deployment of advanced technologies to contribute to market growth

- 10.3.4 JAPAN

- 10.3.4.1 Rising exploration of technologies for disaster relief and elderly assistance applications to drive market

- 10.3.5 INDIA

- 10.3.5.1 Growing emphasis on reducing costs of automation solutions to boost market growth

- 10.3.6 AUSTRALIA

- 10.3.6.1 Increasing adoption of robots in logistics and warehousing applications to augment market growth

- 10.3.7 REST OF ASIA PACIFIC

- 10.4 EUROPE

- 10.4.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.4.2 GERMANY

- 10.4.2.1 Thriving food & beverages, retail, and postal industries to bolster market growth

- 10.4.3 FRANCE

- 10.4.3.1 Burgeoning demand for assistive and surgical robots to accelerate market growth

- 10.4.4 UK

- 10.4.4.1 Rising per capita income and government-led funding for robots to expedite market growth

- 10.4.5 ITALY

- 10.4.5.1 Rapid technological advances and demand for automation solutions to augment market growth

- 10.4.6 SPAIN

- 10.4.6.1 Rising emphasis on improving efficiency and productivity of industrial sectors to drive market

- 10.4.7 REST OF EUROPE

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Growing emphasis on public and specialized education to foster market growth

- 10.5.3 MIDDLE EAST & AFRICA

- 10.5.3.1 Mounting demand for healthcare robots to fuel market growth

- 10.5.3.2 GCC countries

- 10.5.3.3 Africa & Rest of Middle East

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/ RIGHT TO WIN, 2021-2024

- 11.3 REVENUE ANALYSIS, 2021-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 11.6 PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Environment footprint

- 11.7.5.4 Type footprint

- 11.7.5.5 Application footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 INTUITIVE SURGICAL OPERATIONS, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Services/Solutions offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 DJI

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Services/Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 DAIFUKU CO., LTD.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Services/Solutions offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 JD.COM, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Services/Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 IROBOT CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Services/Solutions offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 SAMSUNG ELECTRONICS CO., LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Services/Solutions offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.7 KONGSBERG

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Services/Solutions offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Other developments

- 12.1.8 NORTHROP GRUMMAN

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services/Solutions offered

- 12.1.9 SOFTBANK ROBOTICS GROUP

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Services/Solutions offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 DELAVAL

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services/Solutions offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.1 INTUITIVE SURGICAL OPERATIONS, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 KUKA AG

- 12.2.2 STRYKER

- 12.2.3 NEATO ROBOTICS, INC.

- 12.2.4 GENERAL ELECTRIC COMPANY

- 12.2.5 LG ELECTRONICS

- 12.2.6 HARVEST CROO ROBOTICS LLC

- 12.2.7 STARSHIP TECHNOLOGIES

- 12.2.8 3DR, INC.

- 12.2.9 LELY

- 12.2.10 DILIGENT ROBOTICS INC.

- 12.2.11 AMP ROBOTICS

- 12.2.12 BLUE OCEAN ROBOTICS

- 12.2.13 XAG CO., LTD.

- 12.2.14 EXYN TECHNOLOGIES

- 12.2.15 ROBOTIS CO., LTD.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS