|

|

市場調査レポート

商品コード

1606240

分散型光ファイバーセンサー(DFOS)の世界市場:ファイバータイプ別、動作原理別、散乱プロセス別、用途別 - 予測(~2030年)Distributed Fiber Optic Sensor Market by Fiber Type (Single-Mode, Multimode), Operating Principle (OTDR, OFDR), Scattering Process (Rayleigh, Brillouin, and Raman Scattering Effects), Application (Temperature, Acoustic, Strain) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 分散型光ファイバーセンサー(DFOS)の世界市場:ファイバータイプ別、動作原理別、散乱プロセス別、用途別 - 予測(~2030年) |

|

出版日: 2024年12月03日

発行: MarketsandMarkets

ページ情報: 英文 234 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の分散型光ファイバーセンサー(DFOS)の市場規模は、2024年に推定14億1,170万米ドルであり、2030年までに26億3,070万米ドルになると予測され、2024年~2030年にCAGRで10.9%の成長が見込まれます。

石油・ガス産業では自動化とデジタル化が急速に進んでおり、運転中の高い安全性と効率を確保するために先進のモニタリング技術が必要とされています。このため、分散型光ファイバーセンサー(DFOS)市場が大きく成長する可能性があります。世界中のビル、橋梁、トンネルなどで効果的な構造健全性モニタリングを行う必要性も、リアルタイムで正確な分散型センシング機能を提供するDFOSシステムの使用を推進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | ファイバータイプ、動作原理、散乱プロセス、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「OTDRが予測期間に大きな市場シェアを獲得します。」

さまざまな産業、特に通信、石油・ガス、インフラにおける光ファイバーのテストとモニタリングにおける信頼性と精度の点で定評があるため、OTDRが分散型光ファイバーセンサー(DFOS)市場で大きなシェアを獲得しました。長距離の故障を、最小の信号損失で検出しうるその能力は、精度が不可欠な大規模用途で高く評価されています。

「レイリー散乱・ブラッググレーティング方式セグメントが市場で最高のCAGRで成長する見込みです。」

この成長の主な要因は、ひずみや温度などのほぼすべての物理パラメーターを測定できることであり、このことがその価値を高めています。光散乱の原理を活用することで、伝搬効果を検出して強調することができ、物理的変化の正確なセンシングが可能になります。レイリーベースのセンサーは、振動や音響波をモニターするために作られた分散型音検知システムによく採用されています。さらに、ファイバーブラッグセンサーは非常に汎用性が高く、高温下の利用で優れた性能を発揮し、非常に正確なひずみ測定を実現します。低損失、電磁干渉への耐性、1本のファイバーに複数のグレーティングを多重化しマルチポイントセンシングを可能にする機能など、複数の利点があります。

「北米が予測期間に大きなシェアを占める見込みです。」

この地域の強力な石油・ガス産業は、分散型光ファイバーセンサー(DFOS)技術の大きな成長と進歩を生み出し続けています。米国運輸省によると、米国には世界最大の石油・ガスパイプラインネットワークがあり、そのパイプラインは200万kmを超えます。北米には全地域にわたって石油を輸送するパイプラインの広範なネットワークがあるため、DFOSシステムはパイプラインの完全性の維持、漏れの検出、流量保証の提供、その他のモニタリング機能に広く使用されています。シェールガス探査の成長は石油・ガス産業をさらに強化し、市場にプラスの影響を与えます。

当レポートでは、世界の分散型光ファイバーセンサー(DFOS)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 分散型光ファイバーセンサー(DFOS)市場の企業にとって魅力的な機会

- 分散型光ファイバーセンサー(DFOS)市場:ファイバータイプ別

- 分散型光ファイバーセンサー(DFOS)市場:散乱方式別

- 分散型光ファイバーセンサー(DFOS)市場:動作原理別

- 北米の分散型光ファイバーセンサー(DFOS)市場:ファイバータイプ別、国別

- 分散型光ファイバーセンサー(DFOS)市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 輸入シナリオ(HSコード9001)

- 輸出シナリオ(HSコード9001)

- 特許分析

- 主な会議とイベント(2024年~2025年)

- 関税と規制情勢

- 関税分析(HSコード9001)

- 規制機関、政府機関、その他の組織

- 規制

- 分散型光ファイバーセンサー(DFOS)市場に対する生成AI/AIの影響

- 価格分析

- 分散型光ファイバーセンサー(DFOS)の平均販売価格の動向:用途別(2020年~2023年)

- 分散型光ファイバーセンサー(DFOS)の平均販売価格の動向:地域別(2020年~2023年)

第6章 分散型光ファイバーセンサー(DFOS)市場:ファイバータイプ別

- イントロダクション

- シングルモード

- マルチモード

第7章 分散型光ファイバーセンサー(DFOS)市場:動作原理別

- イントロダクション

- OTDR

- OFDR

第8章 分散型光ファイバーセンサー(DFOS)市場:散乱方式別

- イントロダクション

- ラマン散乱方式

- レイリー散乱・ファイバーブラッググレーティング方式

- ブリルアン散乱方式

第9章 分散型光ファイバーセンサー(DFOS)市場:用途別

- イントロダクション

- 温度検知

- 音検知

- ひずみ検知

第10章 分散型光ファイバーセンサー(DFOS)市場:業界別

- イントロダクション

- 石油・ガス

- 電力・ユーティリティ

- 安全・セキュリティ

- 工業

- インフラ

- 通信

第11章 分散型光ファイバーセンサー(DFOS)市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- ロシア

- スカンジナビア

- 英国

- ドイツ

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インドネシア

- インド

- その他のアジア太平洋

- 中東

- 中東のマクロ経済の見通し

- サウジアラビア

- イラク

- イラン

- その他の中東

- その他の地域

- その他の地域のマクロ経済の見通し

- アフリカ

- 中南米

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2021年~2024年)

- 収益分析(2019年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標(2024年)

- ブランドの比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- SLB

- HALLIBURTON

- YOKOGAWA ELECTRIC CORPORATION

- WEATHERFORD

- LUNA INNOVATIONS INCORPORATED

- OFS FITEL, LLC

- BANDWEAVER

- OMNISENS

- AP SENSING

- DARKPULSE INC

- その他の企業

- AFL

- ARAGON PHOTONICS

- CORNING INCORPORATED

- FOTECH

- HIFI ENGINEERING INC.

- HAWK MEASUREMENT SYSTEMS

- NKT PHOTONICS A/S

- OPTROMIX, INC.

- OZ OPTICS LTD.

- SENSORNET

- SENSURON

- COM & SENS

- SOLIFOS

- VIAVI SOLUTIONS INC.

- ZIEBEL

第14章 付録

List of Tables

- TABLE 1 DISTRIBUTED FIBER OPTIC SENSOR MARKET: RISK ANALYSIS

- TABLE 2 ROLE OF COMPANIES IN DISTRIBUTED FIBER OPTIC SENSOR ECOSYSTEM

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 6 IMPORT DATA FOR HS CODE 9001-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 9001-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 8 LIST OF MAJOR PATENTS, 2023

- TABLE 9 LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 10 MFN TARIFF FOR HS CODE 9001-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2023 AND 2024 (USD)

- TABLE 11 MFN TARIFF FOR HS CODE 9001-COMPLIANT PRODUCTS EXPORTED BY JAPAN, 2023 AND 2024 (USD)

- TABLE 12 MFN TARIFF FOR HS CODE 9001-COMPLIANT PRODUCTS EXPORTED BY UK, 2023 AND 2024 (USD)

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2020-2023 (USD MILLION)

- TABLE 18 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2024-2030 (USD MILLION)

- TABLE 19 SINGLE-MODE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 20 SINGLE-MODE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 21 MULTI-MODE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 22 MULTI-MODE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 23 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2020-2023 (USD MILLION)

- TABLE 24 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2024-2030 (USD MILLION)

- TABLE 25 OPTICAL TIME DOMAIN REFLECTOMETRY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 26 OPTICAL TIME DOMAIN REFLECTOMETRY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 27 OPTICAL FREQUENCY DOMAIN REFLECTOMETRY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 28 OPTICAL FREQUENCY DOMAIN REFLECTOMETRY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 29 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY SCATTERING METHOD, 2020-2023 (USD MILLION)

- TABLE 30 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY SCATTERING METHOD, 2024-2030 (USD MILLION)

- TABLE 31 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 32 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 33 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 34 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (THOUSAND UNITS)

- TABLE 35 TEMPERATURE SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 36 TEMPERATURE SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 37 TEMPERATURE SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 TEMPERATURE SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 39 ACOUSTIC SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 40 ACOUSTIC SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 41 ACOUSTIC SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 ACOUSTIC SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 43 STRAIN SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 44 STRAIN SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 45 STRAIN SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 STRAIN SENSING: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 47 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 48 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 49 OIL & GAS: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 50 OIL & GAS: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 51 OIL & GAS: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 52 OIL & GAS: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 53 POWER & UTILITY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 54 POWER & UTILITY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 55 POWER & UTILITY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 POWER & UTILITY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 57 SAFETY & SECURITY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 58 SAFETY & SECURITY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 59 SAFETY & SECURITY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 SAFETY & SECURITY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 61 INDUSTRIAL: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 62 INDUSTRIAL: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 63 INDUSTRIAL: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 INDUSTRIAL: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 65 INFRASTRUCTURE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 66 INFRASTRUCTURE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 67 INFRASTRUCTURE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 INFRASTRUCTURE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 69 TELECOMMUNICATIONS: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 70 TELECOMMUNICATIONS: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 71 TELECOMMUNICATIONS: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 TELECOMMUNICATIONS: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 73 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2020-2023 (USD MILLION)

- TABLE 76 NORTH AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2024-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2020-2023 (USD MILLION)

- TABLE 78 NORTH AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2024-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 85 US: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 86 US: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 87 CANADA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 88 CANADA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 89 MEXICO: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 90 MEXICO: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 91 EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2020-2023 (USD MILLION)

- TABLE 92 EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2024-2030 (USD MILLION)

- TABLE 93 EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2020-2023 (USD MILLION)

- TABLE 94 EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2024-2030 (USD MILLION)

- TABLE 95 EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 96 EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 97 EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 98 EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 99 EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 100 EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 101 RUSSIA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 102 RUSSIA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 103 SCANDINAVIA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 104 SCANDINAVIA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 105 UK: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 106 UK: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 107 GERMANY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 108 GERMANY: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 109 REST OF EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 110 REST OF EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2020-2023 (USD MILLION)

- TABLE 112 ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2024-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2020-2023 (USD MILLION)

- TABLE 114 ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2024-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 116 ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 118 ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 120 ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 121 CHINA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 122 CHINA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 123 JAPAN: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 124 JAPAN: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 125 INDONESIA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 126 INDONESIA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 127 INDIA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 128 INDIA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 131 MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2020-2023 (USD MILLION)

- TABLE 132 MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2024-2030 (USD MILLION)

- TABLE 133 MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2020-2023 (USD MILLION)

- TABLE 134 MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2024-2030 (USD MILLION)

- TABLE 135 MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 136 MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 137 MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 138 MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 139 MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 140 MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 141 SAUDI ARABIA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 142 SAUDI ARABIA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 143 IRAQ: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 144 IRAQ: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 145 IRAN: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 146 IRAN: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 147 REST OF MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 148 REST OF MIDDLE EAST: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 149 ROW: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2020-2023 (USD MILLION)

- TABLE 150 ROW: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE, 2024-2030 (USD MILLION)

- TABLE 151 ROW: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2020-2023 (USD MILLION)

- TABLE 152 ROW: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE, 2024-2030 (USD MILLION)

- TABLE 153 ROW: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 154 ROW: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 155 ROW: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 156 ROW: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 157 ROW: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 158 ROW: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 159 AFRICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 160 AFRICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 161 SOUTH & CENTRAL AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 162 SOUTH & CENTRAL AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 163 SOUTH & CENTRAL AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 164 SOUTH & CENTRAL AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 165 BRAZIL: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 166 BRAZIL: DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 167 DISTRIBUTED FIBER OPTIC SENSOR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, APRIL 2021-SEPTEMBER 2024

- TABLE 168 DISTRIBUTED FIBER OPTIC SENSOR MARKET: DEGREE OF COMPETITION, 2023

- TABLE 169 DISTRIBUTED FIBER OPTIC SENSOR MARKET: REGION FOOTPRINT

- TABLE 170 DISTRIBUTED FIBER OPTIC SENSOR MARKET: APPLICATION FOOTPRINT

- TABLE 171 DISTRIBUTED FIBER OPTIC SENSOR MARKET: VERTICAL FOOTPRINT

- TABLE 172 DISTRIBUTED FIBER OPTIC SENSOR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 173 DISTRIBUTED FIBER OPTIC SENSOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 174 DISTRIBUTED FIBER OPTIC SENSOR MARKET: PRODUCT LAUNCHES, APRIL 2021-SEPTEMBER 2024

- TABLE 175 DISTRIBUTED FIBER OPTIC SENSOR MARKET: DEALS, APRIL 2021-SEPTEMBER 2024

- TABLE 176 SLB: COMPANY OVERVIEW

- TABLE 177 SLB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 178 SLB: DEALS

- TABLE 179 HALLIBURTON: COMPANY OVERVIEW

- TABLE 180 HALLIBURTON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 181 HALLIBURTON: DEALS

- TABLE 182 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 183 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 184 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 185 YOKOGAWA ELECTRIC CORPORATION: DEALS

- TABLE 186 WEATHERFORD: COMPANY OVERVIEW

- TABLE 187 WEATHERFORD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 188 WEATHERFORD: DEALS

- TABLE 189 LUNA INNOVATIONS INCORPORATED: COMPANY OVERVIEW

- TABLE 190 LUNA INNOVATIONS INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 191 LUNA INNOVATIONS INCORPORATED: DEALS

- TABLE 192 OFS FITEL, LLC: COMPANY OVERVIEW

- TABLE 193 OFS FITEL, LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 194 OFS FITEL, LLC: PRODUCT LAUNCHES

- TABLE 195 OFS FITEL, LLC: DEALS

- TABLE 196 BANDWEAVER: COMPANY OVERVIEW

- TABLE 197 BANDWEAVER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 198 BANDWEAVER: PRODUCT LAUNCHES

- TABLE 199 OMNISENS: COMPANY OVERVIEW

- TABLE 200 OMNISENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 AP SENSING: COMPANY OVERVIEW

- TABLE 202 AP SENSING: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 203 AP SENSING: PRODUCT LAUNCHES

- TABLE 204 AP SENSING: DEALS

- TABLE 205 DARKPULSE INC: COMPANY OVERVIEW

- TABLE 206 DARKPULSE INC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 207 DARKPULSE INC: DEALS

- TABLE 208 AFL: COMPANY OVERVIEW

- TABLE 209 ARAGON PHOTONICS: COMPANY OVERVIEW

- TABLE 210 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 211 FOTECH: COMPANY OVERVIEW

- TABLE 212 HIFI ENGINEERING INC.: COMPANY OVERVIEW

- TABLE 213 HAWK MEASUREMENT SYSTEMS: COMPANY OVERVIEW

- TABLE 214 NKT PHOTONICS A/S: COMPANY OVERVIEW

- TABLE 215 OPTROMIX: COMPANY OVERVIEW

- TABLE 216 OZ OPTICS LTD.: COMPANY OVERVIEW

- TABLE 217 SENSORNET: COMPANY OVERVIEW

- TABLE 218 SENSURON: COMPANY OVERVIEW

- TABLE 219 COM & SENS: COMPANY OVERVIEW

- TABLE 220 SOLIFOS: COMPANY OVERVIEW

- TABLE 221 VIAVI SOLUTIONS INC.: COMPANY OVERVIEW

- TABLE 222 ZIEBEL: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DISTRIBUTED FIBER OPTIC SENSOR MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DISTRIBUTED FIBER OPTIC SENSOR MARKET: RESEARCH DESIGN

- FIGURE 3 DISTRIBUTED FIBER OPTIC SENSOR MARKET: RESEARCH FLOW

- FIGURE 4 DISTRIBUTED FIBER OPTIC SENSOR MARKET: BOTTOM-UP APPROACH

- FIGURE 5 DISTRIBUTED FIBER OPTIC SENSOR MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 6 DISTRIBUTED FIBER OPTIC SENSOR MARKET: TOP-DOWN APPROACH

- FIGURE 7 DISTRIBUTED FIBER OPTIC SENSOR MARKET: DATA TRIANGULATION

- FIGURE 8 DISTRIBUTED FIBER OPTIC SENSOR MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 DISTRIBUTED FIBER OPTIC SENSOR MARKET: RESEARCH LIMITATIONS

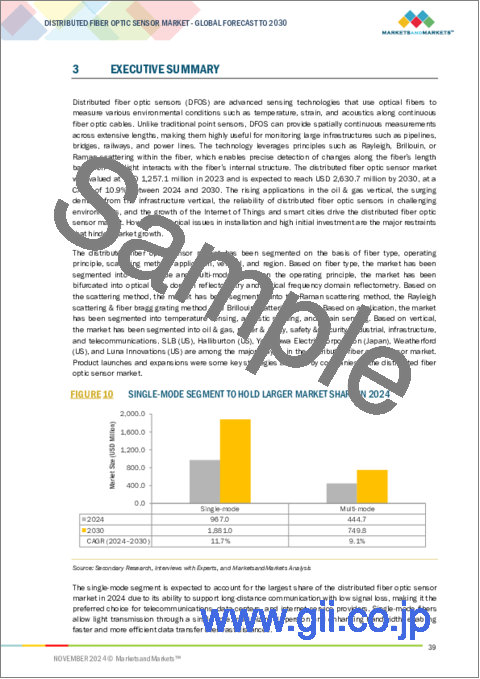

- FIGURE 10 SINGLE-MODE SEGMENT TO HOLD LARGER MARKET SHARE IN 2024

- FIGURE 11 RAYLEIGH SCATTERING & BRAGG GRATING METHOD SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 OPTICAL TIME DOMAIN REFLECTOMETRY SEGMENT TO DOMINATE MARKET BETWEEN 2024 AND 2030

- FIGURE 13 TEMPERATURE SENSING SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2024

- FIGURE 14 INFRASTRUCTURE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 16 INCREASING DEMAND FOR ADVANCED MONITORING SOLUTIONS TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 17 SINGLE-MODE SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2030

- FIGURE 18 RAMAN SCATTERING METHOD SEGMENT TO DOMINATE DISTRIBUTED FIBER OPTIC SENSOR MARKET FROM 2024 TO 2030

- FIGURE 19 OPTICAL TIME DOMAIN REFLECTOMETRY SEGMENT TO HOLD LARGER MARKET SHARE IN 2024

- FIGURE 20 SINGLE-MODE SEGMENT AND US TO ACCOUNT FOR LARGEST SHARES OF NORTH AMERICAN DISTRIBUTED FIBER OPTIC SENSOR MARKET IN 2024

- FIGURE 21 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL DISTRIBUTED FIBER OPTIC SENSOR MARKET BETWEEN 2024 AND 2030

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 IMPACT ANALYSIS: DRIVERS

- FIGURE 24 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 25 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 26 IMPACT ANALYSIS: CHALLENGES

- FIGURE 27 VALUE CHAIN ANALYSIS

- FIGURE 28 DISTRIBUTED FIBER OPTIC SENSOR ECOSYSTEM

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2023-2024

- FIGURE 31 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 34 IMPORT DATA FOR HS CODE 9001-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 35 EXPORT DATA FOR HS CODE 9001-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 36 PATENTS APPLIED AND GRANTED, 2013-2023

- FIGURE 37 IMPACT OF GEN AI/AI ON DISTRIBUTED FIBER OPTIC SENSOR MARKET

- FIGURE 38 AVERAGES SELLING PRICE TREND OF DISTRIBUTED FIBER OPTIC SENSORS, BY APPLICATION, 2020-2023

- FIGURE 39 AVERAGES SELLING PRICE TREND OF DISTRIBUTED FIBER OPTIC SENSORS FOR TEMPERATURE SENSING APPLICATIONS, BY REGION, 2020-2023

- FIGURE 40 SINGLE-MODE SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 41 NUMBER OF INTERNET USERS, 2019-2023

- FIGURE 42 OPTICAL TIME DOMAIN REFLECTOMETRY SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 43 PERCENTAGE OF FIBER CONNECTIONS IN TOTAL FIXED BROADBAND, DECEMBER 2023

- FIGURE 44 RAMAN SCATTERING METHOD SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 45 TEMPERATURE SENSING SEGMENT TO DOMINATE DISTRIBUTED FIBER OPTIC SENSOR MARKET FROM 2024 TO 2030

- FIGURE 46 OIL & GAS SEGMENT TO DOMINATE DISTRIBUTED FIBER OPTIC SENSOR MARKET DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 48 NORTH AMERICA: DISTRIBUTED FIBER OPTIC SENSOR MARKET SNAPSHOT

- FIGURE 49 US TO DOMINATE NORTH AMERICAN DISTRIBUTED FIBER OPTIC SENSOR MARKET FROM 2024 TO 2030

- FIGURE 50 EUROPE: DISTRIBUTED FIBER OPTIC SENSOR MARKET SNAPSHOT

- FIGURE 51 RUSSIA TO HOLD LARGEST SHARE OF EUROPEAN DISTRIBUTED FIBER OPTIC SENSOR MARKET IN 2024

- FIGURE 52 ASIA PACIFIC: DISTRIBUTED FIBER OPTIC SENSOR MARKET SNAPSHOT

- FIGURE 53 CHINA TO CAPTURE LARGEST SHARE OF ASIA PACIFIC DISTRIBUTED FIBER OPTIC SENSOR MARKET IN 2030

- FIGURE 54 DISTRIBUTED FIBER OPTIC SENSOR MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019-2023

- FIGURE 55 MARKET SHARE ANALYSIS OF KEY PLAYERS OFFERING DISTRIBUTED FIBER OPTIC SENSORS, 2023

- FIGURE 56 COMPANY VALUATION, 2024

- FIGURE 57 FINANCIAL METRICS, 2024 (EV/EBITDA)

- FIGURE 58 DISTRIBUTED FIBER OPTIC SENSOR MARKET: BRAND COMPARISON

- FIGURE 59 DISTRIBUTED FIBER OPTIC SENSOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 60 DISTRIBUTED FIBER OPTIC SENSOR MARKET: COMPANY FOOTPRINT

- FIGURE 61 DISTRIBUTED FIBER OPTIC SENSOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 62 SLB: COMPANY SNAPSHOT

- FIGURE 63 HALLIBURTON: COMPANY SNAPSHOT

- FIGURE 64 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 WEATHERFORD: COMPANY SNAPSHOT

- FIGURE 66 LUNA INNOVATIONS INCORPORATED: COMPANY SNAPSHOT

The market for distributed fiber optic sensors (DFOS) is projected to increase at a compound annual growth rate (CAGR) of 10.9% from 2024 to 2030, from an estimated USD 1,411.7 million in 2024 to USD 2,630.7 million by 2030. The oil and gas industry is undergoing fast automation and digitization, where highly advanced monitoring technologies are needed to ensure high safety and efficiency during operation. This may lead to a significant growth in the distributed fiber optic sensors (DFOS) market. The need to impose effective structural health monitoring in buildings, bridges, and tunnels, among others, around the world is also fueling the use of DFOS systems, offering real-time, accurate, and distributed sensing capabilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Fiber Type, Operating Principle, Scattering Process, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Market for optical time domain reflectometry to hold larger market share during the forecast period."

The optical time domain reflectometry (OTDR) held a larger share in the market of the distributed fiber optic sensor due to its established reputation in terms of reliability and accuracy in testing and monitoring the fiber optic across various industries, most notably telecommunications, oil & gas, and infrastructure. Its ability to detect faults over long distances, often with minimal signal loss, highly values it for large-scale applications where precision is essential.

"Rayleigh scattering and Bragg grating method segment to grow at the highest CAGR for distributed fiber optic sensor market."

Rayleigh scattering and Bragg grating method method is expected to grow at the highest CAGR in the distributed fiber optic sensor market. The key factor behind this growth being its capability to measure nearly all physical parameters such as strain and temperature, which drives its value. By leveraging the light scattering principle, it can detect and highlight propagating effects, enabling precise sensing of physical changes. Rayleigh-based sensors are often employed in distributed acoustic sensing systems that are created to monitor vibrations and acoustic waves. Additionally, Fiber Bragg sensors are highly versatile and can perform well in high temperature applications and provide very accurate strain measurements. They offer several advantages, including low loss, immunity to electromagnetic interference, and the capability to multiplex multiple gratings along a single fiber, enabling multi-point sensing.

"North America is expected to hold significant share during the forecast timeline."

North America is expected to dominate in terms of market share in the distributed fiber optic sensor market during the forecast period. The strong oil and gas industry in the region continues to create significant growth and advancements for the distributed fiber optic sensor technology. According to the US Department of Transportation, the US has the largest oil & gas pipeline network in the world, with more than 2 million km of pipelines. As North America has an extensive network of pipelines transporting oil all across the regions, DFOS systems are widely used for pipeline integrity maintenance, leakage detection, flow assurance provision, and other monitoring functions. Growth in shale gas exploration will further intensify the oil & gas industry, and this should have a positive impact on the market.

Extensive primary interviews were conducted with key industry experts in the distributed fiber optic sensor market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The break-up of primary participants for the report has been shown below: The break-up of the profile of primary participants in the distributed fiber optic sensor market:

- By Company Type: Tier 1 - 25%, Tier 2 - 35%, and Tier 3 - 40%

- By Designation: C-Level Executives - 30%, Directors - 40%, Others - 30%

- By Region: North America - 35%, Europe - 30%, Asia Pacific - 25%, ROW- 10%

The report profiles key players in the distributed fiber optic sensor market. Prominent players profiled in this report are SLB (US), Halliburton (US), Yokogawa Electric Corporation (Japan), Weatherford (US), Luna Innovations Incorporated (US), Omnisens (Switzerland), OFS Fitel, LLC (US), Bandweaver (UK), AP Sensing (Germany), and DarkPulse Inc (US), among others.

Apart from this, AFL (US), Aragon Photonics (Spain), Corning Incorporated (US), FOTECH (UK), Hifi Engineering Inc. (Canada), Hawk Measurement Systems (Australia), NKT Photonics A/S (Denmark), Optromix, Inc. (US), OZ Optics Ltd. (Canada), Sensornet (UK), SENSURON (US), Com & Sens (Belgium), Solifos (Switzerland), VIAVI Solutions Inc. (US), Ziebel (US), are among a few emerging companies in the distributed fiber optic sensor market.

Research Coverage: This research report categorizes the distributed fiber optic sensor market based on fiber type (single-mode, multi-mode), operating principle, (optical time domain reflectometry, optical frequency domain reflectometry), application (temperature sensing, acoustic sensing, strain sensing), scattering method (Raman scattering method, Rayleigh scattering & Bragg grating method, Brillouin scattering method), vertical (oil & gas, power & utility, safety & security, industrial, infrastructure, telecommunications, others), and region (North America, Middle East, Europe, Asia Pacific, RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the distributed fiber optic sensor market and forecasts the same till 2030. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the distributed fiber optic sensor ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall distributed fiber optic sensor market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities. The report provides insights on the following pointers:

- Analysis of key drivers (rapid digitalization and automation in oil & gas sector, rising emphasis on efficient structural health monitoring, and rise in smart cities and adoption of Internet of Things), restraints (technical issues associated with installing distributed sensors), opportunities (stringent statutory regulations regarding leak detection, growing emphasis on data-driven decision-making, rising implementation of stringent regulations to reduce emissions), and challenges (High costs of distributed sensor technologies) influencing the growth of the distributed fiber optic sensor market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the distributed fiber optic sensor market.

- Market Development: Comprehensive information about lucrative markets - the report analysis the distributed fiber optic sensor market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the distributed fiber optic sensor market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like SLB (US), Halliburton (US), Yokogawa Electric Corporation (Japan), Weatherford (US), Luna Innovations Incorporated (US), among others in the distributed fiber optic sensor market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DISTRIBUTED FIBER OPTIC SENSOR MARKET

- 4.2 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE

- 4.3 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY SCATTERING METHOD

- 4.4 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE

- 4.5 DISTRIBUTED FIBER OPTIC SENSOR MARKET IN NORTH AMERICA, BY FIBER TYPE AND COUNTRY

- 4.6 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid digitalization and automation in oil & gas sector

- 5.2.1.2 Rising emphasis on efficient structural health monitoring

- 5.2.1.3 Increasing innovation in sensors to improve wellbore surveillance

- 5.2.1.4 Rise in smart cities and adoption of Internet of Things

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technical issues associated with installing distributed sensors

- 5.2.2.2 High initial investments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing emphasis on data-driven decision-making

- 5.2.3.2 Increasing offshore drilling and oil & gas exploration

- 5.2.3.3 Rising implementation of stringent regulations to reduce emissions

- 5.2.4 CHALLENGES

- 5.2.4.1 High costs of distributed sensor technologies

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Quasi-distributed sensing

- 5.6.1.2 Distributed sensing

- 5.6.1.3 Interferometry

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Internet of Things

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Wireless sensor networks

- 5.6.1 KEY TECHNOLOGIES

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 THREAT OF NEW ENTRANTS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 AP SENSING PROVIDES DISTRIBUTED ACOUSTIC SENSING SOLUTION FOR POWER CABLE FAULT DETECTION IN EUROPE

- 5.10.2 DEUTSCHE BAHN UTILIZES AP SENSING'S N52-SERIES DISTRIBUTED ACOUSTIC SENSING UNIT TO PREVENT CABLE THEFT

- 5.10.3 PUBLIC WORKS AUTHORITY OF QATAR INSTALLS AP SENSING LINEAR HEAT DETECTION DEVICES FOR MONITORING PURPOSES

- 5.10.4 SLB INTRODUCES WELLWATCHER BRITEBLUE HT DISTRIBUTED TEMPERATURE SENSING FIBER TO MONITOR STEAM FLOOD OPERATING TEMPERATURE IN CANADA

- 5.10.5 SLB DEPLOYS HIGH DEFINITION VERTICAL SEISMIC DAS SYSTEM FOR BOREHOLE SEISMIC SURVEY IN BELGIUM

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 9001)

- 5.11.2 EXPORT SCENARIO (HS CODE 9001)

- 5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS (HS CODE 9001)

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 REGULATIONS

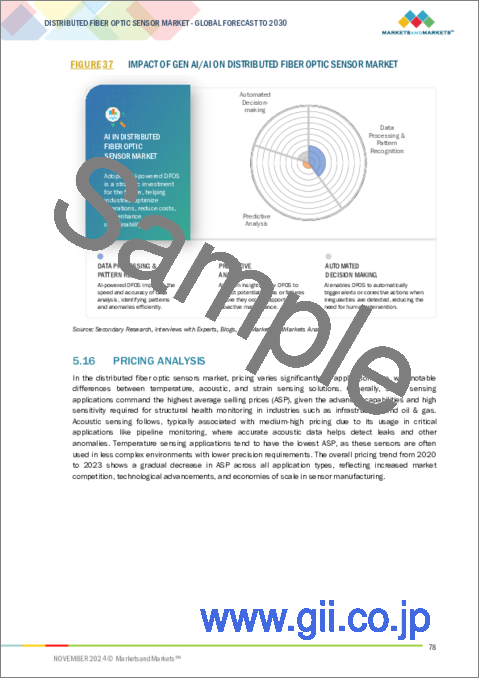

- 5.15 IMPACT OF GEN AI/AI ON DISTRIBUTED FIBER OPTIC SENSOR MARKET

- 5.16 PRICING ANALYSIS

- 5.16.1 AVERAGE SELLING PRICE TREND OF DISTRIBUTED FIBER OPTIC SENSORS, BY APPLICATION, 2020-2023

- 5.16.2 AVERAGE SELLING PRICE TREND OF DISTRIBUTED FIBER OPTIC SENSORS, BY REGION, 2020-2023

6 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY FIBER TYPE

- 6.1 INTRODUCTION

- 6.2 SINGLE-MODE

- 6.2.1 RISING DEMAND FOR HIGH-SPEED, LONG-DISTANCE DATA TRANSMISSION TO FOSTER SEGMENTAL GROWTH

- 6.3 MULTI-MODE

- 6.3.1 INCREASING USE IN SHORT-DISTANCE, HIGH-DENSITY ENVIRONMENTS TO ACCELERATE SEGMENTAL GROWTH

7 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY OPERATING PRINCIPLE

- 7.1 INTRODUCTION

- 7.2 OPTICAL TIME DOMAIN REFLECTOMETRY

- 7.2.1 INCREASING ADOPTION OF FIBER OPTIC NETWORKS IN TELECOM, DATA CENTER, AND OTHER INDUSTRIES TO DRIVE MARKET

- 7.3 OPTICAL FREQUENCY DOMAIN REFLECTOMETRY

- 7.3.1 RISING NEED TO CLOSELY EXAMINE HYDROGEOLOGICAL PROCESSES TO BOOST SEGMENTAL GROWTH

8 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY SCATTERING METHOD

- 8.1 INTRODUCTION

- 8.2 RAMAN SCATTERING METHOD

- 8.2.1 MOUNTING DEMAND FOR REAL-TIME TEMPERATURE MONITORING IN OIL & GAS AND OTHER INDUSTRIES TO EXPEDITE SEGMENTAL GROWTH

- 8.3 RAYLEIGH SCATTERING & FIBER BRAGG GRATING METHOD

- 8.3.1 RISING NEED FOR PRECISE, LONG-DISTANCE INFRASTRUCTURE MONITORING TO BOLSTER SEGMENTAL GROWTH

- 8.4 BRILLOUIN SCATTERING METHOD

- 8.4.1 INCREASING FOCUS ON DUAL-PARAMETER MONITORING IN STRUCTURAL HEALTH APPLICATIONS TO DRIVE MARKET

9 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 TEMPERATURE SENSING

- 9.2.1 BURGEONING DEMAND FOR ACCURATE, LONG-RANGE, AND RELIABLE MONITORING TECHNOLOGIES TO DRIVE MARKET

- 9.3 ACOUSTIC SENSING

- 9.3.1 INCREASING FOCUS ON MONITORING AND SURVEILLANCE OF PIPELINE SYSTEMS TO FOSTER SEGMENTAL GROWTH

- 9.4 STRAIN SENSING

- 9.4.1 MOUNTING ADOPTION OF SMART INFRASTRUCTURE AND IOT-DRIVEN SYSTEMS TO CONTRIBUTE TO SEGMENTAL GROWTH

10 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 OIL & GAS

- 10.2.1 RISING DEPLOYMENT OF DISTRIBUTED ACOUSTIC SENSING SYSTEMS TO MONITOR AND CONTROL PIPELINE SYSTEMS TO DRIVE MARKET

- 10.3 POWER & UTILITY

- 10.3.1 RAPID EXPANSION OF ALL-FIBER NETWORKS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.4 SAFETY & SECURITY

- 10.4.1 INCREASING NEED FOR REAL-TIME, CONTINUOUS MONITORING OF CRITICAL INFRASTRUCTURE TO AUGMENT SEGMENTAL GROWTH

- 10.5 INDUSTRIAL

- 10.5.1 RISING INTEGRATION OF IOT AND OTHER ADVANCED TECHNOLOGIES INTO AUTOMATION SOLUTIONS TO BOLSTER SEGMENTAL GROWTH

- 10.6 INFRASTRUCTURE

- 10.6.1 GROWING EMPHASIS ON MONITORING HERITAGE STRUCTURES USING FIBER OPTIC SENSORS TO FUEL SEGMENTAL GROWTH

- 10.7 TELECOMMUNICATIONS

- 10.7.1 MOUNTING DEMAND FOR HIGH-SPEED DATA TRANSMISSION AND BANDWIDTH TO CONTRIBUTE TO SEGMENTAL GROWTH

11 DISTRIBUTED FIBER OPTIC SENSOR MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing production of oil and related products to contribute to market growth

- 11.2.3 CANADA

- 11.2.3.1 Growing emphasis on fire and safety measures to accelerate market growth

- 11.2.4 MEXICO

- 11.2.4.1 Rising focus on preventing hazardous incidents in oil & gas sector to foster market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 RUSSIA

- 11.3.2.1 Rising investment in energy & defense sectors to drive market

- 11.3.3 SCANDINAVIA

- 11.3.3.1 Increasing penetration of renewable energy in Scandinavian countries to spur market growth

- 11.3.4 UK

- 11.3.4.1 Burgeoning demand for structural health monitoring solutions to boost market growth

- 11.3.5 GERMANY

- 11.3.5.1 Rapid infrastructure development to contribute to market growth

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Rising focus on meeting energy demand to contribute to market growth

- 11.4.3 JAPAN

- 11.4.3.1 Increasing export of liquefied natural gas to augment market growth

- 11.4.4 INDONESIA

- 11.4.4.1 Ongoing oil & gas exploration activities to bolster market growth

- 11.4.5 INDIA

- 11.4.5.1 Rapid expansion of power transmission networks to fuel market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST

- 11.5.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 11.5.2 SAUDI ARABIA

- 11.5.2.1 Rising oil & gas production projects to boost market growth

- 11.5.3 IRAQ

- 11.5.3.1 Increasing focus on infrastructure modernization to augment market growth

- 11.5.4 IRAN

- 11.5.4.1 Rising government initiatives related to oil & gas production to spur market growth

- 11.5.5 REST OF MIDDLE EAST

- 11.6 ROW

- 11.6.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.6.2 AFRICA

- 11.6.2.1 Rising government initiatives to enhance industrial sector to drive market

- 11.6.3 SOUTH & CENTRAL AMERICA

- 11.6.3.1 Brazil

- 11.6.3.1.1 High government expenditure on infrastructure to accelerate market growth

- 11.6.3.2 Argentina

- 11.6.3.2.1 Thriving industrial and safety & security verticals to expedite market growth

- 11.6.3.3 Venezuela

- 11.6.3.3.1 Escalating oil & gas production and infrastructure modernization to foster market growth

- 11.6.3.4 Rest of South & Central America

- 11.6.3.1 Brazil

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 12.3 REVENUE ANALYSIS, 2019-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Application footprint

- 12.7.5.4 Vertical footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SLB

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 HALLIBURTON

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 YOKOGAWA ELECTRIC CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 WEATHERFORD

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 LUNA INNOVATIONS INCORPORATED

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services/Solutions offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 OFS FITEL, LLC

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services/Solutions offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 BANDWEAVER

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services/Solutions offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 OMNISENS

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services/Solutions offered

- 13.1.9 AP SENSING

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services/Solutions offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 DARKPULSE INC

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services/Solutions offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.1 SLB

- 13.2 OTHER PLAYERS

- 13.2.1 AFL

- 13.2.2 ARAGON PHOTONICS

- 13.2.3 CORNING INCORPORATED

- 13.2.4 FOTECH

- 13.2.5 HIFI ENGINEERING INC.

- 13.2.6 HAWK MEASUREMENT SYSTEMS

- 13.2.7 NKT PHOTONICS A/S

- 13.2.8 OPTROMIX, INC.

- 13.2.9 OZ OPTICS LTD.

- 13.2.10 SENSORNET

- 13.2.11 SENSURON

- 13.2.12 COM & SENS

- 13.2.13 SOLIFOS

- 13.2.14 VIAVI SOLUTIONS INC.

- 13.2.15 ZIEBEL

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS