|

|

市場調査レポート

商品コード

1834230

医薬品包装の世界市場 (~2030年):原材料 (プラスチック・紙&板紙・ガラス・金属)・タイプ (プラスチックボトル・ブリスター・キャップ&クロージャー・ラベル&付属品・プレフィルドシリンジ)・投与経路・地域別Pharmaceutical Packaging Market by Raw Material (Plastic, Paper & Paperboard, Glass, Metal), Type (Plastic Bottles, Blisters, Caps & Closures, Labels & Accessories, Prefilled Syringes), Drug Delivery, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医薬品包装の世界市場 (~2030年):原材料 (プラスチック・紙&板紙・ガラス・金属)・タイプ (プラスチックボトル・ブリスター・キャップ&クロージャー・ラベル&付属品・プレフィルドシリンジ)・投与経路・地域別 |

|

出版日: 2025年10月01日

発行: MarketsandMarkets

ページ情報: 英文 314 Pages

納期: 即納可能

|

概要

医薬品包装の市場規模は、2025年の1,748億5,000万米ドルから、予測期間中はCAGR 15.8%で推移し、2030年には3,641億1,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル)・数量 (キロトン) |

| セグメント | タイプ, 包装タイプ, 投与経路, 原材料, 地域 |

| 対象地域 | 北米、アジア太平洋、欧州、中東・アフリカ、南米 |

病院、調剤薬局、オンライン薬局などで安全性・信頼性・患者中心の包装ソリューションに対する需要が高まっており、医薬品包装市場は現在、大きな成長機会を迎えています。医薬品包装は、製品の完全性を維持し、汚染を防止し、安全で便利な投与を可能にする役割を担っています。さらに、規制および安全性に基づく要件の強化に伴い、FDAや欧州医薬品庁(EMA)は、包装材料、シリアライゼーション、偽造防止に関する基準をさらに厳格化していく見込みです。また、製薬企業は今後、改ざん防止、チャイルドレジスタント、スマート包装などの高度な包装システムの開発を進めていくと考えられます。こうした取り組みは、安全性・法規制の遵守・小児向け包装を重視し、RFIDやQRコードを活用したトレーサビリティ技術など、デジタル包装技術の導入をさらに後押しします。医薬品包装は、今後の医療提供体制の進化において、医薬品の安全性・真正性・患者特化機能への投資を支える重要な役割を果たすでしょう。

"包装タイプ別では、一次包装が予測期間中に最も急成長する見通し"

このセグメントは、特にバイオ医薬品や注射剤などの高感度医薬品において、薬剤の安定性・無菌性・患者の安全性を直接確保する役割を果たすため成長が見込まれます。たとえば、プレフィルドシリンジ、ブリスターパック、バイアル、アンプルなどへの需要拡大は、製薬業界の生産増加と患者の利便性志向を反映しています。さらに、一次包装は改ざん防止・偽造対策およびシリアライゼーションへの対応の面でも重要です。バリアコーティング、スマートラベル、チャイルドレジスタントキャップなどの進歩が、機能性と需要をさらに高め、世界の医療市場全体で普及を後押ししています。

"原材料別では、紙・板紙が予測期間中に第2位の市場シェアを占める見通し"

この包装タイプは主に二次・三次包装に使用されます。紙・板紙素材のリサイクル性やコスト面での優位性、プラスチック削減を求める社会的・法的要請への対応が評価されています。紙箱、リーフレット、ラベルなどは、投与指示の表示、シリアライゼーション、偽造防止、環境配慮型廃棄などで重要な役割を果たしています。特に循環型経済の理念に基づき、プラスチック使用を抑える動きが強まっており、こうした流れは先進国市場における紙ベース包装需要の拡大を後押ししています。

"アジア太平洋地域が予測期間中、第2位の市場シェアを占める見通し"

2024年、アジア太平洋地域は世界の医薬品包装市場で第2位のシェアを占めました。この地域の成長の主因は、中国・インド・日本などの新興国を中心とした製薬産業基盤の拡大にあります。医療費の増加、中間層の拡大、医療サービスへのアクセス改善により、医薬品需要が増加し、それに伴って高度な医薬品包装への需要も拡大しています。また、慢性疾患の増加や、国内医薬品サプライチェーンの整備を目指す政府政策も市場拡大を後押ししています。さらに、医薬品の受託製造や包装サービスが成長を続けており、大手企業による投資の増加によって、低コストかつ効率的な生産体制が確立されています。これらの要素が組み合わさることで、アジア太平洋地域は今後も世界の医薬品包装市場の成長を牽引する主要拠点となると見込まれています。

当レポートでは、世界の医薬品包装の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/混乱

- エコシステム分析

- バリューチェーン分析

- 規制状況

- 貿易分析

- 価格分析

- 技術分析

- 特許分析

- ケーススタディ分析

- 主要な会議とイベント

- 投資と資金調達のシナリオ

- 生成AI/AIが医薬品包装市場に与える影響

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- マクロ経済分析

- 2025年の米国関税が医薬品包装市場に与える影響

第6章 医薬品包装市場:包装タイプ別

- 一次包装

- 二次包装

第7章 医薬品包装市場:原材料別

- プラスチック

- 高密度ポリエチレン

- ポリエステル

- ポリプロピレン

- 低密度ポリエチレン

- ポリ塩化ビニル

- 環状オレフィン共重合体

- ポリエチレンテレフタレート

- 紙・板紙

- ガラス

- 金属

- その他の原材料

第8章 医薬品包装市場:投与経路別

- 経口

- 局所

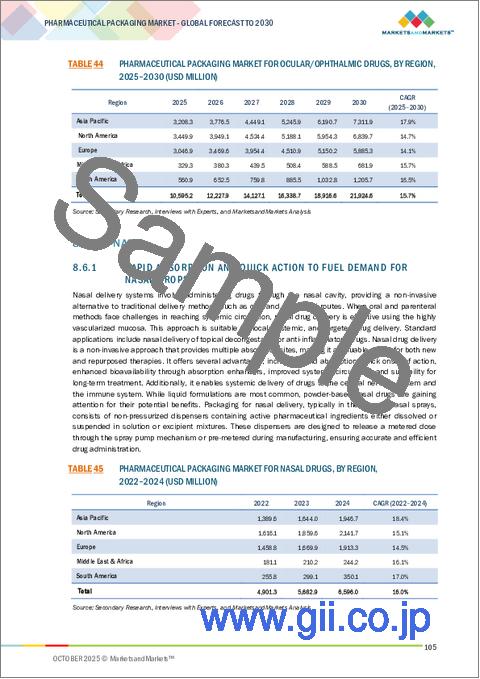

- 点眼

- 経鼻

- 経肺

- 経皮

- 静脈内

- その他

第9章 医薬品包装市場:タイプ別

- プラスチックボトル

- 標準プラスチックボトル

- プラスチックディスペンサーボトル

- プラスチックジャー

- ブリスターパック

- コンパートメントパック

- ウォレットパック

- ラベル・付属品

- 粘着

- ダイカット

- ホログラフィックストリップ

- 改ざん防止

- その他

- キャップ・クロージャー

- 医療用特殊バッグ

- プレフィルドシリンジ

- 温度管理包装

- パウチ&ストリップパック

- アンプル

- バイアル

- プレフィルド吸入器

- 定量噴霧式吸入器

- ドライパウダー吸入器

- 投薬チューブ

- 複合チューブ

- オールプラスチックチューブ

- 折りたたみ式金属チューブ

- 瓶・キャニスター

- カートリッジ

- その他

第10章 医薬品包装市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- スペイン

- ロシア

- その他

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他

第11章 競合情勢

- 概要

- 主要企業の戦略

- 市場シェア分析

- 収益分析

- 企業評価と財務指標

- 製品/ブランド比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- AMCOR PLC(INCLUDING BERRY GLOBAL)

- GERRESHEIMER AG

- SCHOTT AG

- APTARGROUP, INC.

- BD

- WESTROCK COMPANY

- NIPRO

- CATALENT, INC

- SEALED AIR

- WEST PHARMACEUTICAL SERVICES, INC.

- その他の企業

- ALPLA

- ARDAGH GROUP S.A.

- CCL INDUSTRIES INC.

- FRANK NOE

- GAPLAST GMBH

- LONZA

- MONDI

- NOLATO AB

- ORIGIN PHARMA PACKAGING

- COMAR

- BILCARE LIMITED

- SGD PHARMA

- SILGAN PLASTICS

- VETTER PHARMA INTERNATIONAL GMBH

- SVAM TOYAL PACKAGING INDUSTRIES PVT. LTD.