|

|

市場調査レポート

商品コード

1295437

マイクロ灌漑システムの世界市場:種類別 (点滴式・マイクロスプリンクラー式)・作物の種類別 (果樹園作物・ブドウ園、畑作物、プランテーション作物)・エンドユーザー別 (農家、産業ユーザー)・地域別 (北米、欧州、APAC、南米、RoW) の将来予測 (2028年まで)Microirrigation Systems Market by Type (Drip & Micro-sprinkler), Crop Type (Orchard crops & vineyards, Field Crops, Plantation Crops), End User (Farmers, Industrial Users ), & Region( NA, Europe, APAC, South America, RoW) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| マイクロ灌漑システムの世界市場:種類別 (点滴式・マイクロスプリンクラー式)・作物の種類別 (果樹園作物・ブドウ園、畑作物、プランテーション作物)・エンドユーザー別 (農家、産業ユーザー)・地域別 (北米、欧州、APAC、南米、RoW) の将来予測 (2028年まで) |

|

出版日: 2023年06月13日

発行: MarketsandMarkets

ページ情報: 英文 270 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のマイクロ灌漑システムの市場規模は、2022年の104億米ドルから、2028年には178億米ドルに達し、予測期間中に9.4%のCAGR (金額ベース) で成長すると予測されています。

マイクロ灌漑システム市場には、点滴式とマイクロスプリンクラー式の2種類があり、点滴式の方が市場シェアは大きいですが、マイクロスプリンクラー式は高価値作物への使用率が高いなどの要因によって促進されています。マイクロ灌漑システム市場における点滴式の需要は、主に幅広い作物におけるカルシウムの使用量の増加などの要因によるものです。主な制約と課題は、初期投資が高いこと、継続的なメンテナンスが必要なこと、補助金が適切に償還されないことであり、これがマイクロ灌漑システム市場の成長を妨げています。

"種類別では点滴式マイクロ灌漑システムが、予測期間中に高い需要が見込まれる"

点滴式灌漑は、広く普及している価値の高い商業作物に非常に適していると考えられており、油糧種子・豆類・綿花・小麦の畑に適用されることが増えています。この灌漑システムは、起伏のある地形、なだらかな地形、やせた土地、土壌層が浅い地域でも効率的に運用できることが調査で証明されています。これが点滴式灌漑の利点です。世界の人口増加とそれに伴う農産物の需要増を考えると、耕作面積を増やす必要があります。マイクロ灌漑施設、特に点滴式灌漑は、耕作面積を拡大するための実行可能な方法です。点滴式灌漑システムは、灌漑効率はもちろんのこと、雑草の繁殖を抑え、人件費や肥料の節約にも役立ちます。点滴式マイクロ灌漑システムによってもたらされるこれらすべての利点が、その市場と高い需要を牽引しています。

"作物の種類別では、果樹園作物・ブドウ園がマイクロ灌漑システム市場を独占する"

灌漑スケジュールは、ブドウの木の需要に合わせて正確に管理することができ、収量と果実の品質向上が期待できます。チューブ上に等間隔に配置された放出装置により、各植物に均一に水が行き渡ります。放出装置とその流量・間隔は、栽培されているブドウの樹齢と土壌の質によって異なります。マイクロ灌漑はその柔軟性で知られています。各システムは、ブドウ園のニーズに合わせてカスタム設計され、植物の根の部分に最適な水分を維持します。植物の根に直接散水するため、水の無駄が最小限に抑えられ、点滴式システムは最大95%の均一性で作動します。そのため、これらのシステムは干ばつに悩まされる地域に最適です。その結果、これらのシステムは主に果樹園やブドウ園で使用されています。このように、果樹園作物・ブドウ園がマイクロ灌漑システム市場を独占しています。

"アジア太平洋は予測期間中に市場成長に大きく貢献する"

アジア太平洋 (中国、オーストラリア、インド、タイ、インドネシア、フィリピン、ウズベキスタン、カザフスタンなど) マイクロ灌漑システム市場は、人口の増加、急速な都市化、可処分所得の増加といった要因により成長しています。特に、農業がこの地域で最大の雇用先であることが、灌漑システムの需要創出に大きく影響しています。

さらに、マレーシア、ベトナム、インドネシア、インドといった主要国は中所得国であり、食料自給率を上げるためにマイクロ灌漑活動への補助金を増やそうとしています。中国のような国々は灌漑システムへの支出を増やそうとしており、この地域での成長が予測されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- サプライチェーン分析

- 技術分析

- 価格動向分析

- 市場マッピングとエコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- ケーススタディ

- 関税・規制状況

- 規制の枠組み

第7章 マイクロ灌漑システム市場:種類別

- イントロダクション

- 点滴式

- マイクロスプリンクラー式

第8章 マイクロ灌漑システム市場:作物の種類別

- イントロダクション

- 果樹園作物・ブドウ畑

- 畑作物

- プランテーション作物

- その他の種類の作物

第9章 マイクロ灌漑システム市場:エンドユーザー別

- イントロダクション

- 農家

- 産業ユーザー

- その他のエンドユーザー

第10章 マイクロ灌漑システム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- スペイン

- ロシア

- イタリア

- フランス

- ウクライナ

- アゼルバイジャン

- その他の欧州

- アジア太平洋

- 中国

- オーストラリア

- インド

- タイ

- インドネシア

- フィリピン

- ウズベキスタン

- カザフスタン

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- ペルー

- チリ

- その他の南米

- その他の地域 (ROW)

- 南アフリカ

- サウジアラビア

- その他のROW

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場シェア分析

- 主要企業の収益分析

- 評価クアドラント・マトリックス:主要企業

- 評価クアドラント・マトリックス:その他の企業

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- JAIN IRRIGATION SYSTEMS LTD.

- THE TORO COMPANY

- NETAFIM

- NELSON IRRIGATION

- RAIN BIRD CORPORATION

- FINOLEX PLASSON

- MAHINDRA EPC IRRIGATION LIMITED

- T-L IRRIGATION

- HUNTER INDUSTRIES

- RIVULIS

- CHINADRIP IRRIGATION EQUIPMENT CO., LTD.

- ELGO IRRIGATION LTD.

- ANTELCO

- MICROJET

- IRRITEC S.P.A

- その他の企業

- RAINDRIP

- KOTHARI GROUP

- METRO IRRIGATION

- DRTS

- DRIPWORKS

- HARVEL AGUA INDIA PRIVATE LIMITED

- JALDHARADRIP

- SHANGHAI IRRIST CORP. LTD.

- GOLDENKEY

- HEIBEI PLENTIRAIN IRRIGATION EQUIPMENT LTD.

第13章 隣接・関連市場

- イントロダクション

- 制限事項

- 点滴灌漑市場

- 灌漑自動化市場

第14章 付録

According to MarketsandMarkets, the microirrigation systems market is projected to reach USD 17.8 billion by 2028 from USD 10.4 billion in 2022, at a CAGR of 9.4% during the forecast period in terms of value. The probiotics in the animal feed market comprises of both drip and micro sprinkler types; although the drip form holds a larger market share, the micro-sprinkler type is driven by factors such as their high usage for high-value crops. The demand for drip type in microirrigation systems market is mainly due to factors such as increased usage of calcium on a wide range of crops. The major constraints and challenges are high initial investment, continuous maintenance requirements, and lack of timely reimbursement for subsidies which, in turn, hinder the growth of the microirrigation systems market.

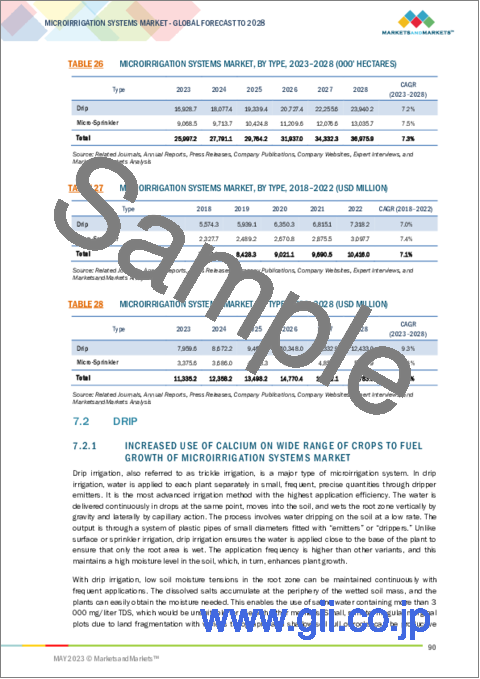

"By type, drip microirrigation system is projected in high demand during the forecast period."

Drip irrigation is considered to be highly suitable for widespread and highly valued commercial crops, it is increasingly being applied to fields of oilseeds, pulses, cotton, and wheat. Research has proven that this system of irrigation can also be operated efficiently in undulating terrains, rolling topography, barren lands, and areas with shallow soil layers. This is an advantage that drip irrigation offers. Given the constant pressure of the global population and the resultant requirement of agricultural commodities, there is a need to increase the area under cultivation. Microirrigation facilities, particularly drip irrigation, are viable methods of expanding the area under cultivation. Apart from irrigation efficiency, drip irrigation systems help in saving labor costs and fertilizers used with less weed growth. All these benefits imparted by drip microirrigation system is driving its market and high demand.

"By crop type, orchard crops & vineyards is expected to dominate the market for microirrigation systems"

Irrigation scheduling can be managed precisely to meet grapevine demands, holding the promise of increased yield and fruit quality. Emitters evenly spaced on the tubing ensure that water is distributed uniformly to each plant. The emission device and its flow rate and spacing depend on the age of the vines being grown and the soil texture. Microirrigation is known for its flexibility. Each system is custom designed to fit the needs of the vineyard to maintain optimum moisture at the plant root zone. As they apply water directly to a plant's roots, a minimal amount of water is wasted, and drip systems can operate at up to 95 percent uniformity. These systems are therefore perfect for drought-plagued areas. As a result, these systems are majorly used for orchard crops and vineyards. Thus, the crop type is dominating the microirrigation systems market.

Asia Pacific will significantly contribute towards market growth during the forecast period

Geographically, the region is segmented as China, Australia, India, Thailand, Indonesia, Philippines, Uzbekistan, Kazakhstan along with Rest of Asia Pacific. The microirrigiation systems market in Asia-Pacific is growing primarily due to factors such as growth in population, rapid urbanization in the Asia Pacific region, rise in disposable incomes, and specifically due to agriculture as the primary occupation in these regions that creates demand for irrigation systems.

Moreover, Major countries, such as Malaysia, Vietnam, Indonesia, and India, are middle-income countries and are working toward increasing subsidies in microirrigation activities to obtain self-sufficiency in terms of food products. Countries such as China are seeking to increase spending on irrigation systems and are projected to grow in the region.

The break-up of Primaries:

By Company Type: Tier1-45%, Tier 2-33%, Tier 3- 22%

By Designation: C-level-45%, D-level - 33%, and Others- 22%

By Region: North America - 10%, Asia Pacific - 50%, Europe - 15%, South America-13%, RoW - 12%,

Others include sales managers, territory managers, and product managers.

Leading players profiled in this report:

- Jain Irrigation Systems Ltd.

- The Toro Company

- Netafim

- Nelson Irrigation

- Rain Bird Corporation

- Finolex Plasson

- Mahindra EPC Irrigations Limited

- T-L Irrigation

- HUNTER INDUSTRIES

- Rivulis

- Chinadrip Irrigation Equipment co., Ltd.

- Elgo Irrigation Ltd.

- Antelco

- Microjet

- Irritec S.p.A

- Rain drip

- Kothari Group

- Metro Irrigation

- DRTS

- Dripworks

- Harvel Agua India Private Limited

- JALDHARADRIP

- Shanghai Irrist Corp., Ltd.

- Goldenkey

- Heibei Plentirain Irrigation Equipment Ltd

The study includes an in-depth competitive analysis of these key players in the microirrigation systems market with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the microirrigation systems market on the basis of Type, Crop Type, End User, and Region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global microirrigation systems market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall microirrigation systems market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (efficient usage of water resources in drought conditions), restraints (continuous maintenance requirements), opportunities (public and private support for irrigation projects in developing countries), and challenges (absence of proper monitoring agency leads to product duplication) influencing the growth of the microirrigation systems market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the probiotics in the microirrigation systems market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the microirrigation systems market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the microirrigation systems market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Jain Irrigations Systems Ltd., The Toro Company, Netafim, Nelson Irrigation, and Rain Bird Corporation are among others in the microirrigation systems market strategies. The report also helps stakeholders understand the microirrigation systems market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 MICROIRRIGATION SYSTEMS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MICROIRRIGATION SYSTEMS MARKET SIZE ESTIMATION (SUPPLY-SIDE)

- 2.2.2 MICROIRRIGATION SYSTEMS MARKET SIZE ESTIMATION (DEMAND-SIDE)

- FIGURE 3 MICROIRRIGATION SYSTEMS MARKET: BOTTOM-UP APPROACH

- 2.2.3 TOP-DOWN APPROACH

- FIGURE 4 MICROIRRIGATION SYSTEMS MARKET: TOP-DOWN APPROACH

- 2.3 GROWTH RATE FORECAST ASSUMPTION

- 2.4 DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.5 RECESSION IMPACT

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 2 MICROIRRIGATION SYSTEMS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 6 MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 7 MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2022 (BY VALUE)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MICROIRRIGATION SYSTEMS MARKET

- FIGURE 10 NEED TO SHIFT FROM TRADITIONAL IRRIGATION METHODS TO TECHNOLOGICALLY ADVANCED SYSTEMS TO DRIVE MARKET GROWTH

- 4.2 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY TYPE AND KEY COUNTRY

- FIGURE 11 DRIP SEGMENT AND CHINA ACCOUNTED FOR SIGNIFICANT SHARE IN 2022

- 4.3 MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE

- FIGURE 12 ORCHARD CROPS & VINEYARDS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 MICROIRRIGATION SYSTEMS MARKET, BY TYPE

- FIGURE 13 DRIP SEGMENT TO ACCOUNT FOR LARGER SHARE BY 2028

- 4.5 MICROIRRIGATION SYSTEMS MARKET, BY END USER

- FIGURE 14 FARMERS SEGMENT TO LEAD MARKET DURING BY 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 15 GLOBAL IRRIGATED AREA, BY SOCIOECONOMIC INDICATOR, 2018

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASE IN POPULATION DENSITY

- FIGURE 16 GLOBAL POPULATION, BY REGION, 2021

- FIGURE 17 POPULATION GROWTH TREND, 1950-2050

- 5.2.2 DISTRIBUTION AND AVAILABILITY OF WATER FOR IRRIGATION

- 5.2.2.1 Rates of water withdrawal

- FIGURE 18 SECTOR-WISE WATER WITHDRAWAL, BY REGION, 2020

- TABLE 3 COUNTRIES WITH LARGEST AGRICULTURAL WATER WITHDRAWALS IN 2020

- FIGURE 19 GLOBAL SECTOR-WISE WATER WITHDRAWAL, 2020

- 5.2.2.2 Area under irrigation

- TABLE 4 LAND AREA EQUIPPED FOR IRRIGATION, BY KEY COUNTRY, 2019

- 5.3 MARKET DYNAMICS

- FIGURE 20 MICROIRRIGATION SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Need for efficient use of water resources in drought conditions

- 5.3.1.2 Demand for technologically advanced irrigation systems

- TABLE 5 COMPARISON BETWEEN FLOOD IRRIGATION AND CENTER PIVOT SYSTEMS

- 5.3.1.3 Low cost of advanced irrigation techniques

- TABLE 6 COMPARISON OF WATER REQUIREMENTS IN DRIP AND SURFACE IRRIGATION FOR HORTICULTURAL CROPS

- 5.3.1.4 High yield requirements for limited area

- TABLE 7 YIELD IMPROVEMENT USING DRIP IRRIGATION, BY CROP, 2019

- 5.3.1.5 Rapid growth in greenhouse vegetable production

- 5.3.1.6 Preference for use of AI in microirrigation systems

- 5.3.2 RESTRAINTS

- 5.3.2.1 High initial investment

- TABLE 8 COST OF MICRO-SPRINKLER IRRIGATION SYSTEMS

- TABLE 9 COST OF DRIP IRRIGATION SYSTEMS

- 5.3.2.2 Need for continuous maintenance

- TABLE 10 COMPARISON OF OPERATING COSTS FOR DIFFERENT SPRINKLER SYSTEMS

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Global presence of agricultural and food companies

- 5.3.3.2 Public and private support for irrigation projects in developing countries

- 5.3.3.3 Expanding microfinance networks

- 5.3.4 CHALLENGES

- 5.3.4.1 Delayed reimbursement of subsidies

- FIGURE 21 US: NET FARM INCOME, 2012-2022 (USD BILLION)

- 5.3.4.2 Absence of monitoring agencies

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 22 PRODUCTION PROCESS TO CONTRIBUTE MAJOR VALUE TO OVERALL PRICE OF MICROIRRIGATION SYSTEMS

- 6.2.1 RESEARCH & RAW MATERIAL

- 6.2.2 MANUFACTURING

- 6.2.3 ASSEMBLY

- 6.2.4 DISTRIBUTION

- 6.2.5 MARKETING & SALES

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 23 ROLE OF DISTRIBUTORS IN SUPPLYING MICROIRRIGATION SYSTEMS TO FARMERS

- 6.3.1 PROMINENT COMPANIES

- 6.3.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 6.3.3 END USERS

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 PRESSURE-COMPENSATING DRIPPERS

- 6.4.2 SELF-FLUSHING DRIPPERS

- 6.5 PRICE TREND ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE, BY TYPE

- FIGURE 24 GLOBAL AVERAGE SELLING PRICE, BY TYPE, 2020-2022

- TABLE 11 MICROIRRIGATION SYSTEMS: AVERAGE SELLING PRICE, BY REGION, 2020-2022 (USD PER HECTARE)

- TABLE 12 AVERAGE SELLING PRICE OFFERED BY KEY PLAYERS, BY TYPE, 2022 (USD PER HECTARE)

- 6.6 MARKET MAPPING AND ECOSYSTEM ANALYSIS

- 6.6.1 UPSTREAM

- 6.6.2 PROVIDERS OF RAW MATERIALS FOR MICROIRRIGATION SYSTEMS

- 6.6.3 REGULATORY BODIES & CERTIFICATION PROVIDERS

- FIGURE 25 MICROIRRIGATION SYSTEMS MARKET MAPPING

- TABLE 13 SUPPLY CHAIN ECOSYSTEM

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.8 TRADE ANALYSIS

- TABLE 14 EXPORT VALUE OF DISPERSING APPLIANCES, BY KEY COUNTRY, 2022

- TABLE 15 IMPORT VALUE OF DISPERSING APPLIANCES, BY KEY COUNTRY, 2022

- TABLE 16 EXPORT VALUE OF DISPERSING APPLIANCES, BY KEY COUNTRY, 2021

- TABLE 17 IMPORT VALUE OF DISPERSING APPLIANCES, BY KEY COUNTRY, 2021

- 6.9 PATENT ANALYSIS

- FIGURE 27 PATENTS GRANTED FOR MICROIRRIGATION SYSTEMS MARKET, 2013-2022

- FIGURE 28 TOTAL NUMBER OF PATENTS GRANTED, BY REGION, 2013-2022

- TABLE 18 PATENTS PERTAINING TO MICROIRRIGATION SYSTEMS, 2013-2022

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.10.2 BARGAINING POWER OF SUPPLIERS

- 6.10.3 BARGAINING POWER OF BUYERS

- 6.10.4 THREAT FROM NEW ENTRANTS

- 6.10.5 THREAT FROM SUBSTITUTES

- 6.11 CASE STUDIES

- 6.11.1 NETAFIM LIMITED SOUGHT ADVANCED MICROIRRIGATION TECHNOLOGY TO INTEGRATE AUTOMATED IRRIGATION CONTROL

- 6.11.2 KEY PLAYERS FOCUSED ON PARTNERSHIPS AND COLLABORATIONS WITH LOCAL PLAYERS TO PROVIDE HIGH-QUALITY PRODUCTS

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.13 REGULATORY FRAMEWORK

- 6.13.1 NORTH AMERICA

- 6.13.1.1 US

- 6.13.1.2 Canada

- 6.13.2 EUROPE

- 6.13.3 ASIA PACIFIC

- 6.13.3.1 China

- 6.13.3.2 India

- 6.13.3.2.1 Quality specifications for laterals

- TABLE 24 QUALITY PARAMETERS FOR LATERALS

- 6.13.1 NORTH AMERICA

7 MICROIRRIGATION SYSTEMS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 29 DRIP SEGMENT TO LEAD MARKET BY 2028

- TABLE 25 MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 26 MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 27 MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 28 MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2 DRIP

- 7.2.1 INCREASED USE OF CALCIUM ON WIDE RANGE OF CROPS TO FUEL GROWTH OF MICROIRRIGATION SYSTEMS MARKET

- TABLE 29 DRIP: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (000' HECTARES)

- TABLE 30 DRIP: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (000' HECTARES)

- TABLE 31 DRIP: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 DRIP: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 MICRO-SPRINKLER

- 7.3.1 NEED FOR HIGH-VALUE CROPS TO DRIVE USE OF MICRO-SPRINKLERS

- TABLE 33 MICRO-SPRINKLER: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (000' HECTARES)

- TABLE 34 MICRO-SPRINKLER: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (000' HECTARES)

- TABLE 35 MICRO-SPRINKLER: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 MICRO-SPRINKLER: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE

- 8.1 INTRODUCTION

- FIGURE 30 ORCHARD CROPS & VINEYARDS SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2028

- TABLE 37 MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 38 MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 8.2 ORCHARD CROPS & VINEYARDS

- 8.2.1 HIGH-PROFIT MARGINS AND INCREASED EXPORT OF ORCHARD CROPS TO ENCOURAGE ADOPTION OF MICROIRRIGATION SYSTEMS

- TABLE 39 ORCHARD CROPS & VINEYARDS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 ORCHARD CROPS & VINEYARDS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 FIELD CROPS

- 8.3.1 INCREASING CONCERNS OVER WATER SCARCITY IN FIELD CROPS TO DRIVE DEMAND FOR MICROIRRIGATION SYSTEMS

- TABLE 41 FIELD CROPS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 FIELD CROPS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 PLANTATION CROPS

- 8.4.1 NEED FOR IMPROVED YIELD AND HIGH AGRICULTURAL EFFICIENCY TO DRIVE DEMAND FOR MICROIRRIGATION SYSTEMS

- TABLE 43 PLANTATION CROPS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 44 PLANTATION CROPS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 OTHER CROP TYPES

- TABLE 45 OTHER CROP TYPES: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 OTHER CROP TYPES: MICROIRRIGATION SYSTEMS MARKET, 2023-2028 (USD MILLION)

9 MICROIRRIGATION SYSTEMS MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 31 FARMERS SEGMENT TO LEAD MARKET BY 2028

- TABLE 47 MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 48 MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 9.2 FARMERS

- 9.2.1 INCREASE IN GOVERNMENT SUPPORT TO DRIVE USE OF MICROIRRIGATION SYSTEMS BY FARMERS

- TABLE 49 FARMERS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 FARMERS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 INDUSTRIAL USERS

- 9.3.1 RISING COMMERCIALIZED FARMING IN DEVELOPING COUNTRIES TO DRIVE DEMAND FOR MICROIRRIGATION SYSTEMS

- TABLE 51 INDUSTRIAL USERS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 INDUSTRIAL USERS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 OTHER END USERS

- TABLE 53 OTHER END USERS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 OTHER END USERS: MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 MICROIRRIGATION SYSTEMS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 32 INDIA AND CHINA TO ACHIEVE SIGNIFICANT GROWTH DURING FORECAST PERIOD

- TABLE 55 MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (000' HECTARES)

- TABLE 56 MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (000' HECTARES)

- TABLE 57 MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 MICROIRRIGATION SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 33 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET SNAPSHOT

- 10.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 34 NORTH AMERICA: RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 59 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2018-2022 (000' HECTARES)

- TABLE 60 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2023-2028 (000' HECTARES)

- TABLE 61 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2023-2028 (000' HECTARES)

- TABLE 64 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 65 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Federal subsidies and increase in scope of automation to drive adoption of microirrigation systems

- TABLE 71 US: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 72 US: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 73 US: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 74 US: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Increase in agricultural production and awareness among farmers to drive demand for microirrigation systems

- TABLE 75 CANADA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 76 CANADA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 77 CANADA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 78 CANADA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.4 MEXICO

- 10.2.4.1 Government policies and high water tariffs to encourage farmers to adopt microirrigation systems

- TABLE 79 MEXICO: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 80 MEXICO: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 81 MEXICO: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 82 MEXICO: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 35 EUROPE: RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 83 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2018-2022 (000' HECTARES)

- TABLE 84 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2023-2028 (000' HECTARES)

- TABLE 85 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 86 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 87 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 88 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 89 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 90 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 91 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 92 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 93 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 94 EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 10.3.2 SPAIN

- 10.3.2.1 Increased cultivation to drive demand for efficient irrigation systems

- TABLE 95 SPAIN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 96 SPAIN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 97 SPAIN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 98 SPAIN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.3 RUSSIA

- 10.3.3.1 Scarcity of rainfall to drive demand for efficient irrigation technologies

- TABLE 99 RUSSIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 100 RUSSIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 101 RUSSIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 102 RUSSIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Abundance of vineyards to encourage demand for microirrigation systems

- TABLE 103 ITALY: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 104 ITALY: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 105 ITALY: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 106 ITALY: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 Rise in population and increased food production to drive microirrigation systems market growth

- TABLE 107 FRANCE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 108 FRANCE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 109 FRANCE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 110 FRANCE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.6 UKRAINE

- 10.3.6.1 Increased export of grains, oilseeds, and vegetable oils to drive use of microirrigation systems

- TABLE 111 UKRAINE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 112 UKRAINE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 113 UKRAINE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 114 UKRAINE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.7 AZERBAIJAN

- 10.3.7.1 Consistent efforts by government to supplement deployment of microirrigation systems to drive market growth

- TABLE 115 AZERBAIJAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 116 AZERBAIJAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 117 AZERBAIJAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 118 AZERBAIJAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- 10.3.8 REST OF EUROPE

- TABLE 119 REST OF EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 120 REST OF EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 121 REST OF EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 122 REST OF EUROPE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET SNAPSHOT

- 10.4.1 RECESSION IMPACT ANALYSIS

- FIGURE 37 ASIA PACIFIC: RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 123 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2018-2022 (000' HECTARES)

- TABLE 124 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2023-2028 (000' HECTARES)

- TABLE 125 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 128 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 129 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Increase in market reach of domestic players and government support to drive microirrigation systems market growth

- TABLE 135 CHINA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 136 CHINA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 137 CHINA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 138 CHINA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.3 AUSTRALIA

- 10.4.3.1 High water tariffs and government incentives for water conservation to drive growth of drip irrigation market

- TABLE 139 AUSTRALIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 140 AUSTRALIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 141 AUSTRALIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 142 AUSTRALIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Government subsidies and concerns over water scarcity to encourage drip irrigation market growth

- TABLE 143 INDIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 144 INDIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 145 INDIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 146 INDIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.5 THAILAND

- 10.4.5.1 Rise in government support to encourage growth of microirrigation systems

- TABLE 147 THAILAND: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 148 THAILAND: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 149 THAILAND: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 150 THAILAND: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.6 INDONESIA

- 10.4.6.1 Need for increased agricultural productivity to drive use of microirrigation systems

- TABLE 151 INDONESIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 152 INDONESIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 153 INDONESIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 154 INDONESIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.7 PHILIPPINES

- 10.4.7.1 Substantial increase in irrigated land to drive microirrigation systems market growth

- TABLE 155 PHILIPPINES: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 156 PHILIPPINES: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 157 PHILIPPINES: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 158 PHILIPPINES: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.8 UZBEKISTAN

- 10.4.8.1 Water scarcity and arid conditions to drive demand for microirrigation systems

- TABLE 159 UZBEKISTAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 160 UZBEKISTAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 161 UZBEKISTAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 162 UZBEKISTAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.9 KAZAKHSTAN

- 10.4.9.1 Increase in employment in agricultural sector to contribute to growth of microirrigation systems market

- TABLE 163 KAZAKHSTAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 164 KAZAKHSTAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 165 KAZAKHSTAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 166 KAZAKHSTAN: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- 10.4.10 REST OF ASIA PACIFIC

- TABLE 167 REST OF ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 168 REST OF ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 169 REST OF ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5 SOUTH AMERICA

- 10.5.1 RECESSION IMPACT ANALYSIS

- FIGURE 38 SOUTH AMERICA: RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 171 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2018-2022 (000' HECTARES)

- TABLE 172 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2023-2028 (000' HECTARES)

- TABLE 173 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 174 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 175 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 176 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARE)

- TABLE 177 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 178 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 179 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 180 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 181 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 182 SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 10.5.2 BRAZIL

- 10.5.2.1 Increase in government regulations on water use to support growth of microirrigation systems market

- TABLE 183 BRAZIL: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 184 BRAZIL: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 185 BRAZIL: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 186 BRAZIL: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.3 ARGENTINA

- 10.5.3.1 Rising government initiatives to encourage growth of microirrigation systems market

- TABLE 187 ARGENTINA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 188 ARGENTINA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 189 ARGENTINA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 190 ARGENTINA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.4 COLOMBIA

- 10.5.4.1 High growth potential of irrigation technologies to drive microirrigation systems market

- TABLE 191 COLOMBIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 192 COLOMBIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 193 COLOMBIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 194 COLOMBIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.5 PERU

- 10.5.5.1 Government initiatives to expand irrigation industry to contribute to growth of microirrigation systems market

- TABLE 195 PERU: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 196 PERU: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 197 PERU: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 198 PERU: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.6 CHILE

- 10.5.6.1 Water scarcity and drought-like conditions to drive use of advanced microirrigation systems

- TABLE 199 CHILE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 200 CHILE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 201 CHILE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 202 CHILE: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.7 REST OF SOUTH AMERICA

- TABLE 203 REST OF SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 204 REST OF SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 205 REST OF SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 206 REST OF SOUTH AMERICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.6 REST OF THE WORLD

- 10.6.1 RECESSION IMPACT ANALYSIS

- FIGURE 39 ROW: RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 207 ROW: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY/REGION, 2018-2022 (000' HECTARES)

- TABLE 208 ROW: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY/REGION, 2023-2028 (000' HECTARES)

- TABLE 209 ROW: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY/REGION, 2018-2022 (USD MILLION)

- TABLE 210 ROW: MICROIRRIGATION SYSTEMS MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- TABLE 211 ROW: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 212 ROW: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 213 ROW: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 214 ROW: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 215 ROW: MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 216 ROW: MICROIRRIGATION SYSTEMS MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 217 ROW: MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2018-2022 (USD MILLION)

- TABLE 218 ROW: MICROIRRIGATION SYSTEMS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 10.6.2 SOUTH AFRICA

- 10.6.2.1 Demand for drip irrigation systems among small-scale farmers to drive microirrigation systems market

- TABLE 219 SOUTH AFRICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 220 SOUTH AFRICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 221 SOUTH AFRICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 222 SOUTH AFRICA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.6.3 SAUDI ARABIA

- 10.6.3.1 Increasing use of microirrigation methods for greenhouse production to drive market demand

- TABLE 223 SAUDI ARABIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 224 SAUDI ARABIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 225 SAUDI ARABIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 226 SAUDI ARABIA: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.6.4 OTHERS IN ROW

- TABLE 227 OTHERS IN ROW: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (000' HECTARES)

- TABLE 228 OTHERS IN ROW: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (000' HECTARES)

- TABLE 229 OTHERS IN ROW: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 230 OTHERS IN ROW: MICROIRRIGATION SYSTEMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- TABLE 231 MICROIRRIGATION SYSTEMS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 11.4 REVENUE ANALYSIS FOR KEY PLAYERS

- FIGURE 40 REVENUE ANALYSIS FOR KEY PLAYERS, 2020-2022 (USD MILLION)

- 11.5 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 41 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2022

- 11.5.5 COMPANY FOOTPRINT FOR KEY PLAYERS

- TABLE 232 COMPANY FOOTPRINT FOR KEY PLAYERS, BY TYPE

- TABLE 233 COMPANY FOOTPRINT FOR KEY PLAYERS, BY CROP TYPE

- TABLE 234 COMPANY FOOTPRINT FOR KEY PLAYERS, BY REGION

- TABLE 235 COMPANY OVERALL FOOTPRINT FOR KEY PLAYERS

- 11.6 EVALUATION QUADRANT MATRIX FOR OTHER PLAYERS

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 42 EVALUATION QUADRANT MATRIX FOR OTHER PLAYERS, 2022

- 11.6.5 COMPETITIVE BENCHMARKING FOR OTHER PLAYERS

- TABLE 236 DETAILED LIST OF OTHER PLAYERS

- TABLE 237 COMPETITIVE BENCHMARKING FOR OTHER PLAYERS, 2022

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- TABLE 238 MICROIRRIGATION SYSTEMS MARKET: PRODUCT LAUNCHES, 2020-2021

- 11.7.2 DEALS

- TABLE 239 MICROIRRIGATION SYSTEMS MARKET: DEALS, 2020-2023

- 11.7.3 OTHERS

- TABLE 240 MICROIRRIGATION SYSTEMS MARKET: OTHERS, 2021-2023

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1 KEY PLAYERS

- 12.1.1 JAIN IRRIGATION SYSTEMS LTD.

- TABLE 241 JAIN IRRIGATION SYSTEMS LTD.: BUSINESS OVERVIEW

- FIGURE 43 JAIN IRRIGATION SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 242 JAIN IRRIGATION SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 243 JAIN IRRIGATION SYSTEMS LTD.: DEALS

- 12.1.2 THE TORO COMPANY

- TABLE 244 THE TORO COMPANY: BUSINESS OVERVIEW

- FIGURE 44 THE TORO COMPANY: COMPANY SNAPSHOT

- TABLE 245 THE TORO COMPANY: PRODUCT LAUNCHES

- TABLE 246 THE TORO COMPANY: DEALS

- 12.1.3 NETAFIM

- TABLE 247 NETAFIM: BUSINESS OVERVIEW

- TABLE 248 NETAFIM: PRODUCT LAUNCHES

- TABLE 249 NETAFIM: DEALS

- TABLE 250 NETAFIM: OTHERS

- 12.1.4 NELSON IRRIGATION

- TABLE 251 NELSON IRRIGATION: BUSINESS OVERVIEW

- 12.1.5 RAIN BIRD CORPORATION

- TABLE 252 RAIN BIRD CORPORATION: BUSINESS OVERVIEW

- TABLE 253 RAIN BIRD CORPORATION: PRODUCT LAUNCHES

- 12.1.6 FINOLEX PLASSON

- TABLE 254 FINOLEX PLASSON: BUSINESS OVERVIEW

- 12.1.7 MAHINDRA EPC IRRIGATION LIMITED

- TABLE 255 MAHINDRA EPC IRRIGATION LIMITED: BUSINESS OVERVIEW

- FIGURE 45 MAHINDRA EPC IRRIGATION LIMITED: COMPANY SNAPSHOT

- 12.1.8 T-L IRRIGATION

- TABLE 256 T-L IRRIGATION: BUSINESS OVERVIEW

- 12.1.9 HUNTER INDUSTRIES

- TABLE 257 HUNTER INDUSTRIES: BUSINESS OVERVIEW

- TABLE 258 HUNTER INDUSTRIES: PRODUCT LAUNCHES

- 12.1.10 RIVULIS

- TABLE 259 RIVULIS: BUSINESS OVERVIEW

- TABLE 260 RIVULIS: DEALS

- TABLE 261 RIVULIS: OTHERS

- 12.1.11 CHINADRIP IRRIGATION EQUIPMENT CO., LTD.

- TABLE 262 CHINADRIP IRRIGATION EQUIPMENT CO., LTD.: BUSINESS OVERVIEW

- TABLE 263 CHINADRIP IRRIGATION EQUIPMENT CO., LTD.: PRODUCT LAUNCHES

- 12.1.12 ELGO IRRIGATION LTD.

- TABLE 264 ELGO IRRIGATION LTD.: BUSINESS OVERVIEW

- 12.1.13 ANTELCO

- TABLE 265 ANTELCO: BUSINESS OVERVIEW

- 12.1.14 MICROJET

- TABLE 266 MICROJET: BUSINESS OVERVIEW

- 12.1.15 IRRITEC S.P.A

- TABLE 267 IRRITEC S.P.A: BUSINESS OVERVIEW

- TABLE 268 IRRITEC S.P.A: DEALS

- TABLE 269 IRRITEC S.P.A: OTHERS

- 12.2 OTHER PLAYERS

- 12.2.1 RAINDRIP

- TABLE 270 RAINDRIP: BUSINESS OVERVIEW

- 12.2.2 KOTHARI GROUP

- TABLE 271 KOTHARI GROUP: BUSINESS OVERVIEW

- 12.2.3 METRO IRRIGATION

- TABLE 272 METRO IRRIGATION: BUSINESS OVERVIEW

- 12.2.4 DRTS

- TABLE 273 DRTS: BUSINESS OVERVIEW

- 12.2.5 DRIPWORKS

- TABLE 274 DRIPWORKS: BUSINESS OVERVIEW

- 12.2.6 HARVEL AGUA INDIA PRIVATE LIMITED

- 12.2.7 JALDHARADRIP

- 12.2.8 SHANGHAI IRRIST CORP. LTD.

- 12.2.9 GOLDENKEY

- 12.2.10 HEIBEI PLENTIRAIN IRRIGATION EQUIPMENT LTD.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 275 ADJACENT MARKETS

- 13.2 LIMITATIONS

- 13.3 DRIP IRRIGATION MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- TABLE 276 DRIP IRRIGATION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 13.4 IRRIGATION AUTOMATION MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- TABLE 277 IRRIGATION AUTOMATION MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS