|

|

市場調査レポート

商品コード

1509568

人数カウントシステムの世界市場:取付プラットフォーム別、オファリング別、タイプ別、技術別、最終用途別、地域別 - 2029年までの予測People Counting System Market by Type (Unidirectional, Bidirectional), Technology (Infrared Beam, Thermal Imaging, Video-Based), Offering (Hardware, Software), End-use Application & Region( North America, Europe, APAC, ROW) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 人数カウントシステムの世界市場:取付プラットフォーム別、オファリング別、タイプ別、技術別、最終用途別、地域別 - 2029年までの予測 |

|

出版日: 2024年07月04日

発行: MarketsandMarkets

ページ情報: 英文 241 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

人数カウントシステムの市場規模は、2024年の12億米ドルから成長し、2029年には21億米ドルに達すると予測されており、2024年から2029年までのCAGRは11.6%になるとみられています。

人数カウントシステムは、任意の時間に特定のエリアにいる個人の数に関する有益な情報を得ることができます。これは、イベント会場や火災安全規制の対象となる建物の収容人数を管理する上で非常に重要です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 取付プラットフォーム別、オファリング別、タイプ別、技術別、最終用途別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、その他の地域 |

ビデオベースの技術を搭載した人数カウントシステムは柔軟性が高く、これらのシステムは、カウントされた人数だけでなく、顧客の行動パターン、特定の場所での滞留時間、人口統計などのデータを収集できる可能性があります。さらに、ビデオ分析とAIの進歩により、照明や障害物が変化するような厳しい環境でも、高精度の人数カウントが可能です。

小売業は、人数カウントデータを活用することで、リアルタイムで実際の消費者トラフィックに基づいて労働力レベルを改善することができます。これにより、混雑時に十分な人員が確保され、顧客からの問い合わせに対応したり、会計処理を迅速化したりすることが保証されます。小売業者は、消費者の動線パターンを調べることで、交通量の多い地域やボトルネックの可能性を発見することができます。リスクの高いエリアに戦略的にセキュリティ・スタッフを配置することで、ロス防止の取り組みに非常に重要な役割を果たすことができます。

当レポートでは、世界の人数カウントシステム市場について調査し、取付プラットフォーム別、オファリング別、タイプ別、技術別、最終用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- エコシステム分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ

- 投資と資金調達のシナリオ

- 技術分析

- 貿易分析

- 関税分析

- 特許分析

- 規制状況

- 2024年~2025年の主な会議とイベント

- 価格分析

第6章 人数カウントシステム市場(取付プラットフォーム別)

- イントロダクション

- 天井

- 壁

- 床

第7章 人数カウントシステム市場(オファリング別)

- イントロダクション

- ハードウェア

- ソフトウェア

第8章 人数カウントシステム市場(タイプ別)

- イントロダクション

- 一方向

- 双方向

第9章 人数カウントシステム市場(技術別)

- イントロダクション

- 赤外線ビーム

- 熱画像

- ビデオベース

- その他

第10章 人数カウントシステム市場(最終用途別)

- イントロダクション

- 小売

- 輸送

- 企業

- ホスピタリティ

- 銀行業務

- ヘルスケア

- スポーツとエンターテイメント

- その他

第11章 人数カウントシステム市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2023年

- 収益分析、2021年~2023年

- 市場シェア分析、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- AXIS COMMUNICATIONS AB

- AXIOMATIC TECHNOLOGIES LTD.

- DILAX INTELCOM GMBH

- EUROTECH S.P.A.

- FOOTFALLCAM

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- HELLA AGLAIA MOBILE VISION GMBH

- IEE SMART SENSING SOLUTIONS

- IRIS-GMBH INFRARED & INTELLIGENT SENSORS

- IRISYS(INFRARED INTEGRATED SYSTEMS LTD)

- RETAILNEXT, INC.

- SENSMAX

- SENSORMATIC SOLUTIONS

- VIVOTEK INC.

- V-COUNT

- その他の企業

- CLEVER DEVICES LTD.

- COUNTWISE

- DELOPT

- DENSITY

- INFODEV EDI INC.

- INKRYPTIS AI

- SENSOURCE

- TELEDYNE TECHNOLOGIES INCORPORATED

- TRAF-SYS

- XOVIS AG

第14章 付録

The people counting system market is projected to grow from USD 1.2 billion in 2024 and is expected to reach USD 2.1 billion by 2029, growing at a CAGR of 11.6% from 2024 to 2029. People counting systems can yield useful information about the number of individuals in a given area at any given time. alarms being set off when a certain occupancy level is reached. This can be very important for controlling capacity in event venues or buildings subject to fire safety regulations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Technology, Offering, End-use Application & Region |

| Regions covered | Asia Pacific, North America, Europe, and the Rest of the World [RoW] |

"Video-based segment of the people counting system market is expected to hold largest market share during the forecast period."

People counting systems equipped with video-based technology are highly flexible. These systems have the ability to record not only the number of people counted but also potentially collect data on customer behavior patterns, dwell times in particular locations, and demographics. Furthermore, due to advancements in video analytics and AI highly precise people counting with features like highly accurate people counting, even in challenging environments with varying lighting or obstructions are available.

"In the End-use Application the retail segment of the people counting system market is expected to hold largest market share during the forecast period."

Retailers can improve workforce levels based on actual consumer traffic in real time by utilizing people counting data. This guarantees that there is enough staff on hand during busy times to respond to queries from customers and expedite the checkout process. Retailers can spot heavy traffic regions or possible bottlenecks by examining consumer flow patterns. By placing security staff in high-risk areas strategically, this can be extremely important for loss prevention efforts.

"The US is expected to hold the largest market size in the North American region during the forecast period."

The US accounted for the largest share of the North American people counting system market in 2023, and a similar trend is expected to be witnessed during the forecast period. The growing transportation sector, which includes railway stations, airports, bus stands, and public transport vehicles, such as buses, trains, and airplanes, accounted for a significant share of the people counting system market in the US. For instance, in February 2023, according to an Airline Business, Atlanta Hartsfield Airport alone handled just under 94 million passengers a year. People counting systems are used to manage continuously flowing passengers effectively, fleet, scheduling of public transport, deployment of demand-based staff, and control of passenger traffic in transportation. Moreover, the presence of major players in this region such as RETAILNEXT, INC. (US), Sensormatic Solutions (US), CountWise (US), and Teledyne Technologies Incorporated. (US), is driving the market.

- By Company Type: Tier 1 - 52%, Tier 2 - 31%, and Tier 3 - 17%

- By Designation: C-level Executives - 47%, Directors -31%, and Others - 22%

- By Region: North America -37%, Europe - 28%, Asia Pacific- 31%, and RoW - 4%

The report profiles key players in the people counting system market with their respective market ranking analysis. Prominent players profiled in this report include Axis Communications AB. (Sweden), Axiomatic Technologies Ltd (UK), DILAX Intelcom GmbH (Germany), Eurotech S.p.A. (Italy), FootfallCam (UK), Hangzhou Hikvision Digital Technology Co., Ltd. (China), HELLA AGLAIA MOBILE VISION GMBH (Germany), IEE Smart Sensing Solutions (Luxembourg), iris-GmbH infrared & intelligent sensors (Germany), Irisys (InfraRed Integrated Systems Ltd) (UK), RETAILNEXT, INC. (US), SensMax (Latvia), Sensormatic Solutions (US), VIVOTEK Inc. (Taiwan), and V-Count (UK). Clever Devices Ltd. (New York), CountWise (US), DELOPT (India), Density (US), Infodev EDI inc. (Canada), Inkryptis AI (India), SenSource (US), Teledyne Technologies Incorporated. (US), Traf-Sys (US), and Xovis AG (Switzerland) are among a few other key companies in the people counting system market.

Report Coverage

The report defines, describes, and forecasts the people counting system market based on By offering, type, technology, end-use application and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the people counting system market. It also analyzes competitive developments such as product launches, acquisitions, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants in the market with information on the closest approximations of the revenue for the overall people counting systems market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following pointers:

- Analysis of key drivers (increasing need for optimizing space management and occupancy control), restraints (Growing privacy threats owing to installation of video-based people counters), opportunities (Integration of 4D technology into video-based people counters), and challenges (Differential store metrics limit effectiveness of video based counters) of the people counting system market.

- Product development /Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the people counting system market.

- Market Development: Comprehensive information about lucrative markets; the report analyses the people counting system market across various regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the people counting system market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and services, offering of leading players like Axis Communications AB. (Sweden), Axiomatic Technologies Ltd (UK), DILAX Intelcom GmbH (Germany), Eurotech S.p.A. (Italy), FootfallCam (UK) among others in the people counting system market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 PEOPLE COUNTING SYSTEM MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- FIGURE 2 PEOPLE COUNTING SYSTEM MARKET: REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 PEOPLE COUNTING SYSTEM MARKET: RESEARCH DESIGN

- 2.2 SECONDARY AND PRIMARY RESEARCH

- FIGURE 4 RESEARCH APPROACH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.1.3 List of major secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primaries

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE): REVENUE OF COMPANIES FROM SALES OF PEOPLE COUNTING SYSTEMS

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to estimate market size using bottom-up analysis (supply side)

- FIGURE 6 PEOPLE COUNTING SYSTEM MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to estimate market size using top-down analysis (demand side)

- FIGURE 7 PEOPLE COUNTING SYSTEM MARKET: TOP-DOWN APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

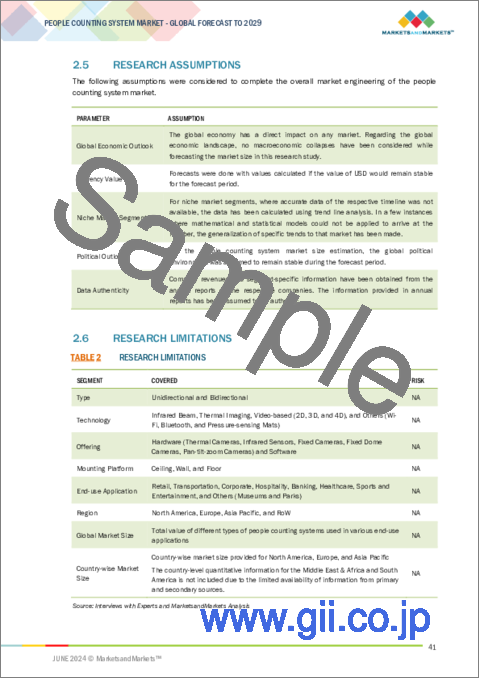

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- TABLE 2 RESEARCH LIMITATIONS

- 2.7 RECESSION IMPACT

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 VIDEO-BASED PEOPLE COUNTING SYSTEMS TO HOLD LARGEST MARKET SIZE IN 2029

- FIGURE 10 BIDIRECTIONAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 RETAIL SEGMENT TO EXIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA TO BE LARGEST MARKET IN 2024

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PEOPLE COUNTING SYSTEM MARKET

- FIGURE 13 INCREASING FOCUS OF RETAIL SECTOR ON PUBLIC SAFETY TO DRIVE ADOPTION OF PEOPLE COUNTING SYSTEMS

- 4.2 PEOPLE COUNTING SYSTEM MARKET, BY OFFERING

- FIGURE 14 HARDWARE SEGMENT TO DOMINATE PEOPLE COUNTING SYSTEM MARKET DURING FORECAST PERIOD

- 4.3 PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION

- FIGURE 15 RETAIL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY

- FIGURE 16 VIDEO-BASED TECHNOLOGY TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- 4.5 PEOPLE COUNTING SYSTEM MARKET IN ASIA PACIFIC, BY END-USE APPLICATION AND COUNTRY

- FIGURE 17 RETAIL SEGMENT AND CHINA HELD LARGEST SHARES OF PEOPLE COUNTING SYSTEM MARKET IN ASIA PACIFIC IN 2023

- 4.6 PEOPLE COUNTING SYSTEM MARKET, BY COUNTRY

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 PEOPLE COUNTING SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 20 DRIVERS

- 5.2.1.1 Rising adoption across various sectors for improved safety and security

- 5.2.1.2 Increasing need to track marketing effectiveness

- 5.2.1.3 Surging use in optimized space management and occupancy control

- 5.2.2 RESTRAINTS

- FIGURE 21 RESTRAINTS

- 5.2.2.1 Privacy threats posed by video-based people counters

- 5.2.2.2 Rapid growth of e-commerce industry

- 5.2.3 OPPORTUNITIES

- FIGURE 22 OPPORTUNITIES

- 5.2.3.1 Integration of 4D technology into video-based people counters

- 5.2.3.2 Growing installation in workspaces across several industries

- 5.2.4 CHALLENGES

- FIGURE 23 CHALLENGES

- 5.2.4.1 Differential store metrics limiting effectiveness of video-based counters

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 24 PEOPLE COUNTING SYSTEM MARKET: VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 26 PEOPLE COUNTING SYSTEM MARKET: ECOSYSTEM ANALYSIS

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 PEOPLE COUNTING SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS (%)

- 5.7.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE END-USE APPLICATIONS

- 5.8 CASE STUDY

- 5.8.1 EXPERIAN FOOTFALL HELPED CALZEDONIA INCORPORATE PEOPLE COUNTING SYSYEM TO ANALYZE CUSTOMER BEHAVIOR

- 5.8.2 TRAF-SYS AIDED HARLEY-DAVIDSON IN EMPLOYING PEOPLE COUNTING TECHNOLOGY TO IMPROVE STAFF MANAGEMENT BASED ON REAL-TIME DATA

- 5.8.3 IPSOS RETAIL INSTALLED SHOPPER COUNT AND OCCUPANCY TO MEASURE FOOTFALL AT PIECE HALL

- 5.8.4 INFRARED INTEGRATED SYSTEMS LTD. DELIVERED PEOPLE COUNTING SYSTEMS TO WESTFIELD STRATFORD TO MAXIMIZE OPERATIONAL EFFICIENCY

- 5.8.5 FOOTFALLCAM PROVIDED PEOPLE COUNTING SYSTEM TO BONMARCHE FOR DATA-DRIVEN DECISION-MAKING

- 5.9 INVESTMENT AND FUNDING SCENARIO

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO FOR STARTUP COMPANIES

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGY

- 5.10.1.1 Artificial intelligence

- 5.10.2 COMPLEMENTARY TECHNOLOGY

- 5.10.2.1 Internet of Things

- 5.10.3 ADJACENT TECHNOLOGY

- 5.10.3.1 Queue management systems

- 5.10.1 KEY TECHNOLOGY

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 847141)

- FIGURE 31 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 847141, BY COUNTRY, 2018-2022

- TABLE 6 IMPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.11.2 EXPORT SCENARIO (HS CODE 847141)

- FIGURE 32 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 847141, BY COUNTRY, 2018-2022

- TABLE 7 EXPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.12 TARIFF ANALYSIS

- TABLE 8 TARIFF FOR HS CODE 847141-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2022

- TABLE 9 TARIFF FOR HS CODE 847141-COMPLIANT PRODUCTS EXPORTED BY US, 2022

- TABLE 10 TARIFF FOR HS CODE 847141-COMPLIANT PRODUCTS EXPORTED BY JAPAN, 2022

- TABLE 11 TARIFF FOR HS CODE 847141-COMPLIANT PRODUCTS EXPORTED BY UK, 2022

- 5.13 PATENT ANALYSIS

- TABLE 12 PATENT REGISTRATIONS RELATED TO PEOPLE COUNTING SYSTEMS

- FIGURE 33 NUMBER OF PATENTS APPLIED AND GRANTED RELATED TO PEOPLE COUNTING SYSTEMS, 2013-2023

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS

- 5.15 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 17 PEOPLE COUNTING SYSTEM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.16 PRICING ANALYSIS

- 5.16.1 AVERAGE SELLING PRICE TREND OF PEOPLE COUNTING SYSTEMS

- FIGURE 34 AVERAGE SELLING PRICE TREND OF PEOPLE COUNTING SYSTEMS OFFERED BY KEY PLAYERS (USD)

- TABLE 18 AVERAGE SELLING PRICE TREND OF PEOPLE COUNTING SYSTEMS OFFERED BY KEY PLAYERS (USD)

- 5.16.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY REGION

- FIGURE 35 AVERAGE SELLING PRICE TREND OF PEOPLE COUNTING SYSTEMS, BY REGION, 2020-2023 (USD)

6 PEOPLE COUNTING SYSTEM MARKET, BY MOUNTING PLATFORM

- 6.1 INTRODUCTION

- 6.2 CEILING

- 6.2.1 HIGH ACCURACY TO PROPEL MARKET GROWTH

- 6.3 WALL

- 6.3.1 COST-EFFECTIVENESS AND RELIABILITY TO DRIVE ADOPTION

- 6.4 FLOOR

- 6.4.1 FEASIBILITY IN WIDE ENTRANCES TO PROPEL MARKET GROWTH

7 PEOPLE COUNTING SYSTEM MARKET, BY OFFERING

- 7.1 INTRODUCTION

- FIGURE 36 HARDWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 19 PEOPLE COUNTING SYSTEM MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 20 PEOPLE COUNTING SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 21 PEOPLE COUNTING SYSTEM MARKET, 2020-2023 (USD MILLION & MILLION UNITS)

- TABLE 22 PEOPLE COUNTING SYSTEM MARKET, 2024-2029 (USD MILLION & MILLION UNITS)

- 7.2 HARDWARE

- 7.2.1 THERMAL CAMERAS

- 7.2.1.1 Growing integration in low-visibility applications to boost market

- 7.2.2 INFRARED SENSORS

- 7.2.2.1 Ease of installation and low cost to drive adoption

- 7.2.3 FIXED CAMERAS

- 7.2.3.1 Rising utilization in residential buildings to support market growth

- 7.2.4 FIXED DOME CAMERAS

- 7.2.4.1 Growing implementation in supermarkets to propel segment growth

- 7.2.5 PAN-TILT-ZOOM CAMERAS

- 7.2.5.1 Growing use in obtaining detailed view of large areas to drive adoption

- 7.2.1 THERMAL CAMERAS

- 7.3 SOFTWARE

- 7.3.1 ABILITY TO PROVIDE PRE-DEFINED OPERATION METRICS TO SUPPORT MARKET GROWTH

8 PEOPLE COUNTING SYSTEM MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 37 BIDIRECTIONAL SEGMENT ACCOUNTED FOR LARGER MARKET SIZE IN 2023

- TABLE 23 PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 24 PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.2 UNIDIRECTIONAL

- 8.2.1 INCREASED DEMAND FROM SMALL ESTABLISHMENTS TO DRIVE MARKET

- TABLE 25 UNIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 26 UNIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 27 UNIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2020-2023 (USD MILLION)

- TABLE 28 UNIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- TABLE 29 UNIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 30 UNIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 BIDIRECTIONAL

- 8.3.1 INTEGRATION WITH HIGH-END ANALYTICS TO BOOST ADOPTION

- FIGURE 38 VIDEO-BASED TECHNOLOGY TO HOLD LARGEST SHARE OF BIDIRECTIONAL SEGMENT DURING FORECAST PERIOD

- TABLE 31 BIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 32 BIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 33 BIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2020-2023 (USD MILLION)

- TABLE 34 BIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- TABLE 35 BIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 BIDIRECTIONAL: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

9 PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- FIGURE 39 VIDEO-BASED TECHNOLOGY TO LEAD DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 37 PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 38 PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 9.2 INFRARED BEAM

- 9.2.1 GROWING ADOPTION BY SMES TO BOOST MARKET

- TABLE 39 INFRARED BEAM: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 40 INFRARED BEAM: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 41 INFRARED BEAM: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2020-2023 (USD MILLION)

- TABLE 42 INFRARED BEAM: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- 9.3 THERMAL IMAGING

- 9.3.1 EASE OF TRACKING ACROSS MULTIPLE DIRECTIONS TO DRIVE ADOPTION

- FIGURE 40 RETAIL APPLICATIONS TO DOMINATE THERMAL IMAGING SEGMENT DURING FORECAST PERIOD

- TABLE 43 THERMAL IMAGING: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 44 THERMAL IMAGING: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 45 THERMAL IMAGING: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2020-2023 (USD MILLION)

- TABLE 46 THERMAL IMAGING: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- 9.4 VIDEO-BASED

- 9.4.1 2D

- 9.4.1.1 Growing use in counting limited traffic to support growth

- 9.4.2 3D

- 9.4.2.1 Increasing applications across various sectors to drive market

- 9.4.3 4D

- 9.4.3.1 Technological advancements to boost segment growth

- TABLE 47 VIDEO-BASED: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 48 VIDEO-BASED: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 49 VIDEO-BASED: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2020-2023 (USD MILLION)

- TABLE 50 VIDEO-BASED: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- 9.4.1 2D

- 9.5 OTHERS

- TABLE 51 OTHER TECHNOLOGIES: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 52 OTHER TECHNOLOGIES: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 53 OTHERS: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2020-2023 (USD MILLION)

- TABLE 54 OTHERS: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

10 PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION

- 10.1 INTRODUCTION

- FIGURE 41 RETAIL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 55 PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2020-2023 (USD MILLION)

- TABLE 56 PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- 10.2 RETAIL

- 10.2.1 INCREASING DEPLOYMENT IN RETAIL STORES AND SUPERMARKETS TO BOOST MARKET

- TABLE 57 RETAIL: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 58 RETAIL: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 59 RETAIL: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 60 RETAIL: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 61 RETAIL: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 RETAIL: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 TRANSPORTATION

- 10.3.1 GROWING DEMAND FOR FLEET MANAGEMENT OPTIMIZATION TO DRIVE MARKET

- TABLE 63 TRANSPORTATION: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 64 TRANSPORTATION: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 65 TRANSPORTATION: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 66 TRANSPORTATION: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 67 TRANSPORTATION: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 TRANSPORTATION: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4 CORPORATE

- 10.4.1 RISING DEMAND FOR SPACE OPTIMIZATION TO PROPEL MARKET

- FIGURE 42 BIDIRECTIONAL TYPE TO HOLD LARGEST SHARE OF CORPORATE SEGMENT DURING FORECAST PERIOD

- TABLE 69 CORPORATE: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 70 CORPORATE: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 71 CORPORATE: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 72 CORPORATE: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 73 CORPORATE: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 CORPORATE: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5 HOSPITALITY

- 10.5.1 INCREASING DEMAND FOR QUEUE MANAGEMENT TO FUEL MARKET GROWTH

- TABLE 75 HOSPITALITY: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 76 HOSPITALITY: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 77 HOSPITALITY: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 78 HOSPITALITY: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 79 HOSPITALITY: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 80 HOSPITALITY: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.6 BANKING

- 10.6.1 RISING FOCUS ON ENHANCING CUSTOMER EXPERIENCE AND OCCUPANCY MANAGEMENT TO DRIVE DEMAND

- TABLE 81 BANKING: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 82 BANKING: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 83 BANKING: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 84 BANKING: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 85 BANKING: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 86 BANKING: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.7 HEALTHCARE

- 10.7.1 GROWING NEED TO OPTIMIZE RESOURCES BASED ON NUMBER OF PATIENTS TO ENHANCE MARKET GROWTH

- TABLE 87 HEALTHCARE: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 88 HEALTHCARE: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 89 HEALTHCARE: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 90 HEALTHCARE: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 91 HEALTHCARE: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 92 HEALTHCARE: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.8 SPORTS AND ENTERTAINMENT

- 10.8.1 INCREASING REQUIREMENT FOR CROWD MANAGEMENT AND HIGH SECURITY TO FUEL MARKET GROWTH

- TABLE 93 SPORTS AND ENTERTAINMENT: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 94 SPORTS AND ENTERTAINMENT: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 95 SPORTS AND ENTERTAINMENT: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 96 SPORTS AND ENTERTAINMENT: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 97 SPORTS AND ENTERTAINMENT: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 98 SPORTS AND ENTERTAINMENT: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.9 OTHERS

- TABLE 99 OTHERS: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 100 OTHERS: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 101 OTHERS: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 102 OTHERS: PEOPLE COUNTING SYSTEM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 103 OTHERS: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 104 OTHERS: PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

11 PEOPLE COUNTING SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 43 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 105 PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 106 PEOPLE COUNTING SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 RECESSION IMPACT ON MARKET IN NORTH AMERICA

- FIGURE 44 NORTH AMERICA: PEOPLE COUNTING SYSTEM MARKET SNAPSHOT

- TABLE 107 NORTH AMERICA: PEOPLE COUNTING SYSTEM MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 108 NORTH AMERICA: PEOPLE COUNTING SYSTEM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 109 NORTH AMERICA: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 110 NORTH AMERICA: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 111 NORTH AMERICA: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2020-2023 (USD MILLION)

- TABLE 112 NORTH AMERICA: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Rising number of retail stores to fuel market growth

- 11.2.3 CANADA

- 11.2.3.1 Increasing demand from retail and transportation sectors to drive market

- 11.2.4 MEXICO

- 11.2.4.1 Substantial increase in number of modern retail stores to propel market

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT ON MARKET IN EUROPE

- FIGURE 45 EUROPE: PEOPLE COUNTING SYSTEM MARKET SNAPSHOT

- TABLE 113 EUROPE: PEOPLE COUNTING SYSTEM, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 114 EUROPE: PEOPLE COUNTING SYSTEM, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 115 EUROPE: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 116 EUROPE: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 117 EUROPE: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2020-2023 (USD MILLION)

- TABLE 118 EUROPE: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Development of technologically advanced products to boost market

- 11.3.3 UK

- 11.3.3.1 Rising adoption in transportation sector to support market

- 11.3.4 FRANCE

- 11.3.4.1 Increasing installation in public transit to drive market

- 11.3.5 ITALY

- 11.3.5.1 Growth in retail and transportation sectors to propel market growth

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- FIGURE 46 ASIA PACIFIC: PEOPLE COUNTING SYSTEM MARKET SNAPSHOT

- TABLE 119 ASIA PACIFIC: PEOPLE COUNTING SYSTEM, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 120 ASIA PACIFIC: PEOPLE COUNTING SYSTEM, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 121 ASIA PACIFIC: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 123 ASIA PACIFIC: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2020-2023 (USD MILLION)

- TABLE 124 ASIA PACIFIC: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- 11.4.2 JAPAN

- 11.4.2.1 Highly efficient railway services to fuel market growth

- 11.4.3 CHINA

- 11.4.3.1 Presence of robust manufacturing industry to drive market growth

- 11.4.4 INDIA

- 11.4.4.1 Rising investments in retail sector to drive market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Growing investments in transportation and retail sectors to propel market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 RECESSION IMPACT ON MARKET IN ROW

- TABLE 125 ROW: PEOPLE COUNTING SYSTEM MARKET, BY GEOGRAPHY, 2020-2023 (USD MILLION)

- TABLE 126 ROW: PEOPLE COUNTING SYSTEM MARKET, BY GEOGRAPHY, 2024-2029 (USD MILLION)

- TABLE 127 ROW: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 128 ROW: PEOPLE COUNTING SYSTEM MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 129 ROW: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2020-2023 (USD MILLION)

- TABLE 130 ROW: PEOPLE COUNTING SYSTEM MARKET, BY END-USE APPLICATION, 2024-2029 (USD MILLION)

- 11.5.2 GCC COUNTRIES

- 11.5.3 REST OF MIDDLE EAST AND AFRICA

- 11.5.4 SOUTH AMERICA

- 11.5.4.1 Rising installation at transportation hubs to boost market

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023

- TABLE 131 PEOPLE COUNTING SYSTEM MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS

- 12.3 REVENUE ANALYSIS, 2021-2023

- FIGURE 47 PEOPLE COUNTING SYSTEM MARKET: REVENUE ANALYSIS OF TOP THREE PLAYERS

- 12.4 MARKET SHARE ANALYSIS, 2023

- FIGURE 48 PEOPLE COUNTING SYSTEM MARKET SHARE ANALYSIS, 2023

- TABLE 132 PEOPLE COUNTING SYSTEM MARKET: DEGREE OF COMPETITION, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 49 MARKET CAPITALIZATION OF KEY PLAYERS

- FIGURE 50 EV/EBITDA OF KEY PLAYERS

- 12.6 BRAND/PRODUCT COMPARISON

- FIGURE 51 PEOPLE COUNTING SYSTEM MARKET: TOP TRENDING BRANDS/PRODUCTS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 52 PEOPLE COUNTING SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Company footprint

- FIGURE 53 COMPANY FOOTPRINT

- 12.7.5.2 Offering footprint

- TABLE 133 OFFERING FOOTPRINT

- 12.7.5.3 Type footprint

- TABLE 134 TYPE FOOTPRINT

- 12.7.5.4 Technology footprint

- TABLE 135 TECHNOLOGY FOOTPRINT

- 12.7.5.5 End-use application footprint

- TABLE 136 END-USE APPLICATION FOOTPRINT

- 12.7.5.6 Region footprint

- TABLE 137 REGION FOOTPRINT

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- FIGURE 54 PEOPLE COUNTING SYSTEM MARKET: STARTUPS/SMES EVALUATION MATRIX (STARTUPS/SMES), 2023

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 138 PEOPLE COUNTING SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 139 PEOPLE COUNTING SYSTEM MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2021-APRIL 2024

- 12.9.2 DEALS

- TABLE 140 PEOPLE COUNTING SYSTEM MARKET: DEALS, JANUARY 2021-APRIL 2024

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 13.2.1 AXIS COMMUNICATIONS AB

- TABLE 141 AXIS COMMUNICATIONS AB: COMPANY OVERVIEW

- FIGURE 55 AXIS COMMUNICATIONS AB: COMPANY SNAPSHOT

- TABLE 142 AXIS COMMUNICATIONS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 AXIS COMMUNICATIONS AB: PRODUCT LAUNCHES & DEVELOPMENTS

- 13.2.2 AXIOMATIC TECHNOLOGIES LTD.

- TABLE 144 AXIOMATIC TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 145 AXIOMATIC TECHNOLOGIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 AXIOMATIC TECHNOLOGIES LTD.: PRODUCT LAUNCHES & DEVELOPMENTS

- 13.2.3 DILAX INTELCOM GMBH

- TABLE 147 DILAX INTELCOM GMBH: COMPANY OVERVIEW

- TABLE 148 DILAX INTELCOM GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 DILAX INTELCOM GMBH: PRODUCT LAUNCHES & DEVELOPMENTS

- 13.2.4 EUROTECH S.P.A.

- TABLE 150 EUROTECH S.P.A.: COMPANY OVERVIEW

- FIGURE 56 EUROTECH S.P.A.: COMPANY SNAPSHOT

- TABLE 151 EUROTECH S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 EUROTECH S.P.A.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 153 EUROTECH S.P.A.: DEALS

- 13.2.5 FOOTFALLCAM

- TABLE 154 FOOTFALLCAM: COMPANY OVERVIEW

- TABLE 155 FOOTFALLCAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 FOOTFALLCAM: PRODUCT LAUNCHES & DEVELOPMENTS

- 13.2.6 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- TABLE 157 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 57 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- TABLE 158 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 160 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: DEALS

- 13.2.7 HELLA AGLAIA MOBILE VISION GMBH

- TABLE 161 HELLA AGLAIA MOBILE VISION GMBH: COMPANY OVERVIEW

- TABLE 162 HELLA AGLAIA MOBILE VISION GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 HELLA AGLAIA MOBILE VISION GMBH: DEALS

- 13.2.8 IEE SMART SENSING SOLUTIONS

- TABLE 164 IEE SMART SENSING SOLUTIONS: COMPANY OVERVIEW

- TABLE 165 IEE SMART SENSING SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 IEE SMART SENSING SOLUTIONS: DEALS

- 13.2.9 IRIS-GMBH INFRARED & INTELLIGENT SENSORS

- TABLE 167 IRIS-GMBH INFRARED & INTELLIGENT SENSORS: COMPANY OVERVIEW

- TABLE 168 IRIS-GMBH INFRARED & INTELLIGENT SENSORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 IRIS-GMBH INFRARED & INTELLIGENT SENSORS: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 170 IRIS-GMBH INFRARED & INTELLIGENT SENSORS: DEALS

- 13.2.10 IRISYS (INFRARED INTEGRATED SYSTEMS LTD)

- TABLE 171 IRISYS (INFRARED INTEGRATED SYSTEMS LTD): COMPANY OVERVIEW

- TABLE 172 IRISYS (INFRARED INTEGRATED SYSTEMS LTD): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.11 RETAILNEXT, INC.

- TABLE 173 RETAILNEXT, INC.: COMPANY OVERVIEW

- TABLE 174 RETAILNEXT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 RETAILNEXT, INC.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 176 RETAILNEXT, INC.: DEALS

- 13.2.12 SENSMAX

- TABLE 177 SENSMAX: COMPANY OVERVIEW

- TABLE 178 SENSMAX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 SENSMAX: PRODUCT LAUNCHES & DEVELOPMENTS

- 13.2.13 SENSORMATIC SOLUTIONS

- TABLE 180 SENSORMATIC SOLUTIONS: COMPANY OVERVIEW

- TABLE 181 SENSORMATIC SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 SENSORMATIC SOLUTIONS: DEALS

- 13.2.14 VIVOTEK INC.

- TABLE 183 VIVOTEK INC.: COMPANY OVERVIEW

- FIGURE 58 VIVOTEK INC.: COMPANY SNAPSHOT

- TABLE 184 VIVOTEK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 VIVOTEK INC.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 186 VIVOTEK INC.: DEALS

- 13.2.15 V-COUNT

- TABLE 187 V-COUNT: COMPANY OVERVIEW

- TABLE 188 V-COUNT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 V-COUNT: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 190 V-COUNT: DEALS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 13.3 OTHER PLAYERS

- 13.3.1 CLEVER DEVICES LTD.

- 13.3.2 COUNTWISE

- 13.3.3 DELOPT

- 13.3.4 DENSITY

- 13.3.5 INFODEV EDI INC.

- 13.3.6 INKRYPTIS AI

- 13.3.7 SENSOURCE

- 13.3.8 TELEDYNE TECHNOLOGIES INCORPORATED

- 13.3.9 TRAF-SYS

- 13.3.10 XOVIS AG

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS