|

|

市場調査レポート

商品コード

1478562

UAV(ドローン)市場:タイプ別、プラットフォーム別、POS別、システム別、機能別、業界別、用途別、操作モード別、MTOW別、航続距離別、地域別 - 2029年までの予測UAV (Drone) Market by Type (Fixed Wing, Rotary Wing, Hybrid), Platform (Civil & Commercial, and Defense & Government), Point of Sale, Systems, Function, Industry, Application, Mode of Operation, MTOW, Range and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| UAV(ドローン)市場:タイプ別、プラットフォーム別、POS別、システム別、機能別、業界別、用途別、操作モード別、MTOW別、航続距離別、地域別 - 2029年までの予測 |

|

出版日: 2024年05月08日

発行: MarketsandMarkets

ページ情報: 英文 449 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

UAV(ドローン)の市場規模は、2024年の302億米ドルから2029年には485億米ドルに成長すると予測され、2024年から2029年までのCAGRは9.9%になるとみられています。

無人航空機(UAV)市場の主な成長促進要因は、多様な用途におけるドローンの統合がエスカレートしていることです。自律性の向上、より効率的な電力システム、高度なセンシング技術などの技術強化により、UAVの能力は拡大しています。さらに、民間および商業空間でのUAV展開をサポートする規制の進化が、市場の拡大を大きく後押ししています。監視、配送サービス、環境モニタリングなどの分野での需要急増も重要な役割を果たしています。UAV技術と新たなデジタルイノベーションの融合は、この分野の上昇軌道を後押しし続けています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、プラットフォーム別、POS別、システム別、機能別、業界別、用途別、操作モード別、MTOW別、航続距離別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

UAV(ドローン)市場は用途別では、軍事、商業、消費者、政府・法執行に分類されます。軍事分野が56.1%と最も高い市場シェアを持っています。UAV(ドローン)市場では、軍事分野が最大の市場シェアを占めると予測されており、その主な要因は、UAVを防衛戦略に組み込み、監視、標的攻撃、偵察任務を強化することにあります。この優位性は、信頼性、航続距離、ペイロード能力を向上させ、軍事ニーズに合致させるUAV技術の継続的な進歩によって促進されています。このセグメントの成長は、運用効率と戦術的優位性のために無人システムを優先する防衛近代化プログラムへの世界各国政府からの多額の投資によってさらに促進されます。このように軍事作戦におけるUAV配備が戦略的に重視されていることは、このセグメントの市場リーダーシップにおける極めて重要な役割を強調しています。

機能別では、UAV市場は、特殊用途ドローン、乗用ドローン、検査&監視ドローン、測量&マッピングドローン、散布&播種ドローン、航空貨物車、およびその他にセグメント化されています。このセグメントの成長は、軍事、農業監視、環境評価、災害管理など、特定の運用要件に合わせたUAVの開発によって推進されています。特殊な機能のためにUAVの汎用性と精度を高める技術強化がこの動向を支えています。これらのドローンの採用は、規制の進展と分野別のインセンティブによってさらに促進され、様々な産業へのUAVの配備を促進しています。このようなニッチ用途との戦略的連携は、このセグメントが市場拡大に大きく貢献していることを裏付けています。

当レポートでは、世界のUAV(ドローン)市場について調査し、タイプ別、プラットフォーム別、POS別、システム別、機能別、業界別、用途別、操作モード別、MTOW別、航続距離別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- バリューチェーン分析

- 貿易データ分析

- 運用データ

- 価格分析

- 部品表

- 事業の型

- ボリュームデータ

- 投資と資金調達のシナリオ

- 主な利害関係者と購入基準

- 技術ロードマップ

- 総所有コスト

- 使用事例分析

- 技術分析

- 規制状況

- 主な会議とイベント

第6章 業界の動向

- イントロダクション

- 技術動向

- UAV製品エコシステム

- UAV仕様

- UAVで使用されるソフトウェア

- UAVサービス

- メガトレンドの影響

- ドローン技術の成熟度マッピング

- サプライチェーン分析

- 特許分析

第7章 UAV市場、POS別

- イントロダクション

- オリジナル機器メーカー(OEM)

- アフターマーケット

第8章 UAV市場、システム別

- イントロダクション

- プラットホーム

- ペイロード

- データリンク

- 地上管制所

- 発射・回収システム

第9章 UAV市場、プラットフォーム別

- イントロダクション

- 民間・商業

- 防衛・政府

- 戦術

第10章 UAV市場、機能別

- イントロダクション

- 特殊用途ドローン

- 乗客用ドローン

- 検査・監視ドローン

- 測量・地図作成用ドローン

- 散布・播種ドローン

- その他

第11章 UAV市場、業界別

- イントロダクション

- 防衛・セキュリティ

- 農業

- 物流・輸送

- エネルギー・電力

- 建設・鉱業

- メディア・エンターテインメント

- 保険

- 野生生物・森林

- 学術

第12章 UAV市場、用途別

- イントロダクション

- 軍隊

- 商業

- 政府・法執行機関

- 消費者

第13章 UAV市場、航続距離別

- イントロダクション

- 視線(VLOS)

- 拡張視線(EVLOS)

- 視界外飛行(BVLOS)

第14章 UAV市場、操作モード別

- イントロダクション

- 遠隔操縦

- オプション操縦

- 完全自律

第15章 UAV市場、タイプ別

- イントロダクション

- 固定翼

- ロータリーウィング

- ハイブリッドウィング

第16章 UAV市場、MTOW別

- イントロダクション

- 25キログラム未満

- 25~170キログラム

- 170キログラム超

第17章 UAV市場、地域別

- イントロダクション

- 景気後退影響分析、地域別

- 北米

- アジア太平洋

- 欧州

- ラテンアメリカ

- 中東

- アフリカ

第18章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 市場ランキング分析

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業評価マトリックス

- 企業価値評価

- 財務指標

- ブランド比較

- 競合シナリオと動向

第19章 企業プロファイル

- 主要参入企業

- SZ DJI TECHNOLOGY CO., LTD.

- NORTHROP GRUMMAN CORPORATION

- ISRAEL AEROSPACE INDUSTRIES LTD.

- TELEDYNE FLIR LLC

- GENERAL ATOMICS AERONAUTICAL SYSTEMS

- RAYTHEON TECHNOLOGIES CORPORATION

- PARROT DRONE SAS

- YUNEEC HOLDING LTD.

- EHANG HOLDINGS LIMITED

- LOCKHEED MARTIN CORPORATION

- THE BOEING COMPANY

- AEROVIRONMENT, INC.

- TEXTRON INC.

- BAE SYSTEMS PLC

- THALES GROUP

- ELBIT SYSTEMS LTD.

- AERONAUTICS LTD

- SKYDIO, INC.

- XAG CO., LTD.

- CHENGDU JOUAV AUTOMATION TECH CO., LTD

- LEONARDO S.P.A.

- その他の企業

- SHIELD AI

- DELAIR

- VOLOCOPTER GMBH

- MICRODRONES

- TURKISH AEROSPACE INDUSTRIES

- AUTEL ROBOTICS.

- VOLANSI, INC.

- FLYABILITY

- WINGTRA

- GARUDA AEROSPACE.

第20章 付録

The UAV (Drone) market is estimated to grow from USD 48.5 billion by 2029, from USD 30.2 billion in 2024, at a CAGR of 9.9% from 2024 to 2029. The principal driver of growth in the Unmanned Aerial Vehicle (UAV) market is the escalating integration of drones in diverse applications. Technological enhancements, such as improved autonomy, more efficient power systems, and advanced sensing technology, have expanded UAV capabilities. Further, regulatory evolution supporting UAV deployment in civilian and commercial spaces significantly fuels market expansion. The demand surge in sectors like surveillance, delivery services, and environmental monitoring also plays a crucial role. The convergence of UAV technology with emerging digital innovations continues to propel the sector's upward trajectory.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Platform, Point of Sale, Systems, Function, Industry, Application, Mode of Operation, MTOW, Range and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Military segment by applications is expected to hold the highest market share in 2024."

Based on applications, the UAV (Drone) market is categorized into military, commercial, consumer, government& law enforcement. The military segment having highest market share of 56.1%. In the UAV (Drone)market, the military segment is forecasted to command the largest market share, predominantly driven by the integration of UAVs into defense strategies for enhanced surveillance, targeted strikes, and reconnaissance missions. This dominance is facilitated by continuous advancements in UAV technologies that improve reliability, range, and payload capabilities, aligning with military needs. The segment's growth is further catalysed by substantial investments from governments worldwide in defense modernization programs that prioritize unmanned systems for operational efficiency and tactical superiority. This strategic emphasis on UAV deployment in military operations underscores its pivotal role in the segment's market leadership.

"Special purpose drone segment by function is estimated to hold the highest market share in 2024."

Based on function, the UAV market has been segmented into special purpose drones, passenger drones, inspection & monitoring drones, surveying & mapping drones, spraying & seeding drones, air cargo vehicles, and others. This segment's growth is propelled by the tailored development of UAVs for specific operational requirements, including military, agricultural monitoring, environmental assessment, and disaster management. Technological enhancements that increase UAV versatility and precision for specialized functions support this trend. The adoption of these drones is further driven by regulatory advancements and sector-specific incentives, which facilitate the deployment of UAVs across varied industries. This strategic alignment with niche applications underscores the segment's significant contribution to market expansion.

"OEM segment by point of sale is estimated to hold the highest market share in 2024."

Based on point of sale, the UAV market has been segmented into original equipment manufacturers (OEM) and aftermarket. In the UAV market, the Original Equipment Manufacturer (OEM) segment is projected to dominate in terms of market share, primarily due to its direct integration at the point of sale. This strategic positioning enables OEMs to capture a significant portion of the market by delivering integrated, ready-to-use UAV solutions directly to consumers. This dominance is facilitated by the OEMs' ability to influence purchasing decisions through direct sales channels, ensuring that their products are the preferred choice for end-users from the outset. Such a model not only streamlines the distribution process but also enhances customer acquisition and retention.

"North America is expected to hold the highest market share in 2024."

In the UAV market forecasts, North America is anticipated to command the predominant market share in 2024. This leadership position is largely driven by robust technological advancements, substantial financial allocations in research and development, and a strong ecosystem of UAV manufacturers and service providers. Additionally, the region benefits from comprehensive regulatory frameworks that not only facilitate drone integration into national airspace but also promote safe and innovative uses across various sectors, including agriculture, surveillance, and logistics. Moreover, the increasing adoption of UAVs by government bodies for security and monitoring tasks, coupled with growing commercial applications, significantly contributes to the expansion of the UAV market. These elements collectively ensure that North America remains at the forefront of UAV market growth, reflecting its pivotal role in shaping global UAV dynamics and technology deployment.

The break-up of the profile of primary participants in the UAV (Drone) market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C Level - 55%, Director Level - 27%, Others - 18%

- By Region: North America - 32%, Europe - 32%, Asia Pacific - 16%, Latin America - 7%, Middle East - 10% & Rest of the World - 3%

General Atomics Aeronautical Systems, Inc. (GA-ASI) (US), Northrop Grumman Corporation (US), Elbit Systems Ltd. (Israel), Israel Aerospace Industries Ltd. (Israel), SZ DJI Technology Co., Ltd. (China), AeroVironment, Inc. (US), Lockheed Martin Corporation (US), Thales Group (France), Aeronautics Ltd. (Israel), etc and several others. These key players offer connectivity applicable to various sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America.

Research Coverage:

This research report categorizes the UAV market based by Point Of Sale (OEM, Aftermarket ) by Systems (Platform, Payload, Datalink, Ground Control Station, UAV Launch And Recovery System) by Platform (Civil & Commercial, Defense & Government)by Function (Special Purpose Drones, Passenger Drones, Inspection & Monitoring Drones, Surveying & Mapping Drones, Spraying & Seeding Drones, Others) By Industry(Defense & Security, Agriculture, Logistics & Transportation, Energy & Power, Construction & mining, Insurance, Wildlife & Forestry, Academic & Forestry). By Application (Military, Commercial, Government & Law Enforcement, Consumer) by Type (Fixed Wing, Rotary Wing, Hybrid Wing) By Operation Mode (Remotely Piloted, Optionally Piloted, Fully Autonomous) By MTOW (<25 KG, 25-170 KG, >170 KG), By Range (Visual Line Of Sight, Extended Visual Line Of Sight, Beyond Visual Line Of Sight).

These segments have been mapped across major regions, namely, North America, Europe, Asia Pacific, and the Middle East, Latin America, and Africa. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the UAV market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; agreements, collaborations, new product launches, contracts, expansion, acquisitions, and partnerships associated with the UAV marketThis report segments the UAV (Drone) market across six key regions: North America, Europe, Asia Pacific, the Middle East, Africa and Latin America along with their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the UAV (Drone) market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, new product launches, contracts, expansions, acquisitions, and partnerships associated with the UAV (Drone) market.

Reasons to buy this report:

This report serves as a valuable resource for market leaders and newcomers in the UAV (Drone) market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulating effective go-to-market strategies for Simulation. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights on the following pointers:

- Analysis of the key driver (Increasing usage in civil and commercial applications) restraint (Lack of qualified and certified drone operators) opportunities (Technological advancements to enhance accuracy of package delivery) and challenges (Lack of sustainable power sources to improve endurance) there are several factors that could contribute to an increase in the UAV (Drone) market.

- Market Penetration: Comprehensive information on UAV (Drone) solutions offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the UAV (Drone) market

- Market Development: Comprehensive information about lucrative markets - the report analyses the UAV (Drone) market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the UAV (Drone) market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the UAV (Drone) market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- FIGURE 1 UAV MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY & PRICING

- TABLE 1 USD EXCHANGE RATES

- 1.5 INCLUSIONS AND EXCLUSIONS

- TABLE 2 UAV MARKET: INCLUSIONS AND EXCLUSIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary respondents

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Regional spilt of UAV market

- 2.3.1.2 Pricing analysis

- TABLE 3 MARKET SIZE ILLUSTRATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 RECESSION IMPACT ANALYSIS

- 2.5.1 KEY ELEMENTS

- 2.5.2 SCENARIO ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 OEM POINT OF SALE SEGMENT TO ACCOUNT FOR DOMINANT SHARE OF UAV MARKET IN 2024

- FIGURE 9 DEFENSE & GOVERNMENT SEGMENT TO DOMINATE UAV MARKET IN 2024

- FIGURE 10 FULLY AUTONOMOUS UAVS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 11 SPECIAL-PURPOSE DRONES TO HOLD LARGEST SHARE OF UAV MARKET IN 2024

- FIGURE 12 MILITARY TO BE LARGEST APPLICATION SEGMENT OF UAV MARKET IN 2024

- FIGURE 13 <25 KG MTOW TO BE LARGEST SEGMENT OF UAV MARKET IN 2024

- FIGURE 14 BVLOS TO BE LARGEST RANGE SEGMENT OF UAV MARKET IN 2024

- FIGURE 15 UAV MARKET IN EUROPE TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UAV MARKET

- FIGURE 16 INCREASING FUNDING AND USE OF UAVS FOR VARIOUS COMMERCIAL AND DEFENSE APPLICATIONS TO DRIVE MARKET

- 4.2 UAV MARKET, BY SPECIAL-PURPOSE DRONE TYPE

- FIGURE 17 UCAV SEGMENT TO LEAD SPECIAL-PURPOSE UAV MARKET DURING FORECAST PERIOD

- 4.3 UAV MARKET, BY SYSTEM

- FIGURE 18 PLATFORM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 UAV MARKET, BY COMMERCIAL APPLICATION

- FIGURE 19 INSPECTION & MONITORING TO BE LARGEST COMMERCIAL APPLICATION DURING FORECAST PERIOD

- 4.5 UAV MARKET, BY GOVERNMENT & LAW ENFORCEMENT APPLICATION

- FIGURE 20 BORDER MANAGEMENT TO BE DOMINANT GOVERNMENT & LAW ENFORCEMENT APPLICATION DURING FORECAST PERIOD

- 4.6 UAV MARKET, BY CONSUMER APPLICATION

- FIGURE 21 PROSUMERS TO BE LEADING CONSUMER APPLICATION SEGMENT OF UAV MARKET

- 4.7 UAV MARKET, BY PROPULSION SYSTEM

- FIGURE 22 ENGINE SEGMENT PROJECTED TO HOLD MAJOR SHARE DURING FORECAST PERIOD

- 4.8 UAV MARKET, BY PAYLOAD TYPE

- FIGURE 23 INTELLIGENCE PAYLOAD TO COMMAND LARGEST SHARE DURING FORECAST PERIOD

- 4.9 UAV MARKET, BY MULTICOPTER TYPE

- FIGURE 24 QUADCOPTER SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 UAV MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising procurement for military applications

- FIGURE 26 NUMBER OF COUNTRIES DEVELOPING, ACQUIRING, AND USING ARMED DRONES, 2000-2020

- 5.2.1.2 Farm management optimization using agricultural drones

- FIGURE 27 AGRICULTURAL DRONES AND THEIR BENEFITS

- 5.2.1.3 Increasing use in civil and commercial applications

- 5.2.1.4 Sensor and technology development

- FIGURE 28 DECREASING COST OF DRONE COMPONENTS (USD)

- 5.2.1.5 Supportive government regulations and initiatives

- TABLE 4 COMMERCIAL INDUSTRIES EXEMPTED BY FAA

- 5.2.2 RESTRAINTS

- 5.2.2.1 Information security risk and lack of standardized air traffic regulations

- 5.2.2.2 Lack of qualified and certified drone operators

- 5.2.2.3 Limited payload capacity of commercial drones

- 5.2.3 OPPORTUNITIES

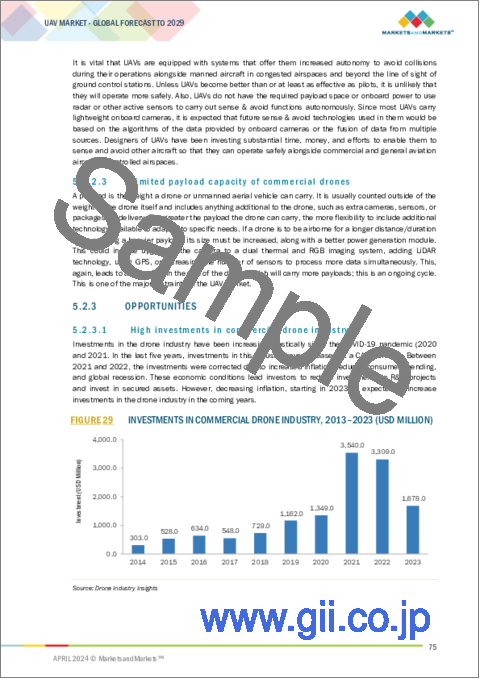

- 5.2.3.1 High investments in commercial drone industry

- FIGURE 29 INVESTMENTS IN COMMERCIAL DRONE INDUSTRY, 2013-2023 (USD MILLION)

- 5.2.3.2 Use of UAVs for cargo delivery in military operations

- 5.2.3.3 Growing use in providing wireless coverage

- 5.2.3.4 Technological advancements to enhance accuracy of package delivery

- 5.2.3.5 Real-time monitoring of road traffic

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues with hijacking and security of UAVs

- 5.2.4.2 Lack of sustainable power sources to improve endurance

- TABLE 5 ENDURANCE-BASED MAPPING OF POWER SOURCES

- 5.2.4.3 Unpredictable weather conditions

- 5.3 ECOSYSTEM ANALYSIS

- 5.3.1 PLATFORM MANUFACTURERS

- 5.3.2 SUBSYSTEM MANUFACTURERS

- 5.3.3 SERVICE PROVIDERS

- 5.3.4 SOFTWARE PROVIDERS

- 5.3.5 MISCELLANEOUS

- FIGURE 30 UAV MARKET ECOSYSTEM

- TABLE 6 ROLE OF COMPANIES IN ECOSYSTEM

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 REVENUE SHIFTS AND NEW REVENUE POCKETS IN UAV MARKET

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 32 VALUE CHAIN ANALYSIS

- 5.5.1 PLANNING AND REVISED FUNDING

- 5.5.2 RESEARCH & DEVELOPMENT

- 5.5.3 RAW MATERIAL PROCUREMENT AND MANUFACTURING

- 5.5.4 ASSEMBLY, TESTING, AND APPROVALS

- 5.5.5 DISTRIBUTION AND AFTER-SALES SERVICES

- 5.6 TRADE DATA ANALYSIS

- TABLE 7 IMPORT AND EXPORT STATISTICS FOR UAVS

- 5.6.1 IMPORT DATA ANALYSIS

- 5.6.1.1 Unmanned aircraft (HS Code: 8806)

- FIGURE 33 TOP 10 IMPORTING COUNTRIES, 2022-2023 (USD THOUSAND)

- 5.6.2 EXPORT DATA ANALYSIS

- 5.6.2.1 Unmanned aircraft (HS Code: 8806)

- FIGURE 34 TOP 10 EXPORTING COUNTRIES, 2022-2023 (USD THOUSAND)

- 5.7 OPERATIONAL DATA

- FIGURE 35 TOTAL ACTIVE FLEET OF DRONES USED BY US NAVY AND MARINE (BY UNITS)

- FIGURE 36 TOTAL ACTIVE FLEET OF DRONES USED BY US AIR FORCE (UNITS)

- FIGURE 37 COMMERCIAL AND RECREATIONAL UAVS REGISTERED IN US, 2017-2023 (UNITS)

- 5.8 PRICING ANALYSIS

- 5.8.1 INDICATIVE PRICING ANALYSIS, BY APPLICATION AND REGION

- FIGURE 38 INDICATIVE PRICING, BY APPLICATION AND REGION (USD)

- TABLE 8 INDICATIVE PRICE RANGE, BY APPLICATION AND REGION (USD)

- TABLE 9 INDICATIVE PRICE RANGE FOR MILITARY UAVS, BY REGION (USD MILLION)

- 5.8.2 INDICATIVE PRICING ANALYSIS, BY PLATFORM

- 5.9 BILL OF MATERIALS

- FIGURE 39 COMMERCIAL DRONE KEY COMPONENT DISTRIBUTION

- FIGURE 40 MILITARY DRONE KEY COMPONENT DISTRIBUTION

- 5.10 BUSINESS MODEL

- 5.10.1 DIRECT SALE BUSINESS MODEL

- FIGURE 41 DIRECT SALE BUSINESS MODEL

- 5.10.2 SUBSCRIPTION-BASED SERVICE MODEL

- FIGURE 42 SUBSCRIPTION-BASED SERVICE MODEL

- 5.10.3 OPERATING LEASE MODEL

- FIGURE 43 OPERATING LEASE MODEL

- TABLE 10 LEASED MILITARY DRONES

- FIGURE 44 BUSINESS MODELS IN UAV MARKET

- FIGURE 45 BUSINESS MODEL COMPARISON

- 5.11 VOLUME DATA

- TABLE 11 UAV MARKET, BY REGION, 2020-2022 (UNITS)

- 5.12 INVESTMENT AND FUNDING SCENARIO

- FIGURE 46 INVESTMENT AND FUNDING SCENARIO, 2019-2023

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 47 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 48 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 13 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.14 TECHNOLOGY ROADMAP

- FIGURE 49 TECHNOLOGY ROADMAP FOR UAV MARKET

- FIGURE 50 EMERGING TRENDS

- 5.15 TOTAL COST OF OWNERSHIP

- TABLE 14 TOTAL COST OF OWNERSHIP OF UAVS

- FIGURE 51 TOTAL COST OF OWNERSHIP ASSOCIATED WITH ACQUISITION OF UAVS

- FIGURE 52 UAV LIFE CYCLE PHASES

- FIGURE 53 AVERAGE BREAKDOWN OF MAJOR COST CATEGORIES AS % OF TOTAL LIFE CYCLE COST

- TABLE 15 ESTIMATED COST OF DRONES

- TABLE 16 TECHNICAL COST OF DRONES

- 5.16 USE CASE ANALYSIS

- 5.16.1 TRANSFER OF MEDICAL PRESCRIPTIONS USING DRONES FROM MANNA AERO

- TABLE 17 ESSENTIAL SUPPLIES DELIVERED BY MANNA AERO IN RURAL AREAS

- 5.16.2 AEROVIRONMENT'S MARITIME INITIATIVE

- TABLE 18 AEROVIRONMENT'S UAS FOR MARITIME COUNTER-TRAFFICKING OPERATIONS

- 5.16.3 CARGO DRONE FIELD TESTS IN AMAZON FOREST IN PERU

- TABLE 19 FIELD TESTS USING CARGO DRONES TO DELIVER VACCINES AND BLOOD SAMPLES

- 5.16.4 NAGORNO-KARABAKH CONFLICT

- TABLE 20 IMPORTANCE OF ARMED DRONES AND HIGHLY TRAINED GROUND FORCES DEMONSTRATED

- 5.16.5 ZIPLINE DRONES USED TO DELIVER COVID-19 VACCINES

- TABLE 21 COVID-19 VACCINES DELIVERED TO GHANA BY ZIPLINE

- 5.16.6 CANYON MAPPING IN COLORADO, US

- TABLE 22 SAND CANYON MAPPED BY CCAC AND CANM

- 5.17 TECHNOLOGY ANALYSIS

- 5.17.1 KEY TECHNOLOGIES

- 5.17.1.1 Artificial intelligence in UAVS

- TABLE 23 COMPANIES WORKING TOWARD DEVELOPMENT OF DRONE SOFTWARE WITH AI

- TABLE 24 COMPANIES WORKING TOWARD DEVELOPMENT OF DRONE EQUIPMENT WITH AI

- TABLE 25 UAV INNOVATIONS

- 5.17.1.2 Mid-Air refueling of drones

- 5.17.1.3 Anti-UAV defense systems

- 5.17.1.4 UAV with LiDAR system

- TABLE 26 USAGE OF DRONES WITH LIDAR SYSTEM

- 5.17.2 COMPLEMENTARY TECHNOLOGIES

- 5.17.2.1 Beyond visual line of sight (BVLOS) operations

- 5.17.2.2 Increased autonomy in traffic management

- 5.17.2.3 Energy harvesting

- 5.17.2.4 Enhanced security protocols

- 5.17.1 KEY TECHNOLOGIES

- 5.18 REGULATORY LANDSCAPE

- 5.18.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 32 DRONE REGULATIONS AND APPROVAL FOR COMMERCIAL SECTOR, BY COUNTRY

- 5.18.2 NORTH AMERICA

- 5.18.2.1 US

- TABLE 33 US: RULES AND GUIDELINES BY FAA FOR OPERATION OF DRONES

- 5.18.2.2 Canada

- TABLE 34 CANADA: RULES AND GUIDELINES FOR OPERATION OF DRONES

- 5.18.3 EUROPE

- 5.18.3.1 UK

- TABLE 35 UK: RULES AND GUIDELINES BY CAA FOR OPERATION OF DRONES

- 5.18.3.2 Germany

- TABLE 36 GERMANY: RULES AND GUIDELINES FOR OPERATION OF DRONES

- 5.18.3.3 France

- TABLE 37 FRANCE: RULES AND GUIDELINES FOR OPERATION OF DRONES

- TABLE 38 UAV REGULATIONS, BY COUNTRY

- 5.19 KEY CONFERENCES AND EVENTS

- TABLE 39 KEY CONFERENCES AND EVENTS, 2024-2025

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 DRONE SWARM TECHNOLOGY

- 6.2.2 SYNTHETIC APERTURE RADAR

- 6.2.3 MANNED-UNMANNED TEAMING (MUM-T)

- 6.2.4 HYPERSONIC ARMED DRONES

- 6.2.5 DRONE MANUFACTURING USING ADVANCED MATERIALS

- 6.2.6 SIGINT BY DRONES

- 6.2.7 NETWORK FUNCTIONS VIRTUALIZATION (NFV)

- 6.2.8 MICROTURBINE ENGINE-POWERED DRONES

- 6.2.9 MICROMECHANICAL FLYING INSECTS

- 6.2.10 SOFTWARE-DEFINED NETWORKING (SDN)

- 6.2.11 MILLIMETER-WAVE (MM-WAVE) TECHNOLOGY

- 6.2.12 TARGET DRONES

- 6.2.13 VALUING UAVS (PILOT-ON-A-CHIP)

- 6.2.14 DRONE INSURANCE

- TABLE 40 INSURANCE COVERAGE OFFERED

- TABLE 41 COMPANIES PROVIDING DRONE INSURANCE

- 6.3 UAV PRODUCT ECOSYSTEM

- 6.3.1 BRIEF DESCRIPTION OF KEY UAV PRODUCTS

- TABLE 42 KEY UAV PRODUCTS

- 6.4 UAV SPECIFICATIONS

- 6.5 SOFTWARE USED IN UAVS

- TABLE 43 RECENT UPGRADES TO UAV-BASED SOFTWARE

- 6.6 UAV SERVICES

- TABLE 44 COMPANIES PROVIDING VARIOUS UAV SERVICES

- 6.7 IMPACT OF MEGATRENDS

- 6.7.1 NANOTECHNOLOGY

- 6.7.2 ARTIFICIAL INTELLIGENCE

- 6.7.3 GREEN INITIATIVE

- 6.7.4 GREATER CUSTOMIZATION

- 6.7.5 DISRUPTIVE TECHNOLOGIES

- 6.7.6 REGULATORY CHANGES

- 6.7.7 EXTENDING REACH OF MOBILE IOT

- 6.7.8 REDUCING ENVIRONMENTAL IMPACT OF DELIVERY VEHICLES

- 6.7.9 3D PRINTING

- 6.8 MATURITY MAPPING OF DRONE TECHNOLOGIES

- FIGURE 54 MATURITY STAGES OF DRONE TECHNOLOGIES

- 6.9 SUPPLY CHAIN ANALYSIS

- FIGURE 55 SUPPLY CHAIN ANALYSIS

- 6.10 PATENT ANALYSIS

- FIGURE 56 PATENT ANALYSIS

- TABLE 45 UAV MARKET: KEY PATENTS, JANUARY 2020-APRIL 2024

7 UAV MARKET, BY POINT OF SALE

- 7.1 INTRODUCTION

- FIGURE 57 OEM SEGMENT OF UAV MARKET TO GROW AT HIGHER CAGR FROM 2024 TO 2029

- TABLE 46 UAV MARKET, BY POINT OF SALE, 2020-2023 (USD MILLION)

- TABLE 47 UAV MARKET, BY POINT OF SALE, 2024-2029 (USD MILLION)

- 7.2 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

- 7.2.1 INCREASING ADOPTION OF NEXT-GENERATION UAVS TO DRIVE MARKET

- 7.3 AFTERMARKET

- 7.3.1 HIGH DEMAND FOR AFTERMARKET SERVICES TO MAINTAIN AND UPGRADE UAVS TO DRIVE MARKET

- TABLE 48 UAV AFTERMARKET, BY SERVICE, 2020-2023 (USD MILLION)

- TABLE 49 UAV AFTERMARKET, BY SERVICE, 2024-2029 (USD MILLION)

- 7.3.2 REPLACEMENT

- 7.3.3 MAINTENANCE, REPAIR, AND OVERHAUL (MRO)

- 7.3.4 SIMULATION & TRAINING

8 UAV MARKET, BY SYSTEM

- 8.1 INTRODUCTION

- FIGURE 58 PLATFORM SEGMENT TO ACCOUNT FOR LARGEST SHARE OF UAV MARKET, 2024-2029

- TABLE 50 UAV MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 51 UAV MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

- 8.2 PLATFORM

- 8.2.1 INCREASING ADOPTION IN COMMERCIAL AND DEFENSE SEGMENTS TO DRIVE MARKET

- TABLE 52 PLATFORM: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 53 PLATFORM: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.2.2 AIRFRAME

- TABLE 54 AIRFRAME: UAV MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 55 AIRFRAME: UAV MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- 8.2.2.1 Alloys

- 8.2.2.2 Plastics

- 8.2.2.3 Composites

- TABLE 56 COMPOSITES: UAV AIRFRAME MATERIAL MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 57 COMPOSITES: UAV AIRFRAME MATERIAL MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.2.2.3.1 Carbon fiber-reinforced polymer (CFRP)

- 8.2.2.3.2 Glass fiber-reinforced polymer (GFRP)

- 8.2.2.3.3 Boron fiber-reinforced polymer (BFRP)

- 8.2.2.3.4 Aramid fiber-reinforced polymer (AFRP)

- 8.2.3 AVIONICS

- TABLE 58 AVIONICS: UAV MARKET, BY SYSTEM TYPE, 2020-2023 (USD MILLION)

- TABLE 59 AVIONICS: UAV MARKET, BY SYSTEM TYPE, 2024-2029 (USD MILLION)

- 8.2.3.1 Flight control

- TABLE 60 FLIGHT CONTROL SYSTEM: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 61 FLIGHT CONTROL SYSTEM: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.2.3.1.1 Air Data/Computer

- 8.2.3.1.2 Autopilot/Flight control computer

- 8.2.3.2 Navigation

- TABLE 62 NAVIGATION: UAV MARKET, BY SYSTEM TYPE, 2020-2023 (USD MILLION)

- TABLE 63 NAVIGATION: UAV MARKET, BY SYSTEM TYPE, 2024-2029 (USD MILLION)

- 8.2.3.2.1 Global positioning system (GPS)/Global navigation satellite system (GNSS)

- 8.2.3.2.2 Inertial navigation system (INS)/Inertial measurement unit (IMU)

- 8.2.3.2.3 Sense & avoid

- 8.2.3.3 Sensor

- TABLE 64 SENSOR: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 65 SENSOR: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.2.3.3.1 Speed sensor

- 8.2.3.3.2 Light sensor

- 8.2.3.3.3 Proximity sensor

- 8.2.3.3.4 Temperature sensor

- 8.2.3.3.5 Position sensor

- 8.2.3.4 Communications

- 8.2.3.5 Others

- 8.2.4 PROPULSION SYSTEM

- TABLE 66 PROPULSION SYSTEM: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 67 PROPULSION SYSTEM: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.2.4.1 Engine

- TABLE 68 ENGINE: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 69 ENGINE: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.2.4.1.1 Gas engine

- 8.2.4.1.2 Electric engine

- 8.2.4.2 Battery

- TABLE 70 BATTERY: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 71 BATTERY: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.2.4.2.1 Rechargeable

- 8.2.4.2.2 Solar cell

- 8.2.4.2.3 Fuel cell

- 8.2.5 SOFTWARE

- 8.3 PAYLOAD

- 8.3.1 HIGH DEMAND FROM COMMERCIAL SEGMENT TO DRIVE MARKET

- TABLE 72 PAYLOAD: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 73 PAYLOAD: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.3.2 CAMERA

- TABLE 74 CAMERA: UAV PAYLOAD MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 75 CAMERA: UAV PAYLOAD MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.3.2.1 High-resolution camera

- 8.3.2.2 Multispectral camera

- 8.3.2.3 Hyperspectral camera

- 8.3.2.4 Thermal camera

- 8.3.2.5 Electro-optical (EO)/Infrared (IR) camera

- 8.3.3 INTELLIGENCE PAYLOAD

- TABLE 76 INTELLIGENCE PAYLOAD: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 77 INTELLIGENCE PAYLOAD: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.3.3.1 Signal intelligence (SIGINT)

- 8.3.3.2 Electronic intelligence (ELINT)

- 8.3.3.3 Communication intelligence (COMINT)

- 8.3.3.4 Telemetry intelligence (TELINT)

- 8.3.4 RADAR

- TABLE 78 RADAR: UAV PAYLOAD MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 79 RADAR: UAV PAYLOAD MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.3.4.1 Synthetic aperture radar (SAR)

- 8.3.4.2 Active electronically scanned array (AESA) radar

- 8.3.5 LIDAR

- 8.3.6 GIMBAL

- 8.4 DATA LINK

- 8.4.1 DEFENSE SECTOR TO UNDERPIN GROWTH OF DATA LINK MARKET

- 8.5 GROUND CONTROL STATION

- 8.5.1 ABILITY TO ENABLE MISSION PLANNING AND OFFER FULL FLIGHT CONTROL FOR DRONES TO DRIVE MARKET

- 8.6 LAUNCH & RECOVERY SYSTEM

- 8.6.1 APPLICATION LIMITED TO SMALL UAVS

9 UAV MARKET, BY PLATFORM

- 9.1 INTRODUCTION

- TABLE 80 UAV MARKET VOLUME (IN UNITS), BY PLATFORM, 2020-2023

- TABLE 81 UAV MARKET VOLUME (IN UNITS), BY PLATFORM, 2024-2029

- FIGURE 59 DEFENSE & GOVERNMENT PLATFORM TO DOMINATE UAV MARKET FROM 2024 TO 2029

- TABLE 82 UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 83 UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- 9.2 CIVIL & COMMERCIAL

- 9.2.1 EMERGING APPLICATIONS IN CIVIL AND COMMERCIAL SECTORS TO DRIVE MARKET

- TABLE 84 CIVIL & COMMERCIAL: UAV MARKET, BY PLATFORM TYPE, 2020-2023 (USD MILLION)

- TABLE 85 CIVIL & COMMERCIAL: UAV MARKET, BY PLATFORM TYPE, 2024-2029 (USD MILLION)

- 9.2.2 MICRO

- 9.2.3 SMALL

- 9.2.4 MEDIUM

- 9.2.5 LARGE

- 9.3 DEFENSE & GOVERNMENT

- 9.3.1 INCREASING USE OF DRONES IN RESCUE AND ISR OPERATIONS TO DRIVE MARKET

- TABLE 86 DEFENSE & GOVERNMENT: UAV MARKET, BY PLATFORM TYPE, 2020-2023 (USD MILLION)

- TABLE 87 DEFENSE & GOVERNMENT: UAV MARKET, BY PLATFORM TYPE, 2024-2029 (USD MILLION)

- 9.3.2 SMALL

- TABLE 88 SMALL UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 89 SMALL UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 9.3.2.1 Nano

- 9.3.2.2 Micro

- 9.3.2.3 Mini

- 9.4 TACTICAL

- TABLE 90 TACTICAL UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 91 TACTICAL UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 9.4.1 CLOSE RANGE

- 9.4.2 SHORT RANGE

- 9.4.3 MEDIUM RANGE

- 9.4.4 LONG RANGE

- 9.4.5 STRATEGIC

- TABLE 92 STRATEGIC UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 93 STRATEGIC UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 9.4.5.1 HALE

- 9.4.5.2 MALE

10 UAV MARKET, BY FUNCTION

- 10.1 INTRODUCTION

- FIGURE 60 SPECIAL-PURPOSE DRONES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE FROM 2024 TO 2029

- TABLE 94 UAV MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 95 UAV MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- 10.2 SPECIAL PURPOSE DRONES

- TABLE 96 SPECIAL PURPOSE DRONES: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 97 SPECIAL PURPOSE DRONES: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 10.2.1 UCAVS

- 10.2.2 SWARM DRONES

- 10.2.3 STRATOSPHERIC DRONES

- 10.2.4 EXO-STRATOSPHERIC DRONES

- 10.3 PASSENGER DRONES

- TABLE 98 PASSENGER DRONES: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 99 PASSENGER DRONES: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 10.3.1 DRONE TAXIS

- 10.3.2 AIR SHUTTLES

- 10.3.3 AIR AMBULANCES

- 10.3.4 PERSONAL AIR VEHICLES

- 10.4 INSPECTION & MONITORING DRONES

- 10.5 SURVEYING & MAPPING DRONES

- 10.6 SPRAYING & SEEDING DRONES

- 10.7 OTHERS

- 10.7.1 PHOTOGRAPHY/FILMING DRONES

- 10.7.2 CARGO DELIVERY DRONES

11 UAV MARKET, BY INDUSTRY

- 11.1 INTRODUCTION

- FIGURE 61 DEFENSE & SECURITY TO COMMAND LARGEST SHARE OF UAV MARKET DURING FORECAST PERIOD

- TABLE 100 UAV MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 101 UAV MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- 11.2 DEFENSE & SECURITY

- 11.2.1 DEVELOPMENT OF ADVANCED UNMANNED SYSTEMS FOR COMBAT OPERATIONS TO DRIVE MARKET

- 11.3 AGRICULTURE

- 11.3.1 INCREASING UTILIZATION OF DRONES FOR MONITORING AND SPRAYING PURPOSES TO DRIVE MARKET

- 11.4 LOGISTICS & TRANSPORTATION

- 11.4.1 RISING DEMAND FOR REDUCED DELIVERY TIMES TO DRIVE MARKET

- TABLE 102 LOGISTICS & TRANSPORTATION: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 103 LOGISTICS & TRANSPORTATION: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 11.4.2 POSTAL & PACKAGE DELIVERY

- 11.4.3 HEALTHCARE & PHARMACY DELIVERY

- 11.4.4 RETAIL & FOOD DELIVERY

- 11.5 ENERGY & POWER

- 11.5.1 NEED FOR REAL-TIME DATA AND MAINTENANCE SURVEILLANCE FOR POWER INFRASTRUCTURE TO DRIVE MARKET

- TABLE 104 ENERGY & POWER: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 105 ENERGY & POWER: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 11.5.2 POWER GENERATION

- 11.5.3 OIL & GAS

- 11.6 CONSTRUCTION & MINING

- 11.6.1 INCREASING AVAILABILITY OF APPLICATION-SPECIFIC DRONES TO DRIVE MARKET

- 11.7 MEDIA & ENTERTAINMENT

- 11.7.1 INCREASING ADOPTION BY AMATEUR PHOTOGRAPHERS AND FILM INDUSTRY TO DRIVE MARKET

- 11.8 INSURANCE

- 11.8.1 NEED TO MONITOR DISASTER-PRONE AREAS AND GATHER DATA FOR GIVING ACCURATE QUOTES TO DRIVE MARKET

- 11.9 WILDLIFE & FORESTRY

- 11.9.1 GROWING DEMAND FOR CONSERVATION AND RESOURCE MANAGEMENT TO DRIVE MARKET

- 11.10 ACADEMICS

- 11.10.1 AVAILABILITY OF VARIETY OF INSTRUMENTS TO DRIVE MARKET

12 UAV MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- TABLE 106 UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2020-2023

- TABLE 107 UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2024-2029

- TABLE 108 UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 109 UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.2 MILITARY

- 12.2.1 EXECUTION OF HIGH-PROFILE MILITARY OR COMBAT MISSIONS TO DRIVE MARKET

- TABLE 110 MILITARY: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 111 MILITARY: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.2.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

- 12.2.3 COMBAT OPERATIONS

- TABLE 112 COMBAT OPERATIONS: MILITARY DRONE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 113 COMBAT OPERATIONS: MILITARY DRONE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.2.3.1 Lethal

- 12.2.3.2 Stealth

- 12.2.3.3 Loitering munition

- 12.2.3.4 Target

- 12.2.4 DELIVERY

- 12.3 COMMERCIAL

- 12.3.1 INTEGRATION OF VARIOUS FEATURES IN DRONES TO DRIVE MARKET

- TABLE 114 COMMERCIAL: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 115 COMMERCIAL: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.3.2 REMOTE SENSING

- 12.3.3 INSPECTION & MONITORING

- 12.3.4 PRODUCT DELIVERY

- 12.3.5 SURVEYING & MAPPING

- 12.3.6 AERIAL IMAGING

- 12.3.7 INDUSTRIAL WAREHOUSING

- 12.3.8 PASSENGER & PUBLIC TRANSPORTATION

- 12.3.9 OTHERS

- 12.4 GOVERNMENT & LAW ENFORCEMENT

- 12.4.1 ADOPTION OF UAVS FOR HOMELAND SECURITY TO DRIVE MARKET

- TABLE 116 GOVERNMENT & LAW ENFORCEMENT: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 117 GOVERNMENT & LAW ENFORCEMENT: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4.2 BORDER MANAGEMENT

- 12.4.3 TRAFFIC MONITORING

- 12.4.4 FIREFIGHTING & DISASTER MANAGEMENT

- 12.4.5 SEARCH & RESCUE

- 12.4.6 POLICE OPERATIONS & INVESTIGATION

- 12.4.7 MARITIME SECURITY

- 12.5 CONSUMER

- 12.5.1 GROWING USE OF UAVS FOR RECREATIONAL ACTIVITIES TO DRIVE MARKET

- TABLE 118 CONSUMER: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 119 CONSUMER: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.5.2 PROSUMERS

- 12.5.3 HOBBYISTS

13 UAV MARKET, BY RANGE

- 13.1 INTRODUCTION

- FIGURE 63 BVLOS SEGMENT TO LEAD UAV MARKET FROM 2024 TO 2029

- TABLE 120 UAV MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 121 UAV MARKET, BY RANGE, 2024-2029 (USD MILLION)

- 13.2 VISUAL LINE OF SIGHT (VLOS)

- 13.2.1 EASE OF USE AND COST-EFFECTIVENESS TO DRIVE MARKET

- 13.3 EXTENDED VISUAL LINE OF SIGHT (EVLOS)

- 13.3.1 INCREASING APPLICATIONS IN COMMERCIAL AND MILITARY SEGMENTS TO DRIVE MARKET

- 13.4 BEYOND VISUAL LINE OF SIGHT (BVLOS)

- 13.4.1 INCREASED DEPLOYMENT FOR MILITARY OPERATIONS

14 UAV MARKET, BY MODE OF OPERATION

- 14.1 INTRODUCTION

- FIGURE 64 OPTIONALLY PILOTED SEGMENT TO ACCOUNT FOR LARGEST SHARE OF UAV MARKET FROM 2024 TO 2029

- TABLE 122 UAV MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 123 UAV MARKET, BY MODE OF OPERATION, 2024-2029 (USD MILLION)

- 14.2 REMOTELY PILOTED

- 14.2.1 AFFORDABLE MANUFACTURING TO DRIVE MARKET

- 14.3 OPTIONALLY PILOTED

- 14.3.1 EXTENSIVE USE IN MILITARY AND COMMERCIAL APPLICATIONS TO DRIVE MARKET

- 14.4 FULLY AUTONOMOUS

- 14.4.1 HUGE DEMAND FOR MILITARY APPLICATIONS TO DRIVE MARKET

15 UAV MARKET, BY TYPE

- 15.1 INTRODUCTION

- FIGURE 65 FIXED WING SEGMENT TO LEAD UAV MARKET FROM 2024 TO 2029

- TABLE 124 UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 125 UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 15.2 FIXED WING

- 15.2.1 LONG-RANGE CAPABILITIES TO DRIVE MARKET

- FIGURE 66 CTOL SEGMENT TO LEAD FIXED-WING UAV MARKET FROM 2024 TO 2029

- TABLE 126 FIXED-WING UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 127 FIXED-WING UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 15.2.2 CTOL

- 15.2.3 VTOL

- 15.3 ROTARY WING

- 15.3.1 LEADING INNOVATORS IN MULTIROTOR UAVS USED IN DEFENSE, COMMERCIAL, AND INDUSTRIAL SECTORS TO DRIVE MARKET

- FIGURE 67 MULTIROTOR SEGMENT TO LEAD ROTARY-WING UAV MARKET FROM 2024 TO 2029

- TABLE 128 ROTARY-WING UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 129 ROTARY WING UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 15.3.1.1 Single rotor

- 15.3.1.2 Multirotor

- FIGURE 68 QUADCOPTER SEGMENT TO LEAD MULTIROTOR UAV MARKET FROM 2024 TO 2029

- TABLE 130 MULTIROTOR UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 131 MULTIROTOR UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 15.3.1.3 Bicopter

- 15.3.1.4 Tricopter

- 15.3.1.5 Quadcopter

- 15.3.1.6 Hexacopter

- 15.3.1.7 Octocopter

- 15.4 HYBRID WING

- 15.4.1 INNOVATION IN HYBRID DRONE TECHNOLOGY TO DRIVE MARKET

16 UAV MARKET, BY MTOW

- 16.1 INTRODUCTION

- FIGURE 69 <25 KILOGRAMS MTOW SEGMENT TO LEAD UAV MARKET FROM 2024 TO 2029

- TABLE 132 UAV MARKET, BY MTOW, 2020-2023 (USD MILLION)

- TABLE 133 UAV MARKET, BY MTOW, 2024-2029 (USD MILLION)

- 16.2 <25 KILOGRAMS

- 16.2.1 COMMERCIAL APPLICATIONS TO DRIVE MARKET

- 16.3 25-170 KILOGRAMS

- 16.3.1 MILITARY APPLICATIONS TO DRIVE MARKET

- 16.4 >170 KILOGRAMS

- 16.4.1 HIGH DEFENSE EXPENDITURE WORLDWIDE TO DRIVE MARKET

17 UAV MARKET, BY REGION

- 17.1 INTRODUCTION

- 17.2 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 134 RECESSION IMPACT ANALYSIS

- FIGURE 70 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF UAV MARKET IN 2024

- TABLE 135 UAV MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 136 UAV MARKET, BY REGION, 2024-2029 (USD MILLION)

- 17.3 NORTH AMERICA

- 17.3.1 RECESSION IMPACT ANALYSIS

- 17.3.2 PESTLE ANALYSIS

- FIGURE 71 NORTH AMERICA: UAV MARKET SNAPSHOT

- FIGURE 72 NORTH AMERICA: UAV VOLUME BY APPLICATION (IN UNITS)

- TABLE 137 NORTH AMERICA: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2020-2023

- TABLE 138 NORTH AMERICA: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2024-2029

- TABLE 139 NORTH AMERICA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 140 NORTH AMERICA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 141 NORTH AMERICA: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 142 NORTH AMERICA: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 143 NORTH AMERICA: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 144 NORTH AMERICA: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 145 NORTH AMERICA: UAV MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 146 NORTH AMERICA: UAV MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 147 NORTH AMERICA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 148 NORTH AMERICA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 149 NORTH AMERICA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 150 NORTH AMERICA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 151 NORTH AMERICA: UAV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 152 NORTH AMERICA: UAV MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 17.3.3 US

- 17.3.3.1 Constant innovation and heavy investment in advanced drone technology to drive the market

- TABLE 153 US: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 154 US: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 155 US: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 156 US: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 157 US: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 158 US: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.3.4 CANADA

- 17.3.4.1 Increasing procurement of military UAVs to drive market

- TABLE 159 CANADA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 160 CANADA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 161 CANADA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 162 CANADA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 163 CANADA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 164 CANADA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.4 ASIA PACIFIC

- 17.4.1 PESTLE ANALYSIS

- 17.4.2 RECESSION IMPACT ANALYSIS

- FIGURE 73 ASIA PACIFIC: UAV MARKET SNAPSHOT

- FIGURE 74 ASIA PACIFIC: UAV VOLUME BY APPLICATION (IN UNITS)

- TABLE 165 ASIA PACIFIC: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2020-2023

- TABLE 166 ASIA PACIFIC: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2024-2029

- TABLE 167 ASIA PACIFIC: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 168 ASIA PACIFIC: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 169 ASIA PACIFIC: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 170 ASIA PACIFIC: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 171 ASIA PACIFIC: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 172 ASIA PACIFIC: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 173 ASIA PACIFIC: UAV MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 174 ASIA PACIFIC: UAV MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 175 ASIA PACIFIC: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 176 ASIA PACIFIC: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 177 ASIA PACIFIC: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 178 ASIA PACIFIC: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 179 ASIA PACIFIC: UAV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 180 ASIA PACIFIC: UAV MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 17.4.3 CHINA

- 17.4.3.1 Constant innovations in drone technology to drive market

- TABLE 181 CHINA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 182 CHINA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 183 CHINA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 184 CHINA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 185 CHINA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 186 CHINA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.4.4 INDIA

- 17.4.4.1 Development of advanced weaponry to improve border security to drive market

- TABLE 187 INDIA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 188 INDIA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 189 INDIA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 190 INDIA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 191 INDIA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 192 INDIA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.4.5 JAPAN

- 17.4.5.1 Modernization in drone designs to drive market

- TABLE 193 JAPAN: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 194 JAPAN: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 195 JAPAN: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 196 JAPAN: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 197 JAPAN: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 198 JAPAN: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.4.6 AUSTRALIA

- 17.4.6.1 Increasing adoption of UAVs for commercial applications to drive market

- TABLE 199 AUSTRALIA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 200 AUSTRALIA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 201 AUSTRALIA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 202 AUSTRALIA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 203 AUSTRALIA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 204 AUSTRALIA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.4.7 SOUTH KOREA

- 17.4.7.1 Innovations in UAVs and increase in defense spending to drive market

- TABLE 205 SOUTH KOREA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 206 SOUTH KOREA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 207 SOUTH KOREA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 208 SOUTH KOREA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 209 SOUTH KOREA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 210 SOUTH KOREA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.4.8 REST OF ASIA PACIFIC

- TABLE 211 REST OF ASIA PACIFIC: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 215 REST OF ASIA PACIFIC: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.5 EUROPE

- 17.5.1 PESTLE ANALYSIS

- 17.5.2 RECESSION IMPACT ANALYSIS

- FIGURE 75 EUROPE: UAV MARKET SNAPSHOT

- FIGURE 76 EUROPE: UAV VOLUME BY APPLICATION (IN UNITS)

- TABLE 217 EUROPE: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2020-2023

- TABLE 218 EUROPE: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2024-2029

- TABLE 219 EUROPE: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 220 EUROPE: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 221 EUROPE: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 222 EUROPE: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 223 EUROPE: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 224 EUROPE: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 225 EUROPE: UAV MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 226 EUROPE: UAV MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 227 EUROPE: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 228 EUROPE: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 229 EUROPE: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 230 EUROPE: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 231 EUROPE: UAV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 232 EUROPE: UAV MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 17.5.3 UK

- 17.5.3.1 Continuous technological advancement in UAVs to drive market

- TABLE 233 UK: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 234 UK: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 235 UK: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 236 UK: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 237 UK: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 238 UK: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.5.4 GERMANY

- 17.5.4.1 Government funding and UAV contracts to drive market

- TABLE 239 GERMANY: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 240 GERMANY: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 241 GERMANY: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 242 GERMANY: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 243 GERMANY: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 244 GERMANY: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.5.5 FRANCE

- 17.5.5.1 Government initiatives boosting UAV use for civil and commercial applications to drive market

- TABLE 245 FRANCE: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 246 FRANCE: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 247 FRANCE: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 248 FRANCE: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 249 FRANCE: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 250 FRANCE: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.5.6 ITALY

- 17.5.6.1 Growing demand for drones from healthcare industry to drive market

- TABLE 251 ITALY: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 252 ITALY: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 253 ITALY: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 254 ITALY: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 255 ITALY: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 256 ITALY: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.5.7 RUSSIA

- 17.5.7.1 Growing focus on enhancing military capabilities to drive market

- TABLE 257 RUSSIA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 258 RUSSIA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 259 RUSSIA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 260 RUSSIA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 261 RUSSIA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 262 RUSSIA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.5.8 SWEDEN

- 17.5.8.1 Increasing deployment for national security forces to drive market

- TABLE 263 SWEDEN: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 264 SWEDEN: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 265 SWEDEN: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 266 SWEDEN: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 267 SWEDEN: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 268 SWEDEN: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.5.9 REST OF EUROPE

- TABLE 269 REST OF EUROPE: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 270 REST OF EUROPE: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 271 REST OF EUROPE: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 272 REST OF EUROPE: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 273 REST OF EUROPE: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 274 REST OF EUROPE: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.6 LATIN AMERICA

- 17.6.1 PESTLE ANALYSIS

- 17.6.2 RECESSION IMPACT ANALYSIS

- FIGURE 77 LATIN AMERICA: UAV MARKET SNAPSHOT

- FIGURE 78 LATIN AMERICA: UAV VOLUME BY APPLICATION (IN UNITS)

- TABLE 275 LATIN AMERICA: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2020-2023

- TABLE 276 LATIN AMERICA: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2024-2029

- TABLE 277 LATIN AMERICA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 278 LATIN AMERICA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 279 LATIN AMERICA: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 280 LATIN AMERICA: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 281 LATIN AMERICA: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 282 LATIN AMERICA: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 283 LATIN AMERICA: UAV MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 284 LATIN AMERICA: UAV MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 285 LATIN AMERICA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 286 LATIN AMERICA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 287 LATIN AMERICA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 288 LATIN AMERICA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 289 LATIN AMERICA: UAV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 290 LATIN AMERICA: UAV MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 17.6.3 BRAZIL

- 17.6.3.1 Increasing procurement of UAVs for safety, security, and advanced intelligence missions to drive market

- TABLE 291 BRAZIL: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 292 BRAZIL: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 293 BRAZIL: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 294 BRAZIL: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 295 BRAZIL: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 296 BRAZIL: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.6.4 MEXICO

- 17.6.4.1 Growing focus on developing drones for monitoring and curbing forest fires to drive market

- TABLE 297 MEXICO: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 298 MEXICO: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 299 MEXICO: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 300 MEXICO: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 301 MEXICO: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 302 MEXICO: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.6.5 ARGENTINA

- 17.6.5.1 Relaxation of UAV regulations to drive market

- TABLE 303 ARGENTINA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 304 ARGENTINA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 305 ARGENTINA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 306 ARGENTINA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 307 ARGENTINA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 308 ARGENTINA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.6.6 REST OF LATIN AMERICA

- TABLE 309 REST OF LATIN AMERICA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 310 REST OF LATIN AMERICA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 311 REST OF LATIN AMERICA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 312 REST OF LATIN AMERICA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 313 REST OF LATIN AMERICA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 314 REST OF LATIN AMERICA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.7 MIDDLE EAST

- 17.7.1 PESTLE ANALYSIS

- 17.7.2 RECESSION IMPACT ANALYSIS

- FIGURE 79 MIDDLE EAST: UAV MARKET SNAPSHOT

- FIGURE 80 MIDDLE EAST: UAV VOLUME BY APPLICATION (IN UNITS)

- TABLE 315 MIDDLE EAST: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2020-2023

- TABLE 316 MIDDLE EAST: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2024-2029

- TABLE 317 MIDDLE EAST: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 318 MIDDLE EAST: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 319 MIDDLE EAST: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 320 MIDDLE EAST: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 321 MIDDLE EAST: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 322 MIDDLE EAST: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 323 MIDDLE EAST: UAV MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 324 MIDDLE EAST: UAV MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 325 MIDDLE EAST: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 326 MIDDLE EAST: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 327 MIDDLE EAST: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 328 MIDDLE EAST: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 329 MIDDLE EAST: UAV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 330 MIDDLE EAST: UAV MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 17.7.3 GCC COUNTRIES

- 17.7.3.1 UAE

- 17.7.3.1.1 Increasing procurement of drones to drive market

- 17.7.3.1 UAE

- TABLE 331 UAE: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 332 UAE: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 333 UAE: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 334 UAE: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 335 UAE: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 336 UAE: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.7.3.2 Saudi Arabia

- 17.7.3.2.1 Rising adoption of UAVs for military applications to drive market

- 17.7.3.2 Saudi Arabia

- TABLE 337 SAUDI ARABIA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 338 SAUDI ARABIA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 339 SAUDI ARABIA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 340 SAUDI ARABIA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 341 SAUDI ARABIA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 342 SAUDI ARABIA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.7.4 ISRAEL

- 17.7.4.1 Increasing use of small drones in ISR applications to drive market

- TABLE 343 ISRAEL: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 344 ISRAEL: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 345 ISRAEL: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 346 ISRAEL: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 347 ISRAEL: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 348 ISRAEL: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.7.5 TURKEY

- 17.7.5.1 Growing demand for UAVs and subsystems by defense forces to drive market

- TABLE 349 TURKEY: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 350 TURKEY: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 351 TURKEY: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 352 TURKEY: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 353 TURKEY: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 354 TURKEY: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.7.6 REST OF MIDDLE EAST

- TABLE 355 REST OF MIDDLE EAST: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 356 REST OF MIDDLE EAST: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 357 REST OF MIDDLE EAST: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 358 REST OF MIDDLE EAST: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 359 REST OF MIDDLE EAST: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 360 REST OF MIDDLE EAST: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.8 AFRICA

- 17.8.1 PESTLE ANALYSIS

- 17.8.2 RECESSION IMPACT ANALYSIS

- FIGURE 81 AFRICA: UAV MARKET SNAPSHOT

- FIGURE 82 AFRICA: UAV MARKET VOLUME, BY APPLICATION ( IN UNITS)

- TABLE 361 AFRICA: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2020-2023

- TABLE 362 AFRICA: UAV MARKET VOLUME (IN UNITS), BY APPLICATION, 2024-2029

- TABLE 363 AFRICA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 364 AFRICA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 365 AFRICA: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 366 AFRICA: CIVIL & COMMERCIAL UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 367 AFRICA: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 368 AFRICA: DEFENSE & GOVERNMENT UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 369 AFRICA: UAV MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 370 AFRICA: UAV MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 371 AFRICA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 372 AFRICA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 373 AFRICA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 374 AFRICA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 375 AFRICA: UAV MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 376 AFRICA: UAV MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 17.8.3 SOUTH AFRICA

- 17.8.3.1 Increasing number of UAV contracts to drive market

- TABLE 377 SOUTH AFRICA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 378 SOUTH AFRICA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 379 SOUTH AFRICA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 380 SOUTH AFRICA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 381 SOUTH AFRICA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 382 SOUTH AFRICA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.8.4 NIGERIA

- 17.8.4.1 Growing use of UAVs in military applications to drive market

- TABLE 383 NIGERIA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 384 NIGERIA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 385 NIGERIA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 386 NIGERIA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 387 NIGERIA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 388 NIGERIA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 17.8.5 REST OF AFRICA

- TABLE 389 REST OF AFRICA: UAV MARKET, BY PLATFORM, 2020-2023 (USD MILLION)

- TABLE 390 REST OF AFRICA: UAV MARKET, BY PLATFORM, 2024-2029 (USD MILLION)

- TABLE 391 REST OF AFRICA: UAV MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 392 REST OF AFRICA: UAV MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 393 REST OF AFRICA: UAV MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 394 REST OF AFRICA: UAV MARKET, BY TYPE, 2024-2029 (USD MILLION)

18 COMPETITIVE LANDSCAPE

- 18.1 INTRODUCTION

- 18.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 395 STRATEGIES ADOPTED BY KEY PLAYERS, 2023

- 18.3 MARKET RANKING ANALYSIS

- FIGURE 83 MARKET RANKING OF KEY PLAYERS FOR CIVIL & COMMERCIAL PLATFORM, 2023

- FIGURE 84 MARKET RANKING OF KEY PLAYERS FOR DEFENSE & GOVERNMENT PLATFORM, 2023

- 18.4 REVENUE ANALYSIS

- FIGURE 85 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2019-2023

- 18.5 MARKET SHARE ANALYSIS

- FIGURE 86 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- TABLE 396 UAV MARKET: DEGREE OF COMPETITION

- 18.6 COMPANY EVALUATION MATRIX

- 18.6.1 STARS

- 18.6.2 EMERGING LEADERS

- 18.6.3 PERVASIVE PLAYERS

- 18.6.4 PARTICIPANTS

- FIGURE 87 COMPANY EVALUATION MATRIX, 2023

- 18.6.5 COMPANY FOOTPRINT

- FIGURE 88 UAV MARKET: COMPANY FOOTPRINT

- TABLE 397 UAV MARKET: APPLICATION FOOTPRINT

- TABLE 398 UAV MARKET: TYPE FOOTPRINT

- TABLE 399 UAV MARKET: PLATFORM FOOTPRINT

- TABLE 400 UAV MARKET: POINT OF SALE FOOTPRINT

- TABLE 401 UAV MARKET: REGION FOOTPRINT

- 18.7 START-UP/SME EVALUATION MATRIX

- 18.7.1 PROGRESSIVE COMPANIES

- 18.7.2 RESPONSIVE COMPANIES

- 18.7.3 DYNAMIC COMPANIES

- 18.7.4 STARTING BLOCKS

- FIGURE 89 START-UP/SME EVALUATION MATRIX, 2023

- 18.7.5 COMPETITIVE BENCHMARKING

- TABLE 402 KEY START-UPS/SMES

- TABLE 403 UAV MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 18.8 COMPANY VALUATION

- FIGURE 90 VALUATION OF PROMINENT MARKET PLAYERS, 2023

- 18.9 FINANCIAL METRICS

- FIGURE 91 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- 18.10 BRAND COMPARISON

- 18.11 COMPETITIVE SCENARIOS AND TRENDS

- 18.11.1 PRODUCT LAUNCHES

- TABLE 404 PRODUCT LAUNCHES, OCTOBER 2020-SEPTEMBER 2023

- 18.11.2 DEALS

- TABLE 405 DEALS, JANUARY 2020-APRIL 2024

- 18.11.3 OTHER DEVELOPMENTS

- TABLE 406 OTHER DEVELOPMENTS, JANUARY 2020-FEBRUARY 2024

19 COMPANY PROFILES

- 19.1 KEY PLAYERS

- (Business overview, Products offered, Recent developments, MnM view, Key strategies, Strategic choices made, and Weaknesses and Competitive threats)**

- 19.1.1 SZ DJI TECHNOLOGY CO., LTD.

- TABLE 407 SZ DJI TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 408 SZ DJI TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 409 SZ DJI TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 410 SZ DJI TECHNOLOGY CO., LTD.: DEALS

- 19.1.2 NORTHROP GRUMMAN CORPORATION

- TABLE 411 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- FIGURE 92 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 412 NORTHROP GRUMMAN CORPORATION: PRODUCTS OFFERED

- TABLE 413 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 414 NORTHROP GRUMMAN CORPORATION: OTHER DEVELOPMENTS

- 19.1.3 ISRAEL AEROSPACE INDUSTRIES LTD.

- TABLE 415 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 93 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 416 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 417 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCT LAUNCHES

- TABLE 418 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

- TABLE 419 ISRAEL AEROSPACE INDUSTRIES LTD.: OTHER DEVELOPMENTS

- 19.1.4 TELEDYNE FLIR LLC

- TABLE 420 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- FIGURE 94 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- TABLE 421 TELEDYNE FLIR LLC: PRODUCTS OFFERED

- TABLE 422 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 423 TELEDYNE FLIR LLC : DEALS

- TABLE 424 TELEDYNE FLIR LLC: OTHER DEVELOPMENTS

- 19.1.5 GENERAL ATOMICS AERONAUTICAL SYSTEMS

- TABLE 425 GENERAL ATOMICS AERONAUTICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 426 GENERAL ATOMICS AERONAUTICAL SYSTEMS: PRODUCTS OFFERED

- TABLE 427 GENERAL ATOMICS AERONAUTICAL SYSTEMS: PRODUCT LAUNCHES

- TABLE 428 GENERAL ATOMICS AERONAUTICAL SYSTEMS: DEALS

- TABLE 429 GENERAL ATOMICS AERONAUTICAL SYSTEMS: OTHER DEVELOPMENTS

- 19.1.6 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 430 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- FIGURE 95 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 431 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

- TABLE 432 RAYTHEON TECHNOLOGIES CORPORATION: OTHER DEVELOPMENTS

- 19.1.7 PARROT DRONE SAS

- TABLE 433 PARROT DRONE SAS: COMPANY OVERVIEW

- FIGURE 96 PARROT DRONE SAS: COMPANY SNAPSHOT

- TABLE 434 PARROT DRONE SAS: PRODUCTS OFFERED

- TABLE 435 PARROT DRONE SAS: DEALS

- TABLE 436 PARROT DRONE SAS: OTHER DEVELOPMENTS

- 19.1.8 YUNEEC HOLDING LTD.

- TABLE 437 YUNEEC HOLDING LTD.: COMPANY OVERVIEW

- TABLE 438 YUNEEC HOLDING LTD.: PRODUCTS OFFERED

- TABLE 439 YUNEEC HOLDING LTD.: DEALS

- 19.1.9 EHANG HOLDINGS LIMITED

- TABLE 440 EHANG HOLDINGS LIMITED: COMPANY OVERVIEW

- FIGURE 97 EHANG HOLDINGS LIMITED: COMPANY SNAPSHOT

- TABLE 441 EHANG HOLDINGS LIMITED: PRODUCTS OFFERED

- TABLE 442 EHANG HOLDINGS LIMITED: PRODUCT LAUNCHES

- TABLE 443 EHANG HOLDINGS LIMITED: DEALS

- TABLE 444 EHANG HOLDINGS LIMITED: OTHER DEVELOPMENTS

- TABLE 445 EHANG HOLDINGS LIMITED: EXPANSIONS

- 19.1.10 LOCKHEED MARTIN CORPORATION

- TABLE 446 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- FIGURE 98 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 447 LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

- TABLE 448 LOCKHEED MARTIN CORPORATION: OTHER DEVELOPMENTS

- 19.1.11 THE BOEING COMPANY

- TABLE 449 THE BOEING COMPANY: COMPANY OVERVIEW

- FIGURE 99 THE BOEING COMPANY: COMPANY SNAPSHOT

- TABLE 450 THE BOEING COMPANY: PRODUCTS OFFERED

- TABLE 451 THE BOEING COMPANY: PRODUCT LAUNCHES

- TABLE 452 THE BOEING COMPANY: DEALS

- TABLE 453 THE BOEING COMPANY: OTHER DEVELOPMENTS

- 19.1.12 AEROVIRONMENT, INC.

- TABLE 454 AEROVIRONMENT, INC.: COMPANY OVERVIEW

- FIGURE 100 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

- TABLE 455 AEROVIRONMENT, INC.: PRODUCTS OFFERED

- TABLE 456 AEROVIRONMENT, INC.: PRODUCT LAUNCHES

- TABLE 457 AEROVIRONMENT, INC.: DEALS

- TABLE 458 AEROVIRONMENT, INC.: OTHER DEVELOPMENTS

- 19.1.13 TEXTRON INC.

- TABLE 459 TEXTRON INC.: COMPANY OVERVIEW

- FIGURE 101 TEXTRON INC.: COMPANY SNAPSHOT

- TABLE 460 TEXTRON INC.: PRODUCTS OFFERED

- TABLE 461 TEXTRON INC.: PRODUCT LAUNCHES

- TABLE 462 TEXTRON INC.: OTHER DEVELOPMENTS

- 19.1.14 BAE SYSTEMS PLC

- TABLE 463 BAE SYSTEMS PLC: COMPANY OVERVIEW

- FIGURE 102 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- TABLE 464 BAE SYSTEMS PLC: PRODUCTS OFFERED

- TABLE 465 BAE SYSTEMS PLC: PRODUCT LAUNCHES

- TABLE 466 BAE SYSTEMS PLC: DEALS

- TABLE 467 BAE SYSTEMS PLC: OTHER DEVELOPMENTS

- 19.1.15 THALES GROUP

- TABLE 468 THALES GROUP: COMPANY OVERVIEW

- FIGURE 103 THALES GROUP: COMPANY SNAPSHOT

- TABLE 469 THALES GROUP: PRODUCTS OFFERED

- TABLE 470 THALES GROUP: DEALS

- TABLE 471 THALES GROUP: OTHER DEVELOPMENTS

- 19.1.16 ELBIT SYSTEMS LTD.

- TABLE 472 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- FIGURE 104 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 473 ELBIT SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 474 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 475 ELBIT SYSTEMS LTD.: DEALS

- TABLE 476 ELBIT SYSTEMS LTD.: OTHER DEVELOPMENTS

- 19.1.17 AERONAUTICS LTD

- TABLE 477 AERONAUTICS LTD: COMPANY OVERVIEW

- TABLE 478 AERONAUTICS LTD: PRODUCTS OFFERED

- TABLE 479 AERONAUTICS LTD: OTHER DEVELOPMENTS

- 19.1.18 SKYDIO, INC.

- TABLE 480 SKYDIO, INC.: COMPANY OVERVIEW

- TABLE 481 SKYDIO, INC.: PRODUCTS OFFERED

- TABLE 482 SKYDIO, INC.: OTHER DEVELOPMENTS

- 19.1.19 XAG CO., LTD.

- TABLE 483 XAG CO., LTD.: COMPANY OVERVIEW

- TABLE 484 XAG CO., LTD.: PRODUCTS OFFERED

- TABLE 485 XAG CO., LTD.: PRODUCT LAUNCHES

- 19.1.20 CHENGDU JOUAV AUTOMATION TECH CO., LTD

- TABLE 486 CHENGDU JOUAV AUTOMATION TECH CO., LTD: COMPANY OVERVIEW

- FIGURE 105 CHENGDU JOUAV AUTOMATION TECH CO., LTD: COMPANY SNAPSHOT

- TABLE 487 CHENGDU JOUAV AUTOMATION TECH CO., LTD: PRODUCTS OFFERED

- TABLE 488 CHENGDU JOUAV AUTOMATION TECH CO., LTD: PRODUCT LAUNCHES

- TABLE 489 CHENGDU JOUAV AUTOMATION TECH CO., LTD: EXPANSIONS

- 19.1.21 LEONARDO S.P.A.

- TABLE 490 LEONARDO S.P.A.: COMPANY OVERVIEW

- FIGURE 106 LEONARDO S.P.A.: COMPANY SNAPSHOT

- TABLE 491 LEONARDO S.P.A.: PRODUCTS OFFERED

- TABLE 492 LEONARDO S.P.A.: DEALS

- 19.2 OTHER PLAYERS

- 19.2.1 SHIELD AI

- TABLE 493 SHIELD AI: COMPANY OVERVIEW

- 19.2.2 DELAIR

- TABLE 494 DELAIR: COMPANY OVERVIEW

- 19.2.3 VOLOCOPTER GMBH

- TABLE 495 VOLOCOPTER GMBH: COMPANY OVERVIEW

- 19.2.4 MICRODRONES

- TABLE 496 MICRODRONES: COMPANY OVERVIEW

- 19.2.5 TURKISH AEROSPACE INDUSTRIES

- TABLE 497 TURKISH AEROSPACE INDUSTRIES: COMPANY OVERVIEW

- 19.2.6 AUTEL ROBOTICS.

- TABLE 498 AUTEL ROBOTICS.: COMPANY OVERVIEW

- 19.2.7 VOLANSI, INC.

- TABLE 499 VOLANSI, INC.: COMPANY OVERVIEW

- 19.2.8 FLYABILITY

- TABLE 500 FLYABILITY: COMPANY OVERVIEW

- 19.2.9 WINGTRA

- TABLE 501 WINGTRA: COMPANY OVERVIEW

- 19.2.10 GARUDA AEROSPACE.

- TABLE 502 GARUDA AEROSPACE.: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent developments, MnM view, Key strategies, Strategic choices made, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

20 APPENDIX