|

|

市場調査レポート

商品コード

1808965

イムノアッセイの世界市場:製品別、技術別、検体別、用途別、エンドユーザー別、地域別 - 2030年までの予測Immunoassay Market by Product (Reagents & Kits, Analyzers), Technology (ELISA, CLIA, Western Blot), Specimen (Blood, Saliva, Urine), Application (Infectious Diseases, Endocrinology), End User (Hospitals & Clinics, Laboratories) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| イムノアッセイの世界市場:製品別、技術別、検体別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月01日

発行: MarketsandMarkets

ページ情報: 英文 494 Pages

納期: 即納可能

|

概要

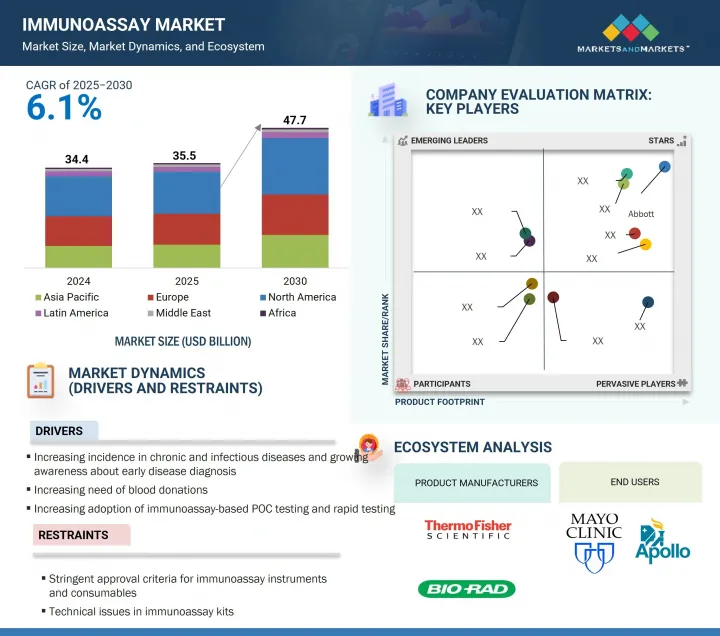

世界のイムノアッセイの市場規模は2025年に355億米ドルと推定され、予測期間中のCAGRは6.1%と見込まれており、2030年には477億米ドルに達すると予測されています。

この成長を促進する主な要因としては、慢性疾患や感染症の増加、イムノアッセイシステムの継続的な技術進歩、政府の支援政策、厳しい規制による薬物・アルコール検査の重視の高まりなどが挙げられます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、技術別、検体別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

製品別では、世界のイムノアッセイ市場は試薬・キットと分析装置に区分されます。試薬・キットは診断市場において最も重要なセグメントであり、その主な理由は幅広い診断アッセイに頻繁に使用されるためです。これらの消耗品に対する継続的な需要は、イムノアッセイ法の世界的な普及が背景にあります。さらに、診断精度と作業効率を向上させる高性能試薬やキットの導入により、より広範な導入が促進され、この分野の成長に拍車がかかっています。

イムノアッセイ市場は、技術別にELISA法、化学発光イムノアッセイ法(CLIA法)、免疫蛍光測定法(IFA法)、迅速検査法、ELISpot法、ウェスタンブロット法、その他の方法に分類されます。CLIA(化学発光イムノアッセイ法)分野は、主に慢性疾患と感染症の両方に適用できる高度な診断能力により、大幅な成長が予測されています。ELISA(Enzyme-Linked Immunosorbent Assay)やラジオイムノアッセイのような従来の方法と比較すると、CLIAは優れた感度、広いダイナミックレンジ、迅速な納期、バックグラウンド干渉の最小化、特異性の向上を示しています。これらの特性により、CLIAは、特に高い精度と信頼性が要求される臨床診断において、好ましい選択肢となっています。

世界のイムノアッセイ市場は、用途別に感染症、循環器、内分泌、腫瘍、骨・ミネラル疾患、自己免疫疾患、血液スクリーニング、アレルギー診断、薬物モニタリング・検査、新生児スクリーニング、その他に分類されます。2022年、診断検査市場は感染症に大きく影響されました。HIV/AIDS、肝炎、マラリア、インフルエンザなどの罹患率の増加が主な原因です。イムノアッセイの利用は、この動向において重要な役割を果たしています。これらの動向は、迅速かつ正確な診断を容易にし、それによって世界の感染症流行の管理を強化するからです。

イムノアッセイ市場は地域別に北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカに区分されます。予測期間中、アジア太平洋地域が最も大きな成長を遂げると予測されています。この急拡大は、相互に関連するいくつかの要因に起因しています。すなわち、患者人口の大幅な拡大、慢性疾患の有病率の上昇、疾患の早期発見の重要性に対する意識の高まり、中国、ヘルスケア、東南アジア諸国などにおける医療インフラの継続的な強化などです。

当レポートでは、世界のイムノアッセイ市場について調査し、製品別、技術別、検体別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 規制分析

- 技術分析

- 貿易分析

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- ケーススタディ分析

- 投資と資金調達のシナリオ

- AI/生成AIがイムノアッセイ市場に与える影響

- 2025年の米国関税がイムノアッセイ市場に与える影響

第6章 イムノアッセイ市場(製品別)

- イントロダクション

- 試薬・キット

- アナライザー

第7章 イムノアッセイ市場(技術別)

- イントロダクション

- ELISA

- CLIA

- IFA

- 迅速検査

- ウェスタンブロッティング

- ELISpot

- その他

第8章 イムノアッセイ市場(検体別)

- イントロダクション

- 血液

- 唾液

- 尿

- その他

第9章 イムノアッセイ市場(用途別)

- イントロダクション

- 感染症

- 内分泌学

- 心臓病学

- 自己免疫疾患

- アレルギー診断

- 腫瘍学

- 骨およびミネラル疾患

- 薬物モニタリングと検査

- 血液検査

- 新生児スクリーニング

- その他

第10章 イムノアッセイ市場(エンドユーザー別)

- イントロダクション

- 病院・クリニック

- 臨床検査室

- 在宅ケア

- 血液バンク

第11章 イムノアッセイ市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- イタリア

- フランス

- スペイン

- 英国

- ロシア

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- インドネシア

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 熟練した研究室スタッフの不足と不利な償還政策が市場の成長を制限している

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- ABBOTT

- F. HOFFMANN-LA ROCHE LTD.

- SIEMENS HEALTHINEERS AG

- DANAHER

- THERMO FISHER SCIENTIFIC INC.

- REVVITY

- BECTON, DICKINSON AND COMPANY(BD)

- DIASORIN S.P.A.

- BIO-RAD LABORATORIES, INC.

- QUIDELORTHO CORPORATION

- BIOMERIEUX

- QIAGEN

- SYSMEX CORPORATION

- AGILENT TECHNOLOGIES, INC.

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- その他の企業

- MERCK KGAA

- MERIDIAN BIOSCIENCE

- BIO-TECHNE

- CELLABS

- ABNOVA CORPORATION

- J. MITRA & CO. PVT. LTD.

- TOSOH CORPORATION(TOSOH BIOSCIENCES)

- CELL SCIENCES

- ENZO BIOCHEM INC.

- CREATIVE DIAGNOSTICS

- BOSTER BIOLOGICAL TECHNOLOGY

- ELABSCIENCE BIONOVATON INC.

- WAK-CHEMIE MEDICAL GMBH

- SERA CARE

- EPITOPE DIAGNOSTICS, INC.

- KAMIYA BIOMEDICAL COMPANY

- GYROS PROTEIN TECHNOLOGIES AB

- TRIVITRON HEALTHCARE

- INBIOS INTERNATIONAL, INC.

- MACCURA BIOTECHNOLOGY CO., LTD.