|

|

市場調査レポート

商品コード

1448472

複合材料市場:動向、機会、競合分析【2024-2030年】Composites Market: Trends, Opportunities and Competitive Analysis [2024-2030] |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 複合材料市場:動向、機会、競合分析【2024-2030年】 |

|

出版日: 2024年02月20日

発行: Lucintel

ページ情報: 英文 150 - page report

納期: 3営業日

|

全表示

- 概要

- 目次

複合材料市場の動向と予測

世界の複合材料市場の将来は、輸送、海洋、風力エネルギー、航空宇宙、パイプ・タンク、建設、E・E、消費財の各セグメントにおける機会で有望視されています。世界の複合材料市場は、2023~2030年のCAGRが4%で、2030年までに推定700億米ドルに達すると予想されます。世界の複合材料最終製品市場は、2030年までに推定1,957億米ドルに達すると予想されます。複合材料最終製品の世界市場は、2030年までに推定1,813億米ドルに達すると予想されます。この市場成長の主要促進要因は、航空宇宙・防衛、自動車産業における軽量材料の需要増加、建設、パイプ・タンク産業における耐腐食性・耐薬品性材料の需要増加、電気・電子産業における電気抵抗性・高難燃性材料の需要増加です。

複合材料市場の新たな動向

業界の力学に直接的な影響を与える新たな動向として、低コストの炭素繊維、高性能ガラス繊維、速硬化樹脂システムの開発が挙げられます。

複合材料市場洞察

- Lucintelは、住宅と商業施設の建設が増加し、リフォームが増加しているため、建設が金額と数量で最大の最終用途であり続けると予測しています。航空宇宙は予測期間中に最も高い成長が見込まれます。

- 輸送市場では軽量材料の生産と使用が増加しているため、輸送は予測期間中最大の最終用途市場であり続けます。航空宇宙は予測期間中最も高い成長が見込まれます。

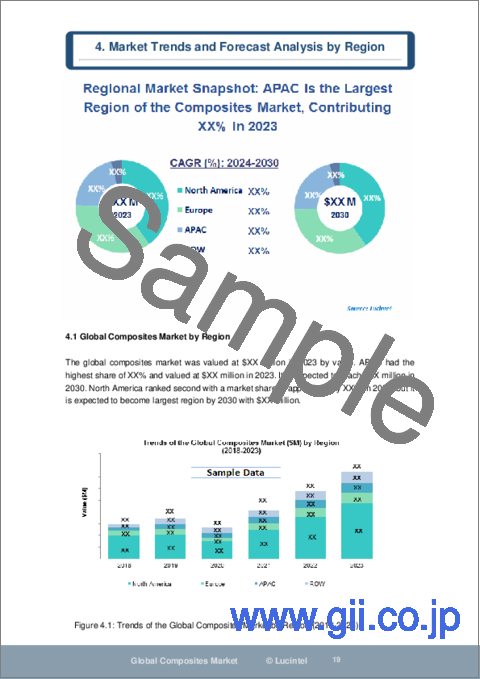

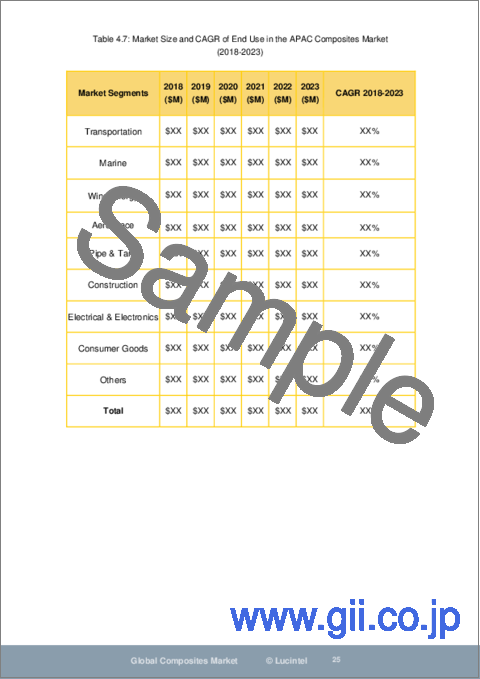

- アジア太平洋は、金額でも数量でも最大の地域であり続けると予想され、建設、輸送、電気・電子セグメントの成長により、予測期間中も最高の成長が見込まれます。成長の主要原動力は、自動車生産の増加、建設業の高成長、インフラ整備です。

よくある質問

Q1.複合材料市場の規模は?

回答:世界の複合材料市場は、2030年までに推定700億米ドルに達すると予想されています。

Q2.市場の成長予測は:

回答:複合材料市場は、2023~2030年にかけてCAGR 4%で成長すると予想されています。

Q3.市場の成長に影響を与える主要促進要因は:

A1.この市場の主要成長促進要因は、航空宇宙・防衛産業、自動車産業における軽量材料の需要増加、建設産業、パイプ・タンク産業における耐腐食性・耐薬品性材料の需要増加、電気・電子産業における電気抵抗・高難燃性材料の需要増加です。

Q4.世界の複合材料の主要用途や最終用途産業は?

A4.建設と輸送が、複合材料の主要最終用途です。

Q5.複合材料市場の新たな動向は何ですか?

回答:業界の動向に直接影響を与える新たな動向は、低コストの炭素繊維、高性能ガラス繊維、速硬化樹脂システムの開発です。

Q6.複合材料市場の主要企業は?

回答:複合材料市場の主要企業をいくつか紹介する:

- Owens Corning

- Jushi Group

- Nippon Electric Glass Co Ltd.

- CPIC

- Toray Industries

- Hexcel Composites

- Mitsubishi Rayon

- Gurit

- Polynt Reichhold

Q7.複合材料材料で今後最も伸びるセグメントは?

A5.Lucintelの予測では、射出成形は、高生産率、低労働コスト、設計の柔軟性から、複合材料製造において予測期間中、金額と数量の面で最大のプロセスになると予想されています。

Q8.市場において、今後5年間に最大になると予想される地域は:

答:アジア太平洋は今後5年間、最大の地域であり続け、最も高い成長を示すと予想されます。

Q9.レポートのカスタマイズは可能か:

答え:はい、Lucintelは追加費用なしで10%のカスタマイズを記載しています。

目次

第1章 エグゼクティブサマリー

第2章 複合材料産業について

- 複合材料産業とは

- 複合材料産業の特徴

第3章 鉄鋼、アルミニウム、プラスチック、複合材料業界の競争分析

- 競合分析

- プラスチック業界概要

- 鉄鋼業界概要

- アルミニウム産業概要

- 複合材料業界概要

第4章 世界の補強市場

- 複合材料における繊維と樹脂の機能

- 繊維のタイプ別の世界の複合材料産業

- 世界の補強市場規模

- 製品形態別ガラス繊維市場規模

- 製品形態別炭素繊維市場

- アラミド繊維市場

- 市場リーダー

- ガラス繊維市場のリーダー

- 炭素繊維市場のリーダー

- アラミド繊維市場のリーダー

第5章 世界の樹脂市場

- 樹脂の種類

- 複合材料産業向けの熱硬化性樹脂

- 複合材料産業用の熱可塑性樹脂

- 複合材料中のさまざまな成分の価格と重量分布

- ポリエステル樹脂の用途

- 樹脂市場

第6章 材料タイプ別の世界の複合材料産業

- アドバンス複合材料市場

- 原材料市場

- 熱硬化性と熱可塑性複合材料市場

- 製品形態別の熱可塑性複合材料市場

- LFRTまたはLFT(長繊維熱可塑性複合材料)

- GMT

- 連続繊維TPC

- 成形材料別複合材料市場

第7章 市場セグメント別の世界複合材料

- セグメント別の世界の複合材料市場

- 複合材料利用の原動力

- さまざまな市場セグメントにおける主要な要件

- 運輸業界の市場展望と動向

- 自動車業界の課題

- 航空宇宙と防衛産業の市場展望と動向

- 建設業界の市場展望と動向

- ブリッジ用途における複合材料

- ブリッジ用途の課題

- 非ブリッジ用途

- パイプとタンク産業の分析

- 海洋市場展望と業界動向

- 消費財市場の展望と業界動向

- 電気・電子産業の展望

- 風力エネルギー

第8章 製造プロセス別の世界の複合材料市場

- 製造プロセス別の世界の複合材料市場

第9章 動向と予測

- 近年の業界の課題

- エネルギーコストの圧迫

- グラスファイバー業界の課題

- 相対的な安全性

- ファブリケーターの課題

- 世界の複合材料産業の動向

- 地域別市場動向

- 用途別市場動向

- 地域別市場動向

- 北米の複合材料産業の動向

- 欧州の複合材料産業の動向

- アジアの複合材料産業の動向

- その他地域の複合材料業界の動向

- 複合材料業界の予測

- 北米の複合材料産業の予測

- 欧州の複合材料産業の予測

- アジアの複合材料産業の予測

- その他地域の複合材料業界の予測

- 複合材料製造プロセスの動向と予測

第10章 地域分析

- 地域別複合材料出荷量

- 国別の複合材料消費量

- 北米諸国への発送

- 欧州諸国への発送

- アジア太平洋諸国での出荷

- 地域別の複合材料の用途

- 北米の複合材料市場

- 欧州の複合材料市場

- アジア太平洋の複合材料市場

第11章 バリューチェーン分析と業界リーダー

- バリューチェーン分析

- 業界のリーダー

- 材料サプライヤー部門の業界リーダー

- ガラス繊維の業界リーダー

- 炭素繊維の業界リーダー

- アラミド繊維の業界リーダー

- プリプレグ製造の業界リーダー

- UPR市場の業界リーダー

- 最終用途市場のリーダー

- 航空宇宙市場の業界リーダー

- 海洋産業のリーダー

- レクリエーション産業のリーダー

- 自動車産業の市場リーダー

- 自動車業界の第一次サプライヤーのリーダー

- 材料サプライヤー部門の業界リーダー

第12章 将来の複合材料産業に必要な材料と技術

第13章 複合材料業界のイノベーション

Composites Market Trends and Forecast

The future of the global composites market looks promising with opportunities in the transportation, marine, wind energy, aerospace, pipe & tank, construction, E&E, and consumer goods. The global composite materials market is expected to reach an estimated $70 billion by 2030 with a CAGR of 4% from 2023 to 2030. The global composite end product market is expected to reach an estimated of $195.7 billion by 2030. The global composite end product market is expected to reach an estimated of $181.3 billion by 2030. The major drivers for growth in this market are increasing demand for lightweight materials in the aerospace & defense, and automotive industries; corrosion- and- chemical-resistant materials' demand in the construction, and pipe & tank industries; electrical resistivity and high flame retardant materials' demand in the electrical and electronics industry.

Emerging Trends in the Composites Market

Emerging trends, which has a direct impact on the dynamics of the industry, are the development of low-cost carbon fibers, high performance glass fiber, and rapid cure resin system.

A total of 240 figures / charts and 55 tables are provided in this 402-page report to help in your business decisions. A sample figure with insights is shown below.

Composites Market by Segment

The study includes a forecast for the global composites market by end use, manufacturing process, molding compound, resin type, fiber type, fiberglass product form, carbon fiber type, and region as follows:

Composites Market by End Use [Volume (Million Pounds) and Value ($M) Shipment Analysis for 2018 - 2030]:

- Transportation

- Marine

- Wind Energy

- Aerospace

- Pipe & Tank

- Construction

- Electrical & Electronics

- Consumer Goods

- Others

Composites Market by Manufacturing Process [Volume (Million Pounds) and Value ($M) Shipment Analysis for 2018 - 2030]:

- Hand Lay-up

- Spray-up

- Resin Infusion (RRIM, RTM, VARTM)

- Filament Winding

- Pultrusion

- Injection Molding

- Compression Molding

- Prepreg Lay-up

- Other

Composites Market by Molding Compound [Volume (Million Pounds) and Value ($M) Shipment Analysis for 2018 - 2030]:

- SMC

- BMC

- Thermoplastic Compounds ( SFT, LFT, GMT, CFT and Other)

Composites Market by Resin Type [Volume (Million Pounds) and Value ($M) Shipment Analysis for 2018 - 2030]:

- Polyester

- Epoxy

- Vinyl ester

- Phenolic

- Thermoplastics

Composites Market by Fiber Type [Volume (Million Pounds) and Value ($M) Shipment Analysis for 2018 - 2030]:

- Glass fiber

- Carbon fiber

- Aramid fiber

Composites Market by Fiber Glass Product Form [Volume (Million Pounds) and Value ($M) Shipment Analysis for 2018 - 2030]:

- Single End Roving

- Multi End Roving

- DUCS

- Continuous Filament Mat

- Yarn

Composites Market by Carbon Fiber Type [Volume (Million Pounds) and Value ($M) Shipment Analysis for 2018 - 2030]:

- PAN Based Carbon Fiber

- PITCH Based Carbon Fiber

Composites Market by Resin Type [Volume (Million Pounds) and Value ($M) Shipment Analysis for 2018 - 2030]:

- North America

- Europe

- Asia Pacific

- ROW

Composites Market by Country [Volume (Million Pounds) and Value ($M) Shipment Analysis for 2018 - 2030]:

- USA

- Canada

- Mexico

- Germany

- UK

- France

- Italy

- Spain

- Netherland

- China

- India

- Japan

- South Korea

- Brazil

- Russi

List of Composites Companies

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies composites companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the composites companies profiled in this report includes.

- Owens Corning

- Jushi Group

- Nippon Electric Glass Co Ltd.

- CPIC

- Toray Industries

- Hexcel Composites

- Mitsubishi Rayon

- Gurit

- Polynt Reichhold

Composites Market Insight

- Lucintel forecasts construction will remain the largest end use by value and volume due to increasing residential and commercial construction and growth in remolding activities. Aerospace is expected to witness highest growth over the forecast period.

- Transportation will remain the largest end use market over the forecast period due to the increasing production and use of lightweight materials in transportation market. Aerospace is expected to witness the highest growth over the forecast period.

- Asia Pacific is expected to remain the largest region by value and volume, and it is also expected to experience the highest growth over the forecast period because of growth in construction, transportation, and the electrical and electronics segments. The major drivers for growth are increasing automotive production, high growth in construction, and infrastructure development.

Features of Global Composites Market

- Market Size Estimates:Global composites market size estimation in terms of value ($M) and volume (M lbs)

- Trend and Forecast Analysis:Market trends (2018-2023) and forecast (2024-2030) by various segments and regions.

- Segmentation Analysis: : Composites market size by various segments, such as end use, manufacturing process, molding compound, resin type, fiber type, fiberglass type, and carbon fiber type in terms of value and volume

- Regional Analysis:Global composites market breakdown by North America, Europe, Asia Pacific, and the Rest of the World.

- Growth Opportunities:Analysis on growth opportunities in different end use, manufacturing process, molding compound, resin type, fiber type, fiberglass type, carbon fiber type, and regions for the composites market

- Strategic Analysis:This includes M&A, new product development, and competitive landscape for the composites market.

- Analysis of competitive intensity of the industry based on Porter's Five Forces model.

FAQ

Q1. How big is the composites market?

Answer:The global composite material market is expected to reach an estimated $70 billion by 2030.

Q2. What is the growth forecast for composites market?

Answer:The composite material market is expected to grow at a CAGR of 4% from 2023 to 2030.

Q3. What are the major drivers influencing the growth of the composites market?

Answer: The major drivers for growth in this market are increasing demand for lightweight materials in the aerospace & defense, and automotive industries; corrosion- and- chemical-resistant materials' demand in the construction, and pipe & tank industries; electrical resistivity and high flame retardant materials' demand in the electrical and electronics industry.

Q4. What are the major applications or end use industries for global composites?

Answer: Construction and transportation are the major end use for global composites.

Q5. What are the emerging trends in composites market?

Answer:Emerging trends, which has a direct impact on the dynamics of the industry, are the development of low-cost carbon fibers, high performance glass fiber, and rapid cure resin system.

Q6. Which are the key players in composites market?

Answer:Some of the key players in the composites market are as follows:

- Owens Corning

- Jushi Group

- Nippon Electric Glass Co Ltd.

- CPIC

- Toray Industries

- Hexcel Composites

- Mitsubishi Rayon

- Gurit

- Polynt Reichhold

Q7.Which composites material segment will be the largest in future?

Answer: Lucintel forecasts that injection molding is expected to be the largest process in terms of value and volume over the forecast period in composite manufacturing because of high-output production rate, low labor cost, and design flexibility.

Q8. In composites market, which region is expected to be the largest in next 5 years?

Answer:APAC is expected to remain the largest region and witness the highest growth over next 5 years

Q9. Do we receive customization in this report?

Answer:Yes, Lucintel provides 10% Customization Without any Additional Cost.

This report answers following 11 key questions

- Q.1 What are some of the most promising potential, high-growth opportunities for the global composites market by end use (transportation, marine, wind energy, aerospace, pipe & tank, construction, electrical & electronics, consumer goods, and others), manufacturing process (hand lay-up, spray up, resin infusion, filament winding, pultrusion, injection molding, compression molding, prepreg lay up, and others), molding compound (SMC, BMC, and thermoplastic compounds), resin type (polyester, epoxy, vinyl ester, phenolic, and thermoplastic), fiber type (glass fiber composites, carbon fiber composites, and aramid fiber composites), fiberglass type (single end roving, multi end roving, chopped strand, woven roving, fabrics, chopped strand mat, continuous filament mat, and others), carbon fiber type (PAN based carbon fiber and pitched based carbon fiber), and region (North America, Europe, APAC, and ROW)?

- Q. 2 Which segments will grow at a faster pace and why?

- Q.3 Which regions will grow at a faster pace and why?

- Q.4 What are the key factors affecting market dynamics? What are the drivers and challenges of the market?

- Q.5 What are the business risks and threats to the market?

- Q.6 What are the emerging trends in this market and the reasons behind them?

- Q.7 What are the changing demands of customers in the market?

- Q.8 What are the new developments in the market? Which companies are leading these developments?

- Q.9 Who are the major players in this market? What strategic initiatives are being implemented by key players for business growth?

- Q.10 What are some of the competitive products and processes in this area and how big of a threat do they pose for loss of market share via material or product substitution?

- Q.11 What M & A activities have taken place in the last 5 years in this market?

Table of Contents

1. Executive Summary

2. About the Composites Industry

- 2.1: What is the Composites Industry

- 2.2: Characteristics of Composites Industry

3. Competitive Analysis of the Steel, Aluminum, Plastic, and Composites Industry

- 3.1: Competitive Analysis

- 3.2: Plastic Industry Overview

- 3.3: Steel Industry Overview

- 3.4: Aluminum Industry Overview

- 3.5: Composites Industry Overview

4. Global Reinforcement Market

- 4.1: Functions of Fiber and Resin Materials in Composites

- 4.2: Global Composites Industry by Fiber Type

- 4.3: Global Market Size for Reinforcement

- 4.3.1: Glass Fiber Market Size by Product Form

- 4.3.2: Carbon Fiber Market by Product Form

- 4.3.3: Aramid Fiber Market

- 4.4: Market Leaders

- 4.4.1: Glass Fiber Market Leaders

- 4.4.2: Carbon Fiber Market Leaders

- 4.4.3: Aramid Fiber Market Leaders

5. Global Resin Market

- 5.1: Types of Resin

- 5.1.1: Thermoset Resin for the Composites Industry

- 5.1.2: Thermoplastic Resin for the Composites Industry

- 5.2: Price and Weight Distribution of various Ingredients in Composites

- 5.2.1: Polyester Resin Applications

- 5.3: Resin Market

6. Global Composites Industry by Material Type

- 6.1: Advance Composites Market

- 6.2: Raw Materials Market

- 6.3: Thermoset and Thermoplastic Composites Market

- 6.4: Thermoplastic Composites Market by Product Form

- 6.4.1: LFRT or LFT (Long Fiber Thermoplastic Composites)

- 6.4.2: GMT

- 6.4.3: Continuous Fiber TPCs

- 6.5: Composites Market by Molding Compound

7. Global Composites by Market Segments

- 7.1: Global Composites Market by Segment

- 7.2: Driving Forces for the Use of Composites Materials

- 7.3: Key Requirements in Various Market Segments

- 7.4: Transportation Industry Market Outlook and Trends

- 7.4.1: Automotive Industry Challenges

- 7.5: Market Outlook and Trends for the Aerospace and Defense Industry

- 7.6: Market Outlook and Trend for the Construction Industry

- 7.6.1: Composites in Bridge Applications

- 7.6.2: Challenges in Bridge Applications

- 7.6.3: Non-Bridge Applications

- 7.7: Pipe and Tank Industry Analysis

- 7.8: Marine Market Outlook and Industry Trends

- 7.9: Consumer Goods Market Outlook and Industry Trends

- 7.10: Electrical and Electronics Industry Outlook

- 7.11: Wind Energy

8. Global Composites Market by Manufacturing Process

- 8.1: Global Composites Market by Manufacturing Process

9. Trends and Forecast

- 9.1: Industry Challenges in Recent Years

- 9.1.1: Energy Cost Squeeze

- 9.1.2: Challenges of the Glass Fiber Industry

- 9.1.3: Relative Safety

- 9.1.4: Challenges for Fabricators

- 9.2: Trends in Global Composites Industry

- 9.2.1: Market Trends by Region

- 9.2.1.1: Market Trend by Applications

- 9.2.1: Market Trends by Region

- 9.3: Trends in the North American Composites Industry

- 9.4: Trends in the European Composites Industry

- 9.5: Trends in the Asian Composites Industry

- 9.6: Trends in the ROW Composites Industry

- 9.7: Composites Industry Forecast

- 9.8: Forecast for the North American Composites Industry

- 9.9: Forecast for the European Composites Industry

- 9.10: Forecast of the Asian Composites Industry

- 9.11: Forecast for the ROW Composites Industry

- 9.12: Trends and Forecast for Composites Manufacturing Processes

10. Regional Analysis

- 10.1: Composites Shipments by Region

- 10.2: Composites Consumption by Country

- 10.2.1: Shipments in North American Countries

- 10.2.2: Shipments in European Countries

- 10.2.3: Shipments in Asia Pacific Countries

- 10.3: Composites Application by Region

- 10.3.1: Composites Market in North America

- 10.3.2: Composites Market in Europe

- 10.3.3: Composites Market in Asia Pacific

11. Value Chain Analysis and Industry Leaders

- 11.1: Value Chain Analysis

- 11.2: Industry Leaders

- 11.2.1: Industry Leaders in Material Supplier Category

- 11.2.1.1: Industry Leaders in Glass Fibers

- 11.2.1.2: Industry Leaders in Carbon Fibers

- 11.2.1.3: Industry Leaders in Aramid Fibers

- 11.2.1.4: Industry Leaders in Prepreg Manufacturing

- 11.2.1.5: Industry Leaders in UPR Market

- 11.2.2: Leaders in End Use Market

- 11.2.2.1: Industry Leaders in Aerospace Market

- 11.2.2.2: Leaders in Marine Industry

- 11.2.2.3: Leaders in the Recreational Industry

- 11.2.2.4: Market Leaders in Automotive Industry

- 11.2.2.5: Industry Leaders in Automotive Tier 1 Suppliers

- 11.2.1: Industry Leaders in Material Supplier Category