|

|

市場調査レポート

商品コード

1546641

CD47阻害剤の世界市場:臨床試験に関する洞察と市場機会の見通し(2028年)Global CD47 Inhibitor Drug Clinical Trials Insight & Market Opportunity Outlook 2028 |

||||||

|

|||||||

| CD47阻害剤の世界市場:臨床試験に関する洞察と市場機会の見通し(2028年) |

|

出版日: 2024年09月01日

発行: KuicK Research

ページ情報: 英文 240 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

細胞表面タンパク質CD47の阻害は、新規のがん免疫療法アプローチとして登場し、近年、学界と産業界の両方の関心を集めています。がん細胞はしばしばCD47を過剰発現しており、このCD47は「私を食べないで」というシグナル経路を誘発し、それによって悪性細胞が免疫監視から逃れるのを助けています。CD47阻害剤は、このタンパク質を阻害することでがん細胞を摘出し、免疫系の攻撃、特にマクロファージの貪食作用の亢進による攻撃を受けやすい状態にしようとするものです。現在、CD47阻害剤は治療薬として承認されていないが、第3相臨床試験中の候補があることから、数年以内に承認される可能性があります。

様々な開発段階にある複数の候補により、CD47阻害剤の研究開発分野は急速に発展しています。現在Gileadの傘下にあるForty Sevenが開発したマグロリマブは、最先端のCD47阻害剤の一つです。血液腫瘍を対象とした初期段階の臨床試験では、特に他のがん治療と併用した場合に有望な結果が得られています。さらに、固形がんを対象とした後期臨床試験では、ドセタキセル、ニボルマブ、ペムブロリズマブ、アザシチジン、ベネトクラクスといった従来のがん治療と併用してマグロリマブを評価する試験が現在進行中です。

CD47を阻害する高親和性SIRPa融合タンパク質であるALXオンコロジーのエボパセプト(ALX148)も重要な候補です。現在、evorpaceptは単剤療法として、また広く使用されている抗がん剤との併用療法として、様々な固形がんや血液がんを対象とした多くの早期臨床試験で評価されています。さらに、HER2+胃がんの治療において、トラスツズマブ、ラムシルマブ、パクリタキセルとの併用でエボパセプトを評価する後期臨床試験も進行中です。TQB 2928(Chia Tai Tianqing Pharmaceutical)、MP 0621(Molecular Partners)、IMC-002(ImmuneOncia Therapeutics)、CC 90002(Celgene)など、他のCD47阻害剤も臨床研究の初期段階にあります。

現在は中国とアメリカの企業が市場を独占していますが、韓国、オーストラリア、カナダ、日本からの参入も増えています。臨床研究を通じて、Shaperon、InnobationBio、Bitterroot Bio、ImmuneOncia Therapeuticsなどの企業がCD47阻害剤で躍進しています。市場競争は激化しており、複数の企業が市場シェアの獲得にしのぎを削っています。したがって、商業的成功のためには、安全性プロファイル、有効性、可能な併用戦略に基づく差別化が不可欠となります。

当レポートは、世界のCD47阻害剤市場について調査し、市場の概要とともに、薬剤動向、臨床試験動向、地域別動向、および市場に参入する企業の競合情勢などを提供しています。

目次

第1章 新たながん免疫療法の標的としてのCD47

第2章 世界のCD47阻害剤の臨床パイプラインの概要

- 国別

- 企業別

- 適応症別

- 患者セグメント別

- 相別

- 優先度別

第3章 CD47阻害剤の臨床試験に関する企業、国、適応症、相別の考察

- 研究

- 前臨床

- 第I相

- 第I/II相

- 第II相

- 第II/III相

- 第III相

第4章 世界のCD47阻害剤市場機会の見通し

- 現在の市場概要

- 将来の見通しと機会

第5章 CD47の適応症別の臨床応用と開発の見通し

- 固形がん

- 造血悪性腫瘍

- 微生物感染症

第6章 CD47阻害剤の臨床開発と国別の動向

- 中国

- 米国

- 韓国

- オーストラリア

- カナダ

第7章 世界のCD47阻害剤市場力学

第8章 競合情勢

- Adagene

- ALX Oncology

- ImmuneOncia Therapeutics

- ImmuneOnco Biopharma

- Light Chain Bioscience

- Phanes Therapeutics

- Virtuoso Therapeutics

List of Figures

- Figure 2-1: Global - Number of CD47 Inhibitor Drugs Clinical Trial By Country, 2022 Till 2028

- Figure 2-2: Global - Number of CD47 Inhibitor Drugs In Clinical Pipeline By Company, 2022 Till 2028

- Figure 2-3: Global - Number of CD47 Inhibitor Drugs In Clinical Pipeline By Indication, 2022 Till 2028

- Figure 2-4: Global - Number of CD47 Inhibitor Drugs In Clinical Pipeline By Patient Segment, 2022 Till 2028

- Figure 2-5: Global - Number of CD47 Inhibitor Drugs In Clinical Pipeline By Phase, 2022 Till 2028

- Figure 2-6: Global - Number of CD47 Inhibitor Drugs In Clinical Pipeline By Priority Status, 2022 Till 2028

- Figure 5-1: NI-1801 Phase I Study (NCT05403554) - Initiation & Completion Year

- Figure 5-2: ALX148 Phase I Study (NCT05868226) - Initiation & Completion Year

- Figure 5-3: Ligufalimab Phase II Study (NCT05382442) - Initiation & Completion Year

- Figure 5-4: PT217 Phase I/II Study (NCT05652686) - Initiation & Completion Year

- Figure 5-5: HMPL-A83 Phase I Study (NCT05429008) - Initiation & Completion Year

- Figure 5-6: ALX148 Phase I Study (NCT05524545) - Initiation & Completion Year

- Figure 5-7: PT217 Phase I/II Study (NCT05652686) - Initiation & Completion Year

- Figure 5-8: AK117 Phase II Study (NCT05382442) - Initiation & Completion Year

- Figure 5-9: AK117 Phase I/II Study (NCT05214482) - Initiation & Completion Year

- Figure 5-10: AK117 Phase II Study (NCT05960955) - Initiation & Completion Year

- Figure 5-11: Evorpacept Phase II/III Study (NCT05002127) - Initiation & Completion Year

- Figure 5-12: PT886 Phase I/II Study (NCT05482893) - Initiation & Completion Year

- Figure 5-13: CC-96673 Phase I Study (NCT04860466) - Initiation & Completion Year

- Figure 5-14: HCB101 Phase I Study (NCT05892718) - Initiation & Completion Year

- Figure 5-15: Evorpacept Phase I/II Study (NCT05025800) - Initiation & Completion Year

- Figure 5-16: AK117 Phase I/II Study (NCT04980885) - Initiation & Completion Year

- Figure 5-17: AK117 Phase I/II Study (NCT06387420) - Initiation & Completion Year

- Figure 5-18: TQB 2928 Phase I Study (NCT06008405) - Initiation & Completion Year

- Figure 5-19: SL-172154 Phase I Study (NCT05275439) - Initiation & Completion Year

- Figure 5-20: SL-172154 Phase Ib Study (NCT05275439) - Initiation & Completion Year

- Figure 5-21: Ligufalimab Phase Ib Study (NCT04900350) - Initiation & Completion Year

- Figure 6-1: South Korea - Prominent CD47 Inhibitor Developers

- Figure 7-1: Global CD47 Inhibitors Market - Drivers & Opportunities

- Figure 7-2: Global CD47 Inhibitors Market - Challenges & Restraints

List of Tables

- Table 5-1: Breast Cancer - Some CD47 inhibitors In Clinical Trials

- Table 5-2: Colorectal Cancer - Some CD47 inhibitors In Clinical Trials

- Table 5-3: Lung Cancer - Some CD47 inhibitors In Clinical Trials

- Table 5-4: Urogenital Cancer - Some CD47 inhibitors In Clinical Trials

- Table 5-5: Gastrointestinal Cancer - Some CD47 inhibitors In Clinical Trials

- Table 5-6: Lymphoma - Some CD47 inhibitors In Clinical Trials

- Table 5-7: Leukemia - Some CD47 inhibitors In Clinical Trials

- Table 5-8: Colorectal Cancer - Some CD47 inhibitors In Clinical Trials

- Table 5-9: Myelodysplastic Syndrome - Some CD47 inhibitors In Clinical Trials

Global CD47 Inhibitor Drug Clinical Trials Insight & Market Opportunity Outlook 2028 Report Highlights

- Global & Regional Market Opportunity Outlook

- Insight On More Than 100 CD47 Inhibitor Drugs In Clinical Trials

- Global CD47 Inhibitors Clinical Trials Insight By Company, Country, Indication & Phase

- Orphan, Fast Track, Breakthrough Therapy Designation Insight

- Key Drugs Initiation & Completion Year

- CD47 Clinical Application & Development Outlook By Indication

- CD47 Inhibitor Drugs Clinical Developments & Trends By Country

- Global CD47 Inhibitor Drug Market Dynamics

Inhibition of the cell surface protein CD47 has emerged as a novel cancer immunotherapy approach that has piqued the interest of both academia and industry in the recent years. Cancer cells often overexpress CD47, which triggers the "don't eat me" signal pathway, thereby helping malignant cells to escape immune surveillance. CD47 inhibitors seek to uncover cancer cells by inhibiting this protein, leaving them open to immune system attack, specifically through increased macrophage phagocytosis. Although no CD47 inhibitor is currently approved for therapeutic usage, the availability of candidates in phase 3 trials suggests that one may be approved in the coming years.

With multiple candidates at varying stages of development, the field of CD47 inhibitor research and development is rapidly evolving. Developed by Forty Seven, which is now a part of Gilead, magrolimab is among the most advanced CD47 inhibitors. In early stage clinical trials for hematological tumors, it has demonstrated encouraging outcomes, especially when combined with other cancer treatments. Furthermore, late stage clinical trials evaluating Magrolimab in solid cancer alongside conventional cancer treatments such as docetaxel, Nivolumab, Pembrolizumab, Azacitidine, and Venetoclax are now under progress.

Another significant candidate is Evorpacept (ALX148) from ALX Oncology, a high affinity SIRPa fusion protein that inhibits CD47. Currently, evorpacept is being assessed as a monotherapy and in combination with widely used anticancer drugs in a number of early phase clinical trials for a variety of solid and hematological tumors. Furthermore, a late-phase trial evaluating Evorpacept in combination with Trastuzumab, Ramucirumab, and Paclitaxel for the treatment of HER2+ gastric cancer is also under progress. A number of other CD47 inhibitors, including as TQB 2928 (Chia Tai Tianqing Pharmaceutical), MP 0621 (Molecular Partners), IMC-002 (ImmuneOncia Therapeutics), and CC 90002 (Celgene), are in the early phases of clinical research.

The emphasis on combination therapies is undoubtedly one of the key trends in clinical development. Combining CD47 inhibitors with other immunotherapies, targeted treatments, and chemotherapy is being studied in an effort to overcome resistance mechanisms and provide synergistic benefits.

Anticipated growth in the global market for CD47 inhibitors is attributed to the rising cancer incidence and increased use of immunotherapies in the upcoming years. The potential of CD47 inhibitors has been acknowledged by a number of prominent pharmaceutical companies, which has resulted in notable partnerships and acquisitions. The commercial interest in this field is demonstrated by Gilead Science's US$ 4.9 billion acquisition of Forty Seven in 2020 and Pfizer's US$ 2.26 billion acquisition of Trillium Therapeutics in 2021.

Although Chinese and American companies presently dominate the market, there is increasing participation from South Korea, Australia, Canada, and Japan. Through clinical research, companies such as Shaperon, InnobationBio, Bitterroot Bio, and ImmuneOncia Therapeutics are making strides with their CD47 inhibitors. The market is becoming increasingly competitive, with several firms striving for market share. Therefore, for commercial success, differentiation based on safety profile, efficacy, and possible combination strategies will be essential.

The market for CD47 inhibitors has both opportunities and challenges. Strong commercial interest and encouraging clinical evidence point to substantial development potential. However, there are challenges to address, such managing toxicity profiles, coming up with the best combination plans, and demonstrating distinct therapeutic advantages over current treatments. As the field develops, biomarker development for response prediction and patient selection will probably become more crucial for clinical development as well as marketing tactics.

In conclusion, the market for CD47 inhibitors globally is an active rapidly expanding area of cancer immunotherapy. In the years to come, CD47 inhibitors could have a big impact on cancer therapy paradigms because there are several candidates in clinical development and a lot of commercial interest.

Table of Contents

1. CD 47 As Novel Cancer Immunotherapy Target

2. Global CD47 Inhibitors Drug Clinical Pipeline Overview

- 2.1 By Country

- 2.2 By Company

- 2.3 By Indication

- 2.4 By Patient Segment

- 2.5 By Phase

- 2.6 By Priority Status

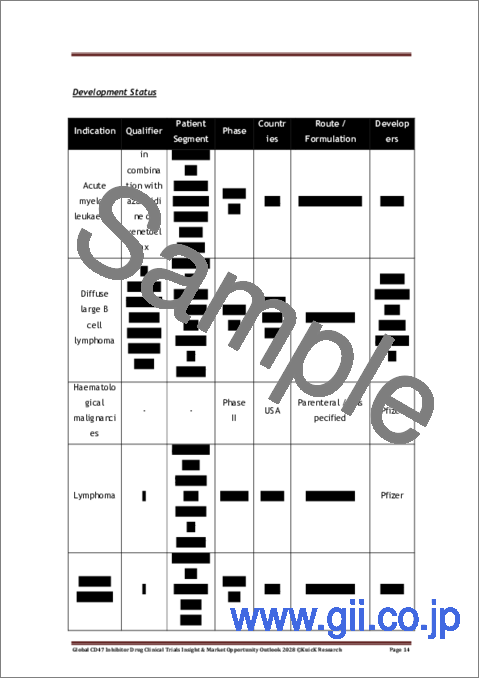

3. CD47 Inhibitors Clinical Trials Insight By Company, Country, Indication & Phase

- 3.1 Research

- 3.2 Preclinical

- 3.3 Phase I

- 3.4 Phase I/II

- 3.5 Phase II

- 3.6 Phase II/III

- 3.7 Phase III

4. Global CD47 Inhibitor Drug Market Opportunity Outlook

- 4.1 Current Market Overview

- 4.2 Future Outlook & Opportunities

5. CD47 Clinical Application & Development Outlook by Indication

- 5.1 Solid Cancers

- 5.1.1 Breast Cancer

- 5.1.2 Colorectal Cancer

- 5.1.3 Lung Cancer

- 5.1.4 Urogenital Cancer

- 5.1.5 Gastrointestinal Cancer

- 5.2 Hematological Malignancies

- 5.2.1 Lymphoma

- 5.2.2 Leukemia

- 5.2.3 Multiple Myeloma

- 5.2.4 Myelodysplastic Syndrome

- 5.3 Microbial Infections

6. CD47 Inhibitor Drugs Clinical Developments & Trends By Country

- 6.1 China

- 6.2 US

- 6.3 South Korea

- 6.4 Australia

- 6.5 Canada

7. Global CD47 Inhibitors Market Dynamics

- 7.1 Favorable Parameters

- 7.2 Market Restraints

8. Competitive Landscape

- 8.1 Adagene

- 8.2 ALX Oncology

- 8.3 ImmuneOncia Therapeutics

- 8.4 ImmuneOnco Biopharma

- 8.5 Light Chain Bioscience

- 8.6 Phanes Therapeutics

- 8.7 Virtuoso Therapeutics