|

|

市場調査レポート

商品コード

1664188

TROP2抗体の世界市場:機会と臨床試験動向(2030年)Global TROP2 Antibody Market Opportunity & Clinical Trials Insight 2030 |

||||||

|

|||||||

| TROP2抗体の世界市場:機会と臨床試験動向(2030年) |

|

出版日: 2025年02月01日

発行: KuicK Research

ページ情報: 英文 200 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

TROP2(絨毛細胞表面抗原2)は、様々ながんとの闘いにおいて重要な治療標的として浮上しています。このI型膜貫通糖タンパク質はTACSTD2遺伝子によってコードされ、特にEpCAM誘導シグナル伝達を調節することによって、細胞シグナル伝達経路の調節に重要な役割を果たしています。TROP2は多くの上皮性がんで過剰発現しており、腫瘍増殖率の上昇と転移を引き起こしています。さらに、その過剰発現は、特に固形がんにおいて予後不良と関連しており、がん標的療法の理想的なターゲットとなっています。

従来のがん治療には、重篤な副作用や特定の患者集団における無効性などの限界が伴うことが多いため、新たなアプローチの必要性が高まっています。標的治療分野は、新規のがん抗原、受容体、バイオマーカーに焦点を当て、近年著しい成長を遂げています。TROP2標的療法はそのような有望な手段の一つであり、いくつかの主要ながん種で高い安全性と治療効果を示しています。これらの治療法は、腫瘍部位に直接細胞傷害性薬剤を送達することを目的としており、従来の治療に伴う副作用を軽減できる可能性があります。

2025年2月現在、3つのTROP2標的治療薬が臨床使用を承認されており、このアプローチの商業化における大きなマイルストーンとなっています。その最初のものがトロデルヴィ(サシツズマブ・ゴビテカン)で、転移性トリプルネガティブ乳がん(TNBC)の治療薬として2020年にFDAの早期承認を取得しました。トロデルヴィはその後、2021年に完全承認を取得し、2023年には適応症をHR+/HER2転移性乳がんに拡大した。もうひとつの重要な承認は2024年後半に、サシツズマブ・チルモテカン(SKB264)がTNBCを適応症として中国で承認されたことです。さらに、アストラゼネカと第一三共が開発したADCであるダトロウェイ(dato-dxd)が米国と日本で乳がんを適応症として承認されました。これらの承認は、がん領域におけるTROP2標的治療薬の役割の増大と市場の可能性の拡大を強調するものです。

トロデルビーの商業的成功は、TROP2標的治療薬市場の主要な促進要因となっています。この薬剤の成功は、TROP2経路へのさらなる調査と投資に拍車をかけ、複数の製薬会社やバイオテクノロジー企業がこのターゲットへの注力を強めています。TROP2領域の主要企業には、ギリアド、アストラゼネカ、第一三共、クルスファーマ、ビオセラ、エスキュゲン・バイオテクノロジー、上海潤思生物科技などがあります。これらの企業の多くはTROP2を標的とした治療法を臨床パイプラインに組み込んでおり、多数の候補薬が開発の初期段階および中期段階にあります。

OBI-992、JS108、ESG-401、SHR-A1921などの治験薬が有望視され、現在いくつかのTROP2標的治療薬が臨床試験中です。モノクローナル抗体、抗体薬物複合体(ADC)、免疫療法、細胞療法を含むこれらの候補は、治療が困難ながん患者の治療選択肢を広げることを目的としています。TROP2標的治療薬市場は、より多くの治療薬がパイプラインを通過するにつれて、大幅な成長が見込まれます。

市場力学の観点からは、このセグメントは引き続き拡大すると予想されます。Trodelvyの臨床的成功、投資の増加、TROP2標的治療薬のパイプラインの増加に牽引され、同市場は大きな成長を遂げようとしています。TNBC、尿路上皮がん、その他の固形がんを含む様々ながん種に適用されるTROP2標的治療の治療可能性は広大です。より多くの治療法が承認され市場に参入するにつれて、TROP2標的治療の商業的側面は継続的に開拓され、患者と製薬企業の双方に新たな機会を提供することになるであろう。

結論として、治療標的としてのTROP2は、がん治療に革命をもたらす大きな可能性を秘めています。すでに3つの薬剤が承認され、さらに多くの薬剤が開発中であることから、TROP2標的治療薬はがん標的治療の要になるものと思われます。大手製薬会社からの関心の高まりは、治験薬の増加とともに、がん市場におけるこの治療法の明るい未来を示唆しています。

当レポートは、世界のTROP2抗体市場について調査し、市場の概要とともに、薬剤動向、臨床試験動向、地域別動向、および市場に参入する企業の競合情勢などを提供しています。

目次

第1章 TROP2標的療法市場のイントロダクション

第2章 TROP2標的抗体の臨床試験に関する世界な洞察

- 企業別

- 国別

- 患者セグメント別

- 相別

- 優先度別

第3章 世界のTROP2抗体市場の見通し

- 現在の市場シナリオ

- 将来の市場機会

第4章 TROP2治療の最前線の市場動向、地域別

- 米国

- 中国

- オーストラリア

- 韓国

- 欧州

- 台湾

- 日本

第5章 世界のTROP2標的抗体市場、がん別

- 乳がん

- 肺がん

- 消化器がん

- 尿路上皮がん

- 卵巣がん

第6章 Trodelvy-初めて承認されたTROP2標的療法

第7章 サシツズマブチルモテカン

第8章 ダトロウェイ

第9章 TROP2抗体の臨床試験の洞察(企業、国、適応症、相別)

- 研究

- 前臨床

- 第I相

- 第I/II相

- 第II相

- 第III相

第10章 上市済みTROP2抗体の臨床的洞察

第11章 TROP2抗体の併用アプローチ

第12章 競合情勢

- Aptamer Sciences

- Aston Science

- AstraZeneca

- Beijing Biocytogen

- BiOneCure Therapeutics

- Biosion

- Bio-Thera Solutions

- Daiichi Sankyo Company

- Hangzhou DAC Biotech

- Innovent Biologics

- LegoChem Biosciences

- Merck

- OBI Pharma

- Peak Bio

- Shanghai Henlius Biotech

- Suzhou GeneQuantum Healthcare

List of Figures

- Figure 1-1: History & Milestones In TROP2 Targeting Therapeutics Market

- Figure 1-2: TROP2 Stimulated Effectors, Biomarker & Pathways

- Figure 1-3: TROP2 Regulated Oncogenic Cell Signaling Pathways

- Figure 1-4: General Mechanism of TROP2 Targeting ADC

- Figure 1-5: Trodelvy - Mechanism Of Action

- Figure 1-6: Frequency of TROP2 Expression by Cancer Type (%)

- Figure 1-7: Role of TROP2 In Cancer

- Figure 2-1: Global -TROP2 Antibodies Clinical Pipeline By Company, 2025 - 2030

- Figure 2-2: Global - TROP2 Antibodies Clinical Pipeline By Country, 2025 - 2030

- Figure 2-3: Global - TROP2 Antibodies Clinical Pipeline By Patient Segment, 2025 - 2030

- Figure 2-4: Global - TROP2 Antibodies Clinical Pipeline By Phase, 2025 - 2030

- Figure 2-5: Global - TROP2 Antibodies Clinical Pipeline By Priority Status, 2025 - 2030

- Figure 3-1: Phase 3 - Key TROP2 Drugs & Companies

- Figure 3-2: Global - TROP2 Targeting Therapy Market (US$ Million), 2020-2024

- Figure 3-3: Global - TROP2 Antibody Market (US$ Million), Q1-Q4'2024

- Figure 3-4: Global - TROP2 Antibody Market By Region (US$ Million), 2024

- Figure 3-5: Global - TROP2 Antibody Market By Region (%), 2024

- Figure 3-6: Future TROP2 Market

- Figure 3-7: Global - TROP2 Antibodies Market (US$ Million), 2025 - 2030

- Figure 4-1: China TROP2 - Key Players & Drugs

- Figure 4-2: FDA018-ADC Phase III Study (NCT06519370) - Initiation & Completion Year

- Figure 4-3: South Korea - Key TROP2 Companies

- Figure 4-4: OBI Pharma TROP2 Therapy Pipeline

- Figure 5-1: Breast Cancer - Estimated & Projected Cases, 2022 & 2030

- Figure 5-2: TROPION-Breast01 (NCT05104866) Phase 3 Study - Initiation & Completion Year

- Figure 5-3: ESG401-101 (NCT04892342) Phase 1a/1b Study - Initiation & Completion Year

- Figure 5-4: ESG401-301 (NCT06383767) Phase 3 Study - Initiation & Completion Year

- Figure 5-5: ESG401-302 (NCT06732323) Phase 3 Study - Initiation & Completion Year

- Figure 5-6: Lung Cancer - Estimated & Projected Cases, 2022 & 2030

- Figure 5-7: EVOKE-01 (NCT05609968) Phase 3 Study - Initiation & Completion Year

- Figure 5-8: EVOKE-03 (NCT05609968) Phase 3 Study - Initiation & Completion Year

- Figure 5-9: EVOKE-02 (NCT05186974) Phase 2 Study - Initiation & Completion Year

- Figure 5-10: Gastrointestinal Cancer - Estimated & Projected Cases, 2022 & 2030

- Figure 5-11: KL264-01 Phase 1/2 Study - Initiation & Completion Year

- Figure 5-12: MK-3475-06C (NCT06469944) Phase 1/2 Study - Initiation & Completion Year

- Figure 5-13: MK-2870-015 (NCT06356311) Phase 3 Study - Initiation & Completion Year

- Figure 5-14: OBI-992-001 (NCT06480240) Phase 1/2 Study - Initiation & Completion Year

- Figure 5-15: MT-302 Phase I Study (NCT05969041) - Initiation & Completion Year

- Figure 5-16: Urothelial Cancer - Estimated & Projected Cases, 2022 & 2030

- Figure 5-17: Urothelial Cancer - Estimated & Projected Cases, 2022 & 2030

- Figure 5-18: BNT-325 (NCT05438329) Phase 1/2 Study - Initiation & Completion Year

- Figure 5-19: TROPION-PanTumor03 (NCT05489211) Phase 2 Study - Initiation & Completion Year

- Figure 6-1: Trodelvy - Patent Expiration Year By Region

- Figure 6-2: Trodelvy - Approval Year By Region

- Figure 6-3: Trodelvy - FDA Orphan Designation Year By Indication

- Figure 6-4: US - Price Of 180mg Vial Of Trodelvy Intravenous Powder (US$), February'2025

- Figure 6-5: EU - Price Of 180mg & 200mg Vials Of Trodelvy Intravenous Powder (US$), February'2025

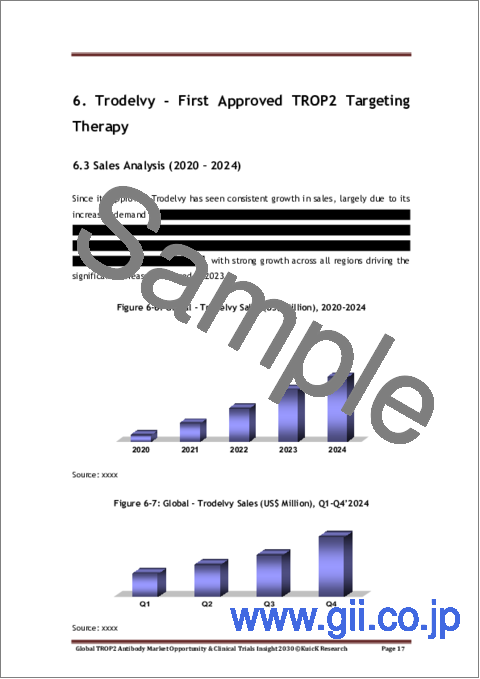

- Figure 6-6: Global - Trodelvy Sales (US$ Million), 2020-2024

- Figure 6-7: Global - Trodelvy Sales (US$ Million), Q1-Q4'2024

- Figure 6-8: Regional -Trodelvy Sales by Region (US$ Million), 2024

- Figure 6-9: Trodelvy Sales By Region (%),2024

- Figure 6-10: US -Trodelvy Sales (US$ Million), 2021-2024

- Figure 6-11: US -Trodelvy Sales (US$ Million), Q1-Q4'2024

- Figure 6-12: Europe - Trodelvy Sales (US$ Million), 2021-2024

- Figure 6-13: Europe - Trodelvy Sales (US$ Million), Q1-Q4'2024

- Figure 6-14: ROW - Trodelvy Sales (US$ Million), 2021-2024

- Figure 6-15: ROW - Trodelvy Sales (US$ Million), Q1-Q4'2024

- Figure 11-1: TROP2 Antibodies Combinations

List of Tables

- Table 4-1: US - Ongoing Clinical Trials For TROP2 Targeting Therapies

- Table 4-2: China - Ongoing Clinical Trials For TROP2 Targeting Therapies

- Table 4-3: Preclinical TROP2 Candidates Development In China

- Table 4-4: Australia - Ongoing Clinical Trials For TROP2 Targeting Therapies

- Table 4-5: South Korea - Ongoing Clinical Trials For TROP2 Targeting Therapies

- Table 4-6: Europe - Ongoing Clinical Trials For TROP2 Targeting Therapies

- Table 4-7: Taiwan - Ongoing Clinical Trials For TROP2 Targeting Therapies

- Table 4-8: Japan - Ongoing Clinical Trials For TROP2 Targeting Therapies

- Table 5-1: Breast Cancer - Approved TROP2 Targeted Therapies

- Table 5-2: Breast Cancer - Some TROP2 Targeted Candidates In Development

- Table 5-3: Lung Cancer - TROP2 ADCs Under Review

- Table 5-4: Lung Cancer - Some TROP2 Targeted Candidates In Development

- Table 5-5: Gastric Cancer - Some TROP2 Targeted Candidates In Development

- Table 5-6: Urothelial Cancer -Key TROP2 Targeted Candidates In Development

- Table 5-7: Urothelial Cancer - Key TROP2 Targeted Candidates In Development

- Table 6-1: Trodelvy - Dose Modifications For Adverse Reactions

- Table 8-1: Datroway - Premedication & Concomitant Medications

- Table 8-2: Datroway - Recommended Dosage Reductions For Adverse Reactions

- Table 8-3: Datroway - Recommended Dosage Modifications

- Table 11-1: TROP2 Targeting Therapy Combination In Development

Global TROP2 Antibody Market Opportunity & Clinical Trials Insight 2030 Report Highlights & Inclusions:

- TROP2 Antibody Global & Regional Sales Insights

- Global TROP2 Antibody Market Opportunity: > US$ 4 Billion

- Global TROP2 Antibody Market Witnessed 23% Growth In 2024

- TROP2 Therapeutic Market Trends By Region & Indications

- Approved Drugs Dosage, Price & Sales Insight: Global & Regional

- TROP2 Antibodies Clinical Trials Insight By Company, Country, Indication & Phase

- Insight On More Than 40 Antibodies In Clinical Trials

TROP2 (Trophoblast cell surface antigen 2) has emerged as a significant therapeutic target in the fight against various cancers. This Type-I transmembrane glycoprotein is encoded by the TACSTD2 gene and plays a key role in regulating cell signaling pathways, particularly by modulating EpCAM-induced signaling. TROP2 is overexpressed in numerous epithelial cancers, leading to an increased tumor growth rate and metastasis. Moreover, its overexpression is associated with poor prognosis, particularly in solid tumors, making it an ideal target for targeted cancer therapies.

As traditional cancer therapies often come with limitations, such as severe side effects and ineffectiveness in certain patient populations, the need for new approaches is growing. The targeted therapy segment has seen significant growth in recent years, with a focus on novel cancer antigens, receptors, and biomarkers. TROP2-targeted therapies represent one such promising avenue, demonstrating high safety and therapeutic efficacy across several major cancer types. These therapies aim to deliver cytotoxic drugs directly to tumor sites, potentially reducing the adverse effects associated with traditional treatments.

As of February 2025, three TROP2-targeted therapies have been approved for clinical use, marking a major milestone in the commercialization of this approach. The first of these is Trodelvy (sacituzumab govitecan), which received accelerated FDA approval in 2020 for the treatment of metastatic triple-negative breast cancer (TNBC). Trodelvy was later granted full approval in 2021 and expanded its indication in 2023 to include HR+/HER2- metastatic breast cancer. Another significant approval came in late 2024, when Sacituzumab Tirumotecan (SKB264) was granted approval in China for TNBC. Additionally, Datroway (dato-dxd), an ADC developed by AstraZeneca and Daiichi Sankyo, was approved for breast cancer in the US and Japan. These approvals highlight the growing role of TROP2-targeted therapies in oncology and the expanding market potential.

The commercial success of Trodelvy has been a key driver of the TROP2-targeted therapy market. The drug's success has spurred additional research and investment into the TROP2 pathway, with several pharmaceutical companies and biotechnology firms intensifying their focus on this target. Major players in the TROP2 space include Gilead, AstraZeneca, Daiichi Sankyo, Klus Pharma, Biothera, Escugen Biotechnology, and Shanghai Junshi Biosciences. Many of these companies have incorporated TROP2-targeted therapies into their clinical pipelines, with numerous candidates in early and mid-stages of development.

Several TROP2-targeted therapies are currently in clinical trials, with investigational drugs such as OBI-992, JS108, ESG-401 and SHR-A1921 showing promise. These candidates, including monoclonal antibodies, antibody-drug conjugates (ADCs), immunotherapies and cell therapies, aim to expand the therapeutic options available to patients with difficult-to-treat cancers. As more of these therapies move through the pipeline, the TROP2-targeted therapy market is expected to experience substantial growth.

In terms of market dynamics, the segment is expected to continue its expansion. Driven by the clinical success of Trodelvy, increasing investments, and a growing pipeline of TROP2-targeted therapies, this market is poised for significant growth. The therapeutic potential of TROP2-targeted treatments is vast, with applications for various cancer types, including TNBC, urothelial carcinoma, and other solid tumors. As more therapies are approved and enter the market, the commercial side of TROP2-targeted therapies will see continued development, offering new opportunities for both patients and pharmaceutical companies.

In conclusion, TROP2 as a therapeutic target holds considerable promise in revolutionizing cancer treatment. With three drugs already approved and many more in the pipeline, TROP2-targeted therapies are positioned to become a cornerstone of targeted cancer therapies. The growing interest from major pharmaceutical companies, along with the increasing number of investigational drugs, signals a bright future for this therapeutic approach in the oncology market.

Table of Contents

1. Introduction to TROP2 Targeting Therapy Market

- 1.1 Overview

- 1.2 TROP2 Targeting Therapeutics Mechanism

- 1.3 TROP2 Ideal Clinical Biomarker For Cancer

2. Global TROP2 Targeted Antibodies Clinical Trials Insight

- 2.1 By Company

- 2.2 By Country

- 2.3 By Patient Segment

- 2.4 By Phase

- 2.5 By Priority Status

3. Global TROP2 Antibody Market Outlook

- 3.1 Current Market Scenario

- 3.2 Future Market Opportunities

4. Unveiling TROP2 Therapeutic Frontiers Market Trend By Region

- 4.1 US

- 4.2 China

- 4.3 Australia

- 4.4 South Korea

- 4.5 Europe

- 4.6 Taiwan

- 4.7 Japan

5. Global TROP2 Targeting Antibodies Market By Cancer

- 5.1 Breast Cancer

- 5.2 Lung Cancer

- 5.3 Gastrointestinal Cancer

- 5.4 Urothelial Cancer

- 5.5 Ovarian Cancer

6. Trodelvy - First Approved TROP2 Targeting Therapy

- 6.1 Overview, Availability & Patent Insight

- 6.2 Dosage & Price Analysis

- 6.3 Sales Analysis (2020 - 2024)

7. Sacituzumab Tirumotecan

- 7.1 Overview, Availability & Patent Insight

8. Datroway

- 8.1 Overview, Availability & Patent Insight

- 8.2 Dosage & Price Analysis

9. TROP2 Antibodies Clinical Trials Insight By Company, Country, Indication & Phase

- 9.1 Research

- 9.2 Preclinical

- 9.3 Phase I

- 9.4 Phase I/II

- 9.5 Phase II

- 9.6 Phase III

10. Marketed TROP2 Antibody Clinical Insight

11. Combination Approaches for TROP2 Antibody

12. Competitive Landscape

- 12.1 Aptamer Sciences

- 12.2 Aston Science

- 12.3 AstraZeneca

- 12.4 Beijing Biocytogen

- 12.5 BiOneCure Therapeutics

- 12.6 Biosion

- 12.7 Bio-Thera Solutions

- 12.8 Daiichi Sankyo Company

- 12.9 Hangzhou DAC Biotech

- 12.10 Innovent Biologics

- 12.11 LegoChem Biosciences

- 12.12 Merck

- 12.13 OBI Pharma

- 12.14 Peak Bio

- 12.15 Shanghai Henlius Biotech

- 12.16 Suzhou GeneQuantum Healthcare