|

|

市場調査レポート

商品コード

1425157

ペット用パラタント市場-2024年から2029年までの予測Pet Palatant Market - Forecasts from 2024 to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ペット用パラタント市場-2024年から2029年までの予測 |

|

出版日: 2024年01月24日

発行: Knowledge Sourcing Intelligence

ページ情報: 英文 145 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

ペット用パラタント市場は予測期間中にCAGR 4.9%で成長し、2022年の3億8,350万7,000米ドルから2029年には5億3,614万3,000米ドルに達すると予測されています。

パラタントは、ペットフードの嗜好性を高めるために設計された特殊な成分システムとして重要な役割を果たしており、嗅覚、味覚、食感、全体的な美的魅力など様々な感覚的側面に対応しています。ペットフードの主流であるドライフードの場合、嗜好性向上剤はペットの興味をそそるように配合されることが多いです。一方、より贅沢な選択肢を求める飼い主に好まれるウェットペットフードも、風味と香りの両方を高め、ペットをより魅力的にするために、口当たり改善剤を加えることができます。動物性タンパク質または植物性タンパク質に由来する嗜好性物質には豊かな歴史があり、初期のものは「ダイジェスト」として知られ、酵素で乾燥タンパク質に分解してペットフードに配合されていました。

市場の促進要因

- ペット飼育率の上昇

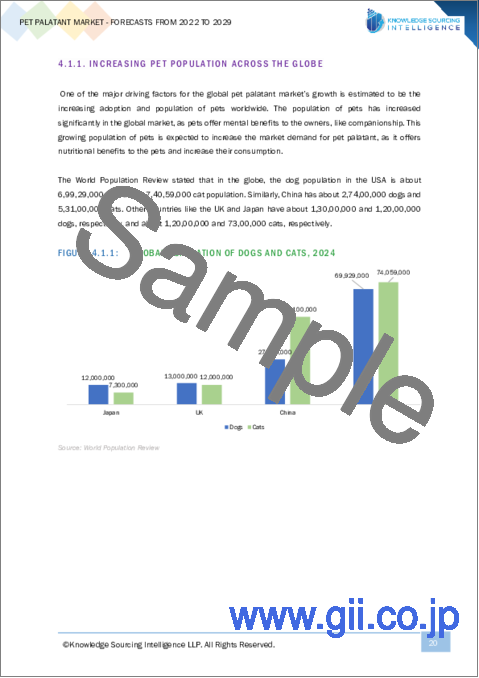

世界的に、ペットが世界中の人々の生活の一部となっているライフスタイルの変化に対応する人口が増加しています。COVID-19の大流行時には、ペットを飼う傾向が強まった。AVMAによると、米国では2016年から2020年にかけて、少なくとも1匹の犬を飼っている家庭の割合が38%から45%に上昇しました。注目すべき動向として、猫の飼育が増加しています。猫を少なくとも1匹飼っている世帯の割合は、2016年から2020年の間に25%から26%へとわずかに上昇し、その後2022年には29%へとさらに上昇します。中国では7,400万人、米国では8,500万人、欧州連合(EU)では9,200万人が犬を飼っています。この数字は、世界のペットの重要性とそのペット用パラタント市場への影響を示唆しています。

- 嗜好性の重要性に対する意識の高まり

ペットフードは主に総合的でバランスの取れた栄養を提供するように設計されているが、製品の嗜好性は市場での成否やリピート購入の可能性を決定する重要な要因として浮上しています。猫も犬も、新しい食べ物を好む新奇行動を示します。ドライペットフードに使用される原材料は犬猫ともにほぼ同様であるが、ドライキャットフードでは動物由来のタンパク質と脂肪の配合に重点が置かれています。ドライペットフード(キブルとも呼ばれる)は、ウェットフードやセミモイストフードに比べ、費用対効果が高く効率的なエネルギー源であるという利点があります。ウェットフードはタンパク質含有量が高く、猫の最適な摂取量に近いため、好ましい選択肢として浮上しています。これらのフードは脂肪分が多く、炭水化物は最小限に抑えられています。一方、ドライフードはタンパク質含有量が少なく、脂肪レベルはウェットフードと同程度で、炭水化物含有量が多い可能性があります。このような栄養組成の相違は、組成と水分含量の両面で肉類と類似しているウェットフードの嗜好性を説明しているの可能性があります。

要するに、ペット、特に猫の嗜好性を理解するには、ペットフードの種類によってタンパク質、脂肪、炭水化物の含有量が微妙に異なることを考慮する必要があり、このことに関する認識と知識の向上がペット用パラタント市場の成長に役立ちます。

目次

第1章 イントロダクション

- 市場概要

- 市場の定義

- 調査範囲

- 市場セグメンテーション

- 通貨

- 前提条件

- 基準年と予測年のタイムライン

第2章 調査手法

- 調査データ

- 調査プロセス

第3章 エグゼクティブサマリー

- 調査ハイライト

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- ポーターのファイブフォース分析

- 業界バリューチェーン分析

第5章 ペット用パラタント市場:ペットタイプ別

- イントロダクション

- 猫

- 犬

第6章 ペット用パラタント市場:供給源別

- イントロダクション

- 肉ベース

- 肝臓

- 内臓

- その他

- 肉以外

第7章 ペット用パラタント市場:形態別

- イントロダクション

- ドライ

- ウェット

第8章 ペット用パラタント市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- インドネシア

- タイ

- その他

第9章 競合環境と分析

- 主要企業と戦略分析

- 市場シェア分析

- 合併、買収、合意とコラボレーション

第10章 企業プロファイル

- Kemin Industries Inc.

- AFB International

- Symrise AG

- Trilogy Essential Ingredients Inc.

- Essentia

- Ainsworth Pet Nutrition

- Profypet

- Young Again Pet Foods LLC

- MMPP Holdings Inc.

- Kerry Group

The pet palatant market is projected to grow at a CAGR of 4.9% over the forecast period, increasing from US$383.507 million in 2022 to reach US$536.143 million by 2029.

Palatants play a crucial role as specialized ingredient systems designed to enhance the palatability of pet food, addressing various sensory aspects such as olfactory senses, taste, texture, and overall aesthetic appeal. In the case of dry pet food, which is the predominant choice, palatants are often incorporated to make it more appealing to pets. On the other hand, wet pet food, preferred by owners seeking a more indulgent option, can also benefit from the addition of palatants to enhance both flavour and aroma, making it more enticing for pets. Palatants can exist in either dry or wet forms and are frequently combined Derived from either animal or plant proteins, palatants have a rich history, with the earliest versions known as "digests," which were enzymatically broken down into dry proteins and incorporated into pet food.

Market Drivers

- Rise in Pet Ownership

Globally, the population is increasingly adopting to changing lifestyle, where pets have become part of life for people across the world. During the COVID-19 pandemic, there was an increased trend towards the adoption of pets. According to the AVMA, the proportion of U.S. households with at least one dog rose from 38% to 45% between 2016 and 2020. In a noteworthy trend, the ownership of cats has been on the rise. The percentage of households with at least one cat experienced a slight increase from 25% to 26% between 2016 and 2020, followed by a further uptick to 29% in 2022. In China, there are a total of 74 million dog owners, while the United States boasts 85 million dog owners, and the European Union comprises 92 million dog owners. Numbers suggest that, the importance of pets globally and its effect on the pet palatant market.

- Growing awareness of the significance of palatability

Although pet food is primarily designed to provide comprehensive and balanced nutrition, the palatability of the product has emerged as a crucial determinant of its success or failure in the market and the likelihood of repeat purchases. Both cats and dogs exhibit neophilic behaviour, indicating a preference for new foods. The ingredients used in dry pet food are largely similar for both cats and dogs, with a greater emphasis on incorporating animal-origin proteins and fats in dry cat foods. Dry pet foods (also known as kibbles) offer the advantage of being a cost-effective and efficient source of energy compared to wet and semi-moist alternatives. Wet diets emerge as favourable options due to their higher protein content, closely aligning with a cat's optimal intake. These diets feature increased fat and minimal carbohydrates. On the other hand, dry foods often contain less protein, comparable fat levels to wet diets, and the potential for high carbohydrate content. This divergence in nutritional composition may explain the preference for wet food, which shares similarities with meat in terms of both composition and water content.

In essence, understanding the preferences of pets, particularly cats, in terms of palatability involves considering the nuanced variations in protein, fat, and carbohydrate content across different types of pet food, growing awareness and knowledge around it helping to grow the pet palatant market.

Market Segments

The pet food market is segmented into three main categories: pet type, source, and form. By pet type, the market is divided into dog food and cat food. By source, the market is segmented into meat-based and non-meat pet food. As such in pet type, dogs exhibit a more accepting attitude towards a diverse range of foods. Their opportunistic feeding behaviour, coupled with a tendency to consume the first available food, can present challenges when attempting to pinpoint the driving forces behind their food intake. On the other hand, cats demonstrate greater selectivity and possess the ability to discern even minor changes in food composition. Consequently, it reflects the distinct preferences and behaviours of each species. This comparative nature extends to the types of products designed specifically for cats and dogs.

North America is anticipated to hold a significant share of the pet palatant market.

North America is projected to account for a notable share of the pet palatant market owing to the people's huge ownership of pets in these regions. Approximately 65.1 million households in the United States share their homes with at least one canine companion, and 46.5 million families are proud owners of a feline friend, according to the American Pet Products Association (APPA). Additionally, 2.2 million Americans enjoy the companionship of a horse as a pet, while an equal number find joy in caring for saltwater fish, as reported by APPA. Between 2020 and 2022, there was a general increase in consumer spending on dogs and cats. Radich reported that the average yearly expenses for veterinary visits in households with a single dog rose from $224 in 2020 to $362 in 2022. Similarly, for households with cats, the mean annual spending on veterinary visits increased from $189 in 2020 to $321 in 2022. Shows the importance of companionship and family importance of these pets.

Market Developments

- September 2023- Symrise launched a cutting-edge production facility for pet food palatability solutions in Latin America. This facility, situated in Chapeco, Brazil, focuses on the manufacturing of liquid and powder palatants catering to both local and international markets. The highly automated plant adheres to stringent food safety standards, ensuring top-notch production processes. The inauguration of this pet food palatants production facility took place in late August 2023, marking a significant milestone for Symrise. The state-of-the-art plant is dedicated to producing palatants specifically designed for cat and dog food, solidifying Symrise's position with the most extensive footprint in the global pet food market

- December 2021- Bessemer Investors LLC disclosed a substantial investment in Pet Flavors, LLC, a company specializing in the production of pharmaceutical-grade flavour bases and palatants for the pet industry. The financial details of this investment have not been disclosed. This strategic move represents Bessemer's foray into the companion animal health market.

- February 2022- Symrise AG officially confirmed the signing of a purchase agreement for the acquisition of Wing Pet Food, a leading Chinese provider of pet food palatability enhancers. This strategic move is geared towards bolstering Symrise's market standing in the realm of pet food palatability and expediting its diversification within the pet food application sector. The acquisition of Wing Pet Food not only adds valuable capabilities but also broadens Symrise's reach into the rapidly growing Asia/Pacific region (APAC), recognized by experts as the fastest-growing region for pet food applications globally.

Company Products

- PetSavio™.- PetSavio™, a delectable bone broth or stock base, has garnered favour among pets due to its irresistible taste. This sought-after product is available in both powder and paste forms. The series comprises PetSavio™ PBP 410 (beef), PetSavio™ PPP 410 (pork), and PetSavio™ PCP 410 (chicken) in powder form. The preparation of the product involves a meticulous process of slow-simmering fish, chicken, pork, or beef bones until they achieve a soft consistency, leaving behind no bone bits. This careful crafting ensures a rich and flavorful broth that pets adore, making PetSavio™ a delightful addition to their cuisine.

- PALASURANCE®- Kemin, recognized as a prominent manufacturer of pet food palatants, introduces its flagship line, PALASURANCE, catering to a diverse range of pet food products. It is crafted to meet the industry and consumer expectations for palatability, PALASURANCE products embody Kemin's commitment to delivering superior taste experiences for pets. The palatability of pet food hinges on various factors, encompassing ingredient freshness, kibble texture, size, shape, and, notably, the application of palatants. With a profound understanding of taste at the molecular level, Kemin, as a pet food palatants manufacturer, designs enhancers within PALASURANCE to optimize both flavour and overall acceptance by pets.

- SPF VET PALTM- SPF VET PALTM by Symrise flavours stands as a reliable companion in enhancing the acceptance of treatments and dietary supplements by pets, ensuring their compliance with prescribed regimens. Elevating palatability becomes a powerful tool in bringing joy to pet parents and promoting the overall health of pets, SPF VET PALTM flavours emerge as a valuable asset. These flavours contribute significantly to the mission of helping pets lead long, healthy lives.

Market Segmentation

By Pet Type

- Cat

- Dog

By Source

- Meat Based

- Liver

- Viscera

- Others

- Non- Meat

By Form

- Dry

- Wet

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Uk

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Others

TABLE OF CONTENTS

1. INTRODUCTION

- 1.1. Market Overview

- 1.2. Market Definition

- 1.3. Scope of the Study

- 1.4. Market Segmentation

- 1.5. Currency

- 1.6. Assumptions

- 1.7. Base, and Forecast Years Timeline

2. RESEARCH METHODOLOGY

- 2.1. Research Data

- 2.2. Research Process

3. EXECUTIVE SUMMARY

- 3.1. Research Highlights

4. MARKET DYNAMICS

- 4.1. Market Drivers

- 4.2. Market Restraints

- 4.3. Market Opportunities

- 4.4. Porter's Five Force Analysis

- 4.4.1. Bargaining Power of Suppliers

- 4.4.2. Bargaining Power of Buyers

- 4.4.3. Threat of New Entrants

- 4.4.4. Threat of Substitutes

- 4.4.5. Competitive Rivalry in the Industry

- 4.5. Industry Value Chain Analysis

5. PET PALATANT MARKET BY PET TYPE

- 5.1. Introduction

- 5.2. Cat

- 5.3. Dog

6. PET PALATANT MARKET BY SOURCE

- 6.1. Introduction

- 6.2. Meat Based

- 6.2.1. Liver

- 6.2.2. Viscera

- 6.2.3. Others

- 6.3. Non-Meat

7. PET PALATANT MARKET BY SOURCE BY FORM

- 7.1. Introduction

- 7.2. Dry

- 7.3. Wet

8. PET PALATANT MARKET BY GEOGRAPHY

- 8.1. Introduction

- 8.2. North America

- 8.2.1. USA

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.3. South America

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Others

- 8.4. Europe

- 8.4.1. UK

- 8.4.2. Germany

- 8.4.3. France

- 8.4.4. Spain

- 8.4.5. Others

- 8.5. Middle East and Africa

- 8.5.1. Saudi Arabia

- 8.5.2. UAE

- 8.5.3. Others

- 8.6. Asia Pacific

- 8.6.1. China

- 8.6.2. Japan

- 8.6.3. South Korea

- 8.6.4. India

- 8.6.5. Indonesia

- 8.6.6. Thailand

- 8.6.7. Others

9. COMPETITIVE ENVIRONMENT AND ANALYSIS

- 9.1. Major Players and Strategy Analysis

- 9.2. Market Share Analysis

- 9.3. Mergers, Acquisitions, Agreements, and Collaborations

10. COMPANY PROFILES

- 10.1. Kemin Industries Inc.

- 10.2. AFB International

- 10.3. Symrise AG

- 10.4. Trilogy Essential Ingredients Inc.

- 10.5. Essentia

- 10.6. Ainsworth Pet Nutrition

- 10.7. Profypet

- 10.8. Young Again Pet Foods LLC

- 10.9. MMPP Holdings Inc.

- 10.10. Kerry Group