|

|

市場調査レポート

商品コード

1171574

ロジック半導体の世界市場予測(2022年~2027年)Logic Semiconductor Market - Forecasts from 2022 to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ロジック半導体の世界市場予測(2022年~2027年) |

|

出版日: 2022年11月25日

発行: Knowledge Sourcing Intelligence

ページ情報: 英文 132 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界のロジック半導体の市場規模は、2020年に1,184億800万米ドルとなり、CAGRで9.97%の成長を示し、2027年に2,302億3,600万米ドルになると予測されています。市場を牽引する要因には、スマートフォンの機能拡張、通信速度を上げながらバッテリー消費を抑えることを重視するメーカーの姿勢、可処分所得の増加による、ウェアラブルデバイスやコネクテッドデバイスの需要の増加などが挙げられます。

当レポートでは、世界のロジック半導体市場について調査し、市場規模や予測、COVID-19の影響、市場の促進要因および課題、市場動向、セグメント別の市場分析、競合情勢、主要企業のプロファイルなどの体系的な情報を提供しています。

目次

第1章 イントロダクション

- 市場概要

- COVID-19の影響

- 市場の定義

- 市場セグメンテーション

第2章 調査手法

- 調査データ

- 前提条件

第3章 エグゼクティブサマリー

- 調査のハイライト

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 業界のバリューチェーン分析

第5章 ロジック半導体市場:タイプ別

- イントロダクション

- 専用ロジック

- ディスプレイドライバー

- 汎用ロジック

- 特定用途向け集積回路

- プログラマブルロジックデバイス

第6章 ロジック半導体市場:業界別

- イントロダクション

- 通信

- 家電

- 自動車

- 製造

第7章 ロジック半導体市場:地域別

- イントロダクション

- 南北アメリカ

- 米国

- その他

- 欧州、中東・アフリカ

- ドイツ

- フランス

- その他

- アジア太平洋地域

- 中国

- 日本

- 韓国

- 台湾

- その他

第8章 競合環境と分析

- 主要企業と戦略分析

- 新興企業と市場の有利性

- 合併、買収、契約、コラボレーション

- ベンダーの競合マトリックス

第9章 企業プロファイル

- Intel Corporation

- NXP Semiconductors

- STMicroelectronics

- Broadcom Inc.

- Samsung Electronics Co., Ltd.

- Texas Instruments

- Bitmain Technologies Limited

- Taiwan Semiconductor Manufacturing Company, Limited

The logic semiconductor market is projected to grow at a CAGR of 9.97% to reach US$230.236 billion by 2027, from US$118.408 billion in 2020.

The expanding functionality of smartphones, as well as the manufacturers' increased emphasis on reducing battery consumption while boosting communication speed, are creating major demand for logic devices. Furthermore, rising disposable income is expected to increase demand for wearable and connected devices, which is expected to fuel market expansion.

Market Overview

Digital technologies have also propelled the growth of the logic semiconductor sector. Furthermore, recent breakthroughs in the logical semiconductors industry, such as AI and IoT, are projected to present significant growth possibilities for the logic semiconductors market. Furthermore, the growing need for logic semiconductors in the automotive and industrial equipment sectors has greatly boosted market demand. The growing desire for electric cars might serve as a growth driver for the worldwide semiconductors industry.

By processing digital data, logic semiconductors govern the functioning of electronic systems. Globally, technological advancements that result in increased consumption raised the demand for consumer electronic devices, and benefits such as added convenience, higher productivity, lower power consumption, and higher quality and reliability are the main growth drivers of the global logic semiconductors market. Furthermore, the rising usage of logic semiconductors for data transmission and broadband-enabled devices, as well as growing economies such as China, India, and others, will open up new prospects for the worldwide logic semiconductors market. However, increasing product modification costs and the growth of System-in-Package (SiP) packaging are major barriers for the worldwide logic semiconductors industry.

Asia Pacific region and North America are anticipated to hold a significant number of shares in the logic semiconductors market.

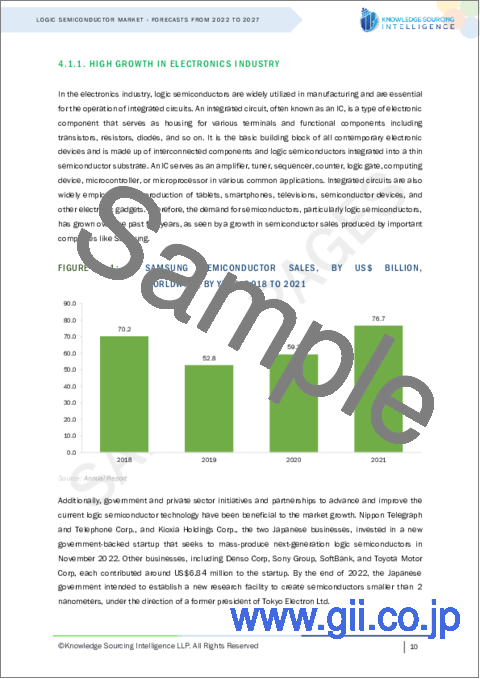

The presence of high-tech companies and the initiative taken by them have majorly influenced the region to generate market demand along with market expansion. For instance, the System LSI Business, Samsung Electronics fabless IC design house, presently offers over 900 products, including SoC (System on Chip), imaging systems, modems, display driver IC (DDI), power control IC (PMIC), and security solutions. The System LSI Business not only produces outstanding individual products, but it is also a whole solution provider capable of integrating diverse logic technologies into a single platform in order to provide clients with optimum solutions. Moreover, in October 2022, at the Tech Day exhibit, Samsung Electronics debuted a variety of innovative logic chip technologies for the first time, including the Exynos Auto V920, 5G Exynos Modem 5300, and QD OLED DDI, which are critical components in sectors such as mobile, home appliances, and automotive.

Furthermore, in November 2021, Samsung stated it will invest $17 billion in a new semiconductor manufacturing plant in Taylor, Texas, including buildings, land upgrades, machinery, and equipment. This is Samsung's largest-ever investment in the United States. This will contribute to an increase in the manufacture of sophisticated logic semiconductor solutions, which power next-generation breakthroughs and technology. Therefore, all these developments will add value to the logic semiconductors market growth in the coming years.

Product Offerings

Taiwan Semiconductor Manufacturing Co. Ltd (TSMC) is introducing its newest advancements in advanced logic technology with the N5A. This logic semiconductor is designed to meet the increased demand for computational capacity in newer and more demanding automotive industries such as AI-enabled driver aids and vehicle cockpit digitalization. N5A applies the latest supercomputer technology to automobiles, delivering the performance, power economy, and logic density of N5 while satisfying the high quality and reliability criteria of AEC-Q100 Grade 2 as well as other vehicle safety and quality standards. The TSMC N5A is backed by the thriving TSMC car design enablement platform.

MIPS Technologies, Inc. and Virage Logic Corp. have developed a streamlined licensing approach that allows System-on-Chip (SoC) designers to license MIPS Technologies' 32-bit CPU cores alongside Virage Logic's semiconductor intellectual property (IP) under a single MIPS Technologies license. The MIPS32 4KEc is the first MIPS Technologies core to be licensed under the new arrangement. It provides startups, fabless semiconductor businesses, and system OEMs with a straightforward, cost-effective, low-risk design route for swiftly deploying a wide range of 32-bit embedded consumer technology applications.

With the debut of their GWU2X and GWU2U USB interface bridging devices, GOWIN Semiconductor Corp., the world's fastest-growing programmable logic firm, introduces the GoBridge ASSP product line. The GWU2X ASSP transforms USB (Universal Serial Bus) devices to four peripheral interfaces: SPI, I2C, JTAG, and GPIO, whereas the GWU2U ASSP translates USB devices to UART. The GoBridge ASSP product family from GOWIN reduces typical interface bridging difficulties in consumer, automobile, industrial, and communication applications.

Key Market Developments

In September 2022, GOWIN Semiconductor Corporation, the world's fastest-growing FPGA company, revealed the availability of its new generation Arora V high-performance FPGA family, which incorporates 270Mbps-12.5Gbps high-speed SerDes interfaces, PCIe 2.1 hardcore with assistance for PCIe x1, x2, and x8 modes, MIPI hardcore single lane device at up to 2.5Gbps, and DDR3 interfacing at speeds up to 1333 Mbps. The first device in the family, the GW5AT-138FC676, has 138K LUT logic resources, 6.4MB block RAM, 1.1MB distributed SRAM, sophisticated DSP blocks, and an integrated ADC. Future devices in the series will include 25K (non-Serdes) and 60K LUT devices.

In July 2022, Samsung plans to expand its semiconductor campus. The new semiconductor campus will cost $17 billion, according to Samsung. It will produce sophisticated logic semiconductor products with 5nm or lower dimensions there. In one of its South Korean plants, the business has already launched the mass manufacture of 3nm chips. When the Taylor factory is fully operating, it may be able to create 2nm solutions. The Korean powerhouse plans to release 2nm semiconductors in 2025.

In August 2022, SK Group, South Korea's second-largest conglomerate, announced the new facility as part of a $22 billion US investment program in semiconductors, renewable energy, and bioscience projects. The White House said that $15 billion will be provided to the semiconductor sector including research and development projects, materials, and the establishment of an enhanced packaging and manufacturing facility. In addition to logic chips created by other US businesses for artificial intelligence and machine learning applications, R&D expenditures will entail the establishment of a countrywide network of R&D collaborations and facilities.

Segmentation

By Type

Special Purpose Logic

Display Drivers

General Purpose Logic

Application Specific Integrated Circuit

Programmable Logic Devices

By Industry Vertical

Communication

Consumer Electronics

Automotive

Manufacturing

By Geography

Americas

USA

Others

Europe Middle East and Africa

Germany

France

Others

Asia Pacific

China

Japan

South Korea

Taiwan

Others

TABLE OF CONTENTS

1. INTRODUCTION

- 1.1. Market Overview

- 1.2. COVID-19 Scenario

- 1.3. Market Definition

- 1.4. Market Segmentation

2. RESEARCH METHODOLOGY

- 2.1. Research Data

- 2.2. Assumptions

3. EXECUTIVE SUMMARY

- 3.1. Research Highlights

4. MARKET DYNAMICS

- 4.1. Market Drivers

- 4.2. Market Restraints

- 4.3. Porter's Five Force Analysis

- 4.3.1. Bargaining Power of Suppliers

- 4.3.2. Bargaining Power of Buyers

- 4.3.3. Threat of New Entrants

- 4.3.4. Threat of Substitutes

- 4.3.5. Competitive Rivalry in the Industry

- 4.4. Industry Value Chain Analysis

5. LOGIC SEMICONDUCTOR MARKET, BY TYPE

- 5.1. Introduction

- 5.2. Special Purpose Logic

- 5.3. Display Drivers

- 5.4. General Purpose Logic

- 5.5. Application-Specific Integrated Circuit

- 5.6. Programmable Logic Devices

6. LOGIC SEMICONDUCTOR MARKET, BY INDUSTRY VERTICAL

- 6.1. Introduction

- 6.2. Communication

- 6.3. Consumer Electronics

- 6.4. Automotive

- 6.5. Manufacturing

7. LOGIC SEMICONDUCTOR MARKET, BY GEOGRAPHY

- 7.1. Introduction

- 7.2. Americas

- 7.2.1. USA

- 7.2.2. Others

- 7.3. Europe Middle East and Africa

- 7.3.1. Germany

- 7.3.2. France

- 7.3.3. Others

- 7.4. Asia Pacific

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. South Korea

- 7.4.4. Taiwan

- 7.4.5. Others

8. COMPETITIVE ENVIRONMENT AND ANALYSIS

- 8.1. Major Players and Strategy Analysis

- 8.2. Emerging Players and Market Lucrativeness

- 8.3. Mergers, Acquisitions, Agreements, and Collaborations

- 8.4. Vendor Competitiveness Matrix

9. COMPANY PROFILES

- 9.1. Intel Corporation

- 9.2. NXP Semiconductors

- 9.3. STMicroelectronics

- 9.4. Broadcom Inc.

- 9.5. Samsung Electronics Co., Ltd.

- 9.6. Texas Instruments

- 9.7. Bitmain Technologies Limited

- 9.8. Taiwan Semiconductor Manufacturing Company, Limited