|

|

市場調査レポート

商品コード

1134393

電気自動車向け水素燃料電池の特許情勢 (2022年)Hydrogen Fuel Cells for Electric Vehicles Patent Landscape 2022 |

||||||

| 電気自動車向け水素燃料電池の特許情勢 (2022年) |

|

出版日: 2022年10月12日

発行: KnowMade

ページ情報: 英文 PDF: 115 Slides, Excel File: 30,000 patent families

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

ドイツの自動車メーカーの特許活動の拡大や中国企業の目覚ましいIPの最近の発展は、自動車メーカーが直面する問題に取り組むための一つの解決策として、バッテリー電気自動車 (BEV) と共に水素ベースの燃料電池電気自動車 (HFCEV) への関心が再び高まっていることを示しています。

分析の背景

現在、世界の運輸部門は、直接排出される二酸化炭素の約4分の1を占めています。これを改善するため、過去数年間、世界各国の政府がグリーン水素製造、水素インフラ、燃料電池電気自動車の将来の繁栄を支援するため、研究開発プログラムに関する政策規制と財政的インセンティブを導入してきました。さらに、自動車メーカー、機器サプライヤー 'OEM)、水素・燃料電池関連企業間の数多くの研究開発プログラム、戦略的提携、パートナーシップも花開き、この特定市場の構造化と強化に向けた強い洞察を与えています。

この10年間、自動車産業における技術的な関心は変化し、各社は研究開発努力と特許取得活動をバッテリー技術に集中させてきました。しかし、電気自動車にはまだ解決されていない問題 (走行距離の自律性、充電速度、安全性など) があるため、2010年代半ばに燃料電池技術に関する特許出願が復活し、2015年から2021年にかけて18%のCAGRで増加しています。

特許情勢の概要

最も活動的な特許出願者 (2020年移行)

新規参入者の出現で盛り上がる分野

道路交通 (自動車、トラック、バス) 用の水素ベースの燃料電池技術は、過去20年間に3万件以上の特許ファミリーが公開され、世界中の多くの企業の注目を集めている分野です。多くのイノベーション主導型産業分野と同様に、日本企業は2000年代に燃料電池関連技術分野を歴史的に支配し、特許活動において量的アプローチを取ってきました。

特許の分類

特許ファミリーは、燃料電池技術 (PEMFC、SOFC、MCFC、PAFC、AFCなど)、電池材料と部品 (電極、膜、触媒、ガス拡散層、バイポーラプレート、電解質など)、管理・制御 (熱管理、圧力管理など)、燃料電池積層、燃料電池システム、水素貯蔵などに分類されます。

特許区分の概要

最大の特許譲受人:サプライチェーン・セグメント別

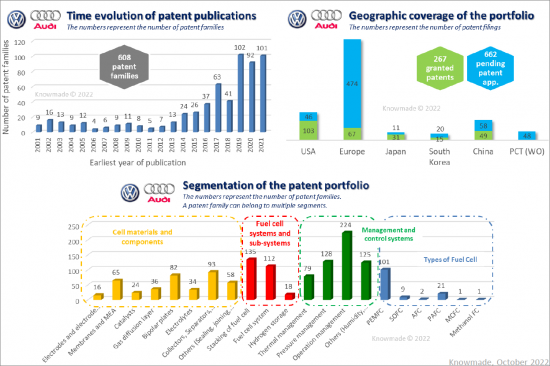

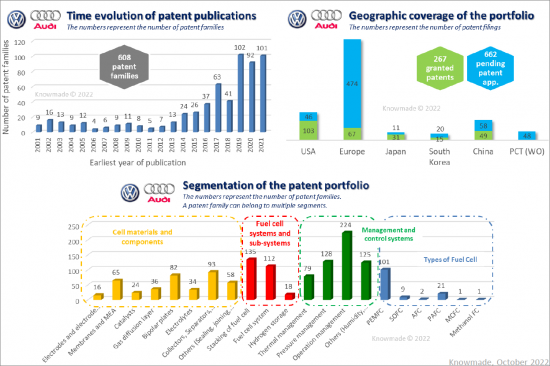

VOLKSWAGEN/AUDI

特許ポートフォリオの概要

当レポートでは、電気自動車 (EV) 向け水素燃料電池の関連特許の動向について分析し、近年の特許出願・公開件数の推移や主な出願国、サプライチェーンの各分野における主要な特許譲受人企業・新規参入企業、IPコラボレーション (特許共同出願) およびIPトランスファー (特許所有権の変更) の動き、セグメント別の詳細な特許分布 (全20種以上)、主要企業15社のIPプロファイル (出願件数、内訳、法的地域、地理的範囲ほか)、主要特許の概略 (全30,000件以上)、といった情報を取りまとめてお届けいたします。

当レポートに記載された企業 (一部)

工業:AGC、Aisin Seiki、Anderson Industries、Asahi Kasei、BAIC Group (Beijing Automotive)、Blue World Technologies、BMW、Bosch、Canon、Cellcentric、Chery Automobile、Daimler、Denso、Dongfeng Motor、FAW (China First Automobile Works)、Ford、FTXT Energy Technology、General Motors、Grove Hydrogen Automotive、Hitachi Group、Honda、Hylium Industries、Hyundai/Kia、J&L Tech、Kolon Industries、LG Group、Mitsubishi Group、Murata Manufacturing/Sony、New Keli Chemical、Nippon Steel、Nissan Group、Nuvoton、Panasonic/Sanyo、Refire Technology、Renault、Samsung Group、Schaeffler Technologies、S-FuelCell、Shanghai Shenli High Technology、Sinohytec、Soken、Sumitomo Group、Sunrise Power、Suzuki Group、Toppan Printing、Toray Industries、Toshiba Group、Toyota Group、Vitesco Technologies、Volkswagen/Audi、Weichai Group、Yutong、など。

研究機関:AIST (National Institute of Advanced Industrial Science & Technology)、Beijing University、CEA (Alternative Energies and Atomic Energy Commission)、Dalian Institute of Chemical Physics - CAS、Jilin University、KAIST (Korea Advanced Institute of Science &Technology)、KIER (Korea Institute of Energy Research)、Seoul National University、Shanghai Jiao Tong University、South China University of Technology、Tongji University、Tsinghua University、Wuhan University of Technology、Zhejiang University、など。

目次

イントロダクション

分析範囲・手法

ハイライトと重要な洞察

特許情勢:概要

- 特許公開のタイムライン

- 本社の時間発展

- 主な特許出願人

- 最も活動的な特許出願人 (2020年1月以降)

- 主な特許出願人:企業の種類別

- 特許出願人:特許公開件数の経時的推移

- 新規参入企業の知的財産

- 特許の現在の法的地位

- 特許譲受人の知財リーダーシップ

- 特許譲受人のIPブロックの可能性

- 有効な特許の地域分布

- 特許譲受人のポートフォリオ:地理的範囲

- 中国の主要企業の知財戦略

IPコラボレーション

知的財産訴訟および異議申し立て

特許の内訳

- パテントファミリーの分布:セグメント別

- 特許公開件数の経時的変化:セグメント別

- 主な特許出願人 vs.セグメント

- 特許出願人ランキング:セグメント別

PEMFCへの注目

- 特許公開件数の経時的推移

- 主な特許出願人

- 特許譲受人の知財リーダーシップ

- 主な特許

主要企業のIPプロファイル

- 主なIP企業:Toyota、Honda、Nissan、Hyundai/Kia、General Motors、Panasonic、Volkswagen/Audi、Bosch、BMW、Grove Hydrogen Automotive、Shen-Li High Tech (Sino Fuel Cell)、FAW、Weichai、Sunrise Power、Cellcentric

- 各企業の概略:競争上の強み、強化の可能性、企業のIPダイナミクス、IPコラボレーション、近年の特許取得活動の概況

KnowMadeについて

The growth in patenting activity among German vehicle manufacturers and the impressive IP recent developments of Chinese companies are indicative of renewed interest in hydrogen-based fuel cell electric vehicles (HFCEV) as one solution, along with battery electric vehicles (BEV), to tackle the issues faced by automakers.

Report's Key Features:

- Describing the global patenting trends,including time evolution of patent publications, countries of patent filings, etc.

- Identifying the main patent assignees and the IP newcomers in the different segments of the supply chain.

- Determining the status of their patenting activity (active / inactive) and their IP dynamics (ramping up, slowing down, steady).

- Identifying the IP collaborations (patent co-filings) and IP transfers (changes of patent ownership).

- Patents categorized into more than 20 segments: fuel cell technologies (PEMFC, SOFC, MCFC, PAFC, AFC, etc.), cell materials and components (electrodes, membranes, catalysts, gas diffusion layer, bipolar plates, electrolytes, etc.), stacking of fuel cells, fuel cell system, thermal management, pressure management, etc.

- IP profile of 15 key players: patent portfolio overview (IP dynamics, segmentation, legal status, geographic coverage, etc.), IP collaborations, and recent patenting activity.

- Excel database containing all patents analyzed in the report, including patent segmentations and hyperlinks to an updated online database.

Context of the report:

Nowadays, the global transportation sector represents about one quarter of all direct carbon dioxide emissions. To remedy this, during the past few years, several national and supranational governments around the world have instigated policy regulations and financial incentives regarding research and development programs in order to help green hydrogen production, hydrogen infrastructures and fuel cell-powered electric vehicles thrive in the future. Moreover, numerous R&D programs, strategic alliances and partnerships among vehicle manufacturers, equipment suppliers (OEM) and hydrogen- and fuel cell-related companies have blossomed, giving a strong insight into the structuring and strengthening of this specific market.

The last 10 years we witnessed a shift in technological interest in the automotive sector, with companies concentrating their R&D efforts and patenting activities on battery technologies. But with some as yet unresolved issues for electric vehicles (mileage autonomy, charging speed and safety to name a few), there was a revival in interest in fuel cell technology patent filings in the mid-2010s, with a CAGR of 18% between 2015 and 2021.

In this context, Knowmade is releasing a new report which aims to provide a comprehensive view of the patent landscape related to hydrogen-based fuel cells for terrestrial electric vehicles (cars, trucks and buses), from electrolyte and electrode materials to the fuel cell system and vehicle integration, segmented into fuel cell technologies - such as proton exchange membrane (PEMFC), solid oxide (SOFC) and molten carbonate (MCFC).

Patent landscape analysis is a powerful tool to understand global hydrogen fuel cell electric vehicles competitive and technological environment. Overall, patenting activity (patent filings) reflects the level of R&D investment made by a country or player in a specific technology, while providing clues as to the technology readiness level reached by the main IP players. What's more, the technology coverage along the value chain and the geographical coverage of the patent portfolios are closely related to the business strategy of IP players.

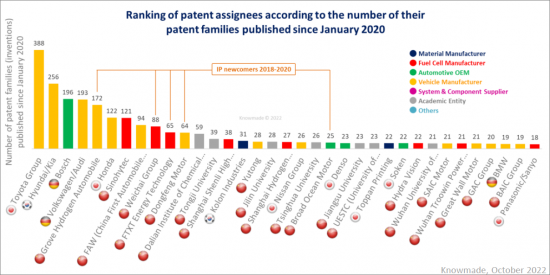

PATENT LANDSCAPE OVERVIEW

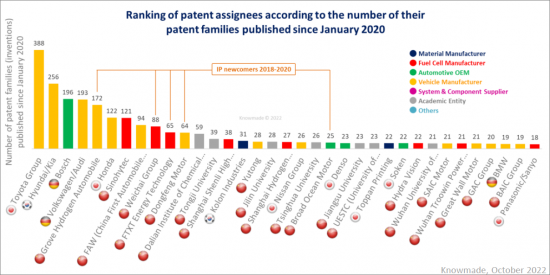

Most active patent applicants since 2020

A sector boosted by the emergence of newcomers

With more than 30,000 patent families published in the past 20 years, hydrogen-based fuel cell technologies for road transportation (cars, trucks, buses) is a sector that has caught the attention of a lot of companies around the world. As in a lot of innovation-led industry sectors, Japanese players historically took over the fuel cell-related technological field in the 2000s, taking a quantitative approach in patenting activity. Players such as car makers (Toyota, Nissan, Honda, Mitsubishi, etc.), equipment suppliers (Aisin Seiki, Denso, Soken, etc.), device manufacturers (Panasonic/Sanyo, Hitachi, Toshiba, Murata/Sony, etc.) or material suppliers (Toppan Printing, Nippon Steel, Toray Industries, Sumitomo, etc.) have been active all along the value chain, from electrode materials and fuel cell stacks to system integration into vehicles. Other players have joined their Japanese counterparts in patent filings in that period, like US General Motors and Ford, German Daimler, Volkswagen/Audi, Bosch and BMW, and South Korean Hyundai/Kia, Samsung and LG. More recently, the patenting activity is led by German vehicle manufacturers and Chinese newcomers, as a way to develop and diversify their businesses, for the former - Volkswagen/Audi, Bosch or BMW - and to take some market shares and develop fuel cell technologies, for the latter - vehicle manufacturers Grove Hydrogen Automotive, FAW China First Automotive Works, Dongfeng Motor, Yutong Bus or SAIC Group, and product devices sellers SinoHytec, Weichai Group, FTXT Energy Technology or Shanghai Shenli High Technology.

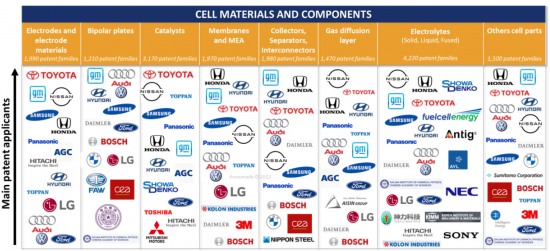

Patent segmentation

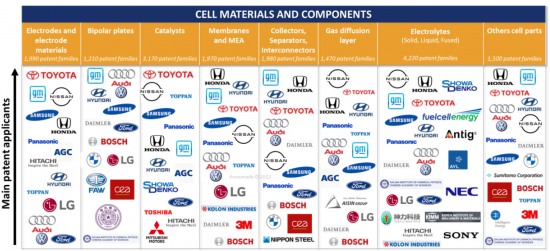

The patent families have been categorized according to the fuel cell technologies (PEMFC, SOFC, MCFC, PAFC, AFC, etc.), cell materials and components (electrodes, membranes, catalysts, gas diffusion layer, bipolar plates, electrolytes, etc.), management and control (thermal management, pressure management, etc.), stacking of fuel cells, fuel cell system, hydrogen storage, etc.

PATENT SEGMENTATION OVERVIEW

Most patent assignees per supply chain segment

IP profiles: focus on the top IP players' patent portfolios

The patent portfolio of 15 companies is analyzed: Toyota, Honda, Nissan, Hyundai/Kia, General Motors, Panasonic, Volkswagen/Audi, Bosch, BMW, Grove Hydrogen Automotive, Shen-Li High Tech (SinoFuelCell), FAW, Weichai, Sunrise Power, Cellcentric. For each player, the hydrogen fuel cell patent portfolio is analyzed to provide an overview of its strengths, its potential for reinforcement, the level of IP activity, IP collaborations and recent patenting activity.

Useful Excel patent database

This report also includes an extensive Excel database with the 30,000+ patent families (inventions) analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to an updated online database (original documents, legal status, etc.), priority date, title, abstract, patent assignees, patent's current legal status, and 20+ segments (PEMFC, SOFC, MCFC, AFC, electrodes, membranes, catalysts, gas diffusion layer, stacking of fuel cells, fuel cell system, hydrogen storage, thermal management, pressure management, etc.).

VOLKSWAGEN/AUDI

Patent portfolio overview

Companies mentioned in the report (non-exhaustive)

Industrials: AGC, Aisin Seiki, Anderson Industries, Asahi Kasei, BAIC Group (Beijing Automotive), Blue World Technologies, BMW, Bosch, Canon, Cellcentric, Chery Automobile, Daimler, Denso, Dongfeng Motor, FAW (China First Automobile Works), Ford, FTXT Energy Technology, General Motors, Grove Hydrogen Automotive, Hitachi Group, Honda, Hylium Industries, Hyundai/Kia, J&L Tech, Kolon Industries, LG Group, Mitsubishi Group, Murata Manufacturing/Sony, New Keli Chemical, Nippon Steel, Nissan Group, Nuvoton, Panasonic/Sanyo, Refire Technology, Renault, Samsung Group, Schaeffler Technologies, S-FuelCell, Shanghai Shenli High Technology, Sinohytec, Soken, Sumitomo Group, Sunrise Power, Suzuki Group, Toppan Printing, Toray Industries, Toshiba Group, Toyota Group, Vitesco Technologies, Volkswagen/Audi, Weichai Group, Yutong, etc.

Research organizations: AIST (National Institute of Advanced Industrial Science & Technology), Beijing University, CEA (Alternative Energies and Atomic Energy Commission), Dalian Institute of Chemical Physics - CAS, Jilin University, KAIST (Korea Advanced Institute of Science &Technology), KIER (Korea Institute of Energy Research), Seoul National University, Shanghai Jiao Tong University, South China University of Technology, Tongji University, Tsinghua University, Wuhan University of Technology, Zhejiang University, etc.

TABLE OF CONTENTS

INTRODUCTION

- Context

- Hydrogen fuel cells: advantagea and drawbacks

- Types of fuel cells: PEMFC, SOFC, MCFC, PAFC, etc.

- Fuel cells in transportation

- Incentives & Policies worldwide

- Latest news

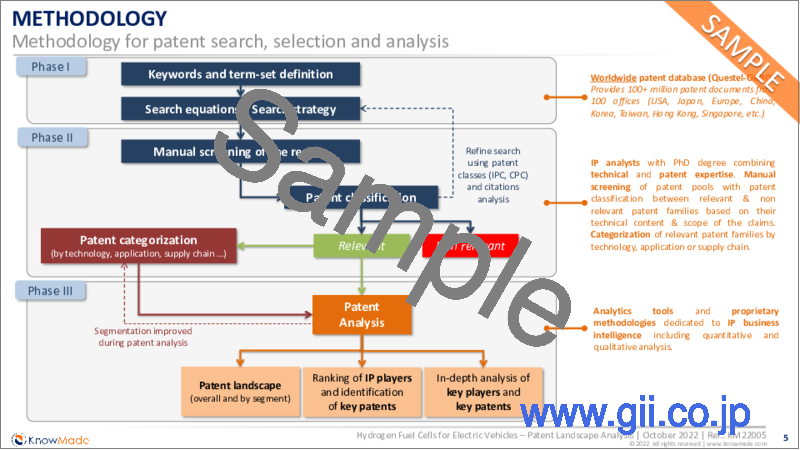

SCOPE OF THE REPORT AND METHODOLOGY

- Key features of the report

- Methodology for patent search ,selection and analysis

- Key IP players & Key patents

- Terminology

HIGHLIGHTS AND KEY INSIGHTS

PATENT LANDSCAPE OVERVIEW

- Timeline of patent publications

- Time evolution of company headquarters

- Main patent assignees

- Most active patent applicants since January 2020

- Main patent assignees by company type

- Patent assignees time evolution of patent publications

- IP newcomers

- Current legal status of patents

- IP leadership of patent assignees

- IP blocking potential of patent assignees

- Geographical distribution of alive patents

- Patent assignees geographical coverage of portfolio

- IP strategy of main Chinese players

IP COLLABORATIONS

IP LITIGATIONS AND OPPOSITIONS

PATENT SEGMENTATION

- Distribution of patent families by segment

- Time evolution of patent publications by segment

- Main patent assignees vs. Segments

- Ranking of patent assignees for each segment

FOCUS ON PEMFC

- Time evolution of patent publications

- Main patent assignees

- IP leadership of patent assignees

- Key patents

IP PROFILES OF KEY PLAYERS103

- Selected IP players: Toyota, Honda, Nissan, Hyundai/Kia, General Motors, Panasonic, Volkswagen/Audi, Bosch, BMW, Grove Hydrogen Automotive, Shen-Li High Tech (Sino Fuel Cell), FAW, Weichai, Sunrise Power, Cellcentric

- For each player: Overview of its strength, its potential for reinforcement, the player's IP dynamics, its IP collaborations and its recent patenting activity