|

|

市場調査レポート

商品コード

1803924

ガラスインターポーザーの世界市場:市場規模・シェア・動向分析 (ウエハーサイズ別、用途別、基板技術別、最終用途産業別、地域別)・展望・将来予測 (2025年~2032年)Global Glass Interposers Market Size, Share & Industry Analysis Report By Wafer Size, By Application, By Substrate Technology, By End Use Industry, By Regional Outlook and Forecast, 2025 - 2032 |

||||||

|

|||||||

| ガラスインターポーザーの世界市場:市場規模・シェア・動向分析 (ウエハーサイズ別、用途別、基板技術別、最終用途産業別、地域別)・展望・将来予測 (2025年~2032年) |

|

出版日: 2025年08月19日

発行: KBV Research

ページ情報: 英文 464 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ガラスインターポーザー市場規模は、予測期間中に12.1%のCAGRで市場成長し、2032年までに3億345万米ドルに達すると予想されます。

主なハイライト:

- 2024年のガラスインターポーザー市場はアジア太平洋市場が支配的となり、2024年には収益シェアの47.9%を占めました。

- 米国市場は北米におけるリーダーシップを維持し、2032年までに市場規模が3,171万米ドルに達すると予測されています。

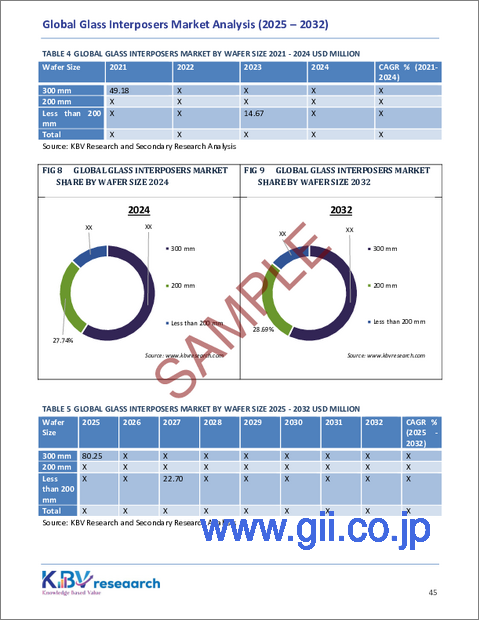

- ウエハーサイズの中で、300 mmセグメントが世界市場を独占し、2024年には59.11%の収益シェアを占めました。

- 用途別では、2.5Dパッケージングセグメントが世界市場をリードすると予想されており、2032年までに収益シェアは50.48%になると予測されています。

- ガラス貫通ビア(TGV)セグメントは、2024年に主要な基板テクノロジーとして浮上し、59.65%の収益シェアを獲得し、予測期間中もその優位性を維持すると予測されています。

- 最終用途別では、民生用電子機器セグメントが2032年に33.78%の収益シェアで市場で成長する見込みで、予測期間を通じてその支配的な地位を維持すると予測されています。

ガラスインターポーザーは、優れた熱特性、強化された機械的堅牢性、および信号整合性により、2.5D半導体パッキングのゲームチェンジャーとして進化しました。インテルやサムスン電子などの市場大手は、AI、通信、自動車、高性能コンピュータ(HPC)などの業界全体にわたる用途で、研究開発、特許登録、および市場展開の取り組みを加速しています。さらに、サムスンは、並行パスイノベーション計画の支援を受けて、2028年までにシリコンインターポーザーからガラスインターポーザーへの移行を実現しようとしています。同社はまた、ケムトロニクス、コーニング、およびフィリオプティクスとも提携しています。同様に、インテルは、フォトニックインテグレーション、ハイブリッドボンディング、および熱伝導ビアシールドなどの領域をカバーする特許保有で優位に立っており、Huawei、SJ Semi、Absolicsなどのプレーヤーとの提携関係にあります。

さらに、戦略的パートナーシップ、材料およびツールのコラボレーション、そして自動車や通信などの分野における技術の利用拡大は、いずれも業界の商業化を推進しています。米国半導体工業会(SIA)によると、2025年第2四半期の世界半導体売上高は1,797億米ドルで、第1四半期と比較して7.8%増加しました。この成長がガラスインターポーザー市場の成長を牽引しています。さらに、ガラスインターポーザーはミリ波用途や高熱環境で最適に機能するため、ADASや基地局での使用が可能です。また、シリコンインターポーザーは依然として最も人気がありますが、Intel、Samsung、Corning、Toppan、Absolics、SJ Semiといった少数の企業が、特許や早期生産能力を通じて、技術とエコシステム管理のリーダーになりつつあります。ガラスインターポーザーは、積極的なグローバルR&D、拡大するIPポートフォリオ、そしてエコシステムロックイン戦略により、迅速な導入に備えています。これは、次世代半導体パッケージング標準が変わろうとしていることを意味します。

市場シェア分析

COVID-19の影響分析

COVID-19の流行は、サプライチェーンへの影響、研究開発活動の遅延、そして台湾、韓国、アメリカといった主要半導体拠点における生産活動の混乱により、ガラスインターポーザー業界に甚大な影響を与えました。ロックダウンと生産停止により、超平坦ガラス基板などのコア材料が不足し、開発試作の進捗が停滞しました。ガラスインターポーザー業界は、COVID-19の流行による世界的な供給途絶と半導体生産の遅延により、一時的に停滞しました。

ウエハーサイズ別の展望

ウエハーサイズに基づいて、市場は300mm、200mm、200mm未満の3つに分類されます。200mmセグメントは、2024年に市場における収益シェアの27.7%を獲得しました。300mmウェーハほどの規模を必要としない一方で、信頼性の高い機能が求められる中規模用途では、200mmウェーハが最適な選択肢です。車載エレクトロニクス、IoTデバイス、産業オートメーションなどの業界では、このウエハーサイズの経済性と互換性が大きなメリットとなっています。

用途別の展望

用途に基づいて、市場は2.5Dパッケージング、3Dパッケージング、ファンアウトパッケージングに分類されます。3Dパッケージングセグメントは、2024年に市場シェアの35.1%を記録しました。これは、ハイエンドプロセッサ、メモリモジュール、そして小型化と性能が不可欠な用途で使用されています。このアプローチは、小型でモバイルなプラットフォームに不可欠なシステム速度と電力効率を向上させます。

地域別の展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAに分割されています。アジア太平洋セグメントは、強力な半導体製造基盤、大量の民生用電子機器生産、広範なインフラ開発により、2024年に市場で47.9%の収益シェアを記録しました。ガラスインターポーザー市場は、強力な研究開発、早期の商品化、高性能コンピューティング(HPC)、AI、フォトニクスへの注力により、北米と欧州で急速に成長しています。イノベーションの主要な中心地である米国では、IntelとCorningが先頭に立っています。一方、欧州は自動車用電子機器に関する知識を活かして、5G基地局やADASモジュールを製造しています。地域のサプライチェーンは、ガラス基板およびツールのサプライヤーとの協調的なエコシステムのおかげで、より強力になっています。

サムスン、TSMC、そしてアジア太平洋のOSATは、韓国、日本、台湾、中国に大規模な投資を行っており、アジア太平洋は最大の成長センターとなっています。材料サプライヤーとの提携と迅速なプロトタイプ作成能力により、特にAIおよびHPCパッケージングにおいて、製品の市場投入プロセスが加速しています。LAMEAは、世界中の大企業からの技術移転により、特に中東と南アフリカにおいて、通信、5Gインフラ、自動車エレクトロニクス分野でのビジネスチャンスを獲得し、着実に成長を遂げています。

目次

第1章 市場の範囲と分析手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 分析手法

第2章 市場要覧

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

第4章 競合分析:世界市場

- 市場シェア分析 (2024年)

- ガラスインターポーザー市場で展開されている最近の戦略

- ポーターのファイブフォース分析

第5章 市場動向:ガラスインターポーザー市場

第6章 競合状況:ガラスインターポーザー市場

第7章 製品ライフサイクル(PLC):ガラスインターポーザー市場

第8章 市場統合:ガラスインターポーザー市場

第9章 ガラスインターポーザー市場のバリューチェーン分析

第10章 主要顧客基準:ガラスインターポーザー市場

第11章 世界のガラスインターポーザー市場:ウエハーサイズ別

- 世界の300mm市場:地域別

- 世界の200mm市場:地域別

- 世界の200mm未満の市場:地域別

第12章 世界のガラスインターポーザー市場:用途別

- 世界の2/5Dパッケージ市場:地域別

- 世界の3Dパッケージ市場:地域別

- 世界のファンアウトパッケージ市場:地域別

第13章 世界のガラスインターポーザー市場:基板技術別

- 世界のガラス貫通ビア(TGV)市場:地域別

- 世界の再配信層(RDL)-ファースト/ラストマーケット:地域別

- 世界のガラスパネルレベルパッケージング(PLP)市場:地域別

第14章 世界のガラスインターポーザー市場:最終用途産業別

- 世界の民生用電子機器市場:地域別

- 世界の通信市場:地域別

- 世界の自動車市場:地域別

- 世界の防衛・航空宇宙市場:地域別

- 世界の医療市場:地域別

- 世界のその他の最終用途産業市場:地域別

第15章 世界のガラスインターポーザー市場:地域別

- 北米

- 北米のガラスインターポーザー市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米のガラスインターポーザー市場:国別

- 欧州

- 欧州のガラスインターポーザー市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州のガラスインターポーザー市場:国別

- アジア太平洋

- アジア太平洋のガラスインターポーザー市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋

- アジア太平洋のガラスインターポーザー市場:国別

- ラテンアメリカ・中東・アフリカ (LAMEA)

- ラテンアメリカ・中東・アフリカのガラスインターポーザー市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカのガラスインターポーザー市場:国別

第16章 企業プロファイル

- Corning Incorporated

- AGC, Inc

- Schott AG(Carl-Zeiss-Stiftung)

- Dai Nippon Printing Co, Ltd.

- Tecnisco, LTD(Disco Corporation)

- Samtec, Inc

- RENA Technologies GmbH

- PLANOPTIK AG

- 3DGS Inc

- Workshop of Photonics

第17章 ガラスインターポーザー市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 2 Global Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 3 Key Customer Criteria Glass Interposers Market

- TABLE 4 Global Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 5 Global Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 6 Global 300 mm Market by Region, 2021 - 2024, USD Million

- TABLE 7 Global 300 mm Market by Region, 2025 - 2032, USD Million

- TABLE 8 Global 200 mm Market by Region, 2021 - 2024, USD Million

- TABLE 9 Global 200 mm Market by Region, 2025 - 2032, USD Million

- TABLE 10 Global Less than 200 mm Market by Region, 2021 - 2024, USD Million

- TABLE 11 Global Less than 200 mm Market by Region, 2025 - 2032, USD Million

- TABLE 12 Global Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 13 Global Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 14 Global 2.5D Packaging Market by Region, 2021 - 2024, USD Million

- TABLE 15 Global 2.5D Packaging Market by Region, 2025 - 2032, USD Million

- TABLE 16 Global 3D Packaging Market by Region, 2021 - 2024, USD Million

- TABLE 17 Global 3D Packaging Market by Region, 2025 - 2032, USD Million

- TABLE 18 Global Fan-Out Packaging Market by Region, 2021 - 2024, USD Million

- TABLE 19 Global Fan-Out Packaging Market by Region, 2025 - 2032, USD Million

- TABLE 20 Global Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 21 Global Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 22 Global Through-Glass Vias (TGV) Market by Region, 2021 - 2024, USD Million

- TABLE 23 Global Through-Glass Vias (TGV) Market by Region, 2025 - 2032, USD Million

- TABLE 24 Global Redistribution Layer (RDL)-First/Last Market by Region, 2021 - 2024, USD Million

- TABLE 25 Global Redistribution Layer (RDL)-First/Last Market by Region, 2025 - 2032, USD Million

- TABLE 26 Global Glass Panel Level Packaging (PLP) Market by Region, 2021 - 2024, USD Million

- TABLE 27 Global Glass Panel Level Packaging (PLP) Market by Region, 2025 - 2032, USD Million

- TABLE 28 Global Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 29 Global Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 30 Global Consumer Electronics Market by Region, 2021 - 2024, USD Million

- TABLE 31 Global Consumer Electronics Market by Region, 2025 - 2032, USD Million

- TABLE 32 Global Telecommunications Market by Region, 2021 - 2024, USD Million

- TABLE 33 Global Telecommunications Market by Region, 2025 - 2032, USD Million

- TABLE 34 Global Automotive Market by Region, 2021 - 2024, USD Million

- TABLE 35 Global Automotive Market by Region, 2025 - 2032, USD Million

- TABLE 36 Global Defense & Aerospace Market by Region, 2021 - 2024, USD Million

- TABLE 37 Global Defense & Aerospace Market by Region, 2025 - 2032, USD Million

- TABLE 38 Global Healthcare Market by Region, 2021 - 2024, USD Million

- TABLE 39 Global Healthcare Market by Region, 2025 - 2032, USD Million

- TABLE 40 Global Other End Use Industry Market by Region, 2021 - 2024, USD Million

- TABLE 41 Global Other End Use Industry Market by Region, 2025 - 2032, USD Million

- TABLE 42 Global Glass Interposers Market by Region, 2021 - 2024, USD Million

- TABLE 43 Global Glass Interposers Market by Region, 2025 - 2032, USD Million

- TABLE 44 North America Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 45 North America Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 46 North America Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 47 North America Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 48 North America 300 mm Market by Country, 2021 - 2024, USD Million

- TABLE 49 North America 300 mm Market by Country, 2025 - 2032, USD Million

- TABLE 50 North America 200 mm Market by Country, 2021 - 2024, USD Million

- TABLE 51 North America 200 mm Market by Country, 2025 - 2032, USD Million

- TABLE 52 North America Less than 200 mm Market by Country, 2021 - 2024, USD Million

- TABLE 53 North America Less than 200 mm Market by Country, 2025 - 2032, USD Million

- TABLE 54 North America Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 55 North America Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 56 North America 2.5D Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 57 North America 2.5D Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 58 North America 3D Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 59 North America 3D Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 60 North America Fan-Out Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 61 North America Fan-Out Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 62 North America Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 63 North America Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 64 North America Through-Glass Vias (TGV) Market by Country, 2021 - 2024, USD Million

- TABLE 65 North America Through-Glass Vias (TGV) Market by Country, 2025 - 2032, USD Million

- TABLE 66 North America Redistribution Layer (RDL)-First/Last Market by Country, 2021 - 2024, USD Million

- TABLE 67 North America Redistribution Layer (RDL)-First/Last Market by Country, 2025 - 2032, USD Million

- TABLE 68 North America Glass Panel Level Packaging (PLP) Market by Country, 2021 - 2024, USD Million

- TABLE 69 North America Glass Panel Level Packaging (PLP) Market by Country, 2025 - 2032, USD Million

- TABLE 70 North America Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 71 North America Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 72 North America Consumer Electronics Market by Country, 2021 - 2024, USD Million

- TABLE 73 North America Consumer Electronics Market by Country, 2025 - 2032, USD Million

- TABLE 74 North America Telecommunications Market by Country, 2021 - 2024, USD Million

- TABLE 75 North America Telecommunications Market by Country, 2025 - 2032, USD Million

- TABLE 76 North America Automotive Market by Country, 2021 - 2024, USD Million

- TABLE 77 North America Automotive Market by Country, 2025 - 2032, USD Million

- TABLE 78 North America Defense & Aerospace Market by Country, 2021 - 2024, USD Million

- TABLE 79 North America Defense & Aerospace Market by Country, 2025 - 2032, USD Million

- TABLE 80 North America Healthcare Market by Country, 2021 - 2024, USD Million

- TABLE 81 North America Healthcare Market by Country, 2025 - 2032, USD Million

- TABLE 82 North America Other End Use Industry Market by Country, 2021 - 2024, USD Million

- TABLE 83 North America Other End Use Industry Market by Country, 2025 - 2032, USD Million

- TABLE 84 North America Glass Interposers Market by Country, 2021 - 2024, USD Million

- TABLE 85 North America Glass Interposers Market by Country, 2025 - 2032, USD Million

- TABLE 86 US Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 87 US Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 88 US Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 89 US Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 90 US Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 91 US Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 92 US Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 93 US Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 94 US Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 95 US Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 96 Canada Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 97 Canada Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 98 Canada Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 99 Canada Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 100 Canada Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 101 Canada Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 102 Canada Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 103 Canada Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 104 Canada Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 105 Canada Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 106 Mexico Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 107 Mexico Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 108 Mexico Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 109 Mexico Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 110 Mexico Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 111 Mexico Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 112 Mexico Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 113 Mexico Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 114 Mexico Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 115 Mexico Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 116 Rest of North America Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 117 Rest of North America Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 118 Rest of North America Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 119 Rest of North America Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 120 Rest of North America Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 121 Rest of North America Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 122 Rest of North America Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 123 Rest of North America Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 124 Rest of North America Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 125 Rest of North America Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 126 Europe Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 127 Europe Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 128 Europe Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 129 Europe Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 130 Europe 300 mm Market by Country, 2021 - 2024, USD Million

- TABLE 131 Europe 300 mm Market by Country, 2025 - 2032, USD Million

- TABLE 132 Europe 200 mm Market by Country, 2021 - 2024, USD Million

- TABLE 133 Europe 200 mm Market by Country, 2025 - 2032, USD Million

- TABLE 134 Europe Less than 200 mm Market by Country, 2021 - 2024, USD Million

- TABLE 135 Europe Less than 200 mm Market by Country, 2025 - 2032, USD Million

- TABLE 136 Europe Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 137 Europe Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 138 Europe 2.5D Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 139 Europe 2.5D Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 140 Europe 3D Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 141 Europe 3D Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 142 Europe Fan-Out Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 143 Europe Fan-Out Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 144 Europe Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 145 Europe Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 146 Europe Through-Glass Vias (TGV) Market by Country, 2021 - 2024, USD Million

- TABLE 147 Europe Through-Glass Vias (TGV) Market by Country, 2025 - 2032, USD Million

- TABLE 148 Europe Redistribution Layer (RDL)-First/Last Market by Country, 2021 - 2024, USD Million

- TABLE 149 Europe Redistribution Layer (RDL)-First/Last Market by Country, 2025 - 2032, USD Million

- TABLE 150 Europe Glass Panel Level Packaging (PLP) Market by Country, 2021 - 2024, USD Million

- TABLE 151 Europe Glass Panel Level Packaging (PLP) Market by Country, 2025 - 2032, USD Million

- TABLE 152 Europe Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 153 Europe Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 154 Europe Consumer Electronics Market by Country, 2021 - 2024, USD Million

- TABLE 155 Europe Consumer Electronics Market by Country, 2025 - 2032, USD Million

- TABLE 156 Europe Telecommunications Market by Country, 2021 - 2024, USD Million

- TABLE 157 Europe Telecommunications Market by Country, 2025 - 2032, USD Million

- TABLE 158 Europe Automotive Market by Country, 2021 - 2024, USD Million

- TABLE 159 Europe Automotive Market by Country, 2025 - 2032, USD Million

- TABLE 160 Europe Defense & Aerospace Market by Country, 2021 - 2024, USD Million

- TABLE 161 Europe Defense & Aerospace Market by Country, 2025 - 2032, USD Million

- TABLE 162 Europe Healthcare Market by Country, 2021 - 2024, USD Million

- TABLE 163 Europe Healthcare Market by Country, 2025 - 2032, USD Million

- TABLE 164 Europe Other End Use Industry Market by Country, 2021 - 2024, USD Million

- TABLE 165 Europe Other End Use Industry Market by Country, 2025 - 2032, USD Million

- TABLE 166 Europe Glass Interposers Market by Country, 2021 - 2024, USD Million

- TABLE 167 Europe Glass Interposers Market by Country, 2025 - 2032, USD Million

- TABLE 168 Germany Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 169 Germany Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 170 Germany Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 171 Germany Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 172 Germany Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 173 Germany Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 174 Germany Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 175 Germany Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 176 Germany Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 177 Germany Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 178 UK Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 179 UK Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 180 UK Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 181 UK Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 182 UK Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 183 UK Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 184 UK Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 185 UK Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 186 UK Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 187 UK Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 188 France Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 189 France Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 190 France Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 191 France Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 192 France Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 193 France Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 194 France Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 195 France Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 196 France Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 197 France Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 198 Russia Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 199 Russia Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 200 Russia Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 201 Russia Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 202 Russia Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 203 Russia Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 204 Russia Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 205 Russia Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 206 Russia Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 207 Russia Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 208 Spain Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 209 Spain Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 210 Spain Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 211 Spain Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 212 Spain Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 213 Spain Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 214 Spain Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 215 Spain Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 216 Spain Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 217 Spain Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 218 Italy Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 219 Italy Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 220 Italy Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 221 Italy Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 222 Italy Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 223 Italy Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 224 Italy Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 225 Italy Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 226 Italy Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 227 Italy Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 228 Rest of Europe Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 229 Rest of Europe Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 230 Rest of Europe Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 231 Rest of Europe Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 232 Rest of Europe Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 233 Rest of Europe Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 234 Rest of Europe Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 235 Rest of Europe Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 236 Rest of Europe Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 237 Rest of Europe Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 238 Asia Pacific Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 239 Asia Pacific Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 240 Asia Pacific Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 241 Asia Pacific Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 242 Asia Pacific Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 243 Asia Pacific Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 244 Asia Pacific 300 mm Market by Country, 2021 - 2024, USD Million

- TABLE 245 Asia Pacific 300 mm Market by Country, 2025 - 2032, USD Million

- TABLE 246 Asia Pacific 200 mm Market by Country, 2021 - 2024, USD Million

- TABLE 247 Asia Pacific 200 mm Market by Country, 2025 - 2032, USD Million

- TABLE 248 Asia Pacific Less than 200 mm Market by Country, 2021 - 2024, USD Million

- TABLE 249 Asia Pacific Less than 200 mm Market by Country, 2025 - 2032, USD Million

- TABLE 250 Asia Pacific Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 251 Asia Pacific Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 252 Asia Pacific 2.5D Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 253 Asia Pacific 2.5D Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 254 Asia Pacific 3D Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 255 Asia Pacific 3D Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 256 Asia Pacific Fan-Out Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 257 Asia Pacific Fan-Out Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 258 Asia Pacific Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 259 Asia Pacific Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 260 Asia Pacific Through-Glass Vias (TGV) Market by Country, 2021 - 2024, USD Million

- TABLE 261 Asia Pacific Through-Glass Vias (TGV) Market by Country, 2025 - 2032, USD Million

- TABLE 262 Asia Pacific Redistribution Layer (RDL)-First/Last Market by Country, 2021 - 2024, USD Million

- TABLE 263 Asia Pacific Redistribution Layer (RDL)-First/Last Market by Country, 2025 - 2032, USD Million

- TABLE 264 Asia Pacific Glass Panel Level Packaging (PLP) Market by Country, 2021 - 2024, USD Million

- TABLE 265 Asia Pacific Glass Panel Level Packaging (PLP) Market by Country, 2025 - 2032, USD Million

- TABLE 266 Asia Pacific Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 267 Asia Pacific Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 268 Asia Pacific Consumer Electronics Market by Country, 2021 - 2024, USD Million

- TABLE 269 Asia Pacific Consumer Electronics Market by Country, 2025 - 2032, USD Million

- TABLE 270 Asia Pacific Telecommunications Market by Country, 2021 - 2024, USD Million

- TABLE 271 Asia Pacific Telecommunications Market by Country, 2025 - 2032, USD Million

- TABLE 272 Asia Pacific Automotive Market by Country, 2021 - 2024, USD Million

- TABLE 273 Asia Pacific Automotive Market by Country, 2025 - 2032, USD Million

- TABLE 274 Asia Pacific Defense & Aerospace Market by Country, 2021 - 2024, USD Million

- TABLE 275 Asia Pacific Defense & Aerospace Market by Country, 2025 - 2032, USD Million

- TABLE 276 Asia Pacific Healthcare Market by Country, 2021 - 2024, USD Million

- TABLE 277 Asia Pacific Healthcare Market by Country, 2025 - 2032, USD Million

- TABLE 278 Asia Pacific Other End Use Industry Market by Country, 2021 - 2024, USD Million

- TABLE 279 Asia Pacific Other End Use Industry Market by Country, 2025 - 2032, USD Million

- TABLE 280 Asia Pacific Glass Interposers Market by Country, 2021 - 2024, USD Million

- TABLE 281 Asia Pacific Glass Interposers Market by Country, 2025 - 2032, USD Million

- TABLE 282 China Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 283 China Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 284 China Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 285 China Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 286 China Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 287 China Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 288 China Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 289 China Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 290 China Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 291 China Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 292 Japan Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 293 Japan Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 294 Japan Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 295 Japan Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 296 Japan Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 297 Japan Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 298 Japan Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 299 Japan Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 300 Japan Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 301 Japan Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 302 India Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 303 India Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 304 India Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 305 India Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 306 India Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 307 India Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 308 India Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 309 India Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 310 India Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 311 India Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 312 South Korea Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 313 South Korea Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 314 South Korea Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 315 South Korea Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 316 South Korea Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 317 South Korea Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 318 South Korea Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 319 South Korea Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 320 South Korea Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 321 South Korea Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 322 Singapore Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 323 Singapore Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 324 Singapore Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 325 Singapore Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 326 Singapore Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 327 Singapore Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 328 Singapore Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 329 Singapore Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 330 Singapore Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 331 Singapore Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 332 Malaysia Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 333 Malaysia Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 334 Malaysia Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 335 Malaysia Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 336 Malaysia Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 337 Malaysia Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 338 Malaysia Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 339 Malaysia Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 340 Malaysia Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 341 Malaysia Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 342 Rest of Asia Pacific Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 343 Rest of Asia Pacific Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 344 Rest of Asia Pacific Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 345 Rest of Asia Pacific Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 346 Rest of Asia Pacific Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 347 Rest of Asia Pacific Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 348 Rest of Asia Pacific Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 349 Rest of Asia Pacific Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 350 Rest of Asia Pacific Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 351 Rest of Asia Pacific Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 352 LAMEA Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 353 LAMEA Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 354 LAMEA Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 355 LAMEA Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 356 LAMEA 300 mm Market by Country, 2021 - 2024, USD Million

- TABLE 357 LAMEA 300 mm Market by Country, 2025 - 2032, USD Million

- TABLE 358 LAMEA 200 mm Market by Country, 2021 - 2024, USD Million

- TABLE 359 LAMEA 200 mm Market by Country, 2025 - 2032, USD Million

- TABLE 360 LAMEA Less than 200 mm Market by Country, 2021 - 2024, USD Million

- TABLE 361 LAMEA Less than 200 mm Market by Country, 2025 - 2032, USD Million

- TABLE 362 LAMEA Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 363 LAMEA Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 364 LAMEA 2.5D Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 365 LAMEA 2.5D Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 366 LAMEA 3D Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 367 LAMEA 3D Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 368 LAMEA Fan-Out Packaging Market by Country, 2021 - 2024, USD Million

- TABLE 369 LAMEA Fan-Out Packaging Market by Country, 2025 - 2032, USD Million

- TABLE 370 LAMEA Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 371 LAMEA Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 372 LAMEA Through-Glass Vias (TGV) Market by Country, 2021 - 2024, USD Million

- TABLE 373 LAMEA Through-Glass Vias (TGV) Market by Country, 2025 - 2032, USD Million

- TABLE 374 LAMEA Redistribution Layer (RDL)-First/Last Market by Country, 2021 - 2024, USD Million

- TABLE 375 LAMEA Redistribution Layer (RDL)-First/Last Market by Country, 2025 - 2032, USD Million

- TABLE 376 LAMEA Glass Panel Level Packaging (PLP) Market by Country, 2021 - 2024, USD Million

- TABLE 377 LAMEA Glass Panel Level Packaging (PLP) Market by Country, 2025 - 2032, USD Million

- TABLE 378 LAMEA Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 379 LAMEA Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 380 LAMEA Consumer Electronics Market by Country, 2021 - 2024, USD Million

- TABLE 381 LAMEA Consumer Electronics Market by Country, 2025 - 2032, USD Million

- TABLE 382 LAMEA Telecommunications Market by Country, 2021 - 2024, USD Million

- TABLE 383 LAMEA Telecommunications Market by Country, 2025 - 2032, USD Million

- TABLE 384 LAMEA Automotive Market by Country, 2021 - 2024, USD Million

- TABLE 385 LAMEA Automotive Market by Country, 2025 - 2032, USD Million

- TABLE 386 LAMEA Defense & Aerospace Market by Country, 2021 - 2024, USD Million

- TABLE 387 LAMEA Defense & Aerospace Market by Country, 2025 - 2032, USD Million

- TABLE 388 LAMEA Healthcare Market by Country, 2021 - 2024, USD Million

- TABLE 389 LAMEA Healthcare Market by Country, 2025 - 2032, USD Million

- TABLE 390 LAMEA Other End Use Industry Market by Country, 2021 - 2024, USD Million

- TABLE 391 LAMEA Other End Use Industry Market by Country, 2025 - 2032, USD Million

- TABLE 392 LAMEA Glass Interposers Market by Country, 2021 - 2024, USD Million

- TABLE 393 LAMEA Glass Interposers Market by Country, 2025 - 2032, USD Million

- TABLE 394 Brazil Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 395 Brazil Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 396 Brazil Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 397 Brazil Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 398 Brazil Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 399 Brazil Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 400 Brazil Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 401 Brazil Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 402 Brazil Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 403 Brazil Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 404 Argentina Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 405 Argentina Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 406 Argentina Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 407 Argentina Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 408 Argentina Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 409 Argentina Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 410 Argentina Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 411 Argentina Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 412 Argentina Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 413 Argentina Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 414 UAE Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 415 UAE Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 416 UAE Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 417 UAE Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 418 UAE Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 419 UAE Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 420 UAE Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 421 UAE Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 422 UAE Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 423 UAE Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 424 Saudi Arabia Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 425 Saudi Arabia Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 426 Saudi Arabia Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 427 Saudi Arabia Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 428 Saudi Arabia Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 429 Saudi Arabia Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 430 Saudi Arabia Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 431 Saudi Arabia Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 432 Saudi Arabia Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 433 Saudi Arabia Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 434 South Africa Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 435 South Africa Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 436 South Africa Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 437 South Africa Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 438 South Africa Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 439 South Africa Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 440 South Africa Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 441 South Africa Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 442 South Africa Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 443 South Africa Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 444 Nigeria Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 445 Nigeria Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 446 Nigeria Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 447 Nigeria Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 448 Nigeria Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 449 Nigeria Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 450 Nigeria Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 451 Nigeria Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 452 Nigeria Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 453 Nigeria Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 454 Rest of LAMEA Glass Interposers Market, 2021 - 2024, USD Million

- TABLE 455 Rest of LAMEA Glass Interposers Market, 2025 - 2032, USD Million

- TABLE 456 Rest of LAMEA Glass Interposers Market by Wafer Size, 2021 - 2024, USD Million

- TABLE 457 Rest of LAMEA Glass Interposers Market by Wafer Size, 2025 - 2032, USD Million

- TABLE 458 Rest of LAMEA Glass Interposers Market by Application, 2021 - 2024, USD Million

- TABLE 459 Rest of LAMEA Glass Interposers Market by Application, 2025 - 2032, USD Million

- TABLE 460 Rest of LAMEA Glass Interposers Market by Substrate Technology, 2021 - 2024, USD Million

- TABLE 461 Rest of LAMEA Glass Interposers Market by Substrate Technology, 2025 - 2032, USD Million

- TABLE 462 Rest of LAMEA Glass Interposers Market by End Use Industry, 2021 - 2024, USD Million

- TABLE 463 Rest of LAMEA Glass Interposers Market by End Use Industry, 2025 - 2032, USD Million

- TABLE 464 Key Information - Corning Incorporated

- TABLE 465 Key Information - AGC, Inc.

- TABLE 466 key Information - Schott AG

- TABLE 467 Key Information - Dai Nippon Printing Co., Ltd.

- TABLE 468 Key Information - Tecnisco, LTD.

- TABLE 469 Key Information - Samtec, Inc.

- TABLE 470 Key Information - RENA Technologies GmbH

- TABLE 471 Key Information - PLANOPTIK AG

- TABLE 472 Key Information - 3DGS Inc.

- TABLE 473 Key Information - Workshop of Photonics

LIST OF FIGURES

- FIG 1 Methodology for the research

- FIG 2 Global Glass Interposers Market, 2021 - 2032, USD Million

- FIG 3 Key Factors Impacting Glass Interposers Market

- FIG 4 Market Share Analysis, 2024

- FIG 5 Porter's Five Forces Analysis - Glass Interposers Market

- FIG 6 Value Chain Analysis of Glass Interposers Market

- FIG 7 Key Customer Criteria Glass Interposers Market

- FIG 8 Global Glass Interposers Market share by Wafer Size, 2024

- FIG 9 Global Glass Interposers Market share by Wafer Size, 2032

- FIG 10 Global Glass Interposers Market by Wafer Size, 2021 - 2032, USD Million

- FIG 11 Global Glass Interposers Market share by Application, 2024

- FIG 12 Global Glass Interposers Market share by Application, 2032

- FIG 13 Global Glass Interposers Market by Application, 2021 - 2032, USD Million

- FIG 14 Global Glass Interposers Market share by Substrate Technology, 2024

- FIG 15 Global Glass Interposers Market by Substrate Technology, 2032

- FIG 16 Global Glass Interposers Market by Substrate Technology, 2021 - 2032, USD Million

- FIG 17 Global Glass Interposers Market share by End Use Industry, 2024

- FIG 18 Global Glass Interposers Market share by End Use Industry, 2032

- FIG 19 Global Glass Interposers Market by End Use Industry, 2021 - 2032, USD Million

- FIG 20 Global Glass Interposers Market share by Region, 2024

- FIG 21 Global Glass Interposers Market share by Region, 2032

- FIG 22 Global Glass Interposers Market by Region, 2021 - 2032, USD Million

- FIG 23 North America Glass Interposers Market, 2021 - 2032, USD Million

- FIG 24 North America Glass Interposers Market share by Wafer Size, 2024

- FIG 25 North America Glass Interposers Market share by Wafer Size, 2032

- FIG 26 North America Glass Interposers Market by Wafer Size, 2021 - 2032, USD Million

- FIG 27 North America Glass Interposers Market share by Application, 2024

- FIG 28 North America Glass Interposers Market share by Application, 2032

- FIG 29 North America Glass Interposers Market by Application, 2021 - 2032, USD Million

- FIG 30 North America Glass Interposers Market share by Substrate Technology, 2024

- FIG 31 North America Glass Interposers Market by Substrate Technology, 2032

- FIG 32 North America Glass Interposers Market by Substrate Technology, 2021 - 2032, USD Million

- FIG 33 North America Glass Interposers Market share by End Use Industry, 2024

- FIG 34 North America Glass Interposers Market share by End Use Industry, 2032

- FIG 35 North America Glass Interposers Market by End Use Industry, 2021 - 2032, USD Million

- FIG 36 North America Glass Interposers Market share by Country, 2024

- FIG 37 North America Glass Interposers Market share by Country, 2032

- FIG 38 North America Glass Interposers Market by Country, 2021 - 2032, USD Million

- FIG 39 Europe Glass Interposers Market, 2021 - 2032, USD Million

- FIG 40 Europe Glass Interposers Market share by Wafer Size, 2024

- FIG 41 Europe Glass Interposers Market share by Wafer Size, 2032

- FIG 42 Europe Glass Interposers Market by Wafer Size, 2021 - 2032, USD Million

- FIG 43 Europe Glass Interposers Market share by Application, 2024

- FIG 44 Europe Glass Interposers Market share by Application, 2032

- FIG 45 Europe Glass Interposers Market by Application, 2021 - 2032, USD Million

- FIG 46 Europe Glass Interposers Market share by Substrate Technology, 2024

- FIG 47 Europe Glass Interposers Market by Substrate Technology, 2032

- FIG 48 Europe Glass Interposers Market by Substrate Technology, 2021 - 2032, USD Million

- FIG 49 Europe Glass Interposers Market share by End Use Industry, 2024

- FIG 50 Europe Glass Interposers Market share by End Use Industry, 2032

- FIG 51 Europe Glass Interposers Market by End Use Industry, 2021 - 2032, USD Million

- FIG 52 Europe Glass Interposers Market share by Country, 2024

- FIG 53 Europe Glass Interposers Market share by Country, 2032

- FIG 54 Europe Glass Interposers Market by Country, 2021 - 2032, USD Million

- FIG 55 Asia Pacific Glass Interposers Market, 2021 - 2032, USD Million

- FIG 56 Asia Pacific Glass Interposers Market, 2021 - 2032, USD Million

- FIG 57 Asia Pacific Glass Interposers Market share by Wafer Size, 2024

- FIG 58 Asia Pacific Glass Interposers Market share by Wafer Size, 2032

- FIG 59 Asia Pacific Glass Interposers Market by Wafer Size, 2021 - 2032, USD Million

- FIG 60 Asia Pacific Glass Interposers Market share by Application, 2024

- FIG 61 Asia Pacific Glass Interposers Market share by Application, 2032

- FIG 62 Asia Pacific Glass Interposers Market by Application, 2021 - 2032, USD Million

- FIG 63 Asia Pacific Glass Interposers Market share by Substrate Technology, 2024

- FIG 64 Asia Pacific Glass Interposers Market by Substrate Technology, 2032

- FIG 65 Asia Pacific Glass Interposers Market by Substrate Technology, 2021 - 2032, USD Million

- FIG 66 Asia Pacific Glass Interposers Market share by End Use Industry, 2024

- FIG 67 Asia Pacific Glass Interposers Market share by End Use Industry, 2032

- FIG 68 Asia Pacific Glass Interposers Market by End Use Industry, 2021 - 2032, USD Million

- FIG 69 Asia Pacific Glass Interposers Market share by Country, 2024

- FIG 70 Asia Pacific Glass Interposers Market share by Country, 2032

- FIG 71 Asia Pacific Glass Interposers Market by Country, 2021 - 2032, USD Million

- FIG 72 LAMEA Glass Interposers Market, 2021 - 2032, USD Million

- FIG 73 LAMEA Glass Interposers Market share by Wafer Size, 2024

- FIG 74 LAMEA Glass Interposers Market share by Wafer Size, 2032

- FIG 75 LAMEA Glass Interposers Market by Wafer Size, 2021 - 2032, USD Million

- FIG 76 LAMEA Glass Interposers Market share by Application, 2024

- FIG 77 LAMEA Glass Interposers Market share by Application, 2032

- FIG 78 LAMEA Glass Interposers Market by Application, 2021 - 2032, USD Million

- FIG 79 LAMEA Glass Interposers Market share by Substrate Technology, 2024

- FIG 80 LAMEA Glass Interposers Market by Substrate Technology, 2032

- FIG 81 LAMEA Glass Interposers Market by Substrate Technology, 2021 - 2032, USD Million

- FIG 82 LAMEA Glass Interposers Market share by End Use Industry, 2024

- FIG 83 LAMEA Glass Interposers Market share by End Use Industry, 2032

- FIG 84 LAMEA Glass Interposers Market by End Use Industry, 2021 - 2032, USD Million

- FIG 85 LAMEA Glass Interposers Market share by Country, 2024

- FIG 86 LAMEA Glass Interposers Market share by Country, 2032

- FIG 87 LAMEA Glass Interposers Market by Country, 2021 - 2032, USD Million

- FIG 88 SWOT Analysis: Corning Incorporated

- FIG 89 SWOT Analysis: AGC, Inc.

- FIG 90 SWOT Analysis: Schott AG

- FIG 91 SWOT Analysis: Samtec, Inc.

The Global Glass Interposers Market size is expected to reach $303.45 million by 2032, rising at a market growth of 12.1% CAGR during the forecast period.

Key Highlights:

- The Asia Pacific market dominated Global Glass Interposers Market in 2024, accounting for a 47.9% revenue share in 2024.

- The U.S. market is projected to maintain its leadership in North America, reaching a market size of USD 31.71 million by 2032.

- Among the Wafer Size, the 300 mm segment dominated the global market, contributing a revenue share of 59.11% in 2024.

- In terms of Application, 2.5D Packaging segment are expected to lead the global market, with a projected revenue share of 50.48% by 2032.

- The Through-Glass Vias (TGV) segment emerged as the leading Substrate Technology in 2024, capturing a 59.65% revenue share, and is projected to retain its dominance during the forecast period.

- The Consumer Electronics segment In End Use is poised to grow at the market in 2032 with 33.78% revenue share, and is projected to maintain its dominant position throughout the forecast period.

Glass interposers evolved as a game-changer for 2.5D semiconductor packing, due to its superior thermal capabilities, enhanced mechanical robustness, and signal integrity. Market giants such as Intel and Samsung Electronics are speeding their R&D, patent registration, and market deployment initiatives, with applications across the industries such as AI, telecommunication, automotive, and high-performance computers (HPC). Furthermore, Samsung is trying to achieve a transition from silicon to glass interposers by 2028 with the help of parallel-path innovation plan. The company is also collaborating with Chemtronics, Corning, and Philoptics. Similarly, Intel dominates in patent holdings, covering domains like photonic integration, hybrid bonding, and thermally conductive via shields, with the association of players like Huawei, SJ Semi, Absolics.

Furthermore, strategic partnerships, material and tooling collaborations, and the growing use of technology in areas like automotive and telecom are all driving the commercialization of the industry. As per the Semiconductor Industry Association (SIA), global semiconductor sales were $179.7 billion during the second quarter of 2025, an increase of 7.8% compared to Q1. This growth is driving the growth of the glass interposers market. In addition, glass interposers work best in mmWave applications and high-heat environments, enabling their use in ADAS and base stations. Moreover, silicon interposers are still the most popular, but a small group of companies-Intel, Samsung, Corning, Toppan, Absolics, and SJ Semi-are becoming leaders in technology and ecosystem control through patents and early production capacity. Glass interposers are ready for quick adoption because of aggressive global R&D, growing IP portfolios, and ecosystem lock-in strategies. This means that next-generation semiconductor packaging standards are about to change.

Market Share Analysis

COVID 19 Impact Analysis

The breakout of COVID-19 substantially impacted the global glass interposers industry because of its ramifications in terms of supply chains, deferment of R&D operations, as well as disruption of production activity in main semiconductor centers like Taiwan, South Korea, as well as America. Lockdowns as well as production halts provided a scarcity of core material like ultra-flat glass substrates, stifling the advancement of developmental prototypes. The glass interposer industry was setback temporarily due to disruption of global supplies as well as time lost in semiconductor production due to the outbreak of COVID-19.

Wafer Size Outlook

Based on Wafer Size, the market is segmented into 300 mm, 200 mm, and Less than 200 mm. The 200 mm segment attained a 27.7% revenue share in the market in 2024. It is a preferred choice for mid-tier applications that don't require the scale of 300 mm wafers but still demand reliable functionality. Industries like automotive electronics, IoT devices, and industrial automation benefit from the affordability and compatibility of this wafer size.

Application Outlook

Based on Application, the market is segmented into 2.5D Packaging, 3D Packaging, and Fan-Out Packaging. The 3D Packaging segment recorded 35.1% revenue share in the market in 2024. It is used in high-end processors, memory modules, and applications where miniaturization and performance are essential. The approach enhances system speed and power efficiency, which is vital in compact and mobile platforms.

Regional Outlook

Region-wise, the market is segmented into North America, Europe, Asia-Pacific, LAMEA. The Asia Pacific segment Registered 47.9% revenue share in the market in 2024, owing to its strong semiconductor manufacturing base, high-volume consumer electronics production, and widespread infrastructure development. The glass interposers market is growing quickly in North America and Europe thanks to strong research and development, early commercialization, and a focus on high-performance computing (HPC), AI, and photonics. Intel and Corning lead the way in the U.S., which is a major center for innovation. Europe, on the other hand, uses its knowledge of automotive electronics to make 5G base stations and ADAS modules. The regional supply chain is getting stronger thanks to collaborative ecosystems with suppliers of glass substrates and tools.

Samsung, TSMC, and regional OSATs are making big investments in South Korea, Japan, Taiwan, and China, making the Asia Pacific region the biggest growth center. Partnerships with material suppliers and the ability to quickly make prototypes are speeding up the process of bringing products to market, especially for AI and HPC packaging. LAMEA is slowly gaining ground, with opportunities in telecom, 5G infrastructure, and automotive electronics, especially in the Middle East and South Africa, thanks to technology transfer from big companies around the world.

Recent Strategies Deployed in the Market

- May-2025: Corning Incorporated teamed up with Broadcom to advance next-gen AI data center capabilities using Corning's innovative glass substrates. These substrates enable ultra-high bandwidth and energy-efficient interconnects essential for advanced chip packaging. The collaboration marks a major step in scaling glass interposers for high-performance computing and AI workloads.

- Aug-2024: Schott AG unveiled a new low-loss glass engineered for high-frequency semiconductor packaging. With a dielectric constant of 4.0 and dielectric loss of just 0.0021 at 10 GHz, it enhances signal integrity and efficiency in 5G/6G, RF, and chip interposers-boosting performance, reliability, and energy savings for cutting-edge semiconductor devices.

- Mar-2023: Dai Nippon Printing Co., Ltd. unveiled a Glass Core Substrate (GCS) with high-density Through-Glass Vias (TGV), engineered to replace traditional resin substrates in advanced semiconductor packaging. Designed for fine-pitch wiring, high aspect-ratio vias (9+), and scalable panel production, it promises enhanced performance and large-area applicability.

- Oct-2022: PLANOPTIK AG unveiled an Advanced Connectivity Technology (ACT) that produces copper-metallized glass interposers up to 300 mm with through-glass vias as small as 100 µm. These 200-1000 µm thick wafers support integrated RDL and enable high-frequency, low-loss 3D connectivity-ideal for 5G, radar, imaging sensors, and beyond.

- Jul-2022: 3DGS Inc. unveiled its pure-play, volume-ready glass foundry using APEX photosensitive glass, offering low-loss, high-Q RF performance in compact interposers. The scalable LC-IPD process and design-to-production flow support 0.1-10 GHz applications, including 2.5D/3D packaging, antennas, and RF filters-boosting glass interposer adoption for heterogeneous integration.

List of Key Companies Profiled

- Corning Incorporated

- AGC Inc.

- Schott AG (Carl-Zeiss-Stiftung)

- Dai Nippon Printing Co., Ltd.

- Tecnisco, LTD. (Disco Corporation)

- Samtec, Inc.

- RENA Technologies GmbH

- PLANOPTIK AG

- 3DGS Inc.

- Workshop of Photonics

Global Glass Interposers Market Report Segmentation

By Wafer Size

- 300 mm

- 200 mm

- Less than 200 mm

By Application

- 2.5D Packaging

- 3D Packaging

- Fan-Out Packaging

By Substrate Technology

- Through-Glass Vias (TGV)

- Redistribution Layer (RDL)-First/Last

- Glass Panel Level Packaging (PLP)

By End Use Industry

- Consumer Electronics

- Telecommunications

- Automotive

- Defense & Aerospace

- Healthcare

- Other End Use Industry

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Glass Interposers Market, by Wafer Size

- 1.4.2 Global Glass Interposers Market, by Application

- 1.4.3 Global Glass Interposers Market, by Substrate Technology

- 1.4.4 Global Glass Interposers Market, by End Use Industry

- 1.4.5 Global Glass Interposers Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.2.3 Market Opportunities

- 3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

- 4.1 Market Share Analysis, 2024

- 4.2 Recent Strategies Deployed in Glass Interposers Market

- 4.3 Porter Five Forces Analysis

Chapter 5. Market Trends Global Glass Interposers Market

Chapter 6. State of Competition Glass Interposers Market

Chapter 7. PLC (Product Life Cycle) Glass Interposers Market

Chapter 8. Market Consolidation - Glass Interposers Market

Chapter 9. Value Chain Analysis of Glass Interposers Market

Chapter 10. Key Customer Criteria - Glass Interposers Market

Chapter 11. Global Glass Interposers Market by Wafer Size

- 11.1 Global 300 mm Market by Region

- 11.2 Global 200 mm Market by Region

- 11.3 Global Less than 200 mm Market by Region

Chapter 12. Global Glass Interposers Market by Application

- 12.1 Global 2.5D Packaging Market by Region

- 12.2 Global 3D Packaging Market by Region

- 12.3 Global Fan-Out Packaging Market by Region

Chapter 13. Global Glass Interposers Market by Substrate Technology

- 13.1 Global Through-Glass Vias (TGV) Market by Region

- 13.2 Global Redistribution Layer (RDL)-First/Last Market by Region

- 13.3 Global Glass Panel Level Packaging (PLP) Market by Region

Chapter 14. Global Glass Interposers Market by End Use Industry

- 14.1 Global Consumer Electronics Market by Region

- 14.2 Global Telecommunications Market by Region

- 14.3 Global Automotive Market by Region

- 14.4 Global Defense & Aerospace Market by Region

- 14.5 Global Healthcare Market by Region

- 14.6 Global Other End Use Industry Market by Region

Chapter 15. Global Glass Interposers Market by Region

- 15.1 North America Glass Interposers Market

- 15.1.1 Market

- 15.1.2 Drivers

- 15.1.3 Market Restraints

- 15.1.4 Market Opportunities

- 15.1.5 Market Challenges

- 15.1.6 Market Trends North America Glass Interposers Market

- 15.1.7 State of Competition North America Glass Interposers Market

- 15.1.8 North America Glass Interposers Market by Wafer Size

- 15.1.8.1 North America 300 mm Market by Country

- 15.1.8.2 North America 200 mm Market by Country

- 15.1.8.3 North America Less than 200 mm Market by Country

- 15.1.9 North America Glass Interposers Market by Application

- 15.1.9.1 North America 2.5D Packaging Market by Country

- 15.1.9.2 North America 3D Packaging Market by Country

- 15.1.9.3 North America Fan-Out Packaging Market by Country

- 15.1.10 North America Glass Interposers Market by Substrate Technology

- 15.1.10.1 North America Through-Glass Vias (TGV) Market by Country

- 15.1.10.2 North America Redistribution Layer (RDL)-First/Last Market by Country

- 15.1.10.3 North America Glass Panel Level Packaging (PLP) Market by Country

- 15.1.11 North America Glass Interposers Market by End Use Industry

- 15.1.11.1 North America Consumer Electronics Market by Country

- 15.1.11.2 North America Telecommunications Market by Country

- 15.1.11.3 North America Automotive Market by Country

- 15.1.11.4 North America Defense & Aerospace Market by Country

- 15.1.11.5 North America Healthcare Market by Country

- 15.1.11.6 North America Other End Use Industry Market by Country

- 15.1.12 North America Glass Interposers Market by Country

- 15.1.12.1 US Glass Interposers Market

- 15.1.12.1.1 US Glass Interposers Market by Wafer Size

- 15.1.12.1.2 US Glass Interposers Market by Application

- 15.1.12.1.3 US Glass Interposers Market by Substrate Technology

- 15.1.12.1.4 US Glass Interposers Market by End Use Industry

- 15.1.12.2 Canada Glass Interposers Market

- 15.1.12.2.1 Canada Glass Interposers Market by Wafer Size

- 15.1.12.2.2 Canada Glass Interposers Market by Application

- 15.1.12.2.3 Canada Glass Interposers Market by Substrate Technology

- 15.1.12.2.4 Canada Glass Interposers Market by End Use Industry

- 15.1.12.3 Mexico Glass Interposers Market

- 15.1.12.3.1 Mexico Glass Interposers Market by Wafer Size

- 15.1.12.3.2 Mexico Glass Interposers Market by Application

- 15.1.12.3.3 Mexico Glass Interposers Market by Substrate Technology

- 15.1.12.3.4 Mexico Glass Interposers Market by End Use Industry

- 15.1.12.4 Rest of North America Glass Interposers Market

- 15.1.12.4.1 Rest of North America Glass Interposers Market by Wafer Size

- 15.1.12.4.2 Rest of North America Glass Interposers Market by Application

- 15.1.12.4.3 Rest of North America Glass Interposers Market by Substrate Technology

- 15.1.12.4.4 Rest of North America Glass Interposers Market by End Use Industry

- 15.1.12.1 US Glass Interposers Market

- 15.2 Europe Glass Interposers Market

- 15.2.1 Market Drivers

- 15.2.2 Market Restraints

- 15.2.3 Market Opportunities

- 15.2.4 Market Challenges

- 15.2.5 Market Trends Europe Glass Interposers Market

- 15.2.6 State of Competition Europe Glass Interposers Market

- 15.2.7 Europe Glass Interposers Market by Wafer Size

- 15.2.7.1 Europe 300 mm Market by Country

- 15.2.7.2 Europe 200 mm Market by Country

- 15.2.7.3 Europe Less than 200 mm Market by Country

- 15.2.8 Europe Glass Interposers Market by Application

- 15.2.8.1 Europe 2.5D Packaging Market by Country

- 15.2.8.2 Europe 3D Packaging Market by Country

- 15.2.8.3 Europe Fan-Out Packaging Market by Country

- 15.2.9 Europe Glass Interposers Market by Substrate Technology

- 15.2.9.1 Europe Through-Glass Vias (TGV) Market by Country

- 15.2.9.2 Europe Redistribution Layer (RDL)-First/Last Market by Country

- 15.2.9.3 Europe Glass Panel Level Packaging (PLP) Market by Country

- 15.2.10 Europe Glass Interposers Market by End Use Industry

- 15.2.10.1 Europe Consumer Electronics Market by Country

- 15.2.10.2 Europe Telecommunications Market by Country

- 15.2.10.3 Europe Automotive Market by Country

- 15.2.10.4 Europe Defense & Aerospace Market by Country

- 15.2.10.5 Europe Healthcare Market by Country

- 15.2.10.6 Europe Other End Use Industry Market by Country

- 15.2.11 Europe Glass Interposers Market by Country

- 15.2.11.1 Germany Glass Interposers Market

- 15.2.11.1.1 Germany Glass Interposers Market by Wafer Size

- 15.2.11.1.2 Germany Glass Interposers Market by Application

- 15.2.11.1.3 Germany Glass Interposers Market by Substrate Technology

- 15.2.11.1.4 Germany Glass Interposers Market by End Use Industry

- 15.2.11.2 UK Glass Interposers Market

- 15.2.11.2.1 UK Glass Interposers Market by Wafer Size

- 15.2.11.2.2 UK Glass Interposers Market by Application

- 15.2.11.2.3 UK Glass Interposers Market by Substrate Technology

- 15.2.11.2.4 UK Glass Interposers Market by End Use Industry

- 15.2.11.3 France Glass Interposers Market

- 15.2.11.3.1 France Glass Interposers Market by Wafer Size

- 15.2.11.3.2 France Glass Interposers Market by Application

- 15.2.11.3.3 France Glass Interposers Market by Substrate Technology

- 15.2.11.3.4 France Glass Interposers Market by End Use Industry

- 15.2.11.4 Russia Glass Interposers Market

- 15.2.11.4.1 Russia Glass Interposers Market by Wafer Size

- 15.2.11.4.2 Russia Glass Interposers Market by Application

- 15.2.11.4.3 Russia Glass Interposers Market by Substrate Technology

- 15.2.11.4.4 Russia Glass Interposers Market by End Use Industry

- 15.2.11.5 Spain Glass Interposers Market

- 15.2.11.5.1 Spain Glass Interposers Market by Wafer Size

- 15.2.11.5.2 Spain Glass Interposers Market by Application

- 15.2.11.5.3 Spain Glass Interposers Market by Substrate Technology

- 15.2.11.5.4 Spain Glass Interposers Market by End Use Industry

- 15.2.11.6 Italy Glass Interposers Market

- 15.2.11.6.1 Italy Glass Interposers Market by Wafer Size

- 15.2.11.6.2 Italy Glass Interposers Market by Application

- 15.2.11.6.3 Italy Glass Interposers Market by Substrate Technology

- 15.2.11.6.4 Italy Glass Interposers Market by End Use Industry

- 15.2.11.7 Rest of Europe Glass Interposers Market

- 15.2.11.7.1 Rest of Europe Glass Interposers Market by Wafer Size

- 15.2.11.7.2 Rest of Europe Glass Interposers Market by Application

- 15.2.11.7.3 Rest of Europe Glass Interposers Market by Substrate Technology

- 15.2.11.7.4 Rest of Europe Glass Interposers Market by End Use Industry

- 15.2.11.1 Germany Glass Interposers Market

- 15.3 Asia Pacific Glass Interposers Market

- 15.3.1 Market Drivers

- 15.3.2 Market Restraints

- 15.3.3 Market Opportunities

- 15.3.4 Market Challenges

- 15.3.5 Market Trends - Asia Pacific Glass Interposers Market

- 15.3.6 State of Competition Asia Pacific Glass Interposers Market

- 15.3.7 Asia Pacific Glass Interposers Market by Wafer Size

- 15.3.7.1 Asia Pacific 300 mm Market by Country

- 15.3.7.2 Asia Pacific 200 mm Market by Country

- 15.3.7.3 Asia Pacific Less than 200 mm Market by Country

- 15.3.8 Asia Pacific Glass Interposers Market by Application

- 15.3.8.1 Asia Pacific 2.5D Packaging Market by Country

- 15.3.8.2 Asia Pacific 3D Packaging Market by Country

- 15.3.8.3 Asia Pacific Fan-Out Packaging Market by Country

- 15.3.9 Asia Pacific Glass Interposers Market by Substrate Technology

- 15.3.9.1 Asia Pacific Through-Glass Vias (TGV) Market by Country

- 15.3.9.2 Asia Pacific Redistribution Layer (RDL)-First/Last Market by Country

- 15.3.9.3 Asia Pacific Glass Panel Level Packaging (PLP) Market by Country

- 15.3.10 Asia Pacific Glass Interposers Market by End Use Industry

- 15.3.10.1 Asia Pacific Consumer Electronics Market by Country

- 15.3.10.2 Asia Pacific Telecommunications Market by Country

- 15.3.10.3 Asia Pacific Automotive Market by Country

- 15.3.10.4 Asia Pacific Defense & Aerospace Market by Country

- 15.3.10.5 Asia Pacific Healthcare Market by Country

- 15.3.10.6 Asia Pacific Other End Use Industry Market by Country

- 15.3.11 Asia Pacific Glass Interposers Market by Country

- 15.3.11.1 China Glass Interposers Market

- 15.3.11.1.1 China Glass Interposers Market by Wafer Size

- 15.3.11.1.2 China Glass Interposers Market by Application

- 15.3.11.1.3 China Glass Interposers Market by Substrate Technology

- 15.3.11.1.4 China Glass Interposers Market by End Use Industry

- 15.3.11.2 Japan Glass Interposers Market

- 15.3.11.2.1 Japan Glass Interposers Market by Wafer Size

- 15.3.11.2.2 Japan Glass Interposers Market by Application

- 15.3.11.2.3 Japan Glass Interposers Market by Substrate Technology

- 15.3.11.2.4 Japan Glass Interposers Market by End Use Industry

- 15.3.11.3 India Glass Interposers Market

- 15.3.11.3.1 India Glass Interposers Market by Wafer Size

- 15.3.11.3.2 India Glass Interposers Market by Application

- 15.3.11.3.3 India Glass Interposers Market by Substrate Technology

- 15.3.11.3.4 India Glass Interposers Market by End Use Industry

- 15.3.11.4 South Korea Glass Interposers Market

- 15.3.11.4.1 South Korea Glass Interposers Market by Wafer Size

- 15.3.11.4.2 South Korea Glass Interposers Market by Application

- 15.3.11.4.3 South Korea Glass Interposers Market by Substrate Technology

- 15.3.11.4.4 South Korea Glass Interposers Market by End Use Industry

- 15.3.11.5 Singapore Glass Interposers Market

- 15.3.11.5.1 Singapore Glass Interposers Market by Wafer Size

- 15.3.11.5.2 Singapore Glass Interposers Market by Application

- 15.3.11.5.3 Singapore Glass Interposers Market by Substrate Technology

- 15.3.11.5.4 Singapore Glass Interposers Market by End Use Industry

- 15.3.11.6 Malaysia Glass Interposers Market

- 15.3.11.6.1 Malaysia Glass Interposers Market by Wafer Size

- 15.3.11.6.2 Malaysia Glass Interposers Market by Application

- 15.3.11.6.3 Malaysia Glass Interposers Market by Substrate Technology

- 15.3.11.6.4 Malaysia Glass Interposers Market by End Use Industry

- 15.3.11.7 Rest of Asia Pacific Glass Interposers Market

- 15.3.11.7.1 Rest of Asia Pacific Glass Interposers Market by Wafer Size

- 15.3.11.7.2 Rest of Asia Pacific Glass Interposers Market by Application

- 15.3.11.7.3 Rest of Asia Pacific Glass Interposers Market by Substrate Technology

- 15.3.11.7.4 Rest of Asia Pacific Glass Interposers Market by End Use Industry

- 15.3.11.1 China Glass Interposers Market

- 15.4 LAMEA Glass Interposers Market

- 15.4.1 Market Drivers

- 15.4.2 Market Restraints

- 15.4.3 Market Opportunities

- 15.4.4 Market Challenges

- 15.4.5 Market Trends - LAMEA Glass Interposers Market

- 15.4.6 State of Competition - LAMEA Glass Interposers Market

- 15.4.7 LAMEA Glass Interposers Market by Wafer Size

- 15.4.7.1 LAMEA 300 mm Market by Country

- 15.4.7.2 LAMEA 200 mm Market by Country

- 15.4.7.3 LAMEA Less than 200 mm Market by Country

- 15.4.8 LAMEA Glass Interposers Market by Application

- 15.4.8.1 LAMEA 2.5D Packaging Market by Country

- 15.4.8.2 LAMEA 3D Packaging Market by Country

- 15.4.8.3 LAMEA Fan-Out Packaging Market by Country

- 15.4.9 LAMEA Glass Interposers Market by Substrate Technology

- 15.4.9.1 LAMEA Through-Glass Vias (TGV) Market by Country

- 15.4.9.2 LAMEA Redistribution Layer (RDL)-First/Last Market by Country

- 15.4.9.3 LAMEA Glass Panel Level Packaging (PLP) Market by Country

- 15.4.10 LAMEA Glass Interposers Market by End Use Industry