|

|

市場調査レポート

商品コード

1789275

農業用散布機器の世界市場規模、シェア、シェア、動向分析:農場規模別、容量別、タイプ別、地域別、展望と予測、2025~2032年Global Agriculture Spraying Equipment Market Size, Share & Industry Analysis Report By Farm Size, By Capacity, By Type, By Regional Outlook and Forecast, 2025 - 2032 |

||||||

|

|||||||

| 農業用散布機器の世界市場規模、シェア、シェア、動向分析:農場規模別、容量別、タイプ別、地域別、展望と予測、2025~2032年 |

|

出版日: 2025年07月18日

発行: KBV Research

ページ情報: 英文 440 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

農業用散布機器の市場規模は、予測期間中に7.5%のCAGRで市場成長し、2032年までに47億米ドルに達すると予想されています。

主なハイライト:

- アジア太平洋地域は2024年に世界市場を独占し、2024年には38%の収益シェアを占めました。

- 中国の農業用散布機器市場は、中国地域で引き続き優位に立つと予想されており、2032年までに市場規模は4億6,294万米ドルに達すると予想されています。

- 農場規模別では、中型農場が世界市場を独占し、2024年には収益シェアの46%を占めました。

- 容量別では、高容量セグメントが2032年に46.71%の収益シェアで世界市場を独占すると予測されています。

- タイプ別では、自走式が2024年にこのセグメントをリードし、収益シェアの27%を獲得し、予測期間中もその優位性を維持すると予測されています。

精密農業と世界の食料安全保障は、農業用散布機器を、手動機器から高度なGPS駆動システムへと急速に進化させてきました。LiDAR対応のスマートアプライ、可変レートノズル、UAV搭載の散布機といった革新的な技術によって、効率性は再定義されました。これらの技術は、薬剤の無駄を最小限に抑え、リアルタイムのキャノピー検知を可能にし、運用コストを大幅に削減します。John DeereなどのOEMメーカーと公的調査機関とのパートナーシップによって生まれたこれらの開発は、業界が持続可能性とデジタル統合へと移行していることを示しています。2050年までに90億人以上の人々に食料を供給しようと世界が奮闘する中、精密散布は、現代の高生産型農業を支えるものから、不可欠な要素へと進化しました。

大規模農家と小規模農家の両方をターゲットとした自動化、電動化、そして地域成長戦略は、市場を同時に変革させています。OEM企業とアグテック系スタートアップ企業は、ロボット散布機器やRTK-GPSドローンから、パッケージ化された農業散布サービス(ASaaS)モデルに至るまで、拡張性の高いテクノロジーを活用したソリューションを提供するために競争し、協力しています。新興国政府は補助金を活用して自動化を推進しています。大手企業は、持続可能性、教育、規制遵守に投資するとともに、低コストのモジュール式技術を活用して、サービスが行き届いていない人々にもサービスを提供しています。持続可能な農業生産への高まるニーズを満たし、このダイナミックな環境で成功するには、エンジニアリング力、ソフトウェアインテリジェンス、エコシステムアライアンス、そしてユーザー中心の設計を融合させる能力が不可欠です。

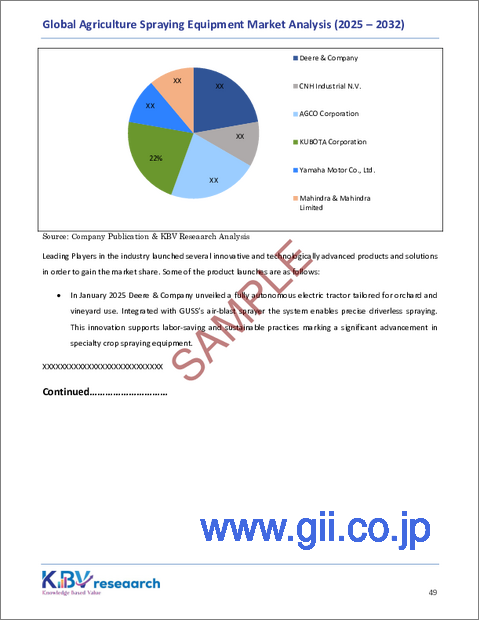

エンドユーザーのダイナミックな需要に応えるため、市場参入企業は製品の発売を主要な戦略として採用しました。たとえば、2025年6月には、CNH Industrial NVが革新的なAI散布機器技術を発表しました。これは、従来のブーム範囲を越えた精密散布を可能にします。リアルタイムの雑草識別とターゲットを絞った散布により、化学薬品の使用量が大幅に削減され、環境への影響も軽減されます。これは、ビジョンシステムと機械学習によって実現されます。このような革新は、CNHのスマート農業散布機器と持続可能な農業慣行に対する戦略的コミットメントを示しています。同様に、2025年3月には、Yamaha Motor Co., Ltd.が、農業分野の効率を高めるための自律技術の進歩を発表しました。播種や散布などの作業の最適化はYamahaの注力分野であり、精密農業における足場を強化し、この市場の発展に貢献しています。

KBV Cardinal matrix - 農業用散布機器市場の競争分析

KBV Cardinal matrixの分析によると、Deere & Companyは農業用散布機器市場の先駆者です。2025年6月、Deere & Companyは欧州市場最大の自走式散布機R975iを発表しました。55メートルのブームと9,000リットルのタンクを備え、高効率な作業を実現する設計となっています。R975iは、ExactApplyやAutoTracなどの先進技術を搭載しており、大規模な農業用散布における正確な散布と生産性の向上を実現します。Mahindra Limited、KUBOTA Corporation、CNH Industrial N.V.などは、農業用散布機器市場における主要なイノベーターです。

市場成長要因

精密農業に対する世界的な需要の高まり

精密農業は、投入効率の向上、作物の収量向上、そして環境への影響の低減を可能にする画期的な農法としてその実力を発揮しています。この先進的な農法は、データ分析、センサー、GPSベースの機器、そして自動化技術を駆使して、圃場の変動を管理します。世界人口の増加に伴い、同一農場における農業生産性の向上への要求はますます重要になっています。したがって、精密農業は少ない資源でより多くの生産を実現するための適切なソリューションであり、高度な農薬散布装置は、この変革を可能にする主要な要素の一つです。

労働力不足と農業機械化の推進

伝統的な農業は、常に労働力の確保を基盤としてきました。しかし、都市部への人口流入、農村部の高齢化、そして肉体労働への魅力の低下が相まって、現在農業を悩ませている深刻な労働力不足につながっています。より良い仕事を求めて農村部から都市部へ移住する若者が増えているため、農家は植え付け、除草、収穫といった重要な時期に十分な労働力を確保できていません。ブラジル、中国、インドなどの国、さらには北米や欧州の一部の地域では、労働力不足が特に深刻です。

市場抑制要因

高額な初期投資と所有コスト

農業用散布機の普及を阻む最も大きな要因の一つとして、その調達と導入にかかる高額な投資が挙げられます。これは、地域における普及拡大の大きな阻害要因となっています。技術の進歩によりコストはさらに削減されたもの、新興諸国の大部分を占める小規模農家や零細農家にとっては、依然として多額の投資が必要です。例えば、自走式ブーム式散布機、ドローン式散布機、自律型ロボットユニットは、数千ドルから数万米ドルの費用がかかる場合があります。さらに、基本機器の付属品、燃料、その他の改造などにかかる追加費用も、導入をさらに困難にしています。

農場規模別の展望

農場規模別に基づき、市場は中規模農場、大規模農場、小規模農場に分類されます。大規模農場セグメントは、2024年の農業用散布機器市場において31%の収益シェアを獲得しました。これらの農場は通常、広大な農地を扱っているため、広い面積を迅速かつ効果的にカバーできる強力な機械が必要です。そのため、大規模農場は、自走式散布機、ドローン式散布機、自律システムなど、スピード、精度、データ駆動型の散布方法を提供する新技術に投資する傾向があります。

容量別の展望

容量別に基づいて、市場は高容量、低容量、および超低容量に分類されます。

高容量散布機器

大規模農場では、多くの場合、高容量散布機器が採用されています。これは、1回の充填サイクルで広い面積をカバーできるためです。これらの装置は数百リットルの薬剤を収容できるため、停止することなく散布できます。強力で高速なため、トウモロコシ、小麦、大豆の栽培に最適です。より多くの薬剤と水を必要としますが、精密散布システムの改善により、過剰使用の削減に役立っています。特に米国、ブラジル、中国など、農業の機械化が進んでいる国では、運用規模の拡大が不可欠であり、これが高容量散布機器が市場で圧倒的なシェアを占めている理由です。

動向:

GPS誘導可変レートアプリケーションシステムの統合

高容量散布機には、GPSベースのシステムや可変レート散布(VRA)技術がますます搭載されるようになっています。これらの機器は、散布量をリアルタイムで制御することで、農家が農薬、肥料、除草剤をより効率的に散布することを可能にします。こうしたソリューションの導入は、運用コストと環境負荷を削減し、生産性を最大化することを目的としています。こうした傾向は、列作農業において特に重要であり、広大な面積を迅速かつ均一に散布することを可能にします。

関連ニュース:

コロラド州のコモディティクラシック(2025年4月)で、John Deereは、カメラで検出されたバイオマスに基づいてノズルレベルの調整を可能にする「See &Spray Select可変レートテクノロジーおよびAutoTrac自動化」を搭載した散布機器のアップデートを発表しました。

引用:

「高容量システムは、速度とスループットを犠牲にできない大規模アプリケーションを支える基盤です。」

エレナ・マルケス博士、Global AgriTech Insightsシニアアナリスト

低容量散布機器

低容量散布機器は、散布範囲と資源消費のバランスが取れているため、中規模農場やブドウ園、果樹園、野菜畑などの特殊作物への散布に最適です。通常、1ヘクタールあたり50~200リットルの液体を使用するため、高容量システムほど多くの資源を消費することなく、十分な散布範囲を確保できます。環境に優しい活動や、化学物質の使用に関する厳格な規制にも適合するため、より多くの農家が利用しています。タンクの補充頻度が少なく、移動が容易で、より正確に散布できるため、農家に好評です。これは、過剰散布による流出や作物への損傷が発生する可能性のある地域では特に重要です。

動向:

スマートノズル技術とセクション制御の採用

低容量散布機には、対象区域を特定し、ドリフトを最小限に抑え、重複を解消できる高度なノズル制御システムが徐々に導入されています。これらのシステムは、パルス幅変調(PWM)システムとAI搭載のブームセクションコントローラーで構成されており、凹凸のある圃場でも正確な散布を可能にします。

関連ニュース:

World Ag Expo 2025では、EcorobotixのARA超高精度散布機器が展示されました。これは、化学薬品の使用量を95%削減しながら個々の植物を処理できるロボットユニットであり、最先端技術がいかにして少量の作業に導入されるかを示しています。

引用:

「少量生産ユニットは、精度を重視し、環境に配慮し、対象を絞った用途に最適なスマートデリバリーシステムへと進化しています。」

プリヤ・シン、AgriWorld Researchサステナビリティ担当ディレクター

タイプ別の展望

タイプ別に見ると、市場は自走式、トラクター搭載型、牽引式、空中式、ハンドヘルドに分類されます。トラクター搭載型は、2024年の農業用散布機器市場において25%の収益シェアを獲得しました。特に中規模・大規模農家に人気のトラクター搭載型が大きな貢献を果たしています。このタイプの散布機は、トラクターの前部または後部に直接取り付けられ、トラクターのエンジンで駆動します。汎用性、手頃な価格、そして使いやすさを兼ね備えたトラクター搭載型散布機は、様々な作物や散布作業に適しています。

地域別の展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEA(ラテンアメリカ、中東・アフリカ)で分析されています。アジア太平洋地域は、2024年の農業用散布機器市場において38%の収益シェアを獲得しました。この大幅な成長の主な理由は、中国、インド、日本などの国々における大規模な農業と機械化への関心の高まりです。この地域には多くの人口が住み、食料需要も高まっているため、効果的で拡張性の高い農法を採用することが不可欠となっています。農業の近代化を促進する政府プログラム、機器購入へのインセンティブ、そして精密農業に関する知識の向上は、この市場セクターの成長を支えています。

市場競争と特性

農業用散布機器市場は、技術革新が急速に進み、精度、自動化、持続可能性への要求が高まっているため、特に競合が激化する中、企業は市場シェアを獲得し、幅広い農業ニーズに対応するために、イノベーション、サービスの統合、そして地域ニーズへの適応に注力しています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場要覧

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

第4章 市場動向-農業用散布機器市場

第5章 競合の現状- 農業用散布機器市場

第6章 農業用散布機器市場における主要な顧客基準

第7章 製品ライフサイクル(PLC):農業用散布機器市場

第8章 農業用散布機器市場分析

第9章 競合分析

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターファイブフォース分析

第10章 農業用散布機器市場のバリューチェーン分析

- インバウンド物流

- オペレーション

- アウトバウンド物流

- マーケティングとセールス

- サービス

第11章 世界市場:農場規模別

- 世界の中規模農場市場:地域別

- 世界の大規模農場市場:地域別

- 世界の小規模農場市場:地域別

第12章 世界市場:容量別

- 世界の高容量市場:地域別

- 世界の低容量市場:地域別

- 世界の超低容量市場:地域別

第13章 世界市場:タイプ別

- 世界の自走式市場:地域別

- 世界のトラクター搭載型市場:地域別

- 世界の牽引式市場:地域別

- 世界の空中式市場:地域別

- 世界のハンドヘルド市場:地域別

第14章 世界市場:地域別

- 北米

- 市場に影響を与える主な要因

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 市場に影響を与える主な要因

- 欧州の市場:国別

- ドイツ

- フランス

- 英国

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋地域

- 市場に影響を与える主な要因

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- 市場に影響を与える主な要因

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- エジプト

- ケニア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第15章 企業プロファイル

- Deere & Company

- CNH Industrial NV

- AGCO Corporation

- KUBOTA Corporation

- Andreas Stihl AG & Co KG

- Buhler Industries Inc

- Yamaha Motor Co, Ltd.

- ISEKI & Co, Ltd.

- Mahindra & Mahindra Limited(Mahindra Group)

- SZ DJI Technology Co, Ltd.

第16章 農業用散布機器市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 2 Global Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 3 Key Costumer Criteria - Agriculture Spraying Equipment Market

- TABLE 4 Consolidation Determinants & Ratings

- TABLE 5 Partnerships, Collaborations and Agreements- Agriculture Spraying Equipment Market

- TABLE 6 Product Launches And Product Expansions- Agriculture Spraying Equipment Market

- TABLE 7 Acquisition and Mergers- Agriculture Spraying Equipment Market

- TABLE 8 Global Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 9 Global Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 10 Global Medium Farms Market by Region, 2021 - 2024, USD Million

- TABLE 11 Global Medium Farms Market by Region, 2025 - 2032, USD Million

- TABLE 12 Global Large Farms Market by Region, 2021 - 2024, USD Million

- TABLE 13 Global Large Farms Market by Region, 2025 - 2032, USD Million

- TABLE 14 Global Small Farms Market by Region, 2021 - 2024, USD Million

- TABLE 15 Global Small Farms Market by Region, 2025 - 2032, USD Million

- TABLE 16 Global Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 17 Global Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 18 Global High Volume Market by Region, 2021 - 2024, USD Million

- TABLE 19 Global High Volume Market by Region, 2025 - 2032, USD Million

- TABLE 20 Global Low Volume Market by Region, 2021 - 2024, USD Million

- TABLE 21 Global Low Volume Market by Region, 2025 - 2032, USD Million

- TABLE 22 Global Ultra-Low Volume Market by Region, 2021 - 2024, USD Million

- TABLE 23 Global Ultra-Low Volume Market by Region, 2025 - 2032, USD Million

- TABLE 24 Global Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 25 Global Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 26 Global Self-propelled Market by Region, 2021 - 2024, USD Million

- TABLE 27 Global Self-propelled Market by Region, 2025 - 2032, USD Million

- TABLE 28 Global Tractor-mounted Market by Region, 2021 - 2024, USD Million

- TABLE 29 Global Tractor-mounted Market by Region, 2025 - 2032, USD Million

- TABLE 30 Global Trailed Market by Region, 2021 - 2024, USD Million

- TABLE 31 Global Trailed Market by Region, 2025 - 2032, USD Million

- TABLE 32 Global Aerial Market by Region, 2021 - 2024, USD Million

- TABLE 33 Global Aerial Market by Region, 2025 - 2032, USD Million

- TABLE 34 Global Handheld Market by Region, 2021 - 2024, USD Million

- TABLE 35 Global Handheld Market by Region, 2025 - 2032, USD Million

- TABLE 36 Use Case - 1 Autonomous and High-Capacity Self-Propelled Units for Industrial-Scale Application

- TABLE 37 Use Case - 2 Cost-Effective Tractor-Integrated Devices for Mid-Scale Operations

- TABLE 38 Use Case - 3 Heavy-Duty Trailed Implements for Large-Capacity Precision Spraying

- TABLE 39 Use Case - 4 Drone-Based Aerial Deployment for Targeted and Remote Area Coverage

- TABLE 40 Use Case - 5 Portable Manual Sprayers for Small Plots and Spot Treatment

- TABLE 41 Global Agriculture Spraying Equipment Market by Region, 2021 - 2024, USD Million

- TABLE 42 Global Agriculture Spraying Equipment Market by Region, 2025 - 2032, USD Million

- TABLE 43 North America Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 44 North America Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 45 North America Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 46 North America Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 47 North America Medium Farms Market by Country, 2021 - 2024, USD Million

- TABLE 48 North America Medium Farms Market by Country, 2025 - 2032, USD Million

- TABLE 49 North America Large Farms Market by Country, 2021 - 2024, USD Million

- TABLE 50 North America Large Farms Market by Country, 2025 - 2032, USD Million

- TABLE 51 North America Small Farms Market by Country, 2021 - 2024, USD Million

- TABLE 52 North America Small Farms Market by Country, 2025 - 2032, USD Million

- TABLE 53 North America Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 54 North America Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 55 North America High Volume Market by Country, 2021 - 2024, USD Million

- TABLE 56 North America High Volume Market by Country, 2025 - 2032, USD Million

- TABLE 57 North America Low Volume Market by Country, 2021 - 2024, USD Million

- TABLE 58 North America Low Volume Market by Country, 2025 - 2032, USD Million

- TABLE 59 North America Ultra-Low Volume Market by Country, 2021 - 2024, USD Million

- TABLE 60 North America Ultra-Low Volume Market by Country, 2025 - 2032, USD Million

- TABLE 61 North America Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 62 North America Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 63 North America Self-propelled Market by Country, 2021 - 2024, USD Million

- TABLE 64 North America Self-propelled Market by Country, 2025 - 2032, USD Million

- TABLE 65 North America Tractor-mounted Market by Country, 2021 - 2024, USD Million

- TABLE 66 North America Tractor-mounted Market by Country, 2025 - 2032, USD Million

- TABLE 67 North America Trailed Market by Country, 2021 - 2024, USD Million

- TABLE 68 North America Trailed Market by Country, 2025 - 2032, USD Million

- TABLE 69 North America Aerial Market by Country, 2021 - 2024, USD Million

- TABLE 70 North America Aerial Market by Country, 2025 - 2032, USD Million

- TABLE 71 North America Handheld Market by Country, 2021 - 2024, USD Million

- TABLE 72 North America Handheld Market by Country, 2025 - 2032, USD Million

- TABLE 73 North America Agriculture Spraying Equipment Market by Country, 2021 - 2024, USD Million

- TABLE 74 North America Agriculture Spraying Equipment Market by Country, 2025 - 2032, USD Million

- TABLE 75 US Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 76 US Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 77 US Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 78 US Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 79 US Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 80 US Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 81 US Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 82 US Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 83 Canada Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 84 Canada Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 85 Canada Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 86 Canada Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 87 Canada Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 88 Canada Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 89 Canada Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 90 Canada Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 91 Mexico Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 92 Mexico Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 93 Mexico Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 94 Mexico Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 95 Mexico Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 96 Mexico Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 97 Mexico Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 98 Mexico Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 99 Rest of North America Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 100 Rest of North America Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 101 Rest of North America Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 102 Rest of North America Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 103 Rest of North America Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 104 Rest of North America Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 105 Rest of North America Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 106 Rest of North America Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 107 Europe Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 108 Europe Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 109 Europe Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 110 Europe Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 111 Europe Medium Farms Market by Country, 2021 - 2024, USD Million

- TABLE 112 Europe Medium Farms Market by Country, 2025 - 2032, USD Million

- TABLE 113 Europe Large Farms Market by Country, 2021 - 2024, USD Million

- TABLE 114 Europe Large Farms Market by Country, 2025 - 2032, USD Million

- TABLE 115 Europe Small Farms Market by Country, 2021 - 2024, USD Million

- TABLE 116 Europe Small Farms Market by Country, 2025 - 2032, USD Million

- TABLE 117 Europe Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 118 Europe Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 119 Europe High Volume Market by Country, 2021 - 2024, USD Million

- TABLE 120 Europe High Volume Market by Country, 2025 - 2032, USD Million

- TABLE 121 Europe Low Volume Market by Country, 2021 - 2024, USD Million

- TABLE 122 Europe Low Volume Market by Country, 2025 - 2032, USD Million

- TABLE 123 Europe Ultra-Low Volume Market by Country, 2021 - 2024, USD Million

- TABLE 124 Europe Ultra-Low Volume Market by Country, 2025 - 2032, USD Million

- TABLE 125 Europe Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 126 Europe Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 127 Europe Self-propelled Market by Country, 2021 - 2024, USD Million

- TABLE 128 Europe Self-propelled Market by Country, 2025 - 2032, USD Million

- TABLE 129 Europe Tractor-mounted Market by Country, 2021 - 2024, USD Million

- TABLE 130 Europe Tractor-mounted Market by Country, 2025 - 2032, USD Million

- TABLE 131 Europe Trailed Market by Country, 2021 - 2024, USD Million

- TABLE 132 Europe Trailed Market by Country, 2025 - 2032, USD Million

- TABLE 133 Europe Aerial Market by Country, 2021 - 2024, USD Million

- TABLE 134 Europe Aerial Market by Country, 2025 - 2032, USD Million

- TABLE 135 Europe Handheld Market by Country, 2021 - 2024, USD Million

- TABLE 136 Europe Handheld Market by Country, 2025 - 2032, USD Million

- TABLE 137 Europe Agriculture Spraying Equipment Market by Country, 2021 - 2024, USD Million

- TABLE 138 Europe Agriculture Spraying Equipment Market by Country, 2025 - 2032, USD Million

- TABLE 139 Germany Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 140 Germany Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 141 Germany Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 142 Germany Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 143 Germany Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 144 Germany Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 145 Germany Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 146 Germany Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 147 France Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 148 France Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 149 France Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 150 France Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 151 France Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 152 France Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 153 France Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 154 France Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 155 UK Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 156 UK Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 157 UK Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 158 UK Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 159 UK Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 160 UK Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 161 UK Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 162 UK Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 163 Russia Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 164 Russia Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 165 Russia Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 166 Russia Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 167 Russia Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 168 Russia Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 169 Russia Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 170 Russia Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 171 Spain Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 172 Spain Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 173 Spain Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 174 Spain Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 175 Spain Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 176 Spain Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 177 Spain Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 178 Spain Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 179 Italy Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 180 Italy Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 181 Italy Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 182 Italy Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 183 Italy Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 184 Italy Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 185 Italy Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 186 Italy Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 187 Rest of Europe Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 188 Rest of Europe Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 189 Rest of Europe Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 190 Rest of Europe Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 191 Rest of Europe Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 192 Rest of Europe Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 193 Rest of Europe Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 194 Rest of Europe Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 195 Asia Pacific Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 196 Asia Pacific Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 197 Asia Pacific Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 198 Asia Pacific Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 199 Asia Pacific Medium Farms Market by Country, 2021 - 2024, USD Million

- TABLE 200 Asia Pacific Medium Farms Market by Country, 2025 - 2032, USD Million

- TABLE 201 Asia Pacific Large Farms Market by Country, 2021 - 2024, USD Million

- TABLE 202 Asia Pacific Large Farms Market by Country, 2025 - 2032, USD Million

- TABLE 203 Asia Pacific Small Farms Market by Country, 2021 - 2024, USD Million

- TABLE 204 Asia Pacific Small Farms Market by Country, 2025 - 2032, USD Million

- TABLE 205 Asia Pacific Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 206 Asia Pacific Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 207 Asia Pacific High Volume Market by Country, 2021 - 2024, USD Million

- TABLE 208 Asia Pacific High Volume Market by Country, 2025 - 2032, USD Million

- TABLE 209 Asia Pacific Low Volume Market by Country, 2021 - 2024, USD Million

- TABLE 210 Asia Pacific Low Volume Market by Country, 2025 - 2032, USD Million

- TABLE 211 Asia Pacific Ultra-Low Volume Market by Country, 2021 - 2024, USD Million

- TABLE 212 Asia Pacific Ultra-Low Volume Market by Country, 2025 - 2032, USD Million

- TABLE 213 Asia Pacific Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 214 Asia Pacific Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 215 Asia Pacific Self-propelled Market by Country, 2021 - 2024, USD Million

- TABLE 216 Asia Pacific Self-propelled Market by Country, 2025 - 2032, USD Million

- TABLE 217 Asia Pacific Tractor-mounted Market by Country, 2021 - 2024, USD Million

- TABLE 218 Asia Pacific Tractor-mounted Market by Country, 2025 - 2032, USD Million

- TABLE 219 Asia Pacific Trailed Market by Country, 2021 - 2024, USD Million

- TABLE 220 Asia Pacific Trailed Market by Country, 2025 - 2032, USD Million

- TABLE 221 Asia Pacific Aerial Market by Country, 2021 - 2024, USD Million

- TABLE 222 Asia Pacific Aerial Market by Country, 2025 - 2032, USD Million

- TABLE 223 Asia Pacific Handheld Market by Country, 2021 - 2024, USD Million

- TABLE 224 Asia Pacific Handheld Market by Country, 2025 - 2032, USD Million

- TABLE 225 Asia Pacific Agriculture Spraying Equipment Market by Country, 2021 - 2024, USD Million

- TABLE 226 Asia Pacific Agriculture Spraying Equipment Market by Country, 2025 - 2032, USD Million

- TABLE 227 China Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 228 China Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 229 China Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 230 China Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 231 China Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 232 China Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 233 China Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 234 China Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 235 Japan Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 236 Japan Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 237 Japan Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 238 Japan Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 239 Japan Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 240 Japan Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 241 Japan Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 242 Japan Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 243 India Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 244 India Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 245 India Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 246 India Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 247 India Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 248 India Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 249 India Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 250 India Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 251 South Korea Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 252 South Korea Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 253 South Korea Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 254 South Korea Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 255 South Korea Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 256 South Korea Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 257 South Korea Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 258 South Korea Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 259 Australia Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 260 Australia Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 261 Australia Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 262 Australia Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 263 Australia Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 264 Australia Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 265 Australia Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 266 Australia Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 267 Malaysia Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 268 Malaysia Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 269 Malaysia Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 270 Malaysia Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 271 Malaysia Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 272 Malaysia Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 273 Malaysia Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 274 Malaysia Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 275 Rest of Asia Pacific Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 276 Rest of Asia Pacific Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 277 Rest of Asia Pacific Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 278 Rest of Asia Pacific Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 279 Rest of Asia Pacific Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 280 Rest of Asia Pacific Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 281 Rest of Asia Pacific Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 282 Rest of Asia Pacific Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 283 LAMEA Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 284 LAMEA Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 285 LAMEA Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 286 LAMEA Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 287 LAMEA Medium Farms Market by Country, 2021 - 2024, USD Million

- TABLE 288 LAMEA Medium Farms Market by Country, 2025 - 2032, USD Million

- TABLE 289 LAMEA Large Farms Market by Country, 2021 - 2024, USD Million

- TABLE 290 LAMEA Large Farms Market by Country, 2025 - 2032, USD Million

- TABLE 291 LAMEA Small Farms Market by Country, 2021 - 2024, USD Million

- TABLE 292 LAMEA Small Farms Market by Country, 2025 - 2032, USD Million

- TABLE 293 LAMEA Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 294 LAMEA Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 295 LAMEA High Volume Market by Country, 2021 - 2024, USD Million

- TABLE 296 LAMEA High Volume Market by Country, 2025 - 2032, USD Million

- TABLE 297 LAMEA Low Volume Market by Country, 2021 - 2024, USD Million

- TABLE 298 LAMEA Low Volume Market by Country, 2025 - 2032, USD Million

- TABLE 299 LAMEA Ultra-Low Volume Market by Country, 2021 - 2024, USD Million

- TABLE 300 LAMEA Ultra-Low Volume Market by Country, 2025 - 2032, USD Million

- TABLE 301 LAMEA Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 302 LAMEA Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 303 LAMEA Self-propelled Market by Country, 2021 - 2024, USD Million

- TABLE 304 LAMEA Self-propelled Market by Country, 2025 - 2032, USD Million

- TABLE 305 LAMEA Tractor-mounted Market by Country, 2021 - 2024, USD Million

- TABLE 306 LAMEA Tractor-mounted Market by Country, 2025 - 2032, USD Million

- TABLE 307 LAMEA Trailed Market by Country, 2021 - 2024, USD Million

- TABLE 308 LAMEA Trailed Market by Country, 2025 - 2032, USD Million

- TABLE 309 LAMEA Aerial Market by Country, 2021 - 2024, USD Million

- TABLE 310 LAMEA Aerial Market by Country, 2025 - 2032, USD Million

- TABLE 311 LAMEA Handheld Market by Country, 2021 - 2024, USD Million

- TABLE 312 LAMEA Handheld Market by Country, 2025 - 2032, USD Million

- TABLE 313 LAMEA Agriculture Spraying Equipment Market by Country, 2021 - 2024, USD Million

- TABLE 314 LAMEA Agriculture Spraying Equipment Market by Country, 2025 - 2032, USD Million

- TABLE 315 Brazil Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 316 Brazil Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 317 Brazil Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 318 Brazil Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 319 Brazil Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 320 Brazil Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 321 Brazil Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 322 Brazil Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 323 Argentina Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 324 Argentina Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 325 Argentina Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 326 Argentina Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 327 Argentina Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 328 Argentina Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 329 Argentina Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 330 Argentina Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 331 Egypt Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 332 Egypt Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 333 Egypt Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 334 Egypt Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 335 Egypt Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 336 Egypt Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 337 Egypt Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 338 Egypt Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 339 Kenya Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 340 Kenya Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 341 Kenya Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 342 Kenya Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 343 Kenya Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 344 Kenya Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 345 Kenya Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 346 Kenya Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 347 South Africa Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 348 South Africa Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 349 South Africa Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 350 South Africa Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 351 South Africa Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 352 South Africa Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 353 South Africa Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 354 South Africa Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 355 Nigeria Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 356 Nigeria Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 357 Nigeria Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 358 Nigeria Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 359 Nigeria Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 360 Nigeria Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 361 Nigeria Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 362 Nigeria Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 363 Rest of LAMEA Agriculture Spraying Equipment Market, 2021 - 2024, USD Million

- TABLE 364 Rest of LAMEA Agriculture Spraying Equipment Market, 2025 - 2032, USD Million

- TABLE 365 Rest of LAMEA Agriculture Spraying Equipment Market by Farm Size, 2021 - 2024, USD Million

- TABLE 366 Rest of LAMEA Agriculture Spraying Equipment Market by Farm Size, 2025 - 2032, USD Million

- TABLE 367 Rest of LAMEA Agriculture Spraying Equipment Market by Capacity, 2021 - 2024, USD Million

- TABLE 368 Rest of LAMEA Agriculture Spraying Equipment Market by Capacity, 2025 - 2032, USD Million

- TABLE 369 Rest of LAMEA Agriculture Spraying Equipment Market by Type, 2021 - 2024, USD Million

- TABLE 370 Rest of LAMEA Agriculture Spraying Equipment Market by Type, 2025 - 2032, USD Million

- TABLE 371 Key Information - Deere & Company

- TABLE 372 Key Information - CNH Industrial N.V.

- TABLE 373 Key Information - AGCO Corporation

- TABLE 374 Key Information - KUBOTA Corporation

- TABLE 375 Key Information - Andreas Stihl AG & Co. KG

- TABLE 376 Key Information - Buhler Industries Inc.

- TABLE 377 Key Information - Yamaha Motor Co., Ltd.

- TABLE 378 Key Information - ISEKI & Co., Ltd.

- TABLE 379 key Information - Mahindra & Mahindra Limited

- TABLE 380 Key Information - SZ DJI Technology Co., Ltd.

LIST OF FIGURES

- FIG 1 Methodology for the research

- FIG 2 Global Agriculture Spraying Equipment Market, 2021 - 2032, USD Million

- FIG 3 Key Factors Impacting Agriculture Spraying Equipment Market

- FIG 4 Key Costumer Criteria - Agriculture Spraying Equipment Market

- FIG 5 KBV Cardinal Matrix

- FIG 6 Key Leading Strategies: Percentage Distribution (2021-2025)

- FIG 7 Key Strategic Move: (Product Launches and Product Expansions : 2022, Jul - 2025, Jun) Leading Players

- FIG 8 Porter's Five Forces Analysis - Agriculture Spraying Equipment Market

- FIG 9 Value Chain Analysis of Agriculture Spraying Equipment Market

- FIG 10 Global Agriculture Spraying Equipment Market share by Farm Size, 2024

- FIG 11 Global Agriculture Spraying Equipment Market share by Farm Size, 2032

- FIG 12 Global Agriculture Spraying Equipment Market by Farm Size, 2021 - 2032, USD Million

- FIG 13 Global Agriculture Spraying Equipment Market share by Capacity, 2024

- FIG 14 Global Agriculture Spraying Equipment Market share by Capacity, 2032

- FIG 15 Global Agriculture Spraying Equipment Market by Capacity, 2021 - 2032, USD Million

- FIG 16 Global Agriculture Spraying Equipment Market share by Farm Size, 2024

- FIG 17 Global Agriculture Spraying Equipment Market share by Farm Size, 2032

- FIG 18 Global Agriculture Spraying Equipment Market by Farm Size, 2021 - 2032, USD Million

- FIG 19 Global Agriculture Spraying Equipment Market share by Region, 2024

- FIG 20 Global Agriculture Spraying Equipment Market share by Region, 2032

- FIG 21 Global Agriculture Spraying Equipment Market by Region, 2021 - 2032, USD Million

- FIG 22 North America Agriculture Spraying Equipment Market, 2021 - 2032, USD Million

- FIG 23 Key Factors Impacting Agriculture Spraying Equipment Market

- FIG 24 North America Agriculture Spraying Equipment Market share by Farm Size, 2024

- FIG 25 North America Agriculture Spraying Equipment Market share by Farm Size, 2032

- FIG 26 North America Agriculture Spraying Equipment Market by Farm Size, 2021 - 2032, USD Million

- FIG 27 North America Agriculture Spraying Equipment Market share by Capacity, 2024

- FIG 28 North America Agriculture Spraying Equipment Market share by Capacity, 2032

- FIG 29 North America Agriculture Spraying Equipment Market by Capacity, 2021 - 2032, USD Million

- FIG 30 North America Agriculture Spraying Equipment Market share by Type, 2024

- FIG 31 North America Agriculture Spraying Equipment Market share by Type, 2032

- FIG 32 North America Agriculture Spraying Equipment Market by Type, 2021 - 2032, USD Million

- FIG 33 North America Agriculture Spraying Equipment Market share by Country, 2024

- FIG 34 North America Agriculture Spraying Equipment Market share by Country, 2032

- FIG 35 North America Agriculture Spraying Equipment Market by Country, 2021 - 2032, USD Million

- FIG 36 Europe Agriculture Spraying Equipment Market, 2021 - 2032, USD Million

- FIG 37 Key Factors Impacting Agriculture Spraying Equipment Market

- FIG 38 Europe Agriculture Spraying Equipment Market share by Farm Size, 2024

- FIG 39 Europe Agriculture Spraying Equipment Market share by Farm Size, 2032

- FIG 40 Europe Agriculture Spraying Equipment Market by Farm Size, 2021 - 2032, USD Million

- FIG 41 Europe Agriculture Spraying Equipment Market share by Capacity, 2024

- FIG 42 Europe Agriculture Spraying Equipment Market share by Capacity, 2032

- FIG 43 Europe Agriculture Spraying Equipment Market by Capacity, 2021 - 2032, USD Million

- FIG 44 Europe Agriculture Spraying Equipment Market share by Type, 2024

- FIG 45 Europe Agriculture Spraying Equipment Market share by Type, 2032

- FIG 46 Europe Agriculture Spraying Equipment Market by Type, 2021 - 2032, USD Million

- FIG 47 Europe Agriculture Spraying Equipment Market share by Country, 2024

- FIG 48 Europe Agriculture Spraying Equipment Market share by Country, 2032

- FIG 49 Europe Agriculture Spraying Equipment Market by Country, 2021 - 2032, USD Million

- FIG 50 Asia Pacific Agriculture Spraying Equipment Market, 2021 - 2032, USD Million

- FIG 51 Key Factors Impacting Agriculture Spraying Equipment Market

- FIG 52 Asia Pacific Agriculture Spraying Equipment Market share by Farm Size, 2024

- FIG 53 Asia Pacific Agriculture Spraying Equipment Market share by Farm Size, 2032

- FIG 54 Asia Pacific Agriculture Spraying Equipment Market by Farm Size, 2021 - 2032, USD Million

- FIG 55 Asia Pacific Agriculture Spraying Equipment Market share by Capacity, 2024

- FIG 56 Asia Pacific Agriculture Spraying Equipment Market share by Capacity, 2032

- FIG 57 Asia Pacific Agriculture Spraying Equipment Market by Capacity, 2021 - 2032, USD Million

- FIG 58 Asia Pacific Agriculture Spraying Equipment Market share by Type, 2024

- FIG 59 Asia Pacific Agriculture Spraying Equipment Market share by Type, 2032

- FIG 60 Asia Pacific Agriculture Spraying Equipment Market by Type, 2021 - 2032, USD Million

- FIG 61 Asia Pacific Agriculture Spraying Equipment Market share by Country, 2024

- FIG 62 Asia Pacific Agriculture Spraying Equipment Market share by Country, 2032

- FIG 63 Asia Pacific Agriculture Spraying Equipment Market by Country, 2021 - 2032, USD Million

- FIG 64 LAMEA Agriculture Spraying Equipment Market, 2021 - 2032, USD Million

- FIG 65 Key Factors Impacting Agriculture Spraying Equipment Market

- FIG 66 LAMEA Agriculture Spraying Equipment Market share by Farm Size, 2024

- FIG 67 LAMEA Agriculture Spraying Equipment Market share by Farm Size, 2032

- FIG 68 LAMEA Agriculture Spraying Equipment Market by Farm Size, 2021 - 2032, USD Million

- FIG 69 LAMEA Agriculture Spraying Equipment Market share by Capacity, 2024

- FIG 70 LAMEA Agriculture Spraying Equipment Market share by Capacity, 2032

- FIG 71 LAMEA Agriculture Spraying Equipment Market by Capacity, 2021 - 2032, USD Million

- FIG 72 LAMEA Agriculture Spraying Equipment Market share by Type, 2024

- FIG 73 LAMEA Agriculture Spraying Equipment Market share by Type, 2032

- FIG 74 LAMEA Agriculture Spraying Equipment Market by Type, 2021 - 2032, USD Million

- FIG 75 LAMEA Agriculture Spraying Equipment Market share by Country, 2024

- FIG 76 LAMEA Agriculture Spraying Equipment Market share by Country, 2032

- FIG 77 LAMEA Agriculture Spraying Equipment Market by Country, 2021 - 2032, USD Million

- FIG 78 Recent strategies and developments: Deere & Company

- FIG 79 SWOT Analysis: Deere & Company

- FIG 80 Recent strategies and developments: CNH Industrial N.V.

- FIG 81 SWOT Analysis: CNH Industrial N.V.

- FIG 82 Recent strategies and developments: AGCO Corporation

- FIG 83 Swot Analysis: AGCO Corporation

- FIG 84 Recent strategies and developments: KUBOTA Corporation

- FIG 85 SWOT Analysis: KUBOTA Corporation

- FIG 86 Recent strategies and developments: Yamaha Motor Co. Ltd.

- FIG 87 SWOT Analysis: Mahindra & Mahindra Limited

The Global Agriculture Spraying Equipment Market size is expected to reach $4.70 billion by 2032, rising at a market growth of 7.5% CAGR during the forecast period.

Key Highlights:

- The Asia Pacific region dominated the Global Market in 2024, accounting for a 38% revenue share in 2024.

- The China Agriculture Spraying Equipment market is expected to continue its dominance in China region thereby reaching a market size of 462.94 MN by 2032.

- Among the various propulsion type segment, the Medium Farms dominated the global market contributing a revenue share of 46% in 2024.

- In terms of the Capacity segmentation, the high volume segment is projected to dominate the global market with the projected revenue share of 46.71% in 2032.

- Self-propelled led the type segment in 2024, capturing a 27% revenue share and is projected to continue its dominance during projected period.

Precision agriculture and global food security have propelled the fast evolution of agricultural spraying equipment from crude manual instruments to highly sophisticated, GPS-driven systems. Efficiency has been redefined by innovations like LiDAR-enabled Smart Apply, variable-rate nozzles, and UAV-based sprayers, which minimize chemical waste, enable real-time canopy detection, and drastically lower operating costs. These developments, which are the result of partnerships between commercial OEMs like John Deere and public research institutes, demonstrate the industry's shift toward sustainability and digital integration. Precision spraying has evolved from a supporting to a crucial part of contemporary, high-output farming as the globe struggles to feed more than 9 billion people by 2050.

The agricultural spraying equipment market is experiencing a rapid evolution from basic manual instruments to very sophisticated and GPS-driven systems. The growing emphasis on food security worldwide and the precision agriculture have driven this evolution in the market. Innovations such as LiDAR-enabled Smart Apply, variable-rate nozzles, and UAV-based sprayers has led to the significant reduction in chemical waste and operating costs and enable real-time canopy identification thereby redefining the efficiency. Such developments are accredited to the partnerships between commercial OEMs such as John Deere and public research institutes and are also the representative of the transition of the industry towards the digital integration and sustainability.

Automation, electrification, and regional growth strategies targeting both large-scale and smallholder farmers are all changing the market at the same time. While OEMs and ag-tech startups compete and work together to provide scalable, tech-enabled solutions-from robotic sprayers and RTK-GPS drones to packaged Agriculture Spraying-as-a-Service (ASaaS) models-governments in emerging nations are using subsidies to encourage automation. Prominent companies are investing in sustainability, education, and regulatory compliance while using low-cost, modular technology to reach underserved populations. In order to satisfy the growing need for sustainable agricultural production, success in this dynamic environment depends on the capacity to combine engineering prowess, software intelligence, ecosystem alliances, and user-centric design.

Growth strategies with orientation towards automation, electrification and regional growth having focus on both large-scale and small-scale farmers are shaping the market. The OEMS and ag-tech startups are engaging together to develop and offer scalable and tech-enabled solutions ranging from robotic sprayers and RTK-GPS drones to packaged Agricultural Spraying-as-a-Service (ASaaS) models. Also, the government across countries are also providing subsidies to boost automation. Leading companies are investing in education, sustainability and regulatory compliance. These companies also reaching the underserved society using economic modular technology. The success roadmap to cater the rising requirement for sustainable agricultural production is influenced by the capacity to combine software intelligence, engineering prowess, user-centric design and ecosystem alliances.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2025, CNH Industrial N.V. unveiled advanced AI sprayer technology offering precision application beyond traditional boom boundaries. Using vision systems and machine learning, it enables real-time weed detection and targeted spraying, minimizing chemical use and environmental impact. This innovation reflects CNH's strategic push for smart agricultural spraying equipment and sustainable farming practices. Moreover, In March, 2025, Yamaha Motor Co., Ltd. unveiled advancements in autonomous technology to boost agricultural efficiency. By enhancing field robotics and automation systems, Yamaha aims to optimize operations such as spraying and seeding, reinforcing its position in precision agriculture and contributing to the evolution of the agricultural spraying equipment market.

Product launches emerged as the major strategy adopted by the market participants in order to match the dynamic demand of the end-users. For e.g. in June 2025, CNH Industrial N.V. revealed innovative AI sprayer technology providing precision application afar conventional boom boundaries. The real-time weed identification and targeted spraying thereby significantly reducing the chemical usage and hence the environmental impact is facilitated by the vision systems and machine learning. Such innovations display CNH's strategic commitment for smart agricultural spraying equipment and sustainable farming practices. Similarly, in March 2025, Yamaha Motor Co., Ltd. revealed the progress in autonomous technology to fuel the efficiency in agriculture sector. The optimization of the operations like seeding and spraying is the focus area of Yamaha thereby Strengthening its foothold in precision agriculture contributing to the evolution of this market.

KBV Cardinal Matrix - Agriculture Spraying Equipment Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Deere & Company is the forerunner in the Agriculture Spraying Equipment Market. In June, 2025, Deere & Company unveiled its R975i, the largest self-propelled sprayer in its European range. Featuring a 55-meter boom and a 9,000-liter tank, it's designed for high-efficiency operations. The R975i features advanced technologies, such as ExactApply and AutoTrac, enabling precise application and boosting productivity in large-scale agricultural spraying. Companies such as Mahindra & Mahindra Limited, KUBOTA Corporation, and CNH Industrial N.V. are some of the key innovators in Agriculture Spraying Equipment Market.

Market Growth Factors

Rising Global Demand for Precision Agriculture

The precision agriculture is proving itself as a ground breaking method of farming enabling the enhancement of input efficiency, improvements in crop yields and reduction in environmental impact. Basically, this advance method utilizes data analytics, sensors, GPS-based instruments and automation to manage field fluctuations. The requirement to enhance the agricultural productivity with same farm has become more pertinent demand as the global population continues to rise. Hence, the precision agriculture is the suitable solution for producing more with less and advanced agriculture spraying equipment is one of the major components which makes this transformation possible.

Labor Shortages and the Push for Farm Mechanization

Traditional agricultural practices have always been based on the availability of labor. However, urban migration, aging rural populations, and the diminishing attraction of physical agricultural labor have all contributed to the severe labor shortage now plaguing the agriculture industry. Farms are having trouble finding enough labor at critical times like planting, weeding, and harvesting as more young people from rural areas move to cities in quest of better prospects. In nations like Brazil, China, India, and even some regions of North America and Europe, the labor shortage is especially acute.

Market Restraining Factors

High Initial Investment and Ownership Costs

As one of the most influential restraint limiting the widespread adoption of agricultural spraying equipment, the high investment required for the procurement and deployment of the agricultural spraying equipment poses a serious restraint in its widespread adoption across the regions. Though with the advancement of the technology which further cut down the costs, still the level of investment is substantial for the small and marginal farmers representing the majority share in developing countries. For instance, the self-propelled boom sprayers, drone sprayers and autonomous robotic units may cost thousands to tens of thousands of dollars. Additionally, the incremental costs related to the base machine accessories, fuel and other modifications etc further makes the condition more challenging.

Farm Size Outlook

Based on Farm Size, the market is segmented into Medium Farms, Large Farms, and Small Farms. The large farms segment procured 31% revenue share in the agriculture spraying equipment market in 2024. These farms usually have a lot of acres to work with, so they need powerful machines that can swiftly and effectively cover large areas. Due to this, big farms are more likely to spend money on new technologies that offer speed, accuracy, and data-driven application methods, such as self-propelled machines, drone-based sprayers, and autonomous systems.

Capacity Outlook

Based on Capacity, the market is segmented into High Volume, Low Volume, and Ultra-Low Volume.

High Volume Sprayers

Most of the time, large-scale farms employ high-volume sprayers since they can cover a lot of land in one refill cycle. These devices can hold hundreds of liters of fluid, which lets them spray without stopping. They are great for growing maize, wheat, and soybeans since they are strong and fast. They require more chemicals and water, but improvements in precision delivery systems are helping to cut down on overuse. The necessity for operational scale, especially in nations such as the U.S., Brazil, and China, where farming is very mechanized, is the reason that makes them so dominant in the market.

Trend:

Integration of GPS-Guided Variable Rate Application Systems

High volume sprayers are progressively equipped with GPS-based systems and variable rate application (VRA) technologies. Such equipment facilitate the farmers to apply pesticides, fertilizers, or herbicides more proficiently by regulating the flow rate in real time. The deployment of such solution is intended to maximize productivity by reducing operational costs and environmental waste. Such a trend is quite relevant for row crop farming thereby facilitating the quick and uniform coverage of large areas.

Supporting News:

At Colorado's Commodity Classic (April 2025), John Deere unveiled updates to its sprayers featuring "See & Spray Select variable rate technology and AutoTrac automation," enabling nozzle-level adjustments based on biomass detected by cameras.

Quote:

"High volume systems are the backbone of large area application-where speed and throughput cannot be compromised."

Dr. Elena Marquez, Senior Analyst, Global AgriTech Insights

Low Volume Sprayers

Low-volume sprayers are outstanding for mid-sized farms and specialist crop applications including vineyards, orchards, and vegetable farms since they balance coverage and resource use. They usually use 50 to 200 L/ha of liquid, which gives them enough coverage without using as many resources as high-volume systems. More people are using them because they work well with ecologically friendly activities and stricter rules about how chemicals can be used. Farmers also like them better since they don't have to refill the tank as often, they are easier to move around, and they apply more accurately, which is especially important in areas where over-spraying could cause runoff or damage to crops.

Trend:

Adoption of Smart Nozzle Technology and Section Control

Low volume sprayers are gradually integrating advanced nozzle control systems which can identify target zones, minimize drift, and remove overlapping. These comprise pulse-width modulation (PWM) systems and AI-powered boom section controllers, that permit precise application even in uneven shaped fields.

Supporting News:

The World Ag Expo 2025 featured Ecorobotix's ARA Ultra-High Precision sprayer, a robotic unit capable of treating individual plants with 95% reductions in chemical use-yet showcasing how cutting-edge tech trickles into low-volume contexts.

Quote:

"Low volume units are evolving into smart delivery systems-precision-focused, environmentally aware, and perfect for targeted application."

Priya Singh, Director of Sustainability, AgriWorld Research

Type Outlook

Based on Type, the market is segmented into Self-propelled, Tractor-mounted, Trailed, Aerial, and Handheld. The tractor-mounted segment garnered 25% revenue share in the agriculture spraying equipment market in 2024. The important contribution is the tractor-mounted category, which medium and large farms particularly like. This kind of sprayer is mounted directly to the front or back of a tractor and runs on the tractor's engine. With their versatility, affordability, and ease of use, tractor-mounted sprayers are appropriate for a variety of crops and spraying jobs.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured 38% revenue share in the agriculture spraying equipment market in 2024. The key reasons for such a significant rise are the large amount of farming that is going on and the growing focus on mechanization in countries like China, India, and Japan. Since the area has a lot of people and food needs are growing, it is now vital to adopt effective and scalable farming methods. Government programs that promote modernization of agriculture, incentives to buy equipment, and a greater knowledge of precision farming are all helping this market sector thrive.

Market Competition and Attributes

The agricultural spraying equipment market is particularly competitive since technology is changing quickly and there is a growing requirement for accuracy, automation, and sustainability. Agile agri-tech entrepreneurs are placing more and more pressure on established machinery makers with their smart, cheap solutions. As competition heats up in different sectors, companies are focusing on innovation, combining services, and adapting to local needs in order to acquire market share and meet a wide range of farming needs.

Recent Strategies Deployed in the Market

- Jun-2025: KUBOTA Corporation and Agtonomy worked together to make self-driving M5N tractors for people who grow specialized crops. This partnership improves spraying and farming operations by automating them, which increases accuracy, labor efficiency, and sustainability. The agreement helps meet the growing need for smart spraying solutions in the agricultural equipment sector.

- May-2025: Deere & Company declared the acquisition of Sentera, a company offering drones and analytics technology, to improve its precision spraying capabilities. The goal of the integration is to improve real-time field reconnaissance, which will help farmers secure their crops better. By merging aerial insights with smart spraying systems, this move makes Deere's digital agriculture products even better.

- Jan-2025: Deere & Company demonstrated an electric tractor that can drive itself and is made for use in orchards and vineyards. The device works with GUSS's air-blast sprayer to allow for accurate spraying without a driver. This new idea helps with methods that save time and are good for the environment, which is a big step forward for specialty crop spraying equipment.

- Aug-2024: AGCO Corporation revealed off new farming tools that focus on innovation that helps farmers. The display features new spraying technologies that improve efficiency and accuracy. These changes show that AGCO is still putting money into agricultural spraying solutions to meet the changing needs of the market for more effective and environmentally friendly farming methods.

- Apr-2024: Trimble and AGCO Corporation worked together to make PTx Trimble. By combining Trimble's GPS with AGCO's machinery, this partnership improves precision agriculture, including spraying technologies. The goal of the project is to improve the efficiency and precision of spraying, which will have a direct effect on the markets for agricultural spraying equipment with next-generation smart solutions.

- Feb-2024: Yamaha Motor Co., Ltd. stated it acquired Robotics Plus, an agri-tech firm based in New Zealand, to improve its ability to automate farming tasks. The move expands Yamaha's portfolio in autonomous spraying and crop-handling systems, which is in line with the growing demand for smart spraying and precision farming equipment in the worldwide agriculture spraying equipment market.

List of Key Companies Profiled

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- KUBOTA Corporation

- Andreas Stihl AG and Co KG

- Buhler Industries Inc.

- Yamaha Motor Co., Ltd.

- ISEKI & Co., Ltd.

- Mahindra & Mahindra Limited (Mahindra Group)

- SZ DJI Technology Co., Ltd.

Global Agriculture Spraying Equipment Market Report Segmentation

By Farm Size

- Medium Farms

- Large Farms

- Small Farms

By Capacity

- High Volume

- Low Volume

- Ultra-Low Volume

By Type

- Self-propelled

- Tractor-mounted

- Trailed

- Aerial

- Handheld

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- Egypt

- Kenya

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Agriculture Spraying Equipment Market, by Farm Size

- 1.4.2 Global Agriculture Spraying Equipment Market, by Capacity

- 1.4.3 Global Agriculture Spraying Equipment Market, by Type

- 1.4.4 Global Agriculture Spraying Equipment Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.2.3 Market Opportunities

- 3.2.4 Market Challenges

Chapter 4. Market Trends - Agriculture Spraying Equipment Market

Chapter 5. State of Competition - Agriculture Spraying Equipment Market

Chapter 6. Key Costumer Criteria - Agriculture Spraying Equipment Market

Chapter 7. Product Life Cycle (PLC): Agriculture Spraying Equipment Market

Chapter 8. Market Consolidation Analysis of Agriculture Spraying Equipment Market

Chapter 9. Competition Analysis - Global

- 9.1 KBV Cardinal Matrix

- 9.2 Recent Industry Wide Strategic Developments

- 9.2.1 Partnerships, Collaborations and Agreements

- 9.2.2 Product Launches and Product Expansions

- 9.2.3 Acquisition and Mergers

- 9.3 Top Winning Strategies

- 9.3.1 Key Leading Strategies: Percentage Distribution (2021-2025)

- 9.3.2 Key Strategic Move: (Product Launches and Product Expansions: 2022, Jul - 2025, Jun) Leading Players

- 9.4 Porter Five Forces Analysis

Chapter 10. Value Chain Analysis of Agriculture Spraying Equipment Market

- 10.1 Inbound Logistics

- 10.2 Operations

- 10.3 Outbound Logistics

- 10.4 Marketing and Sales

- 10.5 Services

Chapter 11. Global Agriculture Spraying Equipment Market by Farm Size

- 11.1 Global Medium Farms Market by Region

- 11.2 Global Large Farms Market by Region

- 11.3 Global Small Farms Market by Region

Chapter 12. Global Agriculture Spraying Equipment Market by Capacity

- 12.1 Global High Volume Market by Region

- 12.2 Global Low Volume Market by Region

- 12.3 Global Ultra-Low Volume Market by Region

Chapter 13. Global Agriculture Spraying Equipment Market by Type

- 13.1 Global Self-propelled Market by Region

- 13.2 Global Tractor-mounted Market by Region

- 13.3 Global Trailed Market by Region

- 13.4 Global Aerial Market by Region

- 13.5 Global Handheld Market by Region

Chapter 14. Global Agriculture Spraying Equipment Market by Region

- 14.1 North America Agriculture Spraying Equipment Market

- 14.2 Key Factors Impacting the Market

- 14.2.1 Market Drivers

- 14.2.2 Market Restraints

- 14.2.3 Market Opportunities

- 14.2.4 Market Challenges

- 14.2.5 North America Agriculture Spraying Equipment Market by Farm Size

- 14.2.5.1 North America Medium Farms Market by Country

- 14.2.5.2 North America Large Farms Market by Country

- 14.2.5.3 North America Small Farms Market by Country

- 14.2.6 North America Agriculture Spraying Equipment Market by Capacity

- 14.2.6.1 North America High Volume Market by Country

- 14.2.6.2 North America Low Volume Market by Country

- 14.2.6.3 North America Ultra-Low Volume Market by Country

- 14.2.7 North America Agriculture Spraying Equipment Market by Type

- 14.2.7.1 North America Self-propelled Market by Country

- 14.2.7.2 North America Tractor-mounted Market by Country

- 14.2.7.3 North America Trailed Market by Country

- 14.2.7.4 North America Aerial Market by Country

- 14.2.7.5 North America Handheld Market by Country

- 14.2.8 North America Agriculture Spraying Equipment Market by Country

- 14.2.8.1 US Agriculture Spraying Equipment Market

- 14.2.8.1.1 US Agriculture Spraying Equipment Market by Farm Size

- 14.2.8.1.2 US Agriculture Spraying Equipment Market by Capacity

- 14.2.8.1.3 US Agriculture Spraying Equipment Market by Type

- 14.2.8.2 Canada Agriculture Spraying Equipment Market

- 14.2.8.2.1 Canada Agriculture Spraying Equipment Market by Farm Size

- 14.2.8.2.2 Canada Agriculture Spraying Equipment Market by Capacity

- 14.2.8.2.3 Canada Agriculture Spraying Equipment Market by Type

- 14.2.8.3 Mexico Agriculture Spraying Equipment Market

- 14.2.8.3.1 Mexico Agriculture Spraying Equipment Market by Farm Size

- 14.2.8.3.2 Mexico Agriculture Spraying Equipment Market by Capacity

- 14.2.8.3.3 Mexico Agriculture Spraying Equipment Market by Type

- 14.2.8.4 Rest of North America Agriculture Spraying Equipment Market

- 14.2.8.4.1 Rest of North America Agriculture Spraying Equipment Market by Farm Size

- 14.2.8.4.2 Rest of North America Agriculture Spraying Equipment Market by Capacity

- 14.2.8.4.3 Rest of North America Agriculture Spraying Equipment Market by Type

- 14.2.8.1 US Agriculture Spraying Equipment Market

- 14.3 Europe Agriculture Spraying Equipment Market

- 14.4 Key Factors Impacting the Market

- 14.4.1 Market Drivers

- 14.4.2 Market Restraints

- 14.4.3 Market Opportunities

- 14.4.4 Market Challenges

- 14.4.5 Europe Agriculture Spraying Equipment Market by Farm Size

- 14.4.5.1 Europe Medium Farms Market by Country

- 14.4.5.2 Europe Large Farms Market by Country

- 14.4.5.3 Europe Small Farms Market by Country

- 14.4.6 Europe Agriculture Spraying Equipment Market by Capacity

- 14.4.6.1 Europe High Volume Market by Country

- 14.4.6.2 Europe Low Volume Market by Country

- 14.4.6.3 Europe Ultra-Low Volume Market by Country

- 14.4.7 Europe Agriculture Spraying Equipment Market by Type

- 14.4.7.1 Europe Self-propelled Market by Country

- 14.4.7.2 Europe Tractor-mounted Market by Country

- 14.4.7.3 Europe Trailed Market by Country

- 14.4.7.4 Europe Aerial Market by Country

- 14.4.7.5 Europe Handheld Market by Country

- 14.4.8 Europe Agriculture Spraying Equipment Market by Country

- 14.4.8.1 Germany Agriculture Spraying Equipment Market

- 14.4.8.1.1 Germany Agriculture Spraying Equipment Market by Farm Size

- 14.4.8.1.2 Germany Agriculture Spraying Equipment Market by Capacity

- 14.4.8.1.3 Germany Agriculture Spraying Equipment Market by Type

- 14.4.8.2 France Agriculture Spraying Equipment Market

- 14.4.8.2.1 France Agriculture Spraying Equipment Market by Farm Size

- 14.4.8.2.2 France Agriculture Spraying Equipment Market by Capacity

- 14.4.8.2.3 France Agriculture Spraying Equipment Market by Type

- 14.4.8.3 UK Agriculture Spraying Equipment Market

- 14.4.8.3.1 UK Agriculture Spraying Equipment Market by Farm Size

- 14.4.8.3.2 UK Agriculture Spraying Equipment Market by Capacity

- 14.4.8.3.3 UK Agriculture Spraying Equipment Market by Type

- 14.4.8.4 Russia Agriculture Spraying Equipment Market

- 14.4.8.4.1 Russia Agriculture Spraying Equipment Market by Farm Size

- 14.4.8.4.2 Russia Agriculture Spraying Equipment Market by Capacity

- 14.4.8.4.3 Russia Agriculture Spraying Equipment Market by Type

- 14.4.8.5 Spain Agriculture Spraying Equipment Market

- 14.4.8.5.1 Spain Agriculture Spraying Equipment Market by Farm Size

- 14.4.8.5.2 Spain Agriculture Spraying Equipment Market by Capacity

- 14.4.8.5.3 Spain Agriculture Spraying Equipment Market by Type

- 14.4.8.6 Italy Agriculture Spraying Equipment Market

- 14.4.8.6.1 Italy Agriculture Spraying Equipment Market by Farm Size

- 14.4.8.6.2 Italy Agriculture Spraying Equipment Market by Capacity

- 14.4.8.6.3 Italy Agriculture Spraying Equipment Market by Type

- 14.4.8.7 Rest of Europe Agriculture Spraying Equipment Market

- 14.4.8.7.1 Rest of Europe Agriculture Spraying Equipment Market by Farm Size

- 14.4.8.7.2 Rest of Europe Agriculture Spraying Equipment Market by Capacity

- 14.4.8.7.3 Rest of Europe Agriculture Spraying Equipment Market by Type

- 14.4.8.1 Germany Agriculture Spraying Equipment Market

- 14.5 Asia Pacific Agriculture Spraying Equipment Market

- 14.6 Key Factors Impacting the Market

- 14.6.1 Market Drivers

- 14.6.2 Market

- 14.6.3 Restraints

- 14.6.4 Market Opportunities

- 14.6.5 Market Challenges

- 14.6.6 Asia Pacific Agriculture Spraying Equipment Market by Farm Size

- 14.6.6.1 Asia Pacific Medium Farms Market by Country

- 14.6.6.2 Asia Pacific Large Farms Market by Country

- 14.6.6.3 Asia Pacific Small Farms Market by Country

- 14.6.7 Asia Pacific Agriculture Spraying Equipment Market by Capacity

- 14.6.7.1 Asia Pacific High Volume Market by Country

- 14.6.7.2 Asia Pacific Low Volume Market by Country

- 14.6.7.3 Asia Pacific Ultra-Low Volume Market by Country

- 14.6.8 Asia Pacific Agriculture Spraying Equipment Market by Type

- 14.6.8.1 Asia Pacific Self-propelled Market by Country

- 14.6.8.2 Asia Pacific Tractor-mounted Market by Country

- 14.6.8.3 Asia Pacific Trailed Market by Country

- 14.6.8.4 Asia Pacific Aerial Market by Country

- 14.6.8.5 Asia Pacific Handheld Market by Country

- 14.6.9 Asia Pacific Agriculture Spraying Equipment Market by Country

- 14.6.9.1 China Agriculture Spraying Equipment Market

- 14.6.9.1.1 China Agriculture Spraying Equipment Market by Farm Size

- 14.6.9.1.2 China Agriculture Spraying Equipment Market by Capacity

- 14.6.9.1.3 China Agriculture Spraying Equipment Market by Type

- 14.6.9.2 Japan Agriculture Spraying Equipment Market

- 14.6.9.2.1 Japan Agriculture Spraying Equipment Market by Farm Size

- 14.6.9.2.2 Japan Agriculture Spraying Equipment Market by Capacity

- 14.6.9.2.3 Japan Agriculture Spraying Equipment Market by Type

- 14.6.9.3 India Agriculture Spraying Equipment Market

- 14.6.9.3.1 India Agriculture Spraying Equipment Market by Farm Size