|

|

市場調査レポート

商品コード

1785253

ビデオ監視ストレージの世界市場規模、シェア、動向分析:ストレージ別、提供別、企業規模別、業種別、地域別、展望と予測、2025年~2032年Global Video Surveillance Storage Market Size, Share & Industry Analysis Report By Storage (Hard Disk Drive, and Solid State Drive ), By Offerings, By Enterprise Size, By Vertical, By Regional Outlook and Forecast, 2025 - 2032 |

||||||

|

|||||||

| ビデオ監視ストレージの世界市場規模、シェア、動向分析:ストレージ別、提供別、企業規模別、業種別、地域別、展望と予測、2025年~2032年 |

|

出版日: 2025年07月08日

発行: KBV Research

ページ情報: 英文 403 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ビデオ監視ストレージ市場規模は、2032年までに330億1,000万米ドルに達し、予測期間中にCAGRで11.9%の成長が予測されています。

ビデオ監視は、標準解像度(SD)から高解像度(HD)、4K、さらには8K解像度へと進化し、監視ユニット1台あたりで生成されるデータ量が大幅に増加しました。特に商業施設、都市部、そして重要インフラ環境において、最新のカメラは、マルチアングルカバレッジ、暗視機能、顔認識機能、動体検知機能といった機能を備えています。そのため、高解像度で機能豊富な監視カメラの普及は、この市場を牽引する根本的な要因であり、産業界は膨大かつ増大し続けるビデオデータに対応できる次世代ストレージインフラへの投資を迫られています。

さらに、スマートシティ開発への世界のシフトにより、ビデオ監視は都市の安全、交通管理、インフラ監視の最前線に躍り出ました。スマートシティは、公共サービスの効率的な管理のために相互接続されたセンサーとデバイスに依存しており、ビデオ監視はリアルタイムの状況認識、脅威検知、そして都市行政の実現において重要な役割を果たしています。そのため、スマートシティの台頭とインフラのデジタル化は、ビデオ監視ストレージの強力な推進力となり、データ量が多く相互接続された環境において、視覚情報をリアルタイムに保存、アクセス、分析するために必要な基盤を確保しています。

市場抑制要因

市場における最も大きな制約の一つは、高度なストレージインフラの導入、管理、維持に伴う初期費用および運用コストの高さです。高解像度化、継続的な録画、統合分析など、ビデオ監視がより高度化するにつれ、ストレージに対する需要は容量だけでなく複雑さも増大しています。そのため、高度なビデオ監視ストレージインフラの導入と維持に伴う高額なコストは、特に信頼性の高い長期的なストレージソリューションを求める中小企業にとって、市場拡大の大きな障壁となっています。

バリューチェーン分析

市場のバリューチェーンは、ストレージソリューションの効率的な開発、導入、運用に貢献する複数の重要な段階を網羅しています。まずハードウェア設計とコンポーネント製造から始まり、次にストレージ管理と分析を可能にするソフトウェア開発へと続きます。システム統合とネットワークアーキテクチャにより、監視デバイスとストレージシステム間のシームレスな接続が確保されます。業界標準を満たすために、厳格なテスト、品質保証、そして規制遵守が実施されます。そして、導入と現場での設置により、ソリューションは運用環境に導入されます。導入後は、生成される膨大な量のビデオデータを保護・処理するために、データ管理、暗号化、そしてセキュリティが不可欠となります。バリューチェーンは、システムの信頼性と継続的な改善を確保するための継続的なサポート、メンテナンス、そしてアップグレードサービスで締めくくられます。

市場シェア分析

COVID-19の影響分析

COVID-19パンデミックは、特に世界のロックダウンの初期段階において、市場に軽微なマイナスの影響を与えました。各国政府が移動制限を実施し、医療支出を優先したため、多くの商業施設やインフラ監視プロジェクトが遅延または一時停止されました。この減速により、特に小売、ホスピタリティ、運輸、建設といったセクターにおいて、監視システムと関連するストレージソリューションの需要が減少し、これらのセクターは最も大きな打撃を受けました。このように、COVID-19パンデミックは市場に軽微なマイナスの影響を与えました。

ストレージの展望

ストレージに基づいて、ビデオ監視ストレージ市場はハードディスクドライブ(HDD)とソリッドステートドライブ(SSD)に分類されます。ソリッドステートドライブ(SSD)セグメントは、2024年に市場の26%の収益シェアを獲得しました。ソリッドステートドライブ(SSD)セグメントは、市場におけるシェアは小さいもの、成長を続けています。SSDは、従来のHDDと比較して、データアクセス速度が速く、耐久性が高く、消費電力が低いことで知られています。

提供の展望

ビデオ監視ストレージ市場は、提供に基づき、ハードウェア、ソリューション、サービスに分類されます。ソリューションセグメントは、2024年にビデオ監視ストレージ市場における収益シェアの25%を記録しました。ソリューションセグメントには、監視データストレージの管理、最適化、セキュリティ保護を目的としたソフトウェアと統合プラットフォームが含まれます。これには、ビデオ管理システム(VMS)、データ圧縮ツール、ストレージ分析、クラウドストレージソリューションなどが含まれます。

企業規模の展望

企業規模別に見ると、ビデオ監視ストレージ市場は大企業と中小企業に分かれています。中小企業セグメントは、2024年のビデオ監視ストレージ市場において36%の収益シェアを獲得しました。中小企業セグメントも市場に大きく貢献しています。中小企業は、小売店、オフィス、製造拠点、公共施設などにおいて、セキュリティ、運用監視、コンプライアンス確保のためにビデオ監視ソリューションを導入するケースが増えています。

業種の展望

ビデオ監視ストレージ市場は、業種別に、商用、軍事・防衛、産業、公共安全、住宅、その他に分類されます。軍事・防衛セグメントは、2024年に市場収益の20%を占めました。軍事・防衛セグメントは、軍事基地、国境地帯、司令センターといった機密性の高い地域における高度なセキュリティ監視のニーズに支えられ、大きな市場シェアを占めています。これらのアプリケーションでは、リアルタイム監視と長期的なビデオ保存をサポートするために、高度なセキュリティと耐久性を備え、多くの場合ミッションクリティカルなストレージシステムが求められています。

地域の展望

地域別に見ると、ビデオ監視ストレージ市場は北米、欧州、アジア太平洋、LAMEAで分析されています。北米セグメントは、2024年に市場における収益シェアの36%を記録しました。北米セグメントは、商業、政府、住宅セクターにおける監視システムの広範な導入に牽引され、ビデオ監視ストレージ市場を独占しています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場要覧

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

第4章 競合分析:世界

- 市場シェア分析、2024年

- ポーターファイブフォース分析

第5章 ビデオ監視ストレージ市場のバリューチェーン分析

- ハードウェア設計とコンポーネント製造

- ソフトウェアおよびファームウェア開発

- システム統合とネットワークアーキテクチャ

- テスト、品質保証、コンプライアンス

- 展開と現場での設置

- データ管理、暗号化、セキュリティ

- 継続的なサポート、メンテナンス、アップグレードサービス

第6章 ビデオ監視ストレージ市場における主要な顧客基準

第7章 世界市場:ストレージ別

- 世界のハードディスクドライブ(HDD)市場:地域別

- 世界のソリッドステートドライブ(SSD)市場:地域別

第8章 世界市場:提供別

- 世界のハードウェア市場:地域別

- 世界のソリューション市場:地域別

- 世界のサービス市場:地域別

第9章 世界市場:企業規模別

- 世界の大企業市場:地域別

- 世界の中小企業市場:地域別

第10章 世界市場:業種別

- 世界の商業市場:地域別

- 世界の軍事・防衛市場:地域別

- 世界の産業市場:地域別

- 世界の公共安全市場:地域別

- 世界の住宅市場:地域別

- 世界その他市場:地域別

第11章 世界市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋地域

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第12章 企業プロファイル

- Cisco Systems, Inc

- Microsoft Corporation

- Intel Corporation

- Crowdstrike Holdings, Inc

- Trend Micro, Inc

- McAfee Corp

- Palo Alto Networks, Inc

- Western Digital Corporation

- Broadcom, Inc

- NetApp, Inc

- Seagate Technology LLC

第13章 ビデオ監視ストレージ市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 2 Global Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 3 Key Customer Criteria of Video Surveillance Storage Market

- TABLE 4 Global Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 5 Global Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 6 Global Hard Disk Drive (HDD) Market by Region, 2021 - 2024, USD Million

- TABLE 7 Global Hard Disk Drive (HDD) Market by Region, 2025 - 2032, USD Million

- TABLE 8 Global Solid State Drive (SSD) Market by Region, 2021 - 2024, USD Million

- TABLE 9 Global Solid State Drive (SSD) Market by Region, 2025 - 2032, USD Million

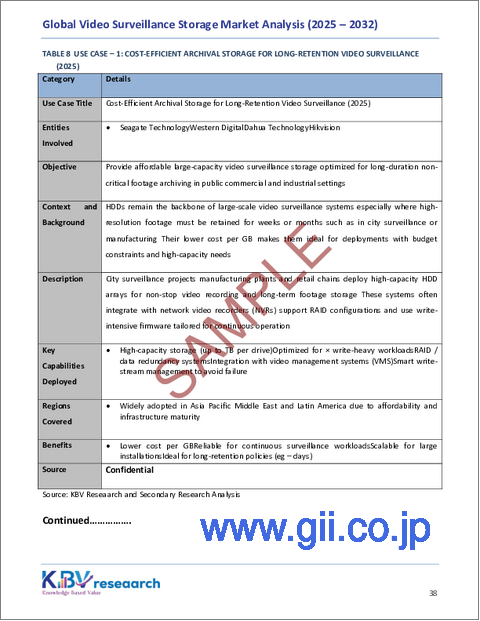

- TABLE 10 Use Case - 1: Cost-Efficient Archival Storage for Long-Retention Video Surveillance (2025)

- TABLE 11 Use Case - 2: High-Speed Edge Video Processing and Real-Time Surveillance Analytics with SSD (2025)

- TABLE 12 Global Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 13 Global Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 14 Global Hardware Market by Region, 2021 - 2024, USD Million

- TABLE 15 Global Hardware Market by Region, 2025 - 2032, USD Million

- TABLE 16 Global Solution Market by Region, 2021 - 2024, USD Million

- TABLE 17 Global Solution Market by Region, 2025 - 2032, USD Million

- TABLE 18 Global Services Market by Region, 2021 - 2024, USD Million

- TABLE 19 Global Services Market by Region, 2025 - 2032, USD Million

- TABLE 20 Use Case - 1: High-Capacity and Durable Storage Hardware for Enterprise Surveillance Systems (2025)

- TABLE 21 Use Case - 2: Intelligent Storage Management and Video Analytics Integration Solutions (2025)

- TABLE 22 Use Case - 3: End-to-End Video Surveillance Storage Deployment, Maintenance, and Cloud Backup Services (2025)

- TABLE 23 Global Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 24 Global Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 25 Global Large Enterprises Market by Region, 2021 - 2024, USD Million

- TABLE 26 Global Large Enterprises Market by Region, 2025 - 2032, USD Million

- TABLE 27 Global Small & Medium size Market by Region, 2021 - 2024, USD Million

- TABLE 28 Global Small & Medium size Market by Region, 2025 - 2032, USD Million

- TABLE 29 Use Case - 1: Scalable, High-Capacity Surveillance Storage for Enterprise-Grade Security (2025)

- TABLE 30 Use Case - 2: Affordable and Scalable Surveillance Storage Solutions for SMEs (2025)

- TABLE 31 Global Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 32 Global Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 33 Global Commercial Market by Region, 2021 - 2024, USD Million

- TABLE 34 Global Commercial Market by Region, 2025 - 2032, USD Million

- TABLE 35 Global Military & Defence Market by Region, 2021 - 2024, USD Million

- TABLE 36 Global Military & Defence Market by Region, 2025 - 2032, USD Million

- TABLE 37 Global Industrial Market by Region, 2021 - 2024, USD Million

- TABLE 38 Global Industrial Market by Region, 2025 - 2032, USD Million

- TABLE 39 Global Public Safety Market by Region, 2021 - 2024, USD Million

- TABLE 40 Global Public Safety Market by Region, 2025 - 2032, USD Million

- TABLE 41 Global Residential Market by Region, 2021 - 2024, USD Million

- TABLE 42 Global Residential Market by Region, 2025 - 2032, USD Million

- TABLE 43 Global Other Vertical Market by Region, 2021 - 2024, USD Million

- TABLE 44 Global Other Vertical Market by Region, 2025 - 2032, USD Million

- TABLE 45 Global Video Surveillance Storage Market by Region, 2021 - 2024, USD Million

- TABLE 46 Global Video Surveillance Storage Market by Region, 2025 - 2032, USD Million

- TABLE 47 North America Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 48 North America Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 49 North America Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 50 North America Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 51 North America Hard Disk Drive (HDD) Market by Country, 2021 - 2024, USD Million

- TABLE 52 North America Hard Disk Drive (HDD) Market by Country, 2025 - 2032, USD Million

- TABLE 53 North America Solid State Drive (SSD) Market by Country, 2021 - 2024, USD Million

- TABLE 54 North America Solid State Drive (SSD) Market by Country, 2025 - 2032, USD Million

- TABLE 55 North America Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 56 North America Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 57 North America Hardware Market by Country, 2021 - 2024, USD Million

- TABLE 58 North America Hardware Market by Country, 2025 - 2032, USD Million

- TABLE 59 North America Solution Market by Country, 2021 - 2024, USD Million

- TABLE 60 North America Solution Market by Country, 2025 - 2032, USD Million

- TABLE 61 North America Services Market by Country, 2021 - 2024, USD Million

- TABLE 62 North America Services Market by Country, 2025 - 2032, USD Million

- TABLE 63 North America Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 64 North America Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 65 North America Large Enterprises Market by Country, 2021 - 2024, USD Million

- TABLE 66 North America Large Enterprises Market by Country, 2025 - 2032, USD Million

- TABLE 67 North America Small & Medium size Market by Country, 2021 - 2024, USD Million

- TABLE 68 North America Small & Medium size Market by Country, 2025 - 2032, USD Million

- TABLE 69 North America Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 70 North America Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 71 North America Commercial Market by Country, 2021 - 2024, USD Million

- TABLE 72 North America Commercial Market by Country, 2025 - 2032, USD Million

- TABLE 73 North America Military & Defence Market by Country, 2021 - 2024, USD Million

- TABLE 74 North America Military & Defence Market by Country, 2025 - 2032, USD Million

- TABLE 75 North America Industrial Market by Country, 2021 - 2024, USD Million

- TABLE 76 North America Industrial Market by Country, 2025 - 2032, USD Million

- TABLE 77 North America Public Safety Market by Country, 2021 - 2024, USD Million

- TABLE 78 North America Public Safety Market by Country, 2025 - 2032, USD Million

- TABLE 79 North America Residential Market by Country, 2021 - 2024, USD Million

- TABLE 80 North America Residential Market by Country, 2025 - 2032, USD Million

- TABLE 81 North America Other Vertical Market by Country, 2021 - 2024, USD Million

- TABLE 82 North America Other Vertical Market by Country, 2025 - 2032, USD Million

- TABLE 83 North America Video Surveillance Storage Market by Country, 2021 - 2024, USD Million

- TABLE 84 North America Video Surveillance Storage Market by Country, 2025 - 2032, USD Million

- TABLE 85 US Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 86 US Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 87 US Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 88 US Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 89 US Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 90 US Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 91 US Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 92 US Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 93 US Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 94 US Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 95 Canada Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 96 Canada Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 97 Canada Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 98 Canada Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 99 Canada Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 100 Canada Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 101 Canada Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 102 Canada Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 103 Canada Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 104 Canada Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 105 Mexico Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 106 Mexico Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 107 Mexico Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 108 Mexico Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 109 Mexico Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 110 Mexico Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 111 Mexico Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 112 Mexico Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 113 Mexico Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 114 Mexico Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 115 Rest of North America Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 116 Rest of North America Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 117 Rest of North America Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 118 Rest of North America Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 119 Rest of North America Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 120 Rest of North America Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 121 Rest of North America Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 122 Rest of North America Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 123 Rest of North America Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 124 Rest of North America Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 125 Europe Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 126 Europe Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 127 Europe Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 128 Europe Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 129 Europe Hard Disk Drive (HDD) Market by Country, 2021 - 2024, USD Million

- TABLE 130 Europe Hard Disk Drive (HDD) Market by Country, 2025 - 2032, USD Million

- TABLE 131 Europe Solid State Drive (SSD) Market by Country, 2021 - 2024, USD Million

- TABLE 132 Europe Solid State Drive (SSD) Market by Country, 2025 - 2032, USD Million

- TABLE 133 Europe Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 134 Europe Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 135 Europe Hardware Market by Country, 2021 - 2024, USD Million

- TABLE 136 Europe Hardware Market by Country, 2025 - 2032, USD Million

- TABLE 137 Europe Solution Market by Country, 2021 - 2024, USD Million

- TABLE 138 Europe Solution Market by Country, 2025 - 2032, USD Million

- TABLE 139 Europe Services Market by Country, 2021 - 2024, USD Million

- TABLE 140 Europe Services Market by Country, 2025 - 2032, USD Million

- TABLE 141 Europe Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 142 Europe Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 143 Europe Large Enterprises Market by Country, 2021 - 2024, USD Million

- TABLE 144 Europe Large Enterprises Market by Country, 2025 - 2032, USD Million

- TABLE 145 Europe Small & Medium size Market by Country, 2021 - 2024, USD Million

- TABLE 146 Europe Small & Medium size Market by Country, 2025 - 2032, USD Million

- TABLE 147 Europe Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 148 Europe Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 149 Europe Commercial Market by Country, 2021 - 2024, USD Million

- TABLE 150 Europe Commercial Market by Country, 2025 - 2032, USD Million

- TABLE 151 Europe Military & Defence Market by Country, 2021 - 2024, USD Million

- TABLE 152 Europe Military & Defence Market by Country, 2025 - 2032, USD Million

- TABLE 153 Europe Industrial Market by Country, 2021 - 2024, USD Million

- TABLE 154 Europe Industrial Market by Country, 2025 - 2032, USD Million

- TABLE 155 Europe Public Safety Market by Country, 2021 - 2024, USD Million

- TABLE 156 Europe Public Safety Market by Country, 2025 - 2032, USD Million

- TABLE 157 Europe Residential Market by Country, 2021 - 2024, USD Million

- TABLE 158 Europe Residential Market by Country, 2025 - 2032, USD Million

- TABLE 159 Europe Other Vertical Market by Country, 2021 - 2024, USD Million

- TABLE 160 Europe Other Vertical Market by Country, 2025 - 2032, USD Million

- TABLE 161 Europe Video Surveillance Storage Market by Country, 2021 - 2024, USD Million

- TABLE 162 Europe Video Surveillance Storage Market by Country, 2025 - 2032, USD Million

- TABLE 163 Germany Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 164 Germany Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 165 Germany Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 166 Germany Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 167 Germany Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 168 Germany Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 169 Germany Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 170 Germany Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 171 Germany Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 172 Germany Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 173 UK Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 174 UK Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 175 UK Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 176 UK Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 177 UK Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 178 UK Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 179 UK Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 180 UK Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 181 UK Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 182 UK Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 183 France Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 184 France Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 185 France Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 186 France Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 187 France Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 188 France Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 189 France Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 190 France Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 191 France Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 192 France Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 193 Russia Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 194 Russia Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 195 Russia Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 196 Russia Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 197 Russia Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 198 Russia Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 199 Russia Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 200 Russia Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 201 Russia Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 202 Russia Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 203 Spain Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 204 Spain Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 205 Spain Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 206 Spain Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 207 Spain Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 208 Spain Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 209 Spain Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 210 Spain Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 211 Spain Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 212 Spain Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 213 Italy Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 214 Italy Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 215 Italy Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 216 Italy Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 217 Italy Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 218 Italy Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 219 Italy Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 220 Italy Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 221 Italy Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 222 Italy Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 223 Rest of Europe Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 224 Rest of Europe Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 225 Rest of Europe Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 226 Rest of Europe Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 227 Rest of Europe Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 228 Rest of Europe Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 229 Rest of Europe Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 230 Rest of Europe Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 231 Rest of Europe Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 232 Rest of Europe Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 233 Asia Pacific Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 234 Asia Pacific Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 235 Asia Pacific Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 236 Asia Pacific Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 237 Asia Pacific Hard Disk Drive (HDD) Market by Country, 2021 - 2024, USD Million

- TABLE 238 Asia Pacific Hard Disk Drive (HDD) Market by Country, 2025 - 2032, USD Million

- TABLE 239 Asia Pacific Solid State Drive (SSD) Market by Country, 2021 - 2024, USD Million

- TABLE 240 Asia Pacific Solid State Drive (SSD) Market by Country, 2025 - 2032, USD Million

- TABLE 241 Asia Pacific Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 242 Asia Pacific Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 243 Asia Pacific Hardware Market by Country, 2021 - 2024, USD Million

- TABLE 244 Asia Pacific Hardware Market by Country, 2025 - 2032, USD Million

- TABLE 245 Asia Pacific Solution Market by Country, 2021 - 2024, USD Million

- TABLE 246 Asia Pacific Solution Market by Country, 2025 - 2032, USD Million

- TABLE 247 Asia Pacific Services Market by Country, 2021 - 2024, USD Million

- TABLE 248 Asia Pacific Services Market by Country, 2025 - 2032, USD Million

- TABLE 249 Asia Pacific Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 250 Asia Pacific Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 251 Asia Pacific Large Enterprises Market by Country, 2021 - 2024, USD Million

- TABLE 252 Asia Pacific Large Enterprises Market by Country, 2025 - 2032, USD Million

- TABLE 253 Asia Pacific Small & Medium size Market by Country, 2021 - 2024, USD Million

- TABLE 254 Asia Pacific Small & Medium size Market by Country, 2025 - 2032, USD Million

- TABLE 255 Asia Pacific Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 256 Asia Pacific Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 257 Asia Pacific Commercial Market by Country, 2021 - 2024, USD Million

- TABLE 258 Asia Pacific Commercial Market by Country, 2025 - 2032, USD Million

- TABLE 259 Asia Pacific Military & Defence Market by Country, 2021 - 2024, USD Million

- TABLE 260 Asia Pacific Military & Defence Market by Country, 2025 - 2032, USD Million

- TABLE 261 Asia Pacific Industrial Market by Country, 2021 - 2024, USD Million

- TABLE 262 Asia Pacific Industrial Market by Country, 2025 - 2032, USD Million

- TABLE 263 Asia Pacific Public Safety Market by Country, 2021 - 2024, USD Million

- TABLE 264 Asia Pacific Public Safety Market by Country, 2025 - 2032, USD Million

- TABLE 265 Asia Pacific Residential Market by Country, 2021 - 2024, USD Million

- TABLE 266 Asia Pacific Residential Market by Country, 2025 - 2032, USD Million

- TABLE 267 Asia Pacific Other Vertical Market by Country, 2021 - 2024, USD Million

- TABLE 268 Asia Pacific Other Vertical Market by Country, 2025 - 2032, USD Million

- TABLE 269 Asia Pacific Video Surveillance Storage Market by Country, 2021 - 2024, USD Million

- TABLE 270 Asia Pacific Video Surveillance Storage Market by Country, 2025 - 2032, USD Million

- TABLE 271 China Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 272 China Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 273 China Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 274 China Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 275 China Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 276 China Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 277 China Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 278 China Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 279 China Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 280 China Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 281 Japan Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 282 Japan Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 283 Japan Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 284 Japan Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 285 Japan Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 286 Japan Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 287 Japan Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 288 Japan Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 289 Japan Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 290 Japan Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 291 India Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 292 India Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 293 India Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 294 India Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 295 India Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 296 India Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 297 India Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 298 India Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 299 India Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 300 India Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 301 South Korea Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 302 South Korea Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 303 South Korea Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 304 South Korea Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 305 South Korea Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 306 South Korea Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 307 South Korea Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 308 South Korea Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 309 South Korea Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 310 South Korea Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 311 Singapore Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 312 Singapore Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 313 Singapore Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 314 Singapore Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 315 Singapore Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 316 Singapore Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 317 Singapore Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 318 Singapore Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 319 Singapore Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 320 Singapore Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 321 Malaysia Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 322 Malaysia Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 323 Malaysia Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 324 Malaysia Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 325 Malaysia Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 326 Malaysia Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 327 Malaysia Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 328 Malaysia Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 329 Malaysia Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 330 Malaysia Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 331 Rest of Asia Pacific Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 332 Rest of Asia Pacific Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 333 Rest of Asia Pacific Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 334 Rest of Asia Pacific Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 335 Rest of Asia Pacific Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 336 Rest of Asia Pacific Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 337 Rest of Asia Pacific Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 338 Rest of Asia Pacific Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 339 Rest of Asia Pacific Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 340 Rest of Asia Pacific Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 341 LAMEA Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 342 LAMEA Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 343 LAMEA Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 344 LAMEA Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 345 LAMEA Hard Disk Drive (HDD) Market by Country, 2021 - 2024, USD Million

- TABLE 346 LAMEA Hard Disk Drive (HDD) Market by Country, 2025 - 2032, USD Million

- TABLE 347 LAMEA Solid State Drive (SSD) Market by Country, 2021 - 2024, USD Million

- TABLE 348 LAMEA Solid State Drive (SSD) Market by Country, 2025 - 2032, USD Million

- TABLE 349 LAMEA Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 350 LAMEA Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 351 LAMEA Hardware Market by Country, 2021 - 2024, USD Million

- TABLE 352 LAMEA Hardware Market by Country, 2025 - 2032, USD Million

- TABLE 353 LAMEA Solution Market by Country, 2021 - 2024, USD Million

- TABLE 354 LAMEA Solution Market by Country, 2025 - 2032, USD Million

- TABLE 355 LAMEA Services Market by Country, 2021 - 2024, USD Million

- TABLE 356 LAMEA Services Market by Country, 2025 - 2032, USD Million

- TABLE 357 LAMEA Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 358 LAMEA Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 359 LAMEA Large Enterprises Market by Country, 2021 - 2024, USD Million

- TABLE 360 LAMEA Large Enterprises Market by Country, 2025 - 2032, USD Million

- TABLE 361 LAMEA Small & Medium size Market by Country, 2021 - 2024, USD Million

- TABLE 362 LAMEA Small & Medium size Market by Country, 2025 - 2032, USD Million

- TABLE 363 LAMEA Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 364 LAMEA Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 365 LAMEA Commercial Market by Country, 2021 - 2024, USD Million

- TABLE 366 LAMEA Commercial Market by Country, 2025 - 2032, USD Million

- TABLE 367 LAMEA Military & Defence Market by Country, 2021 - 2024, USD Million

- TABLE 368 LAMEA Military & Defence Market by Country, 2025 - 2032, USD Million

- TABLE 369 LAMEA Industrial Market by Country, 2021 - 2024, USD Million

- TABLE 370 LAMEA Industrial Market by Country, 2025 - 2032, USD Million

- TABLE 371 LAMEA Public Safety Market by Country, 2021 - 2024, USD Million

- TABLE 372 LAMEA Public Safety Market by Country, 2025 - 2032, USD Million

- TABLE 373 LAMEA Residential Market by Country, 2021 - 2024, USD Million

- TABLE 374 LAMEA Residential Market by Country, 2025 - 2032, USD Million

- TABLE 375 LAMEA Other Vertical Market by Country, 2021 - 2024, USD Million

- TABLE 376 LAMEA Other Vertical Market by Country, 2025 - 2032, USD Million

- TABLE 377 LAMEA Video Surveillance Storage Market by Country, 2021 - 2024, USD Million

- TABLE 378 LAMEA Video Surveillance Storage Market by Country, 2025 - 2032, USD Million

- TABLE 379 Brazil Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 380 Brazil Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 381 Brazil Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 382 Brazil Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 383 Brazil Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 384 Brazil Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 385 Brazil Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 386 Brazil Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 387 Brazil Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 388 Brazil Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 389 Argentina Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 390 Argentina Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 391 Argentina Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 392 Argentina Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 393 Argentina Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 394 Argentina Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 395 Argentina Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 396 Argentina Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 397 Argentina Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 398 Argentina Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 399 UAE Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 400 UAE Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 401 UAE Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 402 UAE Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 403 UAE Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 404 UAE Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 405 UAE Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 406 UAE Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 407 UAE Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 408 UAE Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 409 Saudi Arabia Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 410 Saudi Arabia Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 411 Saudi Arabia Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 412 Saudi Arabia Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 413 Saudi Arabia Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 414 Saudi Arabia Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 415 Saudi Arabia Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 416 Saudi Arabia Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 417 Saudi Arabia Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 418 Saudi Arabia Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 419 South Africa Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 420 South Africa Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 421 South Africa Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 422 South Africa Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 423 South Africa Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 424 South Africa Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 425 South Africa Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 426 South Africa Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 427 South Africa Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 428 South Africa Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 429 Nigeria Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 430 Nigeria Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 431 Nigeria Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 432 Nigeria Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 433 Nigeria Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 434 Nigeria Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 435 Nigeria Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 436 Nigeria Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 437 Nigeria Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 438 Nigeria Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 439 Rest of LAMEA Video Surveillance Storage Market, 2021 - 2024, USD Million

- TABLE 440 Rest of LAMEA Video Surveillance Storage Market, 2025 - 2032, USD Million

- TABLE 441 Rest of LAMEA Video Surveillance Storage Market by Storage, 2021 - 2024, USD Million

- TABLE 442 Rest of LAMEA Video Surveillance Storage Market by Storage, 2025 - 2032, USD Million

- TABLE 443 Rest of LAMEA Video Surveillance Storage Market by Offerings, 2021 - 2024, USD Million

- TABLE 444 Rest of LAMEA Video Surveillance Storage Market by Offerings, 2025 - 2032, USD Million

- TABLE 445 Rest of LAMEA Video Surveillance Storage Market by Enterprise Size, 2021 - 2024, USD Million

- TABLE 446 Rest of LAMEA Video Surveillance Storage Market by Enterprise Size, 2025 - 2032, USD Million

- TABLE 447 Rest of LAMEA Video Surveillance Storage Market by Vertical, 2021 - 2024, USD Million

- TABLE 448 Rest of LAMEA Video Surveillance Storage Market by Vertical, 2025 - 2032, USD Million

- TABLE 449 Key Information - Cisco Systems, Inc.

- TABLE 450 Key Information - Microsoft Corporation

- TABLE 451 Key Information - Intel Corporation

- TABLE 452 Key Information - Crowdstrike Holdings, Inc.

- TABLE 453 Key Information - Trend Micro, Inc.

- TABLE 454 Key Information - McAfee Corp.

- TABLE 455 Key Information - Palo Alto Networks, Inc.

- TABLE 456 Key Information - Western Digital Corporation

- TABLE 457 Key Information - Broadcom, Inc.

- TABLE 458 Key Information - NetApp, Inc.

- TABLE 459 Key Information - Seagate Technology LLC

LIST OF FIGURES

- FIG 1 Methodology for the research

- FIG 2 Global Video Surveillance Storage Market, 2021 - 2032, USD Million

- FIG 3 Key Factors Impacting Video Surveillance Storage Market

- FIG 4 Market Share Analysis, 2024

- FIG 5 Porter's Five Forces Analysis - Video Surveillance Storage Market

- FIG 6 Value Chain Analysis of Video Surveillance Storage Market

- FIG 7 Key Customer Criteria of Video Surveillance Storage Market

- FIG 8 Global Video Surveillance Storage Market share by Storage, 2024

- FIG 9 Global Video Surveillance Storage Market share by Storage, 2032

- FIG 10 Global Video Surveillance Storage Market by Storage, 2021 - 2032, USD Million

- FIG 11 Global Video Surveillance Storage Market share by Offerings, 2024

- FIG 12 Global Video Surveillance Storage Market share by Offerings, 2032

- FIG 13 Global Video Surveillance Storage Market by Offerings, 2021 - 2032, USD Million

- FIG 14 Global Video Surveillance Storage Market share by Enterprise Size, 2024

- FIG 15 Global Video Surveillance Storage Market share by Enterprise Size, 2032

- FIG 16 Global Video Surveillance Storage Market by Enterprise Size, 2021 - 2032, USD Million

- FIG 17 Global Video Surveillance Storage Market share by Vertical, 2024

- FIG 18 Global Video Surveillance Storage Market share by Vertical, 2032

- FIG 19 Global Video Surveillance Storage Market by Vertical, 2021 - 2032, USD Million

- FIG 20 Global Video Surveillance Storage Market share by Region, 2024

- FIG 21 Global Video Surveillance Storage Market share by Region, 2032

- FIG 22 Global Video Surveillance Storage by Region, 2021 - 2032, USD Million

- FIG 23 North America Video Surveillance Storage Market, 2021 - 2032, USD Million

- FIG 24 North America Video Surveillance Storage Market share by Storage, 2024

- FIG 25 North America Video Surveillance Storage Market share by Storage, 2032

- FIG 26 North America Video Surveillance Storage Market by Storage, 2021 - 2032, USD Million

- FIG 27 North America Video Surveillance Storage Market share by Offerings, 2024

- FIG 28 North America Video Surveillance Storage Market share by Offerings, 2032

- FIG 29 North America Video Surveillance Storage Market by Offerings, 2021 - 2032, USD Million

- FIG 30 North America Video Surveillance Storage Market share by Enterprise Size, 2024

- FIG 31 North America Video Surveillance Storage Market share by Enterprise Size, 2032

- FIG 32 North America Video Surveillance Storage Market by Enterprise Size, 2021 - 2032, USD Million

- FIG 33 North America Video Surveillance Storage Market share by Vertical, 2024

- FIG 34 North America Video Surveillance Storage Market share by Vertical, 2032

- FIG 35 North America Video Surveillance Storage Market by Vertical, 2021 - 2032, USD Million

- FIG 36 North America Video Surveillance Storage Market share by Country, 2024

- FIG 37 North America Video Surveillance Storage Market share by Country, 2032

- FIG 38 North America Video Surveillance Storage Market by Country, 2021 - 2032, USD Million

- FIG 39 Europe Video Surveillance Storage Market, 2021 - 2032, USD Million

- FIG 40 Europe Video Surveillance Storage Market share by Storage, 2024

- FIG 41 Europe Video Surveillance Storage Market share by Storage, 2032

- FIG 42 Europe Video Surveillance Storage Market by Storage, 2021 - 2032, USD Million

- FIG 43 Europe Video Surveillance Storage Market share by Offerings, 2024

- FIG 44 Europe Video Surveillance Storage Market share by Offerings, 2032

- FIG 45 Europe Video Surveillance Storage Market by Offerings, 2021 - 2032, USD Million

- FIG 46 Europe Video Surveillance Storage Market share by Enterprise Size, 2024

- FIG 47 Europe Video Surveillance Storage Market share by Enterprise Size, 2032

- FIG 48 Europe Video Surveillance Storage Market by Enterprise Size, 2021 - 2032, USD Million

- FIG 49 Europe Video Surveillance Storage Market share by Vertical, 2024

- FIG 50 Europe Video Surveillance Storage Market share by Vertical, 2032

- FIG 51 Europe Video Surveillance Storage Market by Vertical, 2021 - 2032, USD Million

- FIG 52 Europe Video Surveillance Storage Market share by Country, 2024

- FIG 53 Europe Video Surveillance Storage Market share by Country, 2032

- FIG 54 Europe Video Surveillance Storage Market by Country, 2021 - 2032, USD Million

- FIG 55 Asia Pacific Video Surveillance Storage Market, 2021 - 2032, USD Million

- FIG 56 Asia Pacific Video Surveillance Storage Market share by Storage, 2024

- FIG 57 Asia Pacific Video Surveillance Storage Market share by Storage, 2032

- FIG 58 Asia Pacific Video Surveillance Storage Market by Storage, 2021 - 2032, USD Million

- FIG 59 Asia Pacific Video Surveillance Storage Market share by Offerings, 2024

- FIG 60 Asia Pacific Video Surveillance Storage Market share by Offerings, 2032

- FIG 61 Asia Pacific Video Surveillance Storage Market by Offerings, 2021 - 2032, USD Million

- FIG 62 Asia Pacific Video Surveillance Storage Market share by Enterprise Size, 2024

- FIG 63 Asia Pacific Video Surveillance Storage Market share by Enterprise Size, 2032

- FIG 64 Asia Pacific Video Surveillance Storage Market by Enterprise Size, 2021 - 2032, USD Million

- FIG 65 Asia Pacific Video Surveillance Storage Market share by Vertical, 2024

- FIG 66 Asia Pacific Video Surveillance Storage Market share by Vertical, 2032

- FIG 67 Asia Pacific Video Surveillance Storage Market by Vertical, 2021 - 2032, USD Million

- FIG 68 Asia Pacific Video Surveillance Storage Market share by Country, 2024

- FIG 69 Asia Pacific Video Surveillance Storage Market share by Country, 2032

- FIG 70 Asia Pacific Video Surveillance Storage Market by Country, 2021 - 2032, USD Million

- FIG 71 LAMEA Video Surveillance Storage Market, 2021 - 2032, USD Million

- FIG 72 LAMEA Video Surveillance Storage Market share by Storage, 2024

- FIG 73 LAMEA Video Surveillance Storage Market share by Storage, 2032

- FIG 74 LAMEA Video Surveillance Storage Market by Storage, 2021 - 2032, USD Million

- FIG 75 LAMEA Video Surveillance Storage Market share by Offerings, 2024

- FIG 76 LAMEA Video Surveillance Storage Market share by Offerings, 2032

- FIG 77 LAMEA Video Surveillance Storage Market by Offerings, 2021 - 2032, USD Million

- FIG 78 LAMEA Video Surveillance Storage Market share by Enterprise Size, 2024

- FIG 79 LAMEA Video Surveillance Storage Market share by Enterprise Size, 2032

- FIG 80 LAMEA Video Surveillance Storage Market by Enterprise Size, 2021 - 2032, USD Million

- FIG 81 LAMEA Video Surveillance Storage Market share by Vertical, 2024

- FIG 82 LAMEA Video Surveillance Storage Market share by Vertical, 2032

- FIG 83 LAMEA Video Surveillance Storage Market by Vertical, 2021 - 2032, USD Million

- FIG 84 LAMEA Video Surveillance Storage Market share by Country, 2024

- FIG 85 LAMEA Video Surveillance Storage Market share by Country, 2032

- FIG 86 LAMEA Video Surveillance Storage Market by Country, 2021 - 2032, USD Million

- FIG 87 SWOT Analysis: Cisco Systems, Inc.

- FIG 88 SWOT Analysis: Microsoft Corporation

- FIG 89 SWOT Analysis: Intel corporation

- FIG 90 SWOT Analysis: CROWDSTRIKE HOLDINGS, INC.

- FIG 91 SWOT Analysis: Trend Micro Inc.

- FIG 92 SWOT Analysis: McAfee Corp.

- FIG 93 SWOT Analysis: PALO ALTO NETWORKS, INC.

- FIG 94 SWOT Analysis: WESTERN DIGITAL CORPORATION

- FIG 95 SWOT Analysis: Broadcom, Inc.

- FIG 96 SWOT Analysis: NetApp, Inc.

- FIG 97 SWOT Analysis: SEAGATE TECHNOLOGY LLC

The Global Video Surveillance Storage Market size is expected to reach $33.01 billion by 2032, rising at a market growth of 11.9% CAGR during the forecast period.

Their ability to store high volumes of footage from multiple cameras at a relatively low cost per gigabyte makes them a preferred choice for government facilities, transportation networks, commercial establishments, and critical infrastructure installations. HDDs are also favoured in applications where continuous recording and archival of standard- to high-definition video is essential.

Market Growth Factors

The evolution from standard definition (SD) to high-definition (HD), 4K, and even 8K resolution in video surveillance has significantly increased the amount of data generated per surveillance unit. Modern cameras, especially in commercial, urban, and critical infrastructure environments, now offer features like multi-angle coverage, night vision, facial recognition compatibility, and motion detection. Thus, the widespread deployment of high-resolution and feature-rich surveillance cameras is a foundational driver of this market, compelling industries to invest in next-generation storage infrastructure that can handle the massive and growing load of video data.

Additionally, the global shift toward smart city development has propelled video surveillance into the forefront of urban safety, traffic management, and infrastructure monitoring. Smart cities rely on interconnected sensors and devices to manage public services more efficiently, and video surveillance plays a critical role in enabling real-time situational awareness, threat detection, and civic administration. Therefore, the rise of smart cities and infrastructure digitization has become a powerful catalyst for video surveillance storage, ensuring that data-rich, interconnected environments have the backbone they need to store, access, and analyze visual intelligence in real time.

Market Restraining Factors

One of the most significant restraints in the market is the high upfront and ongoing cost associated with deploying, managing, and maintaining advanced storage infrastructure. As video surveillance becomes more sophisticated-through higher resolution, continuous recording, and integrated analytics-the demand for storage not only increases in volume but also in complexity. Therefore, the high costs associated with deploying and maintaining advanced video surveillance storage infrastructure remain a formidable barrier to market expansion, especially for small and mid-sized entities seeking reliable, long-term storage solutions.

Value Chain Analysis

The value chain of the market encompasses several critical stages that contribute to the efficient development, deployment, and operation of storage solutions. It begins with hardware design and component manufacturing, followed by software development that enables storage management and analytics. System integration and network architecture ensure seamless connectivity between surveillance devices and storage systems. Rigorous testing, quality assurance, and regulatory compliance are carried out to meet industry standards. Deployment and field installation bring the solutions into operational environments. Once installed, data management, encryption, and security become essential to protect and handle the vast amounts of video data generated. The chain concludes with ongoing support, maintenance, and upgrade services to ensure system reliability and continuous improvement.

Market Share Analysis

COVID 19 Impact Analysis

The COVID-19 pandemic exerted a mild negative impact on the market, particularly during the early phases of the global lockdowns. As governments enforced mobility restrictions and prioritized healthcare spending, numerous commercial and infrastructure surveillance projects were delayed or temporarily suspended. This slowdown reduced the demand for surveillance systems and associated storage solutions, particularly in sectors like retail, hospitality, transportation, and construction, which were among the hardest hits. Thus, the COVID-19 pandemic had mild negative impact on the market.

Storage Outlook

Based on storage, the video surveillance storage market is characterized into hard disk drive (HDD) and solid state drive (SSD). The solid state drive (SSD) segment procured 26% revenue share in the market in 2024. The solid state drive (SSD) segment represents a smaller but growing portion of the market. SSDs are known for their faster data access speeds, higher durability, and lower power consumption compared to traditional HDDs.

Offerings Outlook

On the basis of offerings, the video surveillance storage market is classified into hardware, solution, and services. The solution segment recorded 25% revenue share in the video surveillance storage market in 2024. The solution segment encompasses software and integrated platforms designed to manage, optimize, and secure surveillance data storage. This includes video management systems (VMS), data compression tools, storage analytics, and cloud storage solutions.

Enterprise Size Outlook

By enterprise size, the video surveillance storage market is divided into large enterprises and small & medium size. The small & medium size segment garnered 36% revenue share in the video surveillance storage market in 2024. The small and medium-sized enterprises (SMEs) segment also contributes significantly to the market. SMEs are increasingly adopting video surveillance solutions for security, operational monitoring, and compliance purposes across retail outlets, offices, manufacturing units, and public venues.

Vertical Outlook

Based on vertical, the video surveillance storage market is segmented into commercial, military & defence, industrial, public safety, residential, and others. The military & defence segment acquired 20% revenue share in the market in 2024. The military and defence segment holds a significant share of the market, driven by the need for high-security surveillance in sensitive areas such as military bases, border zones, and command centers. These applications demand highly secure, durable, and often mission-critical storage systems to support real-time monitoring and long-term video retention.

Regional Outlook

Region-wise, the video surveillance storage market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 36% revenue share in the market in 2024. The North America segment dominates the video surveillance storage market, driven by the widespread deployment of surveillance systems across commercial, government, and residential sectors.

List of Key Companies Profiled

- Cisco Systems, Inc.

- Microsoft Corporation

- Intel Corporation

- CrowdStrike Holdings, Inc.

- Trend Micro, Inc.

- McAfee Corp.

- Palo Alto Networks, Inc.

- Western Digital Corporation

- Broadcom, Inc.

- NetApp, Inc.

- Seagate Technology LLC

Global Video Surveillance Storage Market Report Segmentation

By Storage

- Hard Disk Drive (HDD)

- Solid State Drive (SSD)

By Offerings

- Hardware

- Solution

- Services

By Enterprise Size

- Large Enterprises

- Small & Medium size

By Vertical

- Commercial

- Military & Defence

- Industrial

- Public Safety

- Residential

- Other Vertical

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Video Surveillance Storage Market, by Storage

- 1.4.2 Global Video Surveillance Storage Market, by Offerings

- 1.4.3 Global Video Surveillance Storage Market, by Enterprise Size

- 1.4.4 Global Video Surveillance Storage Market, by Vertical

- 1.4.5 Global Video Surveillance Storage Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.2.3 Market Opportunities

- 3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

- 4.1 Market Share Analysis, 2024

- 4.2 Porter Five Forces Analysis

Chapter 5. Value Chain Analysis of Video Surveillance Storage Market

- 5.1 Hardware Design and Component Manufacturing

- 5.2 Software and Firmware Development

- 5.3 System Integration and Network Architecture

- 5.4 Testing, Quality Assurance, and Compliance

- 5.5 Deployment and Field Installation

- 5.6 Data Management, Encryption, and Security

- 5.7 Ongoing Support, Maintenance, and Upgrade Services

Chapter 6. Key Customer Criteria of Video Surveillance Storage Market

Chapter 7. Global Video Surveillance Storage Market by Storage

- 7.1 Global Hard Disk Drive (HDD) Market by Region

- 7.2 Global Solid State Drive (SSD) Market by Region

Chapter 8. Global Video Surveillance Storage Market by Offerings

- 8.1 Global Hardware Market by Region

- 8.2 Global Solution Market by Region

- 8.3 Global Services Market by Region

Chapter 9. Global Video Surveillance Storage Market by Enterprise Size

- 9.1 Global Large Enterprises Market by Region

- 9.2 Global Small & Medium size Market by Region

Chapter 10. Global Video Surveillance Storage Market by Vertical

- 10.1 Global Commercial Market by Region

- 10.2 Global Military & Defence Market by Region

- 10.3 Global Industrial Market by Region

- 10.4 Global Public Safety Market by Region

- 10.5 Global Residential Market by Region

- 10.6 Global Other Vertical Market by Region

Chapter 11. Global Video Surveillance Storage Market by Region

- 11.1 North America Video Surveillance Storage Market

- 11.1.1 North America Video Surveillance Storage Market by Storage

- 11.1.1.1 North America Hard Disk Drive (HDD) Market by Country

- 11.1.1.2 North America Solid State Drive (SSD) Market by Country

- 11.1.2 North America Video Surveillance Storage Market by Offerings

- 11.1.2.1 North America Hardware Market by Country

- 11.1.2.2 North America Solution Market by Country

- 11.1.2.3 North America Services Market by Country

- 11.1.3 North America Video Surveillance Storage Market by Enterprise Size

- 11.1.3.1 North America Large Enterprises Market by Country

- 11.1.3.2 North America Small & Medium size Market by Country

- 11.1.4 North America Video Surveillance Storage Market by Vertical

- 11.1.4.1 North America Commercial Market by Country

- 11.1.4.2 North America Military & Defence Market by Country

- 11.1.4.3 North America Industrial Market by Country

- 11.1.4.4 North America Public Safety Market by Country

- 11.1.4.5 North America Residential Market by Country

- 11.1.4.6 North America Other Vertical Market by Country

- 11.1.5 North America Video Surveillance Storage Market by Country

- 11.1.5.1 US Video Surveillance Storage Market

- 11.1.5.1.1 US Video Surveillance Storage Market by Storage

- 11.1.5.1.2 US Video Surveillance Storage Market by Offerings

- 11.1.5.1.3 US Video Surveillance Storage Market by Enterprise Size

- 11.1.5.1.4 US Video Surveillance Storage Market by Vertical

- 11.1.5.2 Canada Video Surveillance Storage Market

- 11.1.5.2.1 Canada Video Surveillance Storage Market by Storage

- 11.1.5.2.2 Canada Video Surveillance Storage Market by Offerings

- 11.1.5.2.3 Canada Video Surveillance Storage Market by Enterprise Size

- 11.1.5.2.4 Canada Video Surveillance Storage Market by Vertical

- 11.1.5.3 Mexico Video Surveillance Storage Market

- 11.1.5.3.1 Mexico Video Surveillance Storage Market by Storage

- 11.1.5.3.2 Mexico Video Surveillance Storage Market by Offerings

- 11.1.5.3.3 Mexico Video Surveillance Storage Market by Enterprise Size

- 11.1.5.3.4 Mexico Video Surveillance Storage Market by Vertical

- 11.1.5.4 Rest of North America Video Surveillance Storage Market

- 11.1.5.4.1 Rest of North America Video Surveillance Storage Market by Storage

- 11.1.5.4.2 Rest of North America Video Surveillance Storage Market by Offerings

- 11.1.5.4.3 Rest of North America Video Surveillance Storage Market by Enterprise Size

- 11.1.5.4.4 Rest of North America Video Surveillance Storage Market by Vertical

- 11.1.5.1 US Video Surveillance Storage Market

- 11.1.1 North America Video Surveillance Storage Market by Storage

- 11.2 Europe Video Surveillance Storage Market

- 11.2.1 Europe Video Surveillance Storage Market by Storage

- 11.2.1.1 Europe Hard Disk Drive (HDD) Market by Country

- 11.2.1.2 Europe Solid State Drive (SSD) Market by Country

- 11.2.2 Europe Video Surveillance Storage Market by Offerings

- 11.2.2.1 Europe Hardware Market by Country

- 11.2.2.2 Europe Solution Market by Country

- 11.2.2.3 Europe Services Market by Country

- 11.2.3 Europe Video Surveillance Storage Market by Enterprise Size

- 11.2.3.1 Europe Large Enterprises Market by Country

- 11.2.3.2 Europe Small & Medium size Market by Country

- 11.2.4 Europe Video Surveillance Storage Market by Vertical

- 11.2.4.1 Europe Commercial Market by Country

- 11.2.4.2 Europe Military & Defence Market by Country

- 11.2.4.3 Europe Industrial Market by Country

- 11.2.4.4 Europe Public Safety Market by Country

- 11.2.4.5 Europe Residential Market by Country

- 11.2.4.6 Europe Other Vertical Market by Country

- 11.2.5 Europe Video Surveillance Storage Market by Country

- 11.2.5.1 Germany Video Surveillance Storage Market

- 11.2.5.1.1 Germany Video Surveillance Storage Market by Storage

- 11.2.5.1.2 Germany Video Surveillance Storage Market by Offerings

- 11.2.5.1.3 Germany Video Surveillance Storage Market by Enterprise Size

- 11.2.5.1.4 Germany Video Surveillance Storage Market by Vertical

- 11.2.5.2 UK Video Surveillance Storage Market

- 11.2.5.2.1 UK Video Surveillance Storage Market by Storage

- 11.2.5.2.2 UK Video Surveillance Storage Market by Offerings

- 11.2.5.2.3 UK Video Surveillance Storage Market by Enterprise Size

- 11.2.5.2.4 UK Video Surveillance Storage Market by Vertical

- 11.2.5.3 France Video Surveillance Storage Market

- 11.2.5.3.1 France Video Surveillance Storage Market by Storage

- 11.2.5.3.2 France Video Surveillance Storage Market by Offerings

- 11.2.5.3.3 France Video Surveillance Storage Market by Enterprise Size

- 11.2.5.3.4 France Video Surveillance Storage Market by Vertical

- 11.2.5.4 Russia Video Surveillance Storage Market

- 11.2.5.4.1 Russia Video Surveillance Storage Market by Storage

- 11.2.5.4.2 Russia Video Surveillance Storage Market by Offerings

- 11.2.5.4.3 Russia Video Surveillance Storage Market by Enterprise Size

- 11.2.5.4.4 Russia Video Surveillance Storage Market by Vertical

- 11.2.5.5 Spain Video Surveillance Storage Market

- 11.2.5.5.1 Spain Video Surveillance Storage Market by Storage

- 11.2.5.5.2 Spain Video Surveillance Storage Market by Offerings

- 11.2.5.5.3 Spain Video Surveillance Storage Market by Enterprise Size

- 11.2.5.5.4 Spain Video Surveillance Storage Market by Vertical

- 11.2.5.6 Italy Video Surveillance Storage Market

- 11.2.5.6.1 Italy Video Surveillance Storage Market by Storage

- 11.2.5.6.2 Italy Video Surveillance Storage Market by Offerings

- 11.2.5.6.3 Italy Video Surveillance Storage Market by Enterprise Size

- 11.2.5.6.4 Italy Video Surveillance Storage Market by Vertical

- 11.2.5.7 Rest of Europe Video Surveillance Storage Market

- 11.2.5.7.1 Rest of Europe Video Surveillance Storage Market by Storage

- 11.2.5.7.2 Rest of Europe Video Surveillance Storage Market by Offerings

- 11.2.5.7.3 Rest of Europe Video Surveillance Storage Market by Enterprise Size

- 11.2.5.7.4 Rest of Europe Video Surveillance Storage Market by Vertical

- 11.2.5.1 Germany Video Surveillance Storage Market

- 11.2.1 Europe Video Surveillance Storage Market by Storage

- 11.3 Asia Pacific Video Surveillance Storage Market

- 11.3.1 Asia Pacific Video Surveillance Storage Market by Storage

- 11.3.1.1 Asia Pacific Hard Disk Drive (HDD) Market by Country

- 11.3.1.2 Asia Pacific Solid State Drive (SSD) Market by Country

- 11.3.2 Asia Pacific Video Surveillance Storage Market by Offerings

- 11.3.2.1 Asia Pacific Hardware Market by Country

- 11.3.2.2 Asia Pacific Solution Market by Country

- 11.3.2.3 Asia Pacific Services Market by Country

- 11.3.3 Asia Pacific Video Surveillance Storage Market by Enterprise Size

- 11.3.3.1 Asia Pacific Large Enterprises Market by Country

- 11.3.3.2 Asia Pacific Small & Medium size Market by Country

- 11.3.4 Asia Pacific Video Surveillance Storage Market by Vertical

- 11.3.4.1 Asia Pacific Commercial Market by Country

- 11.3.4.2 Asia Pacific Military & Defence Market by Country

- 11.3.4.3 Asia Pacific Industrial Market by Country

- 11.3.4.4 Asia Pacific Public Safety Market by Country

- 11.3.4.5 Asia Pacific Residential Market by Country

- 11.3.4.6 Asia Pacific Other Vertical Market by Country

- 11.3.5 Asia Pacific Video Surveillance Storage Market by Country

- 11.3.5.1 China Video Surveillance Storage Market

- 11.3.5.1.1 China Video Surveillance Storage Market by Storage

- 11.3.5.1.2 China Video Surveillance Storage Market by Offerings

- 11.3.5.1.3 China Video Surveillance Storage Market by Enterprise Size

- 11.3.5.1.4 China Video Surveillance Storage Market by Vertical

- 11.3.5.2 Japan Video Surveillance Storage Market

- 11.3.5.2.1 Japan Video Surveillance Storage Market by Storage

- 11.3.5.2.2 Japan Video Surveillance Storage Market by Offerings

- 11.3.5.2.3 Japan Video Surveillance Storage Market by Enterprise Size

- 11.3.5.2.4 Japan Video Surveillance Storage Market by Vertical

- 11.3.5.3 India Video Surveillance Storage Market

- 11.3.5.3.1 India Video Surveillance Storage Market by Storage

- 11.3.5.3.2 India Video Surveillance Storage Market by Offerings

- 11.3.5.3.3 India Video Surveillance Storage Market by Enterprise Size

- 11.3.5.3.4 India Video Surveillance Storage Market by Vertical

- 11.3.5.4 South Korea Video Surveillance Storage Market

- 11.3.5.4.1 South Korea Video Surveillance Storage Market by Storage

- 11.3.5.4.2 South Korea Video Surveillance Storage Market by Offerings

- 11.3.5.4.3 South Korea Video Surveillance Storage Market by Enterprise Size

- 11.3.5.4.4 South Korea Video Surveillance Storage Market by Vertical

- 11.3.5.5 Singapore Video Surveillance Storage Market

- 11.3.5.5.1 Singapore Video Surveillance Storage Market by Storage

- 11.3.5.5.2 Singapore Video Surveillance Storage Market by Offerings

- 11.3.5.5.3 Singapore Video Surveillance Storage Market by Enterprise Size

- 11.3.5.5.4 Singapore Video Surveillance Storage Market by Vertical

- 11.3.5.6 Malaysia Video Surveillance Storage Market

- 11.3.5.6.1 Malaysia Video Surveillance Storage Market by Storage

- 11.3.5.6.2 Malaysia Video Surveillance Storage Market by Offerings

- 11.3.5.6.3 Malaysia Video Surveillance Storage Market by Enterprise Size

- 11.3.5.6.4 Malaysia Video Surveillance Storage Market by Vertical

- 11.3.5.7 Rest of Asia Pacific Video Surveillance Storage Market

- 11.3.5.7.1 Rest of Asia Pacific Video Surveillance Storage Market by Storage

- 11.3.5.7.2 Rest of Asia Pacific Video Surveillance Storage Market by Offerings

- 11.3.5.7.3 Rest of Asia Pacific Video Surveillance Storage Market by Enterprise Size

- 11.3.5.7.4 Rest of Asia Pacific Video Surveillance Storage Market by Vertical

- 11.3.5.1 China Video Surveillance Storage Market

- 11.3.1 Asia Pacific Video Surveillance Storage Market by Storage

- 11.4 LAMEA Video Surveillance Storage Market

- 11.4.1 LAMEA Video Surveillance Storage Market by Storage

- 11.4.1.1 LAMEA Hard Disk Drive (HDD) Market by Country

- 11.4.1.2 LAMEA Solid State Drive (SSD) Market by Country

- 11.4.2 LAMEA Video Surveillance Storage Market by Offerings

- 11.4.2.1 LAMEA Hardware Market by Country

- 11.4.2.2 LAMEA Solution Market by Country

- 11.4.2.3 LAMEA Services Market by Country

- 11.4.3 LAMEA Video Surveillance Storage Market by Enterprise Size

- 11.4.3.1 LAMEA Large Enterprises Market by Country

- 11.4.3.2 LAMEA Small & Medium size Market by Country

- 11.4.4 LAMEA Video Surveillance Storage Market by Vertical

- 11.4.4.1 LAMEA Commercial Market by Country

- 11.4.4.2 LAMEA Military & Defence Market by Country

- 11.4.4.3 LAMEA Industrial Market by Country

- 11.4.4.4 LAMEA Public Safety Market by Country

- 11.4.4.5 LAMEA Residential Market by Country

- 11.4.4.6 LAMEA Other Vertical Market by Country

- 11.4.5 LAMEA Video Surveillance Storage Market by Country

- 11.4.5.1 Brazil Video Surveillance Storage Market

- 11.4.5.1.1 Brazil Video Surveillance Storage Market by Storage

- 11.4.5.1.2 Brazil Video Surveillance Storage Market by Offerings

- 11.4.5.1.3 Brazil Video Surveillance Storage Market by Enterprise Size

- 11.4.5.1.4 Brazil Video Surveillance Storage Market by Vertical

- 11.4.5.2 Argentina Video Surveillance Storage Market

- 11.4.5.2.1 Argentina Video Surveillance Storage Market by Storage

- 11.4.5.2.2 Argentina Video Surveillance Storage Market by Offerings

- 11.4.5.2.3 Argentina Video Surveillance Storage Market by Enterprise Size

- 11.4.5.2.4 Argentina Video Surveillance Storage Market by Vertical

- 11.4.5.3 UAE Video Surveillance Storage Market

- 11.4.5.3.1 UAE Video Surveillance Storage Market by Storage

- 11.4.5.3.2 UAE Video Surveillance Storage Market by Offerings

- 11.4.5.3.3 UAE Video Surveillance Storage Market by Enterprise Size

- 11.4.5.3.4 UAE Video Surveillance Storage Market by Vertical

- 11.4.5.4 Saudi Arabia Video Surveillance Storage Market

- 11.4.5.4.1 Saudi Arabia Video Surveillance Storage Market by Storage

- 11.4.5.4.2 Saudi Arabia Video Surveillance Storage Market by Offerings