|

|

市場調査レポート

商品コード

1709851

ワイヤレス充電器の世界市場規模、シェア、動向分析レポート:製品別、出力範囲別、コンポーネント別、技術別、用途別、地域別、展望と予測、2024年~2031年Global Wireless Charger Market Size, Share & Trends Analysis Report By Product, By Power Output Range, By Component, By Technology, By Application, By Regional Outlook and Forecast, 2024 - 2031 |

||||||

|

|||||||

| ワイヤレス充電器の世界市場規模、シェア、動向分析レポート:製品別、出力範囲別、コンポーネント別、技術別、用途別、地域別、展望と予測、2024年~2031年 |

|

出版日: 2025年04月02日

発行: KBV Research

ページ情報: 英文 396 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ワイヤレス充電器市場規模は、予測期間中に22.5%のCAGRで市場成長し、2031年までに213億5,000万米ドルに達すると予想されています。

市場成長要因

コミュニケーション、生産性、フィットネス、エンターテインメントなど、モバイルテクノロジーを利用する消費者が増えるにつれ、便利で高速、そしてケーブルが絡まない充電ソリューションへの需要が急増しています。現代のデバイスは、洗練されたケーブルレス体験を求める消費者の進化する期待に応えるため、ワイヤレス充電に対応した設計となっています。そのため、複数のデバイスタイプとフォームファクターをサポートするワイヤレス充電ソリューションの需要は、デバイスのエコシステム自体と連動して高まり、現代のデジタルライフスタイルの中心的な要素となることが見込まれています。

さらに、スマートフォン、ウェアラブルデバイス、その他のスマートデバイスへの依存が高まるにつれ、消費者は利便性だけでなくスピードも提供する充電ソリューションを重視するようになっています。これらのデバイスはより強力なアプリケーションや機能をサポートするようになるため、バッテリー消費量は必然的に増加します。これを受けて、ユーザーは電源コンセントに縛られることなく素早く充電する方法を求めており、高速で効率的なワイヤレス充電技術への関心が高まっています。様々な分野でワイヤレス充電器市場が急速に成長し、広く普及しているのは、主に高性能充電ソリューションへの需要の高まりによるものです。

市場抑制要因

ワイヤレス充電器は一般的に有線充電器よりも高価であるため、多くの消費者にとって魅力的な選択肢とはなりにくいです。標準的な有線充電器はスマートフォンに同梱されているか、低価格で入手できることが多いのに対し、ワイヤレス充電器は通常別売りで、価格もかなり高くなります。この価格差は、特に新興市場や、利便性よりも機能性と価格を重視するユーザーにとって、決定的な決定要因となります。そのため、日常的な場面におけるワイヤレス充電技術の入手性や認知度は制限され、普及と市場の成長がさらに鈍化しています。

コンポーネントの見通し

コンポーネントベースでは、市場は送信機と受信機に分かれています。受信機セグメントは2023年に市場の37%の収益シェアを獲得しました。家電ブランドがQiなどのワイヤレス充電規格を採用し続けるにつれ、多くのデバイスがシームレスな互換性を実現するために受信機を内蔵した設計になっています。ミニマルデザインのトレンドとユーザーエクスペリエンスの向上により、メーカーは従来の充電ポートの使用を避ける傾向にあります。

テクノロジー展望

技術に基づいて、市場は誘導型、共振型、RF(無線周波数)、その他に分類されます。誘導型セグメントは、2023年に市場の47%の収益シェアを獲得しました。このセグメントは、実証済みの効率性と安全性、そして特にQi規格を通じた強力な業界からの支持により、市場をリードしています。スマートフォン、スマートウォッチ、イヤホン、その他近接充電を必要とする民生用電子機器に広く使用されています。

製品展望

製品別に見ると、市場は充電パッド、パワーマット、充電スタンド、充電車載マウント、その他に分類されます。充電パッドセグメントは、2023年に市場収益シェアの58%を占めました。これらの平面充電器は、プラグアンドプレイで簡単に充電できるため、従来の有線充電からの移行を検討している日常的なユーザーにとって理想的な選択肢です。洗練されたコンパクトなデザインは、ナイトスタンド、オフィスデスク、カウンタートップなどに簡単に設置でき、住宅および商業施設の両方で人気を博しています。

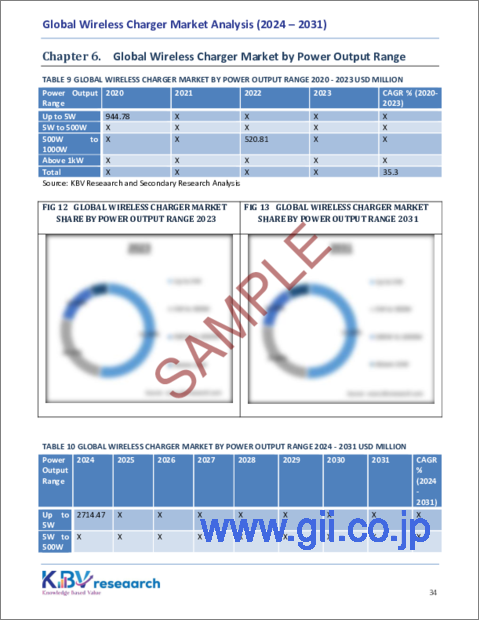

出力見通し

出力に基づいて、市場は5W以下、5W~500W、500W~1000W、そして1kW以上の4つに分類されます。1kW以上のセグメントは、2023年に市場シェアの6%を獲得しました。1kW以上のセグメントは、大容量・高速ワイヤレス充電ソリューションを必要とする電気自動車(EV)、大型産業機器、ドローンなどの無人システムの普及拡大によって牽引されています。

アプリケーションの見通し

用途別に見ると、市場はモビリティ、コンシューマーエレクトロニクス、ドローン、ヘルスケア、産業、防衛、その他に分類されます。ヘルスケア分野は2023年に市場収益の8%を占めました。ウェアラブルモニター、補聴器、携帯型診断装置などの医療機器は、非接触充電の恩恵を受けており、汚染リスクの低減と機器の取り扱いの簡素化が期待されます。

地域展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAの4地域にまたがって分析されています。北米セグメントは2023年に市場シェアの26%を獲得しました。早期の技術導入、成熟したコンシューマーエレクトロニクス業界、そして研究開発への積極的な投資が北米の成長を牽引しています。この地域は、スマートフォンやウェアラブルデバイスの利用率の高さ、そしてスマートホームやIoTデバイスの人気の高まりから恩恵を受けています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場要覧

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

第4章 競合分析- 世界

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 市場シェア分析、2023年

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターファイブフォース分析

第5章 世界市場:製品別

- 世界の充電パッド市場:地域別

- 世界の充電車載市場:地域別

- 世界の充電スタンド市場:地域別

- 世界のパワーマット市場:地域別

- 世界のその他の製品市場:地域別

第6章 世界市場:出力範囲別

- 最大5Wの世界市場:地域別

- 5W~500Wの世界市場:地域別

- 500W~1000Wの世界市場:地域別

- 1kW超の世界市場:地域別

第7章 世界市場:コンポーネント別

- 世界の送信機市場:地域別

- 世界の受信機市場:地域別

第8章 世界市場:技術別

- 世界の誘導市場:地域別

- 世界共鳴市場:地域別

- 世界のRF(無線周波数)市場:地域別

- 世界のその他のテクノロジー市場:地域別

第9章 世界市場:用途別

- 世界のコンシューマーエレクトロニクス市場:地域別

- 世界のモビリティ市場:地域別

- 世界の産業市場:地域別

- 世界のヘルスケア市場:地域別

- 世界の防衛市場:地域別

- 世界のドローン市場:地域別

- 世界のその他のアプリケーション市場:地域別

第10章 世界市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋地域

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第11章 企業プロファイル

- Apple, Inc

- Belkin International, Inc(Foxconn Interconnect Technology Limited)

- Samsung Electronics Co, Ltd.(Samsung Group)

- Continental AG

- Tesla, Inc

- Renesas Electronics Corporation

- WiTricity Corporation

- Powermat Technologies Ltd

- Powercast Corporation

- Qualcomm Incorporated(Qualcomm Technologies, Inc)

第12章 ワイヤレス充電器市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 2 Global Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 3 Partnerships, Collaborations and Agreements- Wireless Charger Market

- TABLE 4 Product Launches And Product Expansions- Wireless Charger Market

- TABLE 5 Global Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 6 Global Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 7 Global Charging Pad Market by Region, 2020 - 2023, USD Million

- TABLE 8 Global Charging Pad Market by Region, 2024 - 2031, USD Million

- TABLE 9 Global Charging Vehicle Mount Market by Region, 2020 - 2023, USD Million

- TABLE 10 Global Charging Vehicle Mount Market by Region, 2024 - 2031, USD Million

- TABLE 11 Global Charging Stand Market by Region, 2020 - 2023, USD Million

- TABLE 12 Global Charging Stand Market by Region, 2024 - 2031, USD Million

- TABLE 13 Global Power Mat Market by Region, 2020 - 2023, USD Million

- TABLE 14 Global Power Mat Market by Region, 2024 - 2031, USD Million

- TABLE 15 Global Other Product Market by Region, 2020 - 2023, USD Million

- TABLE 16 Global Other Product Market by Region, 2024 - 2031, USD Million

- TABLE 17 Global Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 18 Global Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 19 Global Up to 5W Market by Region, 2020 - 2023, USD Million

- TABLE 20 Global Up to 5W Market by Region, 2024 - 2031, USD Million

- TABLE 21 Global 5W to 500W Market by Region, 2020 - 2023, USD Million

- TABLE 22 Global 5W to 500W Market by Region, 2024 - 2031, USD Million

- TABLE 23 Global 500W to 1000W Market by Region, 2020 - 2023, USD Million

- TABLE 24 Global 500W to 1000W Market by Region, 2024 - 2031, USD Million

- TABLE 25 Global Above 1kW Market by Region, 2020 - 2023, USD Million

- TABLE 26 Global Above 1kW Market by Region, 2024 - 2031, USD Million

- TABLE 27 Global Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 28 Global Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 29 Global Transmitters Market by Region, 2020 - 2023, USD Million

- TABLE 30 Global Transmitters Market by Region, 2024 - 2031, USD Million

- TABLE 31 Global Receivers Market by Region, 2020 - 2023, USD Million

- TABLE 32 Global Receivers Market by Region, 2024 - 2031, USD Million

- TABLE 33 Global Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 34 Global Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 35 Global Inductive Market by Region, 2020 - 2023, USD Million

- TABLE 36 Global Inductive Market by Region, 2024 - 2031, USD Million

- TABLE 37 Global Resonant Market by Region, 2020 - 2023, USD Million

- TABLE 38 Global Resonant Market by Region, 2024 - 2031, USD Million

- TABLE 39 Global RF (Radio Frequency) Market by Region, 2020 - 2023, USD Million

- TABLE 40 Global RF (Radio Frequency) Market by Region, 2024 - 2031, USD Million

- TABLE 41 Global Other Technology Market by Region, 2020 - 2023, USD Million

- TABLE 42 Global Other Technology Market by Region, 2024 - 2031, USD Million

- TABLE 43 Global Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 44 Global Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 45 Global Consumer Electronics Market by Region, 2020 - 2023, USD Million

- TABLE 46 Global Consumer Electronics Market by Region, 2024 - 2031, USD Million

- TABLE 47 Global Mobility Market by Region, 2020 - 2023, USD Million

- TABLE 48 Global Mobility Market by Region, 2024 - 2031, USD Million

- TABLE 49 Global Industrial Market by Region, 2020 - 2023, USD Million

- TABLE 50 Global Industrial Market by Region, 2024 - 2031, USD Million

- TABLE 51 Global Healthcare Market by Region, 2020 - 2023, USD Million

- TABLE 52 Global Healthcare Market by Region, 2024 - 2031, USD Million

- TABLE 53 Global Defense Market by Region, 2020 - 2023, USD Million

- TABLE 54 Global Defense Market by Region, 2024 - 2031, USD Million

- TABLE 55 Global Drones Market by Region, 2020 - 2023, USD Million

- TABLE 56 Global Drones Market by Region, 2024 - 2031, USD Million

- TABLE 57 Global Other Application Market by Region, 2020 - 2023, USD Million

- TABLE 58 Global Other Application Market by Region, 2024 - 2031, USD Million

- TABLE 59 Global Wireless Charger Market by Region, 2020 - 2023, USD Million

- TABLE 60 Global Wireless Charger Market by Region, 2024 - 2031, USD Million

- TABLE 61 North America Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 62 North America Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 63 North America Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 64 North America Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 65 North America Charging Pad Market by Region, 2020 - 2023, USD Million

- TABLE 66 North America Charging Pad Market by Region, 2024 - 2031, USD Million

- TABLE 67 North America Charging Vehicle Mount Market by Region, 2020 - 2023, USD Million

- TABLE 68 North America Charging Vehicle Mount Market by Region, 2024 - 2031, USD Million

- TABLE 69 North America Charging Stand Market by Region, 2020 - 2023, USD Million

- TABLE 70 North America Charging Stand Market by Region, 2024 - 2031, USD Million

- TABLE 71 North America Power Mat Market by Region, 2020 - 2023, USD Million

- TABLE 72 North America Power Mat Market by Region, 2024 - 2031, USD Million

- TABLE 73 North America Other Product Market by Region, 2020 - 2023, USD Million

- TABLE 74 North America Other Product Market by Region, 2024 - 2031, USD Million

- TABLE 75 North America Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 76 North America Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 77 North America Up to 5W Market by Country, 2020 - 2023, USD Million

- TABLE 78 North America Up to 5W Market by Country, 2024 - 2031, USD Million

- TABLE 79 North America 5W to 500W Market by Country, 2020 - 2023, USD Million

- TABLE 80 North America 5W to 500W Market by Country, 2024 - 2031, USD Million

- TABLE 81 North America 500W to 1000W Market by Country, 2020 - 2023, USD Million

- TABLE 82 North America 500W to 1000W Market by Country, 2024 - 2031, USD Million

- TABLE 83 North America Above 1kW Market by Country, 2020 - 2023, USD Million

- TABLE 84 North America Above 1kW Market by Country, 2024 - 2031, USD Million

- TABLE 85 North America Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 86 North America Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 87 North America Transmitters Market by Country, 2020 - 2023, USD Million

- TABLE 88 North America Transmitters Market by Country, 2024 - 2031, USD Million

- TABLE 89 North America Receivers Market by Country, 2020 - 2023, USD Million

- TABLE 90 North America Receivers Market by Country, 2024 - 2031, USD Million

- TABLE 91 North America Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 92 North America Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 93 North America Inductive Market by Country, 2020 - 2023, USD Million

- TABLE 94 North America Inductive Market by Country, 2024 - 2031, USD Million

- TABLE 95 North America Resonant Market by Country, 2020 - 2023, USD Million

- TABLE 96 North America Resonant Market by Country, 2024 - 2031, USD Million

- TABLE 97 North America RF (Radio Frequency) Market by Country, 2020 - 2023, USD Million

- TABLE 98 North America RF (Radio Frequency) Market by Country, 2024 - 2031, USD Million

- TABLE 99 North America Other Technology Market by Country, 2020 - 2023, USD Million

- TABLE 100 North America Other Technology Market by Country, 2024 - 2031, USD Million

- TABLE 101 North America Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 102 North America Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 103 North America Consumer Electronics Market by Country, 2020 - 2023, USD Million

- TABLE 104 North America Consumer Electronics Market by Country, 2024 - 2031, USD Million

- TABLE 105 North America Mobility Market by Country, 2020 - 2023, USD Million

- TABLE 106 North America Mobility Market by Country, 2024 - 2031, USD Million

- TABLE 107 North America Industrial Market by Country, 2020 - 2023, USD Million

- TABLE 108 North America Industrial Market by Country, 2024 - 2031, USD Million

- TABLE 109 North America Healthcare Market by Country, 2020 - 2023, USD Million

- TABLE 110 North America Healthcare Market by Country, 2024 - 2031, USD Million

- TABLE 111 North America Defense Market by Country, 2020 - 2023, USD Million

- TABLE 112 North America Defense Market by Country, 2024 - 2031, USD Million

- TABLE 113 North America Drones Market by Country, 2020 - 2023, USD Million

- TABLE 114 North America Drones Market by Country, 2024 - 2031, USD Million

- TABLE 115 North America Other Application Market by Country, 2020 - 2023, USD Million

- TABLE 116 North America Other Application Market by Country, 2024 - 2031, USD Million

- TABLE 117 North America Wireless Charger Market by Country, 2020 - 2023, USD Million

- TABLE 118 North America Wireless Charger Market by Country, 2024 - 2031, USD Million

- TABLE 119 US Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 120 US Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 121 US Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 122 US Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 123 US Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 124 US Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 125 US Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 126 US Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 127 US Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 128 US Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 129 US Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 130 US Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 131 Canada Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 132 Canada Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 133 Canada Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 134 Canada Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 135 Canada Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 136 Canada Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 137 Canada Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 138 Canada Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 139 Canada Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 140 Canada Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 141 Canada Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 142 Canada Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 143 Mexico Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 144 Mexico Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 145 Mexico Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 146 Mexico Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 147 Mexico Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 148 Mexico Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 149 Mexico Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 150 Mexico Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 151 Mexico Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 152 Mexico Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 153 Mexico Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 154 Mexico Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 155 Rest of North America Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 156 Rest of North America Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 157 Rest of North America Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 158 Rest of North America Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 159 Rest of North America Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 160 Rest of North America Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 161 Rest of North America Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 162 Rest of North America Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 163 Rest of North America Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 164 Rest of North America Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 165 Rest of North America Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 166 Rest of North America Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 167 Europe Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 168 Europe Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 169 Europe Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 170 Europe Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 171 Europe Charging Pad Market by Country, 2020 - 2023, USD Million

- TABLE 172 Europe Charging Pad Market by Country, 2024 - 2031, USD Million

- TABLE 173 Europe Charging Vehicle Mount Market by Country, 2020 - 2023, USD Million

- TABLE 174 Europe Charging Vehicle Mount Market by Country, 2024 - 2031, USD Million

- TABLE 175 Europe Charging Stand Market by Country, 2020 - 2023, USD Million

- TABLE 176 Europe Charging Stand Market by Country, 2024 - 2031, USD Million

- TABLE 177 Europe Power Mat Market by Country, 2020 - 2023, USD Million

- TABLE 178 Europe Power Mat Market by Country, 2024 - 2031, USD Million

- TABLE 179 Europe Other Product Market by Country, 2020 - 2023, USD Million

- TABLE 180 Europe Other Product Market by Country, 2024 - 2031, USD Million

- TABLE 181 Europe Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 182 Europe Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 183 Europe Up to 5W Market by Country, 2020 - 2023, USD Million

- TABLE 184 Europe Up to 5W Market by Country, 2024 - 2031, USD Million

- TABLE 185 Europe 5W to 500W Market by Country, 2020 - 2023, USD Million

- TABLE 186 Europe 5W to 500W Market by Country, 2024 - 2031, USD Million

- TABLE 187 Europe 500W to 1000W Market by Country, 2020 - 2023, USD Million

- TABLE 188 Europe 500W to 1000W Market by Country, 2024 - 2031, USD Million

- TABLE 189 Europe Above 1kW Market by Country, 2020 - 2023, USD Million

- TABLE 190 Europe Above 1kW Market by Country, 2024 - 2031, USD Million

- TABLE 191 Europe Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 192 Europe Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 193 Europe Transmitters Market by Country, 2020 - 2023, USD Million

- TABLE 194 Europe Transmitters Market by Country, 2024 - 2031, USD Million

- TABLE 195 Europe Receivers Market by Country, 2020 - 2023, USD Million

- TABLE 196 Europe Receivers Market by Country, 2024 - 2031, USD Million

- TABLE 197 Europe Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 198 Europe Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 199 Europe Inductive Market by Country, 2020 - 2023, USD Million

- TABLE 200 Europe Inductive Market by Country, 2024 - 2031, USD Million

- TABLE 201 Europe Resonant Market by Country, 2020 - 2023, USD Million

- TABLE 202 Europe Resonant Market by Country, 2024 - 2031, USD Million

- TABLE 203 Europe RF (Radio Frequency) Market by Country, 2020 - 2023, USD Million

- TABLE 204 Europe RF (Radio Frequency) Market by Country, 2024 - 2031, USD Million

- TABLE 205 Europe Other Technology Market by Country, 2020 - 2023, USD Million

- TABLE 206 Europe Other Technology Market by Country, 2024 - 2031, USD Million

- TABLE 207 Europe Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 208 Europe Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 209 Europe Consumer Electronics Market by Country, 2020 - 2023, USD Million

- TABLE 210 Europe Consumer Electronics Market by Country, 2024 - 2031, USD Million

- TABLE 211 Europe Mobility Market by Country, 2020 - 2023, USD Million

- TABLE 212 Europe Mobility Market by Country, 2024 - 2031, USD Million

- TABLE 213 Europe Industrial Market by Country, 2020 - 2023, USD Million

- TABLE 214 Europe Industrial Market by Country, 2024 - 2031, USD Million

- TABLE 215 Europe Healthcare Market by Country, 2020 - 2023, USD Million

- TABLE 216 Europe Healthcare Market by Country, 2024 - 2031, USD Million

- TABLE 217 Europe Defense Market by Country, 2020 - 2023, USD Million

- TABLE 218 Europe Defense Market by Country, 2024 - 2031, USD Million

- TABLE 219 Europe Drones Market by Country, 2020 - 2023, USD Million

- TABLE 220 Europe Drones Market by Country, 2024 - 2031, USD Million

- TABLE 221 Europe Other Application Market by Country, 2020 - 2023, USD Million

- TABLE 222 Europe Other Application Market by Country, 2024 - 2031, USD Million

- TABLE 223 Europe Wireless Charger Market by Country, 2020 - 2023, USD Million

- TABLE 224 Europe Wireless Charger Market by Country, 2024 - 2031, USD Million

- TABLE 225 Germany Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 226 Germany Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 227 Germany Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 228 Germany Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 229 Germany Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 230 Germany Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 231 Germany Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 232 Germany Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 233 Germany Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 234 Germany Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 235 Germany Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 236 Germany Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 237 UK Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 238 UK Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 239 UK Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 240 UK Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 241 UK Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 242 UK Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 243 UK Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 244 UK Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 245 UK Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 246 UK Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 247 UK Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 248 UK Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 249 France Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 250 France Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 251 France Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 252 France Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 253 France Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 254 France Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 255 France Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 256 France Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 257 France Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 258 France Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 259 France Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 260 France Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 261 Russia Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 262 Russia Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 263 Russia Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 264 Russia Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 265 Russia Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 266 Russia Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 267 Russia Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 268 Russia Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 269 Russia Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 270 Russia Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 271 Russia Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 272 Russia Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 273 Spain Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 274 Spain Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 275 Spain Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 276 Spain Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 277 Spain Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 278 Spain Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 279 Spain Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 280 Spain Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 281 Spain Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 282 Spain Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 283 Spain Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 284 Spain Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 285 Italy Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 286 Italy Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 287 Italy Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 288 Italy Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 289 Italy Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 290 Italy Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 291 Italy Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 292 Italy Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 293 Italy Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 294 Italy Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 295 Italy Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 296 Italy Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 297 Rest of Europe Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 298 Rest of Europe Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 299 Rest of Europe Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 300 Rest of Europe Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 301 Rest of Europe Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 302 Rest of Europe Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 303 Rest of Europe Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 304 Rest of Europe Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 305 Rest of Europe Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 306 Rest of Europe Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 307 Rest of Europe Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 308 Rest of Europe Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 309 Asia Pacific Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 310 Asia Pacific Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 311 Asia Pacific Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 312 Asia Pacific Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 313 Asia Pacific Charging Pad Market by Country, 2020 - 2023, USD Million

- TABLE 314 Asia Pacific Charging Pad Market by Country, 2024 - 2031, USD Million

- TABLE 315 Asia Pacific Charging Vehicle Mount Market by Country, 2020 - 2023, USD Million

- TABLE 316 Asia Pacific Charging Vehicle Mount Market by Country, 2024 - 2031, USD Million

- TABLE 317 Asia Pacific Charging Stand Market by Country, 2020 - 2023, USD Million

- TABLE 318 Asia Pacific Charging Stand Market by Country, 2024 - 2031, USD Million

- TABLE 319 Asia Pacific Power Mat Market by Country, 2020 - 2023, USD Million

- TABLE 320 Asia Pacific Power Mat Market by Country, 2024 - 2031, USD Million

- TABLE 321 Asia Pacific Other Product Market by Country, 2020 - 2023, USD Million

- TABLE 322 Asia Pacific Other Product Market by Country, 2024 - 2031, USD Million

- TABLE 323 Asia Pacific Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 324 Asia Pacific Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 325 Asia Pacific Up to 5W Market by Country, 2020 - 2023, USD Million

- TABLE 326 Asia Pacific Up to 5W Market by Country, 2024 - 2031, USD Million

- TABLE 327 Asia Pacific 5W to 500W Market by Country, 2020 - 2023, USD Million

- TABLE 328 Asia Pacific 5W to 500W Market by Country, 2024 - 2031, USD Million

- TABLE 329 Asia Pacific 500W to 1000W Market by Country, 2020 - 2023, USD Million

- TABLE 330 Asia Pacific 500W to 1000W Market by Country, 2024 - 2031, USD Million

- TABLE 331 Asia Pacific Above 1kW Market by Country, 2020 - 2023, USD Million

- TABLE 332 Asia Pacific Above 1kW Market by Country, 2024 - 2031, USD Million

- TABLE 333 Asia Pacific Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 334 Asia Pacific Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 335 Asia Pacific Transmitters Market by Country, 2020 - 2023, USD Million

- TABLE 336 Asia Pacific Transmitters Market by Country, 2024 - 2031, USD Million

- TABLE 337 Asia Pacific Receivers Market by Country, 2020 - 2023, USD Million

- TABLE 338 Asia Pacific Receivers Market by Country, 2024 - 2031, USD Million

- TABLE 339 Asia Pacific Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 340 Asia Pacific Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 341 Asia Pacific Inductive Market by Country, 2020 - 2023, USD Million

- TABLE 342 Asia Pacific Inductive Market by Country, 2024 - 2031, USD Million

- TABLE 343 Asia Pacific Resonant Market by Country, 2020 - 2023, USD Million

- TABLE 344 Asia Pacific Resonant Market by Country, 2024 - 2031, USD Million

- TABLE 345 Asia Pacific RF (Radio Frequency) Market by Country, 2020 - 2023, USD Million

- TABLE 346 Asia Pacific RF (Radio Frequency) Market by Country, 2024 - 2031, USD Million

- TABLE 347 Asia Pacific Other Technology Market by Country, 2020 - 2023, USD Million

- TABLE 348 Asia Pacific Other Technology Market by Country, 2024 - 2031, USD Million

- TABLE 349 Asia Pacific Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 350 Asia Pacific Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 351 Asia Pacific Consumer Electronics Market by Country, 2020 - 2023, USD Million

- TABLE 352 Asia Pacific Consumer Electronics Market by Country, 2024 - 2031, USD Million

- TABLE 353 Asia Pacific Mobility Market by Country, 2020 - 2023, USD Million

- TABLE 354 Asia Pacific Mobility Market by Country, 2024 - 2031, USD Million

- TABLE 355 Asia Pacific Industrial Market by Country, 2020 - 2023, USD Million

- TABLE 356 Asia Pacific Industrial Market by Country, 2024 - 2031, USD Million

- TABLE 357 Asia Pacific Healthcare Market by Country, 2020 - 2023, USD Million

- TABLE 358 Asia Pacific Healthcare Market by Country, 2024 - 2031, USD Million

- TABLE 359 Asia Pacific Defense Market by Country, 2020 - 2023, USD Million

- TABLE 360 Asia Pacific Defense Market by Country, 2024 - 2031, USD Million

- TABLE 361 Asia Pacific Drones Market by Country, 2020 - 2023, USD Million

- TABLE 362 Asia Pacific Drones Market by Country, 2024 - 2031, USD Million

- TABLE 363 Asia Pacific Other Application Market by Country, 2020 - 2023, USD Million

- TABLE 364 Asia Pacific Other Application Market by Country, 2024 - 2031, USD Million

- TABLE 365 Asia Pacific Wireless Charger Market by Country, 2020 - 2023, USD Million

- TABLE 366 Asia Pacific Wireless Charger Market by Country, 2024 - 2031, USD Million

- TABLE 367 China Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 368 China Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 369 China Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 370 China Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 371 China Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 372 China Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 373 China Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 374 China Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 375 China Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 376 China Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 377 China Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 378 China Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 379 Japan Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 380 Japan Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 381 Japan Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 382 Japan Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 383 Japan Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 384 Japan Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 385 Japan Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 386 Japan Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 387 Japan Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 388 Japan Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 389 Japan Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 390 Japan Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 391 India Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 392 India Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 393 India Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 394 India Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 395 India Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 396 India Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 397 India Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 398 India Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 399 India Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 400 India Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 401 India Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 402 India Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 403 South Korea Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 404 South Korea Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 405 South Korea Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 406 South Korea Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 407 South Korea Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 408 South Korea Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 409 South Korea Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 410 South Korea Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 411 South Korea Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 412 South Korea Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 413 South Korea Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 414 South Korea Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 415 Singapore Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 416 Singapore Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 417 Singapore Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 418 Singapore Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 419 Singapore Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 420 Singapore Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 421 Singapore Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 422 Singapore Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 423 Singapore Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 424 Singapore Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 425 Singapore Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 426 Singapore Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 427 Malaysia Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 428 Malaysia Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 429 Malaysia Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 430 Malaysia Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 431 Malaysia Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 432 Malaysia Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 433 Malaysia Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 434 Malaysia Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 435 Malaysia Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 436 Malaysia Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 437 Malaysia Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 438 Malaysia Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 439 Rest of Asia Pacific Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 440 Rest of Asia Pacific Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 441 Rest of Asia Pacific Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 442 Rest of Asia Pacific Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 443 Rest of Asia Pacific Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 444 Rest of Asia Pacific Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 445 Rest of Asia Pacific Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 446 Rest of Asia Pacific Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 447 Rest of Asia Pacific Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 448 Rest of Asia Pacific Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 449 Rest of Asia Pacific Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 450 Rest of Asia Pacific Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 451 LAMEA Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 452 LAMEA Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 453 LAMEA Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 454 LAMEA Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 455 LAMEA Charging Pad Market by Country, 2020 - 2023, USD Million

- TABLE 456 LAMEA Charging Pad Market by Country, 2024 - 2031, USD Million

- TABLE 457 LAMEA Charging Vehicle Mount Market by Country, 2020 - 2023, USD Million

- TABLE 458 LAMEA Charging Vehicle Mount Market by Country, 2024 - 2031, USD Million

- TABLE 459 LAMEA Charging Stand Market by Country, 2020 - 2023, USD Million

- TABLE 460 LAMEA Charging Stand Market by Country, 2024 - 2031, USD Million

- TABLE 461 LAMEA Power Mat Market by Country, 2020 - 2023, USD Million

- TABLE 462 LAMEA Power Mat Market by Country, 2024 - 2031, USD Million

- TABLE 463 LAMEA Other Product Market by Country, 2020 - 2023, USD Million

- TABLE 464 LAMEA Other Product Market by Country, 2024 - 2031, USD Million

- TABLE 465 LAMEA Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 466 LAMEA Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 467 LAMEA Up to 5W Market by Country, 2020 - 2023, USD Million

- TABLE 468 LAMEA Up to 5W Market by Country, 2024 - 2031, USD Million

- TABLE 469 LAMEA 5W to 500W Market by Country, 2020 - 2023, USD Million

- TABLE 470 LAMEA 5W to 500W Market by Country, 2024 - 2031, USD Million

- TABLE 471 LAMEA 500W to 1000W Market by Country, 2020 - 2023, USD Million

- TABLE 472 LAMEA 500W to 1000W Market by Country, 2024 - 2031, USD Million

- TABLE 473 LAMEA Above 1kW Market by Country, 2020 - 2023, USD Million

- TABLE 474 LAMEA Above 1kW Market by Country, 2024 - 2031, USD Million

- TABLE 475 LAMEA Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 476 LAMEA Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 477 LAMEA Transmitters Market by Country, 2020 - 2023, USD Million

- TABLE 478 LAMEA Transmitters Market by Country, 2024 - 2031, USD Million

- TABLE 479 LAMEA Receivers Market by Country, 2020 - 2023, USD Million

- TABLE 480 LAMEA Receivers Market by Country, 2024 - 2031, USD Million

- TABLE 481 LAMEA Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 482 LAMEA Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 483 LAMEA Inductive Market by Country, 2020 - 2023, USD Million

- TABLE 484 LAMEA Inductive Market by Country, 2024 - 2031, USD Million

- TABLE 485 LAMEA Resonant Market by Country, 2020 - 2023, USD Million

- TABLE 486 LAMEA Resonant Market by Country, 2024 - 2031, USD Million

- TABLE 487 LAMEA RF (Radio Frequency) Market by Country, 2020 - 2023, USD Million

- TABLE 488 LAMEA RF (Radio Frequency) Market by Country, 2024 - 2031, USD Million

- TABLE 489 LAMEA Other Technology Market by Country, 2020 - 2023, USD Million

- TABLE 490 LAMEA Other Technology Market by Country, 2024 - 2031, USD Million

- TABLE 491 LAMEA Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 492 LAMEA Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 493 LAMEA Consumer Electronics Market by Country, 2020 - 2023, USD Million

- TABLE 494 LAMEA Consumer Electronics Market by Country, 2024 - 2031, USD Million

- TABLE 495 LAMEA Mobility Market by Country, 2020 - 2023, USD Million

- TABLE 496 LAMEA Mobility Market by Country, 2024 - 2031, USD Million

- TABLE 497 LAMEA Industrial Market by Country, 2020 - 2023, USD Million

- TABLE 498 LAMEA Industrial Market by Country, 2024 - 2031, USD Million

- TABLE 499 LAMEA Healthcare Market by Country, 2020 - 2023, USD Million

- TABLE 500 LAMEA Healthcare Market by Country, 2024 - 2031, USD Million

- TABLE 501 LAMEA Defense Market by Country, 2020 - 2023, USD Million

- TABLE 502 LAMEA Defense Market by Country, 2024 - 2031, USD Million

- TABLE 503 LAMEA Drones Market by Country, 2020 - 2023, USD Million

- TABLE 504 LAMEA Drones Market by Country, 2024 - 2031, USD Million

- TABLE 505 LAMEA Other Application Market by Country, 2020 - 2023, USD Million

- TABLE 506 LAMEA Other Application Market by Country, 2024 - 2031, USD Million

- TABLE 507 LAMEA Wireless Charger Market by Country, 2020 - 2023, USD Million

- TABLE 508 LAMEA Wireless Charger Market by Country, 2024 - 2031, USD Million

- TABLE 509 Brazil Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 510 Brazil Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 511 Brazil Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 512 Brazil Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 513 Brazil Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 514 Brazil Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 515 Brazil Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 516 Brazil Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 517 Brazil Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 518 Brazil Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 519 Brazil Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 520 Brazil Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 521 Argentina Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 522 Argentina Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 523 Argentina Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 524 Argentina Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 525 Argentina Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 526 Argentina Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 527 Argentina Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 528 Argentina Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 529 Argentina Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 530 Argentina Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 531 Argentina Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 532 Argentina Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 533 UAE Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 534 UAE Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 535 UAE Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 536 UAE Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 537 UAE Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 538 UAE Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 539 UAE Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 540 UAE Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 541 UAE Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 542 UAE Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 543 UAE Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 544 UAE Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 545 Saudi Arabia Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 546 Saudi Arabia Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 547 Saudi Arabia Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 548 Saudi Arabia Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 549 Saudi Arabia Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 550 Saudi Arabia Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 551 Saudi Arabia Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 552 Saudi Arabia Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 553 Saudi Arabia Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 554 Saudi Arabia Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 555 Saudi Arabia Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 556 Saudi Arabia Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 557 South Africa Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 558 South Africa Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 559 South Africa Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 560 South Africa Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 561 South Africa Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 562 South Africa Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 563 South Africa Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 564 South Africa Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 565 South Africa Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 566 South Africa Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 567 South Africa Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 568 South Africa Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 569 Nigeria Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 570 Nigeria Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 571 Nigeria Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 572 Nigeria Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 573 Nigeria Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 574 Nigeria Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 575 Nigeria Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 576 Nigeria Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 577 Nigeria Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 578 Nigeria Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 579 Nigeria Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 580 Nigeria Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 581 Rest of LAMEA Wireless Charger Market, 2020 - 2023, USD Million

- TABLE 582 Rest of LAMEA Wireless Charger Market, 2024 - 2031, USD Million

- TABLE 583 Rest of LAMEA Wireless Charger Market by Product, 2020 - 2023, USD Million

- TABLE 584 Rest of LAMEA Wireless Charger Market by Product, 2024 - 2031, USD Million

- TABLE 585 Rest of LAMEA Wireless Charger Market by Power Output Range, 2020 - 2023, USD Million

- TABLE 586 Rest of LAMEA Wireless Charger Market by Power Output Range, 2024 - 2031, USD Million

- TABLE 587 Rest of LAMEA Wireless Charger Market by Component, 2020 - 2023, USD Million

- TABLE 588 Rest of LAMEA Wireless Charger Market by Component, 2024 - 2031, USD Million

- TABLE 589 Rest of LAMEA Wireless Charger Market by Technology, 2020 - 2023, USD Million

- TABLE 590 Rest of LAMEA Wireless Charger Market by Technology, 2024 - 2031, USD Million

- TABLE 591 Rest of LAMEA Wireless Charger Market by Application, 2020 - 2023, USD Million

- TABLE 592 Rest of LAMEA Wireless Charger Market by Application, 2024 - 2031, USD Million

- TABLE 593 Key Information - Apple, Inc.

- TABLE 594 Key Information - Belkin International, Inc.

- TABLE 595 Key Information - Samsung Electronics Co., Ltd.

- TABLE 596 Key Information - Continental AG

- TABLE 597 key Information - Tesla, Inc.

- TABLE 598 Key Information - Renesas Electronics Corporation

- TABLE 599 Key Information - WiTricity Corporation

- TABLE 600 Key information - Powermat Technologies Ltd.

- TABLE 601 Key Information - Powercast Corporation

- TABLE 602 Key Information - Qualcomm Incorporated

LIST OF FIGURES

- FIG 1 Methodology for the research

- FIG 2 Global Wireless Charger Market, 2020 - 2031, USD Million

- FIG 3 Key Factors Impacting Wireless Charger Market

- FIG 4 KBV Cardinal Matrix

- FIG 5 Market Share Analysis, 2023

- FIG 6 Key Leading Strategies: Percentage Distribution (2020-2024)

- FIG 7 Key Strategic Move: (Product Launches and Product Expansions : 2022, Dec - 2025, Jan) Leading Players

- FIG 8 Porter's Five Forces Analysis - Wireless Charger Market

- FIG 9 Global Wireless Charger Market share by Product, 2023

- FIG 10 Global Wireless Charger Market share by Product, 2031

- FIG 11 Global Wireless Charger Market by Product, 2020 - 2031, USD Million

- FIG 12 Global Wireless Charger Market share by Power Output Range, 2023

- FIG 13 Global Wireless Charger Market share by Power Output Range, 2031

- FIG 14 Global Wireless Charger Market by Power Output Range, 2020 - 2031, USD Million

- FIG 15 Global Wireless Charger Market share by Component, 2023

- FIG 16 Global Wireless Charger Market share by Component, 2031

- FIG 17 Global Wireless Charger Market by Component, 2020 - 2031, USD Million

- FIG 18 Global Wireless Charger Market share by Technology, 2023

- FIG 19 Global Wireless Charger Market share by Technology, 2031

- FIG 20 Global Wireless Charger Market by Technology, 2020 - 2031, USD Million

- FIG 21 Global Wireless Charger Market share by Application, 2023

- FIG 22 Global Wireless Charger Market share by Application, 2031

- FIG 23 Global Wireless Charger Market by Application, 2020 - 2031, USD Million

- FIG 24 Global Wireless Charger Market share by Region, 2023

- FIG 25 Global Wireless Charger Market share by Region, 2031

- FIG 26 Global Wireless Charger Market by Region, 2020 - 2031, USD Million

- FIG 27 North America Wireless Charger Market, 2020 - 2031, USD Million

- FIG 28 North America Wireless Charger Market share by Product, 2023

- FIG 29 North America Wireless Charger Market share by Product, 2031

- FIG 30 North America Wireless Charger Market by Product, 2020 - 2031, USD Million

- FIG 31 North America Wireless Charger Market share by Power Output Range, 2023

- FIG 32 North America Wireless Charger Market share by Power Output Range, 2031

- FIG 33 North America Wireless Charger Market by Power Output Range, 2020 - 2031, USD Million

- FIG 34 North America Wireless Charger Market share by Component, 2023

- FIG 35 North America Wireless Charger Market share by Component, 2031

- FIG 36 North America Wireless Charger Market by Component, 2020 - 2031, USD Million

- FIG 37 North America Wireless Charger Market share by Technology, 2023

- FIG 38 North America Wireless Charger Market share by Technology, 2031

- FIG 39 North America Wireless Charger Market by Technology, 2020 - 2031, USD Million

- FIG 40 North America Wireless Charger Market share by Application, 2023

- FIG 41 North America Wireless Charger Market share by Application, 2031

- FIG 42 North America Wireless Charger Market by Application, 2020 - 2031, USD Million

- FIG 43 North America Wireless Charger Market share by Country, 2023

- FIG 44 North America Wireless Charger Market share by Country, 2031

- FIG 45 North America Wireless Charger Market by Country, 2020 - 2031, USD Million

- FIG 46 Europe Wireless Charger Market, 2020 - 2031, USD Million

- FIG 47 Europe Wireless Charger Market share by Product, 2023

- FIG 48 Europe Wireless Charger Market share by Product, 2031

- FIG 49 Europe Wireless Charger Market by Product, 2020 - 2031, USD Million

- FIG 50 Europe Wireless Charger Market share by Power Output Range, 2023

- FIG 51 Europe Wireless Charger Market share by Power Output Range, 2031

- FIG 52 Europe Wireless Charger Market by Power Output Range, 2020 - 2031, USD Million

- FIG 53 Europe Wireless Charger Market share by Component, 2023

- FIG 54 Europe Wireless Charger Market share by Component, 2031

- FIG 55 Europe Wireless Charger Market by Component, 2020 - 2031, USD Million

- FIG 56 Europe Wireless Charger Market share by Technology, 2023

- FIG 57 Europe Wireless Charger Market share by Technology, 2031

- FIG 58 Europe Wireless Charger Market by Technology, 2020 - 2031, USD Million

- FIG 59 Europe Wireless Charger Market share by Application, 2023

- FIG 60 Europe Wireless Charger Market share by Application, 2031

- FIG 61 Europe Wireless Charger Market by Application, 2020 - 2031, USD Million

- FIG 62 Europe Wireless Charger Market share by Country, 2023

- FIG 63 Europe Wireless Charger Market share by Country, 2031

- FIG 64 Europe Wireless Charger Market by Product, 2020 - 2031, USD Million

- FIG 65 Asia Pacific Wireless Charger Market, 2020 - 2031, USD Million

- FIG 66 Asia Pacific Wireless Charger Market share by Product, 2023

- FIG 67 Asia Pacific Wireless Charger Market share by Product, 2031

- FIG 68 Asia Pacific Wireless Charger Market by Product, 2020 - 2031, USD Million

- FIG 69 Asia Pacific Wireless Charger Market share by Power Output Range, 2023

- FIG 70 Asia Pacific Wireless Charger Market share by Power Output Range, 2031

- FIG 71 Asia Pacific Wireless Charger Market by Power Output Range, 2020 - 2031, USD Million

- FIG 72 Asia Pacific Wireless Charger Market share by Component, 2023

- FIG 73 Asia Pacific Wireless Charger Market share by Component, 2031

- FIG 74 Asia Pacific Wireless Charger Market by Component, 2020 - 2031, USD Million

- FIG 75 Asia Pacific Wireless Charger Market share by Technology, 2023

- FIG 76 Asia Pacific Wireless Charger Market share by Technology, 2031

- FIG 77 Asia Pacific Wireless Charger Market by Technology, 2020 - 2031, USD Million

- FIG 78 Asia Pacific Wireless Charger Market share by Application, 2023

- FIG 79 Asia Pacific Wireless Charger Market share by Application, 2031

- FIG 80 Asia Pacific Wireless Charger Market by Application, 2020 - 2031, USD Million

- FIG 81 Asia Pacific Wireless Charger Market share by Country, 2023

- FIG 82 Asia Pacific Wireless Charger Market share by Country, 2031

- FIG 83 Asia Pacific Wireless Charger Market by Country, 2020 - 2031, USD Million

- FIG 84 LAMEA Wireless Charger Market, 2020 - 2031, USD Million

- FIG 85 LAMEA Wireless Charger Market share by Product, 2023

- FIG 86 LAMEA Wireless Charger Market share by Product, 2031

- FIG 87 LAMEA Wireless Charger Market by Product, 2020 - 2031, USD Million

- FIG 88 LAMEA Wireless Charger Market share by Power Output Range, 2023

- FIG 89 LAMEA Wireless Charger Market share by Power Output Range, 2031

- FIG 90 LAMEA Wireless Charger Market by Power Output Range, 2020 - 2031, USD Million

- FIG 91 LAMEA Wireless Charger Market share by Component, 2023

- FIG 92 LAMEA Wireless Charger Market share by Component, 2031

- FIG 93 LAMEA Wireless Charger Market by Component, 2020 - 2031, USD Million

- FIG 94 LAMEA Wireless Charger Market share by Technology, 2023

- FIG 95 LAMEA Wireless Charger Market share by Technology, 2031

- FIG 96 LAMEA Wireless Charger Market by Technology, 2020 - 2031, USD Million

- FIG 97 LAMEA Wireless Charger Market share by Application, 2023

- FIG 98 LAMEA Wireless Charger Market share by Application, 2031

- FIG 99 LAMEA Wireless Charger Market by Application, 2020 - 2031, USD Million

- FIG 100 LAMEA Wireless Charger Market share by Country, 2023

- FIG 101 LAMEA Wireless Charger Market share by Country, 2031

- FIG 102 LAMEA Wireless Charger Market by Country, 2020 - 2031, USD Million

- FIG 103 SWOT Analysis: Apple, Inc.

- FIG 104 SWOT analysis: Belkin International, Inc.

- FIG 105 SWOT Analysis: Samsung Electronics Co., Ltd.

- FIG 106 SWOT Analysis: Continental AG

- FIG 107 SWOT Analysis: Tesla, Inc.

- FIG 108 SWOT Analysis: Renesas Electronics Corporation

- FIG 109 SWOT Analysis: QUALCOMM Incorporated

The Global Wireless Charger Market size is expected to reach $21.35 billion by 2031, rising at a market growth of 22.5% CAGR during the forecast period.

The convenience of cable-free charging, along with advancements in fast wireless charging technologies, has driven user adoption across the globe. As manufacturers integrate Qi-compatible features into more devices and accessories, consumers invest in wireless chargers for personal and professional use. Thus, the consumer electronics segment recorded 47% revenue share in the market in 2023. The continued growth of the personal electronics ecosystem, along with increasing consumer preference for minimalistic and clutter-free setups, keeps this segment at the forefront of market demand.s

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2025, Samsung Electronics Co., Ltd. unveiled the Galaxy S25 series with Qi2 Ready certification, requiring cases with built-in Qi2 magnets for wireless charging. It introduced the WWA-T420 3-in-1 charger for phones, watches, earbuds, and the WWA-T430 car charger. A first-party Magnetic Case ensures proper alignment. Additionally, In October, 2024, Tesla, Inc. unveiled a new Wireless Portable Charger that combines style and functionality with a 5000mAh battery, dual-device charging, and a 5V/3A output. It features an Alcantara suede base, a hinged magnetic stand for adjustable positioning, and LED indicators for battery status, making it a sleek and practical charging solution.

Market Growth Factors

With increasing consumers relying on mobile technology for communication, productivity, fitness, and entertainment, the demand for convenient, fast, and tangle-free charging solutions has surged. Modern devices are designed with wireless charging support to meet evolving consumer expectations for sleek and cable-free experiences. Hence, the demand for wireless charging solutions that support multiple device types and form factors is poised to grow in tandem with the device ecosystem itself, making it a central component of modern digital lifestyles.

Additionally, with the growing dependence on smartphones, wearables, and other smart devices, consumers are placing a high priority on charging solutions that offer not only convenience but also speed. As these devices support more powerful applications and features, their battery consumption naturally increases. In response, users are looking for ways to recharge quickly without being tethered to a power outlet, which has led to a surge in interest in fast and efficient wireless charging technologies. The rapid growth and pervasive adoption of the wireless charger market across various sectors are primarily driven by the increasing demand for high-performance charging solutions.

Market Restraining Factors

Wireless chargers are generally priced higher than their wired counterparts, making them a less attractive option for many consumers. While a standard wired charger is often included with the purchase of a smartphone or available at a low cost, wireless chargers typically need to be bought separately and come with a noticeably higher price tag. This price difference becomes a crucial deciding factor, especially in emerging markets or among users prioritizing function and affordability over convenience. This limits the availability and visibility of wireless charging technology in everyday settings, further slowing down its mass adoption and market growth.

Component Outlook

Based on component, the market is bifurcated into transmitters and receivers. The receivers segment procured 37% revenue share in the market in 2023. As consumer electronics brands continue to embrace wireless charging standards like Qi, many devices are being designed with built-in receivers to enable seamless compatibility. The minimalist design trend and improved user experience have encouraged manufacturers to avoid traditional charging ports.

Technology Outlook

On the basis of technology, the market is classified into inductive, resonant, RF (radio frequency), and others. The inductive segment acquired 47% revenue share in the market in 2023. The segment leads the market due to its proven efficiency, safety, and strong industry backing, particularly through the Qi standard. It is widely used in smartphones, smartwatches, earbuds, and other consumer electronics that require close-contact charging.

Product Outlook

By product, the market is divided into charging pad, power mat, charging stand, charging vehicle mount, and others. The charging pad segment witnessed 58% revenue share in the market in 2023. These flat-surface chargers offer a no-fuss, plug-and-play experience, making them an ideal choice for everyday users looking to transition from traditional wired charging. Their sleek and compact design allows for easy placement on nightstands, office desks, and countertops, contributing to their popularity in both residential and commercial settings.

Output Outlook

Based on power output, the market is segmented into up to 5W, 5W to 500W, 500W to 1000W, and above 1kW. The above 1kW segment acquired 6% revenue share in the market in 2023. The above 1kW segment is driven by the growing adoption of electric vehicles (EVs), heavy-duty industrial equipment, and unmanned systems like drones that require high-capacity, fast wireless charging solutions.

Application Outlook

On the basis of application, the market is classified into mobility, consumer electronics, drone, healthcare, industrial, defense, and others. The healthcare segment garnered 8% revenue share in the market in 2023. Medical devices such as wearable monitors, hearing aids, and portable diagnostic equipment benefit from contactless charging, which reduces contamination risks and simplifies device handling.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment acquired 26% revenue share in the market in 2023. Early technology adoption, a mature consumer electronics industry, and strong investments in research and development fuel North America's growth. The region benefits from high smartphone and wearable usage and the increasing popularity of smart homes and IoT devices.

Recent Strategies Deployed in the Market

- Feb-2025: Powercast Corporation teamed up with B&Plus to introduce RF wireless power solutions in Japan, aiming to eliminate battery dependency, reduce costs, and minimize waste. This collaboration supports Japan's 2050 net-zero emissions goal by enhancing energy efficiency in industrial and IoT applications through sustainable, battery-free technologies.

- Jan-2025: Samsung Electronics Co., Ltd. unveiled the Galaxy S25 series with Qi2 Ready certification, requiring cases with built-in Qi2 magnets for wireless charging. It introduced the WWA-T420 3-in-1 charger for phones, watches, earbuds, and the WWA-T430 car charger. A first-party Magnetic Case ensures proper alignment.

- Jan-2025: Samsung Electronics Co., Ltd. unveiled a new power management integrated chip (PMIC) called the S2MIW06, which supports wireless charging speeds of up to 50W. This chip aligns with the forthcoming Qi 2.2 standard and supports all major Qi profiles, including Baseline Power Profile (BPP), Extended Power Profile (EPP), and Magnetic Power Profile (MPP). The MPP uses magnets for precise alignment, reducing overheating and improving charging efficiency.

- Oct-2024: Tesla, Inc. unveiled a new Wireless Portable Charger that combines style and functionality with a 5000mAh battery, dual-device charging, and a 5V/3A output. It features an Alcantara suede base, a hinged magnetic stand for adjustable positioning, and LED indicators for battery status, making it a sleek and practical charging solution.

- Apr-2024: Belkin International, Inc. unveiled its Qi2 wireless charger collection, featuring the BoostCharge Pro 3-in-1 Magnetic Stand, 2-in-1 Magnetic Pad, and Convertible Magnetic Stand. The chargers offer up to 15W fast charging, Qi2 compatibility, and sustainable materials.

- Mar-2024: Apple, Inc. unveiled iOS 17.4 update unlocks Qi2 wireless charging support for iPhone 12, enabling faster 15W charging with compatible chargers. Qi2 offers improved efficiency and magnetic alignment, inspired by MagSafe. Apple, a key Wireless Power Consortium member, contributed to Qi2's development, enhancing wireless charging capabilities.

- Jun-2023: Powermat Technologies Ltd. teamed up with Powercast to form a comprehensive wireless power provider, offering solutions from SmartInductive to RF power transmission over distances up to 120 feet. This collaboration aims to create a seamless, one-stop shop for businesses seeking advanced wireless charging technologies across various applications.

- Feb-2023: Renesas Electronics Corporation unveiled a new wireless power transmitter technology for efficiently charging portable devices. Announced at ISSCC, the innovation enhances power transfer while reducing energy loss. This advancement aims to improve the performance and convenience of wireless charging, supporting a wider range of devices with better efficiency and reliability.

List of Key Companies Profiled

- Apple, Inc.

- Belkin International, Inc. (Foxconn Interconnect Technology Limited)

- Samsung Electronics Co., Ltd. (Samsung Group)

- Continental AG

- Tesla, Inc.

- Renesas Electronics Corporation

- WiTricity Corporation

- Powermat Technologies Ltd.

- Powercast Corporation

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

Global Wireless Charger Market Report Segmentation

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Wireless Charger Market, by Product

- 1.4.2 Global Wireless Charger Market, by Power Output Range

- 1.4.3 Global Wireless Charger Market, by Component

- 1.4.4 Global Wireless Charger Market, by Technology

- 1.4.5 Global Wireless Charger Market, by Application

- 1.4.6 Global Wireless Charger Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.2.3 Market Opportunities

- 3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

- 4.1 KBV Cardinal Matrix

- 4.2 Recent Industry Wide Strategic Developments

- 4.2.1 Partnerships, Collaborations and Agreements

- 4.2.2 Product Launches and Product Expansions

- 4.3 Market Share Analysis, 2023

- 4.4 Top Winning Strategies

- 4.4.1 Key Leading Strategies: Percentage Distribution (2020-2024)

- 4.4.2 Key Strategic Move: (Product Launches and Product Expansions : 2022, Dec - 2025, Jan) Leading Players

- 4.5 Porter Five Forces Analysis

Chapter 5. Global Wireless Charger Market by Product

- 5.1 Global Charging Pad Market by Region

- 5.2 Global Charging Vehicle Mount Market by Region

- 5.3 Global Charging Stand Market by Region

- 5.4 Global Power Mat Market by Region

- 5.5 Global Other Product Market by Region

Chapter 6. Global Wireless Charger Market by Power Output Range

- 6.1 Global Up to 5W Market by Region

- 6.2 Global 5W to 500W Market by Region

- 6.3 Global 500W to 1000W Market by Region

- 6.4 Global Above 1kW Market by Region

Chapter 7. Global Wireless Charger Market by Component

- 7.1 Global Transmitters Market by Region

- 7.2 Global Receivers Market by Region

Chapter 8. Global Wireless Charger Market by Technology

- 8.1 Global Inductive Market by Region

- 8.2 Global Resonant Market by Region

- 8.3 Global RF (Radio Frequency) Market by Region

- 8.4 Global Other Technology Market by Region

Chapter 9. Global Wireless Charger Market by Application

- 9.1 Global Consumer Electronics Market by Region

- 9.2 Global Mobility Market by Region

- 9.3 Global Industrial Market by Region

- 9.4 Global Healthcare Market by Region

- 9.5 Global Defense Market by Region

- 9.6 Global Drones Market by Region

- 9.7 Global Other Application Market by Region

Chapter 10. Global Wireless Charger Market by Region

- 10.1 North America Wireless Charger Market

- 10.1.1 North America Wireless Charger Market by Product

- 10.1.1.1 North America Charging Pad Market by Region

- 10.1.1.2 North America Charging Vehicle Mount Market by Region

- 10.1.1.3 North America Charging Stand Market by Region

- 10.1.1.4 North America Power Mat Market by Region

- 10.1.1.5 North America Other Product Market by Region

- 10.1.2 North America Wireless Charger Market by Power Output Range

- 10.1.2.1 North America Up to 5W Market by Country

- 10.1.2.2 North America 5W to 500W Market by Country

- 10.1.2.3 North America 500W to 1000W Market by Country

- 10.1.2.4 North America Above 1kW Market by Country

- 10.1.3 North America Wireless Charger Market by Component

- 10.1.3.1 North America Transmitters Market by Country

- 10.1.3.2 North America Receivers Market by Country