|

|

市場調査レポート

商品コード

1384972

受動光ネットワークの世界市場規模、シェア、産業動向分析レポート:用途別、コンポーネント別、タイプ別、地域別展望と予測、2023年~2030年Global Passive Optical Network Market Size, Share & Industry Trends Analysis Report By Application (FTTX, and Mobile Backhaul), By Component, By Type (EPON, GPON, and Others), By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| 受動光ネットワークの世界市場規模、シェア、産業動向分析レポート:用途別、コンポーネント別、タイプ別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年10月31日

発行: KBV Research

ページ情報: 英文 256 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

受動光ネットワーク市場規模は2030年までに311億米ドルに達すると予測され、予測期間中のCAGRは13.4%の市場成長率で上昇します。

KBVカーディナルマトリックスに掲載された分析によると、シスコシステムズ社が同市場におけるトップランナーです。華為技術(Huawei Technologies Co., Ltd)、ノキア(Nokia Corporation)、エリクソン(Ericsson AB)などの企業は、市場における主要なイノベーターです。2022年12月、ノキアコーポレーションは、GCC地域最大の通信プロバイダーである「Etisalat by e&」のブランド名で事業を展開するEtisalat UAEと提携しました。この提携により、中東・アフリカ地域で最高のPON(Passive Optical Network)速度が実現しました。

市場成長要因

高速インターネットとデータ・サービスに対する世界の需要の高まり

高速インターネットは今日のデジタル社会の基本的な要件であり、その重要性は高まる一方です。より高速で信頼性の高い接続を求めるユーザーや企業が増えるにつれて、PON技術への需要が高まっています。これが市場成長の原動力となり、投資、技術革新、市場内競争が活発化します。サービスプロバイダーやネットワーク事業者は、顧客の帯域幅需要の増大に対応するため、PON技術の採用に意欲を燃やしています。彼らがPONを選んだ理由は、高速インターネット・アクセスに拡張性とコスト効率の高いソリューションを提供できるからです。このような採用の増加は、市場の裾野を広げます。

PON導入に対する政府の政策とインセンティブの増加

光ファイバーやPONの展開に対する政府の奨励策や資金援助は、公共投資や民間投資の拡大を促します。このような投資の増加は、より広範なネットワーク・インフラにつながり、市場に利益をもたらします。政府のイニシアチブは、多くの場合、サービスが行き届いていない地域や遠隔地に重点を置いています。こうした地域では、コストが高くなるため、非公開会社は投資に消極的になる可能性があります。さらに、デジタルデバイド解消のための政策では、すべての国民が高速インターネットにアクセスできるようにすることが優先されます。このため、PONネットワークが農村部やサービスが行き届いていない地域に展開され、PON技術のメリットがより多くの人々にもたらされることになります。その結果、より多くの顧客がPONサービスにアクセスできるようになり、ユーザーベースが拡大します。こうした要因から、市場は今後急成長します。

市場抑制要因

PONインフラ導入の初期コストの高さ

新規参入の小規模なサービス・プロバイダーにとって、PONインフラを構築するために必要な多額の費用は、参入の大きな障壁となる可能性があります。これは市場競争を制限し、消費者の選択肢を減らし、PONサービスの価格上昇につながる可能性があります。導入コストは市場の分断を招き、PON技術に投資できるのは資金力のある少数の大手サービス・プロバイダーだけとなる可能性があります。さらに、高い初期費用に直面するサービス・プロバイダーは、投資対効果が確実でない、サービスが行き届いていない地域や地方へのPONネットワークの拡大をためらう可能性があります。このため、デジタルデバイドを解消し、より多くの人々にPONサービスを普及させる取り組みが遅れる可能性があります。その結果、これらの要因が今後数年間の受動光ネットワークの需要を妨げると予想されます。

用途の展望

用途に基づき、市場はFTTXとモバイルバックホールに分けられます。2022年には、モバイルバックホールセグメンテーションが市場で大きな収益シェアを占めました。PON技術は、ポイント・ツー・ポイントのマイクロ波や銅ベースのソリューションのような従来の代替手段と比較してコスト効率が高いです。このコスト効率の高さが、モバイルバックホールでの採用の大きな原動力となっています。PONネットワークは高レベルの信頼性と冗長性を提供し、モバイルバックホール分野で継続的な接続性を維持するために不可欠です。これらの要因により、今後数年間はモバイルバックホール分野の需要が高まると思われます。

コンポーネントの展望

コンポーネントベースで、市場は光回線端末(OLT)、光ネットワーク端末、光分配ネットワーク(ODN)に分けられます。2022年には、光ディストリビューションネットワーク(ODN)セグメントが市場で大きな収益シェアを占めました。多くの国や地域では、高速接続の需要増に対応するため、光ファイバーインフラを中心としたブロードバンドネットワークの拡大に投資しています。この拡大がODNコンポーネントとサービスの需要を牽引しています。さらに、5Gの展開は拡大を続けており、5Gの大容量・低遅延要件をサポートする光ファイバーODNのニーズが高まっています。これらの側面は、このセグメントに有利な成長見通しをもたらすと思われます。

タイプ別展望

タイプ別に見ると、市場はEPON、GPON、その他に区分されます。2022年には、GPONセグメントが市場で大きな収益シェアを獲得しました。高速インターネットアクセスの需要は、GPON技術の主要な促進要因です。より多くの人々や企業がより高速で信頼性の高いインターネット接続を必要とする中、サービスプロバイダーはギガビット速度のブロードバンド・サービスを提供するコスト効率の高いソリューションとしてGPONに注目しました。通信サービスは、高速ブロードバンド・サービスを提供するためにGPON技術を使ってネットワークを拡大してきました。この拡大の背景には、インターネットユーザーの増加と、データ量の多いアプリケーションをサポートするための帯域幅拡大のニーズがあります。このような要因から、このセグメントの需要は増加すると思われます。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAに区分されます。2022年には、アジア太平洋セグメントが市場で最も高い収益シェアを獲得しました。アジア太平洋地域は、特に中国やインドなどの国々で人口が急増し、急速に成長しています。この人口動向は、より多くの人々を接続するための通信インフラ整備の必要性を後押ししています。アジアの多くの地域で都市化が進み、都市部や郊外では高速インターネット・サービスへの需要が高まっています。そのため、この分野は今後数年で急成長すると思われます。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場の概要

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第4章 競合分析- 世界

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 地理的拡大

- 市場シェア分析

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターのファイブフォース分析

第5章 世界の受動光ネットワーク市場:用途別

- 世界のFTTX市場:地域別

- 世界のモバイルバックホール市場:地域別

第6章 世界の受動光ネットワーク市場:コンポーネント別

- 世界の光回線端末(OLT)市場:地域別

- 世界の光ネットワーク端末(ONT)市場:地域別

- 世界の光配信ネットワーク(ODN)市場:地域別

第7章 世界の受動光ネットワーク市場:タイプ別

- 世界のEPON市場:地域別

- 世界のGPON市場:地域別

- 世界のその他の市場:地域別

第8章 世界の受動光ネットワーク市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- エジプト

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第9章 企業プロファイル

- Adtran, Inc

- Calix, Inc

- Ciena Corporation

- Cisco Systems, Inc

- Nokia Corporation

- Huawei Technologies Co, Ltd.(Huawei Investment & Holding Co., Ltd.)

- Infinera Corporation

- TP-Link Corporation Limited

- ZTE Corporation

- Ericsson AB

第10章 市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 2 Global Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 3 Partnerships, Collaborations and Agreements- Passive Optical Network Market

- TABLE 4 Product Launches And Product Expansions- Passive Optical Network Market

- TABLE 5 Acquisition and Mergers- Passive Optical Network Market

- TABLE 6 Acquisition and Mergers- Passive Optical Network Market

- TABLE 7 Global Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 8 Global Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 9 Global FTTX Market by Region, 2019 - 2022, USD Million

- TABLE 10 Global FTTX Market by Region, 2023 - 2030, USD Million

- TABLE 11 Global Mobile Backhaul Market by Region, 2019 - 2022, USD Million

- TABLE 12 Global Mobile Backhaul Market by Region, 2023 - 2030, USD Million

- TABLE 13 Global Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 14 Global Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 15 Global Optical Line Terminal (OLT) Market by Region, 2019 - 2022, USD Million

- TABLE 16 Global Optical Line Terminal (OLT) Market by Region, 2023 - 2030, USD Million

- TABLE 17 Global Optical Network Terminal (ONT) Market by Region, 2019 - 2022, USD Million

- TABLE 18 Global Optical Network Terminal (ONT) Market by Region, 2023 - 2030, USD Million

- TABLE 19 Global Optical Distribution Network (ODN) Market by Region, 2019 - 2022, USD Million

- TABLE 20 Global Optical Distribution Network (ODN) Market by Region, 2023 - 2030, USD Million

- TABLE 21 Global Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 22 Global Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 23 Global EPON Market by Region, 2019 - 2022, USD Million

- TABLE 24 Global EPON Market by Region, 2023 - 2030, USD Million

- TABLE 25 Global GPON Market by Region, 2019 - 2022, USD Million

- TABLE 26 Global GPON Market by Region, 2023 - 2030, USD Million

- TABLE 27 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 28 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 29 Global Passive Optical Network Market by Region, 2019 - 2022, USD Million

- TABLE 30 Global Passive Optical Network Market by Region, 2023 - 2030, USD Million

- TABLE 31 North America Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 32 North America Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 33 North America Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 34 North America Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 35 North America FTTX Market by Country, 2019 - 2022, USD Million

- TABLE 36 North America FTTX Market by Country, 2023 - 2030, USD Million

- TABLE 37 North America Mobile Backhaul Market by Country, 2019 - 2022, USD Million

- TABLE 38 North America Mobile Backhaul Market by Country, 2023 - 2030, USD Million

- TABLE 39 North America Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 40 North America Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 41 North America Optical Line Terminal (OLT) Market by Country, 2019 - 2022, USD Million

- TABLE 42 North America Optical Line Terminal (OLT) Market by Country, 2023 - 2030, USD Million

- TABLE 43 North America Optical Network Terminal (ONT) Market by Country, 2019 - 2022, USD Million

- TABLE 44 North America Optical Network Terminal (ONT) Market by Country, 2023 - 2030, USD Million

- TABLE 45 North America Optical Distribution Network (ODN) Market by Country, 2019 - 2022, USD Million

- TABLE 46 North America Optical Distribution Network (ODN) Market by Country, 2023 - 2030, USD Million

- TABLE 47 North America Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 48 North America Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 49 North America EPON Market by Country, 2019 - 2022, USD Million

- TABLE 50 North America EPON Market by Country, 2023 - 2030, USD Million

- TABLE 51 North America GPON Market by Country, 2019 - 2022, USD Million

- TABLE 52 North America GPON Market by Country, 2023 - 2030, USD Million

- TABLE 53 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 54 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 55 North America Passive Optical Network Market by Country, 2019 - 2022, USD Million

- TABLE 56 North America Passive Optical Network Market by Country, 2023 - 2030, USD Million

- TABLE 57 US Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 58 US Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 59 US Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 60 US Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 61 US Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 62 US Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 63 US Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 64 US Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 65 Canada Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 66 Canada Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 67 Canada Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 68 Canada Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 69 Canada Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 70 Canada Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 71 Canada Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 72 Canada Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 73 Mexico Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 74 Mexico Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 75 Mexico Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 76 Mexico Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 77 Mexico Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 78 Mexico Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 79 Mexico Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 80 Mexico Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 81 Rest of North America Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 82 Rest of North America Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 83 Rest of North America Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 84 Rest of North America Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 85 Rest of North America Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 86 Rest of North America Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 87 Rest of North America Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 88 Rest of North America Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 89 Europe Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 90 Europe Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 91 Europe Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 92 Europe Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 93 Europe FTTX Market by Country, 2019 - 2022, USD Million

- TABLE 94 Europe FTTX Market by Country, 2023 - 2030, USD Million

- TABLE 95 Europe Mobile Backhaul Market by Country, 2019 - 2022, USD Million

- TABLE 96 Europe Mobile Backhaul Market by Country, 2023 - 2030, USD Million

- TABLE 97 Europe Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 98 Europe Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 99 Europe Optical Line Terminal (OLT) Market by Country, 2019 - 2022, USD Million

- TABLE 100 Europe Optical Line Terminal (OLT) Market by Country, 2023 - 2030, USD Million

- TABLE 101 Europe Optical Network Terminal (ONT) Market by Country, 2019 - 2022, USD Million

- TABLE 102 Europe Optical Network Terminal (ONT) Market by Country, 2023 - 2030, USD Million

- TABLE 103 Europe Optical Distribution Network (ODN) Market by Country, 2019 - 2022, USD Million

- TABLE 104 Europe Optical Distribution Network (ODN) Market by Country, 2023 - 2030, USD Million

- TABLE 105 Europe Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 106 Europe Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 107 Europe EPON Market by Country, 2019 - 2022, USD Million

- TABLE 108 Europe EPON Market by Country, 2023 - 2030, USD Million

- TABLE 109 Europe GPON Market by Country, 2019 - 2022, USD Million

- TABLE 110 Europe GPON Market by Country, 2023 - 2030, USD Million

- TABLE 111 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 112 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 113 Europe Passive Optical Network Market by Country, 2019 - 2022, USD Million

- TABLE 114 Europe Passive Optical Network Market by Country, 2023 - 2030, USD Million

- TABLE 115 Germany Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 116 Germany Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 117 Germany Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 118 Germany Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 119 Germany Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 120 Germany Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 121 Germany Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 122 Germany Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 123 UK Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 124 UK Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 125 UK Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 126 UK Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 127 UK Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 128 UK Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 129 UK Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 130 UK Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 131 France Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 132 France Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 133 France Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 134 France Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 135 France Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 136 France Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 137 France Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 138 France Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 139 Russia Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 140 Russia Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 141 Russia Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 142 Russia Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 143 Russia Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 144 Russia Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 145 Russia Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 146 Russia Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 147 Spain Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 148 Spain Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 149 Spain Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 150 Spain Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 151 Spain Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 152 Spain Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 153 Spain Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 154 Spain Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 155 Italy Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 156 Italy Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 157 Italy Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 158 Italy Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 159 Italy Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 160 Italy Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 161 Italy Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 162 Italy Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 163 Rest of Europe Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 164 Rest of Europe Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 165 Rest of Europe Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 166 Rest of Europe Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 167 Rest of Europe Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 168 Rest of Europe Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 169 Rest of Europe Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 170 Rest of Europe Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 171 Asia Pacific Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 172 Asia Pacific Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 173 Asia Pacific Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 174 Asia Pacific Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 175 Asia Pacific FTTX Market by Country, 2019 - 2022, USD Million

- TABLE 176 Asia Pacific FTTX Market by Country, 2023 - 2030, USD Million

- TABLE 177 Asia Pacific Mobile Backhaul Market by Country, 2019 - 2022, USD Million

- TABLE 178 Asia Pacific Mobile Backhaul Market by Country, 2023 - 2030, USD Million

- TABLE 179 Asia Pacific Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 180 Asia Pacific Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 181 Asia Pacific Optical Line Terminal (OLT) Market by Country, 2019 - 2022, USD Million

- TABLE 182 Asia Pacific Optical Line Terminal (OLT) Market by Country, 2023 - 2030, USD Million

- TABLE 183 Asia Pacific Optical Network Terminal (ONT) Market by Country, 2019 - 2022, USD Million

- TABLE 184 Asia Pacific Optical Network Terminal (ONT) Market by Country, 2023 - 2030, USD Million

- TABLE 185 Asia Pacific Optical Distribution Network (ODN) Market by Country, 2019 - 2022, USD Million

- TABLE 186 Asia Pacific Optical Distribution Network (ODN) Market by Country, 2023 - 2030, USD Million

- TABLE 187 Asia Pacific Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 188 Asia Pacific Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 189 Asia Pacific EPON Market by Country, 2019 - 2022, USD Million

- TABLE 190 Asia Pacific EPON Market by Country, 2023 - 2030, USD Million

- TABLE 191 Asia Pacific GPON Market by Country, 2019 - 2022, USD Million

- TABLE 192 Asia Pacific GPON Market by Country, 2023 - 2030, USD Million

- TABLE 193 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

- TABLE 194 Asia Pacific Others Market by Country, 2023 - 2030, USD Million

- TABLE 195 Asia Pacific Passive Optical Network Market by Country, 2019 - 2022, USD Million

- TABLE 196 Asia Pacific Passive Optical Network Market by Country, 2023 - 2030, USD Million

- TABLE 197 China Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 198 China Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 199 China Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 200 China Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 201 China Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 202 China Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 203 China Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 204 China Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 205 Japan Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 206 Japan Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 207 Japan Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 208 Japan Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 209 Japan Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 210 Japan Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 211 Japan Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 212 Japan Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 213 India Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 214 India Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 215 India Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 216 India Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 217 India Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 218 India Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 219 India Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 220 India Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 221 South Korea Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 222 South Korea Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 223 South Korea Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 224 South Korea Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 225 South Korea Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 226 South Korea Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 227 South Korea Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 228 South Korea Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 229 Singapore Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 230 Singapore Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 231 Singapore Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 232 Singapore Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 233 Singapore Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 234 Singapore Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 235 Singapore Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 236 Singapore Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 237 Malaysia Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 238 Malaysia Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 239 Malaysia Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 240 Malaysia Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 241 Malaysia Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 242 Malaysia Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 243 Malaysia Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 244 Malaysia Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 245 Rest of Asia Pacific Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 246 Rest of Asia Pacific Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 247 Rest of Asia Pacific Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 248 Rest of Asia Pacific Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 249 Rest of Asia Pacific Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 250 Rest of Asia Pacific Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 251 Rest of Asia Pacific Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 252 Rest of Asia Pacific Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 253 LAMEA Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 254 LAMEA Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 255 LAMEA Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 256 LAMEA Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 257 LAMEA FTTX Market by Country, 2019 - 2022, USD Million

- TABLE 258 LAMEA FTTX Market by Country, 2023 - 2030, USD Million

- TABLE 259 LAMEA Mobile Backhaul Market by Country, 2019 - 2022, USD Million

- TABLE 260 LAMEA Mobile Backhaul Market by Country, 2023 - 2030, USD Million

- TABLE 261 LAMEA Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 262 LAMEA Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 263 LAMEA Optical Line Terminal (OLT) Market by Country, 2019 - 2022, USD Million

- TABLE 264 LAMEA Optical Line Terminal (OLT) Market by Country, 2023 - 2030, USD Million

- TABLE 265 LAMEA Optical Network Terminal (ONT) Market by Country, 2019 - 2022, USD Million

- TABLE 266 LAMEA Optical Network Terminal (ONT) Market by Country, 2023 - 2030, USD Million

- TABLE 267 LAMEA Optical Distribution Network (ODN) Market by Country, 2019 - 2022, USD Million

- TABLE 268 LAMEA Optical Distribution Network (ODN) Market by Country, 2023 - 2030, USD Million

- TABLE 269 LAMEA Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 270 LAMEA Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 271 LAMEA EPON Market by Country, 2019 - 2022, USD Million

- TABLE 272 LAMEA EPON Market by Country, 2023 - 2030, USD Million

- TABLE 273 LAMEA GPON Market by Country, 2019 - 2022, USD Million

- TABLE 274 LAMEA GPON Market by Country, 2023 - 2030, USD Million

- TABLE 275 LAMEA Others Market by Country, 2019 - 2022, USD Million

- TABLE 276 LAMEA Others Market by Country, 2023 - 2030, USD Million

- TABLE 277 LAMEA Passive Optical Network Market by Country, 2019 - 2022, USD Million

- TABLE 278 LAMEA Passive Optical Network Market by Country, 2023 - 2030, USD Million

- TABLE 279 Brazil Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 280 Brazil Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 281 Brazil Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 282 Brazil Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 283 Brazil Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 284 Brazil Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 285 Brazil Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 286 Brazil Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 287 Argentina Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 288 Argentina Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 289 Argentina Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 290 Argentina Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 291 Argentina Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 292 Argentina Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 293 Argentina Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 294 Argentina Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 295 UAE Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 296 UAE Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 297 UAE Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 298 UAE Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 299 UAE Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 300 UAE Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 301 UAE Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 302 UAE Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 303 Egypt Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 304 Egypt Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 305 Egypt Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 306 Egypt Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 307 Egypt Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 308 Egypt Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 309 Egypt Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 310 Egypt Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 311 South Africa Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 312 South Africa Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 313 South Africa Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 314 South Africa Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 315 South Africa Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 316 South Africa Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 317 South Africa Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 318 South Africa Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 319 Nigeria Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 320 Nigeria Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 321 Nigeria Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 322 Nigeria Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 323 Nigeria Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 324 Nigeria Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 325 Nigeria Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 326 Nigeria Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 327 Rest of LAMEA Passive Optical Network Market, 2019 - 2022, USD Million

- TABLE 328 Rest of LAMEA Passive Optical Network Market, 2023 - 2030, USD Million

- TABLE 329 Rest of LAMEA Passive Optical Network Market by Application, 2019 - 2022, USD Million

- TABLE 330 Rest of LAMEA Passive Optical Network Market by Application, 2023 - 2030, USD Million

- TABLE 331 Rest of LAMEA Passive Optical Network Market by Component, 2019 - 2022, USD Million

- TABLE 332 Rest of LAMEA Passive Optical Network Market by Component, 2023 - 2030, USD Million

- TABLE 333 Rest of LAMEA Passive Optical Network Market by Type, 2019 - 2022, USD Million

- TABLE 334 Rest of LAMEA Passive Optical Network Market by Type, 2023 - 2030, USD Million

- TABLE 335 Key Information - ADTRAN, Inc.

- TABLE 336 Key Information - Calix, Inc.

- TABLE 337 Key Information - Ciena Corporation

- TABLE 338 Key Information - Cisco Systems, Inc.

- TABLE 339 Key Information - Nokia Corporation

- TABLE 340 Key Information - Huawei Technologies Co., Ltd.

- TABLE 341 Key Information - Infinera Corporation

- TABLE 342 Key Information - TP-Link Technologies Co. Ltd.

- TABLE 343 Key Information - ZTE Corporation

- TABLE 344 key information - Ericsson AB

The Global Passive Optical Network Market size is expected to reach $31.1 billion by 2030, rising at a market growth of 13.4% CAGR during the forecast period.

North American countries are still expanding the PON coverage to unserved areas as it provides wide coverage with minimal signal loss. Thus, the region would account for nearly, 27% of the total market share by 2030. North America has seen increased investments in fiber optic infrastructure. Fiber optics, the foundation of PONs, provide reliable and high-speed connectivity. As these networks expand, so does the demand for PON solutions. Owing to these factors, the segment will grow rapidly in the upcoming years.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, in March, 2022, ZTE Corporation has announced a strategic collaboration with Converge ICT Solutions Inc. Under this partnership, ZTE Corporation is set to introduce a commercial 10-Gigabit-capable symmetric passive optical network (XGS-PON) infrastructure in the South Luzon and Visayas regions of the Philippines. Moreover, in 2020, February, Infinera CorporationTeamed up with Lumentum Holdings Inc. Under this collaboration infinera would launch XR optics-based networking solution which is powered by infinera's low -power DSP technology.

Based on the Analysis presented in the KBV Cardinal matrix; Cisco Systems, Inc. is the forerunner in the Market. Companies such as Huawei Technologies Co., Ltd, Nokia Corporation, Ericsson AB are some of the key innovators in Market. In December, 2022, Nokia Corporation joined forces with Etisalat UAE, operating under the brand name "Etisalat by e&," the largest telecommunications provider in the GCC region. This partnership showcased the highest Passive Optical Network (PON) speeds in the Middle East and Africa.

Market Growth Factors

Increasing worldwide demand for high-speed Internet and data services

High-speed Internet is a fundamental requirement for today's digital world, and it's only expected to grow in importance. As more users and businesses seek faster and more reliable connections, the demand for PON technology increases. This drives market growth, resulting in more investments, innovation, and competition within the market. Service providers and network operators are motivated to adopt PON technology to meet the growing bandwidth demands of their customers. They chose PON because it offers a scalable and cost-effective solution for high-speed internet access. This increased adoption expands the market's reach.

Rising government policies and incentives for deploying PONs

Government incentives and funding for fiber optics and PON deployments can stimulate greater public and private investment. This increased investment leads to more extensive network infrastructure, benefiting the market. Government initiatives often focus on underserved or remote areas where private companies may be less inclined to invest due to the higher costs. Additionally, policies to bridge the digital divide prioritize ensuring all citizens have high-speed Internet access. This leads to the deployment of PON networks in rural and underserved areas, bringing the benefits of PON technology to a broader population. As a result, more customers gain access to PON services, increasing the user base. Owing to these factors, the market will grow rapidly in the future.

Market Restraining Factors

High initial cost of deploying PON infrastructure

For new and smaller service providers, the considerable expenditure needed to construct PON infrastructure can be a significant barrier to entry. This can limit competition in the market, reducing choices for consumers and potentially leading to higher prices for PON services. The cost of deployment may lead to market fragmentation, where only a few large, well-funded service providers can afford to invest in PON technology. Additionally, service providers that face high upfront costs may be hesitant to expand their PON networks to underserved or rural areas, where the return on investment is less certain. This can slow down efforts to bridge the digital divide and extend PON services to a wider population. As a result, these factors are expected to hinder the demand for passive optical networks in the coming years.

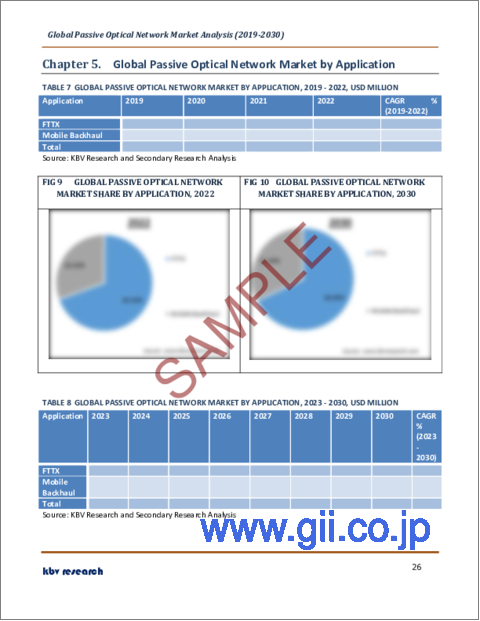

Application Outlook

Based on application, the market is divided into FTTX and mobile backhaul. In 2022, the mobile backhaul segment witnessed a substantial revenue share in the market. PON technology is cost-effective compared to traditional alternatives like point-to-point microwave or copper-based solutions. This cost efficiency is a significant driver for its adoption in mobile backhaul. PON networks offer high levels of reliability and redundancy, which are critical for maintaining continuous connectivity in the mobile backhaul segment. These factors will boost the demand in the mobile backhaul segment in the coming years.

Component Outlook

On the basis of component, the market is divided into optical line terminal (OLT), optical network terminal, and optical distribution network (ODN). In 2022, the optical distribution network (ODN) segment witnessed a substantial revenue share in the market. Many countries and regions are investing in the expansion of broadband networks, with a focus on fiber-optic infrastructure, to meet the growing demand for high-speed connectivity. This expansion drives the demand for ODN components and services. Additionally, 5G deployments continue to expand, there's an increasing need for fiber-optic ODNs to support the high-capacity and low-latency requirements of 5G. These aspects will pose lucrative growth prospects for the segment.

Type Outlook

Based on type, the market is segmented into EPON, GPON, and others. In 2022, the GPON segment garnered a significant revenue share in the market. The demand for high-speed internet access is a major driver for GPON technology. As more people and businesses required faster and more reliable internet connections, service providers turned to GPON as a cost-effective solution for delivering gigabit-speed broadband services. Telecommunication service have expanded their networks using GPON technology to offer high-speed broadband services. This expansion was driven by the growing number of internet users and the need for increased bandwidth to support data-intensive applications. Owing to these factors, there will be increased demand in the segment.

Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific segment acquired the highest revenue share in the market. The Asia Pacific region is home to a large and rapidly growing population, especially in countries like China and India. This demographic trend drives the need for improved telecommunications infrastructure to connect more people. With the ongoing urbanization in many parts of Asia, there is a greater demand for high-speed internet services in urban and suburban areas. Therefore, the segment will grow rapidly in the coming years.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Adtran, Inc., Calix, Inc., Ciena Corporation, Cisco Systems, Inc, Huawei Technologies Co., Ltd. (Huawei investment & Holding Co., Ltd.), Infinera Corporation, Nokia Corporation, TP-Link Corporation Limited, ZTE Corporation and Ericsson AB

Recent Strategies Deployed in Passive Optical Network Market

Partnerships, Collaborations & Agreements:

Oct-2023: TP-Link Corporation Limited has formed a strategic partnership with Qualcomm Technologies, Inc., a leading company specializing in semiconductors, software, and wireless technology services. This collaboration is set to introduce advanced XGS-PON (10 Gigabit Symmetrical Passive Optical Network) Wi-Fi 7 solutions, with the goal of transforming the telecommunications sector. The objective is to offer service providers a swift and flexible deployment approach while delivering unparalleled Wi-Fi and networking experiences to their customers.

Jan-2023: Telekom Research & Development Sdn Bhd (TM R&D), the innovation arm of Telekom Malaysia Berhad (TM), has recently signed a Memorandum of Understanding (MoU) with ZTE (Malaysia) Corporation, a global leading provider of information and communication technology solutions. Through this collaboration TM R&D and ZTE together will explore the strength of next-generation passive Optical network access technology, 50GPON and deliver ultra-broadband access to the government and consumers which will enhance the user experience in Malaysia.

Dec-2022: Nokia Corporation has joined forces with Etisalat UAE, operating under the brand name "Etisalat by e&," the largest telecommunications provider in the GCC region. This partnership showcased the highest Passive Optical Network (PON) speeds in the Middle East and Africa. Furthermore, it aims to support Etisalat in offering top-tier solutions to its client and facilitating the integration of cutting-edge technological innovations within the UAE.

Aug-2022: Nokia Corporation entered into partnership with Furukawa Electric LatAm, the foremost company specializing in network cabling. Under this partnership Nokia with the aimed to expediting the deployment of optical LAN systems in Latin America. This collaboration between Furukawa Electric LatAm and Nokia offers their clients an advanced and pioneering solution that not only promotes sustainability through reduced power consumption but also delivers a dependable and secure technological infrastructure.

Mar-2022: ZTE Corporation has announced a strategic collaboration with Converge ICT Solutions Inc, a prominent fiber optic broadband network provider in the Philippines. Under this partnership, ZTE Corporation is set to introduce a commercial 10-Gigabit-capable symmetric passive optical network (XGS-PON) infrastructure in the South Luzon and Visayas regions of the Philippines.

Sep-2021: Ciena Corporation has officially entered into an agreement to purchase the Vyatta routing and switching technology from AT&T Inc., a leading provider of long-distance telephone and telecommunications services. This strategic acquisition underscores Ciena's commitment to enhancing its Routing and Switching business by integrating Vyatta's expertise and assets. The goal is to empower Ciena's clients to establish virtualized networks and implement new features in 5G, enterprise, and cloud applications swiftly and cost-effectively.

Jul-2020: Nokia and Vecima Networks (TSX: VCM) today announced plans for Vecima to acquire key, next generation technology and products for cable service providers. Under the agreement, Nokia's Gainspeed portfolio along with all supporting technology and assets will transition to Vecima Networks. The planned deal is expected to close quickly subject to customary closing conditions. Financial details are not being disclosed.

Feb-2020: Infinera CorporationTeamed up with Lumentum Holdings Inc., an industry leading designer and manufacturer of innovative photonics-based solutions. Under this collaboration infinera launch XR optics-based networking solution which is powered by infinera's low -power DSP technology. XR optics offers efficient and cost-effective solutions for 5G, broadband, and cloud-based services, with innovative point-to-multipoint technology that could change optical networking economics.

Product Launch and Product Expansions:

May-2023: TP-Link, a prominent global provider of networking products for both consumers and businesses, unveiled two new cutting-edge Wi-Fi 7 devices today. The first is the Deco BE85, a Tri-Band Mesh Wi-Fi system with the extraordinary power of the latest Wi-Fi 7 technology, delivering speeds of up to 22Gbps across three Wi-Fi bands via 12 streams. The second is the Archer BE800, a Tri-Band Wi-Fi Router operating at impressive speeds of up to 19Gbps across three bands. Notably, the Archer BE800 comes equipped with a versatile 10 Gbps SFP+Fiber WAN/LAN combo port, as well as a 10 Gbps WAN/LAN port, offering flexible connectivity support for both fiber and copper connections.

Mar-2023: Huawei Technologies Co., Ltd. unveiled a groundbreaking Lossless Industrial Optical Network solution at the Mobile World Congress 2023 (MWC 2023), marking an industry first. This innovative offering leverages Fifth-generation fixed network (F5G) technologies and was introduced during the F5G Evolution, Unleashing Green Digital Productivity session. It promises to empower customers in constructing exceptionally dependable industrial networks, ultimately enhancing production quality and efficiency.

Nov-2022: TP-Link Corporation Limited, a prominent global supplier of networking products for both consumers and businesses, has introduced three new Wi-Fi 7 routers: Archer BE900, Archer BE800, and Archer BE550. These routers stand out with their innovative and aesthetically pleasing designs while offering impressive performance. The Archer BE900 offers quad-band Wi-Fi with speeds of up to 24 Gbps, the Archer BE800 is a tri-band Wi-Fi 7 router with speeds of up to 19 Gbps, and the Archer BE550 is another tri-band Wi-Fi 7 router, providing speeds of up to 9.2 Gbps.

May-2022: ZTE Corporation, a prominent global provider of telecommunications, enterprise, and consumer technology solutions for mobile internet, made a significant announcement today at the FTTH Conference 2022 in Vienna, Austria. They unveiled the industry's first Optical Network Unit (ONU) prototype that offers support for both 50-Gigabit-Capable Passive Optical Networking (50G PON) and Wi-Fi 7 technologies. This groundbreaking ONU, known by the model number ZXHN F9746Q, utilizes asymmetric 50G PON technology on the network side, achieving impressive data rates with a reception speed of 50 Gbps and a transmission speed of 25 Gbps.

Feb-2022: ZTE Corporation, a prominent global provider of telecommunications, enterprise, and consumer technology solutions for the mobile internet, has announced its plan to unveil the AX11000 Wi-Fi 6E 10-Gigabit-capable Symmetric Passive Optical Network (XGS-PON) Optical Network Terminal (ONT) at the upcoming Mobile World Congress (MWC) 2022, set to commence in Barcelona on February 28, 2022. The XGS-PON ONT, which offers both 10 Gbps wired and 10 Gbps Wi-Fi access speeds, also supports the EasyMesh standard, enabling seamless and high-speed networking for multiple devices.

Mergers & Acquisitions:

Nov-2022: Ciena Corporation has successfully completed the acquisition of Tibit Communications Inc. and Benu Networks, both renowned providers in the realm of Passive Optical Network (PON) technologies and advanced subscriber management solutions. This strategic move by Ciena was driven by its aspiration to enhance its switches and routers portfolio with PON capabilities. The aim is to fortify its software offerings in preparation for the next-generation network infrastructure. Additionally, this acquisition brings a pool of highly skilled professionals into Ciena's workforce, further bolstering its capabilities in subscriber management.

Geographical Expansions:

Feb-2023: Nokia has unveiled plans to broaden its manufacturing operations for PON optical line terminals (OLTs) by expanding its factory located in Sriperumbudur, in close proximity to Chennai, India. This strategic move is a direct response to the rising demand from both domestic Indian customers and a growing global customer base.

Scope of the Study

Market Segments covered in the Report:

By Application

- FTTX

- Mobile Backhaul

By Component

- Optical Line Terminal (OLT)

- Optical Network Terminal (ONT)

- Optical Distribution Network (ODN)

By Type

- EPON

- GPON

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Egypt

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Adtran, Inc.

- Calix, Inc.

- Ciena Corporation

- Cisco Systems, Inc

- Huawei Technologies Co., Ltd. (Huawei investment & Holding Co., Ltd.)

- Infinera Corporation

- Nokia Corporation

- TP-Link Corporation Limited

- ZTE Corporation

- Ericsson AB

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Passive Optical Network Market, by Application

- 1.4.2 Global Passive Optical Network Market, by Component

- 1.4.3 Global Passive Optical Network Market, by Type

- 1.4.4 Global Passive Optical Network Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

Chapter 4. Competition Analysis - Global

- 4.1 KBV Cardinal Matrix

- 4.2 Recent Industry Wide Strategic Developments

- 4.2.1 Partnerships, Collaborations and Agreements

- 4.2.2 Product Launches and Product Expansions

- 4.2.3 Acquisition and Mergers

- 4.2.4 Geographical Expansion

- 4.3 Market Share Analysis, 2022

- 4.4 Top Winning Strategies

- 4.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

- 4.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2020, Feb - 2023, Oct) Leading Players

- 4.5 Porter's Five Forces Analysis

Chapter 5. Global Passive Optical Network Market by Application

- 5.1 Global FTTX Market by Region

- 5.2 Global Mobile Backhaul Market by Region

Chapter 6. Global Passive Optical Network Market by Component

- 6.1 Global Optical Line Terminal (OLT) Market by Region

- 6.2 Global Optical Network Terminal (ONT) Market by Region

- 6.3 Global Optical Distribution Network (ODN) Market by Region

Chapter 7. Global Passive Optical Network Market by Type

- 7.1 Global EPON Market by Region

- 7.2 Global GPON Market by Region

- 7.3 Global Others Market by Region

Chapter 8. Global Passive Optical Network Market by Region

- 8.1 North America Passive Optical Network Market

- 8.1.1 North America Passive Optical Network Market by Application

- 8.1.1.1 North America FTTX Market by Country

- 8.1.1.2 North America Mobile Backhaul Market by Country

- 8.1.2 North America Passive Optical Network Market by Component

- 8.1.2.1 North America Optical Line Terminal (OLT) Market by Country

- 8.1.2.2 North America Optical Network Terminal (ONT) Market by Country

- 8.1.2.3 North America Optical Distribution Network (ODN) Market by Country

- 8.1.3 North America Passive Optical Network Market by Type

- 8.1.3.1 North America EPON Market by Country

- 8.1.3.2 North America GPON Market by Country

- 8.1.3.3 North America Others Market by Country

- 8.1.4 North America Passive Optical Network Market by Country

- 8.1.4.1 US Passive Optical Network Market

- 8.1.4.1.1 US Passive Optical Network Market by Application

- 8.1.4.1.2 US Passive Optical Network Market by Component

- 8.1.4.1.3 US Passive Optical Network Market by Type

- 8.1.4.2 Canada Passive Optical Network Market

- 8.1.4.2.1 Canada Passive Optical Network Market by Application

- 8.1.4.2.2 Canada Passive Optical Network Market by Component

- 8.1.4.2.3 Canada Passive Optical Network Market by Type

- 8.1.4.3 Mexico Passive Optical Network Market

- 8.1.4.3.1 Mexico Passive Optical Network Market by Application

- 8.1.4.3.2 Mexico Passive Optical Network Market by Component

- 8.1.4.3.3 Mexico Passive Optical Network Market by Type

- 8.1.4.4 Rest of North America Passive Optical Network Market

- 8.1.4.4.1 Rest of North America Passive Optical Network Market by Application

- 8.1.4.4.2 Rest of North America Passive Optical Network Market by Component

- 8.1.4.4.3 Rest of North America Passive Optical Network Market by Type

- 8.1.4.1 US Passive Optical Network Market

- 8.1.1 North America Passive Optical Network Market by Application

- 8.2 Europe Passive Optical Network Market

- 8.2.1 Europe Passive Optical Network Market by Application

- 8.2.1.1 Europe FTTX Market by Country

- 8.2.1.2 Europe Mobile Backhaul Market by Country

- 8.2.2 Europe Passive Optical Network Market by Component

- 8.2.2.1 Europe Optical Line Terminal (OLT) Market by Country

- 8.2.2.2 Europe Optical Network Terminal (ONT) Market by Country

- 8.2.2.3 Europe Optical Distribution Network (ODN) Market by Country

- 8.2.3 Europe Passive Optical Network Market by Type

- 8.2.3.1 Europe EPON Market by Country

- 8.2.3.2 Europe GPON Market by Country

- 8.2.3.3 Europe Others Market by Country

- 8.2.4 Europe Passive Optical Network Market by Country

- 8.2.4.1 Germany Passive Optical Network Market

- 8.2.4.1.1 Germany Passive Optical Network Market by Application

- 8.2.4.1.2 Germany Passive Optical Network Market by Component

- 8.2.4.1.3 Germany Passive Optical Network Market by Type

- 8.2.4.2 UK Passive Optical Network Market

- 8.2.4.2.1 UK Passive Optical Network Market by Application

- 8.2.4.2.2 UK Passive Optical Network Market by Component

- 8.2.4.2.3 UK Passive Optical Network Market by Type

- 8.2.4.3 France Passive Optical Network Market

- 8.2.4.3.1 France Passive Optical Network Market by Application

- 8.2.4.3.2 France Passive Optical Network Market by Component

- 8.2.4.3.3 France Passive Optical Network Market by Type

- 8.2.4.4 Russia Passive Optical Network Market

- 8.2.4.4.1 Russia Passive Optical Network Market by Application

- 8.2.4.4.2 Russia Passive Optical Network Market by Component

- 8.2.4.4.3 Russia Passive Optical Network Market by Type

- 8.2.4.5 Spain Passive Optical Network Market

- 8.2.4.5.1 Spain Passive Optical Network Market by Application

- 8.2.4.5.2 Spain Passive Optical Network Market by Component

- 8.2.4.5.3 Spain Passive Optical Network Market by Type

- 8.2.4.6 Italy Passive Optical Network Market

- 8.2.4.6.1 Italy Passive Optical Network Market by Application

- 8.2.4.6.2 Italy Passive Optical Network Market by Component

- 8.2.4.6.3 Italy Passive Optical Network Market by Type

- 8.2.4.7 Rest of Europe Passive Optical Network Market

- 8.2.4.7.1 Rest of Europe Passive Optical Network Market by Application

- 8.2.4.7.2 Rest of Europe Passive Optical Network Market by Component

- 8.2.4.7.3 Rest of Europe Passive Optical Network Market by Type

- 8.2.4.1 Germany Passive Optical Network Market

- 8.2.1 Europe Passive Optical Network Market by Application

- 8.3 Asia Pacific Passive Optical Network Market

- 8.3.1 Asia Pacific Passive Optical Network Market by Application

- 8.3.1.1 Asia Pacific FTTX Market by Country

- 8.3.1.2 Asia Pacific Mobile Backhaul Market by Country

- 8.3.2 Asia Pacific Passive Optical Network Market by Component

- 8.3.2.1 Asia Pacific Optical Line Terminal (OLT) Market by Country

- 8.3.2.2 Asia Pacific Optical Network Terminal (ONT) Market by Country

- 8.3.2.3 Asia Pacific Optical Distribution Network (ODN) Market by Country

- 8.3.3 Asia Pacific Passive Optical Network Market by Type

- 8.3.3.1 Asia Pacific EPON Market by Country

- 8.3.3.2 Asia Pacific GPON Market by Country

- 8.3.3.3 Asia Pacific Others Market by Country

- 8.3.4 Asia Pacific Passive Optical Network Market by Country

- 8.3.4.1 China Passive Optical Network Market

- 8.3.4.1.1 China Passive Optical Network Market by Application

- 8.3.4.1.2 China Passive Optical Network Market by Component

- 8.3.4.1.3 China Passive Optical Network Market by Type

- 8.3.4.2 Japan Passive Optical Network Market

- 8.3.4.2.1 Japan Passive Optical Network Market by Application

- 8.3.4.2.2 Japan Passive Optical Network Market by Component

- 8.3.4.2.3 Japan Passive Optical Network Market by Type

- 8.3.4.3 India Passive Optical Network Market

- 8.3.4.3.1 India Passive Optical Network Market by Application

- 8.3.4.3.2 India Passive Optical Network Market by Component

- 8.3.4.3.3 India Passive Optical Network Market by Type

- 8.3.4.4 South Korea Passive Optical Network Market

- 8.3.4.4.1 South Korea Passive Optical Network Market by Application

- 8.3.4.4.2 South Korea Passive Optical Network Market by Component

- 8.3.4.4.3 South Korea Passive Optical Network Market by Type

- 8.3.4.5 Singapore Passive Optical Network Market

- 8.3.4.5.1 Singapore Passive Optical Network Market by Application

- 8.3.4.5.2 Singapore Passive Optical Network Market by Component

- 8.3.4.5.3 Singapore Passive Optical Network Market by Type

- 8.3.4.6 Malaysia Passive Optical Network Market

- 8.3.4.6.1 Malaysia Passive Optical Network Market by Application

- 8.3.4.6.2 Malaysia Passive Optical Network Market by Component

- 8.3.4.6.3 Malaysia Passive Optical Network Market by Type

- 8.3.4.7 Rest of Asia Pacific Passive Optical Network Market

- 8.3.4.7.1 Rest of Asia Pacific Passive Optical Network Market by Application

- 8.3.4.7.2 Rest of Asia Pacific Passive Optical Network Market by Component

- 8.3.4.7.3 Rest of Asia Pacific Passive Optical Network Market by Type

- 8.3.4.1 China Passive Optical Network Market

- 8.3.1 Asia Pacific Passive Optical Network Market by Application

- 8.4 LAMEA Passive Optical Network Market

- 8.4.1 LAMEA Passive Optical Network Market by Application

- 8.4.1.1 LAMEA FTTX Market by Country

- 8.4.1.2 LAMEA Mobile Backhaul Market by Country

- 8.4.2 LAMEA Passive Optical Network Market by Component

- 8.4.2.1 LAMEA Optical Line Terminal (OLT) Market by Country

- 8.4.2.2 LAMEA Optical Network Terminal (ONT) Market by Country

- 8.4.2.3 LAMEA Optical Distribution Network (ODN) Market by Country

- 8.4.3 LAMEA Passive Optical Network Market by Type

- 8.4.3.1 LAMEA EPON Market by Country

- 8.4.3.2 LAMEA GPON Market by Country

- 8.4.3.3 LAMEA Others Market by Country

- 8.4.4 LAMEA Passive Optical Network Market by Country

- 8.4.4.1 Brazil Passive Optical Network Market

- 8.4.4.1.1 Brazil Passive Optical Network Market by Application

- 8.4.4.1.2 Brazil Passive Optical Network Market by Component

- 8.4.4.1.3 Brazil Passive Optical Network Market by Type

- 8.4.4.2 Argentina Passive Optical Network Market

- 8.4.4.2.1 Argentina Passive Optical Network Market by Application

- 8.4.4.2.2 Argentina Passive Optical Network Market by Component

- 8.4.4.2.3 Argentina Passive Optical Network Market by Type

- 8.4.4.3 UAE Passive Optical Network Market

- 8.4.4.3.1 UAE Passive Optical Network Market by Application

- 8.4.4.3.2 UAE Passive Optical Network Market by Component

- 8.4.4.3.3 UAE Passive Optical Network Market by Type

- 8.4.4.4 Egypt Passive Optical Network Market

- 8.4.4.4.1 Egypt Passive Optical Network Market by Application

- 8.4.4.4.2 Egypt Passive Optical Network Market by Component

- 8.4.4.4.3 Egypt Passive Optical Network Market by Type

- 8.4.4.5 South Africa Passive Optical Network Market

- 8.4.4.5.1 South Africa Passive Optical Network Market by Application

- 8.4.4.5.2 South Africa Passive Optical Network Market by Component

- 8.4.4.5.3 South Africa Passive Optical Network Market by Type

- 8.4.4.6 Nigeria Passive Optical Network Market

- 8.4.4.6.1 Nigeria Passive Optical Network Market by Application

- 8.4.4.6.2 Nigeria Passive Optical Network Market by Component

- 8.4.4.6.3 Nigeria Passive Optical Network Market by Type

- 8.4.4.7 Rest of LAMEA Passive Optical Network Market

- 8.4.4.7.1 Rest of LAMEA Passive Optical Network Market by Application

- 8.4.4.7.2 Rest of LAMEA Passive Optical Network Market by Component

- 8.4.4.7.3 Rest of LAMEA Passive Optical Network Market by Type

- 8.4.4.1 Brazil Passive Optical Network Market

- 8.4.1 LAMEA Passive Optical Network Market by Application

Chapter 9. Company Profiles

- 9.1 Adtran, Inc.

- 9.1.1 Company Overview

- 9.1.2 Financial Analysis

- 9.1.3 Segmental and Regional Analysis

- 9.1.4 Research & Development Expenses

- 9.1.5 SWOT Analysis

- 9.2 Calix, Inc.

- 9.2.1 Company Overview

- 9.2.2 Financial Analysis

- 9.2.3 Regional Analysis

- 9.2.4 Research & Development Expenses

- 9.2.5 SWOT Analysis

- 9.3 Ciena Corporation

- 9.3.1 Company Overview

- 9.3.2 Financial Analysis

- 9.3.3 Segmental and Regional Analysis

- 9.3.4 Research & Development Expense

- 9.3.5 Recent strategies and developments:

- 9.3.5.1 Partnerships, Collaborations, and Agreements:

- 9.3.5.2 Acquisition and Mergers:

- 9.3.6 SWOT Analysis

- 9.4 Cisco Systems, Inc.

- 9.4.1 Company Overview

- 9.4.2 Financial Analysis

- 9.4.3 Regional Analysis

- 9.4.4 Research & Development Expense

- 9.4.5 SWOT Analysis

- 9.5 Nokia Corporation

- 9.5.1 Company Overview

- 9.5.2 Financial Analysis

- 9.5.3 Segmental and Regional Analysis

- 9.5.4 Research & Development Expense

- 9.5.5 Recent strategies and developments:

- 9.5.5.1 Partnerships, Collaborations, and Agreements:

- 9.5.5.2 Geographical Expansions:

- 9.5.6 SWOT Analysis

- 9.6 Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- 9.6.1 Company Overview

- 9.6.2 Financial Analysis

- 9.6.3 Segmental and Regional Analysis

- 9.6.4 Research & Development Expense

- 9.6.5 Recent strategies and developments:

- 9.6.5.1 Product Launches and Product Expansions:

- 9.6.6 SWOT Analysis

- 9.7 Infinera Corporation

- 9.7.1 Company Overview

- 9.7.2 Financial Analysis

- 9.7.3 Regional Analysis

- 9.7.4 Research & Development Expenses

- 9.7.5 Recent strategies and developments:

- 9.7.5.1 Partnerships, Collaborations, and Agreements:

- 9.7.6 SWOT Analysis

- 9.8 TP-Link Corporation Limited

- 9.8.1 Company Overview

- 9.8.2 Recent strategies and developments:

- 9.8.2.1 Partnerships, Collaborations, and Agreements:

- 9.8.2.2 Product Launches and Product Expansions:

- 9.8.3 SWOT Analysis

- 9.9 ZTE Corporation

- 9.9.1 Company Overview

- 9.9.2 Financial Analysis

- 9.9.3 Segmental and Regional Analysis

- 9.9.4 Research & Development Expenses

- 9.9.5 Recent strategies and developments:

- 9.9.5.1 Partnerships, Collaborations, and Agreements:

- 9.9.5.2 Product Launches and Product Expansions:

- 9.9.6 SWOT Analysis

- 9.10. Ericsson AB

- 9.10.1 Company Overview

- 9.10.2 Financial Analysis

- 9.10.3 Segmental and Regional Analysis

- 9.10.4 Research & Development Expense

- 9.10.5 SWOT Analysis