|

|

市場調査レポート

商品コード

1384857

インターベンショナル心臓デバイスの世界市場規模、シェア、産業動向分析レポート:用途別、製品別、地域別展望と予測、2023年~2030年Global Interventional Cardiology Devices Market Size, Share & Industry Trends Analysis Report By End-use (Hospitals & Clinics, Ambulatory Surgical Centers & Others), By Product, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| インターベンショナル心臓デバイスの世界市場規模、シェア、産業動向分析レポート:用途別、製品別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年10月31日

発行: KBV Research

ページ情報: 英文 493 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

インターベンショナル心臓デバイス市場規模は、予測期間中にCAGR 7.4%で成長し、2030年には219億米ドルに達すると予測されます。2022年の市場規模は6,210万500台、成長率は7.3%(2019-2022年)。

KBV Cardinalのマトリックスに示された分析によると、Abbott LaboratoriesとMedtronic PLCがインターベンショナル心臓デバイス市場の先駆者です。Terumo Corporation、Boston Scientific Corporation、Teleflex, Inc.などの企業は、インターベンショナル心臓デバイス市場における主要なイノベーターです。2021年9月、TerumoはEtiometryと提携し、臨床医に患者の状態を深く理解させることに成功しました。

COVID-19影響分析

パンデミックの初期段階では、COVID-19患者の治療を優先し、ヘルスケア資源を節約するために、多くの選択的および非緊急のインターベンショナル心臓外科手術が延期または中止されました。このため、心臓手術は一時的に減少し、関連機器の使用も減少しました。病院やヘルスケア施設は、急性心筋梗塞(心臓発作)のような緊急かつ優先順位の高い症例の治療に重点を移しました。ステント、カテーテル、ガイドワイヤーなどのインターベンショナル心臓デバイスの生産と流通の遅れが市場に影響を与えました。対面でのやり取りを制限し、ウイルス感染のリスクを軽減する必要性から、心臓病患者の遠隔モニタリングが重視されるようになっています。このため、COVID-19の流行は市場に中程度の影響を与えました。

市場成長要因

心血管疾患の有病率の増加

冠動脈疾患(CAD)、心臓発作、心不全などの心血管疾患(CVD)は、依然として世界の罹患率および死亡率の主要原因となっています。CVDの有病率の増加は、インターベンショナル・カーディオロジー手技および機器の需要を牽引しています。心血管疾患は、世界的に罹患率と死亡率の主要な原因の1つです。何百万人もの人々が罹患しているため、診断と治療を必要とする患者数は膨大な数に上ります。世界人口の高齢化に伴い、加齢に関連した心血管疾患の発生率も高くなっています。高齢者はCVDに罹患しやすく、心血管治療への介入や機器の需要が増加しています。CVDの世界の負担は増加の一途をたどっており、増大するヘルスケアニーズに対応するため、インターベンショナル心臓デバイスの市場は拡大が見込まれています。

高齢化人口の割合の増加

世界人口の高齢化に伴い、加齢に関連した心血管疾患の発生率が高くなっています。高齢者は、ステント留置術や血管形成術などのインターベンショナル・カーディオロジー介入が必要になる可能性が高くなります。加齢は冠動脈疾患(CAD)、心臓発作、心不全、不整脈などの心血管系疾患(CVD)の主要な危険因子です。加齢に伴いこれらの疾患を発症する可能性が高くなるため、インターベンショナル・カーディオロジー手技や機器に対する需要が増加しています。加齢は冠動脈におけるアテローム性動脈硬化斑の進行性蓄積と関連しています。その結果、高齢者は心臓発作などの急性冠動脈イベントを経験するリスクが高くなり、緊急の介入が必要となります。これらの技術は、インターベンショナル心臓デバイスの利用を促進し、患者の転帰とヘルスケアの効率を向上させながら、市場の成長を促進します。

市場抑制要因

高コストと経済的圧力

しかし、インターベンショナル心臓デバイスの高額なコストはヘルスケア予算を圧迫し、特にリソースに制約のある環境では高度な治療へのアクセスを制限する可能性があります。技術革新と手頃な価格のバランスを取ることは、根強い課題です。薬剤溶出ステント、バルーン、画像診断装置などのインターベンショナル心臓デバイスは、製造・購入に高額な費用がかかります。高額な初期費用はヘルスケアの予算を圧迫し、特に資源が限られている地域では、先進的な治療や技術へのアクセスを制限する可能性があります。規制の変更、更新、ガイドラインの解釈の変遷は、承認プロセスに不確実性をもたらす可能性があります。規制当局の決定が遅れると、市場参入のタイムラインに影響を及ぼす可能性があります。

最終用途別の展望

最終用途別では、市場は病院・診療所、外来手術センター、その他に区分されます。外来手術センターは2022年の市場で大きな収益シェアを獲得しました。外来手術センター(ASC)は、心臓カテーテル検査、血管形成術、ステント留置などの低侵襲インターベンショナル心臓病学的処置に適しています。患者は侵襲の少ないアプローチから、回復時間の短縮や術後の不快感の軽減といった恩恵を受ける。ASCの集中的で患者中心の環境は、より前向きで個別化された患者体験をもたらします。病院よりも敷居が低いため、患者の不安やストレスも軽減されます。

製品の展望

製品別では、冠動脈ステント、PTCAバルーンカテーテル、付属機器、その他に分類されます。2022年の市場では、PTCAバルーンカテーテル分野がかなりの収益シェアを占めています。PTCAバルーンカテーテルの需要は、冠動脈疾患(CAD)の世界の有病率の上昇に伴い拡大すると予想されます。CADは依然として罹患率および死亡率の主要な原因であるため、血管形成術などのインターベンショナル手技の継続的なニーズがPTCAバルーンカテーテルの使用を後押ししています。PTCAバルーンカテーテルは、従来の開心術に代わって人気を博している低侵襲血管形成術に不可欠なものです。回復に要する時間が短く、入院期間も短縮できるため、患者は侵襲性の低いアプローチを好むことが多いです。PTCAバルーンカテーテルは、重度に石灰化した動脈など、より複雑で困難な病変に対応できるように進化してきました。このような状況用に設計された特殊なバルーンカテーテルは、治療可能な患者の範囲を広げています。

冠動脈ステントの展望

冠動脈ステントの市場は、薬剤溶出ステント、ベアメタルステント、生体吸収性ステントに区分されます。ベアメタルステント(BMS)セグメントは、2022年の市場でかなりの収益シェアを獲得しました。BMSはステンレス鋼またはコバルトクロム合金製の金属製ステントです。薬剤コーティングは施されていないです。薬剤コーティングがないため、BMSは通常、二重抗血小板療法(DAPT)の期間を短くする必要があります。これはDAPTの延長が出血リスクを高める場合に有利です。

PTCAバルーンカテーテルの展望

PTCAバルーンカテーテル市場は、通常型、特殊型、薬剤コーティング型に分類されます。2022年には、通常型セグメントが最大の売上シェアを獲得し、市場を独占しました。インターベンショナル・カーディオロジーは、患者の予後を改善し、症状を軽減し、生活の質を向上させることが多いです。心臓への血流を正常に戻し、胸痛や息切れなどの症状を緩和することができます。薬剤溶出ステントなど多くのインターベンション機器は、再狭窄や動脈再狭窄のリスクを低減し、インターベンションを繰り返す必要性を減らすのに役立ちます。低侵襲手術は一般に、痛みの軽減、入院期間の短縮、通常の活動への早期復帰につながり、患者の快適性を高める。

付属機器の展望

付属機器では、市場はPTCAガイドワイヤー、診断用カテーテル、PTCAガイディングカテーテル、イントロデューサーシースに分類されます。2022年には、PTCAガイドワイヤー部門が市場で最大の売上シェアを記録しました。ワークホースガイドワイヤーは、冠動脈をナビゲートし、血管内の標的部位に到達するために病変(閉塞または狭窄)を横切るために使用されます。バルーン・カテーテルやステントなど、他のインターベンショナル・デバイスを使用するための最初のアクセスやサポートを提供します。これらのガイドワイヤーは、カテーテルを冠動脈内の目的の場所に誘導するのに役立ちます。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAで分析されます。2022年には、アジア太平洋地域が市場で大きな収益シェアを獲得しました。アジア太平洋地域では、冠動脈疾患(CAD)、脳卒中、高血圧などの心血管疾患(CVD)の負担が増加しています。ライフスタイルの変化、都市化、高齢化などの要因がCVDの有病率上昇に寄与しています。多くのアジア太平洋諸国における経済成長はヘルスケア支出の増加につながり、ヘルスケア施設の拡大、先進医療技術の導入、インターベンショナル・カーディオロジー治療へのアクセスの改善を可能にしています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場の概要

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第4章 競合分析- 世界

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 承認

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターのファイブフォース分析

第5章 世界のインターベンショナル心臓デバイス市場:最終用途別

- 世界の病院およびクリニック市場:地域別

- 世界の外来手術センターおよびその他の市場:地域別

第6章 世界のインターベンショナル心臓デバイス市場:製品別

- 世界の冠状動脈ステント市場:地域別

- 世界のインターベンショナル心臓デバイス市場:冠状動脈ステントタイプ別

- 世界の薬剤溶出ステント市場:地域別

- 世界のベアメタルステント市場:地域別

- 世界の生体吸収性ステント市場:地域別

- 世界のアクセサリデバイス市場:地域別

- 世界のインターベンショナル心臓デバイス市場:アクセサリデバイスタイプ別

- 世界のPTCAガイドワイヤー市場:地域別

- 世界の診断用カテーテル市場:地域別

- 世界のPTCAガイディングカテーテル市場:地域別

- 世界のイントロデューサーシース市場:地域別

- 世界のPTCAバルーンカテーテル市場:地域別

- 世界のインターベンショナル心臓デバイス市場:PTCAバルーンカテーテルタイプ別

- 世界の通常市場:地域別

- 世界の専門市場:地域別

- 世界の薬物コーティング市場:地域別

- 世界の血管内画像カテーテルおよび圧力ガイドワイヤー市場:地域別

第7章 世界のインターベンショナル心臓デバイス市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第8章 企業プロファイル

- Abbott Laboratories

- Boston Scientific Corporation

- Terumo Corporation

- Medtronic PLC

- B Braun Melsungen AG

- Biotronik SE & Co KG

- Cardinal Health, Inc

- Teleflex, Inc

- Koninklijke Philips NV

- Alvimedica

第9章 市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Interventional Cardiology Devices Market, 2019 - 2022, USD Million

- TABLE 2 Global Interventional Cardiology Devices Market, 2023 - 2030, USD Million

- TABLE 3 Global Interventional Cardiology Devices Market, 2019 - 2022, Thousand Units

- TABLE 4 Global Interventional Cardiology Devices Market, 2023 - 2030, Thousand Units

- TABLE 5 Partnerships, Collaborations and Agreements- Interventional Cardiology Devices Market

- TABLE 6 Product Launches And Product Expansions- Interventional Cardiology Devices Market

- TABLE 7 Acquisition and Mergers- Interventional Cardiology Devices Market

- TABLE 8 Approvals- Interventional Cardiology Devices Market

- TABLE 9 Global Interventional Cardiology Devices Market by End-use, 2019 - 2022, USD Million

- TABLE 10 Global Interventional Cardiology Devices Market by End-use, 2023 - 2030, USD Million

- TABLE 11 Global Interventional Cardiology Devices Market by End-use, 2019 - 2022, Thousand Units

- TABLE 12 Global Interventional Cardiology Devices Market by End-use, 2023 - 2030, Thousand Units

- TABLE 13 Global Hospitals & Clinics Market by Region, 2019 - 2022, USD Million

- TABLE 14 Global Hospitals & Clinics Market by Region, 2023 - 2030, USD Million

- TABLE 15 Global Hospitals & Clinics Market by Region, 2019 - 2022, Thousand Units

- TABLE 16 Global Hospitals & Clinics Market by Region, 2023 - 2030, Thousand Units

- TABLE 17 Global Ambulatory Surgical Centers & Others Market by Region, 2019 - 2022, USD Million

- TABLE 18 Global Ambulatory Surgical Centers & Others Market by Region, 2023 - 2030, USD Million

- TABLE 19 Global Ambulatory Surgical Centers & Others Market by Region, 2019 - 2022, Thousand Units

- TABLE 20 Global Ambulatory Surgical Centers & Others Market by Region, 2023 - 2030, Thousand Units

- TABLE 21 Global Interventional Cardiology Devices Market by Product, 2019 - 2022, USD Million

- TABLE 22 Global Interventional Cardiology Devices Market by Product, 2023 - 2030, USD Million

- TABLE 23 Global Interventional Cardiology Devices Market by Product, 2019 - 2022, Thousand Units

- TABLE 24 Global Interventional Cardiology Devices Market by Product, 2023 - 2030, Thousand Units

- TABLE 25 Global Coronary Stents Market by Region, 2019 - 2022, USD Million

- TABLE 26 Global Coronary Stents Market by Region, 2023 - 2030, USD Million

- TABLE 27 Global Coronary Stents Market by Region, 2019 - 2022, Thousand Units

- TABLE 28 Global Coronary Stents Market by Region, 2023 - 2030, Thousand Units

- TABLE 29 Global Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, USD Million

- TABLE 30 Global Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, USD Million

- TABLE 31 Global Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, Thousand Units

- TABLE 32 Global Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, Thousand Units

- TABLE 33 Global Drug Eluting Stents Market by Region, 2019 - 2022, USD Million

- TABLE 34 Global Drug Eluting Stents Market by Region, 2023 - 2030, USD Million

- TABLE 35 Global Drug Eluting Stents Market by Region, 2019 - 2022, Thousand Units

- TABLE 36 Global Drug Eluting Stents Market by Region, 2023 - 2030, Thousand Units

- TABLE 37 Global Bare Metal Stents Market by Region, 2019 - 2022, USD Million

- TABLE 38 Global Bare Metal Stents Market by Region, 2023 - 2030, USD Million

- TABLE 39 Global Bare Metal Stents Market by Region, 2019 - 2022, Thousand Units

- TABLE 40 Global Bare Metal Stents Market by Region, 2023 - 2030, Thousand Units

- TABLE 41 Global Bioabsorbable Stents Market by Region, 2019 - 2022, USD Million

- TABLE 42 Global Bioabsorbable Stents Market by Region, 2023 - 2030, USD Million

- TABLE 43 Global Bioabsorbable Stents Market by Region, 2019 - 2022, Thousand Units

- TABLE 44 Global Bioabsorbable Stents Market by Region, 2023 - 2030, Thousand Units

- TABLE 45 Global Accessory Devices Market by Region, 2019 - 2022, USD Million

- TABLE 46 Global Accessory Devices Market by Region, 2023 - 2030, USD Million

- TABLE 47 Global Accessory Devices Market by Region, 2019 - 2022, Thousand Units

- TABLE 48 Global Accessory Devices Market by Region, 2023 - 2030, Thousand Units

- TABLE 49 Global Interventional Cardiology Devices Market by Accessory Devices Type, 2019 - 2022, USD Million

- TABLE 50 Global Interventional Cardiology Devices Market by Accessory Devices Type, 2023 - 2030, USD Million

- TABLE 51 Global PTCA Guidewires Market by Region, 2019 - 2022, USD Million

- TABLE 52 Global PTCA Guidewires Market by Region, 2023 - 2030, USD Million

- TABLE 53 Global Diagnostic Catheters Market by Region, 2019 - 2022, USD Million

- TABLE 54 Global Diagnostic Catheters Market by Region, 2023 - 2030, USD Million

- TABLE 55 Global PTCA Guiding Catheters Market by Region, 2019 - 2022, USD Million

- TABLE 56 Global PTCA Guiding Catheters Market by Region, 2023 - 2030, USD Million

- TABLE 57 Global Introducer Sheaths Market by Region, 2019 - 2022, USD Million

- TABLE 58 Global Introducer Sheaths Market by Region, 2023 - 2030, USD Million

- TABLE 59 Global PTCA Balloon Catheters Market by Region, 2019 - 2022, USD Million

- TABLE 60 Global PTCA Balloon Catheters Market by Region, 2023 - 2030, USD Million

- TABLE 61 Global PTCA Balloon Catheters Market by Region, 2019 - 2022, Thousand Units

- TABLE 62 Global PTCA Balloon Catheters Market by Region, 2023 - 2030, Thousand Units

- TABLE 63 Global Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2019 - 2022, USD Million

- TABLE 64 Global Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2023 - 2030, USD Million

- TABLE 65 Global Normal Market by Region, 2019 - 2022, USD Million

- TABLE 66 Global Normal Market by Region, 2023 - 2030, USD Million

- TABLE 67 Global Specialty Market by Region, 2019 - 2022, USD Million

- TABLE 68 Global Specialty Market by Region, 2023 - 2030, USD Million

- TABLE 69 Global Drug Coated Market by Region, 2019 - 2022, USD Million

- TABLE 70 Global Drug Coated Market by Region, 2023 - 2030, USD Million

- TABLE 71 Global Intravascular Imaging Catheters & Pressure Guidewires Market by Region, 2019 - 2022, USD Million

- TABLE 72 Global Intravascular Imaging Catheters & Pressure Guidewires Market by Region, 2023 - 2030, USD Million

- TABLE 73 Global Intravascular Imaging Catheters & Pressure Guidewires Market by Region, 2019 - 2022, Thousand Units

- TABLE 74 Global Intravascular Imaging Catheters & Pressure Guidewires Market by Region, 2023 - 2030, Thousand Units

- TABLE 75 Global Interventional Cardiology Devices Market by Region, 2019 - 2022, USD Million

- TABLE 76 Global Interventional Cardiology Devices Market by Region, 2023 - 2030, USD Million

- TABLE 77 Global Interventional Cardiology Devices Market by Region, 2019 - 2022, Thousand Units

- TABLE 78 Global Interventional Cardiology Devices Market by Region, 2023 - 2030, Thousand Units

- TABLE 79 North America Interventional Cardiology Devices Market, 2019 - 2022, USD Million

- TABLE 80 North America Interventional Cardiology Devices Market, 2023 - 2030, USD Million

- TABLE 81 North America Interventional Cardiology Devices Market, 2019 - 2022, Thousand Units

- TABLE 82 North America Interventional Cardiology Devices Market, 2023 - 2030, Thousand Units

- TABLE 83 North America Interventional Cardiology Devices Market by End-use, 2019 - 2022, USD Million

- TABLE 84 North America Interventional Cardiology Devices Market by End-use, 2023 - 2030, USD Million

- TABLE 85 North America Interventional Cardiology Devices Market by End-use, 2019 - 2022, Thousand Units

- TABLE 86 North America Interventional Cardiology Devices Market by End-use, 2023 - 2030, Thousand Units

- TABLE 87 North America Hospitals & Clinics Market by Region, 2019 - 2022, USD Million

- TABLE 88 North America Hospitals & Clinics Market by Region, 2023 - 2030, USD Million

- TABLE 89 North America Hospitals & Clinics Market by Region, 2019 - 2022, Thousand Units

- TABLE 90 North America Hospitals & Clinics Market by Region, 2023 - 2030, Thousand Units

- TABLE 91 North America Ambulatory Surgical Centers & Others Market by Region, 2019 - 2022, USD Million

- TABLE 92 North America Ambulatory Surgical Centers & Others Market by Region, 2023 - 2030, USD Million

- TABLE 93 North America Ambulatory Surgical Centers & Others Market by Region, 2019 - 2022, Thousand Units

- TABLE 94 North America Ambulatory Surgical Centers & Others Market by Region, 2023 - 2030, Thousand Units

- TABLE 95 North America Interventional Cardiology Devices Market by Product, 2019 - 2022, USD Million

- TABLE 96 North America Interventional Cardiology Devices Market by Product, 2023 - 2030, USD Million

- TABLE 97 North America Interventional Cardiology Devices Market by Product, 2019 - 2022, Thousand Units

- TABLE 98 North America Interventional Cardiology Devices Market by Product, 2023 - 2030, Thousand Units

- TABLE 99 North America Coronary Stents Market by Country, 2019 - 2022, USD Million

- TABLE 100 North America Coronary Stents Market by Country, 2023 - 2030, USD Million

- TABLE 101 North America Coronary Stents Market by Country, 2019 - 2022, Thousand Units

- TABLE 102 North America Coronary Stents Market by Country, 2023 - 2030, Thousand Units

- TABLE 103 North America Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, USD Million

- TABLE 104 North America Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, USD Million

- TABLE 105 North America Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, Thousand Units

- TABLE 106 North America Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, Thousand Units

- TABLE 107 North America Drug Eluting Stents Market by Country, 2019 - 2022, USD Million

- TABLE 108 North America Drug Eluting Stents Market by Country, 2023 - 2030, USD Million

- TABLE 109 North America Drug Eluting Stents Market by Country, 2019 - 2022, Thousand Units

- TABLE 110 North America Drug Eluting Stents Market by Country, 2023 - 2030, Thousand Units

- TABLE 111 North America Bare Metal Stents Market by Country, 2019 - 2022, USD Million

- TABLE 112 North America Bare Metal Stents Market by Country, 2023 - 2030, USD Million

- TABLE 113 North America Bare Metal Stents Market by Country, 2019 - 2022, Thousand Units

- TABLE 114 North America Bare Metal Stents Market by Country, 2023 - 2030, Thousand Units

- TABLE 115 North America Bioabsorbable Stents Market by Country, 2019 - 2022, USD Million

- TABLE 116 North America Bioabsorbable Stents Market by Country, 2023 - 2030, USD Million

- TABLE 117 North America Bioabsorbable Stents Market by Country, 2019 - 2022, Thousand Units

- TABLE 118 North America Bioabsorbable Stents Market by Country, 2023 - 2030, Thousand Units

- TABLE 119 North America Accessory Devices Market by Country, 2019 - 2022, USD Million

- TABLE 120 North America Accessory Devices Market by Country, 2023 - 2030, USD Million

- TABLE 121 North America Accessory Devices Market by Country, 2019 - 2022, Thousand Units

- TABLE 122 North America Accessory Devices Market by Country, 2023 - 2030, Thousand Units

- TABLE 123 North America Interventional Cardiology Devices Market by Accessory Devices Type, 2019 - 2022, USD Million

- TABLE 124 North America Interventional Cardiology Devices Market by Accessory Devices Type, 2023 - 2030, USD Million

- TABLE 125 North America PTCA Guidewires Market by Country, 2019 - 2022, USD Million

- TABLE 126 North America PTCA Guidewires Market by Country, 2023 - 2030, USD Million

- TABLE 127 North America Diagnostic Catheters Market by Country, 2019 - 2022, USD Million

- TABLE 128 North America Diagnostic Catheters Market by Country, 2023 - 2030, USD Million

- TABLE 129 North America PTCA Guiding Catheters Market by Country, 2019 - 2022, USD Million

- TABLE 130 North America PTCA Guiding Catheters Market by Country, 2023 - 2030, USD Million

- TABLE 131 North America Introducer Sheaths Market by Country, 2019 - 2022, USD Million

- TABLE 132 North America Introducer Sheaths Market by Country, 2023 - 2030, USD Million

- TABLE 133 North America PTCA Balloon Catheters Market by Country, 2019 - 2022, USD Million

- TABLE 134 North America PTCA Balloon Catheters Market by Country, 2023 - 2030, USD Million

- TABLE 135 North America PTCA Balloon Catheters Market by Country, 2019 - 2022, Thousand Units

- TABLE 136 North America PTCA Balloon Catheters Market by Country, 2023 - 2030, Thousand Units

- TABLE 137 North America Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2019 - 2022, USD Million

- TABLE 138 North America Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2023 - 2030, USD Million

- TABLE 139 North America Normal Market by Country, 2019 - 2022, USD Million

- TABLE 140 North America Normal Market by Country, 2023 - 2030, USD Million

- TABLE 141 North America Specialty Market by Country, 2019 - 2022, USD Million

- TABLE 142 North America Specialty Market by Country, 2023 - 2030, USD Million

- TABLE 143 North America Drug Coated Market by Country, 2019 - 2022, USD Million

- TABLE 144 North America Drug Coated Market by Country, 2023 - 2030, USD Million

- TABLE 145 North America Intravascular Imaging Catheters & Pressure Guidewires Market by Country, 2019 - 2022, USD Million

- TABLE 146 North America Intravascular Imaging Catheters & Pressure Guidewires Market by Country, 2023 - 2030, USD Million

- TABLE 147 North America Intravascular Imaging Catheters & Pressure Guidewires Market by Country, 2019 - 2022, Thousand Units

- TABLE 148 North America Intravascular Imaging Catheters & Pressure Guidewires Market by Country, 2023 - 2030, Thousand Units

- TABLE 149 North America Interventional Cardiology Devices Market by Country, 2019 - 2022, USD Million

- TABLE 150 North America Interventional Cardiology Devices Market by Country, 2023 - 2030, USD Million

- TABLE 151 North America Interventional Cardiology Devices Market by Country, 2019 - 2022, Thousand Units

- TABLE 152 North America Interventional Cardiology Devices Market by Country, 2023 - 2030, Thousand Units

- TABLE 153 US Interventional Cardiology Devices Market, 2019 - 2022, USD Million

- TABLE 154 US Interventional Cardiology Devices Market, 2023 - 2030, USD Million

- TABLE 155 US Interventional Cardiology Devices Market, 2019 - 2022, Thousand Units

- TABLE 156 US Interventional Cardiology Devices Market, 2023 - 2030, Thousand Units

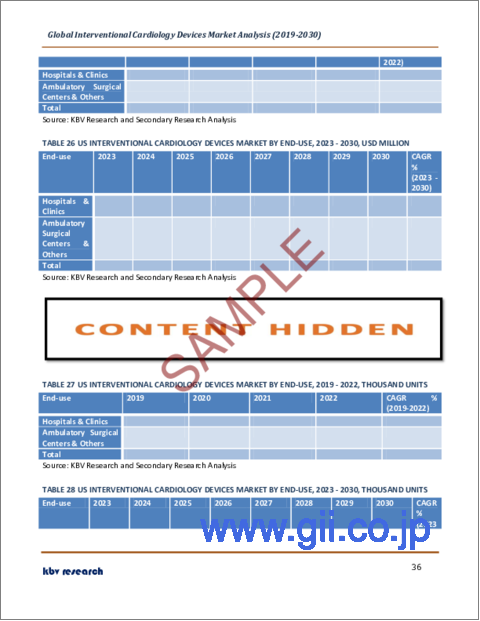

- TABLE 157 US Interventional Cardiology Devices Market by End-use, 2019 - 2022, USD Million

- TABLE 158 US Interventional Cardiology Devices Market by End-use, 2023 - 2030, USD Million

- TABLE 159 US Interventional Cardiology Devices Market by End-use, 2019 - 2022, Thousand Units

- TABLE 160 US Interventional Cardiology Devices Market by End-use, 2023 - 2030, Thousand Units

- TABLE 161 US Interventional Cardiology Devices Market by Product, 2019 - 2022, USD Million

- TABLE 162 US Interventional Cardiology Devices Market by Product, 2023 - 2030, USD Million

- TABLE 163 US Interventional Cardiology Devices Market by Product, 2019 - 2022, Thousand Units

- TABLE 164 US Interventional Cardiology Devices Market by Product, 2023 - 2030, Thousand Units

- TABLE 165 US Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, USD Million

- TABLE 166 US Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, USD Million

- TABLE 167 US Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, Thousand Units

- TABLE 168 US Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, Thousand Units

- TABLE 169 US Interventional Cardiology Devices Market by Accessory Devices Type, 2019 - 2022, USD Million

- TABLE 170 US Interventional Cardiology Devices Market by Accessory Devices Type, 2023 - 2030, USD Million

- TABLE 171 US Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2019 - 2022, USD Million

- TABLE 172 US Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2023 - 2030, USD Million

- TABLE 173 Canada Interventional Cardiology Devices Market, 2019 - 2022, USD Million

- TABLE 174 Canada Interventional Cardiology Devices Market, 2023 - 2030, USD Million

- TABLE 175 Canada Interventional Cardiology Devices Market, 2019 - 2022, Thousand Units

- TABLE 176 Canada Interventional Cardiology Devices Market, 2023 - 2030, Thousand Units

- TABLE 177 Canada Interventional Cardiology Devices Market by End-use, 2019 - 2022, USD Million

- TABLE 178 Canada Interventional Cardiology Devices Market by End-use, 2023 - 2030, USD Million

- TABLE 179 Canada Interventional Cardiology Devices Market by End-use, 2019 - 2022, Thousand Units

- TABLE 180 Canada Interventional Cardiology Devices Market by End-use, 2023 - 2030, Thousand Units

- TABLE 181 Canada Interventional Cardiology Devices Market by Product, 2019 - 2022, USD Million

- TABLE 182 Canada Interventional Cardiology Devices Market by Product, 2023 - 2030, USD Million

- TABLE 183 Canada Interventional Cardiology Devices Market by Product, 2019 - 2022, Thousand Units

- TABLE 184 Canada Interventional Cardiology Devices Market by Product, 2023 - 2030, Thousand Units

- TABLE 185 Canada Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, USD Million

- TABLE 186 Canada Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, USD Million

- TABLE 187 Canada Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, Thousand Units

- TABLE 188 Canada Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, Thousand Units

- TABLE 189 Canada Interventional Cardiology Devices Market by Accessory Devices Type, 2019 - 2022, USD Million

- TABLE 190 Canada Interventional Cardiology Devices Market by Accessory Devices Type, 2023 - 2030, USD Million

- TABLE 191 Canada Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2019 - 2022, USD Million

- TABLE 192 Canada Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2023 - 2030, USD Million

- TABLE 193 Mexico Interventional Cardiology Devices Market, 2019 - 2022, USD Million

- TABLE 194 Mexico Interventional Cardiology Devices Market, 2023 - 2030, USD Million

- TABLE 195 Mexico Interventional Cardiology Devices Market, 2019 - 2022, Thousand Units

- TABLE 196 Mexico Interventional Cardiology Devices Market, 2023 - 2030, Thousand Units

- TABLE 197 Mexico Interventional Cardiology Devices Market by End-use, 2019 - 2022, USD Million

- TABLE 198 Mexico Interventional Cardiology Devices Market by End-use, 2023 - 2030, USD Million

- TABLE 199 Mexico Interventional Cardiology Devices Market by End-use, 2019 - 2022, Thousand Units

- TABLE 200 Mexico Interventional Cardiology Devices Market by End-use, 2023 - 2030, Thousand Units

- TABLE 201 Mexico Interventional Cardiology Devices Market by Product, 2019 - 2022, USD Million

- TABLE 202 Mexico Interventional Cardiology Devices Market by Product, 2023 - 2030, USD Million

- TABLE 203 Mexico Interventional Cardiology Devices Market by Product, 2019 - 2022, Thousand Units

- TABLE 204 Mexico Interventional Cardiology Devices Market by Product, 2023 - 2030, Thousand Units

- TABLE 205 Mexico Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, USD Million

- TABLE 206 Mexico Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, USD Million

- TABLE 207 Mexico Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, Thousand Units

- TABLE 208 Mexico Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, Thousand Units

- TABLE 209 Mexico Interventional Cardiology Devices Market by Accessory Devices Type, 2019 - 2022, USD Million

- TABLE 210 Mexico Interventional Cardiology Devices Market by Accessory Devices Type, 2023 - 2030, USD Million

- TABLE 211 Mexico Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2019 - 2022, USD Million

- TABLE 212 Mexico Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2023 - 2030, USD Million

- TABLE 213 Rest of North America Interventional Cardiology Devices Market, 2019 - 2022, USD Million

- TABLE 214 Rest of North America Interventional Cardiology Devices Market, 2023 - 2030, USD Million

- TABLE 215 Rest of North America Interventional Cardiology Devices Market, 2019 - 2022, Thousand Units

- TABLE 216 Rest of North America Interventional Cardiology Devices Market, 2023 - 2030, Thousand Units

- TABLE 217 Rest of North America Interventional Cardiology Devices Market by End-use, 2019 - 2022, USD Million

- TABLE 218 Rest of North America Interventional Cardiology Devices Market by End-use, 2023 - 2030, USD Million

- TABLE 219 Rest of North America Interventional Cardiology Devices Market by End-use, 2019 - 2022, Thousand Units

- TABLE 220 Rest of North America Interventional Cardiology Devices Market by End-use, 2023 - 2030, Thousand Units

- TABLE 221 Rest of North America Interventional Cardiology Devices Market by Product, 2019 - 2022, USD Million

- TABLE 222 Rest of North America Interventional Cardiology Devices Market by Product, 2023 - 2030, USD Million

- TABLE 223 Rest of North America Interventional Cardiology Devices Market by Product, 2019 - 2022, Thousand Units

- TABLE 224 Rest of North America Interventional Cardiology Devices Market by Product, 2023 - 2030, Thousand Units

- TABLE 225 Rest of North America Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, USD Million

- TABLE 226 Rest of North America Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, USD Million

- TABLE 227 Rest of North America Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, Thousand Units

- TABLE 228 Rest of North America Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, Thousand Units

- TABLE 229 Rest of North America Interventional Cardiology Devices Market by Accessory Devices Type, 2019 - 2022, USD Million

- TABLE 230 Rest of North America Interventional Cardiology Devices Market by Accessory Devices Type, 2023 - 2030, USD Million

- TABLE 231 Rest of North America Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2019 - 2022, USD Million

- TABLE 232 Rest of North America Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2023 - 2030, USD Million

- TABLE 233 Europe Interventional Cardiology Devices Market, 2019 - 2022, USD Million

- TABLE 234 Europe Interventional Cardiology Devices Market, 2023 - 2030, USD Million

- TABLE 235 Europe Interventional Cardiology Devices Market, 2019 - 2022, Thousand Units

- TABLE 236 Europe Interventional Cardiology Devices Market, 2023 - 2030, Thousand Units

- TABLE 237 Europe Interventional Cardiology Devices Market by End-use, 2019 - 2022, USD Million

- TABLE 238 Europe Interventional Cardiology Devices Market by End-use, 2023 - 2030, USD Million

- TABLE 239 Europe Interventional Cardiology Devices Market by End-use, 2019 - 2022, Thousand Units

- TABLE 240 Europe Interventional Cardiology Devices Market by End-use, 2023 - 2030, Thousand Units

- TABLE 241 Europe Hospitals & Clinics Market by Country, 2019 - 2022, USD Million

- TABLE 242 Europe Hospitals & Clinics Market by Country, 2023 - 2030, USD Million

- TABLE 243 Europe Hospitals & Clinics Market by Country, 2019 - 2022, Thousand Units

- TABLE 244 Europe Hospitals & Clinics Market by Country, 2023 - 2030, Thousand Units

- TABLE 245 Europe Ambulatory Surgical Centers & Others Market by Country, 2019 - 2022, USD Million

- TABLE 246 Europe Ambulatory Surgical Centers & Others Market by Country, 2023 - 2030, USD Million

- TABLE 247 Europe Ambulatory Surgical Centers & Others Market by Country, 2019 - 2022, Thousand Units

- TABLE 248 Europe Ambulatory Surgical Centers & Others Market by Country, 2023 - 2030, Thousand Units

- TABLE 249 Europe Interventional Cardiology Devices Market by Product, 2019 - 2022, USD Million

- TABLE 250 Europe Interventional Cardiology Devices Market by Product, 2023 - 2030, USD Million

- TABLE 251 Europe Interventional Cardiology Devices Market by Product, 2019 - 2022, Thousand Units

- TABLE 252 Europe Interventional Cardiology Devices Market by Product, 2023 - 2030, Thousand Units

- TABLE 253 Europe Coronary Stents Market by Country, 2019 - 2022, USD Million

- TABLE 254 Europe Coronary Stents Market by Country, 2023 - 2030, USD Million

- TABLE 255 Europe Coronary Stents Market by Country, 2019 - 2022, Thousand Units

- TABLE 256 Europe Coronary Stents Market by Country, 2023 - 2030, Thousand Units

- TABLE 257 Europe Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, USD Million

- TABLE 258 Europe Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, USD Million

- TABLE 259 Europe Interventional Cardiology Devices Market by Coronary Stents Type, 2019 - 2022, Thousand Units

- TABLE 260 Europe Interventional Cardiology Devices Market by Coronary Stents Type, 2023 - 2030, Thousand Units

- TABLE 261 Europe Drug Eluting Stents Market by Country, 2019 - 2022, USD Million

- TABLE 262 Europe Drug Eluting Stents Market by Country, 2023 - 2030, USD Million

- TABLE 263 Europe Drug Eluting Stents Market by Country, 2019 - 2022, Thousand Units

- TABLE 264 Europe Drug Eluting Stents Market by Country, 2023 - 2030, Thousand Units

- TABLE 265 Europe Bare Metal Stents Market by Country, 2019 - 2022, USD Million

- TABLE 266 Europe Bare Metal Stents Market by Country, 2023 - 2030, USD Million

- TABLE 267 Europe Bare Metal Stents Market by Country, 2019 - 2022, Thousand Units

- TABLE 268 Europe Bare Metal Stents Market by Country, 2023 - 2030, Thousand Units

- TABLE 269 Europe Bioabsorbable Stents Market by Country, 2019 - 2022, USD Million

- TABLE 270 Europe Bioabsorbable Stents Market by Country, 2023 - 2030, USD Million

- TABLE 271 Europe Bioabsorbable Stents Market by Country, 2019 - 2022, Thousand Units

- TABLE 272 Europe Bioabsorbable Stents Market by Country, 2023 - 2030, Thousand Units

- TABLE 273 Europe Accessory Devices Market by Country, 2019 - 2022, USD Million

- TABLE 274 Europe Accessory Devices Market by Country, 2023 - 2030, USD Million

- TABLE 275 Europe Accessory Devices Market by Country, 2019 - 2022, Thousand Units

- TABLE 276 Europe Accessory Devices Market by Country, 2023 - 2030, Thousand Units

- TABLE 277 Europe Interventional Cardiology Devices Market by Accessory Devices Type, 2019 - 2022, USD Million

- TABLE 278 Europe Interventional Cardiology Devices Market by Accessory Devices Type, 2023 - 2030, USD Million

- TABLE 279 Europe PTCA Guidewires Market by Country, 2019 - 2022, USD Million

- TABLE 280 Europe PTCA Guidewires Market by Country, 2023 - 2030, USD Million

- TABLE 281 Europe Diagnostic Catheters Market by Country, 2019 - 2022, USD Million

- TABLE 282 Europe Diagnostic Catheters Market by Country, 2023 - 2030, USD Million

- TABLE 283 Europe PTCA Guiding Catheters Market by Country, 2019 - 2022, USD Million

- TABLE 284 Europe PTCA Guiding Catheters Market by Country, 2023 - 2030, USD Million

- TABLE 285 Europe Introducer Sheaths Market by Country, 2019 - 2022, USD Million

- TABLE 286 Europe Introducer Sheaths Market by Country, 2023 - 2030, USD Million

- TABLE 287 Europe PTCA Balloon Catheters Market by Country, 2019 - 2022, USD Million

- TABLE 288 Europe PTCA Balloon Catheters Market by Country, 2023 - 2030, USD Million

- TABLE 289 Europe PTCA Balloon Catheters Market by Country, 2019 - 2022, Thousand Units

- TABLE 290 Europe PTCA Balloon Catheters Market by Country, 2023 - 2030, Thousand Units

- TABLE 291 Europe Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2019 - 2022, USD Million

- TABLE 292 Europe Interventional Cardiology Devices Market by PTCA Balloon Catheters Type, 2023 - 2030, USD Million

- TABLE 293 Europe Normal Market by Country, 2019 - 2022, USD Million

- TABLE 294 Europe Normal Market by Country, 2023 - 2030, USD Million

- TABLE 295 Europe Specialty Market by Country, 2019 - 2022, USD Million

- TABLE 296 Europe Specialty Market by Country, 2023 - 2030, USD Million

- TABLE 297 Europe Drug Coated Market by Country, 2019 - 2022, USD Million

- TABLE 298 Europe Drug Coated Market by Country, 2023 - 2030, USD Million

- TABLE 299 Europe Intravascular Imaging Catheters & Pressure Guidewires Market by Country, 2019 - 2022, USD Million

- TABLE 300 Europe Intravascular Imaging Catheters & Pressure Guidewires Market by Country, 2023 - 2030, USD Million

- TABLE 301 Europe Intravascular Imaging Catheters & Pressure Guidewires Market by Country, 2019 - 2022, Thousand Units

- TABLE 302 Europe Intravascular Imaging Catheters & Pressure Guidewires Market by Country, 2023 - 2030, Thousand Units

- TABLE 303 Europe Interventional Cardiology Devices Market by Country, 2019 - 2022, USD Million

- TABLE 304 Europe Interventional Cardiology Devices Market by Country, 2023 - 2030, USD Million

- TABLE 305 Europe Interventional Cardiology Devices Market by Country, 2019 - 2022, Thousand Units

- TABLE 306 Europe Interventional Cardiology Devices Market by Country, 2023 - 2030, Thousand Units

The Global Interventional Cardiology Devices Market size is expected to reach $21.9 billion by 2030, rising at a market growth of 7.4% CAGR during the forecast period. In the year 2022, the market attained a volume of 62,100.5 thousand units experiencing a growth of 7.3% (2019-2022).

The drug coating on drug eluting stents (DES) elutes slowly over time, inhibiting tissue growth that can lead to restenosis. This has led to improved long-term outcomes for patients. Consequently, the drug eluting stents segment would generate approximately 53.1% share of the market by 2030. The lower restenosis rates associated with DES have reduced the need for repeat interventions, such as additional angioplasty or stent placement. This translates to improved patient outcomes and reduced healthcare costs. DES has been associated with a lower risk of stent thrombosis (a potentially life-threatening complication), particularly when patients adhere to dual antiplatelet therapy (DAPT).

The major strategies followed by the market participants are Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2023, Koninklijke Philips N.V. collaborated with Biotronik, to widen the range of cardiovascular devices available for Philips SymphonySuite customers. In January, 2023, Terumo collaborated with Siemens Healthineers, to make better heart care available to more people.

Based on the Analysis presented in the KBV Cardinal matrix; Abbott Laboratories and Medtronic PLC are the forerunners in the Interventional Cardiology Devices Market. Companies such as Terumo Corporation, Boston Scientific Corporation and Teleflex, Inc. are some of the key innovators in the Interventional Cardiology Devices Market. In September 2021, Terumo came into collaboration with Etiometry, to provide clinicians with an in-depth understanding of the patient's condition.

COVID-19 Impact Analysis

During the early stages of the pandemic, many elective and non-urgent interventional cardiology procedures were postponed or canceled to prioritize the treatment of COVID-19 patients and to conserve healthcare resources. This led to a temporary decline in cardiac procedures and reduced use of related devices. Hospitals and healthcare facilities shifted their focus toward treating emergent and high-priority cases, such as acute myocardial infarctions (heart attacks), which continued to require interventional cardiology procedures. Delays in producing and distributing interventional cardiology devices, including stents, catheters, and guidewires, affected the market. With the need to limit in-person interactions and reduce the risk of virus transmission, there was a greater emphasis on remote monitoring of cardiac patients. Thus, the COVID-19 pandemic had a moderate effect on the market.

Market Growth Factors

Increasing prevalence of cardiovascular diseases

Cardiovascular diseases (CVDs) such as coronary artery disease (CAD), heart attacks, and heart failure remain a leading cause of morbidity and mortality globally. The growing prevalence of CVDs drives the demand for interventional cardiology procedures and devices. Cardiovascular diseases are among the leading causes of morbidity and mortality globally. They affect millions of people, resulting in a substantial patient population in need of diagnosis and treatment. As the global population ages, there is a higher incidence of age-related cardiovascular conditions. Older adults are more susceptible to CVDs, increasing the demand for cardiovascular interventions and devices. As the global burden of CVDs continues to increase, the market for interventional cardiology devices is expected to expand to meet the growing healthcare needs.

Rising proportion of the aging population

As the global population ages, there is a higher incidence of age-related cardiovascular conditions. Older adults are more likely to require interventional cardiology interventions, such as stenting and angioplasty. Aging is a major risk factor for cardiovascular diseases (CVDs) such as coronary artery disease (CAD), heart attacks, heart failure, and arrhythmias. Individuals are more likely to develop these conditions as they age, leading to an increased demand for interventional cardiology procedures and devices. Aging is associated with the progressive buildup of atherosclerotic plaques in the coronary arteries. As a result, older individuals are at a higher risk of experiencing acute coronary events, such as heart attacks, which require urgent intervention. These technologies enhance the utilization of interventional cardiology devices, driving market growth while improving patient outcomes and healthcare efficiency.

Market Restraining Factors

High cost and economic pressures

However, the high cost of interventional cardiology devices can strain healthcare budgets and limit access to advanced treatments, especially in resource-constrained settings. Striking a balance between innovation and affordability is a persistent challenge. Interventional cardiology devices, such as drug-eluting stents, balloons, and imaging equipment, can be expensive to manufacture and purchase. The high upfront costs can strain healthcare budgets, limiting access to advanced treatments and technologies, particularly in regions with limited resources. Regulatory changes, updates, or evolving interpretations of guidelines can introduce uncertainty into the approval process. Delays in regulatory decisions can impact market entry timelines.

End-use Outlook

By end-use, the market is segmented into hospitals & clinics, ambulatory surgical centers, and others. The ambulatory surgical centers garnered a significant revenue share in market in 2022. Ambulatory surgical centers (ASCs) are well-suited for minimally invasive interventional cardiology procedures, such as cardiac catheterization, angioplasty, and stent placement. Patients benefit from less invasive approaches, leading to quicker recovery times and reduced post-operative discomfort. The focused and patient-centered environment of ASCs can result in a more positive and personalized patient experience. The setting is often less intimidating than a hospital, which can reduce anxiety and stress for patients.

Product Outlook

By product, the market is categorized into coronary stents, PTCA balloon catheters, accessory devices, and others. The PTCA balloon catheters segment covered a considerable revenue share in the market in 2022. The demand for PTCA balloon catheters is expected to grow in line with the increasing prevalence of coronary artery disease (CAD) globally. As CAD remains a leading cause of morbidity and mortality, there is a continued need for interventional procedures, including angioplasty, which drives the use of PTCA balloon catheters. PTCA balloon catheters are integral to minimally invasive angioplasty procedures, which have gained popularity over traditional open-heart surgeries. Patients often prefer these less invasive approaches because they offer shorter recovery times and reduced hospital stays. PTCA balloon catheters have evolved to address more complex and challenging lesions like heavily calcified arteries. Specialized balloon catheters designed for these situations have expanded the range of treatable patients.

Coronary Stents Outlook

Under coronary stents, the market is segmented into drug eluting stents, bare metal stents, and bioabsorbable stents. The bare metal stents (BMS) segment acquired a substantial revenue share in the market in 2022. BMS are metallic stents made from stainless steel or cobalt-chromium alloys. They do not have drug coating. Due to the absence of a drug coating, BMS typically requires a shorter duration of dual antiplatelet therapy (DAPT). This can be advantageous when extended DAPT poses a higher bleeding risk.

PTCA Balloon Catheters Outlook

Under PTCA balloon catheters, the market is fragmented into normal, specialty, and drug coated. In 2022, the normal segment dominated the market with the maximum revenue share. Interventional cardiology procedures often improve patient outcomes, reduce symptoms, and enhance quality of life. They can help restore normal blood flow to the heart and alleviate chest pain, shortness of breath, and other symptoms. Many interventional devices, such as drug-eluting stents, help reduce the risk of restenosis and re-narrowing of arteries, reducing the need for repeat interventions. Minimally invasive procedures are generally associated with less pain, shorter hospital stays, and a quicker return to normal activities, leading to greater patient comfort.

Accessory Devices Outlook

Under accessory devices, the market is classified into PTCA guidewires, diagnostic catheters, PTCA guiding catheters, and introducer sheaths. In 2022, the PTCA guidewires segment registered the maximum revenue share in the market. Workhorse guidewires are used to navigate through coronary arteries and cross lesions (blockages or stenoses) to reach the target site within the vessel. They provide the initial access and support for delivering other interventional devices, such as balloon catheters and stents. These guidewires help guide catheters to the desired location within the coronary arteries.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region acquired a significant revenue share in the market. Asia Pacific is witnessing a growing burden of cardiovascular diseases (CVDs), including coronary artery disease (CAD), stroke, and hypertension. Factors like lifestyle changes, urbanization, and an aging population contribute to the increased prevalence of CVDs. Economic growth in many Asia Pacific countries has led to increased healthcare spending, enabling the expansion of healthcare facilities, the adoption of advanced medical technologies, and improved access to interventional cardiology procedures.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Abbott Laboratories, Boston Scientific Corporation, Terumo Corporation, Medtronic PLC, B. Braun Melsungen AG , Biotronik SE & Co. KG , Cardinal Health, Inc. , Teleflex, Inc. , Koninklijke Philips N.V. ,Alvimedica

Recent Strategies Deployed in Interventional Cardiology Devices Market

Mergers & Acquisition

Feb-2023: Abbott Laboratories took over Cardiovascular Systems, Inc., a medical device company with an innovative atherectomy system used in treating peripheral and coronary artery disease. The acquisition of CSI enhances Abbott's vascular device offerings portfolio.

Aug-2022: Medtronic completed the acquisition of Affera, a US-based developer of medical devices. The acquisition of Affera broadens the acquiring company's cardiac ablation platform.

Feb-2022: Boston Scientific completed the acquisition of Baylis Medical Company, a Canada-based developer of medical devices. This acquisition enables the acquiring company to incorporate Baylis' platforms within its existing electrophysiology and structural heart offerings, thereby reinforcing its market position.

Product Launches and Product Expansions

Aug-2022: Medtronic PLC launched the Onyx Frontier drug-eluting stent (DES), the Onyx Frontier DES is employed in the management of individuals suffering from coronary artery disease (CAD), a condition resulting from the accumulation of plaque within the coronary arteries. The Onyx Frontier drug-eluting stent (DES) features matrix sizes ranging from 2.0mm to 5.0mm diameters, with the expandability of sizes from 4.50-5.00mm.

Jul-2021: Medtronic PLC introduced the Prevail drug-coated balloon (DCB) Catheter. The Prevail DCB employs a fast-absorbing drug, paclitaxel, to facilitate the treatment of de novo lesions, small vessel disease, and in-stent restenosis (ISR). The Prevail DCB would be utilized in percutaneous coronary intervention (PCI) procedures to address narrowed or obstructed coronary arteries in patients diagnosed with coronary artery disease (CAD).

Partnerships, Collaborations & Agreements

Jun-2023: Koninklijke Philips N.V. collaborated with Biotronik, a multi-national cardiovascular biomedical research and technology company. This collaboration aimed to widen the range of cardiovascular devices available for Philips SymphonySuite customers.

Jan-2023: Terumo collaborated with Siemens Healthineers, a medical technology company. The collaboration focuses on reinforcing cardiac care in India. This collaboration aims at making better heart care available to more people.

Sep-2021: Terumo came into collaboration with Etiometry, a US-based provider of clinic decision-support software. The collaboration involves introducing clinical decision support to cardiac surgery patients. Integrating Etiometry's platform with the surgical devices company's devices would provide clinicians with an in-depth understanding of the patient's condition.

Mar-2021: Braun Interventional Systems joined hands with Infraredx, designs, develops, manufactures, and distributes medical devices. Together the companies aimed to boost the FDA investigational device exemption clinical test for the SeQuent Please ReX drug coated PTCA balloon catheter. Additionally, The SeQuent Please ReX drug-coated PTCA balloon catheter is developed to cure coronary in-stent restenosis, or the incremental re-narrowing of a coronary artery following stent transplantation.

Approvals

May-2022: Medtronic PLC received FDA approval for the Onyx Frontier drug-eluting stent (DES). Onyx Frontier DES is aimed at the care of individuals afflicted with coronary artery disease (CAD), a condition initiated by the accumulation of plaque within the coronary artery walls.

Feb-2022: Medtronic plc received a U.S. Food and Drug Administration approval for Freezer and Freezer Xtra Catheters for the treatment of paediatric Atrioventricular Nodal Re-entrant Tachycardia. Catheter ablation is resilient, one-use equipment used to freeze cardiac tissue and block unnecessary electrical signals within the heart. Additionally, Freezer and Freezer Xtra are the first-line antidote for the treatment of AVNRT.

Scope of the Study

Market Segments covered in the Report:

By End-Use (Volume, Thousand Units, USD Million, 2019-2030)

- Hospitals & Clinics

- Ambulatory Surgical Centers & Others

By Product (Volume, Thousand Units, USD Million, 2019-2030)

- Coronary Stents

- Drug Eluting Stents

- Bare Metal Stents

- Bioabsorbable Stents

- Accessory Devices

- PTCA Guidewires

- Diagnostic Catheters

- PTCA Guiding Catheters

- Introducer Sheaths

- PTCA Balloon Catheters

- Normal

- Specialty

- Drug Coated

- Intravascular Imaging Catheters & Pressure Guidewires

By Geography (Volume, Thousand Units, USD Million, 2019-2030)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Abbott Laboratories

- Boston Scientific Corporation

- Terumo Corporation

- Medtronic PLC

- B. Braun Melungeon AG

- Bortnick SE & Co. KG

- Cardinal Health, Inc.

- Teleflex, Inc.

- Koninklijke Philips N.V.

- Alvimedica

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Interventional Cardiology Devices Market, by End-use

- 1.4.2 Global Interventional Cardiology Devices Market, by Product

- 1.4.3 Global Interventional Cardiology Devices Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

Chapter 4. Competition Analysis - Global

- 4.1 KBV Cardinal Matrix

- 4.2 Recent Industry Wide Strategic Developments

- 4.2.1 Partnerships, Collaborations and Agreements

- 4.2.2 Product Launches and Product Expansions

- 4.2.3 Acquisition and Mergers

- 4.2.4 Approvals

- 4.3 Top Winning Strategies

- 4.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

- 4.3.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2019, Jun - 2023, Jun) Leading Players

- 4.4 Porter's Five Force Analysis

Chapter 5. Global Interventional Cardiology Devices Market by End-use

- 5.1 Global Hospitals & Clinics Market by Region

- 5.2 Global Ambulatory Surgical Centers & Others Market by Region

Chapter 6. Global Interventional Cardiology Devices Market by Product

- 6.1 Global Coronary Stents Market by Region

- 6.2 Global Interventional Cardiology Devices Market by Coronary Stents Type

- 6.2.1 Global Drug Eluting Stents Market by Region

- 6.2.2 Global Bare Metal Stents Market by Region

- 6.2.3 Global Bioabsorbable Stents Market by Region

- 6.3 Global Accessory Devices Market by Region

- 6.4 Global Interventional Cardiology Devices Market by Accessory Devices Type

- 6.4.1 Global PTCA Guidewires Market by Region

- 6.4.2 Global Diagnostic Catheters Market by Region

- 6.4.3 Global PTCA Guiding Catheters Market by Region

- 6.4.4 Global Introducer Sheaths Market by Region

- 6.5 Global PTCA Balloon Catheters Market by Region

- 6.6 Global Interventional Cardiology Devices Market by PTCA Balloon Catheters Type

- 6.6.1 Global Normal Market by Region

- 6.6.2 Global Specialty Market by Region

- 6.6.3 Global Drug Coated Market by Region

- 6.7 Global Intravascular Imaging Catheters & Pressure Guidewires Market by Region

Chapter 7. Global Interventional Cardiology Devices Market by Region

- 7.1 North America Interventional Cardiology Devices Market

- 7.1.1 North America Interventional Cardiology Devices Market by End-use

- 7.1.1.1 North America Hospitals & Clinics Market by Region

- 7.1.1.2 North America Ambulatory Surgical Centers & Others Market by Region

- 7.1.2 North America Interventional Cardiology Devices Market by Product

- 7.1.2.1 North America Coronary Stents Market by Country

- 7.1.2.2 North America Interventional Cardiology Devices Market by Coronary Stents Type

- 7.1.2.2.1 North America Drug Eluting Stents Market by Country

- 7.1.2.2.2 North America Bare Metal Stents Market by Country

- 7.1.2.2.3 North America Bioabsorbable Stents Market by Country

- 7.1.2.3 North America Accessory Devices Market by Country

- 7.1.2.4 North America Interventional Cardiology Devices Market by Accessory Devices Type

- 7.1.2.4.1 North America PTCA Guidewires Market by Country

- 7.1.2.4.2 North America Diagnostic Catheters Market by Country

- 7.1.2.4.3 North America PTCA Guiding Catheters Market by Country

- 7.1.2.4.4 North America Introducer Sheaths Market by Country

- 7.1.2.5 North America PTCA Balloon Catheters Market by Country

- 7.1.2.6 North America Interventional Cardiology Devices Market by PTCA Balloon Catheters Type

- 7.1.2.6.1 North America Normal Market by Country

- 7.1.2.6.2 North America Specialty Market by Country

- 7.1.2.6.3 North America Drug Coated Market by Country

- 7.1.2.7 North America Intravascular Imaging Catheters & Pressure Guidewires Market by Country

- 7.1.3 North America Interventional Cardiology Devices Market by Country

- 7.1.3.1 US Interventional Cardiology Devices Market

- 7.1.3.1.1 US Interventional Cardiology Devices Market by End-use

- 7.1.3.1.2 US Interventional Cardiology Devices Market by Product

- 7.1.3.2 Canada Interventional Cardiology Devices Market

- 7.1.3.2.1 Canada Interventional Cardiology Devices Market by End-use

- 7.1.3.2.2 Canada Interventional Cardiology Devices Market by Product

- 7.1.3.3 Mexico Interventional Cardiology Devices Market

- 7.1.3.3.1 Mexico Interventional Cardiology Devices Market by End-use

- 7.1.3.3.2 Mexico Interventional Cardiology Devices Market by Product

- 7.1.3.4 Rest of North America Interventional Cardiology Devices Market

- 7.1.3.4.1 Rest of North America Interventional Cardiology Devices Market by End-use

- 7.1.3.4.2 Rest of North America Interventional Cardiology Devices Market by Product

- 7.1.3.1 US Interventional Cardiology Devices Market

- 7.1.1 North America Interventional Cardiology Devices Market by End-use

- 7.2 Europe Interventional Cardiology Devices Market

- 7.2.1 Europe Interventional Cardiology Devices Market by End-use

- 7.2.1.1 Europe Hospitals & Clinics Market by Country

- 7.2.1.2 Europe Ambulatory Surgical Centers & Others Market by Country

- 7.2.2 Europe Interventional Cardiology Devices Market by Product

- 7.2.2.1 Europe Coronary Stents Market by Country

- 7.2.2.2 Europe Interventional Cardiology Devices Market by Coronary Stents Type

- 7.2.2.2.1 Europe Drug Eluting Stents Market by Country

- 7.2.2.2.2 Europe Bare Metal Stents Market by Country

- 7.2.2.2.3 Europe Bioabsorbable Stents Market by Country

- 7.2.2.3 Europe Accessory Devices Market by Country

- 7.2.2.4 Europe Interventional Cardiology Devices Market by Accessory Devices Type

- 7.2.2.4.1 Europe PTCA Guidewires Market by Country

- 7.2.2.4.2 Europe Diagnostic Catheters Market by Country

- 7.2.2.4.3 Europe PTCA Guiding Catheters Market by Country

- 7.2.2.4.4 Europe Introducer Sheaths Market by Country

- 7.2.2.5 Europe PTCA Balloon Catheters Market by Country

- 7.2.2.6 Europe Interventional Cardiology Devices Market by PTCA Balloon Catheters Type

- 7.2.2.6.1 Europe Normal Market by Country

- 7.2.2.6.2 Europe Specialty Market by Country

- 7.2.2.6.3 Europe Drug Coated Market by Country

- 7.2.2.7 Europe Intravascular Imaging Catheters & Pressure Guidewires Market by Country

- 7.2.3 Europe Interventional Cardiology Devices Market by Country

- 7.2.3.1 Germany Interventional Cardiology Devices Market

- 7.2.3.1.1 Germany Interventional Cardiology Devices Market by End-use

- 7.2.3.1.2 Germany Interventional Cardiology Devices Market by Product

- 7.2.3.2 UK Interventional Cardiology Devices Market

- 7.2.3.2.1 UK Interventional Cardiology Devices Market by End-use

- 7.2.3.2.2 UK Interventional Cardiology Devices Market by Product

- 7.2.3.3 France Interventional Cardiology Devices Market

- 7.2.3.3.1 France Interventional Cardiology Devices Market by End-use

- 7.2.3.3.2 France Interventional Cardiology Devices Market by Product

- 7.2.3.4 Russia Interventional Cardiology Devices Market

- 7.2.3.4.1 Russia Interventional Cardiology Devices Market by End-use

- 7.2.3.4.2 Russia Interventional Cardiology Devices Market by Product

- 7.2.3.5 Spain Interventional Cardiology Devices Market

- 7.2.3.5.1 Spain Interventional Cardiology Devices Market by End-use

- 7.2.3.5.2 Spain Interventional Cardiology Devices Market by Product

- 7.2.3.6 Italy Interventional Cardiology Devices Market

- 7.2.3.6.1 Italy Interventional Cardiology Devices Market by End-use

- 7.2.3.6.2 Italy Interventional Cardiology Devices Market by Product

- 7.2.3.7 Rest of Europe Interventional Cardiology Devices Market

- 7.2.3.7.1 Rest of Europe Interventional Cardiology Devices Market by End-use

- 7.2.3.7.2 Rest of Europe Interventional Cardiology Devices Market by Product

- 7.2.3.1 Germany Interventional Cardiology Devices Market

- 7.2.1 Europe Interventional Cardiology Devices Market by End-use

- 7.3 Asia Pacific Interventional Cardiology Devices Market

- 7.3.1 Asia Pacific Interventional Cardiology Devices Market by End-use

- 7.3.1.1 Asia Pacific Hospitals & Clinics Market by Country

- 7.3.1.2 Asia Pacific Ambulatory Surgical Centers & Others Market by Country

- 7.3.2 Asia Pacific Interventional Cardiology Devices Market by Product

- 7.3.2.1 Asia Pacific Coronary Stents Market by Country

- 7.3.2.2 Asia Pacific Interventional Cardiology Devices Market by Coronary Stents Type

- 7.3.2.2.1 Asia Pacific Drug Eluting Stents Market by Country

- 7.3.2.2.2 Asia Pacific Bare Metal Stents Market by Country

- 7.3.2.2.3 Asia Pacific Bioabsorbable Stents Market by Country

- 7.3.2.3 Asia Pacific Accessory Devices Market by Country

- 7.3.2.4 Asia Pacific Interventional Cardiology Devices Market by Accessory Devices Type

- 7.3.2.4.1 Asia Pacific PTCA Guidewires Market by Country

- 7.3.2.4.2 Asia Pacific Diagnostic Catheters Market by Country

- 7.3.2.4.3 Asia Pacific PTCA Guiding Catheters Market by Country

- 7.3.2.4.4 Asia Pacific Introducer Sheaths Market by Country

- 7.3.2.5 Asia Pacific PTCA Balloon Catheters Market by Country

- 7.3.2.6 Asia Pacific Interventional Cardiology Devices Market by PTCA Balloon Catheters Type

- 7.3.2.6.1 Asia Pacific Normal Market by Country

- 7.3.2.6.2 Asia Pacific Specialty Market by Country

- 7.3.2.6.3 Asia Pacific Drug Coated Market by Country

- 7.3.2.7 Asia Pacific Intravascular Imaging Catheters & Pressure Guidewires Market by Country

- 7.3.3 Asia Pacific Interventional Cardiology Devices Market by Country

- 7.3.3.1 China Interventional Cardiology Devices Market

- 7.3.3.1.1 China Interventional Cardiology Devices Market by End-use

- 7.3.3.1.2 China Interventional Cardiology Devices Market by Product

- 7.3.3.2 Japan Interventional Cardiology Devices Market

- 7.3.3.2.1 Japan Interventional Cardiology Devices Market by End-use

- 7.3.3.2.2 Japan Interventional Cardiology Devices Market by Product

- 7.3.3.3 India Interventional Cardiology Devices Market

- 7.3.3.3.1 India Interventional Cardiology Devices Market by End-use

- 7.3.3.3.2 India Interventional Cardiology Devices Market by Product

- 7.3.3.4 South Korea Interventional Cardiology Devices Market

- 7.3.3.4.1 South Korea Interventional Cardiology Devices Market by End-use

- 7.3.3.4.2 South Korea Interventional Cardiology Devices Market by Product

- 7.3.3.5 Singapore Interventional Cardiology Devices Market

- 7.3.3.5.1 Singapore Interventional Cardiology Devices Market by End-use

- 7.3.3.5.2 Singapore Interventional Cardiology Devices Market by Product

- 7.3.3.6 Malaysia Interventional Cardiology Devices Market

- 7.3.3.6.1 Malaysia Interventional Cardiology Devices Market by End-use

- 7.3.3.6.2 Malaysia Interventional Cardiology Devices Market by Product

- 7.3.3.7 Rest of Asia Pacific Interventional Cardiology Devices Market

- 7.3.3.7.1 Rest of Asia Pacific Interventional Cardiology Devices Market by End-use

- 7.3.3.7.2 Rest of Asia Pacific Interventional Cardiology Devices Market by Product

- 7.3.3.1 China Interventional Cardiology Devices Market

- 7.3.1 Asia Pacific Interventional Cardiology Devices Market by End-use

- 7.4 LAMEA Interventional Cardiology Devices Market

- 7.4.1 LAMEA Interventional Cardiology Devices Market by End-use

- 7.4.1.1 LAMEA Hospitals & Clinics Market by Country

- 7.4.1.2 LAMEA Ambulatory Surgical Centers & Others Market by Country

- 7.4.2 LAMEA Interventional Cardiology Devices Market by Product

- 7.4.2.1 LAMEA Coronary Stents Market by Country

- 7.4.2.2 LAMEA Interventional Cardiology Devices Market by Coronary Stents Type

- 7.4.2.2.1 LAMEA Drug Eluting Stents Market by Country

- 7.4.2.2.2 LAMEA Bare Metal Stents Market by Country

- 7.4.2.2.3 LAMEA Bioabsorbable Stents Market by Country

- 7.4.2.3 LAMEA Accessory Devices Market by Country

- 7.4.2.4 LAMEA Interventional Cardiology Devices Market by Accessory Devices Type

- 7.4.2.4.1 LAMEA PTCA Guidewires Market by Country

- 7.4.2.4.2 LAMEA Diagnostic Catheters Market by Country

- 7.4.2.4.3 LAMEA PTCA Guiding Catheters Market by Country

- 7.4.2.4.4 LAMEA Introducer Sheaths Market by Country

- 7.4.2.5 LAMEA PTCA Balloon Catheters Market by Country

- 7.4.2.6 LAMEA Interventional Cardiology Devices Market by PTCA Balloon Catheters Type

- 7.4.2.6.1 LAMEA Normal Market by Country

- 7.4.2.6.2 LAMEA Specialty Market by Country

- 7.4.2.6.3 LAMEA Drug Coated Market by Country

- 7.4.2.7 LAMEA Intravascular Imaging Catheters & Pressure Guidewires Market by Country

- 7.4.3 LAMEA Interventional Cardiology Devices Market by Country

- 7.4.3.1 Brazil Interventional Cardiology Devices Market

- 7.4.3.1.1 Brazil Interventional Cardiology Devices Market by End-use

- 7.4.3.1.2 Brazil Interventional Cardiology Devices Market by Product

- 7.4.3.2 Argentina Interventional Cardiology Devices Market

- 7.4.3.2.1 Argentina Interventional Cardiology Devices Market by End-use

- 7.4.3.2.2 Argentina Interventional Cardiology Devices Market by Product

- 7.4.3.3 UAE Interventional Cardiology Devices Market

- 7.4.3.3.1 UAE Interventional Cardiology Devices Market by End-use

- 7.4.3.3.2 UAE Interventional Cardiology Devices Market by Product

- 7.4.3.4 Saudi Arabia Interventional Cardiology Devices Market

- 7.4.3.4.1 Saudi Arabia Interventional Cardiology Devices Market by End-use

- 7.4.3.4.2 Saudi Arabia Interventional Cardiology Devices Market by Product

- 7.4.3.5 South Africa Interventional Cardiology Devices Market

- 7.4.3.5.1 South Africa Interventional Cardiology Devices Market by End-use

- 7.4.3.5.2 South Africa Interventional Cardiology Devices Market by Product

- 7.4.3.6 Nigeria Interventional Cardiology Devices Market

- 7.4.3.6.1 Nigeria Interventional Cardiology Devices Market by End-use

- 7.4.3.6.2 Nigeria Interventional Cardiology Devices Market by Product

- 7.4.3.7 Rest of LAMEA Interventional Cardiology Devices Market

- 7.4.3.7.1 Rest of LAMEA Interventional Cardiology Devices Market by End-use

- 7.4.3.7.2 Rest of LAMEA Interventional Cardiology Devices Market by Product

- 7.4.3.1 Brazil Interventional Cardiology Devices Market

- 7.4.1 LAMEA Interventional Cardiology Devices Market by End-use

Chapter 8. Company Profiles

- 8.1 Abbott Laboratories

- 8.1.1 Company Overview

- 8.1.2 Financial Analysis

- 8.1.3 Segmental and Regional Analysis

- 8.1.4 Research & Development Expense

- 8.1.5 Recent strategies and developments:

- 8.1.5.1 Mergers & Acquisition:

- 8.1.6 SWOT Analysis

- 8.2 Boston Scientific Corporation

- 8.2.1 Company Overview

- 8.2.2 Financial Analysis

- 8.2.3 Segmental and Regional Analysis

- 8.2.4 Research & Development Expense

- 8.2.5 Recent strategies and developments:

- 8.2.5.1 Mergers & Acquisition:

- 8.2.6 SWOT Analysis

- 8.3 Terumo Corporation

- 8.3.1 Company Overview

- 8.3.2 Financial Analysis

- 8.3.3 Segmental and Regional Analysis

- 8.3.4 Research & Development Expenses

- 8.3.5 Recent strategies and developments:

- 8.3.5.1 Partnerships, Collaborations & Agreements:

- 8.3.5.2 Product Launches and Product Expansions:

- 8.3.6 SWOT Analysis

- 8.4 Medtronic PLC

- 8.4.1 Company overview

- 8.4.2 Financial Analysis

- 8.4.3 Segmental and Regional Analysis

- 8.4.4 Research & Development Expenses

- 8.4.5 Recent strategies and developments:

- 8.4.5.1 Trials and Approvals:

- 8.4.5.2 Mergers & Acquisition:

- 8.4.5.3 Product Launches and Product Expansions:

- 8.4.6 SWOT Analysis

- 8.5 B. Braun Melsungen AG

- 8.5.1 Company Overview

- 8.5.2 Financial Analysis

- 8.5.3 Segmental and Regional Analysis

- 8.5.4 Research & Development Expenses

- 8.5.5 Recent strategies and developments:

- 8.5.5.1 Partnerships, Collaborations & Agreements:

- 8.5.6 SWOT Analysis

- 8.6 Biotronik SE & Co. KG

- 8.6.1 Company Overview

- 8.6.2 SWOT Analysis

- 8.7 Cardinal Health, Inc.

- 8.7.1 Company Overview

- 8.7.2 Financial Analysis

- 8.7.3 Segmental and Regional Analysis

- 8.7.4 SWOT Analysis

- 8.8 Teleflex, Inc.

- 8.8.1 Company Overview

- 8.8.2 Financial Analysis

- 8.8.3 Segmental Analysis

- 8.8.4 Research & Development Expense

- 8.8.5 SWOT Analysis

- 8.9 Koninklijke Philips N.V.

- 8.9.1 Company Overview

- 8.9.2 Financial Analysis

- 8.9.3 Segmental and Regional Analysis

- 8.9.4 Research & Development Expense

- 8.9.5 Recent strategies and developments:

- 8.9.5.1 Partnerships, Collaborations & Agreements:

- 8.9.6 SWOT Analysis

- 8.10. Alvimedica

- 8.10.1 Company Overview

- 8.10.2 SWOT Analysis