|

|

市場調査レポート

商品コード

1309660

複合AIの世界市場規模、シェア、業界動向分析レポート:技術別、業界別、用途別、提供別、地域別展望と予測、2023年~2030年Global Composite AI Market Size, Share & Industry Trends Analysis Report By Technique, By Vertical, By Application, By Offering, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| 複合AIの世界市場規模、シェア、業界動向分析レポート:技術別、業界別、用途別、提供別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年06月30日

発行: KBV Research

ページ情報: 英文 445 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

複合AI市場規模は2030年までに85億米ドルに達すると予測され、予測期間中のCAGRは36.9%の市場成長率で上昇する見込みです。

KBV Cardinalのマトリックスに掲載された分析によると、Microsoft CorporationとGoogle LLCが同市場の先駆者です。2023年6月、マイクロソフトはインドのIT企業HCLTechとの提携を拡大し、AIを活用したジェネレーティブなビジネス変革ソリューションを企業に提供します。この提携により、マイクロソフトは、AIを活用した業務上の洞察力を活用し、より良い意思決定のためのソリューションを提供することで、顧客により良いサービスを提供できるようになります。

市場成長要因

エッジコンピューティングやIoTとの統合によるリアルタイムの意思決定

エッジコンピューティングの採用は、モノのインターネット(IoT)デバイスのユビキタス化とリアルタイムの意思決定の必要性によって促進されています。データをローカルで処理・分析することで、エッジデバイスと連携した複合AIシステムは待ち時間を短縮し、より迅速な洞察と回答を可能にします。この統合により、エッジコンピューティング環境における複合AIソリューションの展開が可能になります。インテリジェント・アプリケーションと5G/6Gモノのインターネット(IoT)ネットワークは、エッジ・コンピューティングに大きく依存しています。IoTエコシステムは、効果的なデータ分析と洞察の抽出のためにインテリジェントな学習を必要とする、膨大で異種混合の、極めてノイズの多い、時空間相関のあるリアルタイムのデータストリームを作り出します。これらのデバイスには、センサー、モバイル、メモリー・ユニットなどが含まれます。

パフォーマンスと精度を向上させるため、AIアプリケーションはより複雑化している

AIアプリケーションの複雑さは増しており、多くのAIモデルとテクノロジーの融合が必要となっています。組織は現在、MLを使用して大規模なニューラルネットワークを訓練しても、複雑化する課題に対処するための規模を拡大できない場合があるという事実に対処しています。結論として、AIアプリケーションの複雑化は、並外れた性能と精度を求める市場の盛り上がりを支えると思われます。

市場抑制要因

データ・セキュリティとプライバシーの問題

AI技術に対する自信の欠如や、その可能性と制約に対する認識が不十分なため、一部の企業は複合AIソリューションの採用をためらう可能性があります。また、データ・セキュリティやプライバシー、AIアルゴリズムに含まれる可能性のあるバイアスに対する懸念から、導入上の課題が生じる可能性もあります。データ漏えいや個人情報への不正アクセスは、AIの主要なプライバシー問題です。したがって、予測期間中、データ・セキュリティとプライバシーに関する懸念が市場の開拓を抑制する可能性があります。

提供の展望

提供に基づき、市場はハードウェア、ソフトウェア、サービスに区分されます。2022年の市場では、ソフトウェア・セグメントが最も高い収益シェアを占めました。複合AIソフトウェアは、多くの場合、複数のAIモデルまたはアルゴリズムの円滑な統合とオーケストレーションを可能にするプラットフォームまたはフレームワークを提供します。これにより、ユーザーは複雑な問題に対処するために、これらのAIコンポーネントの多くの機能を使用することで、より良い判断を下すことができます。組織は、複合AIソフトウェアを使用して、さまざまな種類のデータを処理・分析し、複雑なパターンを理解し、洞察を提供し、結果を予測し、AIアプローチのミックスを必要とする活動を実行する高度なAIアプリケーションを作成することができます。

ソフトウェアの展望

ソフトウェアでは、市場はAI開発プラットフォーム&ツール、MLフレームワーク、AIミドルウェア、その他のソフトウェアに二分されます。2022年には、AI開発プラットフォーム&ツール分野が市場で最大の収益シェアを記録しました。企業や開発者は、TensorFlow、PyTorch、IBM Watsonのような低コストでアクセス可能なAIツールやプラットフォームの出現により、AIソリューションをより迅速かつシンプルに設計・修正できるようになっています。AIシステムは、コードのコンパイルや品質保証のようなソフトウェア開発手順をスピードアップする可能性があり、ソフトウェア開発にかかる時間と費用を削減することができます。

技術の展望

技術に基づき、市場はプロアクティブメカニズム、データ処理、パターン認識、条件付きモニタリング、データマイニング&機械学習、その他に分類されます。2022年には、データマイニング&機械学習分野が市場で突出した収益シェアを予測しました。データマイニングと機械学習の技術は、複合AIソリューションの商業化に不可欠です。データマイニングと機械学習の手法を組み合わせた複合AIシステムは、システムが膨大な量のデータを分析し、パターンを見つけ、未来を予測し、意思決定を改善することを可能にします。データの力を利用することで、複合AIシステムは、さまざまな領域や用途にわたって、インテリジェントで適応性があり、文脈を認識する機能を提供することができます。

用途の展望

新興国市場は、用途別に、製品設計・開拓、品質管理、予知保全、セキュリティ・監視、顧客サービス、その他に分けられます。2022年には、予測メンテナンス分野が市場で大きな収益シェアを記録しました。機器の故障やメンテナンスの必要性を予測しようとする予知保全では、複合AIが有益である可能性があります。それは、より良い資産管理方法、データに基づく意思決定、正確な予測を提供します。

業界別展望

業界別では、BFSI、小売・eコマース、製造、エネルギー・公益、輸送・物流、ヘルスケア・ライフサイエンス、メディア・エンターテインメント、政府・軍事、通信、その他に区分されます。BFSIセグメントは、2022年の市場で最大の収益シェアを記録しました。BFSI業界では、複合AIソリューションは、コンプライアンスと規制報告、リスク評価と管理、顧客サービス、信用スコアリング、詐欺の検出と防止など、さまざまな目的で使用されています。

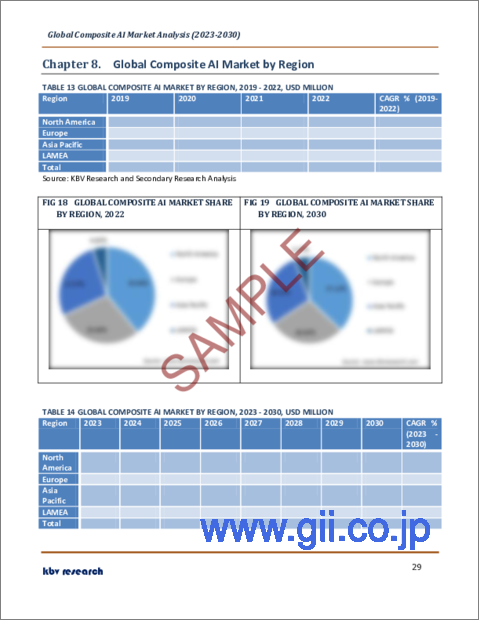

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAで分析されます。北米地域は、2022年の売上高シェアが最も高く、市場をリードしています。北米は複合AIソリューションの導入と拡大における世界的リーダーです。最先端のAI技術ビジネスの存在、強力な研究開発スキル、発展した市場エコシステムなどが、この地域の複合AIソリューションの急速な台頭に一役買っています。複合AIは、ヘルスケア、小売、BFSI、製造などの主要セクターで、イノベーションの促進、消費者体験の向上、業務効率の向上に活用されています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第3章 競合分析- 世界

- KBVカーディナルマトリックス

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 市場シェア分析、2021年

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

第4章 世界の複合AI市場:技術別

- 世界のデータ処理市場:地域別

- 世界のデータマイニングおよび機械学習市場:地域別

- 世界の条件付きモニタリング市場:地域別

- 世界のパターン認識市場:地域別

- 世界の制御メカニズム等市場:地域別

第5章 世界の複合AI市場:業界別

- 世界のBFSI市場:地域別

- 世界の通信市場:地域別

- 世界の小売および電子商取引市場:地域別

- 世界のヘルスケアおよびライフサイエンス市場:地域別

- 世界のメディア&エンターテインメント市場:地域別

- 世界のエネルギーおよび電力市場:地域別

- 世界の輸送および物流市場:地域別

- 世界の政府および防衛市場:地域別

- 世界の製造業市場:地域別

- 世界のその他の市場:地域別

第6章 世界の複合AI市場:用途別

- 世界の製品設計・開発市場:地域別

- 世界の品質管理市場:地域別

- 世界の予知保全市場:地域別

- 世界のセキュリティおよび監視市場:地域別

- 世界の顧客サービスおよびその他の市場:地域別

第7章 世界の複合AI市場:提供別

- 世界のハードウェア市場:地域別

- 世界の複合AI市場:ハードウェアタイプ別

- 世界のプロセッサ市場:地域別

- 世界のメモリユニット市場:地域別

- 世界のネットワーク市場:地域別

- 世界のその他の市場:地域別

- 世界のソフトウェア市場:地域別

- 世界の複合AI市場:ソフトウェアタイプ別

- 世界のAI開発プラットフォームおよびツール市場:地域別

- 世界のMLフレームワーク市場:地域別

- 世界のAIミドルウェア等市場:地域別

- 世界サービス市場:地域別

第8章 世界の複合AI市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第9章 企業プロファイル

- IBM Corporation

- SAS Institute, Inc

- Google LLC(Alphabet Inc)

- Intel Corporation

- Salesforce, Inc

- Microsoft Corporation

- Amazon Web Services, Inc(Amazon.com, Inc.)

- SAP SE

- NVIDIA Corporation

- Squirro AG

LIST OF TABLES

- TABLE 1 Global Composite AI Market, 2019 - 2022, USD Million

- TABLE 2 Global Composite AI Market, 2023 - 2030, USD Million

- TABLE 3 Partnerships, Collaborations and Agreements- Composite AI Market

- TABLE 4 Product Launches And Product Expansions- Composite AI Market

- TABLE 5 Global Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 6 Global Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 7 Global Data Processing Market by Region, 2019 - 2022, USD Million

- TABLE 8 Global Data Processing Market by Region, 2023 - 2030, USD Million

- TABLE 9 Global Data Mining & Machine Learning Market by Region, 2019 - 2022, USD Million

- TABLE 10 Global Data Mining & Machine Learning Market by Region, 2023 - 2030, USD Million

- TABLE 11 Global Conditioned Monitoring Market by Region, 2019 - 2022, USD Million

- TABLE 12 Global Conditioned Monitoring Market by Region, 2023 - 2030, USD Million

- TABLE 13 Global Pattern Recognition Market by Region, 2019 - 2022, USD Million

- TABLE 14 Global Pattern Recognition Market by Region, 2023 - 2030, USD Million

- TABLE 15 Global Proactive Mechanism & Others Market by Region, 2019 - 2022, USD Million

- TABLE 16 Global Proactive Mechanism & Others Market by Region, 2023 - 2030, USD Million

- TABLE 17 Global Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 18 Global Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 19 Global BFSI Market by Region, 2019 - 2022, USD Million

- TABLE 20 Global BFSI Market by Region, 2023 - 2030, USD Million

- TABLE 21 Global Telecommunications Market by Region, 2019 - 2022, USD Million

- TABLE 22 Global Telecommunications Market by Region, 2023 - 2030, USD Million

- TABLE 23 Global Retail & eCommerce Market by Region, 2019 - 2022, USD Million

- TABLE 24 Global Retail & eCommerce Market by Region, 2023 - 2030, USD Million

- TABLE 25 Global Healthcare & Lifesciences Market by Region, 2019 - 2022, USD Million

- TABLE 26 Global Healthcare & Lifesciences Market by Region, 2023 - 2030, USD Million

- TABLE 27 Global Media & Entertainment Market by Region, 2019 - 2022, USD Million

- TABLE 28 Global Media & Entertainment Market by Region, 2023 - 2030, USD Million

- TABLE 29 Global Energy & Power Market by Region, 2019 - 2022, USD Million

- TABLE 30 Global Energy & Power Market by Region, 2023 - 2030, USD Million

- TABLE 31 Global Transportation & Logistics Market by Region, 2019 - 2022, USD Million

- TABLE 32 Global Transportation & Logistics Market by Region, 2023 - 2030, USD Million

- TABLE 33 Global Government & Defense Market by Region, 2019 - 2022, USD Million

- TABLE 34 Global Government & Defense Market by Region, 2023 - 2030, USD Million

- TABLE 35 Global Manufacturing Market by Region, 2019 - 2022, USD Million

- TABLE 36 Global Manufacturing Market by Region, 2023 - 2030, USD Million

- TABLE 37 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 38 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 39 Global Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 40 Global Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 41 Global Product Design & Development Market by Region, 2019 - 2022, USD Million

- TABLE 42 Global Product Design & Development Market by Region, 2023 - 2030, USD Million

- TABLE 43 Global Quality Control Market by Region, 2019 - 2022, USD Million

- TABLE 44 Global Quality Control Market by Region, 2023 - 2030, USD Million

- TABLE 45 Global Predictive Maintenance Market by Region, 2019 - 2022, USD Million

- TABLE 46 Global Predictive Maintenance Market by Region, 2023 - 2030, USD Million

- TABLE 47 Global Security & Surveillance Market by Region, 2019 - 2022, USD Million

- TABLE 48 Global Security & Surveillance Market by Region, 2023 - 2030, USD Million

- TABLE 49 Global Customer Service & Others Market by Region, 2019 - 2022, USD Million

- TABLE 50 Global Customer Service & Others Market by Region, 2023 - 2030, USD Million

- TABLE 51 Global Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 52 Global Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 53 Global Hardware Market by Region, 2019 - 2022, USD Million

- TABLE 54 Global Hardware Market by Region, 2023 - 2030, USD Million

- TABLE 55 Global Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 56 Global Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 57 Global Processors Market by Region, 2019 - 2022, USD Million

- TABLE 58 Global Processors Market by Region, 2023 - 2030, USD Million

- TABLE 59 Global Memory Units Market by Region, 2019 - 2022, USD Million

- TABLE 60 Global Memory Units Market by Region, 2023 - 2030, USD Million

- TABLE 61 Global Networks Market by Region, 2019 - 2022, USD Million

- TABLE 62 Global Networks Market by Region, 2023 - 2030, USD Million

- TABLE 63 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 64 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 65 Global Software Market by Region, 2019 - 2022, USD Million

- TABLE 66 Global Software Market by Region, 2023 - 2030, USD Million

- TABLE 67 Global Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 68 Global Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 69 Global AI Development Platforms & Tools Market by Region, 2019 - 2022, USD Million

- TABLE 70 Global AI Development Platforms & Tools Market by Region, 2023 - 2030, USD Million

- TABLE 71 Global ML Framework Market by Region, 2019 - 2022, USD Million

- TABLE 72 Global ML Framework Market by Region, 2023 - 2030, USD Million

- TABLE 73 Global AI Middleware & Others Market by Region, 2019 - 2022, USD Million

- TABLE 74 Global AI Middleware & Others Market by Region, 2023 - 2030, USD Million

- TABLE 75 Global Services Market by Region, 2019 - 2022, USD Million

- TABLE 76 Global Services Market by Region, 2023 - 2030, USD Million

- TABLE 77 Global Composite AI Market by Region, 2019 - 2022, USD Million

- TABLE 78 Global Composite AI Market by Region, 2023 - 2030, USD Million

- TABLE 79 North America Composite AI Market, 2019 - 2022, USD Million

- TABLE 80 North America Composite AI Market, 2023 - 2030, USD Million

- TABLE 81 North America Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 82 North America Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 83 North America Data Processing Market by Country, 2019 - 2022, USD Million

- TABLE 84 North America Data Processing Market by Country, 2023 - 2030, USD Million

- TABLE 85 North America Data Mining & Machine Learning Market by Country, 2019 - 2022, USD Million

- TABLE 86 North America Data Mining & Machine Learning Market by Country, 2023 - 2030, USD Million

- TABLE 87 North America Conditioned Monitoring Market by Country, 2019 - 2022, USD Million

- TABLE 88 North America Conditioned Monitoring Market by Country, 2023 - 2030, USD Million

- TABLE 89 North America Pattern Recognition Market by Country, 2019 - 2022, USD Million

- TABLE 90 North America Pattern Recognition Market by Country, 2023 - 2030, USD Million

- TABLE 91 North America Proactive Mechanism & Others Market by Country, 2019 - 2022, USD Million

- TABLE 92 North America Proactive Mechanism & Others Market by Country, 2023 - 2030, USD Million

- TABLE 93 North America Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 94 North America Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 95 North America BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 96 North America BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 97 North America Telecommunications Market by Country, 2019 - 2022, USD Million

- TABLE 98 North America Telecommunications Market by Country, 2023 - 2030, USD Million

- TABLE 99 North America Retail & eCommerce Market by Country, 2019 - 2022, USD Million

- TABLE 100 North America Retail & eCommerce Market by Country, 2023 - 2030, USD Million

- TABLE 101 North America Healthcare & Lifesciences Market by Country, 2019 - 2022, USD Million

- TABLE 102 North America Healthcare & Lifesciences Market by Country, 2023 - 2030, USD Million

- TABLE 103 North America Media & Entertainment Market by Country, 2019 - 2022, USD Million

- TABLE 104 North America Media & Entertainment Market by Country, 2023 - 2030, USD Million

- TABLE 105 North America Energy & Power Market by Country, 2019 - 2022, USD Million

- TABLE 106 North America Energy & Power Market by Country, 2023 - 2030, USD Million

- TABLE 107 North America Transportation & Logistics Market by Country, 2019 - 2022, USD Million

- TABLE 108 North America Transportation & Logistics Market by Country, 2023 - 2030, USD Million

- TABLE 109 North America Government & Defense Market by Country, 2019 - 2022, USD Million

- TABLE 110 North America Government & Defense Market by Country, 2023 - 2030, USD Million

- TABLE 111 North America Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 112 North America Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 113 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 114 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 115 North America Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 116 North America Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 117 North America Product Design & Development Market by Country, 2019 - 2022, USD Million

- TABLE 118 North America Product Design & Development Market by Country, 2023 - 2030, USD Million

- TABLE 119 North America Quality Control Market by Country, 2019 - 2022, USD Million

- TABLE 120 North America Quality Control Market by Country, 2023 - 2030, USD Million

- TABLE 121 North America Predictive Maintenance Market by Country, 2019 - 2022, USD Million

- TABLE 122 North America Predictive Maintenance Market by Country, 2023 - 2030, USD Million

- TABLE 123 North America Security & Surveillance Market by Country, 2019 - 2022, USD Million

- TABLE 124 North America Security & Surveillance Market by Country, 2023 - 2030, USD Million

- TABLE 125 North America Customer Service & Others Market by Country, 2019 - 2022, USD Million

- TABLE 126 North America Customer Service & Others Market by Country, 2023 - 2030, USD Million

- TABLE 127 North America Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 128 North America Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 129 North America Hardware Market by Country, 2019 - 2022, USD Million

- TABLE 130 North America Hardware Market by Country, 2023 - 2030, USD Million

- TABLE 131 North America Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 132 North America Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 133 North America Processors Market by Country, 2019 - 2022, USD Million

- TABLE 134 North America Processors Market by Country, 2023 - 2030, USD Million

- TABLE 135 North America Memory Units Market by Country, 2019 - 2022, USD Million

- TABLE 136 North America Memory Units Market by Country, 2023 - 2030, USD Million

- TABLE 137 North America Networks Market by Country, 2019 - 2022, USD Million

- TABLE 138 North America Networks Market by Country, 2023 - 2030, USD Million

- TABLE 139 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 140 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 141 North America Software Market by Country, 2019 - 2022, USD Million

- TABLE 142 North America Software Market by Country, 2023 - 2030, USD Million

- TABLE 143 North America Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 144 North America Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 145 North America AI Development Platforms & Tools Market by Country, 2019 - 2022, USD Million

- TABLE 146 North America AI Development Platforms & Tools Market by Country, 2023 - 2030, USD Million

- TABLE 147 North America ML Framework Market by Country, 2019 - 2022, USD Million

- TABLE 148 North America ML Framework Market by Country, 2023 - 2030, USD Million

- TABLE 149 North America AI Middleware & Others Market by Country, 2019 - 2022, USD Million

- TABLE 150 North America AI Middleware & Others Market by Country, 2023 - 2030, USD Million

- TABLE 151 North America Services Market by Country, 2019 - 2022, USD Million

- TABLE 152 North America Services Market by Country, 2023 - 2030, USD Million

- TABLE 153 North America Composite AI Market by Country, 2019 - 2022, USD Million

- TABLE 154 North America Composite AI Market by Country, 2023 - 2030, USD Million

- TABLE 155 US Composite AI Market, 2019 - 2022, USD Million

- TABLE 156 US Composite AI Market, 2023 - 2030, USD Million

- TABLE 157 US Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 158 US Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 159 US Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 160 US Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 161 US Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 162 US Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 163 US Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 164 US Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 165 US Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 166 US Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 167 US Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 168 US Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 169 Canada Composite AI Market, 2019 - 2022, USD Million

- TABLE 170 Canada Composite AI Market, 2023 - 2030, USD Million

- TABLE 171 Canada Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 172 Canada Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 173 Canada Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 174 Canada Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 175 Canada Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 176 Canada Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 177 Canada Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 178 Canada Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 179 Canada Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 180 Canada Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 181 Canada Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 182 Canada Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 183 Mexico Composite AI Market, 2019 - 2022, USD Million

- TABLE 184 Mexico Composite AI Market, 2023 - 2030, USD Million

- TABLE 185 Mexico Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 186 Mexico Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 187 Mexico Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 188 Mexico Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 189 Mexico Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 190 Mexico Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 191 Mexico Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 192 Mexico Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 193 Mexico Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 194 Mexico Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 195 Mexico Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 196 Mexico Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 197 Rest of North America Composite AI Market, 2019 - 2022, USD Million

- TABLE 198 Rest of North America Composite AI Market, 2023 - 2030, USD Million

- TABLE 199 Rest of North America Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 200 Rest of North America Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 201 Rest of North America Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 202 Rest of North America Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 203 Rest of North America Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 204 Rest of North America Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 205 Rest of North America Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 206 Rest of North America Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 207 Rest of North America Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 208 Rest of North America Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 209 Rest of North America Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 210 Rest of North America Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 211 Europe Composite AI Market, 2019 - 2022, USD Million

- TABLE 212 Europe Composite AI Market, 2023 - 2030, USD Million

- TABLE 213 Europe Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 214 Europe Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 215 Europe Data Processing Market by Country, 2019 - 2022, USD Million

- TABLE 216 Europe Data Processing Market by Country, 2023 - 2030, USD Million

- TABLE 217 Europe Data Mining & Machine Learning Market by Country, 2019 - 2022, USD Million

- TABLE 218 Europe Data Mining & Machine Learning Market by Country, 2023 - 2030, USD Million

- TABLE 219 Europe Conditioned Monitoring Market by Country, 2019 - 2022, USD Million

- TABLE 220 Europe Conditioned Monitoring Market by Country, 2023 - 2030, USD Million

- TABLE 221 Europe Pattern Recognition Market by Country, 2019 - 2022, USD Million

- TABLE 222 Europe Pattern Recognition Market by Country, 2023 - 2030, USD Million

- TABLE 223 Europe Proactive Mechanism & Others Market by Country, 2019 - 2022, USD Million

- TABLE 224 Europe Proactive Mechanism & Others Market by Country, 2023 - 2030, USD Million

- TABLE 225 Europe Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 226 Europe Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 227 Europe BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 228 Europe BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 229 Europe Telecommunications Market by Country, 2019 - 2022, USD Million

- TABLE 230 Europe Telecommunications Market by Country, 2023 - 2030, USD Million

- TABLE 231 Europe Retail & eCommerce Market by Country, 2019 - 2022, USD Million

- TABLE 232 Europe Retail & eCommerce Market by Country, 2023 - 2030, USD Million

- TABLE 233 Europe Healthcare & Lifesciences Market by Country, 2019 - 2022, USD Million

- TABLE 234 Europe Healthcare & Lifesciences Market by Country, 2023 - 2030, USD Million

- TABLE 235 Europe Media & Entertainment Market by Country, 2019 - 2022, USD Million

- TABLE 236 Europe Media & Entertainment Market by Country, 2023 - 2030, USD Million

- TABLE 237 Europe Energy & Power Market by Country, 2019 - 2022, USD Million

- TABLE 238 Europe Energy & Power Market by Country, 2023 - 2030, USD Million

- TABLE 239 Europe Transportation & Logistics Market by Country, 2019 - 2022, USD Million

- TABLE 240 Europe Transportation & Logistics Market by Country, 2023 - 2030, USD Million

- TABLE 241 Europe Government & Defense Market by Country, 2019 - 2022, USD Million

- TABLE 242 Europe Government & Defense Market by Country, 2023 - 2030, USD Million

- TABLE 243 Europe Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 244 Europe Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 245 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 246 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 247 Europe Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 248 Europe Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 249 Europe Product Design & Development Market by Country, 2019 - 2022, USD Million

- TABLE 250 Europe Product Design & Development Market by Country, 2023 - 2030, USD Million

- TABLE 251 Europe Quality Control Market by Country, 2019 - 2022, USD Million

- TABLE 252 Europe Quality Control Market by Country, 2023 - 2030, USD Million

- TABLE 253 Europe Predictive Maintenance Market by Country, 2019 - 2022, USD Million

- TABLE 254 Europe Predictive Maintenance Market by Country, 2023 - 2030, USD Million

- TABLE 255 Europe Security & Surveillance Market by Country, 2019 - 2022, USD Million

- TABLE 256 Europe Security & Surveillance Market by Country, 2023 - 2030, USD Million

- TABLE 257 Europe Customer Service & Others Market by Country, 2019 - 2022, USD Million

- TABLE 258 Europe Customer Service & Others Market by Country, 2023 - 2030, USD Million

- TABLE 259 Europe Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 260 Europe Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 261 Europe Hardware Market by Country, 2019 - 2022, USD Million

- TABLE 262 Europe Hardware Market by Country, 2023 - 2030, USD Million

- TABLE 263 Europe Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 264 Europe Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 265 Europe Processors Market by Country, 2019 - 2022, USD Million

- TABLE 266 Europe Processors Market by Country, 2023 - 2030, USD Million

- TABLE 267 Europe Memory Units Market by Country, 2019 - 2022, USD Million

- TABLE 268 Europe Memory Units Market by Country, 2023 - 2030, USD Million

- TABLE 269 Europe Networks Market by Country, 2019 - 2022, USD Million

- TABLE 270 Europe Networks Market by Country, 2023 - 2030, USD Million

- TABLE 271 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 272 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 273 Europe Software Market by Country, 2019 - 2022, USD Million

- TABLE 274 Europe Software Market by Country, 2023 - 2030, USD Million

- TABLE 275 Europe Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 276 Europe Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 277 Europe AI Development Platforms & Tools Market by Country, 2019 - 2022, USD Million

- TABLE 278 Europe AI Development Platforms & Tools Market by Country, 2023 - 2030, USD Million

- TABLE 279 Europe ML Framework Market by Country, 2019 - 2022, USD Million

- TABLE 280 Europe ML Framework Market by Country, 2023 - 2030, USD Million

- TABLE 281 Europe AI Middleware & Others Market by Country, 2019 - 2022, USD Million

- TABLE 282 Europe AI Middleware & Others Market by Country, 2023 - 2030, USD Million

- TABLE 283 Europe Services Market by Country, 2019 - 2022, USD Million

- TABLE 284 Europe Services Market by Country, 2023 - 2030, USD Million

- TABLE 285 Europe Composite AI Market by Country, 2019 - 2022, USD Million

- TABLE 286 Europe Composite AI Market by Country, 2023 - 2030, USD Million

- TABLE 287 Germany Composite AI Market, 2019 - 2022, USD Million

- TABLE 288 Germany Composite AI Market, 2023 - 2030, USD Million

- TABLE 289 Germany Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 290 Germany Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 291 Germany Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 292 Germany Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 293 Germany Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 294 Germany Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 295 Germany Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 296 Germany Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 297 Germany Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 298 Germany Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 299 Germany Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 300 Germany Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 301 UK Composite AI Market, 2019 - 2022, USD Million

- TABLE 302 UK Composite AI Market, 2023 - 2030, USD Million

- TABLE 303 UK Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 304 UK Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 305 UK Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 306 UK Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 307 UK Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 308 UK Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 309 UK Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 310 UK Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 311 UK Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 312 UK Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 313 UK Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 314 UK Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 315 France Composite AI Market, 2019 - 2022, USD Million

- TABLE 316 France Composite AI Market, 2023 - 2030, USD Million

- TABLE 317 France Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 318 France Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 319 France Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 320 France Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 321 France Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 322 France Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 323 France Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 324 France Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 325 France Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 326 France Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 327 France Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 328 France Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 329 Russia Composite AI Market, 2019 - 2022, USD Million

- TABLE 330 Russia Composite AI Market, 2023 - 2030, USD Million

- TABLE 331 Russia Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 332 Russia Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 333 Russia Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 334 Russia Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 335 Russia Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 336 Russia Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 337 Russia Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 338 Russia Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 339 Russia Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 340 Russia Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 341 Russia Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 342 Russia Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 343 Spain Composite AI Market, 2019 - 2022, USD Million

- TABLE 344 Spain Composite AI Market, 2023 - 2030, USD Million

- TABLE 345 Spain Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 346 Spain Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 347 Spain Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 348 Spain Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 349 Spain Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 350 Spain Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 351 Spain Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 352 Spain Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 353 Spain Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 354 Spain Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 355 Spain Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 356 Spain Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 357 Italy Composite AI Market, 2019 - 2022, USD Million

- TABLE 358 Italy Composite AI Market, 2023 - 2030, USD Million

- TABLE 359 Italy Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 360 Italy Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 361 Italy Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 362 Italy Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 363 Italy Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 364 Italy Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 365 Italy Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 366 Italy Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 367 Italy Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 368 Italy Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 369 Italy Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 370 Italy Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 371 Rest of Europe Composite AI Market, 2019 - 2022, USD Million

- TABLE 372 Rest of Europe Composite AI Market, 2023 - 2030, USD Million

- TABLE 373 Rest of Europe Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 374 Rest of Europe Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 375 Rest of Europe Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 376 Rest of Europe Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 377 Rest of Europe Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 378 Rest of Europe Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 379 Rest of Europe Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 380 Rest of Europe Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 381 Rest of Europe Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 382 Rest of Europe Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 383 Rest of Europe Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 384 Rest of Europe Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 385 Asia Pacific Composite AI Market, 2019 - 2022, USD Million

- TABLE 386 Asia Pacific Composite AI Market, 2023 - 2030, USD Million

- TABLE 387 Asia Pacific Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 388 Asia Pacific Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 389 Asia Pacific Data Processing Market by Country, 2019 - 2022, USD Million

- TABLE 390 Asia Pacific Data Processing Market by Country, 2023 - 2030, USD Million

- TABLE 391 Asia Pacific Data Mining & Machine Learning Market by Country, 2019 - 2022, USD Million

- TABLE 392 Asia Pacific Data Mining & Machine Learning Market by Country, 2023 - 2030, USD Million

- TABLE 393 Asia Pacific Conditioned Monitoring Market by Country, 2019 - 2022, USD Million

- TABLE 394 Asia Pacific Conditioned Monitoring Market by Country, 2023 - 2030, USD Million

- TABLE 395 Asia Pacific Pattern Recognition Market by Country, 2019 - 2022, USD Million

- TABLE 396 Asia Pacific Pattern Recognition Market by Country, 2023 - 2030, USD Million

- TABLE 397 Asia Pacific Proactive Mechanism & Others Market by Country, 2019 - 2022, USD Million

- TABLE 398 Asia Pacific Proactive Mechanism & Others Market by Country, 2023 - 2030, USD Million

- TABLE 399 Asia Pacific Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 400 Asia Pacific Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 401 Asia Pacific BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 402 Asia Pacific BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 403 Asia Pacific Telecommunications Market by Country, 2019 - 2022, USD Million

- TABLE 404 Asia Pacific Telecommunications Market by Country, 2023 - 2030, USD Million

- TABLE 405 Asia Pacific Retail & eCommerce Market by Country, 2019 - 2022, USD Million

- TABLE 406 Asia Pacific Retail & eCommerce Market by Country, 2023 - 2030, USD Million

- TABLE 407 Asia Pacific Healthcare & Lifesciences Market by Country, 2019 - 2022, USD Million

- TABLE 408 Asia Pacific Healthcare & Lifesciences Market by Country, 2023 - 2030, USD Million

- TABLE 409 Asia Pacific Media & Entertainment Market by Country, 2019 - 2022, USD Million

- TABLE 410 Asia Pacific Media & Entertainment Market by Country, 2023 - 2030, USD Million

- TABLE 411 Asia Pacific Energy & Power Market by Country, 2019 - 2022, USD Million

- TABLE 412 Asia Pacific Energy & Power Market by Country, 2023 - 2030, USD Million

- TABLE 413 Asia Pacific Transportation & Logistics Market by Country, 2019 - 2022, USD Million

- TABLE 414 Asia Pacific Transportation & Logistics Market by Country, 2023 - 2030, USD Million

- TABLE 415 Asia Pacific Government & Defense Market by Country, 2019 - 2022, USD Million

- TABLE 416 Asia Pacific Government & Defense Market by Country, 2023 - 2030, USD Million

- TABLE 417 Asia Pacific Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 418 Asia Pacific Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 419 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

- TABLE 420 Asia Pacific Others Market by Country, 2023 - 2030, USD Million

- TABLE 421 Asia Pacific Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 422 Asia Pacific Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 423 Asia Pacific Product Design & Development Market by Country, 2019 - 2022, USD Million

- TABLE 424 Asia Pacific Product Design & Development Market by Country, 2023 - 2030, USD Million

- TABLE 425 Asia Pacific Quality Control Market by Country, 2019 - 2022, USD Million

- TABLE 426 Asia Pacific Quality Control Market by Country, 2023 - 2030, USD Million

- TABLE 427 Asia Pacific Predictive Maintenance Market by Country, 2019 - 2022, USD Million

- TABLE 428 Asia Pacific Predictive Maintenance Market by Country, 2023 - 2030, USD Million

- TABLE 429 Asia Pacific Security & Surveillance Market by Country, 2019 - 2022, USD Million

- TABLE 430 Asia Pacific Security & Surveillance Market by Country, 2023 - 2030, USD Million

- TABLE 431 Asia Pacific Customer Service & Others Market by Country, 2019 - 2022, USD Million

- TABLE 432 Asia Pacific Customer Service & Others Market by Country, 2023 - 2030, USD Million

- TABLE 433 Asia Pacific Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 434 Asia Pacific Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 435 Asia Pacific Hardware Market by Country, 2019 - 2022, USD Million

- TABLE 436 Asia Pacific Hardware Market by Country, 2023 - 2030, USD Million

- TABLE 437 Asia Pacific Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 438 Asia Pacific Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 439 Asia Pacific Processors Market by Country, 2019 - 2022, USD Million

- TABLE 440 Asia Pacific Processors Market by Country, 2023 - 2030, USD Million

- TABLE 441 Asia Pacific Memory Units Market by Country, 2019 - 2022, USD Million

- TABLE 442 Asia Pacific Memory Units Market by Country, 2023 - 2030, USD Million

- TABLE 443 Asia Pacific Networks Market by Country, 2019 - 2022, USD Million

- TABLE 444 Asia Pacific Networks Market by Country, 2023 - 2030, USD Million

- TABLE 445 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

- TABLE 446 Asia Pacific Others Market by Country, 2023 - 2030, USD Million

- TABLE 447 Asia Pacific Software Market by Country, 2019 - 2022, USD Million

- TABLE 448 Asia Pacific Software Market by Country, 2023 - 2030, USD Million

- TABLE 449 Asia Pacific Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 450 Asia Pacific Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 451 Asia Pacific AI Development Platforms & Tools Market by Country, 2019 - 2022, USD Million

- TABLE 452 Asia Pacific AI Development Platforms & Tools Market by Country, 2023 - 2030, USD Million

- TABLE 453 Asia Pacific ML Framework Market by Country, 2019 - 2022, USD Million

- TABLE 454 Asia Pacific ML Framework Market by Country, 2023 - 2030, USD Million

- TABLE 455 Asia Pacific AI Middleware & Others Market by Country, 2019 - 2022, USD Million

- TABLE 456 Asia Pacific AI Middleware & Others Market by Country, 2023 - 2030, USD Million

- TABLE 457 Asia Pacific Services Market by Country, 2019 - 2022, USD Million

- TABLE 458 Asia Pacific Services Market by Country, 2023 - 2030, USD Million

- TABLE 459 Asia Pacific Composite AI Market by Country, 2019 - 2022, USD Million

- TABLE 460 Asia Pacific Composite AI Market by Country, 2023 - 2030, USD Million

- TABLE 461 China Composite AI Market, 2019 - 2022, USD Million

- TABLE 462 China Composite AI Market, 2023 - 2030, USD Million

- TABLE 463 China Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 464 China Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 465 China Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 466 China Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 467 China Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 468 China Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 469 China Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 470 China Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 471 China Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 472 China Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 473 China Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 474 China Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 475 Japan Composite AI Market, 2019 - 2022, USD Million

- TABLE 476 Japan Composite AI Market, 2023 - 2030, USD Million

- TABLE 477 Japan Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 478 Japan Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 479 Japan Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 480 Japan Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 481 Japan Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 482 Japan Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 483 Japan Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 484 Japan Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 485 Japan Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 486 Japan Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 487 Japan Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 488 Japan Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 489 India Composite AI Market, 2019 - 2022, USD Million

- TABLE 490 India Composite AI Market, 2023 - 2030, USD Million

- TABLE 491 India Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 492 India Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 493 India Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 494 India Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 495 India Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 496 India Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 497 India Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 498 India Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 499 India Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 500 India Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 501 India Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 502 India Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 503 South Korea Composite AI Market, 2019 - 2022, USD Million

- TABLE 504 South Korea Composite AI Market, 2023 - 2030, USD Million

- TABLE 505 South Korea Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 506 South Korea Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 507 South Korea Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 508 South Korea Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 509 South Korea Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 510 South Korea Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 511 South Korea Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 512 South Korea Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 513 South Korea Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 514 South Korea Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 515 South Korea Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 516 South Korea Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 517 Singapore Composite AI Market, 2019 - 2022, USD Million

- TABLE 518 Singapore Composite AI Market, 2023 - 2030, USD Million

- TABLE 519 Singapore Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 520 Singapore Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 521 Singapore Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 522 Singapore Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 523 Singapore Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 524 Singapore Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 525 Singapore Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 526 Singapore Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 527 Singapore Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 528 Singapore Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 529 Singapore Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 530 Singapore Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 531 Malaysia Composite AI Market, 2019 - 2022, USD Million

- TABLE 532 Malaysia Composite AI Market, 2023 - 2030, USD Million

- TABLE 533 Malaysia Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 534 Malaysia Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 535 Malaysia Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 536 Malaysia Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 537 Malaysia Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 538 Malaysia Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 539 Malaysia Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 540 Malaysia Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 541 Malaysia Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 542 Malaysia Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 543 Malaysia Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 544 Malaysia Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 545 Rest of Asia Pacific Composite AI Market, 2019 - 2022, USD Million

- TABLE 546 Rest of Asia Pacific Composite AI Market, 2023 - 2030, USD Million

- TABLE 547 Rest of Asia Pacific Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 548 Rest of Asia Pacific Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 549 Rest of Asia Pacific Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 550 Rest of Asia Pacific Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 551 Rest of Asia Pacific Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 552 Rest of Asia Pacific Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 553 Rest of Asia Pacific Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 554 Rest of Asia Pacific Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 555 Rest of Asia Pacific Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 556 Rest of Asia Pacific Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 557 Rest of Asia Pacific Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 558 Rest of Asia Pacific Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 559 LAMEA Composite AI Market, 2019 - 2022, USD Million

- TABLE 560 LAMEA Composite AI Market, 2023 - 2030, USD Million

- TABLE 561 LAMEA Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 562 LAMEA Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 563 LAMEA Data Processing Market by Country, 2019 - 2022, USD Million

- TABLE 564 LAMEA Data Processing Market by Country, 2023 - 2030, USD Million

- TABLE 565 LAMEA Data Mining & Machine Learning Market by Country, 2019 - 2022, USD Million

- TABLE 566 LAMEA Data Mining & Machine Learning Market by Country, 2023 - 2030, USD Million

- TABLE 567 LAMEA Conditioned Monitoring Market by Country, 2019 - 2022, USD Million

- TABLE 568 LAMEA Conditioned Monitoring Market by Country, 2023 - 2030, USD Million

- TABLE 569 LAMEA Pattern Recognition Market by Country, 2019 - 2022, USD Million

- TABLE 570 LAMEA Pattern Recognition Market by Country, 2023 - 2030, USD Million

- TABLE 571 LAMEA Proactive Mechanism & Others Market by Country, 2019 - 2022, USD Million

- TABLE 572 LAMEA Proactive Mechanism & Others Market by Country, 2023 - 2030, USD Million

- TABLE 573 LAMEA Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 574 LAMEA Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 575 LAMEA BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 576 LAMEA BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 577 LAMEA Telecommunications Market by Country, 2019 - 2022, USD Million

- TABLE 578 LAMEA Telecommunications Market by Country, 2023 - 2030, USD Million

- TABLE 579 LAMEA Retail & eCommerce Market by Country, 2019 - 2022, USD Million

- TABLE 580 LAMEA Retail & eCommerce Market by Country, 2023 - 2030, USD Million

- TABLE 581 LAMEA Healthcare & Lifesciences Market by Country, 2019 - 2022, USD Million

- TABLE 582 LAMEA Healthcare & Lifesciences Market by Country, 2023 - 2030, USD Million

- TABLE 583 LAMEA Media & Entertainment Market by Country, 2019 - 2022, USD Million

- TABLE 584 LAMEA Media & Entertainment Market by Country, 2023 - 2030, USD Million

- TABLE 585 LAMEA Energy & Power Market by Country, 2019 - 2022, USD Million

- TABLE 586 LAMEA Energy & Power Market by Country, 2023 - 2030, USD Million

- TABLE 587 LAMEA Transportation & Logistics Market by Country, 2019 - 2022, USD Million

- TABLE 588 LAMEA Transportation & Logistics Market by Country, 2023 - 2030, USD Million

- TABLE 589 LAMEA Government & Defense Market by Country, 2019 - 2022, USD Million

- TABLE 590 LAMEA Government & Defense Market by Country, 2023 - 2030, USD Million

- TABLE 591 LAMEA Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 592 LAMEA Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 593 LAMEA Others Market by Country, 2019 - 2022, USD Million

- TABLE 594 LAMEA Others Market by Country, 2023 - 2030, USD Million

- TABLE 595 LAMEA Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 596 LAMEA Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 597 LAMEA Product Design & Development Market by Country, 2019 - 2022, USD Million

- TABLE 598 LAMEA Product Design & Development Market by Country, 2023 - 2030, USD Million

- TABLE 599 LAMEA Quality Control Market by Country, 2019 - 2022, USD Million

- TABLE 600 LAMEA Quality Control Market by Country, 2023 - 2030, USD Million

- TABLE 601 LAMEA Predictive Maintenance Market by Country, 2019 - 2022, USD Million

- TABLE 602 LAMEA Predictive Maintenance Market by Country, 2023 - 2030, USD Million

- TABLE 603 LAMEA Security & Surveillance Market by Country, 2019 - 2022, USD Million

- TABLE 604 LAMEA Security & Surveillance Market by Country, 2023 - 2030, USD Million

- TABLE 605 LAMEA Customer Service & Others Market by Country, 2019 - 2022, USD Million

- TABLE 606 LAMEA Customer Service & Others Market by Country, 2023 - 2030, USD Million

- TABLE 607 LAMEA Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 608 LAMEA Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 609 LAMEA Hardware Market by Country, 2019 - 2022, USD Million

- TABLE 610 LAMEA Hardware Market by Country, 2023 - 2030, USD Million

- TABLE 611 LAMEA Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 612 LAMEA Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 613 LAMEA Processors Market by Country, 2019 - 2022, USD Million

- TABLE 614 LAMEA Processors Market by Country, 2023 - 2030, USD Million

- TABLE 615 LAMEA Memory Units Market by Country, 2019 - 2022, USD Million

- TABLE 616 LAMEA Memory Units Market by Country, 2023 - 2030, USD Million

- TABLE 617 LAMEA Networks Market by Country, 2019 - 2022, USD Million

- TABLE 618 LAMEA Networks Market by Country, 2023 - 2030, USD Million

- TABLE 619 LAMEA Others Market by Country, 2019 - 2022, USD Million

- TABLE 620 LAMEA Others Market by Country, 2023 - 2030, USD Million

- TABLE 621 LAMEA Software Market by Country, 2019 - 2022, USD Million

- TABLE 622 LAMEA Software Market by Country, 2023 - 2030, USD Million

- TABLE 623 LAMEA Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 624 LAMEA Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 625 LAMEA AI Development Platforms & Tools Market by Country, 2019 - 2022, USD Million

- TABLE 626 LAMEA AI Development Platforms & Tools Market by Country, 2023 - 2030, USD Million

- TABLE 627 LAMEA ML Framework Market by Country, 2019 - 2022, USD Million

- TABLE 628 LAMEA ML Framework Market by Country, 2023 - 2030, USD Million

- TABLE 629 LAMEA AI Middleware & Others Market by Country, 2019 - 2022, USD Million

- TABLE 630 LAMEA AI Middleware & Others Market by Country, 2023 - 2030, USD Million

- TABLE 631 LAMEA Services Market by Country, 2019 - 2022, USD Million

- TABLE 632 LAMEA Services Market by Country, 2023 - 2030, USD Million

- TABLE 633 LAMEA Composite AI Market by Country, 2019 - 2022, USD Million

- TABLE 634 LAMEA Composite AI Market by Country, 2023 - 2030, USD Million

- TABLE 635 Brazil Composite AI Market, 2019 - 2022, USD Million

- TABLE 636 Brazil Composite AI Market, 2023 - 2030, USD Million

- TABLE 637 Brazil Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 638 Brazil Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 639 Brazil Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 640 Brazil Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 641 Brazil Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 642 Brazil Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 643 Brazil Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 644 Brazil Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 645 Brazil Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 646 Brazil Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 647 Brazil Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 648 Brazil Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 649 Argentina Composite AI Market, 2019 - 2022, USD Million

- TABLE 650 Argentina Composite AI Market, 2023 - 2030, USD Million

- TABLE 651 Argentina Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 652 Argentina Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 653 Argentina Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 654 Argentina Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 655 Argentina Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 656 Argentina Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 657 Argentina Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 658 Argentina Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 659 Argentina Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 660 Argentina Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 661 Argentina Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 662 Argentina Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 663 UAE Composite AI Market, 2019 - 2022, USD Million

- TABLE 664 UAE Composite AI Market, 2023 - 2030, USD Million

- TABLE 665 UAE Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 666 UAE Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 667 UAE Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 668 UAE Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 669 UAE Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 670 UAE Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 671 UAE Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 672 UAE Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 673 UAE Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 674 UAE Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 675 UAE Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 676 UAE Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 677 Saudi Arabia Composite AI Market, 2019 - 2022, USD Million

- TABLE 678 Saudi Arabia Composite AI Market, 2023 - 2030, USD Million

- TABLE 679 Saudi Arabia Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 680 Saudi Arabia Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 681 Saudi Arabia Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 682 Saudi Arabia Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 683 Saudi Arabia Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 684 Saudi Arabia Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 685 Saudi Arabia Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 686 Saudi Arabia Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 687 Saudi Arabia Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 688 Saudi Arabia Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 689 Saudi Arabia Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 690 Saudi Arabia Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 691 South Africa Composite AI Market, 2019 - 2022, USD Million

- TABLE 692 South Africa Composite AI Market, 2023 - 2030, USD Million

- TABLE 693 South Africa Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 694 South Africa Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 695 South Africa Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 696 South Africa Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 697 South Africa Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 698 South Africa Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 699 South Africa Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 700 South Africa Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 701 South Africa Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 702 South Africa Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 703 South Africa Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 704 South Africa Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 705 Nigeria Composite AI Market, 2019 - 2022, USD Million

- TABLE 706 Nigeria Composite AI Market, 2023 - 2030, USD Million

- TABLE 707 Nigeria Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 708 Nigeria Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 709 Nigeria Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 710 Nigeria Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 711 Nigeria Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 712 Nigeria Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 713 Nigeria Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 714 Nigeria Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 715 Nigeria Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 716 Nigeria Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 717 Nigeria Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 718 Nigeria Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 719 Rest of LAMEA Composite AI Market, 2019 - 2022, USD Million

- TABLE 720 Rest of LAMEA Composite AI Market, 2023 - 2030, USD Million

- TABLE 721 Rest of LAMEA Composite AI Market by Technique, 2019 - 2022, USD Million

- TABLE 722 Rest of LAMEA Composite AI Market by Technique, 2023 - 2030, USD Million

- TABLE 723 Rest of LAMEA Composite AI Market by Vertical, 2019 - 2022, USD Million

- TABLE 724 Rest of LAMEA Composite AI Market by Vertical, 2023 - 2030, USD Million

- TABLE 725 Rest of LAMEA Composite AI Market by Application, 2019 - 2022, USD Million

- TABLE 726 Rest of LAMEA Composite AI Market by Application, 2023 - 2030, USD Million

- TABLE 727 Rest of LAMEA Composite AI Market by Offering, 2019 - 2022, USD Million

- TABLE 728 Rest of LAMEA Composite AI Market by Offering, 2023 - 2030, USD Million

- TABLE 729 Rest of LAMEA Composite AI Market by Hardware Type, 2019 - 2022, USD Million

- TABLE 730 Rest of LAMEA Composite AI Market by Hardware Type, 2023 - 2030, USD Million

- TABLE 731 Rest of LAMEA Composite AI Market by Software Type, 2019 - 2022, USD Million

- TABLE 732 Rest of LAMEA Composite AI Market by Software Type, 2023 - 2030, USD Million

- TABLE 733 Key information - IBM Corporation

- TABLE 734 Key information - SAS Institute, Inc.

- TABLE 735 Key Information - Google LLC

- TABLE 736 Key Information - Intel Corporation

- TABLE 737 Key Information - Salesforce, Inc.

- TABLE 738 key information - Microsoft Corporation

- TABLE 739 Key Information - Amazon Web Services, Inc.

- TABLE 740 Key Information - SAP SE

- TABLE 741 Key Information - NVIDIA Corporation

- TABLE 742 Key Information - Squirro AG

List of Figures

- FIG 1 Methodology for the research

- FIG 2 KBV Cardinal Matrix

- FIG 3 Market Share Analysis, 2021

- FIG 4 Key Leading Strategies: Percentage Distribution (2019-2023)

- FIG 5 Key Strategic Move: (Partnerships, Collaborations & Agreements : 2020, Jun - 2023, Jun) Leading Players

- FIG 6 Global Composite AI Market share by Technique, 2022

- FIG 7 Global Composite AI Market share by Technique, 2030

- FIG 8 Global Composite AI Market by Technique, 2019 - 2030, USD Million

- FIG 9 Global Composite AI Market share by Vertical, 2022

- FIG 10 Global Composite AI Market share by Vertical, 2030

- FIG 11 Global Composite AI Market by Vertical, 2019 - 2030, USD Million

- FIG 12 Global Composite AI Market share by Application, 2022

- FIG 13 Global Composite AI Market share by Application, 2030

- FIG 14 Global Composite AI Market by Application, 2019 - 2030, USD Million

- FIG 15 Global Composite AI Market share by Offering, 2022

- FIG 16 Global Composite AI Market share by Offering, 2030

- FIG 17 Global Composite AI Market by Offering, 2019 - 2030, USD Million

- FIG 18 Global Composite AI Market share by Region, 2022

- FIG 19 Global Composite AI Market share by Region, 2030

- FIG 20 Global Composite AI Market by Region, 2019 - 2030, USD Million

- FIG 21 Recent strategies and developments: IBM Corporation

- FIG 22 Swot Analysis: IBM Corporation

- FIG 23 Recent strategies and developments: Google LLC

- FIG 24 SWOT Analysis: Alphabet Inc. (Google LLC)

- FIG 25 SWOT Analysis: Intel Corporation

- FIG 26 Recent strategies and developments: Salesforce, Inc.

- FIG 27 SWOT Analysis: Salesforce.com, Inc.

- FIG 28 SWOT Analysis: Microsoft Corporation

- FIG 29 Recent strategies and developments: Amazon Web Services, Inc.

- FIG 30 SWOT analysis: Amazon.com, Inc.

- FIG 31 Recent strategies and developments: SAP SE

- FIG 32 SWOT Analysis: SAP SE

- FIG 33 SWOT Analysis: NVIDIA Corporation

The Global Composite AI Market size is expected to reach $8.5 billion by 2030, rising at a market growth of 36.9% CAGR during the forecast period.

The need of Composite AI in Security & surveillance is growing as organizations may increase situational awareness, strengthen threat detection capabilities, automate monitoring procedures, and allow more effective and proactive security actions by using composite AI in security and surveillance. Therefore, Security & Surveillance acquired $83.4 million revenue in the market in 2022. Composite artificial intelligence (AI) may significantly advance numerous elements of safety monitoring, danger identification, and response. The market is predicted to expand due to the increased requirement for data protection since many firms have recently experienced severe security breaches and data breaches.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2023, Google LLC signed a partnership with Sysdig to integrate its generative artificial intelligence (AI) features with Sysdig's cloud security platform. The partnership would provide the joint customers of the two companies with secure cloud-based automation solutions that would drive better productivity. Additionally, In June, 2023, Salesforce extended its partnership with Google Cloud to develop solutions for AI-powered customer experience solutions. The partnership would allow the two companies to provide their clients with personalized customer experience solutions.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Market. In June, 2023, Microsoft Corporation extended its partnership with HCLTech, an Indian IT company, to provide generative AI-powered business transformation solutions to enterprises. The partnership would allow Microsoft to serve its customers in a better way by providing them with solutions for better decision-making through the use of AI-powered operational insights. Companies such as Intel Corporation, NVIDIA Corporation, SAP SE are some of the key innovators in the Market.

Market Growth Factors

Real-time decision-making via integration with edge computing and IoT

Edge computing adoption is being fueled by the ubiquity of Internet of Things (IoT) devices and the need for real-time decision-making. By processing and analyzing data locally, composite AI systems linked with edge devices may lower latency and enable quicker insights and answers. This integration makes the deployment of composite AI solutions in edge computing settings possible. Intelligent applications and 5G/6G Internet of Things (IoT) networks rely heavily on edge computing. The IoT ecosystem creates enormous, heterogeneous, extremely noisy, spatiotemporal-correlated, real-time data streams that need intelligent learning for effective data analysis and insight extraction. These devices include sensors, mobiles, and memory units.

AI applications are becoming more intricate to improve performance and accuracy

The complexity of AI applications is increasing, necessitating the fusion of many AI models and technologies. Organizations are now dealing with the fact that training a large neural network using ML only sometimes scales to address challenges of growing complexity. In conclusion, the increasing complexity of AI applications will support the rise of the market for extraordinary performance and accuracy.

Market Restraining Factors

Issues with data security and privacy

Due to a lack of confidence in AI technology or incomplete awareness of its potential and constraints, some businesses could hesitate to employ composite AI solutions. Implementation challenges may also arise from worries about data security, privacy, and possible biases in AI algorithms. Data leaks and illegal access to private information are the key privacy issues with AI. Thus, over the projection period, worries about data security and privacy may restrain the development of the market.

Offering Outlook

Based on offering, the market is segmented into hardware, software, and services. The software segment held the highest revenue share in the market in 2022. Composite AI software often provides a platform or framework that enables the smooth integration and orchestration of several AI models or algorithms. It allows users to make better judgments by using the many capabilities of these AI components to address complex problems. Organizations may create sophisticated AI applications that process and analyze various data kinds, comprehend complicated patterns, provide insights, anticipate outcomes, and carry out activities that call for a mix of AI approaches using composite AI software.

Software Outlook

Under software, the market is bifurcated into AI Development Platforms & Tools, ML Frameworks, AI Middleware, and other software. In 2022, the AI Development Platforms & Tools segment registered the largest revenue share in the market. Businesses and developers may now design and modify AI solutions more quickly and simply because of the emergence of low-cost and accessible AI tools and platforms like TensorFlow, PyTorch, and IBM Watson. AI systems may speed up software development procedures like code compilation and quality assurance, which can cut down on the time and expense involved in developing software.

Technique Outlook

Based on technique, the market is categorized into proactive mechanisms, data processing, pattern recognition, conditioned monitoring, data mining & machine learning, and others. In 2022, the data mining & machine learning segment projected a prominent revenue share in the market. Techniques for data mining and machine learning are essential for commercializing Composite AI solutions. Composite AI systems that combine data mining and machine learning methods allow the system to analyze enormous volumes of data, find patterns, anticipate the future, and improve decision-making. Using data's power allows composite AI systems to offer intelligent, adaptive, and context-aware capabilities across a range of domains and applications.

Application Outlook

On the basis of application, the market is divided into product design & development, quality control, predictive maintenance, security & surveillance, customer service, and others. In 2022, the predictive maintenance segment registered a significant revenue share in the market. In predictive maintenance, which seeks to anticipate equipment breakdowns or maintenance requirements, composite AI may be beneficial. It provides better asset management methods, data-driven decision-making, and accurate projections.

Vertical Outlook

Based on the vertical, the market is segmented into BFSI, retail & eCommerce, manufacturing, energy & utilities, transportation & logistics, healthcare & life sciences, media & entertainment, government & military, telecom, and others. The BFSI segment registered the maximum revenue share in the market in 2022. In the BFSI industry, composite AI solutions are used for various purposes, including compliance and regulatory reporting, risk assessment and management, customer service, credit scoring, and fraud detection and prevention.

Regional Outlook