|

|

市場調査レポート

商品コード

1292518

筋骨格系障害治療薬の世界市場規模、シェア、産業動向分析レポート:流通チャネル別、投与経路別、薬剤タイプ別、地域別展望と予測、2023年~2029年Global Musculoskeletal Disorders Drugs Market Size, Share & Industry Trends Analysis Report By Distribution Channel, By Route of Administration, By Drug Type, By Regional Outlook and Forecast, 2023 - 2029 |

||||||

|

|||||||

| 筋骨格系障害治療薬の世界市場規模、シェア、産業動向分析レポート:流通チャネル別、投与経路別、薬剤タイプ別、地域別展望と予測、2023年~2029年 |

|

出版日: 2023年05月31日

発行: KBV Research

ページ情報: 英文 226 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

筋骨格系障害治療薬の市場規模は、2029年までに1,094億米ドルに達し、予測期間中に4.2%のCAGRで成長すると予測されています。

カーディナルマトリックスに掲載されている分析によると、ジョンソン・エンド・ジョンソン、ノバルティスAG、ファイザーが本市場の先行者となっています。2022年3月、ファイザーはアメリカのバイオ医薬品会社であるArena Pharmaceuticalsの買収を完了しました。この買収により、アリーナ・ファーマシューティカルズの素晴らしいパイプラインと経験をファイザーの免疫学と腫脹治癒領域に付加し、免疫炎症性疾患の患者さんの生活を変えるための前進の後押しのさらなる動機付けを支援することを目的としています。AbbVie, Inc.、Amgen, Inc.、UCB S.A.などの企業が、この市場における主要なイノベーターとして挙げられます。

COVID-19の影響分析

COVID-19のパンデミックは、飲食品、ヘルスケア、産業など、いくつかのエンドユーザー産業においてサプライチェーンの混乱を引き起こしました。また、COVID-19に端を発した景気後退により、筋骨格系疾患治療薬の市場も落ち込みました。COVID-19の大流行によりサプライチェーンが寸断され、臨床試験や医薬品開発が遅れたため、運動器疾患治療薬の市場に大きな影響を与えました。鎮痛剤を含む運動器障害治療薬の売上減少により、運動器障害治療薬の市場は期間中に縮小しました。しかし、市場の回復が予測され、筋骨格系疾患治療薬市場は今後も安定した成長が続くと予想されます。

市場の成長要因

筋骨格系疾患は極めて一般的

筋骨格系の障害として分類される疾患や状態は150以上あります。これらの障害は、筋肉、骨、関節、および隣接する結合組織の機能障害を特徴とします。これらの機能障害は、一時的または永続的な機能制限や関与の制限をもたらす可能性があります。WHOによると、全世界で17億1,000万人が、関節リウマチ、変形性関節症、腰痛、首の違和感、骨折、その他の怪我などの筋骨格系疾患に苦しんでいます。筋骨格系疾患はあらゆる年齢層の人々を悩ませていますが、その有病率は年齢や診断によって異なっています。筋骨格系疾患の患者数が増加すれば、その治療薬に対するニーズも高まり、市場拡大が加速されるものと思われます。

アルコール消費量の増加

個人レベルでも社会レベルでも、アルコール消費のレベル、パターン、集団におけるアルコール関連問題の範囲に影響を与える多くの変数が見つかっています。貧しい文化圏では、裕福な文化圏よりも、あるレベルやパターンの飲酒がもたらす健康への悪影響や社会的影響がより大きくなります。世界のアルコール関連による死亡者数のうち、男性が7.7%を占めるのに対し、女性は2.6%です。また、男性の飲酒者は2016年に1人当たり平均19.4リットルの純アルコールを使用しているのに対し、女性の飲酒者は平均7.0リットルを消費しています。関節疾患の発生率の高さとアルコール使用量の多さには関連性があるため、予測期間を通じてアルコール消費量の増加による市場の開拓が予想されます。

市場抑制要因

ヘルスケア専門家の不足

2035年には、1,290万人のヘルスケア専門家が不足すると予測されており、現在の720万人から増加すると考えられています。WHOが発表した最新の調査によると、医療従事者の不足は、迅速な対応がなされない場合、世界中の何十億人もの人々の健康に大きな影響を与える可能性があることが確認されています。この現象の要因として、労働力の高齢化が挙げられ、退職やより高給なポジションへの転職があっても、それに対応できる人材がいないことが挙げられます。また、新規参入者の不足、業界における不十分なトレーニングもあります。世界のさまざまな地域におけるヘルスケア人材の不足は、筋骨格系障害などの疾患の特定と管理に悪影響を及ぼし、関連する薬剤の必要性を減らし、市場拡大の妨げとなります。

薬剤タイプの展望

薬剤の種類により、市場は鎮痛剤、DMARDs、コルチコステロイド、その他に分類されます。2022年には、鎮痛剤セグメントが最大の収益シェアを獲得し、市場を独占しました。これは、鎮痛剤の価格が手ごろであるため、筋骨格系障害の治療薬として市場での需要が高まっているためです。さらに、鎮痛剤には中程度から強力なものまでさまざまな強さがあり、これらの多くは地元のドラッグストアや食料品店で市販されています。このように、OTCとして手頃な価格で入手できることが、このセグメントの拡大を後押しすると予想されます。

投与経路の展望

投与経路によって、市場は経口剤と非経口剤に分けられます。2022年の市場では、経口剤が大きな売上シェアを占めています。これは、多くの患者が他の治療法よりも経口薬を選択するという事実に起因しており、その理由は、経口薬は投与が容易で費用がかからないからです。多くの利点があるため、経口投与ルートは、多くの代替的な薬物送達方法よりも好まれています。その利点とは、異なる種類の薬剤に対応できる信頼性、安全性、優れた患者コンプライアンス、摂取の簡便性、痛みの回避、多用途性などです。経口投与に関連する利点は、市場セグメントの拡大の原動力となるでしょう。

流通経路の展望

流通チャネル別では、病院薬局、オンラインプロバイダー、ドラッグストア・小売薬局に分類されます。ドラッグストア&小売薬局セグメントは、2022年の市場において最大の収益シェアを示しました。これは、関節リウマチなどの筋骨格系の病気に苦しむ患者数が増加し、ドラッグストア&小売薬局における医薬品の需要が高まっているためです。また、これらの店舗では、顧客の合併症に対して、より個別的な解決策を提供することができ、患者は即座に薬を手にすることができるのです。医薬品を簡単に入手できることなどが、このセグメントの成長を高めると予想されます。

地域別の展望

地域別では、北米、欧州、アジア太平洋、LAMEAで市場を分析しています。北米地域は、2022年の市場において最も高い収益シェアを登録しました。この市場は、多数の主要企業の存在と、同地域の筋骨格系障害に対する医薬品生産の改善により拡大しています。さらに、強固なヘルスケアインフラ、大きな購買力、筋骨格障害用の鎮痛剤およびその他の医薬品の採用率の増加により、市場の発展が見込まれています。さらに、肥満、座りがちなライフスタイル、労働災害など、いくつかの原因による筋骨格系疾患の有病率の増加が、これらの症状を治療するための医薬品の需要増につながり、この地域の市場成長を後押ししています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第3章 競合分析- 世界

- KBVカーディナルマトリックス

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 地理的拡大

- 買収と合併

- 承認とトライアル

- 主要成功戦略

- 主な戦略

第4章 世界の筋骨格系疾患治療薬市場:流通チャネル別

- 世界のドラッグストアおよび小売薬局市場:地域別

- 世界の病院薬局市場:地域別

- 世界のオンラインプロバイダー市場:地域別

第5章 世界の筋骨格系疾患治療薬市場:投与経路別

- 世界の非経口薬市場:地域別

- 世界の口腔市場:地域別

第6章 世界の筋骨格系疾患治療薬市場:薬剤の種類別

- 世界の鎮痛剤市場:地域別

- 世界のDMARD市場:地域別

- 世界のコルチコステロイド市場:地域別

- 世界のその他の市場:地域別

第7章 世界の筋骨格系疾患治療薬市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第8章 企業プロファイル

- Johnson & Johnson

- Pfizer, Inc

- AbbVie, Inc

- UCB SA

- Amgen, Inc

- Eli Lilly And Company

- F Hoffmann-La Roche Ltd.

- Merck & Co, Inc.

- Novartis AG

- Teva Pharmaceutical Industries Ltd

LIST OF TABLES

- TABLE 1 Global Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 2 Global Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 3 Partnerships, Collaborations and Agreements- Musculoskeletal Disorders Drugs Market

- TABLE 4 geographical expansions - Musculoskeletal Disorders Drugs Market

- TABLE 5 Acquisition and Mergers- Musculoskeletal Disorders Drugs Market

- TABLE 6 Approvals and trials - Musculoskeletal Disorders Drugs Market

- TABLE 7 Global Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 8 Global Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 9 Global Drug Stores & Retail Pharmacies Market by Region, 2019 - 2022, USD Million

- TABLE 10 Global Drug Stores & Retail Pharmacies Market by Region, 2023 - 2029, USD Million

- TABLE 11 Global Hospital Pharmacies Market by Region, 2019 - 2022, USD Million

- TABLE 12 Global Hospital Pharmacies Market by Region, 2023 - 2029, USD Million

- TABLE 13 Global Online Providers Market by Region, 2019 - 2022, USD Million

- TABLE 14 Global Online Providers Market by Region, 2023 - 2029, USD Million

- TABLE 15 Global Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 16 Global Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 17 Global Parenteral Market by Region, 2019 - 2022, USD Million

- TABLE 18 Global Parenteral Market by Region, 2023 - 2029, USD Million

- TABLE 19 Global Oral Market by Region, 2019 - 2022, USD Million

- TABLE 20 Global Oral Market by Region, 2023 - 2029, USD Million

- TABLE 21 Global Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 22 Global Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 23 Global Analgesics Market by Region, 2019 - 2022, USD Million

- TABLE 24 Global Analgesics Market by Region, 2023 - 2029, USD Million

- TABLE 25 Global DMARDs Market by Region, 2019 - 2022, USD Million

- TABLE 26 Global DMARDs Market by Region, 2023 - 2029, USD Million

- TABLE 27 Global Corticosteroids Market by Region, 2019 - 2022, USD Million

- TABLE 28 Global Corticosteroids Market by Region, 2023 - 2029, USD Million

- TABLE 29 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 30 Global Others Market by Region, 2023 - 2029, USD Million

- TABLE 31 Global Musculoskeletal Disorders Drugs Market by Region, 2019 - 2022, USD Million

- TABLE 32 Global Musculoskeletal Disorders Drugs Market by Region, 2023 - 2029, USD Million

- TABLE 33 North America Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 34 North America Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 35 North America Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 36 North America Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 37 North America Drug Stores & Retail Pharmacies Market by Country, 2019 - 2022, USD Million

- TABLE 38 North America Drug Stores & Retail Pharmacies Market by Country, 2023 - 2029, USD Million

- TABLE 39 North America Hospital Pharmacies Market by Country, 2019 - 2022, USD Million

- TABLE 40 North America Hospital Pharmacies Market by Country, 2023 - 2029, USD Million

- TABLE 41 North America Online Providers Market by Country, 2019 - 2022, USD Million

- TABLE 42 North America Online Providers Market by Country, 2023 - 2029, USD Million

- TABLE 43 North America Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 44 North America Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 45 North America Parenteral Market by Country, 2019 - 2022, USD Million

- TABLE 46 North America Parenteral Market by Country, 2023 - 2029, USD Million

- TABLE 47 North America Oral Market by Country, 2019 - 2022, USD Million

- TABLE 48 North America Oral Market by Country, 2023 - 2029, USD Million

- TABLE 49 North America Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 50 North America Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 51 North America Analgesics Market by Country, 2019 - 2022, USD Million

- TABLE 52 North America Analgesics Market by Country, 2023 - 2029, USD Million

- TABLE 53 North America DMARDs Market by Country, 2019 - 2022, USD Million

- TABLE 54 North America DMARDs Market by Country, 2023 - 2029, USD Million

- TABLE 55 North America Corticosteroids Market by Country, 2019 - 2022, USD Million

- TABLE 56 North America Corticosteroids Market by Country, 2023 - 2029, USD Million

- TABLE 57 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 58 North America Others Market by Country, 2023 - 2029, USD Million

- TABLE 59 North America Musculoskeletal Disorders Drugs Market by Country, 2019 - 2022, USD Million

- TABLE 60 North America Musculoskeletal Disorders Drugs Market by Country, 2023 - 2029, USD Million

- TABLE 61 US Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 62 US Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 63 US Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 64 US Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 65 US Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 66 US Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 67 US Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 68 US Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 69 Canada Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 70 Canada Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 71 Canada Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 72 Canada Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 73 Canada Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 74 Canada Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 75 Canada Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 76 Canada Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 77 Mexico Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 78 Mexico Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 79 Mexico Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 80 Mexico Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 81 Mexico Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 82 Mexico Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 83 Mexico Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 84 Mexico Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 85 Rest of North America Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 86 Rest of North America Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 87 Rest of North America Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 88 Rest of North America Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 89 Rest of North America Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 90 Rest of North America Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 91 Rest of North America Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 92 Rest of North America Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 93 Europe Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 94 Europe Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 95 Europe Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 96 Europe Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 97 Europe Drug Stores & Retail Pharmacies Market by Country, 2019 - 2022, USD Million

- TABLE 98 Europe Drug Stores & Retail Pharmacies Market by Country, 2023 - 2029, USD Million

- TABLE 99 Europe Hospital Pharmacies Market by Country, 2019 - 2022, USD Million

- TABLE 100 Europe Hospital Pharmacies Market by Country, 2023 - 2029, USD Million

- TABLE 101 Europe Online Providers Market by Country, 2019 - 2022, USD Million

- TABLE 102 Europe Online Providers Market by Country, 2023 - 2029, USD Million

- TABLE 103 Europe Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 104 Europe Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 105 Europe Parenteral Market by Country, 2019 - 2022, USD Million

- TABLE 106 Europe Parenteral Market by Country, 2023 - 2029, USD Million

- TABLE 107 Europe Oral Market by Country, 2019 - 2022, USD Million

- TABLE 108 Europe Oral Market by Country, 2023 - 2029, USD Million

- TABLE 109 Europe Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 110 Europe Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 111 Europe Analgesics Market by Country, 2019 - 2022, USD Million

- TABLE 112 Europe Analgesics Market by Country, 2023 - 2029, USD Million

- TABLE 113 Europe DMARDs Market by Country, 2019 - 2022, USD Million

- TABLE 114 Europe DMARDs Market by Country, 2023 - 2029, USD Million

- TABLE 115 Europe Corticosteroids Market by Country, 2019 - 2022, USD Million

- TABLE 116 Europe Corticosteroids Market by Country, 2023 - 2029, USD Million

- TABLE 117 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 118 Europe Others Market by Country, 2023 - 2029, USD Million

- TABLE 119 Europe Musculoskeletal Disorders Drugs Market by Country, 2019 - 2022, USD Million

- TABLE 120 Europe Musculoskeletal Disorders Drugs Market by Country, 2023 - 2029, USD Million

- TABLE 121 Germany Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 122 Germany Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 123 Germany Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 124 Germany Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 125 Germany Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 126 Germany Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 127 Germany Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 128 Germany Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 129 UK Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 130 UK Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 131 UK Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 132 UK Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 133 UK Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 134 UK Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 135 UK Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 136 UK Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 137 France Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 138 France Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 139 France Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 140 France Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 141 France Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 142 France Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 143 France Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 144 France Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 145 Russia Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 146 Russia Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 147 Russia Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 148 Russia Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 149 Russia Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 150 Russia Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 151 Russia Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 152 Russia Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 153 Spain Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 154 Spain Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 155 Spain Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 156 Spain Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 157 Spain Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 158 Spain Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 159 Spain Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 160 Spain Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 161 Italy Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 162 Italy Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 163 Italy Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 164 Italy Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 165 Italy Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 166 Italy Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 167 Italy Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 168 Italy Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 169 Rest of Europe Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 170 Rest of Europe Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 171 Rest of Europe Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 172 Rest of Europe Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 173 Rest of Europe Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 174 Rest of Europe Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 175 Rest of Europe Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 176 Rest of Europe Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 177 Asia Pacific Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 178 Asia Pacific Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 179 Asia Pacific Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 180 Asia Pacific Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 181 Asia Pacific Drug Stores & Retail Pharmacies Market by Country, 2019 - 2022, USD Million

- TABLE 182 Asia Pacific Drug Stores & Retail Pharmacies Market by Country, 2023 - 2029, USD Million

- TABLE 183 Asia Pacific Hospital Pharmacies Market by Country, 2019 - 2022, USD Million

- TABLE 184 Asia Pacific Hospital Pharmacies Market by Country, 2023 - 2029, USD Million

- TABLE 185 Asia Pacific Online Providers Market by Country, 2019 - 2022, USD Million

- TABLE 186 Asia Pacific Online Providers Market by Country, 2023 - 2029, USD Million

- TABLE 187 Asia Pacific Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 188 Asia Pacific Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 189 Asia Pacific Parenteral Market by Country, 2019 - 2022, USD Million

- TABLE 190 Asia Pacific Parenteral Market by Country, 2023 - 2029, USD Million

- TABLE 191 Asia Pacific Oral Market by Country, 2019 - 2022, USD Million

- TABLE 192 Asia Pacific Oral Market by Country, 2023 - 2029, USD Million

- TABLE 193 Asia Pacific Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 194 Asia Pacific Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 195 Asia Pacific Analgesics Market by Country, 2019 - 2022, USD Million

- TABLE 196 Asia Pacific Analgesics Market by Country, 2023 - 2029, USD Million

- TABLE 197 Asia Pacific DMARDs Market by Country, 2019 - 2022, USD Million

- TABLE 198 Asia Pacific DMARDs Market by Country, 2023 - 2029, USD Million

- TABLE 199 Asia Pacific Corticosteroids Market by Country, 2019 - 2022, USD Million

- TABLE 200 Asia Pacific Corticosteroids Market by Country, 2023 - 2029, USD Million

- TABLE 201 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

- TABLE 202 Asia Pacific Others Market by Country, 2023 - 2029, USD Million

- TABLE 203 Asia Pacific Musculoskeletal Disorders Drugs Market by Country, 2019 - 2022, USD Million

- TABLE 204 Asia Pacific Musculoskeletal Disorders Drugs Market by Country, 2023 - 2029, USD Million

- TABLE 205 China Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 206 China Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 207 China Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 208 China Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 209 China Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 210 China Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 211 China Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 212 China Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 213 Japan Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 214 Japan Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 215 Japan Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 216 Japan Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 217 Japan Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 218 Japan Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 219 Japan Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 220 Japan Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 221 India Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 222 India Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 223 India Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 224 India Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 225 India Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 226 India Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 227 India Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 228 India Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 229 South Korea Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 230 South Korea Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 231 South Korea Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 232 South Korea Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 233 South Korea Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 234 South Korea Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 235 South Korea Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 236 South Korea Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 237 Singapore Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 238 Singapore Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 239 Singapore Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 240 Singapore Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 241 Singapore Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 242 Singapore Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 243 Singapore Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 244 Singapore Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 245 Malaysia Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 246 Malaysia Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 247 Malaysia Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 248 Malaysia Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 249 Malaysia Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 250 Malaysia Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 251 Malaysia Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 252 Malaysia Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 253 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 254 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 255 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 256 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 257 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 258 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 259 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 260 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 261 LAMEA Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 262 LAMEA Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 263 LAMEA Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 264 LAMEA Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 265 LAMEA Drug Stores & Retail Pharmacies Market by Country, 2019 - 2022, USD Million

- TABLE 266 LAMEA Drug Stores & Retail Pharmacies Market by Country, 2023 - 2029, USD Million

- TABLE 267 LAMEA Hospital Pharmacies Market by Country, 2019 - 2022, USD Million

- TABLE 268 LAMEA Hospital Pharmacies Market by Country, 2023 - 2029, USD Million

- TABLE 269 LAMEA Online Providers Market by Country, 2019 - 2022, USD Million

- TABLE 270 LAMEA Online Providers Market by Country, 2023 - 2029, USD Million

- TABLE 271 LAMEA Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 272 LAMEA Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 273 LAMEA Parenteral Market by Country, 2019 - 2022, USD Million

- TABLE 274 LAMEA Parenteral Market by Country, 2023 - 2029, USD Million

- TABLE 275 LAMEA Oral Market by Country, 2019 - 2022, USD Million

- TABLE 276 LAMEA Oral Market by Country, 2023 - 2029, USD Million

- TABLE 277 LAMEA Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 278 LAMEA Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 279 LAMEA Analgesics Market by Country, 2019 - 2022, USD Million

- TABLE 280 LAMEA Analgesics Market by Country, 2023 - 2029, USD Million

- TABLE 281 LAMEA DMARDs Market by Country, 2019 - 2022, USD Million

- TABLE 282 LAMEA DMARDs Market by Country, 2023 - 2029, USD Million

- TABLE 283 LAMEA Corticosteroids Market by Country, 2019 - 2022, USD Million

- TABLE 284 LAMEA Corticosteroids Market by Country, 2023 - 2029, USD Million

- TABLE 285 LAMEA Others Market by Country, 2019 - 2022, USD Million

- TABLE 286 LAMEA Others Market by Country, 2023 - 2029, USD Million

- TABLE 287 LAMEA Musculoskeletal Disorders Drugs Market by Country, 2019 - 2022, USD Million

- TABLE 288 LAMEA Musculoskeletal Disorders Drugs Market by Country, 2023 - 2029, USD Million

- TABLE 289 Brazil Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 290 Brazil Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 291 Brazil Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 292 Brazil Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 293 Brazil Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 294 Brazil Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 295 Brazil Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 296 Brazil Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 297 Argentina Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 298 Argentina Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 299 Argentina Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 300 Argentina Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 301 Argentina Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 302 Argentina Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 303 Argentina Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 304 Argentina Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 305 UAE Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 306 UAE Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 307 UAE Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 308 UAE Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 309 UAE Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 310 UAE Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 311 UAE Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 312 UAE Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 313 Saudi Arabia Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 314 Saudi Arabia Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 315 Saudi Arabia Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 316 Saudi Arabia Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 317 Saudi Arabia Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 318 Saudi Arabia Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 319 Saudi Arabia Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 320 Saudi Arabia Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 321 South Africa Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 322 South Africa Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 323 South Africa Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 324 South Africa Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 325 South Africa Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 326 South Africa Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 327 South Africa Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 328 South Africa Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 329 Nigeria Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 330 Nigeria Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 331 Nigeria Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 332 Nigeria Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 333 Nigeria Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 334 Nigeria Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 335 Nigeria Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 336 Nigeria Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 337 Rest of LAMEA Musculoskeletal Disorders Drugs Market, 2019 - 2022, USD Million

- TABLE 338 Rest of LAMEA Musculoskeletal Disorders Drugs Market, 2023 - 2029, USD Million

- TABLE 339 Rest of LAMEA Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 340 Rest of LAMEA Musculoskeletal Disorders Drugs Market by Distribution Channel, 2023 - 2029, USD Million

- TABLE 341 Rest of LAMEA Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2022, USD Million

- TABLE 342 Rest of LAMEA Musculoskeletal Disorders Drugs Market by Route of Administration, 2023 - 2029, USD Million

- TABLE 343 Rest of LAMEA Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2022, USD Million

- TABLE 344 Rest of LAMEA Musculoskeletal Disorders Drugs Market by Drug Type, 2023 - 2029, USD Million

- TABLE 345 Key information -Johnson & Johnson

- TABLE 346 Key Information - Pfizer, Inc.

- TABLE 347 Key information - AbbVie, Inc.

- TABLE 348 Key Information - UCB S.A.

- TABLE 349 Key Information - Amgen, Inc.

- TABLE 350 Key Information - Eli Lilly And Company

- TABLE 351 KEY INFORMATION - F. Hoffmann-La Roche Ltd.

- TABLE 352 KEY INFORMATION - Merck & Co., Inc.

- TABLE 353 Key Information - Novartis AG

- TABLE 354 Key Information - Teva Pharmaceuticals Industries Ltd.

List of Figures

- FIG 1 Methodology for the research

- FIG 2 KBV Cardinal Matrix

- FIG 3 Key Leading Strategies: Percentage Distribution (2019-2023)

- FIG 4 Global Musculoskeletal Disorders Drugs Market Share by Distribution Channel, 2022

- FIG 5 Global Musculoskeletal Disorders Drugs Market Share by Distribution Channel, 2029

- FIG 6 Global Musculoskeletal Disorders Drugs Market by Distribution Channel, 2019 - 2029, USD Million

- FIG 7 Global Musculoskeletal Disorders Drugs Market Share by Route of Administration, 2022

- FIG 8 Global Musculoskeletal Disorders Drugs Market Share by Route of Administration, 2029

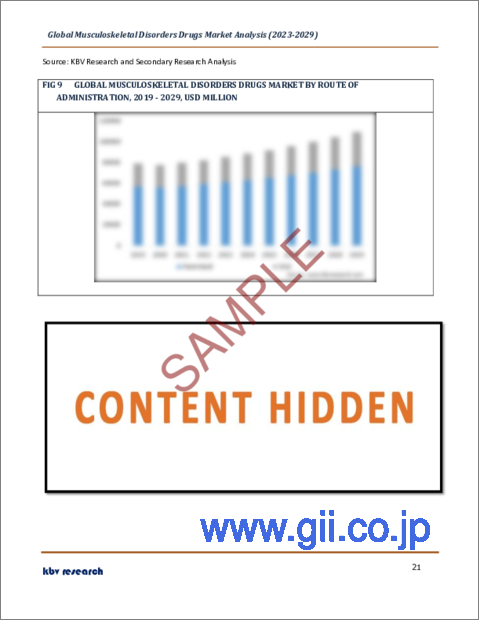

- FIG 9 Global Musculoskeletal Disorders Drugs Market by Route of Administration, 2019 - 2029, USD Million

- FIG 10 Global Musculoskeletal Disorders Drugs Market Share by Drug Type, 2022

- FIG 11 Global Musculoskeletal Disorders Drugs Market Share by Drug Type, 2029

- FIG 12 Global Musculoskeletal Disorders Drugs Market by Drug Type, 2019 - 2029, USD Million

- FIG 13 Global Musculoskeletal Disorders Drugs Market Share by Region, 2022

- FIG 14 Global Musculoskeletal Disorders Drugs Market Share by Region, 2029

- FIG 15 Global Musculoskeletal Disorders Drugs Market by Region, 2019 - 2029, USD Million

- FIG 16 SWOT analysis: Johnson & Johnson

- FIG 17 Recent strategies and developments: Pfizer, Inc.

- FIG 18 Recent strategies and developments: AbbVie, Inc.

The Global Musculoskeletal Disorders Drugs Market size is expected to reach $109.4 billion by 2029, rising at a market growth of 4.2% CAGR during the forecast period.

Asia Pacific is one of the major contributors of the market as China, Japan, and India have aged population, thus capturing approximately 2/5th share of the market by 2029. For instance, over 60% of Japan's population is aged 30 and above. By 2050, most of the global population aged 60 and above is projected to be in low- and middle-income nations. The rise in life expectancy has led to a growing aging population. This emerging trend is advantageous for the market as it leads to a rise in the incidence of musculoskeletal diseases due to the illness's high prevalence in old adults and boosts the demand for its treatments, resulting in market expansion.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2022, The Johnson & Johnson Medical Devices Companies collaborated with Microsoft for expanding its digital surgery ecosystem. In addition, Pfizer came into collaboration with Sirana Pharma focusing on investigating treatment for a rare bone disease, through leveraging Sirana's microRNA targeting approach.

Based on the Analysis presented in the Cardinal matrix; Johnson & Johnson, Novartis AG, and Pfizer, Inc. are the forerunners in the Market. In March, 2022, Pfizer completed the acquisition of Arena Pharmaceuticals, an American biopharmaceutical company. Through this acquisition, the company aimed to adjoin the amazing pipeline and experience of Arena Pharmaceuticals to Pfizer's Immunology and swelling healing area, assisting further motive of advancement boost to change the lives of patients with the immuno-inflammatory illness. Companies such as AbbVie, Inc., Amgen, Inc., and UCB S.A. are some of the key innovators in Market.

COVID-19 Impact Analysis

The COVID-19 pandemic caused supply chain disruptions in several end-user industries, including food and beverage, healthcare, and industrial. In addition, the COVID-19-led economic slowdown resulted in a drop in the market for musculoskeletal disorders drugs. Since the COVID-19 pandemic disrupted supply chains and slowed down clinical studies and drug development, it had a considerable effect on the market for medications for musculoskeletal problems. Due to a drop in sales of medications for musculoskeletal disorders, including analgesics, the market for musculoskeletal disorders drugs shrank during the period. However, a rebound in the market is forecasted, and the musculoskeletal disease medications market is expected to continue growing steadily in the years to come.

Market Growth Factors

Musculoskeletal diseases are extremely common

There are more than 150 diseases and conditions that are categorized as musculoskeletal impairments. These impairments are characterized by muscle, bone, joint, and adjacent connective tissue dysfunction. These dysfunctions can result in temporary or permanent restrictions on functioning and involvement. According to WHO, 1.71 billion individuals globally suffer from musculoskeletal diseases, such as rheumatoid arthritis, osteoarthritis, low back pain, neck discomfort, fractures, and other injuries. Musculoskeletal problems afflict people of all ages; however, the prevalence differs by age and diagnosis. As more people suffer from musculoskeletal problems, there will likely be a greater need for pharmaceuticals to treat them, accelerating market expansion.

Higher alcohol consumption

At both the individual and societal levels, numerous variables that influence alcohol consumption levels, patterns, and the scope of alcohol-related issues in populations have been found. Poorer cultures experience more negative health effects and social implications from drinking at a given level and pattern of drinking than wealthier ones. Men account for 7.7% of all fatalities globally from alcohol-related causes, compared to women, who account for 2.6% of all deaths. In addition, male drinkers used 19.4 liters of pure alcohol on average per person in 2016, whereas female drinkers consumed 7.0 liters on average. As there is a link between higher rates of joint diseases and greater alcohol use, the market is anticipated to develop as a result of rising alcohol consumption throughout the projected period.

Market Restraining Factors

Insufficient availability of healthcare professionals

Projected for 2035, a shortage of 12.9 million healthcare professionals is anticipated, representing an increase from the current 7.2 million deficit. As per the recent research published by WHO, it has been observed that the dearth of healthcare professionals can significantly impact the health of billions of individuals globally if prompt action is not taken. Factors contributing to this phenomenon include an aging workforce, resulting in retirements or departures for higher-paying positions without corresponding replacements. Also, there is a shortage of new entrants and inadequate training in the industry. Insufficient healthcare personnel in different regions of the world will negatively impact the identification and management of ailments such as musculoskeletal disorders, reducing the need for associated medications and hindering market expansion.

Drug Type Outlook

Based on drug type, the market is segmented into analgesics, DMARDs, corticosteroids and others. The analgesics segment dominated the market with maximum revenue share in 2022. This is due to the affordability of analgesics, which is increasing their demand in the market as medications for musculoskeletal disorders. Additionally, they come in a variety of strengths, from moderate to powerful, and many of these are available over the counter at the local drugstore or grocery store. Thus, their affordability and availability as OTC is expected to boost the segment's expansion.

Route of Administration Outlook

On the basis of route of administration, the market is divided into oral and parenteral. The oral segment procured a substantial revenue share in the market in 2022. This is owing to the fact many patients choose oral drugs over other kinds of treatment because they are easier to administer and less expensive. Due to its many benefits, the oral administration route is favored above the many alternative medication delivery methods. These benefits include dependability to accommodate different drug types, safety, excellent patient compliance, simplicity of intake, pain avoidance, and versatility. The benefits associated with the oral route will drive the market segment's expansion.

Distribution Channel Outlook

By distribution channel, the market is classified into hospital pharmacies, online providers and drug stores & retail pharmacies. The drug stores & retail pharmacies segment witnessed the largest revenue share in the market in 2022. This is due to a growth in the number of patients suffering from musculoskeletal ailments such as rheumatoid arthritis, which raises the demand for pharmaceuticals in drug stores and retail pharmacies. Also, these stores are able to provide a much more personalized solution to the customer's complication, and the patient can have their medication instantly. The easy availability of drugs, combined with other factors, is expected to increase the segment's growth.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region registered the highest revenue share in the market in 2022. The market is expanding due to the presence of numerous key companies and improvements in the region's medicine production for musculoskeletal disorders. Additionally, the market is anticipated to develop due to a solid healthcare infrastructure, significant purchasing power, and an increased adoption rate of analgesics and other medications for musculoskeletal disorders. Additionally, there has been an increase in the prevalence of musculoskeletal illnesses due to several causes, such as obesity, sedentary lifestyles, and workplace injuries, which has led to a rise in the demand for medications to treat these conditions, propelling the market growth in the region.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AbbVie, Inc., Amgen, Inc., Eli Lilly And Company, F. Hoffmann-La Roche Ltd., Johnson & Johnson, Merck & Co., Inc., Novartis AG, Pfizer, Inc., Teva Pharmaceutical Industries Ltd., and UCB S.A.

Recent Strategies Deployed in Musculoskeletal Disorders Drugs Market

Acquisitions and Mergers:

Mar-2022: Pfizer completed the acquisition of Arena Pharmaceuticals, an American biopharmaceutical company. Through this acquisition, the company aimed to adjoin the amazing pipeline and experience of Arena Pharmaceuticals to Pfizer's Immunology and swelling healing area, assisting further motive of advancement boost to change the lives of patients with the immuno-inflammatory illness.

Mar-2022: UCB took over Zogenix, a US-based developer of therapeutic solutions. The addition of Zogenix expands and reinforces the acquiring company's market presence and reinforces its sustainable patient value strategy.

Oct-2021: Amgen took over Teneobio, a clinical-stage biotechnology company. With this acquisition, the company aimed to leverage Teneobio's antibody platform to complement its prevailing capabilities. Moreover, the company also aimed to gain a diverse range of building blocks that can be created into new multispecific therapeutics.

Partnerships, Collaborations and Agreements:

Jun-2022: Pfizer came into collaboration with Sirana Pharma, a Germany-based developer of a biotechnology company. The collaboration involves investigating treatment for a rare bone disease, through leveraging Sirana's microRNA targeting approach.

Jan-2022: The Johnson & Johnson Medical Devices Companies collaborated with Microsoft, a US-based technology company. The collaboration involves expanding the medical devices company's digital surgery ecosystem.

Feb-2021: UCB extended its collaboration agreement with Microsoft, a US-based technology company. The agreement involves advancing drug discovery and development. The collaboration integrates Microsoft's cloud, AI, computational services, and UCS's drug discovery abilities, and aims at identifying more effective molecules.

Geographical Expansions:

Sep-2022: AbbVie expanded its already existing facility located in Cork. The expansion includes building a new manufacturing facility and bringing in new technologies.

Approvals and Trials:

Apr-2022: AbbVie received FDA clearance for its RINVOQ. RINVOQ is intended for the treatment of ankylosing spondylitis (AS) in adults. The recently approved drug delivers quick disease control. Further, the approval demonstrates the company's continued advancement towards achieving its mission to accelerate the standards of care in rheumatic diseases.

Scope of the Study

Market Segments covered in the Report:

By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Providers

By Route of Administration

- Parenteral

- Oral

By Drug Type

- Analgesics

- DMARDs

- Corticosteroids

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- AbbVie, Inc.

- Amgen, Inc.

- Eli Lilly And Company

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- UCB S.A.

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Musculoskeletal Disorders Drugs Market, by Distribution Channel

- 1.4.2 Global Musculoskeletal Disorders Drugs Market, by Route of Administration

- 1.4.3 Global Musculoskeletal Disorders Drugs Market, by Drug Type

- 1.4.4 Global Musculoskeletal Disorders Drugs Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market Overview

- 2.1 Introduction

- 2.1.1 Overview

- 2.1.1.1 Market composition & scenario

- 2.1.1 Overview

- 2.2 Key Factors Impacting the Market

- 2.2.1 Market Drivers

- 2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

- 3.1 KBV Cardinal Matrix

- 3.2 Recent Industry Wide Strategic Developments

- 3.2.1 Partnerships, Collaborations and Agreements

- 3.2.2 Geographical Expansions

- 3.2.3 Acquisition and Mergers

- 3.2.4 Approvals and Trials

- 3.3 Top Winning Strategies

- 3.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

Chapter 4. Global Musculoskeletal Disorders Drugs Market by Distribution Channel

- 4.1 Global Drug Stores & Retail Pharmacies Market by Region

- 4.2 Global Hospital Pharmacies Market by Region

- 4.3 Global Online Providers Market by Region

Chapter 5. Global Musculoskeletal Disorders Drugs Market by Route of Administration

- 5.1 Global Parenteral Market by Region

- 5.2 Global Oral Market by Region

Chapter 6. Global Musculoskeletal Disorders Drugs Market by Drug Type

- 6.1 Global Analgesics Market by Region

- 6.2 Global DMARDs Market by Region

- 6.3 Global Corticosteroids Market by Region

- 6.4 Global Others Market by Region

Chapter 7. Global Musculoskeletal Disorders Drugs Market by Region

- 7.1 North America Musculoskeletal Disorders Drugs Market

- 7.1.1 North America Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.1.1.1 North America Drug Stores & Retail Pharmacies Market by Country

- 7.1.1.2 North America Hospital Pharmacies Market by Country

- 7.1.1.3 North America Online Providers Market by Country

- 7.1.2 North America Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.1.2.1 North America Parenteral Market by Country

- 7.1.2.2 North America Oral Market by Country

- 7.1.3 North America Musculoskeletal Disorders Drugs Market by Drug Type

- 7.1.3.1 North America Analgesics Market by Country

- 7.1.3.2 North America DMARDs Market by Country

- 7.1.3.3 North America Corticosteroids Market by Country

- 7.1.3.4 North America Others Market by Country

- 7.1.4 North America Musculoskeletal Disorders Drugs Market by Country

- 7.1.4.1 US Musculoskeletal Disorders Drugs Market

- 7.1.4.1.1 US Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.1.4.1.2 US Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.1.4.1.3 US Musculoskeletal Disorders Drugs Market by Drug Type

- 7.1.4.2 Canada Musculoskeletal Disorders Drugs Market

- 7.1.4.2.1 Canada Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.1.4.2.2 Canada Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.1.4.2.3 Canada Musculoskeletal Disorders Drugs Market by Drug Type

- 7.1.4.3 Mexico Musculoskeletal Disorders Drugs Market

- 7.1.4.3.1 Mexico Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.1.4.3.2 Mexico Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.1.4.3.3 Mexico Musculoskeletal Disorders Drugs Market by Drug Type

- 7.1.4.4 Rest of North America Musculoskeletal Disorders Drugs Market

- 7.1.4.4.1 Rest of North America Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.1.4.4.2 Rest of North America Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.1.4.4.3 Rest of North America Musculoskeletal Disorders Drugs Market by Drug Type

- 7.1.4.1 US Musculoskeletal Disorders Drugs Market

- 7.1.1 North America Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.2 Europe Musculoskeletal Disorders Drugs Market

- 7.2.1 Europe Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.2.1.1 Europe Drug Stores & Retail Pharmacies Market by Country

- 7.2.1.2 Europe Hospital Pharmacies Market by Country

- 7.2.1.3 Europe Online Providers Market by Country

- 7.2.2 Europe Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.2.2.1 Europe Parenteral Market by Country

- 7.2.2.2 Europe Oral Market by Country

- 7.2.3 Europe Musculoskeletal Disorders Drugs Market by Drug Type

- 7.2.3.1 Europe Analgesics Market by Country

- 7.2.3.2 Europe DMARDs Market by Country

- 7.2.3.3 Europe Corticosteroids Market by Country

- 7.2.3.4 Europe Others Market by Country

- 7.2.4 Europe Musculoskeletal Disorders Drugs Market by Country

- 7.2.4.1 Germany Musculoskeletal Disorders Drugs Market

- 7.2.4.1.1 Germany Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.2.4.1.2 Germany Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.2.4.1.3 Germany Musculoskeletal Disorders Drugs Market by Drug Type

- 7.2.4.2 UK Musculoskeletal Disorders Drugs Market

- 7.2.4.2.1 UK Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.2.4.2.2 UK Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.2.4.2.3 UK Musculoskeletal Disorders Drugs Market by Drug Type

- 7.2.4.3 France Musculoskeletal Disorders Drugs Market

- 7.2.4.3.1 France Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.2.4.3.2 France Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.2.4.3.3 France Musculoskeletal Disorders Drugs Market by Drug Type

- 7.2.4.4 Russia Musculoskeletal Disorders Drugs Market

- 7.2.4.4.1 Russia Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.2.4.4.2 Russia Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.2.4.4.3 Russia Musculoskeletal Disorders Drugs Market by Drug Type

- 7.2.4.5 Spain Musculoskeletal Disorders Drugs Market

- 7.2.4.5.1 Spain Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.2.4.5.2 Spain Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.2.4.5.3 Spain Musculoskeletal Disorders Drugs Market by Drug Type

- 7.2.4.6 Italy Musculoskeletal Disorders Drugs Market

- 7.2.4.6.1 Italy Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.2.4.6.2 Italy Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.2.4.6.3 Italy Musculoskeletal Disorders Drugs Market by Drug Type

- 7.2.4.7 Rest of Europe Musculoskeletal Disorders Drugs Market

- 7.2.4.7.1 Rest of Europe Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.2.4.7.2 Rest of Europe Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.2.4.7.3 Rest of Europe Musculoskeletal Disorders Drugs Market by Drug Type

- 7.2.4.1 Germany Musculoskeletal Disorders Drugs Market

- 7.2.1 Europe Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.3 Asia Pacific Musculoskeletal Disorders Drugs Market

- 7.3.1 Asia Pacific Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.3.1.1 Asia Pacific Drug Stores & Retail Pharmacies Market by Country

- 7.3.1.2 Asia Pacific Hospital Pharmacies Market by Country

- 7.3.1.3 Asia Pacific Online Providers Market by Country

- 7.3.2 Asia Pacific Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.3.2.1 Asia Pacific Parenteral Market by Country

- 7.3.2.2 Asia Pacific Oral Market by Country

- 7.3.3 Asia Pacific Musculoskeletal Disorders Drugs Market by Drug Type

- 7.3.3.1 Asia Pacific Analgesics Market by Country

- 7.3.3.2 Asia Pacific DMARDs Market by Country

- 7.3.3.3 Asia Pacific Corticosteroids Market by Country

- 7.3.3.4 Asia Pacific Others Market by Country

- 7.3.4 Asia Pacific Musculoskeletal Disorders Drugs Market by Country

- 7.3.4.1 China Musculoskeletal Disorders Drugs Market

- 7.3.4.1.1 China Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.3.4.1.2 China Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.3.4.1.3 China Musculoskeletal Disorders Drugs Market by Drug Type

- 7.3.4.2 Japan Musculoskeletal Disorders Drugs Market

- 7.3.4.2.1 Japan Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.3.4.2.2 Japan Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.3.4.2.3 Japan Musculoskeletal Disorders Drugs Market by Drug Type

- 7.3.4.3 India Musculoskeletal Disorders Drugs Market

- 7.3.4.3.1 India Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.3.4.3.2 India Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.3.4.3.3 India Musculoskeletal Disorders Drugs Market by Drug Type

- 7.3.4.4 South Korea Musculoskeletal Disorders Drugs Market

- 7.3.4.4.1 South Korea Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.3.4.4.2 South Korea Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.3.4.4.3 South Korea Musculoskeletal Disorders Drugs Market by Drug Type

- 7.3.4.5 Singapore Musculoskeletal Disorders Drugs Market

- 7.3.4.5.1 Singapore Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.3.4.5.2 Singapore Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.3.4.5.3 Singapore Musculoskeletal Disorders Drugs Market by Drug Type

- 7.3.4.6 Malaysia Musculoskeletal Disorders Drugs Market

- 7.3.4.6.1 Malaysia Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.3.4.6.2 Malaysia Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.3.4.6.3 Malaysia Musculoskeletal Disorders Drugs Market by Drug Type

- 7.3.4.7 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market

- 7.3.4.7.1 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.3.4.7.2 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.3.4.7.3 Rest of Asia Pacific Musculoskeletal Disorders Drugs Market by Drug Type

- 7.3.4.1 China Musculoskeletal Disorders Drugs Market

- 7.3.1 Asia Pacific Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.4 LAMEA Musculoskeletal Disorders Drugs Market

- 7.4.1 LAMEA Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.4.1.1 LAMEA Drug Stores & Retail Pharmacies Market by Country

- 7.4.1.2 LAMEA Hospital Pharmacies Market by Country

- 7.4.1.3 LAMEA Online Providers Market by Country

- 7.4.2 LAMEA Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.4.2.1 LAMEA Parenteral Market by Country

- 7.4.2.2 LAMEA Oral Market by Country

- 7.4.3 LAMEA Musculoskeletal Disorders Drugs Market by Drug Type

- 7.4.3.1 LAMEA Analgesics Market by Country

- 7.4.3.2 LAMEA DMARDs Market by Country

- 7.4.3.3 LAMEA Corticosteroids Market by Country

- 7.4.3.4 LAMEA Others Market by Country

- 7.4.4 LAMEA Musculoskeletal Disorders Drugs Market by Country

- 7.4.4.1 Brazil Musculoskeletal Disorders Drugs Market

- 7.4.4.1.1 Brazil Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.4.4.1.2 Brazil Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.4.4.1.3 Brazil Musculoskeletal Disorders Drugs Market by Drug Type

- 7.4.4.2 Argentina Musculoskeletal Disorders Drugs Market

- 7.4.4.2.1 Argentina Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.4.4.2.2 Argentina Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.4.4.2.3 Argentina Musculoskeletal Disorders Drugs Market by Drug Type

- 7.4.4.3 UAE Musculoskeletal Disorders Drugs Market

- 7.4.4.3.1 UAE Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.4.4.3.2 UAE Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.4.4.3.3 UAE Musculoskeletal Disorders Drugs Market by Drug Type

- 7.4.4.4 Saudi Arabia Musculoskeletal Disorders Drugs Market

- 7.4.4.4.1 Saudi Arabia Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.4.4.4.2 Saudi Arabia Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.4.4.4.3 Saudi Arabia Musculoskeletal Disorders Drugs Market by Drug Type

- 7.4.4.5 South Africa Musculoskeletal Disorders Drugs Market

- 7.4.4.5.1 South Africa Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.4.4.5.2 South Africa Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.4.4.5.3 South Africa Musculoskeletal Disorders Drugs Market by Drug Type

- 7.4.4.6 Nigeria Musculoskeletal Disorders Drugs Market

- 7.4.4.6.1 Nigeria Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.4.4.6.2 Nigeria Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.4.4.6.3 Nigeria Musculoskeletal Disorders Drugs Market by Drug Type

- 7.4.4.7 Rest of LAMEA Musculoskeletal Disorders Drugs Market

- 7.4.4.7.1 Rest of LAMEA Musculoskeletal Disorders Drugs Market by Distribution Channel

- 7.4.4.7.2 Rest of LAMEA Musculoskeletal Disorders Drugs Market by Route of Administration

- 7.4.4.7.3 Rest of LAMEA Musculoskeletal Disorders Drugs Market by Drug Type

- 7.4.4.1 Brazil Musculoskeletal Disorders Drugs Market

- 7.4.1 LAMEA Musculoskeletal Disorders Drugs Market by Distribution Channel

Chapter 8. Company Profiles

- 8.1 Johnson & Johnson

- 8.1.1 Company Overview

- 8.1.2 Financial Analysis

- 8.1.3 Segmental &Regional Analysis

- 8.1.4 Research & Development Expenses

- 8.1.5 Recent strategies and developments:

- 8.1.5.1 Partnerships, Collaborations, and Agreements:

- 8.1.6 SWOT Analysis

- 8.2 Pfizer, Inc.

- 8.2.1 Company Overview

- 8.2.2 Financial Analysis

- 8.2.3 Regional & Segmental Analysis

- 8.2.4 Research & Development Expense

- 8.2.5 Recent strategies and developments:

- 8.2.5.1 Partnerships, Collaborations, and Agreements:

- 8.2.5.2 Acquisition and Mergers:

- 8.3 AbbVie, Inc.

- 8.3.1 Company Overview

- 8.3.2 Financial Analysis

- 8.3.3 Regional Analysis

- 8.3.4 Research & Development Expense

- 8.3.5 Recent strategies and developments:

- 8.3.5.1 Approvals and Trials:

- 8.3.5.2 Acquisition and Mergers:

- 8.3.5.3 Geographical Expansions:

- 8.4 UCB S.A.

- 8.4.1 Company Overview

- 8.4.2 Financial Analysis

- 8.4.3 Regional Analysis

- 8.4.4 Research & Development Expense

- 8.4.5 Recent strategies and developments:

- 8.4.5.1 Partnerships, Collaborations, and Agreements:

- 8.4.5.2 Acquisition and Mergers:

- 8.5 Amgen, Inc.

- 8.5.1 Company Overview

- 8.5.2 Financial Analysis

- 8.5.3 Regional Analysis

- 8.5.4 Research & Development Expenses

- 8.5.5 Recent strategies and developments:

- 8.5.5.1 Acquisition and Mergers:

- 8.6 Eli Lilly And Company

- 8.6.1 Company Overview

- 8.6.2 Financial Analysis

- 8.6.3 Regional Analysis

- 8.6.4 Research & Development Expenses

- 8.7 F. Hoffmann-La Roche Ltd.

- 8.7.1 Company Overview

- 8.7.2 Financial Analysis

- 8.7.3 Segmental and Regional Analysis

- 8.7.4 Research & Development Expense

- 8.8 Merck & Co., Inc.

- 8.8.1 Company Overview

- 8.8.2 Financial Analysis

- 8.8.3 Segmental and Regional Analysis

- 8.8.4 Research & Development Expenses

- 8.9 Novartis AG

- 8.9.1 Company Overview

- 8.9.2 Financial Analysis

- 8.9.3 Segmental and Regional Analysis

- 8.9.4 Research & Development Expense

- 8.10. Teva Pharmaceutical Industries Ltd.

- 8.10.1 Company Overview

- 8.10.2 Financial Analysis

- 8.10.3 Regional Analysis

- 8.10.4 Research & Development Expenses