|

|

市場調査レポート

商品コード

1245710

電子制御スタビリティコントロールの世界市場規模、シェア、産業動向分析レポート:コンポーネント別、車両推進力別、車両タイプ別、地域別展望と予測、2022年~2028年Global Electronic Stability Control Market Size, Share & Industry Trends Analysis Report By Component, By Vehicle Propulsion, By Vehicle Type, By Regional Outlook and Forecast, 2022 - 2028 |

||||||

| 電子制御スタビリティコントロールの世界市場規模、シェア、産業動向分析レポート:コンポーネント別、車両推進力別、車両タイプ別、地域別展望と予測、2022年~2028年 |

|

出版日: 2023年02月28日

発行: KBV Research

ページ情報: 英文 213 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

電子安定制御の世界市場規模は、2028年までに136億米ドルに達すると予測され、予測期間中にCAGR 8.0%の市場成長率で上昇すると予想されています。

ESCは、車が促進要因の意図したコースから外れたときなど、ステアリング制御ができなくなる可能性がある場合にのみ、その機能を発揮します。例えば、ハイドロプレーニング現象、滑りやすい路面での不十分な操作によるアンダーステアやオーバーステア、緊急回避の際のスライドなどが考えられます。高速走行中はステアリング入力が必ずしも望ましい進行方向を示すとは限らないため、ESCは望まない時に干渉することがあります。横滑りに対抗し、促進要因の要求した方向にクルマを戻すために、ESCはまず横滑りの方向を判断し、特定の車輪に非対称にブレーキをかけます。また、エンジンの出力を下げたり、トランスミッションを作動させたりして、クルマを減速させることもあります。

COVID-19の影響分析

世界のほとんどの産業分野で、パンデミックによる大きな影響が見られました。公衆衛生問題への影響に加え、金融活動や産業活動にも大きな支障をきたしました。一部の国では、病気の蔓延を食い止めるため、一部または全部の閉鎖を実施しました。また、COVID-19は、現在も自動車分野に影響を及ぼしています。輸出入活動の制限、旅行や輸送の制限など、政府が実施したいくつかの法律や規制によって、業界のサプライチェーンが妨げられています。その結果、自動車や自動車部品などの需要の急激な落ち込みにより、自動車部門に悪影響が及んでいます。したがって、電子安定制御の市場は、世界経済が軌道に乗るにつれて、予測期間中に成長率が上昇すると予測されます。

市場成長要因

自律型モビリティの導入が進む

電子安定制御市場の拡大可能性は、自律走行モビリティの発展と普及に伴い、高い収益性が期待されます。さらに、安全性は自律走行車の主要なセールスポイントです。したがって、これらの車両におけるより優れた安全機能に対する需要は、市場成長にプラスの影響を与えます。さらに、レベル5の車両は、完全な自律走行車を製造するために、ADAS、ESCなどを含む様々な安全システムを搭載する必要があります。自動車メーカーが完全自律走行車の製造に向けた研究開発への投資を増やしているため、今後数年間は電子安定制御の使用量が増加すると予想されます。

安全機能を備えた自動車の高い人気

自動車メーカーは、消費者の需要に応えるために安全機能を開発し、提供しています。したがって、電子安定制御の市場は、安全機能に対する需要の高まりにより拡大しています。自動車の電子制御システムやアンチロックブレーキシステムなどの高度な安全機能への需要により、電子安定制御システムの利用は拡大すると予想されます。また、交通安全の必要性に対する社会的意識の高まりと、自動車へのADAS(先進運転支援システム)の配備が大幅に増加したことが相まって、市場の拡大が急増すると考えられます。

市場抑制要因

エレクトロニック・スタビリティ・コントロール・システムに関する問題

促進要因は、この機能を性能向上と捉えてはいけないです。ESCは曲がりやすくはなりますが、トラクションを高めることはできないので、コーナーを速く走ることはできません。また、高速走行時にESCが邪魔になることもあり、高性能ドライビングとは相容れません。コントロールドリフトでは、ステアリング入力が必ずしも希望する方向を認識しないため、不要なESCの作動が発生する可能性があります。高性能運転はESCとの相性が悪く、またその他の問題もあるため、より良い代替品が必要となり、予測期間中のエレクトロニック・スタビリティ・コントロール市場の成長を妨げると予想されます。

コンポーネントの展望

コンポーネントに基づいて、電子安定制御市場は、油圧ユニット、センサー、電子制御ユニットに分割されます。2021年のエレクトロニック・スタビリティ・コントロール市場では、油圧ユニット部門が最も高い収益シェアを占めています。これは、ブレーキ圧を管理するために必要な、個々のホイールブレーキ用のシフトバルブが油圧ユニットに存在することに起因します。これらは、油圧ユニットにおいて、圧力を増加させる、圧力を維持する、圧力を減少させるという3つの圧力状態を調整するために採用されています。また、油圧ユニットには、ドライビングダイナミクスやブレーキのコントロールユニットが搭載されていることが多いです。

車種別展望

車種別では、電子安定制御市場は、乗用車、小型商用車、大型商用車に分けられます。乗用車セグメントは、2021年に電子安定制御市場で最大の収益シェアを示しました。この成長は、最先端の安全機能を備えたハイエンド乗用車の需要が高まっていることに起因しています。政府の法律や規制は、乗用車にESCを使用することを義務付けています。多くの自動車メーカーが、すでにESCシステムを搭載した乗用車を生産しています。中級クラスの自動車メーカーの中には、安全規則の増加に対応するため、乗用車にESCを追加したいと考えているところもあります。

自動車推進の展望

車両推進力別に、電子安定制御市場は内燃機関車と電気&ハイブリッドに分類されます。2021年の電子安定制御市場では、電気&ハイブリッドセグメントが突出した収益シェアを獲得しています。これは、市販の電気駆動車が、多くの国で提供されている従来型自動車と同様に厳しい安全性試験を受け、販売する国に応じた安全基準を満たすことが求められるためです。また、EVは一般的に、運転しやすく、同乗者にとってもより安全な車両となるよう、最もハイテクな機能を備えています。このような要因が、予測される期間において、このセグメントの成長を促進すると予想されます。

地域別展望

地域別に、北米、欧州、アジア太平洋、LAMEAにまたがる電子安定制御市場を分析しています。アジア太平洋地域は、2021年に最大の収益シェアを獲得し、エレクトロニック・スタビリティ・コントロール市場をリードしています。これは、同地域の自動車生産・販売台数が伸びているためです。アジア太平洋地域は、多くの自動車用電子安定制御システムを占めると予測されています。多くのアジア諸国では、先進運転支援システムの導入率が高まっています。さらに、消費者の可処分所得の増加や高級自動車への需要の高まりなどの要因が、この地域の市場成長を後押しすると予測されています。

目次

第1章 市場の範囲と調査手法

- 市場の定義

- 目的

- 市場の範囲

- セグメンテーション

- 電子制御スタビリティコントロールの世界市場、コンポーネント別

- エレクトロニック・スタビリティ・コントロールの世界市場、車両推進力別

- エレクトロニック・スタビリティ・コントロールの世界市場:車両タイプ別

- エレクトロニック・スタビリティ・コントロールの世界市場、地域別

- 調査手法

第2章 市場の概要

- イントロダクションです

- 概要を説明します

- 市場の構成とシナリオ

- 概要を説明します

- 市場に影響を与える主要因

- 市場促進要因

- 市場抑制要因

第3章 電子制御スタビリティコントロール市場で展開されている戦略

第4章 エレクトロニック・スタビリティ・コントロールの世界市場:コンポーネント別

- 油圧ユニットの世界市場:地域別

- センサーの世界市場:地域別

- 電子制御ユニットの世界市場:地域別

第5章 電子制御スタビリティコントロールの世界市場:車両推進力別

- ICEの世界市場:地域別

- 電気・ハイブリッドの世界市場:地域別

第6章 エレクトロニック・スタビリティ・コントロールの世界市場:車両タイプ別

- 乗用車の世界市場:地域別

- 小型商用車の世界市場:地域別

- 大型商用車の世界市場:地域別

第7章 電子スタビリティコントロールの世界市場地域別市場

- 北米

- 北米のエレクトロニック・スタビリティ・コントロールの国別市場

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米のエレクトロニック・スタビリティ・コントロールの国別市場

- 欧州

- 欧州のエレクトロニック・スタビリティ・コントロールの市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州

- 欧州のエレクトロニック・スタビリティ・コントロールの市場:国別

- アジア太平洋地域

- アジア太平洋のエレクトロニック・スタビリティ・コントロールの国別市場

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋のエレクトロニック・スタビリティ・コントロールの国別市場

- LAMEA

- LAMEAエレクトロニック・スタビリティ・コントロールの国別市場

- ブラジル

- アルゼンチン

- UAE

- サウジアラビア

- 南アフリカ

- ナイジェリア

- LAMEAの残りの地域

- LAMEAエレクトロニック・スタビリティ・コントロールの国別市場

第8章 企業プロファイル

- Robert Bosch GmbH

- Continental AG

- Johnson Electric Holdings Limited

- Aisin Corporation(Toyota Motor Corporation)

- Valeo SA

- Murata Manufacturing Co., Ltd.

- Hitachi, Ltd.

- Knorr-Bremse AG

- ZF Friedrichshafen AG(TRW)

- Mando Corporation(Halla Group)

LIST OF TABLES

- TABLE 1 Global Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 2 Global Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 3 Global Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 4 Global Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 5 Global Hydraulic Unit Market by Region, 2018 - 2021, USD Million

- TABLE 6 Global Hydraulic Unit Market by Region, 2022 - 2028, USD Million

- TABLE 7 Global Sensors Market by Region, 2018 - 2021, USD Million

- TABLE 8 Global Sensors Market by Region, 2022 - 2028, USD Million

- TABLE 9 Global Electronic Control Unit Market by Region, 2018 - 2021, USD Million

- TABLE 10 Global Electronic Control Unit Market by Region, 2022 - 2028, USD Million

- TABLE 11 Global Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 12 Global Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 13 Global ICE Market by Region, 2018 - 2021, USD Million

- TABLE 14 Global ICE Market by Region, 2022 - 2028, USD Million

- TABLE 15 Global Electric & Hybrid Market by Region, 2018 - 2021, USD Million

- TABLE 16 Global Electric & Hybrid Market by Region, 2022 - 2028, USD Million

- TABLE 17 Global Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 18 Global Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 19 Global Passenger cars Market by Region, 2018 - 2021, USD Million

- TABLE 20 Global Passenger cars Market by Region, 2022 - 2028, USD Million

- TABLE 21 Global Light Commercial Vehicles Market by Region, 2018 - 2021, USD Million

- TABLE 22 Global Light Commercial Vehicles Market by Region, 2022 - 2028, USD Million

- TABLE 23 Global Heavy Commercial Vehicles Market by Region, 2018 - 2021, USD Million

- TABLE 24 Global Heavy Commercial Vehicles Market by Region, 2022 - 2028, USD Million

- TABLE 25 Global Electronic Stability Control Market by Region, 2018 - 2021, USD Million

- TABLE 26 Global Electronic Stability Control Market by Region, 2022 - 2028, USD Million

- TABLE 27 North America Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 28 North America Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 29 North America Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 30 North America Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 31 North America Hydraulic Unit Market by Country, 2018 - 2021, USD Million

- TABLE 32 North America Hydraulic Unit Market by Country, 2022 - 2028, USD Million

- TABLE 33 North America Sensors Market by Country, 2018 - 2021, USD Million

- TABLE 34 North America Sensors Market by Country, 2022 - 2028, USD Million

- TABLE 35 North America Electronic Control Unit Market by Country, 2018 - 2021, USD Million

- TABLE 36 North America Electronic Control Unit Market by Country, 2022 - 2028, USD Million

- TABLE 37 North America Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 38 North America Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 39 North America ICE Market by Country, 2018 - 2021, USD Million

- TABLE 40 North America ICE Market by Country, 2022 - 2028, USD Million

- TABLE 41 North America Electric & Hybrid Market by Country, 2018 - 2021, USD Million

- TABLE 42 North America Electric & Hybrid Market by Country, 2022 - 2028, USD Million

- TABLE 43 North America Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 44 North America Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 45 North America Passenger cars Market by Country, 2018 - 2021, USD Million

- TABLE 46 North America Passenger cars Market by Country, 2022 - 2028, USD Million

- TABLE 47 North America Light Commercial Vehicles Market by Country, 2018 - 2021, USD Million

- TABLE 48 North America Light Commercial Vehicles Market by Country, 2022 - 2028, USD Million

- TABLE 49 North America Heavy Commercial Vehicles Market by Country, 2018 - 2021, USD Million

- TABLE 50 North America Heavy Commercial Vehicles Market by Country, 2022 - 2028, USD Million

- TABLE 51 North America Electronic Stability Control Market by Country, 2018 - 2021, USD Million

- TABLE 52 North America Electronic Stability Control Market by Country, 2022 - 2028, USD Million

- TABLE 53 US Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 54 US Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 55 US Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 56 US Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 57 US Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 58 US Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 59 US Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 60 US Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 61 Canada Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 62 Canada Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 63 Canada Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 64 Canada Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 65 Canada Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 66 Canada Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 67 Canada Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 68 Canada Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 69 Mexico Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 70 Mexico Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 71 Mexico Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 72 Mexico Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 73 Mexico Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 74 Mexico Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 75 Mexico Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 76 Mexico Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 77 Rest of North America Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 78 Rest of North America Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 79 Rest of North America Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 80 Rest of North America Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 81 Rest of North America Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 82 Rest of North America Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 83 Rest of North America Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 84 Rest of North America Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 85 Europe Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 86 Europe Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 87 Europe Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 88 Europe Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 89 Europe Hydraulic Unit Market by Country, 2018 - 2021, USD Million

- TABLE 90 Europe Hydraulic Unit Market by Country, 2022 - 2028, USD Million

- TABLE 91 Europe Sensors Market by Country, 2018 - 2021, USD Million

- TABLE 92 Europe Sensors Market by Country, 2022 - 2028, USD Million

- TABLE 93 Europe Electronic Control Unit Market by Country, 2018 - 2021, USD Million

- TABLE 94 Europe Electronic Control Unit Market by Country, 2022 - 2028, USD Million

- TABLE 95 Europe Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 96 Europe Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 97 Europe ICE Market by Country, 2018 - 2021, USD Million

- TABLE 98 Europe ICE Market by Country, 2022 - 2028, USD Million

- TABLE 99 Europe Electric & Hybrid Market by Country, 2018 - 2021, USD Million

- TABLE 100 Europe Electric & Hybrid Market by Country, 2022 - 2028, USD Million

- TABLE 101 Europe Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 102 Europe Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 103 Europe Passenger cars Market by Country, 2018 - 2021, USD Million

- TABLE 104 Europe Passenger cars Market by Country, 2022 - 2028, USD Million

- TABLE 105 Europe Light Commercial Vehicles Market by Country, 2018 - 2021, USD Million

- TABLE 106 Europe Light Commercial Vehicles Market by Country, 2022 - 2028, USD Million

- TABLE 107 Europe Heavy Commercial Vehicles Market by Country, 2018 - 2021, USD Million

- TABLE 108 Europe Heavy Commercial Vehicles Market by Country, 2022 - 2028, USD Million

- TABLE 109 Europe Electronic Stability Control Market by Country, 2018 - 2021, USD Million

- TABLE 110 Europe Electronic Stability Control Market by Country, 2022 - 2028, USD Million

- TABLE 111 Germany Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 112 Germany Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 113 Germany Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 114 Germany Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 115 Germany Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 116 Germany Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 117 Germany Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 118 Germany Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 119 UK Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 120 UK Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 121 UK Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 122 UK Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 123 UK Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 124 UK Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 125 UK Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 126 UK Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 127 France Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 128 France Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 129 France Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 130 France Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 131 France Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 132 France Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 133 France Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 134 France Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 135 Russia Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 136 Russia Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 137 Russia Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 138 Russia Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 139 Russia Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 140 Russia Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 141 Russia Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 142 Russia Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 143 Spain Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 144 Spain Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 145 Spain Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 146 Spain Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 147 Spain Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 148 Spain Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 149 Spain Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 150 Spain Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 151 Italy Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 152 Italy Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 153 Italy Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 154 Italy Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 155 Italy Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 156 Italy Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 157 Italy Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 158 Italy Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 159 Rest of Europe Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 160 Rest of Europe Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 161 Rest of Europe Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 162 Rest of Europe Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 163 Rest of Europe Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 164 Rest of Europe Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 165 Rest of Europe Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 166 Rest of Europe Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 167 Asia Pacific Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 168 Asia Pacific Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 169 Asia Pacific Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 170 Asia Pacific Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 171 Asia Pacific Hydraulic Unit Market by Country, 2018 - 2021, USD Million

- TABLE 172 Asia Pacific Hydraulic Unit Market by Country, 2022 - 2028, USD Million

- TABLE 173 Asia Pacific Sensors Market by Country, 2018 - 2021, USD Million

- TABLE 174 Asia Pacific Sensors Market by Country, 2022 - 2028, USD Million

- TABLE 175 Asia Pacific Electronic Control Unit Market by Country, 2018 - 2021, USD Million

- TABLE 176 Asia Pacific Electronic Control Unit Market by Country, 2022 - 2028, USD Million

- TABLE 177 Asia Pacific Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 178 Asia Pacific Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 179 Asia Pacific ICE Market by Country, 2018 - 2021, USD Million

- TABLE 180 Asia Pacific ICE Market by Country, 2022 - 2028, USD Million

- TABLE 181 Asia Pacific Electric & Hybrid Market by Country, 2018 - 2021, USD Million

- TABLE 182 Asia Pacific Electric & Hybrid Market by Country, 2022 - 2028, USD Million

- TABLE 183 Asia Pacific Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 184 Asia Pacific Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 185 Asia Pacific Passenger cars Market by Country, 2018 - 2021, USD Million

- TABLE 186 Asia Pacific Passenger cars Market by Country, 2022 - 2028, USD Million

- TABLE 187 Asia Pacific Light Commercial Vehicles Market by Country, 2018 - 2021, USD Million

- TABLE 188 Asia Pacific Light Commercial Vehicles Market by Country, 2022 - 2028, USD Million

- TABLE 189 Asia Pacific Heavy Commercial Vehicles Market by Country, 2018 - 2021, USD Million

- TABLE 190 Asia Pacific Heavy Commercial Vehicles Market by Country, 2022 - 2028, USD Million

- TABLE 191 Asia Pacific Electronic Stability Control Market by Country, 2018 - 2021, USD Million

- TABLE 192 Asia Pacific Electronic Stability Control Market by Country, 2022 - 2028, USD Million

- TABLE 193 China Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 194 China Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 195 China Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 196 China Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 197 China Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 198 China Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 199 China Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 200 China Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 201 Japan Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 202 Japan Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 203 Japan Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 204 Japan Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 205 Japan Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 206 Japan Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 207 Japan Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 208 Japan Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 209 India Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 210 India Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 211 India Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 212 India Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 213 India Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 214 India Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 215 India Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 216 India Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 217 South Korea Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 218 South Korea Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 219 South Korea Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 220 South Korea Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 221 South Korea Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 222 South Korea Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 223 South Korea Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 224 South Korea Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 225 Singapore Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 226 Singapore Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 227 Singapore Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 228 Singapore Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 229 Singapore Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 230 Singapore Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 231 Singapore Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 232 Singapore Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 233 Malaysia Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 234 Malaysia Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 235 Malaysia Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 236 Malaysia Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 237 Malaysia Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 238 Malaysia Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 239 Malaysia Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 240 Malaysia Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 241 Rest of Asia Pacific Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 242 Rest of Asia Pacific Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 243 Rest of Asia Pacific Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 244 Rest of Asia Pacific Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 245 Rest of Asia Pacific Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 246 Rest of Asia Pacific Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 247 Rest of Asia Pacific Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 248 Rest of Asia Pacific Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 249 LAMEA Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 250 LAMEA Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 251 LAMEA Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 252 LAMEA Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 253 LAMEA Hydraulic Unit Market by Country, 2018 - 2021, USD Million

- TABLE 254 LAMEA Hydraulic Unit Market by Country, 2022 - 2028, USD Million

- TABLE 255 LAMEA Sensors Market by Country, 2018 - 2021, USD Million

- TABLE 256 LAMEA Sensors Market by Country, 2022 - 2028, USD Million

- TABLE 257 LAMEA Electronic Control Unit Market by Country, 2018 - 2021, USD Million

- TABLE 258 LAMEA Electronic Control Unit Market by Country, 2022 - 2028, USD Million

- TABLE 259 LAMEA Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 260 LAMEA Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 261 LAMEA ICE Market by Country, 2018 - 2021, USD Million

- TABLE 262 LAMEA ICE Market by Country, 2022 - 2028, USD Million

- TABLE 263 LAMEA Electric & Hybrid Market by Country, 2018 - 2021, USD Million

- TABLE 264 LAMEA Electric & Hybrid Market by Country, 2022 - 2028, USD Million

- TABLE 265 LAMEA Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 266 LAMEA Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 267 LAMEA Passenger cars Market by Country, 2018 - 2021, USD Million

- TABLE 268 LAMEA Passenger cars Market by Country, 2022 - 2028, USD Million

- TABLE 269 LAMEA Light Commercial Vehicles Market by Country, 2018 - 2021, USD Million

- TABLE 270 LAMEA Light Commercial Vehicles Market by Country, 2022 - 2028, USD Million

- TABLE 271 LAMEA Heavy Commercial Vehicles Market by Country, 2018 - 2021, USD Million

- TABLE 272 LAMEA Heavy Commercial Vehicles Market by Country, 2022 - 2028, USD Million

- TABLE 273 LAMEA Electronic Stability Control Market by Country, 2018 - 2021, USD Million

- TABLE 274 LAMEA Electronic Stability Control Market by Country, 2022 - 2028, USD Million

- TABLE 275 Brazil Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 276 Brazil Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 277 Brazil Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 278 Brazil Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 279 Brazil Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 280 Brazil Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 281 Brazil Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 282 Brazil Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 283 Argentina Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 284 Argentina Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 285 Argentina Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 286 Argentina Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 287 Argentina Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 288 Argentina Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 289 Argentina Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 290 Argentina Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 291 UAE Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 292 UAE Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 293 UAE Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 294 UAE Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 295 UAE Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 296 UAE Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 297 UAE Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 298 UAE Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 299 Saudi Arabia Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 300 Saudi Arabia Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 301 Saudi Arabia Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 302 Saudi Arabia Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 303 Saudi Arabia Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 304 Saudi Arabia Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 305 Saudi Arabia Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 306 Saudi Arabia Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 307 South Africa Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 308 South Africa Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 309 South Africa Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 310 South Africa Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 311 South Africa Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 312 South Africa Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 313 South Africa Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 314 South Africa Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 315 Nigeria Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 316 Nigeria Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 317 Nigeria Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 318 Nigeria Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 319 Nigeria Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 320 Nigeria Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 321 Nigeria Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 322 Nigeria Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 323 Rest of LAMEA Electronic Stability Control Market, 2018 - 2021, USD Million

- TABLE 324 Rest of LAMEA Electronic Stability Control Market, 2022 - 2028, USD Million

- TABLE 325 Rest of LAMEA Electronic Stability Control Market by Component, 2018 - 2021, USD Million

- TABLE 326 Rest of LAMEA Electronic Stability Control Market by Component, 2022 - 2028, USD Million

- TABLE 327 Rest of LAMEA Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2021, USD Million

- TABLE 328 Rest of LAMEA Electronic Stability Control Market by Vehicle Propulsion, 2022 - 2028, USD Million

- TABLE 329 Rest of LAMEA Electronic Stability Control Market by Vehicle Type, 2018 - 2021, USD Million

- TABLE 330 Rest of LAMEA Electronic Stability Control Market by Vehicle Type, 2022 - 2028, USD Million

- TABLE 331 key information - Robert Bosch GmbH

- TABLE 332 Key Information - Continental AG

- TABLE 333 Key Information - Johnson Electric Holdings Limited

- TABLE 334 Key Information - Aisin Corporation

- TABLE 335 key information - Valeo SA

- TABLE 336 Key Information -Murata Manufacturing Co., Ltd.

- TABLE 337 Key Information - Hitachi, Ltd.

- TABLE 338 Key Information - Knorr-Bremse AG

- TABLE 339 Key Information - ZF Friedrichshafen AG

- TABLE 340 Key Information - Mando Corporation

List of Figures

- FIG 1 Methodology for the research

- FIG 2 Global Electronic Stability Control Market Share by Component, 2021

- FIG 3 Global Electronic Stability Control Market Share by Component, 2028

- FIG 4 Global Electronic Stability Control Market by Component, 2018 - 2028, USD Million

- FIG 5 Global Electronic Stability Control Market Share by Vehicle Propulsion, 2021

- FIG 6 Global Electronic Stability Control Market Share by Vehicle Propulsion, 2028

- FIG 7 Global Electronic Stability Control Market by Vehicle Propulsion, 2018 - 2028, USD Million

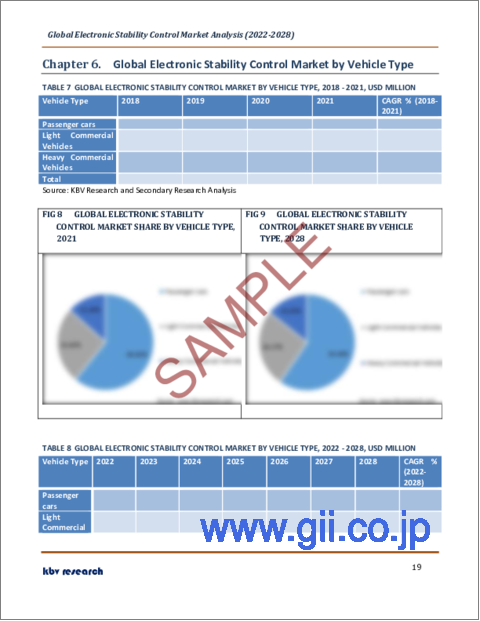

- FIG 8 Global Electronic Stability Control Market Share by Vehicle Type, 2021

- FIG 9 Global Electronic Stability Control Market Share by Vehicle Type, 2028

- FIG 10 Global Electronic Stability Control Market by Vehicle Type, 2018 - 2028, USD Million

- FIG 11 Global Electronic Stability Control Market Share by Region, 2021

- FIG 12 Global Electronic Stability Control Market Share by Region, 2028

- FIG 13 Global Electronic Stability Control Market by Region, 2018 - 2028, USD Million

- FIG 14 Swot analysis: Robert Bosch GmbH

- FIG 15 Recent strategies and developments: Continental AG

- FIG 16 SWOT Analysis: Continental AG

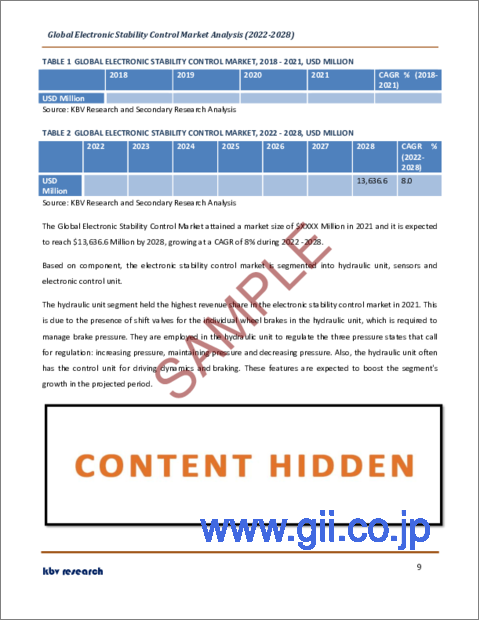

The Global Electronic Stability Control Market size is expected to reach $13.6 billion by 2028, rising at a market growth of 8.0% CAGR during the forecast period.

Automobiles, coaches, buses, and lorries can all be equipped with electronic stability control (ESC), commonly called the electronic stability program. The system, which includes a speed sensor and autonomous brakes for each wheel, is an expansion of antilock braking technology. In diverse driving circumstances, the main goal of ESC is to avoid vehicle skidding. To stop the car from sliding, the system recognizes hazardous driving situations and provides a specified amount of brake pressure to one or more wheels.

In addition, the ESC also automatically modifies the torque during a crucial driving condition to keep the driver in control of the steering. The ESC automatically applies the brakes to assist in steering the car in the direction the driver desires to travel when it senses a lack of steering control. The outer front wheel is automatically braked to oppose oversteer, while the inner rear wheel is automatically braked to counter understeer. Some ESC systems may reduce engine power while waiting for control to return. Instead of enhancing a vehicle's cornering capability, ESC works to lessen the likelihood that the driver may lose control of the car.

Only when there is a likely loss of steering control, such as when the car deviates from the driver's intended course, does the ESC step in. This may occur, for instance, during hydroplaning, understeering or oversteering during poorly assessed maneuvers on slick roads, or sliding during emergency evasive swerves. Since steering input doesn't always indicate the desired direction of travel while driving at high speeds, ESC may interfere when it's not wanted. To oppose the skid and bring the car back in line with the driver's requested direction, ESC first determines the direction of the skid and then applies the brakes asymmetrically to certain wheels. The system may also lower engine power or engage the transmission to slow the car down.

COVID-19 Impact Analysis

Most industry sectors globally have seen a significant effect due to the pandemic. In addition to affecting public health issues, it significantly disrupted financial or industrial activity. Some countries enacted partial or total lockdowns to stop the disease's spread. Also, COVID-19 is still affecting the automobile sector. The industry's supply chain has been hampered by several laws and regulations that the government has implemented, including limitations on import-export activity, travel and transportation restrictions, etc. As a result, the automotive sector has been negatively impacted due to the sharp fall in demand for automobiles, auto components, and other factors. Hence, the market for electronic stability control is projected to experience a rise in growth rate during the projected period as the world economy gets back on track.

Market Growth Factors

Growing adoption of autonomous mobility

The electronic stability control market expansion potential is expected to be highly profitable as autonomous mobility develops and gains popularity. Furthermore, safety is a major selling point for autonomous vehicles. Hence, the demand for better safety features in these vehicles positively affects the market growth. Moreover, level 5 vehicles must be fitted with various safety systems, including ADAS, ESC, and others, to produce fully autonomous vehicles. The usage of the electronic stability control in the next years is anticipated to increase as automakers are raising their investments in R&D efforts to produce fully autonomous cars.

High popularity of automobiles with safety features

Automakers are developing and delivering safety features to meet consumer demand. Thus, the market for electronic stability control is expanding due to the rising demand for safety features. The utilization of electronic stability control systems is expected to grow due to the demand for advanced safety features such as electronic control systems and anti-lock braking systems in automobiles. Also, with the increasing public awareness of the need for road safety combined with a significant uptick in deploying advanced driver assist systems in automobiles, the market expansion will surge.

Market Restraining Factors

Issues with electronic stability control system

Drivers shouldn't regard this functionality as improving performance. While ESC makes turning more manageable, this function can't make corners quicker because it can't enhance traction. Furthermore, high-Performance Driving is incompatible with ESC, which may interfere while driving at high speed. Because the steering input doesn't always recognize the desired direction during controlled drifting, unwanted ESC applications can occur. As high-performance driving can make ESC incompatible, joined with its other issues, the need for better alternatives might arise, which is expected to hamper the electronic stability control market's growth in the projected period.

Component Outlook

Based on component, the electronic stability control market is segmented into hydraulic unit, sensors and electronic control unit. The hydraulic unit segment held the highest revenue share in the electronic stability control market in 2021. This is due to the presence of shift valves for the individual wheel brakes in the hydraulic unit, which is required to manage brake pressure. They are employed in the hydraulic unit to regulate the three pressure states that call for regulation: increasing pressure, maintaining pressure and decreasing pressure. Also, the hydraulic unit often has the control unit for driving dynamics and braking.

Vehicle Type Outlook

On the basis of vehicle type, the electronic stability control market is divided into passenger cars, light commercial vehicles and heavy commercial vehicles. The passenger cars segment witnessed the largest revenue share in the electronic stability control market in 2021. The growth is attributed to the growing demand for high-end passenger cars with cutting-edge safety features. Government laws and regulations require the use of ESC in passenger vehicles. Many automakers are producing passenger cars with ESC systems already installed. Some mid-range automakers want to add ESC to their passenger vehicles in response to the growing number of safety rules.

Vehicle Propulsion Outlook

By vehicle propulsion, the electronic stability control market is classified into ICE and electric & hybrid. The electric & hybrid segment garnered a prominent revenue share in the electronic stability control market in 2021. This is because commercially available electric-drive cars are subject to the same stringent safety testing as conventional vehicles offered in many nations and are required to fulfill the Safety Standards in accordance with the nation they are being sold. Also, EVs are generally equipped with the most high-tech features to provide ease in driving and make the vehicle safer for the passengers. These factors are anticipated to drive the segment's growth in the projected period.

Regional Outlook

Region-wise, the electronic stability control market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region led the electronic stability control market by generating the maximum revenue share in 2021. This is because of the vehicle production and sales growth in the area. Asia Pacific is predicted to account for many automotive electronic stability control systems. There is an increasing adoption rate of advanced driving assistance systems in many Asian nations. Moreover, it is projected that factors including rising consumer disposable income and rising demand for luxury automobiles would boost the market growth in the region.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Robert Bosch GmbH, Continental AG, Johnson Electric Holdings Limited, Aisin Corporation (Toyota Motor Corporation), Valeo SA, Murata Manufacturing Co., Ltd., Hitachi, Ltd., Knorr-Bremse AG, ZF Friedrichshafen AG (TRW), and Mando Corporation (Halla Group).

Strategies Deployed in Electronic Stability Control Market

2022-Mar: Continental AG came into partnership with Nisshinbo Holdings Inc., a Japanese company that has a diverse line of businesses that include electronics, automobile brakes, mechatronics, chemicals, textiles, papers, and real estate. Under this partnership, Continental AG would be able to pivot itself to deliver the Indian automotive sector with the new and latest features in safety technology that are entirely assembled and manufactured in India.

2021-Apr: Hitachi, Ltd., took over GlobalLogic, an American digital services company providing software product design and development services. Through this acquisition, Hitachi, Ltd. would be able to expand its delivery footprints in India with the help and support of GlobalLogic. Moreover, Hitachi, Ltd would be able to grow its customer base in the Europe and US.

2019-Jul: Continental AG unveiled the eHorizon and PreviewESC. Both the new developments consist of data processing, matched sensors, and assistance systems. Additionally, the vehicle would be able to know exactly how fast to travel to secure a journey that is both safe and speedy, as it predicts from the road surface conditions and bends. The eHorizon knows the surface conditions and route of the road ahead and communicates with the control system, whereas, PreviewESC is a different element in attaining accident-free driving.

2019-Mar: ZF Friedrichshafen AG took over WABCO, a U.S.-based provider of electronic braking, stability, suspension, and transmission automation systems for heavy-duty commercial vehicles. Through this acquisition, ZF Friedrichshafen AG would be able to append a steady and expanding business segment and allow its current commercial vehicle division to extend its expertise in vehicle dynamics control. Moreover, this step would construct the footing for ZF to deliver exhaustive systems for automated and secure mobility solutions for passengers and goods to its customers.

2018-Nov: Continental AG took over Cooper Standard Automotive Inc, a leading global supplier of systems and components for the automotive industry. Through this acquisition, Continental AG would be able to extend its international existence for noise reduction and anti-vibration technology, especially in North America. Moreover, this step would improve Continental's vibration control business and its capability to help the automotive industry on a worldwide level.

2018-Sep: Mando Corporation unveiled the new MGH-100. The MGH-100 is the latest electronic brake system, with an anti-lock brake system (ABS) that improves driving safety by lowering skidding while braking. Additionally, MGH-100 has features consisting of more than 40 functions needed for autonomous driving having adaptive cruise control (ACC), and autonomous emergency braking (AEB).

2018-Aug: Murata Manufacturing Co., Ltd. expanded its geographical footprint in Vantaa by building a MEMS sensor manufacturing factory. By expanding its geographical footprints, Murata Manufacturing Co., Ltd. would be able to improve its MEMS sensors production capacity which would further strengthen its business base in the industrial equipment, automotive market, and medical devices markets.

Scope of the Study

Market Segments covered in the Report:

By Component

- Hydraulic Unit

- Sensors

- Electronic Control Unit

By Vehicle Propulsion

- ICE

- Electric & Hybrid

By Vehicle Type

- Passenger cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Robert Bosch GmbH

- Continental AG

- Johnson Electric Holdings Limited

- Aisin Corporation (Toyota Motor Corporation)

- Valeo SA

- Murata Manufacturing Co., Ltd.

- Hitachi, Ltd.

- Knorr-Bremse AG

- ZF Friedrichshafen AG (TRW)

- Mando Corporation (Halla Group)

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Electronic Stability Control Market, by Component

- 1.4.2 Global Electronic Stability Control Market, by Vehicle Propulsion

- 1.4.3 Global Electronic Stability Control Market, by Vehicle Type

- 1.4.4 Global Electronic Stability Control Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market Overview

- 2.1 Introduction

- 2.1.1 Overview

- 2.1.1.1 Market composition & scenario

- 2.1.1 Overview

- 2.2 Key Factors Impacting the Market

- 2.2.1 Market Drivers

- 2.2.2 Market Restraints

Chapter 3. Strategies Deployed in Electronic Stability Control Market

Chapter 4. Global Electronic Stability Control Market by Component

- 4.1 Global Hydraulic Unit Market by Region

- 4.2 Global Sensors Market by Region

- 4.3 Global Electronic Control Unit Market by Region

Chapter 5. Global Electronic Stability Control Market by Vehicle Propulsion

- 5.1 Global ICE Market by Region

- 5.2 Global Electric & Hybrid Market by Region

Chapter 6. Global Electronic Stability Control Market by Vehicle Type

- 6.1 Global Passenger cars Market by Region

- 6.2 Global Light Commercial Vehicles Market by Region

- 6.3 Global Heavy Commercial Vehicles Market by Region

Chapter 7. Global Electronic Stability Control Market by Region

- 7.1 North America Electronic Stability Control Market

- 7.1.1 North America Electronic Stability Control Market by Component

- 7.1.1.1 North America Hydraulic Unit Market by Country

- 7.1.1.2 North America Sensors Market by Country

- 7.1.1.3 North America Electronic Control Unit Market by Country

- 7.1.2 North America Electronic Stability Control Market by Vehicle Propulsion

- 7.1.2.1 North America ICE Market by Country

- 7.1.2.2 North America Electric & Hybrid Market by Country

- 7.1.3 North America Electronic Stability Control Market by Vehicle Type

- 7.1.3.1 North America Passenger cars Market by Country

- 7.1.3.2 North America Light Commercial Vehicles Market by Country

- 7.1.3.3 North America Heavy Commercial Vehicles Market by Country

- 7.1.4 North America Electronic Stability Control Market by Country

- 7.1.4.1 US Electronic Stability Control Market

- 7.1.4.1.1 US Electronic Stability Control Market by Component

- 7.1.4.1.2 US Electronic Stability Control Market by Vehicle Propulsion

- 7.1.4.1.3 US Electronic Stability Control Market by Vehicle Type

- 7.1.4.2 Canada Electronic Stability Control Market

- 7.1.4.2.1 Canada Electronic Stability Control Market by Component

- 7.1.4.2.2 Canada Electronic Stability Control Market by Vehicle Propulsion

- 7.1.4.2.3 Canada Electronic Stability Control Market by Vehicle Type

- 7.1.4.3 Mexico Electronic Stability Control Market

- 7.1.4.3.1 Mexico Electronic Stability Control Market by Component

- 7.1.4.3.2 Mexico Electronic Stability Control Market by Vehicle Propulsion

- 7.1.4.3.3 Mexico Electronic Stability Control Market by Vehicle Type

- 7.1.4.4 Rest of North America Electronic Stability Control Market

- 7.1.4.4.1 Rest of North America Electronic Stability Control Market by Component

- 7.1.4.4.2 Rest of North America Electronic Stability Control Market by Vehicle Propulsion

- 7.1.4.4.3 Rest of North America Electronic Stability Control Market by Vehicle Type

- 7.1.4.1 US Electronic Stability Control Market

- 7.1.1 North America Electronic Stability Control Market by Component

- 7.2 Europe Electronic Stability Control Market

- 7.2.1 Europe Electronic Stability Control Market by Component

- 7.2.1.1 Europe Hydraulic Unit Market by Country

- 7.2.1.2 Europe Sensors Market by Country

- 7.2.1.3 Europe Electronic Control Unit Market by Country

- 7.2.2 Europe Electronic Stability Control Market by Vehicle Propulsion

- 7.2.2.1 Europe ICE Market by Country

- 7.2.2.2 Europe Electric & Hybrid Market by Country

- 7.2.3 Europe Electronic Stability Control Market by Vehicle Type

- 7.2.3.1 Europe Passenger cars Market by Country

- 7.2.3.2 Europe Light Commercial Vehicles Market by Country

- 7.2.3.3 Europe Heavy Commercial Vehicles Market by Country

- 7.2.4 Europe Electronic Stability Control Market by Country

- 7.2.4.1 Germany Electronic Stability Control Market

- 7.2.4.1.1 Germany Electronic Stability Control Market by Component

- 7.2.4.1.2 Germany Electronic Stability Control Market by Vehicle Propulsion

- 7.2.4.1.3 Germany Electronic Stability Control Market by Vehicle Type

- 7.2.4.2 UK Electronic Stability Control Market

- 7.2.4.2.1 UK Electronic Stability Control Market by Component

- 7.2.4.2.2 UK Electronic Stability Control Market by Vehicle Propulsion

- 7.2.4.2.3 UK Electronic Stability Control Market by Vehicle Type

- 7.2.4.3 France Electronic Stability Control Market

- 7.2.4.3.1 France Electronic Stability Control Market by Component

- 7.2.4.3.2 France Electronic Stability Control Market by Vehicle Propulsion

- 7.2.4.3.3 France Electronic Stability Control Market by Vehicle Type

- 7.2.4.4 Russia Electronic Stability Control Market

- 7.2.4.4.1 Russia Electronic Stability Control Market by Component

- 7.2.4.4.2 Russia Electronic Stability Control Market by Vehicle Propulsion

- 7.2.4.4.3 Russia Electronic Stability Control Market by Vehicle Type

- 7.2.4.5 Spain Electronic Stability Control Market

- 7.2.4.5.1 Spain Electronic Stability Control Market by Component

- 7.2.4.5.2 Spain Electronic Stability Control Market by Vehicle Propulsion

- 7.2.4.5.3 Spain Electronic Stability Control Market by Vehicle Type

- 7.2.4.6 Italy Electronic Stability Control Market

- 7.2.4.6.1 Italy Electronic Stability Control Market by Component

- 7.2.4.6.2 Italy Electronic Stability Control Market by Vehicle Propulsion

- 7.2.4.6.3 Italy Electronic Stability Control Market by Vehicle Type

- 7.2.4.7 Rest of Europe Electronic Stability Control Market

- 7.2.4.7.1 Rest of Europe Electronic Stability Control Market by Component

- 7.2.4.7.2 Rest of Europe Electronic Stability Control Market by Vehicle Propulsion

- 7.2.4.7.3 Rest of Europe Electronic Stability Control Market by Vehicle Type

- 7.2.4.1 Germany Electronic Stability Control Market

- 7.2.1 Europe Electronic Stability Control Market by Component

- 7.3 Asia Pacific Electronic Stability Control Market

- 7.3.1 Asia Pacific Electronic Stability Control Market by Component

- 7.3.1.1 Asia Pacific Hydraulic Unit Market by Country

- 7.3.1.2 Asia Pacific Sensors Market by Country

- 7.3.1.3 Asia Pacific Electronic Control Unit Market by Country

- 7.3.2 Asia Pacific Electronic Stability Control Market by Vehicle Propulsion

- 7.3.2.1 Asia Pacific ICE Market by Country

- 7.3.2.2 Asia Pacific Electric & Hybrid Market by Country

- 7.3.3 Asia Pacific Electronic Stability Control Market by Vehicle Type

- 7.3.3.1 Asia Pacific Passenger cars Market by Country

- 7.3.3.2 Asia Pacific Light Commercial Vehicles Market by Country

- 7.3.3.3 Asia Pacific Heavy Commercial Vehicles Market by Country

- 7.3.4 Asia Pacific Electronic Stability Control Market by Country

- 7.3.4.1 China Electronic Stability Control Market

- 7.3.4.1.1 China Electronic Stability Control Market by Component

- 7.3.4.1.2 China Electronic Stability Control Market by Vehicle Propulsion

- 7.3.4.1.3 China Electronic Stability Control Market by Vehicle Type

- 7.3.4.2 Japan Electronic Stability Control Market

- 7.3.4.2.1 Japan Electronic Stability Control Market by Component

- 7.3.4.2.2 Japan Electronic Stability Control Market by Vehicle Propulsion

- 7.3.4.2.3 Japan Electronic Stability Control Market by Vehicle Type

- 7.3.4.3 India Electronic Stability Control Market

- 7.3.4.3.1 India Electronic Stability Control Market by Component

- 7.3.4.3.2 India Electronic Stability Control Market by Vehicle Propulsion

- 7.3.4.3.3 India Electronic Stability Control Market by Vehicle Type

- 7.3.4.4 South Korea Electronic Stability Control Market

- 7.3.4.4.1 South Korea Electronic Stability Control Market by Component

- 7.3.4.4.2 South Korea Electronic Stability Control Market by Vehicle Propulsion

- 7.3.4.4.3 South Korea Electronic Stability Control Market by Vehicle Type

- 7.3.4.5 Singapore Electronic Stability Control Market

- 7.3.4.5.1 Singapore Electronic Stability Control Market by Component

- 7.3.4.5.2 Singapore Electronic Stability Control Market by Vehicle Propulsion

- 7.3.4.5.3 Singapore Electronic Stability Control Market by Vehicle Type

- 7.3.4.6 Malaysia Electronic Stability Control Market

- 7.3.4.6.1 Malaysia Electronic Stability Control Market by Component

- 7.3.4.6.2 Malaysia Electronic Stability Control Market by Vehicle Propulsion

- 7.3.4.6.3 Malaysia Electronic Stability Control Market by Vehicle Type

- 7.3.4.7 Rest of Asia Pacific Electronic Stability Control Market

- 7.3.4.7.1 Rest of Asia Pacific Electronic Stability Control Market by Component

- 7.3.4.7.2 Rest of Asia Pacific Electronic Stability Control Market by Vehicle Propulsion

- 7.3.4.7.3 Rest of Asia Pacific Electronic Stability Control Market by Vehicle Type

- 7.3.4.1 China Electronic Stability Control Market

- 7.3.1 Asia Pacific Electronic Stability Control Market by Component

- 7.4 LAMEA Electronic Stability Control Market

- 7.4.1 LAMEA Electronic Stability Control Market by Component

- 7.4.1.1 LAMEA Hydraulic Unit Market by Country

- 7.4.1.2 LAMEA Sensors Market by Country

- 7.4.1.3 LAMEA Electronic Control Unit Market by Country

- 7.4.2 LAMEA Electronic Stability Control Market by Vehicle Propulsion

- 7.4.2.1 LAMEA ICE Market by Country

- 7.4.2.2 LAMEA Electric & Hybrid Market by Country

- 7.4.3 LAMEA Electronic Stability Control Market by Vehicle Type

- 7.4.3.1 LAMEA Passenger cars Market by Country

- 7.4.3.2 LAMEA Light Commercial Vehicles Market by Country

- 7.4.3.3 LAMEA Heavy Commercial Vehicles Market by Country

- 7.4.4 LAMEA Electronic Stability Control Market by Country

- 7.4.4.1 Brazil Electronic Stability Control Market

- 7.4.4.1.1 Brazil Electronic Stability Control Market by Component

- 7.4.4.1.2 Brazil Electronic Stability Control Market by Vehicle Propulsion

- 7.4.4.1.3 Brazil Electronic Stability Control Market by Vehicle Type

- 7.4.4.2 Argentina Electronic Stability Control Market

- 7.4.4.2.1 Argentina Electronic Stability Control Market by Component

- 7.4.4.2.2 Argentina Electronic Stability Control Market by Vehicle Propulsion

- 7.4.4.2.3 Argentina Electronic Stability Control Market by Vehicle Type

- 7.4.4.3 UAE Electronic Stability Control Market

- 7.4.4.3.1 UAE Electronic Stability Control Market by Component

- 7.4.4.3.2 UAE Electronic Stability Control Market by Vehicle Propulsion

- 7.4.4.3.3 UAE Electronic Stability Control Market by Vehicle Type

- 7.4.4.4 Saudi Arabia Electronic Stability Control Market

- 7.4.4.4.1 Saudi Arabia Electronic Stability Control Market by Component

- 7.4.4.4.2 Saudi Arabia Electronic Stability Control Market by Vehicle Propulsion

- 7.4.4.4.3 Saudi Arabia Electronic Stability Control Market by Vehicle Type

- 7.4.4.5 South Africa Electronic Stability Control Market

- 7.4.4.5.1 South Africa Electronic Stability Control Market by Component

- 7.4.4.5.2 South Africa Electronic Stability Control Market by Vehicle Propulsion

- 7.4.4.5.3 South Africa Electronic Stability Control Market by Vehicle Type

- 7.4.4.6 Nigeria Electronic Stability Control Market

- 7.4.4.6.1 Nigeria Electronic Stability Control Market by Component

- 7.4.4.6.2 Nigeria Electronic Stability Control Market by Vehicle Propulsion

- 7.4.4.6.3 Nigeria Electronic Stability Control Market by Vehicle Type

- 7.4.4.7 Rest of LAMEA Electronic Stability Control Market

- 7.4.4.7.1 Rest of LAMEA Electronic Stability Control Market by Component

- 7.4.4.7.2 Rest of LAMEA Electronic Stability Control Market by Vehicle Propulsion

- 7.4.4.7.3 Rest of LAMEA Electronic Stability Control Market by Vehicle Type

- 7.4.4.1 Brazil Electronic Stability Control Market

- 7.4.1 LAMEA Electronic Stability Control Market by Component

Chapter 8. Company Profiles

- 8.1 Robert Bosch GmbH

- 8.1.1 Company Overview

- 8.1.2 Financial Analysis

- 8.1.3 Segmental and Regional Analysis

- 8.1.4 Research & Development Expense

- 8.1.5 SWOT Analysis

- 8.2 Continental AG

- 8.2.1 Company Overview

- 8.2.2 Financial Analysis

- 8.2.3 Segmental and Regional Analysis

- 8.2.4 Research & Development Expense

- 8.2.5 Recent strategies and developments:

- 8.2.5.1 Partnerships, Collaborations, and Agreements:

- 8.2.5.2 Product Launches and Product Expansions:

- 8.2.5.3 Acquisition and Mergers:

- 8.2.6 SWOT Analysis

- 8.3 Johnson Electric Holdings Limited

- 8.3.1 Company Overview

- 8.3.2 Financial Analysis

- 8.3.3 Regional Analysis

- 8.4 Aisin Corporation (Toyota Motor Corporation)

- 8.4.1 Company Overview

- 8.4.2 Financial Analysis

- 8.4.3 Regional Analysis

- 8.4.4 Research & Development Expenses

- 8.5 Valeo SA

- 8.5.1 Company Overview

- 8.5.2 Financial Analysis

- 8.5.3 Segmental and Regional Analysis

- 8.5.4 Research & Development Expense

- 8.6 Murata Manufacturing Co., Ltd.

- 8.6.1 Company Overview

- 8.6.2 Financial Analysis

- 8.6.3 Segmental and Regional Analysis

- 8.6.4 Research & Development Expense

- 8.6.5 Recent strategies and developments:

- 8.6.5.1 Geographical Expansions:

- 8.7 Hitachi, Ltd.

- 8.7.1 Company Overview

- 8.7.2 Financial Analysis

- 8.7.3 Segmental and Regional Analysis

- 8.7.4 Research & Development Expenses

- 8.7.5 Recent strategies and developments:

- 8.7.5.1 Acquisition and Mergers:

- 8.8 Knorr-Bremse AG

- 8.8.1 Company Overview

- 8.8.2 Financial Analysis

- 8.8.3 Segmental and Regional Analysis

- 8.8.4 Research & Development Expenses

- 8.9 ZF Friedrichshafen AG (TRW)

- 8.9.1 Company Overview

- 8.9.2 Financial Analysis

- 8.9.3 Regional Analysis

- 8.9.4 Research & Development Expenses

- 8.9.5 Recent strategies and developments:

- 8.9.5.1 Acquisition and Mergers:

- 8.10. Mando Corporation (Halla Group)

- 8.10.1 Company Overview

- 8.10.2 Financial Analysis

- 8.10.3 Regional Analysis

- 8.10.4 Research & Development Expenses

- 8.10.5 Recent strategies and developments:

- 8.10.5.1 Product Launches and Product Expansions: