|

|

市場調査レポート

商品コード

1864841

デジタルウォレット市場:2025-2030年Digital Wallets Market: 2025-2030 |

||||||

|

|||||||

| デジタルウォレット市場:2025-2030年 |

|

出版日: 2025年11月10日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

概要

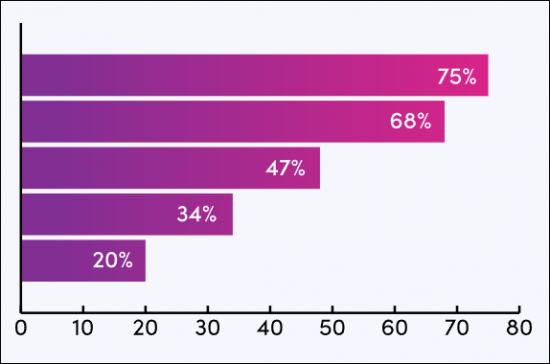

"デジタルウォレット利用者数は2030年までに世界人口の4分の3を超える見通し"

| 主要統計 | |

|---|---|

| 2025年の世界のデジタルウォレット利用者数: | 45億人 |

| 2030年の世界のデジタルウォレット利用者数: | 60億人 |

| 2025年から2030年までのデジタルウォレット利用者増加率: | 70% |

| 予測期間: | 2024年~2029年 |

概要

当調査スイートは、急速に変化するデジタルウォレット市場の詳細な分析を提供し、デジタルウォレットプロバイダーが主要な決済動向と課題、潜在的な成長機会、競合環境を理解することを可能にします。

個別に購入可能な複数のオプションを提供する本調査スイートには、デジタルウォレット市場の将来成長を予測するデータへのアクセスが含まれます。詳細な調査により、市場内の最新の機会と動向が明らかになり、この分野における18の主要デジタルウォレットサービスプロバイダーの広範な分析を含む洞察に富んだ文書が含まれています。また、取引手数料の低減、金融包摂の促進、成長を支える規制、地域間および世代間の差異といった側面を包括的に検証しています。

本レポートの全内容は英語で提供されます。

主な特徴

- 市場力学:デジタルウォレット分野における主要な決済動向と市場拡大に関する洞察を提供します。各種タイプのデジタルウォレット、地域ごとの役割、デジタルウォレットの成長を支えるオープンバンキング、NFC、QRコード決済などの技術、デジタルウォレットが活用される複数の使用事例を詳細に分析します。さらに、デジタルウォレットの将来展望についても展望を提供します。

- 主な知見と戦略的提言:市場における主要な開発機会と調査結果の詳細な分析に加え、新興の動向や市場の今後の展開予測を踏まえた、デジタルウォレットプロバイダー向けの重要な戦略的提言を提示します。

- 業界予測ベンチマーク:予測データには、デジタルウォレットによる決済導入水準と処理決済額が含まれ、NFC、QRコード、デジタル商品、物理商品、国内送金、国際送金、チケット購入、公共料金支払いに分類されます。これには、デジタルウォレット取引あたりの平均コストや各セグメントのユーザー数といった指標に加え、該当する場合にはモバイル利用とオンライン利用の内訳も含まれます。

- Juniper Research競合リーダーボード:デジタルウォレットベンダー18社を対象に、能力・キャパシティの評価を提供します。

サンプルビュー

市場データ・予測レポート

サンプルビュー

市場動向・戦略レポート

市場データ・予測レポート

本調査スイートには、124の表と85,000以上のデータポイントで構成される予測データ一式へのアクセスが含まれます。

調査スイートのサマリーに含まれる指標は以下の通りです。

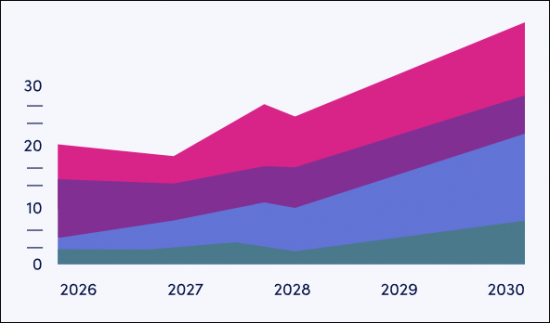

- デジタルウォレット利用者数

- デジタルウォレット取引額

- ウォレット1つあたりの年間平均取引件数

これらの指標は、以下のセグメントに分類されています。

- NFC

- QRコード

- デジタル商品 (モバイル/オンラインのチャネル別)

- 物理商品 (モバイル/オンラインのチャネル別)

- 国内送金 (モバイル/オンラインのチャネル別)

- 国際送金 (モバイル/オンラインのチャネル別)

- チケット販売 (モバイル/オンラインのチャネル別)

- 公共料金支払い (モバイル/オンラインのチャネル別)

競合リーダーボードレポート

競合リーダーボードレポートでは、デジタルウォレット分野における主要18社のベンダーについて、詳細な評価と市場ポジショニングを提供します。対象となるベンダーは以下の通りです。

|

|

|

目次

市場動向・戦略

第1章 重要ポイントと戦略的提言

- 重要ポイント

- 戦略的提言

第2章 将来の市場情勢

- イントロダクション

- 現在の市場情勢

- デジタルウォレットのタイプ

- クローズドループシステム

- セミクローズドループシステム

- オープンループシステム

- 暗号通貨ウォレット

- IoTウォレット

- サマリー

- 資金調達の種類

- パススルーウォレット

- ステージウォレット

- ストアドウォレット (残高保持型)

- サマリー

- 促進要因と動向

- 技術革新

- 消費者行動

- セキュリティと運用レジリエンス

- 規則

- 競合情勢

第3章 主な動向

- オープンバンキング

- スーパーアプリ

- BNPL

- QRコード

- バーチャルカード

- トークン化

- CBDC

- ソーシャルコマース

第4章 国別準備指数

- 焦点市場

- 成長市場

- 飽和市場

- 発展途上市場

競合リーダーボード

第1章 Juniper Research競合リーダーボード

第2章 企業プロファイル

- ベンダープロファイル

- BPC

- Comviva

- Ericsson

- Huawei

- Itexus

- Mangopay

- MeaWallet

- MobiFin

- Netcetera

- Obopay

- OpenWay

- SDK.finance

- Soft Space

- Software Group

- Thales

- Velmie

- Wallet Factory

- Youtap

- 評価手法

- 関連調査

データ・予測

第1章 イントロダクション・調査手法

第2章 市場サマリー

- デジタルウォレット普及率

- デジタルウォレット利用者数

- デジタルウォレット取引件数

- 取引件数 (タイプ別内訳)

- デジタルウォレット取引額

- 取引額 (タイプ別内訳)

第3章 店舗内小売

- 店舗内取引額

- NFC取引額

- QRコード取引額

第4章 送金

- デジタルウォレットによる送金額

- デジタルウォレットによる国内送金額

- デジタルウォレットによる国際送金額

第5章 その他の分野

- デジタルウォレットによる公共料金支払い額

- デジタルウォレットによるチケット購入額

- デジタルウォレットによる遠隔物理商品購入額

- デジタルウォレットによる遠隔デジタル商品購入額