|

|

市場調査レポート

商品コード

1661287

チャージバック管理の世界市場:2025年Global Chargeback Management Market: 2025 |

||||||

|

|||||||

| チャージバック管理の世界市場:2025年 |

|

出版日: 2025年03月03日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

チャージバック管理:2025年に市場をリードする企業は?

概要

当レポートでは、チャージバック管理システムベンダーが、加盟店が直面するチャージバックの増加に対処するために、既存のツールをどのように進化させ、新しいシステムをどのように構築しているかについて、詳細な分析と評価を提供しています。また、フレンドリー詐欺に関連する課題の増加など、チャージバックにおける主要動向や、より広範な不正行為の動向がチャージバック不正防止市場にどのような影響を与えているかについて評価しています。

さらに、Juniper Researchの競合リーダーボードでは、ベンダー15社の位置づけと、その製品と能力の評価を行っています。本レポートは、チャージバック管理システム市場を理解するための重要なツールとなり、主要ベンダーの今後の戦略立案に役立ちます。

主な特徴

- 市場力学:チャージバック管理システム市場の主要動向と市場拡大の課題を洞察し、急速に進化する不正行為の領域がもたらす課題と機会を取り上げます。また、フレンドリー詐欺の増加に対抗するためのチャージバックへのAIの導入や、チャージバック管理システムを採用することによる加盟店のメリットについても評価しています。

- 主な要点と戦略的提言:チャージバック管理システム市場における主な発展機会と知見を詳細に分析し、チャージバック管理のリーダーやカードネットワークなどのステークホルダーに向けた戦略的提言も掲載しています。

- Juniper Researchの競合リーダーボード:チャージバック管理システムベンダー15社の能力を評価し、世界のチャージバック管理市場における主要企業の戦略的研究開発機会を紹介します。

- Accertify

- ACI Worldwide

- BlueSnap

- Chargeback Gurus

- Chargebacks911

- Chargeflow

- ClearSale

- FIS

- Fiserv

- Justt

- Kount

- Mastercard

- Riskified

- Sift

- Verifi

目次

第1章 重要ポイント・戦略的推奨事項

- 重要ポイント

- 戦略的推奨事項

第2章 市場情勢

- チャージバックの主な動向と課題

- 主な動向

- チャージバックの種類が変化するにつれ、チャージバックがより一般的になる

- カードネットワークチャージバック規則の変更

- チャージバック管理に導入されているAI

- 主な課題

- 成功確率が低い

- コスト

- 複雑さ

- 効果的なデジタルツールの欠如

- 主な動向

第3章 競合リーダーボード

- 本レポートを読む理由

- ベンダープロファイル

- Accertify

- ACI Worldwide

- BlueSnap

- Chargeback Gurus

- Chargebacks911

- Chargeflow

- ClearSale

- FIS

- Fiserv

- Justt

- Kount

- Mastercard

- Riskified

- Sift

- Verifi

- 競合リーダーボード評価手法

'Chargeback Management: Which Companies Will Lead the Market in 2025?'

Overview

Our "Chargeback Management" systems research provides in-depth analysis and evaluation of how chargeback management system vendors are evolving existing tools and creating new systems to tackle the increasing tide of chargebacks facing merchants. The report evaluates key trends within chargebacks, such as the increasing challenges associated with friendly fraud, as well as how wider fraud trends are influencing the chargeback fraud protection market.

In addition, it also positions 15 vendors across the Juniper Research Competitor Leaderboard for chargeback management systems; assessed on their products and positioning against their capability and capacity. Collectively, the report provides a critical tool for understanding the chargeback management systems market, enabling key vendors to shape their future strategy.

Key Features

- Market Dynamics: Insights into key trends and market expansion challenges within the chargeback management systems market; addressing challenges and opportunities posed by the fast-evolving fraud space. It also evaluates the introduction of AI into chargebacks to combat the rise of friendly fraud chargebacks, and the benefits for merchants of adopting chargeback management systems.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the chargeback management systems market, accompanied by strategic recommendations for stakeholders, such as leaders in chargeback management and the card networks.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 15 chargeback management system vendors, via the Juniper Research Competitor Leaderboard, featuring strategic development opportunities for key players in the global chargeback management market.

- Accertify

- ACI Worldwide

- BlueSnap

- Chargeback Gurus

- Chargebacks911

- Chargeflow

- ClearSale

- FIS

- Fiserv

- Justt

- Kount

- Mastercard

- Riskified

- Sift

- Verifi

Table of Contents

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

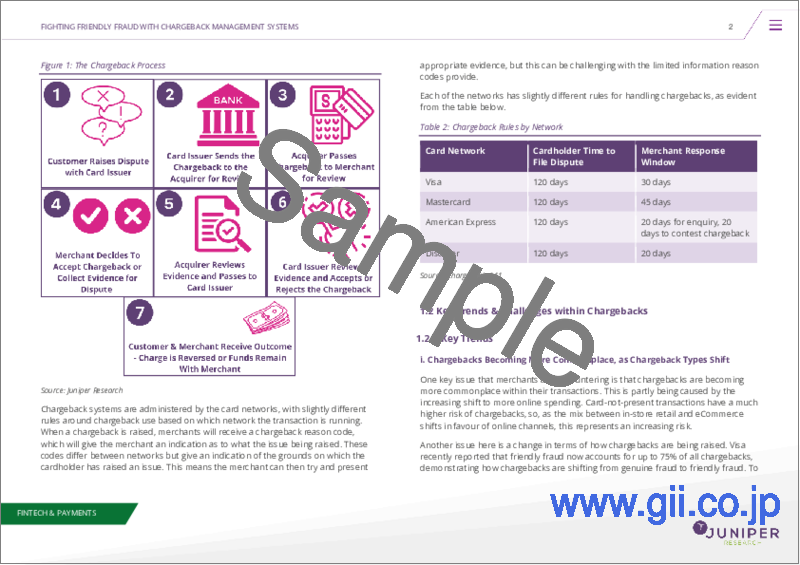

- Figure 2.1: The Chargeback Process

- Table 2.2: Chargeback Rules by Network

- 2.2. Key Trends & Challenges within Chargebacks

- 2.2.1. Key Trends

- i. Chargebacks Becoming More Commonplace, as Chargeback Types Shift

- ii. Changes to Card Network Chargeback Rules

- iii. AI Being Deployed for Chargeback Management

- 2.2.2. Key Challenges

- i. Low Probabilities of Success

- ii. Cost

- Table 2.3: Chargeback Costs by Payment Processors

- iii. Complexity

- iv. Lack of Effective Digital Tools

- 2.2.1. Key Trends

3. Competitor Leaderboard

- 3.1. Why Read this Report?

- Figure 3.1: Juniper Research Competitor Leaderboard Chargeback Management Platform Vendors & Portfolio

- Figure 3.2: Juniper Research Competitor Leaderboard for Chargeback Management Platforms

- Figure 3.3: Juniper Research Leaderboard Chargeback Management Platform Vendors & Positioning

- Figure 3.4: Juniper Research's Competitor Leaderboard Heatmap - Chargeback Management Platform Vendors

- 3.2. Vendor Profiles

- 3.2.1. Accertify

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 3.2.2. ACI Worldwide

- i. Corporate

- Figure 3.5: ACI Worldwide's Financial Snapshot ($m), 2021-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 3.2.3. BlueSnap

- i. Corporate

- Figure 3.6: BlueSnap's Rounds of Funding ($m), 2011-2014

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 3.2.4. Chargeback Gurus

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 3.2.5. Chargebacks911

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 3.2.6. Chargeflow

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 3.2.7. ClearSale

- i. Corporate

- Figure 3.7: ClearSale's Financial Snapshot ($m), 2021-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 3.2.8. FIS

- i. Corporate

- Figure 3.8: FIS' Financial Snapshot ($m), 2021-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 3.2.9. Fiserv

- i. Corporate

- Figure 3.9: Fiserv's Financial Snapshot ($m), 2021-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 3.2.10. Justt

- i. Corporate

- Figure 3.10: Justt's Rounds of Funding ($m), 2020-2024

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 3.2.11. Kount

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 3.2.12. Mastercard

- i. Corporate

- Figure 3.11: Mastercard's Financial Snapshot ($m), 2021-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 3.12: How Does Ethoca Alerts Work?

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 3.2.13. Riskified

- i. Corporate

- Figure 3.13: Riskified Financial Snapshot ($m), 2021-2023

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 3.2.14. Sift

- i. Corporate

- Figure 3.14: Sift's Rounds of Funding ($m), 2011-2021

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 3.2.15. Verifi

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 3.2.1. Accertify

- 3.3. Juniper Research Competitor Leaderboard Assessment Methodology

- 3.3.1. Limitations & Interpretations

- Table 3.15: Chargeback Management Competitor Leaderboard Criteria

- 3.3.1. Limitations & Interpretations