|

|

市場調査レポート

商品コード

1658000

オープンバンキングAPIの世界市場:2025-2029年Global Open Banking APIs Market: 2025-2029 |

||||||

|

|||||||

| オープンバンキングAPIの世界市場:2025-2029年 |

|

出版日: 2025年02月24日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

オープンバンキングAPIコール数は2029年には世界全体で7,200億回を超える見通し

| 主要統計 | |

|---|---|

| 2025年のオープンバンキングAPIコール数: | 1,370億回 |

| 2029年のオープンバンキングAPIコール数: | 7,220億回 |

| 2025年から2029年の市場成長率 | 427% |

| 予測期間: | 2024-2029年 |

当調査パッケージでは、オープンバンキングのインフラや決済サービスのプロバイダー、銀行やその他の金融機関、eコマースプラットフォームや加盟店などのステークホルダーが、今後の成長、主要動向、競合環境を理解できるよう、オープンバンキングAPI市場に関する詳細で鋭い分析を提供します。

本スイートには、オープンバンキングAPIの採用と今後数年間の市場成長をマッピングしたデータへのアクセスや、市場内の最新動向と機会を明らかにする洞察に満ちた調査など、個別に購入できるさまざまなオプションが用意されています。これには、決済、口座情報サービス、融資、ID、保険、FX、カード、住宅ローンなどのニッチな使用事例など、オープンバンキングAPI市場を構成する主要市場セグメントに関する広範な分析が含まれています。さらに、オープンバンキングAPI分野のマーケットリーダー16社に関する広範な分析も掲載しています。

本レポートは、急速に台頭しつつあるオープンバンキングAPI市場を理解するための重要なツールとなり、オープンバンキングAPIのステークホルダーが将来の戦略を策定することを可能にします。本調査スイートは、この比類のない網羅性により、極めて重要で急成長している分野の将来を描くための非常に有用なリソースとなっています。

主な特徴

- 市場力学:世界のオープンバンキングAPI市場における主要動向と市場拡大の課題についての洞察を提供します。具体的には、APIベンダーにとっての収益化機会のリスク、オープンバンキングに対する規制当局の関与の増加によるメリット、オープンバンキングAPIが促進するモデルなどがもたらす課題を取り上げています。また、オープンバンキングAPI市場を構成する様々なセグメントの分析と、これらのセグメントの現状と将来的な状況についての地域別の市場成長分析も含まれています。最後に、本レポートにはJuniper Researchの国別準備指数が含まれており、本予測で取り上げた全61カ国の市場の準備と成長を評価し、将来の展望も示しています。

- 主な要点と戦略的提言:世界のオープンバンキングAPI市場における主な開発機会と知見を詳細に分析し、ステークホルダーへの戦略的提言を添えています。

- ベンチマーク業界予測:オープンバンキング決済総額、オープンバンキングAPIコールによるプラットフォーム収益、オープンバンキングユーザ総数など、さまざまなセグメントにわたるオープンバンキングAPIコール総量の予測に加え、関連する多数の予測を掲載しています。

- Juniper Researchの競合リーダーボード:オープンバンキングAPIベンダー主要16社の能力を評価し、主要企業の戦略的開発機会を特定します。

サンプルビュー

市場データ・予測レポート

市場動向・戦略レポート

市場データ&予測レポート

本調査スイートには、51の表と23,000のデータポイントの予測データ一式へのアクセスが含まれています。調査スイートには以下の指標が含まれます。

- デジタルバンキング利用者数

- 各種セグメントのオープンバンキング利用者数

- オープンバンキングAPIコール数:セグメント別

- 各種セグメントのオープンバンキングAPIコールからのプラットフォーム収益

- オープンバンキング決済の総取引額

オープンバンキングAPIのセグメントには、決済、口座集約と個人財務管理、引受、融資、ID、投資、住宅ローンが含まれます。

Juniper Researchのインタラクティブ予測 (Excel) には以下の機能があります:

- 統計分析:データ期間中のすべての地域と国について表示される特定の指標を検索できるのがメリットです。グラフは簡単に修正でき、クリップボードへのエクスポートも可能です。

- 国別データツール:予測期間中のすべての地域と国の指標を見ることができます。検索バーで表示される指標を絞り込むことができます。

- 国別比較ツール:特定の国を選択して比較することができます。グラフをエクスポートする機能が含まれています。

- What-if分析:5つのインタラクティブなシナリオにより、ユーザーは予測の前提条件と比較することができます。

目次

市場動向と戦略

第1章 重要ポイント・戦略的推奨事項

- 重要ポイント

- 戦略的推奨事項

第2章 市場情勢

- APIインフラ

- APIセキュリティ機能

- 現在の市場

- オープンバンキングAPIによる収益化の機会

- 動向

- 生成AIからエージェントAIへ?

- APIの品質と可用性の向上

- 決済の利用にはAPIの需要が必要

- 利点

- 加盟店のコスト削減

- カスタマイズ

- 新しいビジネスモデル

- 課題

- セキュリティ

- 収益化と収益性

- 規制当局の関与が限定的

第3章 セグメント分析

- 決済

- 銀行口座

- 貸出

- ID

- ニッチなユースケース

- 投資

- カード

- 外為

- 抵当権

第4章 国別準備指数

- 国別準備指数:イントロダクション

- 重点市場

- 成長市場

- 新興国市場

- 国別準備指数ヒートマップ

- 北米

- ラテンアメリカ

- 西欧

- 中央・東欧

- 極東および中国

- インド亜大陸

- その他アジア太平洋地域

- アフリカ・中東

競合リーダーボード

第1章 オープンバンキングAPI:競合リーダーボード

第2章 企業プロファイル

- ベンダープロファイル

- Basiq

- Brankas

- Bud

- Fiserv

- GoCardless

- Mastercard

- MX

- Ozone API

- Plaid

- Raidiam

- Salt Edge

- TrueLayer

- Visa

- Worldline

- Yapily

- Yodlee

- 評価手法

- 関連調査

データ・予測

第1章 市場概要と調査手法

第2章 オープンバンキングAPI:サマリー

- オープンバンキングAPIコール総数

- オープンバンキングAPIプラットフォームの総収益

第3章 オープンバンキングAPI:決済

- ユーザー総数

- APIコール総数

- プラットフォーム総収益

- 決済総額

第4章 オープンバンキングAPI:鋼材集約・個人財務管理 (PFM)

- APIコール総数

第5章 オープンバンキングAPI:引受

- APIコール総数

- プラットフォーム総収益

第6章 オープンバンキングAPI:融資

- ユーザー総数

- APIコール総数

- プラットフォーム総収益

第7章 オープンバンキングAPI:ID

- APIコール総数

- プラットフォーム総収益

第8章 オープンバンキングAPI:投資

- APIコール総数

- プラットフォーム総収益

第9章 オープンバンキングAPI:住宅ローン

- ユーザー総数

- APIコール総数

'Open Banking API Call Volume to Surpass 720 Billion Globally by 2029'

| KEY STATISTICS | |

|---|---|

| Total Open Banking API call volume in 2025: | 137bn |

| Total Open Banking API call volume in 2029: | 722bn |

| 2025 to 2029 market growth: | 427% |

| Forecast period: | 2024-2029 |

Overview

Our "Open Banking APIs" research suite provides detailed and perceptive analysis of this evolving market; enabling stakeholders such as Open Banking infrastructure and payment service providers, banks and other financial institutions, and eCommerce platforms and merchants to understand future growth, key trends, and the competitive environment.

The suite features several different options that can be purchased separately, including access to data mapping the Open Banking APIs adoption and market growth in the coming years, and an insightful study uncovering the latest trends and opportunities within the market. This includes extensive analysis of the key market segments that make up the Open Banking API market, including payments, account information services, lending, identity, insurance, and niche use cases including FX, cards, and mortgages. Additionally, the report contains extensive analysis of the 16 market leaders in the Open Banking APIs space. The coverage can also be purchased as a Full Research Suite, containing all of these elements, at a substantial discount.

Collectively, they provide a critical tool for understanding this rapidly emerging market; enabling Open Banking APIs stakeholders to shape their future strategies. Its unparalleled coverage makes this research suite an incredibly useful resource for charting the future of such a crucially important and rapidly growing sector.

Key Features

- Market Dynamics: Insights into key trends and market expansion challenges within the global Open Banking APIs market. Specifically, the report addresses challenges posed by the risk of monetisation opportunities for API vendors, the benefits of increasing regulatory involvement for Open Banking, and what models of Open Banking APIs facilitate. The research also includes analysis of the various segments comprising the Open Banking APIs market and a regional market growth analysis of the current and future status of these segments. Finally, the report includes the Juniper Research Country Readiness Index which assesses the market readiness and growth across all 61 countries featured in our forecast, as well as providing a future outlook.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the global Open Banking APIs market; accompanied by strategic recommendations for stakeholders.

- Benchmark Industry Forecasts: Includes forecasts for the total volume of Open Banking API calls across various segments, with a multitude of additional forecasts included for all of these markets, featuring total Open Banking payment value, platform revenue from Open Banking API calls, and the total number of Open Banking users.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 16 Open Banking API vendors via the Juniper Research Competitor Leaderboard, featuring strategic development opportunities for key players in the global Open Banking APIs market.

SAMPLE VIEW

Market Data & Forecasting Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the "Open Banking APIs" market includes access to the full set of forecast data of 51 tables and 23,000 datapoints. Metrics in the research suite include:

- Number of Digital Banking Users

- Number of Open Banking Users for Different Segments

- Number of Open Banking API Calls for Different Segments

- Platform Revenue from Open Banking API Calls for Different Segments

- Total Transaction Value of Open Banking Payments

The segments of Open Banking APIs include payments, account aggregation and personal finance management, underwriting, lending, identity, investments, and mortgages.

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via five interactive scenarios.

Market Trends & Strategies Report

This report examines the "Open Banking APIs" market landscape in detail; assessing market trends and factors shaping the evolution of this rapidly growing market. The report delivers comprehensive analysis of the strategic opportunities for Open Banking API players; addressing key verticals and developing challenges, and suggesting how stakeholders should navigate these. It also includes evaluation of key country-level opportunities for Open Banking APIs market growth, based on current Open Banking infrastructure and regulatory developments, market readiness, and more.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 16 leading vendors in the "Open Banking APIs" space. The vendors are positioned as established leaders, leading challengers or disruptors and challengers, based on capacity and capability assessments:

|

|

This document is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive dynamic landscape in a market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- Figure 2.1: Data Flow with Open Banking APIs

- 2.2. API Infrastructure

- Figure 2.2: Enterprise Adoption of APIs without Standardised APIs

- 2.2.1. API Security Features

- 2.3. Current Market

- Figure 2.3: Open Banking Models

- 2.3.1. Monetisation Opportunities from Open Banking APIs

- 2.3.2. Trends

- i. Generative AI to Agentic AI?

- ii. API Quality and Availability Increasing

- iii. Payment Usage Necessitates Demand for APIs

- 2.3.3. Benefits

- i. Cost Reduction for Merchants

- ii. Customisation

- iii. New Business Models

- 2.3.4. Challenges

- i. Security

- ii. Monetisation and Profitability

- iii. Limited Regulator Involvement

- Figure 2.4: Notable Regions for Open Banking and their Regulatory Bodies or Legislation (2024)

3. Segment Analysis

- 3.1. Introduction

- 3.1.1. Payments

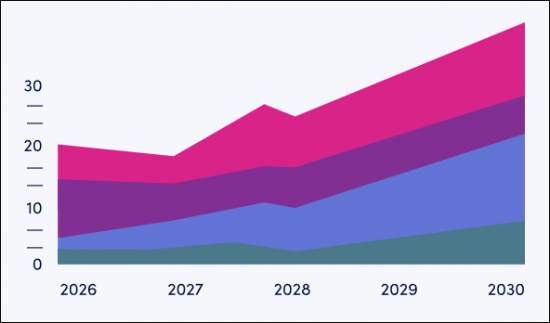

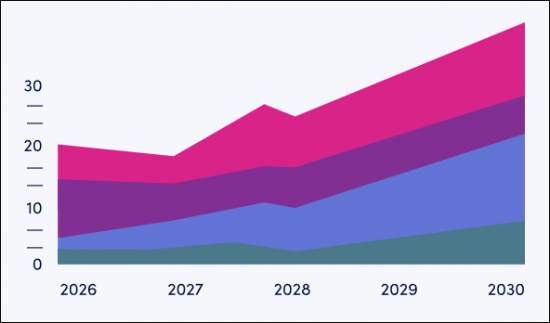

- Figure 3.1: Total Value of Open Banking Payments ($m) Split by 8 Key Regions, 2024-2029

- 3.1.2. Bank Accounts

- Figure 3.2: Total Platform Revenue of Open Banking APIs for Account Aggregation & PFM ($m) Split by 8 Key Regions, 2024-2029

- 3.1.3. Lending

- Figure 3.3: Total Volume of Open Banking Lending API Calls (m) Split by 8 Key Regions, 2024-2029

- 3.1.4. Identity

- Figure 3.4: Total Volume of Identity-related Open Banking API Calls (m) in West Europe, 2024-2029

- 3.1.5. Niche Use Cases

- i. Investments

- Figure 3.5: Total Volume of Open Banking Investment API Calls (m) Split by 8 Key Regions, 2024-2029

- ii. Cards

- iii. FX

- iv. Mortgages

- Figure 3.6: Total Volume of Open Banking Mortgage API Calls (m) Split by 8 Key Regions, 2024-2029

- i. Investments

- 3.1.1. Payments

4. Country Readiness Index

- 4.1. Introduction to Country Readiness Index

- Figure 4.1: Country Readiness Index Regional Definitions

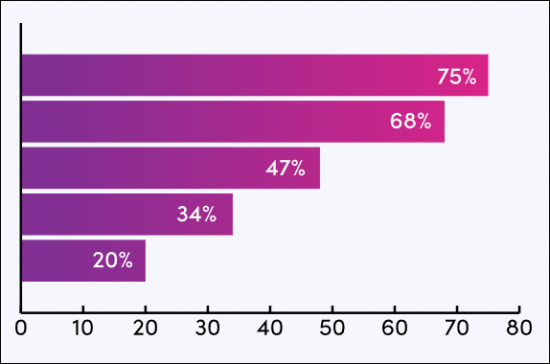

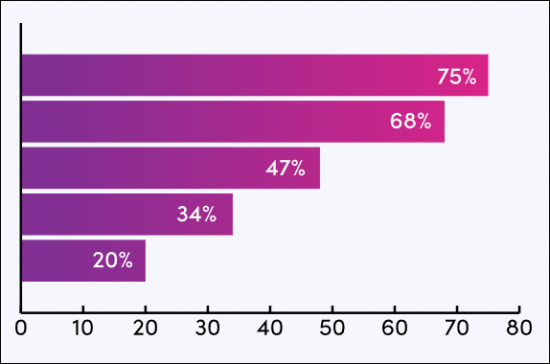

- Table 4.2: Juniper Research's Country Readiness Index Scoring Criteria: Open Banking APIs

- Figure 4.3: Juniper Research's Country Readiness Index: Open Banking APIs

- Table 4.4: Open Banking APIs Country Readiness Index: Market Segments

- 4.1.1. Focus Markets

- i. National Payment Schemes

- Figure 4.5: Open Banking Payment Value ($m) from Several Focus Markets, 2024

- ii. Country-level Assessment: Saudi Arabia

- i. National Payment Schemes

- 4.1.2. Growth Markets

- i. Digital Economies

- Figure 4.6: Total Volume of Open Banking APIs (m) Split by Growth Markets, 2024

- ii. Developing Regulations

- iii. Country-level Assessment: US

- i. Digital Economies

- 4.1.3. Developing Markets

- i. Lacking or Developing Infrastructure

- 4.1.4. Country Readiness Index Heatmaps

- i. North America

- Figure 4.7: Juniper Research's Open Banking APIs Country Readiness Index Heatmap: North America

- ii. Latin America

- Figure 4.8: Juniper Research's Open Banking APIs Country Readiness Index Heatmap: Latin America

- iii. West Europe

- Figure 4.9: Juniper Research's Open Banking APIs Country Readiness Index Heatmap: West Europe

- iv. Central & East Europe

- Figure 4.10: Juniper Research's Open Banking APIs Country Readiness Index Heatmap: Central & East Europe

- v. Far East & China

- Figure 4.11: Juniper Research's Open Banking APIs Country Readiness Index Heatmap: Far East & China

- vi. Indian Subcontinent

- Figure 4.12: Juniper Research's Open Banking APIs Country Readiness Index Heatmap: Indian Subcontinent

- vii. Rest of Asia Pacific

- Figure 4.13: Juniper Research's Open Banking APIs Country Readiness Index Heatmap: Rest of Asia Pacific

- viii. Africa & Middle East

- Figure 4.14: Juniper Research's Open Banking APIs Country Readiness Index Heatmap: Africa & Middle East

- i. North America

Competitor Leaderboard

1. Open Banking APIs: Competitor Leaderboard

- 1.1. Why Read this Report

- Table 1.1: Juniper Research Competitor Leaderboard: Open Banking APIs Vendors

- Figure 1.2: Juniper Research Competitor Leaderboard: Open Banking APIs

- Table 1.3: Juniper Research Leaderboard: Open Banking API Vendors & Positioning

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap: Open Banking APIs

2. Company Profiles

- 2.1. Vendor Profiles

- 2.1.1. Basiq

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.2. Brankas

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. Bud

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. Fiserv

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.5. GoCardless

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Partnerships & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Development Opportunities

- 2.1.6. Mastercard

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Partnerships & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Development Opportunities

- 2.1.7. MX

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Partnerships & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Development Opportunities

- 2.1.8. Ozone API

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths and Strategic Development Opportunities

- 2.1.9. Plaid

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.10. Raidiam

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. Salt Edge

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.12. TrueLayer

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.13. Visa

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.14. Worldline

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.15. Yapily

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.16. Yodlee

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. Basiq

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretations

- Figure 2.1: Juniper Research's Competitor Leaderboard Scoring Criteria - Open Banking APIs

- 2.2.1. Limitations & Interpretations

- 2.3. Related Research

Data & Forecasting

1. Market Overview & Methodology

- 1.1. Introduction

- 1.2. Open Banking APIs: Forecast Methodology & Assumptions

- Figure 1.1: Open Banking APIs Forecast Document

2. Open Banking APIs: Summary

- 2.1. Total Number of Open Banking API Calls

- Figure & Table 2.1: Total Number of Open Banking API Calls (m) Split by 8 Key Regions, 2024-2029

- 2.2. Total Open Banking API Platform Revenue

- Figure & Table 2.2: Total Open Banking API Platform Revenue ($m) Split by 8 Key Regions, 2024-2029

3. Open Banking APIs: Payments

- 3.1. Total Number of Open Banking Payments Users

- Figure & Table 3.1: Total Number of Open Banking API Payments Users (m) Split by 8 Key Regions, 2024-2029

- 3.2. Total Number of Open Banking Payment API Calls

- Figure & Table 3.2: Total Number of Open Banking Payment API Calls (m) Split by 8 Key Regions, 2024-2029

- 3.3. Total Platform Revenue from Open Banking Payments

- Figure & Table 3.3: Total API Platform Revenue of Open Banking Payments ($m) Split by 8 Key Regions, 2024-2029

- 3.4. Total Value of Open Banking Payments

- Figure & Table 3.4: Total Value of Open Banking Payments ($m) Split by 8 Key Regions, 2024-2029

4. Open Banking APIs: Account Aggregation & Personal Finance Management (PFM)

- 4.1. Total Number of Account Aggregation & PFM Open Banking API Calls

- Figure & Table 4.1: Total Number of Open Banking Account Aggregation & PFM API Calls (m) Split by 8 Key Regions, 2024-2029

5. Open Banking APIs: Underwriting

- 5.1. Total Number of Open Banking Underwriting API Calls

- Figure & Table 5.1: Total Number of Open Banking Underwriting API Calls (m) Split by 8 Key Regions, 2024-2029

- 5.2. Total Platform Revenue from Open Banking Underwriting API Calls

- Figure & Table 5.2: Total Platform Revenue from Open Banking Underwriting API Calls ($m) Split by 8 Key Regions, 2024-2029

6. Open Banking APIs: Lending

- 6.1. Total Number of Open Banking Lending Users

- Figure 6.1: Total Number of Open Banking Lending Users (m) Split by 8 Key Regions, 2024-2029

- 6.2. Total Number of Open Banking Lending API Calls

- Figure & Table 6.2: Total Number of Open Banking Lending API Calls (m) Split by 8 Key Regions, 2024-2029

- 6.3. Total Platform Revenue from Open Banking Lending API Calls

- Figure & Table 6.3: Total Platform Revenue from Open Banking Lending API Calls ($m) Split by 8 Key Regions, 2024-2029

7. Open Banking APIs: Identity

- 7.1. Total Number of Open Banking Identity API Calls

- Figure & Table 7.1: Total Number of Open Banking Identity API Calls (m) Split by 8 Key Regions, 2024-2029

- 7.2. Total Platform Revenue from Open Banking Lending API Calls

- Figure 7.2: Total Platform Revenue from Open Banking Lending API ($m) Split by 8 Key Regions, 2024-2029

8. Open Banking APIs: Investments

- 8.1. Total Number of Open Banking Investment API Calls

- Figure & Table 8.1: Total Number of Open Banking Investment API Calls (m) Split by 8 Key Regions, 2024-2029

- 8.2. Total Platform Revenue from Open Banking Investment API Calls

- Figure & Table 8.2: Total Platform Revenue from Open Banking Lending API Calls ($m) Split by 8 Key Regions, 2024-2029

9. Open Banking APIs: Mortgages

- 9.1. Total Number of Open Banking Mortgage Users

- Figure 9.1: Total Number of Open Banking Mortgage Users (m) Split by 8 Key Regions, 2024-2029

- 9.2. Total Number of Open Banking Mortgage API Calls

- Figure & Table 9.2: Total Number of Open Banking Mortgage API Calls (m) Split by 8 Key Regions, 2024-2029