|

|

市場調査レポート

商品コード

1596787

デジタルID検証の世界市場:2024-2029年Global Digital Identity Verification Market: 2024-2029 |

||||||

|

|||||||

| デジタルID検証の世界市場:2024-2029年 |

|

出版日: 2024年12月02日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

"デジタルID検証の支出額は2029年には世界で260億米ドルを超える見通し"

| 主要統計 | |

|---|---|

| 世界のデジタルID検証 (2024年): | 152億米ドル |

| 世界のデジタルID検証 (2029年): | 264億米ドル |

| デジタルID検証の成長率 (2024~2029年): | 107% |

| 予測期間: | 2024~2029年 |

当調査パッケージは、急速に変化するデジタルID検証市場の詳細な分析を提供します。デジタルID検証ソリューションプロバイダーは、主要なデジタルID検証の動向と課題、潜在的な成長機会、競合環境を理解することができます。

本調査スイートには、デジタルID検証市場の今後の成長に関するデータマッピングへのアクセスが含まれています。詳細な調査では、市場内の最新の機会と動向を明らかにし、デジタルID検証ソリューションプロバイダー20社に関する広範な分析を含む洞察に満ちた資料を提供しています。AIや機械学習の利用、さまざまなユーザーの要求、各種課題、新規ユーザーのオンボーディングに採用された新しい技術などが調査・分析されています。

デジタルID検証ベンダーは、効果的かつ効率的な検証サービスを顧客に提供するための今後の戦略を策定することができます。比類のない網羅性により、本調査スイートはこの複雑な市場の将来性を測る上で非常に有用なリソースとなっています。

主な特徴

- 市場力学:デジタルID検証市場における主要な不正動向と市場拡大の課題についての洞察。デジタルIDの進化、技術の進歩、デジタルID導入拡大の障壁を取り上げ、デジタルID検証が行われる複数の使用事例を分析しています。また、デジタルID検証の展望に関する将来展望も示しています。

- 主な要点と戦略的提言:市場開発の主な機会と市場調査結果を詳細に分析し、デジタルID検証ソリューションプロバイダーに対して、新たな動向と市場の進化に関する主な戦略的提言を示します。

- ベンチマーク業界予測:予測には、バンキング、電子政府、eコマースなどのデジタルID検証に関するデータが含まれています。これらの分野はモバイルおよびオンラインの確認方法ごとに分割されているため、それぞれの利用状況を簡単に追跡することができます。このデータには、デバイスごとの概要とセグメント別のデジタルID検証の内訳も含まれています。

- Juniper Researchの競合リーダーボード:デジタルID検証ベンダー20社の能力を評価し、デジタルID検証業界の主要企業に関する分析を掲載しています。

サンプルビュー

市場データ・予測レポート:

市場動向・戦略レポート:

市場データ&予測レポート

本調査スイートには、180の表と82,000以上のデータポイントからなる予測データ一式へのアクセスが含まれています。調査スイートの指標には以下が含まれます。

- デジタルID検証チェックの総数

- デジタルID検証チェックの年間総支出額

- デジタルID検証チェックの平均コスト

これらの指標は、以下の主要市場別で提供されています:

- バンキング

- スマートフォンバンキング

- オンラインバンキング

- 電子政府

- スマートフォン

- オンライン

- eコマース

- スマートフォン

- オンライン

- その他の検証タイプ

- デバイス別の概要

Juniper Researchのインタラクティブ予測 (Excel) には以下の機能があります:

- 統計分析:データ期間中の全地域・国について表示される特定の指標を検索できます。グラフは簡単に変更でき、クリップボードにエクスポートできます。

- 国別データツール:予測期間中のすべての地域と国の指標を確認することができます。ユーザーは検索バーで表示される指標を絞り込むことができます。

- 国別比較ツール:各国を選択して比較することができます。このツールには、グラフをエクスポートする機能が含まれています。

- What-if分析:予測指標を独自の前提条件と比較することができます。

目次

市場動向と戦略

第1章 重要ポイントと戦略的推奨事項

- 重要ポイント

- 戦略的推奨事項

第2章 市場情勢

- ID検証の経緯

- なぜID検証が必要なのか?

- 規制、プロトコル、標準

- eIDAS

- NIST

- FIDO Alliance

第3章 セグメント分析

- セグメント分析

- オンラインゲーム

- 現在の状況

- 最近の動向

- 課題

- 今後の展望

- オンラインギャンブル

- 現在の状況

- 最近の動向

- 課題

- 今後の展望

- eコマース

- 現在の状況

- 最近の動向

- 課題

- 今後の展望

- デジタル政府サービス

- 現在の状況

- 最近の動向

- 課題

- 今後の展望

- 金融サービス

- 現在の状況

- 最近の動向

- 課題

- 今後の展望

- ヘルスケア

- 現在の状況

- 最近の動向

- 課題

- 今後の展望

- アクセス管理

- アクセス管理の種類

- 今後の展望

第4章 検証のタイプ

- 知識ベース認証

- ユーザー名とパスワード

- ワンタイムパスワード

- 一般的な生体認証

- 指紋スキャン

- 顔認識

- 音声認識

- 行動バイオメトリクス

- 生体検知

- 新しい生体認証

- 虹彩スキャン

- 網膜スキャン

- 手形スキャン

- 静脈パターン認識

- ID検証

- 書類確認

- 検証のための文書の使用

- データベース検証

第5章 国別準備指数

- 国別準備指数:イントロダクション

- 重点市場

- 成長市場

- 飽和市場

- 新興国市場

競合リーダーボード

第1章 Juniper Researchの競合リーダーボード

第2章 企業プロファイル

- ベンダープロファイル

- Entrust

- Experian

- G+D & Veridos

- GBG

- IDEMIA

- iDenfy

- InfoCert

- iProov

- Jumio

- LexisNexis Risk Solutions

- Microsoft

- Onfido

- Ping Identity

- SEON

- Signicat

- Socure

- Subex

- Thales

- Trulioo

- Veriff

- Juniper Researchリーダーボード評価手法

データ・予測

第1章 イントロダクション・調査手法

第2章 市場概要

- デジタルID検証チェックの総数

- デジタルID検証チェックの総数:地域別

- デジタルID検証チェックの年間総支出額

- デジタルID検証チェックの平均コスト

第3章 セグメント別

- 銀行

- 総数

- 総支出額

- 電子政府

- 総数

- 総支出額

- eコマース

- 総数

- 総支出額

- その他の検証サービス

- 総数

- 総支出額

'Digital ID Verification Spend to Exceed $26 billion Globally by 2029'

| KEY STATISTICS | |

|---|---|

| Digital identity verification value globally in 2024: | $15.2bn |

| Digital identity verification value globally in 2029: | $26.4bn |

| Total digital identity verification value growth between 2024 & 2029: | 107% |

| Forecast period: | 2024-2029 |

Overview

Our "Digital Identity Verification" research suite provides detailed analysis of this rapidly changing market; allowing digital identity verification solution providers to gain an understanding of key digital identity trends and challenges, potential growth opportunities, and the competitive environment.

Providing multiple options which can be purchased separately, the research suite includes access to data mapping for the future growth of the digital identity verification market. The detailed study reveals the latest opportunities and trends within the market, and an insightful document containing an extensive analysis of 20 digital identity verification solution providers within the space. Aspects such as the use of artificial intelligence and machine learning, different user demands, and the challenges and new techniques employed for onboarding new users are explored throughout the report. The coverage can also be purchased as a Full Research Suite, containing all of these elements, and includes a substantial discount.

Collectively, these elements provide an effective tool for understanding this constantly evolving market; allowing digital identity verification vendors to set out their future strategies to provide effective and efficient verification services to their customers. Its unparalleled coverage makes this research suite an incredibly useful resource for gauging the future of this complex market.

Key Features

- Market Dynamics: Insights into key fraud trends and market expansion challenges within the digital identity verification market. It addresses the challenges posed by the evolution of digital identities, technological advancements, barriers to increased digital identity adoption, and analyses multiple use cases where digital identity checks occur. The research also provides a future outlook on the landscape of digital identity verification.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the market, accompanied by key strategic recommendations for digital identity verification solution providers on emerging trends and how the market is expected to evolve.

- Benchmark Industry Forecasts: The forecasts include data on digital identity verification in banking, eGovernment, eCommerce, and other verification types. These sectors are split by mobile and online verification methods, allowing for usage of each to be easily traced. The data also includes a device split summary and a breakdown of digital identity verification by segment.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 20 digital identity verification vendors, via the Juniper Research Competitor Leaderboard; featuring analysis around major players in the digital identity verification industry.

SAMPLE VIEW

Market Data & Forecasting Report:

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the digital identity verification market includes access to the full set of forecast data, consisting of 180 tables and over 82,000 datapoints. Metrics in the research suite include:

- Total Volume of Digital Identity Verification Checks

- Total Spend on Digital Identity Verification Checks per Annum

- Average Cost of Digital Identity Verification Checks

These metrics are provided for the following key market verticals:

- Banking Verification

- Smartphone Banking

- Online Banking

- eGovernment Verification

- Smartphone eGovernment

- Online eGovernment

- eCommerce Verification

- Smartphone eCommerce

- Online eCommerce

- Other Verification Types

- Device Split Summary

The Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool allows the user to review metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via the search bar.

- Country Comparison Tool: Users can select and compare each of the countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions. 5 interactive scenarios.

Market Trends & Strategies Report

This report examines the digital identity verification market landscape in detail; assessing different market trends and factors that are shaping the evolution of this growing market, such as biometric verification methods, artificial intelligence and machine learning, as well as current and emerging regulations and standards that are specific to different regions, and how user demands are shaping the way in which digital identities are verified; addressing key vertical and developing challenges, and how vendors should navigate these. As well as looking into digital identity verification use cases where identity checks occur, it also includes evaluation of the different methods of verification that are currently being employed, and those which some vendors are experimenting with in order to address user demands.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 20 leading vendors in the digital identity verification solution space. These vendors are positioned as an established leader, leading challenger, or disruptor and challenger based on capacity and capability assessments, including their use of technologies such as artificial intelligence, machine learning, and physical and behavioural biometrics. The 20 vendors consist of:

|

|

This document is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive landscape, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- 2.2. Identity Verification History

- 2.3. Why Does Identity Need to be Verified?

- 2.4. Regulations, Protocols, & Standards

- 2.4.1. eIDAS

- 2.4.2. NIST

- 2.4.3. FIDO Alliance

3. Segment Analysis

- 3.1. Segment Analysis

- 3.2. Online Gaming

- 3.2.1. Current Status

- 3.2.2. Recent Developments

- 3.2.3. Challenges

- 3.2.4. Future Outlook

- 3.3. Online Gambling

- 3.3.1. Current Status

- 3.3.2. Recent Developments

- 3.3.3. Challenges

- 3.3.4. Future Outlook

- 3.4. eCommerce

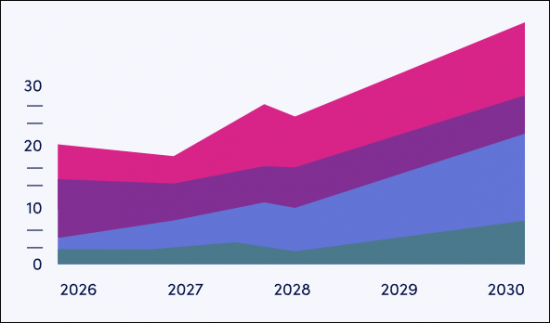

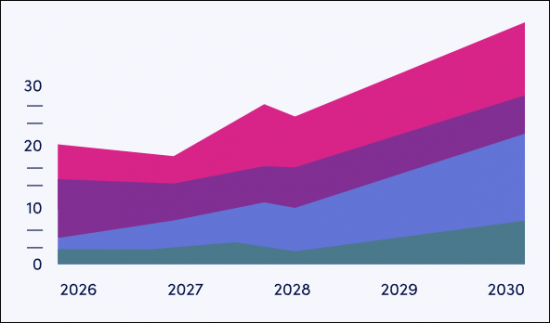

- Figure 3.1: Total Number of eCommerce Payments per Annum Globally (m), 2024-2029

- 3.4.1. Current Status

- 3.4.2. Recent Developments

- 3.4.3. Challenges

- 3.4.4. Future Outlook

- 3.5. Digital Government Services

- Figure 3.2: Total Volume of eGovernment Services' Accesses Secured by Digital Identity Verification Checks (m), Globally, Split by 8 Key Regions, 2024-2029

- 3.5.1. Current Status

- 3.5.2. Recent Developments

- 3.5.3. Challenges

- 3.5.4. Future Outlook

- 3.6. Financial Services

- 3.6.1. Current Status

- 3.6.2. Recent Developments

- 3.6.3. Challenges

- 3.6.4. Future Outlook

- 3.7. Healthcare

- 3.7.1. Current Status

- 3.7.2. Recent Developments

- 3.7.3. Challenges

- 3.7.4. Future Outlook

- 3.8. Access Management

- 3.8.1. Types of Access Management

- i. Discretionary Access Management

- ii. Mandatory Access Management

- iii. Role-based Access Management

- iv. Attribute-based Access Management

- v. Rule-based Access Management

- vi. Risk-adaptive Access Management

- vii. Organisation-based Access Management

- 3.8.2. Future Outlook

- 3.8.1. Types of Access Management

4. Verification Types

- 4.1. Introduction

- 4.1.1. Knowledge-based Authentication

- i. Username and Password

- ii. One-time Password

- 4.1.2. Common Biometrics

- i. Fingerprint Scanning

- ii. Facial Recognition

- iii. Voice Recognition

- iv. Behavioural Biometrics

- v. Liveness Detection

- 4.1.3. Emerging Biometrics

- i. Iris Scanning

- ii. Retina Scanning

- iii. Handprint Scanning

- iv. Vein Pattern Recognition

- 4.1.4. Identification Verification

- i. Document Verification

- ii. Using Documents for Verification

- 4.1.5. Database Verification

- 4.1.1. Knowledge-based Authentication

5. Country Readiness Index

- 5.1. Introduction to Country Readiness Index

- Figure 5.1: Digital Identity Verification Country Readiness Index Regional Definitions

- Table 5.2: Juniper Research Country Readiness Index Scoring Criteria: Digital Identity Verification

- Figure 5.3: Juniper Research Country Readiness Index: Digital Identity Verification

- Figure 5.4: Digital Identity Verification Country Readiness Index: Market Segments

- 5.1.1. Focus Markets

- i. Increased eGovernment Service Investment

- Figure 5.5: Total Spend on eGovernment Service Digital Identity Verification Checks ($m), Split by 8 Key Regions, 2024-2029

- ii. Expansion of eCommerce

- i. Increased eGovernment Service Investment

- 5.1.2. Growth Markets

- i. Potential to Carry Out Checks in More Sectors

- Figure 5.6: Total Number of Digital Identity Verification Checks (m), Split by 7 Growth Markets, 2024-2029

- ii. Strong Investment Opportunities

- Figure 5.7: Total Spend on Digital Identity Verification Checks ($m), Split by 7 Growth Markets, 2024-2029

- i. Potential to Carry Out Checks in More Sectors

- 5.1.3. Saturated Markets

- Figure 5.8: Total Volume of Digital Identity Verification Checks in Banking (m), Split by 8 Saturated Markets, 2024-2029

- 5.1.4. Developing Markets

- Figure 5.9: Total Number of Internet Users Accessing eGovernment Services per Annum (m), Split by Top 8 Developing Markets, 2024-2029

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report?

- Table 1.1: Juniper Research Competitor Leaderboard Digital Identity Verification Vendors Included & Product Portfolios

- Figure 1.2: Juniper Research Competitor Leaderboard for Digital Identity Verification

- Table 1.3: Juniper Research Digital Identity Verification Vendors & Positioning

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap for Digital Identity Verification Vendors

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap for Digital Identity Verification Vendors

2. Company Profiles

- 2.1. Vendor Profiles

- 2.1.1. Entrust

- i. Corporate

- Table 2.1: Entrust, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.2. Experian

- i. Corporate

- Table 2.2: Experian, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.3. G+D & Veridos

- i. Corporate

- Table 2.3: G+D, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.4. GBG

- i. Corporate

- Table 2.4: GBG, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.5. IDEMIA

- i. Corporate

- Table 2.5: IDEMIA, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Opportunities

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.6. iDenfy

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.7. InfoCert

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.8. iProov

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.9. Jumio

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.10. LexisNexis Risk Solutions

- i. Corporate

- Table 2.6: LexisNexis Risk Solutions, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.11. Microsoft

- i. Corporate

- Table 2.7: Microsoft, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.12. Onfido

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.13. Ping Identity

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.14. SEON

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.15. Signicat

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.16. Socure

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.17. Subex

- i. Corporate

- Table 2.8: Subex, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.18. Thales

- i. Corporate

- Table 2.9: Thales, Financial Snapshot ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.19. Trulioo

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.20. Veriff

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.1. Entrust

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretations

- Table 2.10: Juniper Research Digital Identity Verification Assessment Criteria

- 2.2.1. Limitations & Interpretations

Data & Forecasting

1. Introduction & Methodology

- 1.1. Introduction

- 1.2. Methodology & Assumptions

- Figure 1.1: Banking Verification Forecast Methodology

- Figure 1.2: eGovernment Verification Forecast Methodology

- Figure 1.3: eCommerce Verification Forecast Methodology

- Figure 1.4: Other Verification Services Forecast Methodology

2. Market Summary

- 2.1. Total Volume of Digital Identity Verification Checks

- 2.1.1. Split by Region

- Figure & Table 2.1: Total Volume of Digital Identity Verification Checks per Annum (m), Globally, Split by 8 Key Regions, 2024-2029

- 2.1.2. Total Value of Digital Identity Verification Checks

- Figure & Table 2.2: Total Spend on Digital Identity Verification Checks per Annum ($m), Globally, Split by 8 Key Regions, 2024-2029

- 2.1.3. Average Cost of Digital Identity Verification Checks

- Figure & Table 2.3: Average Cost per Digital Identity Verification Check ($), Globally, Split by 8 Key Regions, 2024-2029

- 2.1.1. Split by Region

3. Segment Splits

- 3.1. Banking Verification

- 3.1.1. Total Volume of Digital Identity Verification Checks

- Figure & Table 3.1: Total Volume of Digital Identity Verification Checks in Banking (m), Globally, Split by 8 Key Regions, 2024-2029

- 3.1.2. Total Spend on Digital Banking Identity Verification Checks

- Figure & Table 3.2: Total Spend on Digital Banking Identity Verification Checks per Annum ($m), Globally, Split by 8 Key Regions, 2024-2029

- 3.1.1. Total Volume of Digital Identity Verification Checks

- 3.2. eGovernment Verification

- 3.2.1. Total Volume of eGovernment Identity Verification Checks

- Figure & Table 3.3: Total Volume of eGovernment Services Access Secured by Digital Identity Verification (m), Globally, Split by 8 Key Regions, 2024-2029

- 3.2.2. Total Spend on eGovernment Identity Verification Checks

- Figure & Table 3.4: Total Spend on Digital Identity Verification Checks for eGovernment Services per Annum ($m), Split by 8 Key Regions, 2024-2029

- 3.2.1. Total Volume of eGovernment Identity Verification Checks

- 3.3. eCommerce Verification

- 3.3.1. Total Number of eCommerce Payments That Require a Digital Identity Verification Check

- Figure & Table 3.5: Total Number of eCommerce Payments That Require a Digital Identity Verification Check per Annum (m), Split by 8 Key Regions, 2024-2029

- 3.3.2. Total Spend on Digital Identity Verification for eCommerce Payments

- Figure & Table 3.6: Total Spend on Digital Identity Verification Checks for eCommerce Payments per Annum ($m), Split by 8 Key Regions, 2024-2029

- 3.3.1. Total Number of eCommerce Payments That Require a Digital Identity Verification Check

- 3.4. Other Verification Services

- 3.4.1. Total Number of Digital Identity Verification Checks for Other Verification Services

- Figure & Table 3.7: Total Number of Digital Identity Verification Checks for Other Verification Services per Annum (m), Split by 8 Key Regions, 2024-2029

- 3.4.2. Total Spend on Digital Identity Verification for Other Verification Services

- Figure & Table 3.8: Total Spend on Digital Identity Verification for Other Verification Services per Annum ($m), Split by 8 Key Regions, 2024-2029

- 3.4.1. Total Number of Digital Identity Verification Checks for Other Verification Services